©2015 Tecumseh Products Company Tecumseh Products Company FY2014 Shareholder Update March 5, 2015 These slides should be reviewed in connection with the 2014 annual results conference call audio presentation.

Agenda Business Update 2014 Sales, Financial & Liquidity Overview Closing Remarks / Q&A 2 FY2014 Shareholder Update - March 5, 2015

Disclaimer FY2014 Shareholder Update - March 5, 2015 3 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act that are subject to the safe harbor provisions created by that Act. In addition, forward-looking statements may be made orally in the future by or on behalf of us. Forward-looking statements can be identified by the use of terms such as “expects,” “should,” “may,” “believes,” “anticipates,” “will,” and other future tense and forward-looking terminology, or to the extent not factual, historical information, by the fact that they appear under the caption “Business Update.” Our forward-looking statements generally relate to our future performance, including our anticipated operating results and liquidity sources and requirements, our business strategies and goals, and the effect of laws, rules, regulations, new accounting pronouncements and outstanding litigation, on our business, operating results, and financial condition. Readers and listeners are cautioned that actual results may differ materially from those projected as a result of certain risks and uncertainties, including, but not limited to, i) our history of losses and our ability to maintain adequate liquidity in total and within each foreign operation; ii) our ability to develop successful new products in a timely manner; iii) current and future global or regional political and economic conditions, including housing starts, and the condition of credit markets, which may magnify other risk factors; iv) the success of our effort to effectively improve productivity and restructure our operations in order to reduce costs and bring them in line with projected production levels and product mix; v) the extent of any business disruption that may result from the restructuring and realignment of our manufacturing operations and personnel or system implementations, the ultimate cost of those initiatives and the amount of savings actually realized; vi) loss of, or substantial decline in sales to, any of our key customers; vii) increased or unexpected product warranty claims; viii) actions of competitors in markets with intense competition; ix) financial market changes, including fluctuations in foreign currency exchange rates and interest rates; x) the ultimate cost of defending and resolving legal and environmental matters, including any liabilities resulting from the regulatory antitrust investigations commenced by the United States Department of Justice Antitrust Division and the Secretariat of Economic Law of the Ministry of Justice of Brazil, both of which could preclude commercialization of products or adversely affect profitability and/or civil litigation related to such investigations; xi) local governmental, environmental, trade and energy regulations; xii) availability and volatility in the cost of materials, particularly commodities, including steel, copper and aluminum, whose cost can be subject to significant variation; xiii) significant supply interruptions or cost increases; xiv) loss of key employees; xv) the extent of any business disruption caused by work stoppages initiated by organized labor unions and other labor matters; xvi) risks relating to our information technology systems or failures of third-party technology service providers; xvii) impact of future changes in accounting rules and requirements on our financial statements; xviii) default on covenants of financing arrangements and the availability and terms of future financing arrangements; xix) reduction or elimination of credit insurance; xx) potential political and economic adversities that could adversely affect anticipated sales and production; xxi) in India, potential military conflict with neighboring countries that could adversely affect anticipated sales and production; xxii) weather conditions affecting demand for replacement products; and xxiii) the effect of terrorist activity and armed conflict. These forward-looking statements are made only as of the date of this report, and we undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. For more information regarding these and other uncertainties and factors that could cause our actual results to differ materially from what we have anticipated in our forward-looking statements or otherwise could materially adversely affect our business, financial condition, or operating results, see “Risk Factors” in Item 1A of our Form 10-K filed with the SEC.

Agenda FY2014 Shareholder Update - March 5, 2015 4 Business Update 2014 Sales, Financial & Liquidity Overview Closing Remarks / Q&A

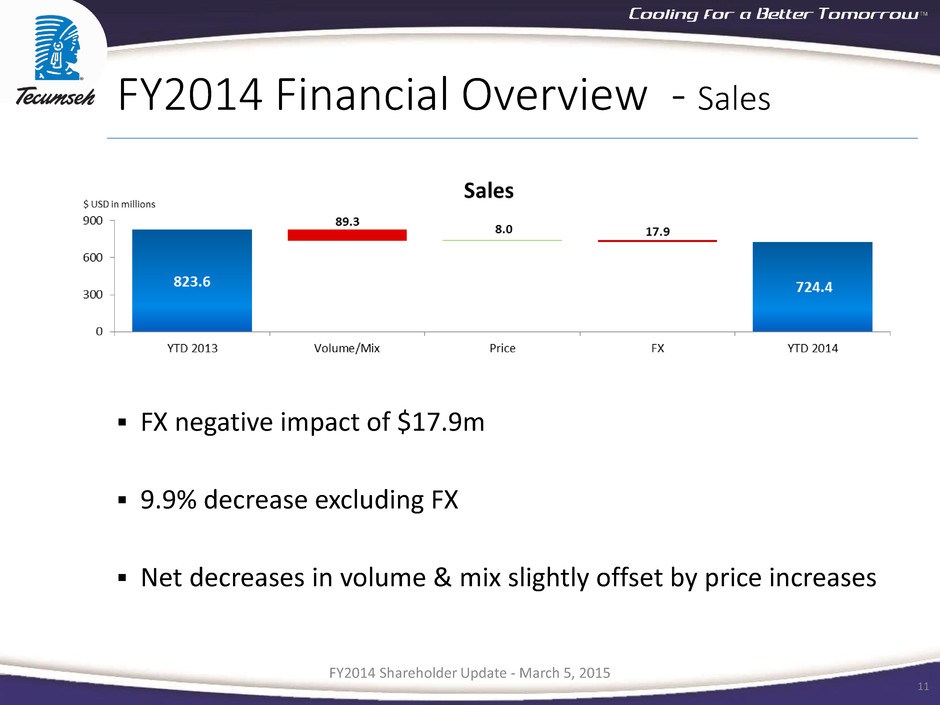

Business Update – Key Figures 2014 Sales -- $724.4m 2013 -- $823.6m 2014 Gross Profit -- $70.7m or 9.8% of net sales 2013 -- $78.1m or 9.5% of net sales 2014 S & A expense -- $92.2m or 12.7% of net sales 2013 – $104.9m or 12.7% of net sales December 31, 2014 cash and cash equivalents -- $42.7m December 31, 2013 -- $55.0m FY2014 Shareholder Update - March 5, 2015 5

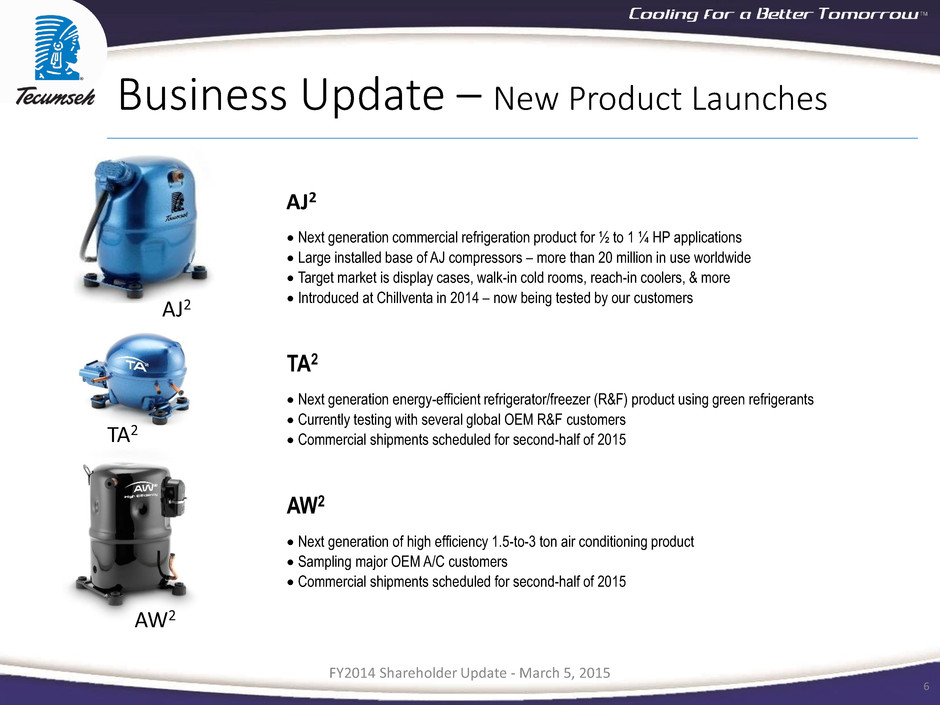

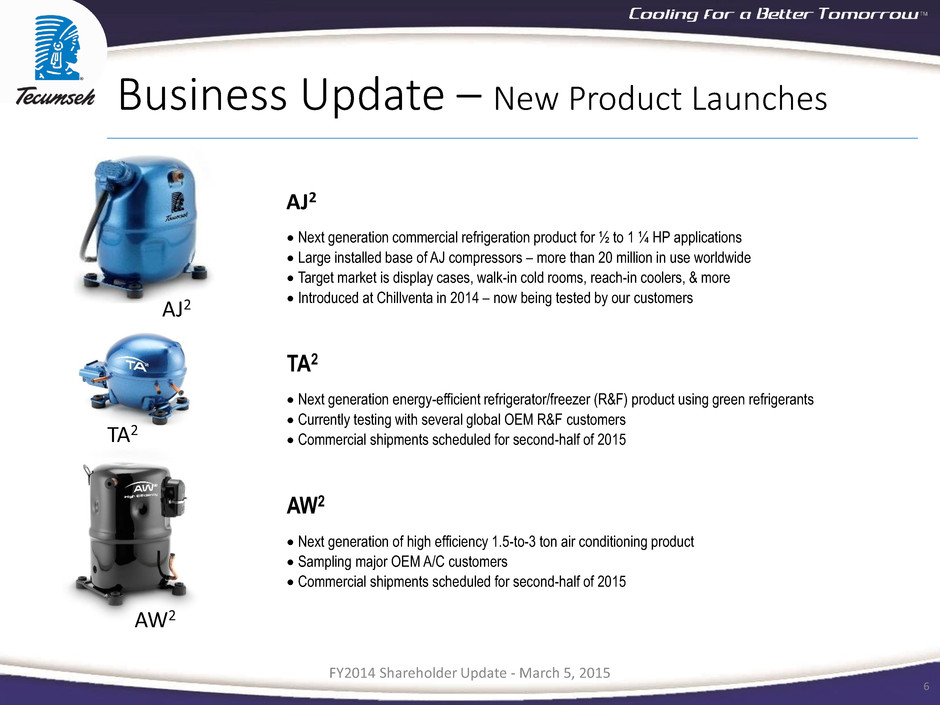

Business Update – New Product Launches FY2014 Shareholder Update - March 5, 2015 6 AJ2 TA2 AW2 AJ2 Next generation commercial refrigeration product for ½ to 1 ¼ HP applications Large installed base of AJ compressors – more than 20 million in use worldwide Target market is display cases, walk-in cold rooms, reach-in coolers, & more Introduced at Chillventa in 2014 – now being tested by our customers TA2 Next generation energy-efficient refrigerator/freezer (R&F) product using green refrigerants Currently testing with several global OEM R&F customers Commercial shipments scheduled for second-half of 2015 AW2 Next generation of high efficiency 1.5-to-3 ton air conditioning product Sampling major OEM A/C customers Commercial shipments scheduled for second-half of 2015

Business Update – Research & Development Innovation & Technology – Gene Fields, Global VP Technology partnership with key OEMS New technology Innovation New refrigerants Product Development & Engineering – Ryan Burns, Global VP Product development Product engineering Lab & testing facilities Product introductions FY2014 Shareholder Update - March 5, 2015 7

Business Update – Operational Focus Areas FY2014 Shareholder Update - March 5, 2015 8 Product Portfolio Management Global Supply Chain Manufacturing Execution Quality / Lean

Business Update - Commercial FY2014 Shareholder Update - March 5, 2015 9 Supplier of the Year - India Most Improved Supplier

Agenda FY2014 Shareholder Update - March 5, 2015 10 Business Update 2014 Sales, Financial & Liquidity Overview Closing Remarks / Q&A

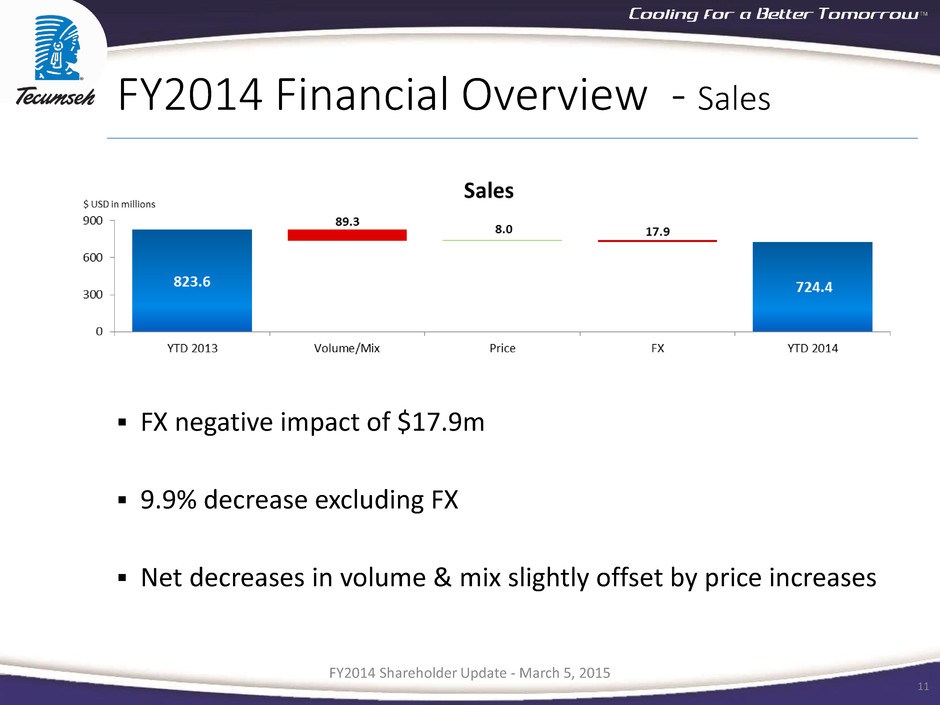

FY2014 Financial Overview - Sales FY2014 Shareholder Update - March 5, 2015 11 FX negative impact of $17.9m 9.9% decrease excluding FX Net decreases in volume & mix slightly offset by price increases

Sales Overview – Commercial Market FY2014 Shareholder Update - March 5, 2015 12

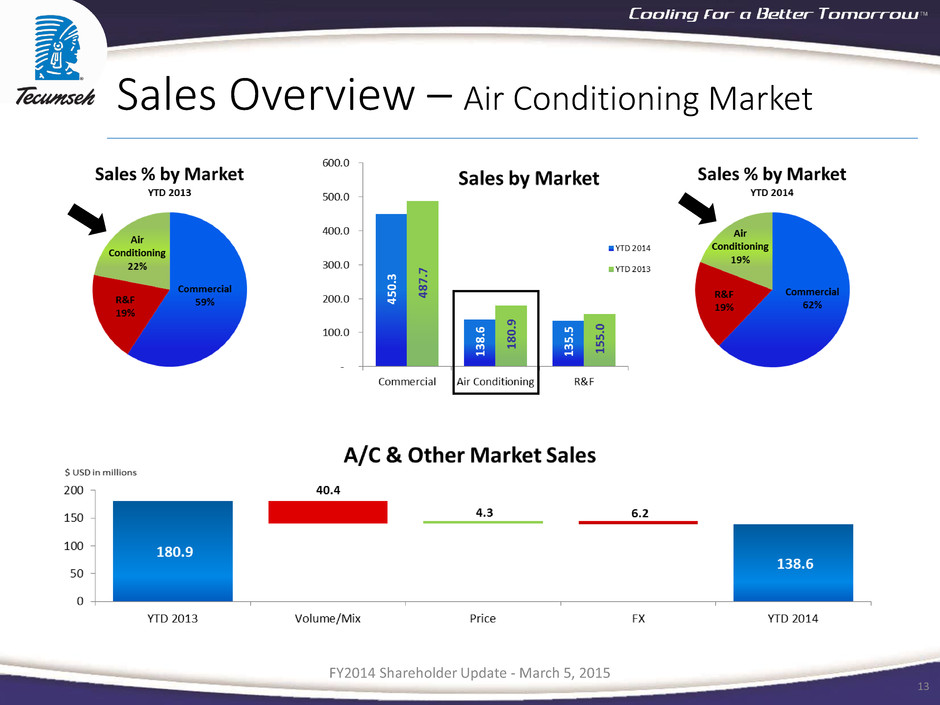

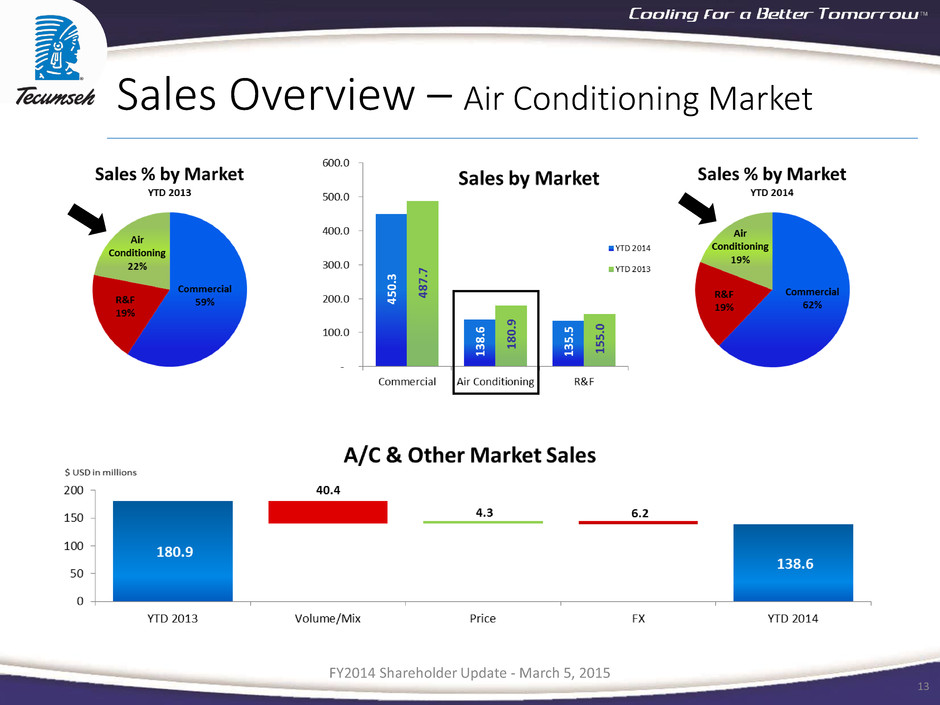

Sales Overview – Air Conditioning Market FY2014 Shareholder Update - March 5, 2015 13

Sales Overview – R&F Market FY2014 Shareholder Update - March 5, 2015 14

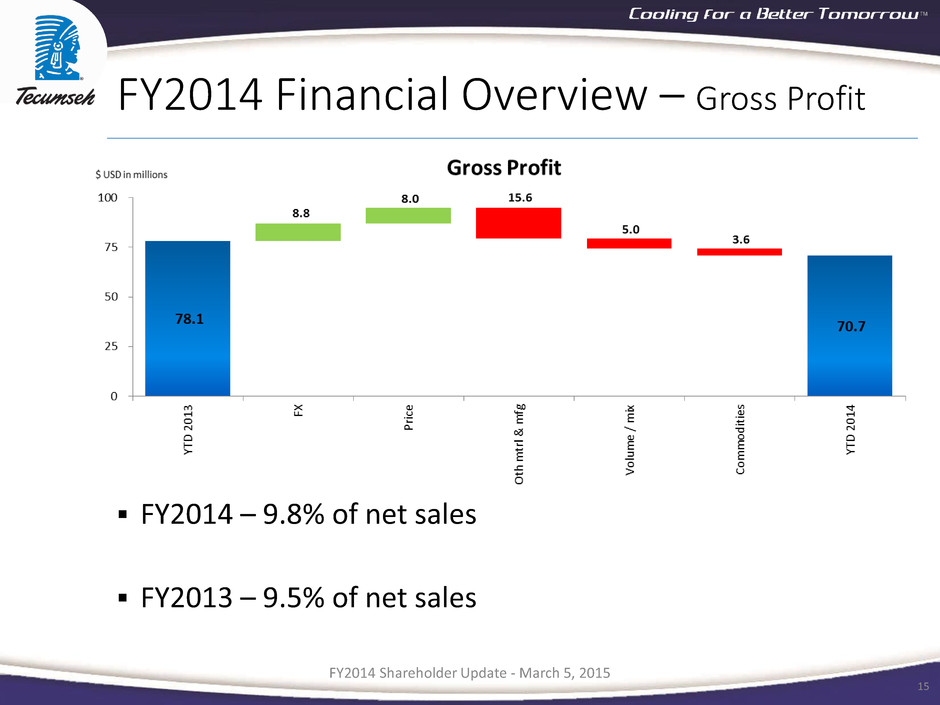

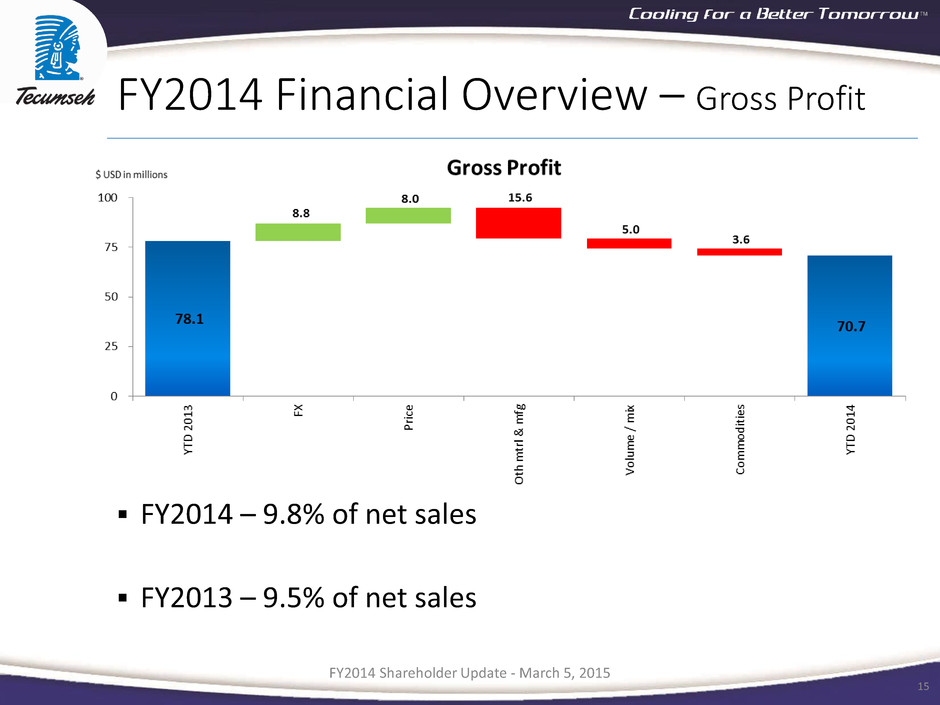

FY2014 Financial Overview – Gross Profit FY2014 Shareholder Update - March 5, 2015 15 FY2014 – 9.8% of net sales FY2013 – 9.5% of net sales

FY2014 Financial Overview – S&A, Other FY2014 Shareholder Update - March 5, 2015 16

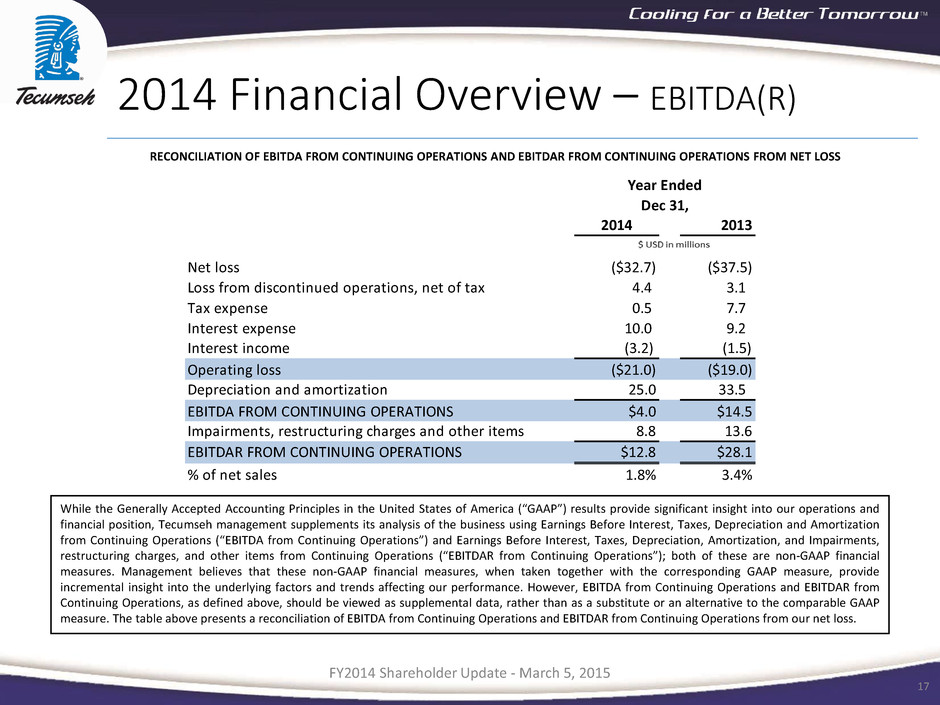

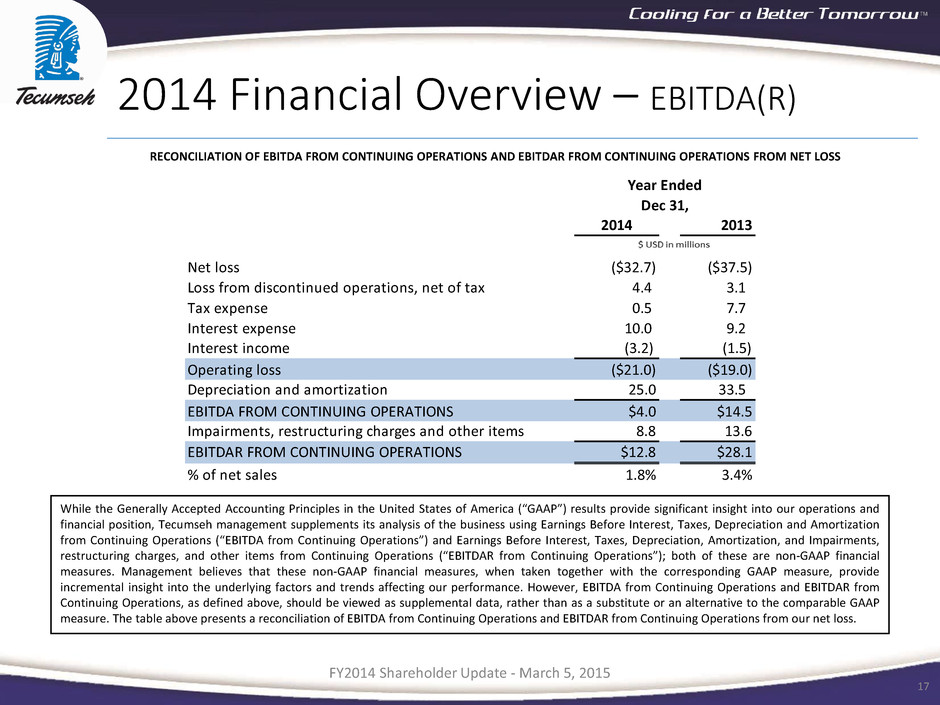

2014 Financial Overview – EBITDA(R) FY2014 Shareholder Update - March 5, 2015 17 While the Generally Accepted Accounting Principles in the United States of America (“GAAP”) results provide significant insight into our operations and financial position, Tecumseh management supplements its analysis of the business using Earnings Before Interest, Taxes, Depreciation and Amortization from Continuing Operations (“EBITDA from Continuing Operations”) and Earnings Before Interest, Taxes, Depreciation, Amortization, and Impairments, restructuring charges, and other items from Continuing Operations (“EBITDAR from Continuing Operations”); both of these are non-GAAP financial measures. Management believes that these non-GAAP financial measures, when taken together with the corresponding GAAP measure, provide incremental insight into the underlying factors and trends affecting our performance. However, EBITDA from Continuing Operations and EBITDAR from Continuing Operations, as defined above, should be viewed as supplemental data, rather than as a substitute or an alternative to the comparable GAAP measure. The table above presents a reconciliation of EBITDA from Continuing Operations and EBITDAR from Continuing Operations from our net loss. RECONCILIATION OF EBITDA FROM CONTINUING OPERATIONS AND EBITDAR FROM CONTINUING OPERATIONS FROM NET LOSS 2014 2013 Net loss ($32.7) ($37.5) Loss from discontinued operations, net of tax 4.4 3.1 Tax expense 0.5 7.7 Interest expense 10.0 9.2 Interest income (3.2) (1.5) Operating loss ($21.0) ($19.0) Depreciation and amortization 25.0 33.5 EBITDA FROM CONTINUING OPERATIONS $4.0 $14.5 Impairments, restructuring charges and other items 8.8 13.6 EBITDAR FROM CONTINUING OPERATIONS $12.8 $28.1 % of net sales 1.8% 3.4% Year Ended Dec 31,

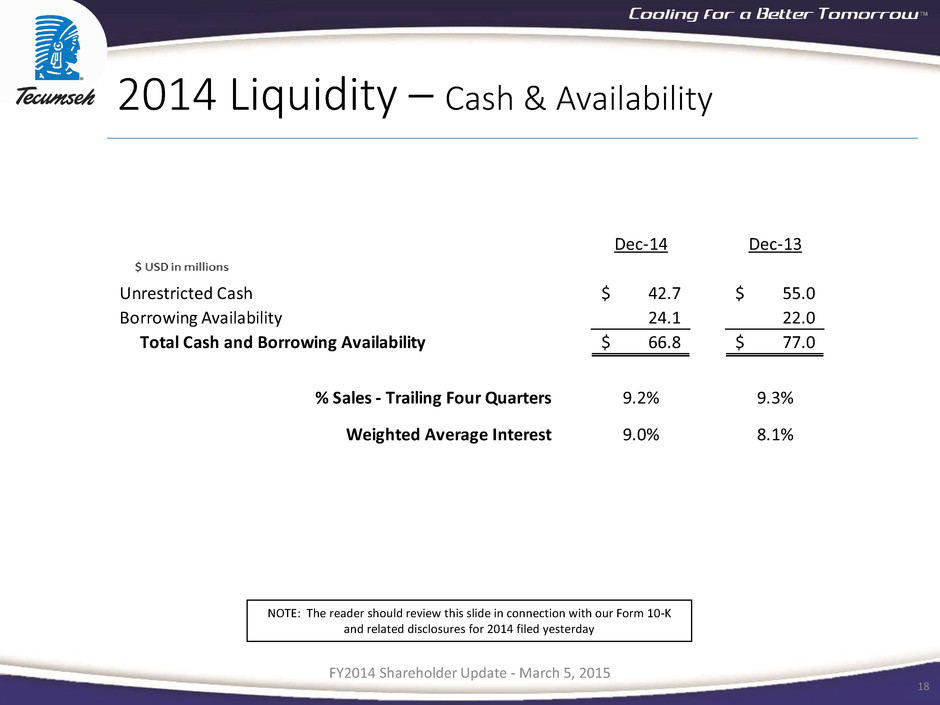

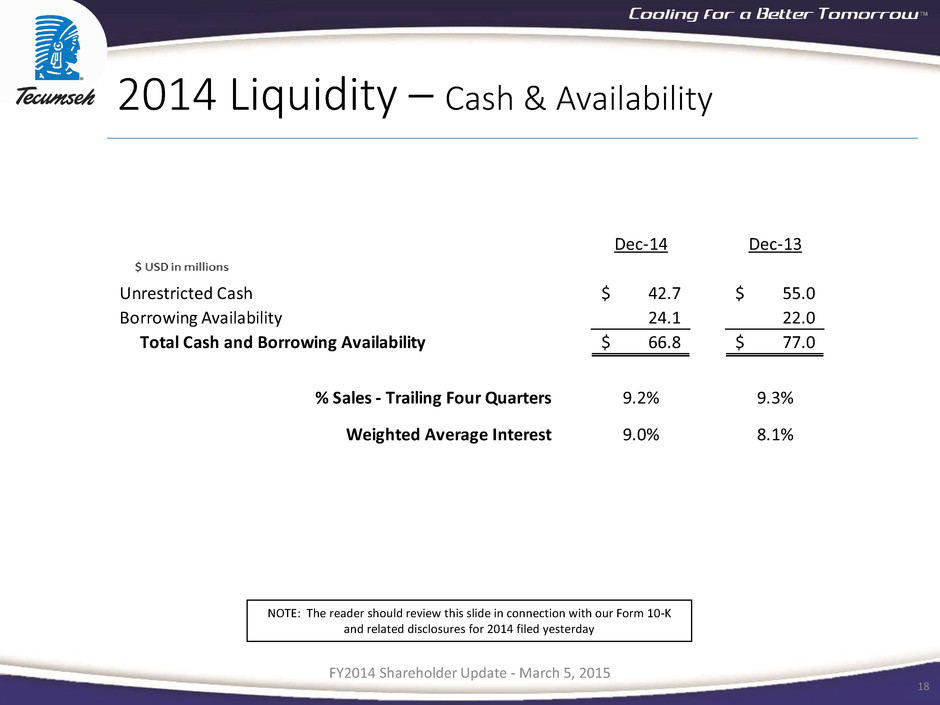

2014 Liquidity – Cash & Availability FY2014 Shareholder Update - March 5, 2015 18 NOTE: The reader should review this slide in connection with our Form 10-K and related disclosures for 2014 filed yesterday Dec-14 Dec-13 Unrestricted Cash 42.7$ 55.0$ Borrowing Availability 24.1 22.0 Total Cash and Borrowing Availability 66.8$ 77.0$ % Sales - Trailing Four Quarters 9.2% 9.3% Weighted Average Interest 9.0% 8.1%

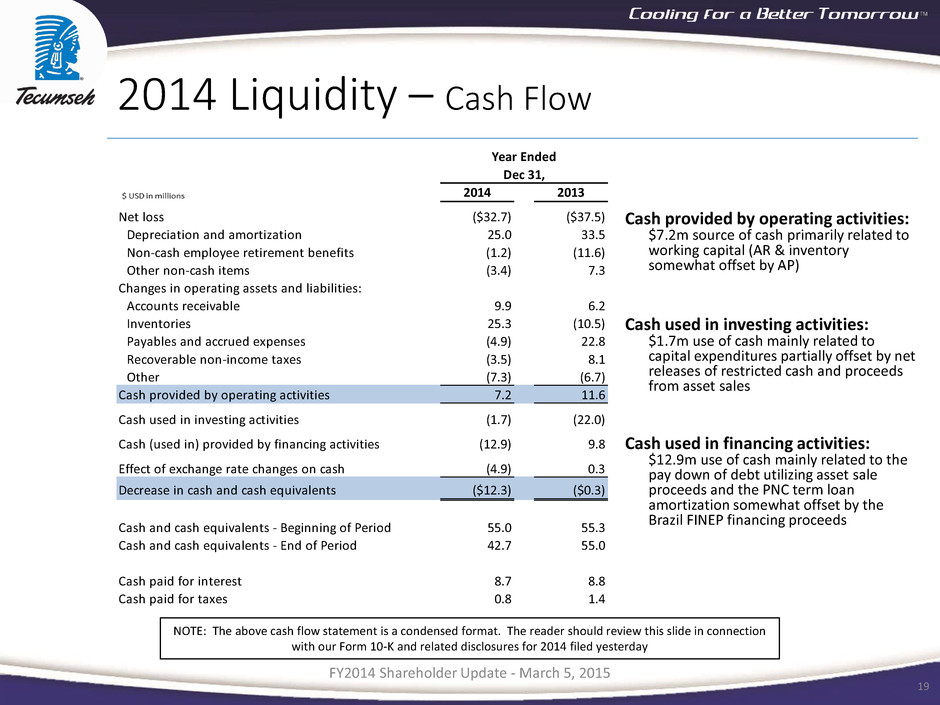

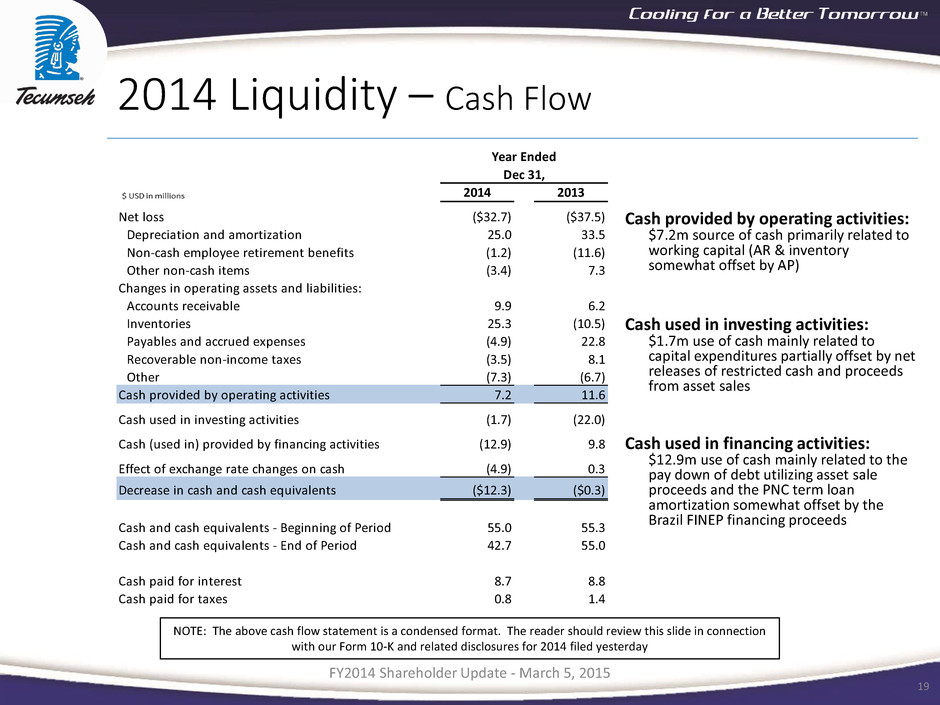

2014 Liquidity – Cash Flow FY2014 Shareholder Update - March 5, 2015 19 NOTE: The above cash flow statement is a condensed format. The reader should review this slide in connection with our Form 10-K and related disclosures for 2014 filed yesterday Cash provided by operating activities: $7.2m source of cash primarily related to working capital (AR & inventory somewhat offset by AP) Cash used in investing activities: $1.7m use of cash mainly related to capital expenditures partially offset by net releases of restricted cash and proceeds from asset sales Cash used in financing activities: $12.9m use of cash mainly related to the pay down of debt utilizing asset sale proceeds and the PNC term loan amortization somewhat offset by the Brazil FINEP financing proceeds 2014 2013 Net loss ($32.7) ($37.5) Depreciation and amortization 25.0 33.5 Non-cash employee retirement benefits (1.2) (11.6) Other non-cash items (3.4) 7.3 Changes in operating assets and liabilities: Accounts receivable 9.9 6.2 Inventories 25.3 (10.5) Payables and accrued expenses (4.9) 22.8 Recoverable non-income taxes (3.5) 8.1 Other (7.3) (6.7) Cash provided by operating activities 7.2 11.6 Cash used in investing activities (1.7) (22.0) Cash (used in) provided by financing activities (12.9) 9.8 Effect of exchange rate changes on cash (4.9) 0.3 Decrease in cash and cash equivalents ($12.3) ($0.3) Cash and cash equivalents - Beginning of Period 55.0 55.3 Cash and cash equivalents - End of Period 42.7 55.0 Cash paid for interes 8.7 8.8 Cash paid for taxes 0.8 1.4 Year Ended Dec 31,

Business Update 2014 Sales, Financial & Liquidity Overview Closing Remarks / Q&A Agenda FY2014 Shareholder Update - March 5, 2015 20

Key Takeaways Long and rich heritage as one of the pioneers of the compressor industry continues with several new key product introductions Renewed focus on innovation with re-alignment of R&D and Engineering departments Stay tuned for an upcoming announcement where we will share with you the components of our performance improvement plan FY2014 Shareholder Update - March 5, 2015 21 Thank you for attending Tecumseh Product Company’s FY2014 Shareholder Update

Contact Information – Today’s Speakers FY2014 Shareholder Update - March 5, 2015 22 Ms. Janice Stipp Executive Vice President, CFO, Treasurer & Secretary Tecumseh Products Company 5683 Hines Drive Ann Arbor, MI 48108 Mr. Harold Karp President & Chief Executive Officer Tecumseh Products Company 5683 Hines Drive Ann Arbor, MI 48108 E-Mail: investor.relations@tecumseh.com Phone: 1 (734) 585 9507