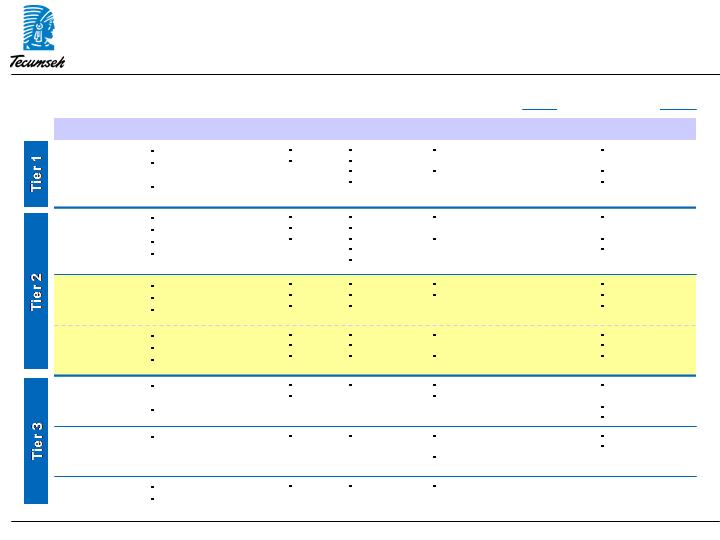

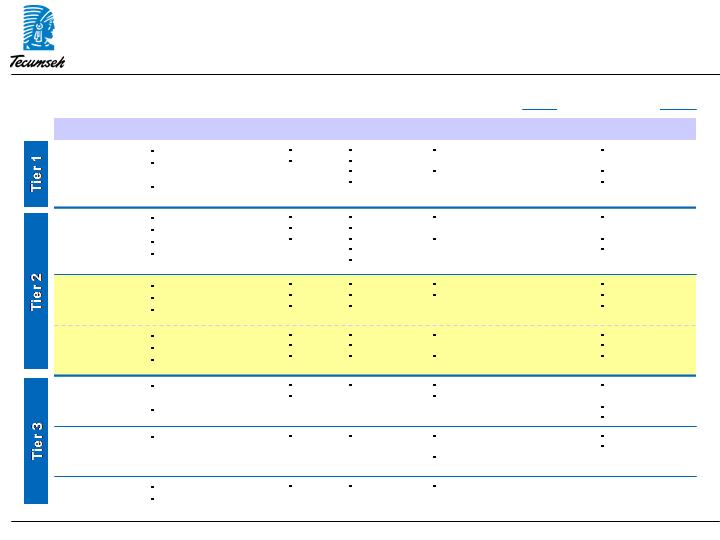

2

We are a mid-tier global compressor player today; by 2012 we

expect to be the same size but with stronger profitability

Tiers based on market positioning and product offering

All players in commercial refrigeration also offer condensing units

Financials (2008)

Player

Summary

Markets

Products

Footprint

Rev ($B)

Strength

Emerson

Climate

Tech.

(Copeland)

Diversified industrial

Market leading products

(scroll) and profitability

Participates in commercial

and AC, but not R&F

Com’l

AC

Recip

Scroll – leader

Controls

Motors, drives

and valves

HCC: US, Ireland,

Germany, Belgium

LCC: Mexico, Czech

Rep., China, India,

Thailand

3.8 (Climate)

24.8 (Corp)

EBIT: 14% (Clim.);

17% (Corp)

Cash: $1.8 Bn

Debt: $4.5 Bn

Danfoss

Diversified industrial

Broad market participation

Complementary products

High debt load (Sauer-

Danfoss acquisition)

R&F

Com’l

AC

Recip

Scroll

Controls

Heating

Motors

HCC: US, Germany,

France

LCC: Mexico,

Slovenia, Slovakia,

China

1.7 (AC Ref)

6.0 (Corp)

EBIT: 3% (AC Ref);

2% (Corp)

Cash: $108 MM

Debt: $1.9 Bn

Tecumseh

(now)

Broad market participation

Strong historical reputation

Lagging profitability

R&F

Com’l

Specialty

AC

Recip

Rotary

Scroll – limited

HCC: US, France

LCC: Brazil, India,

Mexico

1.0

EBIT: -7%

Cash: $110 MM

Debt: $32 MM

(2012 target)

Improved profitability

Enhanced products

All three technologies

R&F

Com’l

Specialty

AC

Recip

Rotary

Scroll –

extensive

HCC: Late Stage

Customization

LCC: Brazil, India,

Mexico, others

1.0

EBIT: 5%

Cash: $141 MM

Debt: $44 MM

Embraco /

Whirlpool

R&F and small

commercial focus

Owned by Whirlpool

R&F

Com’l

Recip – smaller

HCC: Italy

LCC: Brazil,

Slovakia, China

0.9 (Em ’05)

18.9 (Corp)

EBIT: 4% (Em ’05);

4% (Whirlpool)

Cash: $146 MM

Debt: $2.2 Bn

ACC

Shrinking to just R&F

R&F

Recip – smaller

HCC: Germany,

Italy

LCC: Austria,

Hungary, China

~ 0.3 (’07)

EBIT: 3% (’07)

NI: -1% (’07)

Cubigel

Carve-out from ACC

Small, commercial focus

Com’l

Recip – smaller

HCC: Spain

~0.16 (est.)

Sources:

BSRIA, Company websites

Capital IQ, Annual Reports

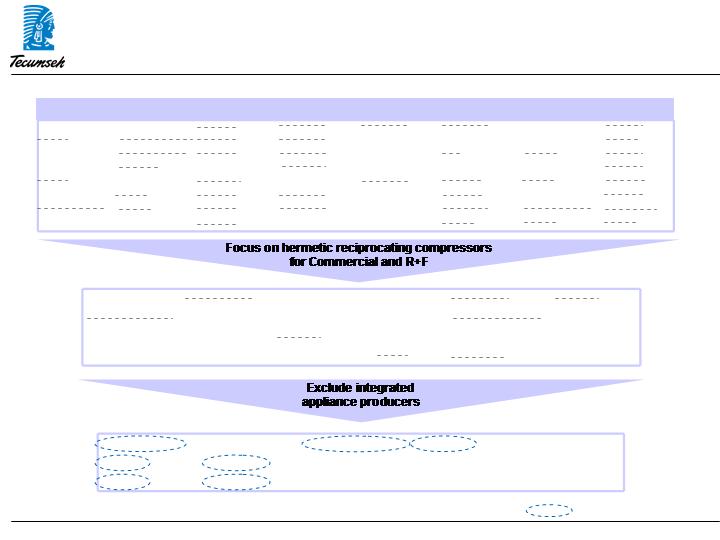

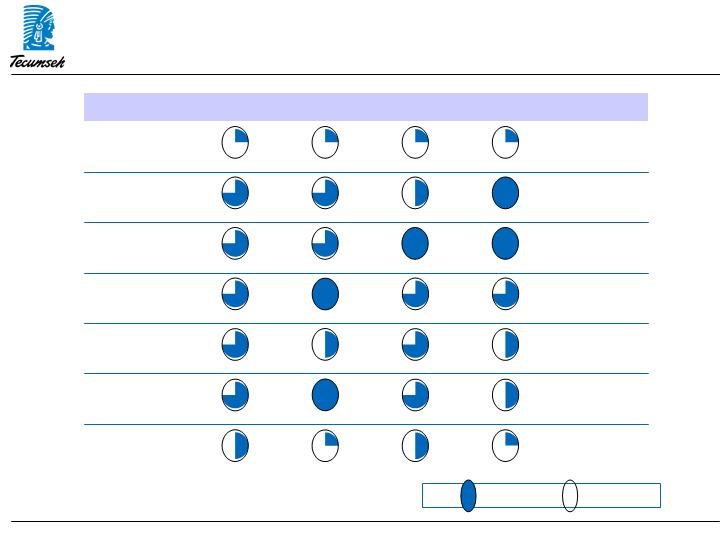

Tecumseh’s Competitive Standing