To vote your proxy by mail, mark your vote on the enclosed proxy card, then follow the directions on the card. To vote your proxy using the Internet or by telephone, see the instructions on the enclosed proxy card. The proxy committee will vote your shares according to your directions. If you do not mark any selections, your shares will be voted as recommended by the Board of Directors.

We encourage you to vote by proxy as soon as possible. The shares represented by the enclosed proxy will be voted if the proxy is properly received before the meeting begins. Solicitation of proxies on behalf of the Board of Directors may be made by mail, personal interviews, telephone or facsimile by Tektronix officers and employees. Tektronix has also retained Morrow & Co., Inc. to assist in the solicitation of proxies from shareholders (primarily brokers, banks and other institutional shareholders) for a fee estimated at approximately $5,000 plus certain expenses. The costs of such solicitation will be paid by the Company.

Any person giving a proxy in the form accompanying this proxy statement has the power to revoke it at any time before its exercise. The proxy may be revoked by filing with the Secretary of the Company an instrument of revocation or a duly executed proxy bearing a later date. The proxy may also be revoked by affirmatively electing to vote in person while in attendance at the meeting. However, a shareholder who attends the meeting need not revoke the proxy and vote in person unless he or she wishes to do so.

Only shareholders of record on July 19, 2004 (the record date) will be entitled to vote at the annual meeting. The majority of the shares of common stock outstanding on the record date must be present in person or by proxy to have a quorum. As of the close of business on July 19, 2004, the Company had 84,195,933 outstanding shares of common stock. This proxy statement and the accompanying proxy were sent to shareholders beginning August 19, 2004.

Shares of Tektronix common stock held in the Tektronix 401(k) Plan (the "Plan") are registered in the name of the trustee under the Plan (the "Trustee"). Participants in the Plan are not eligible to vote directly at the Annual Meeting. However, participants in the Plan are allocated interests in the shares held in the Plan ("Plan Shares") and may instruct the Trustee how to vote the Plan Shares allocated to their accounts. Participants will receive a separate voting instruction form on which they may indicate their voting instructions. Participants have the power to revoke their voting instructions by properly submitting new voting instructions according to the directions on the voting instruction card at any time on or before 8:59 p.m. PDT (11:59 p.m. EDT) on Monday, September 20, 2004. Plan Shares not allocated to participants and Plan Shares for which no instructions are received will be voted by the Trustee in its discretion.

The Board of Directors currently consists of eight members. The Board is divided pursuant to the bylaws into three classes. One class is elected each year for a three-year term. The term of office of Class III directors expires at the 2004 annual meeting; the term of office of Class I directors expires in 2005; and that of Class II

directors expires in 2006. In all cases, the terms of the directors will continue until their respective successors are duly elected.

Action will be taken at the 2004 annual meeting to elect three Class III directors to serve until the 2007 annual meeting of shareholders. The nominees, as well as the Class I and Class II directors who are continuing to serve, are listed below, together with certain information about each of them. The nominees for election at the 2004 annual meeting are David N. Campbell, Merrill A. McPeak, and Richard H. Wills. Messrs. Campbell, McPeak and Wills have served as directors since 1998, 1995 and 2000, respectively.

Directors are elected by a plurality of the votes cast by the shares entitled to vote if a quorum is present at the annual meeting. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the annual meeting but are not counted and have no effect on the determination of whether a plurality exists with respect to a given nominee.

Class III Director Nominees

David N. Campbell, 62, has been a Managing Director of Innovation Advisors, a strategic advisory firm focused on M&A transactions in the IT software and services industry since November 2001. He served as Chairman and Chief Executive Officer of Xpedior, a provider of information technology solutions, from September 1999 to November 2000. Prior to that he served as President of the GTE Technology Organization and from July 1995 to September 1999 he served as President of BBN Technologies, a business unit of GTE Corporation. From March 1983 until September 1994 he served as Chairman of the Board and Chief Executive Officer of Computer Task Group, Incorporated. Mr. Campbell has served as a director of Tektronix since 1998. Mr. Campbell is also a director of Gibraltar Steel Corporation and Apropos Technology.

Merrill A. McPeak, 68, is President of McPeak and Associates, an aerospace consultant firm. He was Chief of Staff, United States Air Force, from October 1990 to October 1994, when he retired. General McPeak has served as a director of Tektronix since March 1995. He is Chairman of the Board of Ethicspoint, Inc., and a director of several other private companies.

Richard H. (Rick) Wills, 49, is Chairman of the Board, President and Chief Executive Officer of the Company. Mr. Wills joined Tektronix in 1979. From 1991 through 1993, he was Oscilloscope Product Line Director. He held the position of Worldwide Director of Marketing for the Measurement Business Division in 1993 and 1994 and was Vice President and General Manager of the Measurement Division’s Design Service and Test Business Unit from 1995 to 1997. Mr. Wills was President of the Tektronix Americas Operations the last half of 1997. In December 1997, he was elected President, European Operations, and in 1999 he was elected President of the Company’s Measurement Business. Mr. Wills was elected a director of Tektronix on January 20, 2000, when he was elected President and Chief Executive Officer of the Company. He was elected Chairman of the Board on September 20, 2001.

Class I (Term Ending 2005)

Pauline Lo Alker, 61, was Chairman of the Board, Chief Executive Officer and President of Amplify.net, Inc., a position she held from June 1998 to May 2004, when she retired. From January 1991 until June 1998, she was President and Chief Executive Officer of Network Peripherals Inc. Mrs. Alker has served as a director of Tektronix since January 1996.

A. Gary Ames, 59, was President and Chief Executive Officer of MediaOne International, formerly US WEST International (communications), from July 1995 to June 2000, when he retired. Mr. Ames was President and Chief Executive Officer of U S WEST Communications from January 1990 to July 1995. From April 1987 to January 1990, Mr. Ames was President and Chief Executive Officer of Mountain Bell. Mr. Ames has served as a director of Tektronix since 1994. He is also a director of Albertson’s, Inc., PacWest Telecommunications, iPass, and F-5 Networks.

Frank C. Gill, 60, is a retired Intel Corporation executive. At the time of his retirement from Intel, he was Executive Vice President and had held a variety of positions in sales, marketing, product development and manufacturing operations during his 23-year career. Mr. Gill has served as a director of Tektronix since

3

March 1999. He is currently a private investor and a director of Logitech International, Pixelworks, Inc., and other private companies.

Class II (Term Ending 2006)

Gerry B. Cameron, 66, retired, was Chairman of U.S. Bancorp from 1994 to December 1998. He was Chief Executive Officer of U.S. Bancorp from January 1994 until its merger with First Bank System on August 1, 1997. Mr. Cameron’s banking career began in 1956 with U.S. National Bank of Oregon. He managed the Commercial Banking Group and the Northwest Group before being appointed Chairman and Chief Executive Officer of Old National Bank in Spokane, Washington in 1987. In 1988, Mr. Cameron was named President and Chief Operating Officer of U.S. Bank of Washington, which was formed when U.S. Bancorp acquired Old National Bank and Peoples Bank. Mr. Cameron has served as a director of Tektronix since 1997. He is also Chairman of the Board of The Regence Group.

Cyril J. Yansouni, 62, has been a director of PeopleSoft since 1992. Mr. Yansouni was Chairman of the Board of Directors of Read-Rite Corporation, a supplier of magnetic recording heads for data storage drives from March 1991 to June 2003, and Chief Executive Officer from March 1991 to June 2000. From 1988 to 1991 Mr. Yansouni was employed by Unisys Corporation, a manufacturer of computer systems, where he served in various senior management capacities, most recently as an Executive Vice President. From 1986 to 1988, Mr. Yansouni was President of Convergent Technologies, a manufacturer of computer systems that was acquired by Unisys Corporation in December 1988. From 1967 to 1986 he was employed by Hewlett-Packard Company, where he served in a variety of technical and management positions, most recently as Vice President and General Manager of the Personal Computer Group. Mr. Yansouni joined the Tektronix Board of Directors in August 2003. He is also a director of Solectron Corp.

CORPORATE GOVERNANCE AND RELATED MATTERS

Board of Directors Meetings, Committees and Compensation

Meetings

The Board of Directors met six times during the last fiscal year. Each director attended at least 95% of the aggregate number of the meetings of the Board and committees on which he or she served.

Committees

The Company currently has standing Audit, Nominating and Corporate Governance, and Organization and Compensation Committees of the Board of Directors. Each committee operates pursuant to a written charter, and the charters are reviewed annually. The charters may be viewed online at www.tektronix.com. The performance of each Committee is reviewed annually. Each Committee may obtain advice and assistance from internal or external legal, accounting and other advisors. The members of the committees are identified in the following table.

Name

| | Audit

| | Nominating and

Corporate

Governance

| | Organization &

Compensation

|

|---|

| Pauline Lo Alker | | | | X | | X |

| A. Gary Ames | | X | | Chair | | | | |

| Gerry B. Cameron | | X | | | | Chair |

| David N. Campbell | | X | | | | X |

| Frank C. Gill | | | | X | | X |

| Merrill A. McPeak | | Chair | | | | X |

Richard H. Wills (no committee assignments)

| | | | | | | | | | | | |

| Cyril J. Yansouni | | X | | X | | | | |

4

All committees currently consist entirely of independent directors in accordance with the rules of the New York Stock Exchange and under criteria established by the Board of Directors (See “Corporate Governance Guidelines and Policies” below).

The Audit Committee assists the Board in its general oversight of the Company’s financial reporting, internal controls and audit functions, and is directly responsible for the appointment, compensation and oversight of the independent auditors. During fiscal year 2004, the Audit Committee held eight meetings. The responsibilities and activities of the Audit Committee are described in more detail in the “Report of the Audit Committee”.

The Nominating and Corporate Governance Committee makes recommendations to the Board regarding (1) Board and committee membership; (2) corporate governance matters, including adoption of, and changes to, the Corporate Governance Guidelines discussed below; and (3) director compensation. The committee also leads the Board in its annual review of the Board’s performance. The Nominating and Corporate Governance Committee held five meetings during the last fiscal year. Any shareholder who wishes to recommend a prospective nominee for the Board of Directors for the Nominating and Corporate Governance Committee consideration may do so pursuant to the procedure described in the Corporate Governance Guidelines and Policies section below.

The Organization and Compensation Committee, which is described in the “Organization and Compensation Committee Report on Executive Compensation”, held four meetings during the last fiscal year.

Director Compensation

Directors who are not employees of the Company receive an annual retainer of $30,000 paid in Common Shares of the Company, purchased in the market. The shares are issued pursuant to the 2001 Non-Employee Directors Compensation Plan. Each committee chairman also receives an annual cash payment of $5,000. Non-employee directors receive $1,200 for each meeting of the Board of Directors attended and $900 for each committee meeting attended, with the exception of committee meetings held during the time normally scheduled for a Board meeting. Directors who are employees of the Company receive no separate compensation as directors. Directors can elect to receive meeting and committee chair fees in stock, rather than cash.

Directors receive annually, on the day following the shareholder’s annual meeting, fully vested, ten-year options to purchase 10,000 Common Shares, with an option price equal to the fair market value of the stock as of the close of trading on the immediately preceding day.

Directors can elect to defer all or part of their compensation under the Tektronix, Inc. Deferred Compensation Plan and the Tektronix, Inc. Stock Deferral Plan. Cash amounts credited to the Deferred Compensation Plan earn a rate of return equal to the rate of return on earnings indices selected in advance by the director. Tektronix Common Shares that are deferred will earn a rate of return based upon the performance of Tektronix Common Shares. Deferred amounts will be paid in a single lump-sum payment or in equal annual installment payments for up to 15 years commencing on the first January following the date the director ceases to be a director, or the first January following the date specified by the director. Deferrals must be for a minimum of three years, unless the director ceases to be a director at an earlier date.

Corporate Governance Guidelines and Policies

The Board of Directors has adopted Corporate Governance Guidelines, which are reviewed periodically by the Nominating and Corporate Governance Committee to determine if changes should be recommended to the Board of Directors. The Corporate Governance Guidelines are available online at www.tektronix.com. Among other matters, the Corporate Governance Guidelines and Company practices and policies include the following:

| • | | A majority of the members of the Board of Directors shall be independent directors, as defined in the applicable rules of the New York Stock Exchange and as determined by the Board under criteria adopted by the Board. Currently, seven of the eight directors are independent, as defined by these rules. Generally, independence means that the director must be independent of management and free from any relationship that, in the opinion of the Board, would interfere with the exercise of independent |

5

| | | judgment as a director. Directors who are employees of the Company or one of its subsidiaries are not independent. |

In addition to New York Stock Exchange rules, the Board has adopted the following criteria to determine the independence of Directors:

No director will be deemed independent unless the Board affirmatively determines that the director has no material relationship with the Company, directly or as an officer, shareholder or partner of

an organization that has a relationship with the Company. The Board will observe all additional criteria for independence established by the New York Stock Exchange or other governing laws and regulations.

The following will not be considered material relationships:

1. Charitable Organizations. The director or any member of his or her immediate family serves as an executive officer, trustee or director of a charitable or educational organization which receives contributions from the Company in a single fiscal year less than $100,000 or 1% of that organization’s consolidated gross revenues, whichever is more; or

2. Commercial Relationships.

(i) The director is an executive officer or employee, or an immediate family member of a director of the Company is an executive officer of another company that does business with the Company and the annual sales to, or purchases from, the Company are less than one percent of the annual revenues of the other company, or

(ii) The director or an immediate family member of a director of the Company is an executive officer of another company which is indebted to the Company, or to which the Company is indebted, and the total amount of either company’s indebtedness to the other is less than one percent of the total consolidated assets of the company he or she serves as an executive officer.

Annually, the Board will review all commercial and charitable relationships of directors to determine whether directors meet the categorical independence tests described above. The Board may determine that a director who has a relationship that exceeds the limits described in paragraph 2(i) (to the extent that any such relationship would not constitute a bar to independence under the New York Stock Exchange listing standards) or paragraph 2(ii), is nonetheless independent. The Company will explain in the next proxy statement the basis for any Board determination that a relationship is immaterial despite the fact that it does not meet the categorical standards set forth above.

The Board has determined that all directors, except Mr. Wills (the Chief Executive Officer), are independent directors under the NYSE rules and these criteria.

| • | | The Board of Directors has adopted a process for identifying and evaluating nominees for director, including suggested director candidates from shareholders, as follows: |

1. Board members identify the need to add a new Board member based on specific criteria or to fill a vacancy.

2. The Nominating and Corporate Governance Committee initiates a search, working with staff support and seeking input from Board members and others as necessary, and hiring a search firm, if desired.

3. The Nominating and Corporate Governance Committee considers director candidate suggestions from many sources, including shareholders. Shareholder nominations should be submitted to: Tektronix, Inc., Chairman of the Nominating and Corporate Governance Committee, c/o the Corporate Secretary, 14200 S.W. Karl Braun Drive, P.O. Box 500, MS 55-720, Beaverton, Oregon 97077-0001. The Nominating and Corporate Governance Committee does not intend to alter the

6

manner in which it evaluates candidates based on whether or not the candidate was recommended by a shareholder.

4. Candidates who satisfy the criteria and otherwise qualify for membership on the Board will be submitted to the Nominating and Corporate Governance Committee for its consideration. The Nominating and Corporate Governance Committee will then determine which candidates should be contacted, and will determine the best means for initiating the contacts. If necessary, the Nominating and Corporate Governance Committee may initiate contacts through a search firm. Such further contacts and interviews with prospective candidates shall be as determined by the Nominating and Corporate Governance Committee.

5. The Nominating and Corporate Governance Committee shall advise the Board of its progress, through committee reports and through informal communications, as necessary.

6. The Nominating and Corporate Governance Committee determines in its discretion whether to recommend a candidate to the Board for consideration as a director nominee.

| • | | The Board has established criteria for nomination to the Board of Directors. The Board seeks diverse candidates who possess the background, skills and expertise to make a significant contribution to the Board, the Company and its shareholders. General criteria include: |

1. Directors should be of the highest ethical character.

2. Directors should have reputations, both personal and professional, that enhance the image and reputation of the Company.

3. Directors should be highly accomplished in their respective fields, with superior credentials and established recognition.

4. When selecting directors, the Board should generally seek active and former executive officers of public companies and leaders of organizations, including scientific, government, educational and other non-profit institutions.

5. Directors should have relevant expertise and experience, and be able to offer advice and guidance to the executive officers.

6. Directors should demonstrate sound business judgment.

7. Directors should work together and with management collaboratively and constructively.

| • | | Directors should not be active members of more than six public companies, and members of the Audit Committee should not serve on more than three public company audit committees. |

| • | | A Lead Director will be appointed annually by the Board. The Lead Director shall be independent, and shall preside over executive sessions of the Board, acting as the liaison between the independent directors and the Chairman/CEO. The Lead Director may also serve as the contact person to facilitate communications by the Company employees and shareholders directly with the non-management members of the Board. The Lead Director may also periodically help schedule or conduct separate meetings of the independent directors. The currently appointed Lead Director is Gerry B. Cameron. |

| • | | Directors must resign from the Board at the Board meeting preceding the annual shareholders meeting immediately following their 70th birthday. In 2001 the Board approved 12-year tenure limits for directors, excluding the Chief Executive Officer. For directors, the 12-year tenure limits commenced on May 17, 2001 and service prior to that date is not included. |

| • | | The non-management directors meet on a regularly scheduled basis in executive session without the Chief Executive Officer and other management. The Lead Director presides at these meetings. |

| • | | Members of Board committees are appointed by the Board, upon recommendation by the Nominating and Corporate Governance Committee. |

7

| • | | The Audit Committee, Nominating and Corporate Governance Committee, and Organization and Compensation Committee consist entirely of independent directors. |

| • | | The Board and each committee has the power to hire independent legal, financial or other advisors as they may deem necessary, without consulting with or obtaining the approval of any officer of the Company. |

| • | | The Board and each committee annually assesses its own performance. |

| • | | The Board annually reviews the Company’s strategic long-range plan, business unit initiatives, capital projects and budget matters. |

| • | | The Organization and Compensation Committee periodically reviews with the Chief Executive Officer and reports to the Board regarding succession planning and leadership development. |

| • | | The Board evaluates the performance of the Chief Executive Officer and other senior management personnel at least annually. |

| • | | Incentive compensation plans link pay directly and objectively to measured financial goals set in advance by the Organization and Compensation Committee. Executive officers are expected to acquire Company stock in accordance with established guidelines. See “Organization and Compensation Committee Report on Executive Compensation” for additional information. |

| • | | Directors are encouraged to make significant progress annually toward accumulating, within five years of becoming a director, Common Shares of the Company with a value equal to five times the director’s annual retainer. For the last fiscal year, all directors have achieved this ownership goal, except for Mr. Yansouni, who became a director in August 2003. |

| • | | Directors are expected to regularly attend shareholder meetings. Last year, all members of the Board of Directors attended the annual meeting of shareholders. |

| • | | The Board of Directors has adopted a code of ethics, known as the Tektronix Business Practices Guidelines, as well as a code of ethics for financial managers. Both are available for viewing on the Company’s Corporate Governance Web site at www.tektronix.com. |

| • | | Shareholders may contact any director, including the Lead Director, by writing to them c/o the Corporate Secretary’s Office at Tektronix, Inc., 14200 S.W. Karl Braun drive, P.O. Box 500, MS 55-720 Beaverton, Oregon 97077-0001. |

| • | | The Board of Directors has adopted procedures for the receipt, retention and treatment of concerns from Company employees and others regarding accounting, internal accounting controls or auditing matters. Employees may submit concerns anonymously pursuant to the Business Practices Guidelines, located on the Company’s Web site. Others may submit concerns in writing to the Chairman of the Audit Committee, c/o the Corporate Secretary, 14200 S.W. Karl Braun Drive, Beaverton, OR 97077-0001. |

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table shows ownership of the Common Shares of the Company on the record date by each person who, to the knowledge of the Board of Directors, owned beneficially more than 5% of the Common Shares:

Name and address of Beneficial Owner

| | | | Amount and nature of

beneficial ownership

| | Percent of

Class

|

|---|

PRIMECAP Management Company (1)

225 So. Lake Avenue #400

Pasadena, CA 91101-3005

| | | | | 11,178,040 | | | | 13.18 | % |

Franklin Resources, Inc., (2)

Charles B. Johnson, Rupert H. Johnson, Jr.,

Franklin Advisers, Inc.

One Franklin Parkway

Building 920

San Mateo, CA 94403 | | | | | 8,897,548 | | | | 10.50 | % |

Private Capital Management, L.P., (3)

Bruce S. Sherman and Gregg J. Powers

8889 Pelican Bay Blvd.

Naples, FL 34108 | | | | | 4,853,540 | | | | 5.7 | % |

Barclays Global Investors, NA, (4)

45 Fremont Street

San Francisco, CA 94105 | | | | | 5,365,930 | | | | 6.34 | % |

| (1) | | Based on information set forth on Schedule 13G/A dated July 7, 2003 (the most recent filing), filed with the SEC by PRIMECAP Management Company. These shares are held with sole voting power as to 1,922,990 shares and sole dispositive power as to 11,178,040 shares. |

| (2) | | Based on information set forth on Schedule 13G/A dated February 9, 2004, filed with the SEC by Franklin Resources Inc. These shares are held as follows: Franklin Advisers, Inc. holds sole voting and dispositive power as to 8,142,226 shares; Franklin Private Client Group, Inc. holds sole voting and dispositive power as to 743,524 shares; and Fiduciary Trust Company International holds sole voting and dispositive power as to 11,798 shares. |

| (3) | | Based on information set forth on Schedule 13G/A dated February 13, 2004, filed with the SEC by Private Capital Management, L.P (PCM). Bruce S. Sherman is CEO of PCM. Gregg J. Powers is President of PCM. In these capacities, PCM, Messrs. Sherman and Powers exercise shared dispositive and shared voting power with regard to 4,853,540 shares. |

| (4) | | Based on information set forth on Schedule 13G dated February 17, 2004, filed with the SEC by Barclays Global Investors, NA. The shares reported are held by the company in trust accounts for the economic benefit of the beneficiaries of those accounts and are held as follows: Barclays Global Investors, NA holds sole voting and dispositive power as to 3,699,432 shares; Barclays Global Fund Advisors holds sole voting and dispositive power as to 321,134 shares; Barclays Global Investors, Ltd holds sole voting power as to 460,837 shares and sole dispositive power as to 466,837 shares; Barclays Bank PLC holds sole voting and dispositive power as to 312,000 shares; and Barclays Capital Securities Limited holds sole voting and sole dispositive power as to 2,609 shares. |

9

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth the beneficial ownership of Common Shares of the Company by the directors, certain executive officers named in the Summary Compensation Table, and all executive officers and directors as a group as of June 30, 2004:

Name

| | | | Number

of Shares (1)

| | Percent

of Class

|

|---|

| Pauline Lo Alker | | | | | 46,688 | | | | * | |

| A. Gary Ames | | | | | 63,491 | | | | * | |

| Gerry B. Cameron | | | | | 57,103 | | | | * | |

| David N. Campbell | | | | | 69,703 | | | | * | |

| Frank C. Gill | | | | | 58,711 | | | | * | |

| Merrill A. McPeak | | | | | 57,346 | | | | * | |

| Cyril J. Yansouni | | | | | 11,195 | | | | * | |

| Richard H. Wills | | | | | 594,242 | (2) | | | * | |

| David E. Coreson | | | | | 121,641 | | | | * | |

| Colin L. Slade | | | | | 130,435 | (3) | | | * | |

| Richard D. McBee | | | | | 94,120 | (4) | | | * | |

| David S. Churchill | | | | | 165,895 | (4) | | | * | |

| All current directors and executive officers as a group (16 individuals) | | | | | 1,727,388 | | | | 2.06 | % |

| (1) | | Unless otherwise indicated, each individual has sole voting and investment power with respect to these shares. |

| | | Includes Common Shares represented by stock options that are currently exercisable under the Company’s stock plans, for which the individual Non-Employee Director has no voting or investment power as follows: Alker, Ames, and Cameron (35,000 shares); Campbell (45,000 shares); Gill (35,000 shares); McPeak (40,000 shares); and Yansouni (10,000 shares). |

| | | Includes shares issued under the Company’s Stock Compensation Plan for Non-Employee Directors and deferred pursuant to the Non-Employee Directors’ Stock Deferral Plan as follows: Mrs. Alker (1,195 shares), Mr. Ames (1,184 shares), Mr. Cameron (13,103 shares), Mr. Campbell (19,512 shares), Mr. McPeak (15,346 shares), and Mr. Yansouni (1,195 shares). Shares are held in trust, and they have no voting or investment power with respect to these shares. |

| | | Includes Common Shares represented by stock options that are currently exercisable or become exercisable within 60 days as follows: Mr. Wills (517,500 shares), Mr. Coreson (94,000 shares), Mr. Slade (99,000 shares), Mr. McBee (72,250 shares), Mr. Churchill (143,500 shares), and all officers and directors as a group (1,366,750 shares), for which the individual has no voting or investment power. |

| | | Includes shares held under the Tektronix 401(k) plan by Mr. Wills (4,791 shares), Mr. Coreson (4,343 shares), Mr. Slade (4,160 shares), Mr. McBee (1,245 shares), and Mr. Churchill (2,104 shares), as to which they have voting but no investment power. Also includes shares held in the Tektronix Stock Fund, an investment option of the Tektronix 401(k) plan, by Mr. McBee (7,088 shares) and Mr. Churchill (5,812 shares), as to which they have investment but no voting power. |

| (2) | | Includes 5,068 shares credited to a stock account under the Company’s Stock Deferral Plan, for which Mr. Wills has no voting or investment power, and 40,000 restricted shares that are subject to forfeiture to the Company under certain conditions and to which Mr. Wills has voting but no investment power. |

| (3) | | Includes 10,000 restricted shares that are subject to forfeiture to the Company under certain conditions and to which Mr. Slade has voting but no investment power. |

| (4) | | Includes 9,000 restricted shares each that are subject to forfeiture to the Company under certain conditions and to which each executive has voting but no investment power. |

10

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table discloses compensation received by the Company’s Chief Executive Officer and the four remaining most highly paid executive officers (collectively, the “Named Officers”) for services rendered as executive officers for the last three fiscal years.

| |

| |

| | Annual Compensation

| | Long-Term Compensation

| |

|---|

| |

| |

| |

| |

| |

| | Awards

| |

|---|

Name and Principal

Position

| | Year

| | Salary

($)

| | Bonus

($)(1)

| | Other

Annual

Compensation

($)

| | Restricted

Stock

Awards

($)

| | Securities

Underlying

Options

(#)(2)

| | All Other

Compensation

($)(3)

|

|---|

| Richard H. Wills | | | 2004 | | | $ | 596,154 | | | $ | 1,192,300 | | | $ | 0 | | | $ | 481,350 | (4) | | | 100,000 | | | $ | 19,637 | (5) |

| | Chairman, President, | | | 2003 | | | | 542,308 | | | | 189,808 | | | | 0 | | | | 0 | | | | 120,000 | | | | 19,967 | (5) |

| | and Chief Executive

Officer | | | 2002 | | | | 411,923 | | | | 58,500 | | | | 0 | | | | 0 | | | | 125,000 | | | | 16,806 | (5) |

| | |

| David E. Coreson (6) | | | 2004 | | | $ | 347,692 | | | $ | 452,000 | | | $ | 0 | | | $ | 0 | | | | 0 | | | $ | 17,508 | |

| | Sr. Vice President | | | 2003 | | | | 318,462 | | | | 66,877 | | | | 0 | | | | 350,200 | (7) | | | 0 | | | | 11,662 | |

| | Central Operations | | | 2002 | | | | 272,538 | | | | 23,400 | | | | 0 | | | | 0 | | | | 52,000 | | | | 10,177 | |

| | |

| Colin L. Slade | | | 2004 | | | $ | 328,846 | | | $ | 427,500 | | | $ | 0 | | | $ | 320,900 | (8) | | | 30,000 | | | $ | 12,317 | |

| | Sr. Vice President and | | | 2003 | | | | 312,385 | | | | 65,601 | | | | 0 | | | | 0 | | | | 60,000 | | | | 12,097 | |

| | Chief Financial Officer | | | 2002 | | | | 257,223 | | | | 21,918 | | | | 0 | | | | 0 | | | | 47,000 | | | | 10,122 | |

| | |

| Richard D. McBee | | | 2004 | | | $ | 284,231 | | | $ | 312,700 | | | $ | 0 | | | $ | 128,360 | (9) | | | 28,000 | | | $ | 13,692 | |

| | Vice President, | | | 2003 | | | | 273,077 | | | | 47,788 | | | | 0 | | | | 194,700 | (10) | | | 50,000 | | | | 9,394 | |

| | Worldwide Sales, Service

and Marketing | | | 2002 | | | | 228,846 | | | | 16,250 | | | | 0 | | | | 0 | | | | 43,000 | | | | 10,442 | |

| | |

| David S. Churchill | | | 2004 | | | $ | 289,231 | | | $ | 289,200 | | | $ | 0 | | | $ | 128,360 | (9) | | | 28,000 | | | $ | 12,281 | |

| | Vice President | | | 2003 | | | | 278,462 | | | | 48,731 | | | | 0 | | | | 194,700 | (10) | | | 50,000 | | | | 9,558 | |

| | Communications

| | | 2002 | | | | 238,000 | | | | 16,900 | | | | 0 | | | | 0 | | | | 43,000 | | | | 10,399 | |

| | and Video | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | | Includes amounts paid or deferred under the Annual Performance Incentive Plan. |

| (2) | | Options were granted in the year indicated. Additional information regarding the options granted during fiscal year 2004 is set forth in the “Stock Option Grants in Last Fiscal Year” table. |

| (3) | | Except as otherwise indicated, represents amounts contributed by the Company under the Company’s 401(k) Plan. |

| (4) | | Represents the grant of stock awards on January 20, 2004 under which Mr. Wills has the right to receive, subject to vesting, 15,000 shares of common stock. The stock awards vest 50% on January 20, 2006 and 50% on January 20, 2007. The value set forth above is based on the closing price on the date of grant, January 20, 2004, which was $32.09. As of May 29, 2004, he holds a total of 15,000 shares as to which restrictions have not lapsed with an aggregate market value of $473,400. His stock awards are entitled to dividends declared payable to common shareholders. |

| (5) | | Includes $6,790 per year supplemental long-term disability plan premium payments for Mr. Wills. |

| (6) | | Mr. Coreson retired from the Company on June 4, 2004. |

| (7) | | Represents the fair market value, on the grant date, of 20,000 restricted shares awarded to Mr. Coreson. Shares vested 100% on May 29, 2004. |

| (8) | | Represents the grant of stock awards on January 20, 2004 under which Mr. Slade has the right to receive, subject to vesting, 10,000 shares of common stock. The stock awards vest 50% on January 20, 2005 and 50% on January 20, 2006. The value set forth above is based on the closing price on the date of grant, January 20, 2004, which was $32.09. As of May 29, 2004, he holds a total of 10,000 shares as to which restrictions have not lapsed with an aggregate market value of $315,600. His stock awards are entitled to dividends declared payable to common shareholders. |

11

| (9) | | Represents the grant of stock awards on January 20, 2004 under which Messrs. McBee and Churchill each have the right to receive, subject to vesting, 4,000 shares of common stock. The stock awards vest 100% on January 20, 2006. The value set forth above is based on the closing price on the date of grant, January 20, 2004, which was $32.09. As of May 29, 2004, they each hold 9,000 shares as to which restrictions have not lapsed with an aggregate market value of $284,040. Their stock awards are entitled to dividends declared payable to common shareholders. |

| (10) | | Represents the grant of stock awards on June 19, 2003 under which Messrs. McBee and Churchill each have the right to receive, subject to vesting, 10,000 shares of common stock. The stock awards vest 50% on June 19, 2004 and 50% on June 19, 2005. At May 31, 2003 the market value of these shares was $21.08 per share. |

Stock Option Grants in Last Fiscal Year

The following table provides information on stock options awarded during the last fiscal year to Named Officers under the Company’s stock option plans.

| | | | Individual Grants

| |

|---|

Name

| | | | Number of

Securities

Underlying

Options

Granted(#)(1)

| | Percent of

Total

Options

Granted to

Employees in

Fiscal Year

| | Exercise

or Base

Price

($/Sh)

| | Expiration

Date

| | Grant Date

Present Value

($)(2)

|

|---|

| Richard H. Wills | | | | | 100,000 | | | | 4.4 | % | | $ | 31.5500 | | | | 01/20/14 | | | $ | 993,000 | |

| David E. Coreson | | | | | 0 | | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

| Colin L. Slade | | | | | 30,000 | | | | 1.3 | % | | $ | 31.5500 | | | | 01/20/14 | | | $ | 297,900 | |

| Richard D. McBee | | | | | 28,000 | | | | 1.2 | % | | $ | 31.5500 | | | | 01/20/14 | | | $ | 278,040 | |

| David S. Churchill | | | | | 28,000 | | | | 1.2 | % | | $ | 31.5500 | | | | 01/20/14 | | | $ | 278,040 | |

| (1) | | The options were granted on January 20, 2004 at 100% of the fair market value on the date of grant pursuant to the Company’s stock option plans. Each option becomes exercisable to the extent of 25% of the shares in 12-month increments, and the optionee may exercise the option for a period of ten years provided that the optionee has been continuously employed by the Company or one of its subsidiaries. Each of the options is subject to accelerated vesting in the event of a future change in control of the Company or the occurrence of certain events indicating an imminent change in control of the Company. Vesting is also accelerated upon the death or disability of the optionee. |

| (2) | | The Company has used a modified Black-Scholes model of option valuation to estimate grant date present value. The actual value realized, if any, may vary significantly from the values estimated by this model. Any future values realized will ultimately depend upon the excess of the stock price over the exercise price on the date the option is exercised. The assumptions used to estimate the January 20, 2004 grant date present value were volatility (31.44%), risk-free rate of return (3.0%), dividend yield (.51%), and time to exercise (5.07 years). |

Aggregated Stock Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table indicates (i) stock options exercised by the Named Officers during the last fiscal year; (ii) the number of shares subject to exercise (vested) and unexercisable (unvested) stock options as of May 29, 2004; and (iii) the fiscal year-end value of “in-the-money” unexercised options.

12

| | | |

| |

| | Number of

Securities Underlying

Unexercised Options

at Fiscal Year-End

| | Value of Unexercised

In-the-Money Options

at Fiscal Year-End(1)(2)

| |

|---|

Name

| | | | Number

Of Shares

Acquired

On Exercise

| | Value

Realized

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Richard H. Wills | | | | | 0 | | | $ | 0 | | | | 442,500 | | | | 252,500 | | | $ | 4,980,125 | | | $ | 1,800,000 | |

| David E. Coreson | | | | | 42,000 | | | $ | 439,284 | | | | 74,000 | | | | 0 | | | $ | 674,115 | | | $ | 0 | |

| Colin L. Slade | | | | | 53,500 | �� | | $ | 621,598 | | | | 73,500 | | | | 98,500 | | | $ | 806,048 | | | $ | 843,090 | |

| Richard D. McBee | | | | | 25,000 | | | $ | 285,863 | | | | 53,500 | | | | 89,500 | | | $ | 519,328 | | | $ | 726,650 | |

| David S. Churchill | | | | | 2,500 | | | $ | 40,576 | | | | 121,000 | | | | 89,500 | | | $ | 1,329,809 | | | $ | 726,650 | |

| (1) | | The unrealized value of in-the-money options at year-end represents the aggregate difference between the market value on May 28, 2004 and the applicable exercise prices. The closing price of the Company’s Common Shares on the last trading day of the fiscal year was $31.56. |

| (2) | | “In-the-money” options are options whose exercise price was less than the market price of Common Shares at May 28, 2004. |

Cash Balance Plan

The Tektronix Cash Balance Plan is an integrated, account-based, defined benefit plan funded entirely by the Company. Employees who are officers of the Company participate in the Cash Balance Plan on the same basis as other employees. Employees outside the U.S. are covered under different retirement plans varying from country to country. The Cash Balance Plan will not be offered to new employees hired after July 31, 2004.

The Retirement Equalization Plan is a supplemental plan to the Tektronix Cash Balance Plan to provide covered officers and other covered employees with the total amount of retirement income that they would otherwise receive under the Cash Balance Plan but for legislated ceilings in compliance with certain sections of the Internal Revenue Code which limit retirement benefits payable from qualified plans.

Under the provisions of the Cash Balance Plan, a cash balance account is established for each participant at plan entry and increased over time with pay and interest credits. Pay credits are equal to 3.5% of eligible pay and are credited to each participant’s cash balance account as of each payroll. The plan is integrated with Social Security and pay credits increase to 7.0% of pay once a participant’s earnings exceed the Social Security wage base for that year. Interest credits are based on one-year Treasury constant maturity rates and are credited to a participant’s cash balance account as of each month end. At termination of employment, a participant (if vested) becomes entitled to receive his or her cash balance account in a single payment or have it converted to a monthly annuity payable for life (or over a joint lifetime with his or her beneficiary). Payment can be delayed until the participant reaches age 65.

Certain special provisions apply for employees who were active participants under the Tektronix Pension Plan as of December 31, 1997. Effective January 1, 1998 (the date the Tektronix Pension Plan was amended to become the Tektronix Cash Balance Plan), an initial cash balance account based on the benefit levels provided under the Tektronix Pension Plan was established for each eligible employee employed on or before December 31, 1997. In addition, pay credits for these employees are 4.5% instead of 3.5%, and pay credits increase to 9.0% of pay once a participant’s earnings exceed the Social Security wage base for that year. A special transition benefit applies for employees age 40 and vested as of December 31, 1997 or employees with 15 or more years of service as of December 31, 1997, regardless of age, and who qualify for early retirement at termination.

Estimated annual benefits payable upon retirement at normal retirement age (as defined under the applicable plan) to each of the Named Officers under the Tektronix Cash Balance Plan and the Retirement Equalization Plan are as follows: Mr. Wills: $22,821.00; Mr. Coreson: $60,405.60; Mr. Slade: $12,661.08; Mr. McBee: $5,070.96; and Mr. Churchill: $7,694.28.

13

Employment and Other Agreements

Each of the Named Officers has an Executive Severance Agreement or similar agreement with the Company pursuant to which the officer would receive severance pay in the event that his employment is terminated by the Company other than for cause, death or disability. Upon such termination, the officer would receive a severance payment generally equal to his annual base salary, benefits under certain of the Company’s incentive plans prorated for the portion of the year during which the officer was a participant and certain outplacement and insurance benefits. Mr. Wills would receive twice his annual base salary and twice his benefits at target under the Annual Performance Incentive Plan (APIP). No benefits are payable under the Executive Severance Agreement if the officer receives severance payments under any other agreement with the Company.

Messrs. Wills and Slade each have an employment agreement with the Company pursuant to which, in the event of a tender or exchange offer for more than 25% of the Company’s outstanding stock, the officer has agreed to remain with the Company until such offer has been terminated or abandoned or a change in control of the Company has occurred. Except for this agreement by the officer to remain so employed by the Company, either the Company or the officer may terminate the employment at any time, subject to the Company’s obligation to provide benefits specified in the agreement following a change in control. The agreements continue in effect until December 31 of each year, and are generally automatically renewed on an annual basis. Prior to a change in control, the Company may terminate any of the agreements if there is a change in the officer’s position other than as a result of a promotion. In the event the officer is terminated within 24 months following a change in control, the officer is entitled to a cash severance payment equal to three times his annual base salary based on the salary in effect prior to termination and certain relocation and insurance benefits. Mr. Wills would also receive three times his benefits at target under APIP. However, such amounts will not be payable if termination is due to death, normal retirement or voluntary action of the officer other than for good reason, or by the Company for cause or permanent disability.

ORGANIZATION AND COMPENSATION COMMITTEE

REPORT ON EXECUTIVE COMPENSATION

Organization and Compensation Committee

The Organization and Compensation Committee of the Board of Directors (the “Committee”) consists entirely of non-employee independent directors as defined by New York Stock Exchange rules and the Company’s independence guidelines. The Committee’s authority and responsibilities are set forth in a charter adopted by the Board of Directors. The charter is reviewed annually. The Committee approves compensation of executive officers, including the Chief Executive Officer. The Committee is responsible for approving executive compensation programs, including incentive compensation and benefit plans, and makes recommendations to the Board of Directors with respect to equity-based plans. The Committee administers the Company’s stock option programs. The Committee reviews and assists in the development of an organizational structure and programs that will attract, retain and promote executives to meet the present and future leadership needs of the Company, including succession planning for senior management positions. The Committee’s charter is available for review on the Company’s Web site at www.tektronix.com.

Overall Policy

The Board of Directors and the Committee believe that the Company’s total executive compensation programs should be related to short and long-term corporate performance and improvement in shareholder value. The Company has developed a total compensation strategy that ties a significant portion of executive compensation to achieving pre-established financial results. The overall objectives of these executive compensation programs are to:

| • | | Attract and retain talented executives; |

| • | | Motivate executives to achieve long-term business strategies while achieving near-term financial targets; and |

14

| • | | Align executive performance with Tektronix’ goals for delivering shareholder value. |

The Company has base pay, annual incentive and long-term incentive compensation programs for its executives, as well as retirement plans including 401(k) and cash balance plans. The Company also has an employee stock purchase plan. Each element of the program serves a somewhat different purpose, but in combination it enables the Company to support stated compensation policies and to offer compensation that is competitive with compensation offered by companies of similar size and complexity within high technology electronics and similar industries. The Committee uses comparative information from a group of companies in the high technology industry for establishing executive compensation goals. The Committee also relies on periodic advice from outside compensation and benefits consultants.

Base Salaries

Base salaries for executive officers are initially determined by evaluating the responsibilities of the position and the experience of the individual and by reference to the competitive marketplace for corporate executives, including a comparison to base salaries for comparable positions at other similarly sized high technology companies. Median levels of base pay provided by comparator companies form the primary reference in determining the salaries of executive officers.

Salary adjustments are determined by evaluating the performance of the Company and each executive officer and also take into account any new responsibilities, as well as salaries for comparable positions at peer companies. The Committee, when appropriate, also considers non-financial performance measures that focus attention on improvement in management processes such as inventory turns, timely new product introductions and development of key contributors.

Incentive Compensation

Annual Performance Incentive Plan. Tektronix’ executive officers are eligible to participate in the Company’s Annual Performance Incentive Plan (APIP), an annual cash incentive compensation plan. For the last fiscal year, Company performance objectives were established at the beginning of the fiscal year. Participants’ performance measurements had established thresholds and targets that determined the amount of cash payments under the plan. The Company’s performance objectives for the last fiscal year were specified levels of net sales and operating income before income taxes (excluding nonrecurring items at the discretion of the Committee for executive officers or the Chief Executive Officer for non-officers). Incentive target performance is based on the Company’s annual incentive plan target approved by the Board of Directors. The Committee may also establish target incentive opportunities for individual positions based on the responsibilities of the position, the ability of the position to impact financial and corporate goals and a comparison of incentives provided to comparable positions at other similarly sized electronics companies, with incentives targeted to provide total annual cash compensation at the median level provided by comparable companies.

Results Sharing Plan. Most employees of Tektronix, not including executive officers, commissioned sales people and other participants in APIP, participate in the Results Sharing Plan. In general, benefits from the Results Sharing Plan are based on consolidated operating income, to the extent that operating income before results sharing and other incentives (excluding nonrecurring items at the discretion of the Chief Executive Officer) exceeds a threshold amount that is determined in advance for each year. Accordingly, the Results Sharing Plan requires employees to produce a predetermined threshold of operating income for the shareholders before receiving any benefits. Payments under this plan are calculated as a percent of base pay, and are made semi-annually.

Stock Options and Restricted Stock. To align shareholder and executive officer interests and to create incentives for improving shareholder value, the long-term component of the Company’s executive compensation program uses stock option awards and, on a selective basis, restricted stock grants to employees, including executive officers. Stock options provide rewards to executives upon creation of incremental shareholder value and the attainment of long-term goals. The Committee expects that stock option awards will be made annually to executive officers, while restricted stock may be granted on a periodic basis. Stock option awards or restricted

15

stock grants are made from the 2002 Stock Incentive Plan. All executive stock option awards or restricted grants are from shareholder approved plans.

Stock options to executive officers are generally awarded annually at the same time that awards are made to key contributors who are not executive officers. The size of stock option award levels (including awards to the Chief Executive Officer) reflect job responsibilities and are based in part on compensation data from a comparative group of electronics companies. Awards are designed to provide compensation opportunities in the range of the median of awards for similar positions in the high technology electronics industry for slightly higher performance levels. The Company also grants stock options at fair market value to new executive officers as a further inducement to join the Company. Stock options provide incentive for the creation of shareholder value over the long term because the full benefit of the compensation package cannot be realized unless the price of Company Common Shares appreciates over a specified number of years. Options awarded during the last fiscal year were awarded at the fair market value of Tektronix Common Shares on the grant date. These options have a ten-year term and fully vest over four years from the grant date (25% each year).

Restricted stock awards have been granted to executive officers under its shareholder approved plans when circumstances warrant providing such incentives to promote Company objectives. Restricted stock is subject to forfeiture and may not be disposed of by the recipient until certain restrictions established by the Committee lapse. Typically, recipients of restricted stock are not required to provide consideration other than the rendering of services and, in some cases, recipients must also achieve specified performance levels.

Stock Ownership Guidelines

Key executives are encouraged to own stock. The Chief Executive Officer is encouraged to own Tektronix stock equal to five times his annual base salary. Other executive officers are encouraged to own three times their base salary. It is expected that they will make substantial progress towards achieving these ownership levels within five years of election to their positions.

Retirement Plans

The Company makes contributions for eligible employees (including executive officers) under its Cash Balance Plan (see “Cash Balance Plan”) and its 401(k) Plan. Under the 401(k) Plan, eligible employees may elect to have up to 50% of their pay contributed to the plan, subject to certain tax limitations ($12,000 in calendar year 2003 and $13,000 in 2004). The Company makes matching contributions up to 4% and fixed contributions equal to 2% of the participant’s compensation, subject to tax limitations. All fixed contributions by the Company are invested entirely in Common Shares of the Company. All matching contributions are in cash and may be invested in funds of the employee’s choice, including Common Shares of the Company.

Deferred Compensation Plan

Senior executives can elect to defer up to 90% of their compensation, all bonuses including stock bonuses, and option gains. Cash amounts credited to the Deferred Compensation Plan earn a rate of return equal to the rate of return on earnings indices selected in advance by the executive. Tektronix Common Shares and stock option gains that are deferred will earn a rate of return based upon the performance of Tektronix Common Shares. Deferred amounts will be paid in a lump sum or in annual installments for up to 15 years, as elected by the executive.

Employee Stock Purchase Plan

All qualifying employees, including executive officers, can participate in the Tektronix, Inc. Employee Stock Purchase Plan. Under this plan, employees can acquire Common Shares of the Company through regular payroll deductions of up to 10% of base pay plus commissions, subject to the limitation that not more than $25,000 in value of stock may be purchased annually. The purchase price of the shares is the lesser of 85% of the closing market price of the Common Shares as of the first or last day of a six month offering period.

16

Compensation of the Chief Executive Officer

In June 2003, the Committee set Richard H. Wills’ salary at $600,000. When setting the base salary, the Committee took into account a comparison of base salaries, perquisites and incentives for chief executive officers of peer companies, the Company’s success in meeting its performance objectives and preserving shareholder value in the face of current market conditions, the assessment by the Committee of Mr. Wills’ individual performance and contributions, and current economic conditions. The Committee believes that Mr. Wills’ annual base salary falls within the competitive range of salaries for similar positions at similar companies. Mr. Wills’ participation in the Annual Performance Incentive Plan (APIP) for the last fiscal year was tied to the Company’s achieving pre-established levels of net sales and operating income before taxes. The Committee believes that Mr. Wills’ targeted APIP level was within the middle range of bonus opportunities for similar positions at similar companies. Mr. Wills’ APIP award for fiscal year 2004 was $1,192,300, which is approximately 200% of his target APIP award. In January 2004, Mr. Wills was granted stock options for 100,000 shares and 15,000 restricted shares. The restricted shares vest one-half on January 20, 2006, and one-half on January 20, 2007.

Deductibility of Compensation

Section 162(m) of the Internal Revenue Code limits to $1,000,000 per person the amount that the Company may deduct for compensation paid to any of its most highly compensated officers. The $1,000,000 cap on deductibility will not apply to compensation that qualifies as “performance-based compensation”. Under the regulations, performance-based compensation includes compensation received through the exercise of a non-statutory stock option that meets certain requirements. This option exercise compensation is equal to the excess of the market price at the time of exercise over the option price and, unless limited by Section 162(m), is generally deductible by the Company. It is the Company’s general intention to grant options that meet the requirements of the regulations. The Company believes that compensation paid under its stock incentive plan qualifies as deductible under Section 162(m). Qualifying compensation for deductibility under Section 162(m) is one of many factors the Committee considers in determining executive compensation arrangements. Deductibility will be maintained when it does not conflict with compensation objectives.

Organization and Compensation Committee report submitted by:

| | Gerry B. Cameron, Chairman

Pauline Lo Alker

David N. Campbell

Frank C. Gill

Merrill A. McPeak |

REPORT OF THE AUDIT COMMITTEE

The Audit Committee assists the Board in its oversight of the Company’s financial reporting, internal control processes, legal compliance, and independent and internal auditors. Each member of the Committee is an independent director as determined by the Board of Directors, based on the New York Stock Exchange listing rules and the Company’s independence guidelines. Each member of the Committee also satisfies the Securities and Exchange Commissions additional independence requirement for members of audit committees. In addition, the Board of Directors has determined that A. Gary Ames is an “audit committee financial expert,” as defined by SEC Rules.

The Audit Committee met eight times during fiscal year 2004. The Committee operates pursuant to a written charter approved by the Board of Directors. The Charter is reviewed annually.

The Audit Committee, the Board of Directors, management, and the auditors each play a role in maintaining the integrity of the Company’s financial reports and internal control processes.

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements. Management is also responsible for establishing and maintaining internal controls and procedures to assure compliance with Generally Accepted Accounting Principles and applicable laws and regulations.

17

The independent auditors are accountable to the Audit Committee, and are responsible for performing an independent audit of the consolidated financial statements in accordance with auditing standards generally accepted in the United States of America.

The Audit Committee stands at the intersection of management, the auditors, and the Board of Directors. Committee members have the experience and training to understand financial statements, and they remain informed of accounting and auditing developments relevant to the Company. The Committee communicates to management and the auditors its goals and expectations in accordance with its delegated responsibilities, and sets the tone for teamwork and effective communication through a supportive but inquisitive relationship with management and the auditors. Each group meets regularly to ensure that expectations are understood and communications are open.

The Audit Committee fulfills its responsibilities primarily by monitoring the participants and processes involved, and reporting to the Board of Directors. The Audit Committee selects, hires, evaluates and discharges the independent auditors and the internal auditor. The Audit Committee meets with the internal and independent auditors, with and without management present, to discuss the results of their examinations, the adequacy of internal controls, and the quality of the Company’s financial reporting. When necessary, the Committee obtains assistance from other outside advisors.

While the Audit Committee does not perform the roles of the independent auditor or management or conduct its own audit, it performs its duties with diligence and appropriate inquiry when reviewing information provided by management and the independent and internal auditors. The Committee will, when necessary, challenge management and the auditors and take appropriate action.

As part of its oversight role, the Audit Committee has reviewed and discussed the Company’s audited financial statements for the year ended May 29, 2004 with management and with representatives of Deloitte & Touche LLP, the Company’s independent auditors. It has also discussed with representatives of Deloitte & Touche the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). The Audit Committee received the written disclosures and the letter from Deloitte & Touche required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and discussed with them their independence. The Committee also concluded that Deloitte & Touche’s provision of non-audit services to the Company, as described in the next section, is compatible with Deloitte & Touche’s independence.

Based on these reviews and discussions, the Audit Committee recommended to the Board of Directors, and the Board of Directors approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the last fiscal year ended May 29, 2004, for filing with the Securities and Exchange Commission.

Audit Committee report submitted by:

| | Merrill A. McPeak, Chairman

A. Gary Ames

Gerry B. Cameron

David N. Campbell

Cyril J. Yansouni |

18

INFORMATION CONCERNING AUDITORS

Independent Accountants

The Board of Directors has selected the accounting firm of Deloitte & Touche LLP as the Company’s independent accountants for the 2004 fiscal year and for the current fiscal year 2005. A representative of Deloitte & Touche is expected to be present at the annual meeting, will have the opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

Fees Paid To Deloitte & Touche LLP

All services to be provided by Deloitte & Touche are required to be approved by the Audit Committee, in advance. The audit and audit related services are approved annually. With respect to services for other than audit and audit related services, at least annually, the independent auditor submits to the Audit Committee, for its approval, anticipated engagements for the ensuing year, either at the time that the Audit Committee reviews and approves the annual audit engagement, or at a time specifically scheduled for reviewing such other services. Quarterly, and in conjunction with the Audit Committee’s regularly scheduled meetings, the independent auditor presents to the Audit Committee for pre-approval any proposed engagements not previously reviewed and approved. In the event that an audit or non-audit service requires approval prior to the next regularly scheduled meeting of the Audit Committee, the auditor must contact the Chairman of the Audit Committee to obtain such approval. The approval will be reported to the Audit Committee at its next regularly scheduled meeting.

The following table shows the fees that the Company paid or accrued for the audit and other services provided by Deloitte & Touche LLP for fiscal years 2003 and 2004 and approved by the Audit Committee in accordance with its policies:

| | | | 2003

| | 2004

|

|---|

| Audit Fees | | | | $ | 1,395,273 | | | $ | 1,412,500 | |

| Audit-Related Fees | | | | | 189,200 | | | | 230,852 | |

| Tax Fees | | | | | 296,918 | | | | 167,294 | |

| Total | | | | $ | 1,881,391 | | | $ | 1,810,646 | |

Audit Fees. This category includes fees for services rendered for the audit of the annual financial statements included in Form 10-K and review of the quarterly financial statements included in Form 10-Q. In addition, amounts include fees for statutory filings and audits, issuance of consents and assistance with and review of documents filed with the Securities and Exchange Commission.

Audit Related Fees. This category includes fees for services which include employee benefit plan audits, due diligence related to mergers and acquisitions, accounting consultation concerning financial accounting and reporting standards and other attest services.

Tax Fees. This category includes fees for tax compliance, tax planning and tax advice.

19

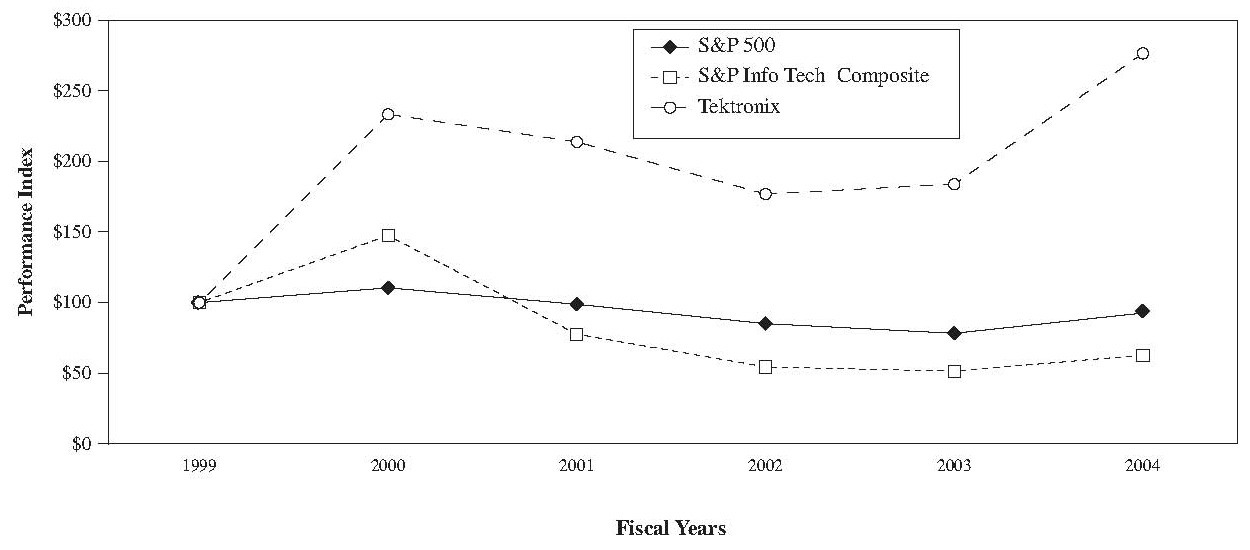

PERFORMANCE GRAPH

The graph below compares the cumulative total shareholder return on the Company’s Common Shares with that of the Standard & Poor’s 500 Stock Index and the Standard & Poor’s Information Technology Composite Index over a period of five years commencing on May 31, 1999 and ending on May 31, 2004. The graph assumes $100 invested on May 31, 1999 in Tektronix Common Shares and $100 invested at that time in each of the S&P indexes. The comparison assumes that all dividends are reinvested.

Comparison of Five-Year Cumulative Total Return

Fiscal Year

| | Tektronix

| | S&P 500

| | S&P Info-Tech

Composite

|

|---|

| 1999 | | 100.00 | | 100.00 | | 100.00 |

| 2000 | | 233.31 | | 110.48 | | 147.50 |

| 2001 | | 213.77 | | 98.82 | | 77.63 |

| 2002 | | 176.88 | | 85.14 | | 54.51 |

| 2003 | | 183.85 | | 78.27 | | 51.50 |

| 2004 | | 276.37 | | 92.62 | | 62.81 |

20

EQUITY COMPENSATION PLAN INFORMATION

The Company maintains stock option plans for selected employees. Under the terms of the plans, stock options are granted at an option price not less than the market value at the date of grant. Options granted between January 1, 1997 and January 1, 2000 generally vest over two years and expire five to ten years from the date of grant. All other options granted generally vest over four years and expire ten years from the date of grant. The following table sets forth information regarding equity compensation plans of the Company as of May 29, 2004:

| | | | Equity Compensation Plan Information

| |

|---|

Plan Category

| | | | Number of Securities to be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights

| | Weighted Average

Exercise Price of

Outstanding Options,

Warrants and Rights

| | Number of Securities

Remaining Available

for Future Issuance

(excluding shares

listed in (a))

|

|---|

| | | | (a)

| | (b)

| | (c)

|

|---|

Equity Compensation Plans Approved by Shareholders

| | | | | | | | | | | | | | |

| 2002 Stock Incentive Plan | | | | | 4,638,333 | | | $ | 18.34 | | | | 3,977,960 | |

| 1998 Stock Option Plan | | | | | 2,078,460 | | | $ | 21.92 | | | | 0 | |

| 1989 Stock Incentive Plan | | | | | 4,461,827 | | | $ | 29.06 | | | | 0 | |

| | Employee Stock Purchase Plan | | | | | 107,454 | | | $ | 26.15 | | | | 440,327 | |

| Equity Compensation Plan Not Approved by Shareholders

2001 Stock Option Plan(1) | | | | | 36,282 | | | $ | 25.69 | | | | 141,453 | |

| | Total | | | | | 11,322,356 | | | $ | 23.31 | | | | 4,559,740 | |

| (1) | | This plan was adopted by the Board of Directors for the sole purpose of making grants to new non-officer employees who join the Company as a result of acquisitions, and grants are limited to such non-officer employees. Options with a term of 10 years were granted at fair market value at the time of grant. The terms of the options are substantially the same as the options granted under plans approved by shareholders. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers, directors and persons who own more than 10% of the Company’s Common Shares to file reports of ownership and changes in ownership with the Securities and Exchange Commission (“SEC”) and the New York Stock Exchange. Executive officers, directors and beneficial owners of more than 10% of the Company’s Common Shares are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on a review of the copies of such forms received by the Company and on written representations from certain reporting persons, the Company believes that all filing requirements applicable to its executive officers, directors, and 10% shareholders were complied with during the last fiscal year.

OTHER MATTERS

Although the Notice of Annual Meeting of Shareholders provides for the transaction of such other business as may properly come before the meeting, the Board of Directors has no knowledge of any matters to be presented at the meeting other than those referred to in this proxy statement. However, the enclosed proxy gives discretionary authority in the event that any other matters should be presented.

HOUSEHOLDING

We have adopted a procedure approved by the Securities and Exchange Commission (SEC) called “householding.” Under this procedure, stockholders of record who have the same address and last name and

21

do not participate in electronic delivery of proxy materials will receive only one copy of the Annual Report and Proxy Statement. This procedure will reduce the Company’s printing costs and postage fees.

Shareholders who participate in householding will continue to receive separate proxy forms. Householding will not affect your dividend check mailings.

Any shareholder who would prefer to have a separate copy of the Proxy Statement and Annual Report delivered to him or her at the shared address for this and future years may elect to do so by calling toll free, (800) 542-1061, or by writing to ADP, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. A copy of the materials will be sent promptly to the shareholder following receipt of such notice.

Shareholders whose shares of common stock are held partially in registered name and partially by a broker or other nominee may receive duplicate deliveries of the Proxy Statement and Annual Report. Certain brokers and nominees have procedures in place to discontinue duplicate mailings upon a shareholder’s request or upon the shareholder’s implied consent not to receive duplicate mailings following notice from the broker. Shareholders desiring to eliminate such duplicate mailings should contact their broker or nominee for more information.

SHAREHOLDER PROPOSALS

The Company’s bylaws require shareholders to give the Company advance notice of any proposal or director nomination to be submitted at any meeting of shareholders. The bylaws prescribe the information to be contained in any such notice, and a copy of the relevant provisions of the bylaws will be provided to any shareholder upon written request to the Secretary at the Company’s principal executive offices. For any shareholder proposal or nomination to be considered at the 2005 Annual Meeting of Shareholders, the shareholder���s notice must be received at the Company’s principal executive office no later than July 5, 2005. In addition, SEC rules require that any shareholder proposal to be considered for inclusion in the Company’s proxy statement for the 2005 Annual Meeting of Shareholders must be received at the Company’s principal executive office no later than April 21, 2005.

INFORMATION AVAILABLE TO SHAREHOLDERS

The Company’s 2004 Annual Report on Form 10-K is being mailed to shareholders with this proxy statement. The Company’s Annual Report on Form 10-K is also available on its Web site at www.tektronix.com.

| | BY ORDER OF THE BOARD OF DIRECTORS  James F. Dalton Vice President, General Counsel

and Secretary |

August 19, 2004

22

TEKTRONIX, INC.

P.O. BOX 500, D/S 50-LAW

14200 SW KARL BRAUN DRIVE

BEAVERTON, OR 97077

| Your Internet or telephone vote authorizes the named proxies

to vote these shares in the same manner as if you marked,

signed and returned your proxy card in the enclosed envelope.

VOTE BY INTERNET -http://www.tektronix.com/proxyvote

Use the Internet to transmit your voting instructions and for electronic delivery of information 24 hours a day up until 8:59 P.M. PDT (11:59 P.M. EDT) Wednesday, September 22, 2004. Have your proxy card in hand when you access the Web site and then follow the instructions listed to submit your electronic vote. Costs normally associated with electronic access, such as Internet usage and telephone charges, will be your responsibility. |

| |

| |

| VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions 24 hours a day up until 8:59 P.M. PDT (11:59 P.M. EDT) Wednesday, September 22, 2004. Have your proxy card in hand when you call and then follow the simple directions provided. |

| |

| VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Tektronix, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. |

| |

| PLEASE DO NOT RETURN THE PROXY CARD BELOW IF YOU VOTE BY INTERNET OR TELEPHONE |

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: |

| TEKTR1 | KEEP THIS PORTION FOR YOUR RECORDS |

DETACH AND RETURN THIS PORTION ONLY |

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

|

| TEKTRONIX, INC. | | | |

| | | | |

| | | | | |

| 1. | ELECTION OF DIRECTORS | For

All

¡ | Withhold

All

¡ | For All

Except

¡ | | To withhold authority to vote, mark

“For All Except” and write the

nominee’s number on the line below.

_________________________ |

| | Nominees: 01) David N. Campbell

02) Merrill A. McPeak

03) Richard H. Wills |

| | |

| | |

| 2. | DISCRETIONARY MATTERS |

| | The Proxies are authorized to vote in their discretion upon any other matters properly coming before the meeting or any

adjournment or adjournments thereof. |

| | |

| Please follow the instructions above to vote by Internet or telephone, or mark, sign (exactly as your name(s) appear above), and

date this card and mail promptly in the postage-paid, return envelope provided. When shares are held jointly, both should sign.

When signing as an attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please

sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by

authorized person. |

| | |

| | Yes | No | | |

| | | | | |