SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________

FORM 10-K

_________________________________________________

|

| |

| (Mark One) |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014 or

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 1-5353

_________________________________________________

TELEFLEX INCORPORATED

(Exact name of registrant as specified in its charter)

_________________________________________________

|

| | |

| Delaware | | 23-1147939 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification no.) |

| | | |

| 550 East Swedesford Road, Suite 400, Wayne, Pennsylvania | | 19087 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (610) 225-6800

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | | Name of Each Exchange On Which Registered |

| Common Stock, par value $1 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

NONE

_________________________________________________

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨ |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

|

| | | | | | |

Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x |

| The aggregate market value of the Common Stock of the registrant held by non-affiliates of the registrant (32,782,693 shares) on June 27, 2014 (the last business day of the registrant’s most recently completed fiscal second quarter) was $3,447,755,823 (1) . The aggregate market value was computed by reference to the closing price of the Common Stock on such date. |

| The registrant had 41,442,707 Common Shares outstanding as of February 13, 2015. |

DOCUMENT INCORPORATED BY REFERENCE:

|

|

| Certain provisions of the registrant’s definitive proxy statement in connection with its 2014 Annual Meeting of Stockholders, to be filed within 120 days of the close of the registrant’s fiscal year, are incorporated by reference in Part III hereof. |

| (1) For the purposes of this definition only, the registrant has defined “affiliate” as including executive officers and directors of the registrant and owners of more than five percent of the common stock of the registrant, without conceding that all such persons are “affiliates” for purposes of the federal securities laws. |

TELEFLEX INCORPORATED

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

TABLE OF CONTENTS

|

| | |

| | | Page |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

Subsidiaries of the Company | |

Consent of Independent Registered Public Accounting Firm | |

| CERTIFICATION OF CHIEF EXECUTIVE OFFICER, PURSUANT TO RULE 13a-14(a) UNDER THE EXCHANGE ACT | |

| CERTIFICATION OF CHIEF FINANCIAL OFFICER, PURSUANT TO RULE 13a-14(a) UNDER THE EXCHANGE ACT | |

| CERTIFICATION OF CHIEF EXECUTIVE OFFICER, PURSUANT TO RULE 13a-14(b) UNDER THE EXCHANGE ACT | |

| CERTIFICATION OF CHIEF FINANCIAL OFFICER, PURSUANT TO RULE 13a-14(b) UNDER THE EXCHANGE ACT | |

Information Concerning Forward-Looking Statements

All statements made in this Annual Report on Form 10-K, other than statements of historical fact, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “will,” “would,” “should,” “guidance,” “potential,” “continue,” “project,” “forecast,” “confident,” “prospects” and similar expressions typically are used to identify forward-looking statements. Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about our business and the industry and markets in which we operate. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or implied by these forward-looking statements due to a number of factors, including:

| |

| • | changes in business relationships with and purchases by or from major customers or suppliers, including delays or cancellations in shipments; |

| |

| • | demand for and market acceptance of new and existing products; |

| |

| • | our ability to integrate acquired businesses into our operations, realize planned synergies and operate such businesses profitably in accordance with expectations; |

| |

| • | our ability to effectively execute our restructuring programs; |

| |

| • | our inability to realize savings resulting from restructuring plans and programs at anticipated levels; |

| |

| • | the impact of recently passed healthcare reform legislation and changes in Medicare, Medicaid and third-party coverage and reimbursements; |

| |

| • | competitive market conditions and resulting effects on revenues and pricing; |

| |

| • | increases in raw material costs that cannot be recovered in product pricing; |

| |

| • | global economic factors, including currency exchange rates, interest rates and sovereign debt issues; |

| |

| • | difficulties entering new markets; and |

| |

| • | general economic conditions. |

For a further discussion of the risks relating to our business, see Item 1A “Risk Factors” in this Annual Report on Form 10-K. We expressly disclaim any obligation to update these forward-looking statements, except as otherwise specifically stated by us or as required by law or regulation.

PART I

Teleflex Incorporated is referred to herein as “we,” “us,” “our,” “Teleflex” and the “Company.”

THE COMPANY

Teleflex is a global provider of medical technology products that enhance clinical benefits, improve patient and provider safety and reduce total procedural costs. We primarily design, develop, manufacture and supply single-use medical devices used by hospitals and healthcare providers for common diagnostic and therapeutic procedures in critical care and surgical applications. We market and sell our products to hospitals and healthcare providers worldwide through a combination of our direct sales force and distributors. Because our products are used in numerous markets and for a variety of procedures, we are not dependent upon any one end-market or procedure. We manufacture our products at 26 manufacturing sites, with major manufacturing operations located in the Czech Republic, Germany, Malaysia, Mexico and the United States.

We are focused on achieving consistent, sustainable and profitable growth and improving our financial performance by increasing our market share and improving our operating efficiencies through:

| |

| • | development of new products and product line extensions; |

| |

| • | investment in new technologies and broadening their applications; |

| |

| • | expansion of the use of our products in existing markets and introduction of our products into new geographic markets; |

| |

| • | achievement of economies of scale as we continue to expand by leveraging our direct sales force and distribution network for new products, as well as increasing efficiencies in our sales and marketing and research and development structures and our manufacturing and distribution facilities; and |

| |

| • | expansion of our product portfolio through select acquisitions, licensing arrangements and business partnerships that enhance, extend or expedite our development initiatives or our ability to increase our market share. |

Our research and development capabilities, commitment to engineering excellence and focus on low-cost manufacturing enable us to consistently bring cost effective, innovative products to market that improve the safety, efficacy and quality of healthcare. Our research and development initiatives focus on developing new, innovative products for existing and new therapeutic applications as well as enhancements to, and line extensions of, existing products. We introduced 16 new products and line extensions during 2014. Our portfolio of existing products and products under development consists primarily of Class I and Class II devices, which require 510(k) clearance by the United States Food and Drug Administration, or FDA, for sale in the United States. We believe that 510(k) clearance reduces our research and development costs and risks, and typically results in a shorter timetable for new product introductions as compared to the premarket approval, or PMA, process that would be required for Class III devices. See "Government Regulation" below.

During 2014, we completed the following acquisitions, which were accounted for as business combinations:

| |

| • | Mayo Healthcare Pty Limited, ("Mayo Healthcare"), a distributor of medical devices and supplies primarily in the Australian market, which complements our anesthesia product portfolio, and |

| |

| • | the assets of Mini-Lap Technologies, Inc. ("Mini-Lap"), a developer of micro-laparoscopic instrumentation, which complements our surgical product portfolio. |

OUR SEGMENTS

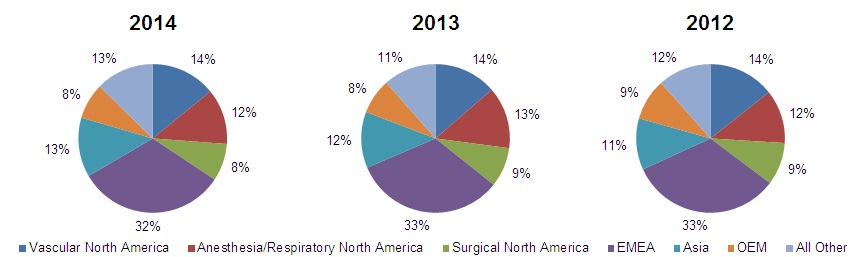

Effective January 1, 2014, we realigned our operating segments due to changes in the Company’s internal financial reporting structure. The Vascular North America, Anesthesia/Respiratory North America and Surgical North America businesses, which previously comprised much of our former Americas reportable segment, are now separate reportable segments. The results of all prior comparative periods presented in this Annual Report on Form 10-K have been restated to reflect the new reporting structure. We conduct our operations through six reportable segments: Vascular North America, Anesthesia/Respiratory North America, Surgical North America, EMEA (Europe, the Middle East and Africa), Asia and OEM. The following charts depict our net revenues by segment as a percentage of our total consolidated net revenues for the years ended December 31, 2014, 2013 and 2012.

Vascular North America: Our vascular access products facilitate a variety of critical care therapies, including the administration of intravenous medications and other therapies and the measurement of blood pressure and taking of blood samples through a single puncture site. Our vascular access devices, which are primarily catheters and related devices, principally consist of the following products:

| |

| • | ARROW central venous catheters, or CVCs: The ARROW CVCs are inserted in the neck or shoulder area and come in multiple lengths and up to four channels, or lumens. The ARROW CVC has a pressure injectable option which gives clinicians who perform contrast-enhanced CT scans the ability to use an indwelling (in the body) pressure injectable ARROW CVC to inject contrast dye for the scan without having to insert a second catheter. |

| |

| • | Arrow EZ-IO system: EZ IO, which was added to our vascular product portfolio through our acquisition of Vidacare Corporation in December 2013, provides immediate vascular access for the delivery of medications and fluids via the intraosseous, or in the bone, route when traditional vascular access is difficult or impossible. In emergency situations, EZ IO enables fast access to deliver lifesaving therapies to help stabilize a patient until a traditional catheter can be inserted. |

| |

| • | ARROW jugular axillo-subclavian central catheters, or JACCs, with Chlorag+ard® technology: JACCs are inserted in the neck or shoulder area and provide an alternative to traditional acute CVCs and peripheral central venous access. Introduced in 2013, this CVC for acute or long-term use combines antimicrobial and antithrombogenic protection with smaller external diameter sizes. This product is well suited for patients with renal issues, chronic patients with poor peripheral access or those with a history of or risk for venous thrombosis. |

| |

| • | ARROW peripherally inserted central catheters, or PICCs: The ARROW PICCs are soft, flexible catheters that are inserted in the upper arm and advanced into a vein that carries blood to the heart to administer various types of intravenous medications and therapies. ARROW PICCs have a pressure injectable option that can withstand the higher pressures required by the injection of contrast media for CT scans. |

| |

| • | ARROW VPS: The ARROW VPS is an advanced vascular positioning system that facilitates precise placement of a PICC or CVC within the heart. The ARROW VPS analyzes multiple metrics, in real time, from its biosensor to help clinicians navigate through the circulatory system and precisely identify the correct catheter tip placement in the heart. Cleared by the FDA as an alternative to chest x-ray confirmation, the ARROW VPS can help to shorten hospital stays while lowering costs associated with catheter insertion procedures. In 2013, we launched the next generation of our ARROW VPS, the ARROW VPS G4, which provides further enhancements to our VPS technology, such as the ability to provide information as to the final catheter position, improved sterile field capability and integration with hospital data management systems. |

| |

| • | ARROW arterial catheterization sets: These sets facilitate arterial pressure monitoring and blood withdrawal for glucose, blood-gas and electrolyte measurement in a wide variety of critical care and intensive care settings. |

| |

| • | ARROW percutaneous sheath introducers: These introducers are used to insert cardiovascular and other catheterization devices into the vascular system during critical care procedures. |

The large majority of our CVCs are treated with the ARROWg+ard or ARROWg+ard Blue Plus antimicrobial surface treatments to reduce the risk of catheter related bloodstream infection. ARROWg+ard Blue Plus provides antimicrobial treatment of certain parts of a catheter. The Chlorag+ard technology, an option on our PICC and JACC catheters, provides both antimicrobial and antithrombogenic protection for up to 30 days, reducing the risk of catheter-related infection, thrombosis and occlusion. These surface treatments help reduce healthcare acquired conditions, such as Catheter Related Blood Stream Infection (CRBSI), potentially saving hospitals significant costs under pay for performance standards, which are standards that provide incentives to clinicians for better health outcomes.

We also offer many of our vascular access catheters in a Maximal Barrier Precautions Tray. The tray is available for CVCs, PICCs and multi access catheters (MAC) and includes a full body drape, coated or non-coated catheter and other accessories. These kits are designed to assist healthcare providers in complying with guidelines for reducing catheter-related bloodstream infections that have been established by a variety of health regulatory agencies, such as the Centers for Disease Control and Prevention and the Joint Commission on the Accreditation of Healthcare Organizations. Our ErgoPACK system provides components which are packaged in the tray in the order in which they will be needed during the procedure and incorporates features intended to enhance ease of use and patient and provider safety.

We believe that our vascular product portfolio is well-positioned to enable hospitals to effectively address the financial and clinical issues associated with vascular access. Our products can reduce injuries to the healthcare provider, expedite placement of a central venous catheter, reduce patient exposure to x-rays, expedite infusion of medication and reduce the risk of catheter related infection, thrombosis and occlusion for the patient. Moreover, we believe our products can help hospitals achieve reduced costs, improved quality and patient outcomes, decreased length of stay and increased satisfaction.

Anesthesia/Respiratory North America: Our anesthesia/respiratory segment provides products for clinicians working primarily in emergency rooms, surgery and critical care settings. The product portfolio includes a variety of airway management, pain management and respiratory care products that are designed to help eliminate complications and improve procedural efficiencies. Our airway management products and related devices consist principally of the following:

| |

| • | LMA Airways: LMA laryngeal masks are used by anesthesiologists and emergency responders to establish an airway to channel anesthesia gas or oxygen to a patient's lungs during surgery or trauma. The LMA Supreme Airway is a second generation airway that features an integrated drain tube to channel fluid and gas safely away from the airway, enabling physicians to use an LMA laryngeal mask in more advanced procedures. |

| |

| • | LMA Atomization: The LMA Atomization portfolio includes products to facilitate intranasal delivery of medications. The inner cavities of the nose provide an absorptive surface that is highly vascular with direct access to the central nervous system. The advantages of intranasal administration include rapid onset, safety and patient comfort. The LMA MAD Nasal is an intranasal atomization device that is designed to be a safe and painless way to deliver medication to a patient's blood stream without an intravenous line or needle. |

| |

| • | RUSCH Endotracheal Tubes and RUSCH Laryngoscopy: We offer a broad range of RUSCH products to facilitate and support endotracheal intubation in multiple settings (surgery, critical care and emergency settings). Endotracheal intubation is commonly used to open the airway to administer oxygen, medication or anesthesia. We provide a broad range of products for laryngoscopy, a procedure that is primarily used to obtain a view of the airway to facilitate tracheal intubation during general anesthesia or cardiopulmonary resuscitation (CPR). In 2014, we introduced the RUSCH DispoLED Laryngoscope Handle. This single-use handle helps facilities comply with standards designed to reduce the risk of patient cross-contamination during intubation. |

| |

| • | ISO-Gard Caregiver Safety: The ISO-Gard Mask with ClearAir Technology helps to reduce clinician exposure to hazardous waste anesthetic gases (WAG), which are commonly used in surgical procedures. The ISO-Gard Mask is designed to reduce WAG within a caregiver's breathing zone to minimize the cumulative effect of low-level exposure to these hazardous gases in the post anesthesia care unit. By providing a means to reduce the amount of WAG within the breathing zone of the caregiver, hospitals can better comply with OSHA requirements and the National Institute for Occupational Safety and Health’s recommendations for workplace safety. |

Our pain management products are designed to provide pain control during a broad range of surgical and obstetric procedures, thereby helping clinicians better manage each patient’s individual pain while reducing complications and associated costs. Our pain management portfolio consists principally of the following:

| |

| • | ARROW Epidural Catheters, Needles and Kits: We offer a broad range of ARROW epidural products to facilitate epidural analgesia. Epidural analgesia may be used separately for pain management, as an adjunct to general anesthesia, as a sole technique for surgical anesthesia and for post-operative pain management. The ARROW FlexTip Plus epidural catheter is clinically proven to significantly reduce complications commonly associated with epidural catheters. |

| |

| • | ARROW Peripheral Nerve Block (PNB) Catheters, Pumps, Needles and Kits: The ARROW PNB products are used by anesthesiologists to provide localized pain relief by injecting anesthetics to deliberately interrupt the signals traveling along a nerve. Nerve blocks are used in a variety of different procedures, including orthopedics, and can last for hours or days. The ARROW Stimucath and FlexBlock catheters allow for location of the nerves and delivery of the anesthetic. The ARROW Autofuser Ambulatory Pain Pump is a disposable anesthetic pump used in conjunction with the ARROW PNB catheters that facilitates multiple days of post-operative pain management. |

Our respiratory products are used in a variety of care settings and include oxygen therapy products, aerosol therapy products, spirometry products, and ventilation management products. Our Hudson RCI brand has been a leader in respiratory care for more than 65 years. In 2014, for the third consecutive year, we were among the six companies to receive the Zenith Award awarded by the American Association for Respiratory Care in recognition of the quality products, programs and support provided to the respiratory community. Our respiratory products consist principally of the following:

| |

| • | Hudson RCI Oxygen Therapy: Supplemental oxygen is one of the most widely used therapies for people admitted to the hospital. It is also frequently used for patients with chronic lung disease who live at home. Oxygen is administered to treat hypoxemia (low oxygen levels in the blood) and to decrease symptoms associated with hypoxemia. We offer a broad range of Hudson RCI Oxygen Therapy products to facilitate the delivery of oxygen, including nasal cannulas, nasal catheters, masks and tubing. |

| |

| • | Hudson RCI Aerosol Therapy: Aerosol therapy is used in the treatment of bronchopulmonary disease and allows the delivery of medications, humidity or both to the mucosa (mucous lining) of the respiratory tract and pulmonary alveoli (tiny air sacks in the lungs that allow oxygen and carbon dioxide to move between the lungs and bloodstream). We offer a broad range of aerosol therapy products, including small volume nebulizers, large volume nebulizers, masks and tubing. These aerosol therapy products are designed to deliver agents that may relieve spasm of the bronchial muscles and reduce edema of the mucous membranes, liquefy bronchial secretions so that they are more easily removed, humidify the respiratory tract and administer antibiotics locally by depositing them in the respiratory tract. |

| |

| • | Hudson RCI Passive Humidification and Filtration: We offer a broad portfolio of Hudson RCI and Gibeck passive humidification and filtration products catering to patients on mechanical ventilation in both the intensive care unit and operating room. When an artificial airway is in place, the respiratory system’s natural processes are bypassed, necessitating the need to heat, humidify and filter the air delivered to the patient. Our passive humidification devices conserve the patient’s exhaled heat and moisture during expiration and return them to gas being delivered during inspiration. This mimics the action of the “normal” upper airways. |

| |

| • | Hudson RCI Active Humidification and Ventilation Management: Active humidification provides patients in respiratory distress or with lung failure with heated and humidified gases in order to promote gas exchange, maintain secretion clearance and decrease the risk of infection. Our ConchaTherm Neptune System is a heated humidifier designed to heat and humidify respiratory gases delivered via endotracheal tubes, nasal cannulas or facemasks to adult, pediatric, infant and neonatal patients. The system features a reusable, electronic piece of equipment and a full range of disposables, including breathing (or ventilator) circuits, humidification chambers and patient interfaces. |

Surgical North America: Our surgical products are predominantly comprised of single-use products, including ligation clips and closure products; appliers and sutures used in a variety of surgical procedures; access ports used in minimally invasive laparoscopic surgical procedures, including robotic surgery, and fluid management products used for chest drainage. Our product portfolio also includes reusable hand-held instruments for general and specialty surgical procedures. Our surgical products, which we market under the Deknatel, Pilling, Pleur-evac, Taut and Weck brands names, include the following:

| |

| • | Hem-o-lok, a significant part of the Weck portfolio, is a locking polymer ligation clip that combines the security of a suture with the speed of a metal clip for open and laparoscopic surgery. Hem-o-lok clips have special applications in urologic, gynecologic and general surgery. |

| |

| • | Weck EFx Endo Fascial Closure System is a port site closure device used in laparoscopic surgical procedures. The Weck EFx System encompasses a design for port site closure that enables reproducible fascial closure in varying body types with a controlled suture delivery. This approach to port site closure is designed to minimize complications and costs associated with port-site herniation. |

In addition, we have developed the Percuvance percutaneous surgical system, which is a percutaneous approach (where access to inner organs or other tissue is achieved via needle puncture) to laparoscopic surgery. The percutaneous approach reduces the number of trocars (a medical device that functions as a portal for the subsequent placement of other instruments), and provides better angles for the surgeon to address the surgical site, while minimizing trauma to patients. We received 510(k) clearance for this product in January 2015, and expect to initiate a controlled launch of the product in the United States and Europe in 2015. With our 2014 acquisition of the Mini-Lap assets, the combined portfolio of Mini-Lap instruments with our Percuvance percutaneous surgical system will enable us to create and build a new category of percutaneous laparoscopic surgery.

Europe, the Middle East and Africa (“EMEA”): Our EMEA segment designs, manufactures and distributes medical devices primarily used in critical care, surgical applications and cardiac care and generally serves two end markets: hospitals and healthcare providers, and home health. The products of the EMEA segment are most widely used in the acute care setting for a range of diagnostic and therapeutic procedures and in general and specialty surgical applications, including urology.

Asia: Our Asia segment, like our EMEA segment, designs, manufactures and distributes medical devices primarily used in critical care, surgical applications and cardiac care and generally serves hospitals and healthcare providers. The products of the Asia segment are most widely used in the acute care setting for a range of diagnostic and therapeutic procedures and in general and specialty surgical applications.

OEM: The OEM segment designs, manufactures and supplies devices and instruments for other medical device manufacturers. Our OEM division, which includes the TFX OEM ® and Deknatel ® OEM brands, provides custom-engineered extrusions, diagnostic and interventional catheters, sheath/dilator sets (introducers) and kits, sutures, performance fibers, and bioresorbable resins and fibers. We offer an extensive portfolio of integrated capabilities, including engineering, material selection, regulatory affairs, prototyping, testing and validation, manufacturing, assembly and packing.

All other businesses: Certain operating segments are not material to our operations and are therefore included in the “All other” line item in tabular presentations of segment information. Our "All other" line item includes specialty products such as interventional access products, which focus on dialysis, oncology and critical care at hospitals. We also provide urology, respiratory, anesthesia and cardiac care products such as diagnostic and intra-aortic balloon catheters, as well as capital equipment, which is provided to specialty market customers including home care, pre-hospital (typically addressing emergencies) and other alternative channels of care as well as to hospitals. Also included in the "All Other" line item is our Latin American business.

Specialty Product Portfolio

Our specialty product line of urology products provides bladder management for patients in the hospital and individuals in the home care markets. The product portfolio consists principally of a wide range of catheters (including Foley, intermittent, external and suprapubic), urine collectors, catheterization accessories and products for operative endourology marketed under the Rusch brand name.

Over the past few years, we have continued to expand our urology product offerings to include a wider range of intermittent catheters, catheter insertion kits and accessories used mainly for people with spinal cord injury, spina bifida, and multiple sclerosis. Many of these products are designed to support user safety and infection prevention efforts. For example, an intermittent catheter with hydrophilic coating (a coating that readily interacts with water), an ergothan tip (a flexible catheter tip that gently adjusts to the anatomy of the urethra), protective sleeve and sterile saline solution is marketed in our EMEA region. In the United States, we recently expanded our hydrophilic coated intermittent catheter line to include FloCath Quick™ coudés (slightly curved tip) for difficult catheterizations as well as Rusch® MMG H2O® Closed Systems without insertion supplies.

Our interventional access products are used in a wide range of applications, including dialysis, oncology and critical care. Dialysis products include the ARROW branded long term hemodialysis catheters, antimicrobial acute hemodialysis catheters and the ARROW-Trerotola™ Percutaneous Thrombectomy Device. Our long term hemodialysis catheter portfolio offers both antegrade and retrograde insertion options for split, step and symmetrical tip configurations. In addition, our symmetrical tip ARROW-Clark™ VectorFlow™ Chronic Hemodialysis catheter was launched in November 2014 after receiving FDA 510(k) clearance. The ARROW acute hemodialysis catheters are available with ARROWg+ard™ antimicrobial technology, which reduces the risk of catheter related infection.

The ARROW Polysite Low Profile Hybrid Port was introduced to the US market in March 2014. Available with or without pressure injection capability, the hybrid design combines a lightweight plastic body for patient comfort and a strong titanium reservoir for durability.

Interventional access products also include several ARROW branded products for critical care applications, including diagnostic and drainage kits, embolectomy balloons, and reinforced percutaneous sheath introducers.

In addition, our acquisition of Vidacare expanded our specialty products portfolio by adding the Vidacare EZ-IO Intraosseous Vascular Access (described above in the Vascular North America product portfolio summary), OnControl® Bone Marrow and OnControl Bone Access systems to the products we offer to our interventional access and specialty markets customers. Vidacare’s OnControl Bone Marrow System enables rapid and safe access for hematology and oncology diagnostic practices. The Vidacare OnControl Bone Access System provides rapid and safe access for surgical bone applications, such as vertebroplasty (a spinal procedure in which bone cement is injected through a small hole in the skin into a fractured vertebra with the goal of relieving back pain caused by vertebral compression fractures) and the biopsy of the vertebral body (the thick oval segment of bone forming the front of the vertebra) and bone lesions.

The pre-hospital care products also include several of the Rusch, Hudson-RCI and LMA branded products for pre-hospital care applications, including airway management and support along with medication delivery.

Cardiac Care Product Portfolio

Products in this portfolio include diagnostic and intra-aortic balloon catheters and capital equipment. Our diagnostic catheters include thermodilution and wedge pressure catheters; specialized catheters used during the x-ray examination of blood vessels, such as Berman and Reverse Berman catheters; therapeutic delivery catheters, such as temporary pacing catheters; sheaths for femoral and trans-radial aortic access used in diagnostic and therapeutic procedures; and intra-aortic balloon, or IAB, catheters. Capital equipment includes our intra-aortic balloon pump, or IABP, consoles. IABP products are used to augment oxygen delivery to the cardiac muscle and reduce the oxygen demand after cardiac surgery, serious heart attack or interventional procedures. We market our cardiac care products under the Arrow brand name.

The IAB and IABP product lines feature the AutoCAT 2 WAVE console and the FiberOptix catheter, which together utilize fiber optic technology for arterial pressure signal acquisition and enable the patented WAVE timing algorithm to support the broadest range of patient heart rhythms, including severely arrhythmic patients.

Latin America

Our Latin America business generally engages in the same type of operations, and serves the same type of end markets, as the EMEA segment.

OUR MARKETS

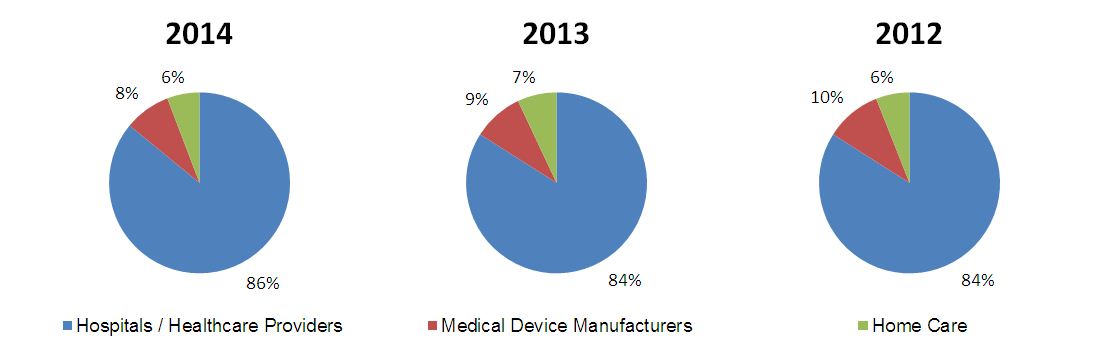

We generally serve three end-markets: hospitals and healthcare providers, medical device manufacturers and home care. These markets are influenced by a number of factors, including demographics, utilization and reimbursement patterns. The following charts depict the percentage of net revenues for the years ended December 31, 2014, 2013 and 2012 derived from each of our end markets.

HISTORY AND RECENT DEVELOPMENTS

Teleflex was founded in 1943 as a manufacturer of precision mechanical push/pull controls for military aircraft. From this original single market, single product orientation, we have grown and evolved through entries into new businesses, development of new products, introduction of products into new geographic or end-markets and acquisitions and dispositions of businesses. Throughout our history, we have continually focused on providing innovative, technology-driven, specialty-engineered products that help our customers meet their business requirements.

Beginning in 2007, we significantly changed the composition of our portfolio of businesses, expanding our presence in the medical device industry, while divesting all of our other businesses, which served the aerospace, automotive, industrial and marine markets. Following the divestitures of our marine business and cargo container and systems businesses in 2011, we became exclusively a medical device company.

GOVERNMENT REGULATION

We are subject to comprehensive government regulation both within and outside the United States relating to the development, manufacture, sale and distribution of our products.

Regulation of Medical Devices in the United States

All of our medical devices manufactured or sold in the United States are subject to the Federal Food, Drug, and Cosmetic Act (“FDC Act”), as implemented and enforced by the FDA. The FDA and, in some cases, other government agencies administer requirements for the design, testing, safety, effectiveness, manufacturing, labeling, storage, record keeping, clearance, approval, advertising and promotion, distribution, post-market surveillance, import and export of our medical devices.

Unless an exemption or pre-amendment grandfather status applies, each medical device that we market must first receive either clearance as a Class I or Class II device (by submitting a premarket notification (“510(k)”)) or approval as a Class III device (by filing a premarket approval application (“PMA”)) from the FDA pursuant to the FDC Act. To obtain 510(k) clearance, a manufacturer must demonstrate that the proposed device is substantially equivalent to a legally marketed 510(k)-cleared device (or pre-amendment device for which FDA has not called for PMAs), referred to as the "predicate device." Substantial equivalence is established by the applicant showing that the proposed device has the same intended use as the predicate device, and it either has the same technological characteristics or has been shown to be equally safe and effective and does not raise different questions of safety and effectiveness as compared to the predicate device. The FDA’s 510(k) clearance process usually takes from four to twelve months, but it can last longer. A device that is not eligible for the 510(k) process because there is no predicate device may be reviewed through the de novo process (the process for approval when no substantially equivalent device exists) if the FDA agrees it is a low to moderate risk device eligible for Class I or Class II designation. A device not eligible for 510(k) clearance or de novo clearance is categorized as Class III and must follow the PMA approval pathway, which requires proof of the safety and effectiveness of the device to the FDA’s satisfaction. The process of obtaining PMA approval is much more costly, lengthy and uncertain than the 510(k) process. It generally takes from one to three years or even longer. Our portfolio of existing products and pipeline of potential new products consist primarily of Class I and Class II devices that require 510(k) clearance. In addition, modifications made to devices after they receive clearance or approval may require a new 510(k) clearance or approval of a PMA or PMA supplement. We cannot be sure that 510(k) clearance or PMA approval will be obtained for any device that we propose to market.

A clinical trial is almost always required to support a PMA application and is sometimes required for a 510(k). The sponsor of a clinical study must comply with and conduct the study in accordance with the applicable federal regulations, including FDA’s investigational device exemption (“IDE”) requirements, and good clinical practice (“GCP”). Clinical trials must also be approved by an institutional review board, or IRB, which is an appropriately constituted group that has been formally designated to review and monitor biomedical research involving human subjects and which has the authority to approve, require modifications in, or disapprove research to protect the rights, safety, and welfare of the human research subject. The FDA may order the temporary, or permanent, discontinuation of a clinical trial at any time, or impose other sanctions, if it believes that the clinical trial either is not being conducted in accordance with FDA requirements or presents an unacceptable risk to the clinical trial patients. An IRB may also require the clinical trial at the site to be halted for failure to comply with the IRB’s requirements, or may impose other conditions.

After a device is placed on the market, numerous regulatory requirements continue to apply. Those regulatory requirements include the following:

| |

| • | device listing and establishment registration; |

| |

| • | adherence to the Quality System Regulation (“QSR”) which requires stringent design, testing, control, documentation, complaint handling and other quality assurance procedures; |

| |

| • | FDA prohibitions against the promotion of off-label uses or indications; |

| |

| • | adverse event reporting; |

| |

| • | post-approval restrictions or conditions, including post-approval clinical trials or other required testing; |

| |

| • | post-market surveillance requirements; |

| |

| • | the FDA’s recall authority, whereby it can ask for the recall of products from the market; and |

| |

| • | voluntary corrections or removals reporting and documentation. |

In September 2013, the FDA issued final regulations and draft guidance documents regarding the Unique Device Identification (“UDI”) System, which will require manufacturers to mark certain medical devices with unique identifiers. While the FDA expects that the UDI System will help track products during recalls and improve patient safety, it will require us to make changes to our manufacturing and labeling, which could increase our costs. The UDI System is being implemented in stages based on device risk, with the first requirements having taken effect in September 2014 and the last taking effect in September 2020.

Our manufacturing facilities, as well as those of certain of our suppliers, are subject to periodic and for-cause inspections to verify compliance with the QSR as well as other regulatory requirements. For example, in March 2014, we received a warning letter from the FDA alleging certain violations of the Quality System Regulation observed during a September 2013 inspection of our Arlington Heights, Illinois manufacturing facility. FDA’s concerns relate to failure to appropriately establish and maintain certain manufacturing, corrective and preventive action, and process validation procedures. In May 2014, the FDA returned to the Arlington Heights facility and re-issued its inspectional observations from the March 2014 warning letter and also required that we report to the FDA a field corrective action we took with respect to a product manufactured at our Arlington Heights facility, which we did. We have provided detailed responses and updates to the FDA as to our corrective actions, and continue to work to address the issues identified by the FDA. Until the violations are corrected, and those corrective actions are accepted and verified by FDA’ s re-inspection, we may be subject to additional enforcement action by the FDA. Additionally, the warning letter states that requests for Certificates to Foreign Governments related to products manufactured at the Arlington Heights facility will not be granted until the violations have been corrected.

Certain of our medical devices are sold in convenience kits that include a drug component, such as lidocaine. These types of kits are generally regulated as combination products within the Center for Devices and Radiological Health under the device regulations because the device generates the primary mode of action of the kit. Although the kit as a whole is regulated as a medical device, it may be subject to certain drug requirements such as current good manufacturing practices (“cGMPs”) to the extent applicable to the drug-component repackaging activities and subject to inspection to verify compliance with cGMPs as well as other regulatory requirements.

If the FDA were to find that we or certain of our suppliers have failed to comply with applicable regulations, it could institute a wide variety of enforcement actions, ranging from issuance of a warning or untitled letter to more severe sanctions, such as product recalls or seizures, civil penalties, consent decrees, injunctions, criminal prosecution, operating restrictions, partial suspension or total shutdown of production, refusal to permit importation or exportation, refusal to grant, or delays in granting, clearances or approvals or withdrawal or suspension of existing clearances or approvals. The FDA also has the authority to request repair, replacement or refund of the cost of any medical device manufactured or distributed by us. Any of these actions could have an adverse effect on our business.

Regulation of Medical Devices Outside of the United States

Medical device laws also are in effect in many of the markets outside of the United States in which we do business. These laws range from comprehensive device approval requirements for some or all of our products to requests for product data or certifications. Inspection of and controls over manufacturing, as well as monitoring of device-related adverse events, are components of most of these regulatory systems.

Healthcare Laws

We are subject to various federal, state and local laws in the United States targeting fraud and abuse in the healthcare industry. These laws prohibit us from, among other things, soliciting, offering, receiving or paying any remuneration to induce the referral or use of any item or service reimbursable under Medicare, Medicaid or other federally or state financed healthcare programs. Violations of these laws are punishable by imprisonment, criminal fines, civil monetary penalties and exclusion from participation in federal healthcare programs. In addition, we are subject to federal and state false claims laws in the United States that prohibit the submission of false payment claims under Medicare, Medicaid or other federally or state funded programs. Certain marketing practices, such as off-label promotion, and violations of federal anti-kickback laws may also constitute violations of these laws.

We are also subject to various federal and state reporting and disclosure requirements related to the healthcare industry. Recent rules issued by the Centers for Medicare & Medicaid Services (CMS) require us to collect and report information on payments or transfers of value to physicians and teaching hospitals, as well as investment interests held by physicians and their immediate family members. The reported data is available to the public on the CMS website. Failure to submit required information may result in civil monetary penalties. In addition, several states now require medical device companies to report expenses relating to the marketing and promotion of device products and to report gifts and payments to individual physicians in these states. Other states prohibit various other marketing-related activities. The federal government and still other states require the posting of information relating to clinical studies and their outcomes. The shifting commercial compliance environment and the need to build and maintain robust and expandable systems to comply with the different compliance and/or reporting requirements among a number of jurisdictions increases the possibility that a healthcare company may violate one or more of the requirements, resulting in increased compliance costs that could adversely impact our results of operations.

Other Regulatory Requirements

We are also subject to the United States Foreign Corrupt Practices Act and similar anti-bribery laws applicable in jurisdictions outside the United State that generally prohibit companies and their intermediaries from improperly offering or paying anything of value to non-United States government officials for the purpose of obtaining or retaining business. Because of the predominance of government-sponsored healthcare systems around the world, most of our customer relationships outside of the United States are with governmental entities and are therefore subject to such anti-bribery laws. Our policies mandate compliance with these anti-bribery laws. We operate in many parts of the world that have experienced governmental corruption to some degree, and in certain circumstances strict compliance with anti-bribery laws may conflict with local customs and practices. In the sale, delivery and servicing of our medical devices and software outside of the United States, we must also comply with various export control and trade embargo laws and regulations, including those administered by the Department of Treasury’s Office of Foreign Assets Control (“OFAC”) and the Department of Commerce’s Bureau of Industry and Security (“BIS”) which may require licenses or other authorizations for transactions relating to certain countries and/or with certain individuals identified by the United States government. Despite our global trade and compliance program, our internal control policies and procedures may not always protect us from reckless or criminal acts committed by our employees, distributors or other agents. Violations of these requirements are punishable by criminal or civil sanctions, including substantial fines and imprisonment.

COMPETITION

The medical device industry is highly competitive. We compete with many companies, ranging from small start-up enterprises to companies that are larger and more established than us and have access to significantly greater financial resources. Furthermore, extensive product research and development and rapid technological advances characterize the market in which we compete. We must continue to develop and acquire new products and technologies for our businesses to remain competitive. We believe that we compete primarily on the basis of clinical superiority and innovative features that enhance patient benefit, product reliability, performance, customer and sales support, and cost-effectiveness. Our major competitors include C. R. Bard, Inc., Medtronic and CareFusion.

SALES AND MARKETING

Our product sales are made directly to hospitals, healthcare providers, distributors and to original equipment manufacturers of medical devices through our own sales forces through independent representatives and through independent distributor networks.

BACKLOG

Most of our products are sold to hospitals or healthcare providers on orders calling for delivery within a few days or weeks, with longer order times for products sold to medical device manufacturers. Therefore, our backlog of orders is not indicative of revenues to be anticipated in any future 12-month period.

PATENTS AND TRADEMARKS

We own a portfolio of patents, patents pending and trademarks. We also license various patents and trademarks. Patents for individual products extend for varying periods according to the date of patent filing or grant and the legal term of patents in the various countries where patent protection is obtained. Trademark rights may potentially extend for longer periods of time and are dependent upon national laws and use of the marks. All product names throughout this document are trademarks owned by, or licensed to, us or our subsidiaries. Although these have been of value and are expected to continue to be of value in the future, we do not consider any single patent or trademark, except for the Teleflex and Arrow brands, to be essential to the operation of our business.

SUPPLIERS AND MATERIALS

Materials used in the manufacture of our products are purchased from a large number of suppliers in diverse geographic locations. We are not dependent on any single supplier for a substantial amount of the materials used or components supplied for our overall operations. Most of the materials and components we use are available from multiple sources, and where practical, we attempt to identify alternative suppliers. Volatility in commodity markets, particularly aluminum, steel and plastic resins, can have a significant impact on the cost of producing certain of our products. We may not be able to successfully pass cost increases through to all of our customers, particularly original equipment manufacturers.

RESEARCH AND DEVELOPMENT

We are engaged in both internal and external research and development. Our research and development costs principally relate to our efforts to bring innovative new products to the markets we serve, and our efforts to enhance the clinical value, ease of use, safety and reliability of our existing product lines. Our research and development efforts support our strategic objectives to provide safe and effective products that reduce infections, improve patient and clinician safety, enhance patient outcomes and enable less invasive procedures. Our research and development expenditures were $61.0 million, $65.0 million and $56.3 million for the years ended December 31, 2014, 2013 and 2012, respectively.

We also acquire or license products and technologies that are consistent with our strategic objectives and enhance our ability to provide a full range of product and service options to our customers.

SEASONALITY

Portions of our revenues are subject to seasonal fluctuations. Incidence of flu and other disease patterns as well as the frequency of elective medical procedures affect revenues related to single-use products. Historically, we have experienced higher sales in the fourth quarter as a result of these factors.

EMPLOYEES

We employed approximately 11,700 full-time and temporary employees at December 31, 2014. Of these employees, approximately 3,100 were employed in the United States and 8,600 in countries other than the United States. Approximately 8% percent of our employees in the United States and in other countries were covered by union contracts or collective-bargaining arrangements. We believe we have good relationships with our employees.

ENVIRONMENTAL

We are subject to various environmental laws and regulations both within and outside the United States. Our operations, like those of other medical device companies, involve the use of substances regulated under environmental laws, primarily in manufacturing and sterilization processes. While we continue to make capital and operational expenditures relating to compliance with existing environmental laws and regulations, we cannot ensure that our costs of complying with current or future environmental protection, health and safety laws and regulations will not exceed our estimates or have a material adverse effect on our business, financial condition, results of operations and cash flows. Further, we cannot ensure that we will not be subject to additional environmental claims for personal injury or cleanup in the future based on our past, present or future business activities.

INVESTOR INFORMATION

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Therefore, we file reports, proxy statements and other information with the Securities and Exchange Commission (SEC). Copies of these reports, proxy statements, and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

You can access financial and other information about us in the Investors section of our website, which can be accessed at www.teleflex.com. We make available through our website, free of charge, copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed with or furnished to the SEC under Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after electronically filing or furnishing such material to the SEC. The information on our website is not part of this Annual Report on Form 10-K. The reference to our website address is intended to be an inactive textual reference only.

We are a Delaware corporation incorporated in 1943. Our executive offices are located at 550 East Swedesford Road, Suite 400, Wayne, PA 19087.

EXECUTIVE OFFICERS

The names and ages of our executive officers and the positions and offices held by each such officer are as follows:

|

| | | | | |

| Name | | Age | | Positions and Offices with Company |

| Benson F. Smith | | 67 |

| | Chairman, President, Chief Executive Officer and Director |

| Liam Kelly | | 48 |

| | Executive Vice President, President, Americas |

| Thomas E. Powell | | 53 |

| | Executive Vice President and Chief Financial Officer |

| Thomas Anthony Kennedy | | 52 |

| | Senior Vice President, Global Operations |

| Karen Boylan | | 43 |

| | Vice President, Global RA/QA |

| Cameron P. Hicks | | 50 |

| | Vice President, Global Human Resources |

| James J. Leyden | | 48 |

| | Vice President, General Counsel and Secretary |

Mr. Smith has been our Chairman, President and Chief Executive Officer since January 2011, and has served as a Director since April 2005. Prior to January 2011, Mr. Smith was the managing partner of Sales Research Group, a research and consulting organization. From 1999 to January 2011, he also served as the Chief Executive Officer of BFS & Associates LLC, which specialized in strategic planning and venture investing. From 2000 until 2005, Mr. Smith also served as a speaker and author at The Gallup Organization, a global research-based consultancy firm. Prior to that, Mr. Smith worked for C.R. Bard, Inc., a company specializing in medical devices, for approximately 25 years, where he held various executive and senior level positions, most recently as President and Chief Operating Officer from 1994 to 1998.

Mr. Kelly has been our Executive Vice President, President, Americas since April 2014. From June 2012 to April 2014 Mr. Kelly served as Executive Vice President, President, International and has held several positions with regard to our EMEA segment, including President from June 2011 to June 2012, Executive Vice President from November 2009 to June 2011, and Vice President of Marketing from April 2009 to November 2009. Prior to joining Teleflex, Mr. Kelly held various senior level positions with Hill-Rom Holdings, Inc., a medical device company, from October 2002 to August 2009, serving as its Vice President of International Marketing and R&D from August 2006 to February 2009.

Mr. Powell has been our Executive Vice President and Chief Financial Officer since February 2013. From March 2012 to February 2013, Mr. Powell was Senior Vice President and Chief Financial Officer. He joined Teleflex in August 2011 as Senior Vice President, Global Finance. Prior to joining Teleflex, Mr. Powell served as Chief Financial Officer and Treasurer of Tomotherapy Incorporated, a medical device company, from June 2009 until June 2011. In 2008, he served as Chief Financial Officer of Textura Corporation, a software provider. From April 2001 until January 2008, Mr. Powell was employed by Midway Games, Inc., a software provider, serving as its Executive Vice President, CFO and Treasurer from September 2001 until January 2008. Mr. Powell has also held leadership positions with Dade Behring, Inc. (now Siemens Healthcare Diagnostics), PepsiCo, Bain & Company, Tenneco Inc. and Arthur Andersen & Company.

Mr. Kennedy has been our Senior Vice President, Global Operations since May 2013. He previously held the position of Vice President, International Operations from December 2012 to May 2013. From July 2007 to December 2012, he held the position of Vice President, EMEA Operations. Prior to joining Teleflex, Mr. Kennedy was a managing director for Saint Gobain Performance Plastics, a producer of engineered, high-performance polymer products, from September 2004 to May 2007. Mr. Kennedy has also held leadership positions with Bio-Medical Research Limited, Marconi Plc, Fore Systems, Inc. and American Power Conversion Corporation.

Ms. Boylan has been our Vice President, Global RA/QA since August 2014. She joined Teleflex in January 2013 as Vice President, International RA/QA. Prior to joining Teleflex, Ms. Boylan served as QA Vice President, Corporate Quality Systems for Boston Scientific, a developer, manufacturer and marketer of medical devices, from April 1996 to December 2012.

Mr. Hicks has been our Vice President, Global Human Resources since April 2013. Prior to joining Teleflex, Mr. Hicks served as Executive Vice President of Human Resources & Organizational Effectiveness for Harlan Laboratories, a private global provider of pre-clinical and non-clinical research services, from July 2010 to March 2013. From April 1990 to January 2010, Mr. Hicks held various leadership roles with MDS Inc., a provider of products and services for the development of drugs and the diagnosis and treatment of disease, including Senior Vice President of Human Resources for MDS’ global Pharma Services division from November 2000 to January 2010.

Mr. Leyden has been our Vice President, General Counsel and Secretary since February 2014. He previously held the positions of Acting General Counsel from November 2013 to February 2014, Deputy General Counsel from February 2013 to November 2013 and Associate General Counsel from December 2004 to February 2013. Prior to joining Teleflex, Mr. Leyden served as general counsel of InfraSource Services, Inc., a utility infrastructure construction company, from April 2004 to December 2004. From February 2002 to April 2004, he served as Associate General Counsel of Aramark Corporation, a provider of food, facility and uniform services.

Our officers are elected annually by our board of directors. Each officer serves at the discretion of the board.

In addition to the other information set forth in this Annual Report on Form 10-K, you should carefully consider the following factors which could have a material adverse effect on our business, financial condition, results of operations or stock price. The risks below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also adversely affect our business, financial condition, results of operations or stock price.

We face strong competition. Our failure to successfully develop and market new products could adversely affect our business.

The medical device industry is highly competitive. We compete with many domestic and foreign medical device companies ranging from small start-up enterprises that might sell only a single or limited number of competitive products or compete only in a specific market segment, to companies that are larger and more established than us, have a broad range of competitive products, participate in numerous markets and have access to significantly greater financial and marketing resources than we do.

In addition, the medical device industry is characterized by extensive product research and development and rapid technological advances. The future success of our business will depend, in part, on our ability to design and manufacture new competitive products and enhance existing products. Our product development efforts may require us to make substantial investments. There can be no assurance that unforeseen problems will not occur with respect to the development, performance or market acceptance of new technologies or products, such as our inability to:

| |

| • | identify viable new products; |

| |

| • | obtain adequate intellectual property protection; |

| |

| • | gain market acceptance of new products; or |

| |

| • | successfully obtain regulatory approvals. |

In addition, our competitors currently may be developing, or may develop in the future, products that provide better features, clinical outcomes or economic value than those that we currently offer or subsequently develop. Our failure to successfully develop and market new products or enhance existing products could have an adverse effect on our business, financial condition and results of operations.

Our customers depend on third party coverage and reimbursements and the failure of healthcare programs to provide coverage and reimbursement, or the reduction in reimbursement levels, for our medical products could adversely affect us.

The ability of our customers to obtain coverage and reimbursement for our products is important to our business. Demand for many of our existing and new medical products is, and will continue to be, affected by the extent to which government healthcare programs and private health insurers reimburse our customers for patients’ medical expenses in the countries where we do business. Even when we develop or acquire a promising new product, demand for the product may be limited unless reimbursement approval is obtained from private and governmental third party payors. Internationally, healthcare reimbursement systems vary significantly. In some countries, medical centers are constrained by fixed budgets, regardless of the extent of their patient treatment. Other countries require application for, and approval of, government or third party reimbursement. Without both favorable coverage determinations by, and the financial support of, government and third party insurers, the market for many of our medical products would be adversely affected. We cannot be sure that third party payors will maintain the current level of coverage and reimbursement to our customers for use of our existing products. Adverse coverage determinations or any reduction in the amount of reimbursement could harm our business by reducing customers’ selection of our products and the prices they are willing to pay.

In addition, as a result of their purchasing power, third party payors are implementing cost cutting measures such as seeking discounts, price reductions or other incentives from medical products suppliers and imposing limitations on coverage and reimbursement for medical technologies and procedures. These trends could compel us to reduce prices for our products and could cause a decrease in the size of the market or a potential increase in competition that could negatively affect our business, financial condition and results of operations.

We may not be successful in achieving expected operating efficiencies and sustaining or improving operating expense reductions, and may experience business disruptions associated with restructuring, facility consolidations, realignment, cost reduction and other strategic initiatives.

Over the past several years we have implemented a number of restructuring, realignment and cost reduction initiatives, including the realignment of our North American organizational structure, facility consolidations and reductions in our workforce. While we have realized some efficiencies from these actions, we may not realize the benefits of these initiatives to the extent we anticipated. Further, such benefits may be realized later than expected, and the ongoing difficulties in implementing these measures may be greater than anticipated, which could cause us to incur additional costs or result in business disruptions. In addition, if these measures are not successful or sustainable, we may be compelled to undertake additional realignment and cost reduction efforts, which could result in significant additional charges. Moreover, if our restructuring and realignment efforts prove ineffective, our ability to achieve our other strategic and business plan goals may be adversely affected.

In addition, as part of our efforts to increase operating efficiencies, we have implemented a number of initiatives over the past several years to consolidate our enterprise resource planning, or ERP, systems. For example, between 2012 and 2013, we migrated our Arrow business onto our principal ERP system. To date, we have not experienced any significant disruptions to our business or operations in connection with these initiatives. However, as we continue our efforts to further consolidate our ERP systems, we could experience business disruptions, which could adversely affect customer relationships and divert the attention of management away from daily operations. In addition, any delays in the implementation of these initiatives could cause us to incur additional unexpected costs. Should we experience such difficulties, our business, cash flows and results of operations could be adversely affected.

We are subject to extensive government regulation, which may require us to incur significant expenses to ensure compliance. Our failure to comply with those regulations could have a material adverse effect on our business, results of operations and financial condition.

Our products are classified as medical devices and are subject to extensive regulation in the United States by the FDA and by comparable government agencies in other countries. The regulations govern, among other things, the development, design, approval, manufacturing, labeling, importing and exporting and sale and marketing of many of our products. Moreover, these regulations are subject to future change.

In the United States, before we can market a new medical device, or a new use of, or claim for, or significant modification to, an existing product, we generally must first receive either 510(k) or de novo clearance or approval of a premarket approval application, or PMA, from the FDA. Similarly, most major markets for medical devices outside the United States also require clearance, approval or compliance with certain standards before a product can be commercially marketed. The process of obtaining regulatory clearances and approvals to market a medical device, particularly from the FDA and certain foreign governmental authorities, can be costly and time consuming, and clearances and approvals might not be granted for new products on a timely basis, if at all. In addition, once a device has been cleared or approved, a new clearance or approval may be required before the device may be modified or its labeling changed. Furthermore, the FDA or a foreign governmental authority may make its review and clearance or approval process more rigorous, which could require us to generate additional clinical or other data, and expend more time and effort, in obtaining future product clearances or approvals. The regulatory clearance and approval process may result in, among other things, delayed realization of product revenues, substantial additional costs or limitations on indicated uses of products, any one of which could have a material adverse effect on our financial condition and results of operations. Even after a product has received marketing approval or clearance, such product approval or clearance can be withdrawn or limited due to unforeseen problems with the device or issues relating to its application.

Failure to comply with applicable regulations could lead to adverse effects on our business, which could include:

| |

| • | partial suspension or total shutdown of manufacturing; |

| |

| • | delays in product manufacturing; |

| |

| • | warning or untitled letters; |

| |

| • | fines or civil penalties; |

| |

| • | delays in obtaining new regulatory clearances or approvals; |

| |

| • | withdrawal or suspension of required clearances, approvals or licenses; |

| |

| • | product seizures or recalls; |

| |

| • | advisories or other field actions; |

| |

| • | operating restrictions; and |

| |

| • | prohibitions against exporting of products to, or importing products from, countries outside the United States. |

We could be required to expend significant financial and human resources to remediate failures to comply with applicable regulations and quality assurance guidelines. In addition, civil and criminal penalties, including exclusion under Medicaid or Medicare, could result from regulatory violations. Any one or more of these events could have a material adverse effect on our business, financial condition and results of operations.

Medical devices are cleared or approved for one or more specific intended uses. Promoting a device for an off-label use could result in government enforcement action.

Furthermore, our facilities are subject to periodic inspection by the FDA and other federal, state and foreign government authorities, which require manufacturers of medical devices to adhere to certain regulations, including the FDA’s Quality System Regulation, which requires periodic audits, design controls, quality control testing and documentation procedures, as well as complaint evaluations and investigation. For example, in March 2014, we received a warning letter from the FDA with respect to our Arlington Heights, Illinois manufacturing facility. For information regarding the warning letter, see "Business - Government Regulation" in Item 1 of this report. In addition, any facilities assembling convenience kits that include drug components and are registered as drug repackaging establishments are subject to current good manufacturing practices requirements. The FDA also requires the reporting of certain adverse events and may require the reporting of recalls or other field safety corrective actions. Issues identified through such inspections and reports may result in FDA enforcement action through any of the actions discussed above. Moreover, issues identified through such inspections and reports may require significant resources to resolve.

We are subject to healthcare fraud and abuse laws, regulation and enforcement; our failure to comply with those laws could have a material adverse effect on our results of operations and financial condition.

We are subject to healthcare fraud and abuse regulation and enforcement by the federal government and the governments of those states and foreign countries in which we conduct our business. The laws that may affect our ability to operate include:

| |

| • | the federal healthcare anti-kickback statute, which, among other things, prohibits persons from knowingly and willfully offering or paying remuneration to induce either the referral of an individual for, or the purchase, order or recommendation of, any good or service for which payment may be made under federal healthcare programs such as Medicare and Medicaid, or soliciting payment for such referrals, purchases, orders and recommendations; |

| |

| • | federal false claims laws which, among other things, prohibit individuals or entities from knowingly presenting, or causing to be presented, false or fraudulent claims for payment from the federal government, including Medicare, Medicaid or other third-party payors; |

| |

| • | the federal Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), which prohibit schemes to defraud any healthcare benefit program and false statements relating to healthcare matters; and |

| |

| • | state law equivalents of each of the above federal laws, such as anti-kickback and false claims laws which may apply to items or services reimbursed by any third-party payor, including commercial insurers. |

If our operations are found to be in violation of any of these laws or any other government regulations, we may be subject to penalties, including civil and criminal penalties, damages, fines, the curtailment or restructuring of our operations, the exclusion from participation in federal and state healthcare programs and imprisonment of personnel, any of which could adversely affect our ability to operate our business and our financial results. The risk of our being found to have violated these laws is increased by the fact that many of them have not been fully interpreted by the regulatory authorities or the courts, and their provisions are open to a variety of interpretations.

Further, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act (collectively, the “Affordable Care Act”), imposed new reporting and disclosure requirements on device manufacturers for any “transfer of value” made or distributed to prescribers and other healthcare providers. Our first report was submitted in 2014, and the reported information was made publicly available in a searchable format in September 2014. In addition, device manufacturers are required to report and disclose any investment interests held by physicians and their immediate family members during the preceding calendar year. Failure to submit required information may result in civil monetary penalties for each payment, transfer of value or ownership or investment interests not reported in an annual submission, up to an aggregate of $150,000 per year (and up to an aggregate of $1 million per year for “knowing failures”).

In addition, there has been a recent trend of increased federal and state regulation of payments made to healthcare providers. Some states, such as California, Connecticut, Nevada and Massachusetts, mandate implementation of compliance programs that include the tracking and reporting of gifts, compensation for consulting and other services, and other remuneration to healthcare providers. The shifting commercial compliance environment and the need to build and maintain robust and expandable systems to comply with the different compliance and/or reporting requirements among a number of jurisdictions increases the possibility that we may inadvertently violate one or more of the requirements, resulting in increased compliance costs that could adversely impact our results of operations.

We may incur material losses and costs as a result of product liability and warranty claims, as well as product recalls, any of which may adversely affect our results of operations and financial condition. Furthermore, as a medical device company, our reputation may be damaged if one or more of our products are, or are alleged to be, defective.