Third Quarter 2024 Earnings Conference Call 10/31/2024 Teleflex Incorporated Exhibit 99.2

The release, accompanying slides, and replay webcast are available online at www.teleflex.com (click on Investors) An audio replay of the call will be available beginning at 11:00 am Eastern Time on October 31, 2024 and can be accessed on the Teleflex website or by telephone. The call can be accessed by dialing 1 800 770 2030 (U.S.) or 1 609 800 9909 (all other locations). The confirmation code is 69028. Conference Call Logistics

Today’s Speakers TELEFLEX EARNINGS CONFERENCE CALL 10/31/2024 Lawrence Keusch VP, Investor Relations and Strategy Development Liam Kelly Chairman, President and CEO Thomas Powell Executive VP and CFO

This presentation contains forward-looking statements, including, but not limited to, our expectation that we will continue to focus on our strategy to drive durable growth and that we will continue to invest in organic and inorganic growth drivers; our forecasted 2024: GAAP, adjusted revenue and adjusted constant currency growth, GAAP and adjusted gross and operating margins and GAAP and adjusted earnings per share and, in each case, our estimates with respect to the items expected to impact those forecasted results; and other matters which inherently involve risks and uncertainties which could cause actual results to differ from those projected or implied in the forward–looking statements. These risks and uncertainties are addressed in our SEC filings, including our most recent Form 10-K. We expressly disclaim any obligation to update forward-looking statements, except as otherwise specifically stated by us or as required by law or regulation. Note on Forward-Looking Statements TELEFLEX EARNINGS CONFERENCE CALL 10/31/20244 Note on Non-GAAP Financial Measures This presentation refers to certain non-GAAP financial measures, including, but not limited to, adjusted revenue, adjusted constant currency revenue growth, adjusted diluted earnings per share, adjusted gross and operating margins and adjusted tax rate. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Tables reconciling these non-GAAP financial measures to the most comparable GAAP financial measures are contained within this presentation and the appendices at the end of this presentation. Additional Notes This document contains certain highlights with respect to our third quarter 2024 and developments and does not purport to be a complete summary thereof. Accordingly, we encourage you to read our Earnings Release for the quarter ended September 29, 2024 located in the investor section of our website at www.teleflex.com and our Quarterly Report on Form 10-Q for the quarter ended September 29, 2024 to be filed with the Securities and Exchange Commission. Unless otherwise noted, the following slides reflect continuing operations.

Liam Kelly Chairman, President and CEO Executive Overview

Q3 Performance Summary ◦ Lowering adjusted constant currency revenue growth guidance range to 3.50% to 4.00%, compared to the prior range of 4.25% to 5.25% ◦ Increased low end of the range for adjusted diluted EPS from continuing operations guidance to $13.90 to $14.20, compared to the prior range of $13.80 to $14.20 ◦ Q3'24 adjusted constant currency revenue grew 2.2% year- over-year ◦ Q3'24 adjusted gross margin of 60.8% and adjusted operating margin of 27.3% ◦ Q3'24 adjusted EPS of $3.49, a 4.1% decrease year-over-year Q3'24 Highlights 2024 Financial Guidance Note: See tables appearing in this presentation and the appendices hereto for reconciliations of non-GAAP financial information. TELEFLEX EARNINGS CONFERENCE CALL 10/31/2024

Q3'24 Segment Revenue Review TELEFLEX EARNINGS CONFERENCE CALL 10/31/20247 Three Months Ended September 29, 2024 As reported Adjusted Dollars in Millions September 29, 2024 October 1, 2023 Reported Revenue Growth September 29, 2024 October 1, 2023 Adjusted Constant Currency Revenue Growth Americas $433.3 $428.2 1.2% $433.3 $428.2 1.5% EMEA 150.2 142.7 5.3% 150.2 142.7 3.9% Asia 98.3 93.2 5.5% 98.3 93.2 5.0% OEM 82.6 82.3 0.3% 82.6 82.3 0.1% Consolidated $764.4 $746.4 2.4% $764.4 $746.4 2.2% Note: See tables appearing in this presentation and the appendices hereto for reconciliations of non-GAAP financial information.

Q3'24 Global Product Category Revenue Review TELEFLEX EARNINGS CONFERENCE CALL 10/31/20248 (1) Includes revenues generated from sales of our respiratory and urology products (other than interventional urology products) and sales pursuant to the manufacturing and supply transition agreement related to our Respiratory business divestiture. Three Months Ended September 29, 2024 As reported Adjusted Dollars in Millions September 29, 2024 October 1, 2023 Reported Revenue Growth September 29, 2024 October 1, 2023 Adjusted Constant Currency Revenue Growth Vascular Access $180.9 $169.9 6.5% $180.9 $169.9 6.3% Interventional 149.9 134.1 11.8% 149.9 134.1 11.4% Anesthesia 101.1 97.6 3.6% 101.1 97.6 3.4% Surgical 111.7 112.8 (0.9)% 111.7 112.8 (1.0)% Interventional Urology 83.4 73.6 13.3% 83.4 73.6 13.3% OEM 82.6 82.3 0.3% 82.6 82.3 0.1% Other(1) 54.8 76.1 (28.0)% 54.8 76.1 (28.3)% Consolidated $764.4 $746.4 2.4% $764.4 $746.4 2.2% Note: See tables appearing in this presentation and the appendices hereto for reconciliations of non-GAAP financial information.

CAUTION: Federal (USA) law restricts this device to sale or use by or on the order of a physician. Refer to the Instructions for Use for a complete listing of the indications, contraindications, warnings, and precautions. Information in this document is not a substitute for the product Instructions for Use. Not all products may be available in all countries. Dr. Schram and Dr. Foote, two of the authors of the study, are paid consultants of Teleflex Incorporated. 1. Fritz, G.D., Sharrak, A., Aubrey, J., Topalli, X., Vrana, A., Opalikihn, A., Zambito, G.M., Martin, T.D., Foote, J.A., Smith, J.R., & Schram, J.L. (2024). Perioperative outcomes using single-fire stapler. Obesity Surgery(2024). https://doi.org/10.1007/s11695-024-07357-4 2. 510(k) No. K210278. The Titan SGS linear cutter is intended for longitudinal transection and resection of gastric tissue for sleeve gastrectomy pouch creation. 2021. Expanding Titan SGS Stapler Clinical Foundation – In August, Teleflex announced the publication of a retrospective study that compared perioperative outcomes of the Titan SGS Stapler with multi-fire surgical staplers at a single site (783 propensity matched patients).1 The study showed that the use of the Titan SGS Stapler’s simplified and efficient stapling process was associated with the following statistically significant findings: – The Titan SGS Stapler continues to be the first and only single-fire, surgical stapler designed and indicated for sleeve gastrectomy pouch creation and the only surgical stapler cleared by the FDA for this specific indication2 Clinical and Commercial Updates TELEFLEX EARNINGS CONFERENCE CALL 10/31/20249 – There were fewer 30-day readmissions, especially those related to nausea and vomiting, in the Titan SGS Stapler cohort (13, 1.7%) compared with the multi-fire cohort (35, 4.5%) (p<0.01)1 – The median operative time for the Titan SGS Stapler was 8 minutes less than multi-fire staplers (p<0.01)1 – In addition, patients were more likely to be discharged within 24 hours after surgery in the Titan SGS Stapler cohort (702, 89.6%) as compared to multi-fire staplers (509, 65.0%)1

CAUTION: Federal (USA) law restricts this device to sale or use by or on the order of a physician. Refer to the Instructions for Use for a complete listing of the indications, contraindications, warnings, and precautions. Information in this document is not a substitute for the product Instructions for Use. Not all products may be available in all countries. First Patient Enrolled in Teleflex's Barrigel Rectal Spacer Trial for Post Radical Prostatectomy Radiation Therapy – The trial will study Barrigel rectal spacer in patients undergoing hypofractionated post-prostatectomy radiation regimen across U.S. sites and one site in Australia – Study endpoints are to demonstrate Barrigel rectal spacer as a safe and effective option that reduces prostate radiation side effects for this patient population Clinical and Commercial Updates TELEFLEX EARNINGS CONFERENCE CALL 10/31/202410

Thomas Powell Executive VP and CFO Financial Overview

Q3'24 Financial Review TELEFLEX EARNINGS CONFERENCE CALL 10/31/202412 Gross margin Operating margin Effective tax rate Earnings per share Note: See appendices for reconciliations of non-GAAP financial information. ◦ GAAP gross margin of 56.3% vs. 55.8% in the prior year period ◦ Adjusted gross margin of 60.8%, up 140 bps year-over-year ◦ GAAP operating margin of 19.5% vs. 22.1% in prior year period ◦ Adjusted operating margin of 27.3%, up 10 bps year-over-year ◦ GAAP tax rate of 15.0% vs. 8.0% in prior year period ◦ Adjusted tax rate of 13.6% vs. 8.0% in prior year period ◦ GAAP EPS of $2.36 vs. $2.91 in prior year period ◦ Adjusted EPS of $3.49, down 4.1% year-over-year Global revenue growth ◦ Revenue increased 2.4% year-over-year on a GAAP basis ◦ Adjusted revenue increased 2.2% year-over-year on a constant currency basis

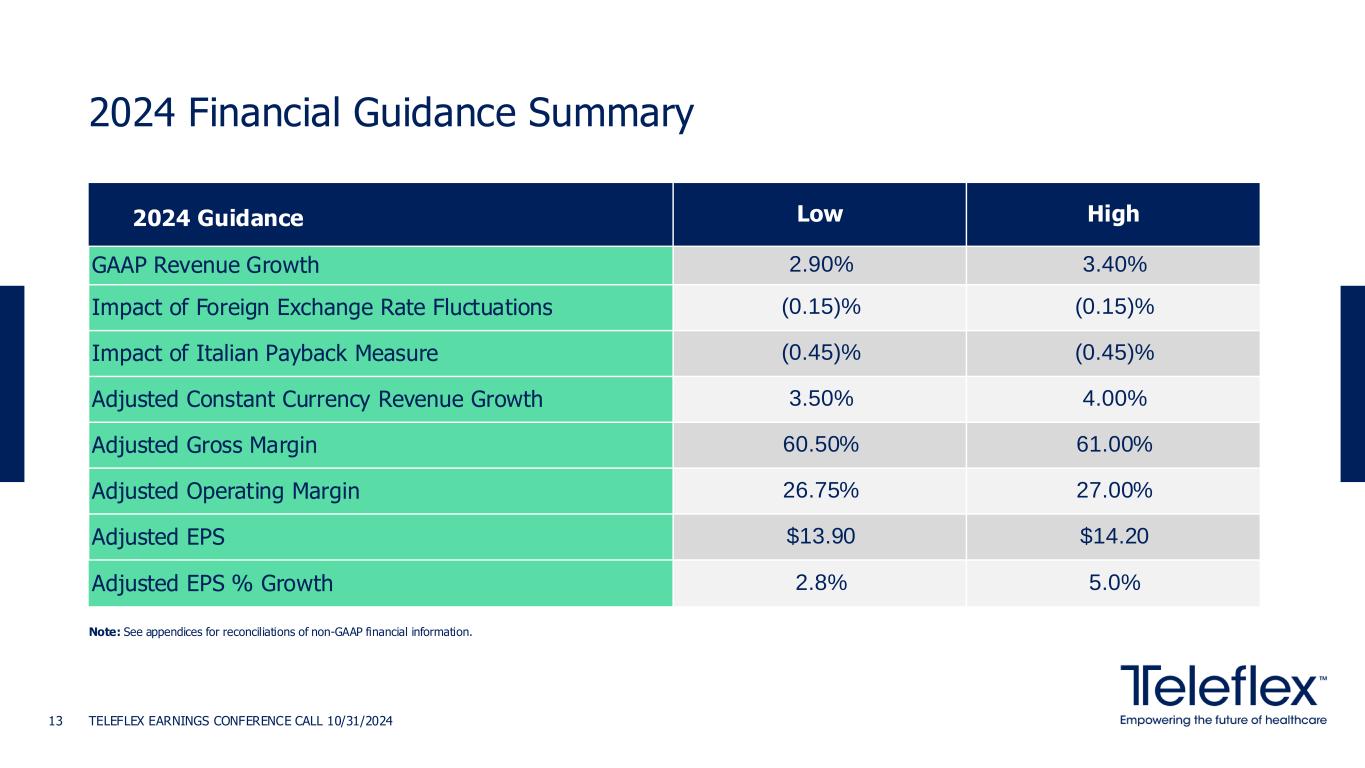

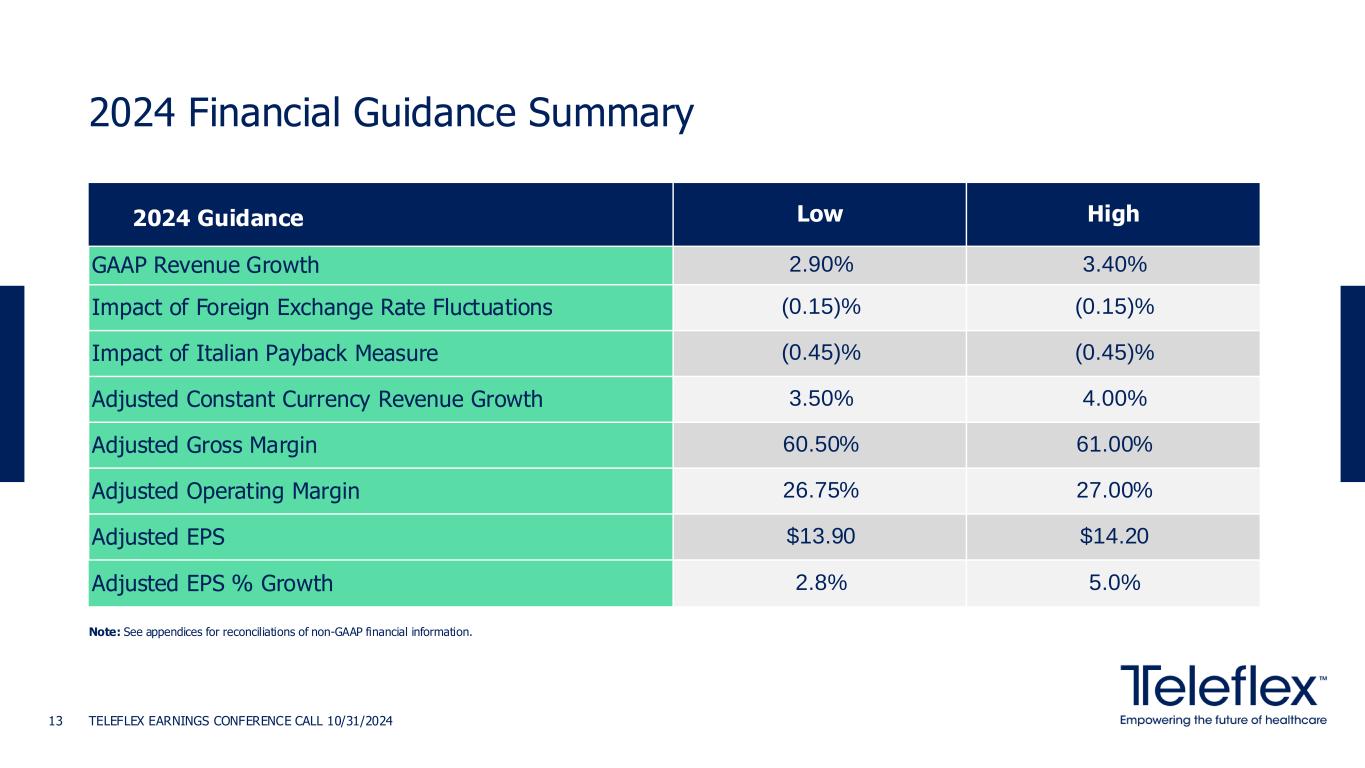

2024 Financial Guidance Summary TELEFLEX EARNINGS CONFERENCE CALL 10/31/202413 2024 Guidance Low High GAAP Revenue Growth 2.90% 3.40% Impact of Foreign Exchange Rate Fluctuations (0.15)% (0.15)% Impact of Italian Payback Measure (0.45)% (0.45)% Adjusted Constant Currency Revenue Growth 3.50% 4.00% Adjusted Gross Margin 60.50% 61.00% Adjusted Operating Margin 26.75% 27.00% Adjusted EPS $13.90 $14.20 Adjusted EPS % Growth 2.8% 5.0% Note: See appendices for reconciliations of non-GAAP financial information.

TELEFLEX EARNINGS CONFERENCE CALL 10/31/202414 Key Takeaways Our diversified portfolio and global footprint drove durable growth in the third quarter. Our execution remains strong, we are launching new products, and our margins remain healthy. The solid third quarter results and IABP opportunity in the fourth quarter have allowed us to increase the low end of our margins and EPS for 2024. We will continue to focus on our strategy to drive durable growth. We will continue to invest in organic and inorganic growth drivers. Our capital allocation strategy now incorporates share repurchase.

TELEFLEX EARNINGS CONFERENCE CALL 10/31/202415 Thank You!

Appendices

The presentation to which these appendices are attached and the following appendices include, among other things, tables reconciling the following applicable non-GAAP financial measures to the most comparable GAAP financial measure: Adjusted revenue. This non-GAAP measure is based upon net revenues, adjusted to exclude the impact in the nine months ended September 29, 2024 of an increase in our reserves, and corresponding reduction to revenue within our EMEA segment, for prior years. The reserve relates to the Italian payback measure, a law that requires suppliers of medical devices to the Italian National Healthcare System to make payments to the Italian government if medical device expenditures in a given year exceed regional expenditure ceilings established for that year. As a result of a recent ruling from the Italian courts, we recognized an increase in our reserves during the nine months ended September 29, 2024, of which $13.8 million related to prior years. The prior year amounts do not represent normal adjustments to revenue, are not expected to recur in future periods and are not recurring in nature, making it difficult to contribute to a meaningful evaluation of our operating performance. Accordingly, management has excluded the $13.8 million prior year amount as it is not indicative of our underlying core performance or business trends. Adjusted constant currency revenue growth. This non-GAAP measure is based upon net revenues, adjusted to exclude, depending on the period presented, the items described i n Adjusted revenue and to eliminate the impact of translating the results of international subsidiaries at different currency exchange rates from period to period. The impact of changes in foreign currency may vary significantly from period to period, and such changes generally are outside of the control of our management. We believe that this measure facilitates a comparison of our operating performance exclusive of currency exchange rate fluctuations that do not reflect our underlying performance or business trends. Adjusted diluted earnings per share. This non-GAAP measure is based upon diluted earnings per share from continuing operations, the most directly comparable GAAP measure, adjusted to exclude, depending on the period presented, the impact of (i) restructuring, restructuring related and impairment items; (ii) acquisition, integration and divestiture related items; (iii) Italian payback measure; (iv) costs incurred in connection with our implementation of a new global ERP solution and related IT transition costs; (v) pension termination and related charges; (vi) certain costs associated with the registration of medical devices under the European Union Medical Device Regulation; (vii) intangible amortization expense; and (viii) tax adjustments. Management does not believe that any of the excluded items are indicative of our underlying core performance or business trends. Adjusted gross profit and margin. These measures exclude, depending on the period presented, the impacts of (i) restructuring, restructuring related and impairment items, (ii) acquisition, integration and divestiture related items and (iii) Italian payback measure. Adjusted operating profit and margin. These measures exclude, depending on the period presented, the impact of (i) restructuring, restructuring related and impairment items; (ii) acquisitions, integration and divestiture related items; (iii) Italian payback measure; (iv) costs incurred in connection with our implementation of a new global ERP solution and related IT transition costs; (v) pension termination and related charges; (vi) intangible amortization expense; and (vii) certain costs associated with the registration of medical devices under the European Union Medical Device Regulation. Adjusted tax rate. This measure is the percentage of the Company’s adjusted taxes on income from continuing operations to its adjusted income from continuing operations before taxes. Adjusted taxes on income from continuing operations excludes, depending on the period presented, the impact of tax benefits or costs associated with (i) restructuring, restructuring related and impairment items; (ii) acquisition, integration and divestiture related items; (iii) Italian payback measure; (iv) costs incurred in connection with our implementation of a new global ERP solution and related IT transition costs; (v) certain costs associated with the registration of medical devices under the European Union Medical Device Regulation; (vi) intangible amortization expense; and (vii) tax adjustments. Non-GAAP Financial Measures TELEFLEX EARNINGS CONFERENCE CALL 10/31/202417

The following is an explanation of certain of the adjustments that are applied with respect to one or more of the non-GAAP financial measures that appear in the presentation to which these appendices are attached: Restructuring, restructuring related and impairment items - Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. Impairment charges occur if, due to events or changes in circumstances, we determine that the carrying value of an asset exceeds its fair value. Impairment charges do not directly affect our liquidity, but could have a material adverse effect on our reported financial results. Acquisition, integration and divestiture related items - Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, tha t are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration costs; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); fair value adjustments to contingent consideration liabilities; and bridge loan facility and backstop financing fees in connection with loan facilities that ultimately were not utilized. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of a divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. Italian payback measure - These adjustments represent the exclusion of the impact from increases in our reserves related to the Italian payback measure pertaining to prior years as described in Adjusted revenue. Other items - These are discrete items that occur sporadically and can affect period-to-period comparisons. Pension termination and related charges - These adjustments represent charges associated with the planned termination of the Teleflex Incorporated Retirement Income Plan, a frozen U.S. defined benefit pension plan, and related direct incremental expenses including certain charges stemming from the liquidation of surplus plan assets. These charges and costs do not represent normal and recurring operating expenses, will be inconsistent in amounts and frequency, and are not expected to recur once the plan termination process has been completed. Accordingly, management has excluded these amounts to facilitate an evaluation of our current operating performance and a comparison to our past operating performance. Non-GAAP Adjustments TELEFLEX EARNINGS CONFERENCE CALL 10/31/202418

European medical device regulation - The European Union (“EU”) has adopted the EU Medical Device Regulation (“MDR”), which replaces the existing Medical Devices D irective (“MDD”) and imposes more stringent requirements for the marketing and sale of medical devices in the EU, including requirements affecting clinical evaluations, quality systems and post- market surveillance. The MDR requirements became effective in May 2021, although certain devices that previously satisfied MDD requirements can continue to be marketed in the EU until December 2027 for highest-risk devices and December 2028 for lower-risk devices, subject to certain limitations. Significantly, the MDR will require the re-registration of previously approved medical devices. As a result, Teleflex will incur expenditures in connection with the new registration of medical devices that previously had been registered under the MDD. Therefore, these expenditures are not considered to be ordinary course expenditures in connection with regulatory matters (in contrast, no adjustment has been made to exclude expenditures related to the registration of medical devices that were not registered previously under the MDD). Intangible amortization expense - Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions. ERP implementation - These adjustments represent direct and incremental costs incurred in connection with our implementation of a new global enterprise resource planning ("ERP") solution and related IT transition costs. An implementation of this scale is a significant undertaking and will require substantial time and attention of management and key employees. The associated costs do not represent normal and recurring operating expenses and will be inconsistent in amounts and frequency making it difficult to contribute to a meaningful evaluation of our operating performance. Tax adjustments - These adjustments represent the impact of the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended returns with respect to prior tax years and/or tax law or certain other discrete changes affecting our deferred tax liability. Non-GAAP Adjustments TELEFLEX EARNINGS CONFERENCE CALL 10/31/202419

Three Months Ended September 29, 2024 September 29, 2024 October 1, 2023 % Increase / (Decrease) Reported Revenue Adjustment Adjusted Revenue Reported Revenue Adjustment Adjusted Revenue Reported Revenue Growth Currency Impact Adjustment Impact Adjusted Constant Currency Revenue Growth Americas $433.3 $— $433.3 $428.2 $— $428.2 1.2% (0.3)% —% 1.5% EMEA 150.2 — 150.2 142.7 — 142.7 5.3% 1.4% —% 3.9% Asia 98.3 — 98.3 93.2 — 93.2 5.5% 0.5% —% 5.0% OEM 82.6 — 82.6 82.3 — 82.3 0.3% 0.2% —% 0.1% Consolidated $764.4 $— $764.4 $746.4 $— $746.4 2.4% 0.2% —% 2.2% TELEFLEX EARNINGS CONFERENCE CALL 10/31/202420 Appendix A1 - Q3'24 Segment Reconciliation of Net Revenue (Dollars in millions)

Nine Months Ended September 29, 2024 September 29, 2024 October 1, 2023 % Increase / (Decrease) Reported Revenue Adjustment Adjusted Revenue Reported Revenue Adjustment Adjusted Revenue Reported Revenue Growth Currency Impact Adjustment Impact Adjusted Constant Currency Revenue Growth Americas $1,266.4 $— $1,266.4 $1,264.7 $— $1,264.7 0.1% (0.1)% —% 0.2% EMEA 456.9 (13.8) 470.7 433.9 — 433.9 5.3% 0.7% (3.2)% 7.8% Asia 269.5 — 269.5 258.6 — 258.6 4.2% (2.3)% —% 6.5% OEM 259.1 — 259.1 243.4 — 243.4 6.4% 0.1% —% 6.3% Consolidated $2,251.9 $(13.8) $2,265.7 $2,200.6 $— $2,200.6 2.3% (0.2)% (0.6)% 3.1% TELEFLEX EARNINGS CONFERENCE CALL 10/31/202421 Appendix A2 - 2024 Segment Reconciliation of Net Revenue (Dollars in millions)

Three Months Ended September 29, 2024 September 29, 2024 October 1, 2023 % Increase / (Decrease) Reported Revenue Adjustment Adjusted Revenue Reported Revenue Adjustment Adjusted Revenue Reported Revenue Growth Currency Impact Adjustment Impact Adjusted Constant Currency Revenue Growth Vascular Access $180.9 $— $180.9 $169.9 $— $169.9 6.5% 0.2% —% 6.3% Interventional 149.9 — 149.9 134.1 — 134.1 11.8% 0.4% —% 11.4% Anesthesia 101.1 — 101.1 97.6 — 97.6 3.6% 0.2% —% 3.4% Surgical 111.7 — 111.7 112.8 — 112.8 (0.9)% 0.1% —% (1.0)% Interventional Urology 83.4 — 83.4 73.6 — 73.6 13.3% —% —% 13.3% OEM 82.6 — 82.6 82.3 — 82.3 0.3% 0.2% —% 0.1% Other(1) 54.8 — 54.8 76.1 — 76.1 (28.0)% 0.3% —% (28.3)% Consolidated $764.4 $— $764.4 $746.4 $— $746.4 2.4% 0.2% —% 2.2% TELEFLEX EARNINGS CONFERENCE CALL 10/31/202422 Appendix A3 - Q3'24 Global Product Category Reconciliation of Net Revenue (Dollars in millions) (1) Includes revenues generated from sales of our respiratory and urology products (other than interventional urology products) and sales pursuant to the manufacturing and supply transition agreement related to our Respiratory business divestiture.

Nine Months Ended September 29, 2024 September 29, 2024 October 1, 2023 % Increase / (Decrease) Reported Revenue Adjustment Adjusted Revenue Reported Revenue Adjustment Adjusted Revenue Reported Revenue Growth Currency Impact Adjustment Impact Adjusted Constant Currency Revenue Growth Vascular Access $543.3 $— $543.3 $521.3 $— $521.3 4.2% (0.1)% —% 4.3% Interventional 425.7 — 425.7 375.8 — 375.8 13.3% (0.1)% —% 13.4% Anesthesia 300.0 — 300.0 291.8 — 291.8 2.8% (0.1)% —% 2.9% Surgical 328.6 — 328.6 317.8 — 317.8 3.4% (0.6)% —% 4.0% Interventional Urology 246.2 — 246.2 226.8 — 226.8 8.6% (0.2)% —% 8.8% OEM 259.1 — 259.1 243.4 — 243.4 6.4% 0.1% —% 6.3% Other(1) 149.0 (13.8) 162.8 223.7 — 223.7 (33.4)% —% (6.1)% (27.3)% Consolidated $2,251.9 $(13.8) $2,265.7 $2,200.6 $— $2,200.6 2.3% (0.2)% (0.6)% 3.1% TELEFLEX EARNINGS CONFERENCE CALL 10/31/202423 Appendix A4 - 2024 Global Product Category Reconciliation of Net Revenue (Dollars in millions) (1) Includes revenues generated from sales of our respiratory and urology products (other than interventional urology products) and sales pursuant to the manufacturing and supply transition agreement related to our Respiratory business divestiture. In 2024, amounts reflect the impact from increases in our reserves related to the Italian payback measure pertaining to prior years. Refer to Non-GAAP Financial Measures for detail on Italian payback measure.

Appendix B1 – Reconciliation of Consolidated Statement of Income Items (Dollars in millions, except per share data) TELEFLEX EARNINGS CONFERENCE CALL 10/31/202424 Three Months Ended September 29, 2024 Revenue Gross margin SG&A (1) R&D (1) Operating margin (2) Income before income taxes Income tax expense Effective income tax rate Diluted earnings per share from continuing operations GAAP Basis $764.4 56.3% 31.6% 5.1% 19.5% $130.6 $19.6 15.0% $2.36 Adjustments Restructuring, restructuring related and impairment items (A) — 0.7 (0.1) — 0.9 6.8 1.2 0.12 Acquisition, integration and divestiture related items (B) — — (0.3) — 0.3 2.0 — 0.04 ERP implementation — — (0.8) — 0.8 6.1 1.0 0.11 MDR — — — (0.2) 0.2 1.3 — 0.03 Pension termination costs — 0.7 — (0.7) (5.4) (1.3) (0.09) Intangible amortization expense — 3.8 (2.5) — 6.3 48.3 5.2 0.92 Adjustments total — 4.5 (3.0) (0.2) 7.8 59.1 6.1 1.13 Adjusted basis $764.4 60.8% 28.6% 4.9% 27.3% $189.7 $25.7 13.6% $3.49 Notes: (1) Selling, general and administrative expenses and research and development expenses are shown as a percentage of as reported and adjusted revenues. (2) Operating margin defined as Income from continuing operations before interest, loss on extinguishment of debt and taxes as a percentage of as reported and adjusted revenues. See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions. Totals may not sum due to rounding.

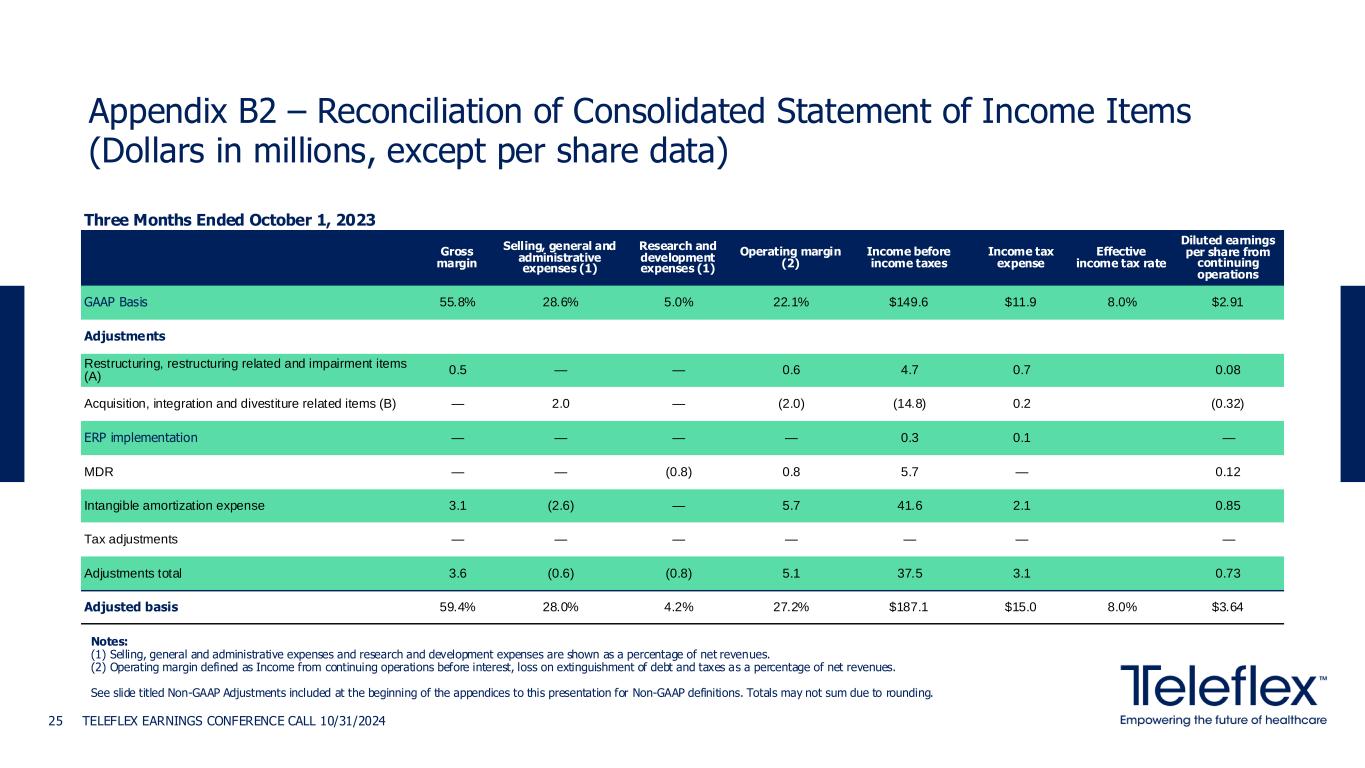

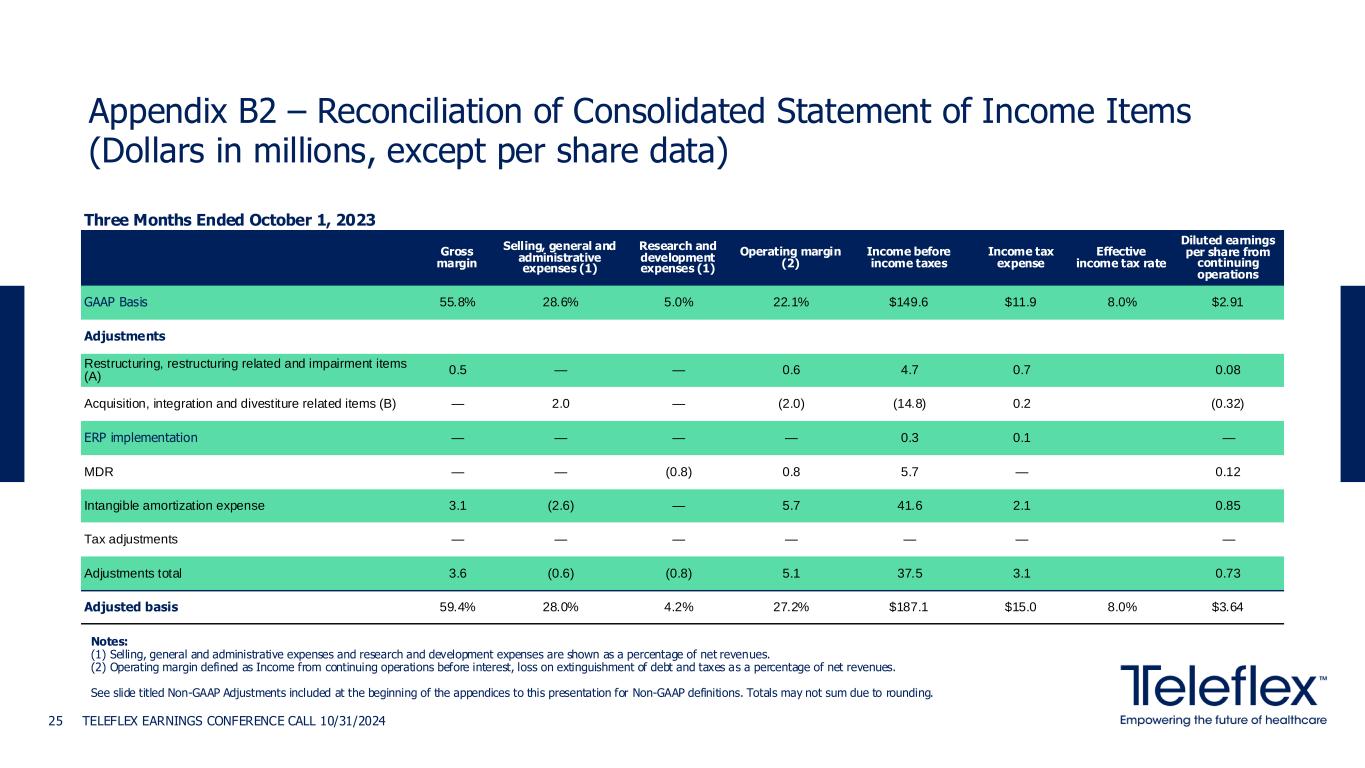

Three Months Ended October 1, 2023 Gross margin Selling, general and administrative expenses (1) Research and development expenses (1) Operating margin (2) Income before income taxes Income tax expense Effective income tax rate Diluted earnings per share from continuing operations GAAP Basis 55.8% 28.6% 5.0% 22.1% $149.6 $11.9 8.0% $2.91 Adjustments Restructuring, restructuring related and impairment items (A) 0.5 — — 0.6 4.7 0.7 0.08 Acquisition, integration and divestiture related items (B) — 2.0 — (2.0) (14.8) 0.2 (0.32) ERP implementation — — — — 0.3 0.1 — MDR — — (0.8) 0.8 5.7 — 0.12 Intangible amortization expense 3.1 (2.6) — 5.7 41.6 2.1 0.85 Tax adjustments — — — — — — — Adjustments total 3.6 (0.6) (0.8) 5.1 37.5 3.1 0.73 Adjusted basis 59.4% 28.0% 4.2% 27.2% $187.1 $15.0 8.0% $3.64 TELEFLEX EARNINGS CONFERENCE CALL 10/31/202425 Notes: (1) Selling, general and administrative expenses and research and development expenses are shown as a percentage of net revenues. (2) Operating margin defined as Income from continuing operations before interest, loss on extinguishment of debt and taxes as a percentage of net revenues. See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions. Totals may not sum due to rounding. Appendix B2 – Reconciliation of Consolidated Statement of Income Items (Dollars in millions, except per share data)

Appendix B3 – Reconciliation of Consolidated Statement of Income Items (Dollars in millions, except per share data) TELEFLEX EARNINGS CONFERENCE CALL 10/31/202426 Nine Months Ended September 29, 2024 Revenue Gross margin SG&A (1) R&D (1) Operating margin (2) Income before income taxes Income tax expense Effective income tax rate Diluted earnings per share from continuing operations GAAP Basis $2,251.9 56.1% 38.8% 5.2% 11.6% $202.2 $(4.6) (2.3)% $4.38 Adjustments Restructuring, restructuring related and impairment items (A) — 0.5 (0.1) — 1.1 24.8 4.3 0.44 Acquisition, integration and divestiture related items (B) — 0.1 (0.4) — 0.5 11.0 0.5 0.22 Italian payback measure (C) 13.8 0.2 (0.2) — 0.6 13.8 — 0.29 ERP implementation — — (0.4) — 0.4 9.2 1.4 0.17 MDR — — — (0.4) 0.3 7.6 — 0.16 Pension termination costs — — (5.9) — 5.9 133.2 56.9 1.61 Intangible amortization expense — 4.0 (2.6) — 6.5 148.0 15.2 2.81 Tax adjustments — — — — — — (2.1) 0.04 Adjustments total 13.8 4.8 (9.6) (0.4) 15.3 347.6 76.2 5.74 Adjusted basis $2,265.7 60.9% 29.2% 4.8% 26.9% $549.8 $71.6 13.0% $10.12 Notes: (1) Selling, general and administrative expenses and research and development expenses are shown as a percentage of as reported and adjusted revenues. (2) Operating margin defined as Income from continuing operations before interest, loss on extinguishment of debt and taxes as a percentage of as reported and adjusted revenues. See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions. Totals may not sum due to rounding.

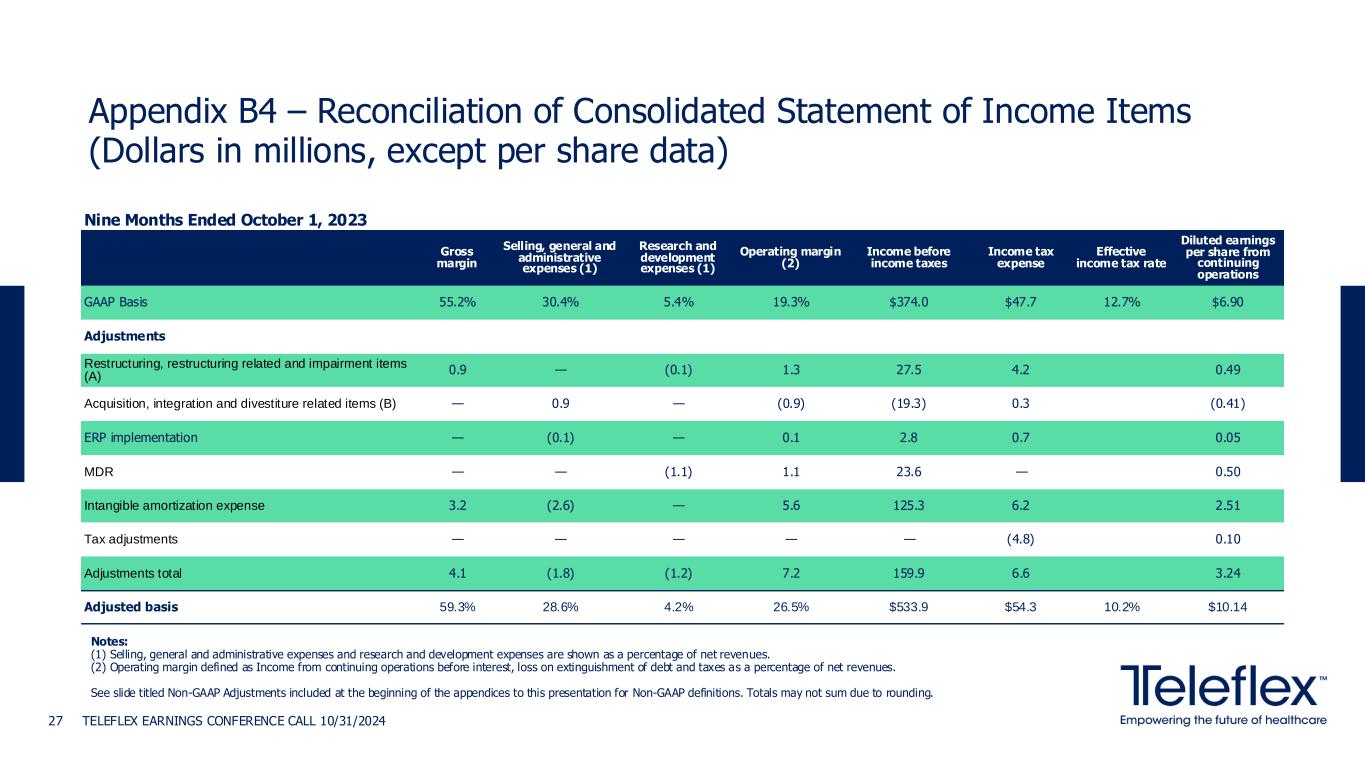

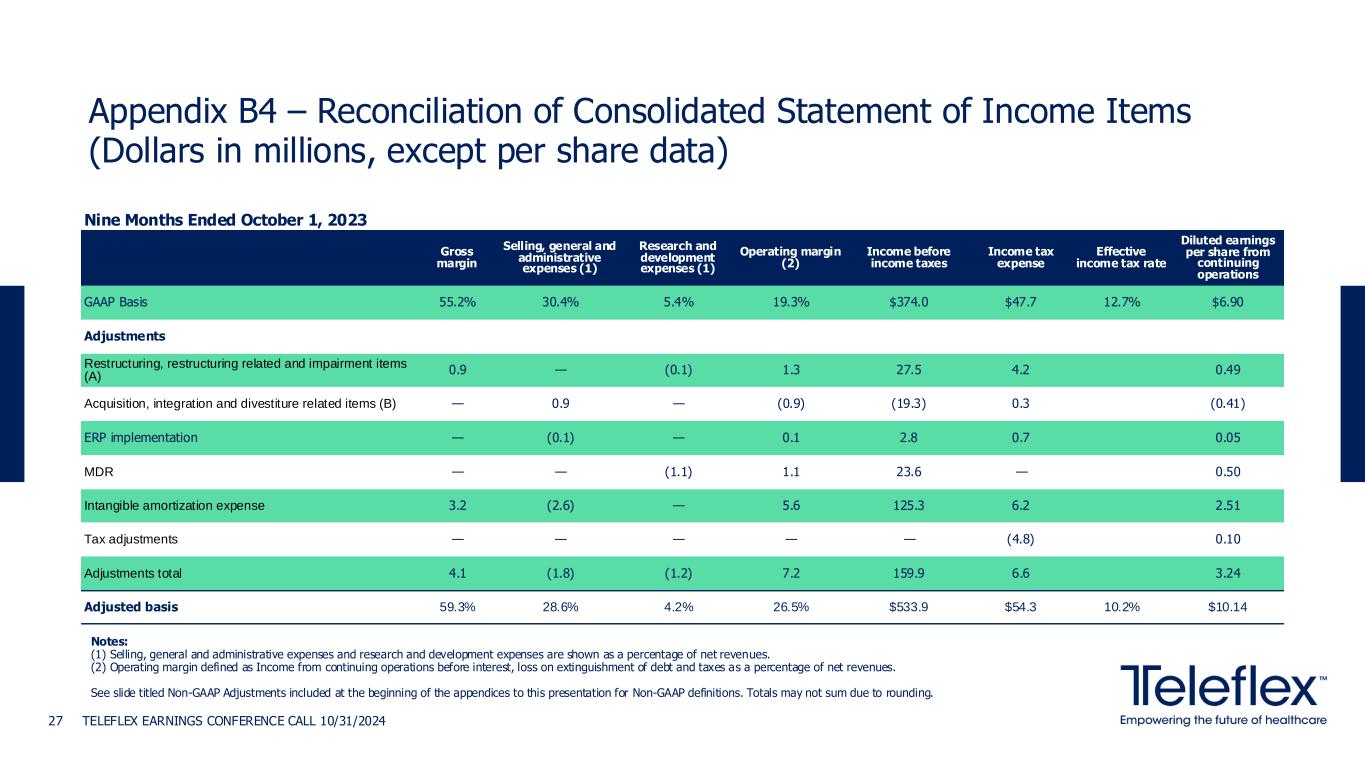

Nine Months Ended October 1, 2023 Gross margin Selling, general and administrative expenses (1) Research and development expenses (1) Operating margin (2) Income before income taxes Income tax expense Effective income tax rate Diluted earnings per share from continuing operations GAAP Basis 55.2% 30.4% 5.4% 19.3% $374.0 $47.7 12.7% $6.90 Adjustments Restructuring, restructuring related and impairment items (A) 0.9 — (0.1) 1.3 27.5 4.2 0.49 Acquisition, integration and divestiture related items (B) — 0.9 — (0.9) (19.3) 0.3 (0.41) ERP implementation — (0.1) — 0.1 2.8 0.7 0.05 MDR — — (1.1) 1.1 23.6 — 0.50 Intangible amortization expense 3.2 (2.6) — 5.6 125.3 6.2 2.51 Tax adjustments — — — — — (4.8) 0.10 Adjustments total 4.1 (1.8) (1.2) 7.2 159.9 6.6 3.24 Adjusted basis 59.3% 28.6% 4.2% 26.5% $533.9 $54.3 10.2% $10.14 TELEFLEX EARNINGS CONFERENCE CALL 10/31/202427 Notes: (1) Selling, general and administrative expenses and research and development expenses are shown as a percentage of net revenues. (2) Operating margin defined as Income from continuing operations before interest, loss on extinguishment of debt and taxes as a percentage of net revenues. See slide titled Non-GAAP Adjustments included at the beginning of the appendices to this presentation for Non-GAAP definitions. Totals may not sum due to rounding. Appendix B4 – Reconciliation of Consolidated Statement of Income Items (Dollars in millions, except per share data)

TELEFLEX EARNINGS CONFERENCE CALL 10/31/202428 A. Restructuring, restructuring related and impairment items – For the three months ended September 29, 2024, pre-tax restructuring charges were $0.3 million and restructuring related charges were $6.5 million. For the three months ended October 1, 2023, pre-tax restructuring charges were $0.2 million and restructuring related charges were $4.5 million. For the nine months ended September 29, 2024, pre-tax restructuring charges were $8.7 million; restructuring related charges were $14.0 million; and impairment charges were $2.1 million. For the nine months ended October 1, 2023, pre-tax restructuring charges were $4.0 million and restructuring related charges were $23.6 million. B. Acquisition, integration and divestiture related items – For the three and nine months ended September 29, 2024 and October 1, 2023, these charges related to changes in the estimated fair value of our contingent consideration liabilities and the acquisition of Palette Life Sciences AB. C. Italian payback measure – Adjustment reflects the impact of an increase in reserves for prior years related to the Italian payback measure and its impact on the adjusted basis for each Non-GAAP financial measure presented within the table. Appendix B Tickmarks

Appendix C - 2024 Adj. Gross and Operating Margin Guidance Reconciliation TELEFLEX EARNINGS CONFERENCE CALL 10/31/202429 Low High Forecasted GAAP Gross Margin 55.76% 56.26% Estimated restructuring, restructuring related and impairment items 0.60% 0.60% Estimated acquisition, integration and divestiture related items 0.06% 0.06% ERP implementation —% —% Italian payback measure 0.20% 0.20% Estimated intangible amortization expense 3.89% 3.89% Forecasted Adjusted Gross Margin 60.50% 61.00% Low High Forecasted GAAP Operating Margin 12.92% 13.17% Estimated restructuring, restructuring related and impairment items 1.12% 1.12% Estimated acquisition, integration and divestiture related items 0.49% 0.49% Estimated other items 0.01% 0.01% Pension termination and related charges 4.48% 4.48% Estimated ERP implementation 0.61% 0.61% Estimated MDR 0.28% 0.28% Italian payback measure 0.39% 0.39% Estimated intangible amortization expense 6.47% 6.47% Forecasted Adjusted Operating Margin 26.75% 27.00%

Appendix D - Reconciliation of 2024 Adjusted Earnings Per Share Guidance TELEFLEX EARNINGS CONFERENCE CALL 10/31/202430 Low High Forecasted GAAP Diluted Earnings Per Share from continuing operations $6.65 $6.95 Estimated restructuring, restructuring related and impairment items, net of tax $0.60 $0.60 Estimated acquisition, integration and divestiture related items, net of tax $0.30 $0.30 Pension termination and related charges, net of tax $1.70 $1.70 Estimated ERP implementation, net of tax $0.32 $0.32 Estimated MDR, net of tax $0.18 $0.18 Italian payback measure, net of tax $0.29 $0.29 Estimated intangible amortization expense, net of tax $3.81 $3.81 Tax adjustments $0.05 $0.05 Forecasted Adjusted Diluted Earnings Per Share from continuing operations, net of tax $13.90 $14.20

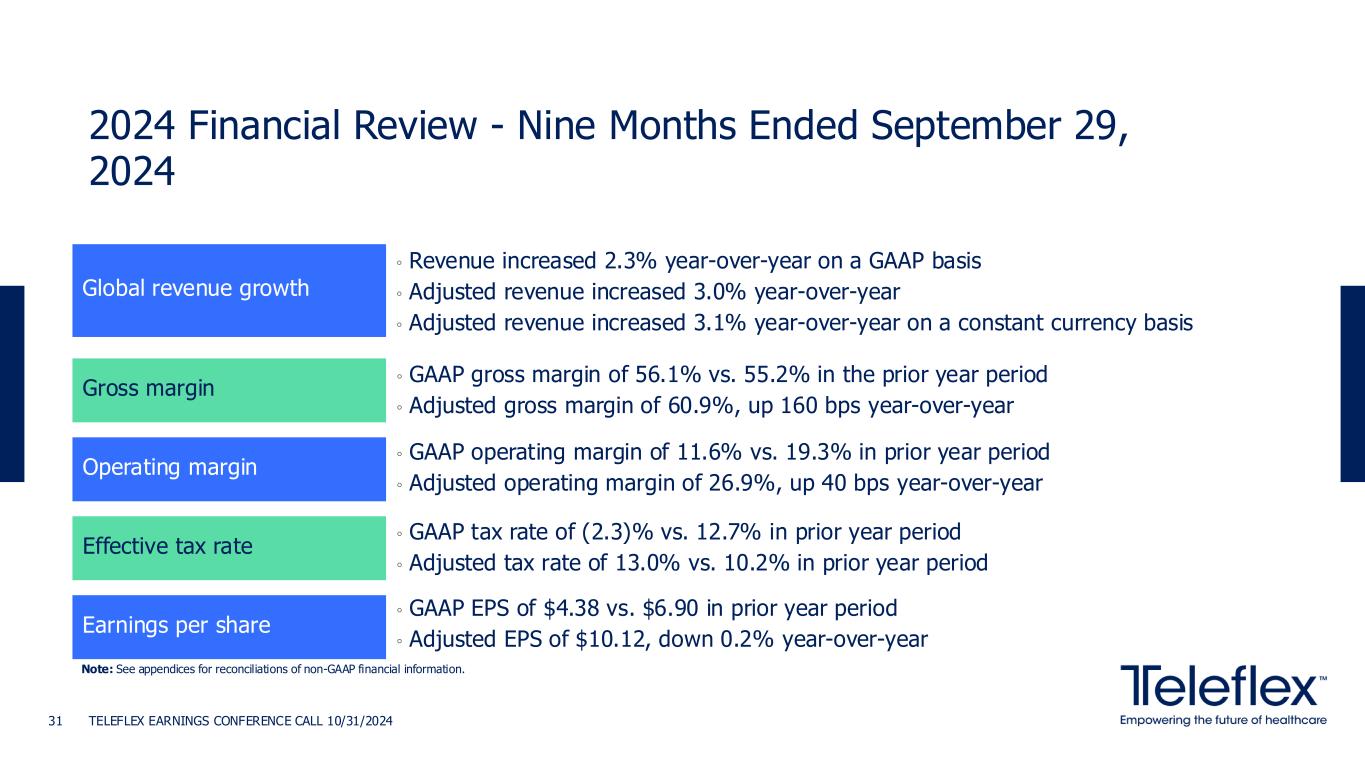

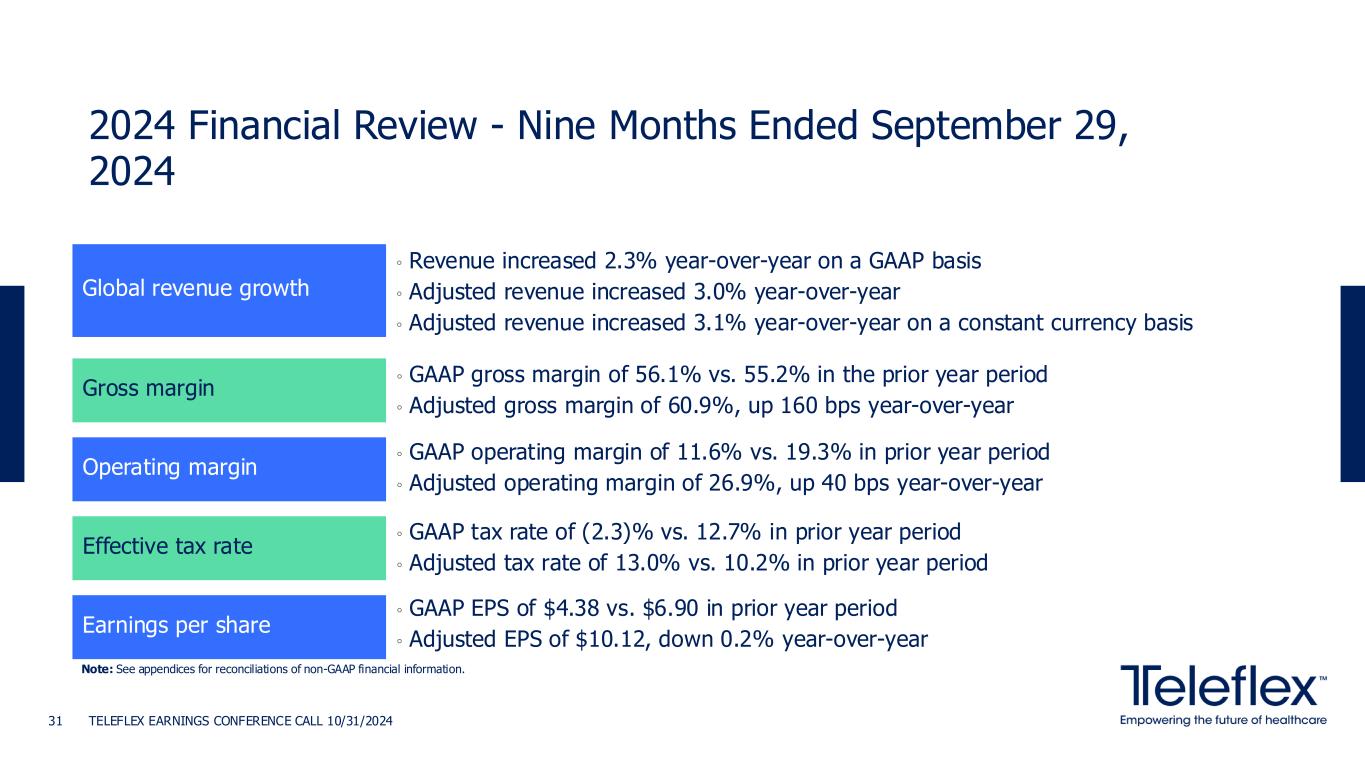

2024 Financial Review - Nine Months Ended September 29, 2024 TELEFLEX EARNINGS CONFERENCE CALL 10/31/202431 Gross margin Operating margin Effective tax rate Earnings per share ◦ GAAP gross margin of 56.1% vs. 55.2% in the prior year period ◦ Adjusted gross margin of 60.9%, up 160 bps year-over-year ◦ GAAP operating margin of 11.6% vs. 19.3% in prior year period ◦ Adjusted operating margin of 26.9%, up 40 bps year-over-year ◦ GAAP tax rate of (2.3)% vs. 12.7% in prior year period ◦ Adjusted tax rate of 13.0% vs. 10.2% in prior year period ◦ GAAP EPS of $4.38 vs. $6.90 in prior year period ◦ Adjusted EPS of $10.12, down 0.2% year-over-year Global revenue growth ◦ Revenue increased 2.3% year-over-year on a GAAP basis ◦ Adjusted revenue increased 3.0% year-over-year ◦ Adjusted revenue increased 3.1% year-over-year on a constant currency basis Note: See appendices for reconciliations of non-GAAP financial information.