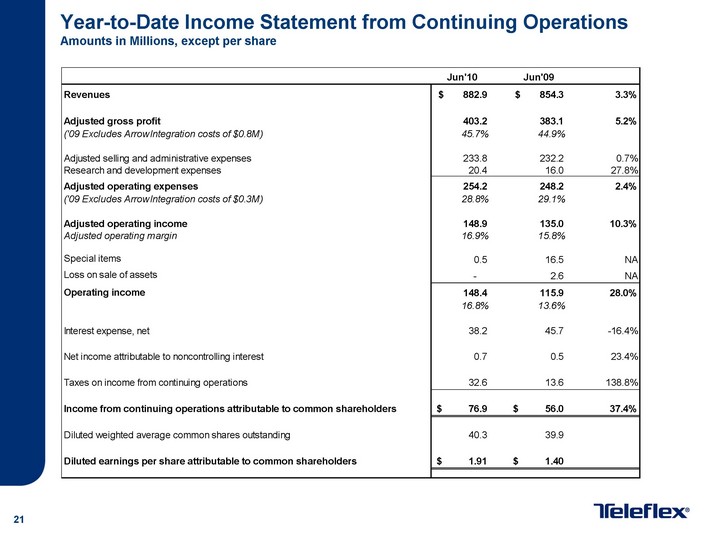

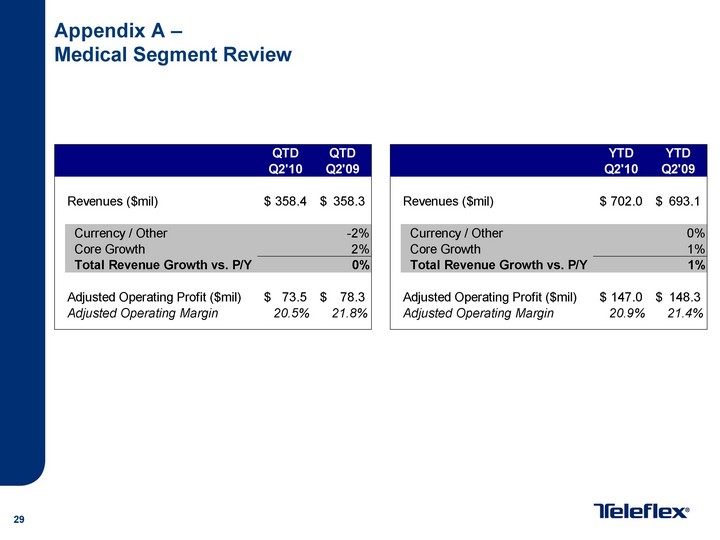

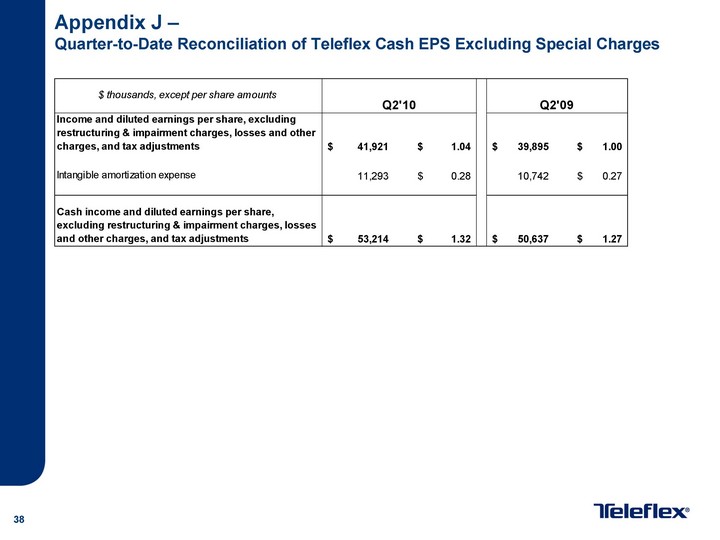

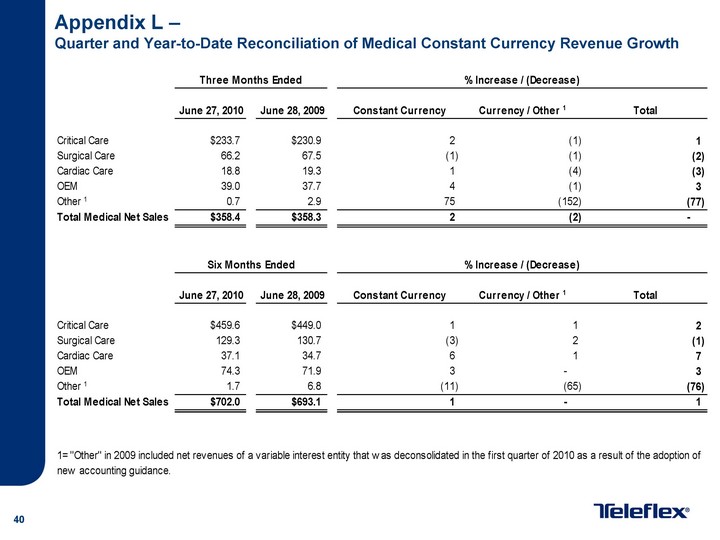

| 2 2 2 Forward-Looking Statements/Additional Notes This presentation and our discussion contain forward-looking information and statements including, but not limited to, expected benefits from elimination of certain management positions; upcoming 2010 Medical Segment product launches; forecasted 2010 total revenue, total company gross margins, total company R&D expense, total company operating margins, effective tax rate and earnings per share from continuing operations on a GAAP basis; forecasted special items, adjusted earnings per share from continuing operations, amortization expense per share and Adjusted Cash EPS (defined below) for 2010; forecasted 2010 cash flow from continuing operations excluding the impact of an amendment of ASC topic 860; forecasted 2010 capital expenditures, depreciation expense, amortization expense and full year average Euro rate; forecasted 2010 Medical Segment revenue, segment operating margins and core revenue growth; forecasted revenue and segment operating margins for our Aerospace and Commercial segments; and other matters which inherently involve risks and uncertainties which could cause actual results to differ from those projected or implied in the forward-looking statements. These risks and uncertainties are addressed in the Company's SEC filings, including its most recent Form 10-K. This presentation includes certain non-GAAP financial measures, which include revenue growth on a constant currency basis; adjusted operating margins; adjusted earnings per share; adjusted gross margins; adjusted cash flow from continuing operations; adjusted gross profit; adjusted selling, engineering and administrative expenses; adjusted operating expenses; adjusted operating income; income and diluted earnings per share, excluding restructuring and impairment charges, losses and other charges; forecasted adjusted earnings per share from continuing operations; forecasted earnings per share from continuing operations before special items and amortization expense, which we refer to as "Adjusted Cash EPS"; and forecasted adjusted cash flow from continuing operations. These non-GAAP measures exclude the impact of restructuring and impairment costs, (gain)/loss on sale of assets and other charges, the impact of an amendment of ASC topic 860, an income tax refund related to gains on a business divestiture and intangible amortization expense. In addition, this presentation includes information regarding adjusted free cash flow, which reflects cash from operations minus capital expenditures and excludes the impact of certain tax payments and the amendment of ASC topic 860. Reconciliation of these non-GAAP measures to the most comparable GAAP measures is contained within this presentation. Segment operating profit is defined as a segment's revenues reduced by its materials, labor and other product costs along with the segment's selling, engineering and administrative expenses and noncontrolling interest. Unallocated corporate expenses, restructuring costs, gain or loss on the sale of assets, acquisition integration costs, fair market adjustments for inventory, interest income and expense and taxes on income are excluded from the measure. Core revenues and growth exclude the impact of translating the results of international subsidiaries at different currency exchange rates from year to year and the comparable activity of companies acquired or divested within the most recent twelve-month period. The following slides reflect continuing operations. |