Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

TFX similar filings

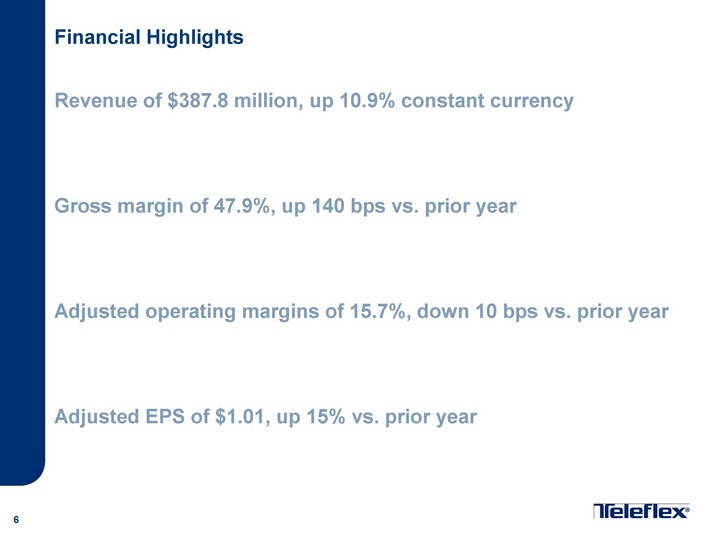

- 31 Jul 12 Teleflex Reports Second Quarter 2012 Results

- 31 Jul 12 Regulation FD Disclosure

- 10 May 12 Submission of Matters to a Vote of Security Holders

- 1 May 12 Regulation FD Disclosure

- 14 Mar 12 Regulation FD Disclosure

- 12 Mar 12 Teleflex Appoints Thomas E. Powell Senior Vice President & Chief Financial Officer

- 23 Feb 12 Regulation FD Disclosure

Filing view

External links