Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

TFX similar filings

- 31 Oct 12 Regulation FD Disclosure

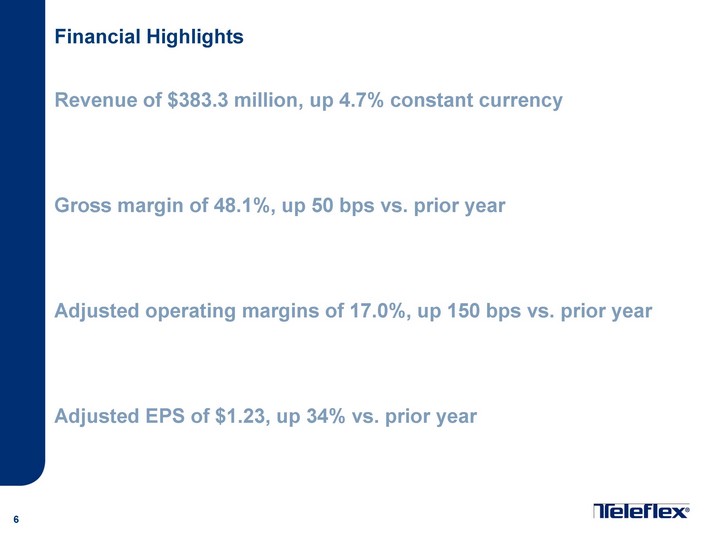

- 31 Oct 12 Teleflex Reports Third Quarter 2012 Results

- 14 Aug 12 Teleflex to Acquire Global Laryngeal Mask Leader

- 31 Jul 12 Regulation FD Disclosure

- 10 May 12 Submission of Matters to a Vote of Security Holders

- 1 May 12 Regulation FD Disclosure

- 1 May 12 Teleflex Reports First Quarter 2012 Results

Filing view

External links