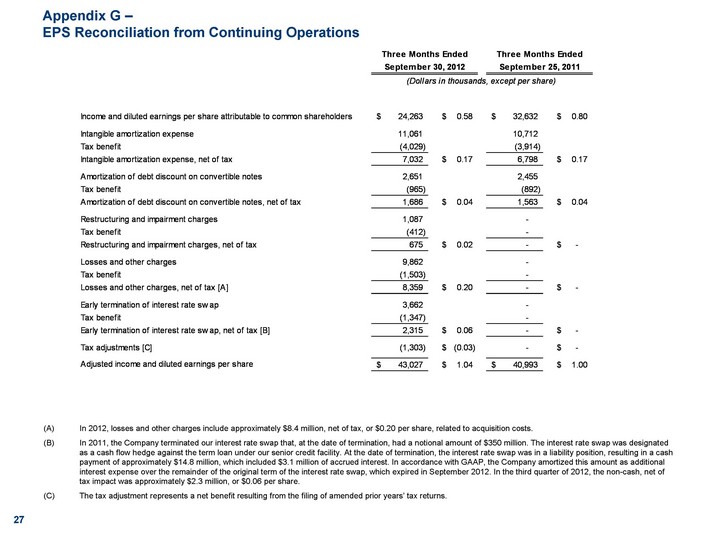

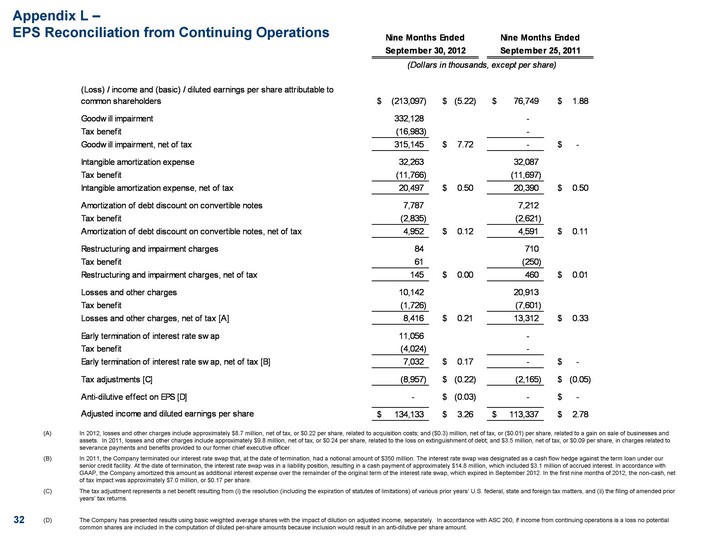

| 32 Appendix L - EPS Reconciliation from Continuing Operations In 2012, losses and other charges include approximately $8.7 million, net of tax, or $0.22 per share, related to acquisition costs; and ($0.3) million, net of tax, or ($0.01) per share, related to a gain on sale of businesses and assets. In 2011, losses and other charges include approximately $9.8 million, net of tax, or $0.24 per share, related to the loss on extinguishment of debt; and $3.5 million, net of tax, or $0.09 per share, in charges related to severance payments and benefits provided to our former chief executive officer. In 2011, the Company terminated our interest rate swap that, at the date of termination, had a notional amount of $350 million. The interest rate swap was designated as a cash flow hedge against the term loan under our senior credit facility. At the date of termination, the interest rate swap was in a liability position, resulting in a cash payment of approximately $14.8 million, which included $3.1 million of accrued interest. In accordance with GAAP, the Company amortized this amount as additional interest expense over the remainder of the original term of the interest rate swap, which expired in September 2012. In the first nine months of 2012, the non-cash, net of tax impact was approximately $7.0 million, or $0.17 per share. The tax adjustment represents a net benefit resulting from (i) the resolution (including the expiration of statutes of limitations) of various prior years' U.S. federal, state and foreign tax matters, and (ii) the filing of amended prior years' tax returns. The Company has presented results using basic weighted average shares with the impact of dilution on adjusted income, separately. In accordance with ASC 260, if income from continuing operations is a loss no potential common shares are included in the computation of diluted per-share amounts because inclusion would result in an anti-dilutive per share amount. |