UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02354

|

| BlackRock Liquidity Funds |

| (Exact name of registrant as specified in charter) |

|

100 Bellevue Parkway Wilmington, DE 19809 |

| (Address of principal executive offices) (Zip code) |

|

Brian Kindelan, Esq. BlackRock Advisors, LLC 100 Bellevue Parkway Wilmington, DE 19809 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 800-441-7762

Date of fiscal year end: October 31, 2007

Date of reporting period: April 30, 2007

Item 1. Reports to Stockholders.

The Registrant’s semi-annual report to shareholders is as follows:

TempFund

TempCash

FedFund

T-Fund

Federal Trust Fund

Treasury Trust Fund

MuniFund

MuniCash

California Money Fund

New York Money Fund

| | |

NOT FDIC INSURED | |  |

MAY LOSE VALUE | |

NO BANK GUARANTEE | |

BLACKROCK LIQUIDITY FUNDS

TABLEOF CONTENTS

PRIVACY PRINCIPLES OF BLACKROCK LIQUIDITY FUNDS

BlackRock is committed to maintaining the privacy of its current and former fund investors and individual clients (collectively, “Clients”) and to safeguarding their nonpublic personal information. The following information is provided to help you understand what personal information BlackRock collects, how we protect that information and why in certain cases we share information with select parties.

If you are located in a jurisdiction where specific laws, rules or regulations require BlackRock to provide you with additional or different privacy-related rights beyond what is set forth below, then BlackRock will comply with those specific laws, rules or regulations.

BlackRock obtains or verifies personal nonpublic information from and about you from different sources, including the following: (i) information we receive from you or, if applicable, your financial intermediary, on applications, forms or other documents; (ii) information about your transactions with us, our affiliates, or others; (iii) information we receive from a consumer reporting agency; and (iv) from visits to our Web sites.

BlackRock does not sell or disclose to nonaffiliated third parties any non-public personal information about its Clients, except as permitted by law or as is necessary to respond to regulatory inquiries or service Client accounts. These nonaffiliated third parties are required to protect the confidentiality and security of this information and to use it only for its intended purpose.

We may share information with our affiliates to service your account or to provide you with information about other BlackRock products or services that may be of interest to you. In addition, BlackRock restricts access to nonpublic personal information about its Clients to those BlackRock employees with a legitimate business need for the information. BlackRock maintains physical, electronic and procedural safeguards that are designed to protect the nonpublic personal information of its Clients, including procedures relating to the proper storage and disposal of such information.

BLACKROCK LIQUIDITY FUNDS

100 Bellevue Parkway

Wilmington, DE 19809

(800) 821-7432

www.blackrock.com

April 30, 2007

Dear Shareholder:

We are pleased to present the Semi-Annual Report to Shareholders of BlackRock Liquidity Funds for the six months ended April 30, 2007.

BlackRock Liquidity Funds offer a variety of high quality Taxable and Tax-Exempt Money Market Funds designed to meet the varied needs of our investors. Please contact your account representative or call our Client Service Center at (800) 821-7432 to discuss your investment options.

We welcome the opportunity to serve your investment needs in the months ahead.

Sincerely,

|

|

|

| Ralph L. Schlosstein |

| Chairman & President |

THISPAGENOTPARTOFYOURFUNDREPORT

1

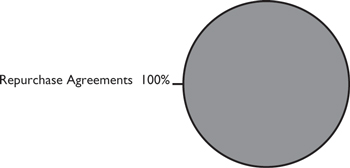

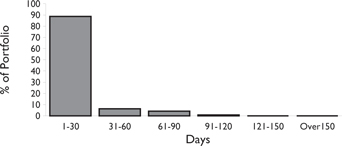

TEMPFUND

FUND PROFILE

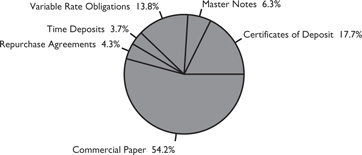

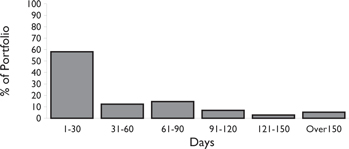

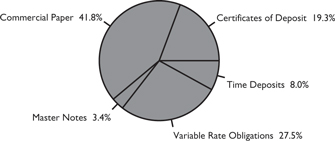

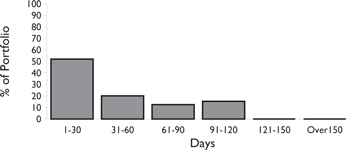

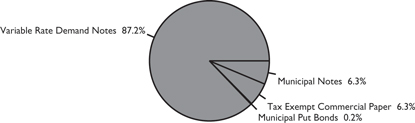

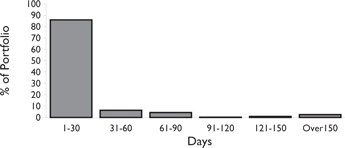

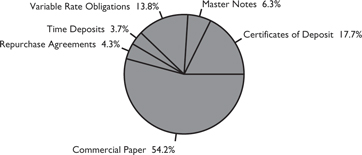

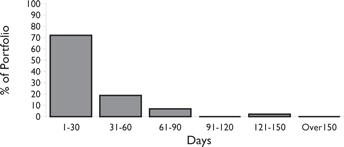

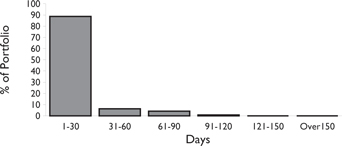

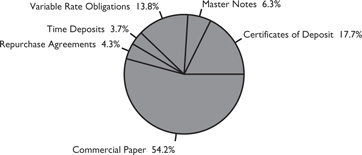

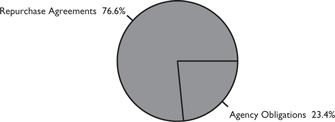

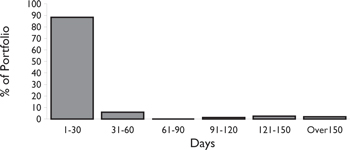

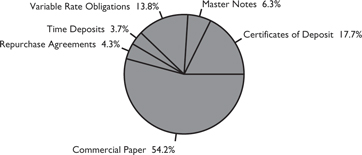

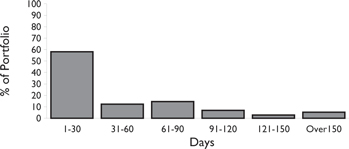

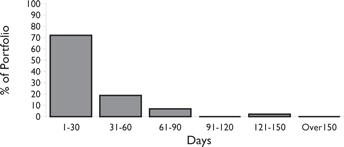

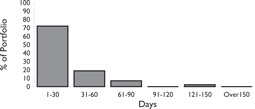

Portfolio Composition - % of Portfolio

Distribution - Weighted Average Maturity 43 days

EXPENSE EXAMPLE

As a shareholder of the Fund, you incur ongoing costs, including advisory fees, distribution (12b-1) and service fees, where applicable, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2006 to April 30, 2007.

The information under “Actual Expenses,” together with the amount you invested, allows you to estimate actual expenses paid over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period,” to estimate the expenses paid on your account during this period.

The information under “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | | | |

| | | Actual Expenses |

| | | Institutional | | Dollar | | Cash

Management | | Cash

Reserve | | Administration | | Bear Stearns | | Bear Stearns

Premier Choice | | Bear Stearns

Private Client | | Bear Stearns

Premier |

Beginning Account Value (11/01/06) (in Dollars) | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 |

Ending Account Value (4/30/07) (in Dollars) | | 1,026.00 | | 1,024.80 | | 1,023.50 | | 1,024.00 | | 1,025.50 | | 1,021.90 | | 1,024.70 | | 1,023.80 | | 1,023.80 |

Expenses Incurred During Period (11/01/06 - 4/30/07)* | | 0.90 | | 2.16 | | 3.41 | | 2.91 | | 1.41 | | 5.01 | | 2.26 | | 3.16 | | 3.16 |

| |

| | | Hypothetical Expenses (5% return before expenses) |

| | | Institutional | | Dollar | | Cash

Management | | Cash

Reserve | | Administration | | Bear Stearns | | Bear Stearns

Premier Choice | | Bear Stearns

Private Client | | Bear Stearns

Premier |

Beginning Account Value (11/01/06) (in Dollars) | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 |

Ending Account Value (4/30/07) (in Dollars) | | 1,024.10 | | 1,022.84 | | 1,021.59 | | 1,022.09 | | 1,023.59 | | 1,019.98 | | 1,022.74 | | 1,021.84 | | 1,021.84 |

Expenses Incurred During Period (11/01/06 - 4/30/07)* | | 0.90 | | 2.16 | | 3.41 | | 2.91 | | 1.41 | | 5.02 | | 2.26 | | 3.16 | | 3.16 |

| * | For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio for the period of 0.18%, 0.43%, 0.68%, 0.58%, 0.28%, 1.00%, 0.45%, 0.63% and 0.63% for Institutional, Dollar, Cash Management, Cash Reserve, Administration, Bear Stearns, Bear Stearns Premier Choice, Bear Stearns Private Client and Bear Stearns Premier classes, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

2

TEMPCASH

FUND PROFILE

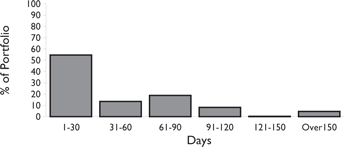

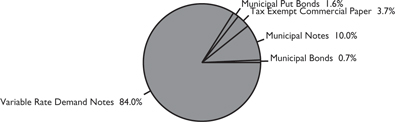

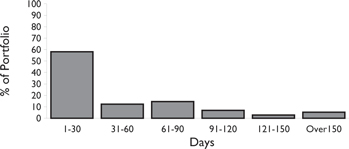

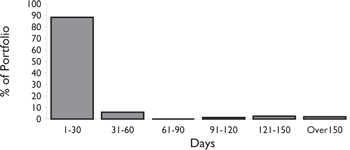

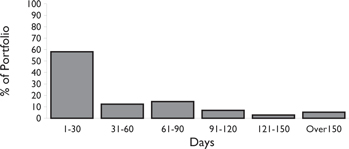

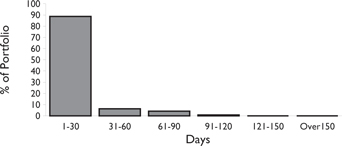

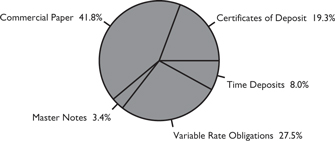

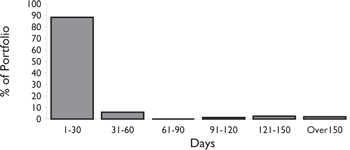

Portfolio Composition - % of Portfolio

Distribution - Weighted Average Maturity 44 days

EXPENSE EXAMPLE

As a shareholder of the Fund, you incur ongoing costs, including advisory fees, distribution (12b-1) and service fees, where applicable, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2006 to April 30, 2007.

The information under “Actual Expenses,” together with the amount you invested, allows you to estimate actual expenses paid over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period,” to estimate the expenses paid on your account during this period.

The information under “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

| | | Actual Expenses | | Hypothetical Expenses (5% return before expenses) |

| | | Institutional | | Dollar | | Cash

Management | | Administration | | Institutional | | Dollar | | Cash

Management | | Administration |

Beginning Account Value (11/01/06) (in Dollars) | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 |

Ending Account Value (4/30/07) (in Dollars) | | 1,026.10 | | 1,024.80 | | 1,023.50 | | 1,025.60 | | 1,024.10 | | 1,022.84 | | 1,021.59 | | 1,023.59 |

Expenses Incurred During Period (11/01/06 - 4/30/07)* | | 0.90 | | 2.16 | | 3.41 | | 1.41 | | 0.90 | | 2.16 | | 3.41 | | 1.41 |

| * | For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio for the period of 0.18%, 0.43%, 0.68% and 0.28% for Institutional, Dollar, Cash Management and Administration classes, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

3

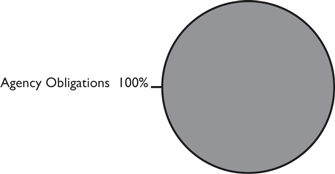

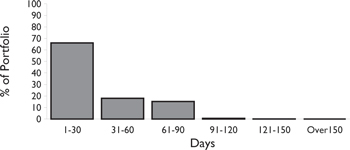

FEDFUND

FUND PROFILE

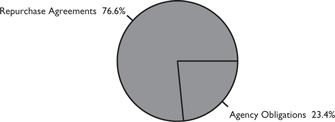

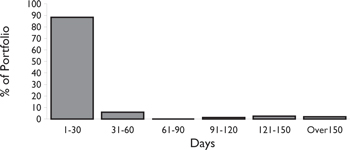

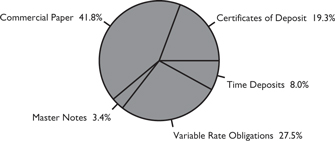

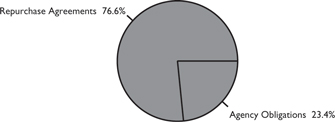

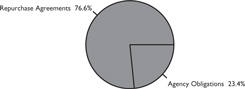

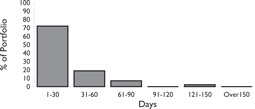

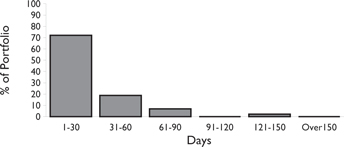

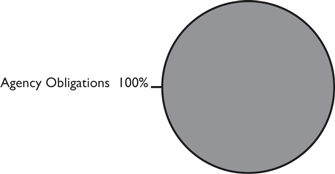

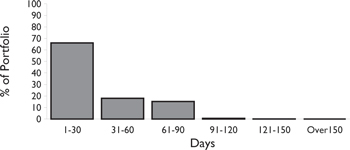

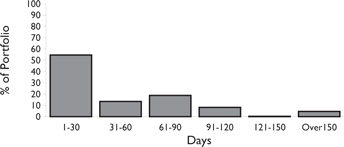

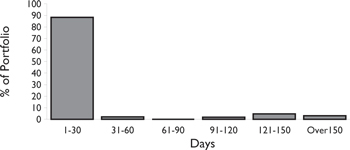

Portfolio Composition - % of Portfolio

Distribution - Weighted Average Maturity 22 days

EXPENSE EXAMPLE

As a shareholder of the Fund, you incur ongoing costs, including advisory fees, distribution (12b-1) and service fees, where applicable, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2006 to April 30, 2007.

The information under “Actual Expenses,” together with the amount you invested, allows you to estimate actual expenses paid over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period,” to estimate the expenses paid on your account during this period.

The information under “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Expenses | | Hypothetical Expenses (5% return before expenses) |

| | | Institutional | | Dollar | | Cash

Reserve | | Administration | | Bear

Stearns | | Bear

Stearns

Premier

Choice | | Bear

Stearns

Private

Client | | Bear

Stearns

Premier | | Institutional | | Dollar | | Cash

Reserve | | Administration | | Bear

Stearns | | Bear

Stearns

Premier

Choice | | Bear

Stearns

Private

Client | | Bear

Stearns

Premier |

Beginning Account Value (11/1/06) (in Dollars) | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 |

Ending Account Value (4/30/07) (in Dollars) | | 1,025.70 | | 1,024.40 | | 1,023.60 | | 1,025.20 | | 1,021.60 | | 1,024.40 | | 1,023.50 | | 1,023.50 | | 1,024.00 | | 1,022.74 | | 1,021.99 | | 1,023.49 | | 1,019.98 | | 1,022.74 | | 1,021.84 | | 1,021.84 |

Expenses Incurred During Period (11/01/06 - 4/30/07)* | | 1.00 | | 2.26 | | 3.01 | | 1.51 | | 5.01 | | 2.26 | | 3.16 | | 3.16 | | 1.00 | | 2.26 | | 3.01 | | 1.51 | | 5.02 | | 2.26 | | 3.16 | | 3.16 |

| * | For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio for the period of 0.20%, 0.45%, 0.60%, 0.30%, 1.00%, 0.45%, 0.63% and 0.63% for Institutional, Dollar, Cash Reserve, Administration, Bear Stearns, Bear Stearns Premier Choice, Bear Stearns Private Client and Bear Stearns Premier classes, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

4

T-FUND

FUND PROFILE

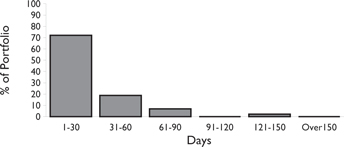

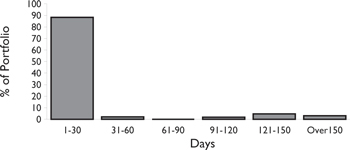

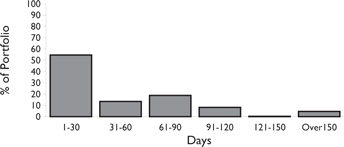

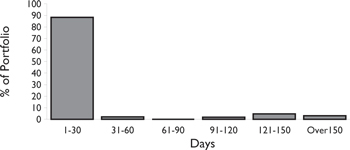

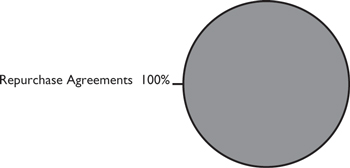

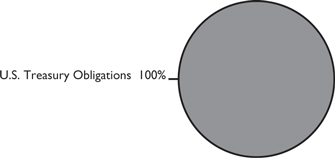

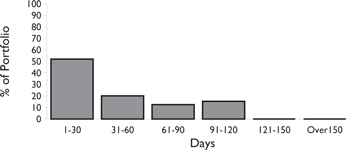

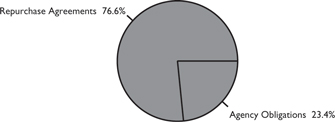

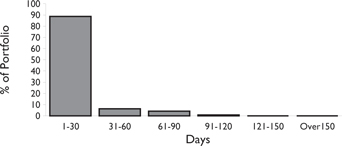

Portfolio Composition - % of Portfolio

Distribution - Weighted Average Maturity 25 days

EXPENSE EXAMPLE

As a shareholder of the Fund, you incur ongoing costs, including advisory fees, distribution (12b-1) and service fees, where applicable, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2006 to April 30, 2007.

The information under “Actual Expenses,” together with the amount you invested, allows you to estimate actual expenses paid over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period,” to estimate the expenses paid on your account during this period.

The information under “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

| | | Actual Expenses | | Hypothetical Expenses (5% return before expenses) |

| | | Institutional | | Dollar | | Cash

Management | | Administration | | Institutional | | Dollar | | Cash

Management | | Administration |

Beginning Account Value (11/01/06) (in Dollars) | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 |

Ending Account Value (4/30/07) (in Dollars) | | 1,025.50 | | 1,024.20 | | 1,022.90 | | 1,025.00 | | 1,024.00 | | 1,022.74 | | 1,021.49 | | 1,023.49 |

Expenses Incurred During Period (11/01/06 - 4/30/07)* | | 1.00 | | 2.26 | | 3.51 | | 1.51 | | 1.00 | | 2.26 | | 3.51 | | 1.51 |

| * | For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio for the period of 0.20%, 0.45%, 0.70% and 0.30% for Institutional, Dollar, Cash Management and Administration classes, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

5

FEDERAL TRUST FUND

FUND PROFILE

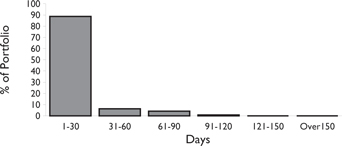

Portfolio Composition - % of Portfolio

Distribution - Weighted Average Maturity 30 days

EXPENSE EXAMPLE

As a shareholder of the Fund, you incur ongoing costs, including advisory fees, distribution (12b-1) and service fees, where applicable, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2006 to April 30, 2007.

The information under “Actual Expenses,” together with the amount you invested, allows you to estimate actual expenses paid over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period,” to estimate the expenses paid on your account during this period.

The information under “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | |

| | | Actual Expenses | | Hypothetical Expenses

(5% return before expenses) |

| | | Institutional | | Dollar | | Institutional | | Dollar |

Beginning Account Value (11/01/06) (in Dollars) | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 |

Ending Account Value (4/30/07) (in Dollars) | | 1,025.40 | | 1,024.10 | | 1,024.00 | | 1,022.74 |

Expenses Incurred During Period (11/01/06 - 4/30/07)* | | 1.00 | | 2.26 | | 1.00 | | 2.26 |

| * | For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio for the period of 0.20% and 0.45% for Institutional and Dollar classes, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

6

TREASURY TRUST FUND

FUND PROFILE

Portfolio Composition - % of Portfolio

Distribution - Weighted Average Maturity 39 days

EXPENSE EXAMPLE

As a shareholder of the Fund, you incur ongoing costs, including advisory fees, distribution (12b-1) and service fees, where applicable, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2006 to April 30, 2007.

The information under “Actual Expenses,” together with the amount you invested, allows you to estimate actual expenses paid over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period,” to estimate the expenses paid on your account during this period.

The information under “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

| | | Actual Expenses | | Hypothetical Expenses (5% return before expenses) |

| | | Institutional | | Dollar | | Cash

Management | | Administration | | Institutional | | Dollar | | Cash

Management | | Administration |

Beginning Account Value (11/01/06) (in Dollars) | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 |

Ending Account Value (4/30/07) (in Dollars) | | 1,024.40 | | 1,023.10 | | 1,021.90 | | 1,023.90 | | 1,024.00 | | 1,022.74 | | 1,021.49 | | 1,023.50 |

Expenses Incurred During Period (11/01/06 - 4/30/07)* | | 1.00 | | 2.26 | | 3.51 | | 1.50 | | 1.00 | | 2.26 | | 3.51 | | 1.50 |

| * | For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio for the period of 0.20%, 0.45%, 0.70% and 0.30% for Institutional, Dollar, Cash Management and Administration classes, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

7

MUNIFUND

FUND PROFILE

Top 10 State Concentration (% of portfolio)

| | | |

Texas | | 11.4 | % |

Illinois | | 6.9 | |

Indiana | | 6.3 | |

Washington | | 6.3 | |

Ohio | | 5.7 | |

Louisiana | | 5.5 | |

North Carolina | | 5.1 | |

Michigan | | 4.6 | |

Colorado | | 4.3 | |

Tennessee | | 3.5 | |

| | | |

Total | | 59.6 | % |

| | | |

Distribution - Weighted Average Maturity 18 days

EXPENSE EXAMPLE

As a shareholder of the Fund, you incur ongoing costs, including advisory fees, distribution (12b-1) and service fees, where applicable, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2006 to April 30, 2007.

The information under “Actual Expenses,” together with the amount you invested, allows you to estimate actual expenses paid over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period,” to estimate the expenses paid on your account during this period.

The information under “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Expenses | | Hypothetical Expenses (5% return before expenses) |

| | | Institutional | | Dollar | | Cash

Management | | Administration | | Bear

Stearns | | Bear

Stearns

Premier

Choice | | Bear

Stearns

Private

Client | | Bear

Stearns

Premier | | Institutional | | Dollar | | Cash

Management | | Administration | | Bear

Stearns | | Bear

Stearns

Premier

Choice | | Bear

Stearns

Private

Client | | Bear

Stearns

Premier |

Beginning Account Value (11/01/06) (in Dollars) | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 |

Ending Account Value (4/30/07) (in Dollars) | | 1,017.20 | | 1,015.90 | | 1,014.70 | | 1,016.70 | | 1,013.20 | | 1,015.90 | | 1,015.00 | | 1,015.00 | | 1,024.00 | | 1,022.74 | | 1,021.49 | | 1,023.49 | | 1,019.98 | | 1,022.74 | | 1,021.84 | | 1,021.84 |

Expenses Incurred During Period (11/01/06 - 4/30/07)* | | 1.00 | | 2.25 | | 3.50 | | 1.50 | | 4.99 | | 2.25 | | 3.15 | | 3.15 | | 1.00 | | 2.26 | | 3.51 | | 1.51 | | 5.02 | | 2.26 | | 3.16 | | 3.16 |

| * | For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio for the period of 0.20%, 0.45%, 0.70%, 0.30%, 1.00%, 0.45%, 0.63% and 0.63% for Institutional, Dollar, Cash Management, Administration, Bear Stearns, Bear Stearns Premier Choice, Bear Stearns Private Client and Bear Stearns Premier classes, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

8

MUNICASH

FUND PROFILE

Top 10 State Concentration (% of portfolio)

| | | |

Texas | | 8.2 | % |

Alabama | | 7.0 | |

Michigan | | 6.6 | |

Ohio | | 5.9 | |

Illinois | | 5.6 | |

Florida | | 5.5 | |

Virginia | | 5.1 | |

Georgia | | 4.6 | |

Pennsylvania | | 4.5 | |

North Carolina | | 4.1 | |

| | | |

Total | | 57.1 | % |

| | | |

Distribution - Weighted Average Maturity 20 days

EXPENSE EXAMPLE

As a shareholder of the Fund, you incur ongoing costs, including advisory fees, distribution (12b-1) and service fees, where applicable, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2006 to April 30, 2007.

The information under “Actual Expenses,” together with the amount you invested, allows you to estimate actual expenses paid over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period,” to estimate the expenses paid on your account during this period.

The information under “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | |

| | | Actual Expenses | | Hypothetical Expenses

(5% return before expenses) |

| | | Institutional | | Dollar | | Institutional | | Dollar |

Beginning Account Value (11/01/06) (in Dollars) | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 |

Ending Account Value (4/30/07) (in Dollars) | | 1,017.40 | | 1,016.20 | | 1,024.00 | | 1,022.74 |

Expenses Incurred During Period (11/01/06 - 4/30/07)* | | 1.00 | | 2.25 | | 1.00 | | 2.26 |

| * | For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio for the period of 0.20%, 0.45% and 0.30% for Institutional, Dollar and Administration classes, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

9

CALIFORNIA MONEY FUND

FUND PROFILE

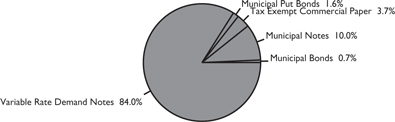

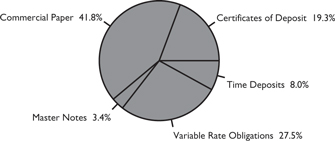

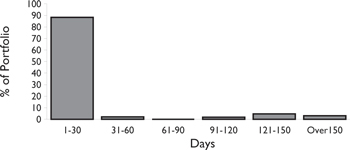

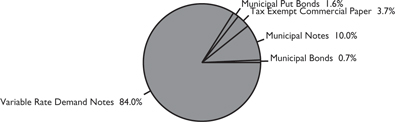

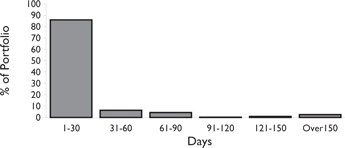

Portfolio Composition - % of Portfolio

Distribution - Weighted Average Maturity 11 days

EXPENSE EXAMPLE

As a shareholder of the Fund, you incur ongoing costs, including advisory fees, distribution (12b-1) and service fees, where applicable, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2006 to April 30, 2007.

The information under “Actual Expenses,” together with the amount you invested, allows you to estimate actual expenses paid over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period,” to estimate the expenses paid on your account during this period.

The information under “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Expenses | | Hypothetical Expenses (5% return before expenses) |

| | | Institutional | | Dollar | | Cash

Management | | Administration | | Bear

Stearns | | Bear

Stearns

Premier

Choice | | Bear

Stearns

Private

Client | | Bear

Stearns

Premier | | Institutional | | Dollar | | Cash

Management | | Administration | | Bear

Stearns | | Bear

Stearns

Premier

Choice | | Bear

Stearns

Private

Client | | Bear

Stearns

Premier |

Beginning Account Value (11/01/06) (in Dollars) | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 |

Ending Account Value (4/30/07) (in Dollars) | | 1,016.70 | | 1,015.40 | | 1,014.20 | | 1,016.20 | | 1,012.70 | | 1,015.40 | | 1,014.50 | | 1,014.50 | | 1,024.00 | | 1,022.74 | | 1,021.49 | | 1,023.49 | | 1,019.98 | | 1,022.74 | | 1,021.84 | | 1,021.84 |

Expenses Incurred During Period (11/01/06 - 4/30/07)* | | 1.00 | | 2.25 | | 3.50 | | 1.50 | | 4.99 | | 2.25 | | 3.15 | | 3.15 | | 1.00 | | 2.26 | | 3.51 | | 1.51 | | 5.02 | | 2.26 | | 3.16 | | 3.16 |

| * | For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio for the period of 0.20%, 0.45%, 0.70%, 0.30%, 1.00%, 0.45%, 0.63% and 0.63% for Institutional, Dollar, Cash Management, Administration, Bear Stearns, Bear Stearns Premier Choice, Bear Stearns Private Client and Bear Stearns Premier classes, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

10

NEW YORK MONEY FUND

FUND PROFILE

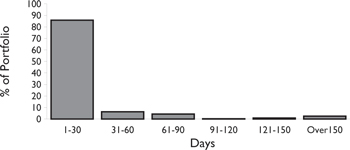

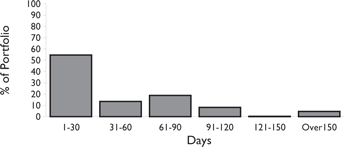

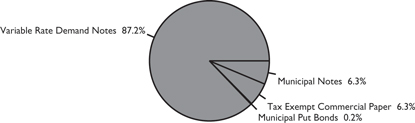

Portfolio Composition - % of Portfolio

Distribution - Weighted Average Maturity 19 days

EXPENSE EXAMPLE

As a shareholder of the Fund, you incur ongoing costs, including advisory fees, distribution (12b-1) and service fees, where applicable, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2006 to April 30, 2007.

The information under “Actual Expenses,” together with the amount you invested, allows you to estimate actual expenses paid over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period,” to estimate the expenses paid on your account during this period.

The information under “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Expenses | | Hypothetical Expenses (5% return before expenses) |

| | | Institutional | | Dollar | | Cash

Management | | Administration | | Bear

Stearns | | Bear

Stearns

Premier

Choice | | Bear

Stearns

Private

Client | | Bear

Stearns

Premier | | Institutional | | Dollar | | Cash

Management | | Administration | | Bear

Stearns | | Bear

Stearns

Premier

Choice | | Bear

Stearns

Private

Client | | Bear

Stearns

Premier |

Beginning Account Value (11/01/06) (in Dollars) | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 | | 1,000.00 |

Ending Account Value (4/30/07) (in Dollars) | | 1,017.10 | | 1,015.80 | | 1,014.60 | | 1,016.60 | | 1,013.00 | | 1,015.80 | | 1,014.90 | | 1,014.90 | | 1,024.00 | | 1,022.74 | | 1,021.49 | | 1,023.49 | | 1,019.98 | | 1,022.74 | | 1,021.84 | | 1,021.79 |

Expenses Incurred During Period (11/01/06 - 4/30/07)* | | 1.00 | | 2.25 | | 3.50 | | 1.50 | | 4.99 | | 2.25 | | 3.15 | | 3.20 | | 1.00 | | 2.26 | | 3.51 | | 1.51 | | 5.02 | | 2.26 | | 3.16 | | 3.21 |

| * | For each class of the Fund, expenses are equal to the Fund’s annualized expense ratio for the period of 0.20%, 0.45%, 0.70%, 0.30%, 1.00%, 0.45%, 0.63% and 0.64% for Institutional, Dollar, Cash Management, Administration, Bear Stearns, Bear Stearns Premier Choice, Bear Stearns Private Client and Bear Stearns Premier classes, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

11

BLACKROCK LIQUIDITY FUNDS

SCHEDULE OF INVESTMENTS

TEMPFUND

| | | | | | | | |

APRIL 30, 2007 (UNAUDITED) (PERCENTAGESSHOWNAREBASEDON NET ASSETS) | | MATURITY | | PAR (000) | | VALUE |

CERTIFICATES OF DEPOSIT — 17.7% | | | | | | | | |

Domestic — 0.7% | | | | | | | | |

Citibank N.A. (A-1+, P-1) | | | | | | | | |

5.30% | | 06/20/07 | | $ | 270,000 | | $ | 270,000,000 |

5.30% | | 07/05/07 | | | 15,000 | | | 15,000,000 |

| | | | | | | | |

| | | | | | | | 285,000,000 |

| | | | | | | | |

Yankee — 17.0% | | | | | | | | |

Banco Bilbao Vizcara Argentina, New York (A-1+, P-1) | | | | | | | | |

5.31%(b) | | 05/23/07 | | | 190,000 | | | 190,000,000 |

5.31%(b) | | 05/29/07 | | | 160,000 | | | 160,000,000 |

Banque Nationale de Paris, New York (A-1+, P-1) | | | | | | | | |

5.34%(b) | | 07/30/07 | | | 502,775 | | | 502,775,000 |

5.27%(b) | | 10/03/07 | | | 550,000 | | | 550,000,000 |

Barclays Bank Plc, New York (A-1+, P-1) | | | | | | | | |

5.30%(b) | | 07/05/07 | | | 700,000 | | | 700,000,000 |

5.27%(b) | | 10/02/07 | | | 525,500 | | | 525,500,000 |

5.27%(b) | | 10/04/07 | | | 231,400 | | | 231,400,000 |

Depfa Bank Plc, New York (A-1+, P-1) | | | | | | | | |

5.30%(b) | | 07/05/07 | | | 258,000 | | | 258,000,000 |

HBOS Treasury Services Plc, New York (A-1+, P-1) | | | | | | | | |

5.32%(b) | | 05/11/07 | | | 100,000 | | | 100,000,000 |

5.27%(b) | | 10/03/07 | | | 360,000 | | | 360,000,000 |

Mizuho Corporate Bank, New York (A-1, P-1) | | | | | | | | |

5.30%(b) | | 05/10/07 | | | 209,000 | | | 209,000,260 |

5.30%(b) | | 05/11/07 | | | 209,000 | | | 209,000,289 |

5.31%(b) | | 05/21/07 | | | 449,000 | | | 449,000,000 |

5.30%(b) | | 05/29/07 | | | 118,000 | | | 118,000,000 |

Nordea Bank Finland, New York (A-1+, P-1) | | | | | | | | |

5.27%(b) | | 10/03/07 | | | 87,000 | | | 87,000,000 |

Norinchukin Bank, New York (A-1, P-1) | | | | | | | | |

5.32%(b) | | 05/25/07 | | | 614,805 | | | 614,805,096 |

5.32%(b) | | 05/29/07 | | | 500,000 | | | 500,000,000 |

5.32%(b) | | 05/29/07 | | | 250,000 | | | 250,001,919 |

Skandinaviska Enskilda Bank, New York (A-1, P-1) | | | | | | | | |

5.30%(b) | | 07/23/07 | | | 40,900 | | | 40,900,000 |

| | | | | | | | |

| | | | | | | | 6,055,382,564 |

| | | | | | | | |

TOTAL CERTIFICATES OF DEPOSIT | | | | | | | | |

(Cost $6,340,382,564) | | | | | | | | 6,340,382,564 |

| | | | | | | | |

COMMERCIAL PAPER — 54.2% | | | | | | | | |

Asset Backed Securities — 42.3% | | | | | | | | |

Amstel Funding Corp. (A-1+, P-1) | | | | | | | | |

5.23% | | 06/05/07 | | | 273,177 | | | 271,787,971 |

5.23% | | 07/25/07 | | | 209,619 | | | 207,030,496 |

5.16% | | 09/28/07 | | | 136,835 | | | 133,893,048 |

Amsterdam Funding Corp. (A-1, P-1) | | | | | | | | |

5.26% | | 05/08/07 | | | 50,000 | | | 49,948,812 |

Aquifer Funding LLC (A-1+, P-1) | | | | | | | | |

5.29% | | 05/07/07 | | | 598,750 | | | 598,574,034 |

Atlantic Asset Securitization Corp. (A-1, P-1) | | | | | | | | |

5.28% | | 05/09/07 | | | 45,000 | | | 44,947,200 |

5.28% | | 05/10/07 | | | 128,864 | | | 128,693,900 |

Atlantis One Funding Corp. (A-1+, P-1) | | | | | | | | |

5.24% | | 05/18/07 | | | 50,708 | | | 50,582,526 |

Atomium Funding LLC (A-1, P-1) | | | | | | | | |

5.24% | | 07/06/07 | | | 119,500 | | | 118,352,003 |

Barton Capital Corp. (A-1+, P-1) | | | | | | | | |

5.28% | | 05/08/07 | | | 79,816 | | | 79,734,056 |

Beethoven Funding Corp. (A-1, P-1) | | | | | | | | |

5.24% | | 06/18/07 | | | 100,000 | | | 99,300,667 |

5.24% | | 06/20/07 | | | 151,988 | | | 150,881,865 |

Beta Finance, Inc. (A-1+, P-1) | | | | | | | | |

5.24% | | 06/20/07 | | | 44,000 | | | 43,679,778 |

5.23% | | 07/05/07 | | | 44,500 | | | 44,079,784 |

Bryant Park Funding Corp. (A-1, P-1) | | | | | | | | |

5.26% | | 05/25/07 | | | 85,000 | | | 84,701,933 |

Cafco LLC (A-1+, P-1) | | | | | | | | |

5.24% | | 05/17/07 | | | 76,100 | | | 75,922,941 |

5.26% | | 06/18/07 | | | 32,285 | | | 32,058,575 |

5.26% | | 06/19/07 | | | 100,730 | | | 100,008,829 |

5.26% | | 06/22/07 | | | 95,100 | | | 94,377,451 |

Cancara Asset Securitisation LLC (A-1+, P-1) | | | | | | | | |

5.27% | | 05/04/07 | | | 100,000 | | | 99,956,083 |

5.27% | | 05/10/07 | | | 131,000 | | | 130,827,407 |

5.27% | | 05/11/07 | | | 179,128 | | | 178,865,777 |

5.24% | | 05/23/07 | | | 98,780 | | | 98,463,551 |

5.26% | | 05/29/07 | | | 77,600 | | | 77,282,530 |

5.24% | | 06/18/07 | | | 131,817 | | | 130,896,039 |

5.23% | | 06/21/07 | | | 47,254 | | | 46,903,887 |

5.23% | | 07/03/07 | | | 144,000 | | | 142,682,040 |

5.24% | | 07/24/07 | | | 46,622 | | | 46,052,512 |

5.24% | | 07/25/07 | | | 292,445 | | | 288,830,258 |

CC USA, Inc. (A-1+, P-1) | | | | | | | | |

5.23% | | 07/25/07 | | | 25,000 | | | 24,691,285 |

Chariot Funding LLC (A-1, P-1) | | | | | | | | |

5.28% | | 05/08/07 | | | 61,570 | | | 61,506,788 |

5.26% | | 05/24/07 | | | 85,366 | | | 85,079,123 |

5.24% | | 06/20/07 | | | 46,135 | | | 45,799,560 |

Charta Corp. (A-1, P-1) | | | | | | | | |

5.28% | | 05/08/07 | | | 78,677 | | | 78,596,225 |

5.27% | | 05/10/07 | | | 145,500 | | | 145,308,304 |

5.24% | | 05/17/07 | | | 100,000 | | | 99,767,333 |

5.24% | | 05/18/07 | | | 125,000 | | | 124,690,990 |

5.24% | | 06/20/07 | | | 50,000 | | | 49,636,458 |

5.23% | | 07/06/07 | | | 25,000 | | | 24,760,292 |

5.24% | | 07/19/07 | | | 101,550 | | | 100,383,402 |

5.24% | | 07/20/07 | | | 101,550 | | | 100,368,635 |

Ciesco LLC (A-1+, P-1) | | | | | | | | |

5.27% | | 05/14/07 | | | 110,500 | | | 110,289,712 |

5.26% | | 05/16/07 | | | 75,000 | | | 74,835,625 |

5.24% | | 07/24/07 | | | 58,700 | | | 57,982,979 |

Clipper Receivables Co. LLC (A-1, P-1) | | | | | | | | |

5.26% | | 05/07/07 | | | 200,000 | | | 199,941,556 |

Concord Minutemen Capital Co. LLC, Series A (A-1, P-1) | | | | | | | | |

5.29% | | 05/02/07 | | | 135,604 | | | 135,584,074 |

5.30% | | 05/08/07 | | | 151,285 | | | 151,129,092 |

Concord Minutemen Capital Co. LLC, Series C (A-1, P-1) | | | | | | | | |

5.27% | | 05/04/07 | | | 60,000 | | | 59,973,650 |

5.27% | | 05/22/07 | | | 80,344 | | | 80,097,009 |

CRC Funding LLC (A-1+, P-1) | | | | | | | | |

5.24% | | 05/17/07 | | | 68,000 | | | 67,841,787 |

5.23% | | 06/01/07 | | | 97,500 | | | 97,060,898 |

5.26% | | 06/21/07 | | | 69,395 | | | 68,877,892 |

5.26% | | 06/22/07 | | | 30,000 | | | 29,772,067 |

5.23% | | 07/06/07 | | | 116,000 | | | 114,887,753 |

5.24% | | 07/24/07 | | | 38,150 | | | 37,683,998 |

Crown Point Capital Co. LLC, Series A (A-1, P-1) | | | | | | | | |

5.27% | | 05/23/07 | | | 50,223 | | | 50,061,254 |

SEEACCOMPANYINGNOTESTOFINANCIALSTATEMENTS.

12

BLACKROCK LIQUIDITY FUNDS

SCHEDULE OF INVESTMENTS

TEMPFUND (CONTINUED)

| | | | | | | | |

APRIL 30, 2007 (UNAUDITED) (PERCENTAGESSHOWNAREBASEDON NET ASSETS) | | MATURITY | | PAR

(000) | | VALUE |

COMMERCIAL PAPER (Continued) | | | | | | | | |

Asset Backed Securities (Continued) | | | | | | | | |

5.23% | | 07/06/07 | | $ | 255,446 | | $ | 252,996,699 |

5.24% | | 07/10/07 | | | 30,324 | | | 30,014,737 |

Crown Point Capital Co. LLC, Series C (A-1, P-1) | | | | | | | | |

5.30% | | 05/07/07 | | | 55,068 | | | 55,051,786 |

5.24% | | 05/10/07 | | | 35,454 | | | 35,407,511 |

5.30% | | 05/16/07 | | | 50,700 | | | 50,588,038 |

Cullinan Finance Corp. (A-1+, P-1) | | | | | | | | |

5.23% | | 06/28/07 | | | 78,700 | | | 78,036,865 |

Curzon Funding LLC (A-1+, P-1) | | | | | | | | |

5.24% | | 05/16/07 | | | 100,000 | | | 99,781,458 |

5.23% | | 06/22/07 | | | 150,000 | | | 148,866,833 |

Dakota Notes Program (A-1, P-1) | | | | | | | | |

5.24% | | 06/14/07 | | | 95,000 | | | 94,391,578 |

5.24% | | 07/18/07 | | | 138,400 | | | 136,827,199 |

Dorada Finance, Inc. (A-1+, P-1) | | | | | | | | |

5.23% | | 07/02/07 | | | 68,000 | | | 67,387,509 |

Emerald Certificates MBNA (A-1+, P-1) | | | | | | | | |

5.25% | | 05/14/07 | | | 66,250 | | | 66,124,401 |

5.26% | | 05/22/07 | | | 86,000 | | | 85,736,123 |

5.25% | | 06/14/07 | | | 69,300 | | | 68,855,325 |

Fairway Finance Co. LLC (A-1, P-1) | | | | | | | | |

5.23% | | 06/18/07 | | | 64,248 | | | 63,799,977 |

5.24% | | 07/09/07 | | | 26,797 | | | 26,527,612 |

5.24% | | 07/16/07 | | | 66,756 | | | 66,016,826 |

Falcon Asset Securitization Corp. (A-1, P-1) | | | | | | | | |

5.26% | | 05/21/07 | | | 55,261 | | | 55,099,515 |

5.26% | | 05/23/07 | | | 101,419 | | | 101,092,994 |

5.26% | | 05/24/07 | | | 206,886 | | | 206,190,748 |

Five Finance, Inc. (A-1+, P-1) | | | | | | | | |

5.23% | | 07/05/07 | | | 32,400 | | | 32,094,045 |

Fountain Square Commercial Funding Corp. (A-1+, P-1) | | | | | | | | |

5.23% | | 05/29/07 | | | 36,768 | | | 36,618,436 |

Foxboro Funding LLC (A-1, P-1) | | | | | | | | |

5.30% | | 06/29/07 | | | 25,398 | | | 25,177,390 |

Govco Inc. (A-1+, P-1) | | | | | | | | |

5.24% | | 05/17/07 | | | 40,000 | | | 39,906,756 |

5.24% | | 05/18/07 | | | 38,395 | | | 38,299,903 |

5.24% | | 05/21/07 | | | 32,500 | | | 32,405,299 |

Grampian Funding LLC (A-1+, P-1) | | | | | | | | |

5.23% | | 06/26/07 | | | 485,000 | | | 481,054,256 |

5.20% | | 08/07/07 | | | 74,000 | | | 72,951,482 |

5.18% | | 08/24/07 | | | 101,000 | | | 99,328,731 |

Greyhawk Funding LLC (A-1+, P-1) | | | | | | | | |

5.24% | | 05/24/07 | | | 21,000 | | | 20,929,764 |

5.23% | | 07/06/07 | | | 140,000 | | | 138,657,633 |

Hudson-Thames LLC (A-1+, P-1) | | | | | | | | |

5.24% | | 05/25/07 | | | 32,743 | | | 32,628,509 |

Jupiter Securitization Corp. (A-1, P-1) | | | | | | | | |

5.26% | | 05/15/07 | | | 101,389 | | | 101,181,603 |

5.26% | | 05/22/07 | | | 101,404 | | | 101,092,859 |

K2 (USA) LLC (A-1+, P-1) | | | | | | | | |

5.24% | | 05/24/07 | | | 57,375 | | | 57,182,738 |

Kitty Hawk Funding Corp. (A-1+, P-1) | | | | | | | | |

5.26% | | 05/17/07 | | | 302,549 | | | 301,841,708 |

5.24% | | 06/25/07 | | | 75,000 | | | 74,399,010 |

Lexington Parker Capital Co. (A-1, P-1) | | | | | | | | |

5.26% | | 05/16/07 | | | 55,265 | | | 55,143,762 |

5.28% | | 05/16/07 | | | 100,000 | | | 99,780,208 |

5.27%(c) | | 05/22/07 | | | 125,519 | | | 125,133,134 |

5.23% | | 07/06/07 | | | 101,383 | | | 100,410,906 |

5.14% | | 08/10/07 | | | 199,557 | | | 196,679,277 |

Liberty Street Funding Corp. (A-1, P-1) | | | | | | | | |

5.28% | | 05/18/07 | | | 75,000 | | | 74,813,177 |

Mane Funding Corp. (A-1+, P-1) | | | | | | | | |

5.25% | | 05/02/07 | | | 74,988 | | | 74,977,064 |

North Sea Funding LLC (A-1+, P-1) | | | | | | | | |

5.27% | | 05/25/07 | | | 110,000 | | | 109,613,533 |

Nyala Funding LLC (A-1+, P-1) | | | | | | | | |

5.26% | | 07/16/07 | | | 35,385 | | | 34,996,551 |

Park Avenue Receivables Co. LLC (A-1, P-1) | | | | | | | | |

5.28% | | 05/14/07 | | | 105,005 | | | 104,804,790 |

5.26% | | 05/16/07 | | | 116,655 | | | 116,399,331 |

Ranger Funding Co. LLC (A-1+, P-1) | | | | | | | | |

5.24% | | 06/04/07 | | | 104,388 | | | 103,870,902 |

Scaldis Capital LLC (A-1+, P-1) | | | | | | | | |

5.27% | | 05/07/07 | | | 455,950 | | | 455,549,524 |

5.26% | | 05/23/07 | | | 75,000 | | | 74,758,917 |

5.26% | | 05/25/07 | | | 265,000 | | | 264,070,733 |

Sedna Finance, Inc. (A-1+, P-1) | | | | | | | | |

5.21% | | 08/13/07 | | | 250,000 | | | 246,237,222 |

5.20% | | 08/28/07 | | | 200,000 | | | 196,562,222 |

Simba Funding Corp. (A-1+, P-1) | | | | | | | | |

5.22% | | 06/01/07 | | | 281,900 | | | 280,631,646 |

5.23% | | 06/01/07 | | | 79,109 | | | 78,752,724 |

5.24% | | 06/21/07 | | | 99,251 | | | 98,514,930 |

5.23% | | 06/22/07 | | | 234,588 | | | 232,815,818 |

5.24% | | 06/22/07 | | | 125,000 | | | 124,053,889 |

Solitaire Funding LLC (A-1+, P-1) | | | | | | | | |

5.24% | | 05/11/07 | | | 51,815 | | | 51,739,580 |

5.28% | | 05/11/07 | | | 115,000 | | | 114,831,493 |

5.23% | | 07/23/07 | | | 101,300 | | | 100,078,519 |

5.24% | | 07/23/07 | | | 100,000 | | | 98,793,042 |

Surrey Funding Corp. (A-1+, P-1) | | | | | | | | |

5.26% | | 05/23/07 | | | 124,160 | | | 123,760,895 |

5.25% | | 06/04/07 | | | 109,690 | | | 109,146,120 |

Sydney Capital Corp. (A-1+, P-1) | | | | | | | | |

5.26% | | 05/07/07 | | | 74,460 | | | 74,438,158 |

5.27% | | 05/24/07 | | | 220,000 | | | 219,259,272 |

Tasman Funding, Inc. (A-1+, P-1) | | | | | | | | |

5.28% | | 05/07/07 | | | 120,387 | | | 120,281,059 |

Thames Asset Global Securitization Corp. (A-1, P-1) | | | | | | | | |

5.25% | | 05/29/07 | | | 25,000 | | | 24,897,917 |

5.24% | | 06/15/07 | | | 40,000 | | | 39,738,000 |

Three Rivers Funding Corp. (A-1, P-1) | | | | | | | | |

5.28% | | 05/09/07 | | | 54,768 | | | 54,703,739 |

Thunder Bay Funding, Inc. LLC (A-1, P-1) | | | | | | | | |

5.28% | | 05/16/07 | | | 114,693 | | | 114,440,675 |

Ticonderoga Funding LLC (A-1+, P-1) | | | | | | | | |

5.28% | | 05/16/07 | | | 176,075 | | | 175,687,635 |

5.27% | | 05/22/07 | | | 20,083 | | | 20,021,262 |

Transamerica Secured Liquidity Notes Corp. LLC (A-1, P-1) | | | | | | | | |

5.32% | | 05/16/07 | | | 80,000 | | | 79,822,667 |

Variable Funding Capital Co. (A-1+, P-1) | | | | | | | | |

5.26% | | 05/23/07 | | | 400,000 | | | 398,714,222 |

Windmill Funding Corp. (A-1+, P-1) | | | | | | | | |

5.26% | | 05/08/07 | | | 50,000 | | | 49,948,812 |

5.27% | | 05/24/07 | | | 184,000 | | | 183,380,482 |

Yorktown Capital LLC (A-1+, P-1) | | | | | | | | |

5.28% | | 05/22/07 | | | 132,338 | | | 131,930,785 |

5.28% | | 05/23/07 | | | 61,925 | | | 61,725,378 |

5.25% | | 05/29/07 | | | 63,250 | | | 62,991,729 |

SEEACCOMPANYINGNOTESTOFINANCIALSTATEMENTS.

13

BLACKROCK LIQUIDITY FUNDS

SCHEDULE OF INVESTMENTS

TEMPFUND (CONTINUED)

| | | | | | | | |

APRIL 30, 2007 (UNAUDITED) (PERCENTAGESSHOWNAREBASEDON NET ASSETS) | | MATURITY | | PAR (000) | | VALUE |

COMMERCIAL PAPER (Continued) | | | | | | | | |

Asset Backed Securities (Continued) | | | | | | | | |

5.28% | | 05/30/07 | | $ | 69,707 | | $ | 69,410,794 |

| | | | | | | | |

| | | | | | | | 15,128,780,045 |

| | | | | | | | |

Banks — 10.4% | | | | | | | | |

Bank of America Corp. (A-1+, P-1) | | | | | | | | |

5.16% | | 08/31/07 | | | 550,000 | | | 540,378,606 |

5.17% | | 09/05/07 | | | 300,000 | | | 294,528,417 |

5.13% | | 09/14/07 | | | 200,000 | | | 196,122,489 |

Citigroup Funding, Inc. (A-1+, P-1) | | | | | | | | |

5.24% | | 05/17/07 | | | 200,000 | | | 199,534,222 |

5.24% | | 05/18/07 | | | 150,000 | | | 149,628,833 |

5.26% | | 05/29/07 | | | 150,000 | | | 149,386,333 |

Natexis Banques Populaires (A-1+, P-1) | | | | | | | | |

5.30% | | 05/01/07 | | | 250,000 | | | 250,000,000 |

5.20% | | 08/10/07 | | | 186,245 | | | 183,525,280 |

Societe Generale N.A., Inc. (A-1+, P-1) | | | | | | | | |

5.20% | | 07/23/07 | | | 373,970 | | | 369,490,826 |

5.14% | | 08/08/07 | | | 539,615 | | | 531,987,542 |

UBS Finance Delaware LLC (A-1+, P-1) | | | | | | | | |

5.23% | | 07/05/07 | | | 150,000 | | | 148,583,542 |

5.24% | | 07/24/07 | | | 311,000 | | | 307,204,763 |

5.23% | | 07/25/07 | | | 388,000 | | | 383,208,739 |

| | | | | | | | |

| | | | | | | | 3,703,579,592 |

| | | | | | | | |

Security Brokers & Dealers — 1.5% | | | | | | | | |

Bear Stearns Co., Inc. (A-1, P-1) | | | | | | | | |

5.18% | | 07/27/07 | | | 61,855 | | | 61,080,679 |

5.18% | | 08/10/07 | | | 191,725 | | | 188,938,703 |

Greenwich Capital Holdings, Inc. (A-1+, P-1) | | | | | | | | |

5.22% | | 07/17/07 | | | 50,000 | | | 49,442,285 |

5.20% | | 08/13/07 | | | 50,000 | | | 49,248,889 |

5.20% | | 08/14/07 | | | 33,700 | | | 33,188,883 |

5.20% | | 08/17/07 | | | 50,000 | | | 49,220,750 |

5.20% | | 08/21/07 | | | 50,000 | | | 49,191,889 |

5.20% | | 08/24/07 | | | 50,000 | | | 49,170,243 |

| | | | | | | | |

| | | | | | | | 529,482,321 |

| | | | | | | | |

TOTAL COMMERCIAL PAPER

(Cost $19,361,841,958) | | | | | | | | 19,361,841,958 |

| | | | | | | | |

MASTER NOTES — 6.3% | | | | | | | | |

Security Brokers & Dealers — 6.3% | | | | | | | | |

Bank of America Securities LLC (A-1+, P-1) | | | | | | | | |

5.38%(d) | | 05/01/07 | | | 608,650 | | | 608,650,000 |

Citigroup Global Markets, Inc. (A-1+, P-1) | | | | | | | | |

5.38%(d) | | 05/01/07 | | | 550,000 | | | 550,000,000 |

Morgan Stanley Mortgage Capital, Inc. (A-1, P-1)(e) | | | | | | | | |

5.48%(d)(f) | | 05/01/07 | | | 1,078,157 | | | 1,078,157,000 |

| | | | | | | | |

TOTAL MASTER NOTES | | | | | | | | |

(Cost $2,236,807,000) | | | | | | | | 2,236,807,000 |

| | | | | | | | |

AGENCY OBLIGATIONS — 0.0% | | | | | | | | |

Federal Home Loan Bank Discount Notes — 0.0% | | | | | | | | |

5.12%(g) | | 07/27/07 | | | 1,952 | | | |

(Cost $1,927,833) | | | | | | | | 1,927,833 |

| | | | | | | | |

U.S. TREASURY OBLIGATIONS — 0.0% | | | | | | | | |

U.S. Treasury Bills — 0.0% | | | | | | | | |

4.75%(g) | | 06/21/07 | | | 15,000 | | | |

(Cost $14,899,062) | | | | | | | | 14,899,062 |

| | | | | | | | |

VARIABLE RATE OBLIGATIONS — 13.5% | | | | | | | | |

Asset Backed Securities — 1.0% | | | | | | | | |

Cullinan Finance Corp. (AAA, Aaa) | | | | | | | | |

5.28%(d) | | 05/25/07 | | | 135,000 | | | 134,995,875 |

Racers Trust, Series 04-6-MM (A-1, P-1) | | | | | | | | |

5.37%(c)(d) | | 05/22/07 | | | 234,650 | | | 234,650,000 |

| | | | | | | | |

| | | | | | | | 369,645,875 |

| | | | | | | | |

Banks — 3.4% | | | | | | | | |

Bank of New York Co., Inc. (A+, Aa3) | | | | | | | | |

5.38%(c)(d) | | 05/29/07 | | | 125,000 | | | 125,000,000 |

Barclays Bank Plc (A-1+, P-1) | | | �� | | | | | |

5.28%(d) | | 05/07/07 | | | 125,000 | | | 124,996,717 |

Calyon, New York (AA-, Aa3) | | | | | | | | |

5.28%(d) | | 06/13/07 | | | 374,000 | | | 373,971,355 |

LP Pinewood SPV (Wachovia Bank N.A. LOC) (A-1+, P-1)(e) | | | | | | | | |

5.32%(d) | | 05/07/07 | | | 50,000 | | | 50,000,000 |

Nordea Bank Finland, New York (AA-, Aa1) | | | | | | | | |

5.26%(d) | | 05/07/07 | | | 250,000 | | | 249,970,652 |

Societe Generale, New York (A-1+, P-1) | | | | | | | | |

5.26%(d) | | 05/21/07 | | | 100,000 | | | 99,991,080 |

Wells Fargo Bank N.A. (AA, Aa1) | | | | | | | | |

5.38%(d) | | 05/02/07 | | | 190,000 | | | 190,000,390 |

| | | | | | | | |

| | | | | | | | 1,213,930,194 |

| | | | | | | | |

Insurance Carriers NEC — 0.7% | | | | | | | | |

Travelers Insurance Co. (A-1+, P-1) | | | | | | | | |

5.43%(d)(f) | | 07/02/07 | | | 250,000 | | | 250,000,000 |

| | | | | | | | |

Life Insurance — 3.6% | | | | | | | | |

Allstate Life Global Funding II (AA, Aa2) | | | | | | | | |

5.33%(c)(d) | | 05/29/07 | | | 75,000 | | | 75,000,000 |

Hartford Life Insurance Co. (A-1+, P-1) | | | | | | | | |

5.42%(d)(f) | | 07/02/07 | | | 100,000 | | | 100,000,000 |

5.42%(d)(f) | | 07/02/07 | | | 100,000 | | | 100,000,000 |

ING Security Life Insurance (AA, Aa3) | | | | | | | | |

5.43%(c)(d) | | 05/09/07 | | | 150,000 | | | 150,000,000 |

MetLife Global Funding I (AA, Aa2) | | | | | | | | |

5.43%(c)(d) | | 05/29/07 | | | 95,000 | | | 95,000,000 |

New York Life Insurance Co. (A-1+, P-1) | | | | | | | | |

5.41%(d)(f) | | 06/13/07 | | | 350,000 | | | 350,000,000 |

Transamerica Occidental Life Insurance Co. (A-1+, P-1) | | | | | | | | |

5.44%(d)(f) | | 05/01/07 | | | 400,000 | | | 400,000,000 |

| | | | | | | | |

| | | | | | | | 1,270,000,000 |

| | | | | | | | |

Personal Credit Institutions — 1.8% | | | | | | | | |

General Electric Capital Corp. (AAA, Aaa) | | | | | | | | |

5.44%(d) | | 05/17/07 | | | 447,600 | | | 447,600,000 |

5.28%(d) | | 05/24/07 | | | 202,000 | | | 202,000,000 |

| | | | | | | | |

| | | | | | | | 649,600,000 |

| | | | | | | | |

Security Brokers & Dealers — 3.0% | | | | | | | | |

The Goldman Sachs Group, Inc. (A-1+, P-1) | | | | | | | | |

5.43%(c)(d)(f) | | 05/01/07 | | | 469,300 | | | 469,300,000 |

5.35%(c)(d)(f) | | 05/21/07 | | | 333,000 | | | 333,000,000 |

Morgan Stanley & Co., Inc. (A-1, P-1) | | | | | | | | |

5.38%(d) | | 05/15/07 | | | 250,000 | | | 250,000,000 |

| | | | | | | | |

| | | | | | | | 1,052,300,000 |

| | | | | | | | |

TOTAL VARIABLE RATE OBLIGATIONS

(Cost $4,805,476,069) | | | | | | | | 4,805,476,069 |

| | | | | | | | |

SEEACCOMPANYINGNOTESTOFINANCIALSTATEMENTS.

14

BLACKROCK LIQUIDITY FUNDS

SCHEDULE OF INVESTMENTS

TEMPFUND (CONCLUDED)

| | | | | | | | | |

APRIL 30, 2007 (UNAUDITED) (PERCENTAGESSHOWNAREBASEDON NET ASSETS) | | MATURITY | | PAR

(000) | | VALUE | |

TIME DEPOSITS — 3.7% | | | | | | | | | |

Deutsche Bank AG (A-1+, P-1) | | | | | | | | | |

5.31% | | 05/01/07 | | $ | 594,000 | | $ | 594,000,000 | |

Wells Fargo Bank N.A. (A-1+, P-1) | | | | | | | | | |

5.25% | | 05/01/07 | | | 733,000 | | | 733,000,000 | |

| | | | | | | | | |

TOTAL TIME DEPOSITS | | | | | | | | | |

(Cost $1,327,000,000) | | | | | | | | 1,327,000,000 | |

| | | | | | | | | |

REPURCHASE AGREEMENTS — 3.7% | | | | | | | | | |

Goldman Sachs & Co. | | | | | | | | | |

5.19% (Agreement dated 04/30/07 to be repurchased at $1,000,144,167, collateralized by $1,390,236,084 Federal National Mortgage Assoc. Variable Rate Notes 3.88% to 6.99% due from 10/01/33 to 04/01/37. The value of the collateral is $1,030,000,000.) | | 05/01/07 | | | 1,000,000 | | | 1,000,000,000 | |

Morgan Stanley & Co., Inc. | | | | | | | | | |

5.23% (Agreement dated 04/30/07 to be repurchased at $254,036,901, collateralized by $265,290,000 Federal National Mortgage Assoc. Discount Notes, Bonds and Medium Term Notes 0.00% to 5.50% due from 07/25/07 to 02/16/17. The value of the collateral is $266,238,418.) | | 05/01/07 | | | 254,000 | | | 254,000,000 | |

UBS Securities LLC | | | | | | | | | |

5.24% (Agreement dated 04/30/07 to be repurchased at $49,123,149, collateralized by $71,970,000 Federal Home Loan Mortgage Corp. Strips 0.00% due 04/15/37. The value of the collateral is $50,591,312.) | | 05/01/07 | | | 49,116 | | | 49,116,000 | |

| | | | | | | | | |

TOTAL REPURCHASE AGREEMENTS

(Cost $1,303,116,000) | | | | | | | | 1,303,116,000 | |

| | | | | | | | | |

TOTAL MARKET VALUE OF SECURITIES BEFORE AFFILIATED INVESTMENTS — 99.1%

(Cost $35,391,450,486) | | | | | | | | 35,391,450,486 | |

| | | | | | | | | |

AFFILIATED INVESTMENTS — 1.0% | | | | | | | | | |

Merrill Lynch & Co., Inc. (A+, Aa3) | | | | | | | | | |

5.32%(d)(h) | | 05/29/07 | | | 121,400 | | | 121,400,000 | |

| | | |

PNC Bank, N.A. | | | | | | | | | |

5.01% | | 05/01/07 | | | 224,200 | | | 224,200,000 | |

(Agreement dated 04/30/07 to be repurchased at $224,231,217, collateralized by $370,268,703 Federal Home Loan Mortgage Corp. Bonds and Federal National Mortgage Assoc. Bonds 5.50% to 6.50% due from 04/01/26 to 11/01/36. The value of the collateral is $368,953,384.) | | | | | | | | | |

| | | | | | | | | |

TOTAL AFFILIATED INVESTMENTS | | | | | | | | | |

(Cost $345,600,000) | | | | | | | | 345,600,000 | |

| | | | | | | | | |

TOTAL INVESTMENTS IN SECURITIES — 100.1% | | | | | | | | | |

(Cost $35,737,050,486(a)) | | | | | | | | 35,737,050,486 | |

| | | |

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.1)% | | | | | | | | (46,517,875 | ) |

| | | | | | | | | |

NET ASSETS — 100.0% | | | | | | | $ | 35,690,532,611 | |

| | | | | | | | | |

| (a) | Aggregate cost for federal income tax purposes. |

| (b) | Issuer is a U.S. branch of a foreign domiciled bank. |

| (c) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional investors. As of April 30, 2007, the Fund held 4.5% of its net assets, with a current market value of $1,607,083,134, in securities restricted as to resale. |

| (d) | Rates shown are as of April 30, 2007 and maturities shown are the next interest readjustment date or the date the principal owed can be recovered through demand. |

| (e) | Ratings reflect those of guarantor. |

| (f) | Illiquid Security. As of April 30, 2007, the Fund held 8.6% of its net assets, with a current market value of $3,080,457,000 in these securities. |

| (g) | The rate shown is the effective yield at the time of purchase. |

| (h) | Security insured by an affiliate. |

SEEACCOMPANYINGNOTESTOFINANCIALSTATEMENTS.

15

BLACKROCK LIQUIDITY FUNDS

SCHEDULE OF INVESTMENTS

TEMPCASH

| | | | | | | | |

APRIL 30, 2007 (UNAUDITED) (PERCENTAGESSHOWNAREBASEDON NET ASSETS) | | MATURITY | | PAR (000) | | VALUE |

CERTIFICATES OF DEPOSIT — 19.3% | | | | | | | | |

Euro Dollar — 1.9% | | | | | | | | |

Unicredito Italiano Bank, Ireland (A-1, P-1) | | | | | | | | |

5.32% | | 05/02/07 | | $ | 180,000 | | $ | 179,999,929 |

| | | | | | | | |

Yankee — 17.4% | | | | | | | | |

Banque Nationale de Paris, New York (A-1+, P-1) | | | | | | | | |

5.34%(b) | | 07/30/07 | | | 123,000 | | | 123,000,000 |

5.27%(b) | | 10/03/07 | | | 86,755 | | | 86,755,000 |

Barclays Bank Plc, New York (A-1+, P-1) | | | | | | | | |

5.32%(b) | | 05/08/07 | | | 55,000 | | | 55,000,000 |

5.27%(b) | | 10/02/07 | | | 200,000 | | | 200,000,000 |

5.27%(b) | | 10/04/07 | | | 65,000 | | | 65,000,000 |

Calyon, New York (A-1+, P-1) | | | | | | | | |

5.35%(b) | | 08/28/07 | | | 180,000 | | | 180,000,000 |

HBOS Treasury Services Plc, New York (A-1+, P-1) | | | | | | | | |

5.27%(b) | | 10/03/07 | | | 100,000 | | | 100,000,000 |

Mizuho Corporate Bank, New York (A-1, P-1) | | | | | | | | |

5.30%(b) | | 05/10/07 | | | 58,000 | | | 58,000,072 |

5.30%(b) | | 05/11/07 | | | 58,000 | | | 58,000,080 |

5.31%(b) | | 05/21/07 | | | 85,000 | | | 85,000,000 |

5.32%(b) | | 05/21/07 | | | 190,000 | | | 190,000,000 |

5.30%(b) | | 05/29/07 | | | 33,000 | | | 33,000,000 |

Norinchukin Bank, New York (A-1, P-1) | | | | | | | | |

5.32%(b) | | 05/25/07 | | | 150,310 | | | 150,310,000 |

Skandinaviska Enskilda Bank, New York (A-1, P-1) | | | | | | | | |

5.31%(b) | | 05/21/07 | | | 60,000 | | | 60,000,000 |

5.30%(b) | | 07/23/07 | | | 11,650 | | | 11,650,000 |

Societe Generale, New York (A-1+, P-1) | | | | | | | | |

5.27%(b) | | 05/11/07 | | | 250,000 | | | 250,000,000 |

| | | | | | | | |

| | | | | | | | 1,705,715,152 |

| | | | | | | | |

TOTAL CERTIFICATES OF DEPOSIT | | | | | | | | |

(Cost $1,885,715,081) | | | | | | | | 1,885,715,081 |

| | | | | | | | |

COMMERCIAL PAPER — 41.7% | | | | | | | | |

Asset Backed Securities — 21.0% | | | | | | | | |

Amsterdam Funding Corp. (A-1, P-1) | | | | | | | | |

5.26% | | 05/23/07 | | | 105,000 | | | 104,662,483 |

Beta Finance, Inc. (A-1+, P-1) | | | | | | | | |

5.23% | | 07/02/07 | | | 63,000 | | | 62,432,545 |

5.22% | | 07/16/07 | | | 67,500 | | | 66,756,150 |

Cancara Asset Securitisation LLC (A-1+, P-1) | | | | | | | | |

5.26% | | 05/29/07 | | | 22,400 | | | 22,308,359 |

CC USA, Inc. (A-1+, P-1) | | | | | | | | |

5.23% | | 07/10/07 | | | 79,000 | | | 78,196,614 |

Charta Corp. (A-1, P-1) | | | | | | | | |

5.23% | | 07/06/07 | | | 125,000 | | | 123,801,458 |

5.24% | | 07/19/07 | | | 30,500 | | | 30,149,619 |

5.24% | | 07/20/07 | | | 30,500 | | | 30,145,183 |

Ciesco LLC (A-1+, P-1) | | | | | | | | |

5.24% | | 07/24/07 | | | 17,650 | | | 17,434,405 |

Concord Minutemen Capital Co. LLC, Series A (A-1, P-1) | | | | | | | | |

5.30% | | 05/16/07 | | | 67,448 | | | 67,299,052 |

CRC Funding LLC (A-1+, P-1) | | | | | | | | |

5.23% | | 07/06/07 | | | 33,000 | | | 32,683,585 |

5.24% | | 07/24/07 | | | 11,500 | | | 11,359,527 |

Crown Point Capital Co. LLC, Series C (A-1, P-1) | | | | | | | | |

5.30% | | 05/07/07 | | | 15,350 | | | 15,345,480 |

5.30% | | 05/16/07 | | | 15,250 | | | 15,216,323 |

Dakota Notes Program (A-1, P-1) | | | | | | | | |

5.24% | | 07/18/07 | | | 41,600 | | | 41,127,251 |

Emerald Certificates MBNA (A-1+, P-1) | | | | | | | | |

5.25% | | 06/14/07 | | | 81,500 | | | 80,977,540 |

Erasmus Capital Corp. (A-1+, P-1) | | | | | | | | |

5.25% | | 06/20/07 | | | 30,431 | | | 30,209,107 |

Falcon Asset Securitization Corp. (A-1, P-1) | | | | | | | | |

5.26% | | 05/25/07 | | | 150,667 | | | 150,138,661 |

Five Finance, Inc. (A-1+, P-1) | | | | | | | | |

5.24% | | 06/27/07 | | | 60,000 | | | 59,502,200 |

Foxboro Funding LLC (A-1, P-1) | | | | | | | | |

5.30% | | 06/29/07 | | | 7,320 | | | 7,256,418 |

Grampian Funding LLC (A-1+, P-1) | | | | | | | | |

5.24% | | 07/23/07 | | | 45,000 | | | 44,456,869 |

Hudson-Thames LLC (A-1+, P-1) | | | | | | | | |

5.25% | | 06/22/07 | | | 22,275 | | | 22,106,081 |

Lexington Parker Capital Co. (A-1, P-1) | | | | | | | | |

5.27% | | 05/18/07 | | | 89,946 | | | 89,722,159 |

5.23% | | 07/10/07 | | | 34,700 | | | 34,347,120 |

5.20% | | 08/09/07 | | | 152,475 | | | 150,270,466 |

Liberty Street Funding Corp. (A-1, P-1) | | | | | | | | |

5.27% | | 05/21/07 | | | 71,000 | | | 70,792,128 |

Lockhart Funding LLC (F-1, P-1) | | | | | | | | |

5.24% | | 06/06/07 | | | 49,406 | | | 49,147,113 |

Ranger Funding Co. LLC (A-1+, P-1) | | | | | | | | |

5.28% | | 05/15/07 | | | 32,440 | | | 32,373,390 |

5.27% | | 05/22/07 | | | 133,376 | | | 132,965,980 |

5.27% | | 05/23/07 | | | 78,163 | | | 77,911,272 |

Solitaire Funding LLC (A-1+, P-1) | | | | | | | | |

5.23% | | 07/23/07 | | | 28,850 | | | 28,502,125 |

5.24% | | 07/23/07 | | | 157,000 | | | 155,105,076 |

Tango Finance Corp. (A-1+, P-1) | | | | | | | | |

5.24% | | 06/25/07 | | | 20,000 | | | 19,839,889 |

Three Rivers Funding Corp. (A-1, P-1) | | | | | | | | |

5.28% | | 05/09/07 | | | 15,450 | | | 15,431,872 |

Thunder Bay Funding, Inc. LLC (A-1, P-1) | | | | | | | | |

5.28% | | 05/16/07 | | | 25,000 | | | 24,945,000 |

Zela Finance, Inc. (A-1+, P-1) | | | | | | | | |

5.24% | | 06/25/07 | | | 60,000 | | | 59,519,667 |

| | | | | | | | |

| | | | | | | | 2,054,438,167 |

| | | | | | | | |

Banks — 20.7% | | | | | | | | |

Abbey National N.A. LLC (A-1+, P-1) | | | | | | | | |

5.22% | | 06/06/07 | | | 30,335 | | | 30,176,651 |

Allied Irish Bank Plc (A-1, P-1) | | | | | | | | |

5.20% | | 08/06/07 | | | 45,875 | | | 45,231,622 |

Banco Bilbao Vizcara Argentina (A-1, P-1) | | | | | | | | |

5.27% | | 05/23/07 | | | 16,200 | | | 16,147,827 |

5.27% | | 05/24/07 | | | 60,000 | | | 59,797,983 |

5.26% | | 06/04/07 | | | 32,350 | | | 32,189,445 |

Bank of America Corp. (A-1+, P-1) | | | | | | | | |

5.20% | | 07/25/07 | | | 337,000 | | | 332,860,002 |

5.17% | | 09/05/07 | | | 25,000 | | | 24,544,035 |

Citigroup Funding, Inc. (A-1+, P-1) | | | | | | | | |

5.24% | | 05/23/07 | | | 100,000 | | | 99,679,472 |

Macquarie Bank Limited (A-1, P-1) | | | | | | | | |

5.16% | | 08/13/07 | | | 100,000 | | | 98,509,333 |

5.22% | | 08/13/07 | | | 23,365 | | | 23,012,993 |

Natexis Banques Populaires (A-1+, P-1) | | | | | | | | |

5.20% | | 08/10/07 | | | 48,945 | | | 48,230,260 |

Nationwide Building Society (A-1, P-1) | | | | | | | | |

5.24% | | 07/05/07 | | | 100,000 | | | 99,054,792 |

Northern Rock Plc (A-1, P-1) | | | | | | | | |

5.23% | | 06/29/07 | | | 100,000 | | | 99,142,369 |

SEEACCOMPANYINGNOTESTOFINANCIALSTATEMENTS.

16

BLACKROCK LIQUIDITY FUNDS

SCHEDULE OF INVESTMENTS

TEMPCASH (CONTINUED)

| | | | | | | | |

APRIL 30, 2007 (UNAUDITED) (PERCENTAGESSHOWNAREBASEDON NET ASSETS) | | MATURITY | | PAR

(000) | | VALUE |

| COMMERCIAL PAPER (Continued) | | | | | | | | |

| Banks (Continued) | | | | | | | | |

Raiffeisen Zentralbank Osterreich AG (A-1, P-1) | | | | | | | | |

5.28% | | 05/18/07 | | $ | 218,370 | | $ | 217,826,046 |

Santander Central Hispano Finance Delaware Inc. (A-1+, P-1) | | | | | | | | |

5.20% | | 07/23/07 | | | 62,325 | | | 61,577,793 |

Skandinaviska Enskilda Bank (A-1, P-1) | | | | | | | | |

5.20% | | 07/25/07 | | | 29,100 | | | 28,742,373 |

5.20% | | 08/08/07 | | | 33,125 | | | 32,650,857 |

Societe Generale N.A., Inc. (A-1+, P-1) | | | | | | | | |

5.20% | | 07/23/07 | | | 46,870 | | | 46,308,621 |

Swedbank Mortgage AB (A-1, P-1) | | | | | | | | |

5.22% | | 06/04/07 | | | 45,505 | | | 45,280,446 |

UBS Finance Delaware LLC (A-1+, P-1) | | | | | | | | |

5.23% | | 07/05/07 | | | 150,000 | | | 148,583,542 |

5.24% | | 07/24/07 | | | 89,000 | | | 87,913,903 |

5.23% | | 07/25/07 | | | 112,000 | | | 110,616,956 |

5.14% | | 08/08/07 | | | 100,000 | | | 98,586,500 |

Unicredito Italiano Bank, Ireland (A-1, P-1) | | | | | | | | |

5.23% | | 07/05/07 | | | 100,000 | | | 99,055,695 |

5.24% | | 07/09/07 | | | 43,500 | | | 43,063,532 |

| | | | | | | | |

| | | | | | | | 2,028,783,048 |

| | | | | | | | |

TOTAL COMMERCIAL PAPER | | | | | | | | |

(Cost $4,083,221,215) | | | | | | | | 4,083,221,215 |

| | | | | | | | |

MASTER NOTES — 3.4% | | | | | | | | |

Security Brokers & Dealers — 3.4% | | | | | | | | |

Citigroup Global Markets, Inc. (A-1+, P-1) | | | | | | | | |

5.38%(c) | | 05/01/07 | | | 235,000 | | | 235,000,000 |

Morgan Stanley Mortgage Capital, Inc. (A-1, P-1)(d) | | | | | | | | |

5.48%(c)(e) | | 05/01/07 | | | 97,451 | | | 97,450,999 |

| | | | | | | | |

TOTAL MASTER NOTES | | | | | | | | |

(Cost $332,450,999) | | | | | | | | 332,450,999 |

| | | | | | | | |

VARIABLE RATE OBLIGATIONS — 27.0% | | | | | | | | |

Asset Backed Securities — 3.0% | | | | | | | | |

Arkle Master Issuer Plc (AAA, Aaa) | | | | | | | | |

5.30%(c)(f) | | 05/17/07 | | | 28,300 | | | 28,300,000 |

Cullinan Finance Corp. (AAA, Aaa) | | | | | | | | |

5.28%(c) | | 05/25/07 | | | 57,000 | | | 56,998,258 |

Holmes Master Issuer Plc, Series 06-1A (AAA, Aaa) | | | | | | | | |

5.30%(c)(f) | | 05/15/07 | | | 29,600 | | | 29,600,000 |

Racers Trust, Series 04-6-MM (A-1, P-1) | | | | | | | | |

5.37%(c)(f) | | 05/22/07 | | | 129,400 | | | 129,400,000 |

Wachovia Asset Securitization, Inc., Series 04-HM1, Class A (AAA, Aaa) | | | | | | | | |

5.31%(c)(f) | | 05/25/07 | | | 22,514 | | | 22,514,213 |

Wachovia Asset Securitization, Inc., Series 04-HM2, Class A (AAA, Aaa) | | | | | | | | |

5.31%(c)(f) | | 05/25/07 | | | 29,026 | | | 29,025,773 |

| | | | | | | | |

| | | | | | | | 295,838,244 |

| | | | | | | | |

Banks — 5.4% | | | | | | | | |

Barclays Bank Plc (A-1+, P-1) | | | | | | | | |

5.28%(c) | | 05/07/07 | | | 125,000 | | | 124,996,717 |

Gables of Germantown (Marshall & Ilsley Bank LOC) (A-1, P-1)(d) | | | | | | | | |

5.36%(c) | | 05/07/07 | | | 15,000 | | | 15,000,000 |

| | | | | | |

Green Knight Economic Development, Series 04 (Fulton Bank LOC) (VMIG-1) | | | | | | |

5.47%(c) | | 05/07/07 | | 2,420 | | 2,420,000 |

HBOS Treasury Services Plc (A-1+, P-1) | | | | | | |

5.39%(c) | | 05/01/07 | | 45,000 | | 45,000,000 |

5.42%(c)(f) | | 06/25/07 | | 150,000 | | 150,000,000 |

Laurel Grocery Co. LLC (U.S. Bank N.A. LOC) (A-1, P-1)(d) | | | | | | |

5.35%(c) | | 05/07/07 | | 1,425 | | 1,425,000 |

MB&B Holdings LLC (Marshall & Ilsley Bank LOC) (A-1, P-1)(d) | | | | | | |

5.36%(c) | | 05/07/07 | | 6,475 | | 6,475,000 |

5.36%(c) | | 05/07/07 | | 3,505 | | 3,505,000 |

North Square Associates LLP (Marshall & Ilsley Bank LOC) (A-1, P-1)(d) | | | | | | |

5.36%(c) | | 05/07/07 | | 14,045 | | 14,045,000 |

Oxford Capital Enterprise LLC (National City Bank N.A. LOC) (A-1, P-1)(d) | | | | | | |

5.35%(c) | | 05/07/07 | | 2,325 | | 2,325,000 |

Paca-Pratt Associates, Inc. (M&T Bank Corp. LOC) (A-1) | | | | | | |

5.37%(c) | | 05/07/07 | | 16,000 | | 16,000,000 |

Park Street Properties I LLC (U.S. Bank N.A. LOC) (VMIG-1) | | | | | | |

5.32%(c) | | 05/02/07 | | 4,040 | | 4,040,000 |

Park Village (Bank One N.A. LOC) (A-1+, P-1)(d) | | | | | | |

5.42%(c) | | 05/07/07 | | 6,810 | | 6,810,000 |

Prospect Aggregates, Inc. (Fulton Bank LOC) (VMIG-1) | | | | | | |

5.47%(c) | | 05/07/07 | | 8,440 | | 8,440,000 |

Shipley Group LP (Fulton Bank LOC) (VMIG-1) | | | | | | |

5.42%(c) | | 05/07/07 | | 14,255 | | 14,255,000 |

Tom Gill LLC (U.S. Bank N.A. LOC) (A-1, P-1)(d) | | | | | | |

5.37%(c) | | 05/07/07 | | 1,490 | | 1,490,000 |

Westpac Banking Corp. (AA, Aa3)(d) | | | | | | |

5.40%(c) | | 06/11/07 | | 108,250 | | 108,250,000 |

| | | | | | |

| | | | | | 524,476,717 |

| | | | | | |

Life Insurance — 8.3% | | | | | | |

Allstate Life Global Funding II (AA, Aa2) | | | | | | |

5.41%(c)(f) | | 05/16/07 | | 100,000 | | 100,000,000 |

5.33%(c)(f) | | 05/29/07 | | 40,000 | | 40,000,000 |

Irish Life & Permanent Plc (A-1, P-1) | | | | | | |

5.34%(c)(f) | | 05/22/07 | | 100,000 | | 100,000,000 |

MetLife Global Funding I (AA, Aa2) | | | | | | |

5.43%(c)(f) | | 05/29/07 | | 40,000 | | 40,000,000 |

Monumental Life Insurance Co. (A-1+, P-1) | | | | | | |

5.50%(c)(e) | | 06/01/07 | | 200,000 | | 200,000,000 |

New York Life Insurance Co. (A-1+, P-1) | | | | | | |

5.41%(c)(e) | | 06/13/07 | | 300,000 | | 300,000,000 |

Transamerica Occidental Life Insurance Co. (A-1+, P-1) | | | | | | |

5.50%(c)(e) | | 06/01/07 | | 26,000 | | 26,000,000 |

| | | | | | |

| | | | | | 806,000,000 |

| | | | | | |

Municipal Bonds — 1.2% | | | | | | |