- TER Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Teradyne (TER) DEF 14ADefinitive proxy

Filed: 27 Mar 20, 10:03am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240. 14a-12 | |

Teradyne, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

TERADYNE, INC.

600 Riverpark Drive

North Reading, Massachusetts 01864

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO THE SHAREHOLDERS:

The Annual Meeting of Shareholders of Teradyne, Inc., a Massachusetts corporation, will be held on Tuesday, May 8, 2020 at 10:00 A.M. Eastern Time, at the offices of Teradyne, Inc. at 600 Riverpark Drive, North Reading, Massachusetts 01864, for the following purposes:

1. To elect the eight nominees named in the accompanying proxy statement to the Board of Directors to serve as directors for aone-year term.

2. To approve, in anon-binding, advisory vote, the compensation of the Company’s named executive officers.

3. To ratify the selection of the firm of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020.

4. To transact such other business as may properly come before the meeting and any postponements or adjournments thereof.

Shareholders entitled to notice of and to vote at the meeting shall be determined as of the close of business on March 12, 2020, the record date fixed by the Board of Directors for such purpose.

By Order of the Board of Directors,

Charles J. Gray, Secretary

March 27, 2020

Shareholders are requested to vote in one of the following three ways: (1) by completing, signing and dating the proxy card provided by Teradyne and returning it by return mail to Teradyne in the enclosed envelope or at the address indicated on the proxy card, (2) by completing a proxy using the toll-free telephone number listed on the proxy card, or (3) by completing a proxy on the Internet at the address listed on the proxy card.

| Page | ||||

| 1 | ||||

| 2 | ||||

PROPOSAL NO. 2: ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS | 7 | |||

PROPOSAL NO. 3: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 9 | |||

| 10 | ||||

| 10 | ||||

| 13 | ||||

| 14 | ||||

| 16 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 20 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 25 | ||||

| 27 | ||||

| 33 | ||||

| 37 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 43 | ||||

| 44 | ||||

| 46 | ||||

| 46 | ||||

| 48 | ||||

| 51 | ||||

| 52 | ||||

Shareholder Proposals for 2021 Annual Meeting of Shareholders | 52 | |||

| 52 | ||||

| 53 | ||||

| 53 | ||||

i

TERADYNE, INC.

600 Riverpark Drive

North Reading, Massachusetts 01864

March 27, 2020

Proxies in the form provided by Teradyne, Inc. (“Teradyne” or the “Company”) are solicited by the Board of Directors (“Board”) of Teradyne for use at the Annual Meeting of Shareholders to be held on Tuesday, May 8, 2020, at 10:00 A.M. Eastern Time, at the offices of Teradyne, Inc. at 600 Riverpark Drive, North Reading, Massachusetts 01864. We currently intend to hold our Annual Meeting of Shareholder in person. However, we are actively monitoring the coronavirus outbreak (COVID-19) and its potential impact on the meeting.

Only shareholders of record as of the close of business on March 12, 2020 (the “Record Date”) will be entitled to vote at this annual meeting and any adjournments thereof. As of the Record Date, 166,614,941 shares of common stock were issued and outstanding. Each share outstanding as of the Record Date will be entitled to one vote, and shareholders may vote in person or by proxy. Delivery of a proxy will not in any way affect a shareholder’s right to attend the annual meeting and vote in person. Any shareholder delivering a proxy has the right to revoke it only by written notice to the Secretary or Assistant Secretary delivered at any time before it is exercised, including at the annual meeting. All properly completed proxy forms returned in time to be cast at the annual meeting will be voted.

Important Notice Regarding the Availability of Proxy Materials for

the Shareholder Meeting to be Held on May 8, 2020

This Proxy Statement and the Accompanying Annual Report on Form10-K, Letter to Shareholders, and Notice, are available atwww.proxyvote.com

At the meeting, the shareholders will consider and vote upon the following proposals put forth by the Board:

1. To elect the eight nominees named in this proxy statement to the Board of Directors to serve as directors for aone-year term.

2. To approve, in anon-binding, advisory vote, the compensation of the Company’s named executive officers.

3. To ratify the selection of the firm of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020.

The Board recommends that you voteFOR the proposals listed above.

On or about March 27, 2020, the Company mailed to its shareholders of record as of March 12, 2020 a notice containing instructions on how to access this proxy statement and the Company’s annual report online and to vote. Also on March 27, 2020, the Company began mailing printed copies of these proxy materials to shareholders that have requested printed copies.

If you received a notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. Instead, the notice instructs you on how to access and review all of the important information contained in the proxy statement and annual report. The notice also instructs you on how you may submit your proxy over the Internet. If you received a notice by mail and would like to receive a printed copy of the proxy materials, you should follow the instructions for requesting such materials included in the notice.

If a shareholder completes and submits a proxy, the shares represented by the proxy will be voted in accordance with the instructions for such proxy. If a shareholder submits a proxy card but does not fill out the voting instructions, shares represented by such proxy will be voted FOR each of the proposals listed above.

Shareholders may vote in one of the following three ways:

1. by completing a proxy on the Internet at the address listed on the proxy card or notice,

2. by completing a proxy using the toll-free telephone number listed on the proxy card or notice, or

3. by completing, signing and dating the proxy card provided by Teradyne and returning it in the enclosed envelope or by return mail to Teradyne at the address indicated on the proxy card.

A majority of the outstanding shares represented at the meeting in person or by proxy shall constitute a quorum for the transaction of business. Abstentions and broker“non-votes” are counted as present or represented for purposes of determining the presence or absence of a quorum for the meeting. A“non-vote” occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner. For this annual meeting, on all matters being submitted to shareholders, an affirmative vote of at least a majority of the shares voting on the matter at the meeting is required for approval. The vote on each matter submitted to shareholders is tabulated separately. Abstentions are not included in the number of shares present, or represented, and voting on each separate matter. Broker“non-votes” are also not included. An automated system administered by Teradyne’s transfer agent tabulates the votes.

The Board knows of no other matter to be presented at the annual meeting. If any other matter should be presented at the annual meeting upon which a vote properly may be taken, shares represented by all proxies received by the Board will be voted in accordance with the judgment of those officers named as proxies and in accordance with the Securities and Exchange Commission’s (“SEC’s”) proxy rules. See the section entitled “Shareholder Proposals for 2021 Annual Meeting of Shareholders” for additional information.

ELECTION OF DIRECTORS

The Board presently consists of eight members, seven of whom are independent directors. Each director is elected annually for aone-year term. The terms of the directors expire at the 2020 Annual Meeting of Shareholders. The Board, based on the recommendation of the Nominating and Corporate Governance Committee, has nominated all current directors forre-election. Teradyne has no reason to believe that any of the nominees will be unable to serve; however, if that should be the case, proxies will be voted for the election of some other person (nominated in accordance with Teradyne’s bylaws) or the Board will decrease the number of directors that currently serve on the Board. If elected, each director will hold office until the 2021 Annual Meeting of Shareholders.

The Board recommends a vote FOR the election to the Board each of Mses. Johnson and Matz and each of Messrs. Bradley, Gillis, Guertin, Jagiela, Tufano and Vallee.

The following table sets forth the nominees to be elected at this annual meeting, the year each person was first appointed or elected, the principal occupation of that person during at least the past five years, that person’s age, any other public company boards on which the nominee serves or has served in the past five years, and the nominee’s qualifications to serve on the Board. In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led the Board to the conclusion that he or she should serve as a director, Teradyne also believes that all of its director nominees have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to Teradyne and the Board. Additionally, Teradyne values the directors’ diversity and significant experience on other public company boards of directors and board committees.

2

Nominees for Directors

Name | Year Became Director | Background and Qualifications | |||||

Michael A. Bradley | 2004 | Mr. Bradley, 71, served as the Company’s Chief Executive Officer from May 2004 until February 2014. He was President of Teradyne from May 2003 until January 2013, President of the Semiconductor Test Division from April 2001 until May 2003 and Chief Financial Officer from July 1999 until April 2001. From 1992 until 2001, he held various Vice President positions at Teradyne. Mr. Bradley has been a director of Entegris, Inc., and its predecessor company Mykrolis Corporation, since 2001 and of Avnet, Inc. since November 2012.

Mr. Bradley contributes valuable institutional knowledge and executive experience from his 41 years with Teradyne, including 10 years as Chief Executive Officer. | |||||

Edwin J. Gillis | 2006 | Mr. Gillis, 71, has worked as a business consultant and private investor since January 2006. From July 2005 to December 2005, he was the Senior Vice President of Administration and Integration of Symantec Corporation, following the merger of Veritas Software Corporation and Symantec Corporation. He served as Executive Vice President and Chief Financial Officer of Veritas Software Corporation from November 2002 to June 2005, as the Executive Vice President and Chief Financial Officer of Parametric Technology Corporation from September 1995 to November 2002, and as the Chief Financial Officer of Lotus Development Corporation from 1991 to September 1995. Prior to joining Lotus, Mr. Gillis was a Certified Public Accountant and partner at Coopers & Lybrand L.L.P. Mr. Gillis has been a director of LogMeIn, Inc. since November 2007. Mr. Gillis was a director of Responsys Inc. from March 2011 to January 2014 and a director of Sophos Plc. from November 2009 to September 2017.

Mr. Gillis contributes extensive experience relating to the issues confronting global technology companies and financial reporting expertise as a former Chief Financial Officer of several publicly traded technology companies. | |||||

Timothy E. Guertin | 2011 | Mr. Guertin, 70, served as Chief Executive Officer of Varian Medical Systems, Inc. (“Varian”) from February 2006 to September 2012 and as President from August 2005 to September 2012. He served as Chief Operating Officer from October 2004 to February 2006 and as Corporate Executive Vice President from October 2002 to August 2006. Prior to that time, he was President of Varian’s Oncology Systems business unit from 1992 to January 2005 and a Corporate Vice President from 1992 to 2002. Mr. Guertin was a director of Varian from August 2005 to February 2020.

Mr. Guertin contributes significant executive experience at a global technology and manufacturing company with issues similar to those confronting Teradyne. | |||||

3

Name | Year Became Director | Background and Qualifications | |||||

Mark E. Jagiela | 2014 | Mr. Jagiela, 59, has served as the Company’s Chief Executive Officer since February 2014. He has served as the President of Teradyne since January 2013 and the President of the Company’s Semiconductor Test Division from 2003 to February 2016. Mr. Jagiela was appointed a Vice President of Teradyne in 2001. He has held a variety of senior management roles at the Company including General Manager of Teradyne’s Japan Division.

Mr. Jagiela contributes valuable executive experience from his 38 years in multiple management roles, including as President and Chief Executive Officer, within Teradyne. | |||||

Mercedes Johnson | 2014 | Ms. Johnson, 66, served as Interim Chief Financial Officer of Intersil Corporation from April 2013 to September 2013 and as the Senior Vice President and Chief Financial Officer of Avago Technologies Limited from December 2005 to August 2008. Prior to joining Avago, Ms. Johnson was Senior Vice President, Finance, of Lam Research Corporation from June 2004 to January 2005 and Chief Financial Officer of Lam from May 1997 to May 2004. Ms. Johnson has been a director of Synopsys, Inc. since February 2017, a director of Millicom International Cellular S.A. since May 2019, and a director of Maxim Integrated Products since September 2019. Ms. Johnson was a director of Intersil Corporation from August 2005 to February 2017, a director of Micron Technology, Inc. from June 2005 to January 2019, and a director of Juniper Networks, Inc. from May 2011 to May 2019.

Ms. Johnson contributes valuable industry experience as a former senior financial executive at semiconductor and semiconductor equipment companies as well as a current member of the boards of directors of global technology companies. | |||||

Marilyn Matz | 2017 | Ms. Matz, 66, is aco-founder of Paradigm4, Inc. and has served as its Chief Executive Officer and Chair of the Board of Directors since December 2009. Previously, Ms. Matz was aco-founder of Cognex Corporation where she held a variety of leadership positions in engineering and business operations from March 1981 to December 2008 including her final role as Senior Vice President and Business Unit Manager of its PC Vision Products Group. Ms. Matz served on the Board of Directors for LogMeIn, Inc. from September 2014 to February 2017.

Ms. Matz contributes valuable technical expertise and leadership experience from more than 38 years in automation, machine vision and software analytics related industries. | |||||

4

Name | Year Became Director | Background and Qualifications | |||||

Paul J. Tufano | 2005 | Mr. Tufano, 66, served as President and Chief Executive Officer of Benchmark Electronics, Inc. from September 2016 to March 2019. He currently serves as an advisor to Benchmark Electronics. Mr. Tufano served as the Chief Financial Officer of Alcatel-Lucent from December 2008 to September 2013 and Chief Operating Officer of Alcatel-Lucent from January 2013 to September 2013. He was Executive Vice President of Alcatel-Lucent from December 2008 to January 2013. He also served as a consultant for Alcatel-Lucent from September 2013 to April 2014. Mr. Tufano was the Executive Vice President and Chief Financial Officer of Solectron Corporation from January 2006 to October 2007 and Interim Chief Executive Officer from February 2007 to October 2007. Prior to joining Solectron, Mr. Tufano worked at Maxtor Corporation where he was President and Chief Executive Officer from February 2003 to November 2004, Executive Vice President and Chief Operating Officer from April 2001 to February 2003 and Chief Financial Officer from July 1996 to February 2003. From 1979 until he joined Maxtor Corporation in 1996, Mr. Tufano held a variety of management positions in finance and operations at International Business Machines Corporation. Mr. Tufano has been a director of EnerSys since April 2015. Mr. Tufano served on the Board of Directors of Benchmark Electronics, Inc. from February 2016 to March 2019.

Mr. Tufano contributes widespread knowledge of the issues confronting complex technology and manufacturing companies and extensive financial reporting expertise. | |||||

Roy A. Vallee | 2000 | Mr. Vallee, 67, served as Executive Chairman of the Board of Directors of Avnet, Inc. from July 2011 to November 2012 and as a director of Avnet, Inc. from 1991 to 2012. From July 1998 to July 2011, he was Chairman of the Board of Directors and Chief Executive Officer of Avnet, Inc. He also was Vice Chairman of the Board of Directors from November 1992 to July 1998 and President and Chief Operating Officer from March 1992 until July 1998. Since 2003, Mr. Vallee has been a director of Synopsys, Inc. and currently serves as lead independent director. He is a former Chairman of the Board of Directors of the Federal Reserve Bank of San Francisco.

Mr. Vallee contributes valuable executive experience within the global technology industry as well as extensive knowledge of the issues affecting complex technology companies. | |||||

5

Director Qualifications and Experience

As described above, each Director nominee brings a diversity of skills and experiences to the Board that are complementary and, together, cover the spectrum of areas that impact the Company’s current and evolving business. A summary of each nominee’s qualifications and experience is set forth in the matrix below. As the matrix is a summary, it does not include all the skills, experience, qualifications and diversity that each nominee offers, and the fact that a particular experience, skill or qualification is not listed does not mean that a nominee does not possess it. The Board believes that the combination of backgrounds, skills and experience has resulted in a Board that is well-equipped to exercise oversight responsibilities on behalf of the Company’s stakeholders.

Qualifications/Skills | Bradley | Gillis | Guertin | Jagiela | Johnson | Matz | Tufano | Vallee | ||||||||

C-Level Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

Global Business Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

Semiconductor and Electronics Industry Experience | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Industrial Automation Industry Experience | ✓ | ✓ | ||||||||||||||

M&A Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

Sales/Marketing Experience | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Technical Product Development Expertise | ✓ | ✓ | ✓ | ✓ | ||||||||||||

Financial Expertise | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

Legal/Regulatory Compliance and Risk Oversight | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

6

ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS

The Company is providing shareholders with the opportunity at the 2020 Annual Meeting to vote on the following advisory resolution, commonly known as“Say-on-Pay”:

RESOLVED, that the shareholders of the Company approve, in anon-binding, advisory vote, the compensation of the Company’s named executive officers as disclosed in the Company’s proxy statement under the headings “Compensation Discussion and Analysis” and “Executive Compensation Tables” pursuant to Item 402 of RegulationS-K.

The Company’s Compensation Committee has implemented an executive compensation program that rewards performance. The Compensation Committee fosters a performance-oriented environment by tying a significant portion of each executive officer’s cash and equity compensation to the achievement of short-term and long-term performance objectives that are important to the Company and its shareholders. The Compensation Committee has designed the Company’s executive compensation program to attract, motivate, reward and retain the senior management talent required to achieve the Company’s corporate objectives and increase shareholder value. The Company believes that its compensation policies and practices reflect apay-for-performance philosophy and are strongly aligned with the long-term interests of shareholders. The Company recommends shareholders read the sections of this proxy statement entitled “Compensation Discussion and Analysis” and “Executive Compensation Tables” before voting on this“Say-on-Pay” advisory proposal.

The executive compensation program resulted in compensation for the Company’s named executive officers that reflects the Company’s challenging performance goals for 2019 and performance in achieving those goals. The Company increased revenues by 9%, to $2.3 billion, generated significant free cash flow and increased earnings per share for the sixth consecutive year, all as described in the section of this proxy statement entitled “Compensation Discussion and Analysis.” The Company grew sales in its semiconductor test, wireless test and system test businesses while achieving market share gains in its memory test business. The Company also grew its industrial automation business year over year, despite challenging global industrial automation conditions, supported by the acquisition of AutoGuide Mobile Robots in the fourth quarter of 2019. Beyond its strong financial performance, the Company introduced major new products in growing segments across its test and industrial automation businesses to expand its served markets and position itself for continued growth.

The Company’s sustained profitability and free cash flow allowed the Company in 2019 to return approximately $560 million to shareholders through payment of quarterly dividends and share repurchases. The Company has announced a new $1 billion share repurchase authorization and plans to repurchase a minimum of $250 million of shares in 2020. The Company also announced an 11% increase to its quarterly dividend to $0.10 per share.

The Company’s performance-based variable compensation for 2019 was tied to the Company’s rate of profitability, revenue growth and the achievement of strategic business objectives, including market share gains, revenue and bookings goals, profit and gross margin targets, strategic customerdesign-in wins and new product launches – the achievement of which positively impact the Company’s long-term performance. In 2019, the Company increased the profit rate before interest and taxes (“PBIT”) target for variable cash compensation from 17% to 19%, increased the targettwo-year rolling revenue growth rate for variable cash compensation from 3% to 5%, and increased the revenue growth rate that results in the maximum payout for the revenue growth metric for variable cash compensation from 10% to 15%. Due to the Company’s PBIT, revenue growth and achievement of certain strategic goals in 2019, executive officers received variable cash compensation payouts ranging from 124% to 137% of their target awards.

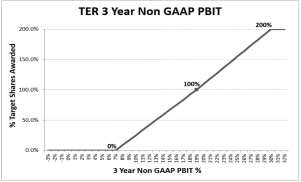

In 2019, the Company’s long-term performance criteria for performance-based stock awards included both a relative total shareholder return component and a cumulative PBIT component, each measured at the end of a

7

three-year performance period, consistent with the Company’s long-term goal to deliver profitability and superior return to shareholders. The relative total shareholder return component is based on a comparison of the Company’s total shareholder return to the performance of the NYSE Composite Index. In 2019, the Company increased the three-year cumulative PBIT rate component of the long-term performance criteria for performance-based stock awards from 17% to 19%. The final number of shares earned for the performance-based stock awards granted in 2019 will be determined in January 2022.

In January 2020, the executive officers achieved: (1) 158% of their target performance-based stock awards granted in 2017 that were eligible to vest with the relative total shareholder return component, based on Teradyne’s relative total shareholder return performance measured against the NYSE Composite Index during the three-year performance period from January 2017 to January 2020; and (2) 200% of their target performance-based stock awards granted in 2017 that were eligible to vest with the PBIT component, based on the Company’s three-year cumulative PBIT rate from January 1, 2017 to December 31, 2019.

The Company’s shareholders voted to approve theSay-on-Pay advisory proposal at the 2019 Annual Meeting of Shareholders with 96% of the votes cast approving the proposal. Notwithstanding this result, the Compensation Committee continues to assess the Company’s executive compensation program to ensure it remains aligned with both short-term and long-term performance. For example, in 2020, the Compensation Committee adjusted the mix of equity awarded to the executive officers by increasing the performance-based stock awards from 50% to 60% of the total grant date fair value of the awards (with performance-based stock awards measured at target), decreasing the time-based stock awards from 40% to 30%, and retainingnon-qualified stock options at 10% of the 2020 equity award. The Compensation Committee also increased the revenue growth rate that results in the maximum payout for the revenue growth metric for variable cash compensation from 15% to 17%.

The performance-based variable cash compensation and equity awards are described in detail in the “Compensation Discussion and Analysis” section of this proxy statement.

The Company will report the results of the“Say-on-Pay” vote in a Form8-K following the 2020 Annual Meeting of Shareholders. The Company also will disclose in subsequent proxy statements how the Company’s compensation policies and decisions take into account the results of the shareholder advisory vote on executive compensation.

The Board recommends a vote FOR the advisory resolution approving the compensation of the Company’s named executive officers as described in this proxy statement.

8

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected (and the Board of Directors has approved) PricewaterhouseCoopers LLP to serve as Teradyne’s independent registered public accounting firm for the fiscal year ending December 31, 2020. PricewaterhouseCoopers LLP, or its predecessor Coopers & Lybrand L.L.P., has served as Teradyne’s independent registered public accounting firm since 1968. The appointment of PricewaterhouseCoopers LLP is in the best interest of Teradyne’s shareholders. Teradyne expects that a representative from PricewaterhouseCoopers LLP will be at the annual meeting, will have the opportunity to make a statement if so desired and will be available to respond to appropriate questions. The ratification of this selection is not required by the laws of The Commonwealth of Massachusetts, where Teradyne is incorporated, but the results of this vote will be considered by the Audit Committee in selecting an independent registered public accounting firm for future fiscal years.

The Board recommends a vote FOR ratification of the selection of PricewaterhouseCoopers LLP.

9

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

Corporate Governance and Board Policies

Teradyne is committed to good, transparent corporate governance to ensure that the Company is managed for the long-term benefit of its shareholders. The Board of Directors has adopted Corporate Governance Guidelines (“Guidelines”) to provide a framework for the effective governance of Teradyne. The Nominating and Corporate Governance Committee periodically reviews the Guidelines and recommends changes, as appropriate, to the Board of Directors for approval. The Board of Directors has also adopted written charters for its standing committees (Audit, Compensation, and Nominating and Corporate Governance), and the Company has a Code of Conduct applicable to all directors, officers and employees. Copies of the Guidelines, committee charters, and Code of Conduct are available on the Company’s web site atwww.teradyne.com under the “Governance” section of the “Investors” link. Teradyne posts additional information on its web site from time to time as the Board makes changes to Teradyne’s corporate governance policies.

Teradyne has instituted a variety of policies and practices to foster and maintain good corporate governance. The Board reviews these practices on a regular basis. Teradyne’s current policies and practices include the following:

| • | Independent directors constitute majority of Board and all members of the Board Committees; |

| • | Independent Board Chair; |

| • | All directors elected annually forone-year term with majority voting for uncontested Board elections; |

| • | Adoption of “Poison Pill” requires shareholder approval; |

| • | Recoupment of incentive compensation from executives for fraud resulting in financial restatement; |

| • | Director and executive officer stock ownership guidelines; |

| • | Annual Board and Committee self-assessments; |

| • | Executive sessions of independent directors at Board meetings; |

| • | Board access to management and independent advisors; |

| • | Board oversight of enterprise risk management, including cybersecurity risks; |

| • | Independent registered public accounting firm and internal auditor meet regularly with Audit Committee without management present; |

| • | An environmental, social and governance program and Corporate Social Responsibility (“CSR”) Report. |

| • | Nominating and Corporate Governance Committee review of Board composition, skills, diversity and succession plan; |

| • | Nominating and Corporate Governance Committee review of director’s change in position; |

| • | Annual Board review of executive succession plan; |

| • | Policy prohibiting employees, executives and directors from hedging Teradyne stock (through short selling or the use of financial instruments such as exchange funds, equity swaps, puts, calls, collars or other derivative instruments) and pledging Teradyne stock as collateral for loans (including through the use of margin accounts); |

| • | No director may serve on more than four other public company boards; |

| • | Directors must be 74 years or younger as of the date of their election or appointment; |

| • | Annual review ofnon-employee director compensation and cap on value of annual equity awards; |

10

| • | Annual Board evaluation of Chief Executive Officer performance; and |

| • | Policy promoting equal opportunity for all employees, including gender pay equity. |

Board Nomination Policies and Procedures

The Nominating and Corporate Governance Committee is responsible for identifying, evaluating and recommending candidates for election to the Board and does not distinguish between nominees recommended by shareholders and other nominees. All nominees must meet, at a minimum, the Board membership criteria described below.

Director nominees are evaluated on the basis of a range of criteria, including (but not limited to): integrity, honesty and adherence to high ethical standards; business acumen, experience and ability to exercise sound judgments and contribute positively to a decision-making process; commitment to understanding Teradyne and its industry; commitment to regularly attend and participate in Board and Committee meetings; ability to ensure that outside commitments do not materially interfere with duties as a Board member; absence of a conflict of interest or appearance of a conflict of interest; and other appropriate considerations.

Nominees shall be 74 years or younger as of the date of election or appointment. No director may serve on more than four other public company boards.

The Board seeks nominees with a broad diversity of viewpoints, professional experience, education, geographic representation, backgrounds and skills. The backgrounds and qualifications of directors, considered as a group, should provide a significant composite mix of backgrounds, expertise and experience that will allow the Board to fulfill its responsibilities. The Board values ethnic, cultural, gender, economic, professional and educational diversity in evaluating new candidates and seeks to incorporate a wide range of those attributes in Teradyne’s Board of Directors. Board composition and succession planning are reviewed regularly to ensure that Teradyne’s directors reflect the knowledge, experience, skills and diversity required for the needs of the Board.

Shareholders wishing to suggest candidates to the Nominating and Corporate Governance Committee for consideration as potential director nominees may do so by submitting the candidate’s name, experience, and other relevant information to the Nominating and Corporate Governance Committee, 600 Riverpark Drive, North Reading, MA 01864. Shareholders wishing to nominate directors may do so by submitting a written notice to the Secretary at the same address in accordance with the nomination procedures set forth in Teradyne’s bylaws. Additional information regarding the nomination procedure is provided in the section below captioned “Shareholder Proposals for 2021 Annual Meeting of Shareholders.”

Director Independence

Teradyne’s Guidelines require that at least a majority of the Board shall be independent and set out standards for determining director independence. To be considered independent, a director must satisfy the definitions pursuant to the SEC rules and the listing standards of The Nasdaq Stock Market LLC (“Nasdaq”), and, in the Board’s judgment, not have a material relationship with Teradyne. Teradyne’s Guidelines are available on Teradyne’s web site atwww.teradyne.com under the “Governance” section of the “Investors” link.

The Board has determined that the following directors are independent using the criteria identified above: Michael A. Bradley, Edwin J. Gillis, Timothy E. Guertin, Mercedes Johnson, Marilyn Matz, Paul J. Tufano and Roy A. Vallee. In determining the independence of Teradyne’s directors, the Board reviewed and determined that the following did not preclude a determination of independence under Teradyne’s standards: Ms. Johnson’s position as a director of Maxim Integrated Products, both a Teradyne supplier and customer; until her retirement in May 2019, Ms. Johnson’s position as a director of Juniper Networks, Inc., one of Teradyne’s customers; until her retirement in January 2019, Ms. Johnson’s position as a director of Micron Technology, Inc., one of

11

Teradyne’s customers; until his retirement in March 2019, Mr. Tufano’s position as President, Chief Executive Officer and director of Benchmark Electronics, Inc., one of Teradyne’s customers; Mr. Bradley’s position as a director of Avnet, Inc., both a Teradyne customer and supplier; and each of Ms. Johnson’s and Mr. Vallee’s position as a director of Synopsys, Inc., both a Teradyne customer and supplier. Teradyne’s business with Maxim Integrated Products, Micron Technology, Avnet, Juniper Networks, Benchmark Electronics and Synopsys during 2019 was immaterial to Teradyne and to the other companies. Teradyne will continue to monitor its business relationships to ensure they have no impact on the independence of its directors. The Board has determined that Michael A. Bradley met the standards for independence on February 1, 2018 because, as of that date, he had not received compensation from Teradyne related to his employment as the Company’s Chief Executive Officer during a twelve-month period within the last three years. The Board has determined that Mark E. Jagiela is not independent because he is Teradyne’s Chief Executive Officer.

All members of the Company’s three standing committees – the Audit, Compensation and Nominating and Corporate Governance Committee – are required to be independent and have been determined by the Board to be independent pursuant to the SEC rules and the listing standards of Nasdaq, as well as Teradyne’s standards.

The independent directors of the Board and its standing committees periodically meet without management present.

Board Leadership Structure and Self-Assessment

Since May 2014, Mr. Vallee has served as an independent Chair of the Board. The Board believes that having an independent Chair is the preferred corporate governance structure for the Company because it strikes an effective balance between management and independent leadership participation in the Board process.

The Board and each of its committees annually undertake a self-assessment, including an evaluation of its composition, mandate and function. The Chair of the Nominating and Corporate Governance Committee manages this annual process and implementation of any action items resulting from the process. For example, as a result of one of the Board’s self-assessments in which the directors expressed their interest in having a separate strategy discussion, an annual strategic session with management was implemented in 2018.

Code of Ethics

The Code of Conduct is Teradyne’s ethics policy. The Board has established a means for anyone to report violations of the ethics policy on a confidential or anonymous basis. Teradyne’s Code of Conduct is available on Teradyne’s web site atwww.teradyne.com under the “Governance” section of the “Investors” link.

Teradyne maintains an insider trading policy as part of its Code of Conduct. Among other things, the insider trading policy prohibits trading on materialnon-public information and prohibits directors, executive officers and certain other employees from buying or selling Teradyne securities during the Company’snon-trading periods, also called “blackout periods”, except pursuant to an approved trading plan.

Teradyne shall disclose any change to or waiver from the Code of Conduct granted to an executive officer or director within four business days of such determination by disclosing the required information on its web site atwww.teradyne.com under the “Governance” section of the “Investors” link.

Corporate Responsibility and Sustainability

Teradyne’s Board of Directors is committed to promoting, creating and maintaining a safe and healthy workplace, environment and society. Teradyne is committed to employee health, safety and welfare, to managing its activities that impact the environment in a responsible and effective manner, and to supporting the communities where its employees live and work. Teradyne strives to be a leader in driving improvements in

12

environmental sustainability, supply chain responsibility, diversity and inclusion, and positive social impact. In August 2019, the Board invited an outside expert to present to the full Board on best practices and trends in corporate social responsibility (“CSR”) programs. In 2019, the Company implemented a more robust CSR program and, in November 2019, published its first CSR report. The Company plans to continue to enhance its program and to provide additional, detailed disclosures to its shareholders, employees, customers, suppliers and other stakeholders. For example, the Company reduced its water usage in its corporate headquarters in North Reading, MA by 25% from 2018 to 2019 by instituting water saving measures. Additionally, in response to employee feedback, Teradyne expanded its training and learning development program for employees globally in 2019. Detailed information regarding Teradyne’s corporate responsibility and sustainability activities is available on its website atwww.teradyne.com under the “Corporate Social Responsibility” link.

Board Oversight of Risk

Management is responsible for theday-to-day management of risks to the Company, while the Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. Management attends regular Board and committee meetings and discusses with the Board and committees various risks confronting the Company, including operational, cybersecurity, legal, market and competitive risks. Management and the Board have not identified any risks arising from Teradyne’s compensation plans, policies and practices for the executives or employees that are reasonably likely to have a material adverse effect on the Company.

Related Party Transactions

Under Teradyne’s written “Conflict of Interest Policy,” which is part of Teradyne’s Code of Conduct, the General Counsel notifies the Audit Committee of any investment or other arrangement to be entered into by Teradyne that could or would be perceived to represent a conflict of interest with any of the executive officers or directors. Every year Teradyne makes an affirmative inquiry of each of the executive officers and directors as to their existing relationships. Teradyne reports any potential conflicts identified through these inquiries to the Audit Committee. No potential conflicts were identified in 2019.

Shareholder Communications with Board of Directors

Shareholders and other interested parties may communicate with one or more members of the Board, including the Chair, or thenon-management directors as a group by writing to theNon-Management Directors, Board of Directors, 600 Riverpark Drive, North Reading, MA 01864 or by electronic mail at nonmanagementdirectors@teradyne.com. Any communications that relate to ordinary business matters that are not within the scope of the Board’s responsibilities, such as customer complaints, will be sent to the appropriate executive. Solicitations, junk mail, and other similarly frivolous or inappropriate communications will not be forwarded, but will be made available to any director who wishes to review them.

Under Teradyne’s Corporate Governance Guidelines, each director is expected to attend each annual meeting of shareholders. All directors attended the 2019 Annual Meeting of Shareholders held on May 7, 2019.

The Board met five times during the year ended December 31, 2019. Thenon-employee directors, all of whom are independent, held executive sessions in which they met without management after its regularly scheduled meetings during 2019. The Chair of the Board presides over all Board meetings and each executive session. During 2019, each director attended at least 75% of the total number of meetings of the Board and committee meetings held while such person served as a director. Teradyne’s Corporate Governance Guidelines, which are available atwww.teradyne.com under the “Corporate Governance” section of the “Investors” link, provide a framework for the conduct of the Board’s business.

13

The Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. In accordance with the listing standards of Nasdaq, all of the committees are comprised of independent directors. The members of each committee are appointed by the Board based on the recommendation of the Nominating and Corporate Governance Committee. Each committee performs a self-evaluation and reviews its charter annually. Actions taken by any committee are reported to the Board, usually at the next Board meeting following the action. The table below shows the current membership of each of the standing committees:

Audit Committee | Compensation Committee | Nominating and Corporate | ||

Edwin J. Gillis* | Timothy E. Guertin* | Timothy E. Guertin | ||

Mercedes Johnson | Marilyn Matz | Marilyn Matz* | ||

Paul J. Tufano | Roy A. Vallee | Roy A. Vallee |

| * | Committee Chair |

The Board will appoint committee members for the 2020-2021 term following the election of directors at the 2020 Annual Meeting of Shareholders.

Audit Committee

The Audit Committee has three members, all of whom have been determined by the Board to be independent pursuant to SEC rules and the listing standards of Nasdaq, as well as Teradyne’s independence standards. In addition, the Board determined that each member of the Audit Committee is financially literate and an “audit committee financial expert” as defined in the rules and regulations promulgated by the SEC. The Board has determined that Ms. Johnson’s simultaneous service on three additional audit committees does not impair her ability to effectively serve on Teradyne’s Audit Committee. The Audit Committee’s oversight responsibilities, described in greater detail in its charter, include, among other things:

| • | overseeing matters relating to the financial disclosure and reporting process, including the system of internal controls; |

| • | reviewing the internal audit function and annual internal audit plan; |

| • | supervising compliance with legal and regulatory requirements; |

| • | reviewing and approving the appointment, compensation, activities, and independence of the independent registered public accounting firm including the selection of the lead audit partner who is rotated every 5 years; and |

| • | conducting a financial risk assessment. |

The Audit Committee met ten times during 2019. The responsibilities of the Audit Committee and its activities during 2019 are more fully described in the Audit Committee Report contained in this proxy statement.

Compensation Committee

The Compensation Committee has three members, all of whom have been determined by the Board to be independent pursuant to SEC rules and the listing standards of Nasdaq, as well as Teradyne’s independence standards. The Compensation Committee’s primary responsibilities, discussed in greater detail in its charter, include, among other things:

| • | oversight of and assessment of the risks associated with Teradyne’s compensation programs, policies and practices; |

14

| • | recommending changes and/or recommending the adoption of new compensation plans to the Board, as appropriate; |

| • | reviewing and recommending to the Board each year the compensation fornon-employee directors; |

| • | evaluating and recommending to the independent directors of the Board the annual cash and equity compensation and benefits to be provided for the Chief Executive Officer; and |

| • | reviewing and approving of the cash and equity compensation and benefit packages of the other executive officers. |

The Compensation Committee has the authority to and does engage the services of independent advisors, experts and others to assist it from time to time. Teradyne’s compensation and benefits group in the Human Resources Department supports the Compensation Committee in its work and assists in administering the compensation plans and programs.

The Compensation Committee met six times during 2019.

The Compensation Committee has retained Compensia, Inc. (“Compensia”), an executive compensation consulting firm, to assist it in carrying out its duties and responsibilities regarding executive andnon-employee director compensation. In 2019, this engagement involved preparing (1) an executive officer compensation competitive analysis; (2) a director compensation competitive analysis; (3) a peer group analysis; and (4) a tally sheet analysis for executive officers. To maintain the independence of its advice, Compensia provides no services to Teradyne other than the services provided to the Compensation Committee. In addition, the Compensation Committee conducts annually a conflict of interest assessment for Compensia and any other independent advisors engaged during the year using the factors applicable to compensation consultations under SEC rules and the listing standards of Nasdaq, and, for 2019, no conflict of interest was identified.

The Compensation Committee also uses proprietary compensation surveys prepared by Radford, a global compensation consultant focused on technology companies.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is comprised entirely of independent directors in accordance with SEC rules and the listing standards of Nasdaq, as well as Teradyne’s independence standards. None of Teradyne’s executive officers serves on the Compensation Committee of any of the companies in which the directors are officers.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee has three members, all of whom have been determined by the Board to be independent pursuant to SEC rules and the listing standards of Nasdaq, as well as Teradyne’s independence standards. The Nominating and Corporate Governance Committee’s primary responsibilities, discussed in greater detail in its charter, include, among other things, to:

| • | identify individuals qualified to become Board members; |

| • | recommend to the Board the nominees for election orre-election as directors at the annual meeting of shareholders; |

| • | develop and recommend to the Board a set of corporate governance principles; |

| • | oversee and advise the Board with respect to corporate governance matters; |

| • | review the Company’s environmental, social and governance program; and |

| • | oversee the evaluation of the Board. |

15

The Nominating and Corporate Governance Committee identifies director candidates through numerous sources, including recommendations from existing Board members, executive officers, and shareholders and through engagements with executive search firms. The Nominating and Corporate Governance Committee regularly reviews Board composition, skills, diversity and succession plans.

Non-employee directors must notify the Nominating and Corporate Governance Committee if the director experiences a change of position from that held upon first becoming a member of the Board. Upon any such notification, the Nominating and Corporate Governance Committee will review the potential impact on the director’s independence and the appropriateness of the director’s continued membership on any Board committees under the circumstances. Teradyne’s Corporate Governance Guidelines also provide that the continuation of a former Chief Executive Officer of the Company on the Board is a matter to be decided by the Board, upon recommendation of the Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee met four times during 2019.

Teradyne uses a combination of cash and stock-based incentive compensation to attract and retain qualified candidates to serve on the Board. Every year, Compensia, the Compensation Committee’s independent compensation consulting firm, conducts an analysis of director compensation, including a review of benchmark data, and reports to the Committee any recommendations regarding director compensation. The Compensation Committee considers Compensia’s annual recommendations as part of its annual review of director compensation.Non-employee directors’ compensation is determined by the Board at the recommendation of the Compensation Committee. In 2019, after review of this data, the Compensation Committee recommended, and the Board approved, an increase in certain of the cash fees payable to thenon-employee directors, as described below. Directors who are employees of Teradyne receive no compensation for their service as a director.

Cash Compensation

In 2019, thenon-employee directors were compensated at the rate of $70,000 per yearpro-rated from January 1, 2019 until May 7, 2019 and compensated at the rate of $80,000 per yearpro-rated from May 7, 2019 through December 31, 2019. Additional fees paid to certainnon-employee directors in 2019 were as follows:

| • | The Board Chair received an additional $55,000 per yearpro-rated from January 1, 2019 until May 7, 2019 and an additional $65,000 per yearpro-rated from May 7, 2019 through December 31, 2019; |

| • | The Chair of the Audit Committee received an additional $25,000 per yearpro-rated from January 1, 2019 until May 7, 2019 and an additional $30,000 per yearpro-rated from May 7, 2019 through December 31, 2019; |

| • | The Chair of the Compensation Committee received an additional $20,000 per year; and |

| • | The Chair of the Nominating and Corporate Governance Committee received an additional $15,000 per year. |

Stock-Based Compensation

Eachnon-employee director receives an annual equity award having a fair market value equal to $200,000 on the earlier of (i) the date of the Annual Meeting of Shareholders or (ii) the last Thursday in May. This annual equity award, which is delivered in the form of restricted stock units, vests in full on the earlier of (i) the first anniversary of the date of grant or (ii) the date of the following year’s Annual Meeting of Shareholders.

Each newnon-employee director is granted an equity award on the date first elected or appointed to the Board having a fair market value equal to $200,000,pro-rated to reflect the period between the director’s date of election or appointment and the date of the next annual board grant. This equity award, which is also delivered in the form of restricted stock units, vests in full on the date of the next annual equity award grant. The equity

16

award is granted under the shareholder-approved 2006 Equity and Cash Compensation Incentive Plan, which limits annual equity awards fornon-employee directors to an amount not to exceed $200,000.

Director Deferral Program

Thenon-employee directors may elect to defer receipt of their cash and/or equity awards and have the compensation invested into (1) an interest-bearing account (based onten-year Treasury note interest rates) or (2) a deferred stock unit (“DSU”) account. If anon-employee director elects to participate in this deferral program, he or she will receive either the cash value of the interest-bearing account or the shares of the Company’s common stock underlying the DSUs, in either case, within 90 days following the end of his or her board service.

Director Stock Ownership Guidelines

The Company maintains stock retention and stock ownership guidelines to align the interests of thenon-employee directors with those of the Company’s shareholders and ensure that the directors have an ongoing financial stake in the Company’s success. Pursuant to the guidelines, thenon-employee directors are expected to attain (within five years from the date of initial election to the Board) and maintain an investment level in shares of the Company’s common stock equal to five times their annual cash retainer. All of thenon-employee directors met the ownership guidelines as of December 31, 2019.

Director Compensation Table for 2019

The table below summarizes the compensation Teradyne paid to thenon-employee directors for the fiscal year ended December 31, 2019.

Name | Fees Earned or Paid in Cash ($) (1) | Stock Awards ($) (2)(3) | Total ($) | ||||||||||||

Michael A. Bradley | $ | 76,485 | $ | 199,661 | $ | 276,146 | |||||||||

Edwin J. Gillis | $ | 104,725 | $ | 199,661 | $ | 304,386 | |||||||||

Timothy E. Guertin | $ | 96,485 | $ | 199,661 | $ | 296,146 | |||||||||

Mercedes Johnson | $ | 76,485 | $ | 199,661 | $ | 276,146 | |||||||||

Marilyn Matz | $ | 91,485 | $ | 199,661 | $ | 291,146 | |||||||||

Paul J. Tufano | $ | 76,485 | $ | 199,661 | $ | 276,146 | |||||||||

Roy A. Vallee | $ | 137,967 | $ | 199,661 | $ | 337,628 | |||||||||

| (1) | Thenon-employee directors were compensated at the rate of $70,000 per yearpro-rated from January 1, 2019 until May 7, 2019 and compensated at the rate of $80,000 per yearpro-rated from May 7, 2019 through December 31, 2019. Mr. Gillis received an additional $25,000 per yearpro-rated from January 1, 2019 until May 7, 2019 and an additional $30,000 per yearpro-rated from May 7, 2019 through December 31, 2019 as Chair of the Audit Committee. Mr. Guertin received an additional $20,000 as Chair of the Compensation Committee. Ms. Matz received an additional $15,000 as Chair of the Nominating and Corporate Governance Committee. Mr. Vallee received an additional $55,000 per yearpro-rated from January 1, 2019 until May 7, 2019 and an additional $65,000 per yearpro-rated from May 7, 2019 through December 31, 2019 as Chair of the Board. Mr. Tufano elected to defer receipt of his cash fees for 2019 and have the fees invested into a DSU account. |

| (2) | The amounts reported in the “Stock Awards” column represent the grant date fair value of the annual 2019 RSU awards calculated in accordance with FASB ASC Topic 718, disregarding the effects of estimated forfeitures. For a discussion of the assumptions underlying this valuation, please see Note Q to the Consolidated Financial Statements included in the Company’s Annual Report on Form10-K for the fiscal year ended December 31, 2019. |

| (3) | As of December 31, 2019, each then-servingnon-employee director held 4,157 restricted stock units with an expected vesting date of May 7, 2020. As of December 31, 2019, Mr. Gillis held 16,379 DSUs, Mr. Guertin held 45,987 DSUs, Mr. Tufano held 31,966 DSUs, and Mr. Vallee held 42,638 DSUs. |

17

AUDIT AND FINANCIAL ACCOUNTING OVERSIGHT

In 2020, the Audit Committee reviewed Teradyne’s audited financial statements for the fiscal year ended December 31, 2019 and met with both management and PricewaterhouseCoopers LLP (“PwC”), Teradyne’s independent registered public accounting firm, to discuss those financial statements.

The Audit Committee also reviewed the report of management contained in Teradyne’s Annual Report on Form10-K for the fiscal year ended December 31, 2019 filed with the SEC, as well as PwC’s report included in Teradyne’s Annual Report on Form10-K related to its audit of (i) the consolidated financial statements and financial statement schedule and (ii) the effectiveness of internal control over financial reporting.

The Audit Committee has discussed with PwC the matters required to be discussed under the rules adopted by the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee has received the written disclosures and the letter from PwC required by the PCAOB regarding PwC’s communications with the Audit Committee concerning independence, and has discussed with PwC its independence.

Based on these reviews and discussions with management and PwC, the Audit Committee recommended to the Board (and the Board has approved) that Teradyne’s audited financial statements be included in its Annual Report on Form10-K for the fiscal year ended December 31, 2019.

AUDIT COMMITTEE

Edwin J. Gillis (Chair)

Mercedes Johnson

Paul J. Tufano

The information contained in the report above shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except to the extent that Teradyne specifically incorporates it by reference in any such filing.

Principal Accountant Fees and Services

Fees for Services Provided by PricewaterhouseCoopers LLP

The following table sets forth the aggregate fees for services provided by PwC, Teradyne’s independent registered public accounting firm, for the fiscal years ended December 31, 2019 and December 31, 2018.

| 2019 | 2018 | |||||||||

Audit Fees | $ | 3,260,225 | $ | 3,279,429 | ||||||

Audit-Related Fees | 203,000 | 406,772 | ||||||||

Tax Fees | 315,373 | 675,793 | ||||||||

All Other Fees | 3,123 | 4,402 | ||||||||

|

|

|

| |||||||

Total: | $ | 3,781,721 | $ | 4,366,396 | ||||||

Audit Fees

Audit Fees are fees related to professional services rendered for the audit of Teradyne’s annual financial statements and internal control over financial reporting for fiscal years 2019 and 2018. These fees include the review of Teradyne’s interim financial statements included in its quarterly reports on Form10-Q and services that are normally provided by PwC in connection with other statutory and regulatory filings or engagements.

18

Audit-Related Fees

Audit-Related Fees in 2019 were for professional services associated with acquisition due diligence. In 2018, services were associated with acquisition due diligence and the new lease accounting standard.

Tax Fees

Tax Fees in 2019 and 2018 were for professional services related to global tax planning and compliance matters.

All Other Fees

All Other Fees are fees for services other than audit fees, audit-related fees and tax fees. In 2019 and 2018, the fees were related to accounting seminars and financial statement disclosure and technical accounting software licenses.

Audit CommitteePre-Approval of Audit and PermissibleNon-Audit Services of Independent Registered Public Accounting Firm

During 2019 and 2018, the Audit Committeepre-approved all audit and other services performed by PwC.

The Audit Committee’s policy is topre-approve all audit and permissiblenon-audit services provided by the independent registered public accounting firm in order to ensure that the provision of such services does not impair the independent registered public accounting firm’s independence. These services may include audit services, audit-related services, tax services and other services. In addition to generallypre-approving, on acase-by-case basis, services provided by the independent registered public accounting firm, the Audit Committee adopted a policy for thepre-approval of certain specified services that may be provided by the independent registered public accounting firm. The services set forth on thepre-approved list have been identified in a sufficient level of detail so that management will not be called upon to make a judgment as to whether a proposed service fits within thepre-approved service list. Pursuant to the policy, management informs the Audit Committee, at least annually or more frequently upon its request, if the Company uses anypre-approved service and the fees incurred in connection with that service.

19

The following table sets forth as of March 12, 2020 information relating to the beneficial ownership of Teradyne’s common stock by each director, each named executive officer and all directors and executive officers as a group.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1)(2) | Percent of Class | ||||||||

Gregory R. Beecher | — | * | ||||||||

Michael A. Bradley (3) | 39,744 | * | ||||||||

Edwin J. Gillis | 79,954 | * | ||||||||

Charles J. Gray | 28,000 | * | ||||||||

Timothy E. Guertin | 65,396 | * | ||||||||

Mark E. Jagiela | 427,350 | * | ||||||||

Mercedes Johnson | 28,710 | * | ||||||||

Marilyn Matz | 13,499 | * | ||||||||

Sanjay Mehta | 16,877 | * | ||||||||

Bradford B. Robbins | 62,983 | * | ||||||||

Gregory S. Smith | 26,348 | * | ||||||||

Paul J. Tufano | 120,413 | * | ||||||||

Roy A. Vallee (4) | 126,344 | * | ||||||||

All executive officers and directors as a group (12 people consisting of 5 executive officers and 7non-employee directors) (5) | 1,035,618 | 0.62 | % | |||||||

| * | less than 1% |

| (1) | Unless otherwise indicated, the named person possesses sole voting and dispositive power with respect to the shares. The address for each named person is: c/o Teradyne, Inc., 600 Riverpark Drive, North Reading, Massachusetts 01864. |

| (2) | Includes shares of common stock which have not been issued but which either (i) are subject to options which either are presently exercisable or will become exercisable within 60 days of March 12, 2020, (ii) are subject to restricted stock units which vest within 60 days of March 12, 2020, or (iii) with respect to certainnon-employee directors, are issuable pursuant to the Teradyne Deferral Plan forNon-Employee Directors (the “Deferral Plan”) within 90 days of the date thenon-employee director ceases to serve as such, as follows: Mr. Beecher, 0 shares; Mr. Bradley, 4,157 shares; Mr. Gillis, 20,536 shares (including 16,379 shares issuable pursuant to the Deferral Plan); Mr. Gray, 0 shares; Mr. Guertin, 50,144 shares (including 45,987 shares issuable pursuant to the Deferral Plan); Mr. Jagiela, 58,992 shares; Ms. Johnson, 4,157 shares; Ms. Matz, 4,157 shares; Mr. Mehta, 16,694 shares; Mr. Robbins, 28,872 shares; Mr. Smith, 0 shares; Mr. Tufano, 36,123 (including 31,966 shares issuable pursuant to the Deferral Plan); Mr. Vallee, 46,795 shares (including 42,638 shares issuable pursuant to the Deferral Plan); all directors and executive officers as a group (except for Mr. Beecher who retired on July 17, 2019), 270,627 shares (including 136,970 shares issuable pursuant to the Deferral Plan). |

| (3) | Includes 35,587 shares of common stock over which Mr. Bradley shares voting and dispositive power with his wife. |

| (4) | Includes 79,549 shares of common stock held in a family trust for the benefit of Mr. Vallee and his wife. |

20

| (5) | The group is comprised of Teradyne’s executive officers and directors on March 12, 2020 and therefore does not include Mr. Beecher who retired on July 17, 2019. Includes (i) an aggregate of 87,864 shares of common stock which the directors and executive officers as a group have the right to acquire by exercise of stock options within 60 days of March 12, 2020 granted under the stock plans, (ii) an aggregate of 45,793 shares of common stock which the directors and executive officers as a group will acquire by the vesting of restricted stock units within 60 days of March 12, 2020, and (iii) an aggregate of 136,970 shares of common stock issuable tonon-employee directors pursuant to the Deferral Plan. |

The following table sets forth certain persons who, based upon Schedule 13G filings made since December 31, 2019, own beneficially more than five percent of Teradyne’s common stock.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class (3) | ||||||||

BlackRock, Inc. (1) | 18,247,350 | 10.9 | % | |||||||

55 East 52nd Street New York, New York 10055 | ||||||||||

The Vanguard Group, Inc. (2) | 16,860,575 | 10.06 | % | |||||||

100 Vanguard Blvd. Malvern, Pennsylvania 19355 | ||||||||||

| (1) | As set forth in Amendment No. 9 to a Schedule 13G, filed on February 4, 2020, BlackRock, Inc. had, as of December 31, 2019, sole dispositive power with respect to all of the shares and sole voting power with respect to 17,253,238 shares. |

| (2) | As set forth in Amendment No. 11 to a Schedule 13G, filed on February 12, 2020, The Vanguard Group, Inc. (“Vanguard”) had, as of December 31, 2019, sole dispositive power with respect to 16,708,281shares, shared dispositive power with respect to 152,294 shares, sole voting power with respect to 133,568 shares, and shared voting power with respect to 38,421 shares. Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of Vanguard, is the beneficial owner of 74,567 shares as a result of its serving as an investment manager of collective trust accounts. Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of Vanguard, is the beneficial owner of 136,728 shares as a result of its serving as investment manager of Australian investment offerings. |

| (3) | Ownership percentages were obtained from Schedule 13G filings and reflect the number of shares of common stock held as of December 31, 2019. |

21

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides information with respect to the following persons who, pursuant to SEC rules, constitute our “named executive officers” for 2019:

| • | Mark E. Jagiela, President and Chief Executive Officer; |

| • | Gregory R. Beecher, former Chief Financial Officer; |

| • | Sanjay Mehta, Vice President, Chief Financial Officer, and Treasurer; |

| • | Charles J. Gray, Vice President, General Counsel and Secretary; |

| • | Bradford B. Robbins, President, Wireless Test Division; and |

| • | Gregory S. Smith, President, Semiconductor Test Division. |

This Compensation Discussion and Analysis describes the material elements of Teradyne’s executive compensation program during the fiscal year ended December 31, 2019. It also provides an overview of the Company’s executive compensation philosophy, as well as the Company’s principal compensation policies and practices. Finally, it analyzes how and why the Compensation Committee of the Board of Directors (the “Compensation Committee”) arrived at the specific compensation decisions for the Company’s executive officers, including the named executive officers, in 2019, and discusses the key factors that the Compensation Committee considered in determining the compensation of the named executive officers.

2019 Executive Compensation Summary

Teradyne is a leading global supplier of automation equipment for test and industrial applications. The Company designs, develops, manufactures and sells automatic test systems used to test semiconductors, wireless products, data storage and complex electronics systems in the consumer electronics, wireless, automotive, industrial, computing, communications, aerospace and defense industries. Teradyne’s industrial automation products include collaborative robotic arms, autonomous mobile robots and advanced robotic control software used by global manufacturing and light industrial customers to improve quality, increase manufacturing and material handling efficiency and decrease manufacturing costs. The automatic test equipment and industrial automation markets are highly competitive and characterized by rapid changes in demand that necessitate adjusting operations and managing spending prudently across business cycles.

In 2019, the Company increased revenue by 9% to $2.3 billion, generated significant free cash flow and increased earnings per share for the sixth consecutive year. The Company grew sales in its semiconductor test, wireless test and system test businesses while achieving market share gains in its memory test business. The Company also grew its industrial automation business year over year, despite challenging global industrial automation conditions, supported by the acquisition of AutoGuide Mobile Robots (“AutoGuide”) in the fourth quarter of 2019. Beyond this strong financial performance, the Company introduced major new products in growing segments across its test and industrial automation businesses to expand its served markets and position itself for continued growth. During 2019, the Company continued to invest for long-term, future growth while maintaining financial discipline.

In 2019, the Company returned approximately $560 million to shareholders through its dividend and share repurchase programs. In January 2020, the Company announced a new $1 billion share repurchase authorization and plans to repurchase a minimum of $250 million of shares in 2020. The Company also announced an 11% increase to its quarterly dividend to $0.10 per share. The dividend and repurchase programs reflect the Company’s confidence in the business and ability to return capital to its shareholders while retaining sufficient financial flexibility to pursue growth opportunities through both internal investments and acquisitions such as AutoGuide.

22

The Company’s 2019 performance-based variable cash compensation was tied to its rate of profitability, atwo-year rolling revenue growth rate metric, and the achievement of strategic business objectives, including market share gains, revenue and bookings goals, profit and gross margin targets, strategic customerdesign-in wins and new product launches. Teradyne’s performance-based executive compensation program resulted in compensation for the Company’s named executive officers that reflects the Company’s challenging performance goals for 2019 and performance in achieving those goals. As a result of the Company’s rate of profitability, revenue growth and achievement of certain strategic goals in 2019, executive officers received variable cash compensation payouts ranging from 124% to 137% of target.

The Compensation Committee believes that the executive compensation for 2019 is reasonable and appropriate and is justified by the performance of the Company and its achievement of its financial and strategic goals.

The variance in compensation of the named executive officers year over year demonstrates the alignment between pay and performance. For example, the variable cash compensation for the named executive officers from 2010 to 2019 has varied from 79% to 200% of target based on the strength of Company performance in the applicable year and contrasts to compensation received from 2007 to 2009 where executive officers received variable cash compensation well below target in a range from 39% to 74% of target based on Company performance as compared to objectives.

| • | From 2007 to 2009, the executive officers received payouts well below their target variable cash compensation (74%, 45% and 39% of target in 2007, 2008 and 2009, respectively) due to the severe industry downturn. Further, in 2009, the executive officers received base salary cuts as high as 20%, which were only restored late in the year when business improved. |

| • | In 2010 and 2011, due to the Company’s record profitability and achievement of strategic business goals, the executive officers received at or close to the maximum 200% of their target variable cash compensation payout. |

| • | From 2012 to 2014, despite challenging market conditions, the Company maintained its profit rate before interest and taxes (“PBIT”)1 and continued to make investments in long-term growth. As a result, the variable cash compensation payout for the executive officers decreased to 153% of target in 2012, 142% in 2013, and 142% in 2014 reflecting strong results, but not as strong as in 2010 or 2011. |

| • | In 2015, the Company increased its PBIT rate to the highest level in three years, generated revenues of over $1.6 billion in a down-cycle year for the semiconductor test market and increased market share in itssystem-on-a-chip, memory and wireless test businesses, while continuing to make investments in long-term growth. As a result, the variable cash compensation payouts for the executive officers increased with a range between 154% and 195% of target. |

| • | In 2016, after multiple years of achieving PBIT goals at sustained revenue levels, the Company established even more challenging performance goals and added atwo-year rolling revenue growth rate metric as an element of the variable cash compensation plan to reinforce the importance of achieving short- and long-term revenue growth as well as achieving its profitability goals. In 2016, the Company grew revenue by 7%, to $1.75 billion, while generating significant free cash flow, maintaining its rate of profitability and achieving market share and other strategic goals. Due to the more challenging performance metrics for 2016, the executive officers received lower variable cash compensation payouts than they received for comparable Company performance in prior years with a range between 79% and 116% of target. |

| 1 | PBIT is anon-GAAP financial measure equal to GAAP income from operations less the following: restructuring and other, net; amortization of acquired intangible assets; acquisition and divestiture related charges or credits; pension actuarial gains and losses;non-cash convertible debt interest expense; and othernon-recurring gains and charges. |

23