COMPANY COLORS

Blue:

R = 0

G = 0

B = 255

Beige:

R = 251

G = 248

B = 216

LONGBOW RESEARCH

CONSTRUCTION MATERIALS CONFERENCE

FEBRUARY 21, 2008

DRAFT

FORWARD-LOOKING STATEMENT

Certain statements contained in this presentation are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to

risks, uncertainties and other factors, which could cause actual results to differ materially from

future results expressed or implied by such forward-looking statements. Potential risks and

uncertainties include, but are not limited to, the impact of competitive pressures and changing

economic and financial conditions on the Company’s business, construction activity in the

Company’s markets, abnormal periods of inclement weather, changes in the cost of raw

materials, fuel and energy, unscheduled plant shutdowns and the impact of environmental laws

and other regulations.

1

TXI – A BUILDING MATERIALS COMPANY

Cement, Aggregate and Concrete

Used in all types of construction

Cement accounts for approximately 75% of Earnings

2

TXI – CEMENT PLANT

3

TXI - QUARRY

4

TXI -KILN

5

TXI - READYMIX CONCRETE

6

PRIMARY EARNINGS DRIVERS

Significant Margin Expansion

Cement Capacity Expansion

From 5 million tons per year to 7.9 million tons per year

in 3 – 4 years

Three Projects

7

TXI – IN SUMMARY

The U.S. cement industry is favorably structured

Flexible capital structure provides foundation for growth

Texas and California are attractive cement markets

TXI is the largest cement supplier in Texas – and a low cost producer

TXI’s California cement plant project is underway

Texas cement expansion projects will enhance competitive position

TXI earnings power example

8

CEMENT INDUSTRY - DEMAND DRIVERS

Source: Portland Cement Association

Cement Demand Drivers

Public Works

Construction

50%

Residential

Construction

25%

Non-

Residential

Construction

25%

9

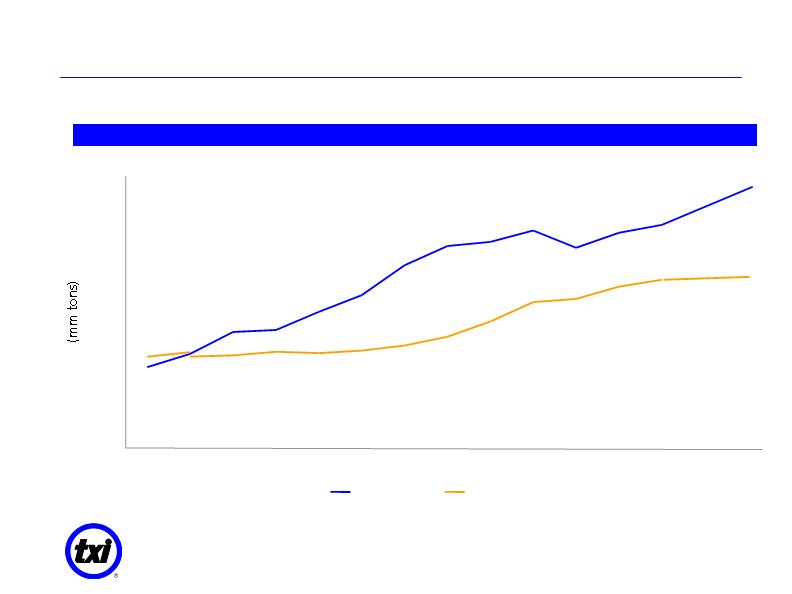

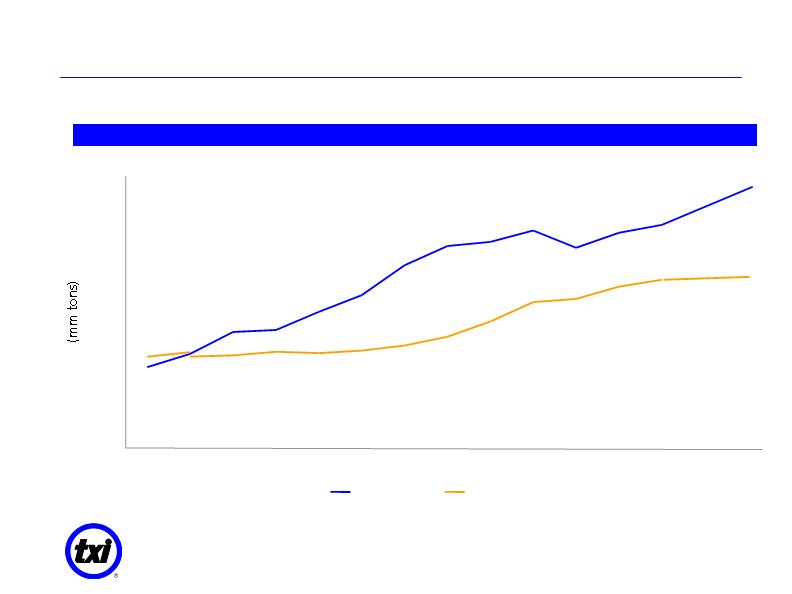

FAVORABLE U.S. INDUSTRY STRUCTURE

U.S. Cement Consumption and Capacity

Source: Portland Cement Association, U.S. Geological Survey, Company Reports

U.S. Cement Consumption Exceeds Domestic Capacity

60

70

80

90

100

110

120

130

140

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005 2006

Consumption

Capacity

10

FAVORABLE INDUSTRY STRUCTURE (continued)

U.S. cement capacity and import terminals are largely owned or controlled by

international producers

High barriers to entry exist for new cement capacity

The Supply of Cement Should Continue To Be Constrained

Cement Consumption Should Continue to Exceed Cement Capacity

11

STRONG POSITIONS IN ATTRACTIVE MARKETS

Texas and California:

Are the two largest U.S. cement markets,

accounting for over 23% of U.S. cement demand

Will continue to receive the largest shares of

Federal transportation funding

Have very favorable population growth trends

TXI is the:

Largest producer of cement in Texas with 30% of

state’s total capacity

Fourth largest cement producer in California with

10% market share

Second largest supplier of aggregates and a leading

supplier of ready-mix concrete in Texas

Largest supplier of expanded shale and clay

aggregates west of the Mississippi River

A leading supplier of sand, gravel and ready-mix

concrete in Louisiana

Cement

Aggregates

CA

TX

LA

12

LOW COST OPERATIONS ARE KEY

13

High Productivity and Efficiency

North

Texas

1

PCA

Comps

2

Labor Productivity

Tons per man hour

6.2

3.6

Energy Efficiency

Mmbtu/ton

3.

4

3.3

kwh/ton

1

11

136

Notes:

1

North Texas numbers are for the t

welve months ended May 31, 2007

2

U.S. and Canadian Labor

–

Ener

gy Input Survey for 2006, Portland Cement

Association

CALIFORNIA PLANT MODERNIZATION AND EXPANSION

Will make TXI the second largest cement producer in the Southern California market

Will make TXI a low cost supplier

Adds 2.3 million tons of state-of-the-art cement capacity

Replaces 1.3 million tons of 50 year-old production capacity

Investment of approximately $400 million

Required permits and permissions are in place

Project is similar to the successful North Texas expansion completed in 2001

Identical kiln production of 6,000 tons per day

Transferable experience in design, construction and commissioning (North Texas plant fully

commissioned within 6 months of start-up)

Significant pre-selling of new capacity already underway

Currently in commissioning phase

14

CENTRAL TEXAS CEMENT PLANT EXPANSION

Enhances TXI’s market-leading position in Texas

Adds 1.4 million tons of state-of-the-art cement capacity

Existing .9 million ton cement facility will remain in operation

Investment of $325 – 350 million

Required permits and permissions are in place

Scheduled to begin operation the winter of fiscal year 2010

15

CEMENT PLANT EXPANSION PROJECTS

* Millions of tons per year

7.9

5.0

TOTAL TXI CAPACITY

3.3

2.8

North Texas Plant Incremental Expansion

2.3

0.9

Central Texas Plant Expansion

2.3

1.3

California Plant Modernization and Expansion

FUTURE

CURRENT

CAPACITY*

16

T X I E A R N I N G S P O T E N T I A L

17

TXI EARNINGS POTENTIAL (continued)

Notes:

1 The October 2006 gain from the cement anti-dumping settlement has been removed.

2 For illustrative purposes only; actual change in margins will depend on the mix of price increases, input costs and efficiency improvements.

3 Under current market conditions and expected operating improvements for the new California facility.

4 Under current market conditions and expected operating improvements for the new Central Texas facility.

280

230

170

145

EBIT

85

70

55

46

D&A

365

300

225

191

EBITDA

Column (3)

Column (2)

Are Attained

FY 2007

($mm)

Project to

Project to

Margin Goals

(1)

Central Texas

California

Assuming

Add

Add

(2)

(4)

(3)

18

PRIMARY EARNINGS DRIVERS

Significant Margin Expansion

Cement Capacity Expansion

From 5 million tons per year to 7.9 million tons per year

in 3 – 4 years

Three Projects

19

20