UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

| ¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| x | | Definitive Proxy Statement | | |

| ¨ | | Definitive Additional Materials | | |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

Texas Industries, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange ActRule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

TEXAS INDUSTRIES, INC.

1341 W. MOCKINGBIRD LANE - DALLAS, TEXAS 75247- (972) 647-6700

August 23, 2013

Dear Shareholder:

You are cordially invited to attend our annual meeting of shareholders, to be held at 9:30 a.m. Central Daylight Time, on Wednesday, October 16, 2013, at The Omni Dallas Hotel at Park West, 1590 LBJ Freeway, Dallas, Texas 75234.

At this year’s annual meeting, you will be asked to elect ten directors for one-year terms and to vote on the other matters described in the accompanying notice of our annual meeting and proxy statement. Our 2013 annual report is available with the proxy statement.

It is important that your shares be represented at the annual meeting regardless of the size of your holdings. If you are unable to attend in person, we urge you to participate by voting your shares by proxy on the internet, by telephone or by filling out and returning the proxy card that we will send you on request. Your vote is extremely important.

We hope you can attend the meeting in person. If you arrive early, you are invited to have coffee and visit informally with the directors.

Sincerely,

Mel G. Brekhus

President and Chief Executive Officer

TEXAS INDUSTRIES, INC.

1341 W. MOCKINGBIRD LANE - DALLAS, TEXAS 75247- (972) 647-6700

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On October 16, 2013

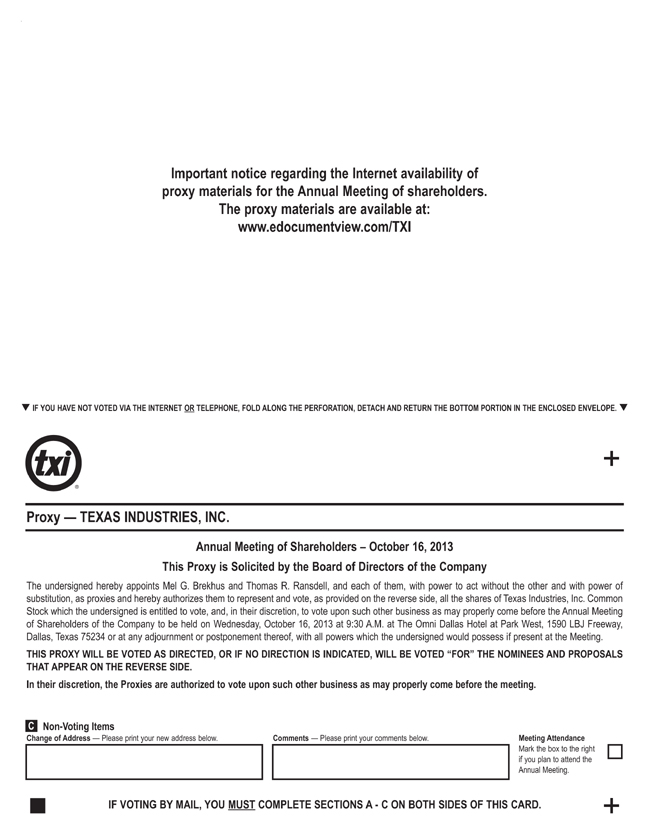

The annual meeting of shareholders of Texas Industries, Inc. will be held at The Omni Dallas Hotel at Park West, 1590 LBJ Freeway, Dallas, Texas 75234, on Wednesday, October 16, 2013, at 9:30 a.m. (CDT). At the meeting, you will be asked to:

| | 1. | Elect ten directors for one-year terms; |

| | 2. | Ratify the selection of Ernst & Young LLP as our independent auditors; |

| | 3. | Approve, in a non-binding advisory vote, our executive compensation; |

| | 4. | Approve the Texas Industries, Inc. Master Performance-Based Incentive Plan to enable certain compensation paid under the Plan to continue to qualify as deductible performance-based compensation under Section 162(m) of the Internal Revenue Code; and |

| | 5. | Vote on any other business properly brought before the meeting. |

Only shareholders of record at the close of business on August 19, 2013, will be entitled to vote at the annual meeting. A list of such shareholders will be open for examination by any shareholder during ordinary business hours for a period of ten days prior to the annual meeting at our executive offices at 1341 W. Mockingbird Lane, Dallas, Texas 75247-6913.

While we encourage you to attend the annual meeting, please vote your shares as soon as possible to ensure that your vote is recorded promptly. Your vote is important.

|

| By Order of the Board of Directors, |

|

|

Frederick G. Anderson Secretary |

Dallas, Texas

August 23, 2013

TEXAS INDUSTRIES, INC.

1341 W. MOCKINGBIRD LANE • DALLAS, TEXAS 75247 • (972) 647-6700

PROXY STATEMENT

TABLE OF CONTENTS

PROXY STATEMENT

INFORMATION ABOUT SOLICITATION AND VOTING

In this Proxy Statement, the terms “we”, “our”, “us” and “Company” mean Texas Industries, Inc., a Delaware corporation. The term “annual meeting” means our annual meeting of shareholders to be held on October 16, 2013.

Solicitation

Pursuant to the rules of the Securities and Exchange Commission, or SEC, we have made this Proxy Statement and related proxy materials available to you on the internet in connection with the solicitation by our Board of Directors of proxies for exercise at our annual meeting. At your request we will deliver printed copies to you by mail. Our proxy materials include this Proxy Statement and our 2013 Annual Report to Shareholders, which includes our audited consolidated financial statements. If you request printed copies of these materials by mail, they will also include a proxy card for the annual meeting.

We are sending an Important Notice Regarding the Availability of Proxy Materials to our record and beneficial shareholders. The mailing of this Notice of Availability of Proxy Materials to our shareholders is scheduled to begin on or about August 23, 2013. The Notice of Availability of Proxy Materials provides instructions on how to access the proxy materials over the internet or to request a paper copy. In addition, shareholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis.

We will pay the cost of solicitation of proxies by our Board of Directors. We may solicit proxies from shareholders in person or by telephone, telecopy, mail or email. We request that banks, brokers and other custodians, nominees and fiduciaries send the Notice of Availability of Proxy Materials and any proxy material to the beneficial owners and secure their voting instructions. We will reimburse them for their reasonable expenses in so doing.

The mailing address of our principal executive office is 1341 W. Mockingbird Lane, Suite 700W, Dallas, TX 75247.

Board Recommendation

We believe that the current Board, with its breadth of relevant and diverse experience, represents the best interests of our shareholders. Furthermore, both our Governance Committee and the Board believe the ten directors nominated by the Board will be productive members of the Board who will make meaningful contributions and should be re-elected. The Board unanimously recommends a voteFOReach of the nominees for director listed below and on the proxy card.

The Board also recommends that you voteFOR the ratification of the selection of Ernst & Young LLP as our independent auditors for the fiscal year 2014 audit.

The Board believes the policies and practices described in the Compensation Discussion and Analysis are effective in motivating management to achieve annual and long-term financial goals of the Company by fostering a pay-for-performance culture, in aligning the executives’ long-term interests with those of our shareholders, and in attracting and retaining executives for long and productive careers. The Board recommends that you voteFOR the non-binding resolution approving the compensation of our named executive officers (the say-on-pay vote).

The Board believes that the Texas Industries, Inc. Master Performance-Based Incentive Plan is one of our most important tools in promoting a culture of pay for performance. Our annual and long-term cash incentive plans, under which cash incentive payments are made only when we achieve defined financial or operating

1

objectives that are important to the financial performance of the Company, are adopted pursuant to the Master Plan. We are requesting shareholder approval of the Master Plan so that these cash incentive payments will qualify as performance based compensation under section 162(m) of the Internal Revenue Code, and will thus be fully deductible by us for federal income tax purposes. The Board recommends that you voteFOR the approval of the plan.

Shares Outstanding and Quorum

We had 28,600,731 shares of common stock outstanding on August 19, 2013, our record date. Each share is entitled to one vote. The presence at the annual meeting, in person or by proxy, of the holders of a majority of our issued and outstanding common stock is necessary to constitute a quorum to transact business. Proxies marked as abstentions and broker non-votes will be included in the number of shares considered to be present at the meeting for purposes of determining a quorum.

Voting Procedures

If you are a shareholder whose shares are registered in your name (i.e., a shareholder of record), you may vote in person at the meeting. We will give you a ballot when you arrive. If you do not wish to vote in person or will not be attending the meeting, we encourage you to vote by proxy. You can vote by proxy in one of the following ways:

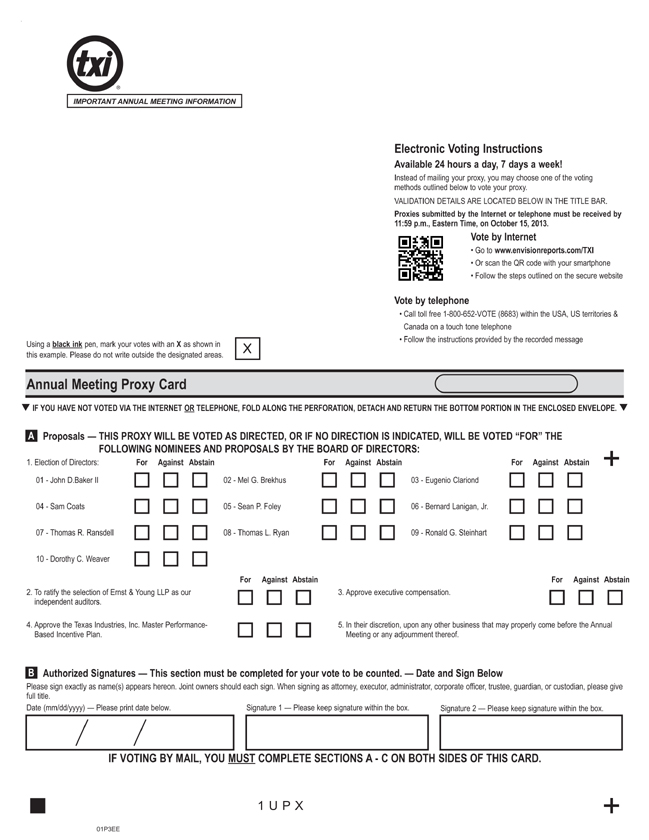

| | • | | Vote by Internet. You can vote via the internet by following the instructions on your Texas Industries, Inc. Notice of Availability of Proxy Materials. The website address for internet voting is indicated on the Notice. The deadline for internet voting is 11:59 p.m., EDT on October 15, 2013. Until that time, internet voting is available 24 hours a day. If you have internet access, we encourage you to vote by internet. It is convenient and saves significant postage and processing costs. |

| | • | | Vote by Telephone. You can vote your shares by telephone by calling the toll-free number indicated on your proxy card. Easy-to-follow voice prompts enable you to vote your shares and confirm that your instructions have been properly recorded. The deadline for telephone voting is 11:59 p.m. EDT on October 15, 2013. Until that time, telephone voting is available 24 hours a day. |

| | • | | Vote by Mail. If you choose to vote by mail, complete, sign, date and return your proxy card in the postage-paid envelope provided. If you have not received a proxy card, follow the instructions on your Texas Industries, Inc. Notice of Availability of Proxy Materials for requesting a paper copy of the proxy materials, including the proxy card and postage-paid envelope. Please promptly mail your proxy card to ensure that it is received prior to the annual meeting. |

If you hold your shares in “street name,” whether through a bank, broker or other firm, we encourage you to provide voting instructions to the firm that holds your shares. You may do so by carefully following the instructions provided in the Notice of Availability of Proxy Materials or the proxy card that you receive from that firm. If you wish to instead vote in person at the meeting, you must obtain a valid proxy from the firm.

If you hold shares in multiple registrations, or in both registered and street name, you will receive a proxy card or a Notice of Availability of Proxy Materials for each account. Please sign and date all proxy cards you receive. If you choose to vote by telephone or internet, please vote once for each proxy card or Notice of Availability of Proxy Materials you receive. Only the latest dated proxy foreach account will be voted.

If you complete and submit your proxy by internet or telephone or on your proxy card, the persons named as proxy holders will vote the shares represented by your proxy in accordance with your instructions. If you do not provide instructions when you complete your proxy, the proxy holders will vote in accordance with the recommendations of the Board of Directors. The Board’s full recommendation is set forth in the description of each proposal in this proxy statement. With respect to any other matter that properly comes before the meeting, the proxy holders will vote in their discretion in accordance with their best judgment.

2

Vote Required for Election or Approval

Election of Directors. Directors will be elected by a majority of the votes cast. Votes cast will include votes for and votes against and exclude abstentions and broker non-votes. As a result, abstentions and broker non-votes will have no effect on the election of directors.

Other Matters. Approval of the ratification of the selection of Ernst & Young LLP as our independent auditors, the advisory vote on executive compensation, and approval of the Texas Industries, Inc. Master Performance-Based Incentive Plan require the affirmative vote of a majority of the shares present or represented by proxy at the annual meeting and entitled to vote. Abstentions will be included in the vote totals and will have the same effect as a negative vote, but broker non-votes will not be included in the vote totals and will have no effect on the vote.

Broker Non-Votes. If you hold your shares in “street name” but do not provide the firm that holds your shares with specific voting instructions, it may vote your shares on routine matters but cannot vote on non-routine matters. At the annual meeting, the vote on the ratification of the selection of Ernst & Young LLP as our independent auditors is considered a routine matter. All other matters are considered non-routine. Thus, you must give specific instructions for your shares to be voted on the election of directors, the advisory vote on executive compensation, and the approval of the Texas Industries, Inc. Master Performance-Based Incentive Plan. When a broker votes a client’s shares on some but not all proposals, the missing votes are referred to as “broker non-votes.” Those shares will be included in determining the presence of a quorum at the meeting but will not be considered “present” for purposes of voting on a non-routine proposal and will not be counted in determining the number of shares necessary for approval.

Changing Your Vote or Revoking Your Proxy

If you are a shareholder of record, you may change or revoke your proxy at any time prior to the close of the polls by submitting a later-dated vote in person at the meeting, or a later-dated proxy by the internet, telephone or mail. Please see “Voting Procedures,” above. You may also revoke your proxy by delivering written notice of revocation to our Corporate Secretary prior to the meeting by mail addressed to Corporate Secretary, Texas Industries, Inc., 1341 W. Mockingbird Lane, Suite 700W, Dallas, TX 75247.

If you hold shares in street name, you must contact the firm that holds your shares to change or revoke any prior voting instructions.

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table furnishes information concerning all persons known to us to beneficially own more than 5% of our common stock.

| | | | | | | | |

Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial Ownership | | | Percent

of Class | |

Southeastern Asset Management, Inc.(1) | | | 8,073,457 | | | | 27.8 | |

6410 Poplar Avenue, Suite 900 Memphis, TN 38119 | | | | | | | | |

| | |

NNS Holding(2) | | | 6,575,056 | | | | 22.7 | |

89 Nexus Way Camana Bay, Grand Cayman Cayman Islands | | | | | | | | |

| | |

Eagle Asset Management, Inc.(3) | | | 1,739,292 | | | | 6.0 | |

4880 Carillon Parkway St. Petersburg, Florida 33716 | | | | | | | | |

| | |

BlackRock, Inc.(4) | | | 1,643,806 | | | | 5.7 | |

400 Howard St. San Francisco, CA 94105 | | | | | | | | |

| (1) | Based on Schedule 13D/A filed on August 5, 2013. Southeastern Asset Management, Inc., or Southeastern, does not have authority to vote 63,500 of the shares reported. Southeastern is the investment advisor for Longleaf Partners Small-Cap Fund, the holder of 7, 510,757 of the shares reported, for which Southeastern shares voting and dispositive authority. |

| (2) | Based on Schedule 13D/A filed on April 12, 2012. Mr. Nassef Sawiris, Mr. Philip Le Cornu and Mr. Philip Norman are directors of NNS Holding with shared power to vote and dispose of the shares held by NNS Holding. |

| (3) | Based on Schedule 13G filed on January 23, 2013. |

| (4) | Based on Schedule 13G/A filed on February 11, 2013. |

4

The following table sets forth as of May 31, 2013, the approximate number of shares of our common stock beneficially owned by each director, nominee for director, and executive officer named in the Summary Compensation Table, and by all of our directors and executive officers as a group.

| | | | | | | | |

Name of Beneficial Owner | | Company Common Stock | |

| | | Beneficially Owned(1) | | | Percent | |

John D. Baker II | | | 39,250 | (3) | | | * | |

Mel G. Brekhus | | | 335,184 | (2) | | | 1.2 | |

Eugenio Clariond | | | 56,609 | (4) | | | * | |

Sam Coats | | | 8,600 | | | | * | |

Sean P. Foley | | | 2,500 | (5) | | | * | |

Bernard Lanigan, Jr. | | | 50,600 | (6) | | | * | |

Thomas R. Ransdell | | | 10,504 | | | | * | |

Robert D. Rogers | | | 202,860 | (2) | | | * | |

Thomas L. Ryan | | | 5,000 | | | | * | |

Ronald G. Steinhart | | | 8,615 | | | | * | |

Dorothy C. Weaver | | | 3,000 | | | | * | |

Kenneth R. Allen | | | 103,870 | (2)(7) | | | * | |

Frederick G. Anderson | | | 81,341 | (2) | | | * | |

James B. Rogers | | | 71,756 | (2) | | | * | |

Stephen D. Mayfield | | | 67,273 | (2) | | | * | |

All directors and executive officers as a group (18 persons) | | | 1,133,311 | (2) | | | 3.9 | |

| * | Represents less than one percent (1%) of the total number of shares outstanding. |

| (1) | Unless indicated in a note below, each person has the sole voting and investment authority with respect to the shares set forth in the table. |

| (2) | This table includes shares of common stock subject to options that are presently exercisable or that became exercisable within 60 days of May 31, 2013, as follows: Mel G. Brekhus—142,330 shares; Robert D. Rogers—6,666 shares; Kenneth R. Allen—50,799 shares; Frederick G. Anderson—80,863 shares; James B. Rogers—51,067 shares; Stephen D. Mayfield—39,000 shares; and all directors and executive officers as a group—451,677 shares. |

| (3) | Includes 36,250 shares owned by a family trust. |

| (4) | Includes 53,609 shares owned by a family trust. |

| (5) | Includes 1,500 shares owned by a family trust. |

| (6) | Includes 48,600 shares owned by a limited liability company over which Mr. Lanigan has voting and investment power. |

| (7) | Includes 281 shares owned jointly with Mr. Allen’s spouse. |

5

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

The Board of Directors currently consists of ten members. The Governance Committee unanimously recommended to the Board, and the Board unanimously nominated for election the ten persons listed below, all of whom are current directors. Upon election at the annual meeting, all directors will serve a one-year term of office expiring at the 2014 annual meeting of shareholders or when their respective successors have been elected and qualified. Each nominee has consented to being named in this proxy statement and to serving as a director if elected.

Unless otherwise indicated, all proxies will be voted for the election of the Board’s nominees. If any of the Board’s nominees are not available for election as a result of unforeseen circumstances, it is the intention of the proxy holders to vote for the election of such substitute nominee, if any, as the Board of Directors may propose.

Director Qualifications

The Board believes that there are general qualifications for service on the Board that are applicable to all directors. Directors should have demonstrated a keen sense of ethics, strength of character, an inquiring and independent mind, exceptional ability, mature judgment and practical wisdom. They should be committed to serving on the Board for an extended period of time, have an interest in learning about all aspects of the Company, and be willing to devote time and energy to the Company beyond just attending Board meetings. The Board looks for individuals who will be effective, in conjunction with other directors, in collectively serving the long-term interests of our shareholders and who will complement the existing Board in experience, gender or nationality.

The Board believes that there are other individual attributes that should be represented on the Board by one or more directors but not necessarily by all directors. These include leadership experience in large, complex and diverse organizations, experience in the cement, aggregates and concrete industry, a strong background in financial or accounting matters, experience in strategic planning, experience in personnel management and business skills in other areas of direct value to the Company. In the biographies of our directors below, we identify the attributes of each director that the Board considers important to be represented on the Board.

Nominees for Director

The following are nominees for election as directors:

John D. Baker, II, age 65, has been a director since 2010. He has been Executive Chairman of Patriot Transportation Holding, Inc. (a motor carrier of liquid and dry bulk commodities and a real estate management and investment company) since October 2010 and Chairman of Panadero Aggregates, Inc. (a producer of aggregates) since August 2010. He was Chief Executive Officer and President of Patriot from February 2008 until October 2010. He was President and Chief Executive Officer of Florida Rock Industries, Inc. (an aggregates, ready-mix concrete and cement company) from 1996 until November 2007. He is currently a director of Patriot Transportation Holding, Inc. and Wells Fargo & Company. During the last five years, Mr. Baker has also been a director of Duke Energy, Inc., Progress Energy, Inc., Vulcan Materials Company, Hughes Supply, Inc., Wachovia Corp. and Florida Rock Industries, Inc. His professional affiliations include the Florida Concrete and Products Association, where he was a former Chairman.

As a result of the positions and experience described above, Mr. Baker has leadership experience with large, complex and diverse organizations, a long history of experience in the cement, aggregates and concrete industry, and experience in strategic planning. His years of service on other public company boards provide him with additional perspectives from which to view the Company’s operations and the Board’s activities.

6

Mel G. Brekhus, age 64, has been a director since 2004. He has been President and Chief Executive Officer of the Company since June 1, 2004. He has been with the Company for over 23 years, rising through various management positions in the cement, aggregate and concrete business until attaining his current position. Mr. Brekhus has over 40 years of experience in engineering, operating and management roles in the cement industry. He held positions as technical services engineer, cement plant chemist, cement plant process engineer and cement plant manager at plants in four different states before joining the management team of the Company. His professional affiliations include the Portland Cement Association, where he is Past Chairman and presently a Director.

As a result of the positions and experience described above, Mr. Brekhus has leadership experience with our Company and with other large, complex and diverse organizations, a long history of experience in the cement, aggregates and concrete industry, and experience in strategic planning.

Eugenio Clariond, age 69, has been a director since 2009. He also served as a director from 1998 until 2005. He has been Chairman of Camiones Sierra Norte (a Navistar International truck and bus dealer in Mexico) since 2011 and Chairman of Grupo Cuprum (aluminum products), Monterrey, Mexico, since November 2010. He was Chairman of Verzatec, S.A. (aluminum and plastic construction products), Monterrey, Mexico, from 2004 until November 2010. He was Chairman of the Board and Chief Executive Officer of Grupo IMSA, S.A. (steel processor, auto parts, aluminum and plastic construction products), Monterrey, Mexico, from 1981 until his retirement in December 2006. He is currently a director of Johnson Controls, Inc., and Mexichem, S.A. During the last five years, Mr. Clariond has also been a director of Navistar (International) Corp., Grupo Financiero Banorte S.A. and The Mexico Fund Inc. Mr. Clariond has been Chairman of the Mexican Fund for Nature Conservancy, and a founding member and past Vice-Chairman of the World Business Council for Sustainable Development. He is Chairman of the United States-Mexico Business Committee of the Mexican Business Council for Foreign Trade. He is also a director of Monterrey Tech and the Center of Studies from the Private Sector for Sustainable Development. He is on the Advisory Board of the McCombs School of Business at the University of Texas at Austin, the Harte Research Institute for Gulf of Mexico Studies and the Jacobs School of Engineering of the University of California at San Diego.

As a result of the positions and experience described above, Mr. Clariond has leadership experience with large, complex and diverse organizations and in strategic planning. His years of service on other public company boards provide him with additional perspectives from which to view the Company’s operations and the Board’s activities.

Sam Coats, age 72, has been a director since 2005. He has been a business and aviation consultant since March 2006. Mr. Coats was President and Chief Executive Officer of Schlotzsky’s, Inc. (fast casual dining restaurants) and S.I. Restructuring, Inc. from June 2004 until March 2006. Schlotzsky’s, Inc. recruited Mr. Coats to help restructure the company and, as a part thereof, it filed under chapter 11 of the Bankruptcy Code in August 2004, from which it has emerged as a successful, growing company. During his career, Mr. Coats has been President and Chief Executive Officer of several companies, including Sammons Travel Group (package tour operator), PROS Revenue Management, Inc. (the world’s leading provider of airline revenue management software systems), and Trinity Texas Corporation (real estate development, quick lubrication centers, oil and gas). Mr. Coats has also served as President of Muse Air Corporation until its acquisition by Southwest Airlines Company, and he has held senior management positions with Southwest Airlines Company, Continental Airlines, Inc., Braniff Airways, Inc. and Texas International Airlines, Inc. He has also practiced law with a major Dallas law firm and served as a member of the Texas legislature. Mr. Coats is active in civic affairs and serves on the boards of a number of non-profit organizations, including the Dallas/Fort Worth International Airport, the Valley International Airport in Harlingen, Texas, the Development Board of the University of Texas at Brownsville, and Central Dallas Community Development Corporation (dedicated to providing affordable housing to low-income clients and permanent housing to the homeless).

As a result of the positions and experience described above, Mr. Coats has leadership experience with several large, complex and diverse organizations, experience in strategic planning and governmental and political matters. His years of service on the boards of other public companies provide him with additional perspectives from which to view the Company’s operations and the Board’s activities.

7

Sean P. Foley, age 55, has been a director since July 2012. He was Senior Vice President – Investment Management of AT&T, Inc. (a leading provider of telecommunications services in the United States and globally) from October 2006 until his retirement in January 2012. He was Vice President & Treasurer of Cingular Wireless (a leading provider of wireless telecommunications services) from 2000 until it was acquired by AT&T in 2005. He was Vice President and Treasurer of U S West, Inc. (a regional provider of telecommunications services in the United States) from 1995 until 2000. Mr. Foley is a former member of the Board of Trustees of Presbyterian College in South Carolina and currently serves on that institution’s investment committee.

As a result of the positions and experience described above, Mr. Foley has leadership experience with large, complex and diverse organizations, a strong background in financial matters and experience in strategic planning.

Bernard Lanigan, Jr., age 65, has been a director since July 2012. He founded and has served as Chairman and Chief Executive Officer of Southeast Asset Advisors, Inc. (a registered investment advisor and wealth management company) since 1991. He also founded and has served as Chairman and Chief Executive Officer of Lanigan & Associates, P.C. (a certified public accounting and consulting firm) since 1974. He also directs and oversees Conifer Advisors, LLC, Conifer Partners I, LLC and Conifer Partners II, LLC (private equity, real estate and special situations investments). Mr. Lanigan is a certified public accountant. He is currently a director of Ruby Tuesday, Inc.

As a result of the positions and experience described above, Mr. Lanigan has leadership experience with large, complex and diverse organizations, a strong background in financial and accounting matters and experience in strategic planning and risk assessment. His years of service on other public company boards provide him with additional perspectives from which to view the Company’s operations and the Board’s activities.

Thomas R. Ransdell, age 71, has been a director since 2005. He has been Chairman of the Board of the Company since June 2013. He has managed private investments since July 2004. He has over 37 years of experience in engineering, operating and management roles in the aggregates industry. He served in various management positions with Vulcan Materials Company (largest domestic producer of aggregates) for over 26 years until his retirement in 2004, rising from the position of Vice President/Texas to President of the Southwest Division. During his tenure with Vulcan, he also served as President and Chief Executive Officer of two international joint venture companies, Calizas Industriales del Carmen and Vulica Shipping Company, which marketed high quality limestone products and provided deep water shipping services. He also spent eleven years in various engineering and management positions in the aggregate operations of Texas Industries, Inc. from 1967 through 1978. His professional affiliations include serving as past Chairman of the National Slag Association and the Texas Aggregate and Concrete Association. He is currently a director of the Cancer Therapy and Research Center Foundation.

As a result of the positions and experience described above, Mr. Ransdell has leadership experience with our Company and another large, complex and diverse organization, a long history of experience in the aggregates industry, and experience in strategic planning.

Thomas L. Ryan, age 48, has been a director since July 2012. He has been Chief Executive Officer of Service Corporation International (largest provider of deathcare products and services in North America) since February 2005 and has served as President of SCI since July 2002. From July 2002 until February 2005 Mr. Ryan was Chief Operating Officer of SCI, and from November 2000 until July 2002 he was Chief Executive Officer of European operations. From the time he joined SCI in 1996 until November 2000, Mr. Ryan served in a variety of financial management roles. Before joining SCI, Mr. Ryan was a certified public accountant with Coopers & Lybrand LLP for eight years. Mr. Ryan is a current director of Chesapeake Energy Corporation and a member of the Board of Trust Managers of Weingarten Realty Investors. He serves as Chairman of the Board of Trustees of the United Way of Greater Houston, and he also serves on the Board of Directors of the Greater Houston Partnership and the GHCF Community Foundation Council. Mr. Ryan also serves on the University of Texas McCombs School of Business Advisory Council.

8

As a result of the positions and experience described above, Mr. Ryan has leadership experience with large, complex and diverse organizations, a strong background in financial and accounting matters and experience in strategic planning and risk assessment. His service on another public company board provides him with additional perspectives from which to view the Company’s operations and the Board’s activities.

Ronald G. Steinhart, age 73, has been a director since 2007. He retired in 2000 as Chairman and Chief Executive Officer of the Commercial Banking Group of Bank One Corporation (commercial banking), a position he had held since 1996. He has over 37 years of experience in the financial services industry. He led a group of investors that established Team Bank (commercial banking) in 1988 and served as its Chairman and Chief Executive Officer until it merged with Bank One Texas in 1992. He was President and Chief Operating Officer of Bank One Texas through 1996. He is also a former President and Chief Operating Officer of InterFirst Corporation (commercial bank holding company), prior to which he teamed with investors to charter or purchase six other banks. He is a current director of Southcross Energy Partners, LLC, Penske Automotive Group, Inc. and Susser Holdings Corporation. During the last five years, Mr. Steinhart has been a director of Animal Health International, Inc. and a trustee of the MFS/Compass Group of mutual funds. Mr. Steinhart is an Advisory Board Member of the McCombs School of Business at the University of Texas at Austin. Among the civic positions in which he has served are Chairman of the Board of Trustees of the Teacher Retirement System of Texas, Chairman of the Housing Authority of the City of Dallas, Chairman of the United Way of Metropolitan Dallas, President of the Federal Advisory Council of the Federal Reserve System, Chairman of the Dallas Citizens Council, and Regent of the Lamar University System.

As a result of the positions and experience described above, Mr. Steinhart has leadership experience with several large, complex and diverse organizations, a strong background in financial and accounting matters, experience in strategic planning and governmental and political matters. His years of service on the boards of other public companies provide him with additional perspectives from which to view the Company’s operations and the Board’s activities.

Dorothy C. Weaver, age 66, has been a director since 2010. She has been Chairman and Chief Executive Officer of Collins Capital Investments, LLC (an investment management company managing multi-manager, multi-strategy funds of hedge funds) since 1995. Prior to that she was President of Intercap Investments, Inc. (a residential and commercial real estate investment firm) for approximately six years. Ms. Weaver is a director of Austin Industries and was formerly a director of Coldwell Banker. She is a former Chairman of the Board of the Federal Reserve Bank of Miami. She has also served as Chairman of the Governor’s Council of Economic Advisors for the State of Florida, and was a founding director of Enterprise Florida, a public-private partnership that replaced Florida’s Department of Commerce. Among the many other civic positions in which she has served are Chairman of the Greater Miami Chamber of Commerce, Chairman of the Strategic Planning Committee of Workforce Florida, Inc., Chairman of the Workforce Development Committee of the Governor’s Blue Ribbon Commission on Education and a member of the board of trustees and the executive committee of Wellesley College.

As a result of the positions and experience described above, Ms. Weaver has a strong background in financial and accounting matters, and experience in strategic planning and governmental and political matters.

Your Board of Directors unanimously recommends that you vote FOR all of the nominees listed above.

9

BOARD OF DIRECTORS AND ITS STANDING COMMITTEES

Board of Directors

The Board of Directors currently has ten members. In fiscal year 2013, the Board of Directors held six meetings. Each incumbent director attended more than 75% of all meetings of the Board of Directors and the committees on which he served during fiscal year 2013. We do not have a formal policy regarding director attendance at annual meetings of shareholders, but we encourage each director to attend each annual meeting of shareholders. Ten directors attended the 2012 annual meeting of shareholders.

The Board of Directors has three standing committees that are described below.

Audit Committee

The audit committee, which met seven times in fiscal year 2013, is currently comprised of Ms. Weaver (Chair), Mr. Coats and Mr. Lanigan. In the business judgment of the Board, each of these directors is financially literate and has been designated by the Board as an “audit committee financial expert” as defined by the Securities and Exchange Commission. In the business judgment of the Board, each has the accounting or related financial management experience required of at least one member under the New York Stock Exchange Listed Company Manual.

The committee selects, evaluates and oversees our independent auditors, and provides oversight on matters relating to our corporate accounting, financial reporting, internal control and disclosure practices. In addition, the committee reviews our audited financial statements and quarterly financial statements with management and independent auditors, recommends whether the annual audited financial statements should be included in our Annual Report on Form 10-K and prepares a report to shareholders to be included in this Proxy Statement.

Compensation Committee

The compensation committee, which met five times in fiscal year 2013, is currently comprised of Mr. Ryan (Chair), Mr. Clariond and Mr. Foley. Mr. Ransdell was Chair of the committee during fiscal year 2013 and at the time the Compensation Committee Report presented below was approved, but Mr. Ryan was elected in July 2013 to succeed Mr. Ransdell due to the election of Mr. Ransdell as Chairman of the Board. The committee reviews the performance of our officers, reviews and approves corporate goals and objectives relevant to the Chief Executive Officer’s compensation, recommends the compensation level of the Chief Executive Officer for consideration and approval by the independent directors on the full Board, reviews the performance of the Company’s management and approves the compensation of executive officers and reviews the compensation of staff and operations officers, recommends incentive goals to be achieved under incentive compensation plans and reviews the results and approves payments under the plans, and reviews incentive compensation plans to confirm that incentive pay does not encourage unnecessary risk taking. The committee recommends variable contributions to our 401(k) plan, recommends incentive compensation and equity based plans to the Board, reviews, approves and administers incentive plans in which our executive officers participate and all equity based plans, reviews and discusses with management our compensation discussion and analysis, and reviews and recommends director compensation. The committee may also advise the Board generally with regard to other compensation and employee benefit matters. The committee may delegate any of its responsibilities and duties to one or more members of the committee except to the extent such delegation would be inconsistent with the requirements of the securities laws or the listing rules of the New York Stock Exchange. To assist it in the conduct of its responsibilities, the committee may consult with management, may seek advice and assistance from our employees, and may retain or obtain the advice of compensation consultants after consideration of the consultant’s independence from management.

10

Governance Committee

The governance committee, which met four times in fiscal year 2013, is comprised of Mr. Baker (Chair), Mr. Ryan and Mr. Steinhart. The committee assists the Board of Directors in identifying individuals qualified to become directors and recommends to the Board the nominees for election as directors at the next annual meeting of shareholders. The committee also assists the Board in determining the composition and structure of the Board and its committees, selection of committee members, developing and implementing our corporate governance guidelines, considering other corporate governance issues, reviewing and considering conflicts of interest and related person transactions involving directors or executive officers and overseeing the evaluation of the Board of Directors and its committees.

11

CORPORATE GOVERNANCE

Director Independence

The Board of Directors has determined that all current directors are independent other than Mr. Brekhus, who is our President and Chief Executive Officer. The Board based its determination on the independence standards described in the Listed Company Manual of the New York Stock Exchange. In determining the independence of Mr. Baker and Ms. Weaver, the Board considered Mr. Baker’s position as a director of Wells Fargo & Co., a lender in our senior credit facility, and Ms. Weaver’s position as a director of Austin Industries, one of our large customers. In determining the independence of Mr. Foley, Mr. Lanigan and Mr. Ryan, the Board considered the business relationships between each of them or their associates and our largest shareholder or its associates, none of which involved the Company.

Currently, all members of the audit, compensation and governance committees are independent directors.

During the last fiscal year our non-management directors and independent directors held executive sessions in accordance with the New York Stock Exchange Listed Company Manual. Our Chairman of the Board presided at executive sessions of the non-management directors and our lead independent director presided at the executive sessions of the independent directors.

Board Leadership Structure

The Board establishes its leadership structure and fills the various roles with directors they believe are best suited at the time for the roles. Although the Board has the flexibility under its corporate governance documents to select the leadership structure it believes is appropriate from time to time, the roles of Chairman of the Board and Chief Executive Officer have been separated for over 40 years. The Board believes this is currently the optimal structure for providing leadership that is both independent in its oversight of management and closely attuned to our specific business. However, the Board understands that the environment in which we operate is dynamic, and the appropriate structure may change from time to time. The Board’s oversight of risk management has not been a significant factor in determining the current Board leadership structure.

Since Robert D. Rogers, our Chairman of the Board during fiscal year 2013, was not an independent director, the Board elected Ronald G. Steinhart as lead independent director. The lead independent director was authorized to call meetings of the independent directors, preside at executive sessions and meetings of the independent directors, and review the agenda for Board meetings. Upon the election of Mr. Ransdell as Chairman of the Board in June 2013, the position of lead independent director was abolished since Mr. Ransdell is independent and could perform the functions formerly performed by the lead independent director.

Board Risk Oversight

The Board has overall responsibility for oversight of risk management. The Board recognizes that it is neither possible nor prudent to eliminate all risk. Appropriate risk taking is an essential element in the success of any business enterprise. Therefore its oversight process is focused on reviewing with management risk assessment, risk mitigation and risk response.

The Board delegates certain responsibilities to committees to assist in fulfilling its risk oversight responsibilities. The Audit Committee focuses on financial and compliance risk. Financial risk involves areas such as our financial statements, financial reporting processes, internal control environment, internal audit, and accounting and legal matters. Compliance risk involves areas such as health, safety and the environment. The Compensation Committee evaluates risks associated with our compensation programs. The Governance Committee monitors risks associated with management succession planning and related party transactions.

12

Codes of Ethics, Corporate Governance Guidelines and Committee Charters

We have an ethical business conduct policy applicable to our directors, officers and employees. Our Board of Directors has also adopted a code of ethics applicable to our chief executive officer, chief financial officer and other senior accounting officers.

Our Board has adopted corporate governance guidelines and written charters governing the audit, compensation and governance committees.

The ethical business conduct policy, code of ethics, corporate governance guidelines and committee charters are available on our website at http://investorrelations.txi.com/governance.cfm. You may also obtain them in print, free of charge, by making a written request to Investor Relations, Texas Industries, Inc., 1341 W. Mockingbird Lane, Suite 700W, Dallas, Texas 75247.

Director Nominations

Under our corporate governance guidelines and the charter of the governance committee, the governance committee identifies nominees for director from various sources, including current directors who are willing to continue service and recommendations of current directors. Shareholders may propose potential nominees (other than self-recommendations) for consideration by the governance committee by submitting the name, qualifications and supporting information to the Secretary of the Company, Texas Industries, Inc., 1341 W. Mockingbird Lane, Dallas, Texas 75247 by the close of business on April 25, 2014. The committee will consider and evaluate persons recommended by shareholders in the same manner as potential nominees identified by the governance committee and the Board of Directors.

In assessing potential director nominees, the committee considers individuals who have demonstrated the general qualifications and one or more of the individual attributes described above under “Election of Directors—Director Qualifications.” The committee will also consider any present or potential conflicts of interest and the number of potential nominees in relation to the number of directors to be elected. Nominees must also be willing to devote sufficient time and effort in carrying out their duties and responsibilities effectively, and should be committed to serving on the Board for an extended period of time. Although the committee does not have a formal policy on diversity, it considers diversity of experience, gender and nationality important because it believes a variety of points of view based on a variety of experiences contributes to effective decision making. In considering candidates, the committee considers the entirety of each candidate’s credentials in the context of these standards.

In addition to proposing nominees for consideration of the governance committee, shareholders may nominate persons for election as director. Such nominations must be submitted to the Secretary of the Company at our principal executive offices not earlier than the close of business on June 18, 2014 and not later than the close of business on July 18, 2014. This submission must contain as to each nominee, (i) all information that would be required to be disclosed in a proxy statement with respect to the election of directors pursuant to the Securities Exchange Act of 1934, as amended; (ii) the written consent of each nominee to serve as a director, if so elected; (iii) a description of all monetary arrangements and other material relationships between the shareholder and the nominee; and (iv) the nominee’s completed questionnaire, representation and agreement required by section 11 of our bylaws. As to the shareholder giving notice and any beneficial owner on whose behalf the nomination is made, the submission must contain (i) the name and address of such shareholder and beneficial owner, (ii) information about ownership and certain other interests in our capital stock; and (iii) certain additional information required by section 8 of our bylaws. The nominations must comply with all requirements of our bylaws.

13

Communications with Directors

Shareholders and other interested parties may communicate directly with the Board of Directors, the independent directors or any particular director by sending written correspondence to the attention of the desired person or persons in care of the General Counsel as follows:

| | • | | by letter addressed to Texas Industries, Inc., 1341 W. Mockingbird Lane, Suite 700W, Dallas, Texas 75247, or |

| | • | | anonymously by email at txi@openboard.info. |

The written communications will be forwarded to the person or persons addressed unless the communications are considered, in the reasonable judgment of the General Counsel, to be inappropriate. Examples of inappropriate communications include customer complaints, solicitations, and communications that do not relate to our business or that relate to improper or irrelevant topics.

Compensation Committee Interlocks and Insider Participation

During the last completed fiscal year, Mr. Ransdell, Mr. Clariond, Mr. Foley and Ms. Weaver were members of our compensation committee. No such current or former member was an officer or employee of the Company or its subsidiaries during the last fiscal year, nor was such member formerly an officer of the Company except Mr. Ransdell, who was an officer of the Company during the 1970’s. None of our executive officers served as a member of the compensation committee (or other board committee performing similar functions, or in the absence of any such committee, the entire board of directors) of another corporation, one of whose executive officers served on our compensation committee or as our director. None of our executive officers served as a director of another corporation, one of whose executive officers served on our compensation committee.

Related Person Transactions and Other Relationships

Our corporate governance guidelines contain our policies and procedures for review, approval or ratification of related person transactions. The related person transactions to which these policies and procedures apply are those for which disclosures would be required by Item 404 of Regulation S-K of the Securities and Exchange Commission.

If an actual or potential related person transaction arises for a director or executive officer, the director or executive officer must promptly inform the governance committee. A proposed transaction of which the committee has notice may be consummated only after it has been submitted to the committee for consideration and the committee concludes in good faith that it is in, or not inconsistent with, our best interests and those of our shareholders.

If a director or executive officer becomes aware of a related person transaction that has not been previously approved or ratified, it must be submitted to the governance committee. If the transaction is ongoing, the committee will evaluate all reasonable options, including ratification, amendment or termination. If the transaction is completed, the committee will evaluate whether rescission of the transaction is appropriate.

We know of no reportable related person transaction that occurred since June 1, 2012, the beginning of our last fiscal year.

14

DIRECTOR COMPENSATION

Directors’ compensation is determined by the Board of Directors after receiving the recommendation of the compensation committee. The compensation committee periodically reviews the compensation of directors. After the review, no adjustment was made in director compensation in fiscal year 2013.

Non-employee directors received an annual fee of $36,000 during fiscal year 2013. In fiscal year 2013 the Board of Directors continued the 10% reduction in the annual fee from the 2009 level. The chairman of the audit committee received an additional annual fee of $10,000, and other members of the committee received an additional annual fee of $2,000. The lead director and the chairmen of the compensation and governance committees each received an additional annual fee of $5,000. Each member of the compensation and governance committees received an additional annual fee of $1,000.

The Chairman of the Board received a grant of 2,500 restricted shares of common stock and each other non-employee director received a grant of 1,000 restricted shares of common stock. All restricted shares will vest at the end of the director’s one year term of office. In addition, all unvested restricted shares will vest upon the death or disability of the director. Upon any other termination of a director’s service, unvested restricted shares will be forfeited and transferred back to the Company.

Pursuant to the Deferred Compensation Plan for Directors, directors were provided the opportunity to defer all or any part of their annual fees by delivering a written election to defer prior to the year during which he or she wishes to defer receipt of the fees. A director’s deferred account balance is denominated in shares of our common stock by crediting to the account the number of shares of common stock determined by dividing the deferred amount of compensation by the average market price of the common stock for the thirty trading days prior to the first day of the year in which the deferred amount would otherwise be paid. Cash dividends are credited to the account in the form of common stock at a value equal to the fair market value of the stock on the date of payment of the cash dividend. The account balance will be distributed in shares of common stock on the earlier of the date, if any, elected by the director in the written election to defer, and the date on which he ceases to serve as a director.

We made an annual charitable contribution of $10,000 to a charity or charities designated by each non-employee director. We also reimbursed directors for travel, lodging and related expenses they incurred in attending Board and committee meetings.

The following table provides information about the compensation paid to our non-employee directors during fiscal year 2013. No compensation was paid to any other non-employee director during the last fiscal year.

| | | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash

($) | | | Stock

Awards(1)

($) | | | All Other

Compensation(2)

($) | | | Total

($) | |

John D. Baker, II | | | 40,500 | | | | 40,470 | | | | 10,000 | | | | 90,970 | |

Eugenio Clariond | | | 36,900 | | | | 40,470 | | | | 10,000 | | | | 87,370 | |

Sam Coats | | | 37,800 | | | | 40,470 | | | | 10,000 | | | | 88,270 | |

Sean P. Foley | | | 36,900 | | | | 40,470 | | | | 10,000 | | | | 87,370 | |

Bernard Lanigan, Jr. | | | 37,800 | | | | 40,470 | | | | 10,000 | | | | 88,270 | |

Thomas R. Ransdell | | | 40,500 | | | | 40,470 | | | | 10,000 | | | | 90,970 | |

Robert D. Rogers | | | 36,000 | | | | 101,175 | | | | 10,000 | | | | 147,175 | |

Thomas L. Ryan | | | 36,900 | | | | 40,470 | | | | 10,000 | | | | 87,370 | |

Ronald G. Steinhart | | | 41,400 | | | | 40,470 | | | | 10,000 | | | | 91,870 | |

Dorothy C. Weaver | | | 45,000 | | | | 40,470 | | | | 10,000 | | | | 95,470 | |

| (1) | The amount shown is the grant date fair value of the only stock award received during the fiscal year. Assumptions used in determining the value of stock awards are set forth in Note 1 to the Consolidated Financial Statements in our 2013 Annual Report to Shareholders. |

15

The number of shares of stock underlying awards outstanding at May 31, 2013 for each director is as follows:

| | | | | | | | |

Name | | Restricted Stock

Awards (#) | | | Stock Option

Awards (#) | |

John D. Baker, II | | | 1,333 | | | | — | |

Eugenio Clariond | | | 1,333 | | | | — | |

Sam Coats | | | 1,333 | | | | — | |

Sean P. Foley | | | 1,000 | | | | — | |

Bernard Lanigan, Jr. | | | 1,000 | | | | — | |

Thomas R. Ransdell | | | 1,333 | | | | — | |

Robert D. Rogers | | | 3,333 | | | | 6,666 | |

Thomas L. Ryan | | | 1,000 | | | | — | |

Ronald G. Steinhart | | | 1,333 | | | | — | |

Dorothy C. Weaver | | | 1,333 | | | | — | |

| (2) | For fiscal year 2013, we made $10,000 contributions to charities designated by each director. Such contributions totaled $100,000. |

16

COMPENSATION DISCUSSION AND ANALYSIS

In this discussion and analysis, we refer to the compensation committee as the Committee, the President and Chief Executive Officer as the CEO, and the executive officers named in the Summary Compensation Table as the named executives.

Summary.

The compensation program for our named executives is designed to attract and retain a highly qualified and productive management team, motivate the achievement of our financial goals by paying for performance and align management’s interest with the interest of our shareholders. The program’s principal elements of compensation include base salary, annual and long-term cash incentives, equity-based long-term incentives and retirement benefits.

During fiscal years 2009 through 2011 the construction industry experienced a deep and persistent recession, which dramatically affected our operations and financial results. Consistent with the terms of our annual and long-term cash incentive plans, which are designed to pay for performance, neither the CEO nor the other named executives received any annual or long-term cash incentive payments for those three years. In fiscal year 2012, we generated a profit, primarily as a result of one-time gains from asset sales. Our focus on reducing costs and generating cash improved pre-tax income by $38.7 million, or 43%, from the prior year after excluding major one-time gains associated with asset transactions and charges associated with restructuring and debt retirements. As a result, the CEO received a modest annual cash incentive payment equal to approximately 29% of his base salary, and the other named executives received approximately 22% of their base salaries. Neither the CEO nor the other named executives received any long-term cash incentive payments.

In fiscal year 2013, we increased our consolidated earnings from continuing operations before interest and taxes by $35 million, from a loss of $26.4 million in the prior year to positive earnings of $8.6 million in 2013 after excluding major one-time gains associated with asset transactions. Based on this performance, the named executives’ annual cash incentive payments under the annual incentive plan decreased by approximately two-thirds from the previous year. Our CEO received an annual cash incentive payment equal to approximately 9.3% of his base salary, and the other named executives received approximately 7.0% of their base salaries. Neither the CEO nor the other named executives received any long-term cash incentive payments.

Our CEO and other named executives did not receive any salary increases in fiscal year 2013, which marked the sixth year that our CEO had not received any increase and the fifth year that our other named executives had not received any increase (except that Mr. James Rogers received a salary increase in 2011 when he was promoted to the position of Vice President and Chief Operating Officer). To the contrary, in fiscal years 2010 through 2012, the base salary of the CEO was reduced by 10%, and the salaries of the other named executives by 5% (including Mr. Rogers). Their salaries were restored to their 2009 level in July 2012.

In fiscal year 2013 we changed our equity based incentive compensation for employees, including our named executives, from stock options to restricted stock units, or RSUs. The Committee’s decision was based on its compensation consultant’s advice that the use of RSUs rather than stock options would be consistent with trends in our industry and the market. The Committee believes that being aligned with market trends in this area is important in attracting and retaining highly qualified and productive members of management. In general, the Committee intends to award RSUs at about one-third the rate it awarded stock options in previous years. In fiscal year 2013 our named executives received awards of RSUs based on the consistent application of longstanding guidelines, but in amounts adjusted downward due to the use of RSUs rather than stock options.

17

Objectives.

The objectives of our management compensation program are to:

| | • | | attract and retain highly qualified and productive individuals on our management team for long and productive careers; |

| | • | | motivate our management team to achieve annual and long-term financial goals of the Company by fostering a pay for performance culture; and |

| | • | | align our management team’s interest with the investment interest of our shareholders in creation of long-term shareholder value. |

Guiding Principles.

The following principles guide us in seeking to achieve these objectives:

| | • | | target compensation at levels that should be competitive in the markets in which we compete for management talent; |

| | • | | emphasize pay for performance by linking a substantial portion of our officers’ total target compensation to our performance; |

| | • | | pay performance-based compensation only when specific goals are achieved; and |

| | • | | encourage our officers to own our stock. |

Elements of Compensation.

Based on this framework, in fiscal year 2013 we provided the following principal elements of compensation for our officers, including the named executives:

| | • | | variable performance-based incentive compensation, including annual and long-term cash incentives and long-term equity based incentives, |

| | • | | retirement and post-employment benefits, and |

| | • | | perquisites and other benefits. |

Typically over half of our CEO’s target cash compensation is comprised of variable performance-based compensation. Our other named executives’ target variable cash compensation is in a similar though somewhat lower range. Our equity based compensation in fiscal year 2013 was comprised entirely of restricted stock units, which were granted at one-third the rate at which stock options had been granted in prior years.

We believe that this mix of fixed and variable compensation is an essential part of the design of a compensation program that meets our objectives. It provides the ability to attract, retain and motivate executives by providing predictable fixed income to meet current living requirements and significant variable compensation opportunities for long term wealth accumulation. At the same time, the variable component of compensation motivates executives to achieve results that should enhance shareholder value.

Salary. Salary is our basic element of compensation. It is the foundation upon which our variable compensation and our retirement plans are based. Salary provides a stable and fixed level of compensation that is necessary to attract an officer to join our management team. It also serves as a retention tool throughout his or her career.

18

We determine salaries of our officers on an individual basis. We consider subjective factors such as the officer’s role and responsibilities, unique skills, individual performance, future potential and internal pay equity, as well as more objective factors such as compensation survey information and Company performance. Quantitative relative weights are not assigned to the different factors, nor is a mathematical formula followed.

The Committee reviews salaries periodically, normally annually. As a general practice, salaries are adjusted for the CEO upon renewal of his employment contract and for the other named executives bi-annually. Salaries may be adjusted more frequently in unusual circumstances such as a promotion, exceptional individual performance or a change in the Company’s performance and prospects. Salaries may be adjusted less frequently during periods of financial distress such as the recent recession.

In their periodic salary reviews, the Committee and the CEO review the five-year compensation history of each officer, including gains upon the exercise of stock options. They also review compensation survey data to confirm that officers’ salaries and total compensation were competitive and that the differences among officers were in line with market practices. The CEO discusses with the Committee his views on the role, responsibilities, performance and potential of each officer, and he recommends salary increases for the officers. Based on the information reviewed, the subjective information provided by the CEO, the Committee members’ knowledge of the individual officers and the Company’s performance and prospects, the Committee makes subjective decisions in approving the increases.

Our CEO and other named executives did not receive any salary increases in fiscal year 2013, which marked the sixth year that our CEO had not received any increase and the fifth year that our other named executives had not received any increase (except that Mr. James Rogers received a salary increase in 2011 when he was promoted to the position of Vice President and Chief Operating Officer). To the contrary, in fiscal years 2010 through 2012, the base salary of the CEO was reduced by 10%, and the salaries of the other named executives by 5% (including Mr. Rogers). Their salaries were restored to their 2009 level in July 2012.

In April 2013, our CEO entered into a new employment agreement that took effect on June 1, 2013 upon expiration of his former contract. The new contract provides for a $100,000 annual increase in salary beginning in fiscal year 2014.

Performance-Based Incentives.Our performance-based incentive compensation includes annual and long-term cash incentives and long-term equity based incentives. We believe that these incentives promote our objectives in the following ways:

| | • | | our annual cash incentives encourage teamwork and focus employees’ work on short-term results that are key to our long-term business success; |

| | • | | our long-term cash incentives create a focus on our long-term growth and profitability; |

| | • | | our equity-based incentives encourage employees to invest in our common stock, which fosters employees’ loyalty and increases their interest in our business and success and aligns their interests with the investment interest of our shareholders in creation of long-term shareholder value; |

| | • | | all our incentives strengthen our ability to attract, motivate and retain executives with the superior capability required to achieve our business objectives in an intensely competitive environment. |

Our annual and long-term cash incentives are paid only when specific goals are achieved. In contrast to salary determinations, an officer’s percentage of participation in our annual and long-term cash incentive plans is based on his or her job level rather than individual performance factors. Our CEO participates at one level in these plans, and our other officers participate at a lower level. We believe that maintaining the same base percentage participation level for all individuals within a job level promotes our objectives by encouraging teamwork and a focus that mirrors the interest of our shareholders.

19

Annual Cash Incentives. In fiscal year 2013, cash payments under our annual cash incentive plan were based on our level of achievement of three objectives that were established when the plan was first adopted. The objectives were based on:

| | • | | selling, general and administrative expense as a percent of net sales (“SG&A expense”), and |

| | • | | return on assets (“ROA”). |

Each year management recommends objectives to the Committee and goals for each objective. The Committee selects objectives and weights them based on their view of the importance of the objectives in achieving the Company’s plan to return to growth and profitability. The specific threshold, target and maximum goals for each objective are set subjectively at levels the Committee believes will motivate superior performance because they are not easily achieved, but are realistically achievable, other than the ROA objective, which in the current economic environment was not realistically achievable. For a summary of the terms of the annual incentive plan, see footnote (3) to the Summary Compensation Table below.

In fiscal year 2013, we increased our consolidated earnings from continuing operations before interest and taxes by $35 million, from a loss of $26.4 million in the prior year to positive earnings of $8.6 million in 2013 after excluding major one-time gains associated with asset transactions. Based on this performance, we achieved the SG&A expense objective at the target level, but we did not achieve the threshold level of the gross margin or ROA objectives. The named executives received the annual incentive payments shown in footnote (3) to the Summary Compensation Table below, which were equal to approximately 9.3% of the CEO’s base salary and 7.0% of the other named executives’ base salary. Neither the CEO nor the other named executives received any long-term cash incentive payments.

The Committee may adjust the calculation of annual incentive plan payments in unusual situations. For fiscal year 2013, the Committee excluded from the calculation the gain from the exchange of our lightweight aggregates business for the ready mix concrete business of Trinity Industries, Inc.

Long-term Cash Incentives. Our long-term cash incentive plan for the three fiscal years ending May 31, 2013 continued to be based on a return on equity objective determined when the plan was first adopted in 2010. We used return on equity because it represents a measure that is significant to shareholders, can be readily compared with other companies or industries and is relatively easy to understand and calculate. In determining our objective, the Committee reviewed the long term manufacturing industry average return on equity and the Company’s recent financial results, current financial position and future prospects. Based on this information, the Committee determined an objective that would result in above average return on equity performance. The specific goal was set subjectively at a level the Committee believed would motivate superior performance because it was not easily achieved, but at the time was thought to be realistically achievable. We established a minimum objective of having an average return on equity of 14% compared to the U.S. manufacturing industry long-term average of 12%. The maximum objective was set at 20%.

For a summary of the terms of the long-term incentive plan, see footnote (3) to the Summary Compensation Table below.

Based on our financial performance for fiscal years 2011 through 2013, which was severely impacted by the depressed economic conditions in the construction industry, the minimum threshold was not achieved, and the CEO and the other named executives did not receive any long-term cash incentive payments for the three fiscal year period.

The Committee may adjust the calculation of long-term incentive plan payments in unusual situations. For the fiscal years 2011 through 2013 plan, the Committee did not adjust the calculation.

20

Equity Based Incentives. In fiscal year 2013 our equity based incentive compensation for employees, including our named executives, consisted of restricted stock units, or RSUs. In previous years our equity-based incentive compensation had been primarily stock options. The Committee’s decision was based on its compensation consultant’s advice in fiscal year 2011 that the use of stock options rather than restricted stock or RSUs was not consistent with trends in our industry and the market. The Committee believes that being aligned with market trends in this area is important in attracting and retaining highly qualified and productive members of management. In general, the Committee intends to award RSUs at about one-third the rate it awarded stock options in previous years since RSUs are considered “full value” awards while stock options require the grantee to purchase the stock at an exercise price equal to the fair market value of the stock on the grant date.

Named executives are eligible for an equity based award on an annual basis. Our officers do not have a role in selecting the grant date. Historically, awards have been granted at the January Committee meeting. Beginning in fiscal year 2014, the Committee plans to grant awards on a fiscal year basis in each July. We also use RSUs as part of the compensation package offered to new officers or upon promotion. Typically, these RSUs are granted at the next meeting after the date of hire or promotion. Occasionally, the RSUs are approved at a meeting prior to the date of hire or promotion, but the grant date is then the date of hire or promotion.

The number of RSUs awarded to a named executive is generally determined by dividing his or her base salary by the current stock price and multiplying that result by a factor between .33 and .83. In determining the factor for a named executive, the Committee considers subjective factors such as the officer’s role and responsibilities, unique skills, individual performance, future potential and internal pay equity. Quantitative relative weights are not assigned to the different factors, nor is a mathematical formula followed.

Based on these factors and formulas, at its meeting on January 8, 2013 the Committee approved the RSU awards shown in the Grants of Plan Based Awards Table below. For a description of the terms of the RSU awards, see footnote (1) to the Summary Compensation Table below.

The Committee has the authority to grant stock options, stock appreciation rights, restricted stock, restricted stock units and other equity-based awards under our 2004 Omnibus Equity Compensation Plan, or 2004 Plan. From time to time the Committee reviews whether other types of awards would be appropriate. It may choose to revise its philosophy on equity based compensation in the future.

We monitor the number of equity based awards outstanding, the number of shares outstanding and the rate at which awards are granted under the 2004 Plan. At May 31, 2013, there were 2,767,638 shares available for future awards.

Retirement and Post-Employment Benefits.Our named executives participate in executive financial security plans, which are voluntary non-qualified deferred compensation plans that allow participants, including the named executives, to defer a portion of their salaries and to receive retirement income at the times and in the amounts defined in the plans. In fiscal year 2012, the Board of Directors froze the plans because of the cost of defined benefit plans. No new participants will be invited to participate in the plans, and current participants will not be allowed to increase their participation. For a summary of the plans, see footnote (4) to the Summary Compensation Table below.

The Board believes that the new Management Deferred Compensation Plan, which was approved by our shareholders in October 2012, will provide officers and key managers with a financial planning tool that will help fill the gap in total compensation that results from freezing the executive financial security plans. This new plan permits participants, including our named executives, to voluntarily defer all or a portion of their incentive cash payments by converting the deferred payments into RSUs. Normal RSU awards may also be deferred beyond their normal vesting date. The Committee may provide that deferrals be matched with additional RSU awards. The Committee provided a 25% match for deferrals of fiscal year 2014 cash incentive payments.

21

Our named executives also participate in the TXI Retirement Plan, a tax qualified defined contribution plan available to all employees. The named executives participate on the same terms as other employees. We do not provide qualified defined benefit pension plans for any officers.

Perquisites and Other Benefits. We provide the named executives with perquisites that the Committee believes are reasonable and consistent with our overall compensation program to better enable us to attract and retain superior employees for key positions. Our named executives’ primary perquisite is an automobile expense allowance of $800 per month. Our named executives participate in other employee benefit plans such as health, life, dental, vision and disability insurance, paid vacation and holiday time and employee assistance program on the same terms as other employees.

Other Philosophical Elements

Role of Compensation Committee and CEO in Setting Compensation. The Board has authorized the Committee to establish our general compensation policies and evaluate the risks associated with our compensation programs. The Committee members take part in the Board’s review of the performance of the CEO. The Committee also evaluates the corporate goals and objectives relevant to the CEO’s compensation and the survey information described below. The Committee determines and approves the compensation of the CEO other than his base salary. His base salary must be approved by our independent directors after receiving the recommendation of the Committee.