UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

___________________

| | | | | | | | |

Filed by the Registrant ☒ | Filed by a party other than the Registrant ☐ | |

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | Definitive Proxy Statement |

| |

| ☐ | Definitive Additional Materials |

| |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

| | |

| Texas Instruments Incorporated |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| ☒ | No fee required. |

| |

| ☐ | Fee paid previously with preliminary materials. |

| |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder:

You are cordially invited to attend the 2025 annual meeting of stockholders on Thursday, April 17, 2025, in the auditorium on our property at 12500 TI Boulevard, Dallas, Texas, at 8:30 a.m. (Central time). If you plan to attend the annual meeting, please see “Attendance and instructions for the annual meeting.” At the meeting we will consider and act upon the following matters:

•the election of directors for the next year,

•advisory approval of the company’s executive compensation,

•ratification of the appointment of Ernst & Young LLP as the company’s independent registered public accounting firm for 2025,

•one stockholder proposal, if properly presented, and

•such other matters as may properly come before the meeting.

Stockholders of record at the close of business on February 20, 2025, are entitled to vote at the annual meeting.

We urge you to vote your shares as promptly as possible by (i) accessing the voting website, (ii) calling the toll-free number or (iii) signing, dating and mailing the enclosed proxy.

| | | | | |

| Sincerely, |

|

Katie Kane Senior Vice President, Secretary and General Counsel |

Dallas, Texas March 5, 2025 | |

2025 PROXY STATEMENT • PAGE 1

TABLE OF CONTENTS

| | | | | |

| |

| |

| Corporate governance and board of directors | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Audit committee matters | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Internet availability of proxy materials | |

| |

2025 PROXY STATEMENT • PAGE 2

PROXY STATEMENT – MARCH 5, 2025

EXECUTIVE OFFICES

12500 TI BOULEVARD, DALLAS, TX 75243

MAILING ADDRESS: P.O. BOX 660199, MS 8658, DALLAS, TX 75266-0199

Voting procedures, quorum and attendance requirements

TI’s board of directors requests your proxy for the annual meeting of stockholders on April 17, 2025. If you sign and return the enclosed proxy or vote by telephone or on the internet, you authorize the persons named in the proxy to represent you and vote your shares for the purposes mentioned in the notice of annual meeting. This proxy statement and related proxy are being distributed on or about March 5, 2025. If you come to the meeting, you can vote in person. If you do not come to the meeting, your shares can be voted only if you have returned a properly signed proxy or followed the telephone or internet voting instructions, which can be found on the enclosed proxy. If you sign and return your proxy but do not give voting instructions, the shares represented by that proxy will be voted as recommended by the board of directors. You can revoke your authorization at any time before the shares are voted at the meeting.

A quorum of stockholders is necessary to hold a valid meeting. If at least a majority of the shares of TI common stock issued and outstanding and entitled to vote are present in person or by proxy, a quorum will exist. Abstentions and broker non-votes are counted as present for purposes of establishing a quorum. Broker non-votes occur when a beneficial owner who holds company stock through a broker does not provide the broker with voting instructions as to any matter on which the broker is not permitted to exercise its discretion and vote without specific instruction.

Shown below is a list of the matters to be considered at the meeting (each of which is discussed elsewhere in this proxy statement) and the vote required for election or approval, as the case may be.

| | | | | | | | |

| Matter | Required Vote for Election or Approval | Impact of Abstentions or Broker Non-Votes |

Election of directors. |

Majority of votes present in person or by proxy at the meeting and entitled to be cast in the election with respect to a nominee must be cast for that nominee. |

Abstentions have the same effect as votes against. Broker non-votes are not counted as votes for or against. |

Advisory vote to approve named executive officer compensation. |

Majority of votes present in person or by proxy at the meeting must be cast for the proposal. |

Abstentions and broker non-votes have the same effect as votes against. |

Proposal to ratify appointment of independent registered public accounting firm. |

Majority of votes present in person or by proxy at the meeting must be cast for the proposal. |

Abstentions have the same effect as votes against. (Brokers are permitted to exercise their discretion and vote without specific instruction on this matter. Accordingly, there are no broker non-votes.) |

Stockholder proposal to permit a combined 10% of stockholders to call a special meeting. |

Majority of votes present in person or by proxy at the meeting must be cast for the proposal. |

Abstentions and broker non-votes have the same effect as votes against. |

Any other matter that may properly be submitted at the meeting. |

Majority of votes present in person or by proxy at the meeting must be cast for the proposal. |

Abstentions and broker non-votes have the same effect as votes against. |

2025 PROXY STATEMENT • PAGE 3

Attendance and instructions for the annual meeting

Attendance at the annual meeting is limited to stockholders or their legal proxy holders. Attendees should park at the South Lobby, where reserved parking will be available. Each attendee must present a government-issued photo ID, such as a driver's license or passport, and an advance registration form to gain access. You may be denied entrance if the required identification and registration form are not presented. All attendees will be required to comply with TI’s then-current site visitor policy, which will be posted on our Investor Relations website on or before April 14, 2025. Be advised that TI’s security policy forbids weapons, cameras and audio/visual recording devices inside TI buildings. All bags will be subject to search upon entry into the building.

If you plan to attend the annual meeting in person, you must print your own advance registration form and bring it to the meeting. Advance registration forms can be printed by clicking on the “Register for Meeting” button found at www.proxyvote.com and following the instructions provided. You will need the 16-digit control number included in your notice, proxy card or voting instruction form. You must request your advance registration form by April 16, 2025, at 11:59 p.m. (Eastern time). If you are unable to print your advance registration form, please call Stockholder Meeting Registration Phone Support (toll-free) at 1-844-318-0137 or 1-925-331-6070 (international toll) for assistance.

Guest advance registration forms are not available. Exceptions may be granted to stockholders who require a companion in order to facilitate their own attendance (for example, due to a physical disability) by contacting Investor Relations.

Additionally, if you plan to attend as proxy for a stockholder of record, you must present a valid legal proxy from the stockholder of record to you. If you plan to attend as proxy for a street name stockholder, you must present a valid legal proxy from the stockholder of record (i.e., the bank, broker or other holder of record) to the street name stockholder that is assignable and a valid legal proxy from the street name stockholder to you. Stockholders may appoint only one proxy holder to attend on their behalf.

Corporate governance and board of directors

Election of directors

Directors are elected at the annual meeting to hold office until the next annual meeting and until their successors are elected and qualified. The board of directors has designated the following persons as nominees: Mark Blinn, Todd Bluedorn, Janet Clark, Carrie Cox, Martin Craighead, Reginald DesRoches, Curtis Farmer, Jean Hobby, Haviv Ilan, Ronald Kirk, Pamela Patsley, Robert Sanchez and Richard Templeton.

If you return a proxy that is not otherwise marked, your shares will be voted FOR each of the nominees.

Director nominees, qualifications and experience

All of the nominees for directorship will be directors of the company at the time of the annual meeting. If any nominee becomes unable to serve before the meeting, the persons named as proxies may vote for a substitute, or the number of directors will be reduced accordingly.

2025 PROXY STATEMENT • PAGE 4

Summary

This table provides a summary view of the qualifications, experience and demographics of each director nominee as of the proxy statement filing date.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Qualifications and Experience | Mark Blinn | Todd Bluedorn | Janet Clark | Carrie Cox | Martin Craighead | Reginald DesRoches | Curtis Farmer | Jean Hobby | Haviv Ilan | Ronald Kirk | Pamela Patsley | Robert Sanchez | Richard Templeton |

| Independence | • | • | • | • | • | • | • | • | | • | • | • | |

| Multinational experience | • | • | • | • | • | | • | • | • | • | • | • | • |

| Executive leadership (public or private) | • | • | • | • | • | • | • | • | • | • | • | • | • |

| Technology, research and development | • | • | • | • | • | • | • | • | • | | • | • | • |

| Manufacturing | • | • | | • | • | | | | • | | | | • |

| End market knowledge | • | • | • | • | • | | | • | • | • | | • | • |

| Regulatory, public policy or legal | • | | | • | | | • | • | | • | • | | |

| Other public board service | • | • | • | • | • | • | • | • | | • | • | • | |

| Financial acumen | • | • | • | • | • | • | • | • | • | • | • | • | • |

| Auditing/Accounting | • | | • | | | | | • | | | • | • | |

| Sustainability | • | • | • | • | • | • | • | | • | • | | • | • |

| | | | | | | | | | | | | |

| Demographic Background | | | | | | | | | | | | | |

| Tenure (years) | 12 | 8 | 10 | 21 | 7 | 1 | 2 | 9 | 3 | 12 | 21 | 14 | 22 |

| Age (years) | 63 | 61 | 70 | 67 | 65 | 57 | 62 | 64 | 56 | 70 | 68 | 59 | 66 |

| Gender | M | M | F | F | M | M | M | F | M | M | F | M | M |

| Race/Ethnicity * | W | W | W | W | W | B | W | W | W | B | W | H | W |

* B = Black/African American; W = White; H = Hispanic/Latino

The board prefers a mix of background and experience among its members. The board does not follow any ratio or formula to determine the appropriate mix. Rather, it uses its judgment to identify nominees whose backgrounds, attributes and experiences, taken as a whole, will contribute to the high standards of board service at the company. The board actively seeks candidates with a broad range of skills, experiences, perspectives and backgrounds, including women and minority candidates, for the pool from which board candidates are chosen. Maintaining a balance of tenure among the directors is also part of the board’s consideration. Longer-serving directors bring valuable experience with the company and familiarity with the strategic and operational challenges it has faced over the years, while newer directors bring fresh perspectives and ideas. To help maintain this balance, the company has a mandatory retirement policy, pursuant to which directors cannot stand for election after reaching age 75. The effectiveness of the board’s approach to board composition decisions is evidenced by the directors’ participation in the insightful and robust, yet respectful, deliberation that occurs at board and committee meetings, and in shaping the agendas for those meetings.

2025 PROXY STATEMENT • PAGE 5

Nominee criteria

In evaluating prospective nominees and as stated in our corporate governance guidelines, the governance and stockholder relations (GSR) committee considers the following criteria:

•Outstanding achievement in the individual’s personal career.

•Relevant commercial expertise.

•International operations experience.

•Financial acumen.

•Government experience.

•Standards of integrity and soundness of judgment.

•Ability to make independent, analytical inquiries.

•Ability to represent the total corporate interests of TI (a director will not be selected to, nor be expected to, represent the interests of any particular group).

•Board diversity (viewpoints, gender, ethnicity).

•Willingness and ability to devote the time required to perform board activities adequately. Directors should not serve on the boards of more than three other public companies.

Nominee assessment

As it considered director nominees for the 2025 annual meeting, the board kept in mind that the most important issues it considers typically relate to the company’s strategic direction; succession planning for senior executive positions; the company’s financial performance; the challenges of running a large, complex enterprise, including the management of its risks; major acquisitions and divestitures; and significant research and development (R&D) and capital investment decisions. These issues arise in the context of the company’s operations, which primarily involve the manufacture and sale of semiconductors all over the world into industrial, automotive, personal electronics, communications equipment and enterprise systems markets.

As described below, each of our director nominees has achieved an extremely high level of success in his or her career, whether at multibillion dollar, multinational corporate enterprises, large academic institutions or significant governmental organizations. In these positions, each has been directly involved in the challenges relating to setting the strategic direction and managing the financial performance, personnel and processes of large, complex organizations, which includes key sustainability matters. Each has had exposure to effective leaders and has developed the ability to judge leadership qualities. Ten of the director nominees have experience in serving on the board of directors of at least one other major corporation, and one has served in high political office, all of which provides additional relevant experience on which each nominee can draw.

In concluding that each nominee should serve as a director, the board relied on the specific experiences and attributes listed below and on the direct personal knowledge, born of previous service on the board, that each of the nominees brings insight to board deliberations as well as a willingness to ask challenging questions.

All nominees for directorship are currently directors of the company.

2025 PROXY STATEMENT • PAGE 6

| | | | | | | | |

| Director nominees | | |

| Mark Blinn | | |

| Former chief executive officer of Flowserve Corporation |

| Career highlights Mr. Blinn served in various positions at Flowserve, including as chief executive officer and president from 2009 to 2017 and chief financial officer from 2004 to 2009. Prior to Flowserve, Mr. Blinn held senior finance positions at several companies, including FedEx Kinko’s Office and Print Services, Inc. and Centex Corporation. As an attorney, he represented financial institutions, foreign corporations and insurance companies. | Key skills and experience •Management responsibility of a large, multinational manufacturer operating in industrial markets •Responsibility for significant capital and R&D investments •Keen appreciation for audit and financial control matters Other current public company directorships •Emerson Electric Co. •Globe Life Inc. •Leggett & Platt, Incorporated Other public company directorships in the last five years •Kraton Corporation |

| Todd Bluedorn | | |

| Former chairman and chief executive officer of Lennox International Inc. |

| Career highlights Mr. Bluedorn served as vice chair of Madison Industries from 2022 to 2023. Prior to Madison Industries, he served as chief executive officer of Lennox International from 2007 to 2022 and chairman of the board from 2012 to 2022. Prior to that, Mr. Bluedorn held several senior management positions at United Technologies Corporation, including leading Otis Elevator — North & South America. | Key skills and experience •Management responsibility of a large, multinational manufacturer operating in industrial markets •Responsibility for significant capital and R&D investments Other current public company directorships •Samsara Inc. Other public company directorships in the last five years •Eaton Corporation plc •Lennox International Inc. |

| Janet Clark | | |

| Former chief financial officer of Marathon Oil Corporation |

| Career highlights Ms. Clark was chief financial officer and executive vice president of Marathon Oil Corporation from 2007 to 2013 and senior vice president and chief financial officer from 2004 to 2007. Prior to Marathon, she served as chief financial officer of Nuevo Energy Company and Santa Fe Snyder Corporation. Ms. Clark has served as a director of Dell Inc. and Exterran Holdings, Inc. She also serves as a director of environmental nonprofit Resources for the Future. | Key skills and experience •Keen appreciation for audit and financial control matters •Oversight of large multinational companies, including one in the technology industry Other current public company directorships •EOG Resources, Inc. Other public company directorships in the last five years •None

|

2025 PROXY STATEMENT • PAGE 7

| | | | | | | | |

| Carrie Cox | | |

| Former chairman and chief executive officer of Humacyte, Inc. |

| Career highlights Ms. Cox was the executive chair of Humacyte, Inc. from 2018 to 2019, where she was also chairman and chief executive officer from 2010 to 2018. Prior to Humacyte, Ms. Cox held several senior management positions in the medical industry, including leading the global pharmaceuticals business at Schering-Plough Corporation and the global prescription business at Pharmacia Corporation. | Key skills and experience •Management responsibility of a large multinational company operating in a regulated industry •Responsibility for significant capital and R&D investments Other current public company directorships •Cartesian Therapeutics, Inc. (f/k/a Selecta Biosciences, Inc.) •Organon & Co. •Solventum Corporation Other public company directorships in the last five years •Array BioPharma Inc. •Cardinal Health, Inc. •Celgene Corporation •electroCore, Inc. |

| Martin Craighead | | |

| Former chairman and chief executive officer of Baker Hughes Inc. |

| Career highlights At Baker Hughes Inc., Mr. Craighead served as chief executive officer from 2012 to 2017 and chairman of the board from 2013 until the company merged with GE in 2017. He then served as vice chair of Baker Hughes, a GE company, until 2019. Prior to leading the company, Mr. Craighead held several senior management roles at Baker Hughes, including as chief operating officer. | Key skills and experience •Management responsibility of a large, multinational company operating in industrial markets •Responsibility for significant capital and R&D investments Other current public company directorships •Emerson Electric Co. Other public company directorships in the last five years •Ecovyst Inc. |

| Reginald DesRoches | |

| President of Rice University |

| Career highlights Dr. DesRoches has been the president of Rice University since 2022 and a professor of engineering since 2017. Prior to his role as president, he served as Rice’s Howard Hughes Provost from 2020 to 2022 and the William and Stephanie Sick Dean of Engineering from 2017 to 2020. Dr. DesRoches previously served as the chair of the School of Civil and Environmental Engineering at Georgia Tech. | Key skills and experience •Management responsibility of a large, internationally recognized research university •Responsibility for significant capital and R&D investments •Keen appreciation for technology matters Other current public company directorships •Brandywine Realty Trust Other public company directorships in the last five years •None |

2025 PROXY STATEMENT • PAGE 8

| | | | | | | | |

| Curtis Farmer | | |

| Chairman, president and chief executive officer of Comerica Incorporated |

| Career highlights At Comerica, Mr. Farmer has served as chief executive officer since 2019, chairman since 2020 and president since 2015. Prior to those roles, he was executive vice president from 2008 to 2011, then vice chairman from 2011 to 2015. Mr. Farmer has also held senior leadership positions at Wachovia Corporation. | Key skills and experience •Management responsibility of a large financial institution •Responsibility for significant capital and R&D investment Other current public company directorships •Comerica Incorporated Other public company directorships in the last five years •None

|

| Jean Hobby | | |

| Retired partner of PricewaterhouseCoopers LLP |

| Career highlights Ms. Hobby was global strategy officer of PricewaterhouseCoopers from 2013 to 2015. Prior to that, she held several senior management positions at the firm, including as technology, media and telecom sector leader and chief financial officer. | Key skills and experience •Extensive audit knowledge and keen appreciation for audit, financial control and technology matters •Management responsibility at a large, multinational company •Strategic planning expertise Other current public company directorships •Hewlett Packard Enterprise Company •Integer Holdings Corporation Other public company directorships in the last five years •None |

| Haviv Ilan | | |

| President and chief executive officer of Texas Instruments Incorporated |

| Career highlights Mr. Ilan has been the president and chief executive officer of the company since 2023. From 2020 to 2023, Mr. Ilan was the executive vice president and chief operating officer, responsible for leading TI’s business and sales organizations, technology and manufacturing operations and information technology services. He has served the company at a senior level since 2014, including as a director since 2021. | Key skills and experience •Management responsibility for the company's operations •Knowledge of the company and the semiconductor industry •Responsibility for significant capital investments Other current public company directorships •None Other public company directorships in the last five years •None |

2025 PROXY STATEMENT • PAGE 9

| | | | | | | | |

| Ronald Kirk | | |

| Senior of counsel at Gibson, Dunn & Crutcher LLP |

| Career highlights Mr. Kirk has been senior of counsel at Gibson, Dunn & Crutcher since 2013 and co-chairs the international trade and ESG practice groups. He served as the U.S. Trade Representative from 2009 to 2013, where he focused on the development and enforcement of U.S. intellectual property law. Mr. Kirk has been a director of Brinker International, Inc. and Dean Foods Company. | Key skills and experience •Management responsibility of a large, complex organization operating internationally •Keen insight into issues bearing on global economic activity and international trade policies Other current public company directorships •Mister Car Wash, Inc. Other public company directorships in the last five years •AMF Hawaii Investments, LLC (f/k/a Macquarie Infrastructure Holdings, LLC) |

| Pamela Patsley | | |

| Former chairman and chief executive officer of MoneyGram International, Inc. |

| Career highlights At MoneyGram, Ms. Patsley was chair and chief executive officer from 2009 to 2015, then executive chair until 2018. Prior to that, she was senior executive vice president at First Data Corporation and chief executive officer of Paymentech, Inc. She also served as chief financial officer of First USA, Inc. and began her career as an auditor. | Key skills and experience •Management responsibility of a large, multinational company •Keen appreciation for audit, financial control and technology matters Other current public company directorships •Hilton Grand Vacations Inc. •Keurig Dr Pepper Inc. •Payoneer Global Inc. Other public company directorships in the last five years •ACI Worldwide, Inc.

|

| Robert Sanchez | | |

| Chairman and chief executive officer of Ryder System, Inc. |

| Career highlights Mr. Sanchez has been chairman and executive officer of Ryder since 2013. During his career at Ryder, Mr. Sanchez has served as president, chief operating officer, chief information officer and chief financial officer. He has also had a broad range of leadership roles in Ryder’s business segments, including as president of its Global Fleet Management Solutions business. | Key skills and experience •Management responsibility of a large, multinational transportation and logistics company •Responsibility for significant capital investments •Keen appreciation for technology matters Other current public company directorships •Ryder System, Inc. Other public company directorships in the last five years •None |

| | |

| | |

| | |

2025 PROXY STATEMENT • PAGE 10

| | | | | | | | |

| Richard Templeton | |

| Chairman of Texas Instruments Incorporated |

| Career highlights Mr. Templeton has been the company’s chairman since 2008 and served as president and chief executive officer from 2004 to June 2018 and July 2018 to 2023. He served 29 years at a senior level at the company and is a 40-year veteran of the semiconductor industry. | Key skills and experience •Deep knowledge of all aspects of the company and the semiconductor industry •Management responsibility of the company •Responsibility for significant capital and R&D investments Other current public company directorships •None Other public company directorships in the last five years •None |

Director nomination process

The board is responsible for approving nominees for election as directors. To assist in this task, the board has designated a standing committee, the GSR committee, that is responsible for reviewing and recommending nominees to the board. The GSR committee is comprised solely of independent directors as defined by the rules of The Nasdaq Stock Market LLC (Nasdaq) and the board’s corporate governance guidelines. Our board of directors has adopted a written charter for the GSR committee. It can be found on our website at www.ti.com/corporategovernance.

It is a long-standing policy of the board to consider prospective board nominees recommended by stockholders. A stockholder who wishes to recommend a prospective board nominee for the GSR committee’s consideration must write to the Secretary of the GSR committee, Texas Instruments Incorporated, P.O. Box 655936, MS 8658, Dallas, TX 75265-5936. The GSR committee will evaluate the stockholder’s prospective board nominee in the same manner as it evaluates other nominees.

Under the company’s by-laws, a stockholder, or a group of up to 20 stockholders, owning at least 3% of the company’s outstanding common stock continuously for at least three years may nominate and include in the company’s proxy materials director nominees constituting up to the greater of two individuals, or 20% of the board of directors, provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in the by-laws, which can be found on our website at www.ti.com/corporategovernance.

The company’s by-laws also allow stockholders to nominate directors without involving the GSR committee or including the nominee in the company’s proxy materials. To do so, stockholders must comply with the requirements set forth in the by-laws.

Communications with the board

Stockholders and others who wish to communicate with the board, a board committee or an individual director may write to them at P.O. Box 655936, MS 8658, Dallas, TX 75265-5936. All communications addressed to the board, a board committee or an individual director that are sent to this address will be shared with the addressee.

Corporate governance

The board has a long-standing commitment to responsible and effective corporate governance. We annually conduct extensive governance reviews and engage in investor outreach.

2025 PROXY STATEMENT • PAGE 11

The board’s corporate governance guidelines (which include the director independence standards), the charters of each of the board’s committees, TI’s “Living our Values: TI’s ambitions, values and code of conduct,” our code of ethics for our chief executive officer (CEO) and senior financial officers and our by-laws are available on our website at www.ti.com/corporategovernance. Stockholders may request copies of these documents free of charge by writing to Texas Instruments Incorporated, P.O. Box 660199, MS 8657, Dallas, TX 75266-0199, Attn: Investor Relations.

We have adopted an insider trading policy that governs the purchase, sale and other disposition of our securities by any director, officer and employee of the company, and the company itself, that is reasonably designed to promote compliance with insider trading laws, rules and regulations, as well as Nasdaq listing standards.

It is against TI policy for any employee, including an executive officer, or director to engage in trading in “puts” (options to sell at a fixed price), “calls” (similar options to buy) or other options or hedging techniques on TI stock specifically designed to limit losses on TI stock or equity compensation held by the employee or director. It is also against TI policy for directors and executive officers to pledge TI stock.

Annual meeting attendance

It is a policy of the board to encourage directors to attend the annual meeting of stockholders. Attendance allows for interaction between stockholders and board members. In 2024, all directors attended TI’s annual meeting of stockholders.

Director independence

The board has determined that each of our directors is independent, with the exception of Messrs. Templeton and Ilan. In connection with this determination, information was reviewed regarding directors’ business and charitable affiliations, directors’ immediate family members and their employers, and any transactions or arrangements between the company and such persons or entities. The board has adopted the following standards for determining independence.

A.In no event will a director be considered independent if:

1.He or she is a current partner of or is employed by the company’s independent auditors;

2.A family member of the director is (i) a current partner of the company’s independent auditors or (ii) currently employed by the company’s independent auditors and personally works on the company’s audit;

3.Within the current or preceding three fiscal years he or she was, and remains at the time of the determination, a partner in or a controlling shareholder, an executive officer or an employee of an organization that in the current year or any of the past three fiscal years (i) made payments to, or received payments from, the company for property or services, (ii) extended loans to or received loans from, the company, or (iii) received charitable contributions from the company in an amount or amounts which, in the aggregate in such fiscal year, exceeded the greater of $200,000 or 2% of the recipient’s consolidated gross revenues for that year (for purposes of this standard, “payments” excludes payments arising solely from investments in the company’s securities and payments under non-discretionary charitable contribution matching programs); or

4.Within the current or preceding three fiscal years a family member of the director was, and remains at the time of the determination, a partner in or a controlling shareholder or an executive officer of an organization that in the current year or any of the past three fiscal years (i) made payments to, or received payments from, the company for property or services, (ii) extended loans to or received loans from the company, or (iii) received charitable contributions from the company in an amount or amounts which, in the aggregate in such fiscal year, exceeded the greater of $200,000 or 2% of the recipient’s consolidated gross revenues for that year (for purposes of this standard, “payments” excludes payments arising solely from investments in the company’s securities and payments under non-discretionary charitable contribution matching programs).

2025 PROXY STATEMENT • PAGE 12

B.In no event will a director be considered independent if within the preceding three years:

1.He or she was employed by the company (except in the capacity of interim chairman of the board, chief executive officer or other executive officer, provided the interim employment did not last longer than one year);

2.He or she received more than $120,000 during any twelve-month period in compensation from the company (other than (i) compensation for board or board committee service, (ii) compensation received for former service lasting no longer than one year as an interim chairman of the board, chief executive officer or other executive officer and (iii) benefits under a tax-qualified retirement plan, or non-discretionary compensation);

3.A family member of the director was employed as an executive officer by the company;

4.A family member of the director received more than $120,000 during any twelve-month period in compensation from the company (excluding compensation as a non-executive officer employee of the company);

5.He or she was (but is no longer) a partner or employee of the company’s independent auditors and worked on the company’s audit within that time;

6.A family member of the director was (but is no longer) a partner or employee of the company’s independent auditors and worked on the company’s audit within that time;

7.He or she was an executive officer of another entity at which any of the company’s current executive officers at any time during the past three years served on that entity’s compensation committee; or

8.A family member of the director was an executive officer of another entity at which any of the company’s current executive officers at any time during the past three years served on that entity’s compensation committee.

C.No member of the audit committee may accept directly or indirectly any consulting, advisory or other compensatory fee from the company, other than in his or her capacity as a member of the board or any board committee. Compensatory fees do not include the receipt of fixed amounts of compensation under a retirement plan (including deferred compensation) for prior service with the company (provided that such compensation is not contingent in any way on continued service). In addition, no member of the audit committee may be an affiliated person of the company except in his or her capacity as a director.

D.With respect to service on the compensation committee, the board will consider all factors that it deems relevant to determining whether a director has a relationship to the company that is material to that director’s ability to be independent from management in connection with the duties of a compensation committee member, including but not limited to:

1.The source of compensation of the director, including any consulting, advisory or compensatory fee paid by the company to the director; and

2.Whether the director is affiliated with the company, a subsidiary of the company or an affiliate of a subsidiary of the company.

E.For any other relationship, the determination of whether it would interfere with the director’s exercise of independent judgment in carrying out his or her responsibilities, and consequently whether the director involved is independent, will be made by directors who satisfy the independence criteria set forth in this section.

For purposes of these independence determinations, “company” and “family member” will have the same meaning as under Nasdaq rules.

2025 PROXY STATEMENT • PAGE 13

Board organization

Board and committee meetings

During 2024, the board held six meetings. The board has three standing committees described below. The standing committees of the board collectively held 18 meetings in 2024. Each director attended at least 75% of the board and relevant committee meetings combined, except Dr. DesRoches who attended 70% of the meetings held in his first year of service which began on March 1, 2024, due to a pre-existing business scheduling conflict that affected two days of meetings. Overall attendance at board and committee meetings was approximately 93%.

| | | | | | | | | | | |

| Director | Audit

Committee | Compensation

Committee | Governance and Stockholder

Relations Committee |

| Mark Blinn | | • | |

| Todd Bluedorn * | | | Chair |

| Janet Clark | Chair | | |

| Carrie Cox | | • | |

| Martin Craighead | | Chair | |

| Reginald DesRoches | • | | |

| Curtis Farmer | • | | |

| Jean Hobby | | | • |

| Haviv Ilan | | | |

| Ronald Kirk | | • | |

| Pamela Patsley | | | • |

| Robert Sanchez | • | | |

| Richard Templeton | | | |

* Lead director

Committees of the board

Audit committee

The audit committee is a separately designated standing committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (Securities Exchange Act). All members of the audit committee are independent under Nasdaq rules and the board’s corporate governance guidelines. From April 27, 2023 to February 29, 2024, the committee members were Ms. Clark (chair), Mr. Farmer and Ms. Hobby. From March 1, 2024 to April 24, 2024, the committee members were Ms. Clark (chair), Dr. DesRoches, Mr. Farmer and Ms. Hobby. Since April 25, 2024, the committee members have been Ms. Clark (chair), Dr. DesRoches, Mr. Farmer and Mr. Sanchez. The audit committee is generally responsible for:

•Reviewing:

◦The annual report of TI’s independent registered public accounting firm related to quality control.

◦TI’s annual and quarterly reports to the SEC, including the financial statements and the “Management’s Discussion and Analysis” portion of those reports, and recommending appropriate action to the board.

◦TI’s audit plans.

◦Before issuance, TI’s news releases regarding annual and interim financial results and discussing with management any related earnings guidance that may be provided to analysts and rating agencies.

◦Relationships between the independent registered public accounting firm and TI.

◦The adequacy of TI’s internal accounting controls and other factors affecting the integrity of TI’s financial reports, and discussing with management and with the independent registered public accounting firm.

◦TI’s risk assessment and risk management practices, including cybersecurity and environmental-related risks.

◦TI’s compliance and ethics program.

2025 PROXY STATEMENT • PAGE 14

◦A report of compliance of management and operating personnel with TI’s code of conduct, including TI’s conflict of interest policy.

◦TI’s non-employee-related insurance programs.

◦Changes, if any, in major accounting policies of the company.

◦Trends in accounting policy changes that are relevant to the company.

◦The company’s policy regarding investments and financial derivative products.

•Discussing TI’s audited financial statements with management and the independent registered public accounting firm, including a discussion with the firm regarding the matters required to be reviewed under applicable legal or regulatory requirements.

•Creating and periodically reviewing TI’s whistleblower policy.

•Appointing, compensating, retaining and overseeing TI’s independent registered public accounting firm.

The board has determined that all members of the audit committee are sufficiently proficient in reading and understanding fundamental financial statements, and three members meet the Nasdaq listing standard of financial sophistication. In addition, the board has designated Ms. Clark as the audit committee financial expert, as defined under the Securities and Exchange Commission’s rules.

The audit committee met seven times in 2024. The audit committee holds regularly scheduled meetings and reports its activities to the board. The audit committee also continued its long-standing practice of meeting directly with our internal audit staff to discuss the audit plan and to allow for direct interaction between audit committee members and our internal auditors.

Compensation committee

All members of the compensation committee are independent. Since April 27, 2023, the committee members have been Mr. Craighead (chair), Mr. Blinn, Ms. Cox and Mr. Kirk. The compensation committee is generally responsible for:

•Reviewing the performance of the CEO and determining his compensation.

•Setting the compensation of the company’s other executive officers.

•Overseeing administration of employee benefit plans.

•Making recommendations to the board regarding:

◦Institution and termination of, revisions in and actions under employee benefit plans that (i) increase benefits only for officers of the company or disproportionately increase benefits for officers of the company more than other employees of the company, (ii) require or permit the issuance of the company’s stock or (iii) require board approval.

◦Reservation of company stock for use as awards of grants under plans or as contributions or sales to any trustee of any employee benefit plan.

•Taking action as appropriate regarding the institution and termination of, revisions in and actions under employee benefit plans that are not required to be approved by the board.

•Appointing, setting the compensation of, overseeing and considering the independence of any compensation consultant or other advisor.

The compensation committee met five times in 2024. The compensation committee holds regularly scheduled meetings, reports its activities to the board, and consults with the board before setting annual executive compensation.

In performing its functions, the committee is supported by the company’s Human Resources organization. The committee has the authority to retain any advisors it deems appropriate to carry out its responsibilities. The committee retained Pearl Meyer as its compensation consultant for the 2024 compensation cycle. The committee instructed the consultant to advise it directly on executive compensation philosophy, strategies, pay levels, decision-making processes and other matters within the scope of the committee’s charter. Additionally, the committee instructed the consultant to assist the company’s Human Resources organization in its support of the committee in these matters with such items as peer-group assessment, analysis of the executive compensation market and compensation recommendations.

2025 PROXY STATEMENT • PAGE 15

The compensation committee considers it important that its compensation consultant’s objectivity not be compromised by other engagements with the company or its management. In support of this belief, the committee has a policy on compensation consultants, a copy of which may be found on www.ti.com/corporategovernance. During 2024, the committee determined that its compensation consultant was independent of the company and had no conflict of interest.

The compensation committee considers executive compensation in a multistep process that involves the review of market information, performance data and possible compensation levels over several meetings leading to the annual determinations in January. Before setting executive compensation, the committee reviews the total compensation and benefits of the executive officers and considers the impact that their retirement, or termination under various other scenarios, would have on their compensation and benefits.

The CEO and the senior vice president responsible for Human Resources, who is an executive officer, are regularly invited to attend meetings of the committee. The CEO is excused from the meeting during any deliberations or vote on his compensation. No executive officer determines his or her own compensation or the compensation of any other executive officer. As members of the board, the members of the committee receive information concerning the performance of the company during the year and interact with our management. The CEO gives the committee and the board an assessment of his own performance during the year just ended. He also reviews the performance of the other executive officers with the committee and makes recommendations regarding their compensation. The senior vice president responsible for Human Resources assists in the preparation of and reviews the compensation recommendations made to the committee other than for his compensation.

The compensation committee’s charter provides that it may delegate its power, authority and rights with respect to TI’s long-term incentive plans, employee stock purchase plan and employee benefit plans to (i) one or more committees of the board established or delegated authority for that purpose or (ii) employees or committees of employees except that no such delegation may be made with respect to compensation of the company’s executive officers.

Pursuant to that authority, the compensation committee has delegated to a special committee established by the board the authority to, among other things, grant a limited number of stock options and restricted stock units (RSUs) under the company’s long-term incentive plans. The sole member of the special committee is Mr. Ilan. The special committee has no authority to grant, amend or terminate any form of compensation for TI’s executive officers. The compensation committee reviews all activity of the special committee.

Governance and stockholder relations committee

All members of the GSR committee are independent. From April 27, 2023 to April 24, 2024, the committee members were Mr. Bluedorn (chair), Ms. Patsley and Mr. Sanchez. Since April 25, 2024, the committee members have been Mr. Bluedorn (chair), Ms. Hobby and Ms. Patsley. The GSR committee is generally responsible for:

•Making recommendations to the board regarding:

◦The development and revision of our corporate governance principles.

◦The size, composition and functioning of the board and board committees.

◦Candidates to fill board positions.

◦Nominees to be designated for election as directors.

◦Compensation of board members.

◦Organization and responsibilities of board committees.

◦Succession planning by the company.

◦Issues of potential conflicts of interest involving a board member raised under TI’s conflict of interest policy.

◦Election of executive officers of the company.

◦Topics affecting the relationship between the company and stockholders.

◦Public issues likely to affect the company.

◦Responses to proposals submitted by stockholders.

2025 PROXY STATEMENT • PAGE 16

•Reviewing:

◦Contribution policies of the company and the TI Foundation.

◦Scope of activities of the company’s political action committee.

◦Revisions to TI’s code of conduct.

•Electing officers of the company other than the executive officers.

•Overseeing an annual evaluation of the board and the committee.

The GSR committee met six times in 2024. The GSR committee holds regularly scheduled meetings and reports its activities to the board.

Board evaluation process

The board recognizes that a robust and constructive evaluation process is an essential part of good corporate governance and board effectiveness. The board and committee annual evaluation processes are designed to assess board and committee effectiveness, as well as individual director performance and contribution levels. The results of the evaluations are part of the GSR committee’s and the board’s consideration in connection with their review of director nominees to ensure the board continues to operate effectively.

Annually, each of our directors completes comprehensive board and committee questionnaires. Each committee oversees its own evaluation process, and the GSR committee also oversees the board evaluation process. The questionnaires and ongoing feedback from individual directors facilitate a candid assessment of (i) the board and committees’ oversight of risk, strategy and operations; (ii) the board’s culture, leadership structure and mix of director skills, qualifications and experiences; and (iii) board and committee meeting mechanics. Our directors are willing to have honest and difficult conversations as needed during the evaluation and nomination process.

Board leadership structure

The board’s current leadership entails an executive chairman (former CEO) and a lead director who presides at executive sessions and performs the duties listed below. The board believes that this structure, combined with its other practices (such as (i) including on each board agenda an opportunity for the independent directors to comment on and influence the proposed strategic agenda for future meetings and (ii) holding an executive session of the independent directors at each board meeting), allows it to maintain the active engagement of independent directors and appropriate oversight of management.

The lead director is elected by the independent directors to serve at least a one-year term. The independent directors have elected Mr. Bluedorn to serve as lead director. The duties of the lead director are to:

•Preside at all meetings of the board at which the chairman is not present, including executive sessions of the independent directors;

•Serve as liaison between the chairman and the independent directors;

•Approve information sent to the board;

•Approve meeting agendas for the board;

•Approve meeting schedules to assure that there is sufficient time for discussion of all agenda items; and

•If requested by major shareholders, ensure that he or she is available for consultation and direct communication.

In addition, the lead director has authority to call meetings of the independent directors.

The board, led by its GSR committee, regularly reviews the board’s leadership structure. The board’s consideration is guided by two questions: Would stockholders be better served, and would the board be more effective with a different structure? The board’s views are informed by a review of the practices of other companies and insight into the preferences of top stockholders, as gathered from face-to-face dialogue and review of published guidelines. The board also considers how board roles and interactions would change if its leadership structure changed. The board’s goal is for each director to have an equal stake in the board’s actions and equal accountability to the company and its stockholders.

2025 PROXY STATEMENT • PAGE 17

The board continues to believe that there is no uniform solution for a board leadership structure. Indeed, the company has had varying board leadership models over its history, at times separating the positions of chairman and CEO and at times combining the two and utilizing a lead director.

Oversight by the board

It is management’s responsibility to assess and manage the various risks TI faces. It is the board’s responsibility to oversee management in this effort. In exercising its oversight, the board has allocated some areas of focus to its committees and has retained areas of focus for itself, as more fully described below.

Management generally views the risks TI faces as falling into the following categories: strategic, operational, financial and compliance. The board as a whole has oversight responsibility for the company’s strategic and operational risks (e.g., major initiatives, competitive markets and products, sales and marketing, R&D and cybersecurity). Throughout the year the CEO discusses these risks with the board. Additionally, at least once each year, the company’s chief information officer provides information on the cybersecurity risks and the company’s approach to protecting the company’s data and systems infrastructure to the board or audit committee. In the event of a material cybersecurity event, management would notify the board and, in compliance with our procedures, determine the timing and extent of the response and public disclosure and whether any future vulnerabilities are expected.

TI’s audit committee has oversight responsibility for financial risk (such as accounting, finance, internal controls and tax strategy). Oversight responsibility for compliance risk is shared by the board committees. For example, the audit committee oversees compliance with the company’s code of conduct and finance- and accounting-related laws and policies, as well as the company’s compliance program itself, including global trade compliance; the compensation committee oversees compliance with the company’s executive compensation plans and related laws and policies; and the GSR committee oversees compliance with governance-related laws and policies, including the company’s corporate governance guidelines. Environmental, social and governance (ESG) matters of significance for TI are overseen by the committee with the appropriate focus.

The audit committee oversees the company’s approach to risk management as a whole, including cybersecurity and environmental-related risks. The company’s chief financial officer (CFO) reviews the company’s risk management process with the audit committee at least annually. In addition, the company’s chief information officer reviews the company’s information technology systems with the audit committee periodically and includes a discussion of key cybersecurity risks as appropriate.

The board’s leadership structure is consistent with the board and committees’ roles in risk oversight. As discussed above, the board has found that its current structure and practices are effective in fully engaging the independent directors. Allocating various aspects of risk oversight among the committees provides for similar engagement. Having the CEO review strategic and operational risks with the board ensures that the director most knowledgeable about the company, the industry in which it operates and the competition and other challenges it faces shares those insights with the board, providing for a thorough and efficient process.

Director compensation

The GSR committee has responsibility for reviewing and making recommendations to the board on compensation for non-employee directors, with the board making the final determination. The committee has no authority to delegate its responsibility regarding director compensation. In carrying out this responsibility, it is supported by TI’s Human Resources organization and the company’s compensation consultant. The CEO, the senior vice president responsible for Human Resources and the Secretary review the recommendations made to the committee.

The compensation arrangements in 2024 for the non-employee directors were:

•Annual retainer of $110,000 for board and committee service.

•Additional annual retainer of $40,000 for service as the lead director.

•Additional annual retainer of $35,000 for service as chair of the audit committee; $25,000 for service as chair of the compensation committee; and $20,000 for service as chair of the GSR committee.

•Annual grant of a 10-year option to purchase TI common stock pursuant to the terms of the Texas Instruments 2018 Director Compensation Plan (Director Plan), which was approved by stockholders in April

2025 PROXY STATEMENT • PAGE 18

2018. The grant date value is approximately $115,000, determined using a Black-Scholes option-pricing model (subject to the board’s ability to adjust the grant downward). These non-qualified options become exercisable in four equal annual installments beginning on the first anniversary of the grant and also will become fully exercisable in the event of termination of service following a change in control (as defined in the Director Plan) of TI. If a director’s service terminates due to death, disability or ineligibility to stand for re-election under the company’s by-laws, or after the director has completed eight years of service, then all outstanding options held by the director shall continue to become exercisable in accordance with their terms. If a director’s service terminates for any other reason, all outstanding options held by the director shall be exercisable for 30 days after the date of termination, but only to the extent such options were exercisable on the date of termination.

•Annual grant of restricted stock units pursuant to the Director Plan with a grant date value of $115,000 (subject to the board’s ability to adjust the grant downward). The restricted stock units vest on the fourth anniversary of their date of grant and upon a change in control as defined in the Director Plan. If a director is not a member of the board on the fourth anniversary of the grant, restricted stock units will nonetheless settle (i.e., the shares will issue) on such anniversary date if the director has completed eight years of service prior to termination or the director’s termination was due to death, disability or ineligibility to stand for re-election under the company’s by-laws. The director may defer settlement of the restricted stock units at his or her election. Upon settlement, the director will receive one share of TI common stock for each restricted stock unit. Dividend equivalents are paid on the restricted stock units at the same rate as dividends on TI common stock. The director may defer receipt of dividend equivalents.

•$1,000 per day compensation for other activities designated by the chairman.

•A one-time grant of restricted stock units with a grant date value of approximately $200,000 upon a director’s initial election to the board.

The board has determined that annual grants of equity compensation to non-employee directors will be timed to occur in January when grants are made to our U.S. employees in connection with the annual compensation review process. See “Process for equity grants” for a discussion regarding the timing of equity compensation grants.

Directors are not paid a fee for meeting attendance, but we reimburse non-employee directors for their travel, lodging and related expenses incurred in connection with attending board, committee and stockholders meetings and other designated events. In addition, non-employee directors may travel on company aircraft to and from these meetings and other designated events.

Under the Director Plan, some directors have chosen to defer all or part of their cash compensation. These deferred amounts are credited to either a cash account or stock unit account. Cash accounts earn interest from TI at a rate currently based on Moody’s Seasoned Aaa Corporate Bonds. For 2024, that rate was 5.36%. Stock unit accounts fluctuate in value with the underlying shares of TI common stock, which will be issued after the deferral period. Dividend equivalents are paid on these stock units. Directors may also defer settlement of the restricted stock units they receive.

We have arrangements with certain customers whereby our employees may purchase consumer products containing TI components at discounted pricing. In addition, the TI Foundation has a matching gift program. In both cases, directors are entitled to participate on the same terms and conditions available to employees.

Non-employee directors are not eligible to participate in any TI-sponsored pension plan.

2025 PROXY STATEMENT • PAGE 19

2024 director compensation

The following table shows the compensation of all persons who were non-employee members of the board during 2024 for services in all capacities to TI in 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash (2) | | Stock Awards (3) | | Option Awards (4) | Non-Equity Incentive Plan Compensation | Change in Pension Value and

Non-qualified Deferred Compensation Earnings (5) | All Other Compensation (6) | Total |

| Mark Blinn | $ | 110,000 | | | $ | 114,850 | | | $ | 114,981 | | — | | — | | | $ | 40 | | | $ | 339,871 | |

| Todd Bluedorn | $ | 156,667 | | | $ | 114,850 | | | $ | 114,981 | | — | | — | | | $ | 40 | | | $ | 386,538 | |

| Janet Clark | $ | 145,000 | | | $ | 114,850 | | | $ | 114,981 | | — | | — | | | $ | 30,040 | | | $ | 404,871 | |

| Carrie Cox | $ | 110,000 | | | $ | 114,850 | | | $ | 114,981 | | — | | $ | 5,130 | | | $ | 27,540 | | | $ | 372,501 | |

| Martin Craighead | $ | 135,000 | | | $ | 114,850 | | | $ | 114,981 | | — | | — | | | $ | 5,040 | | | $ | 369,871 | |

| Reginald DesRoches (1) | $ | 91,667 | | | $ | 199,957 | | | — | | — | | — | | | $ | 22,540 | | | $ | 314,164 | |

| Curtis Farmer | $ | 110,000 | | | $ | 114,850 | | | $ | 114,981 | | — | | — | | | $ | 40 | | | $ | 339,871 | |

| Jean Hobby | $ | 110,000 | | | $ | 114,850 | | | $ | 114,981 | | — | | — | | | $ | 40 | | | $ | 339,871 | |

| Ronald Kirk | $ | 110,000 | | | $ | 114,850 | | | $ | 114,981 | | — | | — | | | $ | 15,040 | | | $ | 354,871 | |

| Pamela Patsley | $ | 123,333 | | | $ | 114,850 | | | $ | 114,981 | | — | | — | | | $ | 30,040 | | | $ | 383,204 | |

| Robert Sanchez | $ | 110,000 | | | $ | 114,850 | | | $ | 114,981 | | — | | — | | | $ | 30,040 | | | $ | 369,871 | |

(1)Dr. DesRoches was elected to the board effective March 1, 2024.

(2)Includes amounts deferred at the director’s election.

(3)Shown is the aggregate grant date fair value of restricted stock units granted in 2024 calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification™ Topic 718, Compensation-Stock Compensation (ASC 718). The assumptions used for purposes of calculating the grant date fair value are described in Note 3 to the financial statements contained in Item 8 (“Note 3 to the 2024 financial statements”) in TI’s annual report on Form 10-K for the year ended December 31, 2024. Each restricted stock unit represents the right to receive one share of TI common stock. For restricted stock units granted prior to 2007, shares are issued at the time of mandatory retirement from the board (age 75) or upon the earlier of termination of service from the board after completing eight years of service or death or disability. For information regarding share issuances under restricted stock units granted after 2006, see the discussion on page 19.

The table below shows the aggregate number of shares underlying outstanding restricted stock units held by the named individuals as of December 31, 2024. | | | | | | | | |

| Name | RSUs (Shares) |

| Mark Blinn | 11,693 | | |

| Todd Bluedorn | 2,422 | | |

| Janet Clark | 10,202 | | |

| Carrie Cox | 33,348 | | |

| Martin Craighead | 2,422 | | |

| Reginald DesRoches | 1,169 | | |

| Curtis Farmer | 1,772 | | |

| Jean Hobby | 2,422 | | |

| Ronald Kirk | 2,422 | | |

| Pamela Patsley | 4,422 | | |

| Robert Sanchez | 9,289 | | |

2025 PROXY STATEMENT • PAGE 20

(4)Shown is the aggregate grant date fair value of options granted in 2024 calculated in accordance with ASC 718. The discussion of the assumptions used for purposes of calculating the grant date fair value appears in Note 3 to the 2024 financial statements. The terms of these options are as set forth on page 19. The table below shows the aggregate number of shares underlying outstanding stock options held by the named individuals as of December 31, 2024. | | | | | | | | |

| Name | Options (Shares) |

| Mark Blinn | 10,194 | | |

| Todd Bluedorn | 22,943 | | |

| Janet Clark | 29,008 | | |

| Carrie Cox | 22,943 | | |

| Martin Craighead | 18,637 | | |

| Reginald DesRoches | — | | |

| Curtis Farmer | 3,066 | | |

| Jean Hobby | 10,194 | | |

| Ronald Kirk | 38,998 | | |

| Pamela Patsley | 22,943 | | |

| Robert Sanchez | 29,008 | | |

(5)SEC rules require the disclosure of earnings on deferred compensation to the extent that the interest rate exceeds a specified rate (Federal Rate), which is 120% of the applicable federal long-term interest rate with compounding. Under the terms of the Director Plan, deferred compensation cash amounts earn interest at a rate based on Moody’s Seasoned Aaa Corporate Bonds. For 2024, this interest rate exceeded the Federal Rate by 0.43 percentage points. Shown is the amount of interest earned on the directors’ deferred compensation accounts that was in excess of the Federal Rate.

(6)Consists of (i) the annual cost ($40 per director) of premiums for travel and accident insurance policies and (ii) contributions under the TI Foundation matching gift program of $30,000 for Ms. Clark, $27,500 for Ms. Cox, $5,000 for Mr. Craighead, $22,500 for Dr. DesRoches, $15,000 for Mr. Kirk, $30,000 for Ms. Patsley and $30,000 for Mr. Sanchez.

2025 PROXY STATEMENT • PAGE 21

Executive compensation

We are providing shareholders the opportunity to cast advisory votes on named executive officer compensation as required by Section 14A of the Securities Exchange Act.

Proposal regarding advisory approval of the company’s executive compensation

The “named executive officers” are the chief executive officer, the chief financial officer and the three other most highly compensated executive officers, as named in the compensation tables on pages 37-50. We ask shareholders to approve the following resolution:

RESOLVED, that the compensation paid to the company’s named executive officers, as disclosed in this proxy statement pursuant to the Securities and Exchange Commission’s compensation disclosure rules, including the Compensation Discussion and Analysis, compensation tables and narrative discussion on pages 22-50 of this proxy statement, is hereby approved. We encourage shareholders to review the Compensation Discussion and Analysis section of the proxy statement, which follows. It discusses our executive compensation policies and programs and explains the compensation decisions relating to the named executive officers for 2024. We believe that the policies and programs serve the interests of our shareholders and that the compensation received by the named executive officers is commensurate with the performance and strategic position of the company.

Although the outcome of this annual vote is not binding on the company or the board, the compensation committee of the board will consider it when setting future compensation for the executive officers.

The board of directors recommends a vote For the annual resolution approving the named executive officer compensation for 2024, as disclosed in this proxy statement.

Compensation discussion and analysis

This section describes TI’s compensation program for executive officers. It will provide insight into the following:

•The elements of the 2024 compensation program, why we selected them and how they relate to one another; and

•How we determined the amount of compensation for 2024.

The executive officers of the company have the broadest job responsibilities and policy-making authority in the company. We hold them accountable for the company’s performance and for maintaining a culture of strong ethics and compliance. Details of compensation for our CEO, our CFO and the three other highest paid individuals who were executive officers in 2024 (collectively called the “named executive officers” (NEOs)) can be found in the tables following the compensation committee report.

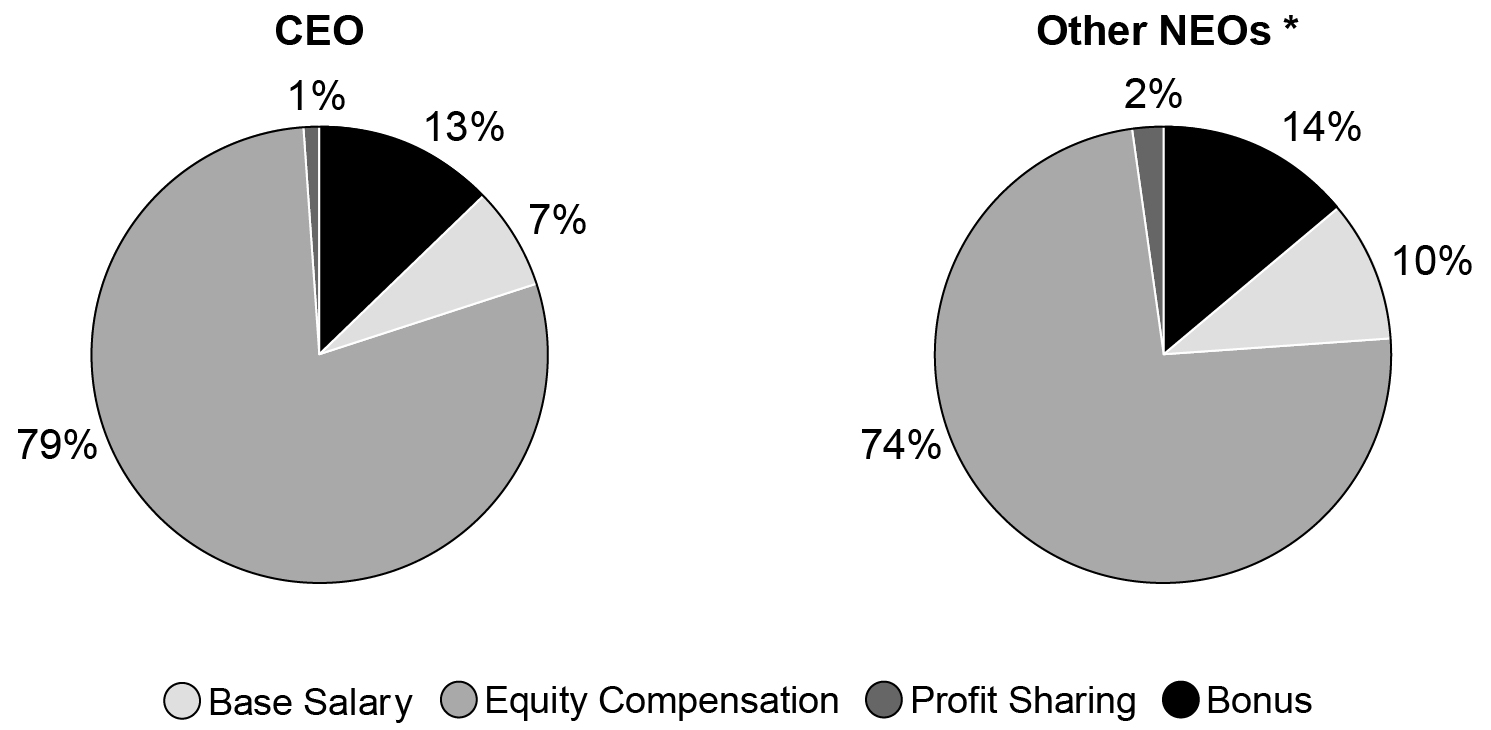

Executive summary

•TI’s compensation program is structured to pay for performance and deliver rewards that encourage executives to think and act in both the short- and long-term interests of our shareholders. The majority of total compensation for our executives each year comes in the form of variable cash and equity compensation. Variable cash is tied to the short-term performance of the company, and the value of equity is tied to the long-term performance of the company. We believe our compensation program holds our executive officers accountable for the financial and competitive performance of TI.

•The compensation committee assesses TI’s results using quantitative and qualitative measures on an absolute and relative basis, as well as TI’s strategic progress. For 2024, TI’s revenue declined, and relative performance was below median. Operating profit margin remained positive on an absolute basis, and above median relative to Semiconductor Peers (as defined below in “Analysis of compensation determinations – Bonus”). Total shareholder return (TSR) was positive on an absolute basis, and above median relative to Semiconductor Peers. In addition to these year-on-year results, the committee determined that the company

2025 PROXY STATEMENT • PAGE 22

continued to strengthen its strategic position, which will benefit the company and drive value for shareholders for the long term. This strategic progress includes continued investments to extend the company’s manufacturing advantage to support future revenue growth and provide customers with geopolitically dependable, low-cost 300mm capacity at scale.

•Based on this year’s performance assessment, the compensation committee determined executive bonuses payable in February 2025 should be down 5% year-on-year.

| | | | | | | | | | | | | | |

| 2024 Absolute Performance | 2024 Relative Performance * |

| Revenue Growth: Total TI | | -10.7% | | Below median |

| Profit from Operations as a % of Revenue (Operating Profit Margin) | | 34.9% | | Above median |

| Total Shareholder Return (TSR) | | 13.1% | | Above median |

|

| Assessment of Strategic Progress | Strengthened strategic position in 2024 |

*Relative to Semiconductor Peers; includes estimates and projections of certain peer companies’ financial results. See “Analysis of compensation determinations – Bonus – Assessment of 2024 performance” for details of the compensation committee’s assessment of TI’s performance. (It is important to note that the median growth rate of Semiconductor Peers includes the benefit of acquisitions, whereas TI’s growth rate is entirely organic.)

•TI generally targets annual equity grants to executives at market median to align with the projected market range for similarly situated executives in our Comparator Group (as defined below in “Compensation philosophy and elements - Comparator Group”).

•2024 compensation decisions for the CEO:

◦Base salary was increased by 8.7% over 2023.

◦For the 2024 performance year, Mr. Ilan’s first full year in the role of CEO, the committee awarded a $2.38 million performance bonus paid in February 2025. The committee determined Mr. Ilan’s bonus by assessing the competitive market range of bonuses for similarly situated CEOs in the Comparator Group and giving due consideration to company performance in 2024.

◦In January 2024, Mr. Ilan received an equity compensation award, which was his first while in the role of CEO, with a grant date fair value of $15 million in order to align his equity compensation with the projected market range for similarly situated CEOs in the Comparator Group.

•Our executive compensation program is designed to encourage executive officers to pursue strategies that serve the long-term interests of the company and shareholders, and not to promote excessive risk-taking by our executives. It is built on a foundation of sound corporate governance and includes:

◦Executive officers do not have employment contracts and are not guaranteed salary increases, bonus amounts or awards of equity compensation.

◦We have never repriced stock options. We do not grant reload options. We grant equity compensation with double-trigger change in control terms, which accelerate the vesting of grants only if the grantee has been terminated involuntarily within a limited time after a change in control of the company.

◦Bonus and equity compensation awards are subject to clawback as described under “Recoupment policy” below.

◦We do not provide excessive perquisites. We provide no tax gross-ups for perquisites.

◦We do not guarantee a return or provide above-market returns on compensation that has been deferred.

◦Pension benefits are calculated on salary and bonus only; the proceeds earned on equity or other performance awards are not part of the pension calculation.

Detailed discussion

Compensation philosophy and elements

For years, we have run our business and invested in our people and communities with three overarching ambitions in mind. First, we will act like owners who will own the company for decades. Second, we will adapt and succeed in

2025 PROXY STATEMENT • PAGE 23

a world that is ever changing. And third, we will be a company that we are personally proud to be a part of and that we would want as our neighbor. When we are successful in achieving these ambitions, our employees, customers, communities and shareholders all win. Central to our ambitions, which are the foundation of our approach to environmental, social and governance (ESG) and sustainability, is a belief that in order for all stakeholders to benefit, the company must grow stronger over the long term. Our compensation program is structured with these ambitions in mind.

The compensation committee of TI’s board of directors is responsible for setting the compensation of all TI executive officers. The committee consults with the other independent directors and its compensation consultant, Pearl Meyer, before setting annual compensation for the executives. The committee chair regularly reports on committee actions at board meetings.

In assessing performance and compensation decisions, the committee does not use formulas, thresholds or multiples. Because market conditions can quickly change in our industry, thresholds established at the beginning of a year could prove irrelevant by year-end. The committee believes its holistic approach, which assesses the company’s absolute and relative performance in hindsight after year-end (for the most recent one- and three-year periods), gives it the insight to most effectively and critically judge results and encourages executives to pursue strategies that serve the long-term interests of the company and its shareholders. It also promotes accuracy in our assessment and comparison to competition and eliminates the need for adjustments to formulas, targets or thresholds during times of uncertain market conditions.

The primary elements of our executive compensation program are as follows:

Near-term compensation, paid in cash

| | | | | |

| Base Salary |

| Purpose | Basic, least variable form of compensation, designed to provide a stable source of income. |

| |

| Strategy | Generally, target market median, giving appropriate consideration to job scope and tenure, to attract and retain highly qualified executives. |

| |

| Terms | Paid twice monthly. |

| |

| | | | | |

| Performance Bonus |

| Purpose | To motivate executives and reward them according to the company’s relative and absolute performance and the executive’s individual performance. |

| |

| Strategy | Determined primarily on the basis of one-year and three-year company performance on certain measures (revenue growth percent, operating profit margin and total shareholder return1) as compared with peer companies and on our strategic progress. These factors have been chosen to reflect our near-term financial performance as well as our progress in building long-term shareholder value. The committee aims to pay total cash compensation (base salary, profit sharing and bonus) appropriately above market median if company performance is above that of peer companies, and pay total cash compensation appropriately below market median if company performance is below peer companies. The committee does not rely on formulas or performance targets or thresholds. Instead, it uses its judgment based on its assessment of the factors described above. |

| |

| Terms | Determined by the committee and paid in a single payment after the performance year. |

11 Total shareholder return refers to the percentage change in the value of a shareholder’s investment in a company over the relevant time period, as determined by dividends paid and the change in the company’s share price during the period. See notes to the performance summary table under “Analysis of compensation determinations – Bonus.”

2025 PROXY STATEMENT • PAGE 24

| | | | | |

| Profit Sharing |

| Purpose | Broad-based program designed to emphasize that each employee contributes to the company’s profitability and can share in it. |

| |