Thermo Fisher Scientific Inc.

Creating the Global Leader in the Life,

Laboratory and Health Sciences Industry

May 8, 2006

Joint Safe Harbor Statement

Forward-Looking Statements

Various remarks that we may make about the new company’s future expectations, plans and prospects constitute forward-looking statements for purposes of the safe harbor

provisions under The Private Securities Litigation Re-form Act of 1995. Forward-looking statements, which involve a number of risks and uncertainties. Thermo Electron and Fisher

Scientific caution readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the

forward-looking information. Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving Thermo

Electron and Fisher Scientific, including future financial and operating results, the new company’s plans, objectives, expectations and intentions and other statements that are not

historical facts.

Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are set forth in Thermo Electron’s and Fisher Scientific’s

filings with the SEC, including their respective Quarterly Reports on Form 10-Q for the first quarter of 2006. These include risks and uncertainties relating to: the ability to obtain

regulatory approvals of the transaction on the proposed terms and schedule; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any

other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain

relationships with customers, employees or suppliers; competition and its effect on pricing, spending, third-party relationships and revenues; the need to develop new products and

adapt to significant techno-logical change; implementation of strategies for improving internal growth; use and protection of intellectual property; dependence on customers’ capital

spending policies and government funding policies; realization of potential future savings from new productivity initiatives; dependence on customers that operate in cyclical industries;

general worldwide economic conditions and related uncertainties; the effect of changes in governmental regulations; exposure to product liability claims in excess of insurance

coverage; and the effect of exchange rate fluctuations on international operations. The parties undertake no obligation to publicly update any forward-looking statement, whether as a

result of new information, future events or otherwise.

Use of Non-GAAP Financial Measures

In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we refer to certain financial measures not prepared in accordance

with GAAP, including adjusted EPS and adjusted operating income, which exclude restructuring and other costs/income and amortization of acquisition-related intangible assets.

Adjusted EPS also excludes certain other gains and losses, tax provisions/benefits related to the previous items, benefits from tax credit carryforwards, the impact of significant tax

audits or events and discontinued operations. We exclude the above items because they are outside of our normal operations and/or, in certain cases, are difficult to forecast

accurately for future periods. We believe that the use of non-GAAP measures helps investors to gain a better understanding of our core operating results and future prospects,

consistent with how management measures and forecasts our performance, especially when comparing such results to previous periods or fore-casts.

Additional Information About this Transaction

In connection with the proposed merger, Thermo Electron will file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 that will include a

joint proxy statement of Thermo Electron and Fisher Scientific that also constitutes a prospectus of Thermo Electron. Thermo Electron and Fisher Scientific will mail the joint proxy

statement/prospectus to their respective stockholders. Investors and security holders are urged to read the joint proxy statement/prospectus regarding the proposed merger when it

becomes available because it will contain important information. You may obtain a free copy of the joint proxy statement/prospectus (when available) and other related documents

filed by Thermo Electron and Fisher Scientific with the SEC at the SEC’s website at www.sec.gov. The joint proxy statement/prospectus (when it is available) and the other

documents may also be obtained for free by accessing Thermo Electron’s website at http://www.thermo.com under the heading “About Thermo” and then under the heading

“Investors” or by accessing Fisher Scientific’s website at http://www.fisherscientific.com under the tab “Investor Info.”

Thermo Electron, Fisher Scientific and their respective directors and executive officers may be soliciting proxies from stockholders in favor of the merger. Information regarding the

persons who may, under the rules of the SEC, be considered participants in the solicitation of the stockholders in connection with the proposed merger will be set forth in the joint

proxy statement/prospectus when it is filed with the SEC. You can find information about Thermo Electron’s executive officers and directors in Thermo Electron’s definitive proxy

statement filed with the SEC on April 11, 2006. You can find information about Fisher Scientific’s executive officers and directors in their definitive proxy statement filed with the SEC

on April 6, 2006. You can obtain free copies of these documents from the Thermo Electron or Fisher Scientific using the contact information above.

2

Combination of Industry Leaders

Accelerates Earnings Growth

Industry transforming

Exciting growth opportunities

World-class capabilities

Compelling financial benefits

3

Transforming Our Industry

Only End-to-End Solutions Provider

Industry Dynamics

Thermo Fisher Solutions

Accelerating Drug Discovery

Pressure to Reduce Costs

Globalization

Regulatory Complexity

Broad Product Offering

Extensive Suite of Services

Integrated Solutions

Global Capabilities

4

Exciting Growth Opportunities

Expanded market access

Expanded products and services offering

Acquisition opportunities

Tremendous Upside for Shareholders

5

World Class Capabilities

Experienced management team

Unparalleled sales and marketing footprint

Extensive R&D capabilities

Global scale

Demonstrated shareholder value creation

Proven Track Record of Success

6

Compelling Financial Benefits

Tremendous Upside for Shareholders

20%+ compound growth in adjusted EPS

18% accretive to 2007 adjusted EPS

$200 million of synergies

Over $1 billion of operating cash flow

7

Transforming Our Company –

Strong Strategic Fit

Complete tool set of customer solutions

Expands reach into high-growth markets and geographies

Unparalleled customer access

Complementary world-class technologies

Opportunity to enhance integrated laboratory workflow solutions

Extensive offering of laboratory support services

Driving Growth at All Levels

8

Transforming Relationships With Customers

Leading Laboratory Provider

Key Strategic Capabilities

Pre-eminent product

brands

Brand Equity

150 years of combined

experience

Proven management team

Experience

Broad product & service

offering

Global capabilities

World class technologies

Capabilities

$9bn revenues

350,000 customers

150 countries

Scale

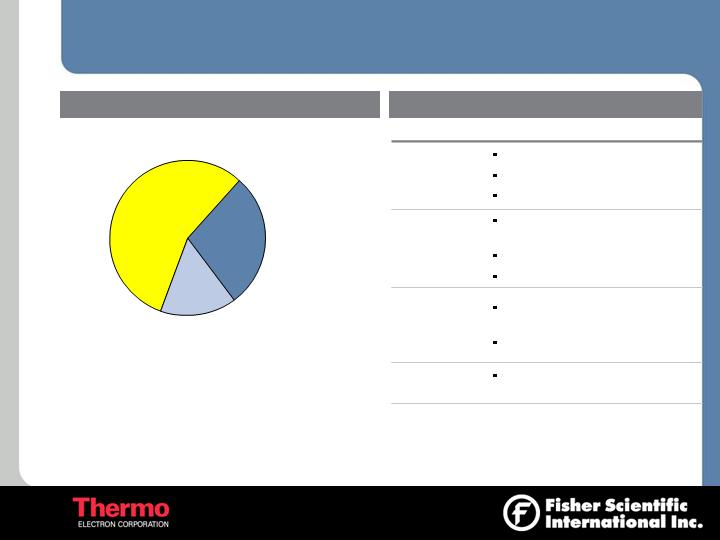

Software & Services

Consumables

Instrumentation

Positioned for Growth

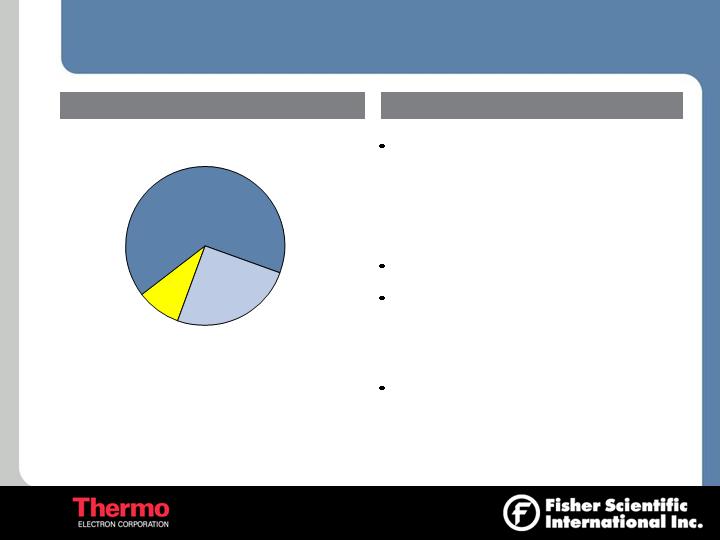

16%

28%

56%

9

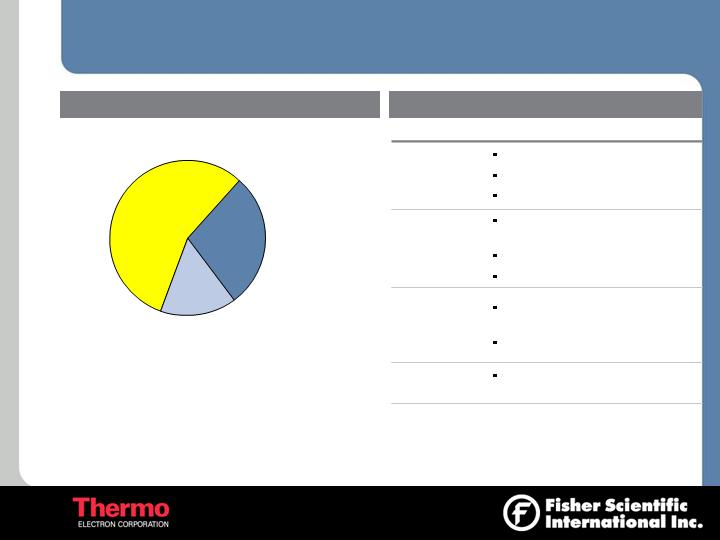

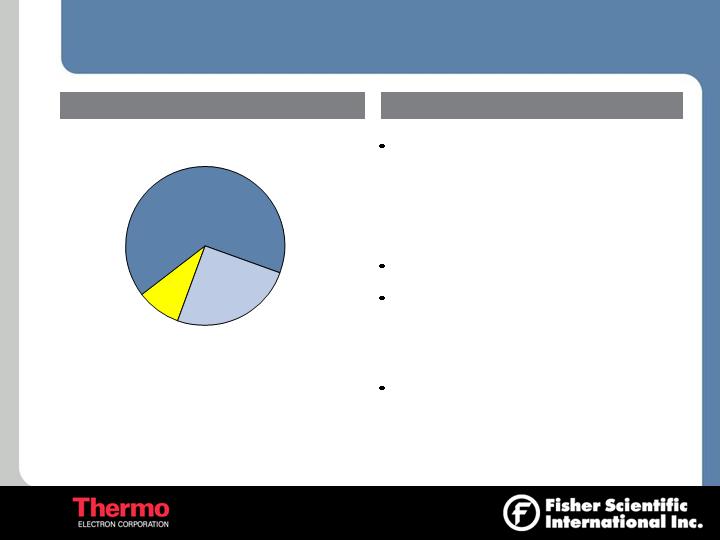

Attractive High Growth Markets

Note: 2005A pro forma revenues; prior to inter-company sales.

Industrial/

Environmental

Life Science

Healthcare

Attractive Growth Opportunities

Customer Base

Exciting Growth Opportunities

36%

19%

45%

Drug Discovery

Proteomics Research

Pharma Services

Molecular Diagnostics

Immunohistochemistry

Environmental Regulatory

Compliance

10

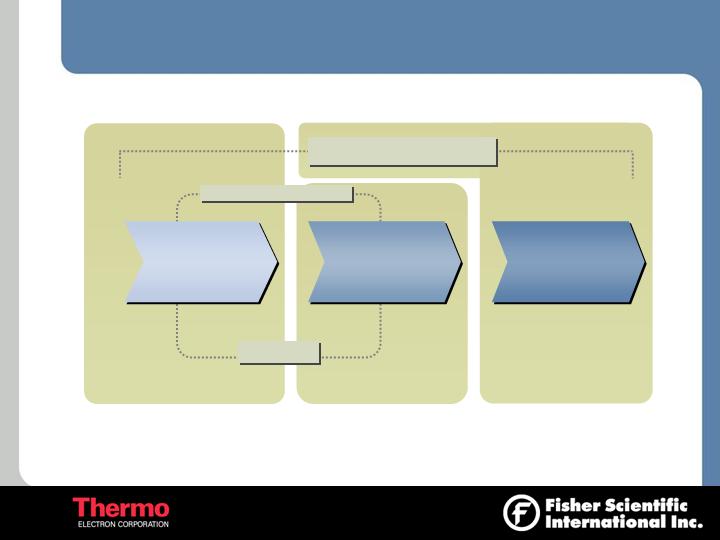

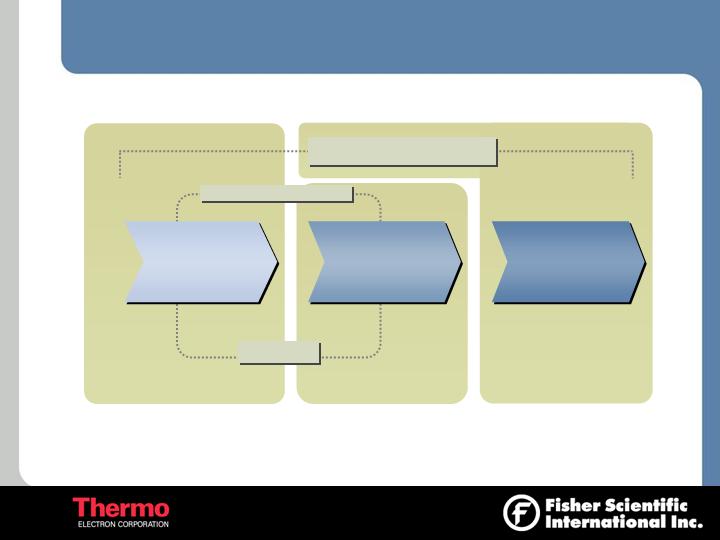

Integrated Workflows

Laboratory Services

Automation

Consumables/Reagents

Sample

Preparation

Sample

Analysis

Data

Interpretation

& Storage

Combination Enhances Workflow Capabilities

11

Integrated Laboratory Workflow Solutions

Data

Interpretation

& Storage

Sample

Preparation

Sample

Analysis

Complementary

Reagents & Consumables

Xcalibur

Biomarker Research Application

Cells or

Tissue

Biomarker

Identified

Fisher

Thermo

12

World Class Portfolio of Services

Positioned to Capitalize on Increased Services Demand

Laboratory Services

Asset management

Regulatory compliance and validation

Equipment maintenance and applications

development

Biopharma Services

Managed R&D services

Clinical trial materials management

Biological specimen management

Diagnostic product formulation

13

Global Leadership

___________________________

Note: 2005A pro forma revenues; prior to inter-company sales.

North America

Asia / ROW

Europe

Unmatched Global Capabilities

Focus on Asian Emerging Markets

Enhanced Presence in Key Geographies

25%

66%

9%

Strong presence in China

- Manufacturing capabilities

- State-of-the-art demo lab

- Over 800 employees

Active sourcing network

Extensive commercial capabilities

- Direct sales/services

- Key account focus

Clinical trials support in India

14

Unparalleled Customer Access

7,500 Sales Representatives

1,500 Field Service

Reps

2,900 Sales

Generalists

1,100

Application

Specialists

2,000 Customer

Service Reps

Superior Capabilities to Accelerate Growth

350,000 Customers Served

150 Countries Served

Leading Brand Names

Superior e-Commerce Platform

15

Revenue Upside Opportunities

Integrated Solutions

Life Science Research / Healthcare Convergence

Emerging Markets

Industry Leadership Driving Upside Growth

16

$200 Million of Synergies

$150 Million Cost Savings

Rationalize manufacturing operations

Leverage combined purchasing power

Consolidate administrative activities

$50 Million Revenue Opportunities

Cross-selling

Enhanced geographic reach

Penetration of new and existing markets

New solutions development

At least $75 Million in 2007

17

Transaction Overview

18

Transaction Terms

Fourth Quarter of 2006

Timing:

Waltham, Massachusetts

Shareholders and Regulatory

Headquarters:

Customary Approvals:

Chief Executive Officer: Marijn Dekkers

Management:

Chairman of the Board: Paul Meister

Thermo: 5 Directors

Fisher: 3 Directors

Board Composition:

Thermo: 39%

Fisher: 61%

Pro Forma Ownership:

2.00 Thermo shares for each Fisher share

Purchase Consideration:

19

Combined Financial Strength

$2.27 - $2.37

Adjusted EPS

(including FAS 123R)

Over $1 billion

$1.5 - $1.6 billion

17%

$9.2 - $9.3 billion

2007

Operating Cash Flow

Adjusted Operating Income

% Margin

Revenue

___________________________

Note: Revenues exclude inter-company sales.

Note: Adjusted results are Non-GAAP measures and exclude amortization of acquisition-related intangible assets, restructuring and other costs. In addition to the financial

measures prepared in accordance with generally accepted accounting principles (GAAP), we refer to certain financial measures not prepared in accordance with GAAP,

including adjusted EPS and adjusted operating income, which exclude restructuring and other costs/income and amortization of acquisition-related intangible assets. Adjusted

EPS also excludes certain other gains and losses, tax provisions/benefits related to the previous items, benefits from tax credit carryforwards, the impact of significant tax audits

or events and discontinued operations. We exclude the above items because they are outside of our normal operations and/or, in certain cases, are difficult to forecast

accurately for future periods. We believe that the use of non-GAAP measures helps investors to gain a better understanding of our core operating results and future prospects,

consistent with how management measures and forecasts our performance, especially when comparing such results to previous periods or forecasts.

20

Longer-term Financial Goals

18 – 20%

Adjusted EPS Growth

19 – 20%

6 - 8%

Adjusted Operating Margin

Organic Revenue Growth

Tremendous Upside for Shareholders

21

The New Thermo Fisher Scientific

Delivering Enhanced Shareholder Value

Combination of complementary industry leaders

Strong track records

Compelling financial benefits

22

Thermo Fisher Scientific Inc.

Creating the Global Leader in the Life,

Laboratory and Health Sciences Industry

May 8, 2006