- TMO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Thermo Fisher Scientific (TMO) DEF 14ADefinitive proxy

Filed: 7 Apr 20, 8:30am

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

| • | Innovating to launch new high-impact products |

| • | Leveraging our leading scale in high-growth and emerging markets, and |

| • | Enhancing our unique customer value proposition. |

| * | Adjusted earnings per share (“EPS”) is a financial measure that is not prepared in accordance with generally accepted accounting principles (“GAAP”). Appendix A to this proxy statement defines this and other non-GAAP financial measures and reconciles them to the most directly comparable historical GAAP financial measures. |

| Date & Time Wednesday, May 20, 2020 1:00 p.m. (Eastern Time) |  | Location* http://www.virtualshareholdermeeting.com/ TMO2020 |  | Record Date March 27, 2020 |

| Proposals | Board Recommendation | For Further Details | ||

| Proposal 1: Elect as directors the 12 nominees named in our proxy statement | FOR each nominee | Page 11 | ||

| Proposal 2: Vote on an advisory resolution to approve executive compensation | FOR | Page 37 | ||

| Proposal 3: Ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent auditors for 2020 | FOR | Page 69 | ||

| Shareholders will also consider any other business properly brought before the meeting. | ||||

| * | In light of the novel coronavirus, or COVID-19, outbreak, for the health and well-being of our shareholders, employees and directors, we have determined that the 2020 Annual Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. At our virtual Annual Meeting, shareholders will be able to attend, vote and submit questions by visiting www.virtualshareholdermeeting.com/TMO2020. Further information about how to attend the annual meeting online, vote your shares online during the meeting and submit questions during the meeting is included in the accompanying proxy statement. |

|  |  | ||

Via the Internet Visit the website listed on your Notice of Internet Availability, proxy card or voting instruction form | By Telephone Call the telephone number on your proxy card or voting instruction form | By Mail Sign, date and return your proxy card or voting instruction form in the enclosed envelope | ||

| Please refer to the enclosed proxy materials or the information forwarded by your bank, broker, trustee or other intermediary to see which voting methods are available to you. | ||||

| 1 | |

| 1 | |

| 3 | |

| 4 | |

| 4 | |

| 5 | |

| 5 | |

| 6 | |

| 11 | |

| 11 | |

| 12 | |

| 18 | |

| 26 | |

| 29 | |

| 32 | |

| 34 | |

| 35 | |

| 37 | |

| 37 | |

| 38 | |

| 55 | |

| 56 | |

| 68 | |

| 69 | |

| 69 | |

| 69 | |

| 70 | |

| 71 | |

| 72 | |

| 72 | |

| 73 | |

| 74 | |

| 75 | |

| 75 | |

| 75 | |

| 76 | |

| 78 | |

| 79 | |

| 79 | |

| 79 | |

| 79 | |

| 80 | |

| 80 |

| Date & Time Wednesday, May 20, 2020 1:00 p.m. (Eastern Time) |  | Location* http://www.virtualshareholdermeeting.com/ TMO2020 |  | Record Date March 27, 2020 |

| * | In light of the novel coronavirus, or COVID-19, outbreak, for the health and well-being of our shareholders, employees and directors, we have determined that the 2020 Annual Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. At our virtual Annual Meeting, shareholders will be able to attend, vote and submit questions by visiting www.virtualshareholdermeeting.com/TMO2020. Further information about how to attend the annual meeting online, vote your shares online during the meeting and submit questions during the meeting is included in the proxy statement. |

2020 Proxy Statement  thermofisher.com thermofisher.com | 1 |

| Healthier | Cleaner | Safer |

|  |  |

| Honor commitments, communicate openly and demonstrate the highest ethical standards |

| Be determined to deliver results with speed, excellence and a passion to succeed | |

| Create value by transforming knowledge and ideas into differentiated products and services for our customers | |

| Make connections to work as one global team, embracing unique perspectives and treating others with dignity and respect |

| 2 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

In 2019, our team executed well to capture the many opportunities we saw in our markets and deliver another year of excellent revenue and earnings growth: • Revenue grew 5% to $25.54 billion • GAAP diluted EPS increased 27% to $9.17 and adjusted EPS* increased 11% to $12.35 • GAAP operating income grew by 21% to $4.59 billion and adjusted operating income* grew by 6% to $5.97 billion • And we generated free cash flow* of $4.08 billion |

We also continued to effectively deploy our capital in 2019 to create significant shareholder value by: • Deploying $1.8 billion to complete strategic acquisitions, including viral vector manufacturer Brammer Bio and a GlaxoSmithKline (“GSK”) active pharmaceutical ingredient manufacturing site in Ireland • Returning capital of $1.8 billion through $1.5 billion of stock buybacks and $300 million of dividends • Refinancing $5.6 billion of debt to generate $80 million of savings annually |

| We became a stronger partner for our customers by continuing to successfully execute our growth strategy, which consists of three pillars: | ||||||

• High-impact innovation: We invested $1 billion in R&D in 2019 and launched a range of new products that strengthened our offering. Some highlights include the Thermo Scientific Orbitrap Exploris 480 and Eclipse mass spectrometers, Thermo Scientific Krios G4 cryo- electron microscope, Applied Biosystems QuantStudio 6 and 7 Pro real-time PCR systems, the addition of numerous allergens to the Thermo Scientific ImmunoCAP ISAC menu and, our new Ion Torrent Genexus next-generation sequencing instrument. | • Scale in high-growth and emerging markets: We built on our industry-leading scale in emerging and high-growth markets in 2019 to showcase our depth of capabilities for customers, including opening new solution centers in Seoul and Shanghai for life sciences applications, Beijing and Delhi for improving food quality and safety and a new Pharma and Biotech Customer Solution Center in Shanghai to accelerate development of new drug therapies. | • Unique customer value proposition: Our success here is most apparent in the way we serve our pharma and biotech customers. We are building an offering of products and services that support them from the discovery of a molecule in the research lab all the way to manufacturing a commercial medicine. We added new capabilities through internal investments in R&D and capacity expansions, and also through strategic bolt-on acquisitions, like Brammer Bio and the GSK facility in Ireland. | ||||

All of these achievements are designed to make Thermo Fisher Scientific a stronger partner for our customers. And when we help them achieve their goals, society benefits. Here are some recent examples: • To meet growing demand for non-opioid pain medications, we are supporting a biotech company in the manufacture of an innovative pain reliever. • Our mass spectrometers are helping the FOSSIL Institute in Brazil study the effects of climate change. • We are supplying our customers around the world who are battling the coronavirus with instruments, assays and safety gear to support virus identification, rapid vaccine development and the protection of citizens. • Within weeks of the first case of the coronavirus in the U.S., the Food and Drug Administration issued emergency use authorization for production of millions of our diagnostic tests. Optimized for our real-time PCR instruments and using our master mixes and sample prep platforms and kits, these tests provide accurate results to medical personnel within four hours, enabling the U.S. and other governments to meet surging demand. |

| * | Adjusted EPS, adjusted operating income and free cash flow are financial measures that are not prepared in accordance with GAAP. Appendix A to this proxy statement defines these non-GAAP financial measures and reconciles them to the most directly comparable historical GAAP financial measures. |

2020 Proxy Statement  thermofisher.com thermofisher.com | 3 |

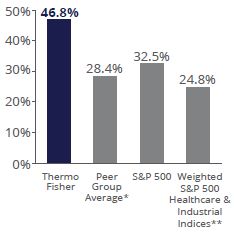

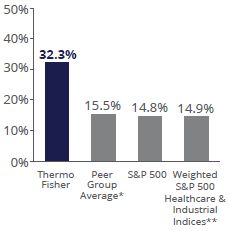

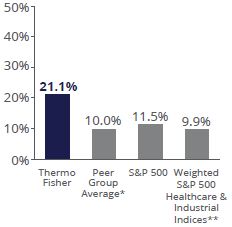

1-Year  | 3-Year  | 5-Year  |

| * | Represents average TSR of companies included in our “Peer Group.” See page 40 for list of companies. |

| ** | Represents average TSR of the S&P’s 500 Healthcare and S&P’s 500 Industrial Indices, weighted 80/20, respectively, to approximate the split of our revenue by end market. |

| Board refreshment remains a key area of focus for us, most recently evidenced by the recent addition of Debora Spar to our Board. |

| Our Bylaws provide for proxy access by shareholders. |

| All of our directors are elected annually. |

In uncontested elections, our directors must be elected by a majority of the votes cast, and an incumbent director who fails to receive such a majority is required to tender his/her resignation. |

Our shareholders have the right to act by written consent. |

| 4 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

|  |  |  |

Deliberate, Assess, and Prepare ・Our Board assesses and monitors: - investor sentiment - shareholder voting results - trends in governance, executive compensation, human capital management, regulatory, environmental, social, and other matters ・Our Board identifies and prioritizes potential topics for shareholder engagement | Outreach and Engagement ・Management regularly meets with shareholders to actively solicit input on a range of issues, and report shareholder views to our Board ・Management routinely engages with investors individually, as well as at conferences and other forums | |||

Respond ・Our Board responds, as appropriate, with enhancements to policy, practices, and disclosure ・For more information on governance enhancements informed by shareholder input, please see page 36 | Evaluate ・Shareholder input informs our Board’s ongoing process of continually improving governance and other practices ・Our Board and management review shareholder input to identify consistent themes, and research and evaluate any identified issues and concerns |

2020 Proxy Statement  thermofisher.com thermofisher.com | 5 |

| Proposal 1 Election of directors We are asking our shareholders to elect each of the 12 director nominees identified below to serve until the 2021 Annual Meeting of shareholders. The Board recommends a vote FOR each director nominee. | See page 11 |  | |

| Committee Membership | ||||||||

| Director Nominee | Age | Director Since | AC | CC | NCGC | SFC | STC | |

| Marc N. Casper Chairman, President and Chief Executive Officer, Thermo Fisher Scientific | 52 | 2009 | |||||

| Nelson J. Chai Independent Chief Financial Officer, Uber Technologies Inc. | 54 | 2010 | |||||

| C. Martin Harris Independent Associate Vice President of the Health Enterprise and Chief Business Officer, Dell Medical School at the University of Texas at Austin | 63 | 2012 | |||||

| Tyler Jacks David H. Koch Professor of Biology at the Massachusetts Institute of Technology and Director of the David H. Koch Institute for Integrative Cancer Research | 59 | 2009 | |||||

| Judy C. Lewent Independent Former Chief Financial Officer, Merck & Co., Inc. | 71 | 2008 | |||||

| Thomas J. Lynch Independent Chairman of the Board and Former Chief Executive Officer, TE Connectivity Ltd. | 65 | 2009 | |||||

| Jim P. Manzi Independent Chairman, Stonegate Capital | 68 | 2000 | |||||

| James C. Mullen Independent Former Chief Executive Officer, Patheon N.V. and Former Chief Executive Officer, Biogen Inc. | 61 | 2018 | |||||

| Lars R. Sørensen Independent Former President and Chief Executive Officer, Novo Nordisk A/S | 65 | 2016 | |||||

| Debora L. Spar Independent Professor, Harvard Business School | 56 | 2019 | |||||

| Scott M. Sperling Independent Co-President, Thomas H. Lee Partners, LP | 62 | 2006 | |||||

| Dion J. Weisler Independent Former President and Chief Executive Officer, HP Inc. | 52 | 2017 | |||||

SFC Strategy and Finance STC Science and Technology |

| 6 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

| Independence | Tenure | Age | Diversity | ||||||||||

| Independent | <5 years | 50-60 years | Female | ||||||||||

| 10 |  | 3 |  | 5 |  | 2 | ||||||

| Not independent | 5-8 years | 61-70 years | Ethnically diverse | ||||||||||

| 2 |  | 2 |  | 6 |  | 2 | ||||||

| 9-12 years | >70 years | Born outside of the U.S. | |||||||||||

| 5 |  | 1 |  | 2 | ||||||||

| >12 years | |||||||||||||

| 2 | ||||||||||||

| 9.1 years Average Tenure | 61 years Average Age |

| Strategic Leadership |  | 100% of directors | ||

| CEO Leadership |  | 67% of directors | ||

| Industry Background |  | 67% of directors | ||

| Public Company Board Service |  | 92% of directors | ||

| Financial Acumen and Expertise |  | 75% of directors | ||

| International Experience |  | 92% of directors | ||

| Senior Management Leadership |  | 92% of directors | ||

| Corporate Finance and M&A Experience |  | 83% of directors |

2020 Proxy Statement  thermofisher.com thermofisher.com | 7 |

| Proposal 2 Approval of an advisory vote on executive compensation We are asking our shareholders to cast a non-binding, advisory vote on the compensation of the executive officers named in the Summary Compensation Table. In evaluating this year’s “say on pay” proposal, we recommend that you review our Compensation Discussion and Analysis, which explains how and why the Compensation Committee of our Board arrived at its executive compensation actions and decisions for 2019. The Board recommends a vote FOR this proposal. | See page 37 |  | |

| 8 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

| • | In February 2019, the Compensation Committee approved increases to base salaries ranging from 0.0% - 6.2% for our Named Executive Officers. |

| • | In February 2019, the Compensation Committee approved an increase to the CFO’s target bonus opportunity. |

| • | In February 2020, the Compensation Committee approved annual cash incentive payouts (for 2019 performance) ranging from 100% – 135% of target for our Named Executive Officers. |

| • | In February 2020, the Compensation Committee certified achievement of 163% payout on 2019 performance-based restricted stock units and the performance requirements for the third 5-year performance period under the 2017 TSR stock option program. |

What We Do |

What We Don’t Do  No tax gross ups No tax gross ups No plans that encourage excessive risk No plans that encourage excessive risk No guaranteed pay increases No guaranteed pay increases No guaranteed bonuses or equity awards No guaranteed bonuses or equity awards No dividends paid on equity awards prior to vesting No dividends paid on equity awards prior to vesting No hedging or pledging of Company stock No hedging or pledging of Company stock No excessive perquisites No excessive perquisites No pension or SERPs (with the exception of legacy accumulated benefits from acquired companies) No pension or SERPs (with the exception of legacy accumulated benefits from acquired companies) |

2020 Proxy Statement  thermofisher.com thermofisher.com | 9 |

| Proposal 3Ratification of the selection of the independent auditorsWe are asking our shareholders to ratify our Audit Committee’s selection of PricewaterhouseCoopers LLP (“PwC”) to act as the independent auditors for Thermo Fisher for 2020. Although our shareholders are not required to approve the selection of PwC, our Board believes that it is advisable to give our shareholders an opportunity to ratify this selection. The Board recommends a vote FOR this proposal. | See page 69 |  | |

| 10 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

2020 Proxy Statement  thermofisher.com thermofisher.com | 11 |

| 12 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

| Casper | Chai | Harris | Jacks | Lewent | Lynch | Manzi | Mullen | Sørensen | Spar | Sperling | Weisler | ||

| Strategic Leadership Experience driving strategic direction and growth of an organization | ||||||||||||

| CEO Leadership Experience serving as the Chief Executive Officer of a major organization | ||||||||||||

| Industry Background Knowledge of or experience in the Company’s specific industry | ||||||||||||

| Public Company Board Service Experience as a board member of another publicly-traded company | ||||||||||||

| Financial Acumen and Expertise Experience or expertise in financial accounting and reporting or the financial management of a major organization | ||||||||||||

| International Experience Experience doing business internationally | ||||||||||||

| Senior Management Leadership Experience serving in a senior leadership role of a major organization (e.g., Chief Financial Officer, General Counsel, President, or Division Head) | ||||||||||||

| Corporate Finance and M&A Experience Experience in corporate lending or borrowing, capital market transactions, significant mergers or acquisition, private equity, or investment banking |

2020 Proxy Statement  thermofisher.com thermofisher.com | 13 |

Marc N. Casper Chairman, President and CEO | Professional Highlights • Thermo Fisher Scientific Inc. - Chairman, President and CEO (2020 - Present) - President and CEO (2009 - 2020) - Executive VP and COO (2008 - 2009) - Executive VP (2006 - 2008) Other current directorships: USBancorp |

Age: 52 Director since: 2009 Committees: Strategy and Finance, Science and Technology | Director Qualifications As the only member of the Company’s management to serve on the Board, Mr. Casper contributes a deep and valuable understanding of Thermo Fisher history and day-to-day operations. This contribution is stemmed further from Mr. Casper’s 20-plus years in the life sciences and healthcare equipment industry, and his long standing employment with the Company. Additionally, Mr. Casper’s experience as the Chief Executive Officer of the Company, and previously serving in various senior level management roles, enables him to provide strategic leadership skills and financial acumen and expertise that are invaluable to the Board. |

Nelson J. Chai Independent | Professional Highlights • CFO, Uber Technologies Inc. (2018 - Present) • President and CEO, The Warranty Group (2017 - 2018) • President, CIT Group (2011 - 2015) Other current directorships: None |

Age: 54 Director since: 2010 Committees: Audit (Chair), Nominating and Corporate Governance | Director Qualifications Mr. Chai’s broad background and experience makes him a suitable and valued member of our Board. Mr. Chai has held executive management positions in a variety of industries and organizations, including his current role as Chief Financial Officer of Uber Technologies Inc., a ridesharing company, and prior roles as President and CEO of The Warranty Group, a provider of specialty insurance products, and President of CIT Group, a financial institution. As a result of his vast background, Mr. Chai brings valuable CEO and strategic leadership, financial acumen and expertise, and accounting experience to our Board. |

| 14 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

C. Martin Harris Independent | Professional Highlights • Associate VP and Chief Business Officer, University of Texas Austin, Dell Medical School (2016 - Present) • Cleveland Clinic Hospital - Chief Strategy Officer, The Cleveland Clinic Foundation (2009 - 2016) - Chief Information Officer and Chairman, Information Technology Division (1996 - 2016) - Staff Physician, Foundation Department of General Internal Medicine (1996 -2016) |

Age: 63 Director since: 2012 Committees: Nominating and Corporate Governance, Science and Technology | Director Qualifications Dr. Harris provides valuable insight and perspective on the healthcare industry stemming from his current role as Chief Business Officer of Dell Medical School of the University of Texas, Austin, and his previous long-standing career as a physician and Chief Information Officer of Cleveland Clinic Hospital, and Chief Strategy Officer of the Cleveland Clinic Foundation. Dr. Harris has been a strategic leader in healthcare organizations, and also brings valuable board-level experience from his many years served on public company boards in the healthcare industry, including his service on various committees, including the Audit, Nominating and Corporate Governance, and Compensation Committees. |

Tyler Jacks Independent | Professional Highlights • Investigator, Howard Hughes Medical Institute (2002 - Present) • Massachusetts Institute of Technology, Koch Institute - Director, Center for Cancer Research (2001 - Present) - Professor, Department of Biology and Center for Cancer Research (2000 - Present) Other current directorships: Amgen, Inc. |

Age: 59 Director since: 2009 Committees: Strategy and Finance, Science and Technology (Chair) | Director Qualifications Dr. Jacks brings to the Board the benefits of his significant experience of many years in the cancer research industry. He has worked for 20 years at Massachusetts Institute of Technology, as director of the Koch Institute, a cancer research center and as a professor in the Department of Biology. Dr. Jacks brings valuable board-level and industry specific experience from his years serving on public company boards in the biotechnology industry and as a member of multiple scientific advisory boards of biotechnology companies, pharmaceutical companies and academic institutions, including his service on various committees, such as the Audit, Compensation and Management Development, Corporate Responsibility and Compliance, and Nominating and Corporate Governance Committees. |

Judy C. Lewent Independent | Professional Highlights • Merck & Co., Inc. - Chief Financial Officer (1990 - 2007) - Executive VP (2001 - 2007) - President, Human Health Asia (2003 - 2005) Other current directorships: Motorola Solutions, Inc. and GlaxoSmithKline plc. |

Age: 71 Director since: 2008 Committees: Strategy and Finance (Chair) | Director Qualifications Ms. Lewent’s nearly 20 years in executive management roles at Merck & Co., Inc., a global pharmaceutical company, enables her to bring valuable experience in a highly regulated industry to the Board. With her experience as the former Chief Financial Officer and Executive Vice President of Merck, Ms. Lewent brings financial acumen and expertise, strategic leadership skills and international experience to the Board. Ms. Lewent also brings valuable board-level experience from her many years served on public company boards, including her service on various committees, such as the Audit, Nominating and Corporate Governance, Remuneration, Risk, and Science Committees. |

2020 Proxy Statement  thermofisher.com thermofisher.com | 15 |

Thomas J. Lynch Independent | Professional Highlights • TE Connectivity, Ltd. - Chairman (2013 - Present) (Director since 2006) - Chief Executive Officer (2006 - 2017) Other current directorships: TE Connectivity Ltd., Cummins Inc. and Automatic Data Processing, Inc. |

Lead Director Age: 65 Director since: 2009 Committees: Compensation | Director Qualifications Mr. Lynch’s many years as the former Chief Executive Officer of TE Connectivity Ltd., a comparably-sized global company in the consumer electronics industry, enables him to bring valuable experience to the Board, such as strategic leadership skills, financial expertise, and international experience. Mr. Lynch also brings valuable board-level experience from his service on public company boards including his service on various committees, such as the Audit, Finance, Compensation, Governance and Nominating, and Corporate Development and Technology Advisory Committees. |

Jim P. Manzi Independent | Professional Highlights • Chairman, Stonegate Capital (1995 - Present) • Chairman, President and CEO, Lotus Development Corporation (1984 - 1995) Other current directorships: None |

Age: 68 Director since: 2000 Previous Chairman: From 2007 to February 2020 and from 2004 to 2006 Committees: Compensation | Director Qualifications Mr. Manzi brings to the Board valuable strategic leadership skills, operational management expertise and overall business acumen, as a result of his senior-level management experience leading Lotus Development Corporation, as Chief Executive Officer, prior to its acquisition, and his current role as Chairman of Stonegate Capital, a private equity firm. Mr. Manzi also brings valuable knowledge of the Company due to his 20 years as a member of our Board, which we believe provides our Board with specific expertise and insight into our business. |

James C. Mullen Independent | Professional Highlights • Chief Executive Officer, Patheon N.V. (2011 - 2017) • Chief Executive Officer, Biogen Inc. (2000 - 2010) Other current directorships: Editas Medicine Inc. Previously held directorships: Insulet Inc. |

Age: 61 Director since: 2018 Committees: Strategy and Finance | Director Qualifications Mr. Mullen brings valuable industry knowledge to the Board, due to his 35 years of extensive management experience and his senior leadership background in the pharmaceutical and biotechnology industries. Mr. Mullen served as Chief Executive Officer of Patheon, a pharmaceutical contract development and manufacturing organization, prior to its acquisition by the Company in 2017, and as Chief Executive Officer of Biogen, Inc. We believe this experience provides our Board with specific expertise and insight into our business. Mr. Mullen also brings valuable board-level experience from his service on the boards of public companies in the pharmaceutical industry, including his service on various committees, such as the Compensation and Nominating and Corporate Governance Committees. |

| 16 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

Lars R. Sørensen Independent | Professional Highlights • President and CEO, Novo Nordisk A/S (2000 - 2017) Other current directorships: Essity Aktiebolag Previously held directorships: Carlsberg AS |

Age: 65 Director since: 2016 Previously served as a director: 2011 - 2015 Committees: Nominating and Corporate Governance (Chair), Strategy and Finance | Director Qualifications Mr. Sorensen brings to the Board valuable strategic leadership skills, financial expertise, industry background, and international experience as a result of his long-standing tenure as Chief Executive Officer at Novo Nordisk A/S, a global healthcare company. Mr. Sorensen also brings valuable board-level experience from his years of serving on public company boards in the life sciences industry, including his service on various committees, such as the Audit, Nominating, and Remuneration Committees, |

Debora L. Spar Independent | Professional Highlights • Professor, Harvard Business School (2018 - Present) • President and CEO, Lincoln Center for the Performing Arts (2017 - 2018) • President of Barnard College (2008 - 2017) Other current directorships: None |

Age: 56 Director since: 2019 Committees: Audit | Director Qualifications Dr. Spar brings to the Board valuable executive management and strategic leadership skills, financial expertise, and a unique perspective on technology’s role in shaping society and the global economy. Dr. Spar also brings valuable experience serving on various committees, such as the Audit, Compensation, Nominating and Corporate Governance, and Strategy Committees. |

Scott M. Sperling Independent | Professional Highlights • Co-President, Thomas H. Lee Partners, LP (1994 - Present) Other current directorships: Agiliti Health, Inc., iHeart Media, Inc. and The Madison Square Garden Company |

Age: 62 Director since: 2006 Committees: Compensation, Strategy and Finance | Director Qualifications Mr. Sperling brings to the Board valuable strategic leadership skills, and corporate finance and acquisition experience due to his current role serving as Co-President of Thomas H. Lee Partners LP., a private equity firm. Mr. Sperling also brings valuable board-level experience from serving on public company boards, including his service on the Nominating and Corporate Governance Committees. |

2020 Proxy Statement  thermofisher.com thermofisher.com | 17 |

Dion J. Weisler Independent | Professional Highlights ・ President and CEO, HP Inc. (2015 - 2019) Other current directorships: HP, Inc. |

Age: 52 Director since: 2017 Committee: Audit, Compensation (Chair) | Director Qualifications Mr. Weisler brings to the Board valuable strategic and senior management leadership skills, financial expertise, international experience, and M&A experience due to his former role serving as Chief Executive Officer at HP Inc., an information technology company. Mr. Weisler also brings valuable board-level experience from his service on HP Inc.’s board. |

・ | leading meetings of the non-management or independent directors; |

・ | presiding over meetings of the Board at which the Chairman is not present; |

・ | calling meetings of non-management or independent directors; |

・ | approving meeting agendas for the Board; |

・ | approving meeting schedules to help ensure sufficient time for discussion; |

・ | serving as a liaison between independent directors and the Chairman; however, each director remains free to communicate directly with the Chairman; and |

・ | being available to meet with shareholders as appropriate. |

| 18 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

・ | The Board’s guidelines. For a director to be considered independent, the Board must determine that he or she does not have any material relationship with the Company. The Board has adopted the following standards to assist it in determining whether a director has a material relationship with the Company, which can be found in the Company’s Corporate Governance Guidelines, on the Company’s website at www.thermofisher.com. Under these standards, a director will not be considered to have a material relationship with the Company if he or she is not: |

・ | A director who is (or was within the last three years) an employee, or whose immediate family member is (or was within the last three years) an executive officer, of the Company; |

・ | A director who is a current employee or greater than 10% equity owner, or whose immediate family member is a current executive officer or greater than 10% equity owner, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues; |

・ | A director who has received, or whose immediate family member has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

・ | A director who is, or whose immediate family member is, a current partner of a firm that is the Company’s internal or external auditor; a director who is a current employee of a firm that is the Company’s internal or external auditor; a director whose immediate family member is a current employee of a firm that is the Company’s internal or external auditor and personally works on the Company’s audit; or a director who was, or whose immediate family member was, within the last three years (but is no longer) a partner or employee of a firm that is the Company’s internal or external auditor and personally worked on the Company’s audit within that time; |

・ | A director who is (or was within the last three years), or whose immediate family member is (or was within the last three years), an executive officer of another company where any of the Company’s current executive officers at the same time serve or served on the other company’s compensation committee; |

・ | A director who is (or was within the last three years) an executive officer or greater than 10% equity owner of another company that is indebted to the Company, or to which the Company is indebted, in an amount that exceeds one percent (1%) of the total consolidated assets of the other company; and |

・ | A director who is a current executive officer of a tax exempt organization that, within the last three years, received discretionary contributions from the Company in an amount that, in any single fiscal year, exceeded the greater of $1 million or 2% of such tax exempt organization’s consolidated gross revenues. (Any automatic matching by the Company of employee charitable contributions will not be included in the amount of the Company’s contributions for this purpose.) |

・ | Applying the guidelines in 2019. In assessing director independence for 2019, the Board considered relevant transactions, relationships and arrangements, including relationships between Board members and the Company. For details, see “Relationships and transactions considered for director independence” below. |

2020 Proxy Statement  thermofisher.com thermofisher.com | 19 |

・ | Additional standards for Audit Committee members. Under a separate SEC independence requirement, Audit Committee members may not accept any consulting, advisory or other fees from the Company, except compensation for Board service, and cannot be an affiliate of the Company. |

・ | Additional standards for Compensation Committee members. In determining that Compensation Committee members are independent, NYSE rules require the Board to consider their sources of compensation, including any consulting, advisory or other compensation paid by the Company. |

Thermo Fisher Transaction & 2019 Magnitude | ||||

Director nominee | Organization | Relationship | Purchases from Thermo Fisher Less than the greater of 2% of the other company’s revenue and $1m | Sales to Thermo Fisher Less than the greater of 2% of the other company’s revenue and $1m |

| Chai | Uber Technologies Inc. | CFO | N/A | |

Harris | University of Texas | Executive | N/A | |

Jacks(2) | Howard Hughes Medical Institute(1) | Investigator | N/A | |

| Massachusetts Institute of Technology | Professor and Director of David H. Koch Institute of Integrative Research | N/A | ||

| Dragonfly Therapeutics, Inc.(3) | Greater than 10% equity owner | N/A | ||

Spar | Harvard University | Professor | N/A | |

Weisler | HP Inc. | CEO & Director(4) | ||

| (1) | The Company’s 2019 sales to Howard Hughes Medical Institute (“HHMI”) represented approximately 5% of HHMI’s 2019 consolidated gross revenues. |

| (2) | As a result of his relationships with HHMI and Dragonfly, Dr. Jacks is not deemed independent under the Company’s Corporate Governance Guidelines. |

| (3) | The Company’s 2019 sales to Dragonfly Therapeutics, Inc. (“Dragonfly”) represented approximately 5% of Dragonfly’s 2019 consolidated gross revenues. |

| (4) | Mr. Weisler ceased to serve as CEO, effective October 31, 2019. |

20 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

Key responsibilities of the Board | ||||||

Oversight of strategy | Oversight of risk | Succession planning | ||||

• The Board oversees and monitors strategic planning • Business strategy is a key focus at the Board level and embedded in the work of Board committees • Company management is charged with developing and executing business strategy and provides regular performance updates to the Board | • The Board oversees risk management • Board committees, which meet regularly and report back to the full Board, play significant roles in carrying out the risk oversight function • Company management is charged with managing risk, through robust internal processes and effective internal controls | • The Board oversees succession planning and talent development for senior executive positions • The Compensation Committee, which meets regularly and reports back to the Board, has primary responsibility for developing succession plans for the CEO position • The CEO is charged with preparing, and reviewing with the Compensation Committee, talent development plans for senior executives and their potential successors | ||||

The Board is committed to oversight of the Company’s business strategy and strategic planning, including work embedded in the Board committees, regular Board meetings and a dedicated meeting each year to focus on strategy. | This ongoing effort enables the Board to focus on Company performance over the short, intermediate and long term, as well as the quality of operations. In addition to financial and operational performance, non- financial measures are discussed regularly by the Board and Board committees. |

2020 Proxy Statement  thermofisher.com thermofisher.com | 21 |

・ | understand critical risks in the Company’s business and strategy; |

・ | allocate responsibilities for risk oversight among the full Board and its committees; |

・ | evaluate the Company’s risk management processes and whether they are functioning adequately; |

・ | facilitate open communication between management and Directors; and |

・ | foster an appropriate culture of integrity and risk awareness. |

22 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

| Audit Committee | |||

Nelson J. Chai (Chair) Members Debora L. Spar Dion J. Weisler Meetings in 2019: 12 • All members are independent, financially literate. • Two members qualify as Audit Committee financial experts. | Principal Responsibilities The Audit Committee is responsible for: ・assisting the Board in its oversight of the integrity of the Company’s financial statements; ・overseeing the Company’s compliance with legal and regulatory requirements; ・assessing the independent auditor’s qualifications and independence; ・overseeing the performance of the Company’s internal audit function and independent auditors; ・discussing with management the Company’s policies with respect to risk assessment and risk management, including guidelines and policies to govern the process by which the Company’s exposure to risk is handled; ・discussing with management the Company’s major financial risk exposures and steps management has taken to monitor and control such exposures; ・overseeing procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters; and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; and ・reviewing cybersecurity and other risks relevant to the Company’s information system controls and security. Certain responsibilities of our Audit Committee and its activities during 2019 are described in the Report of the Audit Committee in this proxy statement under the heading “Audit Committee report.” 2019 Key Activities ・ Received updates on calls received on the Company’s whistleblower hotline ・ Received updates on cybersecurity ・ Received updates on emerging markets ・ Received an update on outstanding litigation and environmental matters and reviewed the appropriateness of related reserves ・ Adopted a new hiring policy for former employees of our Independent Auditor |

| Cybersecurity oversight The Board recognizes the importance of maintaining the trust and confidence of our customers and employees. To more effectively prevent, detect and respond to information security threats, the Company has a dedicated Chief Information Security Officer whose team is responsible for leading enterprise-wide information security strategy, policy, standards, architecture and processes. Both the Audit Committee and the full Board receive regular reports from the Chief Information Security Officer and the Chief Information Officer on, among other things, the Company’s cyber risks and threats, the status of projects to strengthen the Company’s information security systems, assessments of the Company’s security program and the emerging threat landscape. |

2020 Proxy Statement  thermofisher.com thermofisher.com | 23 |

| Compensation Committee | |||

Dion J. Weisler (Chair) Members Thomas J. Lynch Jim P. Manzi Scott M. Sperling Elaine S. Ullian Meetings in 2019: 7 • All members are independent. | Principal Responsibilities The Compensation Committee is responsible for: ・ reviewing and approving compensation matters with respect to the Company’s chief executive officer and its other officers; ・ reviewing and recommending to the Board management succession plans; ・ administering equity-based plans; and ・ overseeing the process for conducting annual risk assessments of the Company’s compensation policies, programs, and practices. Certain responsibilities of our Compensation Committee and its activities during 2019 are described in this proxy statement under the heading “Compensation discussion and analysis.” The Compensation Committee also biennially reviews our director compensation, and makes recommendations on this topic to the Board as it deems appropriate, as described under the heading “Compensation of directors.” Role of Consultant | ||

| The Compensation Committee has sole authority to retain and terminate a compensation consultant to assist in the evaluation of CEO or senior executive compensation. In 2019, the Committee in its sole discretion retained Pearl Meyer & Partners (“Pearl Meyer”) as its independent compensation consultant. Pearl Meyer does not provide any other services to the Company and the Compensation Committee has determined that Pearl Meyer’s work for the Compensation Committee does not raise any conflict of interest. | |||

| The consultant compiles information regarding the components and mix (short-term/ long- term; fixed/variable; cash/equity) of the executive and director compensation programs of the Company and its peer group (see page 40 of this proxy statement for further detail regarding the peer group), analyzes the relative performance of the Company and the peer group with respect to the financial metrics used in the programs, and provides advice to the Compensation Committee regarding the Company’s programs. The consultant also provides information regarding emerging trends and best practices in executive compensation and director compensation and input on the Company’s proxy disclosures. The Committee considers this information when making decisions about compensation levels and design. | |||

| The consultant retained by the Compensation Committee reports to the Compensation Committee Chair and has direct access to Committee members. The consultant periodically meets with members of the Committee either in person or by telephone. | |||

| In addition, the Committee has access to data from other outside firms, such as market surveys and analyses, to stay informed of developments in the design of compensation packages generally and to understand the officer compensation programs of companies with whom we compete for executive talent to ensure our compensation program is in line with current marketplace standards. | |||

| 2019 Key Activities | |||

・Reviewed compensation programs to ensure the design supports the talent needs of the Company by attracting the talent needed for both today and in the future | |||

| ・Based on shareholder feedback made changes to our annual incentive plan and market references for executive compensation | |||

24 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

| Nominating and Corporate Governance Committee | |||

Lars R. Sørensen (Chair) Members Nelson J. Chai C. Martin Harris Meetings in 2019: 5 • All members are independent. | Principal Responsibilities The Nominating and Corporate Governance Committee is responsible for: ・ identifying persons qualified to serve as members of the Board; ・ recommending to the Board persons to be nominated by the Board for election as directors at the annual meeting of shareholders; ・ recommending to the Board the directors to be appointed to each of its committees; ・ overseeing the Company’s corporate responsibility and sustainability efforts and associated risks; ・ developing and recommending to the Board a set of corporate governance guidelines; and ・ overseeing the annual self-evaluation of the Board. 2019 Key Activities ・ Evaluated potential candidates for future election to the Board and nominated Debora L. Spar for election ・ Reviewed the Company’s corporate social responsibility progress, roadmap and key initiatives in depth during two of its meetings ・ Oversaw the evaluation process for the Board and its committees, which consisted of an in-depth interview of each director by Mr. Sorensen | ||

| Strategy and Finance Committee | |||

Judy C. Lewent (Chair) Members Marc N. Casper Tyler Jacks James C. Mullen Lars Sørensen Scott M. Sperling | Principal Responsibilities The Strategy and Finance Committee is responsible for: ・ overseeing the development of an annual strategic plan for the Company; ・ reviewing significant strategic decisions; and ・ overseeing certain of the Company’s material financial matters, including investments and acquisitions and divestitures that are material to the Company’s business. | ||

| Science and Technology Committee | |||

Tyler Jacks (Chair) Members Marc N. Casper C. Martin Harris | Principal Responsibilities The Science and Technology Committee is responsible for: ・ assisting the Board in staying abreast of new technologies, markets and applications for the Company’s products; ・ overseeing the Company’s Scientific Advisory Board; and ・ monitoring and evaluating trends in science and recommending to the Board emerging technologies for building the Company’s technological strength. | ||

2020 Proxy Statement  thermofisher.com thermofisher.com | 25 |

Evaluation survey Form is sent by the N&CG Committee Chair to each board member to request feedback on various topics |  | One-on-one director discussions Individual calls with the N&CG Committee Chair held with each director to obtain candid feedback |  | Group discussion Discussion of evaluation led by the N&CG Committee Chair and summary of assessment is provided to Board |  | Feedback communicated and acted upon Feedback is provided to management by the N&CG Committee Chair on areas for improvement and changes are implemented |

Board composition, performance, and materials |  | ・ Board composition and performance, including mix of skills, experience, tenure, and background ・ Identification of knowledge, background, and skill-sets that would be useful additions to the Board ・ Board refreshment and succession planning ・ Board materials and management reporting, including the quality of materials and Board member interactions with management | |

Structure and effectiveness |  | ・ Board and committee leadership, responsibilities, and effectiveness ・ Committee structure and functioning, responsibilities, communication, and reporting from committees to the Board ・ Effectiveness of meeting structure | |

Board responsibilities |  | ・ Knowledge of the Company ・ Strategic planning, including the process, format, and materials for the Board’s strategy review sessions ・ Talent management and succession planning for the CEO and other senior management, including diversity and inclusion ・ Candor of communications with the CEO |

26 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

・ | the identity of the presiding director at meetings of non-management or independent directors; |

・ | the method for interested parties to communicate directly with the presiding director or with non-management or independent directors as a group; |

・ | the identity of any member of the Company’s Audit Committee who also serves on the Audit Committees of more than three public companies and a determination by the Board that such simultaneous service will not impair the ability of such member to effectively serve on the Company’s Audit Committee; and |

・ | contributions by the Company to a tax exempt organization in which any non-management or independent director serves as an executive officer if, within the preceding three years, contributions in any single fiscal year exceeded the greater of $1 million or 2% of such tax exempt organization’s consolidated gross revenues. |

・ | Proxy access. Our bylaws provide for proxy access, which permits a shareholder, or a group of up to 20 shareholders, owning 3% or more of Thermo Fisher’s outstanding common stock continuously for at least three years, to nominate and include in our proxy materials qualifying director nominees constituting up to the greater of (i) 20% of the number of directors currently serving or (ii) two nominees. |

・ | Declassified Board of Directors. Our bylaws provide that all of our directors will stand for election for a term expiring at the next annual meeting of shareholders. |

・ | Majority Voting for Election of Directors. Our bylaws provide for a majority voting standard in uncontested director elections, so a nominee is elected to the Board if the votes “for” that director exceed the votes “against” (with abstentions and broker non-votes not counted as for or against the election). If a nominee does not receive more “for” votes than “against” votes, the director must offer his or her resignation, which the Board would then determine whether to accept and publicly disclose that determination. |

2020 Proxy Statement  thermofisher.com thermofisher.com | 27 |

・ | No Hedging or Pledging Policy. We prohibit all hedging and pledging transactions involving Company securities by our directors and officers. |

・ | the related person’s interest in the related person transaction; |

・ | the approximate dollar value of the amount involved in the related person transaction; |

・ | the approximate dollar value of the amount of the related person’s interest in the transaction without regard to the amount of any profit or loss; |

・ | whether the transaction was undertaken in the ordinary course of our business; |

・ | whether the terms of the transaction are no less favorable to the Company than terms that could have been reached with an unrelated third party; |

・ | the purpose of, and the potential benefits to the Company of, the transaction; and |

・ | any other information regarding the related person transaction or the related person in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular transaction. |

28 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

2020 Proxy Statement  thermofisher.com thermofisher.com | 29 |

30 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Option Awards ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other Compensation ($)(2) | Total ($) | |

| Nelson J. Chai | $150,000 | $195,052 | — | — | $15,563 (3) | $360,615 | |

| C. Martin Harris | $125,000 | $195,052 | — | — | $2,063 (4) | $322,115 | |

| Tyler Jacks | $140,000 | $195,052 | — | — | $15,563 (3) | $350,615 | |

| Judy C. Lewent | $140,000 | $195,052 | — | — | $16,125 (5) | $351,177 | |

| Thomas J. Lynch | $140,000 | $195,052 | — | — | $15,563 (3) | $350,615 | |

| Jim P. Manzi | $295,000 | $195,052 | — | — | $15,563 (3) | $505,615 | |

James C. Mullen(6) | $125,000 | $195,052 | — | — | $563 | $320,615 | |

| Lars R. Sørensen | $140,000 | $195,052 | — | — | $563 | $335,615 | |

Debora L. Spar(7) | $39,492 | $— | — | — | $— | $39,492 | |

Scott M. Sperling(8) | $125,000 (9) | $195,052 | — | — | $27,275 (10) | $347,327 | |

| Elaine S. Ullian | $125,000 | $195,052 | — | — | $21,214 (11) | $341,266 | |

| Dion J. Weisler | $125,000 (12) | $195,052 | — | — | $1,718 (13) | $321,770 |

| (1) | These amounts represent the aggregate grant date fair value of stock awards granted to directors in 2019, calculated in accordance with the Company’s financial reporting practices. For information on the valuation assumptions with respect to these awards, refer to note 6 of the Thermo Fisher financial statements in the Form 10-K for the year ended December 31, 2019, as filed with the SEC. These amounts do not represent the actual amounts paid to or realized by the directors for these awards during 2019. In May 2019, each non- management director on the Board at that time received a grant of 718 restricted stock units, having a grant date fair value of $195,052, all of which is included in the “stock awards” column. |

| (2) | These amounts include $563 of dividends accrued in the form of dividend equivalents on restricted stock units held by each non- employee director, except for Dr. Spar, for whom the amount is $0. |

| (3) | Includes matching Company contributions of $15,000 under the Matching Charitable Donation Program for Directors. |

| (4) | Includes matching Company contributions of $1,500 under the Matching Charitable Donation Program for Directors. |

| (5) | Includes matching Company contributions of $15,000 under the Matching Charitable Donation Program for Directors and $563 of Company dividends accrued in the form of dividend equivalents in 2019 on deferred stock units held in the Directors Deferred Compensation Plan. |

| (6) | As a result of the end of his service to Patheon upon the Company’s acquisition of Patheon, Mr. Mullen was entitled to receive severance pay of 24 months’ base salary ($2,200,000 in the aggregate) pursuant to his employment agreement with Patheon, payable in 24 monthly installments following the date of termination. These severance payments, which he continued to receive in monthly installments through August 2019, are not included in the table above because they were not contingent on continued service and related solely to Mr. Mullen’s service prior to the Company’s acquisition of Patheon. |

| (7) | Dr. Spar was elected to the Board effective September 5, 2019. |

| (8) | Does not include amounts paid to Mr. Sperling under the Fisher Retirement Plan for Non-Employee Directors because such amounts relate solely to Mr. Sperling’s service as a director of Fisher prior to the Fisher Merger. |

| (9) | Represents compensation deferred and issued as 425 deferred stock units pursuant to the Directors Deferred Compensation Plan. |

| (10) | Includes matching Company contributions of $15,000 under the Matching Charitable Donation Program for Directors and $11,712 of Company dividends accrued in the form of dividend equivalents in 2019 on deferred stock units held in the Directors Deferred Compensation Plan. |

| (11) | Includes matching Company contributions of $15,000 under the Matching Charitable Donation Program for Directors and $5,651 of Company dividends accrued in the form of dividend equivalents in 2019 on deferred stock units held in the Directors Deferred Compensation Plan. |

| (12) | Represents compensation deferred and issued as 425 deferred stock units pursuant to the Directors Deferred Compensation Plan. |

| (13) | Includes $1,155 of Company dividends accrued in the form of dividend equivalents in 2019 on deferred stock units held in the Directors Deferred Compensation Plan. |

2020 Proxy Statement  thermofisher.com thermofisher.com | 31 |

We take measures to ensure strong global citizenship practices both internally and across all our business relationships. We are committed to conducting our business ethically and in full compliance with our internal systems and the laws of the countries where we operate with rigor around governance and ethics, supply chain transparency, and compliance with environmental, health and safety regulations and quality management standards. |  |

32 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

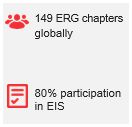

| Our Employee Resource Groups (“ERGs”) - company-supported groups of colleagues - are key partners in attracting, developing and retaining diverse talent to bring an essential variety of experiences and perspectives into our organization. ERGs are championed by an executive sponsor and partner with the D&I team to foster organizational culture, reinforce infrastructure and create personal accountability. We added three new ERGs in 2019: our Asian ERG, Working Parent ERG and Data Science BRG (Business Resource Group) joined the African Heritage, Latino Hispanic Heritage, LGBTA, Millennials, PossAbilities, Women’s and Veterans ERGs. |

2020 Proxy Statement  thermofisher.com thermofisher.com | 33 |

Our efforts to protect the environment start with our own operations. We focus on the efficient use of resources in running our business and reduction of our impact in the communities where we operate. Our commitment to stewardship, culture of continuous improvement and engaged colleagues inspire innovations that reduce the energy and water we consume and the waste we generate. We are committed to reducing our carbon footprint and have set a target to reduce our scope 1 and 2 emissions by 30% by the end of the decade. Our approach to achieving this target is anchored in the framework of process optimization, built environment efficiency and renewable sourcing. |  |

34 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

・ | Providing visibility and transparency into our business, our financial and operational performance and our strategy; |

・ | Determining which issues are important to our shareholders and sharing our views on those issues; and |

・ | Discussing and seeking feedback on our business and our executive compensation and corporate governance policies and practices, and our sustainability initiatives. |

2020 Proxy Statement  thermofisher.com thermofisher.com | 35 |

| What We Learned from our Meetings with Shareholders |

・ Shareholders appreciated being engaged on governance in general and specifically on executive compensation policies and design, corporate governance issues and environmental and social issues, and suggested that we enhance our proxy statement disclosure to provide a better picture of the Company’s practices in these areas. ・ A strong majority of the institutional shareholders we spoke with expressed support for our executive compensation program and generally commented that they viewed it as aligned with performance and shareholder interests. They suggested we enhance our proxy statement disclosure to provide greater transparency on our program. ・ Some investors preferred we target market median in our executive compensation programs and use separate metrics in our short and long term incentive programs, and suggested we explain our reasoning if taking a different approach. ・ Shareholders understand our Mission and the role that our environmental, social and governance (“ESG”) practices play in that. They acknowledged our strong ESG practices and suggested enhancements to the breadth and depth of our disclosures in this area. |

| Governance and Compensation Enhancements Informed by Shareholder Input |

Our Board evaluates and reviews input from our shareholders in considering their independent oversight of management and our long-term strategy. As part of our commitment to constructive engagement with investors, we evaluate and respond to the views voiced by our shareholders. Our dialogue has led to enhancements in our corporate governance, ESG, and executive compensation activities, which our Board believes are in the best interest of the Company and our shareholders. For example, after considering input from shareholders and other stakeholders, we: ・ Enhanced our shareholder engagement efforts to include a greater number of discussions regarding corporate governance, executive compensation and environmental and social issues, including conducting our first “ESG Roadshow” on which management from our investor relations, governance and compensation and corporate social responsibility teams spent several days meeting with shareholders to gather feedback on the Company’s Sustainability program ・ Changed market reference point for compensation paid to our NEOs to median (other than our CEO, for whom the market reference point was already median) ・ Replaced adjusted EPS with adjusted net income as a performance metric in our 2019 annual incentive plan ・ Enhanced our Compensation Discussion and Analysis disclosure to help readers better understand the compensation program features and rationale for metric selection, and to better enable readers to tie the overall business strategy to pay results ・ Enhanced our ESG disclosure by including more detail about our ESG program in our proxy statement ・ Amended our Corporate Governance Guidelines to include the following: ・ a limit on the number of boards on which our directors may sit ・ a requirement that our Nominating and Corporate Governance Committee seek to include diverse candidates including women and minority candidates, in the pool of candidates from which it recommends director nominees ・ an increase in the stock ownership requirement for our CEO and other executive officers ・ Expanded the clawback in our equity awards to allow the Company to recoup compensation in additional circumstances |

36 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

| Approval of an advisory vote on executive compensation Your board of directors recommends a vote FOR approving the compensation of our Named Executive Officers. | |||

2020 Proxy Statement  thermofisher.com thermofisher.com | 37 |

| Named Executive Officer | Title | Date of Appointment to Current Role | Tenure | |

| Marc N. Casper | Chairman, President and Chief Executive Officer | October 2009 | 18 years | |

| Stephen Williamson | Senior Vice President and Chief Financial Officer | August 2015 | 18 years | |

| Mark P. Stevenson | Executive Vice President and Chief Operating Officer | August 2017 | 28 years | |

| Michel Lagarde | Executive Vice President | September 2019 | 4 years | |

| Syed A. Jafry | Senior Vice President | September 2017 | 15 years | |

Patrick M. Durbin(1) | Senior Vice President | October 2015 | 14 years | |

Gregory J. Herrema(2) | Senior Vice President | January 2014 | 18 years |

| (1) | Mr. Durbin’s employment with the Company terminated on October 1, 2019. |

| (2) | Mr. Herrema was no longer an executive officer on December 31, 2019. |

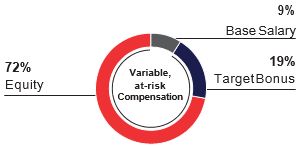

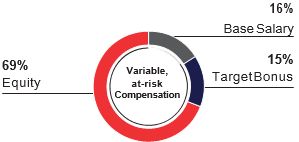

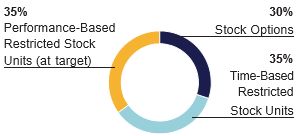

・ | Core elements of compensation comprise base salary, annual cash incentive and long-term incentives delivered in the form of time-based restricted stock units, performance-based restricted stock units and stock options |

・ | Performance measures include organic revenue growth, adjusted operating margin, adjusted net income, adjusted EPS, free cash flow and other drivers of shareholder value creation of strategic significance |

・ | attract and retain the best possible executive talent; |

・ | promote the achievement of key strategic and financial performance; |

・ | motivate long-term value creation; and |

・ | align executive officers’ interests with those of our shareholders. |

・ | competitive positioning of pay versus our peers; |

・ | delivery of a significant portion of pay in the form of variable, at-risk compensation; |

・ | alignment of performance measures with our strategy; |

・ | use of a combination of vehicles that collectively promote the achievement of business results, retention and sustainable long-term value creation; and |

・ | use of stock ownership guidelines, a clawback policy, a stock holding requirement for our CEO, and other risk mitigation tools. |

38 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

Q1 ・ Review of executive bonus pool ・ Review Company and NEO performance and approve year-end compensation (annual bonus and equity programs) ・ Approve annual equity incentive program performance metric selection for current year ・ Approve officer cash compensation (base salary) and target bonus for current year ・ Proxy statement review ・ Conduct annual risk assessment on our global compensation programs and policies | Q2 ・Review proxy advisory firms’ analyses of current proxy statement ・Discuss investor outreach regarding executive compensation ・Propose director equity grants for current year | |

Q4 ・ Committee self-evaluation ・ Committee charter review ・ Equity program and pool review ・ Consider shareholder feedback from outreach discussions | Q3 ・ Management talent and succession plan review and discussion ・ Confirmation of compensation peer group ・ Engagement of independent compensation consultant ・ Review results of executive competitive assessment ・ Confirmation of executive compensation philosophy/review of potential changes |

2020 Proxy Statement  thermofisher.com thermofisher.com | 39 |

| 2019 Peer Group | |||

・ 3M | ・ Becton Dickinson | ・ Eli Lilly | ・ Illinois Tool Works |

・ Abbott Laboratories | ・ Biogen | ・ Emerson Electric | ・ Medtronic |

・ AbbVie | ・ Bristol-Myers Squibb | ・ Gilead Sciences | ・ Merck |

・ Allergan | ・ Danaher | ・ Honeywell International | ・ Texas Instruments |

・ Amgen | ・ Eaton Corporation | ||

40 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

| Base Salary | median |

| Annual Incentive | Not defined |

Target Total Cash(1) | median |

| Target Long-Term Incentive (“LTI”) | Not defined |

Target Direct Compensation(2) | median |

Target Compensation(3) | median |

| (1) | Base salary and target annual incentive |

| (2) | Base salary, target annual incentive and target LTI |

| (3) | Base salary, target annual incentive, target LTI, change in pension value and nonqualified deferred compensation earnings, and all other compensation |

Support long-term view and sustainability of Company | ・Equity compensation in the form of stock options and restricted stock units ・Stock ownership requirement (increased in 2020) ・Stock holding requirement on 50% of shares delivered upon vesting applied to all CEO time- and performance-based restricted stock units |

Ability to take action to affect current and recoup prior compensation | ・Full Committee discretion to reduce awards and payouts under our annual incentive plan and stock incentive plans to zero for certain conduct detrimental to the Company ・Clawback policy (expanded in 2020) |

Committee Oversight | • Annual risk assessment presented to the Committee by General Counsel and VP Executive Compensation ・Assessment considers program design and payouts |

2020 Proxy Statement  thermofisher.com thermofisher.com | 41 |

| Measure | Why It Matters |

| Quantitative | |

| Organic revenue | ・Reflects top line financial performance, which is a strong indicator of our long-term ability to drive shareholder value ・Allows comparison of financial results to both acquisitive and non-acquisitive peer companies ・Prevalent, industry-relevant measure of growth |

| Adjusted net income | ・Reflects achievement of our strategic goals by encouraging efficient operations and resource allocations, in order to maximize earnings relative to the revenue environment ・Ensures all employees can contribute to profitability of the Company |

Adjusted earnings per share (“adjusted EPS”) | ・Prevalent, industry-relevant measure of delivery of shareholder value ・Metric is closely followed by shareholders, analysts and investors |

Adjusted operating income as a percentage of revenue (“adjusted operating margin”) | ・Prevalent, industry-relevant measure of profitability ・Reflects achievement of our strategic goals by encouraging efficient operations and resource allocations, in order to maximize earnings relative to the revenue environment ・Ensures all employees can contribute to profitability of the Company |

| Free cash flow | ・Reflects quality of earnings and incremental cash generated from operations that may be reinvested in our businesses, used to make acquisitions, or returned to shareholders in the form of dividends and/or share repurchases |

Total Shareholder Return | ・Offers clear alignment between the interests of management and shareholders ・Summary indicator of long-term performance ・Relative (as opposed to absolute) nature of goals accounts for macroeconomic factors impacting the broader market |

| Qualitative | |

| Customer allegiance | ・Strong indicator of our long-term ability to drive shareholder value |

Employer of choice/ diversity | ・Ensuring the Company remains focused on attracting and retaining high potential employees and enhancing workforce diversity is important to ensure our ability to execute our other goals |

Positioning for future revenue growth | ・Strong indicator of our long-term ability to drive shareholder value by effectively meeting the needs of our customers in all of the end markets that we serve |

Positioning for future margin expansion | ・Drives strong future profitability |

Effectively execute capital deployment strategy | ・Properly managing the strategic use of capital through acquisitions, dividends, share repurchases and debt repayment is of paramount importance to the Company’s long- term financial health |

| 42 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

| Performance Measure | Definition |

Organic revenue | Reported revenue adjusted for the impact of acquisitions and divestitures and for foreign currency changes |

Adjusted operating income as a percentage of revenue (“adjusted operating margin”) | Operating income before certain charges/credits to cost of revenues and selling, general and administrative expenses, principally associated with acquisition-related activities, restructuring and other costs/income including costs arising from facility consolidations such as severance and abandoned lease expense and gains and losses from the sale of real estate and product lines; and amortization of acquisition-related intangible assets; as a percentage of revenue |

| Adjusted net income | Earnings before certain charges/credits to cost of revenues and selling, general and administrative expenses, principally associated with acquisition-related activities, restructuring and other costs/income including costs arising from facility consolidations such as severance and abandoned lease expense and gains and losses from the sale of real estate and product lines; amortization of acquisition-related intangible assets; and other gains and losses that are either isolated or cannot be expected to occur again with any predictability, tax provisions/ benefits related to the previous items and the impact of significant tax audits or events |

Adjusted earnings per share (“adjusted EPS”) | Adjusted net income per share |

| Free cash flow | Operating cash flow net of capital expenditures |

2020 Proxy Statement  thermofisher.com thermofisher.com | 43 |

| Element | Purpose | Key Features | |

| Base salary | Provide competitive, fixed compensation to attract and retain the best possible executive talent | ・Cash-based ・Reviewed annually; changes effective March/April ・Reference market median for all NEOs ・Takes account of level of responsibility, time in role, performance and the ability to replace the individual | |

Annual cash incentive bonus | Align executive compensation with our corporate strategies and business objectives; promote the achievement of key strategic and financial performance measures by linking annual cash incentives to the achievement of corporate performance goals | ・Cash-based ・Reference market median for all NEOs for target total cash (base salary plus target annual incentive) ・Maximum opportunity 2-times target ・Based on performance goals tied to organic revenue growth, adjusted operating margin, adjusted net income, free cash flow, and a selection of strategic measures | |

Long-term incentives | Align executive compensation with our corporate strategies and business objectives; motivate the Company’s officers to create sustainable long-term value for our shareholders and achieve other business objectives; encourage stock ownership by the Company’s officers in order to align their financial interests with the long-term interests of our shareholders | ・Equity-based ・Granted in a combination of - Performance-based restricted stock units; - Time-based restricted stock units; and - Time-based stock options ・Reference market median for all NEOs for target direct compensation (target total cash plus the grant date value of long-term incentives) ・Based on performance goals tied to organic revenue growth and adjusted EPS (performance-based restricted stock units) ・Legacy award of performance-based stock options, subject to five- year relative TSR performance over four periods spanning 2013 – 2020 |

| 44 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

CEO Target |  |

Peer Group Median CEO |  |

CEO Actual 2019 |  |

Other NEOs (Aggregate) Target |  |

Peer Group Median Other NEOs (Aggregate) |  |

Other NEOs (Aggregate) Actual 2019 |  |

2020 Proxy Statement  thermofisher.com thermofisher.com | 45 |

| Named Executive Officer | 2018 Base Salary | 2019 Base Salary (Effective March 25, 2019) | Increase |

| Marc N. Casper | $1,500,000 | $1,550,000 | 3.3% |

| Stephen Williamson | $659,200 | $700,000 | 6.2% |

| Mark P. Stevenson | $1,014,000 | $1,050,000 | 3.6% |

Michel Lagarde(1) | $750,000 | $750,000 | 0.0% |

| Syed A. Jafry | $618,000 | $650,000 | 5.2% |

| Patrick M. Durbin | $606,400 | $625,000 | 3.1% |

| Gregory J. Herrema | $670,000 | $680,000 | 1.5% |

| (1) | In connection with his promotion to Executive Vice President of the Company, Mr. Lagarde received a base salary increase effective September 5, 2019 to $850,000. |

Financial |  | ・Organic revenue growth (35%) ・Adjusted operating margin (15%) ・Adjusted net income (15%) ・Free cash flow (5%) |

| Non-financial |  | ・Customer allegiance ・Positioning the Company for accelerated revenue growth and margin expansion ・Employer of choice and workforce diversity ・Capital deployment strategy |

| 46 | 2020 Proxy Statement  thermofisher.com thermofisher.com |

| Financial Performance Score: 129% | |

| Organic Revenue Growth (35%) | |

・ The threshold level of performance required was 3.0%, which equated to a payout of 0% ・ For each 0.5% of organic revenue growth above the threshold, the payout increased proportionately by 25 percentage points to 6.0% organic revenue growth ・ To reflect the additional investment and effort required, for exceptional growth between 6.0% and 6.5%, the payout increased proportionately by 25 percentage points for each 0.25% increase in organic revenue growth up to a maximum opportunity of 200% ・ Actual organic revenue growth for the year was 6.1%, resulting in a payout of 157% for this element | |

| Adjusted Operating Income as a Percentage of Revenue (15%) | |

・ The payout factors for this element link the variation in organic revenue growth to margin expansion, meaning that the “threshold” and “maximum” performance requirements (whether expressed as dollars or as a percentage) varied directly with actual organic revenue growth achievement ・ Regardless, the maximum payout in respect of this element is capped at 200% ・ The baseline goal, assuming target organic growth of 5.0%, was 23.69% of revenue. The payout factors for this metric recognize the incremental costs required to achieve accelerated organic revenue growth, and reflect the greater difficulty in achieving margin expansion on lower organic revenue ・ Actual adjusted operating income as a percentage of revenue for the year was 23.4%, resulting in a payout of 0% for this element | |

| Adjusted Net Income (15%) | |

・ The threshold level of performance required was $4,779 million, which equated to a payout of 0% ・ For each additional $24 million of adjusted net income, the payout increased proportionately by 25 percentage points to adjusted net income of $4,971 million ・ Actual adjusted net income for the year was $4,975 million, resulting in a payout of 200% for this element | |

| Free Cash Flow (5%) | |