- TDW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Tidewater (TDW) DEF 14ADefinitive proxy

Filed: 16 Jun 03, 12:00am

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES AND EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

Tidewater Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No Fee Required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total Fee Paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

TIDEWATER INC.

601 Poydras Street, Suite 1900

New Orleans, Louisiana 70130

June 19, 2003

To Our Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Tidewater Inc. to be held at the Pan-American Life Center Auditorium, 11th Floor, 601 Poydras Street, New Orleans, Louisiana, on Thursday, July 31, 2003, at 10:00 a.m., Central Time.

The attached Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted at the meeting. During the meeting, we will also report on the operations of the Company. Our directors, officers, and representatives of our independent auditors will be present to respond to any questions that you may have.

You are requested to vote by proxy as promptly as possible. You can vote by signing, dating, and returning the enclosed proxy card in the envelope provided. You can also call in your vote by touchtone telephone or send it over the Internet using the instructions on the proxy card. If you attend the meeting, which we hope you will do, you may vote in person even if you have previously voted by proxy.

Sincerely,

DEAN E. TAYLOR

President and Chief Executive Officer

INFORMATION ABOUT ATTENDING THE ANNUAL MEETING

If you plan to attend the meeting in person, please bring the following:

| 1. | Proper identification (preferably a driver’s license); and |

| 2. | Acceptable Proof of Ownership if your shares are held in “Street Name.” |

Street Name means your shares are held of record by brokers, banks or other institutions.

Acceptable Proof of Ownership isa letter from your broker stating that you owned Tidewater Inc. stock on the record date or an account statement showing that you owned Tidewater Inc. stock on the record date.

We may exclude from the meeting any person who is not a stockholder of record on the record date (or a duly designated proxy) or a street name holder on the record date evidenced as described above.

TIDEWATER INC.

601 Poydras Street, Suite 1900

New Orleans, LA 70130

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of the Stockholders of TIDEWATER INC. will be held in the Pan-American Life Center Auditorium, 11th Floor, 601 Poydras Street, New Orleans, Louisiana, on Thursday, July 31, 2003, at 10:00 a.m., Central Time, to vote upon the following matters:

| • | The election of three directors for a term of three years; and |

| • | Such other matters as may properly come before the meeting or any adjournment thereof. |

Only stockholders of record at the close of business on June 2, 2003, are entitled to notice of and to vote at the 2003 Annual Meeting.

If you are unable to attend in person and wish to have your shares voted, please complete, date and sign the enclosed proxy, and return it in the accompanying envelope as promptly as possible. Alternatively, you may vote by touchtone telephone or over the Internet as explained on the proxy card. You may revoke your proxy by giving notice to our Secretary at any time before the annual meeting.

By Order of the Board of Directors

CLIFFE F. LABORDE

Executive Vice President, Secretary

and General Counsel

New Orleans, Louisiana

June 19, 2003

Description | Page | |

1 | ||

1 | ||

1 | ||

2 | ||

3 | ||

4 | ||

5 | ||

6 | ||

6 | ||

7 | ||

10 | ||

12 | ||

14 | ||

15 | ||

15 | ||

16 | ||

Exhibit A (Audit Committee Charter) | A-1 |

TIDEWATER INC.

601 Poydras Street, Suite 1900

New Orleans, LA 70130

PROXY STATEMENT

We are furnishing this Proxy Statement to our shareholders in connection with the solicitation on behalf of our board of directors of proxies to be used at our Annual Meeting of Stockholders to be held in the Auditorium of the Pan-American Life Center, 601 Poydras Street, New Orleans, Louisiana, on Thursday, July 31, 2003, at 10:00 a.m. and at any adjournment thereof. Only stockholders of record at the close of business on June 2, 2003, are entitled to vote at the meeting or any adjournment thereof.

We will bear the costs of soliciting proxies. Proxies may be solicited, without extra remuneration, by our directors, officers, or employees by mail, telephone, internet, telex, telefax, telegram, or personal interview. We will reimburse brokers, banks, and other custodians, nominees, or fiduciaries for their reasonable expenses in forwarding proxies and proxy materials to beneficial owners of shares.

You may revoke your proxy at any time before it is voted by voting in person at the meeting or by delivering written revocation or a later dated proxy to our Secretary.

Our bylaws provide that the holders of a majority of the shares of our common stock issued and outstanding and entitled to vote at the annual meeting, present in person or represented by proxy, will constitute a quorum at the annual meeting. The bylaws further provide that, except as otherwise provided by statute, our certificate of incorporation, or the bylaws, all matters coming before the annual meeting will be decided by the vote of the holders of a majority of the number of shares of common stock present in person or represented by proxy and entitled to vote at the annual meeting.

All duly executed proxies received by us in the form enclosed or properly delivered by telephone or over the Internet will be voted as specified and, in the absence of instructions to the contrary, will be voted for the election of the nominees named above.

The board of directors does not know of any matters to be presented at our 2003 annual meeting other than those described herein. However, if any other matters properly come before the meeting or any adjournment thereof, it is the intention of the persons named in the enclosed proxy to vote the shares represented by them in accordance with their best judgment.

Votes cast by proxy or in person at the annual meeting will be counted by the persons appointed by us to act as election inspectors for the meeting. The election inspectors will treat shares represented by proxies that reflect abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum and for purposes of determining the outcome of any matter submitted to the stockholders for a vote.

Abstentions as to particular proposals will have the same effect as votes against such proposals. Broker non-votes as to particular proposals will not, however, be deemed to be a part of the voting power present with respect to such proposals, will not therefore count as votes for or against such proposals and will not be included in calculating the number of votes necessary for approval of such proposals.

As of the close of business on June 2, 2003, we had 60,576,697 shares of common stock issued, outstanding, and entitled to vote. Each share of common stock is entitled to one vote with respect to matters to be voted upon at the meeting.

1

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The table below shows the name, address, and stock ownership of each person known by us to own beneficially more than 5% of our common stock as of June 2, 2003. Unless otherwise indicated, all shares listed as beneficially owned are held with sole voting and investment power:

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent Of Class(1) | ||||

FMR Corp. 82 Devonshire St. Boston, MA 02109 | 4,319,955 | (2) | 7.1 | % | ||

Whitney National Bank, as Trustee of the Tidewater Inc. Grantor Stock Trust 228 St. Charles Avenue New Orleans, LA 70130 | 3,922,291 | (3) | 6.5 | % |

| (1) | Based on 60,576,697 shares of common stock outstanding on June 2, 2003. |

| (2) | Based on Schedule 13G/A dated February 14, 2003 filed with the Securities and Exchange Commission by FMR Corp. FMR Corp. holds voting power only with respect to 447,875 of such shares. |

| (3) | We created the Tidewater Inc. Grantor Stock Trust to acquire, hold and distribute shares of our common stock for the payment of benefits and compensation under our employee benefit plans, including our stock option plans and 401(k) plan. Under the trust, Whitney National Bank, as trustee, will vote all shares of common stock held in the trust in accordance with instructions received from current and former employees (excluding members of our board of directors) who participate in our 401(k) plan or hold options to purchase our common stock granted under our stock option plans (the “Eligible Participants”). For each Eligible Participant, the trustee will vote or abstain from voting, according to instructions received from that Eligible Participant, with respect to that number of trust shares that results from multiplying (x) the total number of trust shares as of the record date by (y) a fraction, the numerator of which is the sum of the number of shares of our common stock allocated to the account of such Eligible Participant in the 401(k) Plan and the number of shares of common stock that are subject to stock options held by such Eligible Participant, and the denominator of which is the total number of shares of our common stock in the 401(k) plan allocated to Eligible Participants and the total number of shares of common stock subject to options held by Eligible Participants, as to which the trustee has received voting instructions. |

2

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth the beneficial ownership of our common stock as of June 2, 2003, by each director who will continue to serve following our Annual Meeting and each director nominee, by each executive officer named in the Summary Compensation Table and by all directors and executive officers as a group:

Name | Amount and Nature of Beneficial Ownership* | Percent of Class(1) | ||||

Robert H. Boh | 30,500 | (2) | * |

| ||

Arthur R. Carlson | 8,600 | (2) | * |

| ||

Stephen W. Dick | 190,621 | (3)(4) | * |

| ||

Cliffe F. Laborde | 281,829 | (3)(4)(5) | * |

| ||

J. Keith Lousteau | 180,115 | (3)(4) | * |

| ||

Jon C. Madonna | 12,500 | (2) | * |

| ||

Paul W. Murrill | 23,069 | (2) | * |

| ||

William C. O’Malley | 1,035,924 | (2)(3) | 1.7 | % | ||

Richard A. Pattarozzi | 2,500 | (2) | * |

| ||

J. Hugh Roff, Jr. | 47,500 | (2)(6) | * |

| ||

Donald G. Russell | 20,250 | (2) | * |

| ||

Dean E. Taylor | 239,364 | (3) | * |

| ||

All directors and executive officers as a group (12 persons) | 2,097,272 | (4)(7) | 3.5 | % |

| * | Less than 1.0%. |

| (1) | Calculated on the basis of 60,576,697 shares of common stock outstanding at June 2, 2003, and includes for each person and group the number of shares the person or group has the right to acquire within 60 days. |

| (2) | Includes shares that may be acquired within 60 days upon exercise of non-employee director stock options, as follows: Mr. Boh, 23,500; Mr. Carlson, 5,500; Mr. Madonna, 10,500; Dr. Murrill, 5,500; Mr. O’Malley, 2,500; Mr. Pattarozzi, 2,500; Mr. Roff, 23,500; and Mr. Russell, 17,500. |

| (3) | Includes shares that may be acquired within 60 days upon exercise of employee stock options, together with related restricted stock awards, as follows: Mr. Dick, 180,939; Mr. Laborde, 268,925; Mr. Lousteau, 175,625; Mr. O’Malley, 752,292; and Mr. Taylor, 232,833. Also includes shares attributable to accounts under our 401(k) Savings Plan as follows: Mr. Dick, 2,538; Mr. Laborde, 1,893; Mr. Lousteau, 4,295; Mr. O’Malley, 606; and Mr. Taylor, 3,253. |

| (4) | Does not include shares held in the Tidewater Inc. Grantor Stock Trust with respect to which Messrs. Dick, Laborde, Lousteau and other participants (other than members of our board) in our stock option plans and 401(k) plan have the power to direct the vote on a pro rata basis. |

| (5) | Includes 1,893 shares held in trusts for Mr. Laborde’s minor children, beneficial ownership of which is disclaimed. |

| (6) | Includes 20,000 shares owned by Roff Interests, Ltd. |

| (7) | Includes 1,725,114 shares of our common stock that such persons have the right to acquire within 60 days through the exercise of options together with related restricted stock awards; 1,893 shares for which directors and executive officers reported indirect ownership and disclaim beneficial ownership; and 12,585 shares attributable to such persons’ accounts in our 401(k) Savings Plan, as to which shares such persons have sole voting power only. |

3

(PROPOSAL 1)

Our bylaws divide our board into three classes, as nearly equal in number as possible, with each class of directors serving a three-year term. The term of office of each class of directors expires in rotation so that one class is elected at each annual meeting for a full three-year term. All of the nominees for director are currently serving as directors.

Our board has nominated and urges you to vote FOR the election of Arthur R. Carlson, Jon C. Madonna and William C. O’Malley for terms of office ending in 2006.

It is intended that the proxies solicited hereby will be voted FOR the election of each of the nominees. In the event any nominee is not a candidate when the election occurs, it is intended that the proxies will be voted for the election of the other nominees and may be voted for any substitute nominee. Our board has no reason to believe that any nominee will not be a candidate or, if elected, will be unable or unwilling to serve as a director. In no event, however, will the proxies be voted for a greater number of persons than the number of nominees named.

Nominees for election at this meeting to terms expiring in 2006:

Arthur R. Carlson, 62, Chairman,TCW Energy and Infrastructure Group, and Managing Director, TCW Group, Inc. (investment advisor); and Director of TCW Asset Management Company. Director since 1982.

Jon C. Madonna, 60, Chairman, DigitalThink, Inc. since April 2002, previously President and Chief Operating Officer since January 2002; President and Chief Executive Officer of Carlson Wagonlit Travel 1999-2000; Vice Chairman of Travelers Group 1997-1998; Chairman and Chief Executive Officer of KPMG Peat Marwick 1990-1996; and Director of Albertson’s Inc., AT&T Corp., DigitalThink, Inc., Neuberger Berman, Inc. and Phelps Dodge Corp. Director since 1999.

William C. O’Malley, 66, Chairman of the Company since 1994; formerly President (1994-2001) and Chief Executive Officer (1994-2002) of the Company; prior thereto, served as Chairman of the Board and Chief Executive Officer of Sonat Offshore Drilling, Inc.; Director of Hibernia Corporation, Plains Resources, and BE&K., Inc. Director since 1994.

Directors whose terms continue until 2004:

Paul W. Murrill, 68, Professional Engineer; Chairman of Piccadilly Cafeterias, Inc., 1994-2000; Special Advisor to the Chairman of the Board of Gulf States Utilities Co. (public utility), 1987-1989, its Chairman, 1982-1987, and its Chief Executive Officer, 1982-1986; and Director of Baton Rouge Water Company, Entergy Corporation, and MicroProbe Inc. Director since 1981.

J. Hugh Roff, Jr., 71, Chairman of the Board of Roff Resources LLC (energy investment) since 1998; and Chairman of the Board of PetroUnited Terminals, Inc. (petrochemical terminals) 1986-1998. Director since 1986.

Dean E. Taylor, 55, Chief Executive Officer since March 2002. President and member of the Board of Directors since October 2001. Executive Vice President from 2000 to 2001. Senior Vice President from 1998 to 2000. Director, Whitney Holding Corporation. Director since 2001.

Directors whose terms continue until 2005:

Robert H. Boh, 72, Chairman and Former President and Chief Executive Officer of Boh Bros. Construction Co. L.L.C. and Boh Company, L.L.C. (construction companies). Director since 1978.

4

Richard A. Pattarozzi, 60, former Vice President of Shell Oil Company E&P and President and Chief Executive Officer of Shell Deepwater Development, Inc. and Shell Deepwater Production, Inc. Director of Global Industries, Inc., Stone Energy, Inc., Transocean, Inc., Superior Energy Services, Inc. and FMC Technologies, Inc. Director since 2001.

Donald G. Russell, 71, Chairman of Russell Companies (oil and gas investments) since 1998; Executive Vice President of Sonat Inc. 1993-1998; Chairman of the Board and Chief Executive Officer of Sonat Exploration Company 1988-1998. Director since 1998.

We have standing audit, compensation, finance, and nominating and corporate governance Committees of our board. During fiscal 2003, our board held seven meetings. Each director who will continue to serve on our board following the Annual Meeting attended at least 75% of the aggregate of the meetings of the board and the committees on which he served.

Our audit committee is composed of Messrs. Madonna, Murrill, Pattarozzi and Russell. The committee met five times during fiscal 2003. The audit committee’s primary function, which is described in its charter attached as Exhibit A, is to oversee management’s conduct of the financial reporting process. Among the audit committee’s key responsibilities are to review with management and the outside auditors our audited financial statements, discuss with management and the outside auditors the quality and adequacy of our internal controls, discuss with the outside auditors the quality and acceptability of the accounting principles applied, review the qualification, performance and independence of the outside auditors, appoint and retain the outside auditors,review and approve the scope and cost of audit and non-audit services to be performed by the outside auditors and oversee our company’s compliance with legal and regulatory requirements. Our board has determined that all of the members of the Audit Committee qualify as audit committee financial experts, as defined by SEC rules.

Our nominating and corporate governance committee is composed of Messrs. Boh, Madonna, and Pattarozzi. The committee was created in March 2003 and did not meet during fiscal 2003. The committee assists the board of directors in reviewing, evaluating, selecting and recommending director nominees when one or more directors are to be appointed, elected or re-elected to the Board. The committee is also responsible for review of director compensation and benefits, director education programs, board performance, and corporate governance guidelines applicable to our company. The committee also recommends committee assignments to the board. For information regarding shareholder nominations, see below under “Stockholder Proposals And Director Nominations”.

Our compensation committee is composed of Messrs. Boh, Carlson, and Roff. The compensation committee met two times during fiscal 2003. The principal functions of the compensation committee include responsibility for considering all substantive elements of the company’s total employee compensation package, including overall plan design for each of the company’s major benefit programs, and determining appropriate actuarial assumptions and funding methods. The compensation committee also has responsibility for determining salary and bonus awards for executive officers and determining stock option and restricted stock awards for all key employees.

Our finance committee is composed of Messrs. Boh, Carlson, and Murrill. The finance committee met three times during fiscal 2003. The principal functions of the finance committee include responsibility for reviewing capital structure, dividend policy, corporate liquidity, and issuance of debt and equity securities. The finance committee also has responsibility for appointing and monitoring independent investment managers and establishing investment policies and guidelines for employee benefit plans.

5

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of our compensation committee are Messrs. Boh, Carlson, and Roff. None of the members of our compensation committee have been officers or employees of our company or any of our subsidiaries. No executive officer of our company served in the last fiscal year as a director or member of the compensation committee of another entity one of whose executive officers served as a member of our board or on our compensation committee.

��

Our outside directors receive an annual retainer of $30,000 and a fee of $1,500 for attendance at each board meeting. The chairman of each board committee receives an additional annual retainer of $5,000, and each committee member, including the chairman, receives a fee of $1,200 for attendance at each committee meeting.

Outside directors also receive an annual grant of options to purchase up to 5,000 shares of our common stock, the exact number to be set by the compensation committee. Outside directors received an option to purchase 5,000 shares of Common Stock in March 2003. The exercise price of the stock options is equal to the closing price for our common stock reported on the New York Stock Exchange on the date of the grant.

William C. O’Malley, our former President and Chief Executive Officer, will continue to serve as Chairman of the Board through our 2003 Annual Meeting and was paid $100,000 per year for his services as Chairman during that period. During that period, he also was permitted to continue to receive perquisites customary and appropriate for the Chairman and retired Chief Executive Officer, including payment of club membership and industry association dues and expenses and provision of office space, clerical support and parking. He is also permitted to continue to participate in the Company’s Executive Medical Plan for 18 months following his retirement on March 28, 2002, and receives other retirement benefits provided in his employment agreement with the company or company benefit plans. Mr. O’Malley also received the regular compensation paid to other outside directors during fiscal 2003.

We provide a Deferred Compensation Plan under which an outside director may elect to defer all or a portion of the fees that are payable to him for service on our board. Deferred amounts are credited to an account in the name of the director as units in one or more investment funds made available through the plan. Prior to an amendment to this plan adopted in November 2002, directors could also elect to have deferred fees treated as invested in phantom shares of our common stock. Upon termination of board service or on another date chosen by the director, amounts accrued under the plan are payable either in a lump sum or over a period of two to ten years, at the election of the director. One director participated in the Deferred Compensation Plan during fiscal 2003.

We also provide a Retirement Plan for the benefit of outside directors who retire from our board on or after reaching age 65 or after completing five or more years of service on our board. Under the Retirement Plan, an eligible director will be entitled to an annual benefit equal to the annual retainer fee for a board member at the time of his retirement. An eligible director who was a member of our board on May 31, 2001, will receive the annual benefit for a term equal to the number of years the retired director served as an outside director. An eligible director who joins our board after May 31, 2001, will receive the annual benefit for a term equal to the number of years the retired director served as an outside director, but not to exceed five years. If a director dies prior to payment of his benefit, a death benefit is payable to his beneficiaries equal to the then present value of the unpaid benefit.

The Deferred Compensation Plan and the Retirement Plan both provide for the protection of benefits in the event of a change of control of our company and also permit the acceleration of payment of benefits in such event.

6

The following table summarizes, for each of the three fiscal years ended March 31, 2001, 2002, and 2003, the compensation paid to each of our executive officers in all capacities in which they served:

SUMMARY COMPENSATION TABLE

Annual Compensation | Long-Term Compensation(1) | ||||||||||||

Name and Principal Position | Fiscal Year | Salary | Bonus | No. of Options Awarded | All Other Compensation(2) | ||||||||

Dean E. Taylor, President and Chief Executive Officer | 2003 2002 2001 | $

| 400,000 270,000 194,138 | $

| 413,312 271,064 247,104 | 75,000 125,000 75,000 | $

| 17,518 13,880 10,183 | |||||

Cliffe F. Laborde, Executive Vice President, Secretary and General Counsel | 2003 2002 2001 |

| 250,000 240,000 233,448 |

| 191,146 197,734 241,260 | 35,000 20,000 75,000 |

| 13,018 13,008 11,362 | |||||

Stephen W. Dick Executive Vice President(3) | 2003 2002 |

| 250,000 203,333 |

| 191,146 182,634 | 35,000 52,500 |

| 13,018 12,652 | |||||

J. Keith Lousteau, Senior Vice President and Chief Financial Officer | 2003 2002 2001 |

| 225,000 200,000 176,488 |

| 172,032 171,198 205,845 | 35,000 30,000 60,000 |

| 12,268 11,658 9,621 | |||||

| (1) | As of March 31, 2003, Mr. Taylor held a restricted stock award for 178 shares of restricted stock with a value of $5,112, Mr. Laborde held a restricted stock award for 403 shares of restricted stock with a value of $11,574 and Mr. Dick held a restricted stock award for 606 shares of restricted stock with a value of $17,404. |

| (2) | Consists of $5,518 in 2003, $5,808 in 2002, and $4,359 in 2001 of health care premiums paid by the Company each year on behalf of each named executive officer under our Executive Medical Plan and the following amounts contributed by us on behalf of each named executive officer pursuant to our 401(k) Savings Plan and Supplemental Savings Plan: Mr. Taylor $12,000 in 2003, $8,072 in 2002 and $5,824 in 2001; Mr. Laborde, $7,500 in 2003, $7,200 in 2002 and $7,003 in 2001; Mr. Dick, $7500 in 2003 and $6,844 in 2002; and Mr. Lousteau, $6,750 in 2003, $5,850 in 2002 and $5,262 in 2001. |

| (3) | Mr. Dick became an executive officer on November 29, 2001. |

7

Stock Options

The following table contains certain information concerning the grant of stock options to the named individuals during the fiscal year ended March 31, 2003

OPTION GRANTS IN FISCAL YEAR ENDED MARCH 31, 2003

Name | Number of Shares Underlying Options Granted(1) | % of Total Options Granted to Employees in Last Fiscal Year | Exercise Price | Expiration Date | Grant Date Present Value(2) | ||||||||

Dean E. Taylor | 75,000 | 12.0 | % | $ | 27.92 | 3/12/13 | $ | 790,500 | |||||

Cliffe F. Laborde | 35,000 | 5.6 | % |

| 27.92 | 3/12/13 |

| 368,900 | |||||

Stephen W. Dick | 35,000 | 5.6 | % |

| 27.92 | 3/12/13 |

| 368,900 | |||||

J. Keith Lousteau | 35,000 | 5.6 | % |

| 27.92 | 3/12/13 |

| 368,900 | |||||

| (1) | The options become exercisable one-third per year and are fully exercisable three years after the date of grant. Exercisability is accelerated upon a change of control. |

| (2) | The theoretical values on grant date are calculated under the Black-Scholes Model. The Black-Scholes Model is a mathematical formula used to value options traded on stock exchanges. This formula considers a number of factors to estimate the option’s theoretical value, including the stock’s historical volatility, dividend rate, exercise period of the option and interest rates. The grant date theoretical value above assumes an expected stock price volatility of 47.2%, an expected annual dividend yield of 2.0%, a 3.0% risk free rate of return and an expected five year stock option life. |

Option Exercises and Holdings

The following table sets forth certain information concerning the exercise of options during the fiscal year ended March 31, 2003, and unexercised options held on March 31, 2003:

AGGREGATED OPTION EXERCISES IN FISCAL YEAR ENDED MARCH 31, 2003

AND OPTION VALUES AS OF MARCH 31, 2003

Number of Shares Acquired on Exercise | Value Realized(1) | Number of Shares Underlying Unexercised Options at March 31, 2003 | Value of Unexercised In-the-Money Options At March 31 2003(2) | ||||||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||

Dean E. Taylor | 1,500 | $ | 4,222 | 234,433 | 183,334 | $ | 362,170 | $ | 73,000 | ||||||

Cliffe F. Laborde | –0– |

| –0– | 268,522 | 73,334 |

| 563,036 |

| 28,000 | ||||||

Stephen W. Dick | 2,666 |

| 19,728 | 175,982 | 75,835 |

| 445,622 |

| 28,000 | ||||||

J. Keith Lousteau | 10,000 |

| 212,089 | 175,625 | 75,000 |

| 272,381 |

| 28,000 | ||||||

| (1) | Reflects the difference between the closing sale price of our stock on the exercise date and the exercise price of the options. |

| (2) | Reflects the difference between the closing sale price of $28.72 per share of our common stock on March 31, 2003, and the exercise price of the options. |

Pension Plans

We sponsor a defined benefit pension plan (“Pension Plan”) and a Supplemental Executive Retirement Plan (“SERP”) covering eligible employees of our company and participating subsidiaries. The SERP provides certain benefits to our officers that the Pension Plan is prevented from providing because of compensation and benefits limits in the Internal Revenue Code. The Pension Plan and the SERP are referred to together as the “Pension Program”.

8

An officer’s benefits under the Pension Program are based on his highest average of 5 consecutive calendar years of pay over the last 10 years (“final average pay”). Upon normal retirement at age 65, an officer participating in the Pension Program receives a monthly benefit equal to the sum of (i) 2% of the portion of final average pay that exceeds Social Security covered compensation, times years of service up to a maximum of 35, plus (ii) 1.35% of the portion of final average pay that does not exceed Social Security covered compensation, times years of service up to a maximum of 35, plus (iii) 1% of final average pay times years of service in excess of 35 years.

Early retirement benefits are available upon retirement after attaining age 55 and completing 10 years of service. There is no reduction for benefits that begin at age 62 or later. For retired employees electing commencement between age 55 and 62, the reduction is 5% per year for each year prior to age 62. A retired employee may select a life annuity or one of several optional forms of settlement.

Employees completing five years of credited service are 100% vested in their Pension Program benefits. Messrs. Taylor, Laborde, Dick and Lousteau have 24, 11, 30 and 25 years of credited service, respectively, under the Company’s Pension Program.

The following table sets forth estimated aggregate annual benefits payable in the form of a straight life annuity under the Pension Program upon retirement at age 65 to persons in the remuneration and years-of-service classifications specified. Benefits are not subject to any deduction for Social Security or other offset amounts.

PENSION PLANS TABLE

Years of Credited Service at Retirement | |||||||||||||

Five-Year Final Average Earnings | 15 | 20 | 25 | 30 | 35 | ||||||||

$ 300,000 | $ | 85,713 | $ | 114,284 | $ | 142,855 | 171,426 | 199,997 | |||||

$ 400,000 |

| 115,713 |

| 154,284 |

| 192,855 | 231,426 | 269,997 | |||||

$ 500,000 |

| 145,713 |

| 194,284 |

| 242,855 | 291,426 | 339,997 | |||||

$ 600,000 |

| 175,713 |

| 234,284 |

| 292,855 | 351,426 | 409,997 | |||||

$ 700,000 |

| 205,713 |

| 274,284 |

| 342,855 | 411,426 | 479,997 | |||||

$ 800,000 |

| 235,713 |

| 314,284 |

| 392,855 | 471,426 | 549,997 | |||||

$ 900,000 |

| 265,713 |

| 354,284 |

| 442,855 | 531,426 | 619,997 | |||||

$1,000,000 |

| 295,713 |

| 394,284 |

| 492,855 | 591,426 | 689,997 | |||||

Change of Control Agreements

We have in effect change of control agreements with each executive officer. The change of control agreements provide for continued employment for a two-year period following a change of control. Should the officer’s employment be terminated during this two-year period for any reason other than death, disability or “Cause”, as defined, or should the officer terminate his employment for “Good Reason”, as defined, the officer will become entitled to certain benefits. The benefits include a lump sum payment equal to three times the officer’s base salary at termination, plus a payment equal to three times the greater of the average of his last three bonuses or the target bonus for which the officer is eligible within the following twelve months. The change of control agreements also provide for a pro-rated bonus assuming performance at the target level for the portion of the year prior to termination. Also, the officer will be entitled to continued life and health insurance benefits for thirty-six months following the date of termination. The officer will immediately become fully vested in his benefits under each of our supplemental or excess retirement plan in which the officer participated. In addition, we will contribute to a trust for the officer’s account an amount equal to the additional benefits to which the officer would have been entitled under any of our qualified or non-qualified defined benefit or defined contribution plans, as if the officer had continued to participate in such plans for three years following the change of control.

9

Principles of Executive Compensation

The compensation committee is composed of independent outside directors who are responsible for our compensation programs. The executive compensation program is designed to help us attract, motivate, and retain the executive talent that we need in order to maximize the return to stockholders. Toward that end, our executive compensation program has been structured based on the following principles:

• Competitive Levels of Compensation—Our company attempts to provide its executives with a total compensation package that, at expected levels of performance, is competitive with those provided to executives who hold comparable positions or have similar qualifications. Total compensation is defined to include base salary, annual incentive bonus, long-term incentives, and executive benefits.

Our philosophy is to provide a total compensation package that is market driven. We generally determine competitive levels of compensation for executive positions based on information drawn from compensation surveys and proxy statements for comparable organizations in setting competitive compensation levels. We also consider market pay data for general industry companies with comparable revenues to our company and the Value Line oilfield service peer group of companies used in the total stockholder return graph in this proxy statement. In fiscal 2003, we retained an independent compensation consultant to provide us with detailed up-to-date information on the director and officer compensation practices of similar companies.

• Pay for Performance—Our base salary and incentive plans are managed within a pay for performance framework. As a result, while the expected value of an executive’s compensation package may be market driven, actual payments made to executives in a given year may be higher or lower than competitive market rates because of company and individual performance.

• Focus on Annual and Long Term Results—As part of our pay for performance program, we maintain both an annual and a long-term incentive plan for key employees. The purpose of the annual incentive plan is to reward short-term performance that is tied to our annual business objectives. The long-term incentive plan focuses on providing stock based incentives that are intended to be consistent with the goals of long-term stockholders.

Description of the Current Executive Compensation Program

This section describes each of the principal elements of our executive compensation program with specific reference to the objectives discussed above. Our compensation program is periodically reviewed to ensure an appropriate mix of base salary, annual incentive, and long-term incentive within the philosophy of providing competitive total direct compensation opportunities.

Base Salary Program. We believe that offering competitive rates of base pay plays an important role in our ability to attract and retain executive talent. Discretionary base salary adjustments are also made based upon each executive’s performance over time. Consequently, executive officers with higher levels of sustained performance over time will be paid correspondingly higher salaries. Generally, salaries for executives are reviewed annually based on a variety of factors, including individual performance, general levels of market salary increases, our company’s overall financial condition and industry conditions.

Annual Incentive Plan. We provide an annual management incentive plan in which all executive officers other than the Chief Executive Officer participate. The annual incentive plan is intended to attract, motivate, and retain high quality executives by offering variable pay tied to Company and individual performance. This program is also an important component in providing a fully competitive compensation package to our executive officers.

A bonus pool is established each year based on our overall performance against measures established by the compensation committee. In fiscal 2003, we considered two performance measures: (1) adjusted net income compared to the budget, and (2) return on total capital compared to a peer group consisting of the Value Line

10

Oilfield Services Group and three direct competitors. As in prior years, the weight of the adjusted net income versus budget measure was 66.67% to once again underscore our emphasis on net income, and the weight of the return on total capital measure was maintained at 33.33%.

For fiscal 2003, we did not reach the target level for adjusted net income as compared to the budget and exceeded the target for return on total capital. As a result, the overall company performance measures generated a bonus pool from which payouts were made. Individual awards from the established bonus pool are approved by the compensation committee. Our Chief Executive Officer provides advice to the compensation committee for specific individual awards. Individual awards from the pool are based on a combination of objective performance criteria (such as operating margins, business unit performance, and the attainment of safety goals), as well as a subjective evaluation of individual employee performance. The Chief Executive Officer participates in a separate Executive Officer Annual Incentive Plan, which is described below under “2003 Chief Executive Officer Compensation.”

Long-Term Incentive Plan. In recent years, we have provided long-term incentives in the form of stock options to our executives. Stock options are intended to reward executives for generating appreciation in our company’s stock price through their individual performance. Stock options granted during the last fiscal year were granted at the fair market value on the date of grant. All stock options have a term of 10 years and vest one-third per year commencing one year following the grant date.

Tidewater’s overall stock option grant levels generally are established by considering industry conditions and market data on grant levels. Individual grants are based on a subjective evaluation of level of responsibility, individual performance, and the expected value of future service to the Company.

2003 Chief Executive Officer Compensation

The salary of our Chief Executive Officer, Dean E. Taylor, was set at $400,000 when he was named to his position in March 2002. We determined his salary level after considering his experience as well as salaries paid to chief executive officers of companies with comparable annual revenues and other companies included in the Value Line Oilfield Services Group.

Under the terms of our Executive Officer Annual Incentive Plan, Mr. Taylor was eligible for an annual incentive award for fiscal 2003. This plan provides for payment of a variable bonus contingent upon achievement of certain company performance goals. For fiscal 2003, the performance measures were: 1) adjusted net income versus budget; 2) return on total capital as compared to a peer group consisting of the Value Line Oilfield Services Group and three direct competitors; and 3) safety performance. The actual amount of the incentive award is dependent upon the attainment of corporate performance in each of these three criteria. The target payout is 113% of base salary; the maximum payout is 208% of base salary. For fiscal 2003, our company’s performance exceeded the target for the return on total capital and safety measures, but did not achieve the target levels for adjusted net income as compared to the budget. As a result, the overall company performance measures generated a fund from which $413,312 was awarded to Mr. Taylor.

In fiscal 2003, Mr. Taylor was granted stock options to purchase 75,000 shares of our common stock based upon the committee’s subjective evaluation of Mr. Taylor’s performance during the last fiscal year and after considering the substantial responsibilities of his new position as Chief Executive Officer. The options vest one-third per year beginning one year following grant.

$1 Million Pay Deductibility Cap

Section 162(m) of the Internal Revenue Code limits the our deductions for compensation, other than qualified performance-based compensation, in excess of $1 million paid to each of our most highly compensated executive officers. Stock options granted by us and bonuses paid through the Executive Officer Annual Incentive

11

Plan are designed to qualify as performance-based and to be excluded in calculating the $1 million limit of Section 162(m).

The committee intends to continue to establish executive officer compensation programs that will maximize our company’s income tax deduction. However, from time to time, the committee may award compensation that is not fully tax deductible if we determine that such award is consistent with our philosophy and in the best interest of our company and our stockholders.

Compensation Committee:

Robert H. Boh, Chairman

Arthur R. Carlson

J. Hugh Roff, Jr.

The audit committee of our board is composed of four directors, all of whom are independent under the rules of the New York Stock Exchange and the Securities and Exchange Commission. The responsibilities of our audit committee are set forth in its charter, which was amended in May 2003 and is attached as Exhibit A to this proxy statement. Management has the primary responsibility for the preparation of the financial statements and our company’s reporting process including the systems of internal controls. Our audit committee oversees the Company’s financial reporting process on behalf of our board.

In fulfilling its oversight responsibilities for fiscal 2003, our audit committee reviewed and discussed our financial statements with management and our independent auditors, including a discussion of the quality, not just the acceptability, of the accounting principles as selected by management and as applied in the financial statements.

In addition, our audit committee has discussed with the independent auditors the matters required by Statement on Auditing Standards No. 61 (Communications with Audit Committees). The independent auditors also provided to our audit committee the written disclosures required by Independence Standards Board Statement No. 1 (Independence Discussions with Audit Committees), and our audit committee discussed with the independent auditors their independence, and considered the compatibility of non-audit services with the auditors’ independence. The audit committee has determined that the provision of non-audit services by Ernst & Young LLP is compatible with maintaining Ernst & Young’s independence.

The committee discussed with our internal and independent auditors the overall scope and plans for their respective audits. The committee met with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of our internal controls, and the overall quality of our financial reporting. The committee held five meetings during fiscal 2003.

The audit committee has instituted a new policy regarding the engagement of independent public auditors. Each year the audit committee will appoint and retain an independent national audit firm to act as auditors of our company’s financial statements for the ensuing year. The audit committee will pre-approve the scope of all audit services annually.Audit services and permitted non-audit services must be pre-approved by the full audit committee, except that the chairman of the audit committee has the authority to pre-approve any such services if the total anticipated cost of the project is expected to be no more than $25,000, provided the full audit committee ratifies the chairman’s approval at its next regular meeting.

12

Other Information

The following table lists the aggregate fees and costs billed by Ernst & Young and its affiliates to our company:

Amount Billed | ||||||

Fiscal Year Ended March 31, 2002 | Fiscal Year Ended March 31, 2003 | |||||

Audit Fees(1) | $ | 453,000 | $ | 470,000 | ||

Audit-Related Fees(2) |

| 22,000 |

| 42,000 | ||

Tax Fees(3) |

| 377,000 |

| 184,000 | ||

All Other Fees |

| –0– |

| –0– | ||

| (1) | Relates to services rendered in connection with auditing our company’s annual consolidated financial statements for each applicable year and reviewing our company’s quarterly financial statements. Also includes services rendered in connection with statutory audits and financial statement audits of our subsidiaries. |

| (2) | Consists of accounting consultations and includes acquisition due diligence. |

| (3) | Consists of United States and foreign corporate tax compliance services and consultations and United States and foreign executive tax compliance services. |

Based on the review and discussions referred to above, the audit committee recommended to the board (and the board has approved) that the audited financial statements be included in our company’s Annual Report on Form 10-K for the year ended March 31, 2003, for filing with the Securities and Exchange Commission. The audit committee has selected Ernst & Young LLP as our company’s independent auditors for fiscal year 2004.

Audit Committee:

Paul W. Murrill, Chairman

Jon C. Madonna

Donald G. Russell

Richard A. Pattarozzi

13

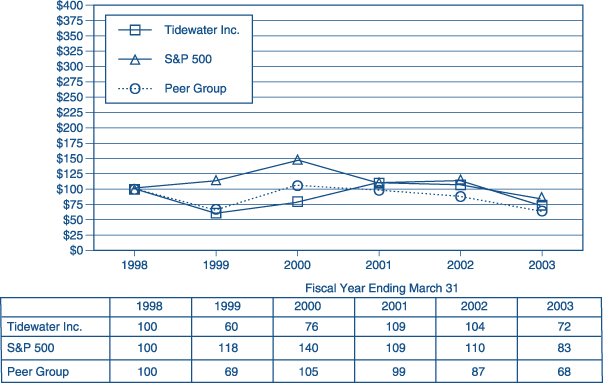

The following graph compares the change in the cumulative total stockholder return on our common stock with the cumulative total return of the Standard & Poor’s 500 Stock Index and the cumulative total return of the Value Line Oilfield Services Group Index over the last five fiscal years. The graph assumes the investment of $100 on April 1, 1998, at closing prices on March 31, 1998, and the reinvestment of dividends. The Value Line Oilfield Services Group consists of 21 companies.

14

INTERESTS IN CERTAIN TRANSACTIONS

Related Party Transactions

During fiscal 2003, we contracted with Bollinger Shipyards, Inc. (“Bollinger Shipyards”) for repair and storage services in the amount of approximately $1,300,713. The contracts were awarded to Bollinger Shipyards on the basis of competitive bidding and/or space availability. Donald T. Bollinger is the Chairman and Chief Executive Officer of Bollinger Shipyards and served as a director of our company prior to his resignation on May 6, 2002. We also entered into a $45 million contract on May 8, 2002, with Bollinger Shipyards on the basis of a competitive bid for the construction of four offshore supply vessels. In the opinion of management, all of our transactions with Bollinger Shipyards were on terms that were usual, customary, and no less favorable to us than would be available from unaffiliated parties.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers, and beneficial owners of more than 10% of our common stock to file certain beneficial ownership reports with the SEC. To our knowledge, based on our review of copies of reports received by us and written representations by certain reporting persons, we believe that during fiscal year 2003 all Section 16(a) filing requirements applicable to our officers, directors and 10% stockholders were complied with in a timely manner, except that one report of an option grant by us to Richard Pattarozzi was received by the SEC late due to the use of an incorrect electronic filing code.

STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS

Our stockholders are entitled to submit proposals on matters appropriate for stockholder action consistent with regulations of the Securities and Exchange Commission and our bylaws.

Should a stockholder intend to present a proposal at the Annual Meeting to be held in 2004, under Securities and Exchange Commission rules, it must be received by the secretary of company at 601 Poydras Street, Suite 1900, New Orleans, Louisiana 70130 not less than 120 days in advance of June 19, 2004, in order to be included in our Proxy Statement and form of proxy relating to that meeting.

Our bylaws provide that in addition to any other applicable requirements for business to be properly brought before the Annual Meeting by a stockholder, the stockholder must give timely notice in writing to the Secretary. To be timely, your notice must be delivered or mailed to and received at our principal executive offices not less than 75 days nor more than 100 days prior to July 31, 2003, which is the anniversary date of our immediately preceding Annual Meeting, provided that in the event that the Annual Meeting is called for a date more than 50 days prior to such anniversary date, your notice, in order to be timely, must be so received not later than the close of business on the 10th day following the day on which such notice of the date of the meeting was mailed or public disclosure of the date of the meeting was made, whichever occurs first. The bylaws provide that your notice to the Secretary must set forth, among other things, specified information as to the matters to be brought before the meeting and as to the stockholder making the proposal. This requirement does not preclude discussion by any stockholder of any business properly brought before the Annual Meeting in accordance with such procedures.

Our bylaws further provide that a stockholder of our company entitled to vote for the election of directors may make nominations of persons for election to our board at a meeting of stockholders by complying with required notice procedures. Such nominations shall be made pursuant to notice in writing to the Secretary, which must be delivered or mailed to and received at our principal executive offices not less than 75 days nor more than 100 days prior to the anniversary date of the immediately preceding Annual Meeting, which is July 31, 2003,

15

provided that in the event the Annual Meeting is called for a date more than 50 days prior to such anniversary date, notice by the stockholder in order to be timely must be so received not later than the close of business on the 10th day following the day on which such notice of the date of the meeting was mailed or public disclosure of the date of the meeting was made, whichever occurs first. Such stockholder’s notice to the Secretary must set forth among other things, specified information as to the nominees and as to the stockholder making the nomination. We may require any proposed nominee to furnish such information as may reasonably be required to determine the eligibility of such proposed nominee to serve as a director of our company.

Our board knows of no business, other than that described above, that will be presented to the meeting but, should any other matters properly arise before the meeting, the persons named in the enclosed proxies will vote the proxies in accordance with their best judgment.

By Order of the Board of Directors

Cliffe F. Laborde

Executive Vice President, Secretary

and General Counsel

New Orleans, Louisiana

June 19, 2003

PLEASE COMPLETE AND RETURN YOUR PROXY CARD PROMPTLY IN THE ENCLOSED ENVELOPE. YOU CAN ALSO CALL IN YOUR VOTE BY TOUCHTONE TELEPHONE OR SEND IT OVER THE INTERNET USING THE INSTRUCTIONS ON THE PROXY CARD.

16

EXHIBIT A

TIDEWATER INC.

Audit Committee Charter

PURPOSE

The Audit Committee (the “Committee”) shall assist the Board of Directors (the “Board”) in fulfilling its responsibility to the shareholders, potential shareholders, the investment community and others to oversee management’s conduct of the Company’s financial reporting process. The primary purpose of the Committee is to (1) assist Board oversight of:

| • | the integrity of the financial statements, reports and other financial information provided by the Company to any governmental or regulatory body, the public or other users thereof; |

| • | the Company’s compliance with legal and regulatory requirements; |

| • | the independent auditor’s qualifications and independence; and |

| • | the performance of the Company’s internal audit function and independent auditor |

and (2) prepare the report required by the Securities and Exchange Commission’s proxy rules to be included in the Company’s annual proxy statement.

The Committee shall have the sole authority to (1) appoint, retain, compensate, evaluate, oversee and terminate the Company’s independent auditor and (2) grant waivers to directors and executive officers of any codes of ethics or business conduct adopted by the Company. The Committee shall be the sole arbiter of disagreements between management and the independent auditor regarding financial reporting.

As used herein, the term “independent auditor” shall mean any public accounting firm registered with the Public Company Accounting Standards Board and engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company.

The Committee’s job is one of oversight and it recognizes that the Company’s management is responsible for preparing the Company’s financial statements and that the independent auditor is responsible for auditing those financial statements. Additionally, the Committee recognizes that financial management, including the internal audit staff, as well as the independent auditor, have more time, knowledge and more detailed information on the Company than do Committee members. Consequently, in carrying out its oversight responsibilities, the Committee is not providing any expert or special assurance as to the Company’s financial statements or any professional certification as to the independent auditor’s work.

The Committee should take appropriate actions to set the corporate “tone” for quality financial reporting, sound business risk practices and ethical behavior.

ORGANIZATION AND ADMINISTRATION

Membership

| • | The Committee shall be comprised of not less than three members of the Board, and the Committee’s composition shall comply with the independence and other membership qualification requirements of the New York Stock Exchange and all legal requirements, including Section 10A of and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as they may be modified or supplemented. |

| • | Each member of the Committee must be financially literate or must become financially literate within a reasonable period of time after appointment to the Committee. In addition, at least one member of the Committee will have accounting or related financial management expertise. |

A-1

Appointment and Term

| • | At its next meeting following the Company’s Annual General Meeting, the Board shall appoint, by a majority vote, the members of the Committee, with one of such members being designated as the chairperson of the Committee. Each member of the Committee so appointed shall serve for a term of one year or until his/her successor is duly appointed and qualified. |

| • | Any vacancy on the Committee may be filled by a majority vote of the Board. If at any time the number of members of the Committee is less than three, the Board shall appoint, by a majority vote, a sufficient number of new members to bring the minimum membership of the Committee to at least three. |

Quorum and Voting

A majority of the members of the Committee shall constitute a quorum. Each member of the Committee is entitled to one vote. The affirmative vote of a majority of the quorum shall be required to adopt and/or approve any matter.

Process

| • | The Committee shall meet at least four times annually, and more frequently if the Committee determines it to be appropriate. At least annually, the Committee shall meet with management, the internal auditor and the independent auditor in separate executive sessions. |

| • | The Committee shall make regular reports of its activities to the Board and should review with the full Board any issues that arise with respect to the quality or integrity of the Company’s financial statements, the Company’s compliance with legal or regulatory requirements, the performance and independence of the Company’s independent auditor or the performance of the internal audit function. |

| • | In discharging its oversight role, the Committee is empowered to investigate any matter that may come to its attention, with full access to all books, records, facilities and personnel of the Company. The Committee shall obtain advice from outside legal, accounting or other advisors as the Committee deems necessary to carry out its duties. Any outside legal, accounting or other advisors retained by the Committee may be discharged only by the Committee. |

| • | The Committee shall receive appropriate funding, as determined by the Committee, from the Company for payment of (1) compensation to any independent auditor, (2) compensation to any outside legal, accounting or other advisors employed by the Committee and (3) ordinary administrative expenses of the Committee that are necessary or appropriate in carrying out its duties. |

| • | The Committee shall review and reassess the adequacy of this Charter on an annual basis and recommend any proposed changes to the Board for approval. |

| • | The Committee shall conduct and present to the Board an annual performance evaluation of the Committee. |

| • | The independent auditor must report directly to the Committee. |

KEY RESPONSIBILITIES

The following functions shall be the common recurring activities of the Committee in carrying out its oversight function:

Appointment and Oversight of Independent Auditor

| • | The Committee shall appoint and retain the independent auditor and approve the independent auditor’s compensation. The Committee shall have the sole authority to terminate the independent auditor. |

A-2

| • | The Committee shall oversee the independent auditor’s preparation and issuance of audit reports and related work. |

| • | The Committee shall pre-approve all audit services and permitted non-audit services to be performed for the Company by the independent auditor. The Committee may delegate authority to pre-approve audit services, other than the audit of the Company’s annual financial statements, and permitted non-audit services to one or more members, provided that decisions made pursuant to such delegated authority shall be presented to the full Committee at its next scheduled meeting. |

| • | The Committee shall set clear hiring policies for employees or former employees of the independent auditor. |

| • | The Committee shall evaluate the independent auditor’s qualification, performance and independence on an annual basis and report its conclusions with respect to the independent auditor to the full Board. In reviewing the independent auditor’s performance and independence, the Committee should (1) take into account the opinions of management and the internal auditors and (2) consider whether there should be periodic rotation of the independent audit firm to assure continuing auditor independence. The evaluation should include an evaluation of the lead partner of the independent auditor. |

| • | In connection with its evaluation of the independent auditor’s qualification, performance and independence, the Committee shall also: |

| • | receive from the independent auditor assurances that the independent auditor is independent within the meaning of the securities laws administered by the Securities and Exchange Commission, including Rule 2-01 of Regulation S-X, as it may be modified or supplemented, and the requirements of the Independence Standards Board and/or any other or superceding rules adopted by the Public Company Accounting Oversight Board; |

| • | request from the independent auditor annually a formal written statement delineating all relationships between the independent auditor and its related entities and the Company and its related entities consistent with Independence Standards Board Standard Number 1, as it may be modified or supplemented, and the requirements of the New York Stock Exchange; |

| • | discuss with the independent auditor any such disclosed relationships and their impact on the independent auditor’s independence; |

| • | confirm annually with the independent auditor that it is registered with the Public Company Accounting Oversight Board (once the Board begins accepting registrations) and that its registration is in good standing; |

| • | if the independent auditor has been employed by the Company for five consecutive years, confirm that the Company’s audit partners have been rotated in accordance with Rule 2-01(c)(6) under Regulation S-X; |

| • | confirm that the Company’s CEO, CFO, CAO, Controller or equivalent officer, if formerly a partner of or employed by the independent auditor, did not participate in any capacity in the audit of the Company during the one year preceding the date of the initiation of the current audit; and |

| • | no less than annually, obtain and review a report by the independent auditor describing: (1) the audit firm’s internal quality control procedures (2) any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm and any steps taken to deal with any such issues. |

A-3

Compliance Responsibilities

| • | The Committee shall establish procedures for (1) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and (2) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

| • | The Committee shall (1) review no less than annually management’s programs governing codes of business conduct and ethics, conflicts of interest, legal, and environmental compliance and (2) obtain reports from management and the internal auditor regarding compliance with law and the Company’s code of business conduct and ethics. |

| • | The Committee shall discuss no less than annually management’s policies with respect to risk assessment and risk management. |

| • | The Committee shall review annually expense accounts of members of executive management of the Company. |

| • | The Committee shall prepare annually its report to be included in the Company’s proxy statement pursuant to Item 306 of Regulation S-K, as it may be modified or supplemented. The Committee shall review the disclosure in the Company’s annual proxy statement regarding the Committee and the independent auditor, including disclosures regarding the independence of Committee members and the fees paid by the Company to the independent auditor. |

Oversight of the Company’s Internal Audit Function

| • | The Committee shall review and approve annually the scope of work to be performed by internal auditors and shall review with the Company’s internal auditors their findings and recommendations. The review should also include discussion of the responsibilities, budget and staffing of the Company’s internal audit function. |

| • | The Committee shall review and approve all changes in the selection or application of accounting principles other than those changes in accounting principles mandated by newly-adopted authoritative accounting pronouncements. |

| • | The Committee shall concur with the appointment or replacement of the Company’s senior internal auditor. |

Oversight of Quarterly Reporting Process

| • | The Committee shall review the interim financial statements with management and the independent auditor prior to the filing of the Company’s Quarterly Report on Form 10-Q and discuss with management the disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Also, the Committee shall discuss the results of the quarterly reviews and any other matters required to be communicated to the Committee by the independent auditor under generally accepted auditing standards for conducting such review (currently Statement of Auditing Standards No. 71). The chair of the Committee may represent the entire Committee for the purposes of this review. |

| • | Prior to the filing of each quarterly report, the Committee shall discuss with management, the internal auditors and the independent auditor the quality and adequacy of the Company’s (1) internal controls for financial reporting, including any audit steps adopted in light of internal control deficiencies, and (2) disclosure controls and procedures. |

| • | The Committee shall discuss earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies (paying particular attention to any use of “pro forma” or “adjusted” non-GAAP information). |

A-4

| • | The Committee shall review analyses prepared by management and/or the internal auditor setting forth significant financial reporting issues and judgments made in connection with the preparation of financial statements, including the effects of alternative GAAP measures and off-balance sheet structures, if any, on the Company’s financial statements. |

Oversight of Annual Financial Statement Audit and Preparation of Annual Report on Form 10-K

In addition to the applicable items under the heading “Oversight of Quarterly Reporting Process,” the Committee shall:

| • | Review with management and the independent auditor the audited financial statements to be included in the Company’s Annual Report on Form 10-K to be filed with the Securities and Exchange Commission (or the Annual Report to Shareholders if distributed prior to the filing of Form 10-K) and review and consider with the independent auditor the matters required to be discussed by Statements of Auditing Standards (“SAS”) Nos. 61 and 90, as they may be modified or supplemented. |

| • | Discuss with management the disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

| • | Discuss with the independent auditor the auditor’s judgment about the quality, not just the acceptability, of the Company’s accounting principles, as applied in its financial statements and as selected by management. |

| • | Obtain from the independent auditor assurances that Section 10(A)(b) of the Securities Exchange Act of 1934 has not been implicated (regarding disclosure to the Committee of illegal acts detected by the independent auditor in the course of the audit). |

| • | Review and approve the disclosures in each Form 10-K regarding management’s annual internal control report and the related attestation report prepared by the independent auditor, once the applicable rules become effective. |

| • | Review and approve the disclosures in each Form 10-K (or proxy statement, if incorporated in the Form 10-K by reference to the proxy statement) regarding “audit committee financial experts.” |

| • | Receive from the independent auditor the report required by Section 10A(k) of the Securities Exchange Act of 1934 regarding (1) all critical accounting policies and practices to be used; (2) all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, the ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor; and (3) other material written communications between the independent auditor and management, such as any management letter or schedule of unadjusted differences, once the requirements become effective. |

| • | Review with the independent auditor any difficulties the auditor encountered in the course of the audit work, including any restrictions on the scope of the independent auditor’s activities and any significant disagreements with management and management’s response. |

| • | Prior to the filing of each Form 10-K, recommend to the full Board, based on the Committee’s review and discussion with management and the independent auditor, that the audited financial statements be included in the Company’s Form 10-K. |

A-5

2730-PS-03

DETACH HERE

P R O X Y

TIDEWATER INC.

This Proxy is solicited on behalf of the Board of Directors

The undersigned appoints William C. O’Malley and Dean E. Taylor as proxies, each with power to act alone or by substitution, to vote all shares of the undersigned at the Annual Meeting of Stockholders of Tidewater Inc. to be held on July 31, 2003, and any adjournments thereof. If the undersigned is a participant in the Tidewater Savings Plan (“Savings Plan”) or in a stock incentive plan sponsored by Tidewater Inc., this proxy card also serves as voting instructions to the Trustees of the Savings Plan and the Tidewater Inc. Grantor Stock Trust to vote at the Annual Meeting, and any adjournment thereof, as specified on the reverse side hereof.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED, OR IF NOT DIRECTED, FOR EACH NOMINEE AND FOR ALL PROPOSALS LISTED HEREIN, AND, AS SAID PROXIES DEEM ADVISABLE, ON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING, RECEIPT OF THE NOTICE OF MEETING AND PROXY STATEMENT IS HEREBY ACKNOWLEDGED. THIS PROXY REVOKES ALL PRIOR PROXIES GIVEN BY THE UNDERSIGNED.

SEE REVERSE SIDE. If you wish to vote in accordance with the Board of Directors’ recommendations, just sign on the reverse side. You need not mark any boxes.

SEE REVERSE SIDE | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | SEE REVERSE SIDE | ||

TIDEWATER INC.

C/O EQUISERVE TRUST COMPANY N.A.

P.O. BOX 8694

EDISON, NJ 08818-8694

Voter Control Number

Your vote is important. Please vote immediately.

Vote-by-Internet | Vote-by-Telephone

| |||

| 1. Log on to the Internet and go to http:/www.eproxyvote.com/tdw | OR | 1. Call toll-free 1-877-PRX-VOTE (1-877-779-8683) | ||

| 2. Enter your Voter Control Number listed above and follow the easy steps outlined on the secured website. | 2. Enter your Voter Control Number listed above and follow the easy recorded instructions. |

If you vote over the Internet or by telephone, please do not mail your card.

DETACH HERE IF YOU ARE RETURNING YOUR PROXY CARD BY MAIL

| [X] | Please mark votes as in this example. |

IF NO DIRECTION IS MADE, THE SHARES WILL BE VOTED IN FAVOR OF THE PROPOSALS SET FORTH BELOW. THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE NOMINEES FOR DIRECTOR LISTED BELOW.

1. To elect directors | ||||

Nominees: (01) Arthur R. Carlson, (02) Jon C. Madonna and (03) William C. O’Malley | ||||

FOR ALL ¨ NOMINEES | WITHHELD ¨ FROM ALL NOMINEES | 2. Such other matters as may properly come before the meeting or any adjournment thereof. | ||

¨ For all nominee(s) except as written above | MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT ¨ | |||

Please vote, date, sign and promptly return this proxy in the enclosed return envelope which is postage prepaid if mailed in the United States.

Please sign exactly as your name appears hereon. If the stock is issued in the names of two or more persons, each of them should sign the proxy. If the proxy is executed by a corporation, it should be signed in the corporate name by an authorized officer. When signing as attorney, executor, administrator, trustee, or guardian, or in any other representative capacity, give full title as such. | ||||

Signature Date: Signature: Date: