- TDW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Tidewater (TDW) DEF 14ADefinitive proxy

Filed: 17 Jun 10, 12:00am

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES AND EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

Tidewater Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No Fee Required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total Fee Paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

TIDEWATER INC.

601 Poydras Street, Suite 1900

New Orleans, Louisiana 70130

June 17, 2010

To Our Stockholders:

You are cordially invited to attend the 2010 Annual Meeting of Stockholders of Tidewater Inc. to be held at the Pan-American Life Center Auditorium, 11th Floor, 601 Poydras Street, New Orleans, Louisiana, on July 22, 2010 at 10:00 a.m., Central Time.

The attached Notice of Annual Meeting and Proxy Statement describe the formal business to be conducted at the meeting. During the meeting, we will also report on the operations of the company. Our directors and officers will be present to respond to any questions that you may have.

You are requested to vote by proxy as promptly as possible. You may vote by signing, dating, and returning the enclosed proxy card in the envelope provided. You may vote by telephone or online using the instructions on the proxy card. If you attend the meeting, which we hope that you will, you may vote in person even if you previously voted by proxy.

Sincerely,

DEAN E. TAYLOR

Chairman, President and Chief Executive Officer

INFORMATION ABOUT ATTENDING THE ANNUAL MEETING

If you plan to attend the meeting in person, please bring the following:

| 1. | proper identification (preferably a driver’s license); and |

| 2. | acceptable proof of ownership if your shares are held in “Street Name.” |

Street Name means your shares are held of record by brokers, banks, or other institutions.

Acceptable proof of ownership is a letter from your broker, bank, or other nominee stating that you were the beneficial owner of our stock on the record date or an account statement showing that you were the beneficial owner of our stock on the record date.

We reserve the right to deny admission to the meeting to any person other than a stockholder of record on the record date (or a duly-designated proxy) or a beneficial owner of shares held in street name on the record date who has followed the procedures outlined above.

TIDEWATER INC.

601 Poydras Street, Suite 1900

New Orleans, Louisiana 70130

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

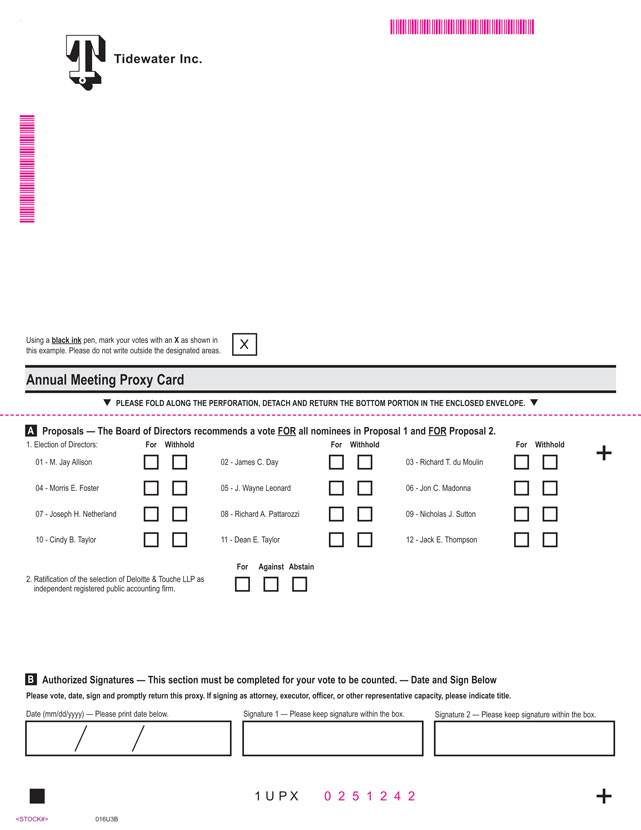

The 2010 Annual Meeting of the Stockholders of Tidewater Inc. will be held in the Pan-American Life Center Auditorium, 11th Floor, 601 Poydras Street, New Orleans, Louisiana, on July 22, 2010, at 10:00 a.m., Central Time, to vote upon the following matters:

| • | the election of 12 directors for a term of one year; |

| • | ratification of the selection of Deloitte & Touche LLP as the company’s independent registered public accounting firm for the fiscal year ending March 31, 2011; and |

| • | such other matters as may properly come before the meeting or any adjournment thereof. |

Only stockholders of record at the close of business on May 28, 2010 are entitled to notice of and to vote at the 2010 annual meeting.

Your vote is important. If you are unable to attend in person and wish to have your shares voted, please complete, date, and sign the enclosed proxy card, and return it in the accompanying envelope as promptly as possible. Alternatively, you may vote by telephone or online as explained on the enclosed proxy card. You may revoke your proxy by giving a revocation notice to our Secretary at any time before the 2010 annual meeting, by delivering timely a proxy bearing a later date, or by voting in person at the meeting.

By Order of the Board of Directors

BRUCE D. LUNDSTROM

Executive Vice President,

General Counsel and Secretary

New Orleans, Louisiana

June 17, 2010

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF OUR

PROXY MATERIALS

FOR THE ANNUAL STOCKHOLDER MEETING ON JULY 22, 2010.

This proxy statement and our 2010 annual report

are available at www.edocumentview.com/TDW

Description | Page | |

| 1 | ||

| 5 | ||

| 6 | ||

| 8 | ||

| 19 | ||

| 20 | ||

| 22 | ||

| 25 | ||

| 28 | ||

| 39 | ||

| 39 | ||

| 40 | ||

| 40 | ||

| 42 | ||

| 44 | ||

| 47 | ||

| 48 | ||

| 50 | ||

| 51 | ||

| 54 | ||

| 55 | ||

| 57 | ||

| 58 | ||

| 58 | ||

| 58 | ||

| 59 | ||

LIST OF COMPANIES INCLUDED IN TOWERS WATSON FISCAL 2010 EXECUTIVE COMPENSATION ANALYSES | Annex A | |

TIDEWATER INC.

601 Poydras Street, Suite 1900

New Orleans, Louisiana 70130

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

| Q: | Why am I receiving these proxy materials? |

| A: | Our board of directors (our “board”) is soliciting your proxy to vote at our 2010 annual meeting because you owned shares of our common stock at the close of business on May 28, 2010, the record date for the meeting, and are entitled to vote those shares at the meeting. This proxy statement, along with a proxy card or a voting instruction card, is being mailed to our stockholders and will be available online at www.edocumentview.com/TDW beginning June 17, 2010. This proxy statement summarizes information you need to vote on the matters that will be considered at the annual meeting. You do not need to attend the annual meeting to vote your shares. |

| Q: | On what matters will I vote? |

| A: | At the annual meeting, our stockholders will be asked to elect 12 directors for a one-year term, to ratify the selection of Deloitte & Touche LLP (“Deloitte & Touche”) as our independent registered public accounting firm for fiscal year 2011, and to consider any other matter that properly comes before the meeting. |

| Q: | Where and when will the meeting be held? |

| A: | The meeting will be held at the Pan-American Life Center Auditorium, 11th Floor, 601 Poydras Street, New Orleans, Louisiana, on July 22, 2010, at 10:00 a.m., Central Time. |

| Q: | Who is soliciting my proxy? |

| A: | Our board is soliciting the proxy that you are entitled to vote at our 2010 annual meeting of stockholders. By completing and returning the proxy card or voting instruction card, you are authorizing the proxy holder to vote your shares at our annual meeting in accordance with your instructions. |

| Q: | How many votes may I cast? |

| A: | You may cast one vote for every share of our common stock that you owned on the record date. With respect to the election of directors, you may cast one vote for every share of our common stock that you owned on the record date for each director nominee. |

| Q: | How many votes can be cast by all stockholders? |

| A: | On the record date, we had 51,859,266 shares of common stock outstanding, all of which were entitled to one vote per share. |

| Q: | How many shares must be present to hold the meeting? |

| A: | Our bylaws provide that the presence at the meeting, whether in person or by proxy, of a majority of the outstanding shares of stock entitled to vote constitutes a quorum. On the record date, 25,929,634 shares constituted a majority of our outstanding stock entitled to vote at the meeting. |

1

| Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

| A: | If your shares are registered in your name with our transfer agent, Computershare, you are the “stockholder of record” with respect to those shares and we have sent these proxy materials directly to you. |

If your shares are held on your behalf in a stock brokerage account or by a bank or other nominee, you are the “beneficial owner” of shares held in “street name” and the proxy materials have been forwarded to you by your broker, bank, or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to instruct your broker, bank, or nominee how to vote your shares by using the voting instruction card included in the mailing or by following their instructions for voting by telephone or the internet.

| Q: | What vote is required to approve each item? |

| A: | Election of Directors. Under our bylaws, our directors are elected by a plurality of the votes cast by holders of common stock present in person or represented by proxy and entitled to vote at the annual meeting. This means that those director nominees who receive the highest number of votes for the available director seats are elected to our board. You may vote “FOR” all director nominees or withhold your vote for any one or more of the director nominees. Only votes “FOR” are counted in determining the number of votes cast in favor of a director nominee. If you hold your shares in street name and do not give voting instructions to your broker, bank, or nominee, they cannot vote your shares with respect to the election of directors. Abstentions and withheld votes have no effect on the plurality vote for the election of directors. |

Although our directors are elected by plurality vote, our board has adopted a majority voting policy that provides that any nominee for director who receives a greater number of “WITHHELD” votes than “FOR” votes in an uncontested election is required to tender his or her resignation for consideration by our board’s nominating and corporate governance committee. We have provided more information about our majority voting policy in this proxy statement under the heading “Election of Directors—Majority Voting Policy.”

Ratification of Independent Registered Public Accounting Firm. The proposal to ratify our board’s selection of Deloitte & Touche as our independent registered public accounting firm requires the affirmative vote of a majority of the shares of common stock present in person or represented by proxy and entitled to vote at the annual meeting. If you hold your shares in street name and do not give voting instructions to your broker, bank, or nominee, they will be entitled to vote your shares with respect to the ratification of the selection of our independent registered public accounting firm. Abstentions will count as a vote against the ratification of the selection of our independent registered public accounting firm.

Any Other Matters. All other matters that properly come before the annual meeting will be decided by the vote of the holders of a majority of the shares of common stock present in person or represented by proxy and entitled to vote at the annual meeting, except where a different vote is required by statute, our certificate of incorporation, or our bylaws.

| Q: | How do I vote? |

| A: | You may vote using any of the following methods: |

| • | Proxy card or voting instruction card: If your shares are registered in your name, you may vote by completing, signing, and dating the proxy card and then returning it in the enclosed prepaid envelope. If your shares are held in street name by a broker, bank, or other nominee, you should have been provided with a voting instruction card that will provide you with the voting procedures you will need to follow to cast your vote. |

| • | By telephone or the Internet: If your shares are registered in your name, you may vote by telephone by calling 1-800-652-8683 or online at www.envisionreports.com/TDW by following the instructions at that site. The availability of telephone and online voting for beneficial owners whose shares are held in |

2

street name will depend on the voting procedures adopted by your broker, bank, or nominee. Therefore, we recommend that you follow the voting instructions in the materials you receive. |

| • | In person at the annual meeting: You may also vote in person at the annual meeting, either by attending the meeting yourself or authorizing a representative to attend the meeting on your behalf. You may also execute a proper proxy designating that person to act as your representative at the meeting. If you are a beneficial owner of shares, you must obtain a proxy from your broker, bank, or nominee naming you as the proxy holder and present it to the inspectors of election with your ballot when you vote at the annual meeting. |

| Q: | Once I deliver my proxy, can I revoke or change my vote? |

| A: | Yes. You may revoke or change your proxy at any time before it is voted at the meeting by giving a written revocation notice to our Secretary, by delivering another proxy by the voting deadline, or by voting in person at the meeting. |

| Q: | Can my shares be voted if I do not return the proxy card and do not attend the meeting in person? |

| A: | If you hold shares in street name and you do not provide voting instructions to your broker, bank, or nominee, your shares will not be voted on any proposal as to which your broker does not have discretionary authority to vote (a “broker non-vote”). Brokers, banks, and other nominees generally have discretionary authority to vote without instructions from beneficial owners on the ratification of the appointment of an independent registered public accounting firm, but do not have discretionary authority to vote without instructions from beneficial owners on the election of directors. |

Shares represented by proxies that include broker non-votes on a given proposal will be considered present at the meeting for purposes of determining a quorum, but those shares will not be considered to be represented at the meeting for purposes of calculating the vote with respect to that proposal.

If you do not vote shares registered in your name, your shares will not be voted. However, the Company may vote your shares if you have returned a blank or incomplete proxy card (see “What happens if I return a proxy card without voting instructions?” below regarding record holders).

| Q: | What happens if I return a proxy card without voting instructions? |

| A: | If you properly execute and return a proxy or voting instruction card, your stock will be voted as you specify. |

If you are a stockholder of record and return a blank or incomplete proxy card without voting instructions, your shares will be voted (i) FOR the director nominees and (ii) FOR the ratification of the selection of Deloitte & Touche as our independent registered public accounting firm for fiscal year 2011.

If you are a beneficial owner of shares and do not give voting instructions to your broker, bank, or nominee, your broker, bank, or nominee will be entitled to vote your shares only with respect to those items over which it has discretionary authority to vote, as discussed above.

| Q: | Who pays for soliciting proxies? |

| A: | We pay all costs of soliciting proxies. In addition to solicitations by mail, we have retained Morrow & Co. to aid in the solicitation of proxies for the 2010 annual meeting at an estimated fee of $7,000. Our directors, officers, and employees may request the return of proxies by mail, telephone, Internet, personal interview, or other means. We are also requesting that banks, brokerage houses, and other nominees or fiduciaries forward the soliciting material to their principals and that they obtain authorization for the execution of proxies. We will reimburse them for their reasonable expenses. |

3

| Q: | Could other matters be considered and voted upon at the meeting? |

| A: | Our board does not expect to bring any other matter before the annual meeting and it is not aware of any other matter that may be considered at the meeting. In addition, under our bylaws, the time has expired for any stockholder to properly bring a matter before the meeting. However, if any other matter does properly come before the meeting, the proxy holder will vote the proxies in his discretion. |

| Q: | What happens if the meeting is postponed or adjourned? |

| A: | Your proxy will still be valid and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy until it is voted. |

| Q: | How can I find out the voting results? |

| A: | We will announce preliminary voting results at the annual meeting. We will also disclose the voting results on a Form 8-K filed with the SEC within four business days after the annual meeting, which will also be available on our website. |

4

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The table below shows the name, address and stock ownership of each person known by us to own beneficially more than 5% of our common stock as of May 14, 2010.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class(1) | ||||

BlackRock, Inc. | 5,643,087 | (2) | 10.88 | % | ||

40 East 52nd Street | ||||||

New York, New York 10022 | ||||||

LSV Asset Management | 2,622,351 | (3) | 5.06 | % | ||

1 North Wacker Drive | ||||||

Suite 4000 | ||||||

Chicago, Illinois 60606 | ||||||

| (1) | Based on 51,858,527 shares of common stock outstanding on May 14, 2010. |

| (2) | Based on a Schedule 13G filed on January 8, 2010 with the SEC by BlackRock, Inc., which has sole voting and investment power over all shares reported. |

| (3) | Based on a Schedule 13G filed on February 11, 2010 with the SEC by LSV Asset Management, which has sole voting and investment power over all shares reported. |

5

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth the beneficial ownership of our common stock as of May 14, 2010, by each director, by each executive officer named in the Summary Compensation Table (“Named Executive Officer” or “NEO”), and by all directors and executive officers as a group:

Name | Amount and Nature of Beneficial Ownership | Percent of Class of Common Stock(1) | Tidewater Inc. Deferred Stock Units(2) | |||||

Directors and Director Nominees | ||||||||

Dean E. Taylor | 506,116 | (3)(4) | * | — | ||||

M. Jay Allison | — | * | 7,717 | |||||

James C. Day | — | * | 5,961 | |||||

Richard T. du Moulin | 24,100 | (5)(6) | * | 8,571 | ||||

Morris E. Foster(7) | — | * | — | |||||

J. Wayne Leonard | 15,000 | (5) | * | 8,571 | ||||

Jon C. Madonna | 7,100 | (5) | * | 8,571 | ||||

Joseph H. Netherland | 4,000 | * | 3,166 | |||||

Richard A. Pattarozzi | 22,500 | (5) | * | 8,571 | ||||

Nicholas J. Sutton | — | * | 8,029 | |||||

Cindy B. Taylor | — | * | 5,200 | |||||

Jack E. Thompson | 7,500 | (5) | * | 8,571 | ||||

Named Executive Officers(8) | ||||||||

Quinn P. Fanning | 47,264 | (3) | * | — | ||||

Jeffrey M. Platt | 105,334 | (3)(9) | * | — | ||||

Stephen W. Dick | 110,191 | (3) | * | — | ||||

Bruce D. Lundstrom | 72,000 | (3) | * | — | ||||

All directors and executive officers as a group (16 persons) | 1,006,356 | (10) | 1.94 | % | 72,928 |

| * | Less than 1.0%. |

| (1) | Calculated on the basis of 51,858,527 shares of common stock outstanding at May 14, 2010, and includes for each person and group the number of shares the person or group has the right to acquire within 60 days of May 14, 2010. |

| (2) | As part of his or her compensation, each non-management director receives an annual grant of deferred stock units with a value equal to $100,000 on March 31 of the year of issuance under the Directors Deferred Stock Units Plan. |

6

| (3) | The total number of shares shown as beneficially owned by each named executive officer includes the following: |

Named Executive Officer | Shares Acquirable within 60 days upon Exercise of Stock Options | Shares Attributable to the NEO’s Account under our 401(k) Plan | Shares of Restricted Stock as to which the NEO Has Sole Voting Power but No Investment Power | |||

Mr. Taylor | 364,424 | 4,093 | 100,069 | |||

Mr. Fanning | 17,243 | 317 | 29,704 | |||

Mr. Platt | 46,142 | 1,032 | 39,114 | |||

Mr. Dick | 50,298 | 142 | 35,764 | |||

Mr. Lundstrom | 31,116 | 407 | 34,641 |

| (4) | Includes 2,877 shares owned by Mr. Taylor’s children, as to which he disclaims beneficial ownership. |

| (5) | Includes shares that may be acquired within 60 days upon exercise of non-management director stock options, as follows: Mr. du Moulin, 15,000; Mr. Leonard, 15,000; Mr. Madonna, 5,000; Mr. Pattarozzi, 22,500; and Mr. Thompson, 5,000. |

| (6) | Includes 1,100 shares owned by Mr. du Moulin’s children, as to which he disclaims beneficial ownership. |

| (7) | Mr. Foster, who is not currently a director of Tidewater, has been nominated for election as director at the 2010 annual meeting. |

| (8) | Information regarding shares beneficially owned by Dean E. Taylor, who is a named executive officer in addition to Messrs. Fanning, Platt, Dick, and Lundstrom, appears immediately above under the caption “Directors and Director Nominees.” |

| (9) | Includes 708 shares acquired in a previous employer’s 401(k) plan. |

| (10) | Includes 610,182 shares of our common stock that such persons have the right to acquire within 60 days through the exercise of options; 3,977 shares for which directors and executive officers reported indirect ownership and disclaim beneficial ownership; and 8,974 shares attributable to such persons’ accounts in our 401(k) Savings Plan. |

7

(PROPOSAL 1)

Our directors are elected annually. Upon the recommendation of our nominating and corporate governance committee, our board has nominated 12 individuals to serve as director, including each of our 11 current board members. Each director elected at the 2010 annual meeting will serve a one-year term beginning at the annual meeting and ending when his or her successor, if any, is elected or appointed. Assuming stockholders elect all of these director nominees at the annual meeting, our board will increase in size from 11 to 12 directors.

We intend to vote the proxies received in response to this solicitation “FOR” the election of each of the nominees. If any nominee is no longer a candidate at the time of the annual meeting, we intend to vote the proxies “FOR” the election of the other nominees and proxies may be voted for any substitute nominee of our board. Our board has no information or reason to believe that any nominee will not be a candidate or, if elected, will be unable or unwilling to serve as a director. In no event will the proxies be voted for more than 12 nominees.

Majority Voting Policy. Our board has adopted a majority voting policy as a part of its Corporate Governance Policy. Under this policy, any director who is standing for re-election in an uncontested election and who ultimately receives a greater number of “WITHHELD” votes than “FOR” votes must tender his or her resignation following certification of the stockholder vote. Our board’s nominating and corporate governance committee is required to promptly consider the tendered resignation and recommend to our board whether to accept the tendered resignation. Our board is required to act on the committee’s recommendation within 90 days following certification of the stockholder vote. We would then promptly and publicly disclose the board’s decision-making process and final decision in a current report on Form 8-K filed with the Securities and Exchange Commission. A copy of our Corporate Governance Policy, which includes our majority voting policy, may be obtained as described under “Corporate Governance—Availability of Corporate Governance Materials.”

Our board of directors recommends that you vote “FOR” each of the following 12 nominees: M. Jay Allison, James C. Day, Richard T. du Moulin, Morris E. Foster, J. Wayne Leonard, Jon C. Madonna, Joseph H. Netherland, Richard A. Pattarozzi, Nicholas J. Sutton, Cindy B. Taylor, Dean E. Taylor, and Jack E. Thompson.

Biographic information for each director nominee is detailed below. Each director nominee’s biography contains information regarding that person’s service as a director, business experience, other directorships held currently or at any time during the last five years, and the nominee’s experiences, qualifications, attributes, or skills that led the committee and our board to determine that he or she should serve as a director for our company.

Name and Age | Business Experience, Qualifications, and Skills | Tidewater Director since | ||

M. Jay Allison, 54 | M. Jay Allison is the President, Chief Executive Officer, and Chairman of the board of directors of Comstock Resources, Inc., a publicly-traded independent energy company specializing in oil and gas acquisitions, exploration, and development. He first joined Comstock Resources in 1987 as its Vice President, Secretary, and Director, was appointed President and Chief Executive Officer in 1988, and was elected the company’s Chairman in 1997.

Mr. Allison holds B.B.A., M.S., and J.D. degrees from Baylor University. From 1981 to 1987, he was a practicing oil and gas attorney with the firm of Lynch, Chappell & Alsup in Midland, Texas. Mr. Allison was Chairman of the board of directors of Bois | 2006 |

8

Name and Age | Business Experience, Qualifications, and Skills | Tidewater Director since | ||

d’Arc Energy, Inc., an independent exploration company engaged in the discovery and production of oil and natural gas in the Gulf of Mexico, from its formation in 2004 until its merger with Stone Energy Corporation in August 2008.

Mr. Allison served on the Board of Regents for Baylor University for nine years. He currently serves on the Advisory Board of the Salvation Army in Dallas, Texas and is the Chairman of the board of the Legacy Christian Academy in Frisco, Texas. Recently, Mr. Allison was awarded the Ernst & Young Entrepreneur Of The Year® 2009 Award in the Energy, Chemicals and Mining category.

Mr. Allison brings over 23 years of executive management and public company board experience to our board. In addition, his legal background, his considerable industry experience, and his experience with mergers and acquisitions make Mr. Allison a valuable member of our board. | ||||

James C. Day, 67 | James C. Day is the retired Chairman of the Board and former Chief Executive Officer and President of Noble Corporation, one of the world’s largest offshore drilling companies. He served as Chairman of the board of directors of Noble from 1992 to 2007, as its Chief Executive Officer from 1984 to 2006, and as President from 1984 to 1999 and again from 2003 to 2006.

Mr. Day began his career at Noble after his graduation from Phillips University with a Bachelor of Science degree in Business Administration. In 2007, he was awarded an Honorary Degree of Doctor of Humane Letters from the University of Oklahoma. From 1993 to 2006, Mr. Day served as a director for Global Industries, Ltd., a publicly-traded provider of offshore marine construction services. He is a former chairman of the International Association of Drilling Contractors and the National Ocean Industries Association.

Mr. Day currently serves as a director of ONEOK, Inc., the general partner of one of largest publicly-traded master limited partnerships and among the largest natural gas distributors in the world, and EOG Resources, Inc., an independent oil and gas company with reserves in the United States as well as in Canada, Trinidad, the United Kingdom, and China. He is an honorary director of the American Petroleum Institute, which awarded him the Gold Medal for Distinguished Achievement, the Institute’s highest award. In addition, Mr. Day is a trustee of The Samuel Roberts Noble Foundation, Inc., and is founder, director, and President of The James C. and Teresa K. Day Foundation. He serves on the boards of numerous other civic, business, and not-for-profit organizations.

Mr. Day brings to the board a broad base of knowledge in various segments of the energy sector—from exploration to drilling to delivery and distribution. His extensive management and operational expertise in the oil and gas industry and his public company board service contribute greatly to the board’s skillset. The board also | 2007 | ||

9

Name and Age | Business Experience, Qualifications, and Skills | Tidewater Director since | ||

| benefits from the perspective Mr. Day gained during his tenure at the helm of a large, publicly-traded company with an international footprint. | ||||

Richard T. du Moulin, 63 | Richard T. du Moulin currently serves as the President of Intrepid Shipping LLC, a position he has held since the company was founded in 2002.

After graduating from Dartmouth College, Mr. du Moulin served in the U.S. Navy from 1969 to 1972. In 1974, he received an MBA from Harvard Business School and began his career at OMI Corporation. During his 15 years with OMI, he served as Executive Vice President, Chief Operating Officer, and as a member of the company’s board of directors. He left OMI in 1989 to start his own company, Intrepid Shipping. That same year, he led a group of partners in a buy-out of Marine Transport Lines (MTL), the oldest transportation company in America, after which Intrepid took on the name of MTL. The company later went public and became Marine Transport Corporation (MTC), and Mr. du Moulin served as its Chairman and Chief Executive Officer from 1998 to 2002. After the acquisition of several competitors, Mr. du Moulin and partners sold MTC to Crowley Maritime in 2000, paving the way for him to re-establish Intrepid Shipping in 2002. Mr. du Moulin served as Chairman of Intertanko, the leading trade organization for the tanker industry, from 1996 to 1999. Mr. du Moulin is a recipient of the U.S. Coast Guard’s Distinguished Service Medal and the shipping industry’s highest honors, the Commodore Award and the AOTAS (Admiral of the Ocean Seas).

Mr. du Moulin is currently a director of Teekay Tankers Ltd., a publicly-traded affiliate of Teekay Corporation, the world’s largest owner/operator of medium-sized crude oil tankers, and Globe Wireless, Inc., a leading provider of maritime communications and information technology solutions. Mr. du Moulin has served on the board of the American Bureau of Shipping and is a trustee of the National Maritime Historical Society. In addition, Mr. du Moulin is a member of the Board of Trustees and Vice Chairman of the Seamens Church Institute of New York and New Jersey.

Mr. du Moulin has considerable executive management, business development, and merger and acquisition experience. His expertise in many aspects of the maritime industry adds significant value to the board’s knowledge base. | 2003 | ||

Morris E. Foster, 67 | Morris E. Foster retired in 2008 as Vice President of ExxonMobil Corporation and President of ExxonMobil Production Company following more than 40 years of service with the ExxonMobil group. Mr. Foster currently serves as Chairman of Stagecoach/Mill Creek Resort, a destination resort in Salado, Texas, and as Chairman of the Board of Regents of Texas A&M University. | Not currently a Tidewater director | ||

10

Name and Age | Business Experience, Qualifications, and Skills | Tidewater Director since | ||

Mr. Foster joined Exxon in 1965 after his graduation from Texas A&M University with a Bachelor of Science in mechanical engineering. He served in a number of production engineering and management roles domestically as well as in the United Kingdom and Malaysia prior to his appointment in 1995 as a Senior Vice President in charge of the upstream business of Exxon Company, USA. In 1998, Mr. Foster was appointed President of Exxon Upstream Development Company, and following the merger of Exxon and Mobil in 1999, he was named to the position of President of ExxonMobil Development Company. In 2004, Mr. Foster was named President of Exxon Mobil Production Company, the division responsible for ExxonMobil’s upstream oil and gas exploration and production business, and a Vice President of ExxonMobil Corporation.

Mr. Foster was inducted into Texas A&M University’s Academy of Distinguished Graduates in 1993. Mr. Foster currently serves on the boards of Scott & White Medical Institute, United Way of the Texas Gulf Coast, Greater Houston Partnership, and First State Bank of Temple Texas. He is a member of the American Petroleum Institute, the Society of Petroleum Engineers, and the Texas Oil & Gas Association.

Mr. Foster has extensive executive management experience in both the development and production segments of the oil and gas industry which we serve. He would bring a sophisticated working knowledge of the intricacies of international operations to our board. In addition, Mr. Foster’s considerable practical experience in operational matters following a merger would provide valuable perspective to our board’s evaluation of corporate opportunities. | ||||

| J. Wayne Leonard, 59 | J. Wayne Leonard is the Chief Executive Officer and Chairman of the board of directors of Entergy Corporation, a Fortune 500 integrated energy company engaged primarily in electric power production and retail distribution operations. Mr. Leonard has over 37 years of experience in the energy and power sector. He was appointed Chief Executive Officer of Entergy in 1999 and elected Chairman in 2006.

Mr. Leonard earned a degree in Accounting and Political Science from Ball State University and an MBA from Indiana University. He is a certified public accountant.

Mr. Leonard has been recognized as one of the top CEOs in the power industry. He received the Platts Global Energy Award of Global Energy CEO of the Year in 2003, having been a finalist for that award for an unprecedented nine consecutive years (2001-2009). Mr. Leonard was named Institutional Investor’s Best CEO (energy/electric utilities) in 2010 and in 2004, and was one of the top four nominees for that award in every year during that period.

Mr. Leonard is currently a director of the Edison Electric Institute, the association of shareholder-owned electric companies. He also | 2003 | ||

11

Name and Age | Business Experience, Qualifications, and Skills | Tidewater Director since | ||

serves as a trustee of United Way of Greater New Orleans and of the National D-Day Museum Foundation, as well as serving on the boards of various other civic and charitable organizations.

Mr. Leonard has considerable leadership experience in the energy sector, and has widely been recognized as a leader in corporate governance. As a certified public accountant, Mr. Leonard has a sophisticated understanding of financial and accounting matters. | ||||

Jon C. Madonna, 67 | Jon C. Madonna retired as Chairman and Chief Executive Officer of KPMG Peat Marwick, an international consulting and accounting firm, in 1996, having spent 28 years in various management positions with that company. More recently, he served as President of DigitalThink, Inc., an electronic learning enterprise solutions company, from 2001 to 2002 and as Chairman from 2002 until the company was acquired by Convergys in 2004.

Between his tenures at KPMG Peat Marwick and DigitalThink, Mr. Madonna held executive positions at Carlson Wagonlit Travel and the Travelers Group. He has previously served on the board of Albertson’s, Inc., Visa U.S.A. Inc., Jazz Technologies, Inc., and Phelps Dodge Corporation. Mr. Madonna holds a Bachelor of Science in Accounting from the University of San Francisco.

Mr. Madonna currently serves as a member of the boards of directors of AT&T Corporation and Freeport-McMoRan Copper & Gold Inc., a publicly-traded copper mining company.

Mr. Madonna brings a strong finance and accounting background to our board. His prior executive management and public board service deepens the board’s knowledge base. Mr. Madonna’s background includes considerable experience in business development and mergers and acquisitions. As a director for other international public companies, Mr. Madonna also provides cross-border experience. | 1999 | ||

Joseph H. Netherland, 63 | Joseph H. Netherland retired as Chairman of the Board of FMC Technologies, Inc., an oil and gas equipment services company, in 2008, although he continues to serve as a member of its board. Mr. Netherland began his career with the Petroleum Equipment Group of FMC Corporation in 1985, and was appointed to the board of FMC Corporation in 1998. He served as an executive and director of FMC Corporation until 2001, when Mr. Netherland was appointed President and Chief Executive Officer of FMC Technologies in connection with its spin-off as a separate, publicly-traded entity.

He holds a degree in industrial engineering from the Georgia Institute of Technology and an M.B.A. from The Wharton School of the University of Pennsylvania.

Mr. Netherland is also a member of the boards of Newfield Exploration Company, a publicly-traded, independent exploration and production company, the American Petroleum Institute, and the

| 2008 | ||

12

Name and Age | Business Experience, Qualifications, and Skills | Tidewater Director since | ||

Petroleum Equipment Suppliers Association. He serves on the Advisory Board of the Department of Engineering at Texas A&M University.

Mr. Netherland brings to our board extensive oilfield service sector industry experience and regulatory knowledge. Mr. Netherland has considerable experience dealing with the complexities of international operations. In addition, his experience dealing with mergers and acquisitions enhances our board’s ability to evaluate corporate opportunities. | ||||

Richard A. Pattarozzi, 66 | Richard A. Pattarozzi retired as Vice President of Shell Oil Company in 2000, having joined the Shell family of companies in 1966. He served as President and Chief Executive Officer for both Shell Deepwater Development, Inc. and Shell Deepwater Production, Inc. from 1995 until 1999.

Mr. Pattarozzi previously served on the boards of Superior Energy Services, Inc., a leading provider of specialized oilfield services and equipment, and Transocean Inc., the former parent holding company and now a wholly-owned subsidiary of Transocean Ltd., the world’s largest offshore drilling contractor. He is the past Chairman of the Board of Trustees of the Offshore Energy Center. Mr. Pattarozzi received a B.S. in Engineering from the University of Illinois.

Mr. Pattarozzi is a member of the boards of FMC Technologies, Inc., Global Industries, Ltd., and serves as the non-executive Chairman of the Board of Stone Energy Corporation, a publicly-traded independent oil and natural gas exploration and production company. Mr. Pattarozzi also currently serves as the secretary of the board of trustees of the National World War II Museum, Inc. in New Orleans and as a trustee of the United Way of Greater New Orleans, having previously served as the latter board’s chairman.

Mr. Pattarozzi has considerable board and senior management experience. His years of working with publicly-traded, multinational companies deepens our board’s ability to understand and respond to the opportunities and challenges our company faces. In addition, Mr. Pattarozzi’s extensive experience in the oil and gas industry has enabled him to gain a thorough grasp of health, safety, and regulatory matters that affect our company. | 2001 | ||

Nicholas J. Sutton, 65 | Nicholas J. Sutton has served as the Chairman and Chief Executive Officer of Resolute Energy Corporation, a publicly-traded company engaged in the acquisition, development and production of domestic oil and gas, since the company’s founding in 2004.

Mr. Sutton was co-founder, Chairman, and Chief Executive Officer of HS Resources, Inc. from 1978 until late 2001, when Kerr-McGee Corporation acquired the company. Mr. Sutton served on the board of Kerr-McGee from 2001 until he founded Resolute in 2004. Mr. Sutton has also served on the boards of the Colorado Oil & Gas Association and the San Francisco Bay Area YMCA.

| 2006 | ||

13

Name and Age | Business Experience, Qualifications, and Skills | Tidewater Director since | ||

Mr. Sutton earned his law degree from the University of California-Hastings College of Law and his engineering undergraduate degree from Iowa State University. He is a Graduate of Harvard Business School’s Executive Education OPM Program. Before founding HS Resources, Mr. Sutton served as a law clerk to the Chief Justice of the California Supreme Court and practiced law with the San Francisco firm of Pillsbury, Madison & Sutro. Mr. Sutton is a member of the board of the St. Francis Memorial Hospital Foundation. He also is a member of the Society of Petroleum Engineers and of the American Association of Petroleum Geologists.

Mr. Sutton brings to the board a deep understanding of our company’s regulatory and legal challenges. His experience founding new businesses provides an entrepreneurial viewpoint and his successful completion of mergers and acquisitions contributes to the board’s ability to evaluate these opportunities. | ||||

Cindy B. Taylor, 48 | Cindy B. Taylor has served as President, Chief Executive Officer, and a director of Oil States International, Inc., a publicly-traded, diversified solutions provider for the oil and gas industry, since 2007. Ms. Taylor first joined Oil States in 2000 as Senior Vice President— Chief Financial Officer and Treasurer, serving as the company’s President and Chief Operating Officer from 2006 until 2007.

Ms. Taylor began her career in 1984 with Ernst & Young, LLP, a public accounting firm, and held various management positions with that firm until 1992. Ms. Taylor was Vice President—Controller of Cliffs Drilling Company from 1992 to 1999 and Chief Financial Officer of LE Simmons & Associates, Inc. from 1999 to 2000. She holds a B.B.A. degree in Accounting from Texas A&M University and is a Certified Public Accountant in the state of Texas.

Ms. Taylor previously served as a director of Global Industries, Ltd. and Boots & Coots International Well Control, Inc., a well control and emergency response company.

Ms. Taylor brings to our board a wealth of financial and accounting experience, and is one of three audit committee financial experts as confirmed by our board. Not only does Ms. Taylor bring a broad spectrum of management experience to the board—as a former chief financial officer, a former chief operating officer, and a current chief executive officer—but she also has a considerable depth of knowledge in each role. Her experience leading a diversified oilfield services company in international transactions enhances our board’s ability to critically evaluate and act upon international opportunities. | 2008 | ||

14

Name and Age | Business Experience, Qualifications, and Skills | Tidewater Director since | ||

Dean E. Taylor, 61 | Dean E. Taylor is our President, Chief Executive Officer, and Chairman of our board of directors. Mr. Taylor began his career with Tidewater in 1978 as an assistant manager with the company’s Gulf of Mexico operations. He was promoted to General Manager of our business activities in Italy in 1979, to General Manager of our Brazilian business activities in 1981, and to General Manager of our operations in the Middle East and India in 1985. Mr. Taylor also served as General Manager of Tidewater’s Mexican operations beginning in 1986, and in 1994, his responsibilities were expanded to cover both Mexico and Venezuela. He was first promoted to corporate Vice President in 1993. Mr. Taylor was appointed President and a director in 2001, Chief Executive Officer in 2002, and was elected to the chairmanship in 2003.

Prior to his employment with Tidewater, Mr. Taylor served seven years of active duty as a U.S. Naval Officer, with duty aboard a Navy destroyer and a U.S. Coast Guard cutter. He also served as a staff Officer for the Commander, U.S. Sixth Fleet. He received a B.A. in English from Tulane University and an MSBA from Boston University. In 2000, he completed the Harvard Advanced Management Program.

Mr. Taylor also serves as a director of Whitney Holding Corporation, a publicly-traded bank holding company headquartered in New Orleans, and the American Bureau of Shipping.

Mr. Taylor has proven himself to be an effective leader of our board, with considerable in-depth knowledge of all facets of our company’s diverse operations. Mr. Taylor’s emphasis on safe operations has led to a very impressive safety record, which places our company at the top of the industry. In addition, the maintenance of a strong balance sheet under his watch has enabled our company to weather the credit crisis and to be well positioned for expansion, acquisitions, or other opportunities requiring the use of liquidity or leverage. Mr. Taylor’s long tenure with our company has enabled him to develop and maintain strong relationships with our clients. | 2001 | ||

Jack E. Thompson, 60 | Jack E. Thompson has been employed as an independent management consultant since 2001. An engineer with over 30 years of experience in mining and mine management, Mr. Thompson served as Chairman and Chief Executive Officer of Homestake Mining Company, a publicly-traded gold mining company, from 1994 until it became a subsidiary of Barrick Gold Corporation in 2001. Mr. Thompson then served as Vice Chairman of Barrick, one of the largest pure gold mining operations in the world, until 2005.

Mr. Thompson holds a Bachelor of Science degree in Mining and Engineering from the University of Arizona and an Honorary Doctorate in Mining Management from the South Dakota School of Mines. | 2005 | ||

15

Name and Age | Business Experience, Qualifications, and Skills | Tidewater Director since | ||

Mr. Thompson has previously served on the boards of directors of Rinker Group Ltd., a publicly-traded, Australian-based multinational building products company acquired by CEMEX in 2007, and Stillwater Mining Company, a publicly-traded mining company primarily engaged in the development, extraction, processing, smelting, refining, and marketing of palladium, platinum, and associated metals in Montana. Mr. Thompson has also served as a director of Phelps Dodge Corporation, a publicly-traded copper mining company which was acquired by Freeport-McMoRan Copper & Gold Inc. in 2007; and Centerra Gold, Inc., a gold mining company that is the largest Western-based gold producer in Central Asia and the former Soviet Union. In addition, he has previously served as a member of the Advisory Board of Resource Capital Funds, LLP. Mr. Thompson has taught seminars and classes on corporate governance and management at the University of Arizona, Golden Gate University, and the University of California at Davis.

Mr. Thompson currently is a director of Molycorp Minerals, LLC, a privately-owned integrated rare earth products and technology company; Anglo American plc, a U.K. company which is one of the world’s largest diversified mining groups; and Century Aluminum Co., a publicly-traded producer of primary aluminum. Mr. Thompson is a member of the Industry Advisory Council for the College of Engineering and the Mining Engineering and Geological Department Advisory Council, both at the University of Arizona. He also serves as Vice Chairman of the board of the John Muir Health Foundation, the fundraising side of a three hospital non-profit group in Contra Costa County, California.

Born in Cuba and now a naturalized U.S. citizen, Mr. Thompson’s Hispanic background and Spanish language skills bring a welcomed diversity of perspective to our board. While many of our director nominees have backgrounds in the oil and gas industry, Mr. Thompson brings a unique perspective as a mining engineer and independent management experience in a similar extractive industry. His considerable experience with the corporate governance issues faced by multinational companies is also a valuable asset to our board. |

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE

“FOR” EACH OF THE TWELVE NOMINEES FOR DIRECTOR LISTED ABOVE.

Director Nominating Process and Considerations. The nominating and corporate governance committee is responsible for reviewing and evaluating with our board of directors the appropriate skills, experience, and background desired of board members in the context of our business and the then-current composition of our board. Under our Corporate Governance Policy and the rules of the New York Stock Exchange, a majority of our directors must be independent. Our board has determined that with the exception of Mr. Taylor, who serves as our Chief Executive Officer, each of our director-nominees meets the New York Stock Exchange’s definition of “independence” (discussed in greater detail below under “Board of Directors—Director Independence”).

16

In considering the composition of our board of directors as a whole, the committee and the board consider the skills and experiences of each candidate to ensure that those specific talents, skills, and other characteristics needed to maintain our board’s effectiveness are possessed by an appropriate combination of directors. The committee seeks a diverse group of prospective candidates for board service who possess the requisite characteristics, skills, and experience to make a significant contribution. Our overarching goal is that the unique skills and experiences of each individual director complement and enhance the overall value of the board.

The committee and our board have not adopted specific criteria for selecting director nominees, preferring to maintain the flexibility to evaluate the board’s needs at any given point in time in light of our company’s business model, strategic plan, and the skills set of the then-current members of the board. However, as evidenced by the biographies of our director nominees that appear above, we believe it is important that our board have individual directors who possess skills in such broad areas as:

| • | strategic planning and business development; |

| • | mergers and acquisitions; |

| • | legal and regulatory compliance; |

| • | finance and accounting matters; |

| • | industry experience and knowledge—particularly in the oil services and maritime sectors; |

| • | demonstrated leadership of large, complex organizations; |

| • | public board service; and |

| • | international business. |

Each candidate is evaluated to ensure that he or she possesses personal and professional character and integrity, and each must demonstrate exceptional ability and judgment in his or her respective endeavors. Candidates must possess sufficient time to effectively carry out their duties and responsibilities. The committee may employ professional search firms (for which it would pay a fee) to assist it in identifying potential nominees for board service with the right mix of skills and disciplines.

This year, the committee reviewed the qualifications of each of our 11 current directors and unanimously recommended each director for an additional one-year term. Upon the recommendation of our chief executive officer, the committee considered another candidate, Morris E. Foster, and voted unanimously to add him as a twelfth candidate. Subsequently, our board unanimously approved this slate of 12 director nominees to be submitted for election by our stockholders at the annual meeting.

Consideration of Candidates Recommended by Stockholders. Our bylaws provide that a stockholder of our company entitled to vote for the election of directors may nominate candidates for election to our board at our annual meeting of stockholders by complying with the required notice procedures, as described in greater detail below. The nominating and corporate governance committee’s policy is to consider director candidates recommended by stockholders on the same basis and in the same manner as it considers all director candidates.

No director candidates were recommended by stockholders in time for consideration at the 2010 annual meeting. To be timely for our 2011 annual meeting, a stockholder’s notice must be given in writing and delivered or mailed to the company’s Secretary and received at our principal executive offices no earlier than April 13, 2011 and no later than May 8, 2011. However, if the 2011 annual meeting is set for a date more than 30 days before or after July 22, 2011, a stockholder’s notice, in order to be timely, must be received by the close of business on the later of 90 days prior to the date of the annual meeting or the tenth day following the day on which the meeting date was publicly announced.

17

Nominee recommendations are required to set forth, among other things, specified information as to the nominees and as to the stockholder making the nomination or proposal. We may require any proposed nominee to furnish such information as may reasonably be required to determine his or her eligibility to serve as a director of our company. A description of these requirements is set forth in the company’s bylaws, which may be obtained as described under “Corporate Governance—Availability of Corporate Governance Materials.”

18

Our board of directors and management have adopted corporate governance practices designed to aid in the fulfillment of their respective duties and responsibilities to our stockholders.

Corporate Governance Policy. Our board has adopted a Corporate Governance Policy, which, in conjunction with our certificate of incorporation, bylaws, and board committee charters, forms the framework for the governance of our company. The nominating and corporate governance committee is charged with reviewing the Corporate Governance Policy annually to assess the continued appropriateness of the guidelines in light of any new regulatory requirements and evolving corporate governance practices. After this review, the committee recommends any proposed changes to the full board for approval.

Code of Business Conduct and Ethics. Our board has also adopted a Code of Business Conduct and Ethics. The Code of Business Conduct and Ethics sets forth principles of ethical and legal conduct to be followed by our directors, officers, and employees. Under this Code, any employee who reasonably believes or suspects that any director or employee has violated the Code of Business Conduct and Ethics is responsible for reporting such activities to his or her supervisor or to our Chief Compliance Officer, either directly or anonymously. We do not permit retaliation of any kind against any person who, in good faith, reports any known or suspected improper activities pursuant to the Code of Business Conduct and Ethics.

Our Code of Business Conduct and Ethics also references disclosure controls and procedures required to be followed by all officers and employees involved with the preparation of the company’s SEC filings. These disclosure controls and procedures are designed to enhance the accuracy and completeness of the company’s SEC filings and, among other things, to ensure continued compliance with the Foreign Corrupt Practices Act.

Communications with Directors. Stockholders and other interested parties may communicate directly with our board, the non-management directors, or any individual director by writing to any one of them in care of our Corporate Secretary at 601 Poydras Street, Suite 1900, New Orleans, Louisiana 70130. Our company or the director contacted will forward the communication to the appropriate director. For more information regarding how to contact the members of our board, please visit our web site at http://www.tdw.com/about/corporate-governance/communicating-concerns-to-the-board-of-directors/.

Complaint Procedures for Accounting, Auditing and Financial Related Matters. The audit committee has established procedures for receiving, reviewing, and responding to complaints from any source regarding accounting, internal accounting controls, and auditing matters. The audit committee has also established procedures for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. Interested parties may communicate such complaints by following the procedures described under the heading “Communications with Directors” above. Employees may report such complaints by following the procedures outlined in the Code of Business Conduct and Ethics and through other procedures communicated and available to them. We do not permit any retaliation of any kind against any person who, in good faith, submits a complaint or concern under these procedures.

Availability of Corporate Governance Materials. You may access our certificate of incorporation, our bylaws, our Corporate Governance Policy, our Code of Business Conduct and Ethics, and all committee charters under “Corporate Governance” in the “About Tidewater” section of our website at http://www.tdw.com. You also may request printed copies, which will be mailed to you without charge, by writing to us in care of our Corporate Secretary, 601 Poydras Street, Suite 1900, New Orleans, Louisiana 70130.

19

As of the date of this proxy statement, our board consists of 11 members. If all director nominees are elected at the 2010 annual meeting, our board will increase in size to 12 directors.

Board Meetings and Attendance. During fiscal 2010, our board held eight meetings. Each of our current directors attended at least 75% of the meetings of the board and of the committees on which he or she served. Our board does not have a policy requiring director attendance at annual meetings; however, our board’s practice is to schedule a meeting on the same date as the annual meeting to facilitate director attendance at the annual meeting. All of the board members who were directors on the date of the 2009 annual meeting attended the 2009 annual meeting.

Director Independence. Our board has affirmatively determined that 10 of our 11 current directors—Messrs. Allison, Day, du Moulin, Leonard, Madonna, Netherland, Pattarozzi, Sutton, and Thompson, and Ms. Taylor—as well as Mr. Morris Foster, a new director nominee, are independent. The standards relied upon by the board in affirmatively determining whether a director is independent are comprised of the objective standards set forth in the corporate governance listing standards of the New York Stock Exchange. In making this determination, our board evaluated responses to a questionnaire completed annually by each director regarding relationships and possible conflicts of interest between each director, the company, and management. In its review of director independence, our board also considered the commercial, industrial, banking, consulting, legal, accounting, charitable, and familial relationships any director may have with the company or management.

Board Leadership Structure. Our board does not have a policy requiring the separation of the offices of chairman and chief executive officer; rather, our board determines from time to time whether it is in the best interests of our company and our stockholders for the roles to be separate or combined. We believe that our board should have the flexibility to make these determinations in a way that will best provide appropriate leadership for our company.

Currently, the roles of chairman and chief executive officer are combined, which we believe fosters clear accountability, effective decision-making, and alignment on corporate strategy. Specifically, our board believes that its current leadership structure, with Mr. Taylor serving as both chief executive officer and board chairman, is appropriate and best serves the interests of our company and our stockholders given Mr. Taylor’s past experience serving in these roles and the efficiencies of having the chief executive officer also serve in the role of chairman. To assure effective independent oversight, however, our board has adopted a number of governance practices, including the appointment of a Lead Independent Director when the roles are combined.

Selection and Role of Lead Independent Director. Under our Corporate Governance Policy, whenever the roles of chairman and chief executive officer are combined, the board elects a Lead Independent Director at the first board meeting following the annual meeting of stockholders. The nominating and corporate governance committee recommends a candidate for election as Lead Independent Director, and our board, taking the committee’s recommendation into consideration, elects an independent director to fill that role for a one-year term. Mr. Pattarozzi has served as our board’s Lead Independent Director since 2008, having been twice nominated by the committee and elected by our board to the position.

The Lead Independent Director’s responsibilities include:

| • | presiding at meetings where the Chairman is not present, including regularly-scheduled executive sessions and sessions where only independent directors are present; |

| • | serving as the principal liaison between the Chairman and the independent directors; and |

| • | assisting the Chairman in setting agendas and schedules for board meetings. |

20

The Lead Independent Director has authority to call meetings of the independent directors, provided notice of the meeting is given to the Chairman.

Executive Sessions of Independent Board Members. The non-management members of the board of directors meet in regularly-scheduled executive sessions presided over by our Lead Independent Director. Our Corporate Governance Policy requires at least three such executive meetings per year. The non-management directors may schedule additional executive sessions throughout the year. During fiscal 2010, the non-management members of our board (all of our directors except Mr. Taylor) met six times in executive session.

Annual Board Self-Assessments. To assist in determining whether the board and committees are functioning effectively, our board has instituted annual self-assessments of the board and each of its committees. The nominating and corporate governance committee oversees this evaluation process. In fiscal 2010, our board and each of its committees completed self-evaluations and reviewed and discussed the results, making changes as deemed necessary to improve director communications and the overall effectiveness of board and committee meetings.

Role of the Board in Risk Oversight. While our board as a whole has responsibility for risk oversight, the committees oversee risks associated with their respective areas of responsibility, as summarized below under “Composition and Role of Board Committees.” Our board and its committees convene an annual joint meeting that focuses on identifying, evaluating, and managing the spectrum of key risks faced by our company. The particular areas of focus include strategic, operational, financial and reporting, compensation, regulatory and compliance, international, and other risks.

21

COMPOSITION AND ROLE OF BOARD COMMITTEES

Our board currently has four standing committees: audit, compensation, nominating and corporate governance, and finance and investment. Each of these four committees is comprised entirely of independent non-management directors and is governed by a written charter which is reviewed annually and approved by the full board. A copy of each committee charter may be obtained online or by mail as described in “Corporate Governance—Availability of Corporate Governance Materials.”

The current members of each board committee are identified in the following table, which also indicates the number of meetings each committee held in fiscal 2010:

| Board Committee | ||||||||

Name of Director | Audit | Compensation | Nominating and Corporate Governance | Finance and Investment | ||||

M. Jay Allison | x | x | ||||||

James C. Day | x | x | ||||||

Richard T. du Moulin | Chairman | x | ||||||

J. Wayne Leonard | x | x | ||||||

Jon C. Madonna | Chairman | x | ||||||

Joseph H. Netherland | x | x | ||||||

Richard A. Pattarozzi | x | x | ||||||

Nicholas J. Sutton | x | x | ||||||

Cindy B. Taylor | x | Chairman | ||||||

Jack E. Thompson | x | Chairman | ||||||

Number of Meetings in Fiscal 2010 | 9 | 6 | 7 | 6 | ||||

Audit Committee. Our board’s audit committee is a separately-designated, standing audit committee established in accordance with the Securities Exchange Act of 1934. Its members are listed in the above chart. The board has determined that three of the five committee members—Messrs. Madonna and Leonard and Ms. Taylor—qualify as an “audit committee financial expert,” as defined by SEC rules.

The main function of our audit committee is to oversee our accounting and financing reporting processes, internal systems of control, independent auditor relationship, and the audits of our financial statements. The audit committee’s key responsibilities include:

| • | appointing and retaining our independent auditor; |

| • | evaluating the qualifications, independence, and performance of our independent auditor; |

| • | reviewing and approving all services (audit and permitted non-audit) to be performed by our independent auditor; |

| • | reviewing with management and the independent auditor our audited financials; |

| • | reviewing the scope, adequacy, and effectiveness of our internal controls; |

| • | reviewing with management our earnings reports and quarterly financial reports; and |

| • | monitoring the company’s efforts to mitigate the risk of financial loss due to failure of third parties. |

The audit committee is also responsible for any audit reports the SEC requires us to include in our proxy statements. In this proxy statement, the requisite report may be found under the heading, “Audit Committee Report.”

22

Compensation Committee. The purpose of the compensation committee is to assist our board of directors in discharging its responsibilities relating to:

| • | overseeing our executive compensation program; |

| • | reviewing and approving corporate goals and objectives relevant to the compensation of our executive officers and determining and approving the compensation of our executive officers; |

| • | consideration of all substantive elements of our employee compensation package, including identifying, evaluating, and mitigating any risks arising from our compensation policies and practices; |

| • | ensuring compliance with laws and regulations governing executive compensation; and |

| • | engaging in such other matters as may from time to time be specifically delegated to the committee by the board of directors. |

The committee reports to the board of directors on all compensation matters regarding our executive officers and employees. The compensation committee is also responsible for reviewing and discussing with management the “Compensation Discussion and Analysis” portion of our proxy statement and, based on such review and discussion, recommending to the board that the Compensation Discussion and Analysis be included in our proxy statement and issuing a Compensation Committee Report to that effect to be included in the proxy statement.

The “Compensation Discussion and Analysis” section of this proxy statement provides a discussion of the process the committee uses in determining executive compensation. Included in the subsection entitled “The Compensation Setting Process” is a description of the scope of the committee’s authority, the role played by our chief executive officer in setting compensation for the other named executive officers, and the committee’s engagement of compensation consultants.

Risk Review of Employee Compensation. Consistent with new SEC disclosure requirements, the compensation committee has performed a risk assessment of our company’s compensation programs. Management has identified the elements of our compensation program that could incentivize risk and has reported to the compensation committee its assessment of those risks and mitigating factors particular to each risk. The compensation committee has concluded that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on our company. Some of the factors considered by the committee include:

| • | the company’s cash/equity mix strikes an appropriate balance between short-term and long-term risk and reward decisions; |

| • | the company performance portion of our annual incentive plans is based on company-wide value creation and safety criteria, which are less likely to be affected by individual or group risk-taking; |

| • | our annual incentive plans include a long-term performance component and have payout caps; |

| • | equity grants contain a mix of options, time-based restricted stock, and performance-based restricted stock; |

| • | the presence of multi-level reviews and approvals of compensation levels and performance criteria; and |

| • | for executives, the existence of an executive compensation recovery policy (“clawback”) and stock ownership guidelines. |

Nominating and Corporate Governance Committee. The purpose of the nominating and corporate governance committee is to:

| • | assist our board by identifying individuals qualified to serve as directors of the company and recommending nominees to the board, |

23

| • | monitor the composition of our board and its committees, |

| • | recommend to our board a set of corporate governance guidelines for the company, |

| • | oversee compliance with legal and regulatory requirements, |

| • | monitor the company’s efforts to assess the adequacy of information technology capacity and infrastructure, |

| • | review director compensation and benefits, and |

| • | lead our board in its annual review of the board’s performance. |

Additional information regarding the committee’s role in nominating directors and the ability of stockholders to recommend candidates for director may be found under “Election of Directors—Director Nominating Process and Considerations” and “—Consideration of Candidates Recommended by Stockholders,” respectively.

The nominating and corporate governance committee is also responsible for annually reviewing and setting director compensation and benefits and for reviewing director education programs. The nominating and corporate governance committee retained Towers Watson in fiscal 2010 to review director retainers, meeting fees, and stock-based compensation provided by our company in comparison to 16 companies in the energy services and marine industries as well as a general market survey of similarly-sized public companies.

Finance and Investment Committee. The purpose of the finance and investment committee is to:

| • | oversee our company’s financial affairs, policies, and strategies, including its annual and long-term financial plans; |

| • | monitor investment policies and guidelines for its employee benefits trust funds; and |

| • | evaluate and analyze the company’s capital structure, tax strategy, dividend policy, and risk profile. |

The finance committee also has responsibility for appointing and monitoring independent investment managers and for overseeing the development of projected operating budgets and capital expenditures and making recommendations as appropriate to our board on an annual and quarterly basis.

24

FISCAL YEAR 2010 DIRECTOR COMPENSATION TABLE

This table reflects all compensation paid to or accrued by each of our outside directors during fiscal 2010. Mr. Foster is not currently a director and therefore is not included in this chart. The compensation of Mr. Taylor, who is our President and Chief Executive Officer in addition to serving as Chairman of our board, is disclosed in the Summary Compensation Table in the section titled “Executive Compensation.”

Name of Director | Fees Earned or Paid in Cash ($) | Stock Awards(1) ($) | Changes in Pension Value and Nonqualified Deferred Compensation Earnings(2) ($) | All Other Compensation(3) ($) | Total ($) | |||||

M. Jay Allison | 80,500 | 105,790 | — | 5,000 | 191,290 | |||||

James C. Day | 72,500 | 104,041 | — | — | 176,541 | |||||

Richard T. du Moulin | 91,000 | 106,688 | 2,622 | 5,000 | 205,310 | |||||

J. Wayne Leonard | 75,000 | 106,688 | 1,922 | — | 183,610 | |||||

Jon C. Madonna | 94,000 | 106,688 | 7,922 | — | 208,610 | |||||

Joseph H. Netherland | 76,000 | 101,158 | — | — | 177,158 | |||||

William C. O’Malley(4) | 24,480 | 28,846 | — | 286,504 | 339,830 | |||||

Richard A. Pattarozzi | 101,000 | 106,688 | 5,504 | 1,900 | 215,092 | |||||

Nicholas J. Sutton | 72,500 | 106,121 | — | — | 178,621 | |||||

Cindy B. Taylor | 85,500 | 103,238 | — | 5,000 | 193,738 | |||||

Jack E. Thompson | 84,500 | 106,688 | 861 | 5,000 | 197,049 | |||||

| (1) | Amounts in this column reflect the aggregate grant date fair value of the deferred stock units granted to each of our non-management directors plus the value of dividends on deferred stock units credited for reinvestment during the fiscal year. Each of the non-management directors, with the exception of Mr. O’Malley (who retired during the fiscal year) was granted 2,116 deferred stock units on March 31, 2010. Mr. O’Malley was granted 652 deferred stock units on July 9, 2009, his last day as a director (see footnote 4). At the end of fiscal 2010, our non-management directors held the following numbers of deferred stock units: Messrs. du Moulin, Leonard, Madonna, Pattarozzi, and Thompson, 8,571 units each; Mr. Sutton, 8,029 units; Mr. Allison, 7,717 units; Mr. Day, 5,961 units; Ms. Taylor, 5,200 units; and Mr. Netherland 3,166 units. |

| (2) | This figure consists solely of changes in pension value. The change in Mr. O’Malley’s pension value was a negative amount ($17,054), which takes into account payments to him from the Retirement Plan during the fiscal year. Those payments are included in “All Other Compensation” and described in footnote 4. |

| (3) | For each director except for Mr. O’Malley (see footnote 4), this figure represents the costs of payments and payment commitments pursuant to our Gift Matching Program. |

| (4) | Mr. O’Malley, our former Chairman and Chief Executive Officer, served as a director from 1994 until July 9, 2009, the date of our 2009 annual meeting, when he had reached our mandatory retirement age for directors (age 72). Under the terms of our Directors Deferred Stock Units Plan, Mr. O’Malley received a total payout of $294,350 on his retirement date, which includes his fiscal year 2010 pro rata grant listed under “Stock Awards.” The amount in his “All Other Compensation” column includes: $265,504 for his payout under the Directors Deferred Stock Units Plan, net of the amount reported under “Stock Awards”; $6,000 for clerical support in fiscal 2010; and $15,000 for payments from the Retirement Plan during fiscal 2010. |

25

We use a combination of cash and equity-based compensation to attract and retain our non-management directors. Compensation for the non-management directors for fiscal 2010 consisted of an annual cash retainer, an additional annual cash retainer for the lead independent director and for the chairs of each board committee, meeting fees, an annual grant of deferred stock units, and other benefits. Officers of the company who also serve as directors do not receive any additional compensation for services as a director.

Director Fees. For fiscal year 2010, the cash and equity-based compensation payable to the non-management directors was as follows:

| • | an annual cash retainer of $40,000; |

| • | an additional annual cash retainer of $20,000 for the lead independent director; |

| • | an additional annual cash retainer of $15,000 for the chair of each of the audit committee and the compensation committee, and $10,000 for the chair of each of the nominating and corporate governance committee and the finance and investment committee; |

| • | a meeting fee of $2,000 for each board meeting attended and $1,500 for each committee meeting attended; and |

| • | an annual grant of deferred stock units valued at date of grant at $100,000 and described in more detail below. |