- TDW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Tidewater (TDW) 8-KOther Events

Filed: 12 Sep 18, 12:00am

Barclays CEO Energy-Power Conference 2018 John Rynd Chief Executive Officer September 6, 2018

FORWARD-LOOKING STATEMENTS Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Tidewater and GulfMark note that certain statements set forth in this presentation provide other than historical information and are forward looking. The unfolding of future economic or business developments may happen in a way not as anticipated or projected by Tidewater and GulfMark and may involve numerous risks and uncertainties that may cause Tidewater’s and GulfMark’s actual achievement of any forecasted results to be materially different from that stated or implied in the forward-looking statement. Among those risks and uncertainties, many of which are beyond the control of Tidewater or GulfMark, include, without limitation, the proposed transaction between Tidewater and GulfMark (the “Transaction”) and the anticipated synergies with respect to the combination of Tidewater and GulfMark; fluctuations in worldwide energy demand and oil and gas prices; fleet additions by competitors and industry overcapacity; customer actions including changes in capital spending for offshore exploration, development and production and changes in demands for different vessel specifications; acts of terrorism and piracy; the impact of potential information technology, cyber security or data security breaches; significant weather conditions; unsettled political conditions, war, civil unrest and governmental actions, especially in higher political risk countries where we operate; labor changes proposed by international conventions; increased regulatory burdens and oversight; changes in law, economic and global financial market conditions, including the effect of enactment of U.S. tax reform or other tax law changes, trade policy and tariffs, interest and foreign currency exchange rate volatility, commodity and equity prices and the value of financial assets; and enforcement of laws related to the environment, labor and foreign corrupt practices. Readers should consider all of these risk factors, other factors that are described in “Forward-Looking Statements,” as well as other information contained in Tidewater’s and GulfMark’s form 10-K’s and 10-Q’s. Although Tidewater and GulfMark believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. These statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including but not limited to: the ability of the parties to consummate the Transaction in a timely manner or at all; satisfaction of the conditions precedent to consummation of the Transaction, including the ability to secure regulatory approvals in a timely manner or at all, and approval by either company’s stockholders; the possibility of litigation (including related to the transaction itself); Tidewater’s and GulfMark’s ability to successfully integrate their operations, technology and employees and realize synergies from the Transaction; unknown, underestimated or undisclosed commitments or liabilities; the conditions in the oil and natural gas industry, including a decline in, or the substantial volatility of, oil or natural gas prices, and changes in the combined companies’ customer requirements; the level of demand for the combined companies’ products and services. Neither Tidewater nor GulfMark undertakes any obligation to update any forward-looking statements or to publicly release the results of any revisions to any forward-looking statements that may be made to reflect events or circumstances that occur, or that either Tidewater or GulfMark becomes aware of, after the date of this communication.

Founded in 1955 – designed the first OSV as we know it Financial restructuring completed July 31, 2017 NYSE-traded Securities (at 31 Aug 2018 close) Common Stock – TDW $32.00 Series A Warrants – TDW WS.A $4.25 Series B Warrants – TDW WS.B $3.56 Market Cap (at 31 Aug 18 close) ~$960 million, based on 30 million shares and $0.001 warrants Balance Sheet Info (at Jun 30, 2018) Cash $464 million Net Debt ($20 million) Book Equity ~$1 billion 204 owned vessels (at Jun 30, 2018) 8.7 year average age for active fleet Distributed across the globe; vessels working in all water depths Announced definitive agreement to combine with GulfMark; closing anticipated Q4 2018 Tidewater overview “Tidewater has become possibly the strongest player in the OSV industry and is set to benefit from a gradual normalization in the OSV market over the coming years…” Clarksons Platou Equity Research “…well positioned to take advantage of the current market downturn through M&A.” Pareto Securities “…Tidewater stands out in the OSV industry with a solid liquidity runway and a net cash position.” Arctic Securities Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc.

Best-positioned to navigate a challenging market Safety Leadership TRIR in FY2017 lower than last five years’ average Trusted Partner 60+ years experience in global OSV market Highly experienced management team Committed to Compliance Global Footprint Presence in all major oil & gas basins Invested in local content Minimal Future Capex Fleet renewal complete No additional construction-related Capex Young, Modern Fleet 141 active vessels / 8.7 year avg. age with 66 vessels stacked, 30 of which are less than 10 years old (as of June 30, ‘18) Diverse fleet capable of supporting all water depths Financial Strength Strong balance sheet, with zero net debt Ample liquidity to deal with industry challenges and fund vessel reactivations Positioned to lead OSV consolidation; proposed GulfMark merger is an important first step Cost Management Vessel opex down > 50% and G&A costs (adj. for restructuring costs) down ~30% relative to Q4 2014 Cost-cutting initiatives on-going Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc.

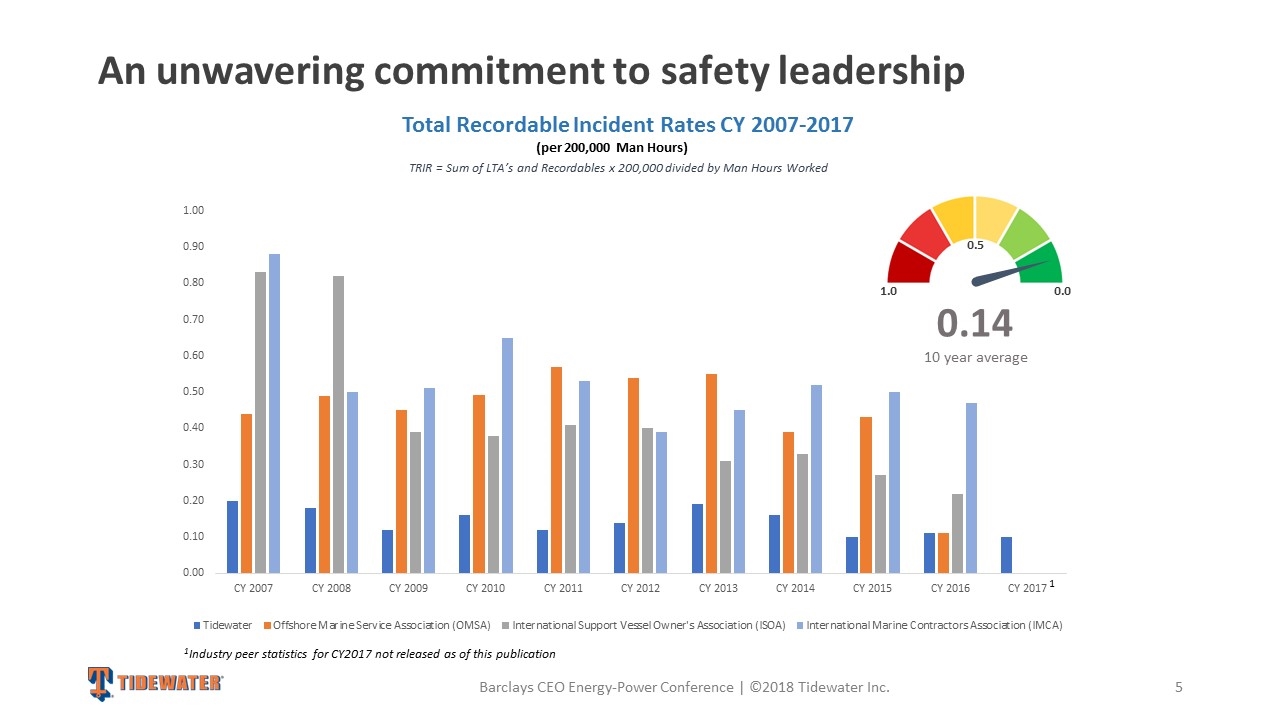

An unwavering commitment to safety leadership Total Recordable Incident Rates CY 2007-2017 (per 200,000 Man Hours) TRIR = Sum of LTA’s and Recordables x 200,000 divided by Man Hours Worked 0.0 1.0 0.5 0.14 10 year average 1 1Industry peer statistics for CY2017 not released as of this publication Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc.

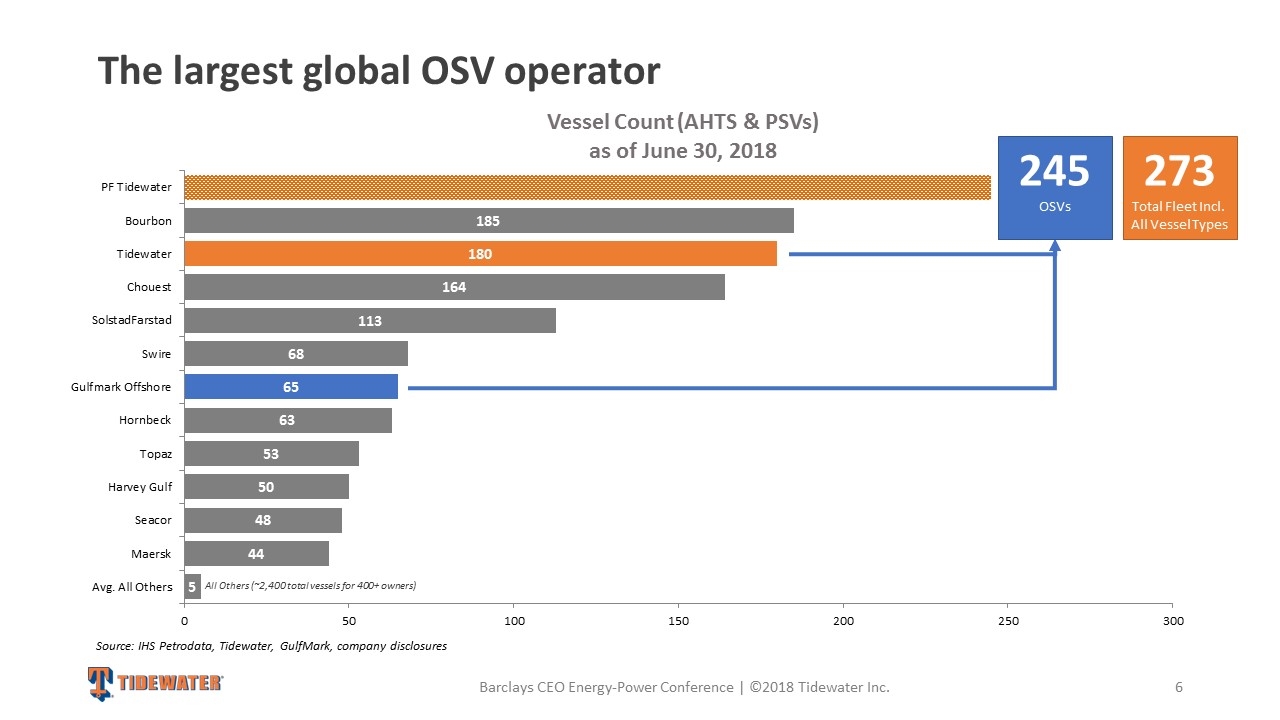

The largest global OSV operator Source: IHS Petrodata, Tidewater, GulfMark, company disclosures Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. All Others (~2,400 total vessels for 400+ owners) Vessel Count (AHTS & PSVs) as of June 30, 2018 273 Total Fleet Incl. All Vessel Types 245 OSVs

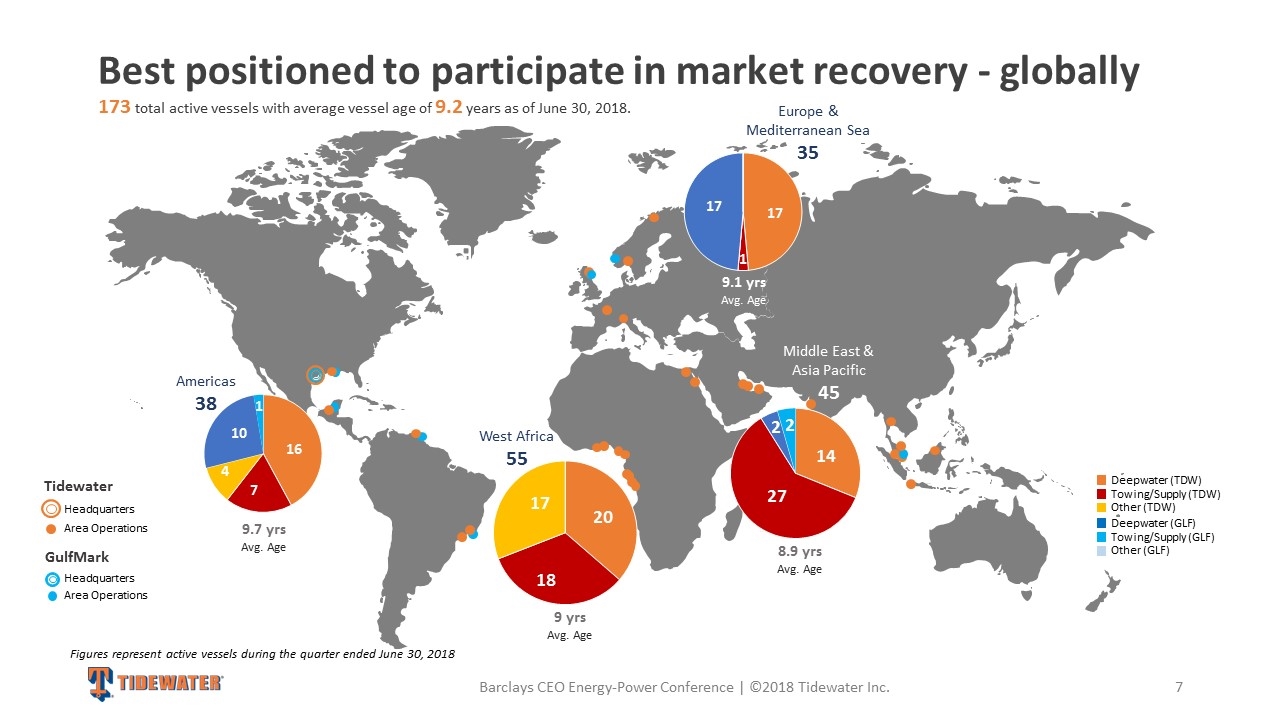

Best positioned to participate in market recovery - globally Headquarters Area Operations Towing Supply 173 total active vessels with average vessel age of 9.2 years as of June 30, 2018. Other Deepwater Towing Supply Deepwater Towing Supply 9.1 yrs Avg. Age Europe & Mediterranean Sea 35 8.9 yrs Avg. Age Middle East & Asia Pacific 45 Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. 9 yrs Avg. Age Figures represent active vessels during the quarter ended June 30, 2018 Tidewater Headquarters Area Operations GulfMark Deepwater (TDW) Towing/Supply (TDW) Other (TDW) Deepwater (GLF) Towing/Supply (GLF) Other (GLF) West Africa 55 Americas 38 9.7 yrs Avg. Age

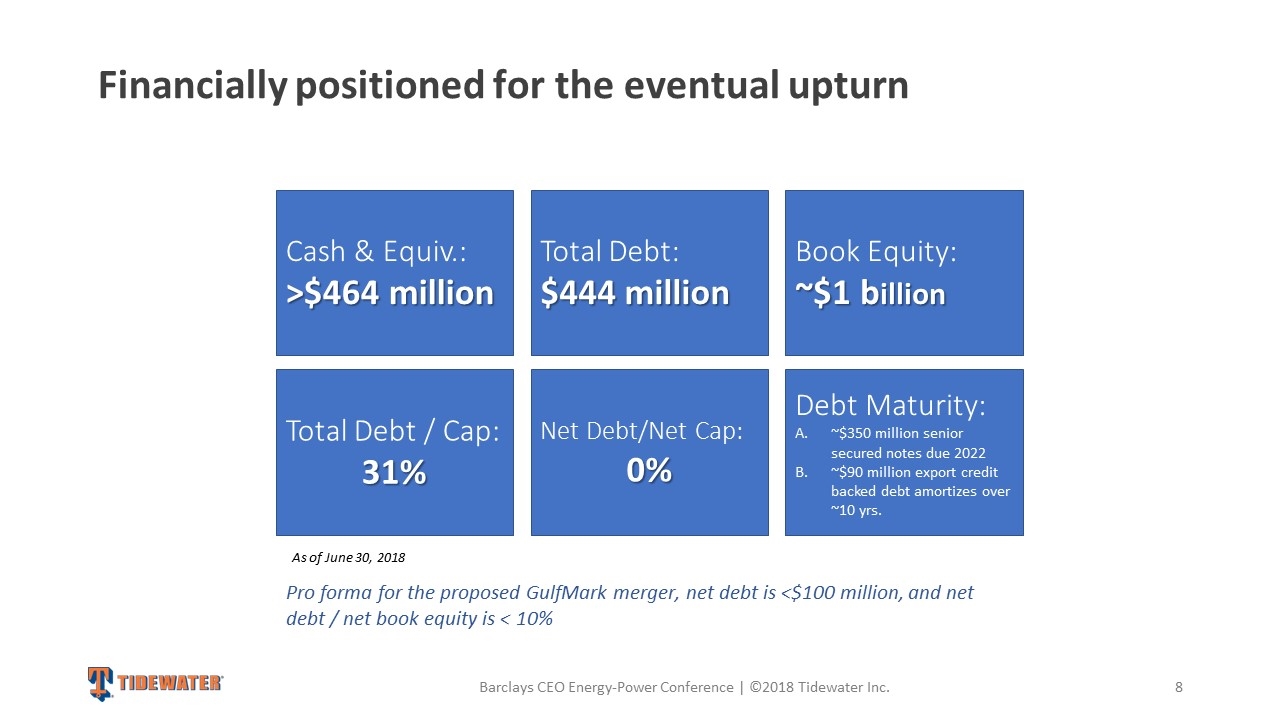

Financially positioned for the eventual upturn Cash & Equiv.: >$464 million Total Debt: $444 million Book Equity: ~$1 billion Net Debt/Net Cap: 0% Total Debt / Cap: 31% Debt Maturity: ~$350 million senior secured notes due 2022 ~$90 million export credit backed debt amortizes over ~10 yrs. As of June 30, 2018 Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. Pro forma for the proposed GulfMark merger, net debt is <$100 million, and net debt / net book equity is < 10%

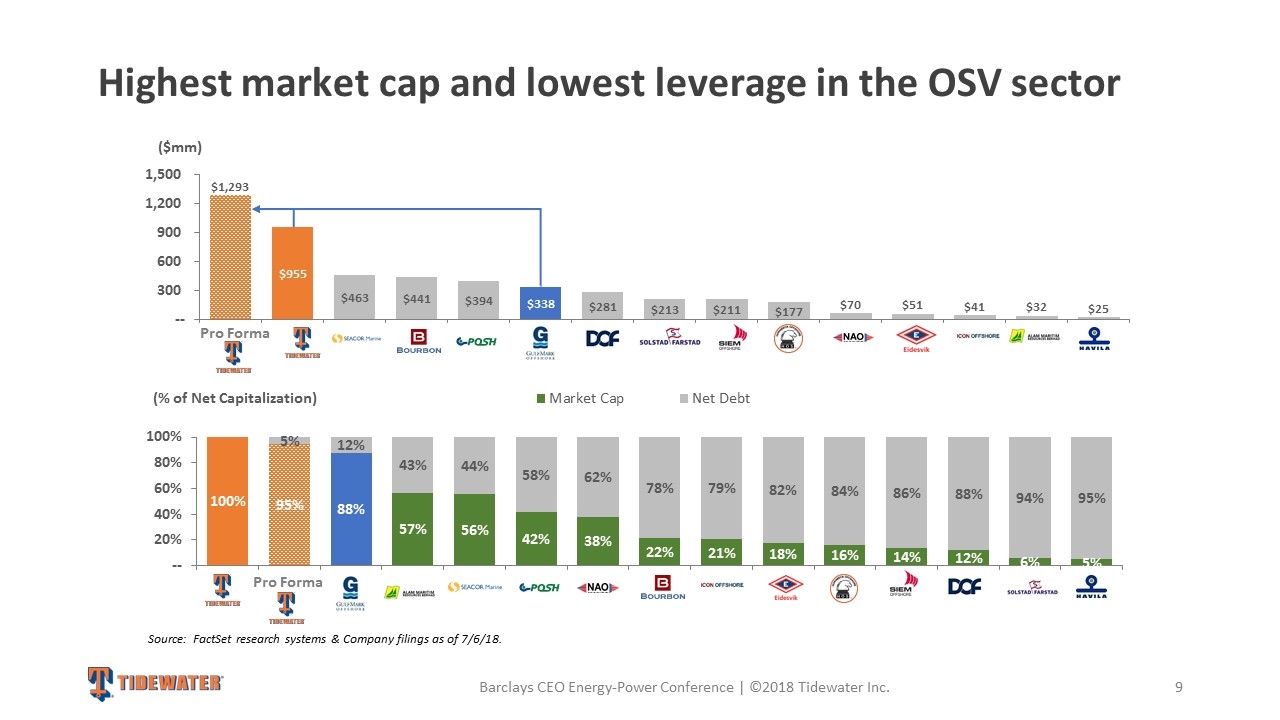

Source: FactSet research systems & Company filings as of 7/6/18. Highest market cap and lowest leverage in the OSV sector Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. Pro Forma Pro Forma

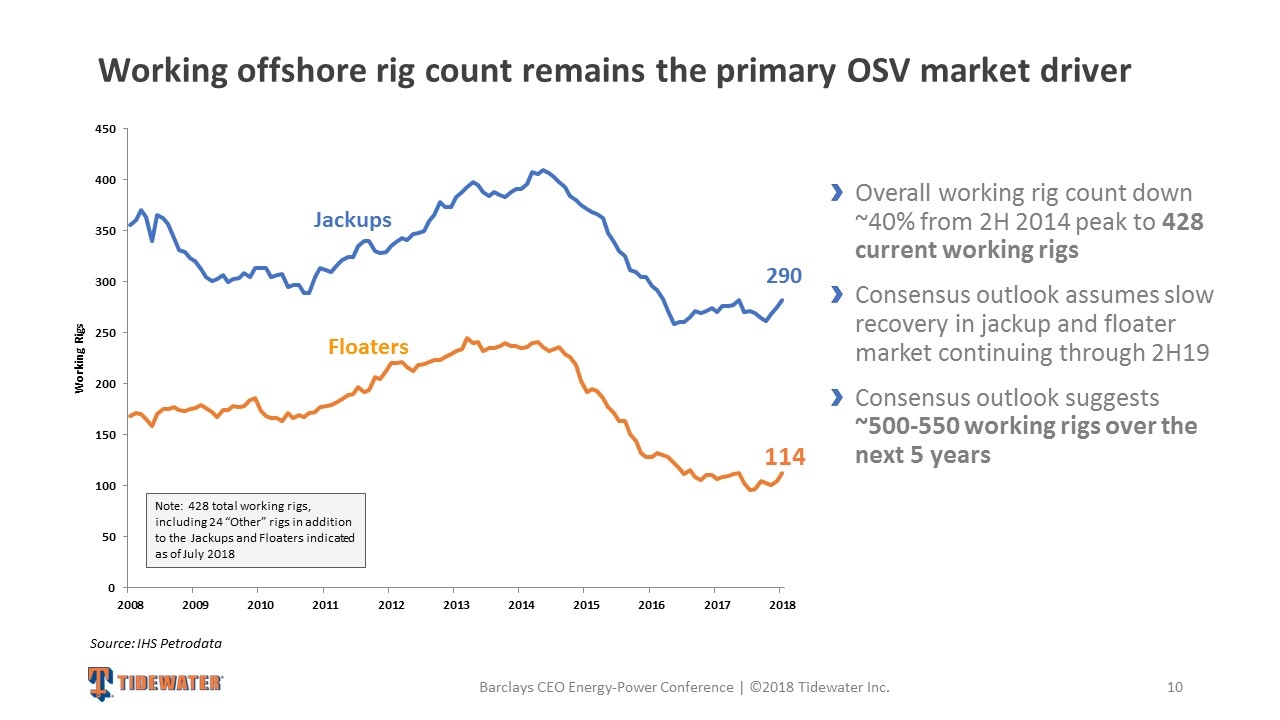

Overall working rig count down ~40% from 2H 2014 peak to 428 current working rigs Consensus outlook assumes slow recovery in jackup and floater market continuing through 2H19 Consensus outlook suggests ~500-550 working rigs over the next 5 years Working offshore rig count remains the primary OSV market driver Source: IHS Petrodata Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. Note: 428 total working rigs, including 24 “Other” rigs in addition to the Jackups and Floaters indicated as of July 2018 114 290 Jackups Floaters

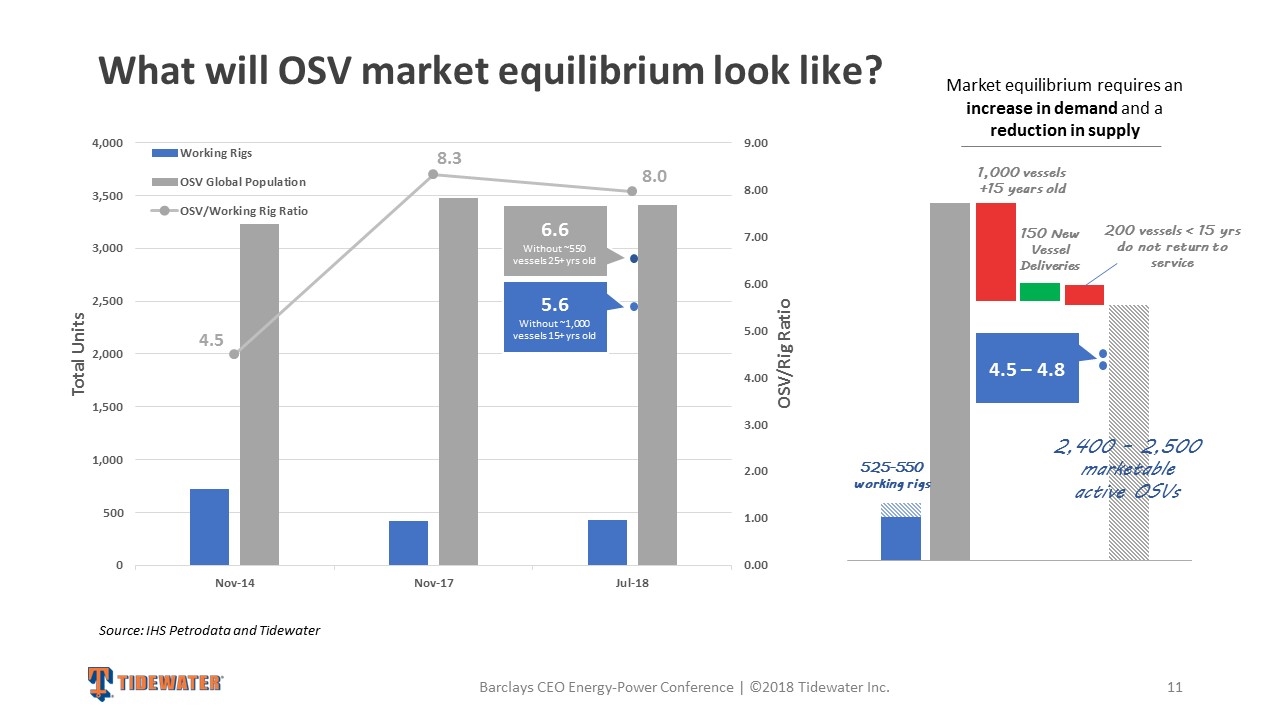

What will OSV market equilibrium look like? Source: IHS Petrodata and Tidewater 1,000 vessels +15 years old 200 vessels < 15 yrs do not return to service 525-550 working rigs 150 New Vessel Deliveries 4.5 – 4.8 2,400 – 2,500 marketable active OSVs Market equilibrium requires an increase in demand and a reduction in supply Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. 6.6 Without ~550 vessels 25+ yrs old 5.6 Without ~1,000 vessels 15+ yrs old

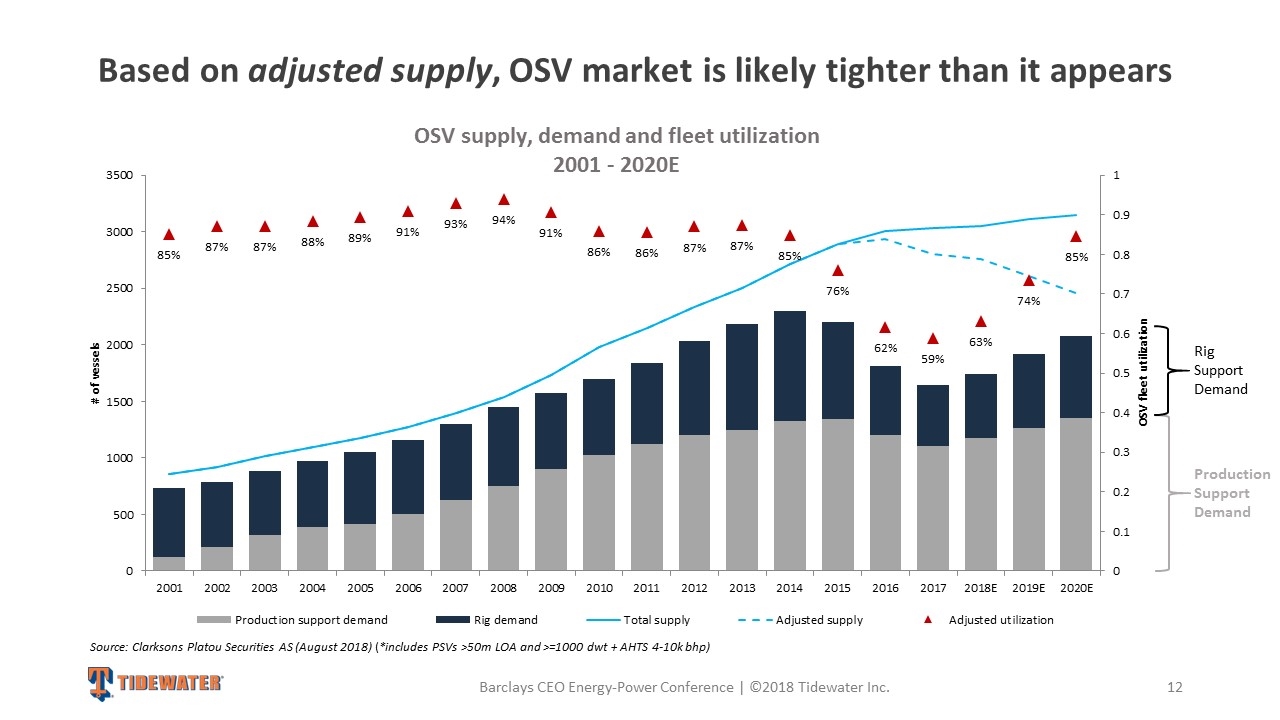

Based on adjusted supply, OSV market is likely tighter than it appears OSV supply, demand and fleet utilization 2001 - 2020E Production Support Demand Rig Support Demand Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. Source: Clarksons Platou Securities AS (August 2018) (*includes PSVs >50m LOA and >=1000 dwt + AHTS 4-10k bhp)

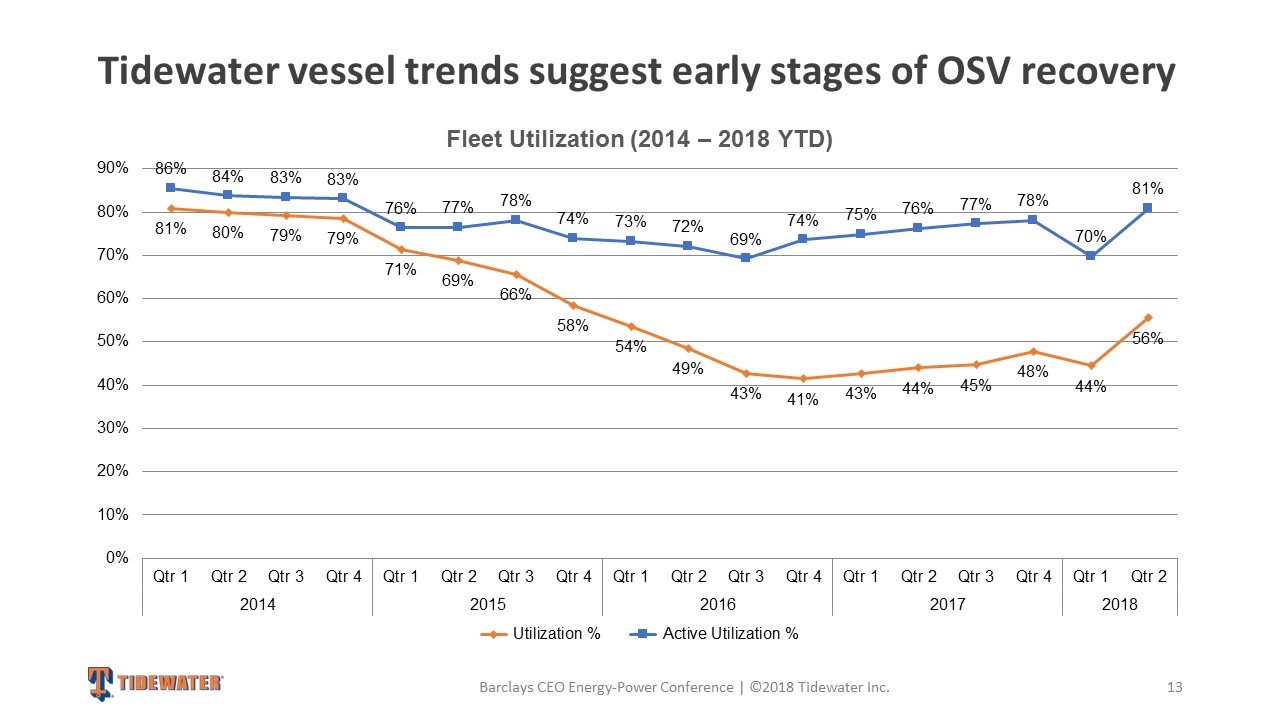

Tidewater vessel trends suggest early stages of OSV recovery Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc.

Go forward strategy Leadership in safety, compliance and operational excellence Protect and preserve strong liquidity position Rationalization of fleet and cost structure provide scope for Margin expansion in the upturn Focused on organic growth opportunities (reactivations) and M&A Deliver best-in-class shareholder returns Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. Stand-alone strategy sound | Proposed GulfMark merger consistent with key objectives

Appendix I – Supporting Information

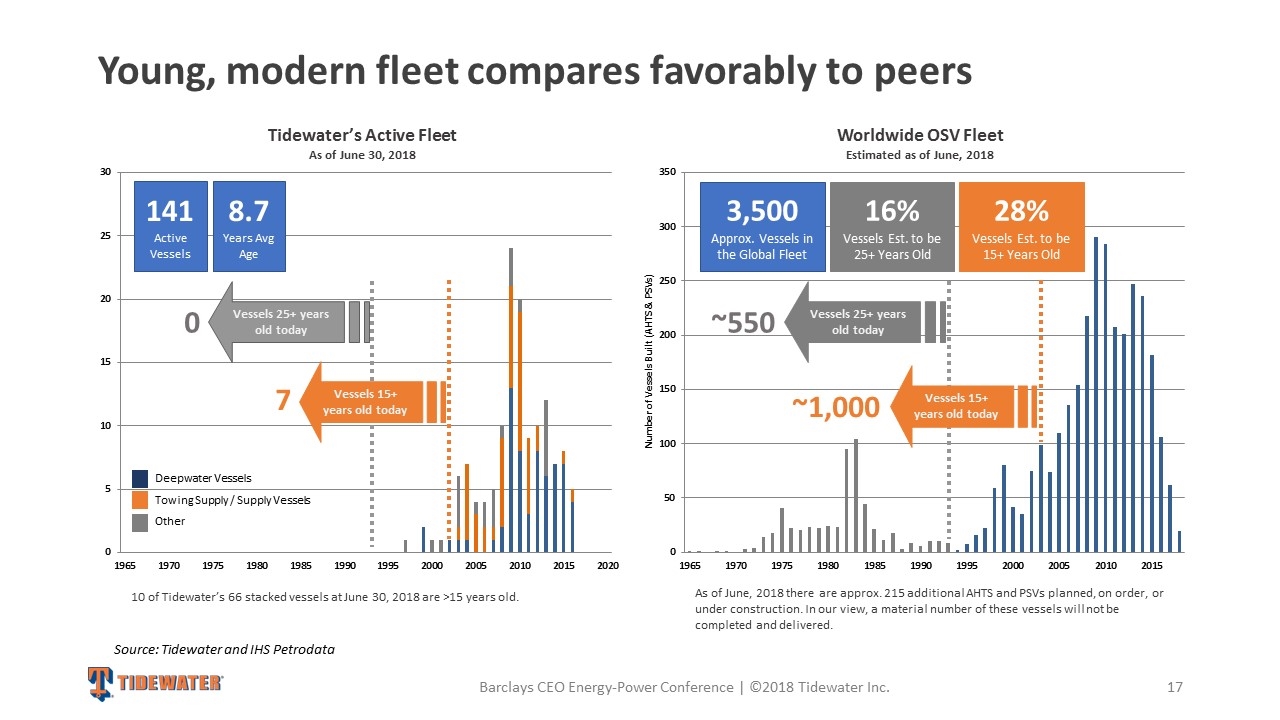

Young, modern fleet compares favorably to peers Source: Tidewater and IHS Petrodata As of June, 2018 there are approx. 215 additional AHTS and PSVs planned, on order, or under construction. In our view, a material number of these vessels will not be completed and delivered. Worldwide OSV Fleet Estimated as of June, 2018 Tidewater’s Active Fleet As of June 30, 2018 10 of Tidewater’s 66 stacked vessels at June 30, 2018 are >15 years old. Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. Deepwater Vessels Towing Supply / Supply Vessels Other 141 Active Vessels 8.7 Years Avg Age Vessels 25+ years old today Vessels 15+ years old today 7 0 3,500 Approx. Vessels in the Global Fleet 16% Vessels Est. to be 25+ Years Old Vessels 25+ years old today Vessels 15+ years old today ~1,000 ~550 28% Vessels Est. to be 15+ Years Old

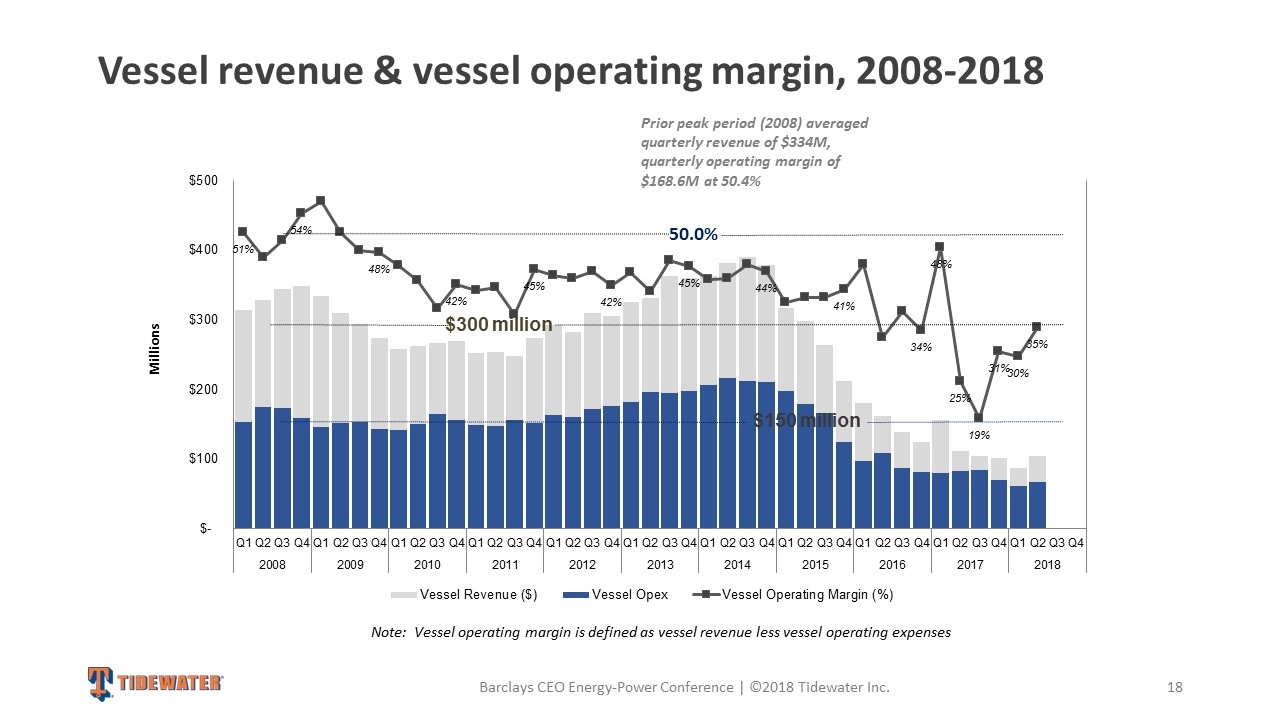

Vessel revenue & vessel operating margin, 2008-2018 Prior peak period (2008) averaged quarterly revenue of $334M, quarterly operating margin of $168.6M at 50.4% Note: Vessel operating margin is defined as vessel revenue less vessel operating expenses $150 million 50.0% Millions Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc.

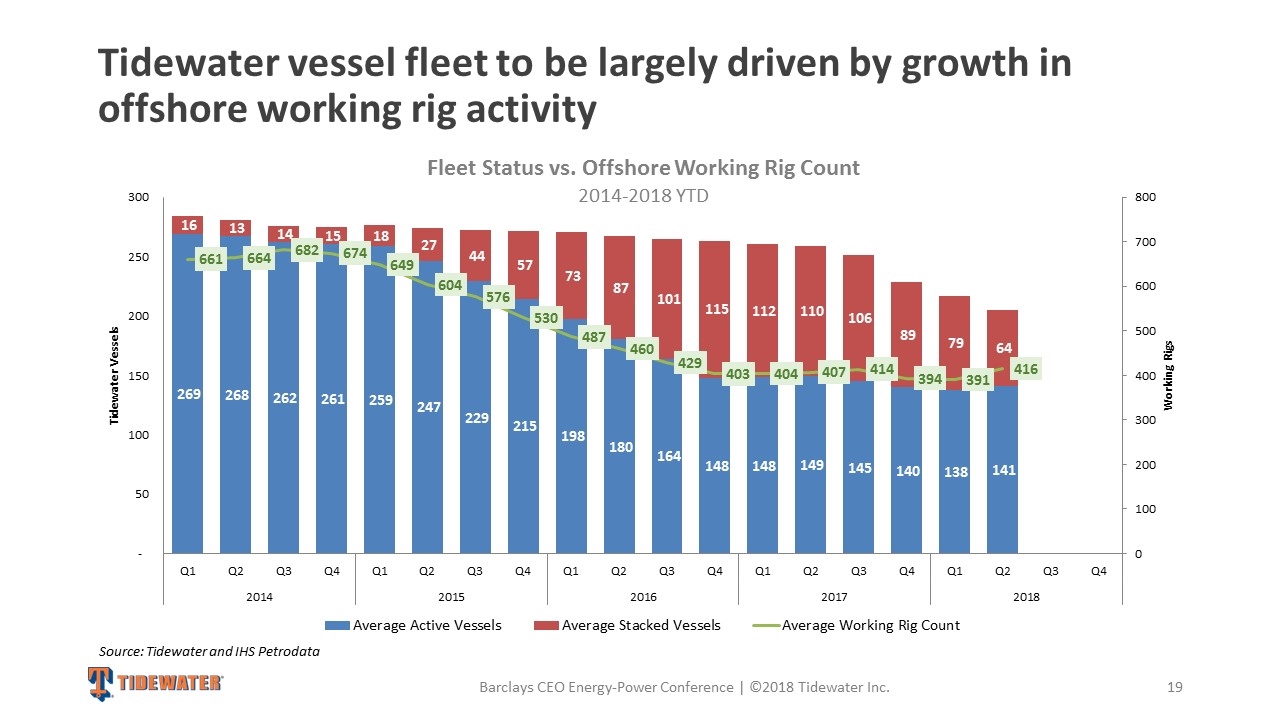

Tidewater vessel fleet to be largely driven by growth in offshore working rig activity Source: Tidewater and IHS Petrodata Fleet Status vs. Offshore Working Rig Count 2014-2018 YTD Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc.

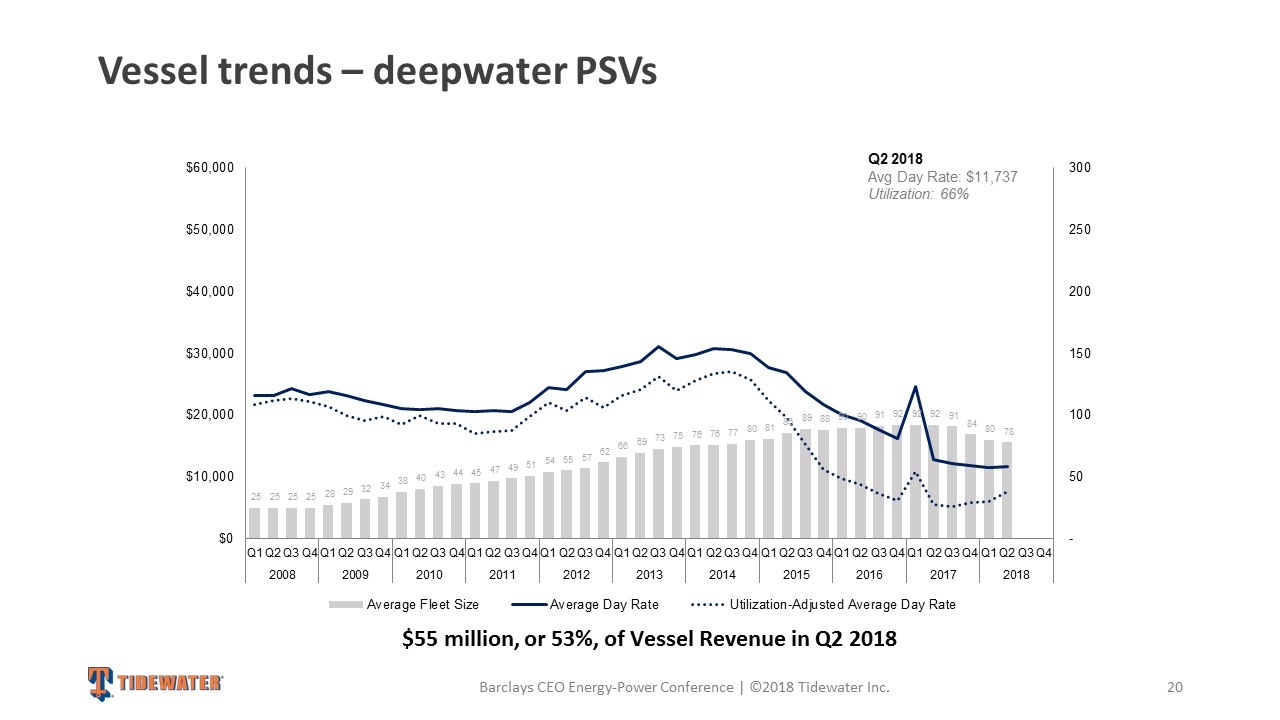

Vessel trends – deepwater PSVs $55 million, or 53%, of Vessel Revenue in Q2 2018 Q2 2018 Avg Day Rate: $11,737 Utilization: 66% Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc.

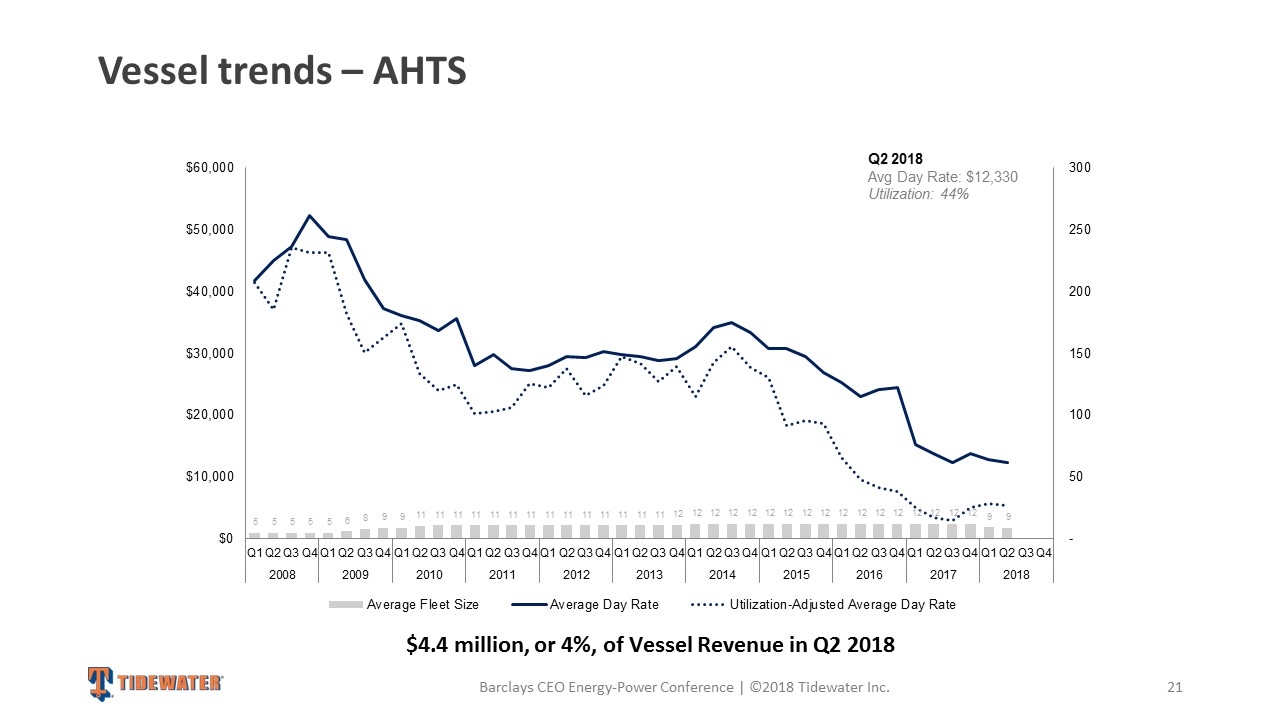

Vessel trends – AHTS $4.4 million, or 4%, of Vessel Revenue in Q2 2018 Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. Q2 2018 Avg Day Rate: $12,330 Utilization: 44%

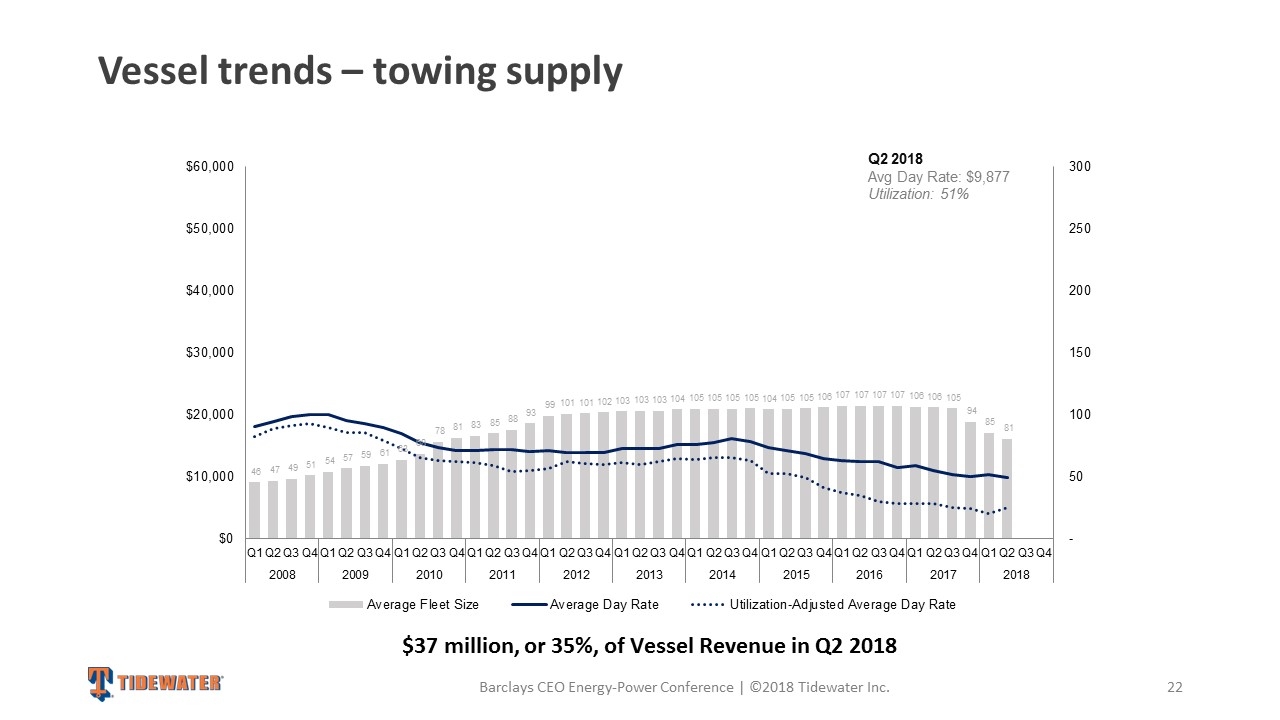

Vessel trends – towing supply $37 million, or 35%, of Vessel Revenue in Q2 2018 Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. Q2 2018 Avg Day Rate: $9,877 Utilization: 51%

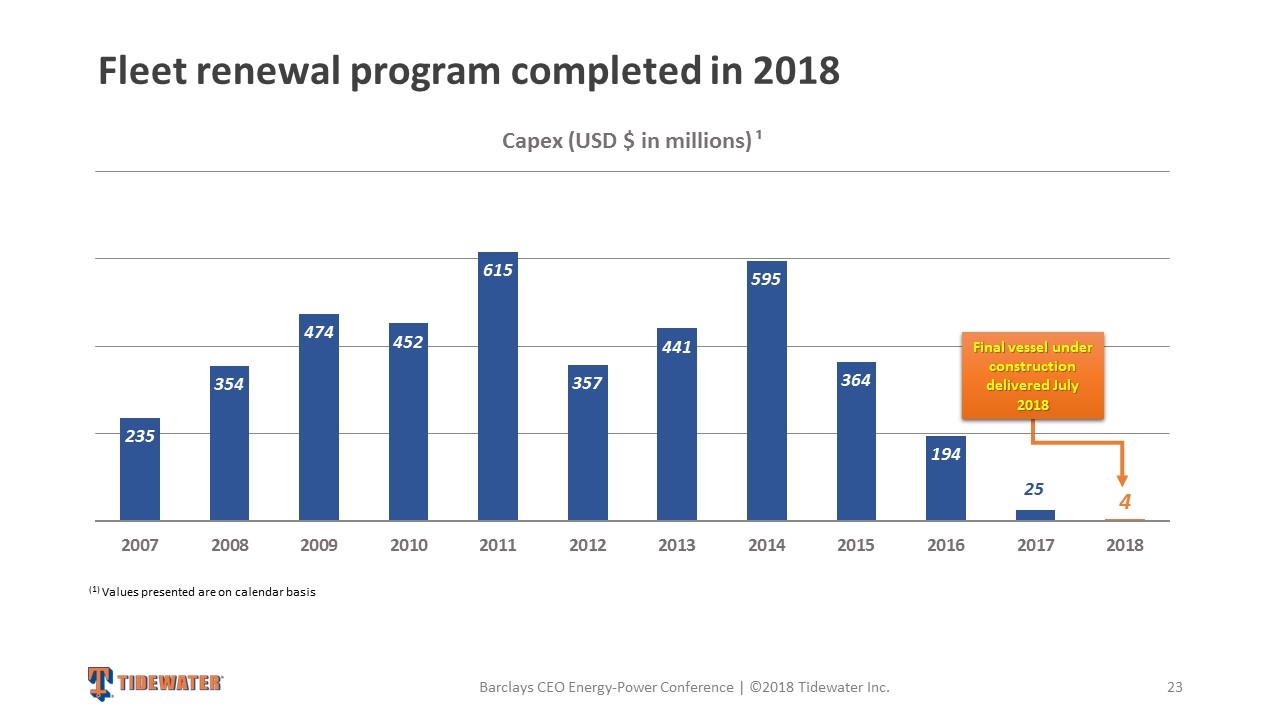

Fleet renewal program completed in 2018 (1) Values presented are on calendar basis Final vessel under construction delivered July 2018 Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc.

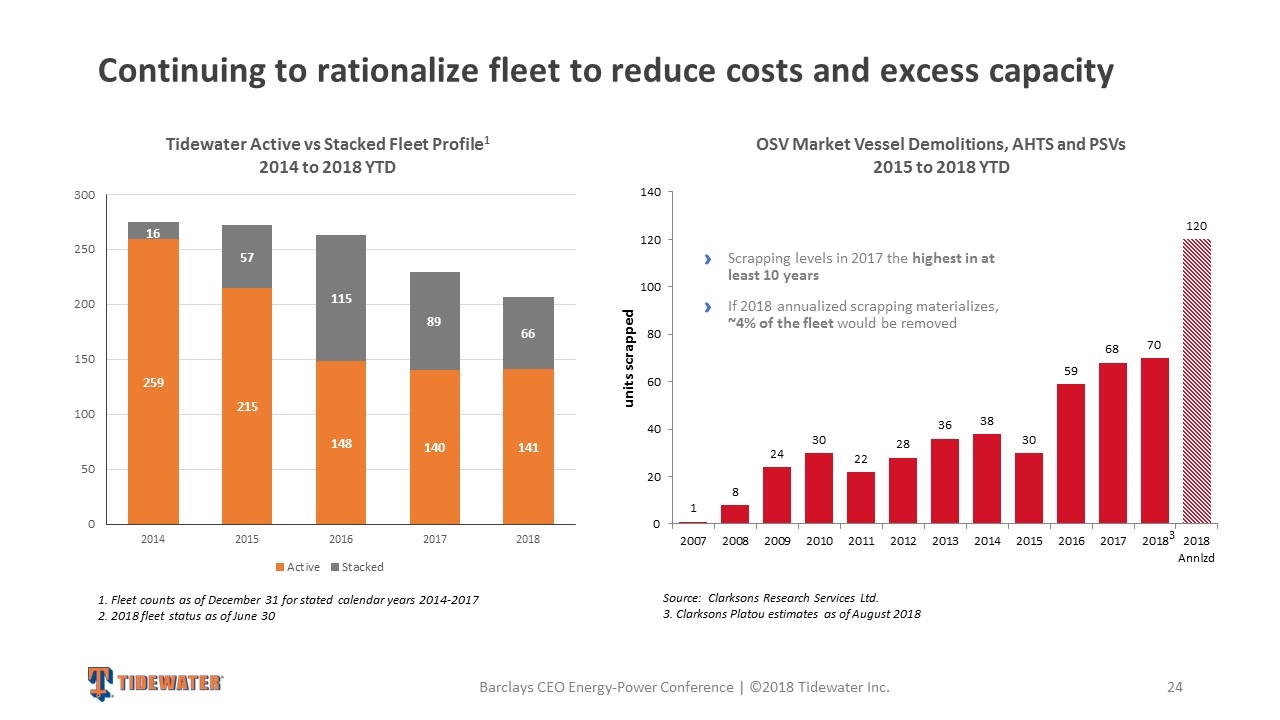

Continuing to rationalize fleet to reduce costs and excess capacity 1. Fleet counts as of December 31 for stated calendar years 2014-2017 2. 2018 fleet status as of June 30 Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc. Scrapping levels in 2017 the highest in at least 10 years If 2018 annualized scrapping materializes, ~4% of the fleet would be removed 3 OSV Market Vessel Demolitions, AHTS and PSVs 2015 to 2018 YTD Source: Clarksons Research Services Ltd. 3. Clarksons Platou estimates as of August 2018

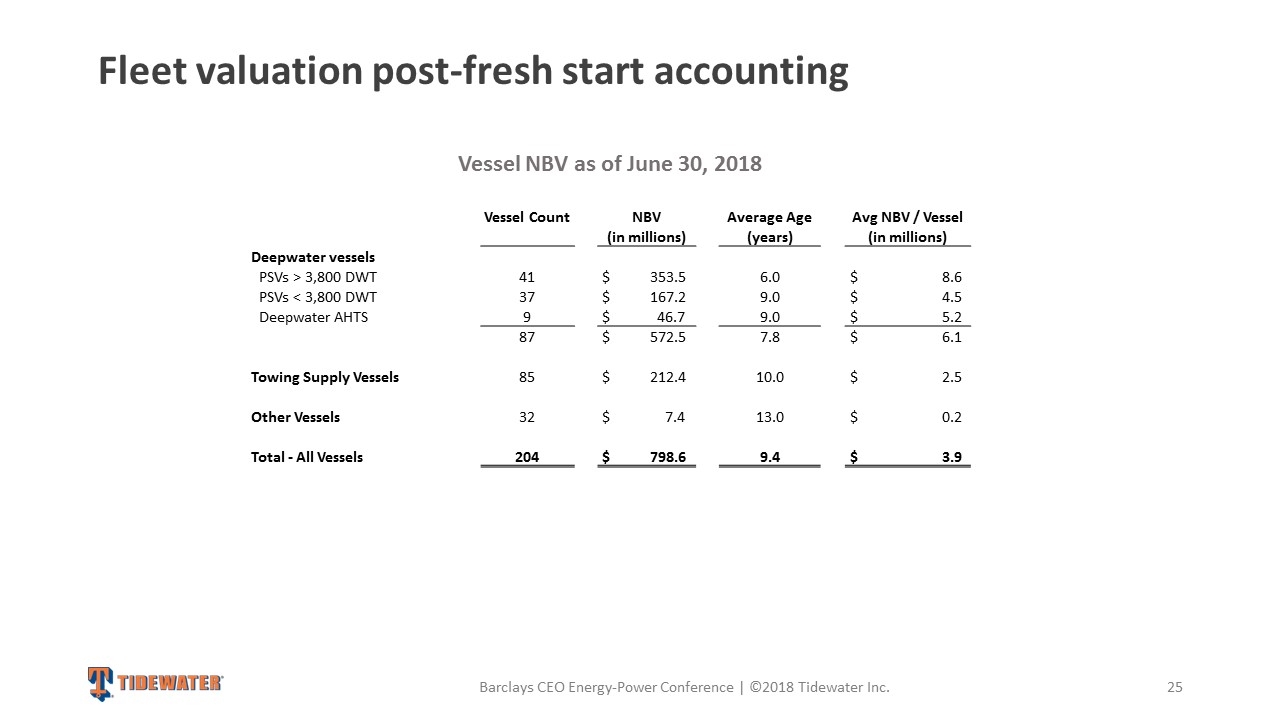

Fleet valuation post-fresh start accounting Vessel Count NBV Average Age Avg NBV / Vessel (in millions) (years) (in millions) Deepwater vessels PSVs > 3,800 DWT 41 $ 353.5 6.0 $ 8.6 PSVs < 3,800 DWT 37 $ 167.2 9.0 $ 4.5 Deepwater AHTS 9 $ 46.7 9.0 $ 5.2 87 $ 572.5 7.8 $ 6.1 Towing Supply Vessels 85 $ 212.4 10.0 $ 2.5 Other Vessels 32 $ 7.4 13.0 $ 0.2 Total - All Vessels 204 $ 798.6 9.4 $ 3.9 Vessel NBV as of June 30, 2018 Barclays CEO Energy-Power Conference | ©2018 Tidewater Inc.

Appendix II – Tidewater/GulfMark Combination

Tidewater / GulfMark Offshore Combination: Creates Global Offshore Leader Investor Presentation July 16, 2018

FORWARD-LOOKING STATEMENTS In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Tidewater and GulfMark note that certain statements set forth in this presentation provide other than historical information and are forward looking. The unfolding of future economic or business developments may happen in a way not as anticipated or projected by Tidewater and GulfMark and may involve numerous risks and uncertainties that may cause Tidewater’s and GulfMark’s actual achievement of any forecasted results to be materially different from that stated or implied in the forward-looking statement. Among those risks and uncertainties, many of which are beyond the control of Tidewater or GulfMark, include, without limitation, the proposed transaction between Tidewater and GulfMark (the “Transaction”) and the anticipated synergies with respect to the combination of Tidewater and GulfMark; fluctuations in worldwide energy demand and oil and gas prices; fleet additions by competitors and industry overcapacity; customer actions including changes in capital spending for offshore exploration, development and production and changes in demands for different vessel specifications; acts of terrorism and piracy; the impact of potential information technology, cyber security or data security breaches; significant weather conditions; unsettled political conditions, war, civil unrest and governmental actions, especially in higher political risk countries where we operate; labor changes proposed by international conventions; increased regulatory burdens and oversight; changes in law, economic and global financial market conditions, including the effect of enactment of U.S. tax reform or other tax law changes, trade policy and tariffs, interest and foreign currency exchange rate volatility, commodity and equity prices and the value of financial assets; and enforcement of laws related to the environment, labor and foreign corrupt practices. Readers should consider all of these risk factors, other factors that are described in “Forward-Looking Statements,” as well as other information contained in Tidewater’s and GulfMark’s form 10-K’s and 10-Q’s. Although Tidewater and GulfMark believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. These statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including but not limited to: the ability of the parties to consummate the Transaction in a timely manner or at all; satisfaction of the conditions precedent to consummation of the Transaction, including the ability to secure regulatory approvals in a timely manner or at all, and approval by either company’s stockholders; the possibility of litigation (including related to the transaction itself); Tidewater’s and GulfMark’s ability to successfully integrate their operations, technology and employees and realize synergies from the Transaction; unknown, underestimated or undisclosed commitments or liabilities; the conditions in the oil and natural gas industry, including a decline in, or the substantial volatility of, oil or natural gas prices, and changes in the combined companies’ customer requirements; the level of demand for the combined companies’ products and services. Neither Tidewater nor GulfMark undertakes any obligation to update any forward-looking statements or to publicly release the results of any revisions to any forward-looking statements that may be made to reflect events or circumstances that occur, or that either Tidewater or GulfMark becomes aware of, after the date of this communication. Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc.

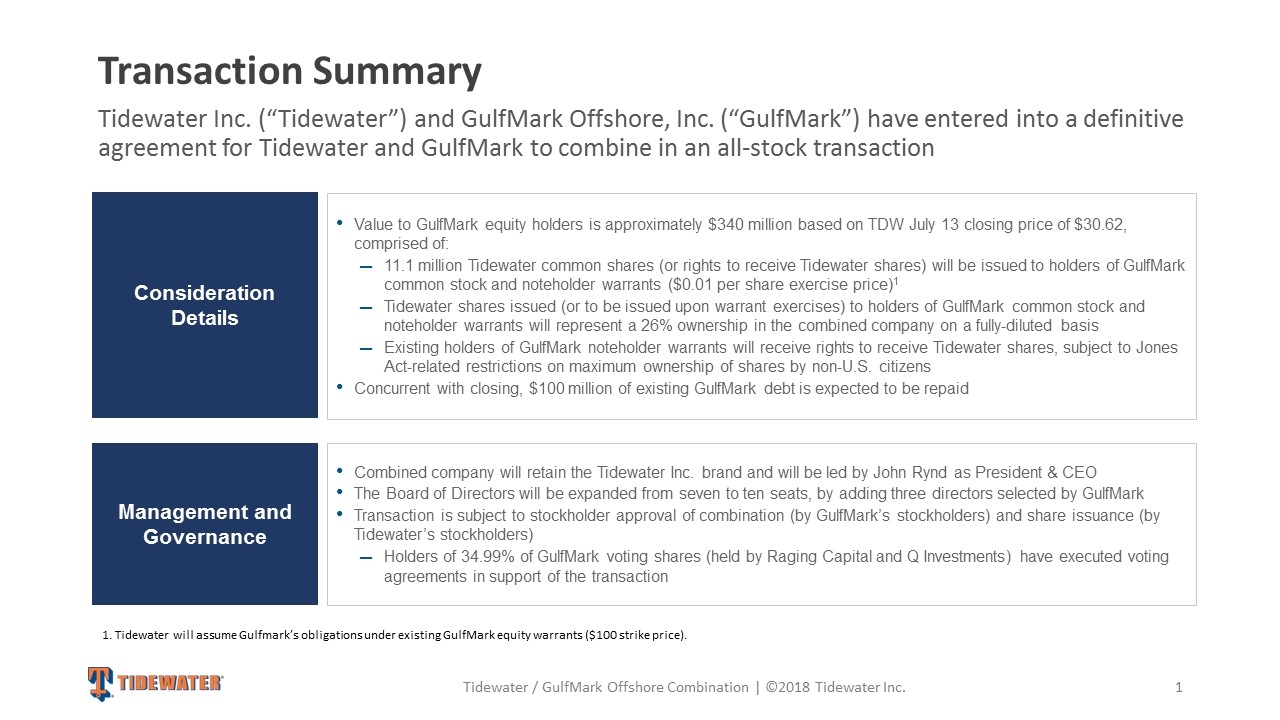

Transaction Summary Value to GulfMark equity holders is approximately $340 million based on TDW July 13 closing price of $30.62, comprised of: 11.1 million Tidewater common shares (or rights to receive Tidewater shares) will be issued to holders of GulfMark common stock and noteholder warrants ($0.01 per share exercise price)1 Tidewater shares issued (or to be issued upon warrant exercises) to holders of GulfMark common stock and noteholder warrants will represent a 26% ownership in the combined company on a fully-diluted basis Existing holders of GulfMark noteholder warrants will receive rights to receive Tidewater shares, subject to Jones Act-related restrictions on maximum ownership of shares by non-U.S. citizens Concurrent with closing, $100 million of existing GulfMark debt is expected to be repaid Consideration Details Combined company will retain the Tidewater Inc. brand and will be led by John Rynd as President & CEO The Board of Directors will be expanded from seven to ten seats, by adding three directors selected by GulfMark Transaction is subject to stockholder approval of combination (by GulfMark’s stockholders) and share issuance (by Tidewater’s stockholders) Holders of 34.99% of GulfMark voting shares (held by Raging Capital and Q Investments) have executed voting agreements in support of the transaction Management and Governance Tidewater Inc. (“Tidewater”) and GulfMark Offshore, Inc. (“GulfMark”) have entered into a definitive agreement for Tidewater and GulfMark to combine in an all-stock transaction 1 Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc. 1. Tidewater will assume Gulfmark’s obligations under existing GulfMark equity warrants ($100 strike price).

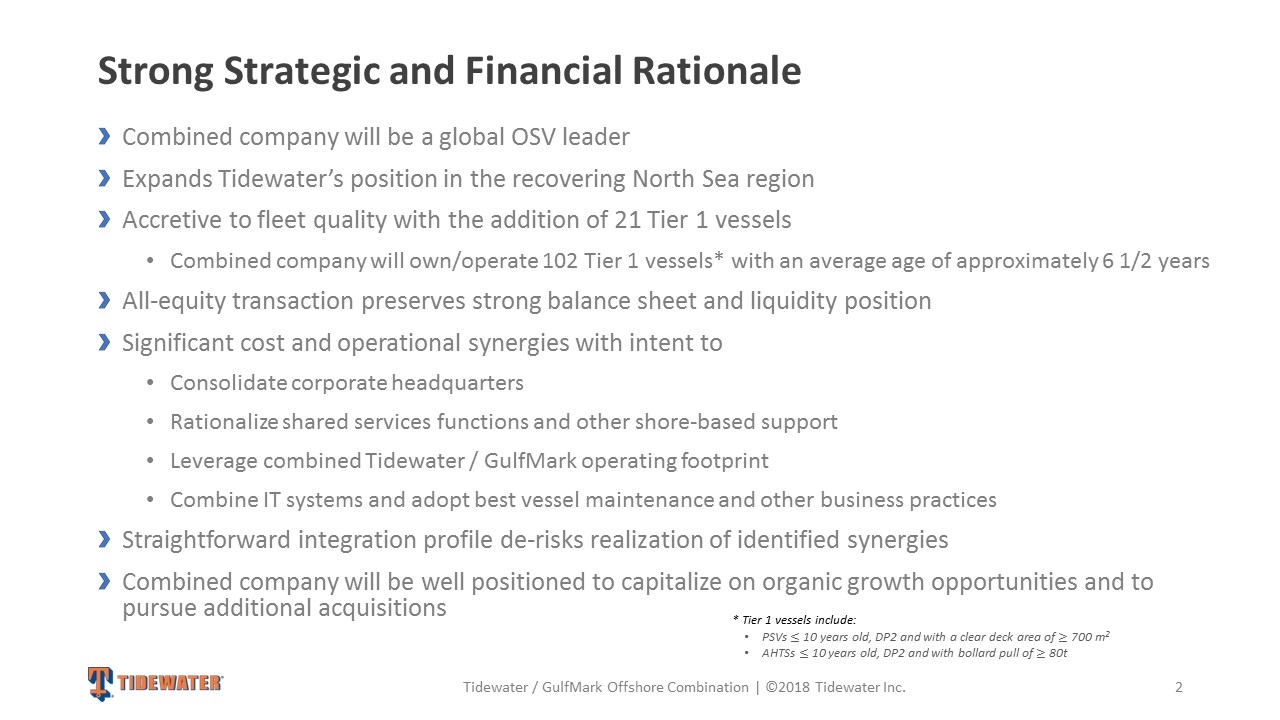

Strong Strategic and Financial Rationale Combined company will be a global OSV leader Expands Tidewater’s position in the recovering North Sea region Accretive to fleet quality with the addition of 21 Tier 1 vessels Combined company will own/operate 102 Tier 1 vessels* with an average age of approximately 6 1/2 years All-equity transaction preserves strong balance sheet and liquidity position Significant cost and operational synergies with intent to Consolidate corporate headquarters Rationalize shared services functions and other shore-based support Leverage combined Tidewater / GulfMark operating footprint Combine IT systems and adopt best vessel maintenance and other business practices Straightforward integration profile de-risks realization of identified synergies Combined company will be well positioned to capitalize on organic growth opportunities and to pursue additional acquisitions * Tier 1 vessels include: PSVs 10 years old, DP2 and with a clear deck area of 700 m2 AHTSs 10 years old, DP2 and with bollard pull of 80t Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc. 2

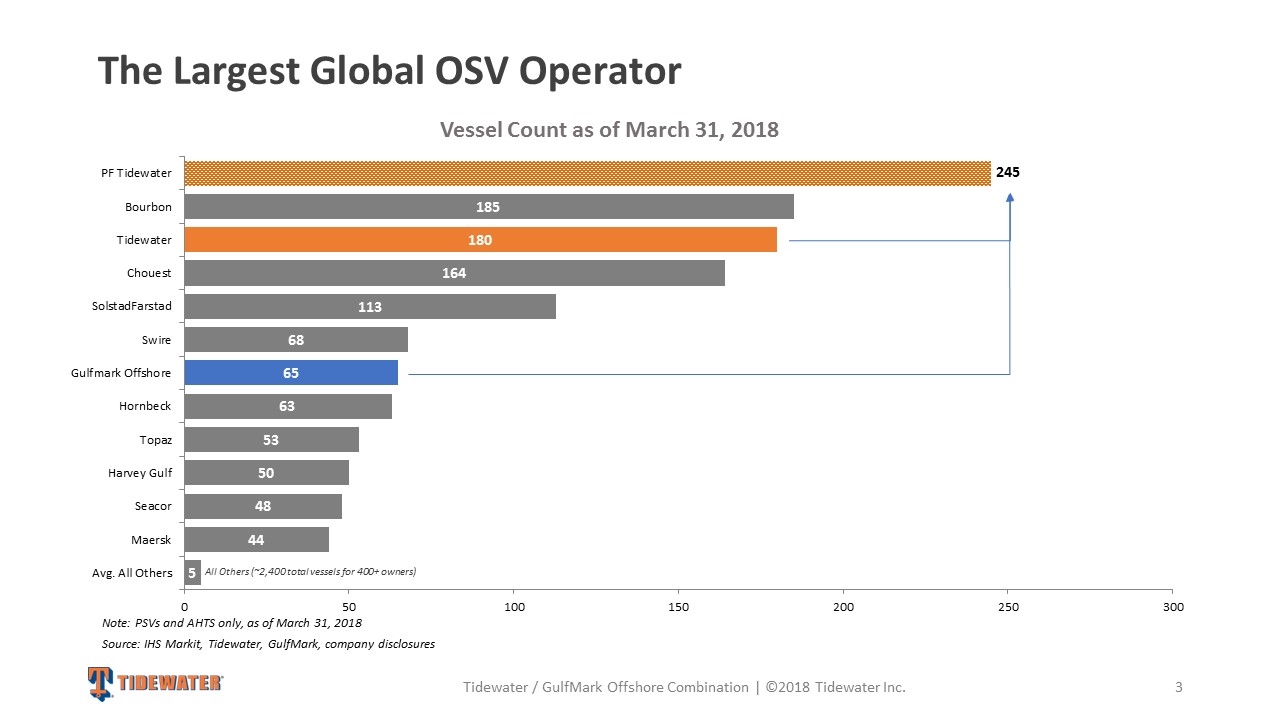

The Largest Global OSV Operator Note: PSVs and AHTS only, as of March 31, 2018 Source: IHS Markit, Tidewater, GulfMark, company disclosures Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc. All Others (~2,400 total vessels for 400+ owners) Vessel Count as of March 31, 2018 3

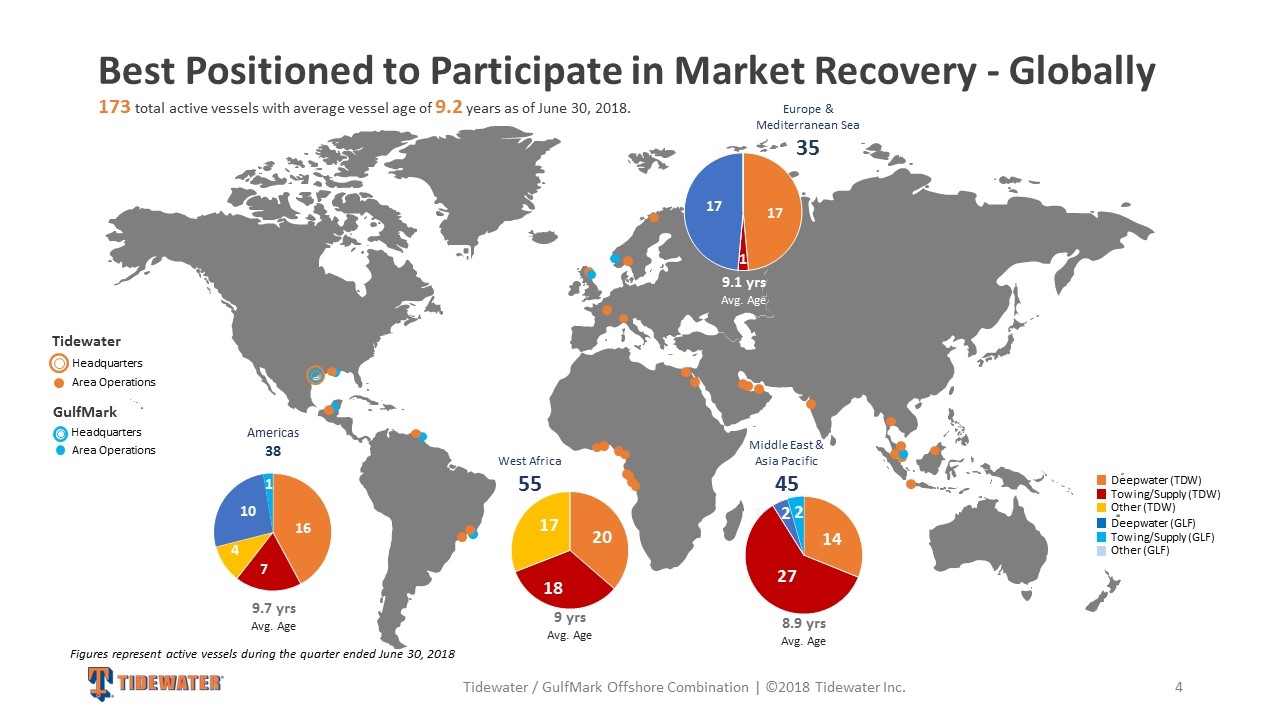

Best Positioned to Participate in Market Recovery - Globally Headquarters Area Operations Americas 38 Towing Supply 173 total active vessels with average vessel age of 9.2 years as of June 30, 2018. Other Deepwater Towing Supply Deepwater Towing Supply 9.7 yrs Avg. Age 9.1 yrs Avg. Age Europe & Mediterranean Sea 35 8.9 yrs Avg. Age Middle East & Asia Pacific 45 Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc. 9 yrs Avg. Age Figures represent active vessels during the quarter ended June 30, 2018 Tidewater Headquarters Area Operations GulfMark Deepwater (TDW) Towing/Supply (TDW) Other (TDW) Deepwater (GLF) Towing/Supply (GLF) Other (GLF) West Africa 55 4

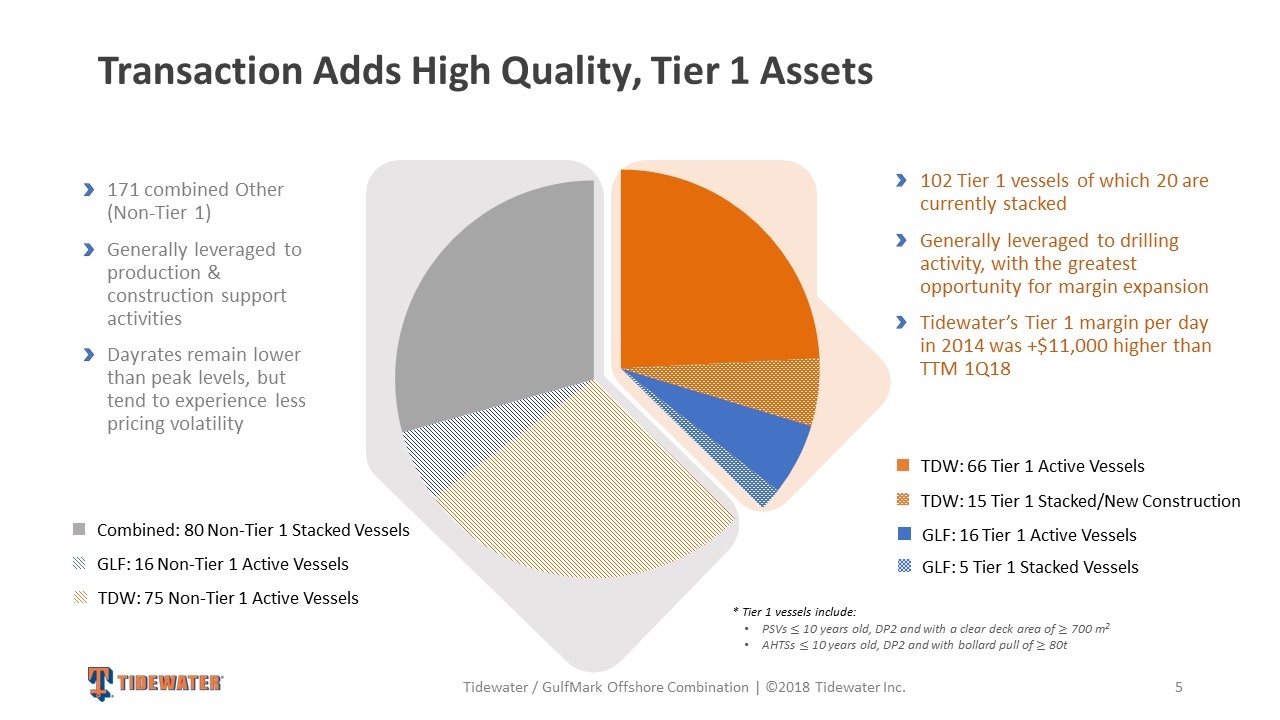

Transaction Adds High Quality, Tier 1 Assets 102 Tier 1 vessels of which 20 are currently stacked Generally leveraged to drilling activity, with the greatest opportunity for margin expansion Tidewater’s Tier 1 margin per day in 2014 was +$11,000 higher than TTM 1Q18 171 combined Other (Non-Tier 1) Generally leveraged to production & construction support activities Dayrates remain lower than peak levels, but tend to experience less pricing volatility 5 TDW: 75 Non-Tier 1 Active Vessels GLF: 16 Non-Tier 1 Active Vessels Combined: 80 Non-Tier 1 Stacked Vessels GLF: 16 Tier 1 Active Vessels TDW: 15 Tier 1 Stacked/New Construction TDW: 66 Tier 1 Active Vessels GLF: 5 Tier 1 Stacked Vessels Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc. * Tier 1 vessels include: PSVs 10 years old, DP2 and with a clear deck area of 700 m2 AHTSs 10 years old, DP2 and with bollard pull of 80t

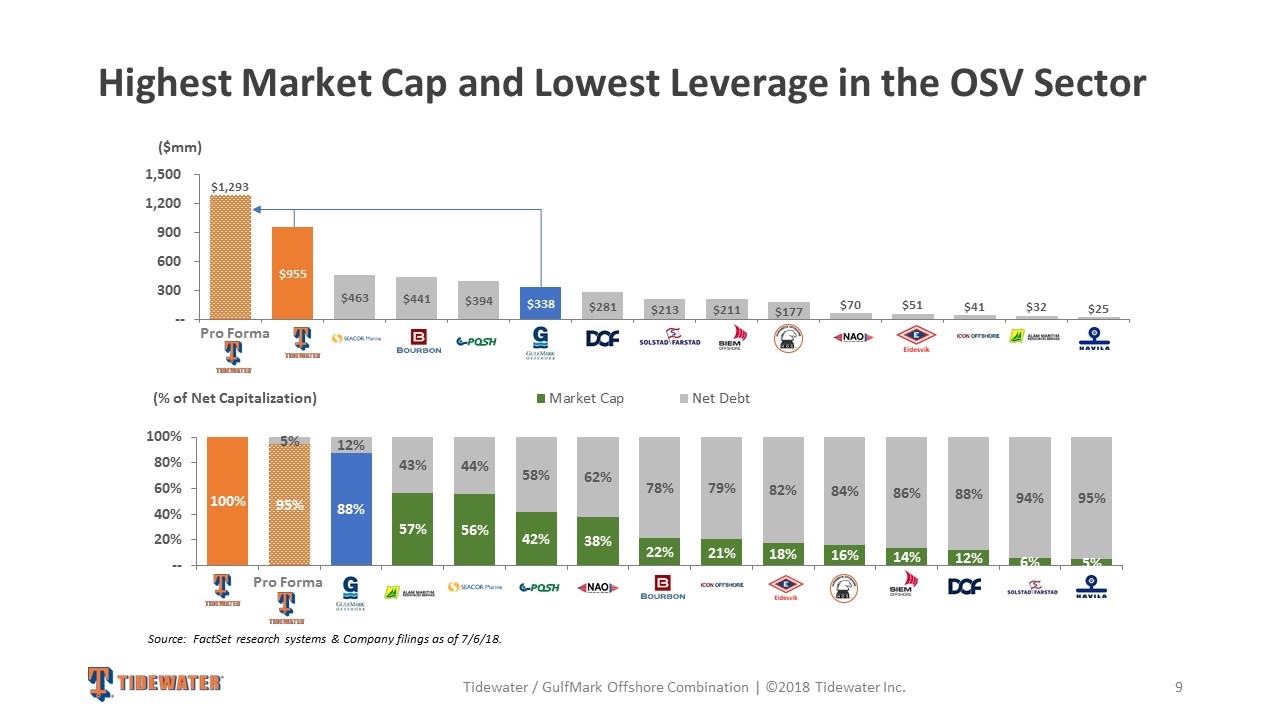

Strongest Financial Position in the OSV Sector Combined company equity market capitalization is ~$1.25 billion, based on Tidewater’s closing stock price on July 13, 2018 Concurrent with closing, $100 mm in outstanding GulfMark debt is expected to be repaid Transaction adjustments include impact of 1.100x exchange ratio, the early repayment of GulfMark debt and frictional costs, including make-whole payments to holders of GulfMark debt Tidewater GulfMark Adjustment Pro Forma Shares Outstanding1,2 30 - 11 41 Cash $445 $53 ($127) $371 Total Debt $448 $92 ($92) $448 Net Debt $3 $40 $34 $77 Total Debt / Total Cap.3 31% - - 25% Net Debt / Net Cap.3 - - - 6% Note: Numbers shown are pro forma as of 3/31/18. 1 Other than shares outstanding, includes 3.9 million new creditor warrants, each of which is exercisable into a share of common stock at a price of $0.001. 2 Excludes 1.16 million RSUs issued in connection with Tidewater’s 2017 stock incentive plan, which generally vests over 3 years. 3 Book basis 6 Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc.

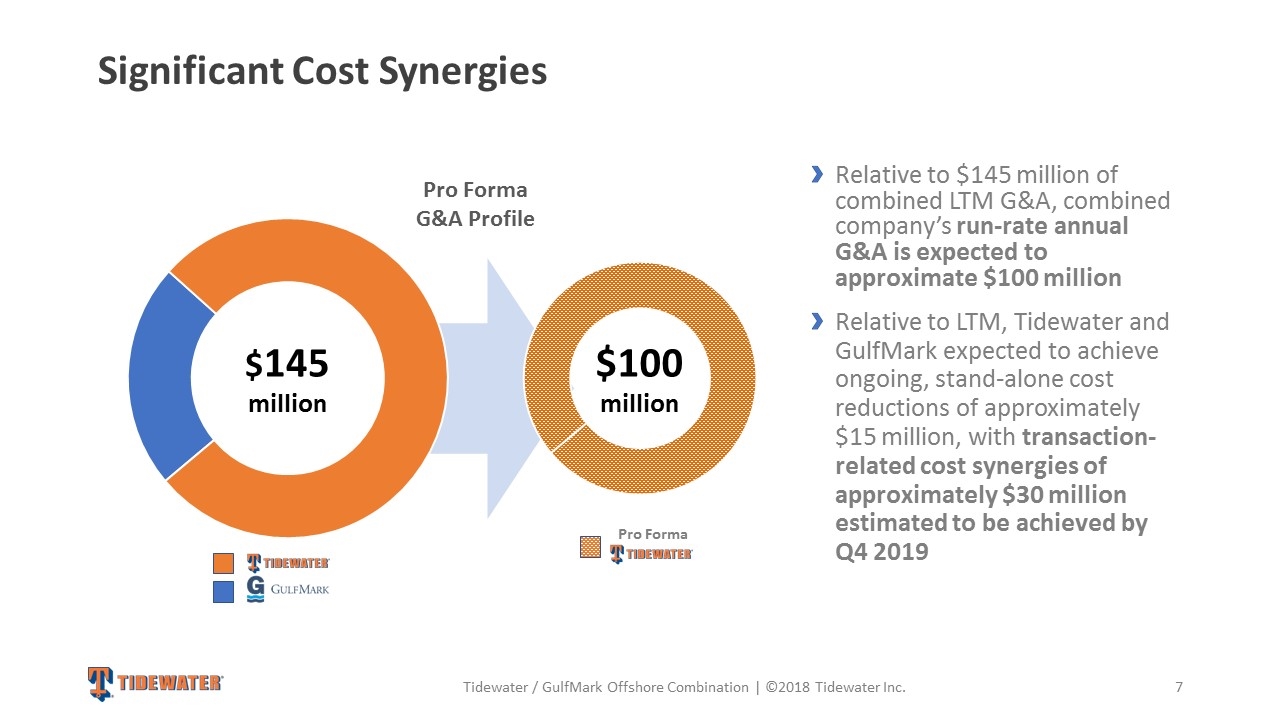

Significant Cost Synergies Relative to $145 million of combined LTM G&A, combined company’s run-rate annual G&A is expected to approximate $100 million Relative to LTM, Tidewater and GulfMark expected to achieve ongoing, stand-alone cost reductions of approximately $15 million, with transaction-related cost synergies of approximately $30 million estimated to be achieved by Q4 2019 Pro Forma G&A Profile Pro Forma 7 Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc.

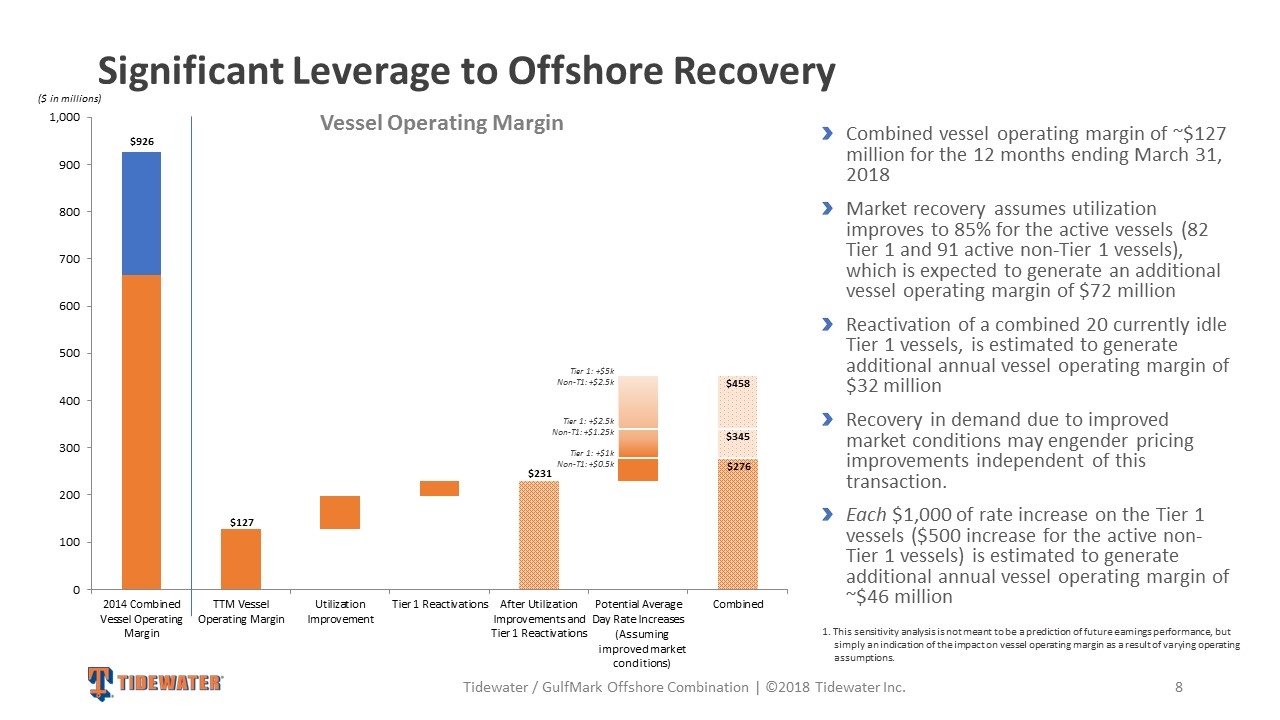

Significant Leverage to Offshore Recovery Combined vessel operating margin of ~$127 million for the 12 months ending March 31, 2018 Market recovery assumes utilization improves to 85% for the active vessels (82 Tier 1 and 91 active non-Tier 1 vessels), which is expected to generate an additional vessel operating margin of $72 million Reactivation of a combined 20 currently idle Tier 1 vessels, is estimated to generate additional annual vessel operating margin of $32 million Recovery in demand due to improved market conditions may engender pricing improvements independent of this transaction. Each $1,000 of rate increase on the Tier 1 vessels ($500 increase for the active non-Tier 1 vessels) is estimated to generate additional annual vessel operating margin of ~$46 million Tier 1: +$5k Non-T1: +$2.5k Tier 1: +$2.5k Non-T1: +$1.25k 8 $231 $276 $345 $458 $127 Tier 1: +$1k Non-T1: +$0.5k $926 Vessel Operating Margin Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc. 1. This sensitivity analysis is not meant to be a prediction of future earnings performance, but simply an indication of the impact on vessel operating margin as a result of varying operating assumptions. (Assuming improved market conditions) ($ in millions)

Source: FactSet research systems & Company filings as of 7/6/18. Highest Market Cap and Lowest Leverage in the OSV Sector Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc. Pro Forma Pro Forma 9

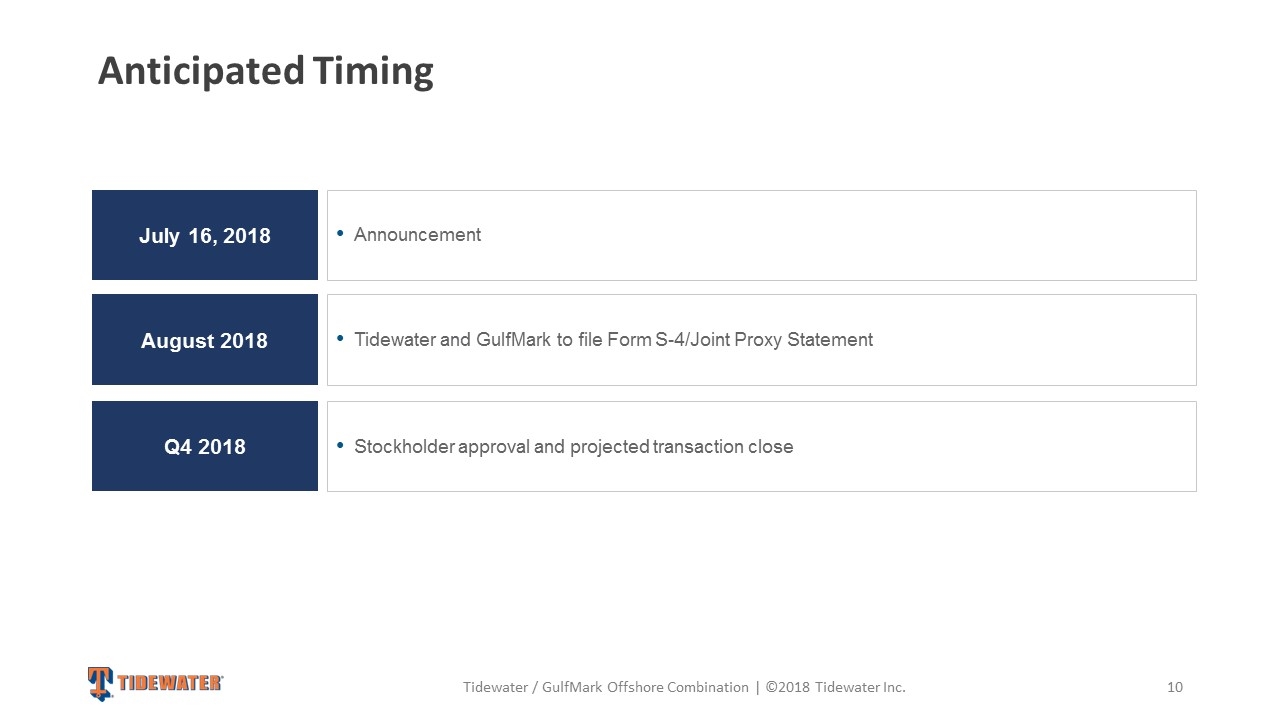

Anticipated Timing Announcement July 16, 2018 Tidewater and GulfMark to file Form S-4/Joint Proxy Statement August 2018 Stockholder approval and projected transaction close Q4 2018 10 Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc.

Strong Strategic and Financial Rationale Combined company will be a global OSV leader Expands Tidewater’s position in the recovering North Sea region Accretive to fleet quality and 2019 EBITDA All-equity transaction preserves quality balance sheet and strong liquidity position Significant cost and operational synergies Straightforward integration profile Combined company will be well positioned to capitalize on organic growth opportunities and to pursue additional acquisitions 11 Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc.

NO OFFER OR SOLICITATION This announcement is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. ADDITIONAL INFORMATION AND WHERE TO FIND IT Tidewater Inc. (“Tidewater” or the “Company”) will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 (the “Joint Proxy Statement/Prospectus”) which will include a registration statement and prospectus with respect to the Company’s shares of common stock to be issued in the Transaction and a joint proxy statement of the Company and GulfMark in connection with the Transaction. The definitive Joint Proxy Statement/Prospectus will contain important information about the proposed Transaction and related matters. STOCKHOLDERS ARE URGED AND ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS CAREFULLY WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. The Joint Proxy Statement/Prospectus and other relevant materials (when they become available) and any other documents filed by the Company or GulfMark with the SEC may be obtained free of charge at the SEC’s website, at www.sec.gov. In addition, security holders will be able to obtain free copies of the Joint Proxy Statement/Prospectus from the Company by contacting Investor Relations by mail at 6002 Rogerdale Road, Suite 600, Houston, TX, Attn: Investor Relations, by telephone at +1-713-470-5314, or by going to the Company’s Investor Relations page on its corporate web site at www.tdw.com, and from GulfMark by contacting Investor Relations by mail at 842 West Sam Houston Parkway North, Suite 400, Houston, TX, 77024, Attn: Investor Relations, by telephone at +1-713-369-7300, or by going to GulfMark’s Investor Relations page on its corporate web site at www.gulfmark.com. PARTICIPANTS IN THE SOLICITATION The Company, GulfMark and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the proposed Transaction. Information about the Company’s directors is set forth in our Transition Report on Form 10-K for the transition period from April 1, 2017 to December 31, 2017, which was filed with the SEC on March 15, 2018. Information about GulfMark’s directors and executive officers is set forth in its Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which was filed with the SEC on April 2, 2018. These documents are available free of charge at the SEC’s web site at www.sec.gov, from the Company by contacting Investor Relations by mail at 6002 Rogerdale Road, Suite 600, Houston, TX, Attn: Investor Relations, or by going to our Investor Relations page on its corporate web site at www.tdw.com, and from GulfMark by contacting Investor Relations by mail at 842 West Sam Houston Parkway North, Suite 400, Houston, TX, 77024, Attn: Investor Relations, or by going to GulfMark’s Investor Relations page on its corporate web site at www.gulfmark.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed Transaction will be included in the Joint Proxy Statement/Prospectus that the Company intends to file with the SEC. Tidewater / GulfMark Offshore Combination | ©2018 Tidewater Inc.