UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

Amendment No. 1

| x | Annual Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 |

For the fiscal year ended May 31, 2007

or

| o | Transition Report Under Section 13 or 15(d) of The Securities Exchange Act of 1934 |

For the transition period from _____________________ to ______________________

| Commission File Number: | 0-8656 |

(Exact name of registrant as specified in its charter)

Delaware | | 13-2635899 |

| (State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

| incorporation or organization) | | |

400 Oser Avenue, Hauppauge, NY 11788 |

| (Address of principal executive offices) |

| Registrant's telephone number: | 631-231-0333 |

| Securities registered pursuant to Section 12(b) of the Exchange Act: | Common Stock, par value $0.01 per share |

| | (Title of Class) |

Securities registered pursuant to Section 12(g) of the Exchange Act:

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. o Yes x No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K contained in this form, and no disclosure will be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the Exchange Act).

o Large accelerated filer | o Accelerated filer | x Non-accelerated filer |

Indicate by check mark whether the Registrant is a shell Company (as defined in Rule 12b-2 of the Act). oYes No x.

The aggregate market value of voting and non-voting common equity held by non-affiliates of the Registrant based upon the closing price of $4.00 at November 30, 2006 was $11,102,000.

The number of shares of the Registrant's common stock outstanding as of July 31, 2007 was 4,568,012.

Documents incorporated by Reference:

The information required in Part III, Items 10, 11, 12, 13 and 14 is incorporated by reference to the Registrant's Proxy Statement in connection with the 2007 Annual Meeting of Stockholders, which will be filed by the Registrant within 120 days after the close of its fiscal year.

Item 5 is hereby amended by adding the following:

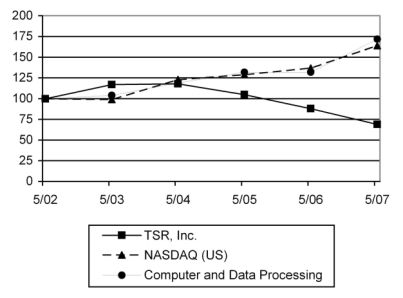

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL RETURNS

The following graph compares cumulative five-year stockholder returns (including reinvestment of dividends) on an indexed basis with the Center for Research in Security Prices ("CRSP") Index for the NASDAQ Stock Market (US Companies) and the CRSP Index for NASDAQ Computer and Data Processing Stocks (SIC Code 737). These indices are included for comparative purposes only and do not necessarily reflect management's opinion that such indices are an appropriate measure of the relative performance of the stock involved, and are not intended to forecast or be indicative of possible future performance of the Common Stock.

Performance Graph of TSR, Inc. Common Stock Versus Broad Market and Peer Group Indices

| | 5/02 | | 5/03 | | 5/04 | | 5/05 | | 5/06 | | 5/07 |

| TSR, Inc. . . . . . . . . . . . . . . . . . . . . . | 100 | | 117 | | 118 | | 105 | | 88 | | 69 |

| NASDAQ (US) . . . . . . . . . . . . . . . . | 100 | | 99 | | 123 | | 129 | | 137 | | 164 |

| Computer and Data Processing . . | 100 | | 104 | | 119 | | 132 | | 132 | | 172 |

Notes:

| A. | The index level for all series was set to $100 at May 31, 2002. |

| B. | The lines represent monthly index levels derived from compounded daily returns that include all dividends. |

| C. | If the monthly interval based on the fiscal year-end is not a trading day, the preceding trading day is used. |

SIGNATURES

Pursuant to the requirements of Section 13 or 15 (d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | TSR, Inc. | |

| | | |

| | | |

| | | | |

| Date: September 12, 2007 | By: | /s/ John Sharkey | |

| | | John Sharkey | |

| | | Vice President, Finance, Controller and Secretary | |

| | | | |