UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from______to_______

Commission file number: 1-1169

THE TIMKEN COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Ohio | | 34-0577130 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

| 4500 Mount Pleasant Street NW | | |

| North Canton | Ohio | | 44720-5450 |

| (Address of principal executive offices) | | (Zip Code) |

234.262.3000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Shares, without par value | | TKR | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 762(b)) by the registered public accounting firm that prepared or issued its audit report ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by an of the registrant's executive officers during the period pursuant to §240.10D-1(b). ☐

As of June 28, 2024, the aggregate market value of the registrant’s common shares held by non-affiliates of the registrant was $4,985,749,739 based on the closing sale price as reported on the New York Stock Exchange.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding at January 31, 2025 |

| Common Shares, without par value | | 70,001,123 shares |

DOCUMENTS INCORPORATED BY REFERENCE

| | | | | | | | |

| Document | | Parts Into Which Incorporated |

| Proxy Statement for the Annual Meeting of Shareholders to be held on or about May 2, 2025 (Proxy Statement) | | Part III |

THE TIMKEN COMPANY

INDEX TO FORM 10-K REPORT

| | | | | | | | | | | |

| | | | PAGE |

| I. | PART I. | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 4A. | | |

| II. | | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| III. | PART III. | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| IV. | | | |

| Item 15. | | |

| Item 16. | | |

PART I.

Item 1. Business

General:

As used herein, the term “Timken” or the “Company” refers to The Timken Company and its subsidiaries unless the context otherwise dictates. Timken designs and manages a portfolio of engineered bearings and industrial motion products, and provides related services. The Company’s growing portfolio features many strong brands, including Timken®, GGB®, Philadelphia Gear®, Cone Drive®, Rollon®, Nadella®, Diamond®, Drives®, Groeneveld®, BEKA®, Des-Case®, Lovejoy®, Lagersmit® and CGI.

The Company was founded in 1899 by Henry Timken, who received two patents on the design of a tapered roller bearing. Timken remains the world's leading authority on tapered roller bearings and has leveraged that expertise to develop a full portfolio of industry-leading engineered bearings and industrial motion products. Timken built its reputation as a global leader by applying its knowledge of metallurgy, friction management and industrial motion to increase the reliability and efficiency of its customers' equipment across a diverse range of industries. Today, the Company's global footprint consists of 124 manufacturing facilities and service centers, 28 technology and engineering centers, and 77 distribution centers and warehouses, supported by a team comprised of approximately 19,000 employees. Timken operates in 45 countries around the globe.

Major Customers:

The Company sells products and services to a diverse customer base globally, including customers in the following market sectors: industrial distribution, renewable energy, automation, automotive original equipment ("OE"), agriculture/turf, rail, aerospace, auto/truck aftermarket, construction, services, metals and mining, heavy truck OE, and marine. No single customer accounts for more than 6% of total net sales.

Products:

Timken manufactures and manages global supply chains for multiple product lines including engineered bearings and industrial motion products designed to operate in demanding environments. The Company leverages its technical knowledge, research expertise, and production and engineering capabilities across all of its products and end markets to deliver high-performance products and services to its customers. Differentiation within these product lines is generally based on application engineering, product performance, product quality or customer service.

Engineered Bearings:

The Timken® bearing portfolio features a broad range of engineered bearing products, including tapered, spherical and cylindrical roller bearings; plain bearings and rod end bearings; thrust and specialty ball bearings; and housed bearings. Timken is a leading authority on tapered roller bearings and leverages its position by applying engineering know-how and technology across its entire bearing portfolio.

A bearing is a mechanical device that reduces friction between moving parts. The purpose of a bearing is to carry a load while allowing a machine shaft to rotate freely. The basic elements of the bearing generally include two rings, called races; a set of rolling elements that rotate around the bearing raceway; and a cage to separate and guide the rolling elements. Bearings come in a number of designs, featuring tapered, spherical, cylindrical or ball rolling elements. The various bearing designs accommodate radial and/or thrust loads differently, making certain bearing types better suited for specific applications.

Selection and development of bearings for customer applications and demand for high reliability require sophisticated engineering and analytical techniques. High precision tolerances, proprietary internal geometries and quality materials provide Timken bearings with high load-carrying capacity, excellent friction-reducing qualities and long service lives. The uses for bearings are diverse and can be found in transportation applications that include premium passenger cars and trucks, heavy trucks, helicopters, airplanes and trains. Ranging in size from precision bearings the size of a pencil eraser to more than roughly three meters in diameter, Timken components are also used in a wide variety of industrial applications, including: paper and steel mills, mining, oil and gas extraction and production, agriculture, construction, machine tools, gear drives, health and positioning control, wind turbines and food and beverage processing.

Tapered Roller Bearings. Timken tapered roller bearings can increase power density and can include customized geometries, engineered surfaces and specialized sealing solutions. The Company’s tapered roller bearing line comes in thousands of combinations in single-, double- and four-row configurations. Tapered roller designs permit ready absorption of both radial and axial load combinations, which makes them particularly well-adapted to reducing friction where shafts, gears or wheels are used.

Spherical and Cylindrical Roller Bearings. Timken also produces spherical and cylindrical roller bearings that are used in gear drives, rolling mills and other industrial and infrastructure development applications. These products are sold worldwide to OE manufacturers ("OEMs") and industrial distributors serving major end-market sectors, including construction and mining, natural resources, wind energy, defense, pulp and paper production, rolling mills and general industrial goods.

Ball Bearings. Timken radial, angular and precision ball bearings are used by customers in a variety of market sectors, including aerospace, agriculture, construction, health, machine tool, the automotive aftermarket and general industries. Radial ball bearings are designed to tolerate relatively high-speed operation under a range of load conditions. These bearing types consist of an inner and outer ring with a cage containing a complement of precision balls. Angular contact ball bearings are designed for a combination of radial and axial loading. Precision ball bearings are manufactured to tight tolerances and come in miniature and instrument, thin section and ball screw support designs.

Housed Bearings. Timken markets among the broadest range of housed or mounted bearings in the industry. These products include durable, heavy-duty components designed to protect spherical, tapered and ball bearings in debris-filled, contaminated or high-moisture environments. Common housed unit applications include material handling and processing equipment.

Plain Bearings. Timken produces a range of plain bearings including rod ends, spherical plain bearings, metal-polymer bearings and journal bearings. These bearings are used to support misalignment and oscillating movements in a variety of applications and end-markets including aircraft controls, packaging equipment, off-highway equipment, heavy truck, performance auto racing, robotics and many more. Various combinations of material pairs and engineered coatings improve friction management for application specific conditions.

Industrial Motion Products:

Linear Motion Solutions. The Company designs and manufactures a global portfolio of Rollon® and Nadella® engineered linear motion products, including linear guides, telescopic rails, linear actuators, seventh-axis robotic transfer units and gantry systems. These engineered products are highly customized to control movements with different variability and complexity based on the application. Rollon and Nadella products serve a wide range of industries, including passenger rail, aerospace, packaging and logistics, medical and automation.

Industrial Drives. The Company’s Philadelphia Gear® line of low- and high-speed gear drive designs are used in large-scale industrial applications such as crushing and pulverizing equipment, conveyors and pumps, power generation and military marine. These gear drive designs are custom made to meet user specifications, offering a wide array of size, footprint and gear arrangements. Timken has one of the broadest and most differentiated precision drives product portfolios in the global automation industry. These products include Cone Drive® high-torque worm gears, harmonic solutions and precision slew drives. Cone Drive products can be found in a variety of industrial end-market sectors, including solar, oil and gas, aerial platforms, automation and food and beverage. The Company's Spinea® line features highly engineered cycloidal reduction gears and actuators. Spinea's solutions primarily serve high precision automation and robotics applications in the factory automation sector. The portfolio also features CGI precision drive systems, which serve a broad range of automation markets with a concentration in medical robotics.

Automatic Lubrication Systems. The Company's Groeneveld® and BEKA® lubrication systems include a wide variety of automatic lubrication delivery devices, oil management systems and safety support systems designed to reduce operational costs for customers while increasing equipment uptime, productivity and safety. These systems support many industries, including renewable energy, transportation, construction, mining, port, forestry and agriculture. Timken also offers over two dozen different formulations of grease, leveraging its knowledge of tribology and anti-friction bearings to enable smooth equipment operation.

Belts. The Company makes and markets a full line of Timken® belts used in industrial, commercial and consumer applications. The portfolio features more than 20,000 parts designed for demanding applications, which are sold to original equipment and aftermarket customers. These belts are engineered for maximum performance and durability, with products available in wrap molded, raw edge, v-ribbed and synchronous belt designs. Common applications include agriculture, construction, industrial machinery, outdoor power equipment and powersports.

Chain. Timken manufactures precision Diamond® and Drives® roller chain, pintle chain, agricultural conveyor chain, engineering class chain and oil field roller chain. These engineered products are used in a wide range of mobile and industrial machinery applications, including agriculture, oil and gas, aggregate and mining, primary metals, forest products and other heavy industries. They are also used in the food and beverage and packaged goods sectors, which often require high-end, specialty products, including stainless-steel and corrosion-resistant roller chain.

Couplings. The Company offers a full range of industrial couplings within its industrial motion products portfolio. The Lovejoy brand is widely known for its flexible coupling design and as the creator of the jaw-style coupling. Lovejoy® couplings are available in curved jaw, jaw in-shear, s-flex, gear-torsional and disc style configurations. These components are used in a wide range of industries such as steel, pulp and paper, power generation, food processing, mining and construction. The Company also offers an extensive line of torsional couplings offered under the Torsion Control Products brand.

Industrial Clutches and Brakes. Timken offers a selection of engineered clutches, brakes, hydraulic power take-off units and other torque management devices marketed under the PT Tech® brand. These products are custom engineered for OEMs and used in marine, mining, aggregate, wood recycling and metals industries.

Seals. The Company's Lagersmit® engineered sealing solutions serve demanding marine, dredging, water, tidal energy and other industrial applications. The business serves leading propulsion manufacturers, ship owners, pump makers and other global industrial customers that require advanced sealing systems. Timken offers other industrial sealing solutions that come in a variety of types and material options and are used in manufacturing, food processing, mining, power generation, chemical processing, primary metals, pulp and paper and oil and gas industry applications.

Other Products. The Company also offers specialty filtration products, augers and other specialized industrial motion products. Des-Case is a technical leader in branded filtration solutions that sit adjacent to Timken's automatic lubrication systems. Des-Case features a comprehensive product offering including breathers, filter elements, condition monitoring, lubrication storage and filter systems used throughout the entire lubricant lifecycle. These solutions are critical for enhancing reliability, reducing downtime and extending the useful life of customers' systems. The Company also designs and manufactures Drives® helicoid and sectional augers for agricultural applications, like conveying, digging and combines. The Company's specialized industrial motion components include Shuton and Ipiranga ball screws among other key products.

Services:

Power Systems. Timken services components in the industrial customer's drive train, including switch gears, electric motors and generators, gearboxes, bearings, couplings and control panels. The Company’s Philadelphia Gear services for gear drive applications include onsite technical services; inspection, repair and upgrade capabilities; and manufacturing of parts to specifications. In addition, the Company’s Wazee, Smith Services, Schulz, Standard Machine and H&N service centers provide customers with services that include motor and generator rewind and repair and uptower wind turbine maintenance and repair. Timken Power Systems commonly serves customers in the power, wind energy, hydro and fossil fuel, water management, paper, mining and general manufacturing sectors.

Bearing Repair. Timken bearing repair services return worn bearings to like-new specifications, which increases bearing service life and often can restore bearings in less time than required to manufacture new. Bearing remanufacturing is available for any bearing type or brand - including competitor products - and is well-suited to heavy industrial applications such as paper, metals, mining, power generation and cement; railroad locomotives, passenger cars and freight cars; and aerospace engines and gearboxes.

Sales and Distribution:

Timken products are sold principally by its internal sales organizations. A portion of each segment's sales are made through authorized distributors or sales agents.

Customer collaboration is central to the Company's sales strategy. Therefore, Timken goes where its customers need us, with sales engineers primarily working in close proximity to customers rather than at production sites. The Company's sales force continuously updates the team's training and knowledge regarding engineered bearings and industrial motion products and related market sector trends, and they assist customers during product development and implementation phases and provide ongoing service and support.

The Company has a joint venture in North America focused on joint logistics and e-business services. This joint venture, CoLinx, LLC, includes five equity members: Timken, SKF Group, Schaeffler Group, RBC Bearings and Gates Industrial Corp. The e-business service focuses on information and business services for authorized distributors in the Engineered Bearings segment.

Timken has entered into individually negotiated contracts with some of its customers. These contracts may extend for one or more years and, if a price is fixed for any period extending beyond current shipments, customarily include a commitment by the customer to purchase a designated percentage of its requirements from Timken. Timken does not believe that there is any significant loss of earnings risk associated with any given contract.

Competition:

The bearing and industrial motion industries are highly competitive. Timken primarily competes based on its total value proposition, including product design and performance, application engineering, quality, price, timeliness of delivery, and the ability to provide technical sales and service support on a global basis. The Company competes with a variety of domestic and foreign manufacturers of anti-friction bearings, including SKF Group and Schaeffler Group, and with a diverse group of domestic and foreign manufacturers of industrial motion products.

Joint Ventures:

Investments in affiliated companies accounted for under the equity method were $0.9 million and $1.7 million, respectively, at December 31, 2024 and 2023. The investment balance at December 31, 2024 was reported in other non-current assets on the Consolidated Balance Sheets.

Backlog:

The following table provides the backlog of orders for the Company's domestic and overseas operations at December 31, 2024 and 2023:

| | | | | | | | |

| |

| (Dollars in millions) | 2024 | 2023 |

| Segment: | | |

| Engineered Bearings | $ | 1,341.8 | | $ | 1,502.0 | |

| Industrial Motion | 679.7 | | 775.2 | |

| Total Company | $ | 2,021.5 | | $ | 2,277.2 | |

Approximately 92% of the Company’s backlog at December 31, 2024 is scheduled for delivery in the succeeding 12 months. Actual shipments depend upon customers' ever-changing production schedules. Accordingly, Timken does not believe that its backlog data and comparisons thereof, as of different dates, reliably indicate future sales or shipments.

Sources and Availability of Raw Materials:

The principal raw materials used by the Company to make engineered bearings are special bar quality ("SBQ") steel and steel components. SBQ steel and steel components are produced around the world by various suppliers. SBQ steel is purchased in bar, tube and wire forms, while steel components are commonly purchased as forgings, semi-finished or finished components. The availability and price of SBQ steel are subject to changes in supply and demand, commodity prices for ferrous scrap, ore, alloy, electricity, natural gas, transportation fuel, and labor costs. The Company manages price variability of commodities by using surcharge mechanisms on some of its contracts with its customers that provides for partial recovery of these cost increases in the price of bearing products.

The availability of bearing-quality tubing is relatively limited, and the Company has taken steps to limit its exposure to this particular form of SBQ steel. Overall, the Company believes that the number of suppliers of SBQ steel is adequate to support the needs of global bearing production, and, in general, the Company is not dependent on any single source of supply.

The Company also purchases a variety of materials and components to produce industrial motion products, such as non-SBQ steel, synthetic rubber, fabrics, castings and plastics. The Company sources these components from various suppliers in the world market. The Company believes its supply base is adequate to support its manufacturing requirements.

Research:

Timken operates a network of technology and engineering centers to support its global customers with sites in North America, Europe and Asia. This network develops and delivers innovative engineered bearings and industrial motion solutions and technical services. Timken's largest technical center is located at the Company's world headquarters in North Canton, Ohio. Other smaller sites in the United States ("U.S.") include Los Alamitos, California; Downer's Grove, Fulton and Montgomery, Illinois; Norton Shores and Traverse City, Michigan; Springfield, Missouri; Keene and Lebanon, New Hampshire; Thorofare, New Jersey; Morganton, North Carolina; Carson City, Nevada; and King of Prussia, Pennsylvania. Within Europe, the Company has technology facilities in Plymouth, England; Annecy and Colmar, France; Heilbronn, Pegnitz and Werdohl, Germany; Valmadrera, Italy; Gorinchem, Netherlands; Porto, Portugal; and Ploiesti, Romania. In Asia, Timken operates technology and engineering facilities in Bangalore, India and Shanghai, China.

Compliance with Governmental Regulations:

Environmental Matters

The Company continues its efforts to protect the environment and comply with environmental protection laws. Additionally, it has invested in pollution control equipment and updated plant operational practices. The Company's manufacturing plants are expected to have an effective environmental management system which follows the ISO 14001 principles and internal audits are performed against this standard. Where appropriate to meet or exceed customer requirements, we are certified under the formal ISO 14001 certification process. As of the end of 2024, 28 of the Company’s plants, which includes a majority of the Company's bearing manufacturing plants, had obtained ISO 14001 certification.

The Company establishes appropriate levels of reserves to cover its environmental expenses and has a well-established environmental compliance audit program for its domestic and international units. This program measures performance against applicable laws, as well as against internal standards that have been established for all units worldwide. It is difficult to assess the possible effect of compliance with future requirements that differ from existing requirements.

The Company and certain of its subsidiaries have previously been and could in the future be identified as potentially responsible parties for investigation and remediation at off-site disposal or recycling facilities under the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), known as the Superfund, or state, foreign, or international laws similar to CERCLA. In general, such claims for investigation and remediation also have been asserted against numerous other entities.

Management believes any ultimate liability with respect to pending actions will not materially affect the Company’s annual results of operations, cash flows or consolidated financial position. The Company also is conducting environmental investigation and/or remediation activities at certain current or former operating sites. The costs of such investigation and remediation activities, in the aggregate, are not expected to be material to the operations or financial position of the Company.

New laws and regulations, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements may require Timken to incur costs, change production methods or materials, or become the basis for new or increased liabilities that could have a materially adverse effect on the Company's business, financial condition or results of operations.

Other Regulations

Because of its global operations, the Company is subject to a wide variety of domestic and foreign laws and regulations, including securities laws, tax laws, data privacy, employment and pension-related laws, competition laws, U.S. and foreign export and trade laws, the Foreign Corrupt Practices Act ("FCPA") and similar worldwide anti-bribery laws, government procurement regulations and laws governing improper business practices. The Company has policies and procedures in place to promote compliance with these laws and regulations and management believes any ultimate liability with respect to pending actions will not materially affect the Company’s annual results of operations, cash flows or consolidated financial position. In the future, the Company may be subject to both new laws and regulations, and changes to existing laws and regulations which may continue to evolve through interpretations by courts and regulators. Accordingly, it is difficult to assess the possible effect of compliance with future requirements that differ from existing requirements. Such changes may require the Company to incur costs and such changes could form the basis for new or increased liabilities that could have a materially adverse effect on the Company’s business, financial condition or results of operations. Refer to Item 1.A Risk Factors – Risks Related to Legal, Compliance and Regulatory Matters for further discussion.

Patents, Trademarks and Licenses:

Timken owns numerous U.S. and foreign patents, trademarks and licenses relating to certain products. While Timken regards these as important, it does not deem its business as a whole, or any industry segment, to be materially dependent upon any one item of intellectual property or group of items.

Employment:

At December 31, 2024, Timken had approximately 19,000 employees worldwide. Approximately 9% of Timken’s U.S. employees are covered under collective bargaining agreements.

Human Capital:

The Company believes that its employees and their collective knowledge and experience are among its most valuable resources. The Company is committed to providing a safe work environment and growth opportunities for its employees to learn and advance their career with the Company to promote and safeguard these key resources.

Employee Health and Safety

Employee health and safety remains a top priority for the Company and the Company's Environmental Health and Safety Steering Committee, which was created in 2009, continues to drive accountability and responsibility for safety throughout the organization.

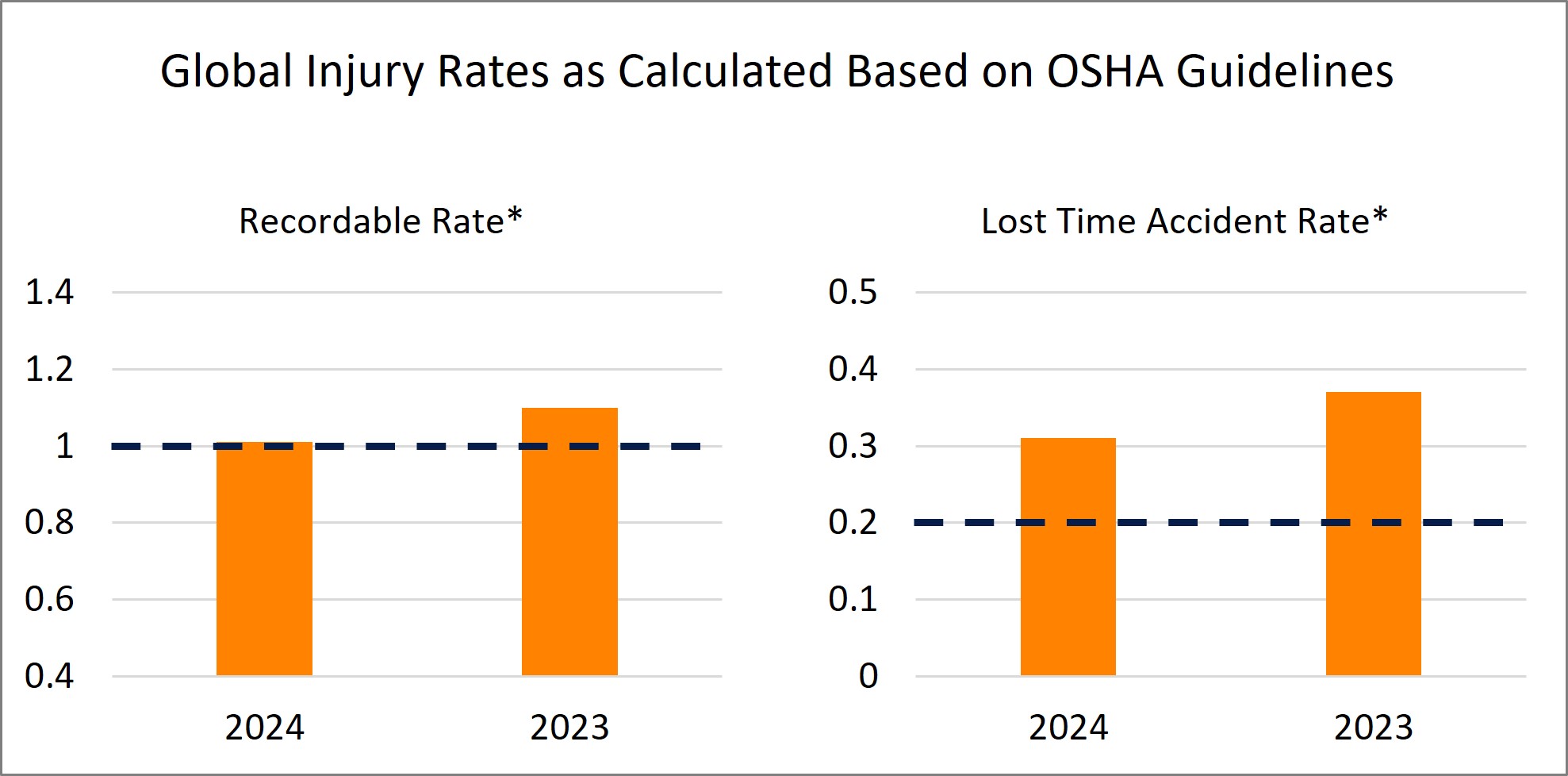

The Company's commitment to the health and safety of its employees is evidenced by its strong safety results in 2024 and 2023 shown in the charts below:

*Rates calculated as (number of injuries and illnesses x 200,000) / employee hours worked per 100 full-time workers. 2024 rates represent the Company's best estimate as of the date of this report

- - - represents the 2023 top quartile cutoff for U.S. metal manufacturers (North American Industry Classification System ("NAICS") code 332) that employ at least 1,000 employees, based on information provided by the U.S. Bureau of Labor Statistics at https://www.bls.gov/iif/.

The Company aims to maintain a recordable rate within the top quartile of U.S. metal manufacturers (NAICS code 332) based on information provided by the U.S. Bureau of Labor Statistics. In 2024, the Company improved on 2023 performance with both its lost time accident rate of 0.31 (0.37 in 2023) and its recordable rate of 1.01 (1.10 in 2023).

Attracting, Retaining, and Motivating Highly Qualified Employees

Successful execution of the Company's strategy depends on attracting, retaining, and motivating highly qualified talent. The Company provides professional growth and learning opportunities and individualized career development to support these objectives. The Company also believes it is important to recognize and reward its employees with pay and comprehensive benefits that are competitive and equitable based on the local markets in which it operates.

The Company believes that having open, honest dialogue with its employees is key to maintaining its strong culture and ethical work practices. In line with that approach, the Company conducts comprehensive surveys on a periodic basis and individual stay interviews to measure employee engagement. Exit interviews are also conducted with employees who voluntarily terminate their employment, which helps improve management processes. The Company deploys pulse surveys to gain insights from employees’ recent experiences and to better understand how effectively it is engaging, energizing and enabling its workforce.

The Company also provides several professional development and training opportunities to advance our employees’ skills and expertise. Some of these opportunities include online-learning platforms, job-specific training, our operations development program (a training program designed to increase the internal pool of employees who are ready to take on leadership positions) and our educational reimbursement programs. The Company has recruited and trained many of its employees through its engineering co-op program, where engineering students have the opportunity to work up to five semesters alongside the Company’s experienced engineers while they complete their bachelor’s degrees. Comprehensive leadership, skill and competency assessments are offered to company employees to best identify and address individual and team development needs and activities. To better inform its hiring and employee development efforts, the Company has also partnered with third-party vendors to provide required training for its managers focused on leadership, diversity and inclusion.

To further our Company’s diverse and inclusive culture, Timken employee resource groups (“ERGs”) around the world help us understand and address the challenges and opportunities faced by our diverse workforce and the benefits inclusion offers in advancing our collective knowledge. Our employees continue to drive new programming and culture acumen development across our six primary ERGs: Women’s International Network (WIN), Multicultural Association of Professionals (MAP), Young Professionals Network (YPN), Veteran Engagement at Timken (VET), Timken PRIDE Network (TPN), and Celebrating Abilities Network (CAN). Additionally, we partner with an online platform, Aperian®, to help our employees further their global competency.

Available Information:

The Company uses its Investor Relations website at http://investors.timken.com, as a channel for routine distribution of important information, including news releases, analyst presentations and financial information. The Company posts filings as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (the "SEC"), including its annual, quarterly and current reports on Forms 10-K, 10-Q and 8-K; its proxy statements; and any amendments to those reports or statements. All such postings and filings are available on the Company’s website free of charge. In addition, this website allows investors and other interested persons to sign up to automatically receive e-mail alerts when the Company posts news releases and financial information on the Company’s website. The content on any website referred to in this Annual Report on Form 10-K is not incorporated by reference into this Annual Report unless expressly noted.

Item 1A. Risk Factors

The following are certain risk factors that could affect our business, financial condition and results of operations. The risks that are described below are not the only ones that we face. These risk factors should be considered in connection with evaluating forward-looking statements contained in this Annual Report on Form 10-K because these factors could cause our actual results and financial condition to differ materially from those projected in forward-looking statements. Although the risks are organized by headings, and each risk is discussed separately, many are interrelated. If any of the following risks actually occur, our business, financial condition or results of operations could be negatively affected.

Risk Relating to our Business

The bearing and industrial motion industries are highly competitive, and this competition results in significant pricing pressure for our products that could affect our revenues and profitability.

The global bearing industry is highly competitive and consolidated. We compete with many domestic and foreign manufacturers of anti-friction bearings. In addition, the industries into which we sell our industrial motion products are also highly competitive and consolidating. Due to competitiveness within these industries, we may not be able to continue to increase prices for our products to cover increases in our costs or to achieve desired profitability. In addition, we face pressure from our customers to reduce prices, which coupled with the contractual nature of business with OEM customers, could adversely affect our revenues and profitability. In addition, our customers may choose to purchase products from one of our competitors rather than pay the prices we seek for our products, which could adversely affect our revenues and profitability.

Our business is capital intensive, and if there are downturns in the industries that we serve, we may be forced to significantly curtail or suspend operations with respect to those industries, which could result in our recording asset impairment charges, restructuring charges or taking other measures that may adversely affect our results of operations and profitability.

Our business operations are capital intensive, and we devote a significant amount of capital to certain industries. Our profitability is dependent on factors such as labor compensation and productivity and inventory and supply chain management, which are subject to risks that we may not be able to control. If there are downturns in the industries that we serve, including as a result of high inflation or a recession, we may be forced to significantly curtail or suspend our operations with respect to those industries, including laying-off employees, reducing production, recording asset impairment charges and other measures, which may adversely affect our results of operations and profitability. We have taken approximately $133 million in impairment and restructuring charges in the aggregate during the last five years. Changes in business or economic conditions, or our business strategy, may result in additional restructuring actions and may require us to take additional charges in the future, which could have a material adverse effect on our earnings.

Changes in customer preferences and inventory reductions by customers or distributors could adversely affect the Company's business.

The Company has previously experienced distributor inventory corrections reflecting de-stocking of the supply chain associated with softer demand in certain markets. The Company's results in a period may be adversely impacted by similar customer inventory adjustments in the future, as well as changes in customer buying preferences.

Any change in raw material prices, the availability or cost of raw materials or logistics expenses could adversely affect our results of operations and profit margins.

We require substantial amounts of raw materials, including steel, to operate our business. Our supply of raw materials could be and has in the past been interrupted for a variety of reasons, including availability and pricing. Prices for raw materials necessary for production have fluctuated significantly in the past, have risen substantially at times in the past, and could continue to do so in the future. We generally attempt to manage these fluctuations by passing along increased raw material prices to our customers in the form of price increases or surcharges; however, we may be unable to continue to increase the price of our products, or may experience a lag in doing so, due to pricing pressure, contract terms or other factors, which could adversely impact our revenue and profit margins.

Moreover, future disruptions in the supply of our raw materials could impair our ability to manufacture our products for our customers, impact our ability to manufacture and deliver our products on a timely basis, require us to pay higher prices in order to obtain these raw materials from other sources or necessitate the use of expedited or more costly freight options. Any significant increase in the prices for such raw materials or logistics expenses could adversely affect our results of operations and profit margins.

We may not realize the improved operating results that we anticipate from past and future acquisitions, may experience challenges in integrating acquired businesses, and may incur unanticipated liabilities and costs associated with such acquired businesses.

We seek to grow, in part, through strategic acquisitions, joint ventures and other alliances, which are intended to complement or expand our businesses, and expect to continue to do so in the future. These acquisitions involve challenges and risks. In the event that we do not successfully integrate these acquisitions into our existing operations so as to realize the expected return on our investment, issues identified in our due diligence review are not adequately addressed or the costs associated with such issues are higher than expected, or we uncover material issues (including historical environmental, trade, sanctions, tax or compliance violations) that were not identified during our due diligence review, our results of operations, cash flow or financial condition could be adversely affected.

Our operating results depend in part on continued successful research, development and marketing of new and/or improved products and services, and there can be no assurance that we will continue to successfully introduce new products and services.

The success of new and improved products and services depends on their initial and continued acceptance by our customers. Our businesses are affected, to varying degrees, by technological change and corresponding shifts in customer demand, which could result in unpredictable product transitions or shortened life cycles, especially as it relates to market and technological changes driven by electrification, environmental requirements, automation, the continued rising importance of e-commerce, artificial intelligence and increased digitization. We may experience difficulties or delays in the research, development, production, or marketing of new products and services that may prevent us from recouping or realizing a return on the investments required to bring new products and services to market. The end result could have a negative impact on our operating results.

Loss of our rights to exclusive use of our intellectual property whether through patent infringement, counterfeiting, theft of trade secrets, or otherwise could have a material adverse effect on the Company. Third-party claims alleging our infringement of intellectual property rights could also have a material adverse effect on the Company.

We rely on a combination of patents, trademarks, trade secret laws, invention assignment agreements, confidentiality agreements, and other arrangements to protect our intellectual property rights. These rights are important to our business, and their loss, whether through patent infringement, counterfeiting, theft of trade secrets, data breach, or otherwise, could have a material adverse effect on the Company.

Additionally, third parties may bring claims and have brought claims in the past to challenge the validity of our patents or other intellectual property rights or allege that we infringe their patents or other intellectual property rights. We may incur substantial costs if our competitors or other third parties validate such claims. If the outcomes of any such disputes are unfavorable to us, we could be subject to damages and reputational harm and our business could be otherwise adversely affected.

Risks Related to our Capital Structure, the Global Financial Markets, and Currency Exchange Rates

An increase in our levels of debt and the corresponding impact to our financial covenants or a failure to maintain our credit ratings could limit our ability to invest in our business.

An increase in our levels of debt might lead us to have less cash flow available for our business operations, capital expenditures, and strategic transactions and our ability to service our debt obligations or to obtain future financing could be negatively impacted by general adverse economic and industry conditions and rising interest rate trends. In addition, a failure to maintain our credit ratings could adversely affect our cost of borrowing, liquidity and access to capital markets.

Some of our debt has variable interest rates, which could increase the cost of servicing such debt, and fixed rate debt may have increased cost to refinance at maturity.

We have seen interest rates rise significantly in recent years, and while rates fell in 2024, they may rise again in the future due to inflation or other causes. As a result, the costs of servicing our variable interest rate debt could increase even if the amount borrowed under such facilities remains the same. Increased servicing costs could in turn negatively impact our profitability and cash flow. In addition, fixed rate debt currently outstanding that matures in the future may be refinanced with higher interest rates leading to additional servicing costs.

The global nature of our business exposes us to foreign currency fluctuations that may affect our asset values, results of operations and competitiveness.

We are exposed to the risks of currency exchange rate fluctuations because a significant portion of our net sales, costs, assets and liabilities, are denominated in currencies other than the U.S. dollar. These risks include a reduction in our net asset values, net sales, operating income and competitiveness.

For those countries outside the U.S. where we have significant sales, a strengthening in the U.S. dollar as we have seen over the past few years or devaluation in the local currency would reduce revenue, operating profit and shareholders' equity due to the impact of foreign exchange translation on our Consolidated Financial Statements. Fluctuations in foreign currency exchange rates may make our products more expensive for others to purchase or increase our operating costs, affecting our competitiveness and our profitability.

Changes in exchange rates between the U.S. dollar and other currencies and volatile economic, political and market conditions throughout the world have in the past adversely affected our financial performance and may in the future adversely affect the value of our assets located outside the U.S., our gross profit and our results of operations.

Our results of operations may be materially affected by conditions in global financial markets or in any of the geographic regions in which we, our customers or our suppliers operate. If an end user cannot obtain financing to purchase our products, either directly or indirectly contained in machinery or equipment, demand for our products will be reduced, which could have a material adverse effect on our financial condition and earnings.

Global financial markets have experienced volatility in the past, including volatility in securities prices and diminished liquidity and credit availability. Our access to the financial markets cannot be assured and is dependent on, among other things, market conditions and company performance. Accordingly, we may be forced to delay raising capital, issue shorter tenors than we prefer or pay unattractive interest rates, which could increase our interest expense, decrease our profitability and significantly reduce our financial flexibility.

If a customer becomes insolvent or files for bankruptcy (events which we have occasionally experienced in the past and continue to experience from time to time), our ability to recover accounts receivable from that customer would be adversely affected and any payment we received during the preference period prior to a bankruptcy filing potentially may be recoverable by the bankruptcy estate. Furthermore, if certain of our customers liquidate in bankruptcy, we may incur impairment charges relating to obsolete inventory and machinery and equipment.

In addition, financial instability of certain companies in the supply chain could disrupt production in any particular industry. A disruption of production in any of the industries where we participate could have a material adverse effect on our financial condition and earnings. If any of our suppliers are unable or unwilling to provide the products or services that we require or materially increase their costs, our ability to offer and deliver our products on a timely and profitable basis could be impaired. Furthermore, if any of our suppliers were to become subject to bankruptcy, receivership or similar proceedings, we may be unable to arrange for alternate or replacement relationships on favorable terms, which could harm our sales and operating results.

Risks Related to the Global Nature of our Operations

Global political instability and other risks of international operations may adversely affect our operating costs, revenues and the price of our products.

Our international operations expose us to risks not present in a purely domestic business, including primarily:

•changes in international treaties or trade unions, which may make our products or our customers' products more costly to export or import;

•changes in tariff regulations, which may make our products more costly to export or import;

•threatened or actual state seizure of foreign-owned manufacturing assets;

•hostilities between countries in which we operate which could limit our ability to manufacture in, sell into, export out of, or access assets located in such jurisdictions;

•the imposition of sanctions on countries in which we operate, from which we receive critical supplies or into which we sell our products;

•strained geopolitical relations between countries in which we have significant operations including the U.S., China and Mexico, among others;

•political protests or unrest which could negatively impact our operations;

•difficulties establishing and maintaining relationships with local OEMs, distributors and dealers;

•import and export licensing requirements;

•compliance with a variety of foreign laws and regulations, including unexpected changes in taxation, environmental, sustainability or other regulatory requirements, which could increase our operating and other expenses and limit our operations;

•additional costs, taxes and restrictions related to repatriation of cash in international jurisdictions;

•disadvantages of competing against companies from countries that are not subject to U.S. laws and regulations, including the FCPA;

•difficulty in staffing and managing geographically diverse operations;

•disruptions to our global supply chain and logistical issues associated with port closures or strikes, delays or increased costs;

•tax exposures related to cross-border intercompany transfer pricing and other tax risks unique to international operations; and

•compliance with data protection regulations.

These and other risks also may increase the relative price of our products compared to those manufactured in other countries, reducing the demand for our products in the markets in which we operate, which could have a material adverse effect on our revenues and earnings.

We have global operations, and changes to government trade policies including the imposition of tariffs and other trade barriers, as well as the resulting consequences, could adversely impact our revenue and profit margins.

The U.S. government has imposed tariffs on certain foreign goods, including steel and other raw materials as well as certain products made from such materials. Changes in U.S. trade policy have resulted in, and could further result in, U.S. trading partners adopting responsive trade policies that make it more difficult or costly for us to export our products to those countries. In addition, the governments of other countries in which we have substantial operations could impose tariffs on, or restrict trade in, the materials and components necessary for the production of our products. These measures could result in an increase in our production costs. If we are unable to increase the price of our products or otherwise mitigate these increased costs, it could adversely impact our revenue and profit margins.

Risks Related to Human Capital Management and Employee Benefits

If we are unable to attract, retain and develop key personnel and develop and successfully execute succession plans, our business could be materially adversely affected.

Our business substantially depends on the continued service of key members of our management and other key employees. The loss of the services of a significant number of members of our management or other key employees could have a material adverse effect on our business. Our future success also will depend on our ability to attract, retain and develop highly skilled personnel at all levels of the organization, such as engineering, finance, marketing and senior management professionals, as well as skilled labor. Competition for these types of employees is intense, and has increased recently, and we could experience difficulty from time to time in hiring, developing and retaining the personnel necessary to support our business. If we do not succeed in retaining and developing our current employees, attracting new high-quality employees, and developing and successfully executing succession plans, our business could be materially adversely affected.

Work stoppages or similar difficulties could significantly disrupt our operations, reduce our revenues and materially affect our earnings.

A work stoppage at one or more of our facilities, whether caused by fire, flooding, epidemics, pandemics, public health concerns, military hostilities, government-imposed shutdowns, severe weather, including that caused by climate change, other natural disaster or otherwise, could have a material adverse effect on our business, financial condition and results of operations. In addition, some of our employees are represented by labor unions or works councils under collective bargaining agreements with varying durations and terms. We have experienced work stoppages at certain of our facilities historically at times, and while these stoppages have been short-term in nature, no assurances can be made that we will not experience additional work stoppages due to government directives, employee health concerns, and other types of conflicts with labor unions, works councils, and other similar groups in the future.

A work stoppage at one of our suppliers could also materially and adversely affect our operations if an alternative source of supply were not readily available. In addition, if one or more of our customers were to experience a work stoppage, that customer could halt or limit purchases of our products, which could have a material adverse effect on our business, financial condition and results of operations. In addition, the credit and default risk or bankruptcy of customers or suppliers as a result of work stoppages could also materially and adversely affect our operations and results.

Expenses and contributions related to our defined benefit plans are affected by factors outside our control, including the performance of plan assets, interest rates, actuarial data and experience, and changes in laws and regulations, all of which could impact our funded status.

Our future expense and funding obligations for defined benefit pension plans depend upon a number of factors, including the level of benefits provided for by the plans, the future performance of assets with specific country economic performance risks set aside in trust for these plans, the level of interest rates used to determine the discount rate to calculate the amount of liabilities, actuarial data and experience, and any changes in government laws and regulations. In addition, if the various investments held by our pension trusts do not perform as expected or the liabilities increase as a result of discount rate changes and other actuarial changes, our pension expense and required contributions would increase and, as a result, could materially adversely affect our business or require us to record charges that could be significant and would cause a reduction in our shareholders' equity. We may be required legally to make contributions to the pension plans in the future in excess of our current expectations, and those contributions could be material.

Future actions involving our defined benefit and other postretirement plans, such as annuity purchases, lump-sum payouts, and/or plan terminations could cause us to incur significant pension and postretirement settlement and curtailment charges, and require cash contributions.

We have purchased annuities and offered lump-sum payouts to defined benefit plan and other postretirement plan participants and retirees in the past. If we were to take similar actions in the future, we could incur significant pension settlement and curtailment charges related to the reduction in pension and postretirement obligations from annuity purchases, lump-sum payouts of benefits to plan participants, and/or plan terminations. Pursuing these types of actions could require us to make additional contributions to the defined benefit plans to maintain a legally required funded status.

Risks Related to Legal, Compliance and Regulatory Matters

Current and future environmental health and safety laws, regulations, and customer requirements impose substantial costs and limitations on our operations and compliance may be more costly than we expect.

We are subject to the risk of potentially substantial environmental liability and limitations on our operations due to current environmental laws and regulations and future environmental laws and regulations could impose additional potential risks and limitations. We are or may become subject to extensive federal, state, local and foreign environmental, health and safety laws and regulations concerning matters such as air emissions, wastewater discharges, the use of per- and polyfluoroalkyl substances ("PFAS"), such as polytetrafluoroethylene ("PTFE"), or other chemicals of concern, waste management (e.g. storage, disposal) and the investigation and remediation of contamination. The risks of substantial costs and liabilities related to compliance with these laws and regulations are an inherent part of our business, and conditions may develop, arise or be discovered that create substantial environmental compliance or remediation liabilities and costs or which may require that we change certain production methods or materials used in our manufacturing processes or products.

Compliance with environmental, health and safety legislation and regulatory requirements may prove to be more limiting and costly than we anticipate. To date, we have committed significant expenditures in our efforts to manage remediation activities and maintain compliance with these requirements at our facilities, and we expect that we will continue to make significant expenditures related to such compliance in the future. From time to time, we may be subject to legal proceedings brought by private parties or governmental authorities with respect to environmental matters, including matters involving alleged noncompliance with or liability arising from environmental, health and safety laws, property damage or personal injury. Actual or alleged violations of environmental, health and safety laws or environmental permit requirements could result in restrictions or prohibitions on operations and substantial civil or criminal fines, as well as, under some environmental, health, and safety laws, the assessment of strict liability and/or joint and several liability. New laws and regulations, including those that may relate to emissions of greenhouse gases or the use, discharge or disposal of chemicals of concern utilized in our manufacturing processes, stricter enforcement of existing laws and regulations, new and more stringent customer requirements, the discovery of previously unknown contamination or the imposition of new clean-up requirements or standards could require us to incur costs, change production methods or materials or become the basis for new or increased liabilities that could have a material adverse effect on our business, financial condition or results of operations.

PTFE and other fluoropolymer materials, which are known to be included in certain of our products, are subject to increasing regulatory scrutiny.

Certain of our products, including but not limited to certain seals and plain bearings, are known to contain PTFE or other fluoropolymer materials, which are included in certain broad definitions of PFAS. These products represent a relatively small portion of our total product portfolio. PFAS have been increasingly scrutinized due to their potential environmental and health risks and are now the subject of increasing regulatory attention from the Environmental Protection Agency, state governments, the European Union and other regulators. These evolving regulations may restrict the use, manufacture, sale and/or distribution of our products or our ability to obtain components of our products, or may require us to report data on our use of certain PFAS. Such regulations could lead to significant costs. In addition, certain PFAS, including PFAS previously or currently within PTFE or other fluoropolymer materials, have increasingly become subject to new or more stringent investigation and remediation requirements where such PFAS is believed to have caused an impact to the environment. Certain of the Company’s operations and facilities have already been, or may in the future become, the subject of formal or informal investigations, enforcement actions or proceedings relating to these regulations or of private or public rights of action for the investigation and remediation of PFAS released into the environment. Such investigations, remediations, other response actions, and any related proceedings could lead to significant costs or limitations on future production in the absence of viable alternatives.

We are subject to a wide variety of domestic and foreign laws and regulations that could adversely affect our results of operations, cash flow or financial condition.

We are subject to a wide variety of domestic and foreign laws and regulations, and legal compliance risks, including securities laws, tax laws, data privacy laws, employment and pension-related laws, competition laws, U.S. and foreign export and trade laws, government procurement regulations, and laws governing improper business practices. We are affected by both new laws and regulations, and changes to existing laws and regulations which may continue to evolve through interpretations by courts and regulators. Furthermore, the laws and regulations to which we are subject may differ from jurisdiction to jurisdiction, further increasing the cost of compliance and the risk of noncompliance.

In addition, we could be adversely affected by violations of the FCPA and similar worldwide anti-bribery laws as well as export controls and economic sanction laws. The FCPA and similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to non-U.S. government officials for the purpose of obtaining or retaining business. In the past, there has been a substantial increase in the global enforcement of anti-corruption laws. We operate in many parts of the world that have experienced governmental corruption to some degree and, in certain circumstances, strict compliance with anti-bribery laws may conflict with local customs and practices. Our policies mandate compliance with these laws, but we cannot assure you that our internal controls and procedures will always protect us from the improper acts committed by our employees, agents or third-party intermediaries. If we are found to be liable for FCPA, export control or sanction violations, we could suffer from criminal or civil penalties or other sanctions, including loss of export privileges or authorization needed to conduct aspects of our international business, which could have a material adverse effect on our business.

Also, our sales to public-sector customers are subject to complex regulations. Noncompliance with government procurement regulations, information security requirements such as the National Institute of Standards and Technology standards and guidelines, or other applicable laws or regulations could result in civil, criminal and administrative liability, termination of government contracts or other public-sector customer contracts, and suspension, debarment or ineligibility from doing business with governmental entities or other customers in the public sector.

Compliance with the laws and regulations described above or with other applicable foreign, federal, state, and local laws and regulations currently in effect or that may be adopted in the future could materially adversely affect our competitive position, operating results, financial condition and liquidity.

The global regulatory landscape is rapidly evolving and new and potentially conflicting requirements or preferences, including with respect to climate change, environmental sustainability and other matters, could lead to added operational complexity and compliance risks while adversely impacting our costs and financial results. In addition, severe weather associated with a changing climate could negatively impact our operations and those of our customers and suppliers.

The pace at which regulators in many jurisdictions are implementing regulatory change is currently heightened across a wide variety of topics including climate change, environmental sustainability, employment and labor, ethics, data privacy, governance, and others. Rapid changes in the regulatory environment may lead to additional costs of compliance and risks associated with non-compliance. Furthermore, regulations governing our global operations may at times conflict across jurisdictions leading to additional complexity and operating costs.

In addition, environmental activism, government regulations and reporting standards, and other initiatives aimed at limiting climate change and reducing global greenhouse gas emissions could interfere with our business strategy and operations as well as require material investment in energy efficiency projects, renewable energy sourcing, emission controls, data collection and verification resources. Severe weather associated with a changing climate could also negatively impact the operation of our facilities, as well as those of our customers and suppliers and impact our ability to insure our assets on commercially desirable terms and conditions.

Actions required to comply with regulations or stakeholder expectations associated with corporate social responsibility (“CSR”) topics, including those related to climate change, could adversely affect our business and performance.

Investors, customers, suppliers, employees, regulators and other stakeholders are increasingly focused on CSR practices and disclosures, and expectations in this area are rapidly evolving and growing and sometimes conflicting. We have announced goals covering certain CSR topics, such as those related to reductions in greenhouse gas emissions and maintaining employee health and safety. Over time, stakeholder expectations for, and regulatory requirements (such as the European Union, Corporate Sustainability Reporting Directive) related to, our CSR program and initiatives may change, and our investors, customers, suppliers, employees or regulators may advocate that we implement additional, or stricter, goals and initiatives related to CSR topics. Greater expectations or legal requirements may cause us to undertake costly initiatives to satisfy such new criteria. If we do not meet, or are perceived to have not met, announced CSR goals or do not accurately disclose our progress on such goals, our reputation, competitive position, financial condition and operating results could be adversely impacted.

Risks Related to Data Privacy and Information Security

The Company may be subject to risks relating to its information technology systems, including the risk of cybersecurity incidents.

The Company relies on information technology systems and those of third parties who provide products or services to us to manage and operate its business and to process, transmit and store data, including its intellectual property, personal data and other proprietary business information and that of its employees, customers and suppliers. Despite security measures taken by the Company, the Company’s information technology systems (both on-premises and third-party managed) may be vulnerable to attacks by hackers or subject to unauthorized access due to employee error, technology vulnerabilities or misconfigurations, supplier error, malfeasance or other causes. Cybersecurity incidents and similar attacks vary in their form and can include the deployment of harmful malware or ransomware, denial-of-services attacks, and other attacks, which may affect business continuity and threaten the availability, confidentiality and integrity of our systems and information. While we have utilized and continue to utilize various controls and systems to mitigate such risks, we cannot assure that the actions we have implemented and are implementing, or that we have required or will require third-party service providers and other business partners to implement, will be sufficient to protect our systems or data. We have been and may in the future be subject to attempts to gain unauthorized access to our information technology systems. To date, the impacts of prior incidents have not had a material adverse effect on us. A cybersecurity incident or failure or disruption relating to our information systems or technology infrastructure or that of our third-party service providers, could expose the Company and its employees, customers and suppliers to risks of misuse of confidential information, manipulation and destruction of data, production downtimes and operational disruptions, which in turn could result in litigation, business disputes and government investigations, and related monetary damages, injunctive requirements and fines, and could adversely affect the Company's reputation, competitive position, business or results of operations.

Data privacy and security concerns, as well as evolving regulation and enforcement, could adversely affect our results of operations and profitability.

We and certain authorized third parties of ours, collect, transmit, store, access and otherwise process certain confidential or sensitive data, including proprietary business information, personal data or other information that is subject to privacy, data protection and security laws, regulations and/or government or customer-imposed controls. We operate in a global environment in which the data privacy regulatory and legal framework and corresponding enforcement and litigation landscape are evolving quickly. Moreover, the data privacy laws and regulations of the specific jurisdictions in which we operate may vary and potentially conflict. These laws and regulations can also impose significant fines and penalties for noncompliance and afford private rights of action to individuals under certain circumstances. As such, we incur and expect to continue to incur significant ongoing costs as part of our efforts to comply with applicable law. Any failure, or perceived failure, to comply with our data protection or privacy-related legal obligations may result in reputational damage, loss of business, regulatory investigations and fines, and litigation, and related monetary damages and injunctive requirements, any of which may adversely affect our results of operations and profitability.

General Risk Factors

Weakness in global economic conditions or in any of the industries or geographic regions in which we or our customers operate, as well as the cyclical nature of our customers' businesses generally or sustained uncertainty in financial markets, could adversely impact our revenues and profitability by reducing demand and margins.

There has been significant volatility in the capital markets and in the end markets and geographic regions in which we and our customers operate, which has negatively affected our revenues. Our revenues also may be negatively affected by changes in customer demand, changes in the product mix and negative pricing pressure in the industries in which we operate. Margins in those industries are highly sensitive to demand cycles, and our customers in those industries historically have tended to delay large capital projects, including expensive maintenance and upgrades during economic downturns. As a result, our revenues and earnings are impacted by overall levels of industrial production.

Rising inflationary pressure has resulted in and could further result in increased employee expenses, shipping costs, raw material costs, energy and fuel costs and other costs of production. If we cannot continue to absorb or pass these increases in our costs of production to our customers, our results of operations, profit margins and cash flows could be adversely affected.

Increases in compensation, wage pressure, and other expenses for our employees have adversely affected our profitability and could continue to do so. These cost increases may continue to be impacted by inflationary pressures that could further reduce our sales or profitability. Inflation has led to and could continue to lead to further increases in other operating costs, such as shipping costs, costs of raw materials, and energy and fuel prices. If we are unable to continue to increase the price of our products to offset further cost increases, or experience a lag in doing so, due to pricing pressure, contract terms or other factors, our financial condition, results of operations and cash flows may be adversely affected.

Warranty, recall, quality or product liability claims could materially adversely affect our earnings.

Warranty, recall, quality or product liability claims could materially adversely affect our earnings and brand reputation. In our business, we are exposed to warranty and product liability claims, including in certain industry segments with potential high value claims, such as rail, aerospace and wind energy, and through our automotive customer contracts which often contain negotiated warranty provisions. In addition, we may be required to participate in the recall of a product. If we fail to meet customer specifications for their products, we may be subject to product quality costs and claims, as well as adverse brand reputational impacts. A successful warranty or product liability claim against us, or a requirement that we participate in a product recall, could have a material adverse effect on our earnings and brand reputation.

If our internal controls are found to be ineffective, our financial results or our stock price may be adversely affected.

Our most recent evaluation resulted in our conclusion that, as of December 31, 2024, our internal control over financial reporting was effective. We believe that we currently have adequate internal control procedures in place for future periods, including processes related to newly acquired businesses; however, increased risk of internal control breakdowns generally exists in a business environment that is decentralized. In addition, if our internal control over financial reporting is found to be ineffective, investors may lose confidence in the reliability of our financial statements, which may adversely affect our stock price.

Changes in accounting standards could have an adverse effect on our results of operations, as reported in our financial statements.

Our consolidated financial statements are prepared in accordance with U.S. Generally Accepted Accounting Principles ("U.S. GAAP"), which is periodically revised and/or expanded. Accordingly, from time to time we are required to adopt new or revised accounting standards and related interpretations issued by recognized authoritative bodies, including the Financial Accounting Standards Board ("FASB") and the SEC. The impact of accounting pronouncements that have been issued but not yet implemented is disclosed in this Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. It is possible that future accounting guidance we are required to adopt, or future changes in accounting principles, could change the current accounting treatment that we apply to our consolidated financial statements and that such changes could have an adverse effect on our results of operations, as reported in our consolidated financial statements.

Item 1B. Unresolved Staff Comments

None.

Item 1C. Cybersecurity

Cybersecurity Risk Management and Governance

Information security is an integral part of the Company’s overall enterprise risk management program. The Company maintains cybersecurity processes designed to detect and assess the severity of cybersecurity threats and incidents and, where applicable and possible, to identify the source of a threat or incident, including, whether it is associated with the use of third-party service providers. The Company's processes also include cybersecurity testing, detection, response, prevention and mitigation strategies, conducting contract and vendor due diligence review, and informing management and the Company's Board of Directors of material cybersecurity threats and incidents. The Company's information security team also engages third-party security consultants for penetration testing, training and system enhancements. The Company provides training and education for employees on cybersecurity awareness, including confidential information protection and simulated phishing attacks where appropriate for the employee’s role.