QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Tipperary Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

TIPPERARY CORPORATION

633 Seventeenth Street

Suite 1550

Denver, Colorado 80202

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON

April 26, 2005

TO THE SHAREHOLDERS:

Notice is hereby given that the Annual Meeting of Shareholders (the "Annual Meeting") of Tipperary Corporation (the "Company"), a Texas corporation, will be held in Salons 5 and 6 of the Marriott City Center, 1701 California Street, Denver, Colorado, on Tuesday, April 26, 2005, at 10:00 a.m., local time, for the purpose of taking action on:

- 1.

- The election of seven (7) directors to serve until the next Annual Meeting of Shareholders or until their successors shall be duly elected and qualified;

- 2.

- The ratification of the reappointment of PricewaterhouseCoopers LLP ("PricewaterhouseCoopers") as the Company's independent auditors for 2005;

- 3.

- A proposal to amend the Articles of Incorporation to increase the Company's authorized shares of Common Stock from 50,000,000 to 100,000,000 shares;

- 4.

- To consider and act upon a proposal to grant warrants to purchase our Common Stock in the following amounts to officers and directors of the Company:

| |

| | Total Shares Subject to Exercise

|

|---|

| a. | | Kenneth L. Ancell—Officer and Director | | 50,000 |

| b. | | David L. Bradshaw—Officer and Director | | 200,000 |

| c. | | Jeff T. Obourn—Officer | | 25,000 |

| d. | | Eugene I. Davis—Director | | 25,000 |

| e. | | Douglas Kramer—Director | | 25,000 |

| f. | | Marshall D. Lees—Director | | 25,000 |

| g. | | Charles T. Maxwell—Director | | 25,000 |

| h. | | D. Leroy Sample—Director | | 25,000 |

- 5.

- The transaction of such other business as may properly come before the Annual Meeting or any adjournment thereof.

The Company's Board of Directors has fixed the close of business on March 9, 2005, as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. These materials were first mailed to shareholders on or about March 31, 2005. The principal executive office and mailing address of the Company is set forth above.

Information concerning the matters to be acted upon at the Annual Meeting is set forth in the accompanying Proxy Statement.

| | BY ORDER OF THE BOARD OF DIRECTORS |

|

Elaine R. Treece

Corporate Secretary |

Date: March 28, 2005

SHAREHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. PLEASE COMPLETE AND PROMPTLY RETURN YOUR SIGNED PROXY IN THE POSTAGE-PAID ENVELOPE. THE PROXY IS REVOCABLE AT ANY TIME PRIOR TO ITS USE. IF YOU ATTEND THE MEETING YOU CAN REVOKE YOUR PROXY AND VOTE IN PERSON.

TIPPERARY CORPORATION

PROXY STATEMENT

SOLICITATION OF PROXY

The accompanying proxy is solicited on behalf of the Board of Directors of the Company in connection with the Annual Meeting of Shareholders to be held on Tuesday, April 26, 2005, ("Annual Meeting") in Salons 5 and 6 of the Marriott City Center, 1701 California Street, Denver, Colorado, at 10:00 a.m., local time.

The annual meeting will be held to elect seven directors to hold office until the next annual meeting or until their successors are otherwise appointed or elected, to ratify the reappointment of the Company's independent auditors, and to amend the Articles of Incorporation to increase our authorized shares of Common Stock and approve warrant grants to officers and directors in respect of 400,000 shares of our Common Stock.

The cost of preparing, assembling and mailing the Notice of Annual Meeting of Shareholders, Proxy Statement and form of proxy, which are first being mailed to the shareholders on or about March 31, 2005, will be borne by the Company. It is contemplated that solicitation of proxies will be primarily by mail, but may be supplemented with personal solicitation by the Company's officers, directors and other regular employees to whom no additional compensation will be paid.

REVOCATION OF PROXY

Any shareholder giving a proxy may revoke it at any time prior to its use by notifying the Company either in person or by written notice of the revocation or by submitting a duly executed proxy bearing a later date which is received by the Company at least two business days prior to the meeting. Shareholder attendance at the Annual Meeting may revoke any proxy given by such shareholder. If no specification is made on the proxy, the shares will be voted in accordance with the recommendation of the Board of Directors, as stated herein, or at the discretion of the named proxy with regard to any other matter that may properly come before the Annual Meeting.

VOTING AT THE ANNUAL MEETING

The close of business on March 9, 2005, has been fixed by the Company's Board of Directors as the record date for the determination of shareholders entitled to vote at the Annual Meeting. As of that date, the Company had issued and outstanding 41,355,994 shares of Common Stock, par value $.02 per share.

The Company's Articles of Incorporation do not permit cumulative voting by shareholders. The Common Stock is the Company's only class of voting securities. Accordingly, each holder of Common Stock as of the record date will be entitled to cast one vote for each share of Common Stock held.

A quorum for the Annual Meeting will consist of attendance, either in person or by proxy, of a majority of outstanding shares of Common Stock. Of the votes cast at the Annual Meeting, a vote of the holders of a majority of the Common Stock present, either in person or by proxy, is required to elect each director nominee, to ratify the reappointment of PricewaterhouseCoopers as the Company's independent auditors for 2005 and approve the proposal to grant warrants to officer and directors in respect of 400,000 shares of Common Stock. A vote of two-thirds of the outstanding shares of Common Stock is required to amend the Articles of Incorporation to increase the Company's authorized shares of Common Stock.

Votes for and against, abstentions and "broker non-votes" will each be counted as present for purposes of determining the presence of a quorum. A broker non-vote occurs when a broker submits a proxy card with respect to shares held in a fiduciary capacity (typically referred to as being held in "street name") but declines to vote on a particular matter because the broker has not received voting instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. Routine matters include the election of directors and ratification of auditors.

1

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth information as of March 9, 2005, regarding the beneficial ownership by persons and entities known by the Company to beneficially own more than 5% of the outstanding Common Stock. Except as otherwise indicated, to the knowledge of the Company, each person or entity whose name appears below has sole voting and investment power over its respective shares of Common Stock.

Name and Address of

Beneficial Owner

| | Amount and Nature of

Beneficial Ownership

| | Percentage of Class

| |

|---|

Slough Estates USA Inc.(1)

444 N. Michigan Avenue, Suite 3230

Chicago, Illinois 60611 | | 24,238,844 | (2) | 56.3 | % |

Wellington Management Company, LLP(3)

75 State Street

Boston, Massachusetts 02109 |

|

5,640,462 |

|

13.6 |

% |

Columbia Wanger Asset Management, L.P.(4)

227 West Monroe Street, Suite 3000

Chicago, Illinois 60606 |

|

2,611,712 |

|

6.3 |

% |

- (1)

- Slough Estates USA Inc. ("Slough"), a Delaware corporation, is a wholly owned U.S. subsidiary of Slough Trading Estate Limited ("STEL"), which is a wholly owned subsidiary of Slough Estates plc ("SEL"). The board of directors of SEL ultimately exercises voting and dispositive power with regard to the shares of the Company's Common Stock. SEL is a publicly held limited liability company. The principal office of both SEL and STEL is located at 234 Bath Road, Slough SL1 4EE, England.

- (2)

- Includes 216,571 shares held as collateral for a loan due from the estate of a former director of the Company and 1,700,000 shares covered by warrants, of which 500,000 shares are covered by warrants expiring on December 22, 2005 and exercisable at $3.00 per share and 1,200,000 shares are covered by warrants which expire December 23, 2009 and are exercisable at $2.00 per share.

- (3)

- This information is based on Schedule 13G filed with the United States Securities and Exchange Commission on February 14, 2005 by Wellington Management Company, LLP ("WMC"), parent company of Wellington Trust Company, NA ("WTC"). WTC is a bank as defined in Section 3(a)(6) of the Securities Exchange Act of 1934. WMC is an Investment Adviser registered under Section 203 of the Investment Advisers Act of 1940. WMC, in its capacity as investment adviser, has shared voting power for 5,640,462 shares and shared dispositive power for 5,739,462 shares. It may be deemed to beneficially own 5,739,462 shares which are held on record by clients of WMC.

- (4)

- This information is based on Schedule 13G/A filed with the United States Securities and Exchange Commission on February 11, 2004 by Columbia Wanger Asset Management, L.P. ("WAM"), WAM Acquisition GP, Inc., the general partner of WAM ("WAM GP") and Columbia Acorn Trust ("Columbia"). WAM is an Investment Adviser registered under Section 203 of the Investment Advisers Act of 1940; WAM GP is the General Partner of the Investment Adviser and Columbia is an Investment Company registered under Section 8 of the Investment Company Act. All shares are included in the shares beneficially owned by WAM and WAM GP with shared voting and dispositive power. Columbia claims beneficial ownership as to shared voting and dispositive power over 2,265,000 shares.

2

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

At December 31, 2004, the Company owed Slough and STEL, our majority shareholder, $17.0 million as set forth in the following table:

Lender

| | Borrower

| | Loan

Initiated

| | USD

Current

Balance

| | Due

Date

| | Annual

Rate

| | Purpose

|

|---|

| STEL | | Company | | MAR

2003 | | $ | 13.0 Million | | APR

2012 | | 13.0 | % | General corporate |

Slough |

|

Company |

|

JUL

2002 |

|

$ |

4.0 Million |

|

APR

2006 |

|

5.8 |

% |

General corporate |

Slough Estates plc, STEL's parent, guaranteed to June 9, 2009 recourse borrowings on the Company's Australian credit facility of $150.0 million AUD that closed in June 2004. As consideration for the guarantee, the Company pays 1% per annum on the daily outstanding balance of the debt guaranteed. During 2004, the Company paid guarantee fees of $425,000.

On August 15, 2003, TOGA borrowed $29.7 million ($45 million AUD) from STEL for the sole purpose of paying off the $22 million long-term debt owed TCW Asset Management Company ("TCW") and to substantially fund the $7.7 million repurchase of the 6% overriding royalty held by TCW on the Company's Comet Ridge properties. As a result of retiring the TCW debt, TOGA's intercompany debt with the Company was reduced by approximately $22 million. In addition, TOGA borrowed $55.0 million AUD under a credit facility agreement with STEL to fund its operations in Australia. These loans bore interest at 13% per annum. In connection with these loans, the Company paid arrangement fees of $250,000 USD and $100,000 AUD (approximately $75,000 USD), respectively to STEL. These loans were paid in full June 18, 2004 with funds from an Australian bank senior credit facility.

In March 2003, the Company entered into a credit facility agreement with STEL allowing the Company to borrow on an unsecured basis up to $8.5 million USD for the Company's U.S. operations. On September 3, 2004, the borrowing limit of this facility was amended to $13 million USD. The Company may repay the loan in whole or in part without prepayment penalties. STEL may demand repayment prior to the maturity date of April 2, 2012 provided that STEL gives 18-month notice. The Company is limited in taking on any additional third party indebtedness, either secured or unsecured, or conferring a priority payment in respect of any obligation without first obtaining written approval from STEL so long as the STEL indebtedness exists. In connection with this credit facility, the Company paid STEL arrangement fees of $40,000 USD. The U.S. dollar value of the outstanding balance of this facility as of December 31, 2004 was $13 million.

In 2002, the Company borrowed $4 million from Slough which is evidenced by a note payable that bears interest at LIBOR plus 3.5% (5.806% as of December 31, 2004) and is payable in full on April 30, 2006.

During 2004, the Company paid Slough and STEL interest on the above loans of approximately $198,000 and $5.5 million, respectively.

3

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth information as of March 9, 2005, regarding shares of the Company's Common Stock beneficially owned by each nominee for director, each executive officer named in the table "Executive Compensation" below and by all executive officers and directors as a group. Except as otherwise indicated, to the knowledge of the Company, each person has sole voting and investment power over his or her respective shares of Common Stock. Options or warrants exercisable within 60 days of March 9, 2005 are included within the total beneficial ownership.

Title of Class

| | Name of

Beneficial Owner

| | Address of

Beneficial Owner

| | Total

Beneficial

Ownership

| | Options or

Warrants

Exercisable

Within

60 Days of

March 9, 2005

| | Percentage

of Class(1)

| |

|---|

| Common Stock—$.02 par value | | David L. Bradshaw | | 633 17th Street, Suite 1550

Denver, CO 80202 | | 541,695 | | 503,567 | | 1.3 | % |

| | | Kenneth L. Ancell | | 952 Echo Lane, Suite 375

Houston, TX 77024 | | 280,825 | | 271,667 | | * | |

| | | Eugene I. Davis | | Five Canoe Brook Drive

Livingston, NJ 07039 | | 65,000 | | 65,000 | | * | |

| | | Douglas Kramer | | 33 West Monroe

Chicago, IL 60603 | | 40,000 | | — | | * | |

| | | Marshall D. Lees | | 444 North Michigan Avenue,

Suite 3230,

Chicago, IL 60611 | | 25,000 | | 25,000 | | * | |

| | | Charles T. Maxwell | | 145 Mason Street

Greenwich, CT 06830 | | 110,000 | | 50,000 | | * | |

| | | D. Leroy Sample | | 20383 Wildcat Run Drive

Estero, FL 33928 | | 61,178 | | 50,000 | | * | |

| | | Jeff T. Obourn | | 633 17th Street, Suite 1550

Denver, CO 80202 | | 275,334 | | 178,334 | | * | |

| | | Joseph B. Feiten | | 633 17th Street, Suite 1550

Denver, CO 80202 | | 12,500 | | 12,500 | | * | |

| | | Executive officers and directors as a group, 9 in number | | | | 1,411,532 | | | | 3.3 | % |

- (1)

- Securities not outstanding but included in the beneficial ownership of each such person are deemed to be outstanding for the purpose of computing the percentage of outstanding securities owned by such person, but are not deemed to be outstanding for the purpose of computing the percentage of the class owned by any other person. An * designates less than 1%.

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

Based solely upon a review of Forms 3 and 4 and amendments thereto furnished to us under Rule 16a-3(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") during the fiscal year ended December 31, 2004 and Forms 5 and amendments thereto furnished to us with respect to the fiscal year ended December 31, 2004, as well as any representation from a reporting person that no Form 5 is required, the Company is not aware of any person that failed to file on a timely basis, as disclosed in the aforementioned Forms, reports required by Section 16(a) of the Exchange Act during the fiscal year ended December 31, 2004.

4

COMMITTEES OF THE BOARD OF DIRECTORS

To assist it in carrying out its duties, the Board has delegated certain authority to three committees whose functions are described below:

Audit Committee

Members at December 31, 2003 and 2004: Directors Davis (Chair), Maxwell and Sample

Number of Meetings in 2004: Six

Functions:

- •

- Assists the Board in fulfilling its oversight responsibilities as they relate to the Company's accounting policies, internal controls, financial reporting practices and legal and regulatory compliance;

- •

- Hires the independent auditors;

- •

- Monitors the independence and performance of the Company's independent auditors and internal auditors;

- •

- Maintains, through regularly scheduled meetings, a line of communication between the Board and the Company's financial management, internal auditors and independent auditors; and

- •

- Oversees compliance with the Company's policies for conducting business, including ethical business standards.

The Board of Directors adopted an Audit Committee Charter on June 13, 2000 and subsequently amended and restated the Charter on March 19, 2004. The amended and restated Audit Committee Charter may be obtained by writing the Secretary of the Company at our address set forth above.

Compensation Committee

Members at December 31, 2003 and 2004: Directors Davis, Kramer (Chair) and Lees

Number of Meetings in 2004: One

Functions:

- •

- Assisting the Board in overseeing the management of the Company's human resources including:

- •

- compensation and benefits programs

- •

- CEO performance and compensation; and

- •

- executive development and succession and diversity efforts

- •

- Oversees the evaluation of management; and

- •

- Prepares the report of the Committee on executive compensation.

Nominating Committee

Members at December 31, 2003 and 2004: Directors Bradshaw (Chair) and Lees

Number of Meetings in 2004: One

Functions:

- •

- Identifies individuals qualified to become board members, consistent with the criteria approved by the Board;

- •

- Recommends director nominees and individuals to fill vacant positions;

5

- •

- Assists the Board in interpreting the Company's Board Governance Guidelines, the Board's Principles of Conduct and any other similar governance documents adopted by the Board;

- •

- Oversees the evaluation of the Board and its committees; and

- •

- Generally oversees the governance of the Board.

Under American Stock Exchange rules, the Company is considered to be a "controlled" company due to Slough's majority ownership of the Company. Although the Company is not required to maintain a Nominating Committee due to its "controlled" status, the Company has had a Nominating Committee since 1992. Mr. Bradshaw is employed by the Company as its President and Chief Executive Officer. Mr. Lees is not employed by the Company; however, he is an employee of Slough.

This Committee will consider a candidate for director proposed by a stockholder. A candidate must be highly qualified in terms of business experience and be both willing and expressly interested in serving on the Board. A stockholder wishing to propose a candidate for the Committee's consideration should forward the candidate's name and information about the candidate's qualifications to Tipperary Corporation, Nominating Committee, 633 Seventeenth Street, Suite 1550, Denver, Colorado 80202, Attn.: David L. Bradshaw, Chairman.

AUDIT COMMITTEE REPORT

The Audit Committee consists of three directors, each of whom meet the independence requirements of the American Stock Exchange ("AMEX"). The members of the committee are Eugene I. Davis, who serves as Chairman, Charles T. Maxwell and D. Leroy Sample. Mr. Sample has been determined by the Company's Board of Directors to be a financial expert pursuant to the Securities Act of 1933 and AMEX rules. This committee assists the Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. The Board of Directors has approved a charter adopted by the Audit Committee. The Audit Committee met six times during 2004.

Management has the primary responsibility for the financial statements and the reporting process, including the Company's systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements for the year ended December 31, 2004 with management, including a discussion of the quality and the acceptability of the Company's financial reporting and controls.

The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, which includes, among other items, matters related to the audit of the Company's financial statements.

The Audit Committee has obtained from the independent auditors a formal written statement describing any relationships between the auditors and the Company that might bear on the auditors' independence as required by Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees," and satisfied itself as to the auditors' independence.

Based on the review and discussions referred to above, the Audit Committee has recommended to the Board of Directors that the Company's audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 2004 for filing with the Securities and Exchange Commission. The Audit Committee has also approved the reappointment of PricewaterhouseCoopers LLP as the Company's independent auditors.

Eugene I. Davis, Chairman

Charles T. Maxwell

D. Leroy Sample

6

DIRECTORS MEETINGS AND ATTENDANCE

During the fiscal year ended December 31, 2004, there were three meetings of the Company's Board of Directors. All directors attended at least 75% of the board meetings and committee meetings on which such directors served.

COMPENSATION OF DIRECTORS

Directors who are officers or employees of the Company are not compensated for serving as directors or for attending meetings. During the fiscal year ended December 31, 2004, the Company compensated its nonemployee, outside directors at the rate of $8,000 annually and $1,000 for each board meeting attended. Directors are not compensated for attendance at Board committee meetings.

EXECUTIVE COMPENSATION

The table below presents the compensation awarded to, earned by, or paid to the Company's President and Chief Executive Officer, its Executive Vice President—Corporate Development, its Senior Vice President and its Chief Financial Officer, for the calendar years ended December 31, 2004 and 2003 and 2002. No other executive officer of the Company received total annual salary and bonus for any year in excess of $100,000.

SUMMARY COMPENSATION TABLE

| |

| | Annual Compensation

| | Long-Term

Compensation

| |

|

|---|

| |

| |

| |

| |

| | Awards

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other

Annual

Compensation(1)

| | Securities

Underlying

Options &

Warrants

| | All Other

Compensation(2)

|

|---|

David L. Bradshaw,

President & Chief Executive Officer | | 2004

2003

2002 | | $

$

$ | 274,064

271,025

242,333 | | $

$

$ | 80,000

100,000

60,000 | | $

| 84,000

—

— | | —

40,000

— | | $

$

$ | 6,500

6,000

5,500 |

Kenneth L. Ancell

Executive Vice President—Corporate Development | | 2004

2003

2002 | | $

$

$ | 226,645

219,478

216,491 | | $

$

$ | 40,000

40,000

40,000 | | | —

—

— | | —

10,000

— | | $

$

$ | 1,434

1,224

1,887 |

Jeff T. Obourn

Sr. Vice President | | 2004

2003

2002 | | $

$

$ | 193,006

186,521

166,137 | | $

$

$ | 60,000

70,000

35,000 | | $

| 8,959

—

— | | —

20,000

— | | $

$

$ | 2,607

2,375

3,323 |

Joseph B. Feiten

Chief Financial Officer | | 2004

2003 | | $

$ | 138,606

132,309 | | $

$ | 20,000

20,000 | | $

| 13,875

— | | —

5,000 | | $

$ | 1,460

1,300 |

- (1)

- The amounts listed represent the gain on the exercise of options exercised during 2004. The Company furnished other various benefits, the value of which are not reported in this column because the Company has concluded that the aggregate amount of these benefits is less than 10% of cash compensation paid.

- (2)

- Represents the Company's matching contribution to its Section 401(k) Retirement Savings Plan.

There were no stock warrants or options granted to executive officers during the year ended December 31, 2004.

7

The following table sets forth information with respect to stock warrants and option exercises during the fiscal year ended December 31, 2004, by the named executive officers and the value of such officer's unexercised stock options and warrants at December 31, 2004:

| | Aggregated Warrants and Option Exercises In Last Fiscal Year

And Fiscal Year-End Warrants and Option Values

|

|---|

| |

| |

| | Number of Unexercised

Warrants and Options Held

at Fiscal Year End

| | Value of Unexercised

In-the-Money Warrants and

Options at Fiscal Year End

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| David L. Bradshaw | | 80,000 | | $ | 84,000 | | 490,233 | | 26,667 | | $ | 1,187,683 | | $ | 48,267 |

| Kenneth L. Ancell | | — | | | — | | 268,333 | | 6,667 | | $ | 585,283 | | $ | 12,067 |

| Jeff T. Obourn | | 35,000 | | $ | 78,958 | | 171,667 | | 13,333 | | $ | 664,367 | | $ | 24,133 |

| Joseph B. Feiten | | 7,500 | | $ | 13,875 | | 10,833 | | 11,867 | | $ | 19,517 | | $ | 21,033 |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The table below provides certain information as of December 31, 2004 with respect to compensation plans under which equity securities of the Company are authorized for issuance:

Plan category

| | Number of Securities

to Be Issued Upon

Exercise of

Outstanding Options,

Warrants and Rights

| | Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

| | Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

|

|---|

| Equity compensation plans approved by security holders | | 293,500 | | $ | 3.68 | | 284,000 |

| Equity compensation plans not approved by security holders | | 1,201,900 | | $ | 2.49 | | — |

| | |

| | | | |

|

| Total | | 1,495,400 | | $ | 2.70 | | 284,000 |

| | |

| | | | |

|

At December 31, 2004, the Company had 284,000 options outstanding under two plans.

The 1987 Employee Stock Option Plan (the "1987 Plan") provided for option grants for a maximum of 383,000 shares. The 1987 Plan expired December 31, 1996. The 121,000 options outstanding as of December 31, 2004 under this plan have terms of ten years from the dates of grant ending no later than October 2006, an exercise price equal to the fair market value of the stock on the date of grant and qualify as incentive stock options as defined in the Internal Revenue Code of 1986 ("the Code"). These options remain in full force and effect pursuant to each option's terms.

The 1997 Long-Term Incentive Plan (the "1997 Plan") was adopted to replace the expired 1987 Plan. The 1997 Plan was amended in January 2000, to increase the shares of common stock issuable from 250,000 to 500,000 for a period expiring in 2007. The 163,000 options outstanding as of December 31, 2004 under the plan have terms of ten years from the dates of grant and an exercise price equal to the fair market value of the stock on the date of grant. The 1997 Plan provides that participants may be granted awards in the form of incentive stock options, non-qualified options as defined in the Code, stock appreciation rights, performance awards related to the Company's operations, or restricted stock. At December 31, 2004, a total of 293,500 shares were available for future grant.

At December 31, 2004, the Company had 3,191,900 warrants outstanding with directors, employees and non-employees. From time to time, the Company has offered warrants to directors and employees as an incentive to provide long-term service to the Company. The terms of each warrant are negotiated. Less frequently, the Company has offered warrants to consultants as part of their compensation agreements.

8

PERFORMANCE GRAPH

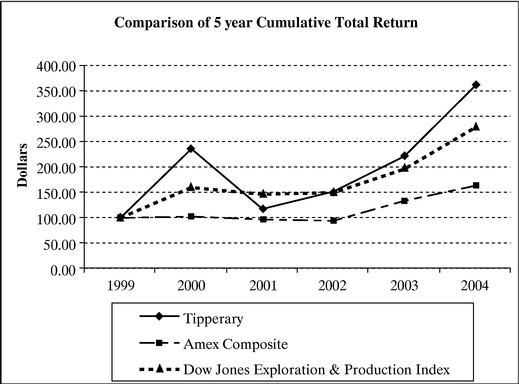

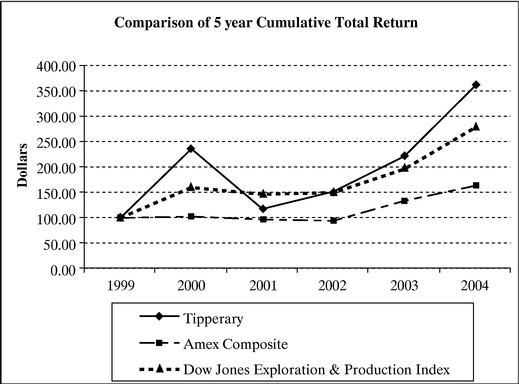

The following graph compares the annual percentage change in the Company's cumulative total shareholder return (stock price appreciation plus reinvested dividends) on Common Stock with the cumulative total return of the American Stock Exchange (AMEX) Composite Index and the Dow Jones Exploration & Production Index ("Peer Group Index") for the period from December 31, 1999 through December 31, 2004. The Peer Group Index includes 55 companies comparable with the Company. The graph assumes that the value of an investment in the Company's Common Stock and each index was $100 on December 31, 1999. Numerical comparisons are presented following the graph.

COMPARISON OF TOTAL RETURN

AMONG TIPPERARY CORPORATION,

PEER GROUP INDEX AND AMEX MARKET VALUE INDEX

ASSUMES $100 INVESTED ON DECEMBER 31, 1999

ASSUMES DIVIDENDS REINVESTED

YEAR ENDED DECEMBER 31, 2004

| | YEARS ENDED DECEMBER 31

|

|---|

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003

| | 2004

|

|---|

| Tipperary | | 100.00 | | 236.36 | | 117.82 | | 152.00 | | 221.82 | | 361.45 |

| Amex Market Composite Index | | 100.00 | | 102.38 | | 96.66 | | 94.01 | | 133.83 | | 163.35 |

| Dow Jones Exploration & Production Index | | 100.00 | | 159.71 | | 146.63 | | 149.81 | | 196.34 | | 278.55 |

COMPENSATION COMMITTEE REPORT

The Compensation Committee, which is composed of three nonemployee directors, makes recommendations to the Board concerning the compensation of the Company's executive officers. At the end of each year, the Committee evaluates the Company's performance relative to its business plan and its peer group performance. Additionally, each executive officer's contribution to the Company's achievements during the year is evaluated.

9

The goal of the Compensation Committee is to ensure that the Company employs qualified, experienced executive officers whose financial interest is aligned with that of the shareholders. The Committee considers general industry practice, tax effects and other factors in structuring executive compensation awards. The following is a discussion of forms of compensation currently being utilized.

Base salaries for each of the Company's executive officers are determined by taking into consideration performance, length of tenure with the Company, compensation by industry competitors for comparable positions and career achievements. Salaries paid within the industry are weighted more heavily in setting base salary levels. In order to determine comparable salary levels paid within the industry, the Committee reviews various industry surveys and publicly filed information of its competitors.

In addition to their base salaries, the Company's executive officers may be awarded an annual bonus, depending on Company performance relative to its business plan and the Committee's assessment of the executive officer's personal contribution to such performance. Such performance may be measured by several criteria that are considered important to the Company's success. These criteria are not specifically weighted in the determination of whether to award an annual bonus to an executive officer, since the relative importance of such criteria may change from year to year and the relative responsibilities of each executive officer in the achievement of each of the objectives may differ. Examples of criteria considered are: quantity of oil and gas reserves added; finding cost of oil and gas reserves; control of lifting costs; efficiency of general and administrative expenses, management of exploration projects; and overall financial management.

The Company also utilizes stock warrants and options ("options") as an incentive for executive officers. The size of option grants is dependent on individual performance, level of responsibility and base salary and the number of shares covered by all outstanding options in relation to the total number of outstanding shares of Common Stock and Common Stock equivalents. Options are used in order to align the benefits received by the executive officers with the amount of appreciation realized by the stockholders. Options granted to current officers and directors have been at exercise prices not less than the fair market value of the stock on the date of the grant.

David L. Bradshaw was elected Chief Executive Officer on January 16, 1996. Mr. Bradshaw is currently employed by the Company under a two-year employment agreement entered into September 18, 2001, providing for, among other things, minimum compensation at the rate of $210,000. The agreement will renew automatically for additional two-year periods unless terminated under the terms of the agreement. Mr. Bradshaw's salary for 2002, 2003 and 2004 was $220,000, $250,000 and $255,000, respectively. During 2002, 2003 and 2004 he received bonuses of $60,000, $100,000 and $80,000, respectively. The Compensation Committee reviewed industry salary surveys and determined that Mr. Bradshaw's total cash compensation was comparable to similar positions with industry competitors and reasonable in view of his performance. In evaluating his performance during the last three years and using the above criteria, the Committee considered the significant increase in total proved reserves, the growth of gas sales in Australia, and the accumulation of several domestic exploration prospects. The Committee believes that the combination of stock and cash compensation paid to the chief executive officer is designed to closely align his interests with those of the shareholders, and that his compensation is related directly to his performance as a person with considerable experience and ability in the oil and gas business.

Compensation Committee

as of March 1, 2005

Eugene I. Davis

Douglas Kramer, Chairman

Marshall D. Lees

10

EMPLOYMENT AGREEMENTS

On September 18, 2001, the Company entered into a two-year employment agreement with David L. Bradshaw for the position of Chairman, President and Chief Executive Officer, providing for, among other things, minimum compensation at the rate of $210,000 per year. In addition, Mr. Bradshaw may receive bonuses at times and in amounts to be determined by the Company's Compensation Committee based upon corporate and individual performance. The agreement will renew automatically for additional two-year periods unless terminated under the terms of the agreement. The employment agreement provides that in the event Mr. Bradshaw's employment is terminated by the Company without cause, other than as a result of death or disability, Mr. Bradshaw will be entitled to any unpaid compensation and bonus, if any, accrued through the date of termination, which shall be one year after notice is given, plus all compensation which accrues for one year following the termination date.

On October 17, 2002, the Company entered into a three-year employment agreement with Kenneth L. Ancell for the position of Executive Vice President—Corporate Development, providing for, among other things, minimum compensation at the rate of $195,000 per year. In addition, Mr. Ancell may receive a performance bonus equal to 20-25% of his basic compensation if he and the Company achieve such performance goals as may reasonably be set in the discretion of management of the Company. The employment agreement provides that in the event Mr. Ancell's employment is terminated by the Company without cause, other than as a result of death or disability, Mr. Ancell will be entitled to any unpaid compensation and bonus, if any, accrued through the date of termination, which requires 15 days notice, plus compensation which accrues for six months following the end of the employment term.

On January 17, 2002, the Company entered into a three-year employment agreement with Jeffrey T. Obourn for the position of Senior Vice President, providing for, among other things, minimum compensation at the rate of $150,000 per year. This agreement was extended for a period of one year on January 6, 2005. In addition, Mr. Obourn may receive bonuses at times and in amounts to be determined by the Company's Compensation Committee and upon approval of the Board of Directors based upon corporate and individual performance. The employment agreement provides that in the event Mr. Obourn's employment is terminated by the Company without cause, other than as a result of death or disability, Mr. Obourn will be entitled to any unpaid compensation and bonus, if any, accrued through the date of termination, which shall be one year after notice is given, plus compensation which accrues for one year following the termination date.

PROPOSAL I

ELECTION OF DIRECTORS

The Company's Bylaws authorize the Board of Directors to be comprised of not less than three nor more than 15 members. The Company's Board of Directors has presently determined that the Board shall be comprised of seven members, but reserves the right to increase the number of directors if the need arises. The seven nominees listed below have been recommended by the Nominating Committee and approved by the full Board of Directors. Upon election, they shall constitute at that date the Company's entire Board of Directors.

The Company has determined that three of the seven nominees listed below are "independent" as defined by the American Stock Exchange. Messrs. Bradshaw and Ancell are not independent since they are also employees of the Company. Messrs. Kramer and Lees are also officers and directors of our majority shareholder, Slough, or its related affiliates.

It is intended that the enclosed proxy will be voted FOR the election of the seven nominees named below to the Company's Board of Directors, unless authority to so vote is withheld on the proxy. In the event any nominee is unable to serve as a director for any reason not currently known or contemplated, the person named as Proxy will have discretionary authority in that instance to vote the proxy for any substitute

11

nominee that the Board of Directors may designate. Each nominee elected to serve as director will hold office until the next Annual Meeting or until his successor is elected and qualified.

The following sets forth information as of March 9, 2005, with respect to each nominee for director:

David L. Bradshaw, 50, has been a director of the Company since January 23, 1990, and became President and Chief Executive Officer of the Company on January 16, 1996. Mr. Bradshaw, a certified public accountant, began his employment with the Company in January 1986, and has held various positions with the Company, including Chief Financial Officer and Chief Operating Officer, prior to his current position. Prior to joining the Company, Mr. Bradshaw was an officer and owner in a privately held oil and gas company.

Kenneth L. Ancell, 62, was elected to the Board of Directors on July 11, 1996, and became Executive Vice President—Corporate Development of the Company in 1999. For 17 years before joining the Company as an employee, Mr. Ancell was a petroleum engineer and a principal in a Houston-based consulting engineering firm. Prior to forming this consulting firm, Mr. Ancell was employed as a petroleum engineer by various energy companies developing coalseam gas projects. He has served as a senior project advisor for the United Nations coalseam gas project in China, and was a Distinguished Lecturer on coalseam gas reserves for the Society of Petroleum Engineers. Mr. Ancell has expertise in oil and gas recovery processes and more than 25 years of coalseam gas experience.

Eugene I. Davis, 50, was elected to the Board of Directors on September 2, 1992, and had served as independent legal counsel to the Company from 1984 until 1992. In 1999, he became Chairman and Chief Executive Officer of PIRINATE Consulting Group, L.L.C., a privately held consulting firm specializing in crisis and turn-around management, merger and acquisition consulting, hostile and friendly takeovers, proxy contests and strategic planning advisory services for public and private business entities. Mr. Davis was Chairman, Chief Executive Officer and President of RBX Industries, Inc. from August 2001 to December 2003, after having been appointed Chief Restructuring Officer in January 2001. From January 2000 through August 2001, Mr. Davis was Chairman and Chief Executive Officer of Murdock Communications Corp., a NASDAQ listed company. From May 1999 through June 2001, he was the Chief Executive Officer of SmarTalk Teleservices, Inc., which had filed a petition under Chapter 11 of the Federal Bankruptcy Code in March 1999. He was Chief Operating Officer of TotalTel USA Communications, Inc. in 1998. Both SmarTalk Teleservices, Inc. and TotalTel USA Communications, Inc. were NASDAQ listed companies. He is a director of Metals USA, Inc., and Knology, Inc., which are public companies, and Eagle Geophysical, Inc. In addition, he is a member of the Board of Advisors of PPM America Special Investment Funds. In 2004, he became a board member of Exide Technologies and chairman of the board of Atlas Air Worldwide Holdings, both of which are public companies.

Douglas Kramer, 68, was elected to the Board of Directors on August 19, 1996. Mr. Kramer is Chairman and a Director of Draper and Kramer, Inc., a real estate management, mortgage banking and advisory company headquartered in Chicago. He is also a Director of Slough Estates plc, a London, England-based property company. He is also Chairman and a Director of Slough Estates USA Inc., a wholly-owned subsidiary of Slough Estates plc.

Marshall D. Lees, 51, was elected to the Board of Directors on September 30, 1995. In 1987 Mr. Lees joined Slough Estates plc, a London, England-based property company. He is the Chief Executive Officer of Slough Estates North America, which includes Slough Estates USA Inc., and Slough Estates Canada Limited. He became an Executive Director of Slough Estates plc in 1998. He is also a Director of Charterhouse Group International, Inc.

Charles T. Maxwell, 73, has been a director of the Company since May 2000. Mr. Maxwell is senior energy analyst with Weeden & Co. L.P., Greenwich, CT, serving institutional clients in the US and abroad. He is also a director of Chesapeake Energy Corporation (CHK-NYSE), a prominent independent gas producer in the US Mid-Continent area. Mr. Maxwell was formerly vice chairman and senior energy strategist at

12

Cyrus J. Lawrence, Inc., then a member firm of the New York Stock Exchange, where he worked for 29 years.

D. Leroy Sample, 63, was elected to the Board of Directors on November 30, 2000. Mr. Sample was a business assurance partner in the international accounting firm of PricewaterhouseCoopers LLP in Chicago for 24 years until he retired in July 1999. He began his career with the firm in 1963. Mr. Sample is a certified public accountant.

EXECUTIVE OFFICERS

In addition to information regarding Messrs. Bradshaw and Ancell set forth above, the following sets forth information with respect to the remainder of the Company's executive officers:

Jeff T. Obourn, 47, has been a Senior Vice President of the Company since January 16, 1996. He became employed as the Company's Vice President—Land on February 1, 1993. From 1987 to 1993, Mr. Obourn was President of Obourn Brothers, Inc., of Englewood, Colorado, an oil and gas land brokerage business.

Joseph B. Feiten, 52, a certified public accountant, has been the Company's Chief Financial Officer since June 10, 2002. In April 2002, Mr. Feiten returned to consulting to the oil and gas industry after having resigned from PricewaterhouseCoopers in June 2000 to become president of a privately-held company serving pediatricians and children's hospitals. After the merger of Price Waterhouse with Coopers in 1998, Mr. Feiten was the global director of training for the firm's Global Energy & Mining industry program. From 1991 to 1998, he was the director of Coopers & Lybrand's US oil and gas industry program.

There are no family relationships between or among the executive officers and nominees to the Board of Directors of the Company. There are no arrangements or understandings between any of the directors or nominees or any other person pursuant to which any person was or is to be elected as a director or nominee.

CODE OF BUSINESS CONDUCT AND ETHICS

The Company has adopted a Code of Business Conduct and Ethics which is applicable to its directors and employees. A copy may be obtained by writing to our corporate secretary at Tipperary Corporation, 633 17th Street, Suite 1550, Denver, Colorado 80202, phone 303-293-9379.

PROPOSAL 2

APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors, subject to ratification by the shareholders at the Annual Meeting, has reappointed PricewaterhouseCoopers LLP as the Company's independent auditor for 2005. PricewaterhouseCoopers has been the Company's independent accounting firm since 1998. Price Waterhouse LLP served as the Company's independent auditor from 1971 through 1997. The Company has been advised that neither PricewaterhouseCoopers nor any member thereof has any direct financial interest or any material indirect interest in the Company.

13

PRINCIPAL ACCOUNTANT FEES

During 2004 and 2003, the Company paid the following fees to PricewaterhouseCoopers LLP:

| | 2004

| | 2003

|

|---|

| Audit Fees | | $ | 97,000 | | $ | 101,000 |

| Audit Related Fees | | | 21,000 | | | 5,000 |

| Tax fees | | | — | | | 24,000 |

| All other fees(1) | | | 4,000 | | | 27,000 |

| | |

| |

|

| Total | | $ | 122,000 | | $ | 157,000 |

| | |

| |

|

- (1)

- Services relating to litigation, acquisitions and oil and gas operations.

To help assure independence of the independent auditors, the Audit Committee has established a policy whereby all audit, review, attest and non-audit engagements of the principal auditor or other firms must be approved in advance by the Audit Committee; provided, however, thatde minimis non-audit services may instead be approved in accordance with applicable Securities and Exchange Commission rules. This policy is set forth in an Audit Committee charter. One hundred percent of the fees shown in the principal accountant fees schedule for 2004 were approved by the Audit Committee.

SHAREHOLDERS ARE REQUESTED TO VOTE FOR THE RATIFICATION OF THE REAPPOINTMENT OF PRICEWATERHOUSECOOPERS AS THE COMPANY'S INDEPENDENT AUDITORS FOR 2005.

Representatives of PricewaterhouseCoopers are expected to be present at the Annual Meeting and will be afforded an opportunity to make a statement, if they desire to do so. It is expected that such representatives will be available to respond to appropriate shareholder questions.

PROPOSAL 3

TO AMEND THE ARTICLES OF INCORPORATION TO INCREASE

THE COMPANY'S AUTHORIZED COMMON SHARES

To provide for future capital needs of the Company, the Board of Directors on January 11, 2005, unanimously adopted a resolution, subject to shareholder approval, to amend Article Four of the Company's Articles of Incorporation to provide additional authorized shares of Class A Common Stock (a copy of Article Four, as it is proposed to be amended, is attached to this Proxy Statement as Exhibit A). The proposal provides for an increase in the authorized capital stock as follows:

Title

| | Shares Currently

Authorized

| | Proposed to be

Authorized

|

|---|

| Common Stock, $.02 par value | | 50,000,000 | | 100,000,000 |

Cumulative Preferred Stock, $1.00 par value |

|

10,000,000 |

|

No change |

Non-cumulative Preferred Stock, $1.00 par value |

|

10,000,000 |

|

No change |

Of the 50,000,000 shares currently authorized, 41,365,594 have been issued and approximately 3,473,900 shares are reserved for issuance under options and warrants previously granted, leaving approximately 5,160,506 shares currently available for issuance. There are not a significant amount of shares of Common Stock authorized for issuance. There is no pending or planned transaction which would require the issuance of any of the newly authorized Common Stock. The additional stock, if authorized, will be used from time to time on terms and conditions as then determined by the Board of Directors of the Company in accordance with applicable Texas law. While the Board of Directors has no plans to issue proposed additional authorized stock other than as discussed above, it believes the Company should have the ability

14

to do so if and when the Board determines that such issuance would be in the best interest of its shareholders. The Board believes that by enabling the Company to issue additional stock, the Company will be in a better position to take advantage of future expansion or capital funding opportunities.

Provisions in Article Four concerning the Preferred Stock are not proposed to be amended.

In accordance with the Articles of Incorporation, no holder of shares of Common Stock shall be entitled, as such, to any preemptive right or preferential right to subscribe to any unissued stock or any other securities which the Company may now or hereafter be authorized to issue.

The proposal is not part of a plan by the Company's management to adopt a series of anti-takeover amendments over a period of time, nor does management presently intend to propose other anti-takeover measures in future proxy solicitations. The proposal is not the result of management's knowledge of any specific effort to accumulate securities of the company or to obtain control of the Company be means of a merger, tender offer, solicitation and opposition to management or otherwise. The measure is being proposed for the reasons set forth above.

At present the Company's Articles of Incorporation and Bylaws do not contain other provisions having anti-takeover effect.

As indicated, there is no specific transaction pending or planned for the issuance of the additional Common Stock proposed to be authorized. It is contemplated that such stock, when issued, may be used to acquire additional capital and to fund the future growth of the Company.

If approved by two-thirds of the issued and outstanding shares of Common Stock, the proposed amendment will become effective upon filing of an Amendment to the Company's Articles of Incorporation with the Texas Secretary of State.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF THE PROPOSAL TO AMEND THE ARTICLES OF INCORPORATION TO INCREASE THE COMPANY'S AUTHORIZED SHARES.

PROPOSAL 4

WARRANTS

Approval of Warrants to be Granted to Certain Officers and Directors of Tipperary Corporation

Stockholders of the Company are being asked to approve the issuance of warrants to purchase Common Stock in the following amounts to officers and directors of the Company:

| |

| | Total Shares Subject to Exercise

|

|---|

| a. | | Kenneth L. Ancell—Officer and Director | | 50,000 |

| b. | | David L. Bradshaw—Officer and Director | | 200,000 |

| c. | | Jeff T. Obourn—Officer | | 25,000 |

| d. | | Eugene I. Davis—Director | | 25,000 |

| e. | | Douglas Kramer—Director | | 25,000 |

| f. | | Marshall D. Lees—Director | | 25,000 |

| g. | | Charles T. Maxwell—Director | | 25,000 |

| h. | | D. Leroy Sample—Director | | 25,000 |

Purpose

The purpose of the warrants is to reward and retain the Company's officers and directors, as well as properly motivate such persons to put forth their best efforts on behalf of the Company and its stockholders. The Board believes that the grant of the above warrants achieves those goals.

15

Attached as Exhibit B is the standard form of warrant proposed to be issued to each of the above persons.

The vesting of the warrants to be granted will follow a vesting schedule over three years and will expire, if not exercised prior thereto, two years after the resignation or removal of the respective officer from the employ of the Company or a director terminates service. If the recipient should resign or be removed as an employee from the Company, then the warrant will be vested only to the extent vested on such date of resignation or removal according to the vesting schedule. The initial exercise price of the warrants is $4.95 per share, the closing price of our Common Stock on the American Stock Exchange (AMEX) on January 10, 2005.

The provisions as to adjustment of the initial exercise price and the number of shares of Common Stock to be issued include adjustments where the Company subdivides or combines its outstanding shares of Common Stock into a greater or lesser number of shares of Common Stock as well as adjustments if and whenever the Company shall issue or sell any shares of Common Stock for consideration per share of Common Stock that is less than the exercise price in effect immediately prior to the time of such issue or sale at less than the applicable market price under the terms of the warrants; provided, however, that no adjustment to the exercise price may be made by reason of:

- •

- the grant of warrants or the issuance of shares of Common Stock upon the exercise of any outstanding warrants;

- •

- the grant by the Company of options to purchase shares in connection with any purchase or option plan for the benefit of employees of the Company, or any affiliates or subsidiaries thereof; or

- •

- the issuance (whether directly or by assumption in a merger or otherwise) or sale (including any issuance or sale to holders of shares of Common Stock) of any securities convertible into or exchangeable for shares of Common Stock, or the grant of rights to subscribe for or to purchase, or of options for the purchase of shares of convertible securities, regardless of whether the right to convert or exchange such convertible securities or such rights or options are immediately exercisable.

No adjustment of the exercise price will be required to be made by the Company if the amount of any required adjustment is less than 5% of the exercise price. In such case any such adjustment will be carried forward and will be made at the time of and together with the next subsequent adjustment which, together with any adjustment carried forward, will amount to not less than 5% of the exercise price.

Federal Income Tax Consequences to the Recipients and the Company

The tax consequences of the warrants under current federal law are summarized in the following discussion which deals with the general tax principles applicable to the grant of the warrants, and is intended for general information only. For federal income tax purposes, the recipient of the warrants granted will not have taxable income upon the grant of the warrant, nor will the Company then be entitled to any deduction. Generally, upon exercise of warrants, the holder will realize ordinary income, and the Company will be entitled to a deduction, in an amount equal to the difference between the exercise price and the fair market value of the stock on the date of exercise. A holder's basis for the stock for the purpose of determining his gain or loss on his subsequent disposition of the shares generally will be the fair market value of the stock on the date of exercise of the warrant.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE GRANT OF THE ABOVE DESCRIBED WARRANTS.

16

FORM 10-K

Shareholders may obtain, without charge, the Company's Annual Report on Form 10-K for the year ended December 31, 2004, as filed with the Securities and Exchange Commission by writing to the Secretary of the Company at 633 Seventeenth Street, Suite 1550, Denver, Colorado 80202, or through a link on the Company's website at www.tipperarycorp.com.

SHAREHOLDER PROPOSALS

Under the rules of the SEC, if a shareholder wants us to include a proposal in our proxy statement and form of proxy for presentation at our 2006 Annual Meeting of Shareholders, the proposal must be received by us at our principal executive offices at 633 17thStreet, Suite 1550, Denver, Colorado 80202 by November 30, 2005. The proposal should be sent to the attention of Secretary of the Company. The SEC also sets forth procedures under which shareholders may make proposals outside of the process described above in order for a shareholder to nominate persons for election as Directors or to introduce an item of business at an Annual Meeting of Shareholders. These procedures require that shareholders must submit nominations or items of business in writing to the Secretary of the Company at our principal executive offices. We must receive the notice of your intention to introduce a nomination or to propose an item of business at our 2006 Annual Meeting no later than:

- •

- 60 days in advance of the 2006 Annual Meeting if it is being held within 30 days preceding the anniversary date (April 26, 2005) of this year's meeting; or

- •

- 90 days in advance of the meeting if it is being held on or after the anniversary date of this year's meeting.

For any other meeting, the nomination or item of business must be received by the tenth day following the date of public disclosure of the date of the meeting. These requirements are separate from and in addition to the SEC's requirements described in the first paragraph of this section relating to including a proposal in our proxy statements.

Our Annual Meeting of Shareholders is generally held on the last Tuesday of April. Assuming that our 2006 Annual Meeting is held on schedule, we must receive notice of your intention to introduce a nomination or other item of business at that meeting by February 25, 2006.

SHAREHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Because of the Company's small size, to date it has not developed formal processes by which shareholders may communicate directly with directors. Instead, the Company believes that its informal process by which any communication sent to the Board of Directors either generally or in care of a corporate officer, has served the shareholders' needs. In view of recently adopted SEC disclosure requirements related to this issue, the Board of Directors expects to review in the coming months whether more specific procedures are required. Until any other procedures are developed and posted on the Company's web site at www.tipperarycorp.com, any communication to the Board of Directors may be mailed to the Board, in care of the Secretary of the Company, at 633 Seventeenth Street, Suite 1550, Denver, Colorado 80202. Shareholders should clearly note on the mailing envelope that the letter is a "Shareholder-Board Communication." All such communications should identify the author as a shareholder and clearly state whether the intended recipients are all members of the board of directors or just certain specified individual directors. The Secretary of the Company will make copies of all such communications and circulate them to the appropriate director or directors.

17

DISCRETIONARY AUTHORITY

The Company's Board of Directors does not know of any other business to be presented at the Annual Meeting. If any other matter properly comes before the Annual Meeting, however, it is intended that the person named in the enclosed proxy will vote said proxy in accordance with his best judgment.

| | BY ORDER OF THE BOARD OF DIRECTORS |

|

Elaine R. Treece

Corporate Secretary |

Date: March 28, 2005

18

Exhibit A

(AS PROPOSED TO BE AMENDED)

ARTICLE FOUR

The total number of shares of all classes of stock which the Corporation shall have authority to issue is one hundred twenty million (120,000,000) shares, consisting of ten million (10,000,000) shares of Cumulative Preferred Stock of the par value of one dollar ($1.00) per share, ten million (10,000,000) shares of Non-cumulative Preferred Stock of the par value of one dollar ($1.00) per share, and one hundred million (100,000,000) shares of Common Stock of the par value of two cents ($.02) per share. The Cumulative Preferred Stock and Non-cumulative Preferred Stock are sometimes hereinafter referred to jointly as the "Preferred Stock" and shall be equal in rights and preferences and in all respects identical except as specifically set forth in the preferences, limitations and relative rights of the Preferred Stock. The preferences, limitations and relative rights of the Preferred Stock and Common Stock shall be as follows:

- (A)

- PREFERRED STOCK

(1) The shares of each class of Preferred Stock may be divided into and issued in series. Each such series shall be so designated as to distinguish the shares thereof from the shares of all other series and classes, and all shares of the Preferred Stock shall be identical, except as set forth in Section 3(a) and Section 4 hereof and as to the following relative rights and preferences, as to which there may be variations between different series:

- (a)

- The rate of dividend;

- (b)

- The price at, and the terms and conditions on which, shares may be redeemed;

- (c)

- The amount payable upon shares in the event of involuntary liquidation;

- (d)

- The amount payable upon shares in the event of voluntary liquidation;

- (e)

- Mandatory or optional sinking fund provisions, if any, for the redemption or purchase of shares;

- (f)

- The terms and conditions on which shares may be converted, if the shares of any series are issued with the privilege of conversion; and

- (g)

- Voting rights, including the number of votes per share, or any fraction thereof, the matters on which such shares can vote and the contingencies which make such voting rights effective.

(2) The Board of Directors of the Corporation is hereby authorized, from time to time, by resolution or resolutions providing for the issuance thereof, to divide the shares of Cumulative Preferred Stock and Non-cumulative Preferred Stock into and to establish series thereof, to designate each such series, to fix and determine the relative rights and preferences of the shares of any series so established, and to issue and sell any and all of the authorized and unissued shares of Preferred Stock as shares of any series thereof established by action of the Board of Directors pursuant hereto.

(3) Except as specifically noted, the following provisions shall apply to all shares of the Preferred Stock irrespective of class or series:

(a) To the extent that the resolution or resolutions creating any series of either class of Preferred Stock shall provide that any dividends shall be paid thereon, the holders of Preferred Stock of each such class and series shall be entitled to receive on the dates and for the periods hereafter specified by the Board of Directors, dividends in cash, payable when, if, and as declared by the Board of Directors out of any funds legally available therefore, at such rates as shall be determined by the Board of Directors for the respective series, from the date upon which such shares shall have been originally issued.

1

(i) With respect to Cumulative Preferred Stock, such dividends if any, shall be cumulative from the date of issue, and no dividend other than a dividend payable in Common Stock of the Corporation) or other distribution shall be paid or declared or made on, and no amounts shall be applied to the purchase or redemption of, Non-cumulative Preferred Stock, the Common Stock or any other class of stock ranking junior to the Cumulative Preferred Stock as to dividends or assets unless (i) full cumulative dividends for all past dividend periods shall have been paid or declared and set apart for payment, and full dividends for the then current dividend period shall have been or simultaneously therewith shall be paid or declared and set apart for payment on outstanding Cumulative Preferred Stock of all series entitled to receive dividends at the rates determined for the respective series; and (ii) after giving effect to such payment of dividends, other distribution, purchase, or payment of dividends, other distribution, purchase, or redemption, the aggregate capital of the Corporation applicable to all capital stock of the Corporation then outstanding, plus the consolidated earned and capital surplus of the Corporation, shall exceed the aggregate amount payable on involuntary dissolution, liquidation or winding up of the Corporation on all shares of the Preferred Stock and all stock ranking prior to or on a parity with the Preferred Stock as to dividends or assets outstanding after the payment of such dividends, other distribution, purchase, or redemption. Accumulations of dividends shall not bear interest. Dividends shall not be paid or declared and set apart for payment on the Cumulative Preferred Stock of any one series for any dividend period unless dividends have been or are contemporaneously paid or declared and set apart for payment on the Cumulative Preferred Stock of all series entitled thereto for all dividend periods terminating on the same or earlier date.

(ii) With respect to Non-cumulative Preferred Stock, no dividend (other than a dividend payable in Common Stock of the Corporation) or other distribution shall be paid or declared or made on, and no amounts shall be applied to the purchase or redemption of the Common Stock or any other class of stock ranking junior to the Non-cumulative Preferred Stock as to dividends or assets unless (i) full cumulative dividends for all past dividend periods shall have been paid or declared and set apart for payment, and full dividends for the then current dividend period shall have been or simultaneously therewith shall be paid or declared and set apart for payment, on outstanding Cumulative Preferred Stock of all series entitled to receive dividends at the rates determined for the respective series (ii) full dividends for the then current dividend period shall have been or simultaneously therewith shall be paid or declared and set apart for payment, on outstanding Noncumulative Preferred Stock of all series entitled to receive dividends at the rates determined for the respective series; and (iii) after giving effect to such payment of dividends, other distribution, purchase, or redemption, the aggregate capital of the Corporation applicable to all capital stock of the Corporation then outstanding, plus the consolidated earned and capital surplus of the Corporation, shall exceed the aggregate amount payable on involuntary dissolution, liquidation or winding up of the Corporation on all shares of the Preferred Stock and all stock ranking prior to or on a parity with the Preferred Stock as to dividends or assets outstanding after the payment of such dividends, other distribution, purchase, or redemption. Dividends shall not be paid or declared and set apart for payment on the Non-cumulative Preferred Stock of any one series for any dividend period unless dividends have been or are contemporaneously paid or declared and set apart for the payment on Non-cumulative Preferred Stock of all series entitled thereto for all dividend periods terminating on the same or earlier date.

(b) In the event of any dissolution, liquidation or winding up of the Corporation, whether voluntarily, or involuntarily, the holders of Preferred Stock of each class and series then outstanding, without any preference for the shares of any class or series of Preferred Stock over the shares of any other class or series of Preferred Stock, shall be entitled to receive in cash out of the assets of the Corporation, whether capital or surplus or otherwise, before any distribution of the assets shall be

2

made to the holders of Common Stock or of any other class of stock ranking junior to the Preferred Stock as to dividends or assets, the amount determined by the Board of Directors, pursuant to the authority granted in Paragraph (A)(2) of this Article, to be payable on the shares of such series in the event of voluntary or involuntary dissolution, liquidation or winding up, as the case may be, together, in all cases involving the Cumulative Preferred Stock with unpaid accumulated dividends, if any, whether such dividends are earned, declared or otherwise, to the date fixed on all shares of the Preferred Stock. In the event of such voluntary or involuntary dissolution, liquidation or winding up, as the case may be, then the assets available for payment shall be distributed ratably among the holders of the Preferred Stock of all classes and series in accordance with the amounts so determined to be payable on the shares of each series in the event of voluntary or involuntary dissolution, liquidation or winding up, as the case may be, in proportion to the full preferential amounts, together with any and all dividend arrearages to which they are respectively entitled. After payment to the holders of the Preferred Stock of the full preferential amounts hereinbefore provided for, the holders of Preferred Stock will have no other rights or claims to any of the remaining assets of the Corporation either upon distribution of such assets or upon dissolution, liquidation, or winding up. The sale of all or substantially all of the property of the Corporation to, or the merger, consolidation or reorganization of the Corporation into or with, any other corporation, or the purchase or redemption by the Corporation of the shares of its Preferred Stock or its Common Stock or any other class of its stock shall not be deemed to be a distribution of assets or a dissolution, liquidation or winding up for the purposes of this paragraph.

(c) So long as full cumulative dividends on all outstanding shares of Cumulative Preferred Stock for all dividend periods ending on or prior to the date fixed for redemption and full dividends on all outstanding shares of Non-cumulative Preferred Stock for the then current dividend period shall have been paid or declared and set apart for payment and subject to any applicable requirements of Texas law, the Corporation may (i) at the option of the Board of Directors of the Corporation, redeem the whole or any part of the shares of any class or series of Preferred Stock determined by it to be redeemable pursuant to the authority granted in Paragraph (A) (2) of this Article, and without redeeming the shares of any other class or series thereof; or (ii) redeem the whole or any part of any class or series of Preferred Stock to meet any sinking fund requirement determined pursuant to the authority granted in Paragraph (A) (2) of this Article, and without redeeming the shares of any other class or series thereof, in each case on the terms and conditions and at the redemption price so determined for such series, plus the amount of unpaid accumulated dividends, if any, to the date of such redemption. All such redemptions of Preferred Stock shall be effected in accordance with the procedure for redemptions set forth in the Texas Business Corporation Act in effect at the times of such redemptions.

On or before the date fixed for redemption, the Corporation may provide for payment of a sum sufficient to redeem the shares called for redemption either (1) by setting aside the sum, separate from its other funds, in trust for the benefit of the holders of the shares to be redeemed; or (2) by depositing such sum in a bank or trust company (either such a financial institution located in Texas having capital and surplus of at least ten million dollars ($10,000,000) according to its latest statement of condition, or in such other financial institution which is now or hereafter duly appointed and acting as transfer agent of the Corporation) as a trust fund, with irrevocable instructions and authority to the bank or trust company to give or complete the notice of redemption and to pay, on or after the date fixed for redemption, the redemption price on surrender of certificates evidencing the shares of Preferred Stock called for redemption. From and after the date fixed for redemption, (a) the share shall be deemed to be redeemed; (b) dividends thereon shall cease to accumulate; (c) such setting aside or deposit shall be deemed to constitute full payment for the shares; (d) the shares shall no longer be deemed to be outstanding; (e) the holders thereof shall cease to be shareholders with respect to such shares; and (f) the holders shall have no right with respect thereto, except the right to receive their proportionate shares of the funds set aside pursuant hereto or deposited upon surrender

3

of the respective certificates, and any right to convert such shares which may exist. Any interest accrued on funds set aside or deposited pursuant hereto shall belong to the Corporation. If the holders of shares do not, within six (6) years after such deposit, claim any amount so deposited for redemption thereof, the bank or trust company shall upon demand pay over to the Corporation the balance of the funds so deposited and the bank or trust company shall thereupon be relieved of all responsibility to such holders.

(d) So long as full cumulative dividends on all outstanding shares of Cumulative Preferred Stock for all dividend periods and full dividends on all shares of Non-cumulative Preferred Stock for the then current dividend period ending on or prior to the date of purchase shall have been paid or declared and set apart for payment and subject to any applicable requirements of Texas law, the Corporation may purchase, directly or indirectly, shares of Preferred Stock of any class or series to the extent of the aggregate of unrestricted capital surplus and unrestricted reduction surplus available therefore.

(e) Upon any issue for money or other consideration of any stock of the Corporation that may be authorized from time to time, or treasury stock, no holder of Preferred Stock shall have any preemptive or other right to subscribe for, purchase, or receive any proportionate or other share of the stock so issued, but rather the Board of Directors may dispose of all or any portion of such stock as and when it may determine, free of any such rights, whether by offering the same to shareholders or by sale to other disposition as said Board of Directors may deem advisable.

(4) Voting Powers