Searchable text section of graphics shown above

[LOGO]

Annual Meeting

April 26, 2005

The following information contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which can be identified by words such as “may,” “will,” “expect,” “anticipate,” “estimate,” “continue,” or comparable words. In addition, all statements other than statements of historical facts that address activities that Tipperary expects or anticipates will or may occur in the future are forward-looking statements. You are encouraged to read the SEC reports of Tipperary, particularly its Form 10-K for the Fiscal Year Ended December 31, 2004, for meaningful cautionary language disclosing why actual results may vary materially from those anticipated by management.

Overview

• AMEX listed company (TPY)

• Offices in Denver, Houston and Brisbane, Australia

• 62 employees; 13 in the U.S. and 49 in Australia

• Focused on Coalseam Gas and Conventional Natural Gas

• 41,355,994 shares outstanding

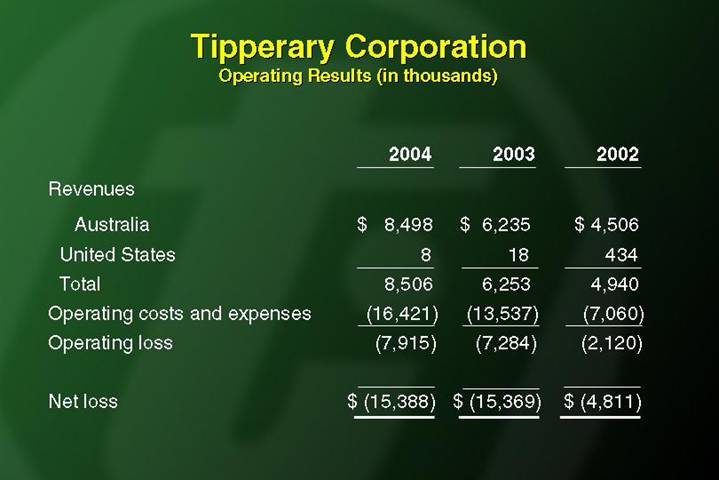

Tipperary Corporation

Operating Results (in thousands)

| | 2004 | | 2003 | | 2002 | |

Revenues | | | | | | | |

Australia | | $ | 8,498 | | $ | 6,235 | | $ | 4,506 | |

United States | | 8 | | 18 | | 434 | |

Total | | 8,506 | | 6,253 | | 4,940 | |

Operating costs and expenses | | (16,421 | ) | (13,537 | ) | (7,060 | ) |

Operating loss | | (7,915 | ) | (7,284 | ) | (2,120 | ) |

| | | | | | | |

Net loss | | $ | (15,388 | ) | $ | (15,369 | ) | $ | (4,811 | ) |

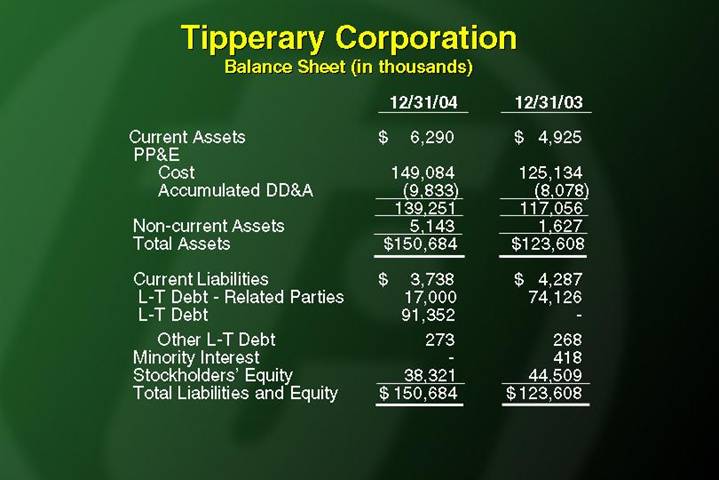

Tipperary Corporation

Balance Sheet (in thousands)

| | 12/31/04 | | 12/31/03 | |

Current Assets | | $ | 6,290 | | $ | 4,925 | |

PP&E | | | | | |

Cost | | 149,084 | | 125,134 | |

Accumulated DD&A | | (9,833 | ) | (8,078 | ) |

| | 139,251 | | 117,056 | |

Non-current Assets | | 5,143 | | 1,627 | |

Total Assets | | $ | 150,684 | | $ | 123,608 | |

| | | | | |

Current Liabilities | | $ | 3,738 | | $ | 4,287 | |

L-T Debt - Related Parties | | 17,000 | | 74,126 | |

L-T Debt | | 91,352 | | — | |

Other L-T Debt | | 273 | | 268 | |

Minority Interest | | — | | 418 | |

Stockholders’ Equity | | 38,321 | | 44,509 | |

Total Liabilities and Equity | | $ | 150,684 | | $ | 123,608 | |

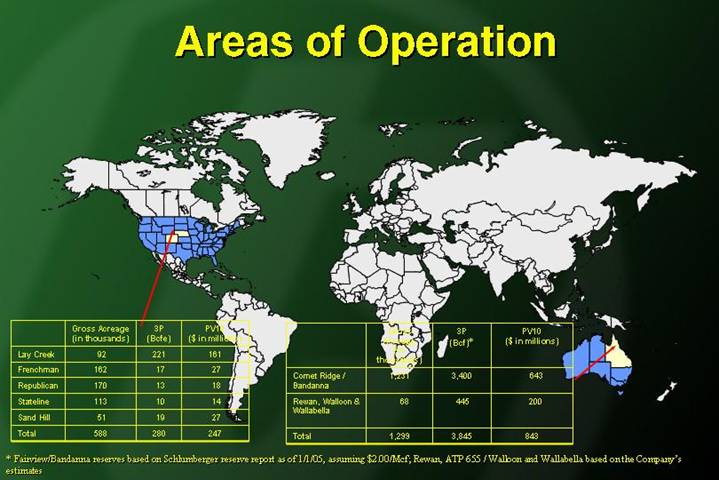

Areas of Operation

[GRAPHIC]

| | Gross Acreage | | 3P | | PV10 | |

| | (in thousands) | | (Bcfe) | | ($ in millions) | |

Lay Creek | | 92 | | 221 | | 161 | |

Frenchman | | 162 | | 17 | | 27 | |

Republican | | 170 | | 13 | | 18 | |

Stateline | | 113 | | 10 | | 14 | |

Sand Hill | | 51 | | 19 | | 27 | |

Total | | 588 | | 280 | | 247 | |

[GRAPHIC]

| | Gross Acreage | | 3P | | PV10 | |

| | (in thousands) | | (Bcf)* | | ($ in millions) | |

Comet Ridge / Bandanna | | 1,231 | | 3,400 | | 643 | |

Rewan, Walloon & Wallabella | | 68 | | 445 | | 200 | |

Total | | 1,299 | | 3,845 | | 843 | |

* Fairview/Bandanna reserves based on Schlumberger reserve report as of 1/1/05, assuming $2.00/Mcf; Rewan, ATP 655 / Walloon and Wallabella based on the Company’s estimates

Australia Summary

• Litigation resolution

• Reserve overview

• Maps of Comet Ridge Project

• Market demand

• Production and capacity

• 2005 plans

• Economics

Litigation Resolution

Tri-Star Petroleum Settlement finalized Dec. 17, 2004

• Tri-Star relinquished all claims to operatorship

• Tri-Star assigned to Tipperary substantially all of its rights in Comet Ridge, including its 2.25% working interest

• Tipperary paid Tri-Star $5 million, plus royalty equal to 1.5% of total project revenue

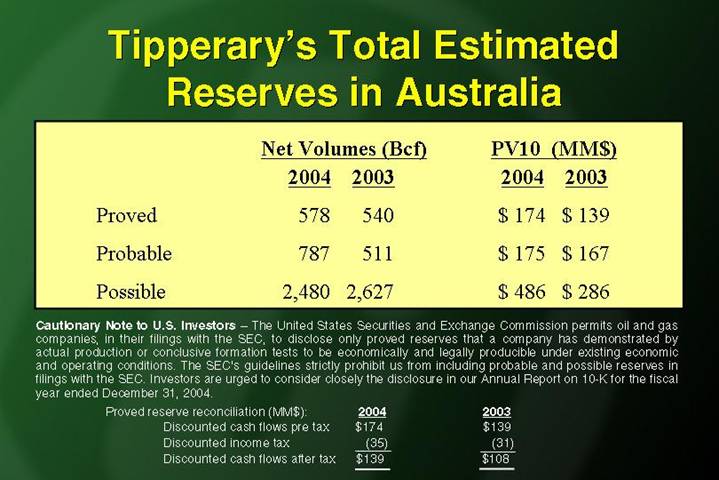

Tipperary’s Total Estimated

Reserves in Australia

| | Net Volumes (Bcf) | | PV10 (MM$) | |

| | 2004 | | 2003 | | 2004 | | 2003 | |

| | | | | | | | | |

Proved | | 578 | | 540 | | $ | 174 | | $ | 139 | |

| | | | | | | | | |

Probable | | 787 | | 511 | | $ | 175 | | $ | 167 | |

| | | | | | | | | |

Possible | | 2,480 | | 2,627 | | $ | 486 | | $ | 286 | |

Cautionary Note to U.S. Investors – The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. The SEC’s guidelines strictly prohibit us from including probable and possible reserves in filings with the SEC. Investors are urged to consider closely the disclosure in our Annual Report on 10-K for the fiscal year ended December 31, 2004.

| | 2004 | | 2003 | |

Proved reserve reconciliation (MM$): | | | | | |

Discounted cash flows pre tax | | $ | 174 | | $ | 139 | |

Discounted income tax | | (35 | ) | (31 | ) |

Discounted cash flows after tax | | $ | 139 | | $ | 108 | |

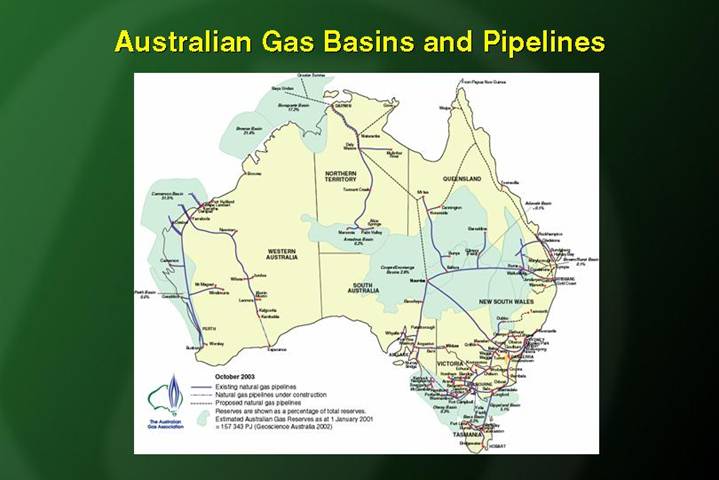

Australian Gas Basins and Pipelines

[GRAPHIC]

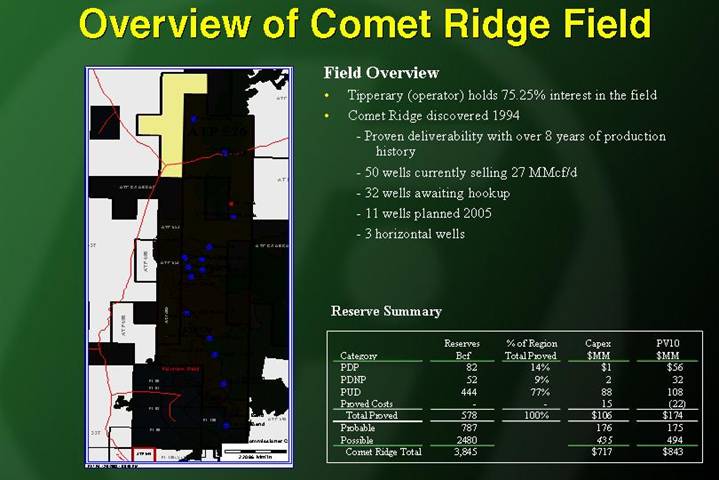

Overview of Comet Ridge Field

[GRAPHIC]

Field Overview

• Tipperary (operator) holds 75.25% interest in the field

• Comet Ridge discovered 1994

• Proven deliverability with over 8 years of production history

• 50 wells currently selling 27 MMcf/d

• 32 wells awaiting hookup

• 11 wells planned 2005

• 3 horizontal wells

Reserve Summary

| | Reserves | | % of Region | | Capex | | PV10 | |

Category | | Bcf | | Total Proved | | $MM | | $MM | |

PDP | | 82 | | 14 | % | $ | 1 | | $ | 56 | |

PDNP | | 52 | | 9 | % | 2 | | 32 | |

PUD | | 444 | | 77 | % | 88 | | 108 | |

Proved Costs | | — | | — | | 15 | | (22 | ) |

Total Proved | | 578 | | 100 | % | $ | 106 | | $ | 174 | |

Probable | | 787 | | | | 176 | | 175 | |

Possible | | 2480 | | | | 435 | | 494 | |

Comet Ridge Total | | 3,845 | | | | $ | 717 | | $ | 843 | |

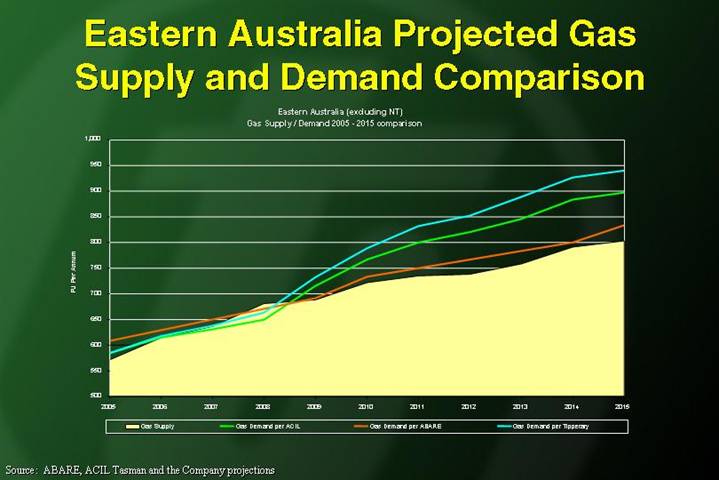

Eastern Australia Projected Gas

Supply and Demand Comparison

Eastern Australia (excluding NT)

Gas Supply / Demand 2005 - 2015 comparison

[CHART]

Source: ABARE, ACIL Tasman and the Company projections

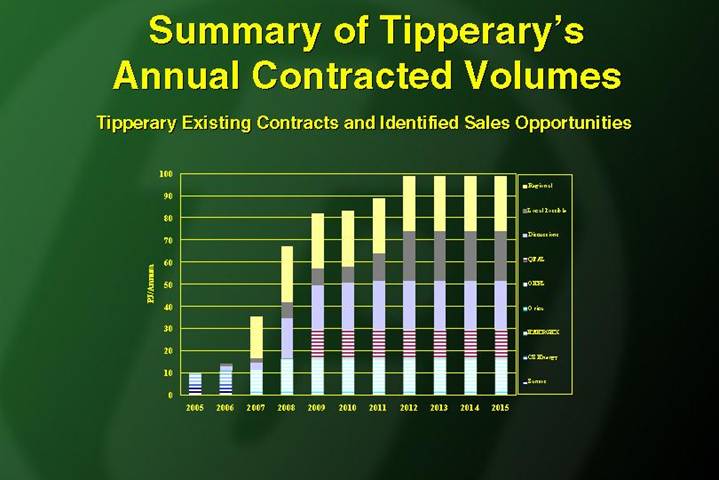

Gas Markets

• ENERGEX

• QFAL

• OERL

• Orica

• Santos

• CS Energy

• Other

Summary of Tipperary’s

Annual Contracted Volumes

Tipperary Existing Contracts and Identified Sales Opportunities

[CHART]

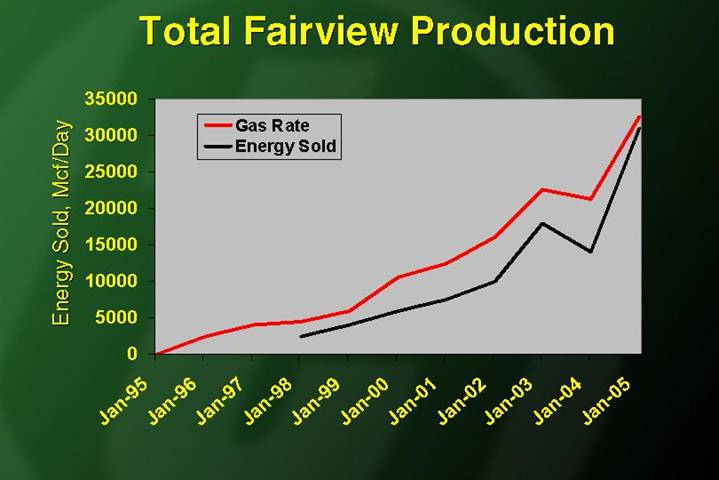

Total Fairview Production

Energy Sold, Mcf/Day

[CHART]

Highlights of Australia

2005 Development Plan

• Complete Southern Gathering System

• Drill Three Horizontal Wells

• Obtain New Seismic in Petroleum Leases

• Drill 11 Development Wells

• Set 3,600 hp Compression, 15MMcf/d Capacity

• Increase Sales Capacity to 45 MMcf/d

• Capital Budget U.S. $20 million

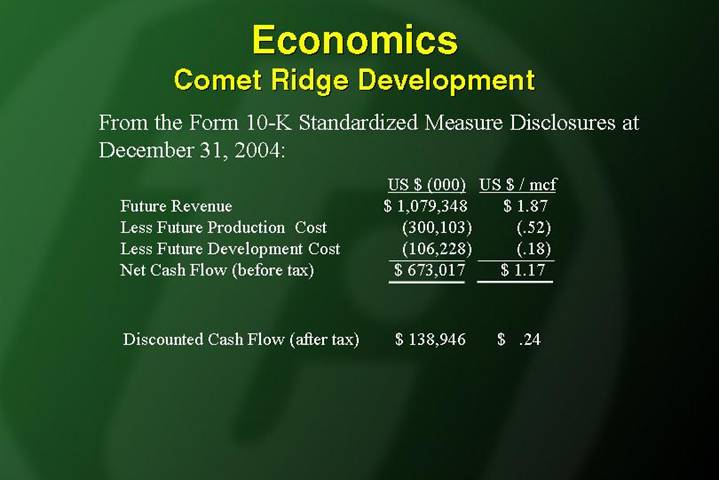

Economics

Comet Ridge Development

From the Form 10-K Standardized Measure Disclosures at December 31, 2004:

| | US $ (000) | | US $ / mcf | |

Future Revenue | | $ | 1,079,348 | | $ | 1.87 | |

Less Future Production Cost | | (300,103 | ) | (.52 | ) |

Less Future Development Cost | | (106,228 | ) | (.18 | ) |

Net Cash Flow (before tax) | | $ | 673,017 | | $ | 1.17 | |

| | | | | | | |

Discounted Cash Flow (after tax) | | $ | 138,946 | | $ | .24 | |

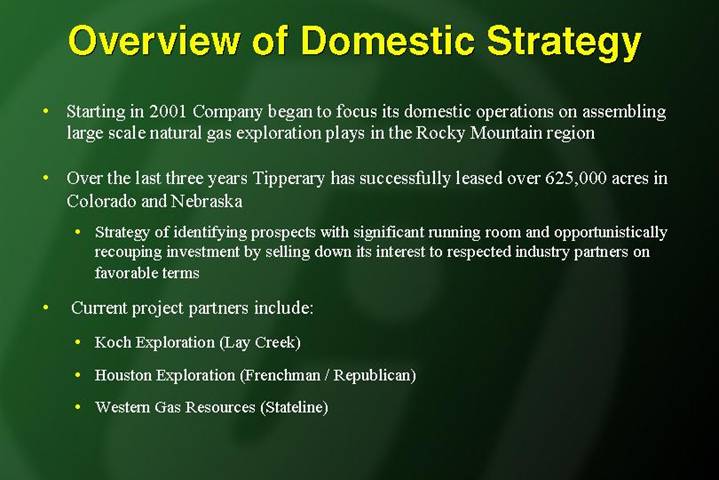

Overview of Domestic Strategy

• Starting in 2001 Company began to focus its domestic operations on assembling large scale natural gas exploration plays in the Rocky Mountain region

• Over the last three years Tipperary has successfully leased over 625,000 acres in Colorado and Nebraska

• Strategy of identifying prospects with significant running room and opportunistically recouping investment by selling down its interest to respected industry partners on favorable terms

• Current project partners include:

• Koch Exploration (Lay Creek)

• Houston Exploration (Frenchman / Republican)

• Western Gas Resources (Stateline)

Colorado & Western Nebraska Activity

[GRAPHIC]

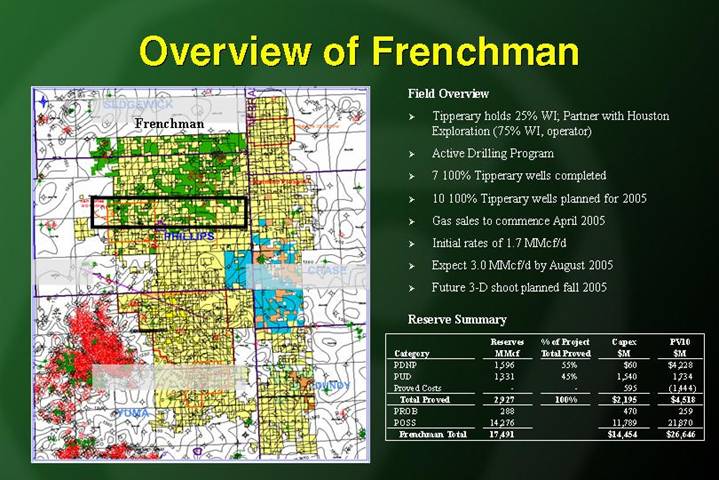

Overview of Frenchman

[GRAPHIC]

Field Overview

• Tipperary holds 25% WI; Partner with Houston Exploration (75% WI, operator)

• Active Drilling Program

• 7 100% Tipperary wells completed

• 10 100% Tipperary wells planned for 2005

• Gas sales to commence April 2005

• Initial rates of 1.7 MMcf/d

• Expect 3.0 MMcf/d by August 2005

• Future 3-D shoot planned fall 2005

Reserve Summary

| | Reserves | | % of Project | | Capex | | PV10 | |

Category | | MMcf | | Total Proved | | $M | | $M | |

PDNP | | 1,596 | | 55 | % | $ | 60 | | $ | 4,228 | |

PUD | | 1,331 | | 45 | % | 1,540 | | 1,734 | |

Proved Costs | | — | | — | | 595 | | (1,444 | ) |

Total Proved | | 2,927 | | 100 | % | $ | 2,195 | | $ | 4,518 | |

PROB | | 288 | | | | 470 | | 259 | |

POSS | | 14,276 | | | | 11,789 | | 21,870 | |

Frenchman Total | | 17,491 | | | | $ | 14,454 | | $ | 26,646 | |

Overview of Republican

[GRAPHIC]

Field Overview

• Tipperary holds 20% WI; Partner with Houston Exploration (80%, operator)

• Active Drilling Program

• 25 wells completed

• 22 additional wells planned with AFE approval

• Gathering System construction to be completed by 2Q’05

• Currently processing 155 square mile 3-D shoot

• 12 new locations already identified

• Expect first gas sales by June 2005 at 750 Mcf/d net to Tipperary

Reserve Summary

| | Reserves | | % of Project | | Capex | | PV10 | |

Category | | MMcf | | Total Proved | | $M | | $M | |

PDNP | | 303 | | 66 | % | $ | 10 | | $ | 569 | |

PUD | | 157 | | 34 | % | 135 | | 201 | |

Proved Costs | | — | | — | | 24 | | (3 | ) |

Total Proved | | 460 | | 100 | % | $ | 169 | | $ | 767 | |

PROB | | 239 | | | | 192 | | 311 | |

POSS | | 11,986 | | | | 10,176 | | 17,094 | |

Republican Total | | 12,685 | | | | $ | 10,537 | | $ | 18,172 | |

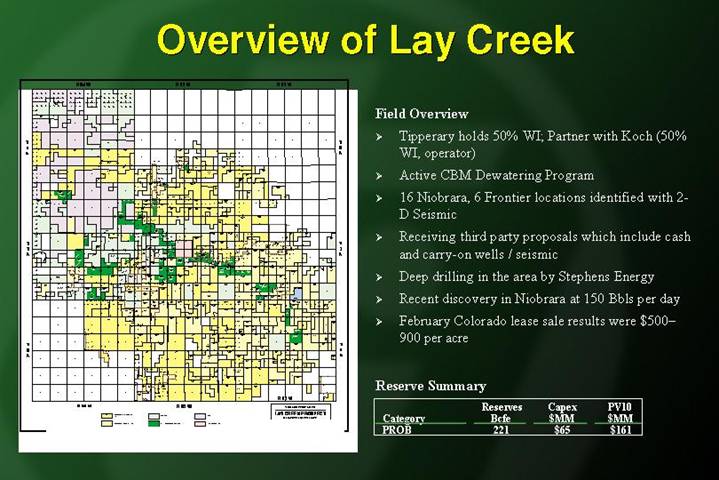

Overview of Lay Creek

[GRAPHIC]

Field Overview

• Tipperary holds 50% WI; Partner with Koch (50% WI, operator)

• Active CBM Dewatering Program

• 16 Niobrara, 6 Frontier locations identified with 2-D Seismic

• Receiving third party proposals which include cash and carry-on wells / seismic

• Deep drilling in the area by Stephens Energy

• Recent discovery in Niobrara at 150 Bbls per day

• February Colorado lease sale results were $500–900 per acre

Reserve Summary

| | Reserves | | Capex | | PV10 | |

Category | | Bcfe | | $MM | | $MM | |

PROB | | 221 | | $ | 65 | | $ | 161 | |

| | | | | | | | | |

Overview of Stateline

[GRAPHIC]

Field Overview

• Tipperary holds 25% WI; Partner with Western Gas (75% WI, operator)

• Offsets Active Drilling Program

• On trend with 17 new wells drilled by Western Gas

• Processing 27 square mile 3-D shoot

• Expect drilling in 2Q’05

Reserve Summary

| | Reserves | | Capex | | PV10 | |

Category | | Bcf | | $MM | | $MM | |

POSS | | 10 | | $ | 9 | | $ | 14 | |

| | | | | | | | | |

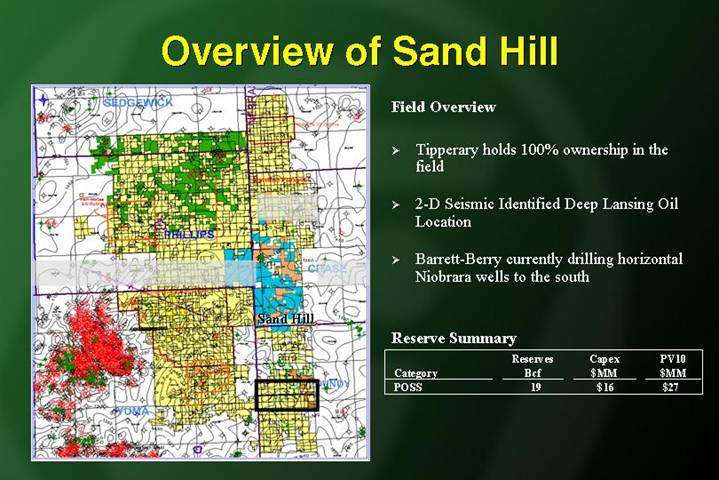

Overview of Sand Hill

[GRAPHIC]

Field Overview

• Tipperary holds 100% ownership in the field

• 2-D Seismic Identified Deep Lansing Oil Location

• Barrett-Berry currently drilling horizontal Niobrara wells to the south

Reserve Summary

| | Reserves | | Capex | | PV10 | |

Category | | Bcf | | $MM | | $MM | |

POSS | | 19 | | $ | 16 | | $ | 27 | |

| | | | | | | | | |

Tipperary’s Plans

• Increase Comet Ridge gas production and sign additional sales contracts

• Evaluate substantial U.S. acreage position with industry partners

• Create and increase proved gas reserves in Australia and the United States

Financing

• Slough Estates USA has initiated a process to sell all of its Tipperary holdings – represented by Petrie Parkman

• Tipperary’s independent directors engaged investment banker Houlihan Lokey Howard & Zukin to assist and advise the

non-Slough directors

• The process is underway