QuickLinks -- Click here to rapidly navigate through this document

Melvin J. Gordon, Chairman and Chief Executive Officer and Ellen R. Gordon, President and Chief Operating Officer.

Tootsie Roll Industries, Inc. has been engaged in the manufacture and sale of candy for 105 years. Our products are primarily sold under the familiar brand names, Tootsie Roll, Tootsie Roll Pops, Caramel Apple Pops, Child's Play, Charms, Blow Pop, Blue Razz, Cella's chocolate covered cherries, Mason Dots, Mason Crows, Junior Mints, Charleston Chew, Sugar Daddy, Sugar Babies, Andes and Fluffy Stuff cotton candy.

We believe that the differences among companies are attributable to the caliber of their people, and therefore we strive to attract and retain superior people for each job.

We believe that an open family atmosphere at work combined with professional management fosters cooperation and enables each individual to maximize his or her contribution to the company and realize the corresponding rewards.

We do not jeopardize long-term growth for immediate, short-term results.

We maintain a conservative financial posture in the deployment and management of our assets.

We run a trim operation and continually strive to eliminate waste, minimize cost and implement performance improvements.

We invest in the latest and most productive equipment to deliver the best quality product to our customers at the lowest cost.

We seek to outsource functions where appropriate and to vertically integrate operations where it is financially advantageous to do so.

We view our well known brands as prized assets to be aggressively advertised and promoted to each new generation of consumers.

![]()

1

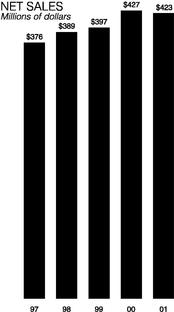

Sales in 2001 were $423 million, representing a decline of 1% from the record sales of $427 million attained in 2000. Our sales results were generally influenced by the slowdown in the domestic economy.

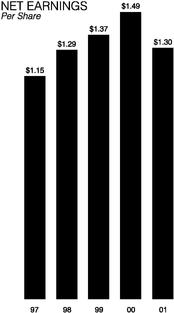

Net earnings for the year were $1.30 per share, or 13% below 2000 earnings per share of $1.49. 2001 earnings were adversely affected by lower sales, changes in product mix and generally higher operating costs. We also had charges of $0.04 per share related to an inventory adjustment and the closing of our smallest plant. Absent these nonrecurring items, earnings would have been $1.34 per share or 10% below 2000.

Financial Highlights

| | December 31, | |||

|---|---|---|---|---|

| | 2001 | 2000 | ||

| | (in thousands except per share data) | |||

Net Sales | $423,496 | $427,054 | ||

| Net Earnings | 65,687 | 75,737 | ||

Working Capital | 188,250 | 145,765 | ||

| Net Property, Plant and Equipment | 132,575 | 131,118 | ||

| Shareholders' Equity | 508,461 | 458,696 | ||

Average Shares Outstanding* | 50,451 | 50,898 | ||

| Per Share Items* | ||||

| Net Earnings | $1.30 | $1.49 | ||

| Shareholders' Equity | 10.09 | 9.09 | ||

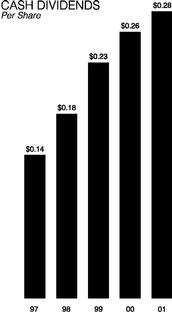

| Cash Dividends Paid | .28 | .26 | ||

*Based on average shares outstanding adjusted for stock dividends.

Some key financial highlights that occurred during 2001 include:

- •

- Cash dividends were paid for the fifty-ninth consecutive year.

- •

- The dollar amount of cash dividends paid increased by 8%.

- •

- A stock dividend was distributed in April, the thirty-seventh consecutive year we have paid stock dividends.

- •

- Capital expenditures of $14 million were made to increase efficiency, improve quality and to support future growth.

The conservative balance sheet we have established over the years enabled us to navigate the challenges faced during 2001 without jeopardizing future operations. Indeed, cash and investments in marketable securities grew by $51 million during the year, placing us in an even stronger position to respond to future investment opportunities, including suitable business acquisitions, as they may arise.

Sales and Marketing

Targeted consumer and trade promotions that highlight the attributes of quality and value in our portfolio of venerable candy brands have long been a key component of the sales and marketing strategy of the company, and they remained so once again during 2001.

Carefully planned and executed promotions helped to move our products into distribution and to subsequently move them off of the shelf with strong consumer take-away. This held true during 2001, and our products continue to be popular in the trade due to their strong brand recognition and historically high sell-through.

Halloween and Back to School are our main selling periods and thus a focus of our promotional activities. In 2001 promotions such as shipper displays and pallet packs contributed to sales in our Halloween packaged goods line, most notably so in the grocery, mass merchandiser and drug classes of trade.

Our Bonus Bag program and a tie-in between three of our most popular products and the video release ofThe Mummy Returns added to packaged goods growth outside of Halloween. A continued focus on seasonal offerings for Easter, Valentine and Christmas boosted sales during those periods. Another avenue of growth for the year was our theater line featuring Junior Mints, Dots, Sugar Babies and Mini Charleston Chews in jumbo, reclosable boxes that enable consumers to enjoy a treat now and still save some for later.

2

Sales of Andes Crème de Menthe Thins and Fluffy Stuff cotton candy, acquired during 2000, also contributed to 2001 sales. Andes had a particularly strong Christmas due to successful promotional efforts while Fluffy Stuff benefited from increased distribution and two seasonal line extensions: Cotton Tails for Easter and Snow Balls for Christmas.

New products also added to sales during the year. Hot Chocolate Pops, a delicious blend of rich chocolate hard candy and luscious marshmallow flavored caramel, and Fruit Smoothie Pops, four varieties of fruity yogurt hard candy pops with a chewy fruit center, have proven to be popular niche items among consumers. Dead Heads, a ghoulishly delicious,skull-shaped flat pop that turns your tongue red, was a well-received addition to the Charms Halloween line.

Notwithstanding the successes and positive results outlined above, sales declined by 1% during the year as weak economic conditions affected our sales. The catastrophic events of September 11 furtherdampened demand during the critical Halloween period as consumers were hesitant in planning their parties and trick-or-treat activities in the aftermath of 9/11. As our country banded together to recover from this tragedy, Tootsie Roll introduced a limited edition of our popular Tootsie Roll Midgee in a patriotic red, white and blue wrapper, paying tribute to themany brave men and women who have heroically served in so many ways during this challenging time.

Advertising and Public Relations

As we have done for many years, we continued to rely upon television to convey our advertisingmessages to consumers. The emphasis in 2001 was our classic "How Many Licks?" Tootsie Pop commercial, one of the longest running consumer product campaigns, which we targeted to children on prominent cartoon shows on cable television.

Our products received additional cable television exposure on the Food Network's top rated programUnwrapped, which featured Tootsie Pops and Blow Pops on a lollipop segment, Dots and Junior Mints in a piece about "movie candy," and Charleston Chew and Sugar Babies during a look at "retro" candy.

Our website, tootsie.com, was enhanced with the addition of a direct link for consumers to contactthe company. Thousands of inquiries have been received, ranging from compliments about our products to requests for financial information. We have also received numerous e-mails seeking an answer to the age-old question: "How many licks does it take to get to the Tootsie Roll center of a Tootsie Pop?" But, of course, "The world may never know!"

3

Numerous articles and stories appeared in newspapers and magazines during the year commenting favorably on the company and its well-known products. Among these, Forbes Magazine named us one of the 200 Best Small Companies in America, and our Chairman and Chief Executive Officer was, for the second consecutive year, ranked by Chief Executive Magazine as one of the best performing executives in the food, beverage and tobacco industries.

Manufacturing

Although we have been making Tootsie Rolls for 105 years, we continue to seek out innovative ways to improve upon what we are doing. Beginning in 2001, the wrappers on our bars are being changed to a new foil-based film. Test results indicate that this film provides a better moisture barrier and thus improves the shelf life of the candy. At the same time, the reflective quality of the foil improves the appearance of our traditional graphics.

Likewise, in response to trade demands for scanable products,wrappers on the Blow Pop count goods line were revamped during the year and a bar code panel was added. On the Tootsie Pop, we preserved the traditional wrapper and added a bar code on the base of the stick of the pop. These are but a few examples of our ongoing efforts to remain contemporary in our methods while preserving the identity of our brands.

Capital investments of $14 million were made during the year to increase efficiency, improve quality and to support future growth. Major projects included a 200,000 square foot expansion of a distribution facility and additional production capacity for Fluffy Stuff.

Purchasing

Prices for the major commodities we use firmed somewhat during the year, but our hedging program largely mitigated the impact of these increases. Corrugated prices declined somewhat while folding carton and film prices were stable throughout 2001.

We continue to use competitive bidding, hedging and forwardpurchase contracts to control costs and lock in prices at favorable levels when we feel it is prudent to do so and to ensure that the company's purchases are sourced as economically as possible.

Information Technology

During 2001 we continued the work that began in 2000 on the redevelopment of several key business applications and processes. These new applications will give us state-of-the-art, web enabled tools that are critical to remaining competitive in today's business environment.

Likewise, we have deployed an extranet to enhance communications with our business partners and incorporated imaging technology to streamline one of our routine accounting tasks. Such initiatives are critical to maintaining efficiency in our operations.

We are committed to deploying leading edge practices and technologies in every aspect of our operations and view our information technologies as a prime strategic tool for future growth.

International

Sales increased in Canada in 2001 as did our export sales to many foreign markets, while sales in Mexico declined.

We continue to prudently cultivate foreign markets where we see growth potential.

In Conclusion...

2001, an economic downturn year climaxed by the 9/11 tragedy, was one of the more challenging years we have had in some time. We wish to thank the many loyal employees, customers, suppliers, sales brokers and foreign distributors who have worked with us, as well as our shareholders who have been supportive through the years.

![]()

Melvin J. Gordon

Chairman of the Board and

Chief Executive Officer

![]()

Ellen R. Gordon

President and

Chief Operating Officer

4

Management's Discussion and Analysis of Financial

Condition and Results of Operations

(in thousands except per share, percentage and ratio figures)

FINANCIAL REVIEW

This financial review discusses the company's financial condition, results of operations, liquidity and capital resources and critical accounting policies. It should be read in conjunction with the Consolidated Financial Statements and related footnotes that follow this discussion.

FINANCIAL CONDITION

Our financial condition was further strengthened by the operating results achieved in 2001. Working capital, principally cash and cash equivalents, grew by 29.1% to $188,250 in 2001 from $145,765 in 2000 primarily due to cash generated by operating activities exceeding cash used for investing and financing activities by $45,650.

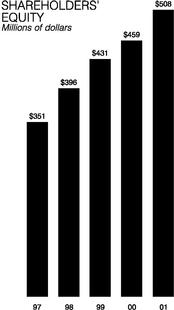

Shareholders' equity increased by 10.8% to $508,461 in 2001 from $458,696 in 2000, reflecting 2001 earnings of $65,687, partially offset by stock repurchases of $1,932 and cash dividends of $14,168. The company has paid cash dividends for fifty-nine consecutive years. Shareholders also received a 3% stock dividend in 2001, the thirty-seventh consecutive year that one has been distributed.

The company maintains a conservative financial posture and continues to be financed principally by funds generated from operations rather than with borrowed funds. We have sufficient capital to respond to future investment opportunities. Accordingly, we continue to seek appropriate acquisitions to complement our existing business.

RESULTS OF OPERATIONS

2001 vs. 2000

Sales in 2001 were $423,496, a decrease of 1% from the $427,054 sales in 2000.

Halloween sales once again made the third quarter our highest selling period, although third quarter and nine month 2001 sales declined from the prior year periods generally due to unfavorable economic conditions which were somewhat offset by successful marketing and promotional programs in certain trade classes, sales of new products and by sales of brands acquired during 2000.

Sales in our Canadian operation increased due to further gains in distribution and successful promotions, while sales in Mexico declined mainly due to the implementation of tighter seasonal sales terms. Export sales grew in 2001 due to the addition of the brands acquired in 2000, as well as due to distribution gains for existing products in certain foreign markets.

Cost of goods sold was $216,657 or 51.2% of sales in 2001 as compared to $207,100 or 48.5% of sales in 2000. The increase in cost of goods sold is due to product mix, lower profit margins of the acquired brands, and higher overhead costs from multiple plant locations, including increased energy costs.

In addition, a nonrecurring finished goods inventory writedown of $1,100 and a plant closing charge of $1,500, $1,275 of which related to the writedown of plant equipment, added to cost of goods sold in the third and fourth quarter, respectively. These charges, coupled with the seasonal nature of our business and corresponding variations in the product mix, caused gross margins for the third and fourth quarters to fall below the 48.8% of sales averaged over the entire year.

Operating expenses, comprised of selling, marketing, advertising, physical distribution, general and

5

administrative expense, as a percent of sales increased from 24.8% in 2000 to 25.8% in 2001 due to higher distribution and delivery expenses relating to higher fuel costs, and higher trade promotion spending and customer deductions.

Amortization of intangibles increased from $3,420 in 2000 to $3,778 in 2001, reflecting a full year of amortization associated with the brands acquired during 2000. As a result of the lower sales and higher costs discussed above, earnings from operations declined from $110,729 in 2000 to $93,944 in 2001.

Other income, consisting primarily of interest income net of interest expense, was $6,843 in 2001 versus $7,079 in 2000, due to lower interest rates. The effective tax rate was 34.8% in 2001 as compared to 35.7% in 2000.

Consolidated net earnings were $65,687 and $75,737 and earnings per share were $1.30 and $1.49 in 2001 and 2000, respectively. Average shares outstanding declined slightly from 50,898 to 50,451 due to share repurchases.

2000 vs. 1999

Net sales increased by 7.6% in 2000 to $427,054 compared to 1999 sales of $396,750. Sales remained at the highest level in the third quarter, due to successful Halloween and Back to School promotions.

Other factors contributing to sales increases during the year were growth across many of our core brands, gains in our seasonal lines, incremental business from product line extensions, increases in certain international markets and sales from acquired brands.

Comparing quarterly sales in 2000 to those of 1999, the third quarter showed the largest increase in dollar terms due to Halloween, and the fourth quarter showed the greatest growth in percentage terms due to $14,457 in sales from acquired brands. In the fourth quarter we experienced general softness in our markets.

Cost of goods sold as a percentage of sales remained consistent at 48.5%. Raw material prices were generally favorable during the year but were offset by higher packaging costs and product mix variations, some of which are related to the acquired brands.

Gross margin grew by 7.7% to $219,954 due to increased sales. As a percentage of sales, gross margin essentially remained constant at 51.5%. Gross margins in the third and fourth quarters continue to be somewhat lower due to the seasonal nature of our business and to the product mix sold in those quarters.

Operating expenses, as a percentage of sales, increased slightly from 24.4% to 24.8%. Amortization of intangible assets increased from $2,706 to $3,420 reflecting the partial year impact of two acquisitions. Earnings from operations increased from $104,519 to $110,729, a 5.9% increase.

Other income was $7,079 versus $6,928 in 1999. The effective tax rate of 35.7% was comparable to the 1999 rate of 36.0%.

Consolidated net earnings rose 6.2% to $75,737 from $71,310. Earnings per share increased by 8.8% to $1.49 from $1.37. Earnings per share increased by a greater percentage than net earnings due to lower average shares outstanding during 2000 as a result of share repurchases made during the year.

LIQUIDITY AND CAPITAL RESOURCES

Cash flows from operating activities were $81,505 in 2001, $84,881 in 2000 and $72,935 in 1999. The decline in 2001 versus 2000 was due to lower net earnings partially offset by lower accounts receivable and higher depreciation and amortization. The increase in 2000 versus 1999 was attributable to higher net earnings, higher depreciation and amortization, a decline in other receivables and a smaller increase in other assets than in 1999, partially offset by increased accounts receivable.

Cash flows from investing activities in 2001 reflect capital expenditures of $14,148 and a net increase in marketable securities of $5,607. In 2000, capital expenditures were $16,189, $74,293 was used for the purchase of Fluffy Stuff and Andes Candies, and marketable securities decreased by $24,015, which was used to help finance the acquisitions. In 1999 capital expenditures were $20,283 and there was a net increase in marketable securities of $6,710.

Cash flows from financing activities reflect share repurchases of $1,932, $32,945 and $26,869 in 2001, 2000 and 1999, respectively. In 2000 there were short-term borrowings of $43,625 related to the Andes acquisition, which were subsequently repaid. The company's capital structure is not complex and we are not involved in any "off balance sheet" or other complex financing arrangements.

Cash dividends of $14,168, $13,091 and $11,313 were paid in 2001, 2000 and 1999, respectively. 2001 was the fifty-ninth consecutive year in which we have paid cash dividends.

6

QUANTITATIVE AND QUALITATIVE DISCLOSURE OF MARKET RISK

The company is exposed to various market risks, including fluctuations in the prices of ingredients and packaging material. We also invest in securities with maturities of generally up to three years, the majority of which are held to maturity, which limits the company's exposure to interest rate fluctuations. There was no material change in the company's market risks during 2001.

CRITICAL ACCOUNTING POLICIES AND OTHER MATTERS

Financial Reporting Release No. 60, recently issued by the Securities and Exchange Commission, requires all registrants to discuss "critical" accounting policies or methods used in the preparation of financial statements. In the opinion of management, the company does not have any individual accounting policy that is "critical." However, following is a summary of the more significant accounting policies and methods used.

Revenue recognition

Revenue, net of applicable provisions for discounts, returns and allowances, is recognized upon delivery of products to customers. Provisions for bad debts are recorded as selling, marketing and administrative expense. Such provisions have not been significant to the company's financial position or results of operations. Beginning January 1, 2002, new accounting standards that require certain advertising and promotional costs traditionally reported as selling, marketing and administrative costs to be reclassified as a reduction of net sales will be adopted.

Customer incentive programs, advertising and marketing

Advertising and marketing costs are recorded in the period to which such costs relate. The company does not defer the recognition of any amounts on its consolidated balance sheet with respect to such costs. Customer incentives and other promotional costs are recorded in the period in which these programs are offered, based on sales volumes, incentive program terms and estimates of utilization and redemption rates.

Investments

The company invests in certain high-quality debt securities primarily Aa or better rated municipal bonds. The accounting for such investments is outlined in Note 1 of the Notes to Consolidated Financial Statements. No credit losses have been incurred on these investments.

Financial Reporting Release No. 61, also recently issued by the Securities and Exchange Commission, requires all registrants to discuss liquidity and capital resources, trading activities involving non-exchange traded contracts and relationships and transactions with related parties that derive benefit from their non-independent relationships with the registrant. Other than contracts for raw materials and packaging, including commodity hedges entered into in the ordinary course of business, the company does not have any significant contractual obligations or future commitments, and is not involved in any other significant transactions covered by this release.

The results of our operations and our financial condition are expressed in the following financial statements.

7

CONSOLIDATED STATEMENT OF

Earnings, Comprehensive Earnings and Retained Earnings

| TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES | (in thousands except per share data) | |||||

| | For the year ended December 31, | |||||||

|---|---|---|---|---|---|---|---|---|

2001 | 2000 | 1999 | ||||||

Net sales | $423,496 | $427,054 | $396,750 | |||||

| Cost of goods sold | 216,657 | 207,100 | 192,561 | |||||

| Gross margin | 206,839 | 219,954 | 204,189 | |||||

| Selling, marketing and administrative expenses | 109,117 | 105,805 | 96,964 | |||||

| Amortization of intangible assets | 3,778 | 3,420 | 2,706 | |||||

| Earnings from operations | 93,944 | 110,729 | 104,519 | |||||

| Other income, net | 6,843 | 7,079 | 6,928 | |||||

| Earnings before income taxes | 100,787 | 117,808 | 111,447 | |||||

| Provision for income taxes | 35,100 | 42,071 | 40,137 | |||||

| Net earnings | $ 65,687 | $ 75,737 | $ 71,310 | |||||

Net earnings | $ 65,687 | $ 75,737 | $ 71,310 | |||||

| Other comprehensive earnings (loss) | 277 | (1,250 | ) | 1,583 | ||||

| Comprehensive earnings | $ 65,964 | $ 74,487 | $ 72,893 | |||||

Retained earnings at beginning of year | $180,123 | $158,619 | $164,652 | |||||

| Net earnings | 65,687 | 75,737 | 71,310 | |||||

| Cash dividends ($.28, $.26 and $.23 per share) | (14,021 | ) | (13,350 | ) | (11,654 | ) | ||

| Stock dividends | (70,444 | ) | (40,883 | ) | (65,689 | ) | ||

| Retained earnings at end of year | $161,345 | $180,123 | $158,619 | |||||

| Earnings per share | $ 1.30 | $ 1.49 | $ 1.37 | |||||

| Average common and class B common shares outstanding | 50,451 | 50,898 | 51,877 | |||||

(The accompanying notes are an integral part of these statements.)

8

CONSOLIDATED STATEMENT OF

Financial Position

| TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES | (in thousands) | |||

| Assets | December 31, | ||||||||

|---|---|---|---|---|---|---|---|---|---|

2001 | 2000 | ||||||||

CURRENT ASSETS: | |||||||||

| Cash and cash equivalents | $106,532 | $ 60,882 | |||||||

| Investments | 68,629 | 71,605 | |||||||

| Accounts receivable trade, less allowances of $2,037 and $2,147 | 20,403 | 23,568 | |||||||

| Other receivables | 3,329 | 1,230 | |||||||

| Inventories: | |||||||||

| Finished goods and work-in-process | 24,770 | 24,984 | |||||||

| Raw materials and supplies | 16,392 | 16,906 | |||||||

| Prepaid expenses | 4,269 | 2,685 | |||||||

| Deferred income taxes | 1,772 | 1,351 | |||||||

| Total current assets | 246,096 | 203,211 | |||||||

| PROPERTY, PLANT AND EQUIPMENT, at cost: | |||||||||

| Land | 8,354 | 8,327 | |||||||

| Buildings | 43,613 | 36,937 | |||||||

| Machinery and equipment | 189,528 | 183,858 | |||||||

| 241,495 | 229,122 | ||||||||

| Less—Accumulated depreciation | 108,920 | 98,004 | |||||||

| 132,575 | 131,118 | ||||||||

| OTHER ASSETS: | |||||||||

| Intangible assets, net of accumulated amortization of $30,695 and $26,917 | 117,499 | 121,263 | |||||||

| Investments | 71,131 | 62,548 | |||||||

| Cash surrender value of life insurance and other assets | 51,375 | 44,302 | |||||||

| 240,005 | 228,113 | ||||||||

| $618,676 | $562,442 | ||||||||

(The accompanying notes are an integral part of these statements.)

9

| (in thousands except per share data) | ||||

| Liabilities and Shareholders' Equity | December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

2001 | 2000 | |||||||||

CURRENT LIABILITIES: | ||||||||||

| Accounts payable | $ 9,223 | $ 10,296 | ||||||||

| Dividends payable | 3,536 | 3,436 | ||||||||

| Accrued liabilities | 34,295 | 33,336 | ||||||||

| Income taxes payable | 10,792 | 10,378 | ||||||||

| Total current liabilities | 57,846 | 57,446 | ||||||||

| NONCURRENT LIABILITIES: | ||||||||||

| Deferred income taxes | 16,792 | 12,422 | ||||||||

| Postretirement health care and life insurance benefits | 7,450 | 6,956 | ||||||||

| Industrial development bonds | 7,500 | 7,500 | ||||||||

| Deferred compensation and other liabilities | 20,627 | 19,422 | ||||||||

| Total noncurrent liabilities | 52,369 | 46,300 | ||||||||

| SHAREHOLDERS' EQUITY: | ||||||||||

| Common stock, $.69-4/9 par value— 120,000 and 120,000 shares authorized— 34,139 and 32,986, respectively, issued | 23,708 | 22,907 | ||||||||

| Class B common stock, $.69-4/9 par value— 40,000 and 40,000 shares authorized— 16,319 and 16,056, respectively, issued | 11,332 | 11,150 | ||||||||

| Capital in excess of par value | 323,981 | 256,698 | ||||||||

| Retained earnings, per accompanying statement | 161,345 | 180,123 | ||||||||

| Accumulated other comprehensive earnings (loss) | (9,913 | ) | (10,190 | ) | ||||||

| Treasury stock (at cost)— 53 shares and 52 shares, respectively | (1,992 | ) | (1,992 | ) | ||||||

| 508,461 | 458,696 | |||||||||

| $618,676 | $562,442 | |||||||||

(The accompanying notes are an integral part of these statements.)

10

CONSOLIDATED STATEMENT OF

Cash Flows

| TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES | (in thousands) | |||||

| | For the year ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2001 | 2000 | 1999 | |||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||||

| Net earnings | $ 65,687 | $ 75,737 | $ 71,310 | |||||||||

| Adjustments to reconcile net earnings to net cash provided by operating activities: | ||||||||||||

| Depreciation and amortization | 16,700 | 13,314 | 9,979 | |||||||||

| Gain on retirement of fixed assets | — | (46 | ) | (43 | ) | |||||||

| Changes in operating assets and liabilities, excluding acquisitions: | ||||||||||||

| Accounts receivable | 3,096 | (4,460 | ) | 400 | ||||||||

| Other receivables | (2,100 | ) | 4,486 | (2,392 | ) | |||||||

| Inventories | 910 | (768 | ) | 1,592 | ||||||||

| Prepaid expenses and other assets | (8,857 | ) | (7,903 | ) | (15,672 | ) | ||||||

| Accounts payable and accrued liabilities | (224 | ) | (1,717 | ) | 968 | |||||||

| Income taxes payable and deferred | 4,402 | 5,691 | 2,232 | |||||||||

| Postretirement health care and life insurance benefits | 494 | 399 | 412 | |||||||||

| Deferred compensation and other liabilities | 1,206 | 337 | 4,162 | |||||||||

| Other | 191 | (189 | ) | (13 | ) | |||||||

| Net cash provided by operating activities | 81,505 | 84,881 | 72,935 | |||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||||||

| Acquisitions of businesses, net of cash acquired | — | (74,293 | ) | — | ||||||||

| Capital expenditures | (14,148 | ) | (16,189 | ) | (20,283 | ) | ||||||

| Purchase of held to maturity securities | (243,530 | ) | (156,322 | ) | (238,949 | ) | ||||||

| Maturity of held to maturity securities | 228,397 | 176,576 | 235,973 | |||||||||

| Purchase of available for sale securities | (64,640 | ) | (78,993 | ) | (117,694 | ) | ||||||

| Sale and maturity of available for sale securities | 74,166 | 82,754 | 113,960 | |||||||||

| Net cash used in investing activities | (19,755 | ) | (66,467 | ) | (26,993 | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||||||

| Issuance of notes payable | — | 43,625 | — | |||||||||

| Repayments of notes payable | — | (43,625 | ) | — | ||||||||

| Treasury stock purchases | — | — | (1,019 | ) | ||||||||

| Shares repurchased and retired | (1,932 | ) | (32,945 | ) | (25,850 | ) | ||||||

| Dividends paid in cash | (14,168 | ) | (13,091 | ) | (11,313 | ) | ||||||

| Net cash used in financing activities | (16,100 | ) | (46,036 | ) | (38,182 | ) | ||||||

| Increase (decrease) in cash and cash equivalents | 45,650 | (27,622 | ) | 7,760 | ||||||||

| Cash and cash equivalents at beginning of year | 60,882 | 88,504 | 80,744 | |||||||||

| Cash and cash equivalents at end of year | $106,532 | $ 60,882 | $ 88,504 | |||||||||

| Supplemental cash flow information: | ||||||||||||

| Income taxes paid | $ 30,490 | $ 35,750 | $ 38,827 | |||||||||

| Interest paid | $ 356 | $ 1,067 | $ 453 | |||||||||

(The accompanying notes are an integral part of these statements.)

11

Notes to Consolidated Financial Statements

($ in thousands except per share data)

TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES

NOTE 1—SIGNIFICANT ACCOUNTING POLICIES:

Basis of consolidation:

The consolidated financial statements include the accounts of Tootsie Roll Industries, Inc. and its wholly-owned subsidiaries (the company), which are primarily engaged in the manufacture and sale of candy products. All significant intercompany transactions have been eliminated.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Revenue recognition and other accounting pronouncements:

Revenues are recognized when products are shipped and delivered to customers. Shipping and handling costs of $28,069, $26,661, and $24,260 in 2001, 2000 and 1999, respectively, are included in selling, marketing and administrative expenses. Accounts receivable are unsecured. Revenues from a major customer aggregated approximately 16.9%, 17.8% and 17.9% of total net sales during the years ended December 31, 2001, 2000 and 1999, respectively.

Emerging Issues Task Force Issue No. 00-25, "Vendor Income Statement Characterization of Consideration Paid to a Reseller of the Vendor's Products" and Issue No. 00-14, "Accounting for Certain Sales Incentives" require that cooperative advertising and certain sales incentives costs traditionally reported as selling, marketing and administrative expense be reclassified as a reduction of net sales beginning with the quarter ending March 31, 2002. As a result of adopting this change, approximately $31,741, $30,238 and $27,415 of expense will be reclassified to a reduction of net sales for the years ended December 31, 2001, 2000 and 1999, respectively. These reclassifications will not affect the company's financial position or net income.

Effective January 1, 2001, the company adopted SFAS 133 "Accounting for Derivative Instruments and Hedging Activities" and the related SFAS 138 "Accounting for Certain Derivative Instruments and Certain Hedging Activities" with no material effect on the company's results of operations or financial position. These standards require that derivative instruments be recorded on the balance sheet at fair value, and that changes therein be recorded either in earnings or other comprehensive earnings, depending on whether the derivative is designated and effective as part of a hedge transaction and, if so, the type of hedge transaction. Gains and losses on derivative instruments reported in other comprehensive earnings are reclassified to earnings in the periods in which earnings are affected by the hedged item.

From time to time, the company enters into commodities futures contracts that are intended and effective as hedges of market price risks associated with the anticipated purchase of certain raw materials (primarily sugar). To qualify as a hedge, the company evaluates a variety of characteristics of these transactions, including the probability that the anticipated transaction will occur. If the anticipated transaction were not to occur, the gain or loss would then be recognized in current earnings.

To qualify for hedge accounting, financial instruments must maintain a high correlation with the item being hedged throughout the hedged period. The company does not engage in trading or other speculative use of derivative instruments. The company does assume the risk that counter parties may not be able to meet the terms of their contracts. The company does not expect any losses as a result of counter party defaults, and at December 31, 2001 had open contracts to purchase half of its expected 2002 and 2003 sugar usage.

Cash and cash equivalents:

The company considers temporary cash investments with an original maturity of three months or less to be cash equivalents.

Investments:

Investments consist of various marketable securities with maturities of generally up to three years. The company classifies debt and equity securities as either held to maturity, available for sale or trading. Held to maturity securities represent those securities that the company has both the positive intent and ability to hold to maturity and are carried at amortized cost. Available for sale securities represent those securities that do not meet the classification of held to maturity, are not actively traded and are carried at fair value. Unrealized gains and losses on these securities are excluded from earnings and are reported as a separate component of shareholders' equity, net of applicable taxes, until realized. Trading securities relate to deferred compensation arrangements and are carried at fair value.

Inventories:

Inventories are stated at cost, not in excess of market. The cost of domestic inventories ($35,982 and $37,505 at December 31, 2001 and 2000, respectively) has been determined by the last-in, first-out (LIFO) method. The excess of current cost over LIFO cost of inventories approximates $4,261 and $2,993 at December 31, 2001 and 2000, respectively. The cost of foreign inventories ($5,180 and $4,385 at December 31, 2001 and 2000, respectively) has been determined by the first-in, first-out (FIFO) method.

Property, plant and equipment:

Depreciation is computed for financial reporting purposes by use of the straight-line method based on useful lives of 20 to 35 years for buildings and 12 to 20 years for machinery and equipment. Depreciation expense was $14,148, $10,069 and $7,663 in 2001, 2000 and 1999, respectively, including $1,275 of equipment that was written down related to a plant closing in 2001.

Carrying value of long-lived assets:

In the event that facts and circumstances indicate that the company's long-lived assets may be impaired, an evaluation of recoverability would be performed. Such an evaluation entails comparing the estimated future undiscounted cash flows associated with the asset to the asset's carrying amount to determine if a write down to market value or discounted cash flow value is required. The company considers that no circumstances currently exist that would require such an evaluation.

Postretirement health care and life insurance benefits:

The company provides certain postretirement health care and life insurance benefits. The cost of these postretirement benefits is accrued during employees' working careers. The company also funds the premiums on split-dollar life insurance policies for certain members of management, and records an asset equal to the cumulative premium paid as this amount will be recovered upon termination of the policies.

Intangible assets:

Intangible assets represent the excess of cost over the acquired net tangible assets of operating companies, which has historically been amortized on a straight-line basis over a 15 to 40 year period.

During 2001 the Financial Accounting Standards Board (SFAS) issued SFAS 141, "Business Combinations" and SFAS 142 "Goodwill and other Intangible Assets." SFAS 141 requires that the purchase method of accounting be used for all business combinations initiated after June 30, 2001 and provides specific criteria for the recognition and measurement of intangible assets apart from goodwill. SFAS 142 prohibits the amortization of goodwill and indefinite-lived intangible assets and requires that they be tested annually for impairment.

In connection with the adoption of SFAS 142 in the first quarter of 2002, the company expects to reclassify substantially all of its intangible assets, primarily to tradenames and the remainder to goodwill. The company expects that amortization of such assets will substantially cease and that the required impairment tests will be completed in the first quarter of 2002. The company has not yet determined what effect these impairment tests will have on its earnings and financial position.

12

Comprehensive earnings:

Comprehensive earnings includes net earnings, foreign currency translation adjustments and unrealized gains/losses on commodities and marketable securities.

Earnings per share:

A dual presentation of basic and diluted earnings per share is not required due to the lack of potentially dilutive securities under the company's simple capital structure. Therefore, all earnings per share amounts represent basic earnings per share.

NOTE 2—ACQUISITIONS:

During 2000, the company acquired the assets of two confectionery companies for $74,293 in cash, which was funded through existing cash and $38,800 of short term borrowings. The acquisition cost has been allocated to the assets acquired and liabilities assumed based on their respective appraised values as follows:

Current assets | $ | 6,304 | ||

| Property, plant and equipment | 29,400 | |||

| Intangible assets, primarily trademarks | 39,546 | |||

| Liabilities | (957 | ) | ||

| Total purchase price | $ | 74,293 | ||

The acquisitions were accounted for by the purchase method. Accordingly, the operating results of the acquired businesses have been included in the consolidated financial statements since the date of acquisition. The operating results of the acquired businesses did not have a material effect on the company's financial statements.

NOTE 3—ACCRUED LIABILITIES:

Accrued liabilities are comprised of the following:

| | December 31, | |||||

|---|---|---|---|---|---|---|

| | 2001 | 2000 | ||||

| Compensation | $ | 10,516 | $ | 10,069 | ||

| Other employee benefits | 4,375 | 4,107 | ||||

| Taxes, other than income | 2,549 | 2,174 | ||||

| Advertising and promotions | 9,777 | 9,038 | ||||

| Other | 7,078 | 7,948 | ||||

| $ | 34,295 | $ | 33,336 | |||

NOTE 4—INCOME TAXES:

The domestic and foreign components of pretax income are as follows:

| | 2001 | 2000 | 1999 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Domestic | $ | 98,827 | $ | 115,823 | $ | 110,052 | ||||

| Foreign | 1,960 | 1,985 | 1,395 | |||||||

| $ | 100,787 | $ | 117,808 | $ | 111,447 | |||||

The provision for income taxes is comprised of the following:

| | 2001 | 2000 | 1999 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Current: | ||||||||||

| Federal | $ | 27,588 | $ | 33,908 | $ | 34,290 | ||||

| Foreign | 749 | 426 | 783 | |||||||

| State | 2,480 | 3,613 | 4,294 | |||||||

| $ | 30,817 | $ | 37,947 | $ | 39,367 | |||||

| | 2001 | 2000 | 1999 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Deferred: | |||||||||||

| Federal | $ | 4,011 | $ | 3,500 | $ | 1,039 | |||||

| Foreign | 52 | 346 | (388 | ) | |||||||

| State | 220 | 278 | 119 | ||||||||

| 4,283 | 4,124 | 770 | |||||||||

| $ | 35,100 | $ | 42,071 | $ | 40,137 | ||||||

Deferred income taxes are comprised of the following:

| | December 31, | ||||||

|---|---|---|---|---|---|---|---|

| | 2001 | 2000 | |||||

| Workers' compensation | $ | 527 | $ | 405 | |||

| Reserve for uncollectible accounts | 432 | 455 | |||||

| Other accrued expenses | 1,199 | 1,397 | |||||

| VEBA funding | (450 | ) | (370 | ) | |||

| Other, net | 64 | (536 | ) | ||||

| Net current deferred income tax asset | $ | 1,772 | $ | 1,351 | |||

| | December 31, | ||||||

|---|---|---|---|---|---|---|---|

| | 2001 | 2000 | |||||

| Depreciation | $ | 15,309 | $ | 12,076 | |||

| Postretirement benefits | (2,570 | ) | (2,345 | ) | |||

| Deductible goodwill | 9,036 | 7,855 | |||||

| Deferred compensation | (6,595 | ) | (6,174 | ) | |||

| Accrued commissions | 2,377 | 2,232 | |||||

| Foreign subsidiary tax loss carryforward | (1,100 | ) | (521 | ) | |||

| Other, net | 335 | (701 | ) | ||||

| Net long-term deferred income tax liability | $ | 16,792 | $ | 12,422 | |||

At December 31, 2001, gross deferred tax assets and gross deferred tax liabilities were $14,683 and $29,703, respectively. The deferred tax assets are shown net of valuation allowances of $1,097 and $752 at December 31, 2001 and December 31, 2000, respectively, relating to prepaid taxes in a foreign jurisdiction.

The effective income tax rate differs from the statutory rate as follows:

| | 2001 | 2000 | 1999 | ||||

|---|---|---|---|---|---|---|---|

| U.S. statutory rate | 35.0 | % | 35.0 | % | 35.0 | % | |

| State income taxes, net | 1.8 | 2.2 | 2.6 | ||||

| Amortization of intangible assets | 0.4 | 0.4 | 0.4 | ||||

| Exempt municipal bond interest | (2.0 | ) | (1.8 | ) | (1.9 | ) | |

| Other, net | (0.4 | ) | (0.1 | ) | (0.1 | ) | |

| Effective income tax rate | 34.8 | % | 35.7 | % | 36.0 | % | |

The company has not provided for U.S. federal or foreign withholding taxes on $6,883 of foreign subsidiaries' undistributed earnings as of December 31, 2001 because such earnings are considered to be permanently reinvested. It is not practicable to determine the amount of income taxes that would be payable upon remittance of the undistributed earnings.

13

NOTE 5—SHARE CAPITAL AND CAPITAL IN EXCESS OF PAR VALUE:

| | | | Class B Common Stock | | | | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Common Stock | Treasury Stock | | ||||||||||||||||

| | Capital in excess of par value | ||||||||||||||||||

| | Shares | Amount | Shares | Amount | Shares | Amount | |||||||||||||

| | (000's) | | (000's) | | (000's) | | | ||||||||||||

| Balance at January 1, 1999 | 32,439 | $ | 22,527 | 15,422 | $ | 10,710 | (25 | ) | $ | (973 | ) | $ | 210,064 | ||||||

| Issuance of 3% stock dividend | 971 | 674 | 461 | 320 | (1 | ) | — | 64,514 | |||||||||||

| Purchase of shares for the treasury | — | — | — | — | (24 | ) | (1,019 | ) | — | ||||||||||

| Conversion of Class B common shares to common shares | 176 | 122 | (176 | ) | (122 | ) | — | — | — | ||||||||||

| Purchase and retirement of common shares | (732 | ) | (508 | ) | — | — | — | — | (25,342 | ) | |||||||||

| Balance at December 31, 1999 | 32,854 | 22,815 | 15,707 | 10,908 | (50 | ) | (1,992 | ) | 249,236 | ||||||||||

| Issuance of 3% stock dividend | 969 | 673 | 470 | 326 | (2 | ) | — | 39,742 | |||||||||||

| Conversion of Class B common shares to common shares | 121 | 84 | (121 | ) | (84 | ) | — | — | — | ||||||||||

| Purchase and retirement of common shares | (958 | ) | (665 | ) | — | — | — | — | (32,280 | ) | |||||||||

| Balance at December 31, 2000 | 32,986 | 22,907 | 16,056 | 11,150 | (52 | ) | (1,992 | ) | 256,698 | ||||||||||

| Issuance of 3% stock dividend | 986 | 685 | 480 | 333 | (1 | ) | — | 69,180 | |||||||||||

| Conversion of Class B common shares to common shares | 217 | 151 | (217 | ) | (151 | ) | — | — | — | ||||||||||

| Purchase and retirement of common shares | (50 | ) | (35 | ) | — | — | — | — | (1,897 | ) | |||||||||

| Balance at December 31, 2001 | 34,139 | $ | 23,708 | 16,319 | $ | 11,332 | (53 | ) | $ | (1,992 | ) | $ | 323,981 | ||||||

The Class B Common Stock has essentially the same rights as Common Stock, except that each share of Class B Common Stock has ten votes per share (compared to one vote per share of Common Stock), is not traded on any exchange, is restricted as to transfer and is convertible on a share-for-share basis, at any time and at no cost to the holders, into shares of Common Stock which are traded on the New York Stock Exchange.

Average shares outstanding and all per share amounts included in the financial statements and notes thereto have been adjusted retroactively to reflect annual three percent stock dividends.

NOTE 6—INDUSTRIAL DEVELOPMENT BONDS:

Industrial development bonds are due in 2027. The average floating interest rate was 3.0% and 4.7% in 2001 and 2000, respectively.

NOTE 7—EMPLOYEE BENEFIT PLANS:

Pension plans:

The company sponsors defined contribution pension plans covering certain nonunion employees with over one year of credited service. The company's policy is to fund pension costs accrued based on compensation levels. Total pension expense for 2001, 2000 and 1999 approximated $2,823, $2,535 and $2,062, respectively. The company also maintains certain profit sharing and savings-investment plans. Company contributions in 2001, 2000 and 1999 to these plans were $765, $754 and $616, respectively.

The company also contributes to multi-employer defined benefit pension plans for its union employees. Such contributions aggregated $859, $787 and $713 in 2001, 2000 and 1999, respectively. The relative position of each employer associated with the multi-employer plans with respect to the actuarial present value of benefits and net plan assets is not determinable by the company.

Postretirement health care and life insurance benefit plans:

The company provides certain postretirement health care and life insurance benefits for corporate office and management employees. Employees become eligible for these benefits if they meet minimum age and service requirements and if they agree to contribute a portion of the cost. The company has the right to modify or terminate these benefits. The company does not fund postretirement health care and life insurance benefits in advance of payments for benefit claims.

The changes in the accumulated postretirement benefit obligation at December 31, 2001 and 2000 consist of the following:

| | December 31, | ||||||

|---|---|---|---|---|---|---|---|

| | 2001 | 2000 | |||||

| Benefit obligation, beginning of year | $ | 6,956 | $ | 6,557 | |||

| Net periodic postretirement benefit cost | 705 | 518 | |||||

| Benefits paid | (211 | ) | (119 | ) | |||

| Benefit obligation, end of year | $ | 7,450 | $ | 6,956 | |||

Net periodic postretirement benefit cost included the following components:

| | 2001 | 2000 | 1999 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Service cost—benefits attributed to service during the period | $ | 351 | $ | 286 | $ | 306 | ||||

| Interest cost on the accumulated postretirement benefit obligation | 422 | 341 | 302 | |||||||

| Amortization of unrecognized net gain | (68 | ) | (109 | ) | (77 | ) | ||||

| Net periodic postretirement benefit cost | $ | 705 | $ | 518 | $ | 531 | ||||

For measurement purposes, an 8.0% annual rate of increase in the per capita cost of covered health care benefits was assumed for 2001; the rate was assumed to decrease gradually to 5.5% for 2006 and remain at that level thereafter. The health care cost trend rate assumption has a significant effect on the amounts reported. The weighted-average discount rate used in determining the accumulated postretirement benefit obligation was 7.0% and 7.25% at December 31, 2001 and 2000, respectively.

Increasing or decreasing the health care trend rates by one percentage point in each year would have the following effect:

| | 1% Increase | 1% Decrease | |||||

|---|---|---|---|---|---|---|---|

| Effect on postretirement benefit obligation | $ | 982 | $ | (803 | ) | ||

| Effect on total of service and interest cost components | $ | 135 | $ | (108 | ) | ||

NOTE 8—OTHER INCOME, NET:

Other income (expense) is comprised of the following:

2001 | 2000 | 1999 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Interest income | $ | 6,556 | $ | 7,636 | $ | 7,449 | ||||

| Interest expense | (356 | ) | (866 | ) | (453 | ) | ||||

| Dividend income | 55 | 421 | 611 | |||||||

| Foreign exchange losses | (177 | ) | (42 | ) | (126 | ) | ||||

| Royalty income | 403 | 225 | 263 | |||||||

| Miscellaneous, net | 362 | (295 | ) | (816 | ) | |||||

| $ | 6,843 | $ | 7,079 | $ | 6,928 | |||||

NOTE 9—COMMITMENTS:

Rental expense aggregated $730, $580 and $457 in 2001, 2000 and 1999, respectively.

Future operating lease commitments are not significant.

14

NOTE 10—COMPREHENSIVE INCOME:

Components of accumulated other comprehensive earnings (loss) are shown as follows:

Foreign Currency Items | Unrealized Gains (Losses) on Securities | Unrealized Gains (Losses) on Derivatives | Accumulated Other Comprehensive Earnings/(Loss) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Balance at January 1, 1999 | $ | (11,082 | ) | $ | 559 | $ | — | $ | (10,523 | ) | |||

| Change during period | 653 | 930 | 0 | 1,583 | |||||||||

| Balance at December 31, 1999 | (10,429 | ) | 1,489 | 0 | (8,940 | ) | |||||||

| Change during period | (394 | ) | (856 | ) | — | (1,250 | ) | ||||||

| Balance at December 31, 2000 | (10,823 | ) | 633 | 0 | (10,190 | ) | |||||||

| Change during period | 846 | (184 | ) | (385 | ) | 277 | |||||||

| Balance at December 31, 2001 | $ | (9,977 | ) | $ | 449 | $ | (385 | ) | $ | (9,913 | ) | ||

The individual tax effects of each component of other comprehensive earnings (loss) for the year ended December 31, 2001 are shown as follows:

| | Before Tax Amount | Tax (Expense) Benefit | Net-of-Tax Tax Amount | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Foreign currency translation adjustment | $ | 846 | $ | — | $ | 846 | ||||||

| Unrealized gains (losses) on securities: | ||||||||||||

| Unrealized holding gains (losses) arising during 2001 | (316 | ) | 117 | (199 | ) | |||||||

| Less: reclassification adjustment for gains (losses) realized in earnings | (23 | ) | 8 | (15 | ) | |||||||

| Net unrealized gains | (293 | ) | 109 | (184 | ) | |||||||

| Unrealized gains (losses) on derivatives: | ||||||||||||

| Unrealized holding gains (losses) arising during 2001 | (264 | ) | 98 | (166 | ) | |||||||

| Less: reclassification adjustment for gains (losses) realized in earnings | 346 | (127 | ) | 219 | ||||||||

| Net unrealized gains | (610 | ) | 225 | (385 | ) | |||||||

| Other comprehensive earnings | $ | (57 | ) | $ | 334 | $ | 277 | |||||

NOTE 11—DISCLOSURES ABOUT THE FAIR VALUE AND CARRYING AMOUNT OF FINANCIAL INSTRUMENTS:

The carrying amount approximates fair value of cash and cash equivalents because of the short maturity of those instruments. The fair values of investments are estimated based on quoted market prices. The fair value of the company's industrial development bonds approximates their carrying value because they have a floating interest rate. The carrying amount and estimated fair values of the company's financial instruments are as follows:

| | 2001 | 2000 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Carrying Amount | Fair Value | Carrying Amount | Fair Value | ||||||||

| Cash and cash equivalents | $ | 106,532 | $ | 106,532 | $ | 60,882 | $ | 60,882 | ||||

| Investments held to maturity | 102,585 | 103,543 | 98,164 | 100,127 | ||||||||

| Investments available for sale | 22,253 | 22,253 | 22,565 | 22,565 | ||||||||

| Investments in trading securities | 14,922 | 14,922 | 13,424 | 13,424 | ||||||||

| Industrial development bonds | 7,500 | 7,500 | 7,500 | 7,500 | ||||||||

A summary of the aggregate fair value, gross unrealized gains, gross unrealized losses and amortized cost basis of the company's investment portfolio by major security type is as follows:

| | December 31, 2001 | December 31, 2000 | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | Unrealized | | | Unrealized | |||||||||||||||||||

| Held to Maturity: | Amortized Cost | | Amortized Cost | | |||||||||||||||||||||

| Fair Value | Gains | Losses | Fair Value | Gains | Losses | ||||||||||||||||||||

| Unit investment trusts of preferred stocks | $ | — | $ | — | $ | — | $ | — | $ | 1,462 | $ | 3,381 | $ | 1,919 | $ | — | |||||||||

| Municipal bonds | 127,667 | 128,631 | 964 | — | 97,744 | 97,807 | 63 | — | |||||||||||||||||

| Unit investment trusts of municipal bonds | 918 | 910 | — | (8 | ) | 941 | 932 | — | (9 | ) | |||||||||||||||

| Private export funding securities | — | — | — | — | 4,115 | 4,104 | — | (11 | ) | ||||||||||||||||

| $ | 128,585 | $ | 129,541 | $ | 964 | $ | (8 | ) | $ | 104,262 | $ | 106,224 | $ | 1,982 | $ | (20 | ) | ||||||||

| Available for Sale: | |||||||||||||||||||||||||

| Municipal bonds | $ | 23,679 | $ | 23,665 | — | $ | (14 | ) | $ | 32,487 | $ | 32,221 | $ | — | $ | (266 | ) | ||||||||

| Mutual funds | 2,454 | 3,179 | 725 | — | 2,454 | 3,724 | 1,270 | — | |||||||||||||||||

| $ | 26,133 | $ | 26,844 | $ | 725 | $ | (14 | ) | $ | 34,941 | $ | 35,945 | $ | 1,270 | $ | (266 | ) | ||||||||

Held to maturity securities of $26,000 and $6,097 and available for sale securities of $4,591 and $13,380 were included in cash and cash equivalents at December 31, 2001 and 2000, respectively. There were no securities with maturities greater than four years and gross realized gains and losses on the sale of available for sale securities in 2001 and 2000 were not significant.

NOTE 12—SUMMARY OF SALES, NET EARNINGS AND ASSETS BY GEOGRAPHIC AREA:

| | 2001 | 2000 | 1999 | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

United States | Mexico and Canada | Consoli- dated | United States | Mexico and Canada | Consoli- dated | United States | Mexico and Canada | Consoli- dated | |||||||||||||||||||

| Sales to unaffiliated customers | $ | 392,024 | $ | 31,472 | $ | 423,496 | $ | 394,545 | $ | 32,509 | $ | 427,054 | $ | 365,975 | $ | 30,775 | $ | 396,750 | |||||||||

| Sales between geographic areas | 3,649 | 2,731 | 3,626 | 3,343 | 3,787 | 1,794 | |||||||||||||||||||||

| $ | 395,673 | $ | 34,203 | $ | 398,171 | $ | 35,852 | $ | 369,762 | $ | 32,569 | ||||||||||||||||

| Net earnings | $ | 65,370 | $ | 317 | $ | 65,687 | $ | 73,929 | $ | 1,808 | $ | 75,737 | $ | 69,917 | $ | 1,393 | $ | 71,310 | |||||||||

| Total assets | $ | 596,303 | $ | 22,373 | $ | 618,676 | $ | 540,697 | $ | 21,745 | $ | 562,442 | $ | 505,152 | $ | 24,264 | $ | 529,416 | |||||||||

| Net assets | $ | 489,552 | $ | 18,909 | $ | 508,461 | $ | 439,685 | $ | 19,011 | $ | 458,696 | $ | 409,160 | $ | 21,486 | $ | 430,646 | |||||||||

Total assets are those assets associated with or used directly in the respective geographic area, excluding intercompany advances and investments.

15

Report of Independent Accountants

To the Board of Directors and Shareholders of Tootsie Roll Industries, Inc.

In our opinion, the accompanying consolidated statements of financial position and the related consolidated statements of earnings, comprehensive earnings and retained earnings and of cash flows present fairly, in all material respects, the financial position of Tootsie Roll Industries, Inc. and its subsidiaries at December 31, 2001 and 2000, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2001 in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the company's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these statements in accordance with auditing standards generally accepted in the United States of America, which require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion expressed above.

![]()

Chicago, Illinois

February 11, 2002

Quarterly Financial Data (Unaudited)

TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES

| | (Thousands of dollars except per share data) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2001 | First | Second | Third | Fourth | Total | |||||

| Net sales | $82,621 | $86,882 | $158,781 | $95,212 | $423,496 | |||||

| Gross margin | 42,958 | 43,517 | 76,304 | 44,060 | 206,839 | |||||

| Net earnings | 12,385 | 13,902 | 27,010 | 12,390 | 65,687 | |||||

| Net earnings per share | .25 | .28 | .54 | .25 | 1.30 | |||||

2000 | ||||||||||

| Net sales | $78,015 | $90,376 | $165,873 | $92,790 | $427,054 | |||||

| Gross margin | 41,067 | 48,209 | 83,225 | 47,453 | 219,954 | |||||

| Net earnings | 13,063 | 15,652 | 31,514 | 15,508 | 75,737 | |||||

| Net earnings per share | .25 | .31 | .62 | .30 | 1.49 | |||||

1999 | ||||||||||

| Net sales | $74,200 | $88,265 | $152,667 | $81,618 | $396,750 | |||||

| Gross margin | 38,815 | 45,902 | 77,651 | 41,821 | 204,189 | |||||

| Net earnings | 12,325 | 14,751 | 29,283 | 14,951 | 71,310 | |||||

| Net earnings per share | .23 | .28 | .56 | .29 | 1.37 | |||||

Net earnings per share is based upon average outstanding shares as adjusted for 3% stock dividends issued during the second quarter of each year. The sum of the per share amounts may not equal annual amounts due to rounding.

2001-2000 QUARTERLY SUMMARY OF TOOTSIE ROLL INDUSTRIES, INC. STOCK PRICE AND DIVIDENDS PER SHARE

STOCK PRICES*

| | 2001 | 2000 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | High | Low | High | Low | ||||||||

| 1st Qtr | $ | 51.10 | $ | 43.31 | $ | 32.88 | $ | 28.31 | ||||

| 2nd Qtr | $ | 48.89 | $ | 38.54 | $ | 38.00 | $ | 30.38 | ||||

| 3rd Qtr | $ | 40.55 | $ | 35.08 | $ | 42.44 | $ | 34.88 | ||||

| 4th Qtr | $ | 39.44 | $ | 36.35 | $ | 47.81 | $ | 35.63 | ||||

*NYSE — Composite Quotations

| Estimated Number of shareholders at December 31, 2001 | 9,500 |

DIVIDENDS

| | 2001 | 2000 | ||||

|---|---|---|---|---|---|---|

| 1st Qtr | $ | .0680 | $ | .0587 | ||

| 2nd Qtr | $ | .0700 | $ | .0680 | ||

| 3rd Qtr | $ | .0700 | $ | .0680 | ||

| 4th Qtr | $ | .0700 | $ | .0680 | ||

NOTE: In addition to the above cash dividends, a 3% stock dividend was issued on April 18, 2001 and April 19, 2000. Cash dividends are restated to reflect 3% stock dividends.

16

Five Year Summary of Earnings and Financial Highlights

| TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES | ||||||||||

| (Thousands of dollars except per share, percentage and ratio figures) | ||||||||||

(See Management's Comments starting on page 5) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2001 | 2000 | 1999 | 1998 | 1997 | |||||||||||||||

Sales and Earnings Data | |||||||||||||||||||

| Net sales | $ | 423,496 | $ | 427,054 | $ | 396,750 | $ | 388,659 | $ | 375,594 | |||||||||

| Gross margin | 206,839 | 219,954 | 204,189 | 201,042 | 187,281 | ||||||||||||||

| Interest expense | 356 | 866 | 453 | 756 | 483 | ||||||||||||||

| Provision for income taxes | 35,100 | 42,071 | 40,137 | 38,537 | 34,679 | ||||||||||||||

| Net earnings | 65,687 | 75,737 | 71,310 | 67,526 | 60,682 | ||||||||||||||

| % of sales | 15.5% | 17.7% | 18.0% | 17.4 | % | 16.2 | % | ||||||||||||

| % of shareholders' equity | 12.9% | 16.5% | 16.6% | 17.0 | % | 17.3 | % | ||||||||||||

Per Common Share Data (1) | |||||||||||||||||||

| Net sales | $ | 8.39 | $ | 8.39 | $ | 7.65 | $ | 7.42 | $ | 7.14 | |||||||||

| Net earnings | 1.30 | 1.49 | 1.37 | 1.29 | 1.15 | ||||||||||||||

| Shareholders' equity | 10.09 | 9.09 | 8.38 | 7.60 | 6.69 | ||||||||||||||

| Cash dividends declared | .28 | .26 | .23 | .18 | .14 | ||||||||||||||

| Stock dividends | 3 | % | 3 | % | 3 | % | 3 | % | 3 | % | |||||||||

Additional Financial Data | |||||||||||||||||||

| Working capital | $ | 188,250 | $ | 145,765 | $ | 168,423 | $ | 175,155 | $ | 153,355 | |||||||||

| Net cash provided by operating activities | 81,505 | 84,881 | 72,935 | 77,735 | 68,176 | ||||||||||||||

| Net cash used in investing activities | 19,755 | 66,467 | 26,993 | 34,829 | 31,698 | ||||||||||||||

| Net cash used in financing activities | 16,100 | 46,036 | 38,182 | 22,595 | 21,704 | ||||||||||||||

| Property, plant & equipment additions | 14,148 | 16,189 | 20,283 | 14,878 | 8,611 | ||||||||||||||

| Net property, plant & equipment | 132,575 | 131,118 | 95,897 | 83,024 | 78,364 | ||||||||||||||

| Total assets | 618,676 | 562,442 | 529,416 | 487,423 | 436,742 | ||||||||||||||

| Long term debt | 7,500 | 7,500 | 7,500 | 7,500 | 7,500 | ||||||||||||||

| Shareholders' equity | 508,461 | 458,696 | 430,646 | 396,457 | 351,163 | ||||||||||||||

| Average shares outstanding (1) | 50,451 | 50,898 | 51,877 | 52,384 | 52,627 | ||||||||||||||

- (1)

- Adjusted for annual 3% stock dividends and the 2-for-1 stock split effective July 13, 1998.

17

Board of Directors | ||

Melvin J. Gordon(1) | Chairman of the Board and Chief Executive Officer | |

| Ellen R. Gordon(1) | President and Chief Operating Officer | |

| Charles W. Seibert(2)(3) | Retired Banker | |

| Lana Jane Lewis-Brent(2)(3) | President, Paul Brent Designer, Inc. | |

| Richard P. Bergeman(2)(3) | Retired Senior Vice President, Bestfoods | |

| (1)Member of the Executive Committee | ||

| (2)Member of the Audit Committee | ||

| (3)Member of the Compensation Committee | ||

Officers | ||

Melvin J. Gordon | Chairman of the Board and Chief Executive Officer | |

| Ellen R. Gordon | President and Chief Operating Officer | |

| G. Howard Ember, Jr. | Vice President, Finance & Asst. Secy. | |

| John W. Newlin, Jr. | Vice President, Manufacturing | |

| Thomas E. Corr | Vice President, Marketing & Sales | |

| James M. Hunt | Vice President, Physical Distribution | |

| Barry P. Bowen | Treasurer & Asst. Secy. | |

| Daniel P. Drechney | Controller | |

Offices, Plants | ||

Executive Offices | 7401 S. Cicero Ave. Chicago, Illinois 60629 www.tootsie.com | |

| Plants | Illinois Tennessee Massachusetts Wisconsin New York Mexico City | |

| Foreign Sales Offices | Mexico City, Mexico Mississauga, Ontario | |

Subsidiaries | ||

Andes Candies L.P. Andes Manufacturing LLC Andes Services LLC C.C. L.P., Inc. C.G.C. Corporation C.G.P., Inc. Cambridge Brands, Inc. Cambridge Brands Mfg., Inc. Cambridge Brands Services, Inc. Cella's Confections, Inc. Charms Company Charms L.P. Charms Marketing Company Henry Eisen Advertising Agency, Inc. J.T. Company, Inc. O'Tec Industries, Inc. | Tootsie Roll of Canada Ltd. Tootsie Roll Central Europe Ltd. The Tootsie Roll Company, Inc. Tootsie Roll Management, Inc. Tootsie Roll Mfg., Inc. Tootsie Rolls—Latin America, Inc. Tootsie Roll Worldwide Ltd. The Sweets Mix Company, Inc. TRI de Latino America S.A. de C.V. TRI Finance, Inc. TRI International Co. TRI-Mass., Inc. TRI Sales Co. TRI Sales Finance Company Ltd. Tutsi S.A. de C.V. World Trade & Marketing Ltd. | |

Other Information | ||||

Stock Exchange | New York Stock Exchange, Inc. (Since 1922) | |||

| Stock Identification | Ticker Symbol: TR CUSIP No. 890516 10-7 | |||

| Stock Transfer Agent and Stock Registrar | Mellon Investor Services LLC Overpeck Centre 85 Challenger Road Ridgefield Park, NJ 07660 1-800-851-9677 www.mellon-investor.com | |||

| Independent Accountants | PricewaterhouseCoopers LLP One North Wacker Chicago, IL 60606 | |||

| General Counsel | Becker Ross Stone DeStefano & Klein 317 Madison Avenue New York, NY 10017 | |||

| Annual Meeting | May 6, 2002 Mutual Building, Room 1200 909 East Main Street Richmond, VA 23219 |  | ||

Printed on recycled paper. | |||

18

Corporate Profile

Corporate Principles

To Our Shareholders

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Consolidated Statement of Earnings, Comprehensive Earnings and Retained Earnings

Consolidated Statement of Financial Position

Consolidated Statement of Cash Flows

Notes to Consolidated Financial Statements

Report of Independent Accountants

Quarterly Financial Data (Unaudited)

Five Year Summary of Earnings and Financial Highlights