EXHIBIT 13.3

TransCanada PipeLines Limited

2016 Annual information form

March 15, 2017

BLANK PAGE FOR MARGINS - REMOVE!

|

| | |

| | TCPL Annual information form 2016 | 2 |

Contents |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Acquisition of Columbia Pipeline Group, Inc. | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Presentation of information

Unless the context indicates otherwise, a reference in this Annual information form (AIF) to TransCanada PipeLines Limited (TCPL) or the Company, we, us and our includes TCPL's parent, TransCanada Corporation (TransCanada) and the subsidiaries of TCPL through which its various business operations are conducted, and a reference to TransCanada includes TransCanada Corporation and the subsidiaries of TransCanada Corporation, including TCPL. Where TCPL is referred to with respect to actions that occurred prior to its 2003 plan of arrangement (the Arrangement) with TransCanada, which is described below under the heading TransCanada PipeLines Limited – Corporate structure, these actions were taken by TCPL or its subsidiaries. The term subsidiary, when referred to in this AIF, with reference to TCPL means direct and indirect wholly owned subsidiaries of, and legal entities controlled by, TransCanada or TCPL, as applicable.

Unless otherwise noted, the information contained in this AIF is given at or for the year ended December 31, 2016 (Year End). Amounts are expressed in Canadian dollars unless otherwise indicated. Information in relation to metric conversion can be found at Schedule A to this AIF. The Glossary found at the end of this AIF contains certain terms defined throughout this AIF and abbreviations and acronyms that may not otherwise be defined in this document.

Certain portions of TCPL's Management's discussion and analysis dated February 15, 2017 (MD&A) are incorporated by reference into this AIF as stated below. The MD&A can be found on SEDAR (www.sedar.com) under TCPL's profile.

Financial information is presented in accordance with United States generally accepted accounting principles (GAAP). We use certain financial measures that do not have a standardized meaning under GAAP and therefore they may not be comparable to similar measures presented by other entities. Refer to the About this document – Non-GAAP measures section of the MD&A for more information about the non-GAAP measures we use and a reconciliation to their GAAP equivalents, which section of the MD&A is incorporated by reference herein.

Forward-looking information

This AIF, including the MD&A disclosure incorporated by reference herein, contains certain information that is forward-looking and is subject to important risks and uncertainties. We disclose forward-looking information to help current and potential investors understand management’s assessment of our future plans and financial outlook, and our future prospects overall.

Statements that are forward-looking are based on certain assumptions and on what we know and expect today and generally include words like anticipate, expect, believe, may, will, should, estimate or other similar words.

Forward-looking statements in this document include information about the following, among other things:

| |

| • | planned changes in our business including the divestiture of certain assets |

| |

| • | our financial and operational performance, including the performance of our subsidiaries |

| |

| • | expectations or projections about strategies and goals for growth and expansion |

| |

| • | expected cash flows and future financing options available to us |

| |

| • | expected dividend growth |

| |

| • | expected costs for planned projects, including projects under construction, permitting and in development |

| |

| • | expected schedules for planned projects (including anticipated construction and completion dates) |

| |

| • | expected regulatory processes and outcomes |

| |

| • | expected impact of regulatory outcomes |

| |

| • | expected outcomes with respect to legal proceedings, including arbitration and insurance claims |

| |

| • | expected capital expenditures and contractual obligations |

| |

| • | expected operating and financial results |

| |

| • | the expected impact of future accounting changes, commitments and contingent liabilities |

| |

| • | expected industry, market and economic conditions. |

Forward-looking statements do not guarantee future performance. Actual events and results could be significantly different because of assumptions, risks or uncertainties related to our business or events that happen after the date of this document.

Our forward-looking information is based on the following key assumptions, and subject to the following risks and uncertainties:

|

| | |

| 2 | TCPL Annual information form 2016 | |

Assumptions

| |

| • | planned monetization of our U.S. Northeast power business |

| |

| • | inflation rates, commodity prices and capacity prices |

| |

| • | nature and scope of hedging |

| |

| • | regulatory decisions and outcomes |

| |

| • | the Canadian dollar to U.S. dollar exchange rate remains at or near current levels |

| |

| • | planned and unplanned outages and the use of our pipeline and energy assets |

| |

| • | integrity and reliability of our assets |

| |

| • | access to capital markets |

| |

| • | anticipated construction costs, schedules and completion dates. |

Risks and uncertainties

| |

| • | our ability to realize the anticipated benefits from the acquisition of Columbia Pipeline Group, Inc. (Columbia) |

| |

| • | timing and execution of our planned asset sales |

| |

| • | our ability to successfully implement our strategic initiatives |

| |

| • | whether our strategic initiatives will yield the expected benefits |

| |

| • | the operating performance of our pipeline and energy assets |

| |

| • | amount of capacity sold and rates achieved in our pipeline businesses |

| |

| • | the availability and price of energy commodities |

| |

| • | the amount of capacity payments and revenues we receive from our energy business |

| |

| • | regulatory decisions and outcomes |

| |

| • | outcomes of legal proceedings, including arbitration and insurance claims |

| |

| • | performance and credit risk of our counterparties |

| |

| • | changes in market commodity prices |

| |

| • | changes in the political environment |

| |

| • | changes in environmental and other laws and regulations |

| |

| • | competitive factors in the pipeline and energy sectors |

| |

| • | construction and completion of capital projects |

| |

| • | costs for labour, equipment and materials |

| |

| • | access to capital markets |

| |

| • | interest, tax and foreign exchange rates |

| |

| • | technological developments |

| |

| • | economic conditions in North America as well as globally. |

You can read more about these factors and others in reports we have filed with Canadian securities regulators and the U.S. Securities and Exchange Commission (SEC).

As actual results could vary significantly from the forward-looking information, you should not put undue reliance on forward-looking information and should not use future-oriented information or financial outlooks for anything other than their intended purpose. We do not update our forward-looking statements due to new information or future events, unless we are required to by law.

|

| | |

| | TCPL Annual information form 2016 | 3 |

TransCanada PipeLines Limited

CORPORATE STRUCTURE

TCPL's head office and registered office are located at 450 - 1st Street S.W., Calgary, Alberta, T2P 5H1. TCPL is a reporting issuer in the jurisdictions of Canada. Significant dates and events are set forth below.

|

| |

| Date | Event |

| | |

| March 21, 1951 | Incorporated by Special Act of Parliament as Trans-Canada Pipe Lines Limited. |

| April 19, 1972 | Continued under the Canada Corporations Act by Letters Patent, which included the alteration of its capital and change of name to TransCanada PipeLines Limited. |

| June 1, 1979 | Continued under the Canada Business Corporations Act (CBCA). |

| July 2, 1998 | Certificate of Arrangement issued in connection with the Plan of Arrangement with NOVA Corporation under which the companies merged and then split off the commodity chemicals business carried on by NOVA Corporation into a separate public company. |

| January 1, 1999 | Certificate of Amalgamation issued reflecting TCPL's vertical short form amalgamation with a wholly owned subsidiary, Alberta Natural Gas Company Ltd. |

| January 1, 2000 | Certificate of Amalgamation issued reflecting TCPL's vertical short form amalgamation with a wholly owned subsidiary, NOVA Gas International Ltd. |

| May 4, 2001 | Restated TCPL Articles of Incorporation filed. |

| June 20, 2002 | Restated TCPL Limited By-Laws filed. |

| May 15, 2003 | Certificate of Arrangement issued in connection with the plan of arrangement with TransCanada. TransCanada was incorporated pursuant to the provisions of the CBCA on February 25, 2003. The arrangement was approved by TCPL common shareholders on April 25, 2003 and following court approval, Articles of Arrangement were filed making the arrangement effective May 15, 2003. The common shareholders of TCPL exchanged each of their common shares of TCPL for one common share of TransCanada. The debt securities and preferred shares of TCPL remained obligations and securities of TCPL. TCPL continues to carry on business as the principal operating subsidiary of the TransCanada group of entities. |

|

| | |

| 4 | TCPL Annual information form 2016 | |

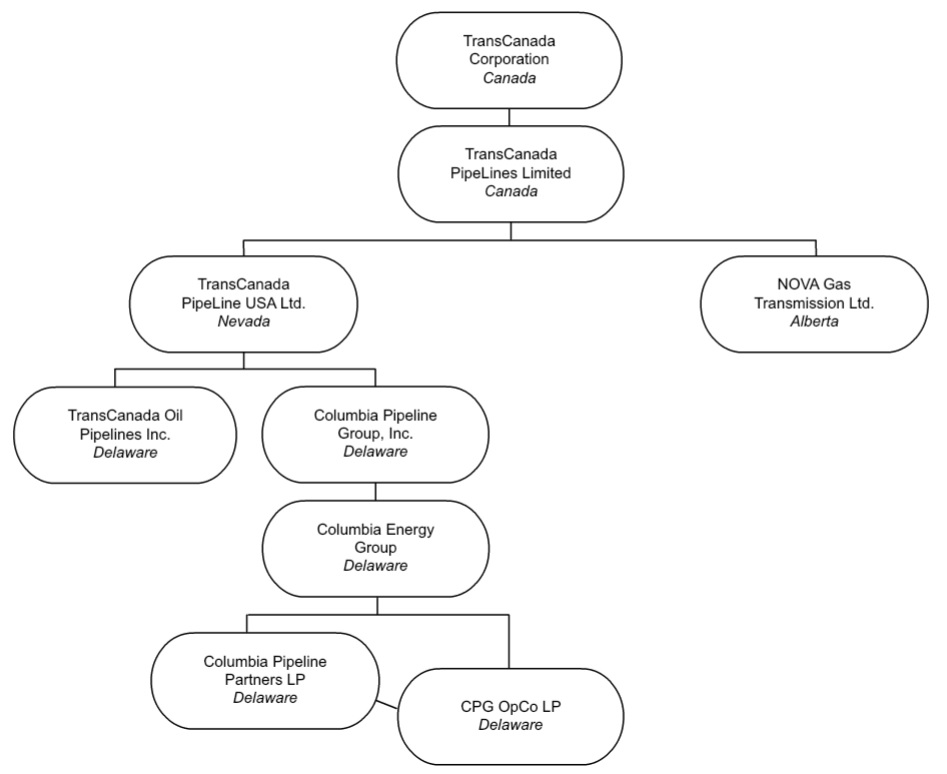

INTERCORPORATE RELATIONSHIPS

The following diagram presents the name and jurisdiction of incorporation, continuance or formation of TCPL’s principal subsidiaries as at Year End. Each of the subsidiaries shown has total assets that exceeded 10 per cent of the total consolidated assets of TCPL as at year end or revenues that exceeded 10 per cent of the total consolidated revenues of TCPL for the year then ended. TCPL beneficially owns, controls or directs, directly or indirectly, 100 per cent of the voting shares or units in each of these subsidiaries.

|

|

TransCanada Corporation – Canada TransCanada PipeLines Limited – Canada TransCanada PipeLine USA Ltd. – Nevada TransCanada Oil Pipelines Inc. – Delaware Columbia Pipeline Group, Inc. – Delaware Columbia Energy Group – Delaware Columbia Pipeline Partners LP – Delaware CPG OpCo LP – Delaware NOVA Gas Transmission Ltd. – Alberta

|

The above diagram does not include all of the subsidiaries of TCPL. The assets and revenues of excluded subsidiaries in the aggregate did not exceed 20 per cent of the total consolidated assets of TCPL as at Year End or total consolidated revenues of TCPL for the year then ended.

|

| | |

| | TCPL Annual information form 2016 | 5 |

General development of the business

We operate in three core businesses: Natural Gas Pipelines, Liquids Pipelines and Energy. As a result of our acquisition of Columbia on July 1, 2016 and the pending sales of the U.S. Northeast power business, we have determined that a change in our operating segments is appropriate. Accordingly, we consider ourselves to be operating in the following segments: Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines, Liquids Pipelines and Energy. This provides information that is aligned with how management decisions about our business are made and how performance of our business is assessed. We also have a non-operational Corporate segment consisting of corporate and administrative functions that provide governance and other support to our operational business segments.

Natural Gas Pipelines and Liquids Pipelines are principally comprised of our respective natural gas and liquids pipelines in Canada, the U.S. and Mexico as well as our regulated natural gas storage operations in the U.S. Energy includes our power operations and the non-regulated natural gas storage business in Canada.

Summarized below are significant developments that have occurred in our Natural Gas Pipelines, Liquids Pipelines and Energy businesses, respectively, and certain acquisitions, dispositions, events or conditions which have had an influence on that development, during the last three financial years and year to date in 2017. Further information about changes in our business that we expect to occur during the current financial year can be found in the Canadian Natural Gas Pipelines , U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines, Liquids Pipelines and Energy sections of the MD&A, which sections of the MD&A are incorporated by reference herein.

NATURAL GAS PIPELINES

Developments in the Canadian Natural Gas Pipelines segment

|

| |

| Date | Description of development |

| | |

| Canadian Regulated Pipelines |

| | |

| NGTL System |

| | |

| March 2014 | We received an NEB Safety Order (the Order) in response to the recent pipeline releases on the NGTL System. The Order required us to reduce the maximum operating pressure on three per cent of NGTL’s pipeline segments. We filed a request for a review and variance of the Order that would minimize gas disruptions while still maintaining a high level of safety, which the NEB granted in April 2014 subject to certain conditions. We accelerated components of our integrity management program to address the NEB Order. |

| March 2014 | The NEB approved approximately $400 million in NGTL facility expansions. |

| Fourth Quarter 2014 | We continued to experience significant growth on the NGTL System as a result of growing natural gas supply in northwestern Alberta and northeastern British Columbia (B.C.) from unconventional gas plays and substantive growth in intra-basin delivery markets. This demand growth was driven primarily by oil sands development, gas-fired electric power generation and expectations regarding B.C. west coast LNG projects. |

| First Quarter 2015 | The NGTL System had approximately $6.7 billion of new supply and demand facilities under development and we continued to advance several of these capital expansion projects by filing the regulatory applications with the NEB. We also received additional requests for firm receipt service. |

| Fourth Quarter 2015 / First Quarter 2016 | In 2015, we placed approximately $350 million of facilities in service. In 2016, the NGTL System continued to develop further new supply and demand facilities. We had approximately $2.3 billion of facilities that received regulatory approval and had approximately $450 million currently under construction. We filed for approval for a further approximately $2.0 billion of facilities which are currently under regulatory review. Applications for approval to construct and operate an additional $3.0 billion of facilities have yet to be filed. Included in our capital program is the recently announced 2018 expansion of a further $600 million of facilities required on the NGTL System. The 2018 expansion includes multiple projects totaling approximately 88 km (55 miles) of 20-to 48-inch diameter pipeline, one new compressor, approximately 35 new and expanded meter stations and other associated facilities. Subject to regulatory approvals, construction is expected to start in 2017, with all facilities expected to be in service in 2018. |

| October 2016 | On October 6, 2016, the NEB recommended government approval of the $0.4 billion Towerbirch Project. This project consists of a 55 km (34 miles) 36-inch pipeline loop and a 32 km (20 miles) 30-inch pipeline extension of the NGTL System in northwest Alberta and northeast B.C. The NEB approved the continued use of the existing rolled-in toll methodology for this project. On October 31, 2016, the Government of Canada approved our $1.3 billion NGTL 2017 Facilities Application, which is a major component of the 2016/2017 program. This NGTL expansion program consists of five pipeline loops ranging in size from 24-inch up to 48-inch pipe of approximately 230 km (143 miles) in length, plus two compressor station unit additions of approximately 46.5 MW (62,360 HP). |

|

| | |

| 6 | TCPL Annual information form 2016 | |

|

| |

| Date | Description of development |

| December 2016 | We announced the $0.6 billion Saddle West expansion of the NGTL System to increase natural gas transportation capacity on the northwest portion of our system. The project will consist of 29 km (18 miles) of 36-inch pipeline looping of existing mainlines, the addition of five compressor units at existing station sites and new metering facilities. The project is underpinned by incremental firm service contracts and is expected to be in-service in 2019. NGTL currently has a $3.7 billion near-term capital program for completion to 2020, including the Saddle West expansion and excluding the $1.7 billion North Montney and $1.9 billion Merrick pipeline projects. In 2016, we have placed in service approximately $0.5 billion of facilities. We currently have regulatory approval for $2.0 billion of facilities and plan to place in service $1.6 billion of new facilities in 2017. |

| | |

| NGTL Revenue Requirement Settlements |

| | |

| October 2014 | We reached a revenue requirement settlement with our shippers for 2015 on the NGTL System. |

| February 2015 | We received NEB approval for our revenue requirement settlement with our shippers for 2015 on the NGTL System. The terms of the one year settlement include continuation of the 2014 ROE of 10.1 per cent on 40 per cent deemed equity, continuation of the 2014 depreciation rates and a mechanism for sharing variances above and below a fixed operating, maintenance and administration (OM&A) expense amount that is based on an escalation of 2014 actual costs. |

| December 2015 | We reached a two-year revenue requirement agreement with customers and other interested parties on the annual costs, including return on equity and depreciation required to operate the NGTL System for 2016 and 2017. The agreement fixes the equity return at 10.1 per cent on 40 per cent deemed common equity, establishes depreciation at a forecast composite rate of 3.16 per cent and fixes OM&A costs at $222.5 million annually. An incentive mechanism for variances will enable NGTL to capture savings from improved performance and provide for the flow-through of all other costs, including pipeline integrity expenses and emissions costs. on December 1, 2015, NGTL filed with the NEB for approval of the agreement. |

| | |

| North Montney |

| | |

| June 2015 | The NEB approved the $1.7 billion North Montney Mainline (NMML) project subject to certain terms and conditions. Under one of these conditions, construction on the NMML project can only begin after a positive final investment decision (FID) has been made on the proposed Pacific North West LNG project (PNW LNG). The NMML will provide substantial new capacity on the NGTL System to meet the transportation requirements associated with rapidly increasing development of natural gas resources in the Montney supply basin in northeastern B.C. The project will connect Montney and other Western Canada Sedimentary Basin (WCSB) supply to both existing and new natural gas markets, including LNG markets. The project will also include an interconnection with our proposed Prince Rupert Gas Transmission Project (PRGT) to provide natural gas supply to the proposed PNW LNG liquefaction and export facility near Prince Rupert, B.C. |

| September 2016 | The Canadian Government approved the sunset clause extension request we filed in March 2016, for the NMML Certificate of Public Convenience and Necessity for one year to June 10, 2017. The extension continues to be subject to the condition that construction shall not begin until a positive FID has been made on PNW LNG. NGTL continues to work with our customers and stakeholders to be ready to initiate construction of the $1.7 billion North Montney facilities, however, the in-service date will be finalized once a FID has been made. |

| March 2017 | We announced that we filed a variance application with the NEB to proceed with construction of the NMML project in northeast B.C. As discussed above, TransCanada had previously been granted the required primary federal and provincial approvals to construct NMML, subject to conditions that included the requirement for a positive final investment decision on the proposed PNW LNG project. The requested variance would allow TransCanada to move forward with construction of the majority of the NMML Project, at an estimated capital cost of approximately $1.4 billion, prior to a final investment decision on the PNW LNG project. In support of the variance for the NMML project, TransCanada secured new 20-year commercial contracts with 11 shippers for approximately 1.5 Bcf/d of firm service. |

| | |

| Canadian Mainline – Kings North and Station 130 Facilities |

| | |

| Fourth Quarter 2016 | We placed in service the approximate $310 million Kings North Connector and the approximate $75 million compressor unit addition at Station 130 on the Canadian Mainline system. These two projects are consistent with our current 2015-2020 Mainline Settlement with our shippers and provide optionality to access alternative supply sources while contracting for increased short haul transportation service within the Eastern Triangle area of the Canadian Mainline system. |

| | |

| Canadian Mainline – Eastern Mainline Project |

| | |

| May 2014 | We filed a project description with the NEB for the Eastern Mainline Project. |

| October 2014 | We filed an application with the NEB for the Energy East pipeline project and to transfer a portion of the Canadian Mainline from natural gas service to crude oil service. We also filed an application for the Eastern Mainline Project, consisting of new gas facilities in southeastern Ontario required as a result of the proposed transfer of Mainline assets to crude oil service for the Energy East pipeline project. This $2 billion project consists of new gas facilities in southeastern Ontario that will be required as a result of the proposed Energy East pipeline project that includes a planned transfer of a portion of Canadian Mainline from natural gas service to crude oil service. |

| August 2015 | TransCanada announced it had reached an agreement with eastern local distribution companies (LDCs)

that resolved their issues with Energy East pipeline project and the Eastern Mainline Project. |

|

| | |

| | TCPL Annual information form 2016 | 7 |

|

| |

| Date | Description of development |

| December 2015 | Application amendments were filed that reflect the agreement we announced in August 2015 with eastern LDCs resolving their issues with Energy East pipeline project and the Eastern Mainline Project. The agreement provided gas consumers in eastern Canada with sufficient natural gas transmission capacity and provides for reduced natural gas transmission costs. |

| January 2016 | The Canadian federal government announced interim measures for its review of the Energy East pipeline project. The government announced it will undertake additional consultations with aboriginal groups, help facilitate expanded public input into the NEB, and assess upstream GHG emissions associated with the project. The government will seek a six month extension to the NEB’s legislative review and a three month extension to the legislative time limit for the government’s decision. We are reviewing these changes and will assess the impacts to the Eastern Mainline Project. The Eastern Mainline Project is conditioned on the approval and construction of the Energy East pipeline. Refer to the General development of the business – Liquids pipelines section for an update on Energy East. |

| | |

| Canadian Mainline – Other Expansions |

| | |

| January 2014 | Shippers on the Canadian Mainline elected to renew approximately 2.5 Bcf/d of their contracts through November 2016. |

| November 2014 | In addition to the Eastern Mainline Project, we executed new short haul arrangements in the Eastern Triangle portion of the Canadian Mainline that require new facilities, or modifications to existing facilities. These projects are subject to regulatory approval and, once constructed, will provide capacity needed to meet customer requirements in eastern Canada. |

| First Quarter 2016 | In addition to the Eastern Mainline Project, new facilities investments totaling approximately $700 million over the 2016 to 2017 period in the Eastern Triangle portion of the Canadian Mainline were required to meet contractual commitments from shippers. Also refer to the Canadian Mainline - Kings North and Station 130 Facilities section

above. |

| Third Quarter 2016 | We launched an open season for the Canadian Mainline, seeking binding commitments on our new long-term, fixed-price proposal to transport WCSB supply from the Empress receipt point in Alberta to the Dawn hub in Southern Ontario. The open season for the proposed service resulted in bids that fell well short of the volumes required to make the proposal viable. On November 15, 2016 we announced we would not proceed with the service offering at that time. |

| First Quarter 2017 | In addition to the Eastern Mainline Project, new facilities investments in the Eastern Triangle portion of the Canadian Mainline are planned for 2017. Including the Vaughan Loop, with a planned in-service date of November 2017, we have approximately $300 million of additional investment to meet contractual commitments from shippers. |

| March 2017 | We announced the successful conclusion of a long-term, fixed-price Open Season to transport natural gas on the Canadian Mainline from the Empress receipt point in Alberta to the Dawn hub in Southern Ontario. The recent Open Season resulted in binding, long-term contracts from WCSB gas producers to transport 1.5 PJ/d of natural gas at a simplified toll of $0.77/GJ. |

| | |

| Canadian Mainline Settlement |

| | |

| March 2014 | The Canadian Mainline and the three largest Canadian local distribution companies (LDCs) entered into a settlement (LDC Settlement) which was filed with the NEB for approval in December 2013. In March 2014, the NEB responded to the LDC Settlement application and did not approve the application as a settlement, but allowed us the option to continue with the application as a contested tolls application, amend the application or terminate the processing of the application. The LDC Settlement calculated tolls for 2015 on a base ROE of 10.1 per cent on 40 per cent deemed common equity. It also included an incentive mechanism that required a $20 million (after tax) annual contribution by us from 2015 to 2020, which could have resulted in a range of ROE outcomes from 8.7 per cent to 11.5 per cent. The LDC Settlement would have enabled the addition of facilities in the Eastern Triangle to serve immediate market demand for supply diversity and market access. The LDC Settlement was intended to provide a market driven, stable, long-term accommodation of future demand in this region in combination with the anticipated lower demand for transportation on the Prairies Line and the Northern Ontario Line while providing a reasonable opportunity to recover our costs. The LDC Settlement also retained pricing flexibility for discretionary services and implemented certain tariff changes and new services as required by the terms of the settlement. We amended the application with additional information. |

| November 2014 | Following a hearing, the NEB approved the Canadian Mainline's 2015 - 2030 Tolls and Tariff Application (the NEB 2014 Decision) which superseded the NEB 2013 Decision. The application reflected components of the LDC Settlement. In 2014, the Canadian Mainline operated under the NEB's decision for the years 2013-2017, which included an approved ROE of 11.5 per cent on deemed common equity of 40 per cent and an incentive mechanism based on total net revenues. |

| First Quarter 2015 | In 2015, the Canadian Mainline began operating under the NEB 2014 Decision. |

| August 2015 | TransCanada announced it had reached an agreement with the eastern LDCs that resolves the LDCs’ issues with Energy East and the Eastern Mainline Project. |

| | |

|

| | |

| 8 | TCPL Annual information form 2016 | |

|

| |

| Date | Description of development |

| | |

| LNG PIPELINE PROJECTS |

| |

| Prince Rupert Gas Transmission |

| | |

| November 2014 | We received an Environmental Assessment Certificate (EAC) from the B.C. Environmental Assessment Office (EAO). We submitted our pipeline permit applications to the B.C. Oil and Gas Commission (OGC) for construction of the pipeline. We made significant changes to the project route since first announced, increasing it by 150 km (93 miles) to 900 km (559 miles), taking into account Aboriginal and stakeholder input. We continued to work closely with Aboriginal groups and stakeholders along the proposed route to create and deliver appropriate benefits to all impacted groups. We concluded a benefits agreement with the Nisga’a First Nation to allow 85 km (52 miles) of the proposed natural gas pipeline to run through Nisga'a Lands. |

| June 2015 | PNW LNG announced a positive FID for its proposed liquefaction and export facility, subject to two conditions. The first condition, approval by the Legislative Assembly of B.C. of a Project Development Agreement between PNW LNG and the Province of B.C., was satisfied in July 2015. The second condition is a positive regulatory decision on PNW LNG’s environmental assessment by the Government of Canada. |

| Third Quarter 2015 | We received all remaining permits from the B.C. OGC which completed the eleven permits required to build and operate PRGT. Environmental permits for the project were received in November 2014 from the B.C. EAO. With these permits, PRGT has all of the primary regulatory permits required for the project. We remain on target to begin construction following confirmation of a FID by PNW LNG. The in-service date for PRGT will be aligned with PNW LNG’s liquefaction facility timeline. |

| September 2016 | PNW LNG received an environmental certificate from the Government of Canada for a proposed LNG plant at Prince Rupert, B.C. PNW LNG has indicated they will conduct a total project review over the coming months prior to announcing next steps for the project. The project has key approvals in place and will advance construction following direction from PNW LNG. |

| December 2016 | PNW LNG received an LNG export license from the NEB which extended the export term from 25 years to 40 years.

We continued our engagement with Indigenous groups and have now signed project agreements with 14 First Nation groups along the pipeline route. Project agreements outline financial and other benefits and commitments that will be provided to each First Nation for as long as the project is in service. PRGT is a 900 km (559 miles) natural gas pipeline that will deliver gas from the North Montney producing region at an expected interconnect on the NGTL System near Fort St. John, B.C. to PNW LNG's proposed LNG facility near Prince Rupert, B.C. Should the project not proceed, our project costs (including carrying charges) are fully recoverable. The in-service date for PRGT will be aligned with PNW LNG's liquefaction facility timeline. |

| | |

| Coastal GasLink |

| | |

| January 2014 | We filed the EAC application with the B.C. EAO. We focused on community, landowner, government and Aboriginal engagement as the project advanced through the regulatory process. The pipeline was expected to be placed in service near the end of the decade, subject to a FID to be made by LNG Canada after obtaining final regulatory approvals. Coastal GasLink is a 670 km (416 miles) pipeline that will deliver natural gas from Montney gas producing region at an expected interconnect on NGTL near the Dawson Creek, B.C. area, to LNG Canada’s proposed LNG facility near Kitimat, BC. Should the project not proceed, our project costs (including carrying charges) are fully recoverable. |

| October 2014 | The EAO issued an EAC for Coastal GasLink. In 2014, we also submitted applications to the B.C. OGC for the permits required under the Oil and Gas Activities Act to build and operate Coastal GasLink. |

| First Quarter 2016 | We continued to engage with Indigenous groups and have now announced project agreements with 11 First Nation groups along the pipeline route which outline financial and other benefits and commitments that will be provided to each First Nation group for as long as the project is in service. We also continued to engage with stakeholders along the pipeline route and progressed detailed engineering and construction planning work to refine the capital cost estimate. In response to feedback received, we applied for a minor route amendment to the B.C. EAO in order to provide an option in the area of concern. |

| July 2016 | The LNG Canada joint venture participants announced a delay to their FID for the proposed liquefied natural gas facility in Kitimat, B.C. A future FID date has not been disclosed. We worked with LNG Canada to maintain the appropriate pace of the Coastal GasLink development schedule and work activities. We continued our engagement with Indigenous groups along our pipeline route and have now concluded long-term project agreements with 17 First Nation communities. We look to continue discussions with the remaining First Nations who have not signed project agreements. |

| | |

| Merrick Mainline |

| | |

| June 2014 | We announced the signing of agreements for approximately 1.9 Bcf/d of firm natural gas transportation services to underpin the development of a major extension of our NGTL System. The Merrick Mainline pipeline will deliver natural gas from NGTL's existing Groundbirch Mainline and the proposed PRGT project. Since the Merrick Mainline is dependent upon the construction of the downstream infrastructure, the in-service date of the Merrick Mainline remains uncertain. |

| | |

|

| | |

| | TCPL Annual information form 2016 | 9 |

Developments in the U.S. Natural Gas Pipelines segment

|

| |

| Date | Description of development |

| | |

| COLUMBIA ACQUISITION |

| | |

| July 2016 | On July 1, 2016, we acquired 100 per cent ownership of Columbia for a purchase price of US$10.3 billion in cash. The acquisition was financed through the issuance of TCPL common shares to TransCanada and an intercompany loan due to TransCanada in connection with proceeds received from the sale of TransCanada subscription receipts. The sale of TransCanada subscription receipts was completed on April 1, 2016 through a public offering and gross proceeds of approximately $4.4 billion were transferred to TCPL prior to the closing of the acquisition. In addition, we drew on acquisition bridge facilities in the aggregate amount of US$6.9 billion. In respect of the acquisition, we filed a business acquisition report on Form 51-102F4 on July 22, 2016, which can be found on the Company’s SEDAR profile at www.SEDAR.com. For more information about the acquisition of Columbia, refer to the About our business – Acquisition of Columbia Pipeline Group, Inc. section of the MD&A. |

| | |

| COLUMBIA CAPITAL PROJECTS |

| |

| Third Quarter 2016 | The July 1, 2016 acquisition of Columbia included a capital expansion program that was underway for new facilities planned to be in service in 2016 through 2018 as well as modernization programs for existing assets to be completed through 2020. The large capital expansion program, less projects completed in 2016, consists of US$6.8 billion related to our regulated pipeline business and US$0.3 billion related to our midstream business. The estimated project costs exclude AFUDC. The following summarizes the eight key capital projects for this new set of assets that are now part of our overall U.S. Natural Gas Pipelines footprint. For clarification, when used below, Columbia Gas is our natural gas transportation system for the Appalachian basin, which contains the Marcellus and Utica shale plays. This system also interconnects with other pipelines that provide access to key markets in the U.S. Northeast and south to the Gulf of Mexico and its growing demand for natural gas to serve LNG exports. Access to markets from producers in the region is driving the large capital program for new pipeline facilities on this system. Columbia Gulf is our pipeline system originally designed as a long haul delivery system transporting supply from the Gulf of Mexico to major supply markets in the U.S. Northeast. The pipeline is now transitioning and expanding to accommodate new supply in the Appalachian basin and its interconnect with Columbia Gas and other pipelines to deliver gas to various Gulf Coast markets. |

| | |

| Leach XPress |

| |

| June 2015 | The FERC 7(C) application for this Columbia Gas project was filed. The project is designed to transport approximately 1.5 Bcf/d of Marcellus and Utica gas supply to delivery points along the pipeline and to the Leach interconnect with Columbia Gulf. The project consists of 219 km (136 miles) of 36-inch greenfield pipe, 39 km (24 miles) of 36-inch loop, three km (two miles) of 30- inch greenfield pipe, 82.8 MW (111,000 hp) of greenfield compression and 24.6 MW (33,000 hp) of brownfield compression. |

| September 2016 | The Final Environmental Impact Statement (FEIS) for the project was received. |

| January 2017 | The FERC Order approving the construction of the facility was issued. Once remaining regulatory approvals are obtained, we plan to begin right-of-way preparation and construction activities in February 2017. We expect the project, with an estimated capital investment of US$1.4 billion, to be in service in fourth quarter 2017. |

| | |

| Rayne XPress |

| |

| July 2015 | The FERC 7(C) application for this Columbia Gulf project was filed. The project is designed to transport approximately 1.1 Bcf/d of southwest Marcellus and Utica production associated with the Leach XPress expansion and an interconnect with the Texas Eastern System to various delivery points on Columbia Gulf and the Gulf Coast. The project consists of bi-directional compressor station modifications along Columbia Gulf, 38.8 MW (52,000 hp) of greenfield compression, 20.1 MW (27,000 hp) of replacement compression and six km (four miles) of 30-inch pipe replacement. |

| September 2016 | The FEIS for the project was received. |

| January 2017 | The FERC Order approving the construction of the facility was issued. We expect the project, with an estimated capital investment of US$0.4 billion, to be in service on November 1, 2017. |

| | |

| Mountaineer XPress |

| |

| April 2016 | The FERC 7(C) application for this Columbia Gas project was filed. The project is designed to transport approximately 2.7 Bcf/d of Marcellus and Utica gas supply to delivery points along the pipeline and to the Leach interconnect with Columbia Gulf. The project consists of 264 km (164 miles) of 36-inch greenfield pipeline, 10 km (six miles) of 24-inch lateral pipeline, 0.6 km (0.4 miles) of 30-inch replacement pipeline, 114.1 MW (153,000 hp) of greenfield compression and 55.9 MW (75,000 hp) of brownfield compression. We expect this project, with an estimated capital investment of US$2.0 billion, to be in service in fourth quarter 2018. |

| | |

|

| | |

| 10 | TCPL Annual information form 2016 | |

|

| |

| Date | Description of development |

| | |

| Gulf XPress |

| |

| April 2016 | The FERC 7(C) application for this Columbia Gulf project was filed. The project is designed to transport approximately 0.9 Bcf/d associated with the Mountaineer XPress expansion to various delivery points on Columbia Gulf and the Gulf Coast. The project consists of adding seven greenfield midpoint compressor stations along the Columbia Gulf route totaling 182.7 MW (254,000 hp). We expect this project, with an estimated capital investment of US$0.6 billion, to be placed in service in fourth quarter 2018. |

| | |

| Cameron Access Project |

| |

| September 2015 | The FERC certificate for this Columbia Gulf project was received. The project is designed to transport approximately 0.8 Bcf/d of gas supply to the Cameron LNG export terminal in Louisiana. The project consists of 44 km (27 miles) of 36-inch greenfield pipeline, 11 km (seven miles) of 30-inch looping and 9.7 MW (13,000 hp) of greenfield compression. We expect this project, with an estimated capital investment of US$0.3 billion, to be in service in first quarter 2018. |

| | |

| WB XPress |

| |

| December 2015 | The FERC 7(C) application for both segments of this Columbia Gas project was filed. The project is designed to transport approximately 1.3 Bcf/d of Marcellus gas supply westbound (0.8 Bcf/d) to the Gulf Coast via an interconnect with the Tennessee Gas Pipeline, and eastbound (0.5 Bcf/d) to Mid-Atlantic markets. The project consists of 47 km (29 miles) of various diameter pipeline, 338 km (210 miles) of restoring and uprating maximum operating pressure of existing pipeline, 29.8 MW (40,000 hp) of greenfield compression and 99.9 MW (134,000 hp) of brownfield compression. We expect this project, with an estimated capital investment of US$0.8 billion, to have a Western build in service in the beginning of second quarter 2018 and an Eastern build in service in fourth quarter 2018. |

| | |

| Modernization I & II |

| |

| First Quarter 2017 | Columbia Gas and its customers have entered into a settlement arrangement, approved by FERC, which provides recovery and return on investment to modernize its system, improve system integrity and enhance service reliability and flexibility. The modernization program includes, among other things, replacement of aging pipeline and compressor facilities, enhancements to system inspection capabilities and improvements in control systems. Modernization I has been approved for up to US$0.6 billion of work with approximately US$0.2 billion remaining to be spent in 2017. Modernization II has been approved for up to US$1.1 billion of work to be completed through 2020. As per terms of the arrangements, facilities in service by October 31 collect revenues effective February 1 of the following year. |

| | |

| Midstream – Gibraltar Pipeline Project |

| |

| December 2016 | The first phase of the multi-phase project was completed. We expect to complete the US$0.3 billion investment to construct an approximate 1,000 TJ/d dry gas header pipeline in southwest Pennsylvania by the end of 2017. |

| | |

| OTHER U.S. NATURAL GAS PIPELINES |

| | |

| Columbia Pipeline Partners LP (CPPL) |

| | |

| November 2016 | We entered into an agreement and plan of merger through which Columbia agreed to acquire, for cash, all of the outstanding publicly held common units of CPPL at a price of US$17.00 per common unit for an aggregate transaction value of approximately US$915 million. The transaction closed on February 17, 2017. |

| | |

| ANR Pipeline |

| | |

| March 2014 | We secured nearly 2.0 Bcf/d of additional firm natural gas transportation commitments for existing and expanded capacity on ANR Pipeline's Southeast Mainline (SEML). The capacity sales and expansion projects include reversing the Lebanon Lateral in western Ohio, additional compression at Sulphur Springs, Indiana, expanding the Rockies Express pipeline interconnect near Shelbyville, Indiana and 600 MMcf/d of capacity as part of a reversal project on ANR's SEML. Capital costs associated with the ANR System expansions required to bring the additional capacity to market were estimated to be US$150 million. The capacity was subscribed at maximum rates for an average term of 23 years with approximately 1.25 Bcf/d of new contracts beginning service in late 2014. These secured contracts on the SEML will move Utica and Marcellus shale gas to points north and south on the system. ANR also assessed further demand from our customers to transport natural gas from the Utica/Marcellus formation, which was expected to result in incremental opportunities to enhance and expand the system. |

| January 2016 | ANR Pipeline filed a Section 4 Rate Case that requests an increase to ANR's maximum transportation rates. Shifts in ANR’s traditional supply sources and markets, necessary operational changes, needed infrastructure updates, and evolving regulatory requirements are driving required investment in facility maintenance, reliability and system integrity as well as an increase in operating costs that resulted in the current tariff rates not providing a reasonable return on our investment. We also pursued a collaborative process to find a mutually beneficial outcome with our customers through settlement negotiations. ANR's last rate case filing was more than 20 years ago. |

|

| | |

| | TCPL Annual information form 2016 | 11 |

|

| |

| Date | Description of development |

| Second and Third Quarters 2016 | ANR reached a settlement with its shippers effective August 1, 2016 and received FERC approval on December 16, 2016. Per the settlement, transmission reservation rates will increase by 34.8 per cent and storage rates will remain the same for contracts one to three years in length, while increasing slightly for contracts of less than one year and decreasing slightly for contracts more than three years in duration. There is a moratorium on any further rate changes until August 1, 2019. ANR may file for new rates after that date if it has spent more than US$0.8 billion in capital additions, but must file for new rates no later than an effective date of August 1, 2022. In addition to ANR’s rate case settlement, FERC approvals were obtained for settlements with shippers for our Iroquois, Tuscarora and Columbia Gulf pipelines. |

| | |

| Great Lakes |

| | |

| February 2016 | We reduced forecasted cash flows for the next ten years as compared to those utilized in previous impairment tests. There is a risk that continued reductions in future cash flow forecasts and adverse changes in other key assumptions could result in a future impairment of a portion of the goodwill balance relating to Great Lakes. Our share of the goodwill related to Great Lakes, net of non-controlling interests, was US$386 million at December 31, 2016 (2015 – US$386 million). |

| | |

| Sale of Gas Transmission Northwest LLC (GTN) Pipeline, Iroquois Gas Transmission System, L.P. (Iroquois) and Portland Natural Gas Transmission System (PNGTS) to TC PipeLines, LP (TCLP) |

| |

| April 2015 | We closed the sale of our remaining 30 per cent interest in GTN to TCLP for an aggregate purchase price of US$457 million. Proceeds were comprised of US$246 million in cash, the assumption of US$98 million in proportional GTN debt and US$95 million of new Class B units of TCLP. |

| January 2016 | We closed the sale of 49.9 per cent of our total 61.7 per cent interest in PNGTS to TCLP for US$223 million including the assumption of US$35 million of proportional PNGTS debt. |

| First/Second Quarter 2016 | On March 31, 2016, we acquired an additional 4.87 per cent interest in Iroquois for an aggregate purchase price of US$54 million, and on May 1, 2016, a further 0.65 per cent was acquired for US$7 million. As a result, our interest in Iroquois increased to 50 per cent. |

| February 2017 | We offered to sell a 49.3 per cent interest in Iroquois, together with our remaining 11.8 per cent interest in PNGTS, subject to satisfactory negotiation of terms, compliance with any applicable regulatory requirements, and Partnership Board approval, to TCLP. TransCanada’s Board of Directors approved the sales of Iroquois and PNGTS. |

| | |

| TC Offshore LLC (TC Offshore) |

| | |

| December 2015 | We entered into an agreement to sell TC Offshore to a third party and expected the sale to close in early 2016. As a result, at December 31, 2015, the related assets and liabilities were classified as held for sale and were recorded at their fair values less costs to sell. This resulted in a pre-tax loss provisions of $125 million recorded in 2015. |

| March 2016 | We completed the sale of TC Offshore to a third party. |

| | |

| LNG PIPELINE PROJECTS |

| | |

| Alaska LNG Project |

| | |

| April 2014 | The State of Alaska passed new legislation to provide a framework for us, the three major North Slope producers (the ANS Producers), and the Alaska Gasline Development Corp. (AGDC) to advance the development of an LNG export project. |

| June 2014 | We executed an agreement with the State of Alaska to abandon the previous Alaska to Alberta project governance and framework and executed a new precedent agreement where we will act as the transporter of the State’s portion of natural gas under a long-term shipping contract in the Alaska LNG Project. We also entered into a Joint Venture Agreement with the three major ANS Producers and AGDC to commence the pre-front end engineering and design (pre-FEED) phase of Alaska LNG Project. The pre-FEED work was anticipated to take two years to complete with our share of the cost to be approximately US$100 million. The precedent agreement also provided us with full recovery of development costs in the event the project did not proceed. |

| November 2015 | We sold our interest in the Alaska LNG project to the State of Alaska. The proceeds of US$65 million from this sale provide a full recovery of costs incurred to advance the project since January 1, 2014 including a carrying charge. With this sale, our involvement in developing a pipeline system for commercializing Alaska North Slope natural gas ceases. |

|

| | |

| 12 | TCPL Annual information form 2016 | |

Developments in the Mexico Natural Gas Pipelines segment

|

| |

| Date | Description of development |

| | |

| Mexico Natural Gas Pipelines |

| |

| Topolobampo |

| |

| First Quarter 2017 | The Topolobampo project is a 530 km (329 miles), 30-inch pipeline with a cost of US$1.0 billion that will receive natural gas from upstream pipelines near El Encino in the state of Chihuahua. The pipeline will deliver natural gas from these interconnecting pipelines to delivery points along the pipeline route including our Mazatlán pipeline at El Oro in the state of Sinaloa. Construction of the pipeline is supported by a 25-year natural gas Transportation Service Agreement (TSA) for 670 MMcf/d with the CFE. Completion of construction is delayed into 2017 due to delays with Indigenous consultations by others. Under the terms of the TSA, this delay is recognized as a force majeure event with provisions allowing for the collection of revenue as per the original TSA service commencement date of July 2016. |

| |

| Mazatlán |

| | |

| November 2015 | The Mazatlán project is a 413 km (257 miles), 24-inch diameter pipeline running from El Oro to Mazatlán within the state of Sinaloa with an estimated cost of US$0.4 billion. This pipeline is supported by a 25-year natural gas TSA for 200 MMcf/d with the CFE. |

| Third Quarter 2016 | Physical construction is complete and is awaiting natural gas supply from upstream interconnecting pipelines. We have met our obligations and thus are collecting revenue as per provisions in the contract and per the original TSA service commencement date of December 2016. |

| |

| Tula |

| | |

| November 2015 | We were awarded the contract to build, own and operate the US$0.6 billion, 36 inch, 300 km (186 miles) pipeline supported by a 25-year natural gas TSA for 886 MMcf/d with the CFE. The pipeline will transport natural gas from Tuxpan, Veracruz to markets near Tula, Querétaro extending through the states of Puebla and Hidalgo. |

| Third Quarter 2016 | Construction commenced in the region that does not require Indigenous community consultations by others. Completion of construction is revised to 2018 due to delays with Indigenous consultation. |

| |

| Villa de Reyes Pipeline |

| | |

| April 2016 | We announced that we were awarded the contract to build, own and operate the Villa de Reyes pipeline in Mexico. Construction of the pipeline is supported by a 25-year natural gas transportation service contract for 886 MMcf/d with the CFE. We expect to invest approximately US$0.6 billion to construct 36- and 24-inch diameter pipelines totaling 420 km (261 miles) with an anticipated in-service date of early 2018. The bi-directional pipeline will transport natural gas between Tula, in the state of Hidalgo, and Villa de Reyes, in the state of San Luis Potosí. The project will interconnect with our Tamazunchale and Tula pipelines as well as with other transporters in the region. |

| |

| Sur de Texas |

| | |

| June 2016 | We announced that our joint venture with IEnova had been chosen to build, own and operate the US$2.1 billion Sur de Texas pipeline in Mexico. We will have a 60 per cent interest in this project. Construction of the pipeline is supported by a 25-year natural gas transportation service contract for 2.6 bcf/d with the CFE. We expect to invest approximately US$1.3 billion in the joint venture to construct the 42-inch diameter, approximately 800 km (497 miles) pipeline with an anticipated in-service date of late 2018. The pipeline will start offshore in the Gulf of Mexico, at the border point near Brownsville, Texas, and end in Tuxpan, Mexico in the state of Veracruz. The project will deliver natural gas to our Tamazunchale and Tula pipelines and to other transporters in the region. |

| |

| Tamazunchale Pipeline Extension Project |

| | |

| November 2014 | Construction of the US$600 million extension was completed. Delays from the original service commencement date in March 2014 were attributed primarily to archeological findings along the pipeline route. Under the terms of the transportation service agreement, these delays were recognized as a force majeure with provisions allowing for collection of revenue from the original service commencement date. |

| | |

Further information about developments in the Natural Gas Pipelines business, including changes that we expect will occur in the current financial year, can be found in the MD&A in the About our business – Our strategy and Natural Gas Pipelines business sections; Canadian Natural Gas Pipelines – Financial results, Outlook, Understanding the Canadian Natural Gas Pipelines segment and Significant events sections; U.S. Natural Gas Pipelines – Financial results, Outlook, Understanding the U.S. Natural Gas Pipelines segment and Significant events sections; and Mexico Natural Gas Pipelines – Financial results, Outlook, Understanding the Mexico Natural Gas Pipelines segment, and Significant events sections, which sections of the MD&A are incorporated by reference herein.

|

| | |

| | TCPL Annual information form 2016 | 13 |

LIQUIDS PIPELINES

|

| |

| Date | Description of development |

| | |

| Keystone Pipeline System |

| | |

| Second Quarter 2015 | We entered into an agreement with CITGO Petroleum (CITGO) to construct a US$65 million pipeline connection between the Keystone Pipeline and CITGO’s Sour Lake, Texas terminal, which supplies their 425,000 Bbl/d Lake Charles, Louisiana refinery. The connection is targeted to be operational in fourth quarter 2016. |

| Fourth Quarter 2015 | We secured additional long term contracts bringing our total contract position up to 545,000 Bbl/d. |

| January 2016 | We entered into an agreement with Magellan Midstream Partners L.P. (Magellan) to connect our Houston Terminal to Magellan's Houston and Texas City, Texas delivery system. We will own 50 per cent of this US$50 million pipeline project which will enhance connections for our Keystone Pipeline to the Houston market. The pipeline is expected to be operational during the first half of 2017, subject to the receipt of all necessary rights-of-way, permits and regulatory approvals. |

| Second Quarter 2016 | On April 2, 2016, we shut down the Keystone Pipeline after a leak was detected along the pipeline right-of-way in Hutchinson County, South Dakota. We reported the total volume of the release of 400 barrels to the National Response Center and the Pipeline and Hazardous Materials Safety and Administration (PHMSA). Temporary repairs were completed and the Keystone Pipeline was restarted by mid-April 2016. Shortly thereafter in early May 2016, permanent pipeline repairs were completed and restoration work was completed by early July 2016. Corrective measures required by PHMSA were completed in September 2016. This shutdown did not significantly impact our 2016 earnings. |

| August 2016 | The Houston Lateral pipeline and terminal, an extension from the Keystone Pipeline to Houston, Texas, went into service. The terminal has an initial storage capacity for 700,000 barrels of crude oil. |

| December 2016 | The HoustonLink pipeline which connects the Houston Terminal to Magellan's Houston and Texas City, Texas delivery system was completed. |

| December 2016 | The CITGO Sour Lake pipeline connection between the Keystone Pipeline and CITGO's Sour Lake, Texas terminal was placed into service. |

| | |

| Keystone XL |

| | |

| January 2015 | The Nebraska State Supreme Court vacated the lower court’s ruling that the law was unconstitutional. As a result, the Governor’s January 2013 approval of the alternate route through Nebraska for Keystone XL remains valid. Landowners have filed lawsuits in two Nebraska counties seeking to enjoin Keystone XL from condemning easements on state constitutional grounds. |

| November 2015 | The decision on the Keystone XL Presidential permit application was delayed throughout 2015 by the Department of State (DOS) and was ultimately denied in November 2015. At December 31, 2015, as a result of the denial of the Presidential permit, we evaluated our investment in Keystone XL and related projects, including Keystone Hardisty Terminal, for impairment. As a result of our analysis, we determined that the carrying amount of these assets was no longer recoverable, and recognized a total non-cash impairment charge of $3.7 billion ($2.9 billion aftertax). The impairment charge was based on the excess of the carrying value of $4.3 billion over the fair value of $621 million, which includes $93 million fair value for Keystone Hardisty Terminal. The calculation of this impairment is discussed further in the Other information – Critical accounting estimates section of the MD&A. The Keystone Hardisty Terminal remains on hold with an estimated in-service date to be driven by market need. Also in November 2015, we withdrew our application to the Nebraska Public Service Commission for approval of the route for Keystone XL in the state. The application was initially filed in October 2015. The withdrawal was made without prejudice to potentially refile if we elect to pursue the project. |

| January 2016 | On January 5, 2016, the South Dakota PUC accepted Keystone XL’s certification that it continues to comply with the conditions in its existing 2010 permit authority in the state. On January 6, 2016, we filed a Notice of Intent to initiate a claim under Chapter 11 of North American Free Trade Agreement (NAFTA) in response to the U.S. Administration’s decision to deny a Presidential permit for the Keystone XL Pipeline on the basis that the denial was arbitrary and unjustified. Through the NAFTA claim, we are seeking to recover more than US$15 billion in costs and damages that we estimated to have suffered as a result of the U.S. Administration’s breach of its NAFTA obligations. In June 2016, we filed a Request for Arbitration in a dispute against the U.S. Government pursuant to the Convention on Settlement of Investment Disputes between States and Nationals of Other States, the Rules of Procedure for the Institution of Conciliation and Arbitration Proceedings and Chapter 11 of NAFTA. This arbitration is in a preliminary stage and the likelihood of success and resulting impact on the Company's financial position or results of operations is unknown at this time. On January 5, 2016, we also filed a lawsuit in the U.S. Federal Court in Houston, Texas, asserting that the U.S. President’s decision to deny construction of Keystone XL exceeded his power under the U.S. Constitution. The federal court lawsuit does not seek damages, but rather a declaration that the permit denial is without legal merit and that no further Presidential action is required before construction of the pipeline can proceed. |

| January 2017 | On January 24, 2017, the U.S. President signed a Presidential Memorandum inviting TransCanada to refile an application for the U.S. Presidential Permit. On January 26, 2017, we filed a Presidential Permit application with the U.S. Department of State for the project. The pipeline will begin in Hardisty, Alberta, and extend south to Steele City, Nebraska. Given the passage of time since the November 6, 2015 denial of the Presidential Permit, we are updating our shipping contracts and some shippers may increase or decrease their volume commitments. We expect the project to retain sufficient commercial support for us to make a FID. |

| | |

|

| | |

| 14 | TCPL Annual information form 2016 | |

|

| |

| Date | Description of development |

| | |

| Energy East |

| | |

| April 2015 | We announced that the proposed marine terminal and associated tank terminal in Cacouna, Québec will not be built as a result of the recommended reclassification of the beluga whale, indigenous to the site, as an endangered species. |

| November 2015 | Following consultation with stakeholders and shippers, we announced the intention to amend the Energy East pipeline application to remove a port in Québec and proceed with a single marine terminal in Saint John, New Brunswick. |

| December 2015 | We filed an amendment to the existing project application with the NEB that adjusted the proposed route, scope and capital cost of the project reflecting refinement and scope change including the removal of the port in Québec. The project will continue to serve the three eastern Canadian refineries along the route in Montréal and Québec City, Québec and Saint John, New Brunswick. Changes to the project schedule and scope, as reflected in the amendment, contributed to a revised project capital cost estimate of $15.7 billion, excluding the transfer of Canadian Mainline natural gas assets. |

| March 2016 | On March 1, 2016, the Province of Québec filed a court action seeking an injunction to compel the Energy East Pipeline to comply with the province’s environmental regulations. On March 30, 2016, the Québec Superior Court joined the injunction action led by the Province of Québec with the prior action led by Québec Environmental Law Centre / Centre québécois du droit de l’environnement (CQDE), which sought a declaration to compel the Energy East pipeline to submit to the mandatory provincial environmental review process. As a result of communication with the Ministère du Développement durable, Environnement et la Lutte contre les changements climatiques, on April 22, 2016, we filed a project review engaging an environmental assessment under the Environmental Quality Act (Québec) according to an agreed upon schedule for key steps in that process. This process was in addition to environmental assessment required under the NEB Act and the Canadian Environmental Assessment Act, 2012. The Attorney General for Québec agreed to suspend its litigation against TransCanada and Energy East and to withdraw it once the provincial environmental assessment process has been completed. The CQDE similarly agreed to suspend the action. These suspensions were in effect until early November 2016, but may have to be extended given the delay in the NEB process noted below. The first phase of Energy East public hearings for the voluntary Québec le Bureau d’audiences publiques sur l’environnement (BAPE) process was completed. The voluntary BAPE hearing process is intended to inform the Province of Québec in its participation in the federal process and provides project information to the public. A second phase, consisting of a series of public input sessions, has been suspended as it has been replaced with the environmental assessment as described above. |

| May 2016 | We filed a consolidated application with the NEB for the Energy East pipeline. In June 2016, Energy East achieved a major milestone with the NEB’s announcement determining the Energy East pipeline application is sufficiently complete to initiate the formal regulatory review process. However, in August 2016, panel sessions were cancelled as three NEB panelists recused themselves from continuing to sit on the panel to review the project due to allegations of reasonable apprehension of bias. The Chair of the NEB and the Vice Chair, who is also a panel member, have recused themselves of any further duties related to the project. As a result, all hearings for the project were adjourned until further notice. |

| January 2017 | On January 9, 2017, the NEB appointed three new permanent panel members to undertake the review of the Energy East and Eastern Mainline projects. On January 27, 2017, the new NEB panel members voided all decisions made by the previous hearing panel members and all decisions will be removed from the official hearing record. We are not required to refile the application and parties will not be required to reapply for intervener status. However, all other proceedings and associated deadlines are no longer applicable. It is expected the next step will be a determination of the application’s completeness and the issuance of a hearing order which triggers the 21-month time limit for the NEB to adjudicate the application. |

| | |

| White Spruce |

| | |

| December 2016 | We finalized a long term transportation agreement to develop and construct the 20-inch diameter White Spruce pipeline, which will transport crude oil from a major oil sands plant in northeast Alberta, into the Grand Rapids pipeline system. The total capital cost for the project is approximately $200 million and it is expected to be in service in 2018 subject to regulatory approvals. |

| | |

| Northern Courier |

| | |

| Fourth Quarter 2016 | Construction continued on the Northern Courier pipeline to transport bitumen and diluent between the Fort Hills mine site and Suncor Energy's terminal located north of Fort McMurray, Alberta. The project is fully underpinned by long term contracts with the Fort Hills partnership. We expect to begin commercial operation in fourth quarter 2017. |

| | |

| Grand Rapids |

| | |

| August 2015 | We announced a joint venture between Grand Rapids and Keyera Corp. for provision of diluent transportation service on the 20-inch pipeline between Edmonton and Fort Saskatchewan, Alberta .The joint venture will be incorporated into Grand Rapids and it will provide enhanced diluent supply alternatives to our shippers. |

|

| | |

| | TCPL Annual information form 2016 | 15 |

|

| |

| Date | Description of development |

| Fourth Quarter 2016 | Construction continued on the Grand Rapids pipeline. We entered into a partnership with Brion Energy to develop Grand Rapids with each party owning 50 per cent of the pipeline project. Our partner has also entered into a long-term transportation service contract in support of the project. We will operate Grand Rapids once it is complete and we expect crude oil transportation to begin in the second half of 2017. Construction is also progressing on the 20-inch diameter diluent joint venture pipeline between Edmonton and Fort Saskatchewan, Alberta. The joint venture between Grand Rapids and Keyera Corp. will be incorporated into Grand Rapids and will provide enhanced diluent supply alternatives to our shippers. We anticipate the pipeline to be in service in late 2017. |

| |

| Upland Pipeline |

| | |

| April 2015 | We filed an application to obtain a U.S. Presidential permit for the Upland Pipeline. The pipeline will provide crude oil transportation from and between multiple points in North Dakota and interconnect with the Energy East pipeline system at Moosomin, Saskatchewan. Subject to regulatory approvals, we anticipate the Upland Pipeline to be in service in 2020. The commercial contracts we have executed for Upland Pipeline are conditioned on the Energy East pipeline project proceeding. |

| January 2016 | We are reviewing the Canadian federal government's interim measures for pipeline reviews and to assess their impact to Upland Pipeline. |

| | |

| Liquids Marketing |

| | |

| 2015 | We established a liquids marketing business to expand into other areas of the liquids business value chain. The liquids marketing business will generate revenue by capitalizing on asset utilization opportunities by entering into short-term or long-term pipeline or storage terminal capacity contracts. Volatility in commodity prices and changing market conditions could impact the value of those capacity contracts. Availability of alternative pipeline systems that can deliver into the same areas can also impact contract value. The liquids marketing business complies with our risk management polices which are described in the Other information - Risks and risk management section of the MD&A. |

Further information about developments in the Liquids Pipelines business, including changes that we can expect will occur in the current financial year, can be found in the MD&A in the About our business – Our strategy, Liquids Pipelines – Financial results, Liquids Pipelines – Outlook, Liquids Pipelines – Understanding the Liquids Pipelines business and Liquids Pipelines – Significant events sections, which sections of the MD&A are incorporated by reference herein.

|

| | |

| 16 | TCPL Annual information form 2016 | |

ENERGY

|

| |

| Date | Description of development |

| | |

| Canadian Power |

| | |

| Alberta PPAs |

| | |

| June 2015 | The Alberta government announced a renewal and change to the SGER in Alberta. Since 2007, under the SGER, established industrial facilities with GHG emissions above a certain threshold are required to reduce their emissions by 12 per cent below an average intensity baseline and a carbon levy of $15 per tonne is placed on emissions above this target. The changed regulations include an increase in the emissions reductions target to 15 per cent in 2016 and 20 per cent in 2017, along with an increase in the carbon levy to $20 per tonne in 2016 and $30 per tonne in 2017. Starting in 2018, coal-fired generators will pay $30 per tonne of CO2 on emissions above what Alberta's cleanest natural gas-fired plant would emit to produce an equivalent amount of electricity. |

| 2016 | On March 7, 2016, we issued notice to the Balancing Pool to terminate our Alberta PPAs. On July 22, 2016, we, along with the ASTC Power Partnership, issued a notice referring the matter to be resolved by binding arbitration pursuant to the dispute resolution provisions of the PPAs. On July 25, 2016, the Government of Alberta brought an application in the Court of Queen’s Bench to prevent the Balancing Pool from allowing termination of a PPA held by another party which contains identically worded termination provisions to our PPAs. The outcome of this court application could have affected resolution of the arbitration of the Sheerness, Sundance A and Sundance B PPAs. In December 2016, management engaged in settlement negotiations with the Government of Alberta and finalized terms of the settlement of all legal disputes related to the PPA terminations. The Government and the Balancing Pool agreed to our termination of the PPAs resulting in the transfer of all our obligations under the PPAs to the Balancing Pool. Upon final settlement of the PPA terminations, we transferred to the Balancing Pool a package of environmental credits held to offset the PPA emissions costs and recorded a non-cash charge of $92 million before tax ($68 million after tax) related to the carrying value of our environmental credits. In first quarter 2016, as a result of our decision to terminate the PPAs, we recorded a non-cash impairment charge of $240 million before tax ($176 million after tax) comprised of $211 million before tax ($155 million after tax) related to the carrying value of our Sundance A and Sheerness PPAs and $29 million before tax ($21 million after tax) on our equity

investment in the ASTC Power Partnership which previously held the Sundance B PPA. |

| | |

| Ontario Cap and Trade |

| | |

| May 2016 | Legislation enabling Ontario’s cap and trade program was signed into law with the new regulation taking effect July 1, 2016. This regulation sets a limit on annual province-wide greenhouse gas emissions beginning in January 2017 and introduces a market to administer the purchase and trading of emissions allowances. The regulation places the compliance obligation for emissions from our natural gas fired power facilities on local gas distributors, with the distributors then flowing the associated costs to the facilities themselves. The IESO has proposed contract amendments for contract holders to address costs and other issues associated with this change in law. We continue to work with the IESO to finalize these amendments. We do not expect a significant overall impact to our Energy business as a result of this new regulation. |

| | |

| Napanee |

| | |

| January 2015 | We began construction activities on a 900 MW natural gas-fired power plant at Ontario Power Generation’s Lennox site in eastern Ontario in the town of Greater Napanee. Production from the facility is fully contracted with the IESO. |

| First Quarter 2016 | Construction continues and we expect to invest approximately $1.1 billion in the Napanee facility during construction and commercial operations are expected to begin in 2018. |

| | |

| Bécancour |

| | |

| May 2014 | We received final approval from the Régie de l’énergie for the December 2013 amendment to the original suspension agreement with Hydro-Québec Distribution (HQ). Under the amendment, HQ continued to have the option (subject to certain conditions) to further extend the suspension of all electricity generation from the Bécancour power plant past 2017. The amendment also includes revised provisions intended to reduce HQ’s payments to us for Bécancour's natural gas transportation costs during the suspension period, although we retain our ability to recover our full capacity costs under the Electricity Supply Contract with HQ while the facility is suspended. In addition, HQ exercised its option in the amended suspension agreement to extend suspension of all electricity generation to the end of 2017, and requested further suspension of generation to the end of 2018. In June 2015, HQ had requested further suspension of generation to the end of 2019. In June 2016, HQ requested further suspension of generation to the end of 2020. |

| August 2015 | We executed an agreement with HQ allowing HQ to dispatch up to 570 MW of peak winter capacity from our Bécancour facility for a term of 20 years commencing in December 2016. |

| November 2016 | HQ released a new ten year supply plan indicating additional peak winter capacity from Bécancour is not required at this time. Prior to this development, the regulator in Québec, Régie de l'énergie, reversed its initial decision to approve this agreement. Management does not expect further developments at Bécancour until November 2019 when the next 10 year supply plan is filed. |

|

| | |

| | TCPL Annual information form 2016 | 17 |

|

| |

| Date | Description of development |

| | |

| Bruce Power |

| | |

| March 2014 | Cameco Corporation sold its 31.6 per cent limited partnership interest in Bruce B to BPC Generation Infrastructure Trust. |

| Fourth Quarter 2014 | New Canadian federal legislation was passed in 2015 respecting the determination of liability and compensation for a nuclear incident in Canada resulting in personal injuries and damages. In 2016 the act was proclaimed to come into force by cabinet and the provisions are effective as of January 1, 2017. This legislation will replace existing legislation which currently provides that the licensed operator of a nuclear facility has absolute and exclusive liability and limits the liability to a maximum of $75 million. The new law is fundamentally consistent with the existing regime although the maximum liability will increase to $650 million and increase in increments over three years to a maximum of $1 billion. The operator will also be required to maintain financial assurances such as insurance in the amount of the maximum liability. Our indirect subsidiary owns 50 per cent of the common shares of Bruce Power Inc., the licensed operator of Bruce Power, and as such Bruce Power Inc. is subject to this liability in the event of an incident as well as the legislation’s other requirements. |