TransCanada PipeLines Limited

2017 Annual information form

March 12, 2018

|

| | |

| | TCPL Annual information form 2017 | 2 |

Presentation of information

Unless the context indicates otherwise, a reference in this Annual information form (AIF) to TransCanada PipeLines Limited (TCPL) or the Company, we, us and our includes TCPL's parent, TransCanada Corporation (TransCanada) and the subsidiaries of TCPL through which its various business operations are conducted, and a reference to TransCanada includes TransCanada Corporation and the subsidiaries of TransCanada Corporation, including TCPL. Where TCPL is referred to with respect to actions that occurred prior to its 2003 plan of arrangement (the Arrangement) with TransCanada, which is described below under the heading TransCanada PipeLines Limited – Corporate structure, these actions were taken by TCPL or its subsidiaries. The term subsidiary, when referred to in this AIF, with reference to TCPL means direct and indirect wholly owned subsidiaries of, and legal entities controlled by, TransCanada or TCPL, as applicable.

Unless otherwise noted, the information contained in this AIF is given at or for the year ended December 31, 2017 (Year End). Amounts are expressed in Canadian dollars unless otherwise indicated. Information in relation to metric conversion can be found at Schedule A to this AIF. The Glossary found at the end of this AIF contains certain terms defined throughout this AIF and abbreviations and acronyms that may not otherwise be defined in this document.

Certain portions of TCPL's management's discussion and analysis dated February 14, 2018 (MD&A) are incorporated by reference into this AIF as stated below. The MD&A can be found on SEDAR (www.sedar.com) under TCPL's profile.

Financial information is presented in accordance with U.S. generally accepted accounting principles (GAAP). We use certain financial measures that do not have a standardized meaning under GAAP and therefore they may not be comparable to similar measures presented by other entities. Refer to the About this document – Non-GAAP measures section of the MD&A for more information about the non-GAAP measures we use and a reconciliation to their GAAP equivalents, which section of the MD&A is incorporated by reference herein.

Forward-looking information

This AIF, including the MD&A disclosure incorporated by reference herein, contains certain information that is forward-looking and is subject to important risks and uncertainties. We disclose forward-looking information to help current and potential investors understand management’s assessment of our future plans and financial outlook, and our future prospects overall.

Statements that are forward-looking are based on certain assumptions and on what we know and expect today and generally include words like anticipate, expect, believe, may, will, should, estimate or other similar words.

Forward-looking statements included or incorporated by reference in this document include information about the following, among other things:

| |

| • | planned changes in our business |

| |

| • | our financial and operational performance, including the performance of our subsidiaries |

| |

| • | expectations or projections about strategies and goals for growth and expansion |

| |

| • | expected cash flows and future financing options available to us |

| |

| • | expected dividend growth |

| |

| • | expected costs for planned projects, including projects under construction, permitting and in development |

| |

| • | expected schedules for planned projects (including anticipated construction and completion dates) |

| |

| • | expected regulatory processes and outcomes |

| |

| • | expected outcomes with respect to legal proceedings, including arbitration and insurance claims |

| |

| • | expected capital expenditures and contractual obligations |

| |

| • | expected operating and financial results |

| |

| • | the expected impact of future accounting changes, commitments and contingent liabilities |

| |

| • | the expected impact of H.R. 1, the Tax Cuts and Jobs Act (U.S. Tax Reform) |

| |

| • | expected industry, market and economic conditions. |

Forward-looking statements do not guarantee future performance. Actual events and results could be significantly different because of assumptions, risks or uncertainties related to our business or events that happen after the date of this document.

|

| | |

| 2 | TCPL Annual information form 2017 | |

Our forward-looking information is based on the following key assumptions, and subject to the following risks and uncertainties:

Assumptions

| |

| • | planned wind-down of our U.S. Northeast power marketing business |

| |

| • | inflation rates and commodity prices |

| |

| • | nature and scope of hedging |

| |

| • | regulatory decisions and outcomes |

| |

| • | interest, tax and foreign exchange rates, including the impact of U.S. Tax Reform |

| |

| • | planned and unplanned outages and the use of our pipeline and energy assets |

| |

| • | integrity and reliability of our assets |

| |

| • | access to capital markets |

| |

| • | anticipated construction costs, schedules and completion dates. |

Risks and uncertainties

| |

| • | our ability to successfully implement our strategic priorities and whether they will yield the expected benefits |

| |

| • | the operating performance of our pipeline and energy assets |

| |

| • | amount of capacity sold and rates achieved in our pipeline businesses |

| |

| • | the availability and price of energy commodities |

| |

| • | the amount of capacity payments and revenues from our energy business |

| |

| • | regulatory decisions and outcomes |

| |

| • | outcomes of legal proceedings, including arbitration and insurance claims |

| |

| • | performance and credit risk of our counterparties |

| |

| • | changes in market commodity prices |

| |

| • | changes in the political environment |

| |

| • | changes in environmental and other laws and regulations |

| |

| • | competitive factors in the pipeline and energy sectors |

| |

| • | construction and completion of capital projects |

| |

| • | costs for labour, equipment and materials |

| |

| • | access to capital markets |

| |

| • | interest, tax and foreign exchange rates, including the impact of U.S. Tax Reform |

| |

| • | technological developments |

| |

| • | economic conditions in North America as well as globally. |

You can read more about these factors and others in reports we have filed with Canadian securities regulators and the U.S. Securities and Exchange Commission (SEC).

As actual results could vary significantly from the forward-looking information, you should not put undue reliance on forward-looking information and should not use future-oriented financial information or financial outlooks for anything other than their intended purpose. We do not update our forward-looking statements due to new information or future events, unless we are required to by law.

|

| | |

| | TCPL Annual information form 2017 | 3 |

TransCanada PipeLines Limited

CORPORATE STRUCTURE

TCPL's head office and registered office are located at 450 - 1st Street S.W., Calgary, Alberta, T2P 5H1. TCPL is a reporting issuer in the jurisdictions of Canada. Significant dates and events are set forth below.

|

| |

| Date | Event |

| March 21, 1951 | Incorporated by Special Act of Parliament as Trans-Canada Pipe Lines Limited. |

| April 19, 1972 | Continued under the Canada Corporations Act by Letters Patent, which included the alteration of its capital and change of name to TransCanada PipeLines Limited. |

| June 1, 1979 | Continued under the Canada Business Corporations Act (CBCA). |

| July 2, 1998 | Certificate of Arrangement issued in connection with the Plan of Arrangement with NOVA Corporation under which the companies merged and then split off the commodity chemicals business carried on by NOVA Corporation into a separate public company. |

| January 1, 1999 | Certificate of Amalgamation issued reflecting TCPL's vertical short form amalgamation with a wholly owned subsidiary, Alberta Natural Gas Company Ltd. |

| January 1, 2000 | Certificate of Amalgamation issued reflecting TCPL's vertical short form amalgamation with a wholly owned subsidiary, NOVA Gas International Ltd. |

| May 4, 2001 | Restated TCPL Articles of Incorporation filed. |

| June 20, 2002 | Restated TCPL Limited By-Laws filed. |

| May 15, 2003 | Certificate of Arrangement issued in connection with the plan of arrangement with TransCanada. TransCanada was incorporated pursuant to the provisions of the CBCA on February 25, 2003. The arrangement was approved by TCPL common shareholders on April 25, 2003 and following court approval, Articles of Arrangement were filed making the arrangement effective May 15, 2003. The common shareholders of TCPL exchanged each of their common shares of TCPL for one common share of TransCanada. The debt securities and preferred shares of TCPL remained obligations and securities of TCPL. TCPL continues to carry on business as the principal operating subsidiary of the TransCanada group of entities. |

|

| | |

| 4 | TCPL Annual information form 2017 | |

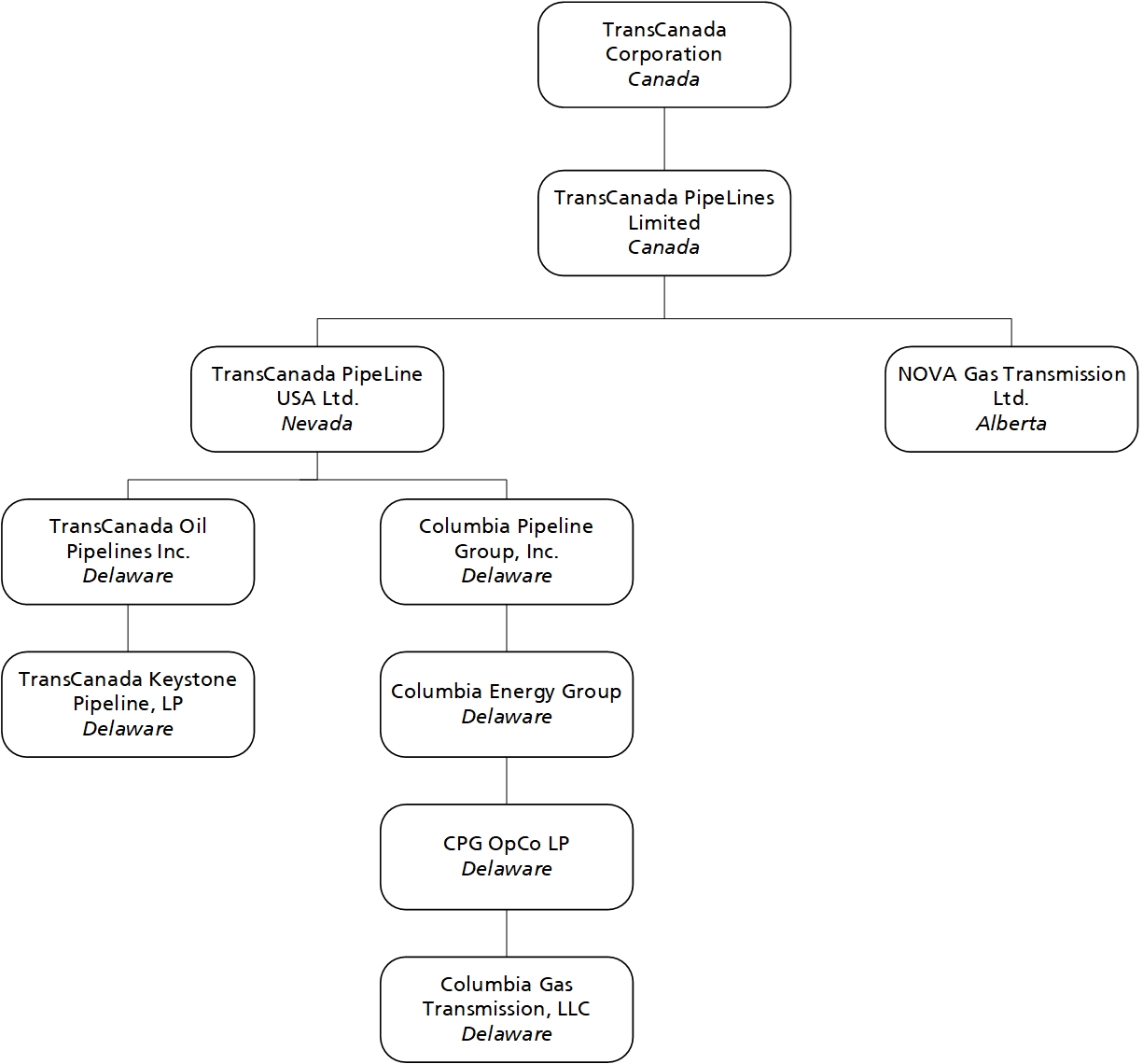

INTERCORPORATE RELATIONSHIPS

The following diagram presents the name and jurisdiction of incorporation, continuance or formation of TCPL’s principal subsidiaries as at Year End. Each of the subsidiaries shown has total assets that exceeded ten per cent of the total consolidated assets of TCPL as at Year End or revenues that exceeded ten per cent of the total consolidated revenues of TCPL as at Year End. TCPL beneficially owns, controls or directs, directly or indirectly, 100 per cent of the voting shares or units in each of these subsidiaries.

|

|

TransCanada Corporation Canada TransCanada PipeLines Limited Canada TransCanada PipeLine USA Ltd. Nevada TransCanada Oil Pipelines Inc. Delaware TransCanada Keystone Pipeline, LP Delaware Columbia Pipeline Group, Inc. Delaware Columbia Energy Group Delaware CPG OpCo LP Delaware Columbia Gas Transmission, LLC Delaware NOVA Gas Transmission Ltd. Alberta

|

The above diagram does not include all of the subsidiaries of TCPL. The assets and revenues of excluded subsidiaries in the aggregate did not exceed 20 per cent of the total consolidated assets of TCPL as at Year End or total consolidated revenues of TCPL as at Year End.

|

| | |

| | TCPL Annual information form 2017 | 5 |

General development of the business

We operate in three core businesses - Natural Gas Pipelines, Liquids Pipelines and Energy. As a result of our acquisition of Columbia Pipeline Group, Inc. (Columbia) on July 1, 2016 and the sale of the U.S. Northeast power business, we determined that a change in our operating segments was appropriate. Accordingly, we consider ourselves to be operating in the following five segments: Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines, Liquids Pipelines and Energy. This provides information that is aligned with how management decisions about our business are made and how performance of our business is assessed. We also have a non-operational Corporate segment consisting of corporate and administrative functions that provide governance and other support to our operational business segments.

Natural Gas Pipelines and Liquids Pipelines are principally comprised of our respective natural gas and liquids pipelines in Canada, the U.S. and Mexico, as well as our regulated natural gas storage operations in the U.S. Energy includes our power operations and the non-regulated natural gas storage business in Canada.

Summarized below are significant developments that have occurred in our Natural Gas Pipelines, Liquids Pipelines and Energy businesses, respectively, and certain acquisitions, dispositions, events or conditions which have had an influence on those developments, during the last three financial years and year to date in 2018. Further information about changes in our business that we expect to occur during the current financial year can be found in the Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines, Liquids Pipelines and Energy sections of the MD&A, which sections of the MD&A are incorporated by reference herein.

NATURAL GAS PIPELINES

Developments in the Canadian Natural Gas Pipelines Segment

|

| |

| Date | Description of development |

| | |

| CANADIAN REGULATED PIPELINES |

| | |

| NGTL System |

| 2015 | The NGTL System had approximately $6.7 billion of new supply and demand facilities under development and we continued to advance several of these capital expansion projects by filing the regulatory applications with the National Energy Board (Canada) (NEB). In 2015, we placed approximately $0.35 billion of facilities in service. |

| 2016 | In 2016, the NGTL System continued to develop new supply and demand facilities. We had approximately $2.3 billion of facilities that received regulatory approval and approximately $0.45 billion under construction. On October 6, 2016, the NEB recommended government approval of the Towerbirch Project and the continued use of the existing rolled-in toll methodology for the project. On October 31, 2016, the Government of Canada also approved our application for a $1.3 billion NGTL System expansion program. This NGTL System expansion program consists of five pipeline loops ranging in size from 24 to 48-inch pipe of approximately 230 km (143 miles) in length, and two compressor station unit additions of approximately 46.5 MW (62,360 hp). In December 2016, we announced the $0.6 billion Saddle West expansion of the NGTL System to increase natural gas transportation capacity on the northwest portion of our system, consisting of 29 km (18 miles) of 36-inch pipeline looping of existing mainlines, the addition of five compressor units at existing station sites and new metering facilities. The project is underpinned by incremental firm service contracts and is expected to be in-service in 2019. In 2016, we placed approximately $0.5 billion of facilities in service. |

| 2017 | In March 2017, the Government of Canada approved the $0.4 billion Towerbirch Project, which consists of a 55 km (34 mile), 36-inch pipeline loop and a 32 km (20 mile), 30-inch pipeline extension of the NGTL System in northwest Alberta and northeast British Columbia (B.C.), which was subsequently placed in service in November 2017. In June 2017, we announced a new $2 billion expansion program on our NGTL System based on new contracted customer demand for approximately 3.2 PJ/d (3 Bcf/d) of incremental firm receipt and delivery services, subject to regulatory approvals. In 2017, we placed approximately $1.7 billion of new facilities in service on the NGTL System, and reduced project estimates by $0.6 billion. |

| 2018 | In February 2018, we announced a new NGTL System expansion totaling $2.4 billion, with in-service dates between 2019 and 2021. The new expansion program includes approximately 375 km (233 miles) of 16- to 48-inch pipeline, four compressor units totaling 120 MW, and associated metering stations and facilities. We anticipate incremental firm receipt contracts of 664 TJ/d (620 MMcf/d) and firm delivery contracts to our major border export and intra-basin delivery locations of 1.1 PJ/d (1.0 Bcf/d). |

|

| | |

| 6 | TCPL Annual information form 2017 | |

|

| |

| Date | Description of development |

| | |

| NGTL Revenue Requirement Settlements |

| 2015 | In February 2015, we received NEB approval for our revenue requirement settlement with our shippers on the NGTL System. The terms of the settlement included the continuation of the 2014 return on equity (ROE) of 10.1 per cent on 40 per cent deemed equity, continuation of the 2014 depreciation rates and a mechanism for sharing variances above and below a fixed operating, maintenance and administration (OM&A) expense amount that was based on an escalation of 2014 actual costs. In December 2015, we reached a two-year revenue requirement agreement (2016-2017 Settlement) with customers and other interested parties on the annual costs, including ROE and depreciation required to operate the NGTL System for 2016 and 2017. The 2016-2017 Settlement fixed ROE at 10.1 per cent on 40 per cent deemed equity, established depreciation at a forecast composite rate of 3.16 per cent and fixed OM&A costs at $222.5 million annually. An incentive mechanism for variances enabled NGTL to capture savings from improved performance and provided for the flow-through of all other costs, including pipeline integrity expenses and emissions costs. |

| 2017 | The 2016-2017 Settlement expired on December 31, 2017. We continue to work with interested parties towards a new revenue requirement arrangement for 2018 and longer. While these discussions are underway, NGTL is operating under interim tolls for 2018 that were approved by the NEB on November 24, 2017. |

| | |

| North Montney |

| 2015 | In June 2015, the NEB approved the $1.7 billion North Montney Mainline (NMML) project, subject to certain terms and conditions. Under one of these conditions, construction on the NMML project was only to begin after a positive final investment decision (FID) had been made on the Pacific North West liquefied natural gas (LNG) project (PNW LNG). The NMML project provides substantial new capacity on the NGTL System to meet the transportation requirements associated with rapidly increasing development of natural gas resources in the Montney supply basin in northeastern B.C. The NMML project connects Montney and other Western Canadian Sedimentary Basin (WCSB) supply to existing and new natural gas markets, including LNG markets. The project also includes an interconnection with our Prince Rupert Gas Transmission Project (PRGT) to provide natural gas supply to the proposed PNW LNG liquefaction and export facility near Prince Rupert, B.C. |

| 2016 | In September 2016, the Government of Canada approved a sunset clause extension request that we filed in March 2016, for the NMML Certificate of Public Convenience and Necessity, for one year to June 10, 2017. |

2017

| In March 2017, we filed an application with the NEB for a variance to the existing approvals for the NMML project on the NGTL System to remove the condition that the NMML project could only proceed once a positive FID was made for the PNW LNG project. The NMML project is now underpinned by restructured 20-year commercial contracts with shippers and is not dependent on PNW LNG project proceeding. A hearing on the matter began the week of January 22, 2018 and a decision from the NEB is anticipated in second quarter 2018. |

| | |

| Sundre Crossover Project |

| 2017 | On December 28, 2017, the NEB approved the Sundre Crossover project on the NGTL System. The approximate $100 million, 21 km (13 mile), 42-inch pipeline project will increase delivery of 245 TJ/d (229 MMcf/d) to the Alberta/ B.C. border to connect with TransCanada downstream pipelines. In-service is planned for April 1, 2018. |

| | |

| Canadian Mainline – Kings North and Station 130 Facilities |

| 2016 | In fourth quarter 2016, we placed in service the approximate $310 million Kings North Connector and the approximate $75 million compressor unit addition at Station 130 on the Canadian Mainline system. These two projects are consistent with our current LDC Settlement (defined below) with our shippers and provide optionality to access alternative supply sources while contracting for increased short-haul transportation service within the Eastern Triangle area of the Canadian Mainline system. |

| | |

| Canadian Mainline – Eastern Mainline Project |

| 2015 | In August 2015, we announced that we had reached an agreement with eastern local distribution companies (LDCs) that resolved their issues with the Energy East pipeline project and the Eastern Mainline project. Application amendments were filed in December 2015 that reflected the agreement. The agreement provided gas consumers in eastern Canada with sufficient natural gas transmission capacity and provides for reduced natural gas transmission costs. |

| 2016 | The Eastern Mainline project was conditioned on the approval and construction of the Energy East pipeline. Refer to the General development of the business – Liquids Pipelines section for information on Energy East. |

| 2017 | In October 2017, after a careful review of the changed circumstances, we informed the NEB that we would not be proceeding with the Energy East and Eastern Mainline project applications, that in effect provided public notice that the projects were canceled. Refer to the General development of the business – Liquids Pipelines section for information on Energy East. |

|

| | |

| | TCPL Annual information form 2017 | 7 |

|

| |

| Date | Description of development |

| | |

| Canadian Mainline – Other Expansions |

| 2016 | In addition to the Eastern Mainline Project, new facilities investments totaling approximately $700 million over the 2016-2017 period in the Eastern Triangle portion of the Canadian Mainline were required to meet contractual commitments from shippers. In third quarter 2016, we launched an open season for the Canadian Mainline, seeking binding commitments on our new long-term, fixed-price proposal to transport WCSB supply from the Empress receipt point in Alberta to the Dawn hub in Southern Ontario. The open season for the proposed service resulted in bids that fell short of the volumes required to make the proposal viable. On November 15, 2016 we announced we would not proceed with the service offering. Refer to the Canadian Mainline – Kings North and Station 130 Facilities section above. |

| 2017 | Including the Vaughan Loop, which was placed in service in November 2017, we had approximately $245 million of additional investment to meet contractual commitments from shippers that went into service in 2017 on the Canadian Mainline. The Canadian Mainline also received requests for expansion capacity to the southern Ontario market plus delivery to Atlantic Canada via the Trans-Québec & Maritimes and PNGTS (defined below) systems. The requests for approximately 86 TJ/d (80 MMcf/d) of firm service underpin the need for new compression at the existing Maple compressor site. Customers have executed 15-year precedent agreements to proceed with the project, which has an estimated cost of $110 million. An application to the NEB seeking project approval was filed on November 2, 2017. We have requested a decision by the NEB to proceed with the project in first quarter 2018 to meet an anticipated in-service date of November 1, 2019. |

| | |

| Dawn Long-Term Fixed-Price Service |

| 2017 | On November 1, 2017, we began offering a new NEB-approved service on the Mainline referred to as the Dawn Long-Term Fixed-Price (LTFP) service. This LTFP service enables WCSB producers to transport up to 1.5 PJ/d (1.4 Bcf/d) of natural gas at a simplified toll of $0.77/GJ from the Empress receipt point in Alberta to the Dawn hub in Southern Ontario. The LTFP service is underpinned by ten-year contracts that have early termination rights after five years. Any early termination will result in an increased toll for the last two years of the contract. |

| | |

| Canadian Mainline Settlement |

| 2015 | In 2015, the Canadian Mainline began operating under the NEB-approved Canadian Mainline's 2015-2030 Tolls and Tariff Application. |

| 2017 | While the 2015-2030 settlement (LDC Settlement) specified tolls for 2015 to 2020, the NEB ordered a toll review halfway through this six-year period, to be filed by December 31, 2017. The 2018-2020 toll review must include costs, forecast volumes, contracting levels, the deferral account balance, and any other material changes. A supplemental agreement for the 2018-2020 period was executed between TransCanada and eastern LDCs on December 8, 2017, and filed for approval with the NEB on December 18, 2017 (the Supplemental Agreement). The Supplemental Agreement, supported by a majority of Canadian Mainline stakeholders, proposes lower tolls, preserves an incentive arrangement that provides an opportunity for 10.1 per cent, or greater return, on a 40 per cent deemed equity and describes the revenue requirements and billing determinants for the 2018-2020 period. We anticipate the NEB will provide directions and process to adjudicate the application in first quarter 2018. Interim tolls for 2018, as established by the Supplemental Agreement, were filed and subsequently approved by the NEB on December 19, 2017. |

| | |

| LNG PIPELINE PROJECTS |

| |

| Prince Rupert Gas Transmission |

| 2015 | In June 2015, PNW LNG announced a positive FID for its proposed liquefaction and export facility, subject to two conditions. The first condition, approval by the Legislative Assembly of B.C. of a project development agreement between PNW LNG and the Province of B.C., was satisfied in July 2015. The second condition was a positive regulatory decision on PNW LNG’s environmental assessment by the Government of Canada. Environmental permits for the project were received in November 2014 from the B.C. Environmental Assessment Office (BCEAO). In third quarter 2015, we received all remaining permits from the B.C. Oil and Gas Commission (OGC). With these permits, PRGT received all of the primary regulatory permits required for the project. |

| 2016 | In September 2016, PNW LNG received an environmental certificate from the Government of Canada for a proposed LNG plant at Prince Rupert, B.C. In December 2016, PNW LNG received an LNG export license from the NEB which extended the export term from 25 years to 40 years. We continued our engagement with Indigenous groups and signed project agreements with 14 First Nation groups along the pipeline route, which outlined financial and other benefits and commitments that would be provided to each First Nation for as long as the project was in service. |

| 2017 | In July 2017, we were notified that PNW LNG would not be proceeding with their proposed LNG project and that Progress Energy would be terminating their agreement with us for development of the PRGT project. In accordance with the terms of the agreement, we received a payment of $0.6 billion from Progress Energy in October 2017 for full recovery of our costs plus carrying charges. |

|

| | |

| 8 | TCPL Annual information form 2017 | |

|

| |

| Date | Description of development |

| | |

| Coastal GasLink |

| 2016 | In first quarter 2016, we continued to engage with Indigenous groups and announced project agreements with 11 First Nation groups along the pipeline route which outlined financial and other benefits and commitments that would be provided to each First Nation group for as long as the project was in service. We also continued to engage with stakeholders along the pipeline route and progressed detailed engineering and construction planning work to refine the capital cost estimate. In response to feedback received, we applied for a minor route amendment to the BCEAO in order to provide an option in the area of concern. In July 2016, the LNG Canada joint venture participants announced a delay to their FID for the proposed LNG facility in Kitimat, B.C. We worked with LNG Canada to maintain the appropriate pace of the Coastal GasLink development schedule and work activities. We continued our engagement with Indigenous groups along our pipeline route and concluded long-term project agreements with 17 First Nation communities. |

| 2017 | The continuing delay in the FID for the LNG Canada project triggered a restructuring of the provisions in the Coastal GasLink project agreement with LNG Canada that resulted in the payment of certain amounts to TransCanada with respect to carrying charges on costs incurred. In September 2017, an approximate $80 million payment was received related to costs incurred since inception of the project. Following a payment of $8 million in fourth quarter 2017, additional quarterly payments of approximately $7 million will be received until further notice. We continue to work with LNG Canada under the agreement towards an FID. Coastal GasLink filed an amendment to the Environmental Assessment Certificate in November 2017 for an alternate route on a portion of the pipeline. A decision from the BCEAO is expected in 2018. Should the project not proceed, our project costs, including carrying charges are fully recoverable. |

|

| | |

| | TCPL Annual information form 2017 | 9 |

Developments in the U.S. Natural Gas Pipelines Segment |

| |

| Date | Description of development |

| | |

| U.S. NATURAL GAS PIPELINES - COLUMBIA |

| |

| Columbia Acquisition |

| 2016 | On July 1, 2016, we acquired 100 per cent ownership of Columbia for a purchase price of US$10.3 billion in cash. The acquisition was initially financed through proceeds of $4.4 billion from the sale of subscription receipts, draws on acquisition bridge facilities in the aggregate amount of US$6.9 billion and existing cash on hand. The sale of the subscription receipts was completed on April 1, 2016, through a public offering, and following the closing of the acquisition, the subscription receipts were exchanged into 96.6 million TransCanada common shares. |

| | |

| Columbia Pipeline Partners LP (CPPL) |

| 2016 | In November 2016, we announced that we entered into an agreement and plan of merger through which Columbia agreed to acquire, for cash, all of the outstanding publicly held common units of CPPL. |

| 2017 | In February 2017, we completed the acquisition, for cash, of all outstanding publicly held common units of CPPL at a price of US$17.00 and a stub period distribution of US$0.10 per common unit for an aggregate transaction value of US$921 million. |

| | |

| Leach XPress |

| 2015 | The Federal Energy Regulatory Commission (U.S.) (FERC) 7(C) application for this Columbia Gas project was filed in June 2015. The project transports approximately 1.6 PJ/d (1.5 Bcf/d) of Marcellus and Utica gas supply to delivery points along the pipeline and to the Leach interconnect with Columbia Gulf. The project consists of 260 km (160 miles) of 36-inch greenfield pipe, 39 km (24 miles) of 36-inch loop, three km (two miles) of 30-inch greenfield pipe, 82.8 MW (111,000 hp) of greenfield compression and 24.6 MW (33,000 hp) of brownfield compression. |

| 2016 | The Final Environmental Impact Statement (FEIS) for the project was received in September 2016. |

| 2018 | The US$1.6 billion project was placed in service on January 1, 2018. |

| | |

| Mountaineer XPress |

| 2016 | The FERC 7(C) application for this Columbia Gas project was filed in April 2016. The project is designed to transport approximately 2.9 PJ/d (2.7 Bcf/d) of Marcellus and Utica gas supply to delivery points along the pipeline and to the Leach interconnect with Columbia Gulf. The project consists of 275 km (171 miles) of 36-inch greenfield pipeline, ten km (six miles) of 24-inch lateral pipeline, 0.6 km (0.4 miles) of 30-inch replacement pipeline, 114.1 MW (153,000 hp) of greenfield compression and 55.9 MW (75,000 hp) of brownfield compression. |

| 2017 | The FERC certificate for the Mountaineer Xpress project was received on December 29, 2017. The project is expected to have a US$0.6 billion increase in its capital project cost due to increased construction cost estimates. As a result of a cost sharing mechanism, overall project returns are not anticipated to be materially affected. The US$2.6 billion project is expected to be placed in service in fourth quarter 2018. |

| |

| Rayne XPress |

| 2015 | The FERC 7(C) application for this Columbia Gulf project was filed in July 2015. The project transports approximately 1.1 PJ/d (1 Bcf/d) of supply from an interconnect with the Leach XPress pipeline project and another interconnect, to markets along the system and to the Gulf Coast. The project consists of bi-directional compressor station modifications along Columbia Gulf, 38.8 MW (52,000 hp) of greenfield compression, 20.1 MW (27,000 hp) of replacement compression and six km (four miles) of 30-inch pipe replacement. |

| 2016 | The FEIS for the project was received in September 2016. |

| 2017 | The US$0.4 billion project was placed in service on November 2, 2017. |

| | |

| Gulf XPress |

| 2016 | The FERC 7(C) application for this Columbia Gulf project was filed in April 2016. The project is designed to transport approximately 0.9 Bcf/d associated with the Mountaineer XPress expansion to various delivery points on Columbia Gulf and the Gulf Coast. The project consists of adding seven greenfield midpoint compressor stations along the Columbia Gulf route totaling 182.7 MW (245,000 hp). |

| 2017 | The FERC certificate for Gulf Xpress project was received on December 29, 2017. We expect this project, with an estimated capital investment of US$0.6 billion, to be placed in service in 2018. |

| | |

| Cameron Access Project |

| 2015 | The FERC certificate for this Columbia Gulf project was received in September 2015. The project is designed to transport approximately 0.8 Bcf/d of gas supply to the Cameron LNG export terminal in Louisiana. The project consists of 55 km (34 miles) of 36-inch greenfield pipeline, 11 km (seven miles) of 30-inch looping and 9.7 MW (13,000 hp) of greenfield compression. We expect this project, with an estimated capital investment of US$0.3 billion, to be in service in first quarter 2018. |

|

| | |

| 10 | TCPL Annual information form 2017 | |

|

| |

| Date | Description of development |

| | |

| WB XPress |

| 2015 | The FERC 7(C) application for both segments of this Columbia Gas project was filed in December 2015. The project is designed to transport approximately 1.3 Bcf/d of Marcellus gas supply westbound (0.8 Bcf/d) to the Gulf Coast via an interconnect with the Tennessee Gas Pipeline, and eastbound (0.5 Bcf/d) to Mid-Atlantic markets. The project consists of 47 km (29 miles) of various diameter pipeline, 338 km (210 miles) of restoring and uprating maximum operating pressure of existing pipeline, 29.8 MW (40,000 hp) of greenfield compression and 99.9 MW (134,000 hp) of brownfield compression. |

| 2017 | The FERC certificate for the WB XPress project was received in November 2017. We expect this project, with an estimated capital investment of US$0.8 billion, to be fully in service in 2018. |

| | |

| Buckeye XPress |

| 2017 | The Buckeye XPress project represents an upsizing of an existing pipeline replacement project in conjunction with our Columbia Gas modernization program. The US$0.2 billion cost to upsize the replacement pipe and install compressor upgrades will enable us to offer 290 TJ/d (275 MMcf/d) of incremental pipeline capacity to accommodate growing Appalachian production. We expect the project to be placed in service in late-2020. |

| | |

| Modernization I & II |

| 2017 | Columbia Gas and its customers entered into a settlement arrangement, approved by the FERC, which provides recovery and return on investment to modernize its system, improve system integrity, and enhance service reliability and flexibility. The modernization program includes, among other things, replacement of aging pipeline and compressor facilities, enhancements to system inspection capabilities, and improvements in control systems. The US$1.5 billion Modernization I arrangement was completed under the terms of a 2012 settlement agreement, with the final US$0.2 billion spent in 2017. Modernization II has been approved for up to US$1.1 billion of work starting in 2018 and to be completed through 2020. As per terms of the arrangements, facilities in service by October 31 collect revenues effective February 1 of the following year. |

| | |

| Gibraltar |

| 2016 | The first phase of the multi-phase project was completed in December 2016. |

| 2017 | The US$0.3 billion Midstream project to construct an approximate 1,000 TJ/d (934 MMcf/d) dry gas header pipeline in southwest Pennsylvania was placed in service on November 1, 2017. |

| | |

| OTHER U.S. NATURAL GAS PIPELINES |

| | |

| ANR Pipeline |

| 2016 | ANR Pipeline filed a Section 4 Rate Case that requested an increase to ANR's maximum transportation rates in January 2016. Shifts in ANR’s traditional supply sources and markets, necessary operational changes, needed infrastructure updates, and evolving regulatory requirements were driving required investment in facility maintenance, reliability and system integrity as well as an increase in operating costs that resulted in the current tariff rates not providing a reasonable return on our investment. We also pursued a collaborative process to find a mutually beneficial outcome with our customers through settlement negotiations. ANR's last rate case filing was more than 20 years ago. ANR reached a settlement with its shippers effective August 1, 2016 and received FERC approval on December 16, 2016. Per the settlement, transmission reservation rates would increase by 34.8 per cent and storage rates would remain the same for contracts one to three years in length, while increasing slightly for contracts of less than one year and decreasing slightly for contracts more than three years in duration. There is a moratorium on any further rate changes until August 1, 2019. ANR may file for new rates after that date if it has spent more than US$0.8 billion in capital additions, but must file for new rates no later than an effective date of August 1, 2022. |

| | |

| Great Lakes |

| 2015 | We test goodwill for impairment annually or more frequently if events or changes in circumstances lead us to believe it might be impaired. Our share of the goodwill related to Great Lakes, net of non-controlling interests, was US$386 million at December 31, 2015. |

| 2016 | Our share of the goodwill related to Great Lakes, net of non-controlling interests, was US$382 million at December 31, 2016. |

| 2017 | On October 30, 2017, Great Lakes filed a rate settlement with the FERC to satisfy its obligations from its previous 2013 rate settlement for new rates to be in effect by January 1, 2018. The settlement, if approved by the FERC, will decrease Great Lakes’ maximum transportation rates by 27 per cent effective October 1, 2017. Great Lakes expects that the impact from other changes, including the recent long-term transportation contract with the Canadian Mainline as described below, other revenue opportunities on the system and the elimination of the revenue sharing mechanism with its customers, will essentially offset the full year impact of the reduction in Great Lakes’ rates beginning in 2018. In conjunction with the Canadian Mainline's LTFP service (see Canadian Regulated Pipelines – Dawn Long-Term Fixed-Price Service above), Great Lakes entered into a new ten-year gas transportation contract with the Canadian Mainline. This contract received NEB approval in September 2017, effective November 1, 2017, and contains volume reduction options up to full contract quantity beginning in year three. |

|

| | |

| | TCPL Annual information form 2017 | 11 |

|

| |

| Date | Description of development |

| 2017 (continued) | In relation to goodwill impairment, although evolving market conditions and other factors relevant to Great Lakes' long term financial performance have been positive, there is a risk that reductions in future cash flow forecasts or adverse changes in other key assumptions could result in a future impairment of a portion of the goodwill balance relating to Great Lakes. Our share of the goodwill related to Great Lakes, net of non-controlling interests, was US$379 million at Year End. At Year End, the estimated fair value of Great Lakes exceeded its carrying value by less than ten per cent. Further information about impairment of goodwill can be found in the MD&A in the Other Information – Critical Accounting Estimates – Impairment of long-lived assets, equity investments and goodwill section, which section of the MD&A is incorporated by reference herein. |

| | |

| Northern Border |

| 2017 | Northern Border filed a rate settlement with the FERC on December 4, 2017, reflecting a settlement-in-principle with its shippers, which precludes the need to file a general rate case as contemplated by its previous 2012 settlement. Northern Border anticipates that the FERC will accept the settlement agreement and that it will be unopposed. This is expected to provide Northern Border with rate stability over the longer term. We have a 12.9 per cent indirect ownership interest in Northern Border though TC PipeLines, LP (TCLP). |

| | |

| Portland Natural Gas Transmission System (PNGTS) |

| 2016 | In January 2016, we closed the sale of our 49.9 per cent of our total 61.7 per cent interest in PNGTS to TCLP for US$223 million. Proceeds were comprised of US$188 million in cash and the assumption of US$35 million of a proportionate share of PNGTS debt. |

| 2017 | In June 2017, we closed the sale of a 49.34 per cent of our 50 per cent interest in Iroquois, along with an option to sell the remaining 0.66 per cent at a later date, to TCLP. At the same time, we closed the sale of our remaining 11.81 per cent interest in PNGTS to TCLP. Proceeds from these transactions were US$765 million, before post-closing adjustments, and were comprised of US$597 million in cash and US$168 million representing a proportionate share of Iroquois and PNGTS debt. In December 2017, PNGTS executed precedent agreements with several LDCs in New England and Atlantic Canada to re-contract certain system capacity set to expire in 2019, as well as expand the PNGTS system to bring its certificated capacity from 222 TJ/d (210 MMcf/d) up to 290 TJ/d (275 MMcf/d). The approximate US$80 million Portland XPress Project (PXP) will proceed concurrently with upstream capacity expansions. The in-service dates of PXP are being phased-in over a three-year period beginning November 1, 2018. |

| | |

| Iroquois Gas Transmission System, L.P. (Iroquois) |

| 2016 | FERC approvals were obtained for settlements with shippers for our Iroquois, Tuscarora and Columbia Gulf pipelines in third quarter 2016. On March 31, 2016, we acquired an additional 4.87 per cent interest in Iroquois for an aggregate purchase price of US$54 million and on May 1, 2016, a further 0.65 per cent was acquired for US$7 million. As a result, our interest in Iroquois increased to 50 per cent. |

| 2017 | In June 2017, we closed the sale of a 49.34 per cent of our 50 per cent interest in Iroquois, along with an option to sell the remaining 0.66 per cent at a later date, to TCLP. At the same time, we closed the sale of our remaining 11.81 per cent interest in PNGTS to TCLP. Refer to the Portland Natural Gas Transmission System section above. |

| | |

| Gas Transmission Northwest LLC (GTN) |

| 2015 | In April 2015, we closed the sale of our remaining 30 per cent interest in GTN to TCLP for an aggregate purchase price of US$457 million. Proceeds were comprised of US$264 million in cash, the assumption of US$98 million of debt, being proportional GTN debt and US$95 million of new Class B units of TCLP. |

| | |

| TC Offshore LLC (TC Offshore) |

| 2015 | We entered into an agreement to sell TC Offshore to a third party. As a result, at December 31, 2015, the related assets and liabilities were classified as held for sale and were recorded at their fair values less costs to sell. This resulted in a pre-tax loss provisions of $125 million recorded in 2015. |

| 2016 | We completed the sale of TC Offshore in March 2016. |

| | |

| LNG PIPELINE PROJECTS |

| | |

| Alaska LNG Project |

| 2015 | In November 2015, we sold our interest in the Alaska LNG project to the State of Alaska. The proceeds of US$65 million from this sale provide a full recovery of costs incurred to advance the project since January 1, 2014 including a carrying charge. With this sale, our involvement in developing a pipeline system for commercializing Alaska North Slope natural gas ceased. |

|

| | |

| 12 | TCPL Annual information form 2017 | |

Developments in the Mexico Natural Gas Pipelines segment |

| |

| Date | Description of development |

| | |

| MEXICO NATURAL GAS PIPELINES |

| |

| Topolobampo |

| 2016 | In November 2012, we were awarded the contract to build, own and operate the Topolobampo project. Construction on the project is supported by a 25-year Transportation Service Agreement (TSA) for 717 TJ/d (670 MMcf/d) with the Comisión Federal de Electricidad (Mexico) (CFE). The Topolobampo project is a 560 km (348 mile), 30-inch pipeline that will receive gas from the upstream pipelines near El Encino, in the state of Chihuahua, and deliver natural gas from these interconnecting pipelines to delivery points along the pipeline route including our Mazatlán pipeline at El Oro, in the state of Sinaloa. |

| 2017 | The Topolobampo project is substantially complete, excluding a 20 km (12 mile) section due to delays experienced by the Secretary of Energy, the government department which conducts indigenous consultations in Mexico. The issue has been resolved and construction on this final section is expected to be completed in second quarter 2018. Under the terms of the TSA, the delays were recognized as a force majeure event with provisions allowing for the collection of revenue as per the original TSA service commencement date of July 2016. The pipeline cost estimate is approximately US$1.2 billion, an increase of US$0.2 billion from the original estimate, due to the delays. |

| |

| Mazatlán |

| 2015 | The Mazatlán project is a 430 km (267 mile), 24-inch pipeline running from El Oro to Mazatlán, in the state of Sinaloa, with an estimated cost of US$0.4 billion. This pipeline is supported by a 25-year natural gas TSA for 214 TJ/d (200 MMcf/d) with the CFE. |

| 2016 | Physical construction was completed in 2016 and was awaiting natural gas supply from upstream interconnecting pipelines. We met our obligations and have been collecting revenue as per provisions in the contract and per the original TSA service commencement date of December 2016. |

| 2017 | The Mazatlán project was commissioned and brought into full service in July 2017. |

| |

| Tula |

| 2015 | In November 2015, we were awarded the contract to build, own and operate the US$0.7 billion, 36-inch, 300 km (186 mile) pipeline with a 16-inch, 24 km (15 mile) lateral, supported by a 25-year natural gas TSA for 949 TJ/d (886 MMcf/d) with the CFE. The pipeline will transport natural gas from Tuxpan, Veracruz to markets near Tula, Querétaro extending through the states of Puebla and Hidalgo. |

| 2017 | Construction of the Tula pipeline was substantially completed in 2017, with the exception of approximately 90 km (56 miles) of the pipeline. Project completion has been revised to late 2019 due to delays experienced by the Secretary of Energy, the governmental department which conducts indigenous consultations in Mexico. The delay has been recognized by the CFE as a force majeure event and we are finalizing amending agreements to formalize the schedule and payment impacts. As a result of the delay and increased cost of land and permitting, estimated project costs have increased by US$0.1 billion from the original estimate. Full completion of the project has been revised to the end of 2019. |

| |

| Villa de Reyes |

| 2016 | In April 2016, we were awarded the contract to build, own and operate the Villa de Reyes pipeline in Mexico. Construction of the pipeline is supported by a 25-year natural gas TSA for 949 TJ/d (886 MMcf/d) with the CFE. We expect to invest approximately US$0.6 billion to construct 36- and 24-inch pipelines totaling 420 km (261 miles). The bi-directional pipeline will transport natural gas between Tula, in the state of Hidalgo, and Villa de Reyes, in the state of San Luis Potosí. The project will interconnect with our Tamazunchale and Tula pipelines as well as with other transporters in the region. |

| 2017 | Construction of the project has commenced, however, delays due to archeological investigations by state authorities have caused the in-service date to be revised to late 2018. The delay has been recognized as a force majeure event by the CFE and we are finalizing amending agreements to formalize the schedule and payment impacts. As a result of the delay and increased cost of land and permitting, estimated project costs have increased by US$0.2 billion from the original estimate. |

| |

| Sur de Texas |

| 2016 | The US$2.1 billion Sur de Texas project is a joint venture with IEnova in which we hold a 60 per cent interest representing an investment of approximately US$1.3 billion. Construction of the pipeline is supported by a 25-year natural gas TSA for 2.8 PJ/d (2.6 bcf/d) with the CFE. The 42-inch, approximately 800 km (497 mile) pipeline will start offshore in the Gulf of Mexico, at the border point near Brownsville, Texas, and end in Tuxpan in the state of Veracruz. The project will deliver natural gas to our Tamazunchale and Tula pipelines and to other transporters in the region. |

| 2017 | Pipeline construction is progressing toward an anticipated in-service date of late 2018, with approximately 60 per cent of the off-shore construction completed as at Year End. |

Further information about developments in the Natural Gas Pipelines business, including changes that we expect will occur in the current financial year, can be found in the MD&A in the Natural Gas Pipelines business section; Canadian Natural Gas Pipelines – Understanding our Canadian Natural Gas Pipelines segment, Significant events, Financial results and Outlook sections; U.S. Natural Gas Pipelines – Understanding our U.S. Natural Gas Pipelines segment, Significant events, Financial results and Outlook sections; and Mexico Natural Gas Pipelines – Understanding our Mexico Natural Gas Pipelines segment, Significant events, Financial results and Outlook sections, which sections of the MD&A are incorporated by reference herein.

|

| | |

| | TCPL Annual information form 2017 | 13 |

LIQUIDS PIPELINES

Development in the Liquids Pipelines Segment

|

| |

| Date | Description of development |

| | |

| Keystone Pipeline System |

| 2015 | In 2015, we entered into an agreement with CITGO Petroleum (CITGO) to construct a US$65 million pipeline connection between the Keystone Pipeline and CITGO’s Sour Lake, Texas terminal, which supplies their 425,000 Bbl/d Lake Charles, Louisiana refinery. We secured additional long-term contracts bringing our total contract position up to 545,000 Bbl/d. |

| 2016 | In January 2016, we entered into an agreement with Magellan Midstream Partners L.P. (Magellan) to connect our Houston Terminal to Magellan's Houston and Texas City, Texas delivery system. We will own 50 per cent of this US$50 million pipeline project which will enhance connections for our Keystone Pipeline to the Houston market. On April 2, 2016, we shut down the Keystone Pipeline after a leak was detected along the pipeline right-of-way in Hutchinson County, South Dakota. We reported the total volume of the release of 400 barrels to the National Response Centre (NRC) and the Pipeline and Hazardous Materials Safety and Administration (PHMSA). Temporary repairs were completed and the Keystone Pipeline was restarted by mid-April 2016. Shortly thereafter in early May 2016, permanent pipeline repairs were completed and restoration work was completed by early July 2016. Corrective measures required by PHMSA were completed in September 2016. This shutdown did not significantly impact our 2016 earnings. The Houston Lateral pipeline and terminal, an extension from the Keystone Pipeline to Houston, Texas, went into service in August 2016. The terminal has an initial storage capacity for 700,000 barrels of crude oil. The HoustonLink pipeline which connects the Houston Terminal to Magellan's Houston and Texas City, Texas delivery system was completed in December 2016. The CITGO Sour Lake pipeline connection between the Keystone Pipeline and CITGO's Sour Lake, Texas terminal was placed into service in December 2016. |

| 2017 | In fourth quarter 2017, we concluded open seasons for the Keystone pipeline and Marketlink and secured incremental long-term contractual support. On November 16, 2017, the Keystone pipeline was temporarily shut down after a leak was detected in Marshall County, South Dakota. The estimated volume of the release was 5,000 barrels as reported to the NRC and the PHMSA. On November 29, 2017, the pipeline was repaired and returned to service at a reduced pressure in the affected section of the pipeline. Further investigative activities and corrective measures required by PHMSA are planned for 2018. This shutdown did not have a significant impact on our 2017 earnings. |

| | |

| Keystone XL |

| 2015 | In January 2015, the Nebraska State Supreme Court vacated a lower court's ruling, which had given the state Public Service Commission (PSC) rather than the governor, the authority to approve an alternative route through Nebraska for Keystone XL, as unconstitutional. As a result, the Governor’s January 2013 approval of the alternate route through Nebraska for Keystone XL remained valid. Landowners filed lawsuits in two Nebraska counties seeking to enjoin Keystone XL from condemning easements on state constitutional grounds. The decision on the Keystone XL Presidential permit application was delayed throughout 2015 by the U. S. Department of State (DOS) and was ultimately denied in November 2015. At December 31, 2015, as a result of the denial of the Presidential permit, we evaluated our investment in Keystone XL and related projects, including Keystone Hardisty Terminal, for impairment. As a result of our analysis, we determined that the carrying amount of these assets was no longer recoverable, and recognized a total non-cash impairment charge of $3.7 billion ($2.9 billion after-tax). The impairment charge was based on the excess of the carrying value of $4.3 billion over the fair value of $621 million, which includes $93 million fair value for Keystone Hardisty Terminal. The calculation of this impairment is discussed further in the Other information – Critical accounting estimates section of the MD&A, which section is incorporated by reference herein. In November 2015, we withdrew our application to the PSC for approval of the route for Keystone XL in the state. The application was initially filed in October 2015. The withdrawal was made without prejudice to potentially refile if we elect to pursue the project. |

| 2016 | On January 5, 2016, the South Dakota Public Utilities Commission (PUC) accepted Keystone XL’s certification that it continued to comply with the conditions in its existing 2010 permit authority in the state. On January 6, 2016, we filed a Notice of Intent to initiate a claim under Chapter 11 of North American Free Trade Agreement (NAFTA) in response to the U.S. Administration’s decision to deny a Presidential permit for the Keystone XL Pipeline on the basis that the denial was arbitrary and unjustified. Through the NAFTA claim, we were seeking to recover more than US$15 billion in costs and damages that we estimated to have suffered as a result of the U.S. Administration’s breach of its NAFTA obligations. In June 2016, we filed a Request for Arbitration in a dispute against the U.S. Government pursuant to the Convention on Settlement of Investment Disputes between States and Nationals of Other States, the Rules of Procedure for the Institution of Conciliation and Arbitration Proceedings and Chapter 11 of NAFTA. On January 5, 2016, we also filed a lawsuit in the U.S. Federal Court in Houston, Texas, asserting that the U.S. President’s decision to deny construction of Keystone XL exceeded his power under the U.S. Constitution. The federal court lawsuit did not seek damages, but rather a declaration that the permit denial was without legal merit and that no further Presidential action was required before construction of the pipeline could proceed. |

|

| | |

| 14 | TCPL Annual information form 2017 | |

|

| |

| Date | Description of development |

| 2017 | On January 24, 2017, the U.S. President signed a Presidential Memorandum inviting TransCanada to refile an application for the U.S. Presidential Permit. On January 26, 2017, we filed a Presidential Permit application with the DOS for the project. In February 2017, we filed an application with the PSC to seek approval for the Keystone XL pipeline route through the state. In March 2017, the DOS issued a U.S. Presidential Permit authorizing construction of the U.S./ Canada border crossing facilities of the Keystone XL project. We discontinued our claim under Chapter 11 of NAFTA and withdrew the U.S. Constitutional challenge. Later in March 2017, two lawsuits were filed in Montana District Court challenging the validity of the Presidential Permit. Along with the U.S. Government, we filed motions for dismissal of these lawsuits which were subsequently denied on November 22, 2017. The cases will now proceed to the consideration of summary judgment motions. In July 2017, we launched an open season to solicit additional binding commitments from interested parties for transportation of crude oil on the Keystone pipeline and for the Keystone XL project from Hardisty, Alberta to Cushing, Oklahoma and the U.S. Gulf Coast. The successful open season concluded on October 26, 2017. On November 20, 2017, we received PSC approval for the alternative mainline route. On November 24, 2017, we filed a motion with the PSC to reconsider its ruling and permit us to file an amended application that would support their decision and would address certain issues related to their selection of the alternative route, which was denied on December 19, 2017. On December 27, 2017, opponents of the Keystone XL project and intervenors in the Keystone XL Nebraska regulatory proceeding filed an appeal of the PSC decision seeking to have that decision overturned. TransCanada supports the decision of the PSC and will actively participate in the appeal process to defend that decision. In January 2018, we secured sufficient commercial support to commence construction preparation for the Keystone XL project. Subject to certain conditions, we expect to commence primary construction in 2019, and once commenced, construction is anticipated to take approximately two years to complete. |

| | |

| Energy East |

| 2015 | In April 2015, we announced that the proposed marine terminal and associated tank terminal in Cacouna, Québec would not be built as a result of the recommended reclassification of the beluga whale, indigenous to the site, as an endangered species. In November 2015, following consultation with stakeholders and shippers, we announced the intention to amend the Energy East pipeline application to remove a port in Québec and proceed with a single marine terminal in Saint John, New Brunswick. In December 2015, we filed an amendment to the existing project application with the NEB that adjusted the proposed route, scope and capital cost of the project reflecting refinement and scope change including the removal of the port in Québec. |

| 2016 | In May 2016, we filed a consolidated application with the NEB for the Energy East pipeline. In June 2016, Energy East achieved a major milestone with the NEB’s announcement determining the Energy East pipeline application was sufficiently complete to initiate the formal regulatory review process. However, in August 2016, panel sessions were canceled as three NEB panelists recused themselves from continuing to sit on the panel to review the project due to allegations of reasonable apprehension of bias. The Chair of the NEB and the Vice-Chair, who is also a panel member, recused themselves of any further duties related to the project. As a result, all hearings for the project were adjourned until further notice. |

| 2017 | On January 9, 2017, the NEB appointed three new permanent panel members to undertake the review of the Energy East and Eastern Mainline projects. On January 27, 2017, the new NEB panel members voided all decisions made by the previous hearing panel members and all decisions were removed from the official hearing record. We were not required to refile the application and parties were not required to reapply for intervener status. On September 7, 2017, we requested the NEB suspend the review of the Energy East and Eastern Mainline project applications for 30 days to provide time for us to conduct a careful review of the NEB's changes, which were announced on August 23, 2017, regarding the list of issues and environmental assessment factors related to the projects and how these changes impact the projects' costs, schedules and viability. On October 5, 2017, after careful review of the changed circumstances, we informed the NEB that we would not be proceeding with the Energy East and Eastern Mainline project applications. We also notified Québec’s Ministère du Développement durable, de l'Environnement et la Lutte contre les changements climatiques (MDDELCC) that we were withdrawing the Energy East project from the environmental review process. As the Energy East pipeline was also to provide transportation services for the Upland pipeline, the DOS was notified in October 2017, that we would no longer be pursuing the U.S. Presidential Permit application for that project. We reviewed the $1.3 billion carrying value of the projects, including allowance of funds used during construction (AFUDC) capitalized since inception, and recorded a $954 million after-tax non-cash charge in our fourth quarter 2017 results. We ceased capitalizing AFUDC on the projects effective August 23, 2017, the date of the NEB's announced scope changes. With Energy East's inability to reach a regulatory decision, no recoveries of costs from third parties are forthcoming. |

|

| | |

| | TCPL Annual information form 2017 | 15 |

|

| |

| Date | Description of development |

| | |

| Grand Rapids |

| 2015 | In August 2015, we announced a joint venture between Grand Rapids and Keyera Corp. (Keyera) for provision of diluent transportation service on the 20-inch pipeline between Edmonton and Fort Saskatchewan, Alberta. The joint venture was incorporated into Grand Rapids to provide enhanced diluent supply alternatives to our shippers. |

| 2016 | Construction continued on the Grand Rapids pipeline. We entered into a partnership with Brion Energy Corporation (Brion) to develop Grand Rapids with each party owning 50 per cent of the pipeline project. Our partner also entered into a long-term transportation service contract in support of the project. Construction progressed on the 20-inch diluent joint venture pipeline between Edmonton and Fort Saskatchewan, Alberta. The joint venture between Grand Rapids and Keyera was incorporated into Grand Rapids to provide enhanced diluent supply alternatives to our shippers. |

| 2017 | In late August 2017, the Grand Rapids pipeline, jointly owned by TransCanada and PetroChina Canada Ltd. (formerly Brion), was placed in service. The 460 km (287 mile) crude oil transportation system connects producing areas northwest of Fort McMurray, Alberta to terminals in the Edmonton/ Heartland region. |

| | |

| Northern Courier |

| 2016 | Construction continued on the Northern Courier pipeline to transport bitumen and diluent between the Fort Hills mine site and Suncor Energy's terminal located north of Fort McMurray, Alberta. The project is fully underpinned by long-term contracts with the Fort Hills partnership. |

| 2017 | In November 2017, the Northern Courier pipeline, a 90 km (56 mile) pipeline system, achieved commercial in-service. |

| | |

| White Spruce |

| 2016 | In December 2016, we finalized a long-term transportation agreement to develop and construct the 20-inch White Spruce pipeline, which would transport crude oil from Canadian Natural Resources Limited's Horizon facility in northeast Alberta, to the Grand Rapids pipeline system. The total capital cost for the project amounts to approximately $200 million. |

| 2018 | In first quarter 2018, we anticipate receiving a decision from the AER on the regulatory permit to construct the $200 million White Spruce pipeline. Due to the delay in the regulatory process, we expect the White Spruce pipeline to be in-service in 2019. |

| |

| Upland Pipeline |

| 2015 | In April 2015, we filed an application to obtain a U.S. Presidential permit for the Upland pipeline, which would provide crude oil transportation from and between multiple points in North Dakota and interconnect with the Energy East pipeline system at Moosomin, Saskatchewan. The commercial contracts that we executed for Upland pipeline were conditioned on the Energy East pipeline project proceeding. |

| 2016 | We reviewed the Canadian federal government's interim measures for pipeline reviews to assess their impact to Upland Pipeline. |

| 2017 | On October 5, 2017, after careful review of the changed circumstances, we informed the NEB that we would not be proceeding with the Energy East and Eastern Mainline project applications. We notified MDDELCC that we were withdrawing the Energy East project from the environmental review process. As the Energy East pipeline was also to provide transportation services for the Upland pipeline, the DOS was notified on October 5, 2017, that we would no longer be pursuing the U.S. Presidential Permit application for that project. Refer to the Energy East section above. |

| | |

| Liquids Marketing |

| 2015 | We established a liquids marketing business to expand into other areas of the liquids business value chain. Our liquids marketing business provides customers with a variety of crude oil marketing services including transportation, storage and crude oil supply, primarily transacted through purchase and sale of physical crude oil. |

Further information about developments in the Liquids Pipelines business, including changes that we can expect will occur in the current financial year, can be found in the MD&A in the Liquids Pipelines – Understanding our Liquids Pipelines business, Significant events, Financial results and Outlook sections, which sections of the MD&A are incorporated by reference herein.

|

| | |

| 16 | TCPL Annual information form 2017 | |

ENERGY

Development in the Energy Segment

|

| |

| Date | Description of development |

| | |

| CANADIAN POWER |

| | |

| Alberta PPAs |

| 2015 | In June 2015, the Alberta government announced a renewal and change to the Specified Gas Emitters Regulation (SGER) in Alberta. Since 2007, under the SGER, established industrial facilities with greenhouse gas (GHG) emissions above a certain threshold are required to reduce their emissions by 12 per cent below an average intensity baseline, and a carbon levy of $15 per tonne is placed on emissions above this target. The changes to the SGER included an increase in the emissions reductions target to 15 per cent in 2016 and 20 per cent in 2017, along with an increase in the carbon levy to $20 per tonne in 2016 and $30 per tonne in 2017. Starting in 2018, coal-fired generators will pay $30 per tonne of CO2 on emissions above what Alberta's cleanest natural gas-fired plant would emit to produce an equivalent amount of electricity. |

| 2016 | On March 7, 2016, we issued notice to the Balancing Pool to terminate our Alberta PPAs. On July 22, 2016, we, along with the ASTC Power Partnership (ASTC), issued a notice referring the matter to be resolved by binding arbitration pursuant to the dispute resolution provisions of the PPAs. On July 25, 2016, the Government of Alberta brought an application in the Court of Queen’s Bench to prevent the Balancing Pool from allowing termination of a PPA held by another party which contains identically worded termination provisions to our PPAs. The outcome of this court application could have affected resolution of the arbitration of the Sheerness, Sundance A and Sundance B PPAs. In December 2016, management engaged in settlement negotiations with the Government of Alberta and finalized terms of the settlement of all legal disputes related to the PPA terminations. The Government of Alberta and the Balancing Pool agreed to our termination of the PPAs resulting in the transfer of all our obligations under such PPAs to the Balancing Pool. Upon final settlement of the PPA terminations, we transferred to the Balancing Pool a package of environmental credits held to offset the PPA emissions costs and recorded a non-cash charge of $92 million before-tax ($68 million after-tax) related to the carrying value of our environmental credits. In first quarter 2016, as a result of our decision to terminate the PPAs, we recorded a non-cash impairment charge of $240 million before-tax ($176 million after-tax) comprised of $211 million before-tax ($155 million after-tax) related to the carrying value of our Sundance A and Sheerness PPAs and $29 million before-tax ($21 million after-tax) on our equity investment in the ASTC which previously held the Sundance B PPA. |

| | |

| Ontario Cap and Trade |

| 2016 | Legislation enabling Ontario’s cap and trade program came into force effective July 1, 2016. This regulation set a limit on annual province-wide GHG emissions beginning in January 2017 and introduced a market to administer the purchase and trading of emissions allowances. The regulation places the compliance obligation for emissions from our natural gas-fired power facilities on local gas distributors, with the distributors then flowing the associated costs to the facilities themselves. The IESO has proposed contract amendments for contract holders to address costs and other issues associated with this change in law. We do not expect a significant overall impact to our Energy business as a result of this new regulation. |

| | |

| Napanee |

| 2015 | In January 2015, we began construction activities on our 900 MW natural gas-fired power plant at Ontario Power Corporation's (OPG) Lennox site in in the town of Greater Napanee. |

| 2017 | Construction continued on the power plant. We expect to invest approximately $1.3 billion in the Napanee facility during construction and commercial operations are expected to begin in fourth quarter 2018. Costs have increased due to delays in the construction schedule. Once in service, production from the facility is fully contracted with IESO for a 20-year period. |

| | |

| Bécancour |

| 2015 | We executed an agreement with Hydro-Québec Distribution (HQ) allowing HQ to dispatch up to 570 MW of peak winter capacity from our Bécancour facility for a term of 20 years commencing in December 2016. |

| 2016 | In November 2016, HQ released a new ten-year supply plan indicating additional peak winter capacity from Bécancour is not required at this time. Prior to this development, the regulator in Québec, Régie de l'énergie, reversed its initial decision to approve this agreement. Management does not expect further developments at Bécancour until November 2019 when the next ten-year supply plan is filed. |

| | |

| Bruce Power |

| 2015 | Bruce Power entered into an agreement with the IESO to extend the operating life of the facility to the end of 2064. This new agreement represents an extension and material amendment to the earlier agreement that led to the refurbishment of Units 1 and 2 at the site. The amended agreement, effective January 1, 2016, allows Bruce Power to immediately invest in life extension activities for Units 3 through 8. Our estimated share of investment in the Asset Management program to be completed over the life of the agreement is approximately $2.5 billion (2014 dollars). Our estimated share of investment in the Major Component Replacement (MCR) work that is expected to begin in 2020 is approximately $4 billion (2014 dollars). Under certain conditions, Bruce Power and the IESO can elect to not proceed with the remaining MCR investments should the cost exceed certain thresholds or prove to not provide sufficient economic benefits. The agreement was structured to account for changing cost inputs over time, including ongoing operating costs and additional capital investments. |

|

| | |

| | TCPL Annual information form 2017 | 17 |

|

| |

| Date | Description of development |

| 2015 (continued) | Beginning in January 2016, Bruce Power received a uniform price of $65.73 per MWh for all units, which included certain flow-through items such as fuel and lease expense recovery. Over time, the uniform price is subject to adjustments for the return of and on capital invested at Bruce Power under the Asset Management and MCR capital programs, along with various other pricing adjustments that would allow for a better matching of revenues and costs over the long-term. In connection with this opportunity, we exercised our option to acquire an additional 14.89 per cent ownership interest in Bruce B for $236 million from the Ontario Municipal Employees Retirement System. Subsequent to this acquisition, Bruce A and Bruce B were merged to form a single partnership structure, of which we hold a 48.4 per cent interest. In 2015, we recognized a $36 million charge, representing our proportionate share on the retirement of Bruce Power debt in conjunction with this merger. |

| 2016 | Bruce Power issued bonds and borrowed under its bank credit facility as part of a financing program to fund its capital program and make distributions to its partners. Distributions received by us from Bruce Power in second quarter 2016 included $725 million from this financing program. |

| 2017 | In February 2017, Bruce Power issued senior notes in capital markets under its financing program and distributed $362 million to TransCanada. |

| | |

| Ontario Solar |

| 2017 | On October 24, 2017, we entered into an agreement to sell our Ontario solar assets comprised of eight facilities with a total generating capacity of 76 MW, to Axium Infinity Solar LP. On December 19, 2017, we closed the sale for $541 million resulting in a gain of $127 million ($136 million after-tax). |

| |

| U.S. POWER |

| |

| Monetization of U.S. Northeast Power Business |

| 2016 | In November 2016, we announced the sale of Ravenswood, Ironwood, Ocean State Power and Kibby Wind to Helix Generation, LLC, an affiliate of LS Power Equity Advisors and the sale of TC Hydro to Great River Hydro, LLC, an affiliate of ArcLight Capital Partners, LLC. |

| 2017 | In April 2017, we closed the sale of TC Hydro to Great River Hydro, LLC for US$1.07 billion, before post-closing adjustments and recorded a gain of $715 million ($440 million after-tax). In June 2017, we closed the sale of Ravenswood, Ironwood, Ocean State Power and Kibby Wind to Helix Generation, LLC for US$2.029 billion, before post-closing adjustments. In addition to the pre-tax losses of approximately $829 million ($863 million after-tax) that we recorded in 2016 upon entering into agreements to sell these assets, an additional pre-tax loss on sale of approximately $211 million ($167 million after-tax) was recorded in 2017, primarily related to an adjustment to the purchase price and repair costs for an unplanned outage at Ravenswood prior to close, partially offset by insurance recoveries for a portion of the repair costs. Proceeds from the sale transactions were used to fully retire the remaining bridge facilities that partially funded the acquisition of Columbia. On December 22, 2017, we entered into an agreement to sell our U.S. power retail contracts as part of the continued wind down of our U.S. power marketing operations. The transaction is expected to close in first quarter 2018, subject to regulatory and other approvals. |

| | |

| Ironwood |

| 2016 | In February 2016, we acquired the 778 MW Ironwood natural gas fired, combined cycle power plant located in Lebanon, Pennsylvania for US$653 million in cash after post-acquisition adjustments. The Ironwood power plant delivers energy into the PJM Interconnection area power market. Refer to the Monetization of U.S. Northeast Power Business section above. |

Further information about developments in the Energy business, including changes that we expect will occur in the current financial year, can be found in the MD&A in the About our business – Our strategy, Energy – Understanding our Energy business, Significant events, Financial results and Outlook sections, which sections of the MD&A are incorporated by reference herein.

|

| | |

| 18 | TCPL Annual information form 2017 | |

Business of TCPL

We are a leading North American energy infrastructure company focused on Natural Gas Pipelines, Liquids Pipelines and Energy. Refer to the About our business – Three core businesses – 2017 Financial highlights - Consolidated results section of the MD&A for our revenues from operations by segment, for the years ended December 31, 2017 and 2016, which section of the MD&A is incorporated by reference herein.

The following is a description of each of TransCanada's three core businesses.

NATURAL GAS PIPELINES