TC Energy Corporation

2024 Annual information form

February 13, 2025

Contents

| | | | | |

| |

| |

| |

| |

| |

| BUSINESS OF TC ENERGY | |

| |

| |

| |

| Power and Energy Solutions | |

| |

| |

| Health, safety, sustainability and environmental protection and social policies | |

| |

| |

| |

| |

| |

| |

| |

| Fitch | |

| DBRS | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

TC Energy Annual information form 2024 | 1

Presentation of information

Throughout this Annual information form (AIF), the terms, we, us, our, the Company and TC Energy mean TC Energy Corporation and its subsidiaries. In particular, TC Energy includes references to TransCanada PipeLines Limited (TCPL). The term subsidiary, when referred to in this AIF, with reference to TC Energy means direct and indirect wholly-owned subsidiaries of, and legal entities controlled by, TC Energy or TCPL, as applicable.

Unless otherwise noted, the information contained in this AIF is given at or for the year ended December 31, 2024 (Year End). Amounts are expressed in Canadian dollars, unless otherwise indicated. Information in relation to metric conversion can be found at Schedule A to this AIF. The Glossary found at the end of this AIF contains certain terms defined throughout this AIF and abbreviations and acronyms that may not otherwise be defined in this document.

Certain portions of TC Energy's management's discussion and analysis dated February 13, 2025 (MD&A) are incorporated by reference into this AIF as stated below and noted elsewhere in this AIF. The MD&A can be found on SEDAR+ (www.sedarplus.ca) under TC Energy's profile.

Financial information is presented in accordance with United States (U.S.) generally accepted accounting principles (GAAP).

2 | TC Energy Annual information form 2024

Forward-looking information

This AIF, including the MD&A disclosure incorporated by reference herein, contains certain information that is forward looking and is subject to important risks and uncertainties. We disclose forward-looking information to help the reader understand management’s assessment of our future plans and financial outlook and our future prospects overall.

Statements that are forward looking are based on certain assumptions and on what we know and expect today and generally include words like anticipate, expect, believe, may, will, should, estimate or other similar words.

Forward-looking statements included or incorporated by reference in this AIF include information about the following, among other things:

•our financial and operational performance, including the performance of our subsidiaries

•expectations about strategies and goals for growth and expansion, including acquisitions

•expected cash flows and future financing options available along with portfolio management

•expectations regarding the size, structure, timing, conditions and outcome of ongoing and future transactions

•expected dividend growth

•expected access to and cost of capital

•expected energy demand levels

•expected costs and schedules for planned projects, including projects under construction and in development

•expected capital expenditures, contractual obligations, commitments and contingent liabilities, including environmental remediation costs

•expected regulatory processes and outcomes

•expected outcomes with respect to legal proceedings, including arbitration and insurance claims

•expected impact of future tax and accounting changes

•commitments and targets contained in our Report on Sustainability and GHG Emissions Reduction Plan, including statements related to our GHG emissions intensity reduction goals

•expected industry, market and economic conditions, and ongoing trade negotiations, including their impact on our customers and suppliers.

Forward-looking statements do not guarantee future performance. Actual events and results could be significantly different because of assumptions, risks or uncertainties related to our business or events that happen after the date of this AIF.

Our forward-looking information is based on the following key assumptions and subject to the following risks and uncertainties:

Assumptions

•realization of expected benefits from acquisitions and divestitures, including the Spinoff Transaction

•regulatory decisions and outcomes

•planned and unplanned outages and the utilization of our pipelines, power and storage assets

•integrity and reliability of our assets

•anticipated construction costs, schedules and completion dates

•access to capital markets, including portfolio management

•expected industry, market and economic conditions, including the impact of these on our customers and suppliers

•inflation rates, commodity and labour prices

•interest, tax and foreign exchange rates

•nature and scope of hedging.

Risks and uncertainties

•realization of expected benefits from acquisitions and divestitures, including the Spinoff Transaction

•our ability to successfully implement our strategic priorities, including the Focus Project, and whether they will yield the expected benefits

•our ability to implement a capital allocation strategy aligned with maximizing shareholder value

•operating performance of our pipelines, power generation and storage assets

•amount of capacity sold and rates achieved in our pipeline businesses

•amount of capacity payments and revenues from power generation assets due to plant availability

TC Energy Annual information form 2024 | 3

•production levels within supply basins

•construction and completion of capital projects

•cost, availability of, and inflationary pressures on, labour, equipment and materials

•availability and market prices of commodities

•access to capital markets on competitive terms

•interest, tax and foreign exchange rates

•performance and credit risk of our counterparties

•regulatory decisions and outcomes of legal proceedings, including arbitration and insurance claims

•our ability to effectively anticipate and assess changes to government policies and regulations, including those related to the environment

•our ability to realize the value of tangible assets and contractual recoveries

•competition in the businesses in which we operate

•unexpected or unusual weather

•acts of civil disobedience

•cybersecurity and technological developments

•sustainability-related risks including climate-related risks and the impact of energy transition on our business

•economic and political conditions, and ongoing trade negotiations in North America, as well as globally

•global health crises, such as pandemics and epidemics, and the impacts related thereto.

You can read more about these factors and others in the MD&A and in other reports we have filed with Canadian securities regulators and the SEC.

As actual results could vary significantly from the forward-looking information, you should not put undue reliance on

forward-looking information and should not use future-oriented information or financial outlooks for anything other than their intended purpose. We do not update our forward-looking statements due to new information or future events unless we are required to by law.

4 | TC Energy Annual information form 2024

TC Energy Corporation

CORPORATE STRUCTURE

Our head office and registered office are located at 450 – 1 Street S.W., Calgary, Alberta, T2P 5H1. TC Energy was incorporated pursuant to the provisions of the Canada Business Corporations Act (CBCA) on February 25, 2003 in connection with a plan of arrangement with TCPL (Arrangement), which established TC Energy as the parent company of TCPL. The Arrangement was approved by TCPL common shareholders on April 25, 2003 and, following court approval and the filing of Articles of Arrangement, the Arrangement became effective on May 15, 2003. TCPL continues to carry on business as the principal operating subsidiary of TC Energy. TC Energy does not hold any material assets directly other than the common shares of TCPL and receivables from certain of TC Energy's subsidiaries.

On October 1, 2024, TC Energy separated into two independent, publicly listed companies through the spinoff of its Liquids Pipelines business into South Bow Corporation (South Bow) by way of a plan of arrangement under the CBCA (the Spinoff Transaction). In connection with the Spinoff Transaction, TC Energy restated its Articles of Incorporation on October 1, 2024 to effectively consolidate previous amendments made to its articles which provided for the issuance of various series of preferred shares.

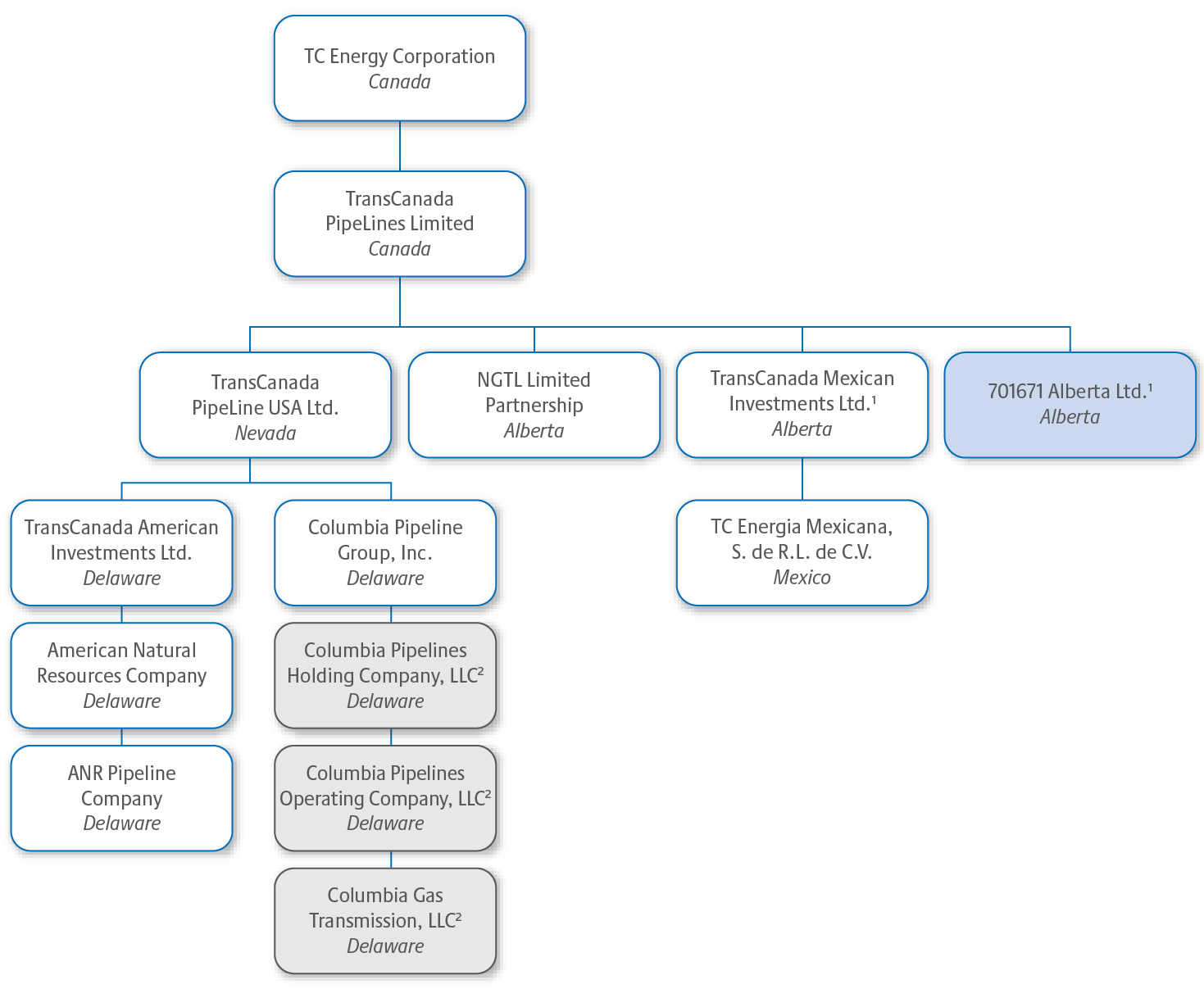

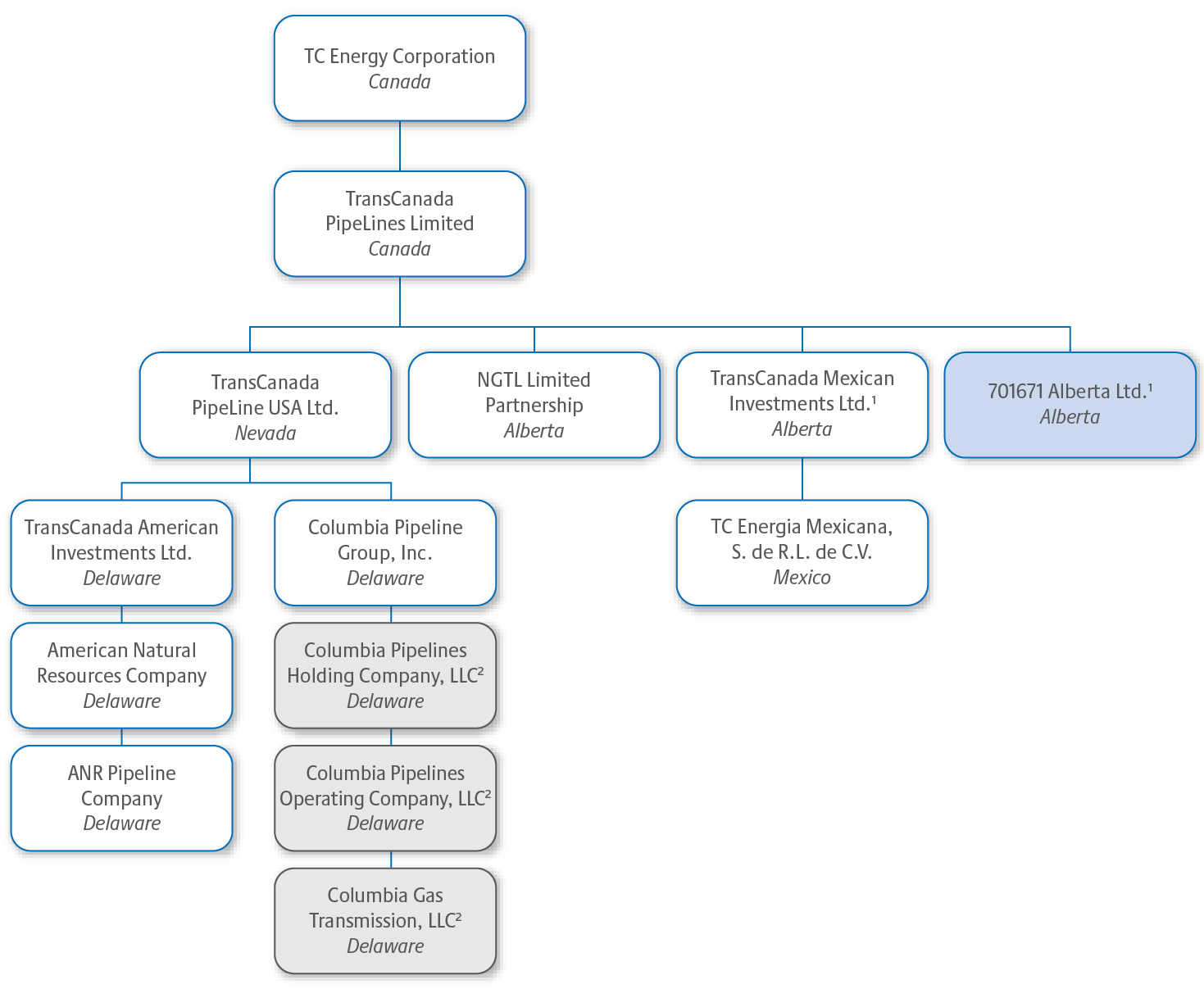

INTERCORPORATE RELATIONSHIPS

The following diagram presents the name and jurisdiction of incorporation, continuance or formation of TC Energy’s principal subsidiaries as at Year End. Each of the subsidiaries shown has total assets that exceeded 10 per cent of the consolidated assets of TC Energy as at Year End or revenues that exceeded 10 per cent of the consolidated revenues of TC Energy as at Year End. Except as otherwise indicated below, TC Energy beneficially owns, controls or directs, directly or indirectly, 100 per cent of the voting shares or units in each of these subsidiaries.

| | |

| TC Energy Corporation Canada TransCanada PipeLines Limited Canada TransCanada PipeLine USA Ltd. Nevada TransCanada American Investments Ltd. Delaware Columbia Pipeline Group, Inc. Delaware Columbia Pipelines Holding Company, LLC2 Delaware Columbia Pipelines Operating Company, LLC2 Delaware Columbia Gas Transmission, LLC2 Delaware 15142083 Canada Ltd. Canada 6297782 LLC Delaware TransCanada Oil Pipelines Inc. Delaware 701671 Alberta Ltd.1 Alberta TransCanada Mexican Investments Ltd.1 Alberta |

The above diagram does not include all of the subsidiaries of TC Energy. The total assets and revenues of excluded subsidiaries in the aggregate did not exceed 20 per cent of the consolidated assets of TC Energy as at Year End or consolidated revenues of TC Energy as at Year End.

| | | | | |

| |

1 701671 Alberta Ltd. and TransCanada Mexican Investments Ltd. assets and revenues do not exceed 10 per cent of the total consolidated assets or revenues of TC Energy but have been included to meet the total consolidated revenues and assets criteria of excluded subsidiaries threshold of less than 20 per cent. |

2 TC Energy beneficially owns, controls or directs, directly or indirectly, 60 per cent of the voting shares or units in each of these subsidiaries. |

TC Energy Annual information form 2024 | 5

Business of TC Energy

We operate in two core businesses – Natural Gas Pipelines and Power and Energy Solutions. In order to provide information that is aligned with how management decisions about our businesses are made and how performance of our businesses is assessed, our results are reflected in four operating segments: Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines and Power and Energy Solutions. We also have a Corporate segment consisting of corporate and administrative functions that provide governance, financing and other support to TC Energy's business segments.

For information regarding our Natural Gas Pipelines business, including pipeline holdings, developments, opportunities, regulation and competitive position refer to the Natural Gas Pipelines Business, Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines and Mexico Natural Gas Pipelines sections of the MD&A, which sections are incorporated by reference herein.

For information regarding our Power and Energy Solutions business, including holdings, developments, opportunities, regulation and competitive position refer to the Power and Energy Solutions section of the MD&A, which section is incorporated by reference herein.

Refer to the About our business – 2024 Financial highlights - Consolidated results section of the MD&A for our revenues from operations by segment, for the years ended December 31, 2024 and 2023, which section is incorporated by reference herein.

General development of the business

Summarized below are significant developments that have occurred in our Natural Gas Pipelines, Liquids Pipelines and Power and Energy Solutions businesses, respectively, and certain acquisitions, dispositions, events or conditions which have had an influence on those developments, during the last three financial years and year to date in 2025. Further information about developments in our business, including changes that we expect will occur in 2025, can be found in the Natural Gas Pipelines Business, Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines, Power and Energy Solutions, About our business - Capital program - Secured projects, and Discontinued operations sections of the MD&A, which sections are incorporated by reference herein.

6 | TC Energy Annual information form 2024

NATURAL GAS PIPELINES

Developments in the Canadian Natural Gas Pipelines Segment

| | |

| CANADIAN REGULATED PIPELINES |

| 2021 NGTL System Expansion Program |

| The 2021 NGTL System Expansion Program was completed in 2024 and consists of 344 km (214 miles) of new pipeline, three new compressor units and associated facilities and added approximately 1.59 PJ/d (1.45 Bcf/d) of incremental capacity to the NGTL System. The capital cost of the program was $3.6 billion. |

| 2022 NGTL System Expansion Program |

| The 2022 NGTL System Expansion Program was completed in 2023 and consists of approximately 166 km (103 miles) of new pipeline, one compressor unit and associated facilities and provides incremental capacity of approximately 773 TJ/d (722 MMcf/d) to meet firm-receipt and intra-basin delivery requirements with eight-year minimum terms. The capital cost of the program was $1.4 billion. |

| 2023 NGTL System Intra-Basin Expansion |

| The NGTL System Intra-Basin Expansion was completed in 2024 and consists of 23 km (14 miles) of new pipeline and two new compressor stations and is underpinned by approximately 255 TJ/d (238 MMcf/d) of new firm-service contracts with 15-year terms. The capital cost of the expansion was $0.5 billion. |

| NGTL System/Foothills West Path Delivery Program |

| The NGTL System/Foothills West Path Delivery Program was completed in 2023 and consisted of a multi-year expansion of the NGTL System and Foothills system to facilitate incremental contracted export capacity connecting to the GTN pipeline system. The combined NGTL System and Foothills program consists of approximately 107 km (66 miles) of pipeline and associated facilities and is underpinned by 275 TJ/d (258 MMcf/d) of new firm-service contracts with terms that exceed 30 years. The capital cost of the program was $1.6 billion. |

| Valhalla North and Berland River Project |

| In November 2022, we sanctioned the Valhalla North and Berland River (VNBR) Project to serve aggregate system requirements and connect migrating supply to key demand markets, designed to provide incremental capacity on the NGTL System of approximately 428 TJ/d (400 MMcf/d). With an estimated capital cost of $0.5 billion, the project consists of approximately 33 km (21 miles) of new pipeline, one new non-emitting electric compressor unit and associated facilities. On December 21, 2023, we received approval from the CER to construct, own and operate the VNBR project. Construction activities commenced in 2024 with anticipated in-service dates commencing in second quarter 2026. |

| NGTL Ownership Transfer |

| On April 1, 2024, ownership of the NGTL System was transferred from Nova Gas Transmission Ltd. to NGTL GP Ltd. on behalf of NGTL Limited Partnership as part of an ordinary course corporate reorganization to support business optimization. The previously announced equity interest purchase agreement in respect of the sale by TC Energy of a 5.34 per cent interest in the NGTL System and Foothills Pipeline assets to an Indigenous-owned investment partnership was terminated by TC Energy on February 6, 2025. |

| NGTL System - Revenue Requirement Settlement and Multi-Year Growth Plan |

On September 26, 2024, the CER approved a five-year negotiated revenue requirement settlement commencing on January 1, 2025. The settlement enables an investment framework that supports our Board of Directors' approval to allocate approximately $3.3 billion of capital towards progression of a new multi-year growth plan for expansion facilities on the NGTL System. It is comprised of multiple distinct projects with targeted in-service dates between 2027 and 2030, subject to final company and regulatory approvals. The completion of the multi-year growth plan is expected to enable approximately 1.0 Bcf/d of incremental system throughput. The settlement maintains an ROE of 10.1 per cent on 40 per cent deemed common equity while increasing NGTL System depreciation rates, with an incentive that allows the NGTL System the opportunity to further increase depreciation rates if tolls fall below specified levels, or if growth projects are undertaken. The settlement introduces a new incentive mechanism to reduce both physical emissions and emissions compliance costs, which builds on the incentive mechanism for certain operating costs where variances from projected amounts and emissions savings are shared with our customers. A provision for review by customers exists in the settlement if tolls exceed a pre-determined level or if final company approvals of the multi-year growth plan are not obtained. |

TC Energy Annual information form 2024 | 7

| | |

| LNG PIPELINE PROJECTS |

| Coastal GasLink Pipeline |

The Coastal GasLink pipeline is a 671 km (417 mile) pipeline that transports natural gas from a receipt point in the Dawson Creek area of British Columbia to LNG Canada's (LNGC) natural gas liquefaction facility near Kitimat, British Columbia. Transportation service on the pipeline is underpinned by 25-year TSAs (with renewal provisions) with each of the five LNGC joint venture participants (LNGC Participants). We hold a 35 per cent ownership interest in Coastal GasLink LP (CGL LP), the entity that owns the Coastal GasLink pipeline. Additionally, we hold a 100 percent ownership interest in the general partner of CGL LP, the entity that is contracted to develop, construct and operate the pipeline. In July 2022, CGL LP executed definitive agreements with LNGC Participants, TC Energy and the other CGL LP partners (collectively, the July 2022 Agreements) that amended existing project and funding agreements to address and resolve disputes over certain incurred and anticipated project costs. Subsequent to the execution of the July 2022 Agreements, the project faced material cost pressures, driven by labour, contractor and weather challenges, which ultimately increased the estimated cost of the project to approximately $14.5 billion, excluding potential cost recoveries and after accounting for certain factors that may be outside the control of CGL LP. In connection with this cost estimate, we announced our expectation that additional equity contributions required to fund the incremental project costs would be predominantly funded by us, with no anticipated change to our 35 per cent ownership interest. We further announced that our share of equity contributions over the project life was expected to be an amount of up to $5.5 billion. The expectation that additional equity contributions would predominantly be funded by us resulted in the recognition of other-than-temporary impairments to the carrying value of our investment in CGL LP in each of the four quarters up to and including September 30, 2023. As a result, we recorded cumulative pre-tax impairment charges of $5,148 million ($4,586 million after tax) between December 2022 and September 2023. There has been no further indication of other-than-temporary impairments of our investment in CGL LP since September 2023 and we have not recorded any further impairment charges. In 2023, the Coastal GasLink pipeline project successfully achieved mechanical completion, completed pipeline commissioning activities and was ready to deliver gas to the LNGC facility. These milestones entitled CGL LP to receive a $200 million readiness incentive payment from LNGC which, in accordance with the contractual terms between the CGL LP partners, fully accrued in December 2023 and was paid in full to TC Energy as the project developer in February 2024. In June 2024, CGL LP successfully completed a $7.15 billion refinancing of its existing construction credit facility through a private placement bond offering of senior secured notes to Canadian and U.S. investors. Proceeds from the offering were used to repay the majority of the outstanding $8.0 billion balance on CGL LP's construction credit facility. The remaining balance on the construction credit facility was settled through the use of proceeds from the unwinding of certain hedging arrangements associated with the construction credit facility. In November 2024, CGL LP executed a commercial agreement with LNGC and LNGC Participants that declared commercial in-service for the pipeline, allowing for the collection of tolls from customers retroactive to October 1, 2024. The agreement also includes a one-time payment of $199 million from LNGC Participants to TC Energy in recognition of the completion of certain work and the final settlement of costs. The payment is to be made by LNGC Participants upon the earlier of three months after the declared in-service of the LNGC facility, or December 15, 2025. The payment accrues in full to TC Energy in accordance with the contractual terms between the CGL LP partners and has been accounted for as an in-substance distribution from CGL LP. Under the terms of the July 2022 Agreements, equity financing required to fund construction of the pipeline to completion was initially provided through a subordinated loan agreement, with a committed capacity of $3,375 million, between TC Energy and CGL LP (the Subordinated Loan). Draws by CGL LP on the Subordinated Loan were to be repaid with funds from equity contributions to the partnership by the CGL LP partners, including us, after the Coastal GasLink pipeline was in service. In December 2024, following the commercial in-service of the Coastal GasLink pipeline, CGL LP repaid the $3,147 million balance owing to TC Energy under the Subordinated Loan. Our share of equity contributions required by CGL LP to fund repayment of the Subordinated Loan amounted to $3,137 million. At December 31, 2024, our share of total partner equity contributions to fund the capital cost of the project was $5.3 billion. While unused capacity of $228 million remains available under the Subordinated Loan, we do not anticipate that CGL LP will draw on a significant portion of the remaining availability. In late third quarter 2024, the Coastal GasLink pipeline began delivering commissioning gas to the LNGC facility. Post-construction reclamation activities are expected to be complete in 2025 and the project remains on track with its capital cost estimate of approximately $14.5 billion. CGL LP continues to pursue cost recovery, including certain arbitration proceedings which involve claims by, and the defense of certain claims against, CGL LP. With the exception of settlements made with respect to certain contractor disputes, including with SA Energy Group, these claims have not yet been conclusively determined, but our expectation is that these proceedings are likely to result in net cost recoveries. |

8 | TC Energy Annual information form 2024

| | |

| Coastal GasLink - Cedar Link Expansion |

In June 2024, CGL LP sanctioned the Cedar Link project following a positive final investment decision (FID) for the construction of the Cedar LNG facility by the Cedar LNG joint venture partners, Haisla Nation and Pembina Pipeline Corporation. The Cedar LNG facility is a proposed floating liquefied natural gas facility to be constructed in Kitimat, B.C. The Cedar Link project is an expansion of the Coastal GasLink pipeline that is expected to enable delivery of up to 0.4 Bcf/d of natural gas to the Cedar LNG facility. With an estimated cost of $1.2 billion, the expansion project includes the addition of a new compressor station, connector pipeline and meter station to the existing Coastal GasLink pipeline infrastructure. Funding for the expansion will be provided through project-level credit facilities of up to $1.4 billion secured by CGL LP in June 2024, equity funding to be provided by the CGL LP partners, including us, and the recovery of construction carrying costs from LNGC Participants who have elected to make payments on a quarterly basis throughout construction. The incremental funds available through the project-level credit facilities and cash AFUDC payments provide additional contingency to mitigate future funding requirements for CGL LP should costs exceed initial estimates of $1.2 billion. TC Energy has entered into an equity contribution agreement to fund up to a maximum of $37 million for its proportionate share of the equity requirements related to the Cedar Link project. All major regulatory permits have been received and construction began in July 2024. The planned in-service date for the Cedar Link project is 2028, subject to the completion of plant commissioning activities at the Cedar LNG facility. |

| Coastal GasLink - Indigenous Equity Option |

| In March 2022, we announced the signing of option agreements to sell up to a 10 per cent equity interest in CGL LP, to Indigenous communities across the project corridor, from our current 35 per cent equity ownership. The equity option is exercisable after commercial in-service of the Coastal GasLink pipeline, subject to customary regulatory approvals and consents, including the consent of LNGC. As a result of the commercial agreement with LNGC and LNGC Participants, the Coastal GasLink pipeline was declared commercially in service prior to the LNGC plant. Accordingly, we are actively collaborating with the participating Indigenous communities to establish a mutually agreeable timeframe in which the option can be exercised. |

TC Energy Annual information form 2024 | 9

Developments in the U.S. Natural Gas Pipelines Segment

| | |

| U.S. NATURAL GAS PIPELINES - COLUMBIA PIPELINE GROUP |

| Columbia Gas and Columbia Gulf Monetization |

| On October 4, 2023, we completed the sale of a 40 per cent equity interest in Columbia Gas and Columbia Gulf to Global Infrastructure Partners (GIP) for proceeds of $5.3 billion (US$3.9 billion). Columbia Gas and Columbia Gulf are held by a newly formed entity with GIP. Preceding the close of the equity sale, on August 8, 2023, Columbia Pipelines Operating Company LLC and Columbia Pipelines Holding Company LLC issued US$4.6 billion and US$1.0 billion of long-term, senior unsecured debt, respectively. The net proceeds from the offerings were used to repay existing intercompany indebtedness with TC Energy entities and were directed towards reducing leverage. We continue to have a controlling interest in Columbia Gas and Columbia Gulf and we remain the operator of these pipelines. TC Energy and GIP each fund their proportionate share of annual maintenance, modernization and sanctioned growth capital expenditures through internally generated cash flows, debt financing within the Columbia entities, or from proportionate contributions from TC Energy and GIP. |

| Columbia Gas Rate Case Settlement |

| In September 2024, Columbia Gas filed a Section 4 rate case with FERC requesting an increase to the maximum transportation rates expected to become effective April 1, 2025, subject to refund. We intend to pursue a collaborative process to find a mutually beneficial outcome with our customers through settlement. |

| Columbia Gas - VR Project |

| In July 2021, we approved the VR Project, a delivery market project on Columbia Gas designed to replace and upgrade certain facilities while improving reliability and reducing emissions. In November 2023, the FERC provided a certificate order approving the VR Project. The VR Project is subject to customary conditions precedent and normal-course regulatory approvals. It is anticipated to be in-service in 2025. |

|

|

| Columbia Gas - KO Transmission Enhancement Acquisition |

| On April 28, 2022, we approved the approximately US$80 million acquisition of KO Transmission assets to be integrated into our Columbia Gas pipeline to provide additional last-mile connectivity of Columbia Gas into northern Kentucky and southern Ohio to growing LDC markets and a platform for future capital investments including future conversions of coal-fueled power plants in the region. FERC approval for the acquisition was received in November 2022 and the transaction closed in February 2023. |

| Columbia Gas - Virginia Electrification Project |

| In February 2024, the Virginia Electrification Project, an expansion project that replaced and upgraded certain facilities through conversion to electric compression, was placed in service. |

| Columbia Gulf Rate Settlement |

| On July 7, 2023, Columbia Gulf filed an uncontested rate settlement, which set new recourse rates for Columbia Gulf effective March 1, 2024 and instituted a rate moratorium through February 28, 2027. Columbia Gulf must file for new rates no later than March 1, 2029. |

| Columbia Gulf - Louisiana XPress Project |

| The Louisiana XPress project, a Columbia Gulf project designed to connect natural gas supply to U.S. Gulf Coast LNG export facilities, was phased into service over the course of third quarter 2022. |

| Columbia Gulf - Pulaski and Maysville Projects |

| In November 2024, we approved two projects on our Columbia Gulf System: the Pulaski and Maysville Projects. These mainline extension projects off Columbia Gulf will facilitate full coal-to-gas conversion at two existing power plants and are expected to provide 0.2 Bcf/d of capacity for incremental gas-fired generation. The projects have anticipated in-service dates in 2029 and total estimated costs of US$0.7 billion. |

| Columbia Gulf - Southeast Virginia Energy Storage Project |

| In November 2024, we approved the US$0.3 billion Southeast Virginia Energy Storage Project. This is an LNG peaking facility in southeast Virginia that will serve an existing LDC's growing winter peak day load and mitigate its peak day pricing exposure, as well as increase operational flexibility on the Columbia Gas system. The project has an anticipated in-service date of 2030. |

10 | TC Energy Annual information form 2024

| | |

| OTHER U.S. NATURAL GAS PIPELINES |

| ANR Section 4 Rate Case |

| ANR reached a settlement with its customers effective August 2022 and received FERC approval in April 2023. As part of the settlement, there is a moratorium on any further rate changes until November 1, 2025. ANR must file for new rates with an effective date no later than August 1, 2028. The settlement also included an additional rate step up effective August 2024 related to certain modernization projects. In second quarter 2023, previously accrued rate refund liabilities, including interest, were refunded to customers. |

| ANR Pipeline - Alberta XPress Project |

| The Alberta XPress Project, an expansion project on ANR which utilizes existing capacity on the Great Lakes and Canadian Mainline systems to connect growing supply from the WCSB to U.S. Gulf Coast LNG export markets, was placed in service January 2023. |

| ANR Pipeline - Elwood Power Project/ANR Horsepower Replacement |

|

| The Elwood Power Project/ANR Horsepower Replacement, an expansion project to replace, upgrade and modernize certain facilities while improving reliability and reducing GHG emissions along a highly utilized section of the ANR pipeline system, was placed in service in November 2022. |

| ANR Pipeline - Wisconsin Access Project |

|

| The Wisconsin Access Project, a project to replace, upgrade and modernize certain facilities while improving reliability and reducing GHG emissions along portions of the ANR pipeline system, was placed in service in November 2022. |

| ANR Pipeline - WR Project |

| In November 2021, we approved the WR Project, a delivery market project on ANR to replace and upgrade certain facilities while improving reliability and reducing emissions along portions of the ANR pipeline system in principal delivery markets. In December 2023, the FERC approved the WR Project. It is expected to be placed in service in late 2025. |

| ANR Pipeline - Ventura XPress Project |

| In December 2022, we approved the Ventura XPress Project, a set of ANR projects designed to improve base system reliability and allow for additional long-term contracted transportation services to a point of delivery on the Northern Border pipeline at Ventura, Iowa. The project is expected to be placed in service in 2025. |

| ANR Pipeline - Heartland Project |

| In February 2024, we approved the US$0.9 billion Heartland Project, an expansion project on our ANR system that is expected to increase capacity and improve system reliability. The Heartland Project involves pipeline looping, compressor facility additions as well as upgrades and is expected to increase ANR’s overall market share in the Midwest region. The anticipated in-service date is late 2027. |

| Gas Transmission Northwest LLC (GTN) - GTN XPress |

| In December 2024, the GTN XPress project, an expansion of the GTN system that will provide for the transport of incremental contracted export capacity facilitated by the NGTL System/Foothills West Path Delivery Program, was placed in service. The capital cost of this project was approximately US$0.1 billion. |

| Great Lakes Rate Settlement |

| In April 2022, FERC approved Great Lakes' unopposed rate case settlement with its customers by which Great Lakes and the settling parties agreed to maintain existing recourse rates through October 31, 2025. |

| Gillis Access Project |

| In March 2024, the Gillis Access Project, a 68 km (42 mile) greenfield pipeline system that connects gas production sourced from the Gillis hub to downstream markets in southeast Louisiana, was placed in service. The capital cost of this project was approximately US$0.3 billion. |

| Gillis Access Project - Extension |

| In February 2023, we approved a 63 km (39 mile), 1.4 Bcf/d extension of the Gillis Access Project to further connect supplies from the Haynesville basin at Gillis. Effective September 1, 2024, all remaining shipper conditions expired and the project was expanded to 1.9 Bcf/d. The project has anticipated in-service dates starting in late 2026 and total estimated costs of US$0.4 billion. |

| North Baja - North Baja XPress Project |

| In June 2023, the North Baja XPress Project, an expansion project designed to expand capacity and meet increased customer demand on our North Baja pipeline, was placed in service. |

TC Energy Annual information form 2024 | 11

| | |

| Portland Natural Gas Transmission System (PNGTS) |

| On March 4, 2024, we announced that TC Energy and its partner Northern New England Investment Company, Inc., a subsidiary of Énergir L.P. (Énergir), entered into a purchase and sale agreement to sell PNGTS to BlackRock, through a fund managed by its Diversified Infrastructure business, and investment funds managed by Morgan Stanley Infrastructure Partners (the Purchaser). On August 15, 2024, we completed the sale of PNGTS for a gross purchase price of approximately $1.6 billion (US$1.1 billion), which included US$250 million of senior notes outstanding held at PNGTS and assumed by the Purchaser. We are providing customary transition services and will continue to work jointly with the Purchaser to facilitate the safe and orderly transition of this natural gas system. |

| Bison XPress Project |

| In third quarter 2023, we approved the Bison XPress Project, an expansion project on our Northern Border and Bison systems that will replace and upgrade certain facilities and provide much needed production egress from the Bakken basin to a delivery point at the Cheyenne Hub. In October 2024, FERC provided a certificate order approving the project that has an anticipated in-service date in 2026. |

12 | TC Energy Annual information form 2024

Developments in the Mexico Natural Gas Pipelines Segment

| | |

| MEXICO NATURAL GAS PIPELINES |

| TGNH Strategic Alliance with the CFE |

In August 2022, we announced a strategic alliance with Mexico’s state-owned electric utility, the CFE, for the development of new natural gas infrastructure in central and southeast Mexico. In connection with the strategic alliance, we reached an FID to develop and construct the Southeast Gateway pipeline, a 1.3 Bcf/d, 715 km (444 mile) offshore natural gas pipeline to serve the southeast region of Mexico. We continue to be aligned with the CFE on finalizing the remaining project completion activities for achieving an in-service date of May 1, 2025. The estimated project cost for the Southeast Gateway pipeline is approximately US$3.9 billion, which is lower than the initial cost estimate of US$4.5 billion. During second quarter 2024, upon the CFE’s equity injection of US$340 million as well as non-cash consideration in recognition of the completion of certain contractual obligations, including land acquisition and permitting support, the CFE became a partner in TGNH with a 13.01 per cent equity interest. Provided that the CFE's contractual commitments are met related to land acquisition, community relations and permitting support, the CFE's equity in TGNH would build up to a maximum of 15 per cent with the in-service of the Southeast Gateway pipeline and will increase to approximately 35 per cent upon expiry of the contract in 2055.

|

| Tula |

| In third quarter 2022, we placed the east section of the Tula pipeline into commercial service and we reached an agreement with the CFE to jointly develop and complete the remaining segments of the Tula pipeline, with the central segment subject to an FID. Due to the delay of an FID, recording AFUDC on the assets under construction for the Tula pipeline project was suspended in late 2023. |

| Villa de Reyes |

| We placed the north and lateral sections of the Villa de Reyes pipeline into commercial service in third quarter 2022 and third quarter 2023, respectively. We continue to work with our partner, the CFE, to complete the south section of the Villa de Reyes pipeline. The in-service date will be determined upon resolution of outstanding stakeholder issues. |

TC Energy Annual information form 2024 | 13

LIQUIDS PIPELINES

Developments in the Liquids Pipelines Segment

| | |

| Spinoff Transaction |

On July 27, 2023, we announced plans to separate into two independent, investment-grade, publicly listed companies through the spinoff of our Liquids Pipelines business into its own entity named South Bow Corporation. TC Energy shareholders voted to approve the Spinoff Transaction at our 2024 Annual and Special Meeting of shareholders held on June 4, 2024. The Spinoff Transaction received final approval from the Court of King’s Bench of Alberta on June 4, 2024 and was completed on October 1, 2024. The Spinoff Transaction was effected by way of a plan of arrangement under the CBCA pursuant to which, among other things, holders of TC Energy common shares retained their interest in TC Energy and received a pro rata allocation of South Bow’s common shares. On October 1, 2024, TC Energy and South Bow entered into a separation agreement setting forth the terms of the separation of the Liquids Pipelines business from the business of TC Energy, including the transfer of certain assets related to the Liquids Pipelines business from TC Energy to South Bow and the allocation of certain liabilities and obligations related to the Liquids Pipelines business between TC Energy and South Bow. The separation agreement provides, among other things, that TC Energy will indemnify South Bow for 86 per cent of total net liabilities and costs associated with the Milepost 14 incident and the existing variable toll disputes on the Keystone Pipeline System (excluding any future impacts to the variable toll after October 1, 2024) subject to a maximum liability to South Bow of $30 million, in aggregate, for those two matters. Due to the inherent uncertainties of the final amounts to be settled under these indemnities, any amounts that may ultimately be payable in respect of these net liabilities to South Bow could differ materially from those reported at December 31, 2024. |

14 | TC Energy Annual information form 2024

POWER AND ENERGY SOLUTIONS

Developments in the Power and Energy Solutions Segment

| | |

| CANADIAN POWER |

| Canadian Cogeneration Plants |

| In 2024, we executed contract extensions of 5-years at Mackay River, a natural gas cogeneration plant located in Alberta, and 10-years at Grandview, a natural gas cogeneration plant located in New Brunswick. |

| Saddlebrook Solar |

| In October 2023, we completed construction of the 81 MW Saddlebrook Solar project near Aldersyde, Alberta and began commissioning activities, including supplying generation to the Alberta market. Full commercial operation was achieved on January 5, 2024. The project was partially supported with funding from Emissions Reduction Alberta and Lockheed Martin. |

| Renewable Energy Contracts and/or Investment Opportunities |

| In November 2023, a majority of the 297 MW Sharp Hills Wind Farm achieved commercial operation resulting in the commencement of our 15-year Power Purchase Agreement for 100 per cent of the power produced and the rights to all environmental attributes from the facility. In second quarter 2023, we finalized contracts to sell 50 MW under our 24-by-7 carbon-free power offering in Alberta, which provides customers power and carbon credits for the decarbonization of the customers’ Scope 2 emissions. Contract terms range from 15 to 20 years and commenced in January 2025. |

| Bruce Power |

The Unit 6 MCR, which began in January 2020, was declared commercially operational in September 2023, ahead of schedule and on budget despite challenges from the COVID-19 pandemic. In first quarter 2023, Unit 3 was removed from service and began its MCR construction, with an expected return to service in 2026. The Unit 4 MCR final cost and schedule estimate was submitted to the IESO in December 2023, and received IESO approval on February 8, 2024. The Unit 4 MCR commenced on January 31, 2025 with an expected completion in 2028. The Unit 5 MCR final cost and schedule estimate was submitted to the IESO on January 31, 2025. Future MCR investments will be subject to discrete decisions for each unit with specified off-ramps available for Bruce Power and the IESO. In 2021, Bruce Power launched Project 2030 with the goal of achieving a site peak output of 7,000 MW by 2033 in support of climate change targets and future clean energy needs. Project 2030 will focus on continued asset optimization, innovation and leveraging new technology, which could include integration with storage and other forms of energy, to increase the site peak output at Bruce Power. Project 2030 is arranged in three stages with Stage 1, 2 and 3a fully approved for execution. Stage 1 started in 2019 and is expected to add 150 MW of output and Stage 2, which began in early 2022, is targeting another 200 MW. Bruce Power is also progressing with Stage 3a which is designed to provide an additional incremental capacity of approximately 90 MW. Bruce Power's contract price increased in April 2022, in accordance with contract terms, reflecting capital to be invested under the Unit 3 MCR program and the 2022 to 2024 Asset Management program plus normal annual inflation adjustments. The contract price was then increased again in April 2024 as a result of the IESO approving the Unit 4 MCR program and will increase again in April 2025 to reflect the 2025 to 2027 Asset Management program plus normal annual inflation adjustments and the 9-year reset for salaries and pensions. |

| Ontario Pumped Storage Project (OPSP) |

| We continue to progress the development of the OPSP, a pumped hydro storage facility located near Meaford, Ontario. The 1,000-megawatt project will provide enough electricity to power 1 million homes for up to 11 hours, while enhancing the reliability and efficiency of Ontario's electricity system. This project is designed to store emission-free energy when available and provide that energy to Ontario during periods of peak demand, thereby maximizing the value of nuclear and other existing emissions-free generation in the province. We and our prospective partners, Saugeen Ojibway Nation, will advance pre-development work on the OPSP following the Ontario Government's recent announcement on January 24, 2025 to invest up to $285 million. With the Ontario Government’s investment, the OPSP can now advance critical development work, including the completion of a detailed cost estimate, the commencement of federal and provincial environmental assessments, advanced design and engineering and continued community engagement. The OPSP remains subject to approval by our Board of Directors, the Saugeen Ojibway Nation and the Government of Ontario. |

| U.S. POWER |

| In March 2023, we acquired 100 per cent of the Class B Membership interests in the 155 MW Fluvanna Wind Farm located in Scurry County, Texas for US$99 million, before post-closing adjustments. In June 2023, we acquired 100 per cent of the Class B Membership Interests in the 148 MW Blue Cloud Wind Farm located in Bailey County, Texas for US$125 million, before post-closing adjustments. In addition to these two wind farms, as of December 31, 2024, we have approximately 350 MW of wind generation PPAs and associated environmental attributes in the U.S. |

| OTHER ENERGY SOLUTIONS |

| In October 2022, we acquired a 30 per cent ownership interest in the Lynchburg Renewable Fuels project, a renewable natural gas (RNG) production facility in Lynchburg, Tennessee being developed by 3 Rivers Energy Partners, LLC (3 Rivers Energy). Along with our ownership interest, we will market all RNG and environmental attributes generated from the facility once operational, which we expect in 2025. |

TC Energy Annual information form 2024 | 15

General

EMPLOYEES

At Year End, TC Energy's principal operating subsidiary, TCPL, had 6,668 employees, substantially all of whom were employed in Canada and the U.S., as set forth in the following table.

| | | | | |

| Calgary | 2,179 | |

| Western Canada (excluding Calgary) | 584 | |

| Eastern Canada | 276 | |

| Houston | 751 | |

| U.S. Midwest | 779 | |

| U.S. Northeast | 249 | |

| U.S. Southeast/Gulf Coast (excluding Houston) | 1,133 | |

| U.S. West Coast | 85 | |

| Mexico | 632 | |

| Total | 6,668 | |

HEALTH, SAFETY, SUSTAINABILITY AND ENVIRONMENTAL PROTECTION AND SOCIAL POLICIES

A discussion of our health, safety, sustainability and environmental protection policies can be found in the MD&A in the Other information – Health, safety, sustainability and environmental matters section, which section is incorporated by reference herein.

Social Policies

We have a number of corporate governance documents, such as policies and standards, including a Commitment Statement, to help guide our teams’ behavior and actions, so they understand their responsibility and extend respect, courtesy and the opportunity to respond to Indigenous groups and other stakeholders. We have a Code of Business Ethics (COBE) Policy which applies to all employees, officers and directors, and contingent workforce contractors of TC Energy and its wholly-owned subsidiaries and operated entities in countries where we conduct business, with the exception of independently operated entities whose corporate governance documents meet or exceed TC Energy’s requirements. Annual online COBE training is provided to all employees and contingent workforce contractors, and all employees and contingent workforce contractors (including executive officers) and directors must certify their compliance with COBE annually.

We also have an Avoiding Bribery and Corruption (ABC) Program which includes an ABC Policy, annual online training included as part of annual online COBE training, instructor-led training provided to personnel in higher risk areas of our business, a supplier and contractor due diligence review process, and auditing of certain types of transactions.

Our Indigenous Relations Policy is informed by our guiding principles and corporate values to ensure we build and sustain support through early and honest communication, by mitigating impacts, and through mutually beneficial partnerships. We seek to listen to Indigenous peoples and incorporate their traditional and local knowledge in project design and planning. We strive to work with Indigenous communities to mitigate negative impacts and maximize benefits through hiring and buying locally. We aim to build mutually beneficial, partnership-oriented relationships with Indigenous communities who are most impacted by our activities. In Canada, we will seek to expand benefits for equity participation in our projects because the best way to align interests from the start is to sit at the table together as partners/owners. Through all these efforts, we strive to be considered as a partner of choice for Indigenous groups and play a meaningful role in reconciliation.

Consistent with our corporate values, Commitment Statement and as outlined in our COBE Policy, TC Energy does not tolerate human rights abuses. In our business activities, including engaging with Indigenous groups and other stakeholders across Canada, the U.S and Mexico, we are committed to respecting human rights and will not be complicit with, or engage in, any activity that supports or facilitates abuse of human rights such as forced labour, child labour, or physical or mental abuses.

16 | TC Energy Annual information form 2024

Risk factors

A discussion of our risk factors can be found in the MD&A in the Natural Gas Pipelines Business, Natural Gas Pipelines - Business risks, Power and Energy Solutions – Business risks and Other information – Risk oversight and enterprise risk management sections, which sections are incorporated by reference herein.

Dividends

Our Board has not adopted a formal dividend policy. The Board reviews the financial performance of TC Energy quarterly and makes a determination of the appropriate level of dividends to be declared in the following quarter. Currently, our payment of dividends is primarily funded from dividends TC Energy receives as the sole common shareholder of TCPL.

Provisions of various trust indentures and credit arrangements with certain of our subsidiaries can restrict those subsidiaries’ ability and, in certain cases, our ability to declare and pay dividends or make distributions under certain circumstances. In the opinion of management, these provisions do not currently restrict our ability to declare or pay dividends.

Additionally, pursuant to the terms of the trust notes issued by TransCanada Trust (a financing trust subsidiary wholly-owned by TCPL) and related agreements, in certain circumstances, including where holders of the trust notes receive deferral preferred shares of TCPL in lieu of cash interest payments and where exchange preferred shares of TCPL are issued to holders of the trust notes as a result of certain bankruptcy related events, TC Energy and TCPL would be prohibited from declaring or paying dividends on or redeeming their outstanding preferred shares (or, if none are outstanding, their respective common shares) until all such exchange or deferral preferred shares are redeemed by TCPL. No deferral preferred shares or exchange preferred shares of TCPL have ever been issued.

Dividends on our preferred shares are payable quarterly, as and when declared by the Board. The dividends declared on our common and preferred shares during the past three completed financial years, and the increase to the quarterly dividend per common share on our outstanding common shares for the quarter ending March 31, 2025, are set out in the MD&A under the heading About our business – 2024 Financial highlights – Dividends section, which section is incorporated by reference herein.

TC Energy Annual information form 2024 | 17

Description of capital structure

SHARE CAPITAL

TC Energy’s authorized share capital consists of an unlimited number of common shares and an unlimited number of first preferred shares and second preferred shares, issuable in series. The number of common shares and preferred shares issued and outstanding as at Year End are set out in the MD&A in the Financial Condition – Share information section, which section is incorporated by reference herein. The following is a description of the material characteristics of each of these classes of shares.

Common shares

The common shares entitle the holders thereof to one vote per share at all meetings of shareholders, except meetings at which only holders of another specified class of shares are entitled to vote, and, subject to the rights, privileges, restrictions and conditions attaching to the first preferred shares and the second preferred shares, whether as a class or a series, and to any other class or series of shares of TC Energy which rank prior to the common shares, entitle the holders thereof to receive (i) dividends if, as and when declared by the Board out of the assets of TC Energy properly applicable to the payment of the dividends in such amount and payable at such times and at such place or places as the Board may from time to time determine, and (ii) the remaining property of TC Energy upon a liquidation, dissolution or winding up of the Company.

We have a shareholder rights plan (the Plan) that is designed to protect the rights of our shareholders, ensure they are treated fairly and provide the Board with adequate time to identify, develop and negotiate alternative value maximizing transactions if there is a take-over bid for TC Energy. The Plan creates a right attaching to each common share outstanding and to each common share subsequently issued. Each right becomes exercisable 10 trading days after a person has acquired (an acquiring person), or commences a take-over bid to acquire, 20 per cent or more of the common shares, other than by an acquisition pursuant to a take-over bid permitted under the terms of the Plan (a permitted bid). Prior to a flip-in event (as described below), each right permits registered holders to purchase from the Company common shares of TC Energy at an exercise price equal to three times the market price of such shares, subject to adjustments and anti-dilution provisions (the exercise price). The beneficial acquisition by any person of 20 per cent or more of the common shares, other than by way of a permitted bid, is referred to as a flip-in event. Ten trading days after a flip-in event, each right will permit registered holders other than an acquiring person to receive, upon payment of the exercise price, the number of common shares with an aggregate market price equal to twice the exercise price. The Plan was reconfirmed at the 2022 annual meeting of TC Energy shareholders and must be reconfirmed at every third annual meeting thereafter. Reconfirmation of the Plan will be voted on at the 2025 annual meeting of TC Energy shareholders.

A discussion of our dividend reinvestment and share purchase plan can be found in the MD&A in the About our business - 2024 Financial highlights – Dividends – Dividend reinvestment and share purchase plan and the Financial condition - Dividend reinvestment plan sections, which sections are incorporated by reference herein.

18 | TC Energy Annual information form 2024

First preferred shares

Subject to certain limitations, the Board may, from time to time, issue first preferred shares in one or more series and determine for any such series, its designation, number of shares and respective rights, privileges, restrictions and conditions. The first preferred shares as a class have, among others, the provisions described below.

The first preferred shares of each series rank on a parity with the first preferred shares of every other series, and are entitled to preference over the common shares, the second preferred shares and any other shares ranking junior to the first preferred shares with respect to the payment of dividends, the repayment of capital and the distribution of assets of TC Energy in the event of its liquidation, dissolution or winding up.

Except as provided by the CBCA, the holders of the first preferred shares will not have any voting rights nor will they be entitled to receive notice of or to attend shareholders' meetings. The holders of any particular series of first preferred shares will, if the directors so determine prior to the issuance of such series, be entitled to such voting rights as may be determined by the Board if TC Energy fails to pay dividends on that series of preferred shares for any period as may be so determined by the Board. TC Energy currently does not intend to issue any first preferred shares with voting rights, and any issuances of first preferred shares are expected to be made only in connection with corporate financings.

The provisions attaching to the first preferred shares as a class may be modified, amended or varied only with the approval of the holders of the first preferred shares as a class. Any such approval to be given by the holders of the first preferred shares may be given by the affirmative vote of the holders of not less than 66 2/3 per cent of the first preferred shares represented and voted at a meeting or adjourned meeting of such holders.

The holders of Series 1, 3, 5, 7, 9 and 11 preferred shares will be entitled to receive quarterly fixed rate cumulative preferential cash dividends, as and when declared by the Board, to be reset periodically on prescribed dates to an annualized rate equal to the sum of the then five-year Government of Canada bond yield, calculated at the start of the applicable five-year period, and a spread as set forth in the table below and have the right to convert their shares into cumulative redeemable Series 2, 4, 6, 8, 10 and 12 preferred shares, respectively, subject to certain conditions, on such conversion dates as set forth in the table below. The Series 1, 3, 5, 7, 9 and 11 preferred shares are redeemable by TC Energy in whole or in part on such redemption dates as set forth in the table below, by the payment of an amount in cash for each share to be redeemed equal to $25.00 plus all accrued and unpaid dividends thereon.

The holders of Series 2, 4, 6, 8, 10 and 12 preferred shares will be entitled to receive quarterly floating rate cumulative preferential cash dividends, as and when declared by the Board, at an annualized rate equal to the sum of the then 90-day Government of Canada treasury bill rate, recalculated quarterly, and a spread as set forth in the table below and have the right to convert their shares into Series 1, 3, 5, 7, 9 and 11 preferred shares, respectively, subject to certain conditions, on such conversion dates as set forth in the table below. The Series 2, 4, 6, 8, 10 and 12 preferred shares are redeemable by TC Energy in whole or in part after their respective initial redemption date as set forth in the table below, by the payment of an amount in cash for each share to be redeemed equal to (i) $25.00 in the case of redemptions on such redemption dates as set out in the table below, or (ii) $25.50 in the case of redemptions on any other date, in each case plus all accrued and unpaid dividends thereon.

TC Energy Annual information form 2024 | 19

In the event of liquidation, dissolution or winding up of TC Energy, the holders of Series 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11 and 12 preferred shares shall be entitled to receive $25.00 per preferred share plus all accrued and unpaid dividends thereon in preference over the common shares or any other shares ranking junior to the first preferred shares.

| | | | | | | | | | | |

| Series of first preferred shares | Initial redemption/conversion date | Redemption/conversion dates | Spread (%) |

| Series 1 preferred shares | December 31, 2014 | December 31, 2029 and every fifth year thereafter | 1.92 | |

| Series 2 preferred shares | — | December 31, 2029 and every fifth year thereafter | 1.92 | |

| Series 3 preferred shares | June 30, 2015 | June 30, 2025 and every fifth year thereafter | 1.28 | |

| Series 4 preferred shares | — | June 30, 2025 and every fifth year thereafter | 1.28 | |

| Series 5 preferred shares | January 30, 2016 | January 30, 2026 and every fifth year thereafter | 1.54 | |

| Series 6 preferred shares | — | January 30, 2026 and every fifth year thereafter | 1.54 | |

| Series 7 preferred shares | April 30, 2019 | April 30, 2029 and every fifth year thereafter | 2.38 | |

| Series 8 preferred shares | — | April 30, 2029 and every fifth year thereafter | 2.38 | |

| Series 9 preferred shares | October 30, 2019 | October 30, 2029 and every fifth year thereafter | 2.35 | |

| Series 10 preferred shares | — | October 30, 2029 and every fifth year thereafter | 2.35 | |

| Series 11 preferred shares | November 30, 2020 | November 28, 2025 and every fifth year thereafter | 2.96 | |

| Series 12 preferred shares | — | November 28, 2025 and every fifth year thereafter | 2.96 | |

Except as provided by the CBCA, the respective holders of the first preferred shares of each outstanding series are not entitled to receive notice of, attend at, nor vote at any meeting of shareholders unless and until TC Energy shall have failed to pay eight quarterly dividends on such series of preferred shares, whether or not consecutive, in which case the holders of the first preferred shares of such series shall have the right to receive notice of and to attend each meeting of shareholders at which directors are to be elected and which take place more than 60 days after the date on which the failure first occurs, and to one vote with respect to resolutions to elect directors for each of the first preferred share of such series, until all arrears of dividends have been paid. Subject to the CBCA, the series provisions attaching to the first preferred shares may be amended with the written approval of all the holders of such series of shares outstanding or by at least two thirds of the votes cast at a meeting of the holders of such shares duly called for that purpose and at which a quorum is present.

Second preferred shares

The rights, privileges, restrictions and conditions attaching to the second preferred shares are substantially identical to those attaching to the first preferred shares, except that the second preferred shares rank junior to the first preferred shares with respect to the payment of dividends, repayment of capital and the distribution of assets of TC Energy in the event of a liquidation, dissolution or winding up of TC Energy.

20 | TC Energy Annual information form 2024

Credit ratings

Although TC Energy has not issued debt to the public, it has been assigned credit ratings by Moody's Investors Service, Inc. (Moody's), S&P Global Ratings (S&P) and Fitch Ratings Inc. (Fitch), and its outstanding preferred shares have also been assigned credit ratings by S&P, Fitch and DBRS Limited (DBRS). Moody's has assigned TC Energy an issuer rating of Baa3 with a stable outlook, S&P has assigned an issuer credit rating of BBB+ with a negative outlook, and Fitch has assigned a long-term issuer default rating of BBB+ with a stable outlook. TC Energy does not presently intend to issue debt securities to the public in its own name and any future debt financing requirements are expected to continue to be funded primarily through its subsidiary, TCPL. The following table sets out the current credit ratings assigned to those outstanding classes of securities of the Company, TCPL and TransCanada Trust, a wholly-owned financing trust subsidiary of TCPL, and certain related subsidiaries which have been rated by Moody's, S&P, Fitch and DBRS:

| | | | | | | | | | | | | | |

| Moody's | S&P | Fitch | DBRS |

| TCPL - Senior unsecured debt | Baa2 | BBB+ | BBB+ | BBB (high) |

| TCPL - Junior subordinated notes | Baa3 | BBB- | Not rated | BBB (low) |

| TransCanada Trust - Subordinated trust notes | Ba1 | BBB- | BBB- | Not rated |

| TC Energy Corporation - Preferred shares | Not rated | P-2 (Low) | BBB- | Pfd-3 (high) |

| Commercial paper (TCPL and TCPL guaranteed) | P-2 | A-2 | F2 | R-2 (high) |

| Rating outlook/status | Stable | Negative | Stable | Stable |

Credit ratings are intended to provide investors with an independent measure of credit quality of an issue of securities. Credit ratings are not recommendations to purchase, hold or sell securities and do not address the market price or suitability of a specific security for a particular investor. There is no assurance that any rating will remain in effect for any given period of time or that any rating will not be revised or withdrawn entirely by a rating agency in the future if, in its judgment, circumstances so warrant.

Each of the Company, TCPL, TransCanada Trust and certain of our other subsidiaries paid fees to each of Moody's, S&P, Fitch and DBRS for the credit ratings rendered in respect of their outstanding classes of securities noted above. In addition to annual monitoring fees for the Company and TCPL and their rated securities, additional payments are made in respect of other services provided in connection with various rating advisory services.

The information concerning our credit ratings relates to our financing costs, liquidity and operations. The availability and cost of our funding options may be affected by certain factors, including the global capital markets environment and outlook as well as our financial performance. Our access to capital markets for required capital at competitive rates is influenced by our credit rating and rating outlook, as determined by credit rating agencies such as Moody's, S&P, Fitch and DBRS. If our ratings were downgraded, TC Energy's financing costs and future debt issuances could be unfavourably impacted. A description of the rating agencies' credit ratings listed in the table above is set out below.

MOODY’S

Moody's has different rating scales for short- and long-term obligations. Numerical modifiers 1, 2 and 3 are appended to each rating classification from Aa through Caa. The modifier 1 indicates that the obligation ranks in the higher end of its generic rating category; the modifier 2 indicates a mid-range ranking; and a modifier 3 indicates a ranking in the lower end of that generic rating category. The Baa2 rating assigned to TCPL's senior unsecured debt and the Baa3 rating assigned to TCPL's junior subordinated notes are in the fourth highest of nine rating categories for long-term obligations. Obligations rated Baa are judged to be medium-grade and are subject to moderate credit risk, and as such, may possess certain speculative characteristics. The Ba1 rating assigned to the TransCanada Trust subordinated trust notes, is in the fifth highest of nine rating categories for long-term obligations. Obligations rated Ba are judged to have speculative elements and are subject to substantial credit risk. The P-2 rating assigned to TCPL's and TCPL guaranteed U.S. commercial paper programs is the second highest of four rating categories for short-term debt issuers. Issuers rated P-2 have a strong ability to repay short-term debt obligations. Outlooks may be assigned at the issuer level or at the rating level. A Moody’s rating outlook is an opinion regarding the likely rating direction over the medium term. A stable outlook indicates a low likelihood of a rating change over the medium term. A negative, positive or developing outlook indicates a higher likelihood of a rating change over the medium term.

TC Energy Annual information form 2024 | 21

S&P

S&P has different rating scales for short- and long-term obligations and Canadian preferred shares. Ratings from AA through CCC may be modified by the addition of a plus (+) or minus (-) sign to show the relative standing within a particular rating category. The BBB+ rating assigned to TCPL's senior unsecured debt is in the fourth highest of 10 rating categories for long-term obligations. A BBB rating indicates the obligor's capacity to meet its financial commitment is adequate; however, adverse economic conditions or changing circumstances are more likely to weaken the obligor's capacity to meet its financial commitments on the obligation. The BBB- ratings assigned to TCPL’s junior subordinated notes and to the TransCanada Trust subordinated trust notes, is in the fourth highest of 10 rating categories for long-term debt obligations and the P-2 (Low) rating assigned to TC Energy’s preferred shares is the second highest of eight rating categories for Canadian preferred shares. The BBB- ratings assigned to TCPL's junior subordinated notes and the TransCanada Trust subordinated trust notes, and the P-2 (Low) rating assigned to TC Energy's preferred shares indicate these obligations exhibit adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to weaken the obligor’s capacity to meet its financial commitment on the obligation. TCPL's and TCPL guaranteed U.S. commercial paper programs are each rated A-2 which is the second highest of six rating categories for short-term debt issuers. Short-term debt issuers rated A-2 have satisfactory capacity to meet their financial commitments, however they are somewhat more susceptible to adverse effects of changes in circumstances and economic conditions than obligors in the highest rating category. S&P assigns outlooks to issuers and not to individual debt securities. An S&P outlook assesses the potential direction of a long-term credit rating over the intermediate term, which is generally up to two years for investment grade issuers. S&P has assigned a negative outlook to the Company, meaning that a rating may be lowered by S&P.

FITCH

Fitch has different rating scales for short- and long-term obligations. Ratings from AA through CCC may be modified by the addition of a plus (+) or minus (-) sign to show the relative status within a particular rating category. The BBB+ rating assigned to TCPL's senior unsecured debt, and the BBB- ratings assigned to the TransCanada Trust subordinated trust notes and TC Energy's preferred shares are in the fourth highest of 11 rating categories for long-term obligations. A BBB rating indicates that expectations of default risk are currently low and that the capacity for payment of financial commitments is considered adequate, but adverse business or economic conditions are more likely to impair this capacity. The F2 rating assigned to TCPL's and TCPL guaranteed U.S. commercial paper program is the second highest of seven rating categories for short-term debt issuers. Issuers rated F2 have good intrinsic capacity for timely payment of financial commitments. Ratings outlooks by Fitch indicate the direction a rating is likely to move over a one-to-two year period and reflect financial or other trends that have not yet reached or been sustained to the level that would cause a rating action, but which may do so if such trends continue.

22 | TC Energy Annual information form 2024

DBRS

DBRS has different rating scales for short- and long-term obligations and Canadian preferred shares. High or low grades are used to indicate the relative standing within all rating categories other than AAA and D and other than in respect of DBRS’ ratings of commercial paper and short-term debt, which utilize high, middle and low subcategories for its R-1 and R-2 rating categories. In respect of long-term debt and preferred share ratings, the absence of either a high or low designation indicates the rating is in the middle of the category. The BBB (high) rating assigned to TCPL's senior unsecured debt and the BBB (low) rating assigned to TCPL's junior subordinated notes are in the fourth highest of 10 categories for long-term debt and indicate adequate credit quality. The capacity for the payment of financial obligations is considered acceptable. Long-term debt rated BBB may be vulnerable to future events. The Pfd-3 (high) rating assigned to TC Energy's preferred shares is in the third highest of six rating categories for preferred shares. Preferred shares rated Pfd-3 are generally of adequate credit quality. While protection of dividends and principal is still considered acceptable, the issuing entity is more susceptible to adverse changes in financial and economic conditions, and there may be other adverse conditions present which detract from debt protection. Pfd-3 ratings generally correspond with issuers with a BBB category or higher reference point. The R-2 (high) rating assigned to TCPL's Canadian commercial paper program is in the fourth highest of 10 rating categories for short-term debt issuers and indicates the upper end of adequate credit quality. The capacity for payment of short-term financial obligations as they fall due is acceptable. Short-term debt rated R-2 (high) may be vulnerable to future events. Rating trends provide guidance in respect of DBRS' opinion regarding the outlook for a credit rating. The rating trend indicates the direction in which DBRS considers the credit rating may move if present circumstances continue. In cases when a significant event occurs that directly impacts the credit quality of a particular entity or group of entities and there is uncertainty regarding the outcome, and DBRS is unable to provide an objective, forward-looking opinion in a timely fashion, then the credit ratings of the issuer are typically placed “Under Review” with the appropriate Implications designation of Positive, Negative or Developing.

Market for securities

TC Energy's common shares are listed on the TSX and the NYSE under the symbol TRP. The following table sets out our preferred shares listed on the TSX.

| | | | | | | | |

| Type | Issue Date | Stock Symbol |

| Series 1 preferred shares | September 30, 2009 | TRP.PR.A |

| Series 2 preferred shares | December 31, 2014 | TRP.PR.F |

| Series 3 preferred shares | March 11, 2010 | TRP.PR.B |

| Series 4 preferred shares | June 30, 2015 | TRP.PR.H |

| Series 5 preferred shares | June 29, 2010 | TRP.PR.C |

| Series 6 preferred shares | February 1, 2016 | TRP.PR.I |

| Series 7 preferred shares | March 4, 2013 | TRP.PR.D |

| Series 9 preferred shares | January 20, 2014 | TRP.PR.E |

| Series 10 preferred shares | October 30, 2024 | TRP.PR.L |

| Series 11 preferred shares | March 2, 2015 | TRP.PR.G |

TC Energy Annual information form 2024 | 23

The following tables set out the reported monthly high, low, and month end closing trading prices and monthly trading volumes of the common shares of TC Energy on the TSX and the NYSE, and the respective Series 1, 2, 3, 4, 5, 6, 7, 9, 10 and 11 preferred shares on the TSX, for the periods indicated:

COMMON SHARES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TSX (TRP) | Unadjusted | | Adjusted1 | | Volume traded | |

High

($) | Low

($) | Close

($) | | High

($) | Low

($) | Close

($) | | |

| December 2024 | $69.24 | $64.03 | $66.99 | | $69.24 | $64.03 | $66.99 | | 151,062,244 | | |

| November 2024 | $70.32 | $64.27 | $68.26 | | $70.32 | $64.27 | $68.26 | | 55,299,104 | | |

| October 2024 | $66.70 | $58.61 | $64.76 | | $66.70 | $58.41 | $64.76 | | 115,600,458 | | |

| September 2024 | $64.83 | $60.72 | $64.29 | | $59.05 | $55.31 | $58.56 | | 211,845,569 | | |

| August 2024 | $62.54 | $58.02 | $62.42 | | $56.97 | $52.85 | $56.86 | | 62,059,330 | | |

| July 2024 | $58.95 | $50.59 | $58.62 | | $53.69 | $46.08 | $53.40 | | 147,184,435 | | |

| June 2024 | $55.08 | $51.25 | $51.86 | | $50.17 | $46.68 | $47.24 | | 206,485,429 | | |

| May 2024 | $53.64 | $48.91 | $52.56 | | $48.86 | $44.55 | $47.88 | | 71,238,170 | | |

| April 2024 | $55.01 | $48.12 | $49.32 | | $50.11 | $43.83 | $44.93 | | 180,758,148 | | |

| March 2024 | $55.28 | $52.88 | $54.44 | | $50.36 | $48.17 | $49.59 | | 208,202,477 | | |

| February 2024 | $54.20 | $50.27 | $53.68 | | $49.37 | $45.79 | $48.90 | | 52,414,242 | | |

| January 2024 | $53.80 | $51.62 | $53.04 | | $49.01 | $47.02 | $48.31 | | 124,330,081 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NYSE (TRP) | Unadjusted | | Adjusted1 | | Volume traded | |

High

(US$) | Low

(US$) | Close

(US$) | | High

(US$) | Low

(US$) | Close

(US$) | | |

| December 2024 | $49.40 | $44.69 | $46.53 | | $49.40 | $44.69 | $46.53 | | 48,534,667 | | |

| November 2024 | $50.37 | $46.09 | $48.93 | | $50.37 | $46.09 | $48.93 | | 41,660,192 | | |

| October 2024 | $48.42 | $43.39 | $46.51 | | $48.25 | $43.24 | $46.51 | | 56,811,598 | | |

| September 2024 | $48.14 | $44.75 | $47.55 | | $43.85 | $40.76 | $43.31 | | 65,369,870 | | |

| August 2024 | $46.40 | $41.08 | $46.34 | | $42.27 | $37.42 | $42.21 | | 47,121,504 | | |

| July 2024 | $42.72 | $37.07 | $42.41 | | $38.91 | $33.77 | $38.63 | | 68,942,809 | | |

| June 2024 | $40.25 | $37.40 | $37.90 | | $36.66 | $34.07 | $34.52 | | 62,162,596 | | |

| May 2024 | $39.31 | $35.54 | $38.56 | | $35.81 | $32.37 | $35.12 | | 57,521,741 | | |

| April 2024 | $40.52 | $34.95 | $35.85 | | $36.91 | $31.84 | $32.66 | | 95,447,544 | | |

| March 2024 | $41.03 | $38.92 | $40.20 | | $37.37 | $35.45 | $36.62 | | 66,128,989 | | |

| February 2024 | $40.13 | $37.20 | $39.55 | | $36.55 | $33.88 | $36.03 | | 46,690,037 | | |

| January 2024 | $40.29 | $38.28 | $39.43 | | $36.70 | $34.87 | $35.92 | | 45,267,886 | | |