As filed with the SEC on May 29, 2007.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-02273 |

|

TRANSAMERICA INCOME SHARES, INC. |

(Exact name of registrant as specified in charter) |

|

570 Carillon Parkway, St. Petersburg, Florida | | 33716 |

(Address of principal executive offices) | | (Zip code) |

|

Dennis P. Gallagher, Esq., P.O. Box 9012, Clearwater, Florida 33758-9771 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (727) 299-1800 | |

|

Date of fiscal year end: | March 31 | |

|

Date of reporting period: | April 1, 2006 - March 31, 2007 | |

| | | | | | | | | |

Item 1: Report(s) to Shareholders. The Annual Report is attached.

TRANSAMERICA INCOME SHARES, INC.

Annual Report

March 31, 2007

Transamerica Income Shares, Inc.

MARKET ENVIRONMENT

Against a backdrop of rising commodities prices and a robust economy, the Federal Reserve Board ("Fed") began the reporting period in inflation-fighting mode, raising the federal funds rate twice by June to 5.25%. Initially, yields across the board rose. However, by June weakness in the housing market generated concerns that the economy would slow, triggering a move to lower yields. With the bond market increasingly convinced that there would be no further Fed rate increases for the rest of the year, investors favored riskier investments, bidding up prices for corporate bonds, especially lower-rated and higher-Beta bonds.

By February, the Fed had signaled a shift to a neutral bias. Yields fell for all securities, and the yield curve ended the twelve-month period lower overall and somewhat steeper than it began, contributing to a twelve-month total return of 6.38% for the Lehman Brothers U.S. Government/Credit Index ("LB Gov't/Credit"). Spurred by investors' appetite for risk in the latter half of the period, high-yield bonds fared even better, with the lowest-rated bonds returning in excess of 10% for the period.

PERFORMANCE

For the year ended March 31, 2007, Transamerica Income Shares, Inc. returned 6.32%.

STRATEGY REVIEW

For much of the year, the portfolio was positioned for an end to Fed rate increases, with a longer duration than the LB Gov't/Credit. This positioning undermined performance initially, as interest rates and bond yields rose, but worked in the portfolio's favor during the second-half rallies. For the full period, our interest rate positioning contributed modestly to results.

The portfolio's results also were due to an overweighting in investment-grade corporate bonds and a significant exposure to the outperforming high-yield bond sector (i.e., approximately 25% to 30% of assets throughout the period).

In the investment-grade corporate sector, we initially emphasized bonds of energy, basic materials and industrial corporations that were able to increase prices due to robust demand in a strong global economy, as well as shorter-maturity corporate bonds for their relatively lower volatility. Later, with the U.S. economy slowing and more companies becoming targets of risky private equity buyouts, we assumed a more defensive posture. Trimming industrial, basic materials and other cyclical holdings, we added investments in large, high-quality companies (mostly banks and financial companies) that are less susceptible to takeover.

Transamerica Income Shares, Inc.

The consistent exposure to high-yield securities also helped to curb this buyout risk while adding significantly to current income. Within the sector, we emphasized B-rated securities in many cases, from companies that had already been bought and are now engaged in paying down the debt (e.g., premium retailer The Neiman Marcus Group, Inc.). We also made a much smaller but strategic investment in CCC-rated bonds. We believed that, given the resilience of the economy and corporate profits, and the ready availability of capital, defaults among these lower-grade bonds would not increase.

With aggregate personal income growing, unemployment at low levels, and overseas economies strong (which should sustain demand for U.S. exports), we believe the U.S. economy will continue to expand at a moderate pace. Combined with inflation that is hovering at the high end of the Fed's comfort zone, that should give the Fed little reason to reduce interest rates quickly. With that in mind, we will maintain the portfolio's overweightings in corporate and high-yield bonds.

Heidi Y. Hu, CFA

Peter O. Lopez

Brian W. Westhoff, CFA

Co-Portfolio Managers

Transamerica Investment Management, LLC

Transamerica Income Shares, Inc.

SCHEDULE OF INVESTMENTS

At March 31, 2007

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| U.S. GOVERNMENT AGENCY OBLIGATIONS (1.4%) | |

Freddie Mac, Series 2631, Class CE

4.25%, due 10/15/2026 | | $ | 2,000 | | | $ | 1,960 | | |

Total U.S. Government Agency Obligations

(cost: $1,960) | | | | | | | 1,960 | | |

| MORTGAGE-BACKED SECURITIES (1.2%) | |

Crown Castle Towers LLC,

Series 2006-1A, Class C - 144A

5.47%, due 11/15/2036 | | | 1,700 | | | | 1,704 | | |

Total Mortgage-Backed Securities

(cost: $1,700) | | | | | | | 1,704 | | |

| CORPORATE DEBT SECURITIES (94.4%) | |

| Aerospace (3.0%) | |

Boeing Co. (The)

8.75%, due 08/15/2021 | | | 2,000 | | | | 2,628 | | |

Embraer Overseas, Ltd.,

Guaranteed Note-144A

6.38%, due 01/24/2017 | | | 1,525 | | | | 1,548 | | |

| Agriculture (1.1%) | |

Michael Foods, Inc.

8.00%, due 11/15/2013 | | | 1,500 | | | | 1,522 | | |

| Air Transportation (0.8%) | |

FedEx Corp.

9.65%, due 06/15/2012 | | | 1,000 | | | | 1,190 | | |

| Amusement & Recreation Services (0.7%) | |

Harrah's Operating Co., Inc.

5.50%, due 07/01/2010 | | | 1,000 | | | | 984 | | |

| Automotive (0.3%) | |

General Motors Corp.

7.13%, due 07/15/2013† | | | 500 | | | | 467 | | |

The notes to the financial statements are an integral part of this report.

3

Transamerica Income Shares, Inc.

SCHEDULE OF INVESTMENTS

At March 31, 2007

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Automotive Service Stations (0.7%) | |

Petro Stopping Centers, LP / Petro

Financial Corp.

9.00%, due 02/15/2012 | | $ | 1,000 | | | $ | 1,030 | | |

| Beverages (1.5%) | |

Brown-Forman Corp.

5.20%, due 04/01/2012 | | | 1,400 | | | | 1,395 | | |

FBG Finance, Ltd. - 144A

5.88%, due 06/15/2035 | | | 800 | | | | 734 | | |

| Business Credit Institutions (2.4%) | |

Pemex Finance, Ltd.

9.03%, due 02/15/2011 | | | 3,120 | | | | 3,344 | | |

| Business Services (1.1%) | |

Cardtronics, Inc., Senior Subordinated Note

9.25%, due 08/15/2013 | | | 800 | | | | 840 | | |

FTI Consulting, Inc., Senior Note

7.75%, due 10/01/2016 | | | 300 | | | | 315 | | |

iPayment, Inc., Senior Subordinated Note

9.75%, due 05/15/2014 | | | 350 | | | | 359 | | |

| Chemicals & Allied Products (3.2%) | |

ICI Wilmington, Inc.

4.38%, due 12/01/2008 | | | 3,400 | | | | 3,350 | | |

Ineos Group Holdings PLC - 144A

8.50%, due 02/15/2016 | | | 500 | | | | 479 | | |

Mosaic Global Holdings, Inc.,

Senior Note-144A

7.63%, due 12/01/2016† | | | 400 | | | | 422 | | |

Reichhold Industries, Inc.,

Senior Note-144A

9.00%, due 08/15/2014 | | | 300 | | | | 307 | | |

The notes to the financial statements are an integral part of this report.

4

Transamerica Income Shares, Inc.

SCHEDULE OF INVESTMENTS

At March 31, 2007

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Commercial Banks (7.9%) | |

ACE Cash Express, Inc., Senior Note - 144A

10.25%, due 10/01/2014 | | $ | 250 | | | $ | 257 | | |

Barclays Bank PLC

6.28%, due 12/15/2031(a)(b) | | | 1,500 | | | | 1,444 | | |

HBOS PLC - 144A

5.92%, due 10/01/2015†(a)(b) | | | 1,400 | | | | 1,372 | | |

HSBC Capital Funding LP - 144A

10.18%, due 06/30/2030(a)(b) | | | 1,500 | | | | 2,182 | | |

HSBK Europe BV - 144A

7.75%, due 05/13/2013 | | | 500 | | | | 524 | | |

ICICI Bank, Ltd., Subordinated Note - 144A

6.38%, due 04/30/2022(b) | | | 920 | | | | 912 | | |

Shinsei Finance Cayman, Ltd. - 144A

6.42%, due 07/20/2016(a)(b) | | | 1,000 | | | | 1,010 | | |

Wachovia Capital Trust III

5.80%, due 03/15/2011(a)(b) | | | 1,396 | | | | 1,413 | | |

ZFS Finance USA Trust I - 144A

6.45%, due 12/15/2035(b) | | | 2,000 | | | | 2,000 | | |

| Communication (6.7%) | |

Echostar DBS Corp., Senior Note

7.13%, due 02/01/2016 | | | 775 | | | | 800 | | |

Intelsat Subsidiary Holding Co., Ltd.

8.25%, due 01/15/2013 | | | 800 | | | | 834 | | |

Kabel Deutschland GmbH

10.63%, due 07/01/2014 | | | 1,000 | | | | 1,115 | | |

News America Holdings

9.25%, due 02/01/2013 | | | 2,985 | | | | 3,541 | | |

Viacom, Inc., Senior Note

6.25%, due 04/30/2016 | | | 3,100 | | | | 3,143 | | |

The notes to the financial statements are an integral part of this report.

5

Transamerica Income Shares, Inc.

SCHEDULE OF INVESTMENTS

At March 31, 2007

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Department Stores (1.0%) | |

Neiman-Marcus Group, Inc.

9.00%, due 10/15/2015 | | $ | 1,275 | | | $ | 1,396 | | |

| Electric Services (6.0%) | |

AES Gener SA

7.50%, due 03/25/2014† | | | 1,500 | | | | 1,595 | | |

Dominion Resources, Inc.

5.69%, due 05/15/2008 | | | 1,900 | | | | 1,904 | | |

PPL Capital Funding, Guaranteed Note

6.70%, due 03/30/2067(b) | | | 2,050 | | | | 2,015 | | |

PSEG Funding Trust

5.38%, due 11/16/2007 | | | 3,000 | | | | 2,997 | | |

| Electronic Components & Accessories (0.2%) | |

NXP BV, Senior Note - 144A

7.88%, due 10/15/2014 | | | 275 | | | | 284 | | |

| Food & Kindred Products (1.2%) | |

ConAgra Foods, Inc, - 144A

5.82%, due 06/15/2017 | | | 1,140 | | | | 1,148 | | |

ConAgra Foods, Inc.

9.75%, due 03/01/2021 | | | 235 | | | | 305 | | |

Nutro Products, Inc. - 144A

10.75%, due 04/15/2014 | | | 290 | | | | 313 | | |

| Food Stores (0.9%) | |

Stater Brothers Holdings, Inc.

8.13%, due 06/15/2012† | | | 1,200 | | | | 1,236 | | |

The notes to the financial statements are an integral part of this report.

6

Transamerica Income Shares, Inc.

SCHEDULE OF INVESTMENTS

At March 31, 2007

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Gas Production & Distribution (3.1%) | |

Kinder Morgan Energy Partners, LP

7.75%, due 03/15/2032 | | $ | 1,500 | | | $ | 1,696 | | |

MarkWest Energy Partners, LP / MarkWest

Energy Finance Corp., Senior Note

8.50%, due 07/15/2016 | | | 700 | | | | 730 | | |

Northwest Pipeline

9.00%, due 08/01/2022 | | | 175 | | | | 180 | | |

Southern Union Co., Senior Note

6.15%, due 08/16/2008 | | | 1,800 | | | | 1,813 | | |

| Holding & Other Investment Offices (5.1%) | |

Ameriprise Financial, Inc.

7.52%, due 06/01/2066(b) | | | 2,000 | | | | 2,159 | | |

Healthcare Realty Trust, Inc. REIT,

Senior Note

8.13%, due 05/01/2011 | | | 1,350 | | | | 1,471 | | |

Hospitality Properties Trust REIT

6.30%, due 06/15/2016 | | | 1,968 | | | | 2,041 | | |

Rouse Co., LP/TRC Co-Issuer, Inc. REIT,

Senior Note - 144A

6.75%, due 05/01/2013 | | | 800 | | | | 815 | | |

Susser Holdings LLC, Senior Note

10.63%, due 12/15/2013 | | | 704 | | | | 768 | | |

The notes to the financial statements are an integral part of this report.

7

Transamerica Income Shares, Inc.

SCHEDULE OF INVESTMENTS

At March 31, 2007

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Hotels & Other Lodging Places (4.4%) | |

Host Marriott, LP REIT

7.13%, due 11/01/2013 | | $ | 1,500 | | | $ | 1,534 | | |

Las Vegas Sands Corp.

6.38%, due 02/15/2015 | | | 800 | | | | 764 | | |

Park Place Entertainment Corp.

7.00%, due 04/15/2013 | | | 1,500 | | | | 1,594 | | |

Starwood Hotels & Resorts Worldwide, Inc.

7.88%, due 05/01/2012 | | | 1,500 | | | | 1,612 | | |

Wyndham Worldwide Corp. - 144A

6.00%, due 12/01/2016 | | | 675 | | | | 675 | | |

| Industrial Machinery & Equipment (1.1%) | |

Cummins Engine Co., Inc.

5.65%, due 03/01/2098 | | | 2,000 | | | | 1,523 | | |

| Insurance (3.6%) | |

Metlife, Inc.

6.40%, due 12/15/2036* | | | 2,230 | | | | 2,177 | | |

Oil Insurance, Ltd. - 144A

7.56%, due 06/30/2011(a)(b) | | | 1,500 | | | | 1,579 | | |

Reinsurance Group of America

6.75%, due 12/15/2065(b) | | | 1,400 | | | | 1,391 | | |

| Lumber & Other Building Materials (0.9%) | |

CRH America, Inc.

5.30%, due 10/15/2013 | | | 770 | | | | 754 | | |

Masonite Corp.,

Senior Subordinated Note - 144A

11.00%, due 04/06/2015† | | | 550 | | | | 511 | | |

The notes to the financial statements are an integral part of this report.

8

Transamerica Income Shares, Inc.

SCHEDULE OF INVESTMENTS

At March 31, 2007

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Metal Mining (2.4%) | |

Barrick Gold Finance, Inc.

7.50%, due 05/01/2007 | | $ | 2,000 | | | $ | 2,003 | | |

Freeport-McMoRan Copper & Gold, Inc.,

Senior Note

8.38%, due 04/01/2017 | | | 125 | | | | 135 | | |

Vale Overseas, Ltd., Guaranteed Note

6.25%, due 01/23/2017 | | | 1,175 | | | | 1,197 | | |

| Mortgage Bankers & Brokers (3.6%) | |

Galaxy Entertainment Finance Co., Ltd.,

Senior Note - 144A

9.88%, due 12/15/2012 | | | 500 | | | | 546 | | |

Glencore Funding LLC - 144A

6.00%, due 04/15/2014 | | | 1,500 | | | | 1,487 | | |

ILFC E-Capital Trust II - 144A

6.25%, due 12/21/2065(b) | | | 2,000 | | | | 2,047 | | |

Innophos Investments Holdings, Inc.

13.37%, due 02/15/2015 | | | 180 | | | | 188 | | |

MUFG Capital Finance 1, Ltd.

6.35%, due 07/25/2016(a)(b) | | | 750 | | | | 766 | | |

| Motion Pictures (2.9%) | |

Time Warner, Inc.

9.13%, due 01/15/2013 | | | 3,500 | | | | 4,102 | | |

The notes to the financial statements are an integral part of this report.

9

Transamerica Income Shares, Inc.

SCHEDULE OF INVESTMENTS

At March 31, 2007

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Oil & Gas Extraction (3.6%) | |

Chesapeake Energy Corp.

6.88%, due 01/15/2016 | | $ | 1,500 | | | $ | 1,519 | | |

Gazprom International SA - 144A

7.20%, due 02/01/2020 | | | 572 | | | | 601 | | |

OPTI Canada, Inc., Senior Note - 144A

8.25%, due 12/15/2014 | | | 1,000 | | | | 1,040 | | |

PetroHawk Energy Corp., Senior Note

9.13%, due 07/15/2013 | | | 1,000 | | | | 1,065 | | |

Sabine Pass LNG, LP, Senior Secured

Note - 144A

7.50%, due 11/30/2016 | | | 850 | | | | 856 | | |

| Paper & Allied Products (1.6%) | |

Celulosa Arauco y Constitucion SA

8.63%, due 08/15/2010 | | | 2,000 | | | | 2,196 | | |

| Paperboard Containers & Boxes (0.5%) | |

Graham Packaging Co., Inc.

9.88%, due 10/15/2014† | | | 650 | | | | 663 | | |

| Personal Credit Institutions (2.2%) | |

Erac USA Finance Company - 144A

6.80%, due 02/15/2008 | | | 2,100 | | | | 2,116 | | |

General Motors Acceptance Corp.

5.13%, due 05/09/2008 | | | 600 | | | | 593 | | |

GMAC LLC, Senior Note

6.00%, due 12/15/2011 | | | 435 | | | | 422 | | |

| Petroleum Refining (2.2%) | |

Enterprise Products Operating, LP

8.38%, due 08/01/2066(b) | | | 1,400 | | | | 1,532 | | |

Valero Energy Corp.

6.88%, due 04/15/2012 | | | 1,500 | | | | 1,597 | | |

The notes to the financial statements are an integral part of this report.

10

Transamerica Income Shares, Inc.

SCHEDULE OF INVESTMENTS

At March 31, 2007

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Primary Metal Industries (0.9%) | |

Metals USA Holdings Corp.,

Senior Note - 144A

11.37%, due 01/15/2012* | | $ | 290 | | | $ | 284 | | |

PNA Group, Inc., Senior Note - 144A

10.75%, due 09/01/2016 | | | 375 | | | | 403 | | |

Texas Industries, Inc.

7.25%, due 07/15/2013 | | | 500 | | | | 515 | | |

| Printing & Publishing (0.5%) | |

RH Donnelley Corp., Senior Note

8.88%, due 01/15/2016 | | | 500 | | | | 531 | | |

Valassis Communications, Inc.,

Senior Note - 144A

8.25%, due 03/01/2015† | | | 250 | | | | 246 | | |

| Radio & Television Broadcasting (1.4%) | |

Chancellor Media Corp.

8.00%, due 11/01/2008 | | | 1,415 | | | | 1,466 | | |

Umbrella Acquisition - 144A

9.75%, due 03/15/2015† | | | 500 | | | | 498 | | |

| Railroads (1.1%) | |

BNSF Funding Trust I, Guaranteed Note

6.61%, due 12/15/2055(b) | | | 1,710 | | | | 1,590 | | |

| Real Estate (1.1%) | |

Colonial Realty, LP

7.00%, due 07/14/2007 | | | 1,500 | | | | 1,506 | | |

| Restaurants (1.1%) | |

Aramark Corp., Senior Note - 144A

8.50%, due 02/01/2015 | | | 1,000 | | | | 1,040 | | |

Sbarro, Inc., Senior Note - 144A

10.38%, due 02/01/2015 | | | 500 | | | | 520 | | |

The notes to the financial statements are an integral part of this report.

11

Transamerica Income Shares, Inc.

SCHEDULE OF INVESTMENTS

At March 31, 2007

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Retail Trade (0.3%) | |

Michaels Stores, Inc., Senior

Subordinated Note - 144A

11.38%, due 11/01/2016† | | $ | 375 | | | $ | 404 | | |

| Rubber & Misc. Plastic Products (0.4%) | |

Titan International, Inc., Senior Note - 144A

8.00%, due 01/15/2012 | | | 600 | | | | 617 | | |

| Savings Institutions (0.7%) | |

Sovereign Capital Trust VI, Guaranteed Note

7.91%, due 06/13/2036 | | | 875 | | | | 974 | | |

| Security & Commodity Brokers (4.0%) | |

E*Trade Financial Corp.

8.00%, due 06/15/2011 | | | 1,500 | | | | 1,579 | | |

JP Morgan Chase Capital XVIII

6.95%, due 08/17/2036* | | | 2,000 | | | | 2,084 | | |

Lazard Group, Senior Note

7.13%, due 05/15/2015 | | | 1,250 | | | | 1,318 | | |

Western Union Co. (The)

5.93%, due 10/01/2016 | | | 685 | | | | 686 | | |

| Stone, Clay & Glass Products (1.0%) | |

Lafarge SA

7.13%, due 07/15/2036 | | | 1,300 | | | | 1,400 | | |

| Telecommunications (2.0%) | |

At&t Wireless Services, Inc.

8.13%, due 05/01/2012 | | | 1,400 | | | | 1,576 | | |

Verizon Global Funding Corp.

7.75%, due 12/01/2030 | | | 1,100 | | | | 1,275 | | |

| Transportation & Public Utilities (0.9%) | |

Hertz Corp., Senior Subordinated Note

10.50%, due 01/01/2016 | | | 1,125 | | | | 1,283 | | |

| Water Transportation (1.6%) | |

Royal Caribbean Cruises, Ltd.

8.75%, due 02/02/2011 | | | 2,000 | | | | 2,190 | | |

The notes to the financial statements are an integral part of this report.

12

Transamerica Income Shares, Inc.

SCHEDULE OF INVESTMENTS

At March 31, 2007

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Wholesale Trade Nondurable Goods (1.5%) | |

Alliance One International, Inc.,

Senior Note - 144A

8.50%, due 05/15/2012 | | $ | 1,000 | | | $ | 1,008 | | |

Supervalu, Inc., Senior Note

7.50%, due 11/15/2014 | | | 1,000 | | | | 1,043 | | |

Total Corporate Debt Securities

(cost: $130,125) | | | | | | | 133,148 | | |

| | | Shares | | Value | |

| PREFERRED STOCKS (1.3%) | |

| Holding & Other Investment Offices (0.6%) | |

| Tanger Factory Outlet Centers REIT | | | 33,334 | | | $ | 860 | | |

| Telecommunications (0.7%) | |

| Centaur Funding Corp. - 144A | | | 852 | | | | 998 | | |

Total Preferred Stocks

(cost: $1,671) | | | | | | | 1,858 | | |

| | | Principal | | Value | |

| SECURITY LENDING COLLATERAL (5.5%) | |

| Debt (5.5%) | |

| Euro Dollar Overnight (2.7%) | |

Svenska Handlesbanken

5.38%, due 04/02/2007 | | $ | 3,731 | | | $ | 3,731 | | |

| Repurchase Agreements (2.8%)†† | |

Morgan Stanley Dean Witter & Co.

5.49%, dated 03/30/2007 to be

repurchased at $4,002 on 04/02/2007 | | | 4,000 | | | | 4,000 | | |

Total Security Lending Collateral

(cost: $7,731) | | | | | | | 7,731 | | |

Total Investment Securities

(cost: $143,187)# | | | | | | $ | 146,401 | | |

The notes to the financial statements are an integral part of this report.

13

Transamerica Income Shares, Inc.

SCHEDULE OF INVESTMENTS

At March 31, 2007

(all amounts except share amounts in thousands)

NOTES TO SCHEDULE OF INVESTMENTS:

† At March 31, 2007, all or a portion of this security is on loan (See Note 1). The value at March 31, 2007, of all securities on loan is $7,534.

(a) The security has a perpetual maturity. The date shown is the next call date.

(b) Coupon rate is fixed for a predetermined period of time and then converts to a floating rate until maturity/call date. Rate is listed as of March 31, 2007.

* Floating or variable rate note. Rate is listed as of March 31, 2007.

†† Cash collateral for the Repurchase Agreements, valued at $4,145, that serve as collateral for securities lending, are invested in corporate bonds with interest rates and maturity dates ranging from 3.00%-8.63% and 03/15/2008-12/01/2096, respectively.

# Aggregate cost for federal income tax purposes is $144,263. Aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value were $2,882 and $744, respectively. Net unrealized appreciation for tax purposes is $2,138.

DEFINITIONS:

144A 144A Securities are registered pursuant to Rule 144A of the Securities Act of 1933. These securities are deemed to be liquid for purposes of compliance limitations on holdings of illiquid securities and may be resold as transactions exempt from registration, normally to qualified institutional buyers. At March 31, 2007, these securities aggregated $33,487 or 23.7% of the net assets of the Fund.

REIT Real Estate Investment Trust

Guaranteed Note These securities are deemed to be liquid for purposes of compliance limitations on holdings of illiquid securities.

The notes to the financial statements are an integral part of this report.

14

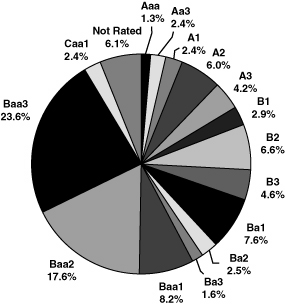

Transamerica Income Shares, Inc.

GRAPHIC PRESENTATION OF PORTFOLIO HOLDINGS

(unaudited)

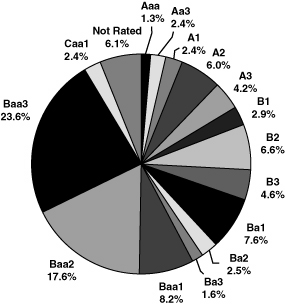

Bond Credit Quality (Moody's Ratings)

Credit Rating Description

Aaa Prime grade obligations. Exceptional financial security and ability to meet senior financial obligations.

Aa3 High grade obligations. Strong capacity to pay interest and repay principal.

A1 Upper medium grade obligations. Superior ability for repayments of senior short-term debt obligations.

A2 Upper medium grade obligations. Strong ability for repayments of senior short-term debt obligations.

A3 Upper medium grade obligations. Acceptable ability for repayments of senior short-term debt obligations.

15

B1 Moderate vulnerability to adverse business, financial and economic conditions but currently has the capacity to meet financial commitments.

B2 More vulnerable to adverse business, financial and economic conditions but currently has the capacity to meet financial commitments.

B3 Assurance of interest and principal payments or of maintenance of other terms of the contract over any long period of time may be small.

Ba1 Moderate vulnerability in the near-term but faces major ongoing uncertainties in the event of adverse business, financial and economic conditions.

Ba2 Vulnerable in the near-term but faces major ongoing uncertainties in the event of adverse business, financial and economic conditions.

Ba3 More vulnerable in the near-term but faces major ongoing uncertainties in the event of adverse business, financial and economic conditions.

Baa1 Medium grade obligations. Interest payments and principal security are adequate for the present but certain protective elements may be lacking or may be characteristically unreliable over great length of time.

Baa2 Medium grade obligations. Interest payments and principal security appear adequate for the present but certain protective elements may be lacking or may be characteristically unreliable over great length of time.

Baa3 Medium grade obligations. Interest payments and principal security are not as adequate for the present but certain protective elements may be lacking or may be characteristically unreliable over great length of time.

Caa1 Highly vulnerable may be in default on their policyholder obligations or there may be present elements of danger with respect to payment of policyholder obligations and claims.

16

Transamerica Income Shares, Inc.

UNDERSTANDING YOUR FUND'S EXPENSES

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur ongoing costs, including management and advisory fees and other Fund expenses.

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at October 1, 2006 and held for the entire period until March 31, 2007.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR

COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

17

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions.

| Transamerica Income Shares, Inc. | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | |

Expenses Paid

During Period(a) | |

| Actual | | $ | 1,000.00 | | | $ | 1,060.50 | | | | 0.78 | % | | $ | 4.01 | | |

| Hypothetical(b) | | | 1,000.00 | | | | 1,021.04 | | | | 0.78 | | | | 3.93 | | |

(a) Expenses are calculated using the Fund's annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by number of days in the period (182 days), and divided by the number of days in the year (365 days).

(b) 5% return per year before expenses.

18

Transamerica Income Shares, Inc.

STATEMENT OF ASSETS AND LIABILITIES

At March 31, 2007

(all amounts except per share amounts in thousands)

| Assets: | |

Investment securities, at value (cost: $143,187)

(including securities loaned of $7,534) | | $ | 146,401 | | |

| Cash | | | 1,030 | | |

| Receivables: | |

| Investment securities sold | | | 4,303 | | |

| Interest | | | 2,533 | | |

| | | | 154,267 | | |

| Liabilities: | |

| Investment securities purchased | | | 4,675 | | |

| Accounts payable and accrued liabilities: | |

| Management and advisory fees | | | 60 | | |

| Transfer agent fees | | | 2 | | |

| Administration fees | | | 3 | | |

| Dividends to shareholders | | | 695 | | |

| Payable for collateral for securities on loan | | | 7,731 | | |

| Other | | | 77 | | |

| | | | 13,243 | | |

Net Assets applicable to 6,319 capital shares

outstanding, $1.00 par value (authorized

20,000 shares) | | $ | 141,024 | | |

| Net Asset Value Per Share | | $ | 22.32 | | |

| Net Assets Consist of: | |

| Paid-in capital | | $ | 141,184 | | |

Undistributed (accumulated) net investment

income (loss) | | | (1,764 | ) | |

Undistributed (accumulated) net realized gain

(loss) from investment securities | | | (1,610 | ) | |

Net unrealized appreciation (depreciation) on

investment securities | | | 3,214 | | |

| Net Assets | | $ | 141,024 | | |

The notes to the financial statements are an integral part of this report.

19

Transamerica Income Shares, Inc.

STATEMENT OF OPERATIONS

For the year ended March 31, 2007

(all amounts in thousands)

| Investment Income: | |

| Interest | | $ | 9,150 | | |

| Dividends | | | 147 | | |

| Income from loaned securities — net | | | 20 | | |

| | | | 9,317 | | |

| Expenses: | |

| Management and advisory fees | | | 697 | | |

| Transfer agent fees | | | 54 | | |

| Printing and shareholder reports | | | 46 | | |

| Custody fees | | | 22 | | |

| Administration fees | | | 28 | | |

| Legal fees | | | 84 | | |

| Audit fees | | | 41 | | |

| Director fees | | | 70 | | |

| Other | | | 32 | | |

| Total Expenses | | | 1,074 | | |

| Net Investment Income (Loss) | | | 8,243 | | |

| Net Realized and Unrealized Gain (Loss) | |

Realized gain (loss) from investment

securities | | | (476 | ) | |

Increase (decrease) in unrealized appreciation

(depreciation) on investment securities | | | 2,702 | | |

Net Realized and Unrealized Gain (Loss) on

Investment Securities | | | 2,226 | | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | | $ | 10,469 | | |

The notes to the financial statements are an integral part of this report.

20

Transamerica Income Shares, Inc.

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended March 31,

(all amounts in thousands)

| | | 2007 | | 2006 | |

Increase (Decrease) in Net

Assets From: | |

| Operations: | |

| Net investment income (loss) | | $ | 8,243 | | | $ | 7,159 | | |

Net realized gain (loss) from

investment securities | | | (476 | ) | | | 384 | | |

Change in unrealized appreciation

(depreciation) on investment

securities | | | 2,702 | | | | (4,791 | ) | |

| | | | 10,469 | | | | 2,752 | | |

| Distributions to Shareholders: | |

| From net investment income | | | (8,720 | ) | | | (8,248 | ) | |

| From net realized gains | | | — | | | | (591 | ) | |

| Return of capital | | | — | | | | (1,018 | ) | |

| | | | (8,720 | ) | | | (9,857 | ) | |

Net increase (decrease) in net

assets | | | 1,749 | | | | (7,105 | ) | |

| Net Assets: | |

| Beginning of year | | | 139,275 | | | | 146,380 | | |

| End of year | | $ | 141,024 | | | $ | 139,275 | | |

Undistributed (accumulated)

net investment income (loss) | | $ | (1,764 | ) | | $ | (1,787 | ) | |

The notes to the financial statements are an integral part of this report.

21

Transamerica Income Shares, Inc.

FINANCIAL HIGHLIGHTS

For a share outstanding throughout each period:

| | | Year ended March 31, | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Net Asset Value | |

| Beginning of year | | $ | 22.04 | | | $ | 23.17 | | | $ | 24.34 | | | $ | 22.97 | | | $ | 23.18 | | |

| Investment Operations | |

| Net investment income(b) | | | 1.30 | | | | 1.13 | | | | 1.24 | | | | 1.42 | | | | 1.62 | | |

Net realized and

unrealized gain (loss)

on Investments | | | 0.36 | | | | (0.70 | ) | | | (0.85 | ) | | | 1.61 | | | | 0.06 | | |

Total from investment

operations | | | 1.66 | | | | 0.43 | | | | 0.39 | | | | 3.03 | | | | 1.68 | | |

Distributions to

Shareholders | |

| Net investment income | | | (1.38 | ) | | | (1.30 | ) | | | (1.56 | ) | | | (1.66 | ) | | | (1.80 | ) | |

Net realized gains

on investments | | | — | | | | (0.10 | ) | | | — | | | | — | | | | (0.09 | ) | |

| Return of Capital | | | — | | | | (0.16 | ) | | | — | | | | — | | | | — | | |

| Total distributions | | | (1.38 | ) | | | (1.56 | ) | | | (1.56 | ) | | | (1.66 | ) | | | (1.89 | ) | |

| Net Asset Value | |

| End of year | | $ | 22.32 | | | $ | 22.04 | | | $ | 23.17 | | | $ | 24.34 | | | $ | 22.97 | | |

| | | | | | | | | | | | | | | | | | | | | | |

Market Value per

Share | |

| End of year | | $ | 21.11 | | | $ | 21.23 | | | $ | 21.74 | | | $ | 24.62 | | | $ | 24.12 | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Total Return(a) | | | 6.32 | % | | | 4.87 | % | | | (5.43 | )% | | | 9.40 | % | | | 1.27 | % | |

Ratio and

Supplemental Data | |

Expenses to average

net assets: | | | 0.77 | % | | | 0.84 | % | | | 0.72 | % | | | 0.69 | % | | | 0.73 | % | |

| Net investment income | | | 5.91 | % | | | 4.95 | % | | | 5.24 | % | | | 5.97 | % | | | 7.25 | % | |

| Portfolio turnover rate | | | 68 | % | | | 95 | % | | | 59 | % | | | 90 | % | | | 76 | % | |

Net assets end of the

year (in thousands) | | $ | 141,024 | | | $ | 139,275 | | | $ | 146,380 | | | $ | 153,816 | | | $ | 145,149 | | |

| | | | | | | | | | | | | | | | | | | | | | |

The number of shares outstanding at the end of each period was 6,318,771.

(a) Based on the market price of the Fund's shares and including the reinvestment of dividends and distributions at prices obtained by the Fund's dividend reinvestment plan.

(b) The net investment income per share data was determined by using average shares outstanding throughout the year.

The notes to the financial statements are an integral part of this report.

22

Transamerica Income Shares, Inc.

NOTES TO FINANCIAL STATEMENTS

At March 31, 2007

(all amounts in thousands)

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Transamerica Income Shares, Inc. (the "Fund") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a diversified, closed-end management investment company. The Fund's investment objective is to seek as high a level of current income consistent with prudent investment, with capital appreciation as only a secondary objective.

In the normal course of business the Fund enters into contracts that contain a variety of representations and warranties, which provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

In preparing the Fund's financial statements in accordance with accounting principles generally accepted in the United States of America ("GAAP"), estimates or assumptions (which could differ from actual results) may be used that affect reported amounts and disclosures. The following policies were consistently followed by the Fund, in accordance with GAAP.

Securities Valuations: Fund investments traded on an exchange are valued at the last sale price or closing price on the day of valuation on the exchange where the security is principally traded.

Certain debt securities are valued based on a price quotation or other equivalent indication of value supplied by an exchange, a pricing service or a major market maker; how

23

Transamerica Income Shares, Inc.

NOTES TO FINANCIAL STATEMENTS (continued)

At March 31, 2007

(all amounts in thousands)

ever, those that mature in sixty days or less are valued at amortized cost, which approximates market.

Other securities for which quotations are not readily available or whose values have been determined to be unreliable are valued at fair market value as determined in good faith by the Fund's Administrative Valuation Committee, under the supervision of the Board's Valuation Oversight Committee, using guidelines adopted by the Board of Directors.

Cash: The Fund may leave cash overnight in its cash account with the custodian, Investors Bank & Trust Company ("IBT"). IBT has been contracted on behalf of the Fund to invest the excess cash into a savings account, which at March 31, 2007 was paying an interest rate of 3.64%.

Repurchase Agreements: The Fund is authorized to enter into repurchase agreements. The Fund, through its custodian, IBT, receives delivery of the underlying securities, the value of which at the time of purchase is required to be an amount equal to at least 100% of the resale price. The Fund will bear the risk of value fluctuations until the security can be sold and may encounter delays and incur costs in liquidating the security. In the event of bankruptcy or insolvency of the seller, delays and costs may be incurred.

Securities Lending: The Fund may lend securities to qualified borrowers, with IBT acting as the Fund's lending agent. The Fund earns negotiated lenders' fees. The Fund receives cash and/or securities as collateral against the loaned securities. Cash collateral received is invested in short-term, interest-bearing securities. The Fund monitors the market value of securities loaned on a daily basis and requires collateral in an amount at least equal to the value

24

Transamerica Income Shares, Inc.

NOTES TO FINANCIAL STATEMENTS (continued)

At March 31, 2007

(all amounts in thousands)

of the securities loaned. Income from loaned securities on the Statement of Operations is net of fees, in the amount of $9, earned by IBT for its services.

Securities Transactions and Investment Income: Security transactions are recorded on the trade date. Security gains and losses are calculated on the specific identification basis. Dividend income, if any, is recorded on the ex-dividend date. Interest income, including accretion of discounts and amortization of premiums, is recorded on the accrual basis commencing on the settlement date.

Dividend Distributions: Dividend distributions are declared monthly. Capital gains distributions are declared annually. Distributions are generally paid in the month following the ex-date, on or about the fifteenth calendar day. See "Automatic Reinvestment Plan" on page 39 for opportunity to reinvest distributions in shares of the Fund's common stock.

NOTE 2. RELATED PARTY TRANSACTIONS

Transamerica Fund Advisors, Inc. ("TFAI") is the Fund's investment adviser. Transamerica Fund Services, Inc. ("TFS") is the Fund's administrator. Mellon Investor Services, LLC ("Mellon") is the Fund's transfer agent. TFAI and TFS are affiliates of AEGON, NV, a Netherlands corporation.

Certain officers and directors of the Fund are also officers and/or directors of TFAI and TFS.

Transamerica Investment Management, LLC ("TIM") is both an affiliate of the Fund and a sub-adviser to the Fund.

As of March 31, 2007, an investor owned 7.6% of the outstanding shares of the Fund.

25

Transamerica Income Shares, Inc.

NOTES TO FINANCIAL STATEMENTS (continued)

At March 31, 2007

(all amounts in thousands)

Investment Advisory Fees: The Fund pays management fees to TFAI based on average daily net assets ("ANA") at the following rate:

0.50% of ANA

TFAI currently voluntarily waives its advisory fee and will reimburse the Fund to the extent that operating expenses exceed the following stated limit:

1.50% of the first $30 million of ANA

1.00% of ANA over $30 million

There were no fees waived during the year ended March 31, 2007.

Administrative Services: The Fund has entered into an agreement with TFS for financial and legal fund administration services. The Fund pays TFS an annual fee of 0.02% of average net assets. The Legal fees on the Statement of Operations are fees paid to external legal counsel.

NOTE 3. SECURITY TRANSACTIONS

The cost of securities purchased and proceeds from securities sold (excluding short-term securities) for the year ended March 31, 2007, were as follows:

| Purchases of securities: | |

| Long-Term | | $ | 86,734 | | |

| U.S. Government | | | 11,202 | | |

Proceeds from maturities and sales of

securities: | |

| Long-Term | | | 82,635 | | |

| U.S. Government | | | 10,392 | | |

26

Transamerica Income Shares, Inc.

NOTES TO FINANCIAL STATEMENTS (continued)

At March 31, 2007

(all amounts in thousands)

NOTE 4. FEDERAL INCOME TAX MATTERS

The Fund has not made any provision for federal income or excise taxes due to its policy to distribute all of its taxable income and capital gains to its shareholders and otherwise qualify as a regulated investment company under Subchapter M of the Internal Revenue Code. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatments for items including, but not limited to, bond premium amortization and dividends payable.

Therefore, distributions determined in accordance with tax regulations may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book\tax differences to reflect tax character. Financial records are not adjusted for temporary differences. These reclassifications are as follows:

| Paid in capital | | $ | 2 | | |

Undistributed (accumulated) net

investment income (loss) | | $ | 500 | | |

Undistributed (accumulated) net

realized gains (loss) | | $ | (502 | ) | |

The tax character of distributions paid may differ from the character of distributions shown in the Statements of Changes in Net Assets due to short-term gains being treated

27

Transamerica Income Shares, Inc.

NOTES TO FINANCIAL STATEMENTS (continued)

At March 31, 2007

(all amounts in thousands)

as ordinary income for tax purposes. The tax character of distributions paid during 2006 and 2007 was as follows:

| 2006 Distributions paid from: | |

| Ordinary income | | $ | 8,248 | | |

| Long-term capital gains | | $ | 591 | | |

| Return of capital | | $ | 1,018 | | |

| 2007 Distributions paid from: | |

| Ordinary income | | $ | 8,720 | | |

| Long-term capital gains | | $ | — | | |

| Return of capital | | $ | — | | |

The following capital loss carryforwards are available to offset future realized gains through the periods listed:

Capital Loss

Carryforwards | |

Available through | |

| $ | 49 | | | March 31, 2014 | |

| $ | 1,561 | | | March 31, 2015 | |

The tax basis components of distributable earnings as of March 31, 2007, are as follows:

| Undistributed ordinary income | | $ | 7 | | |

| Accumulated long-term capital loss | | $ | — | | |

| Capital loss carryforward | | $ | (1,610 | ) | |

| Post-October capital loss deferral | | $ | — | | |

| Dividends Payable | | $ | (695 | ) | |

Net unrealized appreciation

(depreciation) | | $ | 2,138 | | |

28

Transamerica Income Shares, Inc.

NOTES TO FINANCIAL STATEMENTS (continued)

At March 31, 2007

(all amounts in thousands)

NOTE 5. REGULATORY PROCEEDINGS

There continues to be significant federal and state regulatory activity relating to financial services companies, particularly mutual fund companies and their investment advisers. As part of an ongoing investigation regarding potential market timing, recordkeeping and trading compliance issues and matters affecting the Fund's investment adviser, TFAI, and certain affiliates and former employees of TFAI, the SEC staff has indicated that it is likely to take some action against TFAI and certain of its affiliates at the conclusion of the investigation. The potential timing and the scope of any such action is difficult to predict. Although the impact of any action brought against TFAI and/or its affiliates is difficult to assess at the present time, the Fund currently believes that the likelihood that any such action will have a material adverse impact on it is remote. It is important to note that the Fund is not aware of any allegation of wrong doing against it and its Board at the time this annual report is printed. Although it is not anticipated that these developments will have an adverse impact on the Fund, there can be no assurance at this time. TFAI and its affiliates are actively working with the SEC in regard to this matter; however, the exact resolution cannot be determined at this time. TFAI will take such actions that it deems necessary or appropriate to continue providing management services to the Fund and to bring all matters to an appropriate conclusion.

TFAI and/or its affiliates, and not the Fund, will bear the costs regarding these regulatory matters.

29

Transamerica Income Shares, Inc.

NOTES TO FINANCIAL STATEMENTS (continued)

At March 31, 2007

(all amounts in thousands)

NOTE 6. RECENTLY ISSUED ACCOUNTING

PRONOUNCEMENTS

In July 2006, the Financial Accounting Standards Board ("FASB") released FASB Interpretation No. 48 "Accounting for Uncertainty in Income Taxes" ("FIN 48"), an interpretation of FASB Statement No. 109. FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the accounting and disclosure of tax positions taken or expected to be taken in the course of preparing the Fund's tax returns to determine whether the tax positions are "more-likely-than-not" of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is effective during the first required financial reporting period for fiscal years beginning after December 15, 2006. Management is evaluating the anticipated impact, if any, that FIN 48 will have on the Fund upon adoption, which, pursuant to a delay granted by the U.S. Securities and Exhange Commission, is expected to be on September 28, 2007.

In September 2006, FASB issued its new Standard No. 157, "Fair Value Measurements" ("FAS 157"). FAS 157 is designed to unify guidance for the measurement of fair value of all types of assets, including financial instruments, and certain liabilities, throughout a number of accounting standards. FAS 157 also establishes a hierarchy for measuring fair value in generally accepted accounting principles and expands financial statement disclosures about fair value measurements that are relevant to mutual funds. FAS 157 is effective for financial statements issued for fiscal years

30

Transamerica Income Shares, Inc.

NOTES TO FINANCIAL STATEMENTS (continued)

At March 31, 2007

(all amounts in thousands)

beginning after November 15, 2007, and earlier application is permitted. The Manager is evaluating the application of FAS 157 to the Fund, and the significance of its impact, if any, on the Fund's financial statements.

31

REPORT OF INDEPENDENT REGISTERED CERTIFIED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders

of Transamerica Income Shares, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Transamerica Income Shares, Inc.(the "Fund") at March 31, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in a ccordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at March 31, 2007 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

Tampa, Florida

May 18, 2007

32

SUPPLEMENTAL INFORMATION (unaudited)

TAX INFORMATION

For corporate shareholders, 0.72% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends received deduction.

The Fund designates a maximum amount of $62,501 as qualified dividend income, which is 0.72% of what was distributed.

The information and distributions reported herein may differ from the information and distributions taxable to the shareholders for the calendar year ended December 31, 2006. Complete information was computed and reported in conjunction with year 2006 Form 1099-DIV.

33

INVESTMENT ADVISORY AGREEMENTS – REVIEW AND RENEWAL

At an in-person meeting of the Board of Directors of the Fund held on November 7, 2006, at which a majority of the Directors were in attendance, including a majority of the Directors who are not interested persons of the Fund ("Independent Directors"), the Board considered and reviewed the Management and Investment Advisory Agreement between TFAI and the Fund, which includes investment sub-advisory arrangements between TFAI and TIM, to determine whether the agreement should be renewed for a one-year period. Following its review and consideration, the Board determined that the Management and Investment Advisory Agreement will enable shareholders of the Fund to obtain high quality services at a cost that is appropriate, reasonable, and in the best interests of shareholders. Accordingly, the Board, including the Independent Directors, unanimously approved the renewal of the Management and Investment Advisory Agreement of the Fund. In reaching t his decision, the Board requested, and TFAI and TIM provided, information that it believed to be reasonably necessary to evaluate the agreement. In addition, the Board carefully considered the information that it received throughout the year from TFAI and TIM (such as in person presentations by TIM) as part of its regular oversight of the Fund, as well as comparative performance, fee and expense information prepared by Lipper, Inc. ("Lipper"), an independent provider of mutual fund performance, fee and expense information, and profitability data prepared by management. In considering the proposed continuation of the Management and Investment Advisory Agreement, the Board evaluated a number of considerations that the Board believed, in light of the legal advice provided by counsel and independent legal counsel and their own business judgment, to be relevant. The Board based its decisions on the following considerations, among others, although it did not identify any consideration or particular information tha t was controlling of its decisions:

The nature, extent and quality of the advisory service to be provided. The Board considered the nature and quality

34

of the services provided by TFAI and TIM to the Fund in the past, as well as the services anticipated to be provided in the future. The Board concluded that TFAI and TIM are capable of providing high quality services to the Fund, as indicated by the nature and quality of services provided in the past, TFAI's and TIM's management capabilities demonstrated with respect to the funds they manage (including the Fund), the experience, capability and integrity of TFAI's and TIM's senior management, the financial resources of TFAI and TIM, TFAI's management oversight process, the professional qualifications and experience of TIM's portfolio management team and investment process, and the Fund's investment performance. The Board also concluded that TFAI and TIM proposed to provide investment and related services that were of the same quality and quantity as services provided to the Fund in the past, and that these services are appropriate in scope an d extent in light of the Fund's operations, the competitive landscape of the investment company industry, and investor needs, and that TFAI's and TIM's obligations will remain substantially the same. The Board also considered the nature and quality of other services provided by TFAI to the Fund, such as compliance and legal services, and determined that such services were necessary for the Fund's operations and performed in a competent, professional manner.

The investment performance of the Fund. The Board examined both the short-term and longer-term performance of the Fund, including relative performance against a group of comparable investment companies as prepared by Lipper, for various trailing periods ended June 30, 2006. The Board considered that, although the Fund had, relative to peer funds, below average performance when measured by market price returns, which are driven by supply and demand in the market for the Fund and largely outside of the control of TFAI or TIM, the Fund had demonstrated strong net asset value-based returns, which are driven by the investment performance of the Fund's underlying securities, and are traditionally a more appropriate benchmark for evaluating the Fund's performance. In that regard, the Board noted that the Fund's net asset value-based returns

35

exceeded the return of the Lehman Government/Credit Bond Index for the one-, three- and five-year trailing periods. On the basis of the Board's assessment of the nature, extent and quality of advisory services to be provided or procured by TFAI and TIM, the Board concluded that TFAI and TIM are capable of generating a level of investment performance that is appropriate in light of the Fund's investment objectives, policies and strategies and competitive with many other investment companies, and also determined that TFAI's and TIM's performance records indicate that their continued management is likely to benefit the Fund and its shareholders.

The cost of advisory services provided and the level of profitability. The Board reviewed the profitability information regarding TFAI's costs of procuring portfolio management services, as well as the costs of its provision of administration, transfer agency, fund accounting and other services to the Fund. The Directors carefully considered revenues earned and expenses incurred by TFAI in managing the Fund. The Board reviewed data from Lipper that compared the Fund's management fees (including management fees at various asset levels), other fees and expenses and portfolio turnover rates against peer groups of comparable investment companies. In particular, on the basis of the Lipper Report, the Board determined that the advisory fees and overall expense ratio of the Fund were somewhat higher than median or average advisory fees and expense ratios of comparable cl osed-end investment companies and considered the reasons for this. The Board noted that the Fund's relative expense ratio and the relatively low profitability of the Fund can be attributed in significant part to the small level of assets in the Fund. On the basis of the Board's review of the fees to be charged by TFAI and TIM for investment advisory and related services, TFAI's profitability information (derived from TFAI's audited financial statements), TFAI's estimated management income resulting from its management of the Fund, TIM's margin, as well as the entirety of TFAI's and its affiliates' service relationships with the Fund, the Board determined that the level of management fees and overall expense

36

ratios of the Fund, as well as TFAI's and TIM's profitability, are appropriate in light of the service provided, the management fees and overall expense ratios of comparable investment companies, the anticipated low level of profitability of the relationship between the Fund, TFAI, TIM, and their affiliates, and the small level of assets in the Fund.

Whether fee levels reflect economies of scale and the extent to which economies of scale would be realized as the Fund grows. While the Fund's investment advisory fees do not reduce should Fund assets grow meaningfully, the Directors concluded that the Fund's investment advisory fees are appropriate in light of the relatively small size of the Fund, and appropriately reflect the current economic environment for TFAI, the current profitability levels of TFAI and TIM, and the competitive nature of the investment company market. The Board determined that the Fund has not achieved meaningful economies of scale, which therefore cannot be reflected in the investment advisory fees. Because the Fund, as a closed-end fund, does not currently contemplate offering new securities, the Board concluded that there is no immediate opportunity for the Fund to realize economies of scale and increase its assets through new issuances, and hence no reason at the present time to reflect advisory fee breakpoints premised on significant asset growth. However, the Board noted that it will have the opportunity to periodically re-examine whether the Fund has achieved economies of scale by virtue of asset growth due to investment performance, as well as the appropriateness of advisory fees payable to TFAI and TIM in the future.

Benefits (such as soft dollars) to TFAI or TIM from their relationship with the Fund. The Board concluded that benefits derived by TFAI and TIM from their relationships with the Fund are reasonable and fair, and are consistent with industry practice and the best interests of the Fund and its shareholders. The Board further noted that neither TFAI nor TIM realize "soft dollar" benefits from their relationships with the Fund.

37

Other considerations: In approving the renewal of the Management and Investment Advisory Agreement, the Board determined that TFAI has made a commitment to the recruitment and retention of high quality personnel, and maintains the financial, compliance and operational resources reasonably necessary to manage the Fund in a professional manner that is consistent with the best interests of the Fund and its shareholders. In this regard, the Board favorably considered the program in place by TFAI to enforce compliance with applicable laws and regulations and oversee the portfolio management activities of TIM. The Board also determined that TFAI has made a significant entrepreneurial commitment to the management and success of the Fund, which entails a substantial financial commitment on its part.

38

AUTOMATIC REINVESTMENT PLAN

Holders of 50 (not in thousands) shares or more of the Fund's common stock are offered the opportunity to reinvest dividends and other distributions in shares of the common stock of the Fund through participation in the Automatic Reinvestment Plan (the "Plan"). Under the Plan, Mellon, as Transfer Agent, automatically invests dividends and other distributions in shares of the Fund's common stock by making purchases in the open market. Plan participants may also deposit cash in amounts (not in thousands) between $25 and $2,500 with Mellon for the purchase of additional shares. Dividends, distributions and cash deposits are invested in, and each participant's account credited with, full and fractional shares.

The price at which Mellon is deemed to have acquired shares for a participant's account is the average price (including brokerage commissions and any other costs of purchase) of all shares purchased by it for all participants in the Plan.

Your dividends and distributions, even though automatically reinvested, continue to be taxable as though received in cash.

Another feature of the Plan is the "Optional Cash Only" feature. You can make additional investments only, without reinvesting your monthly dividend. If you own 50 shares (not in thousands) or more, registered in your name and currently in your Plan account, and desire to periodically send additional contributions (not in thousands) between $25 and $2,500 for investment, you may do so. The shares you own and the new shares acquired through this feature will not participate in automatic reinvestment of dividends and distributions. Rather, the shares you acquire if you participate in the "Optional Cash Only" feature of the Plan will be held for safekeeping in your Plan account. Each investment will be made on or near the next dividend payment date. All other procedures for the purchase and sale of shares described above will apply.

39

Mellon charges a service fee (not in thousands) of $1.75 for each investment, including both dividend reinvestment and optional cash investment.

Shareholders interested in obtaining a copy of the Plan should contact Mellon:

Mellon Investor Services LLC

Shareholder Investment Services

Newport Office Center VII

480 Washington Boulevard

Jersey City, NJ 07310

(800) 454-9575

40

This page has been intentionally left blank.

41

The Directors and Officers of the Fund are listed below together with their respective positions with the Fund and a brief statement of their principal occupations during the past five years:

Name, Address and Date

of Birth ("DOB") | | Position(s)

Held with

Fund | | Term of

Office and

Length of

Time

Served* | | Principal Occupation(s)

During Past 5 Years | | Number of

Funds in

Complex

Overseen | | Other

Directorships | |

Peter R. Brown

8323 40th Place North

St. Petersburg, FL 33709

(DOB: 5/10/28) | | Chairman, Director | | | 2002- | present | | Chairman & Trustee, Transamerica IDEX Mutual Funds (TA IDEX) and AEGON/Transamerica Series Trust (ATST) (1986-present); Director, Transamerica Index Funds, Inc. (TIF) (2002-2004); Chairman of the Board, Peter Brown Construction Company (1963- 2000); Rear Admiral (Ret.) U.S. Navy Reserve, Civil Engineer Corps | | | 91 | | | N/A | |

|

Daniel Calabria

7068 S. Shore Drive S.

South Pasadena, FL 33707

(DOB: 3/5/36) | | Director | | | 2002- | present | | Trustee, TA IDEX (1996-present); ATST (2001-present); Member of Investment Committee, Ronald McDonald House Charities of Tampa Bay, Inc. (1997-present); Trustee, The Hough Group of Funds (1993-2004); prior to 1996, served in senior executive capacities for several mutual fund management companies for more than 30 years | | | 91 | | | N/A | |

|

Janice B. Case

205 Palm Island NW

Clearwater, FL 33767

(DOB: 9/27/52) | | Director | | | 2002- | present | | Trustee, TA IDEX (2002-present); ATST (2001-present); Senior Vice President, Florida Power Corporation (1996-2000); Director, Cadence Network, Inc. (1997-2004); Trustee, Morton Plant Mease Healthcare (1999-2005); Director Arts Center & Theatre (2001-present) | | | 91 | | | Director, Central Vermont Public Service Corp (2001-present); Director, Western Electricity Coordinating Council (2002-present) | |

|

Charles C. Harris

2 Seaside Lane, #304

Belleair, FL 33756

(DOB: 7/15/30) | | Director | | | 2002- | present | | Trustee, TA IDEX (1994-present); ATST (1986-present) | | | 91 | | | N/A | |

|

42

43

Name, Address and Date

of Birth ("DOB") | | Position(s)

Held with

Fund | | Term of

Office and

Length of

Time

Served* | | Principal Occupation(s)

During Past 5 Years | | Number of

Funds in

Complex

Overseen | | Other

Directorships | |

Leo J. Hill

7922 Bayou Club Blvd.

Largo, FL 33777

(DOB: 3/27/56) | | Director | | | 2002- | present | | Trustee, TA IDEX (2002-present); ATST (2001-present); Owner & President, Prestige Automotive Group (2001-2005); President, L. J. Hill & Company (1999-Present); Market President, Nations Bank of Sun Coast Florida (1998-1999); President & CEO, Barnett Banks of Treasure Coast Florida (1994-1998); EVP & Sr. Credit Officer, Barnett Banks of Jacksonville, Florida (1991-1994); Sr. Vice President & Sr. Loan Administration Officer, Wachovia Bank of Georgia (1976-1991) | | | 91 | | | N/A | |

|

Russell A. Kimball, Jr.

1160 Gulf Blvd.

Clearwater Beach, FL 33767

(DOB: 8/17/44) | | Director | | | 2002- | present | | Trustee, TA IDEX (2002-present); ATST (1986-present); General Manager, Sheraton Sand Key Resort (1975-present) | | | 91 | | | N/A | |

|

Norm R. Nielsen

9687 Cypress Hammock, #201

Bonita Springs, FL 34135

(DOB 5/11/39) | | Director | | | 2006- | present | | Trustee, TA IDEX (2006-present); ATST (2006-present); President, Kirkwood Community College (1985-2005); Director, Iowa Health Systems (1994-2003); Director, Iowa City Area Development (1996-2004) | | | 91 | | | Iowa Student Loan Liquidity Corporation (1998-present); Buena Vista University Board of Trustees (2004-present); U.S. Bank (1988-present) | |

|

William W. Short, Jr.

7882 Lantana Creek Road

Largo, FL 33777

(DOB: 2/25/36) | | Director | | | 2002- | present | | Trustee, TA IDEX (1986-present); ATST (2000-present); Retired CEO and Chairman of the Board, Shorts, Inc. | | | 91 | | | N/A | |

|

John W. Waechter

5913 Bayview Circle

Gulfport, FL 33707

(DOB: 2/25/52) | | Director | | | 2004- | present | | Trustee, TA IDEX (2005-present); ATST (2004-present); Executive Vice President, Chief Financial Officer, Chief Compliance Officer, William R. Hough & Co. (1979-2004); Treasurer, The Hough Group of Funds (1993-2004) | | | 91 | | | N/A | |

|

44

45

Name, Address and Date

of Birth ("DOB") | | Position(s)

Held with

Fund | | Term of

Office and

Length of

Time

Served* | | Principal Occupation(s)

During Past 5 Years | | Number of

Funds in

Complex

Overseen | | Other

Directorships | |

John K. Carter **

(DOB: 4/24/61) | | Director, President & Chief Executive Officer | | | 2006- | present | | Trustee (September 2006-present), President & CEO (July 2006-present), Sr. Vice President (1999-June 2006), Chief Compliance Officer, General Counsel & Secretary (1999-August 2006), TA IDEX; Trustee (September 2006-present), President & CEO (July 2006-present), Sr. Vice President (1999-June 2006), Chief Compliance Officer, General Counsel & Secretary (1999-August 2006), ATST; Sr. Vice President (2002-June 2006), General Counsel, Secretary & Chief Compliance Officer (2002-August 2006), TIS; President, CEO (July 2006-present), Sr. Vice President (1999-June 2006), Director (2000-present), General Counsel, & Secretary (2000-August 2006), Chief Compliance Officer, (2004-August 2006), TFAI; President, CEO (July 2006-present), Sr. Vice President (1999-June 2006), Director (2001-present), General Counsel, & Secretary (2001-August 2006), TFS; Vice President, AFSG Securities Corporation (AFSG) (2001-present); CEO (July 2006-pr esent), Vice President, Secretary & Chief Compliance Officer (2003-August 2006), Transamerica Investors, Inc. (TII); Sr. Vice President, General Counsel & Secretary, TIF (2002-2004); Vice President, Transamerica Investment Services, Inc. (TISI) (2003-2005) & Transamerica Investment Management, LLC (TIM) (2001-2005) | | | 91 | | | N/A | |

|

* Each Director shall hold office until 1) his or her successor is elected and qualified or 2) he or she resigns or his or her term as a Director is terminated in accordance with the Fund's bylaws.

** May be deemed an "interested person" of the Fund as defined in the 1940 Act, due to employment with an affiliate of TFAI.

46

47

| Officers: | |

|

Name, Address*

and Age | | Position | | Term of Office

and Length of

Time Served** | | Principal Occupation(s)

During Past 5 Years | |

Dennis P. Gallagher

(DOB: 12/19/70) | | Sr. Vice President, General Counsel & Secretary | | | 2006- | present | | Sr. Vice President, General Counsel & Secretary, TA IDEX & ATST (September 2006-present); Vice President & Secretary, TII (September 2006-present); Director, Sr. Vice President, General Counsel & Secretary, TFAI & TFS (September 2006-present); Director, Deutsche Asset Management (1998-2006) | |

|

Joseph Carusone***

(DOB: 9/8/65) | | Interim Principal Financial Officer | | | 2007- | present | | President, Diversified Investors Securities Corp. (January 2007-present); Vice President, Diversified Investment Advisors (1999-present); Principal Financial Officer & Treasurer, Diversified Investors Funds Group (2001-present); Trustee, Transamerica Financial Life Insurance Company (2004-present) | |

|

48

Name, Address*

and Age | | Position | | Term of Office

and Length of

Time Served** | | Principal Occupation(s)

During Past 5 Years | |

T. Gregory Reymann, II

(DOB:5/13/58) | | Sr. Vice President & Chief Compliance Officer | | | 2006- | present | | Chief Compliance Officer & Sr. Vice President, TA IDEX, TFAI & ATST (September 2006-present); Chief Compliance Officer (September 2006-present) & Vice President (2005-present), TII; Vice President & Senior Counsel, TFS (2005-2006); Vice President & Counsel, ATST, TA IDEX, TFAI, TIS (2004-2006), TFS (2004-2005) & TIF (2004); Attorney, Gould, Cooksey, et. al. (2002-2004) | |

|

* The business address of each officer is 570 Carillon Parkway, St. Petersburg, FL 33716. No officer of the Fund, except the Chief Compliance Officer, receives any compensation from the Fund.

** Elected and serves at the pleasure of the Board of Directors of the Fund.

*** The business address of Mr. Carusone is 4 Manhattanville Road, Purchase, NY 10577.

49

PROXY VOTING POLICIES AND PROCEDURES AND QUARTERLY PORTFOLIO HOLDINGS

A description of the Fund's proxy voting policies and procedures is available upon request by calling 1-888-233-4339 (toll free) or can be located on the Securities and Exchange Commission (SEC) website at (www.sec.gov).

In addition, the Fund is required to file Form N-PX, with the complete proxy voting records for the 12 months ended June 30th, no later than August 31st of each year. Form N-PX is available, without charge, from the Fund by calling 1-888-233-4339, and can also be located on the SEC's website at www.sec.gov.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarter of each fiscal year on Form N-Q, which is available on the SEC website at www.sec.gov. The Fund's Form N-Q may be reviewed and copied at the SEC Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 202-551-8090.

On August 7, 2006, the Fund submitted a CEO annual certification to the NYSE on which the Fund's chief executive officer certified that he was not aware, as of that date, of any violation by the Fund of the NYSE's corporate governance listing standards. In addition, the Fund's report to the SEC on Form N-CSR contains certifications by the Fund's principal executive officer and principal financial officer as required by Rule 30a-2(a) under the 1940 Act, relating to, among other things, the quality of the Fund's disclosure controls and procedures and internal control over financial reporting.

50

Investment Adviser

Transamerica Fund Advisors, Inc.

570 Carillon Parkway

St. Petersburg, FL 33716-1202

Sub-Adviser

Transamerica Investment Management, LLC

11111 Santa Monica Boulevard, Suite 820

Los Angeles, CA 90025

Transfer Agent

Mellon Investor Services LLC

Newport Office Center VII

480 Washington Boulevard

Jersey City, NJ 07310

1-800-454-9575

For hearing and speech impaired (TDD)

1-800-231-5469

www.mellon-investor.com

Custodian

Investors Bank & Trust Company

200 Clarendon Street

Boston, MA 02116

1-617-937-6700

Listed

New York Stock Exchange

Symbol: TAI

NASDAQ Symbol: XTAIX

Transamerica Income Shares, Inc. is a closed-end management investment company which invests primarily in debt securities. Its objective is to provide a high level of current income.

Item 2: Code of Ethics.

(a) Registrant has adopted a code of ethics that applies to its principal executive officer, principal financial officer, and any other officers who serve a similar function.

(b) Registrant’s code of ethics is reasonably designed as described in this Form N-CSR.

(c) During the period covered by the report, no amendments were made to the provisions of this code of ethics.

(d) During the period covered by the report, Registrant did not grant any waivers, including implicit waivers, from the provisions of this code of ethics.

(e) Not Applicable

(f) Registrant has filed this code of ethics as an exhibit pursuant to Item 12(a)(1) of Form N-CSR.

Item 3: Audit Committee Financial Expert.

Registrant’s Board of Directors has determined that John Waechter is an “audit committee financial expert,” as such term is defined in Item 3 of Form N-CSR. Mr. Waechter is “independent” under the standards set forth in Item 3 of Form N-CSR. The designation of Mr. Waechter as an “audit committee financial expert” pursuant to Item 3 of Form N-CSR does not (i) impose upon him any duties, obligations, or liabilities that are greater than the duties, obligations and liabilities imposed upon him as a member of the Registrant’s Audit Committee or Board of Directors in the absence of such designation; or (ii) affect the duties, obligations or liabilities of any other member of the Registrant’s Audit Committee or Board of Directors.

Item 4: Principal Accountant Fees and Services.

| | | | Fiscal Year Ended 3/31 | |

(in thousands) | | 2006 | | 2007 | |

| | | | | | | |

(a) | | Audit Fees | | 34 | | 36 | |

(b) | | Audit-related Fees | | 0 | | 0 | |

(c) | | Tax Fees | | 1 | | 2 | |

(d) | | All Other Fees | | N/A | | N/A | |

(e) (1) | | Pre-approval policy * (see below) | | | | | |

(e) (2) | | % of above that were pre-approved | | 0% | | 0% | |

(f) | | If greater than 50%, disclose hours | | N/A | | N/A | |

(g) | | Non-audit fees rendered to Adviser (or affiliate that provided services to Registrant) | | N/A | | N/A | |

(h) | | Disclose whether the Audit Committee has considered whether the provisions of non-audit services rendered to the Adviser that were NOT pre-approved is compatible with maintaining the auditor’s independence | | Yes | | Yes | |

* (e) (1) The Audit Committee may delegate any portion of its authority, including the authority to grant pre-approvals of audit and permitted non-audit services, to one or more members or a subcommittee. Any decision of the subcommittee to grant pre-approvals shall be presented to the full Audit Committee at its next regularly scheduled meeting.

Item 5: Audit Committee of Listed Registrant.

The following individuals comprise the standing Audit Committee: John W. Waechter, Chairperson; Peter R. Brown; Daniel Calabria; Janice B. Case; and Leo J. Hill.

Item 6: Schedule of Investments.

The Schedules of Investments of the Registrant are included in the annual report to shareholders filed under Item 1 of this Form N-CSR.

Item 7: Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

TRANSAMERICA INCOME SHARES, INC. (THE “FUND”)

PROXY VOTING POLICIES AND PROCEDURES

I. Statement of Principle