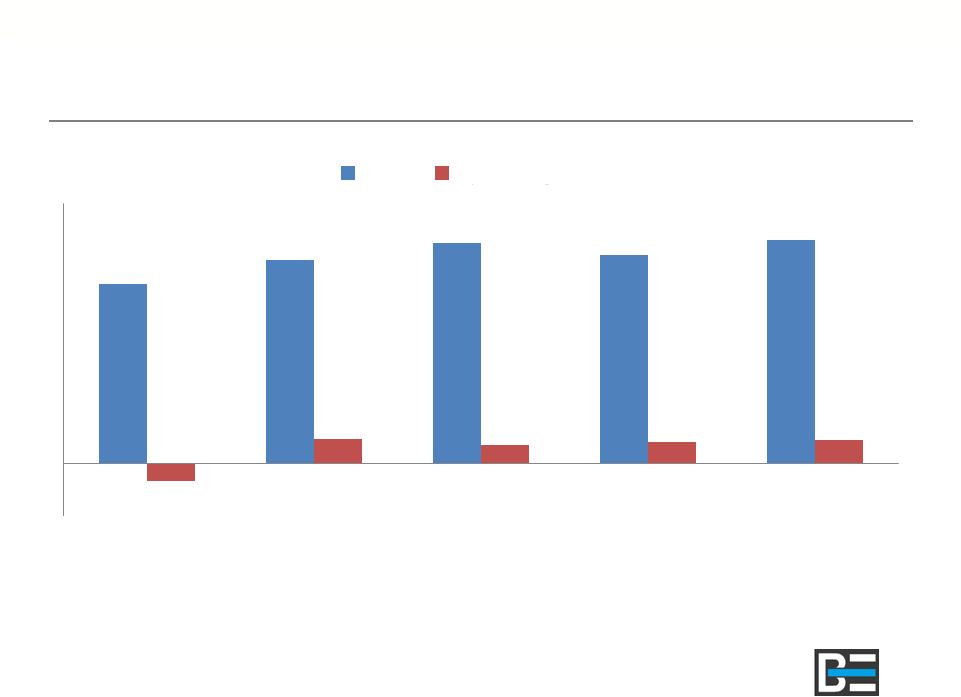

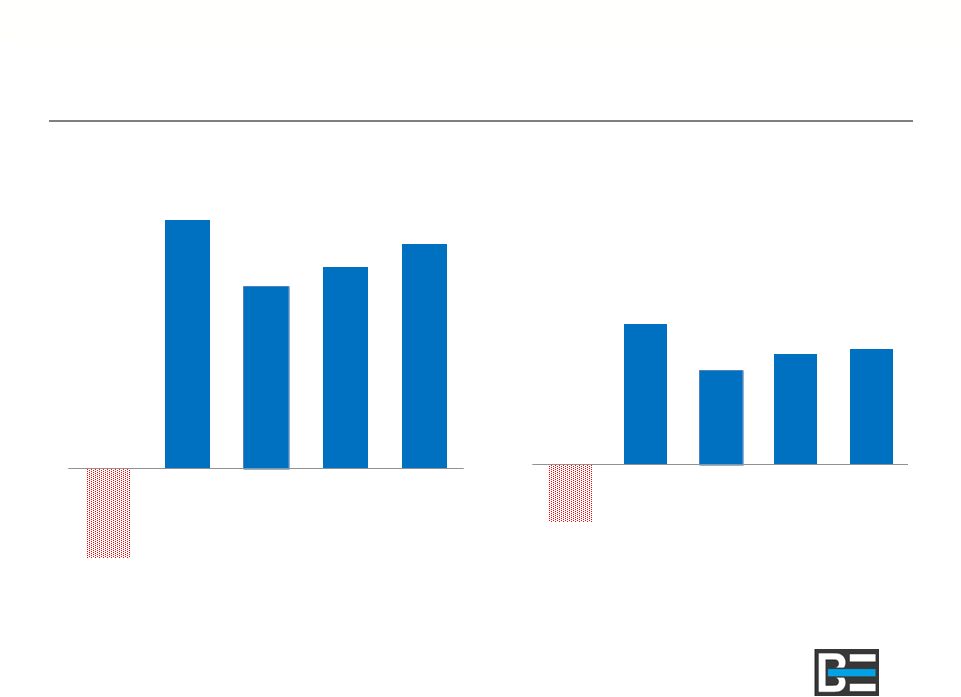

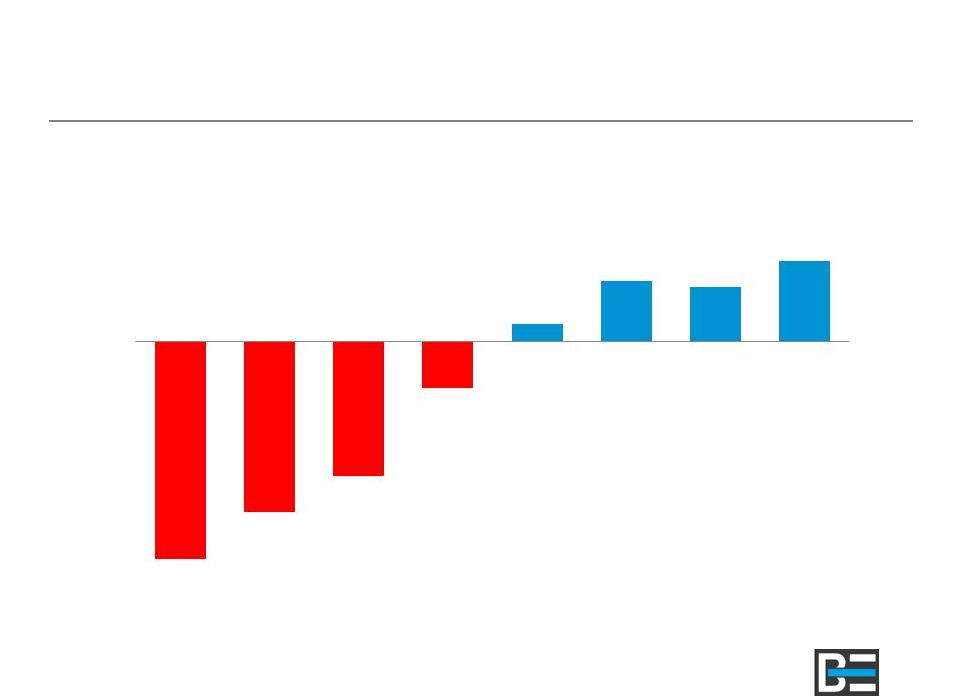

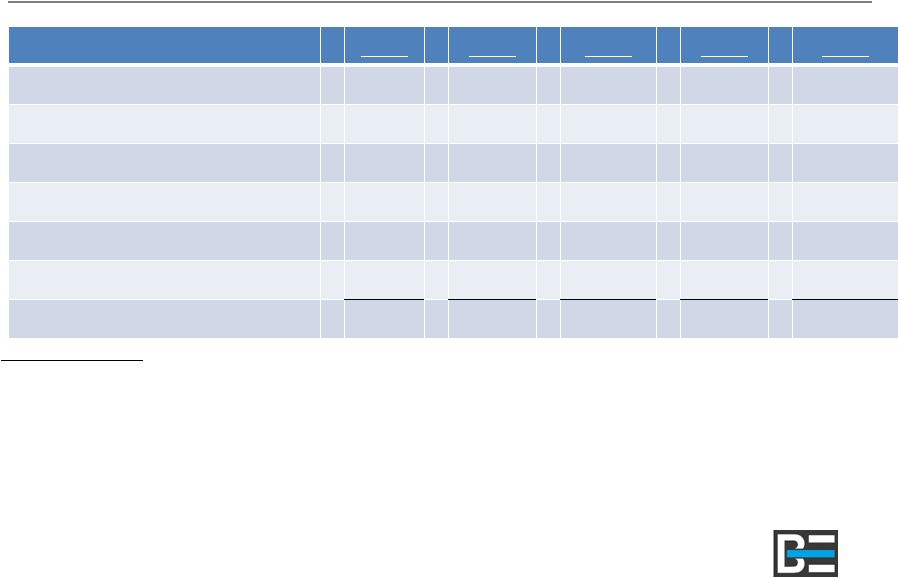

Use or disclosure of data contained on this sheet or subsequent sheets is subject to the restriction on the title page. Appendix: Adjusted EBITDA Reconciliation ($ in Thousands) Adjusted EBITDA* FY10 FY11 FY12 FY13 FY14 Net income (loss) $ (6,043) $ 5,026 $ 3,776 $ 4,076 $ 5,641 Provision (benefit) for income taxes (2,029) 3,524 2,741 3,794 3,310 Depreciation and amortization 1,587 2,271 1,709 1,475 1,699 Relocation expense 817 211 - - - Interest expense 891 694 396 227 49 Other expense-net 458 213 109 93 89 Adjusted EBITDA $ (4,319) $ 11,939 $ 8,731 $ 9,665 $ 10,788 17 Non–GAAP Financial Measures In addition to disclosing financial results that are determined in accordance with Generally Accepted Accounting Principles generally accepted in the United States of America (“GAAP”), the Company also discloses Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, other income/expense, loss on debt extinguishment, and relocation expense). The Company presents Adjusted EBITDA because it considers it an important supplemental measure of performance. Measures similar to Adjusted EBITDA are widely used by the Company and by others in the Company's industry to evaluate performance and valuation. The Company believes Adjusted EBITDA facilitates operating performance comparisons from period to period and company to company by backing out potential differences caused by variations in capital structure (affecting relative interest expense), tax positions (such as the impact on periods or companies of changes in effective tax rates or net operating losses) and the age and book depreciation of facilities and equipment (affecting relative depreciation expense). The Company also presents Adjusted EBITDA because it believes it is frequently used by investors and other interested parties as a basis for evaluating performance. Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation or as a substitute for analysis of the Company's results as reported under GAAP. Some of the limitations of Adjusted EBITDA are that (i) it does not reflect the Company's cash expenditures for capital assets, (ii) it does not reflect the significant interest expense or cash requirements necessary to service interest or principal payments on the Company's debt, and (iii) it does not reflect changes in, or cash requirements for, the Company's working capital. Furthermore, other companies in the aerospace and defense industry may calculate these measures differently than the manner presented above. Accordingly, the Company focuses primarily on its GAAP results and uses Adjusted EBITDA only supplementally. |