SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2014

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-7872

BREEZE-EASTERN CORPORATION

(Exact name of registrant as specified in its charter)

Delaware |

| 95-4062211 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. employer

identification no.) |

| |

35 Melanie Lane Whippany, New Jersey | 07981 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (973) 602-1001

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value $0.01 | | NYSE MKT |

(Title of class) | | (Name of Exchange on Which Registered) |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | | ¨ | | | Accelerated filer | | ¨ |

| | | | |

Non-accelerated filer | | ¨ | | | Smaller reporting company | | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates of the registrant on September 30, 2013 (the last business day of the registrant’s most recently completed second fiscal quarter), based on the closing price of the registrant’s common stock on the NYSE MKT (formerly NYSE Amex) on such date, was $25,802,151. Shares of common stock held by executive officers and directors have been excluded since such persons may be deemed affiliates. This determination of affiliate status is not a determination for any other purpose.

As of May 27, 2014, the registrant had 9,703,877 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant’s Proxy Statement for the 2014 Annual Meeting of Stockholders is incorporated by reference into Part III of this Annual Report on Form 10-K. With the exception of those portions that are specifically incorporated by reference in this Annual Report on Form 10-K, such Proxy Statement shall not be deemed filed as part of this Report or incorporated by reference herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended March 31, 2014.

BREEZE-EASTERN CORPORATION

INDEX TO ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED MARCH 31, 2014

2

($ in Thousands Except Share Amounts)

PART I

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” or “will.” These forward-looking statements are not guarantees and are subject to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements.

For us, particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include: changes in business conditions, changes in applicable laws, rules and regulations affecting us in locations in which we conduct business, interest rate trends, a decline or redirection of the United States (“U.S.”) defense budget, the failure of Congress to approve a budget or continuing resolution, or continuation of the current sequestration, the termination of any contracts with the U.S. Government, changes in our sales strategy and product development plans, changes in the marketplace, developments in environmental proceedings that we are involved in, continued services of our executive management team, competitive pricing pressures, security breaches, market acceptance of our products under development, delays in the development of products, changes in spending allocation or the termination, postponement, or failure to fund one or more significant contracts by the U.S. Government or other customers, determination by us to dispose of or acquire additional assets, events impacting the U.S. and world financial markets and economies; and such other factors that may be identified from time to time in our Securities and Exchange Commission (“SEC”) filings and other public announcements including those set forth under “Item 1A. Risk Factors” beginning on page 6 of this report and “Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations” on page 16 of this report.

All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the foregoing. Readers are cautioned not to place undue reliance on our forward-looking statements, as they speak only as of the date made. Except as required by law, we assume no duty to update or revise our forward-looking statements.

Breeze-Eastern Corporation, a Delaware corporation, designs, develops, manufactures, sells and services sophisticated engineered mission equipment for specialty aerospace and defense applications. We were originally organized in 1962 as a California corporation and reincorporated in Delaware in 1986. Unless the context otherwise requires, references to the “Company,” the “Registrant,” “Breeze-Eastern,” “we” or “us” refer to Breeze-Eastern Corporation and its consolidated subsidiaries. All references to years in this report refer to the fiscal year ended March 31 of the indicated year unless otherwise specified. This report reflects all adjustments of a normal recurring nature, which are, in the opinion of management, necessary for fair presentation of the results of operations for the periods reflected. Certain prior fiscal year amounts may have been reclassified to conform to the current fiscal year presentation.

CORE BUSINESS

Our core business is aerospace and defense products. We have long been recognized as a leading global designer, manufacturer, service provider, and supplier of mission-critical rescue hoists and cargo hook systems. We also manufacture weapons handling systems, cargo winches, and tie-down equipment. These products are sold primarily to military and civilian agencies and aerospace contractors. Our emphasis is on the engineering, assembly, testing, service, and support of our products.

PRODUCTS AND SERVICES

Our products and related services aggregate into one reportable segment. The nature of the production process (assemble, inspect, and test), customers, and product distribution are similar for all products. We sell our products through internal marketing representatives and independent sales representatives and distributors.

PRODUCTS

Products include new equipment and spare parts sales and represented approximately 72%, 75%, and 76% of our total revenues in fiscal 2014, fiscal 2013, and fiscal 2012, respectively.

3

($ in Thousands Except Share Amounts)

As a pioneer of helicopter rescue hoist technology, we continue to develop sophisticated helicopter hoist and winch systems, including systems for the current generation of Sikorsky H-60 Blackhawk and Naval Hawk, CH-53K, King Stallion, Bell-Boeing V-22 Osprey, Boeing CH-47 Chinook, Eurocopter Ecureuil, Dolphin, EH-101 Merlin/Cormorant, Changhe Z-11, Agusta Westland A-W109, AW119 and AW139 helicopters. We also design, market, sell and service a broad line of hydraulic and electric aircraft cargo winch systems with capacities from 900 pounds to over 7,000 pounds. Sales of hoist and winch products accounted for approximately 55%, 54%, and 56% of our total revenues in fiscal 2014, fiscal 2013, and fiscal 2012, respectively.

Our external cargo hook systems are original equipment on leading military medium and heavy lift helicopters. These hook systems range from smaller 1,000-pound capacity models up to the largest 36,000-pound capacity hooks employed on the Sikorsky CH-53 Super Stallion helicopter. Our latest designs incorporate load sensing and display technology and automatic load release features. We also manufacture cargo and aircraft tie-downs which are included in this product line. Sales of cargo hook products accounted for approximately 15%, 16%, and 14% of our total revenues in fiscal 2014, fiscal 2013, and fiscal 2012, respectively.

We make static-line retrieval and cargo winches for military cargo aircraft including the Boeing C-17, Alenia C-27J, CASA CN-235, CASA C-295, and Airbus A400M.

Once our products are qualified and approved for use with a particular aircraft model, sales of products and services generally continue for the life of the aircraft model, which can be for decades. It is expensive and difficult for a second supplier’s product to become qualified and approved on the same aircraft.

Our weapons handling systems include weapons handling equipment for land-based rocket launchers and munitions hoists for loading missiles and other loads using electric power or exchangeable battery packs. We supply this equipment for the United States, Japanese, and European Multiple-Launch Rocket Systems (MLRS) and the United States High Mobility Artillery Rocket System (HIMARS). We also provide actuators and specialty gear boxes for specialty weapons applications. Sales of weapons handling products accounted for approximately 2%, 5%, and 6% of our total revenues in fiscal 2014, fiscal 2013, and fiscal 2012, respectively.

SERVICES

Services include overhaul and repair and engineering sales and represented 28%, 25%, and 24% of our total revenues in fiscal 2014, fiscal 2013, and fiscal 2012, respectively.

We perform overhaul, repair, and maintenance services for all of our products. Most of these services are performed at our Whippany, New Jersey facility. We have also licensed third-party service centers around the world to perform these services. Overhaul and repair represented 25%, 24%, and 23% of our total revenues in fiscal 2014, fiscal 2013, and fiscal 2012, respectively.

In addition to performing research and development to design new products, improve existing products, and add new features to our product line, we also provide engineering services to adapt our products to customer specific needs and aircraft models on a fee-for-service basis.

We discuss segment information in Note 14 of our “Notes to Consolidated Financial Statements” contained elsewhere in this report.

MAJOR CUSTOMERS

We have three major customers: the U.S. Government, United Technologies Corporation, and Finmeccanica SpA, which accounted for 30%, 14%, and 13%, respectively, of the total consolidated net sales for fiscal 2014.

GOVERNMENT SALES

Our direct sales to the U.S. Government and sales for U.S. Government and foreign government end use represented 81%, 66%, and 76% of consolidated revenue during fiscal 2014, fiscal 2013, and fiscal 2012, respectively. U.S. Government sales, both direct and indirect, are generally procured using standard government fixed price or cost reimbursable contracts. As a U.S. Government contractor, we are subject to routine audits by U.S. Government agencies.

In accordance with normal practice, contracts and orders with the U.S. Government are subject to partial or complete termination at any time, at the option of the customer. In the event of a termination for convenience by the government, there generally are provisions for recovery of our allowable incurred costs and a proportionate share of the profit or fee on the work completed, consistent with U.S. Government regulations.

4

($ in Thousands Except Share Amounts)

BACKLOG

We measure backlog by the amount of products or services that customers committed by contract to purchase as of a given date. Backlog at March 31, 2014 was $119,464 as compared with $115,102 at March 31, 2013 as new orders exceeded shipments in fiscal 2014. Approximately $76,454 of our backlog at March 31, 2014 is not scheduled for shipment during the next twelve months. For additional discussion on our backlog, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

COMPONENTS, RAW MATERIALS, AND SEASONALITY

The various component parts and, to some extent, assembly of components and subsystems by subcontractors used by us to produce our products are generally available from more than one source. In those instances where only a single source for any material or part is available, such items can generally be redesigned to accommodate materials or parts made by other suppliers, although this may lead to lengthy delays and higher costs in meeting customer requirements. In some cases, we stock an adequate supply of the single source materials or parts for use until a new supplier can be approved.

In recent years, our revenues in the second half of our fiscal year have generally exceeded revenues in the first half. The timing of U.S. Government awards, availability of U.S. Government funding, and product deliveries are among the factors affecting the periods in which revenues are recorded. Management expects this trend to continue in fiscal 2015.

EMPLOYEES

As of March 31, 2014, we had 181 salaried and hourly employees, and the United Auto Workers (UAW) represented 60 hourly employees at our facility. We reached a three-year collective bargaining agreement with the UAW effective October 1, 2013. We consider our relations, with both our union and non-union employees, to be generally satisfactory.

INTERNATIONAL OPERATIONS AND SALES

We currently have no operations based outside of the United States. We had export sales of $37,101, $28,936, and $31,212 in fiscal 2014, fiscal 2013, and fiscal 2012, respectively, representing 43%, 36%, and 37% of our consolidated net sales in each of those years. The risks and profitability of international sales are generally comparable with similar products sold by us in the United States. Net export sales by geographic area and customer domicile are set forth in Note 14 of our consolidated financial statements contained elsewhere in this report.

COMPETITION

We compete in some markets with the hoist and winch business unit of the Goodrich Corporation, which was acquired by United Technologies in calendar 2012, and is part of a larger corporation that has substantially greater financial and technical resources than us. United Technologies is also our second-largest customer. We also compete in some markets for cargo hooks with Onboard Systems. Generally, competitive factors include design capabilities, product performance, delivery, and price. Our ability to compete successfully in these markets depends on our ability to develop and apply technological innovations and to expand our customer base and product lines. Technological innovation, development, and application requires significant investment and capital expenditures. While we make each investment with the intent of getting a good financial return, in some cases we may not fully recover the full investment through future sales of products or services.

RESEARCH AND DEVELOPMENT

We conduct extensive research and development activities, primarily for developing new or improved products, under customer-sponsored contracts and for our own investment. Research and development costs, which are charged to Engineering expense when incurred, amounted to $6,916, $7,664, and $14,702 for the years ended March 31, 2014, 2013, and 2012, respectively. Customer-sponsored research and development costs are charged to cost of sales when the associated revenue is recognized and were $1,472, $2,119, and $1,744 in fiscal 2014, fiscal 2013, and fiscal 2012, respectively.

INTELLECTUAL PROPERTY

We have been one of the market leaders since the initial development of rescue hoists for use on helicopters and have continually designed and manufactured rescue hoists since the 1940’s. Our intellectual property product knowledge enables us to continually evolve mission-critical products to meet our customers’ evolving needs. We generally retain the intellectual property rights to products we develop which typically lasts for the life of the product.

5

($ in Thousands Except Share Amounts)

REGULATORY MATTERS

Aircraft Regulation

In the United States, our commercial aircraft products are required to comply with Federal Aviation Administration regulations governing production and quality systems, airworthiness and installation approvals, repair procedures and continuing operational safety. Internationally, similar requirements exist for airworthiness, installation and operational approvals. These requirements are generally administered by the national aviation authorities of each country and, in the case of Europe, coordinated by the European Aviation Safety Agency (EASA).

Environmental Matters

We maintain compliance with federal, state, and local laws and regulations relating to materials used in production and to the discharge of wastes, and other laws and regulations relating to the protection of the environment. The costs of such compliance at our Whippany, New Jersey facility are not material to our operations.

We are subject to federal and state requirements for protection of the environment, including those for the remediation of contaminated sites relating to predecessor entities and previously-owned subsidiaries. At various times, we have been identified as a potentially responsible party pursuant to the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (CERCLA), and analogous state environmental laws, for the cleanup of contamination resulting from past disposals of hazardous wastes at certain former facilities and at sites to which we, among others, sent wastes in the past. CERCLA requires potentially responsible persons to pay for the cleanup of sites from which there has been a release or threatened release of hazardous substances. Courts have interpreted CERCLA to impose strict joint and several liability on all persons liable for cleanup costs. As a practical matter, however, at sites where there are multiple potentially responsible persons, the costs of cleanup typically are allocated among the parties according to a volumetric or other standard.

Where appropriate, we have sought contribution to remediation costs from other potentially responsible parties and made claims under available insurance policies. We also periodically assess the amount of reserves held for environmental liabilities for these sites based upon current information. While there is an inherent uncertainty in assessing the potential total cost to investigate and remediate a given site, we make a determination as to the reasonable cost of investigation and remediation of each site based upon the information available to us at that time. Furthermore, the remediation efforts for a particular site may take place over a number of years and therefore a significant portion of the expenses represented by these reserves may not be incurred for some time. Factors that affect the actual liability for these sites include changes in federal and state environmental laws resulting in more stringent remediation requirements and actual operating results from remediation efforts which vary from estimated results.

Information concerning our specific environmental liabilities and reserves is contained in Note 13 of our “Notes to Consolidated Financial Statements” contained elsewhere in this report.

ADDITIONAL INFORMATION

We maintain a website at http://www.breeze-eastern.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, which we file with the Securities and Exchange Commission (SEC) are available on our web site, free of charge, as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. Information that can be accessed through our website is not incorporated by reference in this Report and, accordingly, readers should not consider such information to be part of this Report. The reports noted above may also be obtained at the SEC’s public reference room at 100 F Street, NE, Washington, DC 20549. The SEC also maintains a web site at www.sec.gov that contains reports, proxy statements, and information regarding SEC registrants, including Breeze-Eastern.

An investment in our common stock involves risk. You should carefully consider the following risk factors in addition to other information in this Annual Report on Form 10-K before purchasing our common stock. The risks and uncertainties described below are those that we currently deem to be material and that we believe are specific to our company and our industry. In addition to these risks, our business may be subject to risks currently unknown to us. If any of these or other risks actually occurs, our business may be adversely affected, the trading price of our common stock may decline and you may lose all or part of your investment.

6

($ in Thousands Except Share Amounts)

Risks Associated with our Business and/or Industry

A substantial amount of our revenue is derived from the U.S. Government, United Technologies Corporation, and Finmeccanica SpA. A termination or reduction in the volume of business with any of these customers would have a material adverse effect on our revenue and profits.

Approximately 30%, 14%, and 13% of our consolidated net sales in fiscal 2014 were to the U.S. Government (direct), United Technologies Corporation, and Finmeccanica SpA. Other than sales to Finmeccanica SpA, these sales are made principally for the benefit of the military services of the U.S. Department of Defense and defense organizations of other countries and are affected by, among other things, budget authorization and appropriation processes. In the event that defense expenditures are reduced for products we manufacture or services we provide and are not offset by revenues from additional foreign sales, new programs, or products or services that we currently manufacture or provide, we may experience a reduction in our revenues and earnings and a material adverse effect on our business, financial condition, and results of operations. Further, there can be no assurance that our significant customers will continue to buy our products and services at current or increased levels. Specifically, United Technologies Corporation recently acquired Goodrich Corporation which has a hoist & winch business unit, which might potentially have an impact on our sales to United Technology Corporation.

We depend heavily on government contracts that may not be fully funded or may be terminated, and the failure to receive funding or the termination of one or more of these contracts could reduce our sales and increase our costs.

Sales to the U.S. Government and its prime contractors and subcontractors represent a significant portion of our business. In fiscal 2014, sales under U.S. Government contracts represented approximately 53% of our total sales, while sales to foreign governments represented approximately 28% of our total sales. We expect that the percentage of our revenues from government contracts will continue to be substantial in the future. Government programs can be structured into a series of individual contracts. The funding of these programs is generally subject to annual congressional appropriations, and congressional priorities are subject to change. In addition, Congress may reduce expenditures for defense programs or terminate such programs at any time. A decline in government expenditures or redirection of government funding may result in a reduction in the volume of contracts awarded to us. We have resources applied to specific government contracts and if any of those contracts were terminated, we may incur substantial costs redeploying those resources.

As a U.S. Government contractor, we are subject to a number of procurement rules and regulations and any non-compliance could subject us to fines, penalties or debarment.

We must comply with and are affected by laws and regulations relating to the award, administration, and performance of U.S. Government contracts. Government contract laws and regulations affect how we conduct business with our customers and, in some instances, impose added costs on our business. A violation of specific laws and regulations could result in fines and penalties, contract termination, or debarment from bidding on future contracts. These fines and penalties could be imposed for failing to follow procurement integrity and bidding rules, employing improper billing practices or otherwise failing to follow cost accounting standards, receiving or paying kickbacks, or filing false claims. We have been, and expect to continue to be, subjected to audits by government agencies. The failure to comply with the terms of government contracts could harm our business reputation and could also result in progress payments being withheld.

Our business could be adversely affected by a negative audit by the U.S. Government.

As a U.S. Government contractor, we are subject to routine audits by U.S. Government agencies, such as the Defense Contract Audit Agency (DCAA). These agencies review a contractor’s performance under its contracts, cost structure, and compliance with applicable laws, regulations, and standards. The DCAA also reviews the adequacy of a contractor’s compliance with its internal control systems and policies, including the contractor’s purchasing, property, estimating, compensation, and management information systems. Any costs found to be improperly allocated to a specific contract will not be reimbursed or must be refunded if already reimbursed. If an audit uncovers improper or illegal activities, we may be subject to civil and criminal penalties as well as administrative sanctions, which may include termination of contracts, forfeiture of profits, suspension of payments, fines, and suspension or prohibition from doing business with the U.S. Government. In addition, we could suffer serious reputational harm if allegations of impropriety were made against us.

7

($ in Thousands Except Share Amounts)

The U.S. Government has the right to terminate or not renew any contract with us at any time and without notice. Any such action would have a material adverse effect on our results of operations.

In some instances, laws and regulations impose terms or rights that are more favorable to the government than those typically available to commercial parties in negotiated transactions. For example, the U.S. Government may terminate any government contract and, in general, subcontracts, at its convenience as well as for default based on performance. Upon termination for convenience of a fixed-price type contract, we normally are entitled to receive the purchase price for delivered items, reimbursement for allowable costs for work-in-process, and an allowance for profit on the contract or adjustment for loss if contract completion would have resulted in a loss. Upon termination for convenience of a cost-reimbursement contract, we normally are entitled to reimbursement of allowable costs plus a portion of the fee. Such allowable costs would normally include the cost to terminate agreements with our suppliers and subcontractors. The amount of the fee recovered, if any, is related to the portion of the work accomplished prior to termination and is determined by negotiation.

A termination arising from default could expose us to liability and have a material adverse effect on our ability to compete for future contracts and orders. In addition, on those contracts for which we are teamed with others and are not the prime contractor, the U.S. Government could terminate a prime contract under which we are a subcontractor, irrespective of the quality of our services as a subcontractor.

In addition, our U.S. Government contracts typically span one or more base years and multiple option years. The U.S. Government generally has the right to not exercise option periods and may not exercise an option period if the U.S. Government is not satisfied with our performance on the contract.

The aircraft manufacturing industry is heavily regulated, and if we fail to comply with applicable requirements, our results of operations could suffer.

Governmental agencies throughout the world, including the U.S. Federal Aviation Administration, or the FAA, prescribe standards and qualification requirements for aircraft components, including virtually all aviation products. Specific regulations vary from country to country, although compliance with FAA requirements generally satisfies regulatory requirements in other countries. We include, with some of the products we sell to our aircraft manufacturing customers, documentation certifying that each part complies with applicable regulatory requirements and meets applicable standards of airworthiness established by the FAA or the equivalent regulatory agencies in other countries. In order to sell our products, we and the products we manufacture must also be certified by our individual OEM customers. If any of the material authorizations or approvals qualifying us to supply our products is revoked or suspended, then the sale of the subject product would be prohibited by law, which would have an adverse effect on our business, financial condition, and results of operations.

From time to time, the FAA or equivalent regulatory agencies in other countries propose new regulations or changes to existing regulations, which are usually more stringent than existing regulations. If these proposed regulations are adopted and enacted, we may incur significant additional costs to achieve compliance, which could have a material adverse effect on our business, financial condition, and results of operations.

Cancellations, reductions, or delays in customer orders, contracts and anticipated contracts may adversely affect our results of operations.

Our overall operating results are affected by many factors, including the timing of orders from large customers and the timing of expenditures to manufacture parts and purchase inventory in anticipation of future sales of products and services. A large portion of our operating expenses are relatively fixed. Cancellations, reductions, or delays in customer orders, contracts and anticipated contracts could have a material adverse effect on our business, financial condition, and results of operations.

We may be required to recognize a loss contract at a future date if certain events that we currently estimate are likely to occur do not, in fact, occur.

As more fully discussed under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Critical Accounting Policies” and in the notes to our consolidated financial statements, the earnings or losses recognized on individual contracts and the timing thereof are based on multiple estimates, including the probability of negotiating future contracts, revenues from existing contracts, costs and profitability. Although we update these estimates regularly, estimates are inherently uncertain, and our ultimate profitability on a contract may not be fully known until completion. We recognize estimated contract losses when determined, regardless of where we are in the contract cycle, and adjust contract profit estimates based on ongoing contract profitability reviews. If the estimates noted above were to change significantly, requiring us to recognize unforeseen losses, our financial condition and results of operations could be materially adversely affected.

8

($ in Thousands Except Share Amounts)

During a period in which a contract loss is first recognized, or in a period when estimated contract profits become lower than previous estimates, income recorded on that contract in prior periods would be reversed. This could cause the profit or loss contribution from any given contract to fluctuate significantly from quarter to quarter.

Engineering product development delays or customer engineering product development contract cancellations may adversely affect our results of operations.

Our new product development requires up-front engineering research & development expenditures that impact current income and qualification units that are capitalized as intangible assets on the consolidated balance sheets if there is an existing contract or anticipated contract under a program. These engineering research & development expenditures may not result in future revenue-generating products or may not become technically viable as a result of pre-production qualification testing. These research & development expenditures are generally incurred as a part of awarded new product development for customers’ aerospace platforms. If the product being designed does not meet customer technical specifications or timely delivery needs, we may need to write-off capitalized qualification units and reimburse customers for their costs that result from our product delivery delay.

Our backlog is subject to reduction and cancellation at any time without notice, which could negatively impact our future revenues and results of operations.

Backlog represents products or services that our customers have committed by contract to purchase from us. Backlog as of March 31, 2014 was $119,464. Backlog is subject to fluctuations and is not necessarily indicative of future sales. The U.S. Government may unilaterally modify or cancel its contracts with us. In addition, under certain of our commercial contracts, our customers may unilaterally modify or terminate their orders at any time for their convenience. Accordingly, certain portions of our backlog can be cancelled or reduced at the option of the U.S. Government and commercial customers. Our failure to replace cancelled or reduced backlog could negatively impact our revenues and results of operations.

We are subject to competition from entities which could have a substantial impact on our business.

We compete in some markets with entities that are larger and have substantially greater financial and technical resources than us. Generally, competitive factors include design capabilities, product performance, delivery, and price. Our ability to compete successfully in such markets will depend on our ability to develop and apply technological innovations and to expand our customer base and product lines. In addition, the development and application of technological innovations may mandate an expenditure of significant capital which may not be recovered through future sales of products or services. There can be no assurance that we will continue to successfully compete in any or all of the businesses discussed above. Our failure to compete successfully or to invest in technology where there is no recovery through product sales could have a materially adverse effect on our profitability.

We are subject to liability under environmental laws.

Our business and facilities are subject to numerous federal, state, and local laws and regulations relating to the use, manufacture, storage, handling, and disposal of hazardous materials and other waste products. Environmental laws generally impose liability for investigation, remediation, and removal of hazardous materials and other waste products on property owners and those who dispose of materials at waste sites whether or not the waste was disposed of legally at the time in question. We are currently addressing environmental remediation at certain former facilities, and we have been named as a potentially responsible party along with other organizations in a number of environmental clean-up sites and may be named in connection with future sites. We are required to contribute to the costs of the investigation and remediation and have taken reserves in our financial statements for future costs deemed probable and estimable for these costs. Although we have estimated and reserved for future environmental investigation and remediation costs, the final resolution of these liabilities may significantly vary from our estimates and could potentially have an adverse effect on our results of operations and financial position. Our contingencies associated with environmental matters are described in Note 13 of “Notes to Consolidated Financial Statements” which is included elsewhere in this report.

Our sales to foreign countries expose us to risks and adverse changes in local legal, tax, and regulatory schemes.

In fiscal 2014, 43% of our consolidated sales were to customers outside the United States. We expect international export sales to continue to contribute to our earnings for the foreseeable future. The export sales are subject in varying degrees to risks inherent in doing business outside the United States. Such risks include, without limitation:

· | The possibility of unfavorable circumstances arising from host country laws or regulations; |

· | Potential negative consequences from changes to significant taxation policies, laws, or regulations; |

· | Changes in tariff and trade barriers and import or export licensing requirements; and |

9

($ in Thousands Except Share Amounts)

· | Political or economic instability, insurrection, civil disturbance, or war. |

Government regulations could limit our ability to sell our products outside the United States and otherwise adversely affect our business.

In fiscal 2014, approximately 35% of our sales were subject to compliance with the United States Export Administration regulations. Our failure to obtain the requisite licenses, meet registration standards or comply with other government export regulations would hinder our ability to generate revenues from the sale of our products outside the United States. Compliance with these government regulations may also subject us to additional fees and operating costs. The absence of comparable restrictions on competitors in other countries may adversely affect our competitive position. In order to sell our products in European Union countries, we must satisfy certain technical requirements. If we are unable to comply with those requirements with respect to a significant quantity of our products, our sales in Europe would be restricted. Doing business internationally also subjects us to numerous U.S. and foreign laws and regulations, including, without limitation, regulations relating to import-export control, technology transfer restrictions, foreign corrupt practices and anti-boycott provisions. Failure by us or our sales representatives or consultants to comply with these laws and regulations could result in administrative, civil or criminal liabilities and could, in the extreme case, result in suspension or debarment from government contracts or suspension of our export privileges, which would have a material adverse effect on us.

While we believe our control systems are effective, there are inherent limitations in all control systems, and misstatements due to error or fraud may occur and not be detected.

We continue to take action to assure compliance with the internal controls, disclosure controls, and other requirements of the Sarbanes-Oxley Act of 2002. Our management, including our Chief Executive Officer and Chief Financial Officer, cannot guarantee that our internal controls and disclosure controls will prevent all possible errors or all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. In addition, the design of a control system must reflect the fact that there are resource constraints, and the benefit of controls must be relative to their costs. Because of the inherent limitations in all control systems, no system of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple error or mistake. Further, controls can be circumvented by individual acts of some persons, by collusion of two or more persons, or by management override of the controls. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, a control may become inadequate because of changes in conditions or the degree of compliance with policies or procedures may deteriorate. Because of inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and may not be detected.

The terms of our credit agreement may restrict our current and future operating and financial flexibility.

The credit agreement that is in effect with respect to our debt includes covenants that, among other things, restrict our ability to:

· | not to spend or incur obligations to acquire fixed assets for more than $2,000 in any single fiscal year; |

· | create, incur, assume or guarantee additional indebtedness; |

· | create, incur, assume or permit any liens on any asset; |

· | enter into sale and leaseback transactions; |

· | change our organizational documents; and |

· | change the nature of our business. |

Our credit agreement also contains covenants that require us to:

· | maintain a tangible net worth equal to at least $22,500; |

· | maintain a ratio of funded debt to EBITDA (a) at all times while EBITDA in said ratio exceeds $25,000, not exceeding 3.0:1.0, and (b) at all other times, not exceeding 2.5:1.0; and |

· | maintain an interest coverage ratio of at least 3.0:1.0. |

We may be unable to comply with the covenants under our credit agreement in the future. A failure to comply with the covenants under our credit agreement could result in an event of default. In the event of a default our lender could elect to declare all borrowings,

10

($ in Thousands Except Share Amounts)

accrued and unpaid interest and other fees outstanding, due and payable, and require us to apply all of our available cash to repay these borrowings.

We conduct operations at a single location.

All of our operations are conducted at our Whippany, New Jersey facility. Substantial impairment of this facility as a consequence of a natural disaster, work stoppage, or other event could have a material adverse effect on our operations.

We depend on component availability, subcontractor performance, and key suppliers to manufacture and deliver our products and services.

We depend upon suppliers to deliver component parts and, to some extent, to assemble components and subsystems to manufacture our products in a timely and satisfactory manner and to remain in full compliance with applicable customer terms and conditions. We are generally subject to specific procurement requirements, which may limit the suppliers and subcontractors we may utilize. In some instances, we are dependent on sole-source suppliers. If any of these suppliers or subcontractors fails to meet our needs, developing alternatives could cause delays and increase costs in meeting customer requirements. While we may enter into long-term or volume purchase agreements with certain suppliers and take other actions to ensure the availability of needed materials, components, and subsystems, we cannot be sure that such items will be available in the quantities we require, if at all. If we experience a material supplier or subcontractor problem, the ability to satisfactorily and timely meet customer obligations could be negatively impacted, which could result in reduced sales, termination of contracts, and damage to our reputation and customer relationships. We could also incur additional costs in addressing such a problem. Any of these events could have a negative impact on our results of operations and financial condition.

Our operating results and financial condition may be adversely impacted by the current worldwide economic conditions.

We currently generate operating cash flows, which combined with access to the credit markets, provides discretionary funding capacity. However, current uncertainty in the global economic conditions could impact customer demand for our products, as well as our ability to manage normal commercial relationships with our customers, suppliers, and creditors. If economic conditions deteriorate significantly, our business could be negatively impacted from reduced demand for our products or supplier or customer disruptions.

Our future growth and continued success depends upon retaining key employees.

Our success depends on our senior management personnel and our ability to attract and retain other highly qualified management personnel. We face competition for management from other companies and organizations, and therefore may not be able to retain our existing management personnel or fill new management positions or vacancies created by expansion or turnover at existing compensation levels. We have entered into employment agreements with some members of senior management and have made efforts to reduce the effect of the loss of senior management personnel through management succession planning. The loss of senior managers could have a material and adverse effect on our business. In addition, competition for qualified technical personnel in our industry is intense, and management believes that our future growth and success will depend upon the ability to attract, train, and retain such personnel.

Our profitability could be negatively affected if we fail to maintain satisfactory labor relations.

Approximately 33% of our workforce is employed under a collective bargaining agreement with the United Auto Workers (UAW), which from time to time is subject to renewal and negotiation. Although we have historically enjoyed satisfactory relations with both our unionized and non-unionized employees, if we are subject to labor actions, including work stoppages or slowdowns, we may experience an adverse impact on our operating results.

Our failure to adequately protect our intellectual property could have an adverse effect on our business.

Intellectual property is important to our success. We rely upon confidentiality procedures and contractual provisions to protect our business and proprietary technology. Our general policy is to enter into confidentiality agreements with our employees and consultants, and nondisclosure agreements with all other parties to whom we disclose confidential information. We may apply for legal protection for certain of our other intellectual property in the future. These patents, trademarks and any additional legal protection we may obtain in the future may be challenged by others or invalidated through administrative process or litigation. As a result, our means of protecting our proprietary technology and brands may be inadequate. Furthermore, despite our efforts, we may be unable to prevent third parties from infringing upon or misappropriating our intellectual property. Any such infringement or misappropriation could have a material adverse effect on our business, financial condition and results of operations.

11

($ in Thousands Except Share Amounts)

Our business could be negatively impacted by security threats, including cyber security threats, and other disruptions.

As a defense contractor, we face various security threats, including cyber security threats to gain unauthorized access to sensitive information; threats to the security of our facility and infrastructure; and threats from terrorist acts. Although we utilize various procedures and controls to monitor these threats and mitigate our exposure to such threats, there can be no assurance that these procedures and controls will be sufficient in preventing security threats from materializing. If any of these events were to materialize, they could lead to losses of sensitive information, critical infrastructure, personnel or capabilities, essential to our operations and could have a material adverse effect on our reputation, financial position, results of operations, or cash flows.

Cyber security attacks in particular are evolving and include, but are not limited to, malicious software, attempts to gain unauthorized access to data, and other electronic security breaches that could lead to disruptions in mission critical systems, unauthorized release of confidential or otherwise protected information and corruption of data. These events could damage our reputation and lead to financial losses from remedial actions, loss of business or potential liability.

We use estimates when competing for contracts. Variances between actual and estimates could affect our profitability and overall financial position.

The competitive bidding process requires judgment relative to assessing risks, estimating contract revenues and costs, and making assumptions for schedule and technical risks. Due to the size and nature of many of our contracts, the estimation of total revenues and costs at completion is complicated and subject to many variables. For example, assumptions have to be made regarding the length of time to complete the contract because costs also include expected increases in wages and prices for materials. Similarly, assumptions have to be made regarding the future impact of efficiency initiatives and cost reduction efforts. Incentives, awards, price escalations, or penalties related to performance on contracts are considered in estimating revenue and profit rates and are recorded when there is sufficient information to assess anticipated performance. Because of the significance of the judgments and estimation processes described above, it is possible that materially different amounts could be obtained if different assumptions were used or if the underlying circumstances were to change. Changes in underlying assumptions, circumstances, or estimates may have a material adverse effect upon future period financial reporting and performance.

Risks Related to our Common Stock

Our common stock is thinly traded and subject to volatility.

Although our common stock is traded on the NYSE MKT, it may remain relatively illiquid, or “thinly traded,” which can increase share price volatility and make it difficult for investors to buy or sell shares in the public market without materially affecting the quoted share price. Investors may be unable to buy or sell a certain quantity of our shares in the public market within one or more trading days. If limited trading in our stock continues, it may be difficult for holders to sell their shares in the public market at any given time at prevailing prices.

The prevailing market price of our common stock may fluctuate significantly in response to a number of factors, some of which are beyond our control, including the following:

· | Actual or anticipated fluctuations in operating results; |

· | Changes in market valuations of other similarly situated companies; |

· | Announcements by us or our competitors of significant technical innovations, contracts, acquisitions, strategic partnerships, joint ventures, or capital commitments; |

· | Additions or departures of key personnel; |

· | Future sales of common stock; |

· | Any deviations in net revenues or in losses from levels expected by the investment community; |

· | Trading volume fluctuations; and |

· | Business pressures on any of our large shareholders resulting from their holdings in other unrelated businesses. |

Our share ownership is highly concentrated.

Our directors, officers, and principal stockholders, and certain of their affiliates, beneficially own approximately 80% of our common stock and will continue to have significant influence over the outcome of all matters submitted to the stockholders for approval, including the election of our directors.

12

($ in Thousands Except Share Amounts)

We have adopted a shareholder rights plan which could make it more difficult for a third-party to acquire the Company.

We adopted a shareholders rights plan intended to protect us from efforts to obtain control of the Company that are inconsistent with the best interests of the Company and its stockholders. The rights will be exercisable ten days following the earlier of the public announcement that a stockholder has acquired 15% or more of our common stock without Board approval or the announcement of a tender offer which results in the ownership of 15% or more of our common stock. The rights also become exercisable if a person or group that already owns 15% or more of the Company’s common stock acquires any additional shares (other than pursuant to the Company’s employee benefit plans) without Board of Directors approval. If the rights become exercisable, all rights holders (other than the person/entity triggering the rights) will be entitled to acquire Company securities at a substantial discount. The rights may substantially dilute the stock ownership of a person or group attempting to take over the Company without the approval of the Board of Directors, the rights plan could make it more difficult for a third-party to acquire the Company or a significant percentage of the outstanding capital stock, without first negotiating with the Board of Directors. The shareholder rights plan expires July 18, 2014.

We do not pay a dividend.

Cash dividend payments in the future may depend upon our earnings (if any), financial condition, and capital requirements. We do not have plans at this time to pay dividends.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

The following table sets forth certain information concerning our sole operating facility as of March 31, 2014:

Location | | Use of Premises | | Owned or

Leased | | Sq. Ft | |

Whippany, New Jersey | | Executive offices and manufacturing plant | | Leased | | 115,335 | |

In May, 2009, we executed a 10-year lease, at market terms, for our facility in Whippany, New Jersey.

Our current business is only conducted at our Whippany, New Jersey facility. Properties owned in Saltzburg, Pennsylvania; Glen Head, New York; and Irvington, New Jersey were operated by one or more of our predecessor affiliates or parent company, TransTechnology Corporation, and are not used in our operations. The Saltzburg and Irvington properties have a zero book value. Our contingencies associated with environmental liabilities are discussed in Note 13 of the “Notes to Consolidated Financial Statements” contained elsewhere in this report.

The Glen Head, New York property is subject to a sale agreement at a price of $4,000. This property is carried on our books as an asset held for sale for $3,800, which includes estimated disposal costs. Closing on the property is subject to the buyer receiving development approvals and us completing environmental obligations and reviews. The buyer has indicated to us its intent to build residential housing on the property and has been engaged in the lengthy process of securing the municipal approvals necessary to redevelop this industrial site for residential use.

We are engaged in various legal proceedings incidental to our business. Our management, after taking into consideration information provided by our legal counsel, believes that these matters will have no material effect on our consolidated financial position or the results of operations or cash flows in future periods.

We are subject to federal and state requirements for protection of the environment, including those for discharge of hazardous materials and remediation of contaminated sites. As a result, we are a party to or have our former property subject to various lawsuits or proceedings involving environmental protection matters. Due in part to their complexity and pervasiveness, such requirements have resulted in us being involved with related legal proceedings, claims, and remediation obligations. The extent of our financial exposure cannot in all cases be reasonably estimated at this time. For information regarding these matters, including current estimates of the amounts that we believe are required for remediation or clean-up to the extent estimable, see Note 13 in the “Notes to Consolidated Financial Statements” contained elsewhere in this report.

13

($ in Thousands Except Share Amounts)

ITEM 4. | MINE SAFETY DISCLOSURES |

None.

14

($ in Thousands Except Share Amounts)

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock, par value $0.01, is listed for trading on the NYSE MKT under the trading symbol BZC. The following table sets forth the range of high and low sale prices of our common stock as reported on the NYSE MKT for the periods indicated.

| | High | | | Low | |

Fiscal 2013 | | | | | | | | |

First Quarter | | $ | 8.55 | | | $ | 6.03 | |

Second Quarter | | | 7.90 | | | | 6.41 | |

Third Quarter | | | 8.35 | | | | 7.50 | |

Fourth Quarter | | | 8.26 | | | | 7.90 | |

Fiscal 2014 | | | | | | | | |

First Quarter | | $ | 9.30 | | | $ | 8.13 | |

Second Quarter | | | 9.92 | | | | 8.65 | |

Third Quarter | | | 9.88 | | | | 9.00 | |

Fourth Quarter | | | 9.90 | | | | 9.16 | |

Holders

As of May 27, 2014, the number of stockholders of record of the Company’s common stock was 1,258. On May 27, 2014, the closing sales price of a share of common stock was $9.58 per share.

Dividends

We have not paid any cash dividends on our common stock since fiscal 2001. We currently intend to retain earnings, if any, to fund our operations. The payment of future cash dividends, if any, will be reviewed periodically by our Board of Directors and will depend upon the results of operations, financial condition, contractual and legal restrictions and other factors the Board of Directors deem relevant.

15

($ in Thousands Except Share Amounts)

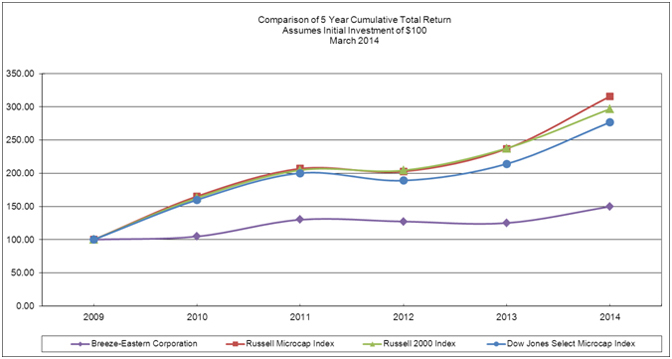

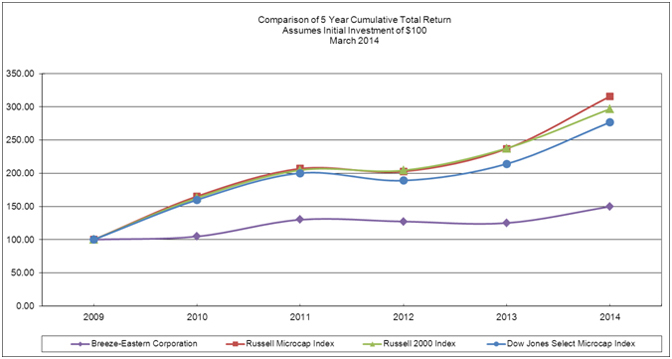

Stock Performance Graph

The following Performance Graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that the Company specifically incorporates such information by reference into such filing.

This stock performance graph compares the Company’s total cumulative stockholder return on its common stock during the period from April 1, 2009 through March 31, 2014, with the cumulative return on a Peer Issuer Group Index. The graph assumes a $100 investment on March 31, 2009.

| | Years Ended March 31, | |

| | 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

Breeze-Eastern Corporation | | $ | 100.00 | | | $ | 104.70 | | | $ | 129.99 | | | $ | 127.27 | | | $ | 124.99 | | | $ | 149.68 | |

Russell Microcap Index | | | 100.00 | | | | 165.14 | | | | 206.95 | | | | 202.68 | | | | 237.00 | | | | 315.77 | |

Russell 2000 Index | | | 100.00 | | | | 162.76 | | | | 204.75 | | | | 204.37 | | | | 237.69 | | | | 296.87 | |

Dow Jones Select Microcap Index | | | 100.00 | | | | 159.80 | | | | 200.18 | | | | 188.98 | | | | 214.20 | | | | 276.79 | |

16

($ in Thousands Except Share Amounts)

ITEM 6. | SELECTED FINANCIAL DATA |

The following table sets forth selected financial data for the most recent five year period ended March 31, 2014. This financial data should be read together with our consolidated financial statements and related notes, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and other financial data appearing elsewhere in this report.

| | Years ended March 31, | |

| | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

Results from Operations | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 85,933 | | | $ | 79,956 | | | $ | 84,942 | | | $ | 78,200 | | | $ | 69,027 | |

Gross profit | | | 31,131 | | | | 32,813 | | | | 35,214 | | | | 30,952 | | | | 20,651 | |

Operating income (loss) | | | 9,089 | | | | 8,190 | | | | 7,022 | | | | 9,457 | | | | (6,723 | ) |

Interest expense | | | 49 | | | | 227 | | | | 396 | | | | 694 | | | | 891 | |

Net income (loss) | | | 5,641 | | | | 4,076 | | | | 3,776 | | | | 5,026 | | | | (6,043 | ) |

Net income (loss) per share: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.58 | | | $ | 0.43 | | | $ | 0.40 | | | $ | 0.53 | | | $ | (0.64 | ) |

Diluted | | | 0.58 | | | | 0.43 | | | | 0.39 | | | | 0.53 | | | | (0.64 | ) |

Approximate Shares outstanding at year-end | | | 9,704,000 | | | | 9,544,000 | | | | 9,490,000 | | | | 9,429,000 | | | | 9,397,000 | |

Financial Position | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 79,793 | | | $ | 73,413 | | | $ | 79,851 | | | $ | 78,148 | | | $ | 76,108 | |

Working capital | | | 39,708 | | | | 34,034 | | | | 39,148 | | | | 32,376 | | | | 25,188 | |

Long-term debt | | | — | | | | — | | | | 8,215 | | | | 11,500 | | | | 14,786 | |

Stockholders’ equity | | | 50,484 | | | | 43,072 | | | | 38,152 | | | | 33,433 | | | | 27,820 | |

Book value per share at year end | | | 5.20 | | | | 4.51 | | | | 4.02 | | | | 3.55 | | | | 2.96 | |

Ratios | | | | | | | | | | | | | | | | | | | | |

Current ratio | | | 3.50 | | | | 3.32 | | | | 3.37 | | | | 3.11 | | | | 2.72 | |

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This Management’s Discussion and Analysis of Financial Condition and Results of Operation and other parts of this Annual Report on Form 10-K contain forward-looking statements that involve risks and uncertainties. All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof, and except as required by law, we assume no obligation to update any such forward-looking statements. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the caption “Risk Factors” beginning on page 6 of this report and elsewhere herein. The following should be read in conjunction with our annual consolidated financial statements, including the notes thereto, contained elsewhere in this report. All references to years in this Management’s Discussion and Analysis of Financial Condition and Results of Operations refer to the fiscal year ended March 31 of the indicated year unless otherwise specified.

OVERVIEW

We design, develop, manufacture, sell, and service sophisticated engineered mission equipment for specialty aerospace and defense applications. We have long been recognized as a leading global designer, manufacturer, service provider, and supplier of mission-critical rescue hoists. We also manufacture weapons-handling systems, cargo winches, cargo hook systems and tie-down equipment. Our products are designed to be efficient and reliable in extreme operating conditions and are used to complete rescue operations and military insertion/extraction operations, move and transport cargo, and load weapons onto aircraft and ground-based launching systems.

Our primary strategy is to continue to expand our position as a market leader in the design, development, and service of sophisticated mission equipment for specialty aerospace and defense applications. We intend to maintain our position by continuing to focus on our principal customers and on geographic areas where we have developed our reputation as a premier provider of aircraft hoist and lift equipment, and by expanding both our customer base and product lines. We believe that continued spending on research and development to improve the quality of our product offerings and remaining on the leading edge of technological advances in our chosen markets is also crucial to our business. In this regard, we will continue to commit resources to product research and development.

17

($ in Thousands Except Share Amounts)

Our business is affected by global economic and geo-political conditions. As U.S. military activity in Iraq and Afghanistan declines, United States defense spending reductions and redirections could have a material impact on our revenues and earnings in future periods. Similarly, European government military and spending reductions could have a material impact on revenues and earnings in future periods. However, we believe that the primary military missions that drive procurement and the use of our equipment (search and rescue, special operations, and cargo delivery) will continue to get a relatively high funding priority.

We have experienced product development schedule delays and increased investment due to OEM customer extended development timetables and due to our own product development progress. The Airbus A400M military transport aircraft development has taken longer than originally anticipated, but we commenced shipping in the third quarter of fiscal 2014 and we expect to complete engineering qualification in the next several months. Our engineering expense in fiscal 2012 was reported net of reimbursements from Airbus, and we received no reimbursements in fiscal 2013 and fiscal 2014.

CRITICAL ACCOUNTING POLICIES

Our consolidated financial statement preparation conforms to accounting principles generally accepted in the United States of America and requires us to make estimates, judgments, and assumptions. We believe that the estimates, judgments, and assumptions upon which we rely are reasonable based upon information available at the time that they are made. These estimates, judgments, and assumptions can affect the reported amounts of assets and liabilities as of the date of the financial statements, as well as the reported amounts of revenues and expenses during the periods presented. To the extent that there are material differences between these estimates, judgments, or assumptions and actual results, our financial statements will be affected. We believe the following critical accounting policies are affected by significant estimates, assumptions, and judgments used in preparing our consolidated financial statements.

Inventory. We purchase parts and materials to assemble and manufacture components for use in our products and for use by our engineering and repair and overhaul departments. The decision to purchase a set quantity of a particular material is influenced by several factors including current and projected cost, future estimated availability, production lead time, existing and projected contracts to produce certain items, and the estimated needs for our overhaul and repair business.

We value inventories using the lower of cost or market on a first-in, first-out (FIFO) basis. We reduce the carrying amount of these inventories to net realizable value based on our assessment of inventory that is considered excess or obsolete based on the historical usage. Since all of our products are produced to meet specific customer requirements, the reserve focus is on purchased and manufactured parts.

Inventory obsolescence is determined by identifying specific items based on the age of inventory and by establishing a general reserve based on annual purchases. Analyzing inventory by age showed little movement once items have aged five years, and historical trends showed that 1.1% of purchases would eventually be scrapped. Therefore, each $1,000 of inventory purchased will result in an increase of $11 in inventory reserves. Management periodically reviews this methodology to ensure it is reasonably accurate and will make future adjustments as necessary through current earnings. In fiscal 2014, 2013, and 2012, we increased the inventory obsolescence reserve by $291, $540, and $496, respectively.

Inventories are discussed further in Notes 1 and 2 of the “Notes to Consolidated Financial Statements” contained elsewhere in this report.

Qualification Units and Analysis of Contract Profitability. We capitalize as intangible assets engineering qualification units, which are pre-production product assets that are tested as part of qualifying production units for use on an aircraft. Prior to qualification testing, the pre-qualification units (materials and external testing costs) are also classified with qualification units. Engineering qualification units are ultimately expensed, as the Company amortizes qualification unit costs to expense over future equipment unit shipments.

We review qualification units and pre-qualification assets for impairment annually or whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. We test qualification units and pre-qualification assets for impairment two ways. The first test is for technical obsolescence. If product development or product testing results in a design or technical change, qualification units and pre-qualification assets that become obsolete are expensed in the current period.

Secondly, we analyze contracts to ensure their profitability, comparing undiscounted future cash flows of existing and anticipated production contracts to the ultimate cost of production and development, including qualification units and pre-qualification assets. If the test indicates a contract was not going to produce sufficient profits to cover the cost of qualification units and pre-qualification assets, these assets would become impaired. This impairment loss would reduce the carrying amount of the related assets and we would accrue any additional losses on the contract.

18

($ in Thousands Except Share Amounts)

In assessing anticipated production contracts, we evaluate undiscounted future cash flows that may include revenue from anticipated price increases of un-priced change orders. These revenues are included when price recovery is probable, which is based on the likelihood that the customer will qualify the unit for production, and the related production costs are identifiable and reasonable. We may also estimate the number of production units in continuing long-term production for delivery under existing or anticipated contracts.

As indicated above, the process of analyzing contracts may involve an assessment of the likelihood of our negotiating either future production contracts or future sales price increases. If we determine that it is probable such events will occur, the related production volume or increased pricing is included in the contract analysis. If the probable event were ultimately not to occur, a loss would be recognized at the time such determination is made which could significantly affect our results from operations.

Revenue Recognition. Revenue related to equipment sales is recognized when title and risk of loss have been transferred, collectability is reasonably assured, and pricing is fixed or determinable. Revenue related to repair and overhaul sales is recognized when the related repairs or overhaul are complete and the unit is shipped to the customer. Revenue related to contracts in which we are reimbursed for costs incurred plus an agreed upon profit are recorded as costs are invoiced.

Environmental Reserves. We provide for a best estimate of environmental liability reserves when, after consultation with internal and external counsel and other environmental consultants, we determine that a liability is both probable and estimable. In many cases, we do not fix or cap the liability for a particular site when first recorded. Factors that affect the recorded amount of the liability in future years include our participation percentage due to a settlement by, or bankruptcy of, other potentially responsible parties, a change in the environmental laws resulting in more stringent requirements, a change in the estimate of future costs that will be incurred to remediate the site, and changes in technology related to environmental remediation. Current estimated exposures related to environmental claims are discussed further in Note 13 of our “Notes to Consolidated Financial Statements” contained elsewhere in this report.

Deferred Tax Asset. See Note 5 of the “Notes to Consolidated Financial Statements” contained elsewhere in this report.

Stock-Based Compensation. See Note 9 of the “Notes to Consolidated Financial Statements” contained elsewhere in this report.

RESULTS OF OPERATIONS

Fiscal 2014 Compared with Fiscal 2013

| | Fiscal Year Ended | | | Increase/

(Decrease) | |

| | March 31,

2014 | | | March 31,

2013 | | | $ | | | % | |

Products | | $ | 62,234 | | | $ | 59,765 | | | $ | 2,469 | | | | 4.1 | % |

Services | | | 23,699 | | | | 20,191 | | | | 3,508 | | | | 17.4 | |

Net sales | | | 85,933 | | | | 79,956 | | | | 5,977 | | | | 7.5 | |

Products | | | 39,585 | | | | 34,255 | | | | 5,330 | | | | 15.6 | |

Services | | | 15,217 | | | | 12,888 | | | | 2,329 | | | | 18.1 | |

Cost of sales | | | 54,802 | | | | 47,143 | | | | 7,659 | | | | 16.2 | |

Gross profit | | | 31,131 | | | | 32,813 | | | | (1,682 | ) | | | (5.1 | ) |

As a % of net sales | | | 36.2 | % | | | 41.0 | % | | | N/A | | | | (4.8 | )%Pt. |

Selling, general, and administrative expenses | | | 13,880 | | | | 15,246 | | | | (1,366 | ) | | | (9.0 | ) |

Engineering expense | | | 8,162 | | | | 9,377 | | | | (1,215 | ) | | | (13.0 | ) |

Operating income | | | 9,089 | | | | 8,190 | | | | 899 | | | | 11.0 | |

Interest expense | | | 49 | | | | 227 | | | | (178 | ) | | | (78.4 | ) |

Income tax provision | | | 3,310 | | | | 3,794 | | | | (484) | | | | (12.8) | |

Effective tax rate | | | 37.0 | % | | | 48.2 | % | | | N/A | | | | (11.2) | %Pt. |

Net income | | $ | 5,641 | | | $ | 4,076 | | | $ | 1,565 | | | | 38.4 | % |

Net Sales. Fiscal 2014 net sales of $85,933 increased by $5,977, or 7.5%, from net sales of $79,956 in fiscal 2013.

Product sales in fiscal 2014 were $62,234, an increase of $2,469, or 4.1%, from $59,765 in fiscal 2013. The increase was primarily due to higher new equipment volume for hoists & winches to international OEMs, as we began shipping product for the Airbus

19

($ in Thousands Except Share Amounts)

A400M in the third quarter of the 2014 fiscal year. This was partly offset by lower spare parts revenue due to terminating the services of a distributor which resulted in sales returns totaling $1,538 of spare parts. Excluding this sales return, spare parts volume increased.

Service sales in fiscal 2014 were $23,699, an increase of $3,508, or 17.4%, from $20,191 in fiscal 2013. The increase was due to higher overhaul & repair volume of hoists & winches for the U.S. Military and higher billable engineering services.

The timing of U.S. Government awards, availability of U.S. Government funding, and product delivery schedules are among the factors that affect the period of recording revenues. Recent years reported revenues in the second half of the fiscal year exceeding revenues in the first half of the fiscal year. Fiscal 2014 continued that pattern.

Cost of Sales. Products cost of sales of $39,585 in fiscal 2014 increased 15.6% from $34,255 in the prior fiscal year primarily due to greater new equipment sales. Services costs of sales of $15,217 in fiscal 2014 were $2,329 above the prior fiscal year due to greater billable engineering services costs and to higher O&R volume.

Gross profit. Gross profit of $31,131 in fiscal 2014 was $1,682, or 5.1%, lower than $32,813 in the prior fiscal year. The reduced gross profit was due to losses on billable engineering; terminating services of a distributor, as noted above, which resulted in sales returns and related reduction in gross profit of $1,033; and a greater proportion of sales of new equipment sold to large domestic and international OEMs.