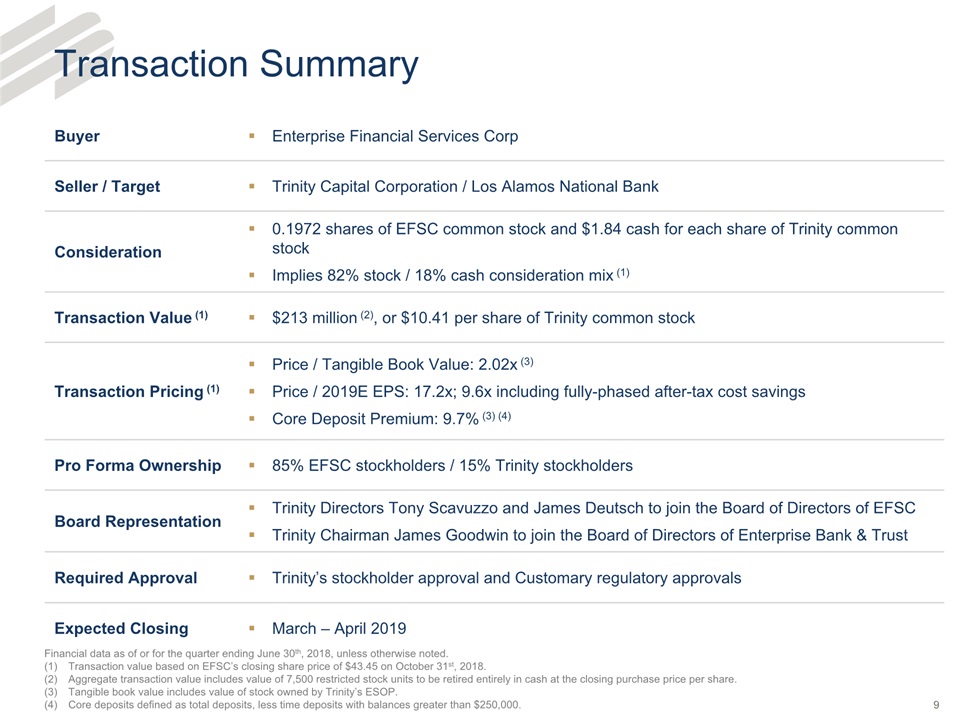

Forward-Looking Statements 2 Some of the information in this presentation contains certain “forward-looking statements” within the meaning of and intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 regarding Enterprise Financial Services Corp ("EFSC“ or the “Company”), including its wholly owned subsidiary Enterprise Bank & Trust, Trinity Capital Corporation (“Trinity"), including its wholly owned subsidiary Los Alamos National Bank and the proposed merger. Forward-looking statements typically are identified with use of terms such as “may,” “might,” “will, “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “could,” “continue” and the negative of these terms and similar words, although some forward-looking statements may be expressed differently. Forward-looking statements also include, but are not limited to, statements regarding plans, objectives, expectations or consequences of announced transactions and statements about the future performance, operations, products and services of the Company and its subsidiaries. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. You should be aware that our actual results could differ materially from those anticipated by the forward-looking statements or historical performance due to a number of factors, including, but not limited to: the expected cost savings, synergies and other financial benefit from the merger might not be realized within the expected time frames or at all; governmental approval of the merger may not be obtained or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; conditions to the closing of the merger may not be satisfied; the shareholders of Trinity may fail to approve the merger. Annualized pro forma, projected and estimated numbers in this investor presentation are used for illustrative purposes only, and not forecasts and may not reflect actual results.Readers are cautioned not to place undue reliance on our forward-looking statements, which reflect management’s analysis and expectations only as of the date of such statements. Forward-looking statements speak only as of the date they are made, and the Company does not intend, and undertakes no obligation, to publicly revise or update forward-looking statements after the date of this report, whether as a result of new information, future events or otherwise, except as required by federal securities law. You should understand that it is not possible to predict or identify all risk factors. Readers should carefully review all disclosures we file from time to time with the Securities and Exchange Commission (the “SEC”) which are available on our website at www.enterprisebank.com under "Investor Relations."Additional Information About the Merger and Where to Find ItIn connection with the proposed merger transaction, EFSC will file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 that will include a Proxy Statement of Trinity, and a Prospectus of EFSC, as well as other relevant documents concerning the proposed transaction. Shareholders are urged to read the Registration Statement and any other relevant documents filed with the SEC, including the Proxy Statement/Prospectus that will be part of the Registration Statement, as well as any amendments or supplements to those documents, when it becomes available, because they will contain important information about the proposed merger. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about EFSC and Trinity, may be obtained at the SEC’s Internet site (www.sec.gov). EFSC and Trinity and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Trinity in connection with the proposed merger. Information about the directors and executive officers of EFSC is set forth in the proxy statement for EFSC’s 2018 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 14, 2018 and as amended by supplements to the proxy statement filed with the SEC on March 14, 2018, March 30, 2018, and April 19, 2018. Information concerning Trinity’s participants is set forth in the definitive proxy statement, dated April 20, 2018, for Trinity’s 2018 annual meeting of shareholders as filed with the SEC on Schedule 14A. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.