Investor Contact: TrinityInvestorRelations@trin.net Website: www.trin.net

Investor Presentation – March 2019 I. Trinity Industries Overview and Key Investment Considerations 4 II. Overview of Railcar Market Fundamentals 9 III. Commercial Introduction of Trinity’s Integrated Rail Platform 13 – Railcar Leasing and Management Services Group 18 – Rail Products Group 24 IV. Financial Discussion and Strategic Objectives 30 V. Appendix 38 2

Forward Looking Statements Some statements in this presentation, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Trinity's estimates, expectations, beliefs, intentions or strategies for the future, and the assumptions underlying these forward-looking statements, including, but not limited to, future financial and operating performance, future opportunities and any other statements regarding events or developments that Trinity believes or anticipates will or may occur in the future. Trinity uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “projected,” “outlook,” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this presentation, and Trinity expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Trinity’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based, except as required by federal securities laws. Forward- looking statements involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to risks and uncertainties regarding economic, competitive, governmental, and technological factors affecting Trinity’s operations, markets, products, services and prices, and such forward-looking statements are not guarantees of future performance. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward- looking statements, see “Risk Factors” and “Forward-Looking Statements” in Trinity’s Annual Report on Form 10-K for the most recent fiscal year, as may be revised and updated by Trinity’s Quarterly Reports on Form 10-Q, and Trinity’s Current Reports on Form 8-K. 3

Trinity Industries, Inc. Overview • Trinity Industries, Inc. owns market-leading businesses that provide railcar products and services in North America marketed under the trade name TrinityRail® • The Company services its customers through a unique integrated rail platform that combines premier railcar leasing and management services and a flexible rail manufacturing footprint to provide a single source for comprehensive rail transportation solutions • Trinity reports its financial operations through three business segments: – Railcar Leasing and Management Services Group – Rail Products Group External Revenue by Business Group(2) – and All Other Group • In November 2018, the Company completed a spin-off of its infrastructure-related businesses effected through a tax-free dividend to Trinity shareholders • Total Revenue and EBITDA for 2018 was approximately $2.5 billion and $583 million respectively – Market Cap as of 12/31/18: $3.0 Billion – Enterprise Value as of 12/31/18: $6.9 Billion (in $mms) (4) – Est. Shares Outstanding at 3/31/19: ~ 131 million(1) (3) See appendix for footnotes and reconciliation of non-GAAP measures 4

Trinity’s Business Segments Trinity Industries, Inc. (FY 2018 Financials) Total Revenues: $2.5B Operating Profit: $315M Income from Continuing Operations: $109M EBITDA*: $583M Railcar Leasing and Intersegment Management Services Rail Products Group All Other Group Eliminations Revenue: $843M $2,347M $361M ($1,042)M Operating Profit: $351M $172M $36M ($95)M Adjusted OP*: $548M $202M $51M ($95)M ▪ Railcar leasing services ▪ Tank and freight railcars ▪ Highway Products ▪ Intersegment Eliminations, primarily from the sale of ▪ Trinity Logistics Group ▪ Asset management ▪ Maintenance services railcars from the Rail ▪ Railcar investment vehicle ▪ Railcar parts and heads Products Group to the (RIV) sales Railcar Leasing and Management Services Group for new railcar equipment supported by a firm customer contract for the lease *See appendix for reconciliation of non-GAAP measures 5

A Rich History of Evolutionary and Transformative Growth The recently completed spin-off of the infrastructure-related businesses enables Trinity to concentrate its focus on the rail transportation industry, where Trinity has established market leading positions over the past 60 years, and align resources around the integrated rail platform • After supplying components to the rail industry for many years, Trinity produces its first finished tank car. See appendix for footnotes 6

Strategic Objectives and Key Priorities for the Future Financial Levers to Operational Levers to Generate Improvement in Drive Greater Returns and Returns in the Near Term Growth over the Longer Term • Reduce Trinity’s cost of capital through a more • Scale the lease fleet for transformative growth optimized balance sheet utilizing a prudent investment approach and innovative technology solutions • Opportunistically deploy capital on accretive business investments to improve return on • Invest in the Maintenance Services business to equity reduce lease fleet maintenance and compliance expenses and capture third-party profit • Return additional capital to shareholders through dividends and share repurchases • Align corporate overhead to go-forward Trinity business needs • Leverage the integrated rail platform to deepen customer relationships and generate additional recurring sources of revenue 7

Key Investment Considerations Railcars are an attractive long-term investment in an undervalued asset class with positive fundamental demand drivers Highly compelling integrated rail platform unique to Trinity with leading market positions and distinct opportunities for transformative growth Heightened focus on driving improvement in returns through the use of operational and financial levers Disciplined capital allocation approach for deploying a strong balance sheet with financial flexibility to drive value creation Experienced management team and strong corporate culture built on the expectation of premier performance 8

Railcar Market Overview 9

Railcars are an Attractive Long-term Investment in an Undervalued Asset Class Tax-advantaged Direct correlation to 50 year hard asset with 50 year hard asset asset class GDP fundamentals inflation protection with inflation protection • Rail transportation and its • Railcars have economic useful lives of • Superior risk-adjusted returns; tax- infrastructure are critical components 35-50 years advantaged return of capital of the supply chain that is core to U.S. • Long-lived, essential-use, servicing- • Traditional 7 year MACRS industrial production intensive equipment, with positive depreciation schedule compared to • Railcar loading volumes directly yield relationship to inflation 35 year straight-line book correlate to overall GDP • Low risk of technological depreciation to a 10% residual value fundamentals and encapsulate the obsolescence • Low volatility for residuals dynamics of specific railcar • Active secondary market provides • Under the 2017 Tax Act, 100% write- submarkets, each with different support for strong asset valuations off year one for capital equipment, demand drivers including railcars A green way to fuel the Serves as a natural Stable and predictable North American interest rate hedge cash flows supply chain • Rising interest rate environments • Stable, predictable cash flows through • Railroads produce 75% less greenhouse have historically led to higher lease long-term leases with historically high gas emissions than trucking. rates utilization throughout rail cycles • Railroads move 1/3 of all U.S. exports • Rent yields have historically shown • Essential-use assets that are vital to and domestic intercity freight volume, correlation with interest rates, lessee’s operations and revenue but only account for 0.6% of total Producer Price Index (PPI) and generation greenhouse emissions. industrial production • Low credit defaults and prioritized • At the end of their useful lives, railcars asset class in event of bankruptcy are generally sold for scrap • Strong incentives for incumbent • A railcar can be fully recycled through lessee renewal scrap and salvage See appendix for source info 10

Rail Transportation is an Integral Component of the North American Industrial Supply Chain U.S. Freight Ton Miles Connecting the Consumer by Mode(1) to the Global Market Pipeline 19% 1.7 mm 3,500 Air Railcars in North commodities3 America2 < 1% Truck 47% Water 35% 6.2 trillion 80% 8% of railroad revenue is of U.S. grain total ton miles driven by exported to Mexico international trade4 moves by rail5 85% 84% of auto assembly in of Canadian propane 6 7 Rail Mexico moves by rail exports move by rail 25% See appendix for footnotes 11

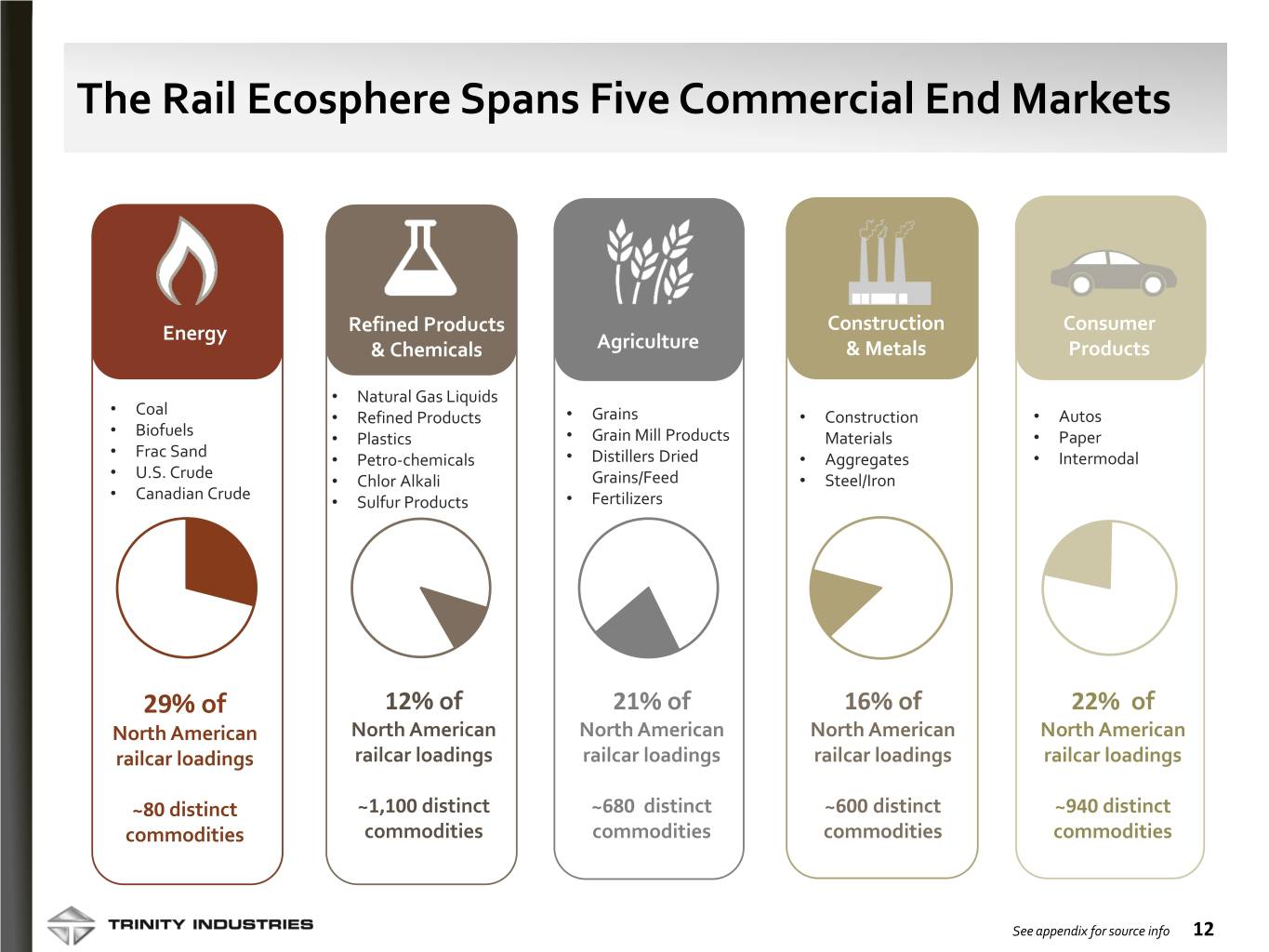

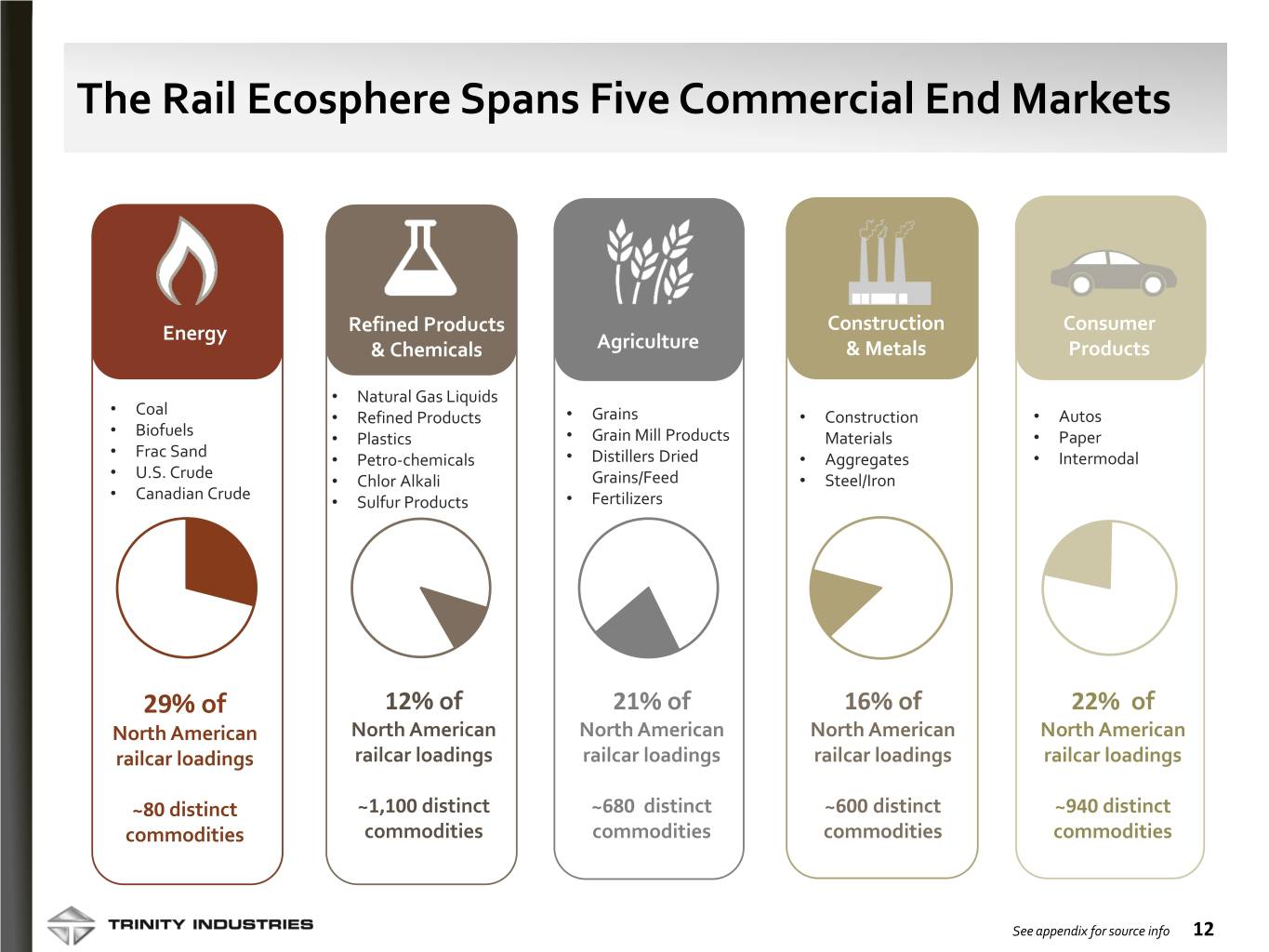

The Rail Ecosphere Spans Five Commercial End Markets Energy Refined Products Construction Consumer & Chemicals Agriculture & Metals Products • Natural Gas Liquids • Coal • Refined Products • Grains • Construction • Autos • Biofuels • Plastics • Grain Mill Products Materials • Paper • Frac Sand • Petro-chemicals • Distillers Dried • Aggregates • Intermodal • U.S. Crude • Chlor Alkali Grains/Feed • Steel/Iron • Canadian Crude • Sulfur Products • Fertilizers 29% of 12% of 21% of 16% of 22% of North American North American North American North American North American railcar loadings railcar loadings railcar loadings railcar loadings railcar loadings ~80 distinct ~1,100 distinct ~680 distinct ~600 distinct ~940 distinct commodities commodities commodities commodities commodities See appendix for source info 12

Trinity’s Integrated Rail Platform 13

Trinity’s Integrated Rail Platform Delivers Value to Stakeholders The TrinityRail® integrated platform is strategically “Built to Deliver,” leveraging our deep rail industry knowledge from our broad market view point to differentiate the value proposition to all of our stakeholders 14

Trinity’s Integrated Rail Platform – a Collaboration of Businesses .TrinityRail’s integrated platform of businesses collaborates to create customer-centric solutions designed to optimize the ownership and usage of railcar equipment throughout the railcar’s life cycle . The platform includes a broad portfolio of railcar products and services that range from railcar leasing and management services and railcar maintenance and modifications to railcar manufacturing and aftermarket parts across a wide landscape of end markets . TrinityRail’s commercial services team customizes packages of products and services to fulfill each customer’s unique needs, including customers with sizable railcar fleet requirements and those that use specialized railcar equipment for niche markets 15

Trinity’s Integrated Rail Platform Reaches the Entire Rail Market and Delivers to the Needs of Each Customer Channel Shippers Railroads Leasing Rail Investors (RIVs) % 1 1 Bringing investment 17% 31% 52% scale to our market approach N.A. Fleet Fleet N.A. Ownership Products Products Products Used Used Products Leasing Leasing Leasing Leasing Channels Services Services Services by Customer Customer by Services Services Pension funds Insurance companies KeyCustomers See appendix for source info 16

Trinity’s Integrated Rail Platform Meets Customer Demand with a Broad Product Portfolio TrinityRail offers: • The broadest array of railcar types for every commodity • Custom design configurations covering all potential end market opportunities • Requested specifications by our customers Covered Tank Cars Auto Racks Hoppers Coal Mill Box Cars Railcars Gondolas Intermodal Railcars 17

Trinity’s Integrated Rail Platform: Railcar Leasing and Management Services Group 18

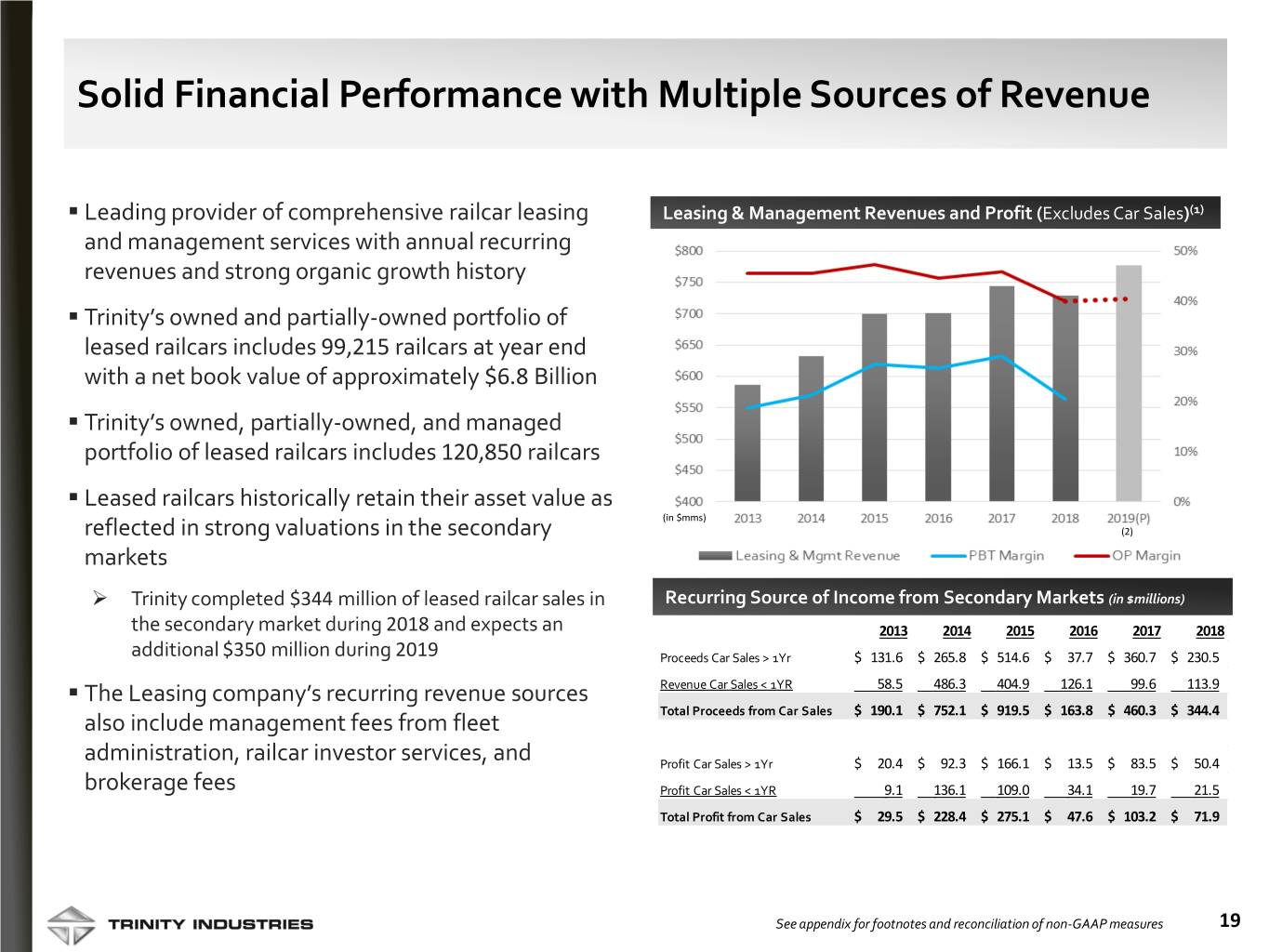

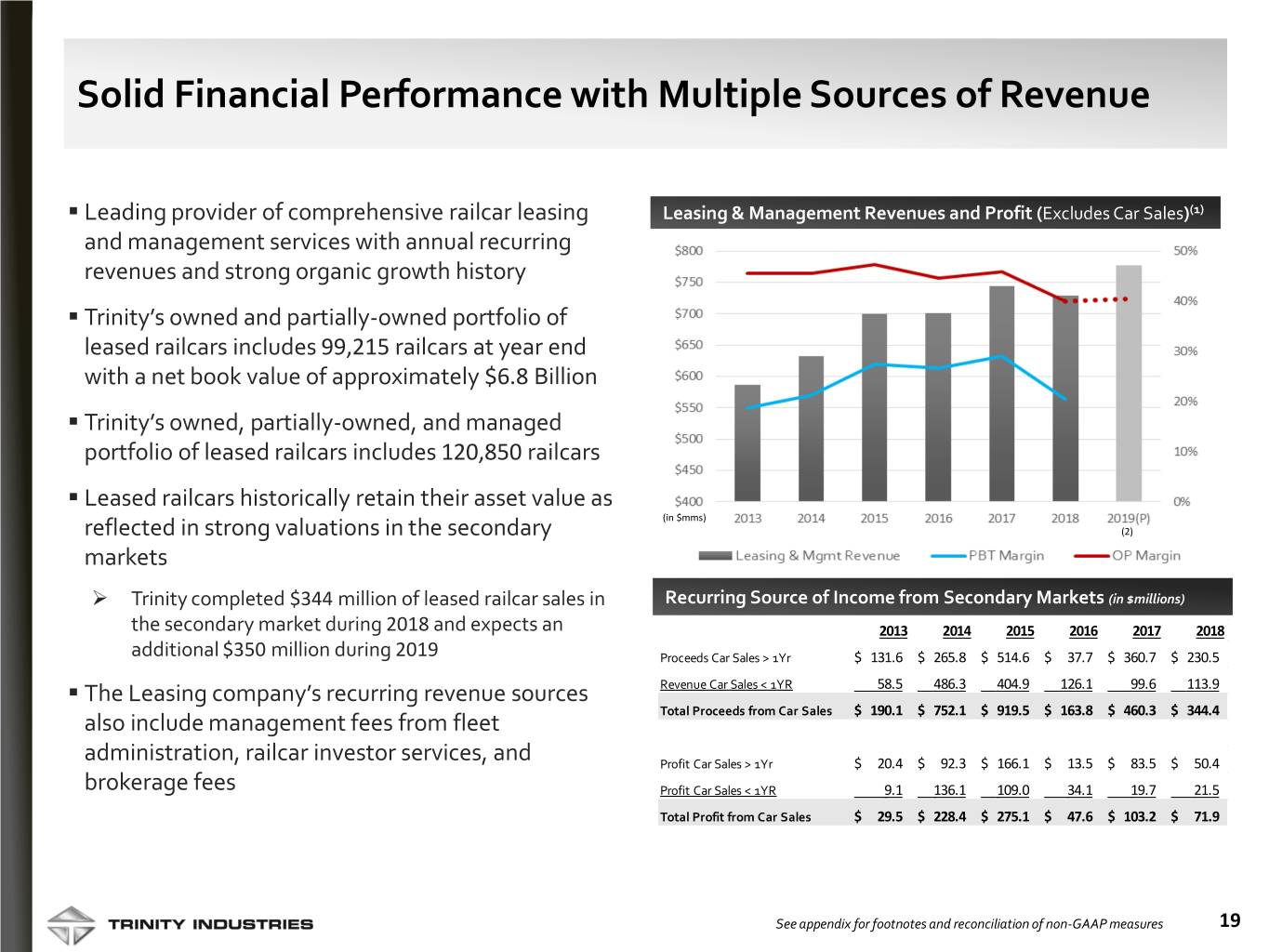

Solid Financial Performance with Multiple Sources of Revenue . Leading provider of comprehensive railcar leasing Leasing & Management Revenues and Profit (Excludes Car Sales)(1) and management services with annual recurring revenues and strong organic growth history . Trinity’s owned and partially-owned portfolio of leased railcars includes 99,215 railcars at year end with a net book value of approximately $6.8 Billion . Trinity’s owned, partially-owned, and managed portfolio of leased railcars includes 120,850 railcars . Leased railcars historically retain their asset value as (in $mms) reflected in strong valuations in the secondary (2) markets Trinity completed $344 million of leased railcar sales in Recurring Source of Income from Secondary Markets (in $millions) the secondary market during 2018 and expects an 2013 2014 2015 2016 2017 2018 additional $350 million during 2019 Proceeds Car Sales > 1Yr $ 131.6 $ 265.8 $ 514.6 $ 37.7 $ 360.7 $ 230.5 . The Leasing company’s recurring revenue sources Revenue Car Sales < 1YR 58.5 486.3 404.9 126.1 99.6 113.9 Total Proceeds from Car Sales $ 190.1 $ 752.1 $ 919.5 $ 163.8 $ 460.3 $ 344.4 also include management fees from fleet administration, railcar investor services, and Profit Car Sales > 1Yr $ 20.4 $ 92.3 $ 166.1 $ 13.5 $ 83.5 $ 50.4 brokerage fees Profit Car Sales < 1YR 9.1 136.1 109.0 34.1 19.7 21.5 Total Profit from Car Sales $ 29.5 $ 228.4 $ 275.1 $ 47.6 $ 103.2 $ 71.9 Margin on Railcar Sales 15.5% 30.4% 29.9% 29.1% 22.4% 20.9% See appendix for footnotes and reconciliation of non-GAAP measures 19

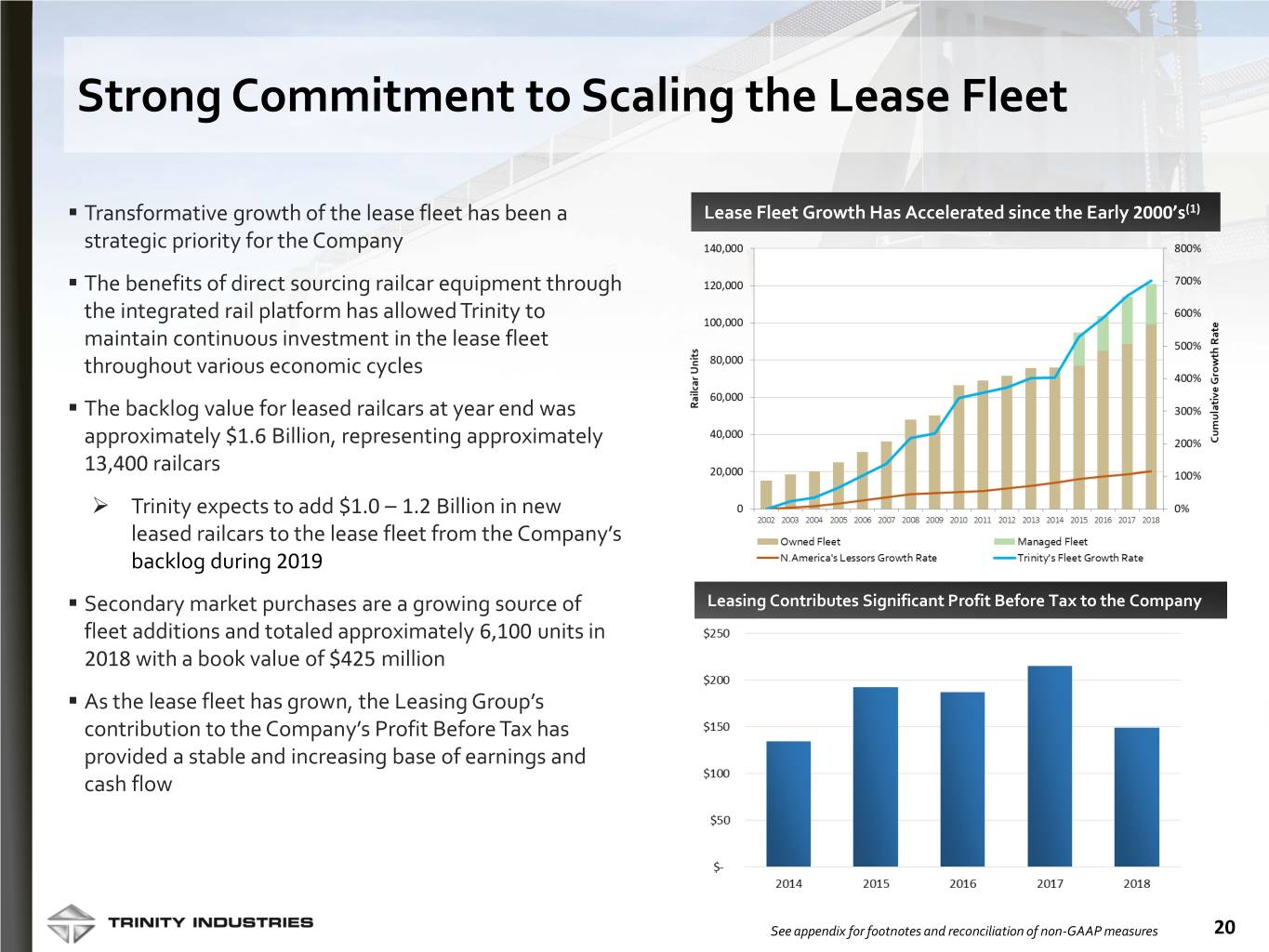

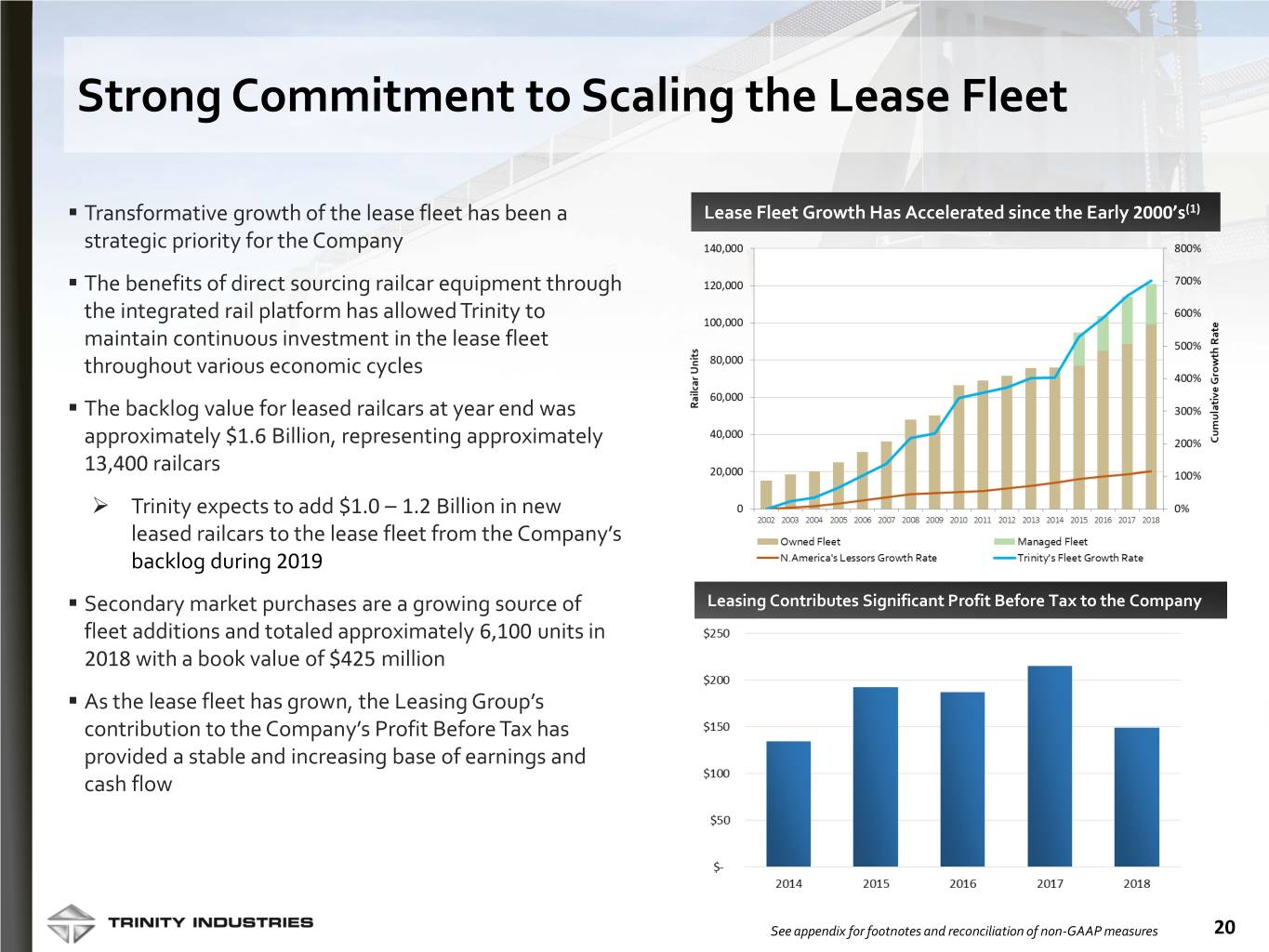

Strong Commitment to Scaling the Lease Fleet . Transformative growth of the lease fleet has been a Lease Fleet Growth Has Accelerated since the Early 2000’s(1) strategic priority for the Company . The benefits of direct sourcing railcar equipment through the integrated rail platform has allowed Trinity to maintain continuous investment in the lease fleet throughout various economic cycles . The backlog value for leased railcars at year end was approximately $1.6 Billion, representing approximately 13,400 railcars Trinity expects to add $1.0 – 1.2 Billion in new leased railcars to the lease fleet from the Company’s backlog during 2019 . Secondary market purchases are a growing source of Leasing Contributes Significant Profit Before Tax to the Company fleet additions and totaled approximately 6,100 units in 2018 with a book value of $425 million . As the lease fleet has grown, the Leasing Group’s contribution to the Company’s Profit Before Tax has provided a stable and increasing base of earnings and cash flow See appendix for footnotes and reconciliation of non-GAAP measures 20

Strong Cash Flow and Economic Profit from Lease Operations and Healthy Cash on Cash Returns from Lease Portfolio . A primary benefit of Trinity’s integrated rail platform is that Economic Profit from Lease Operations is Accelerating (in $millions) Trinity can record its investment in leased railcars at cost 2013 2014 2015 2016 2017 2018 which is reflected in the net book value of property, plant, and Leasing & Mgmt Revenue $ 586.9 $ 632.0 $ 699.9 $ 700.9 $ 743.6 $ 728.9 equipment in the Consolidated Balance Sheet Leasing & Mgmt Profit 267.3 287.9 331.1 312.5 341.3 291.8 OP Margin 45.5% 45.6% 47.3% 44.6% 45.9% 40.0% . Operational cash flow considerations for the Leasing Group (Less): Interest Expense (157.3) (153.3) (138.8) (125.2) (125.8) (142.3) include leasing rental revenues, maintenance and repair, Profit Before Tax (Ex. Railcar Sales) $ 110.0 $ 134.6 $ 192.3 $ 187.3 $ 215.5 $ 149.5 depreciation, property taxes and insurance (all included in the PBT Margin 18.7% 21.3% 27.5% 26.7% 29.0% 20.5% calculation of operating profit) and interest expense which (Add): Depreciation 129.0 130.0 142.3 156.2 172.3 196.6 together generally comprise the total economic profit from Economic Profit (Ex. Railcar Sales) $ 239.0 $ 264.6 $ 334.6 $ 343.5 $ 387.8 $ 346.1 the Leasing business Young Lease Fleet is Yielding Solid Cash on Cash Returns . Typically, the basis Trinity has in a leased railcar declines at a faster rate than the operational cash flow the railcar produces. This can result in improving financial metrics over time as a railcar’s value declines through depreciation while the cash flows it produces remain steady to increasing. . Using a cash-on-cash return metric helps Trinity normalize the year-to-year return profile of a railcar lease fleet that is continually adding new railcars to a large and maturing fleet . The average age of the Trinity lease fleet is 9.1 years (in $mms) See appendix for reconciliation of non-GAAP measures 21

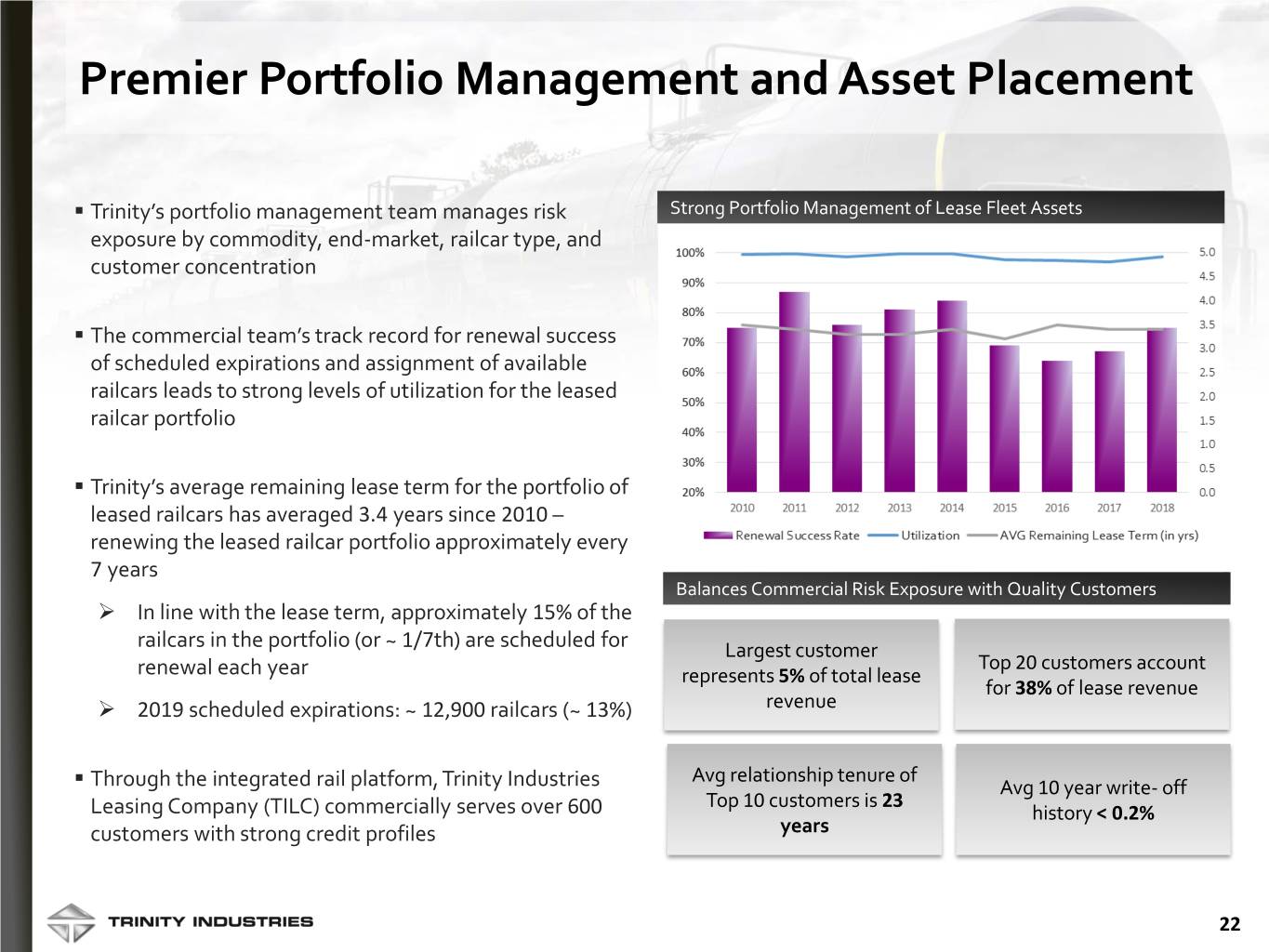

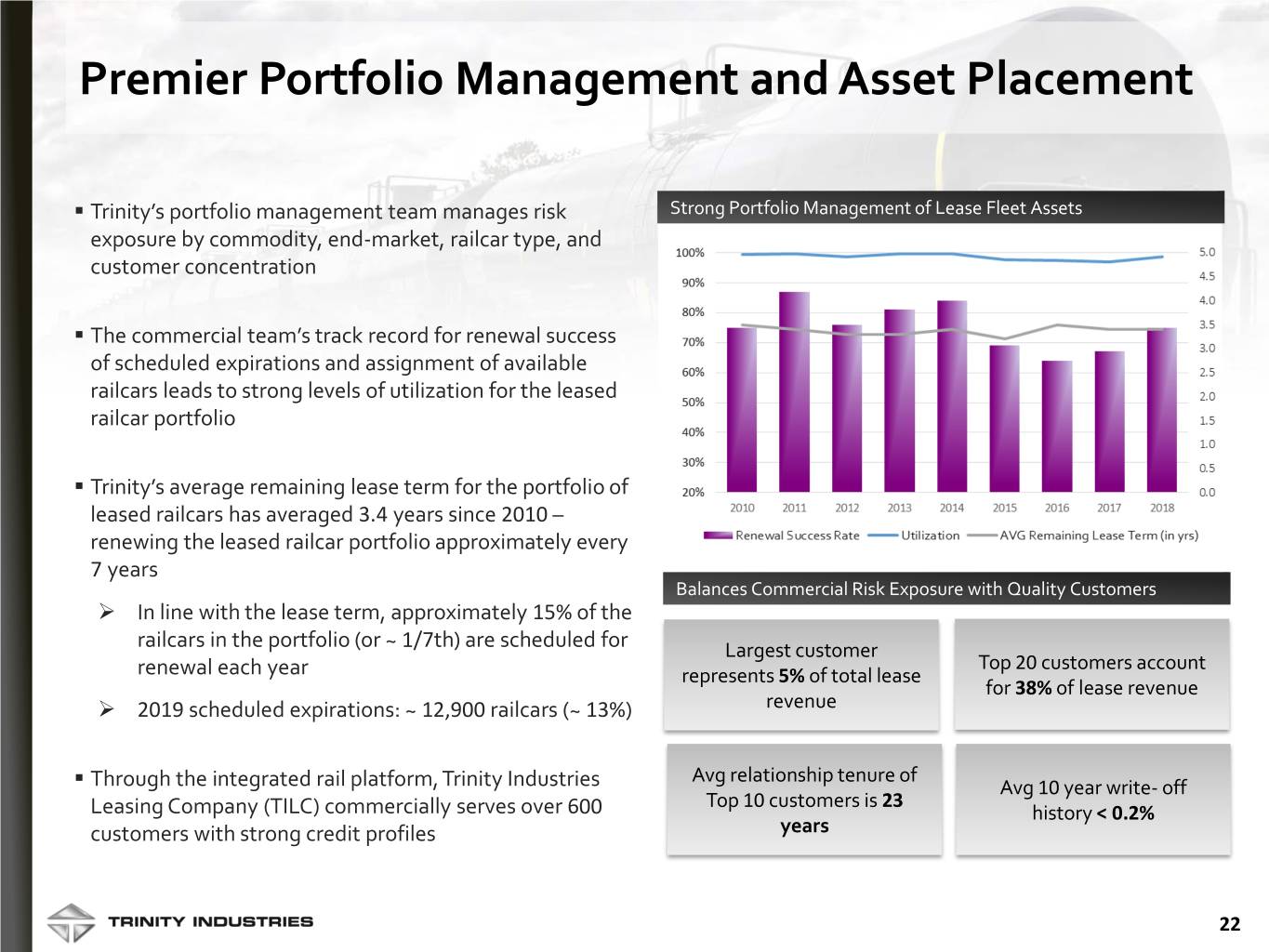

Premier Portfolio Management and Asset Placement . Trinity’s portfolio management team manages risk Strong Portfolio Management of Lease Fleet Assets exposure by commodity, end-market, railcar type, and customer concentration . The commercial team’s track record for renewal success of scheduled expirations and assignment of available railcars leads to strong levels of utilization for the leased railcar portfolio . Trinity’s average remaining lease term for the portfolio of leased railcars has averaged 3.4 years since 2010 – renewing the leased railcar portfolio approximately every 7 years Balances Commercial Risk Exposure with Quality Customers In line with the lease term, approximately 15% of the railcars in the portfolio (or ~ 1/7th) are scheduled for Largest customer Top 20 customers account renewal each year represents 5% of total lease for 38% of lease revenue 2019 scheduled expirations: ~ 12,900 railcars (~ 13%) revenue . Avg relationship tenure of Through the integrated rail platform, Trinity Industries Avg 10 year write- off Top 10 customers is 23 Leasing Company (TILC) commercially serves over 600 history < 0.2% customers with strong credit profiles years 22

Diversified Portfolio of Assets Across End Markets and Railcar Designs Trinity maintains a well-balanced portfolio diversified across end markets and railcar designs to minimize risk and exposure concentrations throughout the railcar cycle Commercial End Markets / Commodities Construction & Consumer Refined Products & Car Type Agriculture Energy Total Metals Products Chemicals Open Hopper/Gondolas Aggregates, Steel and Metals Coal 12% Cement, Construction Small Covered Hopper (< 5K cu/ft) Fertilizer Frac Sand Materials, Steel and Metals 12% DDG and Feeds, Grain Mill Large Covered Hopper (> 5K cu/ft) Products, Grains, Food and Lumber (Wood Chips) Other Chemical (Soda Ash) 14% Other Ag, Fertilizer Specialty Covered Hopper Grain Mill Products Aggregates, Cement Coal (Fly Ash) Plastics 8% Freight Car = 55% Lumber, Steel and Metals, Other Freight Food Autos, Paper, Intermodal Other Chemicals Cement 9% NGL, Chlor Alkali, Petro- Pressure Tank Cars Fertilizer chemical, Other Chemicals 9% Sulfur Products, Chlor Alkali, Gen. Service Tank Cars (< 20K gal) Grain Mill Products Aggregates (Clay Slurry) Other Chemicals 4% Refined Products, Petro- Gen. Service Tank Cars (20K-25K gal) Fertilizer, Food, Animal Feed chemicals, Other Chemicals 5% Major Railcar Category Types Category Railcar Major Refined Products, Petro- Gen. Service Tank Cars (25K-30K gal) Grain Mill Products, Food Crude Oil, Biofuels chemicals, Other Chemicals 10% Refined Products, Tank Car = 45% Gen. Service Tank Cars (> 30K gal) Biofuels, Crude Oil Petrochemicals, Other 12% Chemicals, NGLs Chlor Alkali, Other Chemicals, Specialty Tank Cars Fertilizer Sulfur Products 5% Total 22% 8% 8% 31% 31% ~ 900 Different Commodities ~ 270 Different Railcar Designs 23

Trinity’s Integrated Rail Platform: Rail Products Group 24

Elevating our Financial Performance through the Railcar Cycle . Leading manufacturer of railcars in North America with Rail Products Revenues and Profit Cycle is Inflecting Positive(1) the broadest product offering and a focus on advanced engineering designs . Flexible manufacturing footprint with emphasis on streamlined manufacturing efficiencies and centralized sourcing to enhance cost savings . High variable cost business due to material input costs; pricing and operating leverage enhanced by capacity availability and specialized, commodity-specific designs, and long production runs of similar railcar types in high (in $mms) demand (2) . Trinity delivered 20,105 railcars representing 40% of Healthy Backlogs Enable Strong Production Visibility (units) industry shipments during 2018; Trinity received orders for 28,795 railcars representing 37% of the industry total during 2018 . Trinity’s $3.6 billion order backlog of 30,875 railcars accounts for 38% of industry backlog as of December 2018 and includes a broad mix of railcar types across many industrial sectors . Orders received during the fourth quarter of 2018 of 8,045 railcars were strong relative to recent quarters and reflected a broad mix of railcar types. (2) See appendix for footnotes 25

Building Premier Products and Services Innovative Durability and Superior Performing Designs Reliability Products Innovative Durability & Superior • Innovative railcar designs • Lower life-cycle Performing that optimizeDesigns and Reliability • Maximize the in-service time maintenance costs for the enhance a railcar’s of a customer’sProducts railcar railcar owner performance for a • Cycle loading/unloading customer • 35-50 year assets require efficiencies sound engineering • Attention to loading and unloading features Investing in product development that continues to differentiate our product portfolio for customers and drive operational performance 26

Flexibility in Manufacturing is Key to Our Operations Trinity has invested significantly in its manufacturing footprint, establishing a strong manufacturing platform and ability to respond to changes in market demand Flexibility Trinity's manufacturing flexibility across railcar products – both tank cars and freight railcars – and maintenance services enhances our ability to opportunistically respond to changes in market demand Cost-Effective Trinity’s manufacturing scale, vertical integration, and presence in the Southern U.S. and Mexico provide cost effective benefits across our integrated rail platform 27

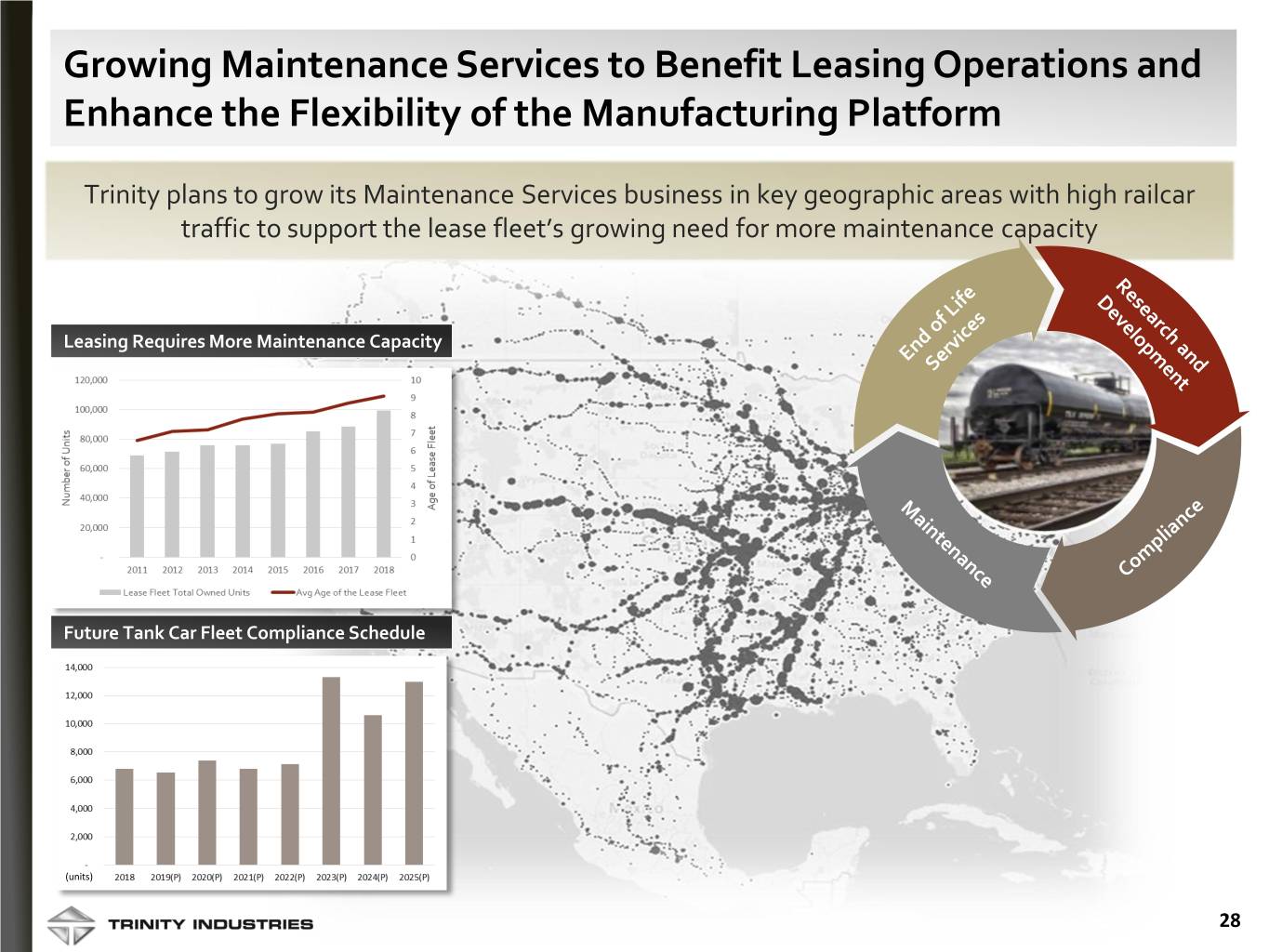

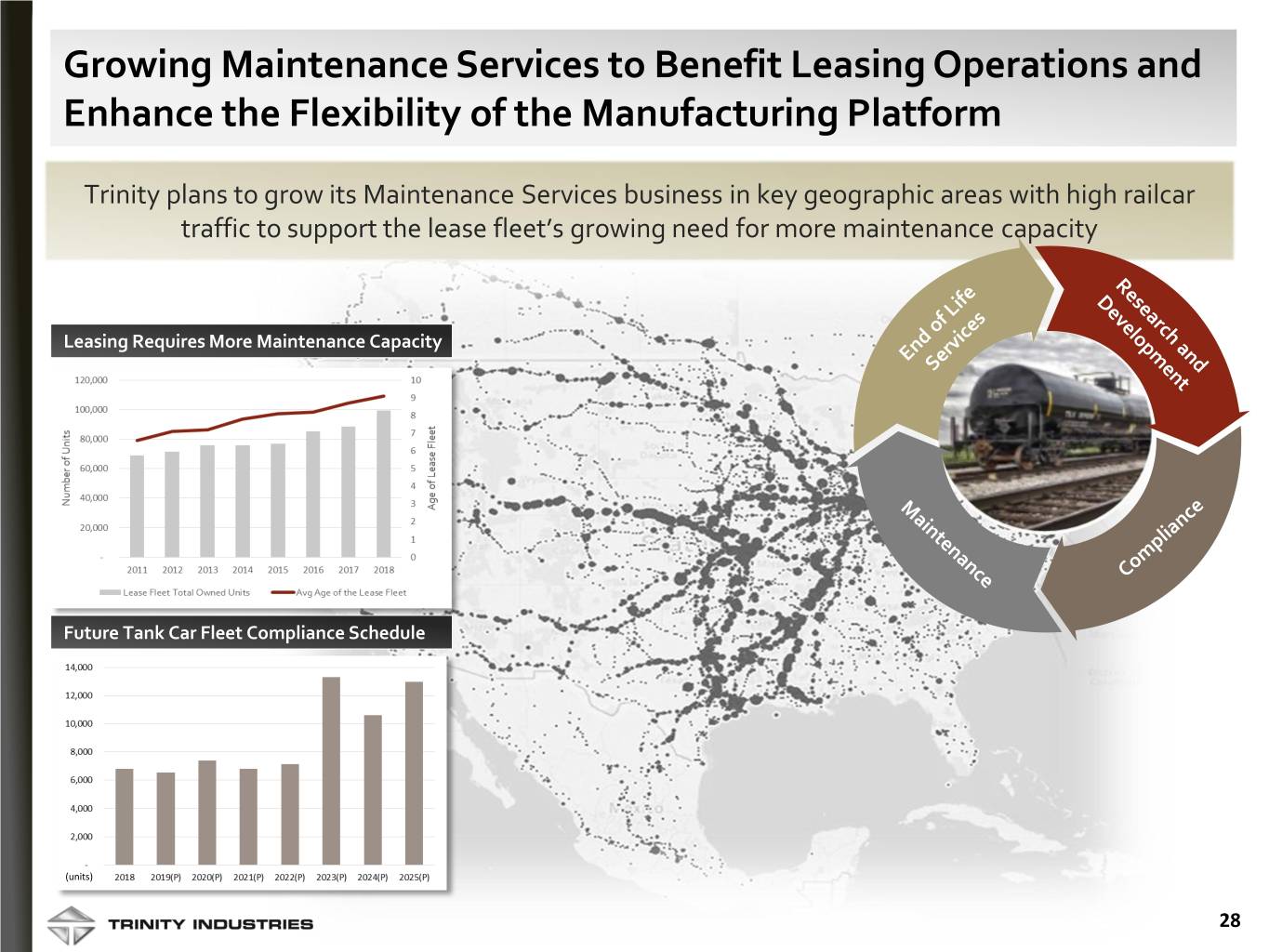

Growing Maintenance Services to Benefit Leasing Operations and Enhance the Flexibility of the Manufacturing Platform Trinity plans to grow its Maintenance Services business in key geographic areas with high railcar traffic to support the lease fleet’s growing need for more maintenance capacity Leasing Requires More Maintenance Capacity Future Tank Car Fleet Compliance Schedule (units) 28

Strong Legacy of Collaborative Culture and Commitment to Excellence The hardworking men and women of Trinity embody the spirit of craftsmanship in their work. They take great pride in what they do, and it translates into strong collaboration and operational flexibility resulting in scale, manufacturing synergies, and financial performance. Continuous Improvement Collaboration Craftsmanship 29

Financial Discussion & Strategic Objectives 30

Trinity’s Business Segments Trinity Industries, Inc. (FY 2018 Financials) Total Revenues: $2.5B Operating Profit: $315M Income from Continuing Operations: $109M EBITDA*: $583M Railcar Leasing and Intersegment Management Services Rail Products Group All Other Group Eliminations Revenue: $843M $2,347M $361M ($1,042)M Operating Profit: $351M $172M $36M ($95)M Adjusted OP*: $548M $202M $51M ($95)M ▪ Railcar leasing services ▪ Tank and freight railcars ▪ Highway Products ▪ Intersegment Eliminations, primarily from the sale of ▪ Trinity Logistics Group ▪ Asset management ▪ Maintenance services railcars from the Rail ▪ Railcar investment vehicle ▪ Railcar parts and heads Products Group to the (RIV) sales Railcar Leasing and Management Services Group for new railcar equipment supported by a firm customer contract for the lease *See appendix for reconciliation of non-GAAP measures 31

Improving Company Outlook for FY 2019 (as of 2/21/19) 2018 Results 2019 Guidance YoY Δ Expected Total EPS: $0.70 per diluted share ~ $1.15 - $1.35 ~ +80% at midpoint Corporate expenses: $149mm ~ $115 - $125mm ~ -20% at midpoint Interest Expense, net: $167mm ~ $225mm ~ +35% Tax rate: 28% ~ 27% ~ -100 basis points Total Company Manufacturing & Corporate CapEx: $37mm ~ $90 - 110mm ~ +170% at midpoint Leasing & Management Revenues: $729mm ~ $770 - 785mm ~ +7% at midpoint Leasing & Management OP: $292mm ~ $310 - 320mm ~ +8% at midpoint Total proceeds from sales of leased railcars: $344mm ~ $350 - 510mm(1) ~ +10% at midpoint Net investment in lease fleet: $948mm ~ $1.2 – 1.4B ~ +37% at midpoint Leasing Group Rail Products Revenue: $2.3B ~ $3.1 – 3.3B ~ +40% at midpoint Rail Products Operating Margin: 7.3% ~ 9.0 – 9.5% ~ +200 basis points at midpoint Railcar deliveries: 20,105 ~ 23,500 – 25,500 ~ +22% at midpoint Revenue elimination from sales to Leasing Group: $990mm ~ $1.4B ~ +41% Profit elimination from sales to Leasing Group: $95mm ~ $160mm ~ +68% Rail Products Group Operating Profit: $36mm ~ $10mm ~ -72% All Other Group Positive Impact to EPS | Negative impact to EPS Any forward-looking statements made by the Company speak only as of the date on which they are made. Except as required by federal securities law, the Company is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise. See appendix for footnotes 32

Long Term Vision Aligned with Shareholder Value Our vision for Trinity is to be a premier provider of railcar products and services in North America while generating high-quality earnings and returns for shareholders. While our portfolio of businesses has evolved, our culture and commitment to excellence remain the same. Our accomplishments through the years are attributable to: • the skills, talents, and integrity of our people, • the synergies within our integrated platform of products and services, • the depth of our operational capabilities, and • our commitment to excellence and continuous improvement. As Trinity repositions the Company as an integrated railcar products and services provider to our stakeholders, our strategic objectives and key priorities involve employing financial levers to optimize the capital structure in the near term and deploying operational levers for growth and improve returns over the longer term 33

Focused Approach on Improving Returns Optimize the capital structure while growing the business through prudent investment to drive growth and enhance returns for shareholders Target high-return capital Invest in value-creating investments that position business opportunities the manufacturing footprint to meet strong demand Operational that grow the lease fleet Optimize corporate opportunities, and scale the costs to align with Levers and build out our service rail maintenance business offerings for leasing and expand geographically Trinity’s go-forward customers to lower maintenance costs business model Optimize the capital Lower overall cost of Regularly and Financial structure through added capital through prudent methodically return Levers leverage on the Leasing balance sheet cash to shareholders company balance sheet management and through a consistent enhanced returns on dividend and additional investments share repurchases 34

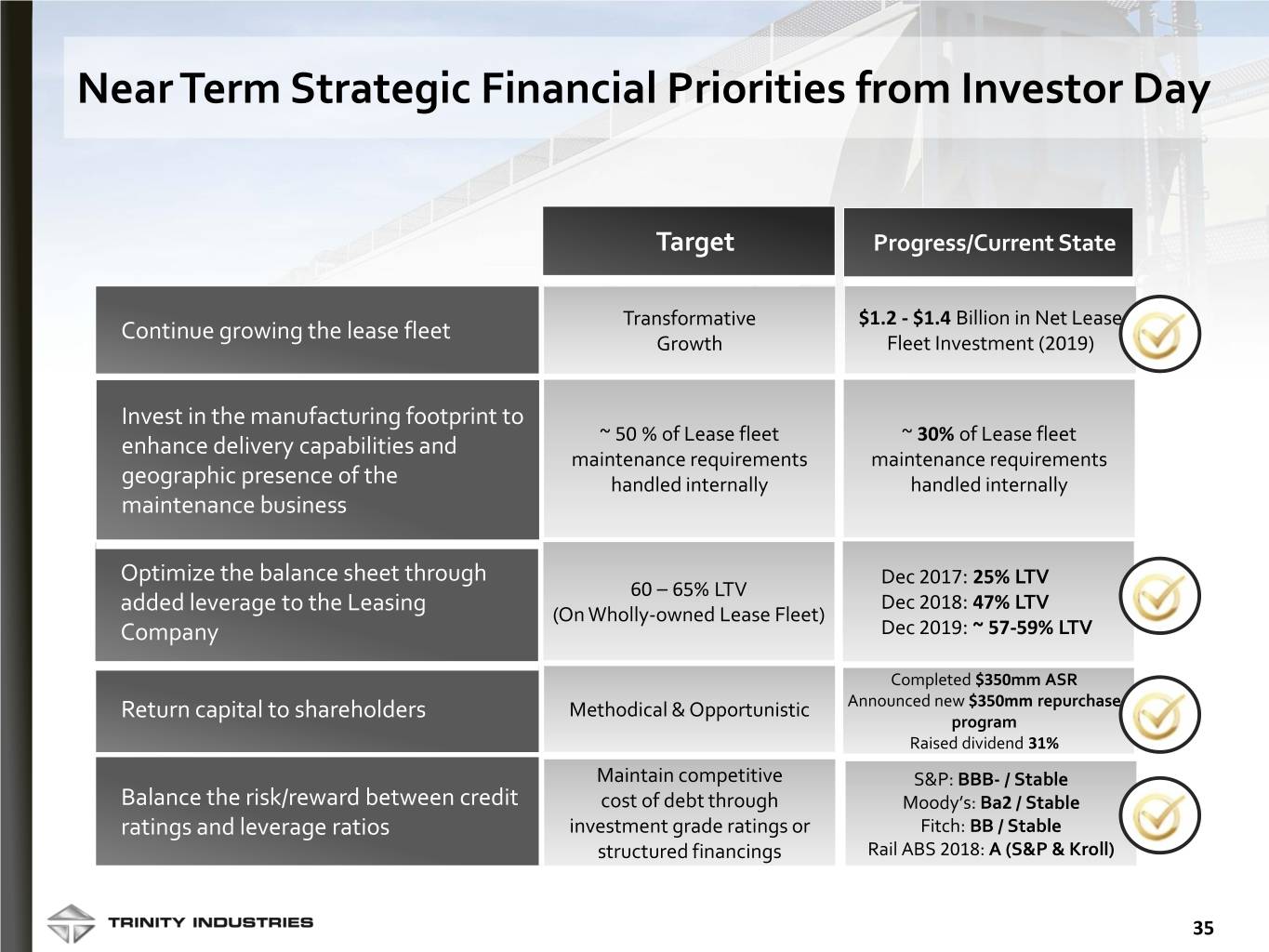

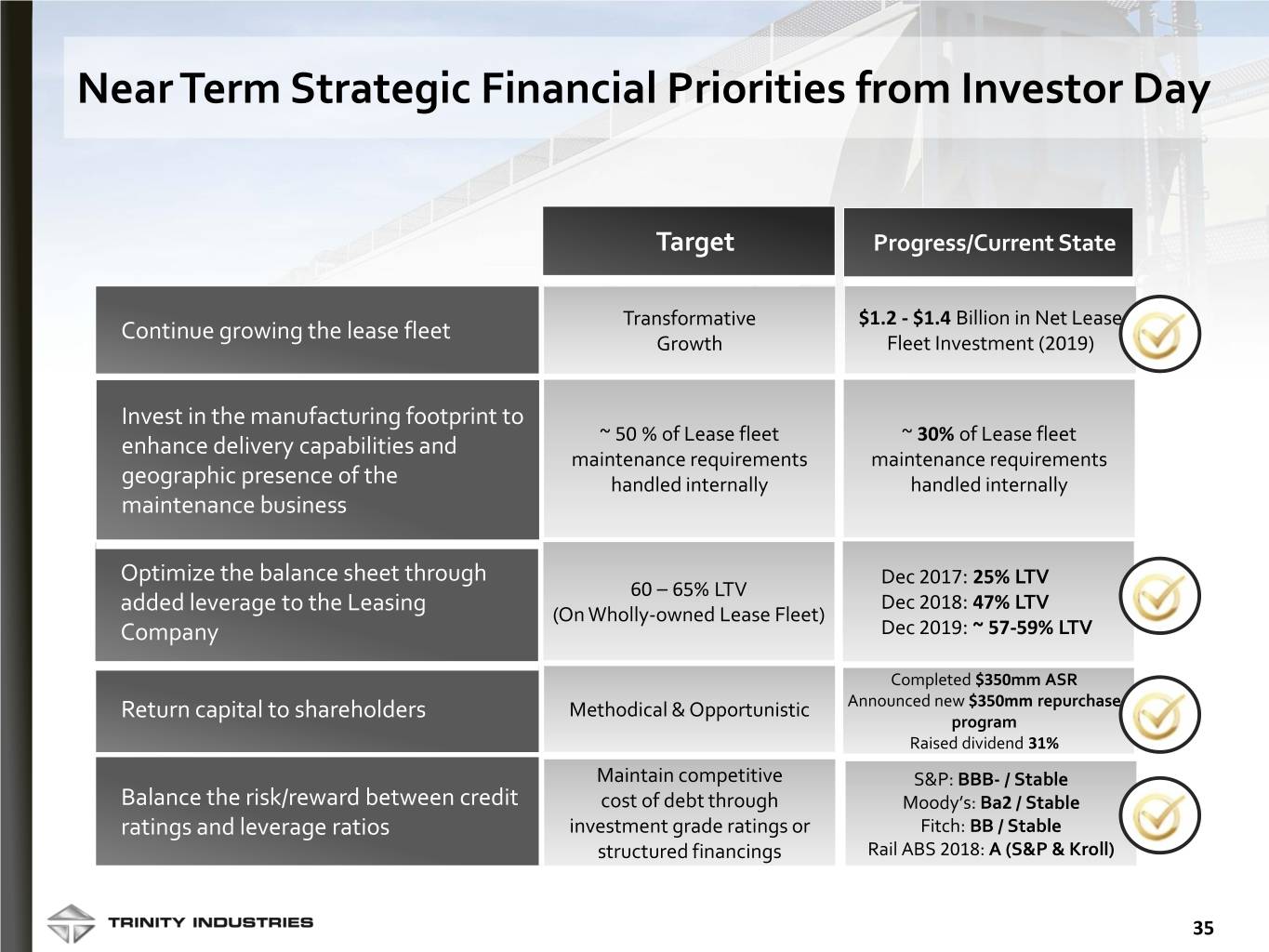

Near Term Strategic Financial Priorities from Investor Day Target Progress/Current State Transformative $1.2 - $1.4 Billion in Net Lease Continue growing the lease fleet Growth Fleet Investment (2019) Invest in the manufacturing footprint to enhance delivery capabilities and ~ 50 % of Lease fleet ~ 30% of Lease fleet maintenance requirements maintenance requirements geographic presence of the handled internally handled internally maintenance business Optimize the balance sheet through Dec 2017: 25% LTV 60 – 65% LTV Dec 2018: 47% LTV added leverage to the Leasing (On Wholly-owned Lease Fleet) Company Dec 2019: ~ 57-59% LTV Completed $350mm ASR Methodical & Opportunistic Announced new $350mm repurchase Return capital to shareholders program Raised dividend 31% Maintain competitive S&P: BBB- / Stable Balance the risk/reward between credit cost of debt through Moody’s: Ba2 / Stable ratings and leverage ratios investment grade ratings or Fitch: BB / Stable structured financings Rail ABS 2018: A (S&P & Kroll) 35

Balance Sheet Positioned for Deployment of Capital Trinity’s balance sheet positions the Company for opportunistic deployment of capital with an under-levered leasing company and strong liquidity Wholly-Owned Partially- Total Company Lease Fleet Owned Fleet NBV, PP&E + All Cash NBV, PP&E + All Cash $5,117mm $1,851mm $6,685 mm Sources* Sources* Total Debt* $2,317mm $1,315mm Total Debt* $4,029 mm Loan to Value 47% 73% (Total Debt/NBV PP&E) Approximate Leasing Stockholders $2,800mm $536mm $2,562 mm Book Equity Equity* Shares Outstanding 133 mm Unencumbered Railcars Total Liquidity (Cash, $1,459mm Corporate Revolver, Railcar $947mm Available for Financing Warehouse) *Selected Balance Sheet Items as of 12/31/18 36

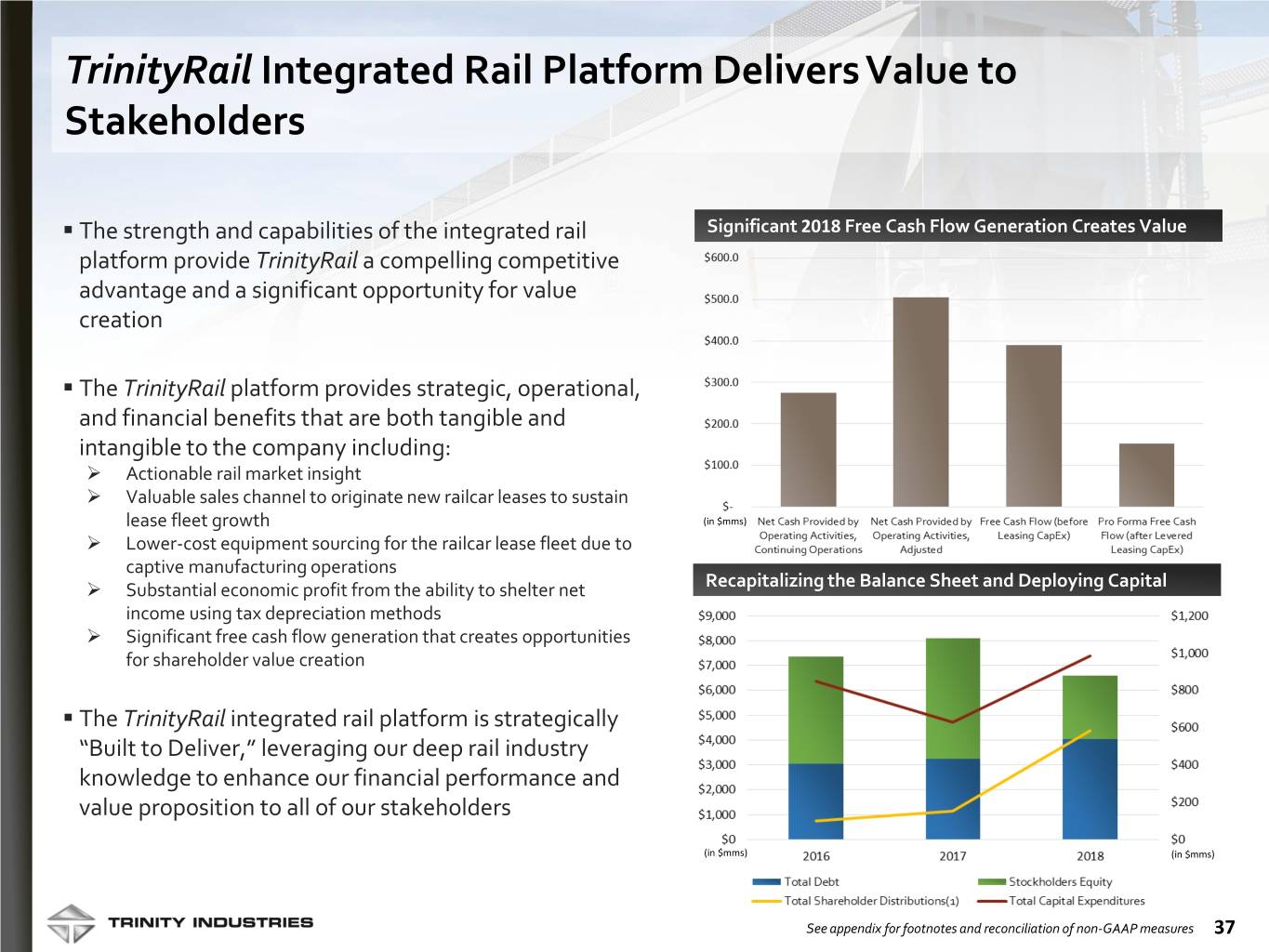

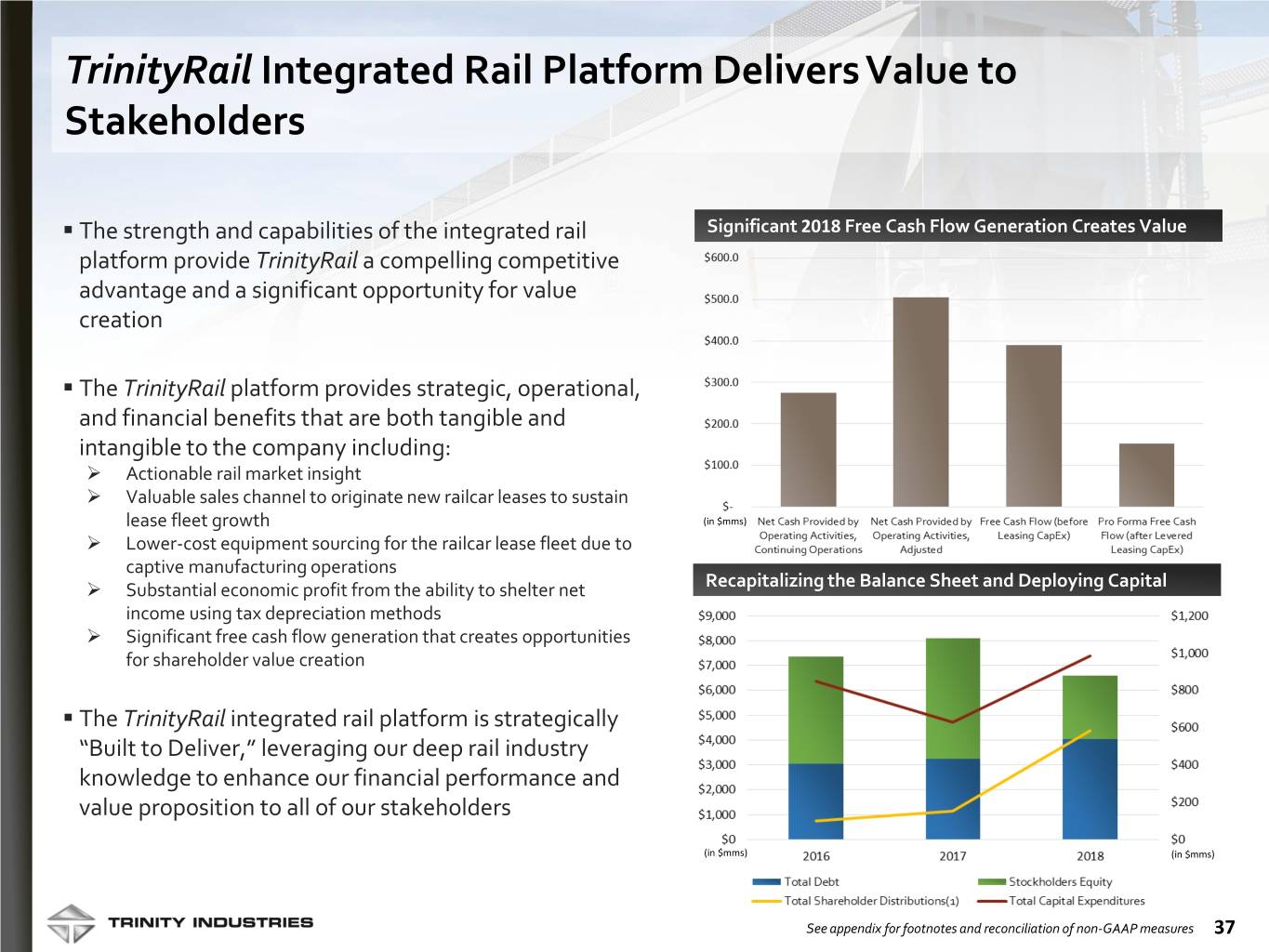

TrinityRail Integrated Rail Platform Delivers Value to Stakeholders . The strength and capabilities of the integrated rail Significant 2018 Free Cash Flow Generation Creates Value platform provide TrinityRail a compelling competitive advantage and a significant opportunity for value creation . The TrinityRail platform provides strategic, operational, and financial benefits that are both tangible and intangible to the company including: Actionable rail market insight Valuable sales channel to originate new railcar leases to sustain lease fleet growth (in $mms) Lower-cost equipment sourcing for the railcar lease fleet due to captive manufacturing operations Substantial economic profit from the ability to shelter net Recapitalizing the Balance Sheet and Deploying Capital income using tax depreciation methods Significant free cash flow generation that creates opportunities for shareholder value creation . The TrinityRail integrated rail platform is strategically “Built to Deliver,” leveraging our deep rail industry knowledge to enhance our financial performance and value proposition to all of our stakeholders (in $mms) (in $mms) See appendix for footnotes and reconciliation of non-GAAP measures 37

Appendix 38

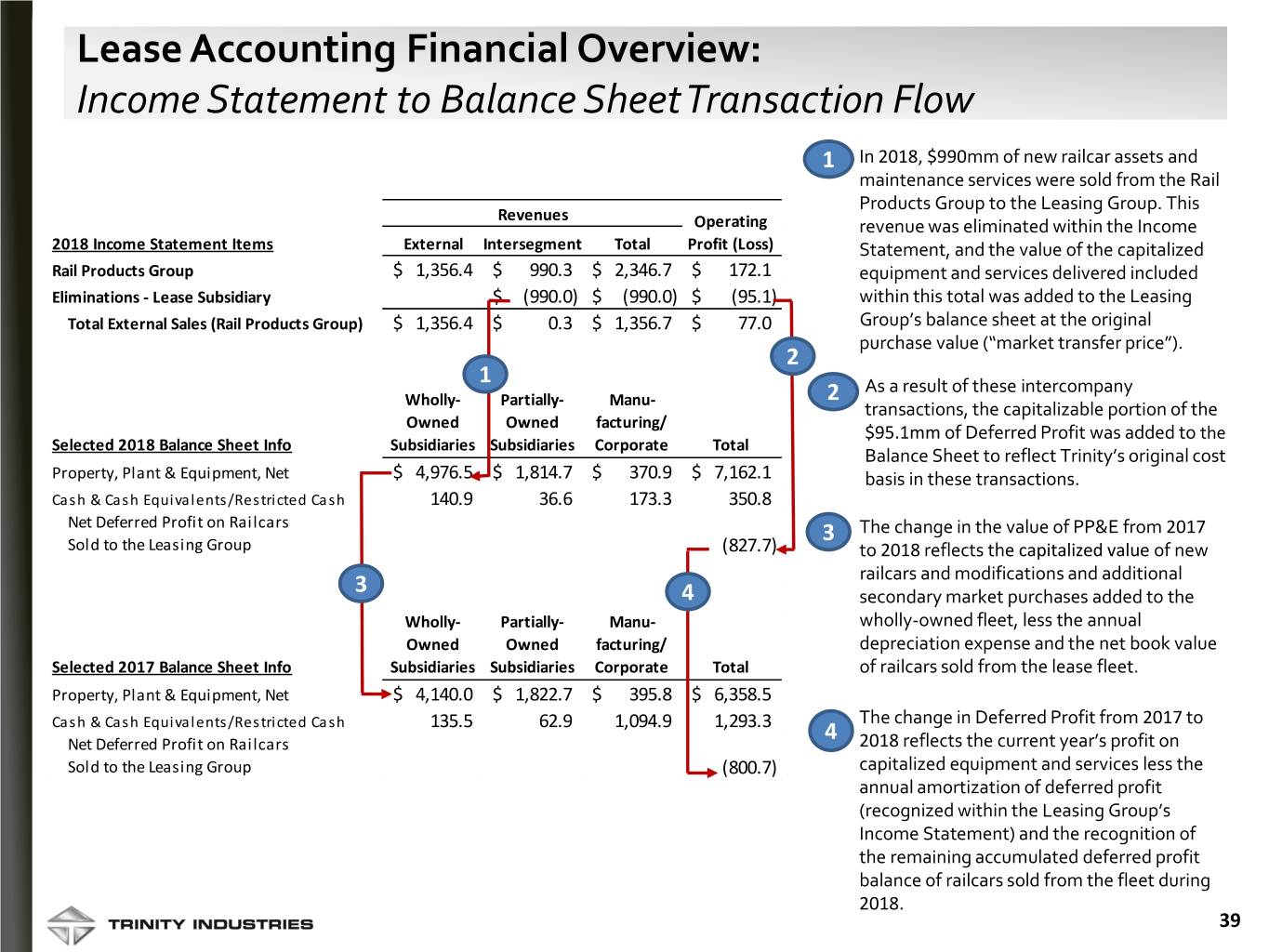

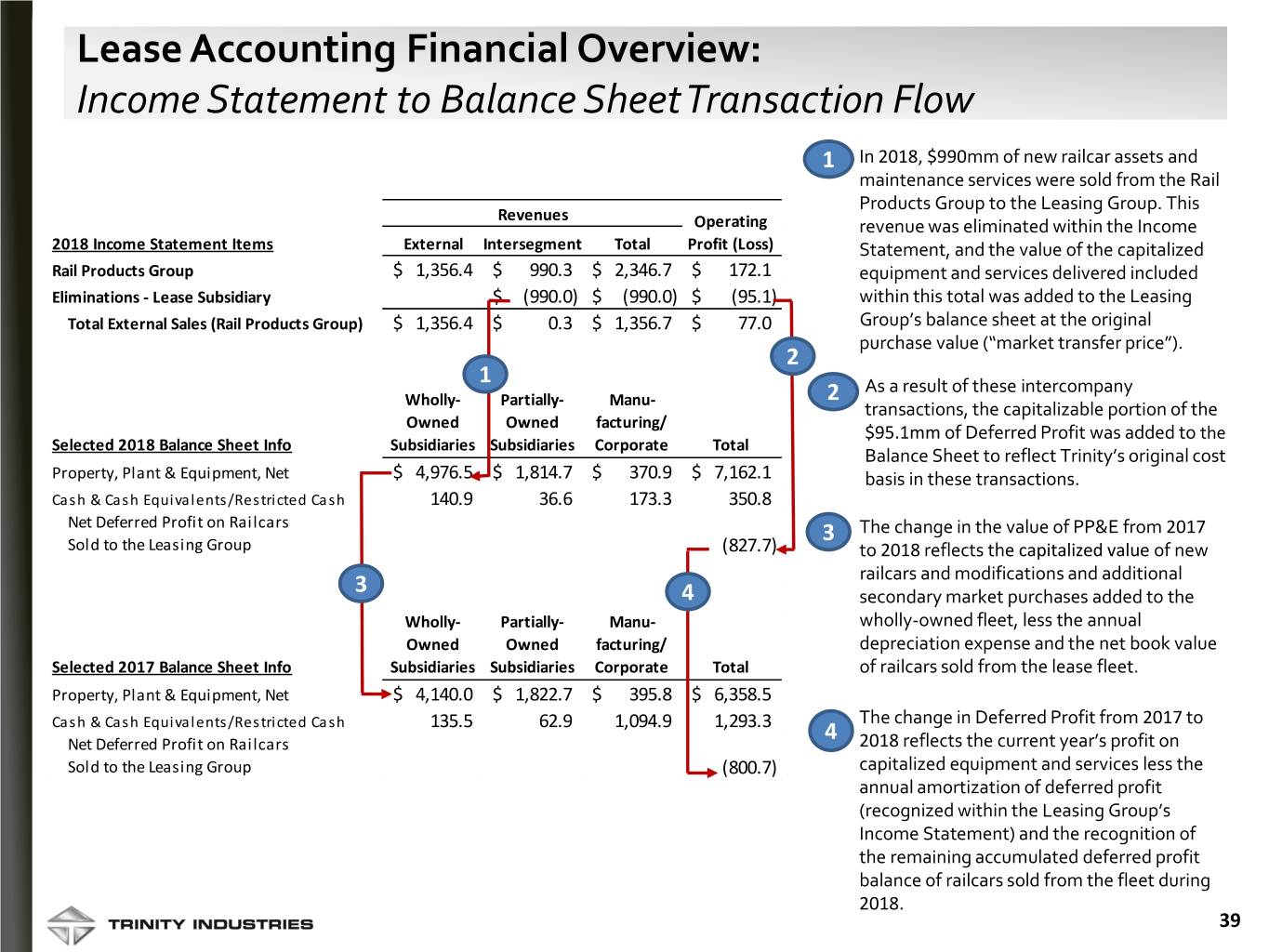

Lease Accounting Financial Overview: Income Statement to Balance Sheet Transaction Flow 1 In 2018, $990mm of new railcar assets and maintenance services were sold from the Rail Products Group to the Leasing Group. This Revenues Operating revenue was eliminated within the Income 2018 Income Statement Items External Intersegment Total Profit (Loss) Statement, and the value of the capitalized Rail Products Group $ 1,356.4 $ 990.3 $ 2,346.7 $ 172.1 equipment and services delivered included Eliminations - Lease Subsidiary $ (990.0) $ (990.0) $ (95.1) within this total was added to the Leasing Total External Sales (Rail Products Group) $ 1,356.4 $ 0.3 $ 1,356.7 $ 77.0 Group’s balance sheet at the original purchase value (“market transfer price”). 2 1 2 As a result of these intercompany Wholly- Partially- Manu- transactions, the capitalizable portion of the Owned Owned facturing/ $95.1mm of Deferred Profit was added to the Selected 2018 Balance Sheet Info Subsidiaries Subsidiaries Corporate Total Balance Sheet to reflect Trinity’s original cost Property, Plant & Equipment, Net $ 4,976.5 $ 1,814.7 $ 370.9 $ 7,162.1 basis in these transactions. Cash & Cash Equivalents/Restricted Cash 140.9 36.6 173.3 350.8 Net Deferred Profit on Railcars 3 The change in the value of PP&E from 2017 Sold to the Leasing Group (827.7) to 2018 reflects the capitalized value of new 3 railcars and modifications and additional 4 secondary market purchases added to the Wholly- Partially- Manu- wholly-owned fleet, less the annual Owned Owned facturing/ depreciation expense and the net book value Selected 2017 Balance Sheet Info Subsidiaries Subsidiaries Corporate Total of railcars sold from the lease fleet. Property, Plant & Equipment, Net $ 4,140.0 $ 1,822.7 $ 395.8 $ 6,358.5 The change in Deferred Profit from 2017 to Cash & Cash Equivalents/Restricted Cash 135.5 62.9 1,094.9 1,293.3 4 Net Deferred Profit on Railcars 2018 reflects the current year’s profit on Sold to the Leasing Group (800.7) capitalized equipment and services less the annual amortization of deferred profit (recognized within the Leasing Group’s Income Statement) and the recognition of the remaining accumulated deferred profit balance of railcars sold from the fleet during 2018. 39

Rail Products Group Quarterly Revenue and Operating Profit* As Previously Reported vs. Recast Post-Spin Rail Products Group Q1-2017* Q2-2017* Q3-2017* Q4-2017 Q1-2018* Q2-2018* Q3-2018* Q4-2018 - Recast post-spin Revenue $ 469.0 $ 455.8 $ 481.2 $ 638.0 $ 588.1 $ 566.2 $ 497.6 $ 694.8 Operating Profit 50.1 29.8 43.0 73.4 51.5 48.5 28.0 44.1 Operating Profit Margin % 10.7% 6.5% 8.9% 11.5% 8.8% 8.6% 5.6% 6.3% Rail Group Q1-2017 Q2-2017 Q3-2017 Q4-2017 Q1-2018 Q2-2018 Q3-2018 Q4-2018 - Previously reported Revenue $ 478.3 $ 465.9 $ 492.4 $ 647.2 $ 598.5 $ 575.2 $ 506.8 - Operating Profit 50.5 36.7 50.5 78.4 58.9 57.7 32.9 - Operating Profit Margin % 10.6% 7.9% 10.3% 12.1% 9.8% 10.0% 6.5% - *The highlighted financials provided for the recasted revenues and operating profit for Quarters 1 – 3 of 2017 and 2018 represent management estimates of the financial performance of the business post spin-off, including preliminary, unaudited adjustments that reflect the entities included in the spin-off as discontinued operations 40

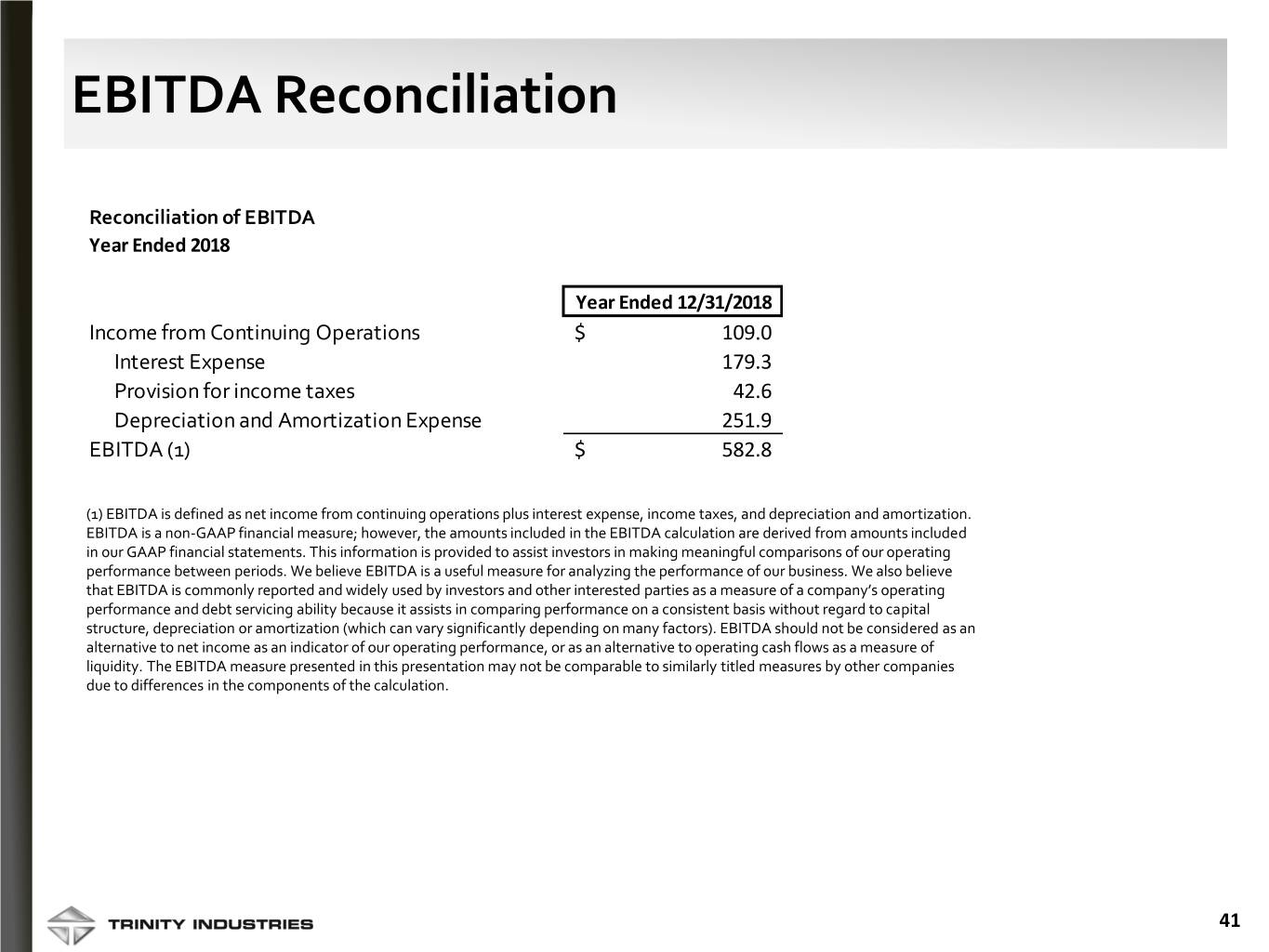

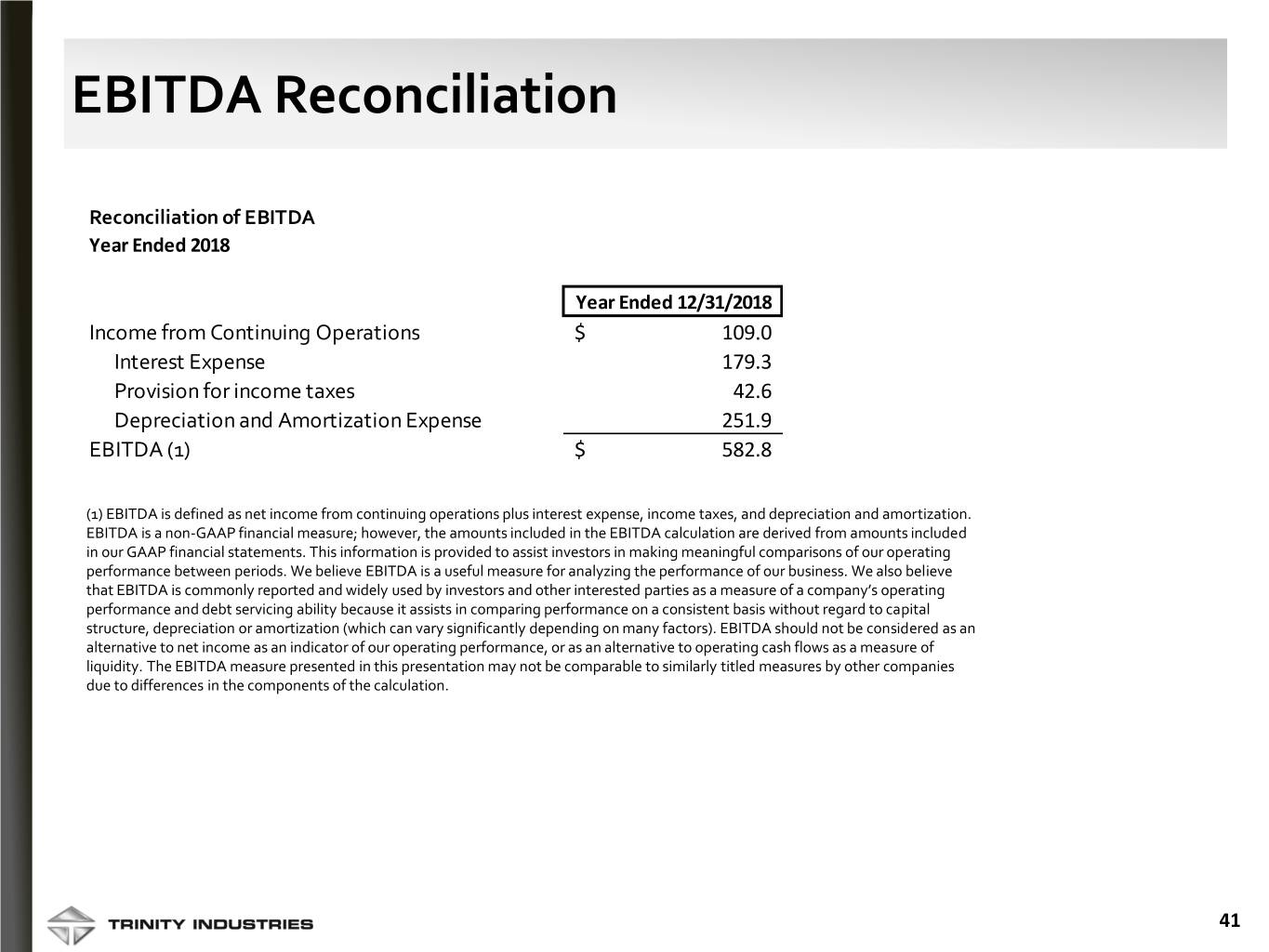

EBITDA Reconciliation Reconciliation of EBITDA Year Ended 2018 Year Ended 12/31/2018 Income from Continuing Operations $ 109.0 Interest Expense 179.3 Provision for income taxes 42.6 Depreciation and Amortization Expense 251.9 EBITDA (1) $ 582.8 (1) EBITDA is defined as net income from continuing operations plus interest expense, income taxes, and depreciation and amortization. EBITDA is a non-GAAP financial measure; however, the amounts included in the EBITDA calculation are derived from amounts included in our GAAP financial statements. This information is provided to assist investors in making meaningful comparisons of our operating performance between periods. We believe EBITDA is a useful measure for analyzing the performance of our business. We also believe that EBITDA is commonly reported and widely used by investors and other interested parties as a measure of a company’s operating performance and debt servicing ability because it assists in comparing performance on a consistent basis without regard to capital structure, depreciation or amortization (which can vary significantly depending on many factors). EBITDA should not be considered as an alternative to net income as an indicator of our operating performance, or as an alternative to operating cash flows as a measure of liquidity. The EBITDA measure presented in this presentation may not be comparable to similarly titled measures by other companies due to differences in the components of the calculation. 41

Adjusted OP Reconciliation Year Ended 12/31/2018 Rail Products Leasing Group All Other Corporate Eliminations Consolidated Group Operating Profit $ 351.1 $ 172.1 $ 35.7 $ (149.0) $ (94.8) $ 315.1 Depreciation Expense 196.6 30.3 15.1 9.9 - 251.9 Adjusted Operating Profit (1) $ 547.7 $ 202.4 $ 50.8 $ (139.1) $ (94.8) $ 567.0 (1) Adjusted Operating Profit is a non-GAAP financial measure derived from amounts included in our GAAP financial statements and is defined as Operating Profit as computed in accordance with GAAP for Trinity's business segments, adjusted to add back depreciation expense. Management believes this non-GAAP financial measure is useful to both management and investors in their analysis of operations for the company's business segments. This non-GAAP measure is reconciled to Operating Profit, the most directly comparable GAAP financial measure, in the table above. Non-GAAP measures should not be considered in isolation or as a substitute for our reporting results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. 42

Leasing & Management PBT Reconciliation (in millions except for PBT Margin) 2013 2014 2015 2016 2017 2018 From Lease Operations (Ex. Car Sales): Revenue $ 586.9 $ 632.0 $ 699.9 $ 700.9 $ 743.6 $ 728.9 Operating Profit $ 267.3 $ 287.9 $ 331.1 $ 312.5 $ 341.3 $ 291.8 Less: Interest Expense $ (157.3) $ (153.3) $ (138.8) $ (125.2) $ (125.8) $ (142.3) Profit Before Tax (PBT) $ 110.0 $ 134.6 $ 192.3 $ 187.3 $ 215.5 $ 149.5 PBT Margin 18.7% 21.3% 27.5% 26.7% 29.0% 20.5% 43

Lease Operations Cash on Cash Return Reconciliation Cash on Cash Return Calculation 2012 2013 2014 2015 2016 2017 2018 Economic ("Cash") Profit (from Lease Operations) $ 188.8 $ 239.0 $ 264.6 $ 334.6 $ 343.5 $ 387.8 $ 346.1 Net Leasing PP&E $ 4,205.9 $ 4,649.7 $ 4,599.1 $ 5,064.9 $ 5,803.2 $ 5,962.7 $ 6,791.2 Restricted Cash $ 223.2 $ 260.7 $ 234.7 $ 195.8 $ 178.1 $ 195.1 $ 171.5 Deferred Income Balance $ 446.2 $ 549.7 $ 557.2 $ 674.0 $ 798.1 $ 800.7 $ 827.7 Total Debt $ 2,691.3 $ 2,613.0 $ 2,729.8 $ 2,394.4 $ 2,238.0 $ 2,403.9 $ 3,631.8 Net Leasing PP&E (Avg Yr/Yr) $ 4,203.5 $ 4,427.8 $ 4,624.4 $ 4,832.0 $ 5,434.1 $ 5,883.0 $ 6,377.0 Restricted Cash (Avg Yr/Yr) $ 231.8 $ 242.0 $ 247.7 $ 215.3 $ 187.0 $ 186.6 $ 183.3 Less: Deferred Income Balance (Avg Yr/Yr) $ (488.9) $ (498.0) $ (553.5) $ (615.6) $ (736.1) $ (799.4) $ (814.2) Less: Total Debt (Avg Yr/Yr) ######## $ (2,652.2) $ (2,671.4) $ (2,562.1) $ (2,316.2) $ (2,321.0) $ (3,017.9) Equity/Cash Contribution Total $ 1,290.5 $ 1,519.7 $ 1,647.3 $ 1,869.6 $ 2,568.8 $ 2,949.2 $ 2,728.2 Cash on Cash Return 14.6% 15.7% 16.1% 17.9% 13.4% 13.1% 12.7% Implied Leasing ROE Calculation Leasing Profit Before Tax $ 68.3 $ 110.0 $ 134.6 $ 192.3 $ 187.3 $ 215.5 $ 149.5 Approximate Leasing Book Equity $ 1,779.3 $ 2,017.6 $ 2,200.7 $ 2,485.2 $ 3,304.8 $ 3,748.6 $ 3,542.4 Implied Return on Equity 3.8% 5.5% 6.1% 7.7% 5.7% 5.7% 4.2% Economic Profit is a non-GAAP financial measure derived from amounts included in our GAAP financial statements and is defined as Leasing and Management Operating Profit as computed in accordance with GAAP, adjusted to deduct interest expense and add back depreciation expense. This non-GAAP measure is reconciled to Operating Profit, the most directly comparable GAAP financial measure, in the table on Page 21. Additionally, Cash on Cash Return is a Non- GAAP measure that is calculated using Economic Profit divided by the Company’s cash investment in the Leasing Group’s PP&E. Management believes these non-GAAP financial measures are useful to both management and investors in their analysis of investments for the Company's leasing business. Non-GAAP measures should not be considered in isolation or as a substitute for our reporting results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. 44

Free Cash Flow Reconciliation Free Cash Flow Calculation 2016 2017 2018 Net Cash Provided by Operating Activities, Continuing Operations $ 837.5 $ 610.1 $ 274.2 Add: Proceeds from railcar lease fleet sales owned more than one year at the time of sale 37.7 360.7 230.5 Net Cash Provided by Operating Activities, Adjusted $ 875.2 $ 970.8 $ 504.7 Total Manufacturing CapEx (49.5) (22.0) (37.3) Dividends Paid (66.7) (72.6) (77.4) Free Cash Flow (before Leasing CapEx) $ 759.0 $ 876.2 $ 390.0 Capital expenditure - leasing, net (799.1) (608.3) (948.3) Assumed Leverage for Lease Fleet Growth @ 75% $ 599.3 $ 456.2 $ 711.2 Cash Required for Leasing CapEx after Leverage (199.8) (152.1) (237.1) Pro Forma Free Cash Flow (after Levered Leasing CapEx) $ 559.2 $ 724.1 $ 152.9 Free Cash Flow is a non-GAAP financial measure and is defined as Net Cash Provided by Operating Activities from Continuing Operations as computed in accordance with GAAP, plus cash proceeds from sales of leased railcars, less cash payments for manufacturing capital expenditures and dividends. We believe Free Cash Flow is useful to both management and investors as it provides a relevant measure of liquidity and a useful basis for assessing our ability to fund our operations and repay our debt. Free Cash Flow is reconciled to Net Cash Provided by Operating Activities from Continuing Operations, the most directly comparable GAAP financial measure, in the table above. Non- GAAP measures should not be considered in isolation or as a substitute for our reporting results prepared in accordance with GAAP and, as calculated, may not be comparable to other similarly titled measures for other companies. 45

Footnotes Slide 4 – Trinity Industries, Inc. Overview (1) Management’s expectations for shares outstanding expected at 3/31/2019 (provided on Q4-18 Earnings Conference Call) (2) Intersegment Revenues are eliminated (3) FY 2017 EPS excludes a $3.06 non-cash benefit related to the effects of the Tax Cuts and Jobs Act (4) FY 2019 projections (“2019(P)”) represent managements estimates as of 2/21/19. Any forward-looking statements made by the Company speak only as of the date on which they are made. Except as required by federal securities law, the Company is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise. Slide 6 – A Rich History of Evolutionary and Transformative Growth Timeline references solely indicate current entities of Trinity Industries consisting of rail-related businesses, and the highway and logistics businesses Slide 10 – Railcars are an Attractive Long-term Investment in an Undervalued Asset Class https://www.aar.org/wp-content/uploads/2019/02/AAR-Sustainability-Fact-Sheet-2019.pdf Slide 11 - Rail Transportation is an Integral Component of the North American Industrial Supply Chain (1) FTR Associates 9/17/2018 (2) Company Annual Reports and Bloomberg, 9/17/18 (3) Umler®, January 2018 report; The Umler® system is an electronic resource that contains critical data for North American transportation equipment. Originally created in 1968, Umler maintains data for more than two million pieces of equipment used in rail, steamship and highway service (4) AAR Economic Impact (5) http://www.grainnet.com/article/140832/importance-of-rail-for-moving-grain-to-mexico (6) http://automotivelogistics.media/news/in-depth-analysis-strong-logistics-and-supply-base-central-to-fords-new-mexico-plant (7) https://apps.neb-one.gc.ca/CommodityStatistics/ExportVolumeByTransportModeSummary.aspx?commodityCode=PR Slide 12 – Rail Ecosphere Spans Five Commercial End Markets (1) All statistics cited on this slide: 2016 STB Waybill Sample – reflects vast majority of commodity types (2)Umler® North American fleet ownership data Slide 13 - Railcar Market Fundamentals are Normalizing All data provided from AAR industry reports and company SEC filings Slide 17 – The Integrated Rail Platform Reaches the Entire Rail Market and Delivers to the Needs of Each Customer Channel Umler ® North American fleet ownership data 46

Footnotes (continued) Slide 20- Solid Financial Performance with Multiple Sources of Revenue (1) Operations Margin calculated using only revenues and profit from Leasing Operations including Partially Owned Subsidiaries and excluding Car Sales; PBT Margin calculated using Operating Profit from Leasing Operations less Leasing Interest Expense; See Appendix page 44 (2) FY 2019 projections (“2019(P)”) represent managements estimates as of 2/21/19. Any forward-looking statements made by the Company speak only as of the date on which they are made. Except as required by federal securities law, the Company is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise. Slide 21 – Strong Commitment to Scaling the Lease Fleet (1) Umler® North American fleet ownership data Slide 26 – Elevating our Financial Performance through the Railcar Cycle (1) Intersegment Revenues are eliminated and Group revenues were not recast prior to 2016 following the Company’s spin-off of Arcosa, Inc. (2) FY 2019 projections (“2019(P)”) represent managements estimates as of 2/21/19. Any forward-looking statements made by the Company speak only as of the date on which they are made. Except as required by federal securities law, the Company is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise. Slide 33 – Improving Company Outlook for FY 2019 (1) Total proceeds from sales of leased railcars of $350mm to $510mm includes the effect of approximately $160mm sales-type lease for a specific customer Slide 38 – TrinityRail Integrated Rail Platform Delivers Value to Stakeholders (1) Total shareholder distributions includes Dividends and Share repurchases 47