Exhibit 99.6 1Q 2020 – Earnings Conference Call Supplemental Material April 30, 2020 – based on financial results as of March 31, 2020 Investor Contact: TrinityInvestorRelations@trin.net Website: www.trin.net

Forward Looking Statements Some statements in this presentation, which are not historical facts, are “forward‐looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward‐looking statements include statements about Trinity's estimates, expectations, beliefs, intentions or strategies for the future, and the assumptions underlying these forward‐looking statements, including, but not limited to, future financial and operating performance, future opportunities and any other statements regarding events or developments that Trinity believes or anticipates will or may occur in the future, including the potential financial and operational impacts of the COVID‐19 pandemic. Trinity uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “projected,” “outlook,” and similar expressions to identify these forward‐looking statements. Forward‐looking statements speak only as of the date of this release, and Trinity expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward‐looking statement contained herein to reflect any change in Trinity’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based, except as required by federal securities laws. Forward‐looking statements involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to risks and uncertainties regarding economic, competitive, governmental, and technological factors affecting Trinity’s operations, markets, products, services and prices, and such forward‐ looking statements are not guarantees of future performance. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward‐looking statements, see “Risk Factors” and “Forward‐Looking Statements” in Trinity’s Annual Report on Form 10‐K for the most recent fiscal year, as may be revised and updated by Trinity’s Quarterly Reports on Form 10‐Q, and Trinity’s Current Reports on Form 8‐K. Additionally, the information and metrics on slide 5 are assumptions used for scenario modeling purposes only. They are not statements of the Company’s expectations, projections, guidance, forecasts, or estimates and readers should not interpret them as such. 2

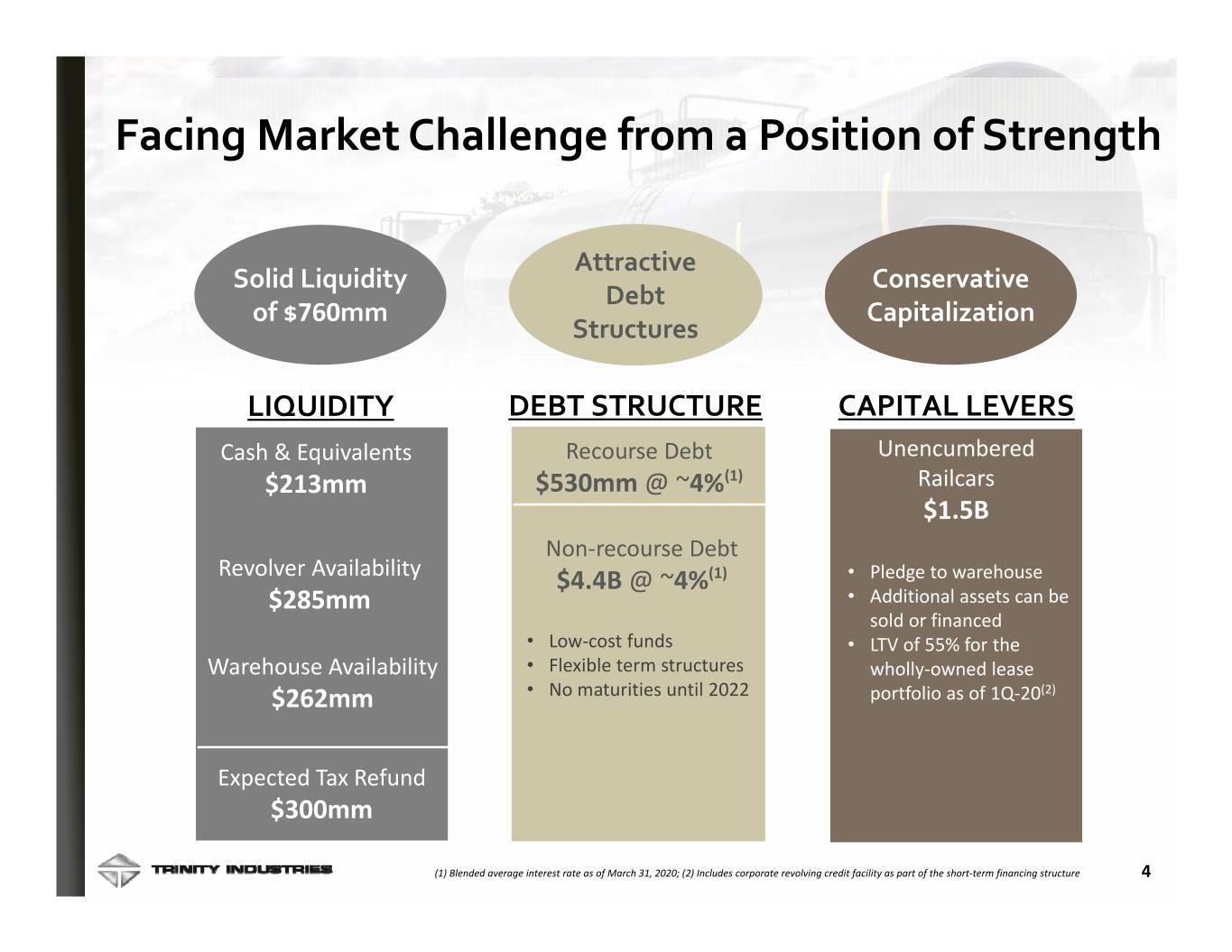

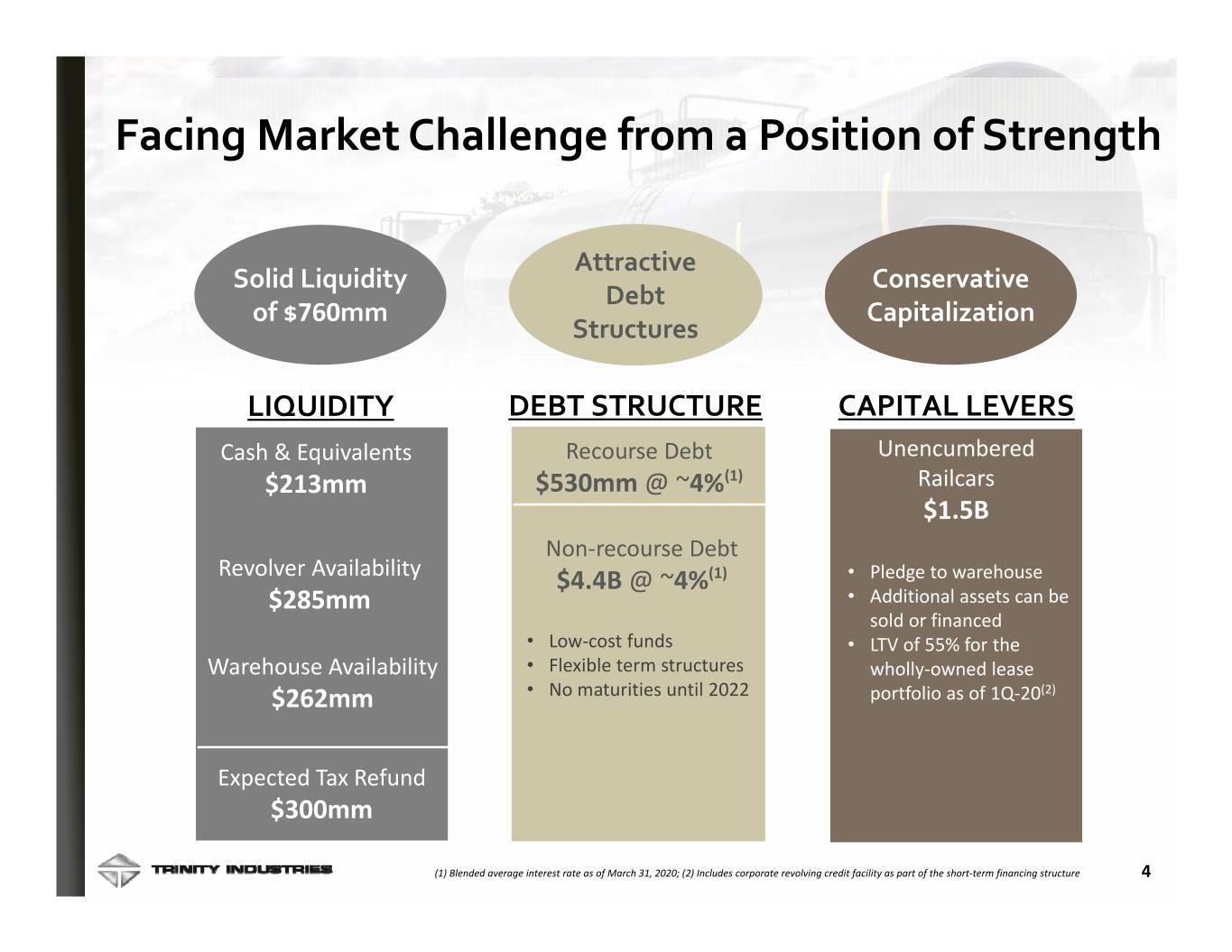

Facing Market Challenge from a Position of Strength Attractive Solid Liquidity Conservative Debt of $760mm Capitalization Structures LIQUIDITY DEBT STRUCTURE CAPITAL LEVERS Cash & Equivalents Recourse Debt Unencumbered $213mm $530mm @ ~4%(1) Railcars $1.5B Non‐recourse Debt Revolver Availability $4.4B @ ~4%(1) • Pledge to warehouse $285mm • Additional assets can be sold or financed • Low‐cost funds • LTV of 55% for the Warehouse Availability • Flexible term structures wholly‐owned lease $262mm • No maturities until 2022 portfolio as of 1Q‐20(2) Expected Tax Refund $300mm (1) Blended average interest rate as of March 31, 2020; (2) Includes corporate revolving credit facility as part of the short‐term financing structure 4

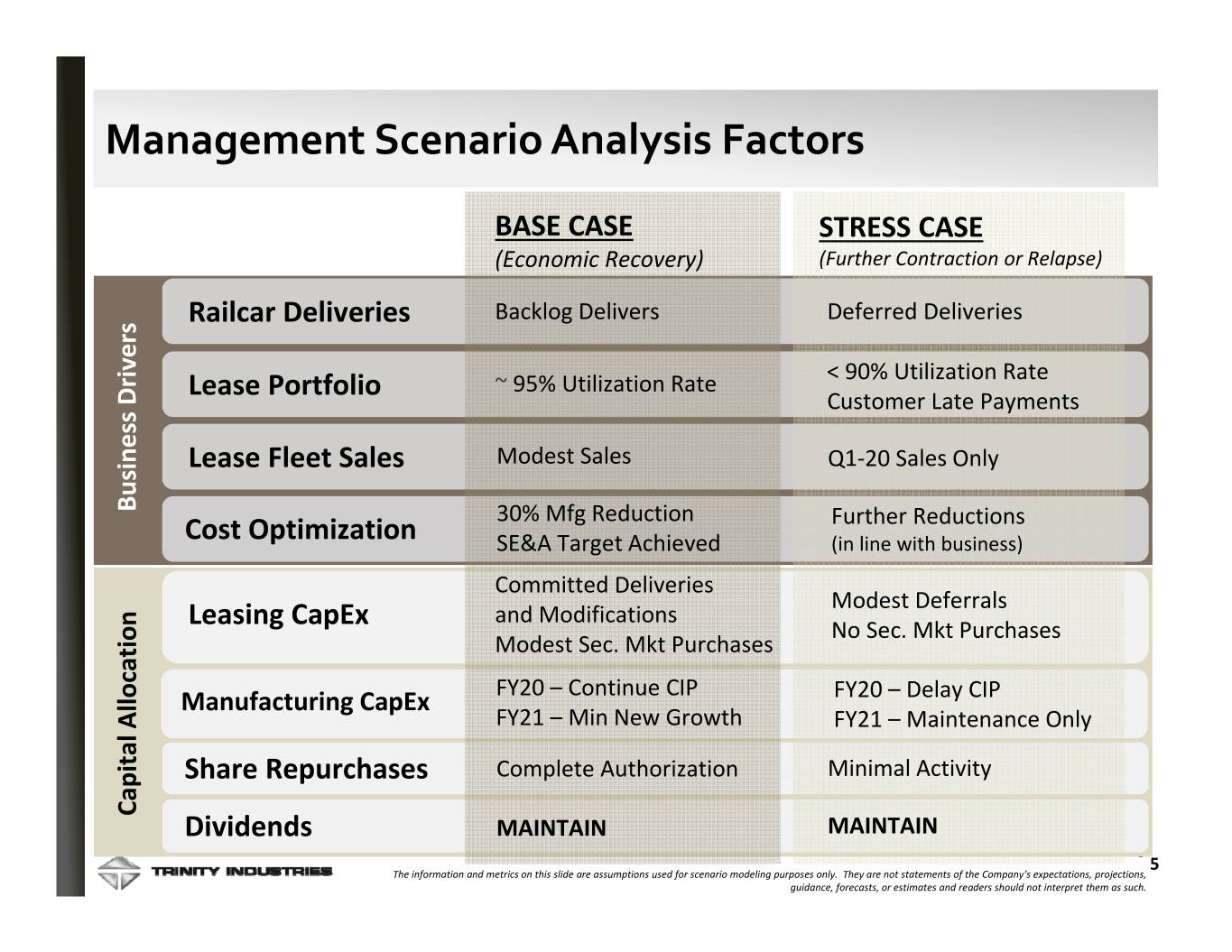

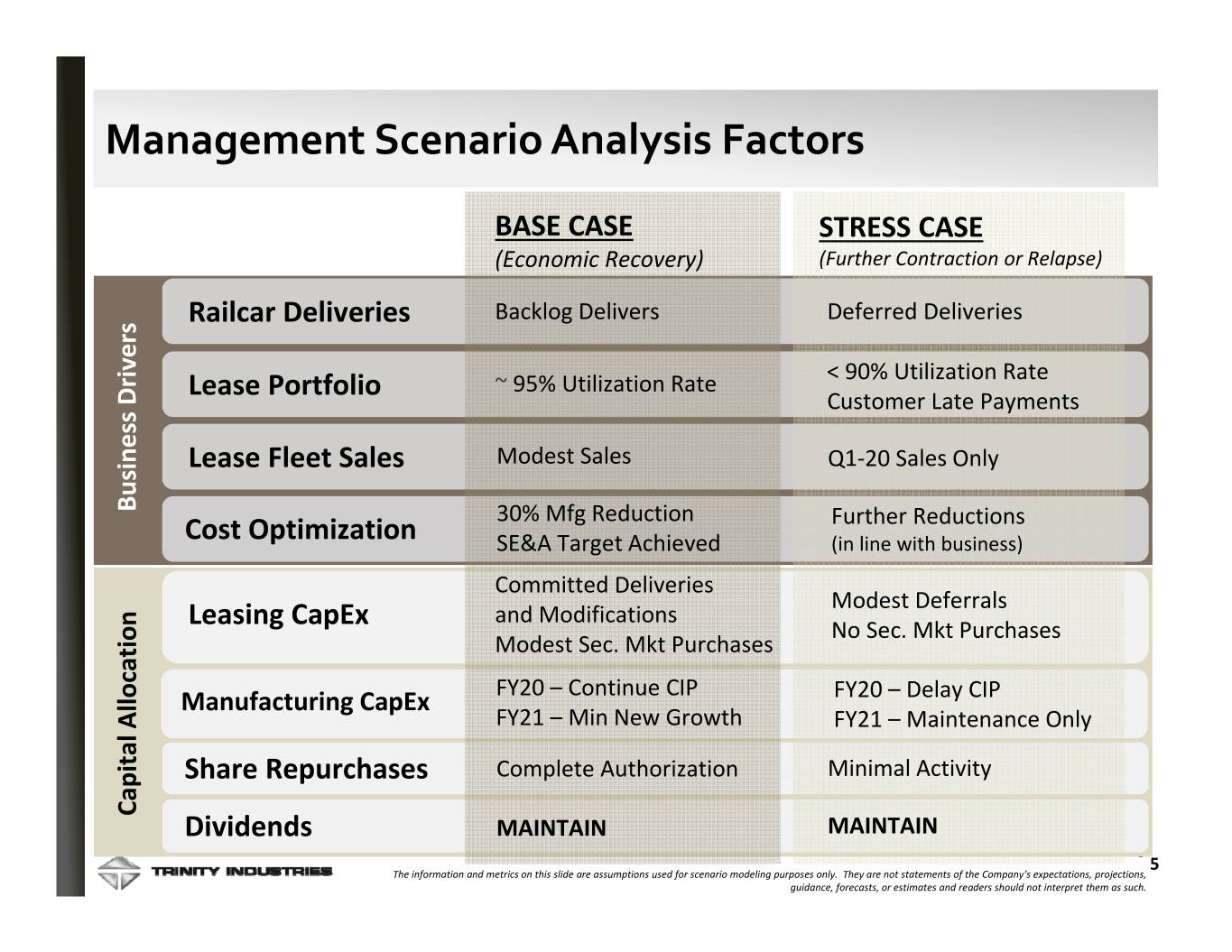

Management Scenario Analysis Factors BASE CASE STRESS CASE (Economic Recovery) (Further Contraction or Relapse) Railcar Deliveries Backlog Delivers Deferred Deliveries Lease Portfolio ~ 95% Utilization Rate < 90% Utilization Rate Drivers Customer Late Payments Lease Fleet Sales Modest Sales Q1‐20 Sales Only Business 30% Mfg Reduction Further Reductions Cost Optimization SE&A Target Achieved (in line with business) Committed Deliveries Modest Deferrals and Modifications Leasing CapEx No Sec. Mkt Purchases Modest Sec. Mkt Purchases FY20 – Continue CIP Manufacturing CapEx FY20 – Delay CIP Allocation FY21 – Min New Growth FY21 – Maintenance Only Share Repurchases Complete Authorization Minimal Activity Capital Dividends MAINTAIN MAINTAIN 5 5 The information and metrics on this slide are assumptions used for scenario modeling purposes only. They are not statements of the Company’s expectations, projections, guidance, forecasts, or estimates and readers should not interpret them as such.