- TRN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Trinity Industries (TRN) DEF 14ADefinitive proxy

Filed: 30 Mar 12, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | |||

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

þ | Definitive Proxy Statement | |||

¨ | Definitive Additional Materials | |||

¨ | Soliciting Material Pursuant to §240.14a-12 | |||

Trinity Industries, Inc. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

þ | No fee required. | |||

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

1) | Title of each class of securities to which transaction applies:

| |||

| ||||

2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

5) | Total fee paid: | |||

| ||||

¨ | Fee paid previously with preliminary materials. | |||

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

1) | Amount Previously Paid:

| |||

| ||||

2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

3) | Filing Party:

| |||

| ||||

4) | Date Filed:

| |||

| ||||

Trinity Industries, Inc.

2525 Stemmons Freeway

Dallas, Texas 75207-2401

www.trin.net

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on April 30, 2012

TO: Trinity Industries, Inc. Stockholders:

Please join us for the 2012 Annual Meeting of Stockholders of Trinity Industries, Inc. The meeting will be held at the principal executive offices of the Company, 2525 Stemmons Freeway, Dallas, Texas 75207, onMonday, April 30, 2012,at 8:30 a.m., Central Daylight Time.

At the meeting, the stockholders will act on the following matters:

(1) Election of the eleven nominees named in the attached proxy statement as directors;

(2) Advisory vote to approve named executive officer compensation;

(3) Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2012; and

(4) Any other matters that may properly come before the meeting.

All stockholders of record at the close of business on March 16, 2012 are entitled to vote at the meeting or any postponement or adjournment of the meeting. A list of the stockholders is available at the Company’s offices in Dallas, Texas.

| By Order of the Board of Directors |

|

| JARED S. RICHARDSON |

| Associate General Counsel and Secretary |

March 30, 2012

YOUR VOTE IS IMPORTANT!

Please vote as promptly as possible by using the internet or telephone or by signing, dating, and returning the enclosed proxy card to the address listed on the card.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be Held on April 30, 2012:

This Proxy Statement and the Annual Report to Stockholders for the fiscal year ended December 31, 2011, are available for viewing, printing, and downloading athttps://materials.proxyvote.com/896522.

| Page | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

Advisory Vote to Approve Named Executive Officer Compensation | 12 | |||

| 13 | ||||

Fees of Independent Registered Public Accounting Firm for Fiscal Years 2011 and 2010 | 13 | |||

| 14 | ||||

| 16 | ||||

| 16 | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 40 | ||||

Discussion Regarding Summary Compensation Table and Grants of Plan-Based Awards Table | 41 | |||

| 43 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

Security Ownership of Certain Beneficial Owners and Management | 53 | |||

| 55 | ||||

| 55 | ||||

| 55 | ||||

Director Nominations or Other Business for Presentation at the 2013 Annual Meeting | 55 | |||

| 56 | ||||

| 56 | ||||

Trinity Industries, Inc.

2525 Stemmons Freeway

Dallas, Texas 75207-2401

www.trin.net

For

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on April 30, 2012

This Proxy Statement is being mailed on or about March 30, 2012 to the stockholders of Trinity Industries, Inc. (the “Company”) in connection with the solicitation of proxies by the Board of Directors of the Company to be voted at the Annual Meeting of Stockholders of the Company to be held at the offices of the Company, 2525 Stemmons Freeway, Dallas, Texas, on Monday, April 30, 2012, at 8:30 a.m., Central Daylight Time (the “Annual Meeting”), or at any postponement or adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The Company’s mailing address is 2525 Stemmons Freeway, Dallas, Texas, 75207.

You may vote in person by attending the meeting, by completing and returning a proxy by mail, or by using the internet or telephone. To vote your proxy by mail, mark your vote on the enclosed proxy card, then follow the instructions on the card. To vote your proxy using the internet or telephone, see the instructions on the proxy form and have the proxy form available when you access the internet website or place your telephone call.

The named proxies will vote your shares according to your directions. If you sign and return your proxy but do not make any of the selections, the named proxies will vote your shares: (i) FOR the election of the eleven nominees for directors as set forth in this Proxy Statement, (ii) FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in these materials, and (iii) FOR the ratification of Ernst & Young LLP as independent registered public accounting firm of the Company for the fiscal year ending December 31, 2012. The proxy may be revoked at any time before it is exercised by filing with the Company a written revocation addressed to the Corporate Secretary, by executing a proxy bearing a later date or by attending the Annual Meeting and voting in person.

The cost of soliciting proxies will be borne by the Company. In addition to the use of postal services or the internet, proxies may be solicited by directors, officers, and regular employees of the Company (none of whom will receive any additional compensation for any assistance they may provide in the solicitation of proxies) in person or by telephone. The Company has hired Georgeson, Inc. to assist in the solicitation of proxies at an estimated cost of $10,000 plus disbursements.

The outstanding voting securities of the Company consist of shares of common stock, $1.00 par value per share (“Common Stock”). The record date for the determination of the stockholders entitled to notice of and to vote at the Annual Meeting, or any postponement or adjournment thereof, has been established by the Board of Directors as the close of business on March 16, 2012. At that date, there were outstanding and entitled to vote 80,245,108 shares of Common Stock.

The presence, in person or by proxy, of the holders of record of a majority of the outstanding shares entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting, but if a quorum should not be present, the meeting may be adjourned from time to time until a quorum is obtained. A holder of Common Stock will be entitled to one vote per share on each matter properly brought before the meeting. Cumulative voting is not permitted in the election of directors.

The proxy card provides space for a stockholder to withhold voting for any or all nominees for the Board of Directors. The election of directors requires a plurality of the votes cast at the meeting. All other proposals require the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the meeting. Shares of a stockholder who abstains from voting on any or all proposals will be included for the purpose of determining the presence of a quorum. Votes withheld with respect to the election of the Company’s directors will not be counted either in favor of or against the election of the nominees. In the case of

1

the other proposals being submitted for stockholder approval, an abstention will effectively count as a vote cast against such proposal. Broker non-votes on any matter, as to which the broker has indicated on the proxy that it does not have discretionary authority to vote, will be treated as shares not entitled to vote with respect to that matter. However, such shares will be considered present and entitled to vote for quorum purposes so long as they are entitled to vote on other matters.

The business affairs of the Company are managed under the direction of the Board of Directors (also referred to in this proxy statement as the “Board”) in accordance with the General Corporation Law of the State of Delaware and the Company’s Certificate of Incorporation and Bylaws. The role of the Board of Directors is to oversee the management of the Company for the benefit of the stockholders. This responsibility includes monitoring senior management’s conduct of the Company’s business operations and affairs; reviewing and approving the Company’s financial objectives, strategies, and plans; risk management oversight; evaluating the performance of the chief executive officer and other executive officers; and overseeing the Company’s policies and procedures regarding corporate governance, legal compliance, ethical conduct, and maintenance of financial and accounting controls. The Board of Directors first adopted Corporate Governance Principles in 1998, which are reviewed annually by the Corporate Governance and Directors Nominating Committee and were last amended in December 2011. The Company has a long-standing Code of Business Conduct and Ethics, which is applicable to all employees of the Company, including the chief executive officer, the chief financial officer, and principal accounting officer, as well as the Board of Directors. The Company intends to post any amendments to or waivers from its Code of Business Conduct and Ethics on the Company’s website to the extent applicable to an executive officer or a director of the Company. The Corporate Governance Principles and the Code of Business Conduct and Ethics are available on the Company’s web site atwww.trin.netunder the heading “Investor Relations-Governance.”

The directors hold regular and special meetings and spend such time on the affairs of the Company as their duties require. During 2011, the Board of Directors held seven meetings. The Board also meets regularly in non-management executive sessions and selects the Presiding Director, who serves as the lead independent director and chairs the non-management executive sessions. Mr. Rhys J. Best currently serves in that capacity. In 2011, all directors of the Company attended at least 75% of the meetings of the Board of Directors and the committees on which they served, except for Mr. Ronald W. Haddock, who attended 71%. Mr. Haddock serves as interim chief executive officer for AEI Services, LLC, and his responsibilities included attending meetings for AEI Services, LLC that conflicted with some of the Company’s Committee meetings. The Company believes this was a temporary situation, and values Mr. Haddock’s service on the Board of Directors. It is Company policy that each director is expected to attend the Annual Meeting. All directors were in attendance at the 2011 Annual Meeting.

The Board of Directors makes all determinations with respect to director independence in accordance with the New York Stock Exchange (“NYSE”) listing standards and the rules and regulations promulgated by the Securities and Exchange Commission (“SEC”). In addition, the Board of Directors has established certain guidelines to assist it in making any such determinations regarding director independence (the “Independence Guidelines”), which are available on the Company’s website atwww.trin.netunder the heading “Investor Relations-Governance-Categorical Standards of Director Independence.” The Independence Guidelines set forth commercial and charitable relationships that may not rise to the level of material relationships that would impair a director’s independence as set forth in the NYSE listing standards and SEC rules and regulations. The actual determination of whether such relationships as described in the Independence Guidelines actually impair a director’s independence is made by the Board on a case-by-case basis.

The Board undertook its annual review of director independence and considered transactions and relationships between each director or any member of his or her immediate family and the Company and its subsidiaries and affiliates. In making its determination, the Board applied the NYSE listing standards and SEC rules and regulations together with the Independence Guidelines. In making such determinations, the Board,

2

amongst other things, considered transactions (i) between the Company’s subsidiaries and subsidiaries of Austin Industries, Inc. (“Austin Industries”) for which Mr. Ronald J. Gafford serves as President and Chief Executive Officer, and (ii) between the Company’s subsidiaries and Southcross Energy, LLC (“Southcross”), for which Mr. David W. Biegler serves as Chairman and Chief Executive Officer.

In 2011, the transactions with Austin Industries involved billings to Austin Industries by the Company of approximately $2,603,000, and invoices to the Company from Austin Industries of approximately $3,700. The transactions involved amounts constituting less than 2% of the consolidated gross revenues of each of Austin Industries and the Company in 2011, were made in the ordinary course of business in arms-length transactions, and substantially all were determined by competitive bids. The transactions involved the purchase by Austin Industries from the Company’s subsidiaries of concrete, and highway products, and the purchase by subsidiaries of the Company of demolished concrete from Austin Industries. Mr. Gafford did not have a direct financial interest in any of the transactions with Austin Industries.

In 2011, a subsidiary of the Company and Southcross entered into a transaction involving the purchase by Southcross from the subsidiary of storage tanks for approximately $1,400,000. This transaction involved an amount constituting less than 2% of the consolidated gross revenues of each of Southcross and the Company in 2011, was made in the ordinary course of business in arms-length transactions, and was the result of a competitive bid process. Mr. Biegler did not have a direct financial interest in this transaction.

As a result of its review, the Board affirmatively determined that the following directors are independent of the Company and its management under the standards set forth in the listing standards of the NYSE and the SEC rules and regulations: John L. Adams, Rhys J. Best, David W. Biegler, Leldon E. Echols, Ronald J. Gafford, Ronald W. Haddock, Adrian Lajous, Melendy E. Lovett, Charles W. Matthews, Diana S. Natalicio, and Douglas L. Rock; and that Timothy R. Wallace is not independent because of his employment as Chairman, Chief Executive Officer, and President of the Company. Dr. Natalicio has reached the mandatory retirement age and is therefore not standing for re-election.

Mr. Wallace serves as the Chairman, Chief Executive Officer, and President of the Company. As stated in the Corporate Governance Principles, the Board believes that the decision as to whether the offices of Chairman and Chief Executive Officer should be combined or separated is the responsibility of the Board. The members of the Board possess experience and unique knowledge of the challenges and opportunities the Company faces. They are, therefore, in the best position to evaluate the current and future needs of the Company and to judge how the capabilities of the directors and senior managers can be most effectively organized to meet those needs. Given his deep knowledge of the Company and experience in leading it through a range of business environments, the Board believes that the most effective leadership structure for the Company is to have Mr. Wallace serve as both Chairman and Chief Executive Officer.

While Mr. Wallace serves as both Chairman and Chief Executive Officer, all other directors are independent. After considering the recommendations of the Human Resources Committee, the independent directors determine Mr. Wallace’s compensation. Further, the Company has four standing committees and an independent Presiding Director. Mr. Wallace does not serve on any Board committee. The Board routinely holds executive succession planning discussions with the Vice President of Organizational Development and Mr. Wallace with respect to all executive officer positions. The Board believes that each of these measures helps to counter-balance any risk in having Mr. Wallace serve as both Chairman and Chief Executive Officer. For these reasons, the Board believes that this leadership structure is effective for the Company.

Mr. Best currently serves as Presiding Director. The Presiding Director has the following roles and responsibilities:

| • | Serve as a member of the Corporate Governance and Directors Nominating Committee; |

| • | Preside at each executive session of non-management and independent directors; |

3

| • | Preside at all meetings when the Chairman and Chief Executive Officer is not present; |

| • | As needed or appropriate, develop agendas for executive sessions of non-management and independent directors; |

| • | Serve as the principal liaison to advise the Company’s Chairman and Chief Executive Officer of actions and/or suggestions taken or made during executive sessions; |

| • | Confer periodically with the Chairman and Chief Executive Officer regarding the quality, quantity, and timeliness of information to be furnished from time to time to the members of the Board; |

| • | To the extent that the Presiding Director is not the Chairman of the Corporate Governance and Directors Nominating Committee, the Presiding Director assists the Chairman of the Corporate Governance and Directors Nominating Committee in planning and executing each self-evaluation process of the Board; |

| • | In those instances where an ongoing dialog between the stockholders and the non-management directors is appropriate, serve as a conduit for communications between the stockholders and the non-management directors; and |

| • | Perform such other duties as the Board from time to time may assign. |

The standing committees of the Board of Directors are the Audit Committee, Corporate Governance and Directors Nominating Committee, Finance and Risk Committee, and Human Resources Committee. Each of the committees is governed by a charter, a current copy of which is available on the Company’s website atwww.trin.netunder the heading “Investor Relations-Governance.” Mr. Wallace, Chairman, Chief Executive Officer, and President of the Company, does not serve on any Board committee. Since Ms. Lovett recently joined the Board of Directors, she does not currently serve on any committees. It is currently anticipated that she will be added to the Audit Committee and the Human Resources Committee. Director membership of the committees is identified below.

| Director | Audit Committee | Corporate Governance & Directors Nominating Committee | Finance & Risk Committee | Human Committee | ||||||||||||||||

John L. Adams | * | * | * | |||||||||||||||||

Rhys J. Best | * | * | * | |||||||||||||||||

David W. Biegler | * | * | * | |||||||||||||||||

Leldon E. Echols | * | * | * | * | ||||||||||||||||

Ronald J. Gafford | * | * | * | |||||||||||||||||

Ronald W. Haddock | * | * | * | |||||||||||||||||

Adrian Lajous | * | * | ||||||||||||||||||

Charles W. Matthews | * | * | * | |||||||||||||||||

Diana S. Natalicio | * | |||||||||||||||||||

Douglas L. Rock | * | * | ||||||||||||||||||

| * | Member |

| ** | Chair |

4

Audit Committee

The Audit Committee’s function is to oversee the integrity of the Company’s financial statements and related disclosures; the Company’s compliance with legal and regulatory requirements; the qualifications, independence, and performance of the Company’s independent auditing firm; the performance of the Company’s internal audit function; the Company’s internal accounting and disclosure control systems; the Company’s procedures for monitoring compliance with its Code of Business Conduct and Ethics; and the Company’s policies and procedures with respect to risk assessment, management, and mitigation. In carrying out its function, the Audit Committee (i) reviews with management, the chief audit executive, and the independent auditors the Company’s financial statements, the accounting principles applied in their preparation, the scope of the audit, any comments made by the independent auditors upon the financial condition of the Company and its accounting controls and procedures; (ii) reviews with management its processes and policies related to risk assessment, management, and mitigation, compliance with corporate policies, compliance programs, internal controls, corporate aircraft usage, summaries of management’s travel and entertainment reports; and (iii) performs such other matters as the Audit Committee deems appropriate. The Audit Committee also pre-approves all auditing and all allowable non-audit services provided to the Company by the independent auditors. The Audit Committee selects and retains the independent auditors for the Company, subject to stockholder ratification, and approves audit fees. The Audit Committee met seven times during 2011. The Board of Directors has determined that all members of the Audit Committee are “independent” as defined by the rules of the SEC and the listing standards of the NYSE. The Board has determined that Mr. Echols, Chair of the Audit Committee, Mr. Biegler, Mr. Haddock, and Mr. Rock are each qualified as an audit committee financial expert within the meaning of SEC regulations.

Corporate Governance and Directors Nominating Committee

The functions of the Corporate Governance and Directors Nominating Committee (“Nominating Committee”) are to identify and recommend to the Board individuals qualified to be nominated for election to the Board; review the qualifications of the members of each committee (including the independence of directors) to ensure that each committee’s membership meets applicable criteria established by the SEC and NYSE; recommend to the Board the members and Chairperson for each Board committee; periodically review and assess the Company’s Corporate Governance Principles and the Company’s Code of Business Conduct and Ethics and make recommendations for changes thereto to the Board; periodically review the Company’s orientation program for new directors and the Company’s practices for continuing education of existing directors; annually review director compensation and benefits and make recommendations to the Board regarding director compensation and benefits; review, approve, and ratify all transactions with related persons that are required to be disclosed under the rules of the SEC; annually conduct an individual director performance review of each incumbent director; and oversee the annual self-evaluation of the performance of the Board. Each of the members of the Nominating Committee is an independent director under the NYSE listing standards. The Nominating Committee met three times during 2011.

In performing its annual review of director compensation, the Nominating Committee utilizes independent compensation consultants from time to time to assist in making its recommendations to the Board. The Nominating Committee reviewed the director compensation for 2011 and recommended certain changes, as outlined in “Director Compensation.”

The Nominating Committee will consider director candidates recommended to it by stockholders. In considering candidates submitted by stockholders, the Nominating Committee will take into consideration the needs of the Board and the qualifications of the candidate. To have a candidate considered by the Nominating Committee, a stockholder must submit the recommendation in writing and must include the following information:

| • | The name of the stockholder, evidence of the person’s ownership of Company stock, including the number of shares owned and the length of time of ownership, and a description of all arrangements or understandings regarding the submittal between the stockholder and the recommended candidate; and |

5

| • | The name, age, business, and residence addresses of the candidate, the candidate’s résumé or a listing of his or her qualifications to be a director of the Company, and the person’s consent to be a director if selected by the Nominating Committee, nominated by the Board, and elected by the stockholders. |

The stockholder recommendation and information described above must be sent to the Corporate Secretary at 2525 Stemmons Freeway, Dallas, Texas 75207 and must be received by the Corporate Secretary not less than 120 days prior to the anniversary date of the date the Company’s proxy statement was released in connection with the previous year’s Annual Meeting of Stockholders.

The Nominating Committee believes that the qualifications for serving as a director of the Company are that a nominee demonstrate depth of experience at the policy-making level in business, government or education, possess the ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company and a willingness to exercise independent judgment, and have an impeccable reputation for honest and ethical conduct in both his or her professional and personal activities. In addition, the Nominating Committee examines a candidate’s time availability, the candidate’s ability to make analytical and probing inquiries, and financial independence to ensure he or she will not be financially dependent on director compensation.

The Nominating Committee identifies potential nominees by asking, from time to time, current directors and executive officers for their recommendation of persons meeting the criteria described above who might be available to serve on the Board. The Nominating Committee also may engage firms that specialize in identifying director candidates. As described above, the Nominating Committee will also consider candidates recommended by stockholders.

Once a person has been identified by the Nominating Committee as a potential candidate, the Nominating Committee makes an initial determination regarding the need for additional Board members to fill vacancies or expand the size of the Board. If the Nominating Committee determines that additional consideration is warranted, the Nominating Committee will review such information and conduct interviews as it deems necessary to fully evaluate each director candidate. In addition to the qualifications of a candidate, the Nominating Committee will consider such relevant factors as it deems appropriate, including the current composition of the Board, the evaluations of other prospective nominees, and the need for any required expertise on the Board or one of its committees. The Nominating Committee also contemplates multiple dynamics that promote and advance diversity among its members. Although the Nominating Committee does not have a formal diversity policy, the Nominating Committee considers a number of factors regarding diversity of personal and professional backgrounds (both domestic and international), national origins, specialized skills and acumen, and breadth of experience in industry, manufacturing, financing transactions, and business combinations. The Nominating Committee’s evaluation process will not vary based on whether or not a candidate is recommended by a stockholder.

Finance and Risk Committee

The oversight duties of the Finance and Risk Committee (the “Finance Committee”) include periodically reviewing the Company’s financial status and compliance with debt instruments; reviewing and making recommendations to the Board regarding financings and refinancing and authorizing financings and refinancing within limits prescribed by the Board; reviewing and assessing risk exposure related to the Company’s operations; monitoring the funds for the Company’s benefit plans; reviewing the Company’s insurance coverages; and reviewing significant acquisitions and dispositions of businesses or assets and authorizing such transactions within limits prescribed by the Board. The Finance Committee met nine times in 2011. The Company periodically identifies, assesses, and risk rates the business, commercial, operational, financial, and other risks associated with its products and services.

Human Resources Committee

The Human Resources Committee (the “HR Committee”) makes recommendations to the Board of Directors in its responsibilities relating to the fair and competitive compensation of the Company’s Chief

6

Executive Officer. The HR Committee has been delegated authority by the Board of Directors to make compensation decisions with respect to the other named executive officers (as defined below). Each of the members of the HR Committee is an independent director under the NYSE listing standards. The HR Committee met five times during 2011.

The HR Committee reviews management succession and approves awards under the Company’s incentive compensation and equity based plans. The HR Committee annually evaluates the leadership and performance of Mr. Wallace, the Company’s Chairman, Chief Executive Officer, and President (collectively referred to as the “CEO”). The HR Committee annually recommends to the Company’s independent directors the total compensation for the CEO. The independent directors are responsible for approving the CEO’s compensation. The CEO provides to the HR Committee his assessment of the performance of his direct reports. The HR Committee also has access to the Company’s key leaders. The HR Committee reviews and approves compensation for the Chief Financial Officer (the “CFO”) and the other executive officers named in the “Summary Compensation Table.” The CEO, the CFO, and the other executive officers named in the “Summary Compensation Table” are referred to in this proxy statement as the “named executive officers.”

The Role of the Compensation Consultant

The HR Committee hires independent executive compensation consultants to provide an assessment of the Company’s executive compensation programs and to perform five key tasks. The consultants (i) review and assist in the design of the Company’s compensation programs, (ii) provide insight into compensation best practices used by other companies, (iii) benchmark the Company’s compensation pay levels with relevant industry surveys, (iv) provide proxy disclosure information for comparator companies, and (v) provide input to the HR Committee on the structure and overall competitiveness of the Company’s compensation programs.

The HR Committee retained the services of Meridian Compensation Partners, LLC (the “Compensation Consultant”) to assist in providing an independent assessment of the executive compensation programs. Meridian Compensation Partners, LLC was the HR Committee’s sole compensation consultant in 2011. The Compensation Consultant reported directly to the HR Committee for the purposes of advising it on matters relating to 2011 compensation. The services of the Compensation Consultant were used only in conjunction with executive compensation matters. The Compensation Consultant was not retained by the Company for any other purpose.

The HR Committee instructed the Compensation Consultant to provide analyses, insight, and benchmarking information for 2011 on the named executive officers and other key executives to determine whether the compensation packages for these executives were competitive with the market and met the objective of the Company to attract, motivate, and retain the best talent. The Compensation Consultant was instructed to:

| • | review the total direct compensation (base salary, annual incentive, and long term incentive); |

| • | confirm that the comparator companies selected by the HR Committee were appropriate; and |

| • | gather publicly traded comparator company proxies and market surveys to ascertain market competitive rates specifically for the named executive officers. |

The Compensation Consultant benchmarked all components of compensation for 2011, excluding the Executive Perquisite Allowance, and determined the 25th percentile, 50th percentile (market median), and the 75th percentile for each position.

The Role of Management

The CEO, the CFO, and the Senior Vice President of Human Resources work with the HR Committee and the Compensation Consultant to develop the framework and design the plans for all compensation components. The CEO and CFO recommend the financial performance measurements for the annual incentive awards and the long term performance-based restricted stock awards, subject to HR Committee approval. The CFO certifies as to the achievement of these financial performance measures. The Senior Vice President of Human Resources

7

implements compensation-related policies and procedures and oversees the execution of each plan. The HR Committee recommends to the independent directors Mr. Wallace’s compensation for their approval. The CEO makes recommendations to the HR Committee on compensation for each of the other named executive officers.

The Role of the HR Committee

The HR Committee reviews the CEO’s assessment of the performance of the other named executive officers. The review is conducted prior to the year in which any adjustment to base salary, annual incentive or long term incentive becomes effective. Both annual incentives and long term incentives are established as a percent of base salary with threshold, target, and maximum payout levels.

The HR Committee realizes that benchmarking and comparing peer group proxy disclosure data require certain levels of interpretation due to the complexities associated with executive compensation plans. The HR Committee uses the benchmarking information and the peer group proxy disclosure data provided by the Compensation Consultant as general guidelines and makes adjustments to compensation levels based on what the HR Committee believes is in the best interests of the Company’s stockholders. The HR Committee uses its judgment and bases its consideration of each executive’s compensation on past and expected future performance in respect to specific financial, strategic, and operating objectives; the scope of each executive’s responsibilities within the Company; the executive’s value to the Company; and market survey data that establishes the market ranges against which compensation is benchmarked.

Board’s Role in Risk Oversight

The Audit Committee has the responsibility to oversee the Company’s policies and procedures relating to risk assessment, management, and mitigation. The Finance Committee has the responsibility to review and assess risk exposure related to the Company’s operations, including safety, environmental, financial, contingent liabilities, and other risks which may be material to the Company, as well as the activities of management in identifying, assessing, and mitigating against business, commercial, operational, financial, and personal risks associated with the Company’s products and services. The Finance Committee accomplishes this responsibility as described in “Corporate Governance — Board Committees — Finance and Risk Committee.” In addition, the Audit Committee, in its discretion, reviews the Company’s major risks and exposures, including (i) any special-purpose entities, complex financing transactions and related off-balance sheet accounting matters; and (ii) legal matters that may significantly impact the Company’s financial statements or risk management.

Risk Assessment of Compensation Policies and Practices

The Company conducts a detailed risk assessment of its compensation policies and practices for its employees, including its executive officers. The Company’s Internal Audit group reviews the Company’s compensation policies and practices (the “Compensation Policies”), and meets with the Company’s management to discuss risks presented by the Compensation Policies. Based on these discussions, and a review of the Compensation Policies, the Internal Audit group assesses the likelihood and potential impact of the risk presented by the Compensation Policies.

The Internal Audit group presents its findings to an internal committee consisting of a cross-section of corporate and business segment executives that meets quarterly to review identified risks and assess exposures. This committee considers the Internal Audit group’s findings and assessments. This committee has concluded that the Compensation Policies are not reasonably likely to have a material adverse effect on the Company.

Compensation Committee Interlocks and Insider Participation

Messrs. Best, Echols, Gafford, Haddock, Jess T. Hay, Matthews, Rock, and Dr. Natalicio served on the HR Committee during the last completed fiscal year. None of the members of the HR Committee has ever served as an executive officer or employee of the Company or any of its subsidiaries. There were no compensation committee interlocks during 2011. Mr. Hay retired from service on the Board of Directors and the HR Committee in May 2011.

8

The Board has established a process to receive communications by mail from stockholders and other interested parties. Stockholders and other interested parties may contact any member of the Board, including the Presiding Director, Mr. Best, or the non-management directors as a group, any Board committee or any chair of any such committee. To communicate with the Board of Directors, any individual director or any group or committee of directors, correspondence should be addressed to the Board of Directors or any such individual director or group or committee of directors by either name or title. All such correspondence should be sent “c/o Corporate Secretary” at 2525 Stemmons Freeway, Dallas, Texas 75207.

All communications received as set forth in the preceding paragraph will be opened by the office of the Corporate Secretary for the sole purpose of determining whether the contents represent a message to directors. Any contents that are not in the nature of advertising, promotions of a product or service, or offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Corporate Secretary will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope is addressed.

PROPOSAL 1 — ELECTION OF DIRECTORS

The Board of Directors currently consists of twelve members, but will decrease to eleven effective with Dr. Natalicio’s retirement at the time of the Annual Meeting of Stockholders.

Following a recommendation from the Nominating Committee, each member of the Board of Directors other than Dr. Natalicio has been nominated by the Board for election at the Annual Meeting to hold office until the next Annual Meeting or the election of their respective successors. The director nominees are John L. Adams, Rhys J. Best, David W. Biegler, Leldon E. Echols, Ronald J. Gafford, Ronald W. Haddock, Adrian Lajous, Melendy E. Lovett, Charles W. Matthews, Douglas L. Rock, and Timothy R. Wallace. The Board of Directors has determined that all of the director nominees other than Mr. Wallace are “independent directors.” Mr. Wallace is the Company’s Chairman, Chief Executive Officer, and President. Therefore, the Board of Directors has concluded that Mr. Wallace is not an independent director.

The Board of Directors believes that each of the director nominees possesses the qualifications described above in “Corporate Governance — Board Committees — Corporate Governance and Directors Nominating Committee.” That is, the Board believes that each nominee possesses: (i) deep experience at the policy making level in business, government or education, (ii) the ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company, (iii) a willingness to exercise independent judgment, and (iv) an impeccable reputation for honest and ethical conduct in both his or her professional and personal activities.

The information provided below is biographical information about each of the nominees, as well as a description of the experience, qualifications, attributes or skills that led the Board to conclude that the individual should be nominated for election as a director of the Company.

Timothy R. Wallace, 58. Director since 1992. Mr. Wallace has been Chairman, Chief Executive Officer, and President of the Company since 1999. From 2004 — 2008, Mr. Wallace was a director of MoneyGram International, Inc., a payment service and money transfer business.

Mr. Wallace joined the Company in 1975. During his long tenure with the Company, Mr. Wallace has consistently shown strong performance in a variety of roles, requiring a wide range of business and interpersonal skills. He has provided excellent leadership to the Company in his current positions, exhibiting sound judgment and business acumen.

9

John L. Adams, 67. Director since 2007. Mr. Adams is Chairman of the Finance Committee and a member of the Nominating Committee. Mr. Adams served as Executive Vice President of the Company from 1999 — 2005, serving thereafter on a part time basis as Vice Chairman until leaving the employ of the Company to join the Board of Directors in 2007. Prior to joining the Company, Mr. Adams was with Texas Commerce Bank (now JPMorgan Chase Bank of Texas) for 25 years, with his last position being Chairman, President, and CEO. Since 2007, he has served on several corporate and not-for-profit boards. Mr. Adams is the Chairman of the board and a director of Group 1 Automotive, Inc., a company engaged in the ownership and operation of automotive dealerships and collision centers. He also serves on the audit committee and is a director of Dr Pepper Snapple Group, Inc., a company that is a leading brand owner, bottler, and distributor of non-alcoholic beverages in the U.S., Canada, and Mexico.

As a result of his past employment by the Company, Mr. Adams brings significant knowledge and understanding of the Company’s operations and business environment. In addition, he has experience as a senior executive in the banking industry, which provides the Board with experience in managing financing transactions. His service on the boards of other significant companies provides the Board with additional perspective on the Company’s operations.

Rhys J. Best, 65. Director since 2005. Mr. Best serves as the Presiding Director, and is a member of Nominating Committee, the Finance Committee, and the HR Committee. Mr. Best served, beginning in 1999, as Chairman, President, and CEO of Lone Star Technologies, Inc., a company engaged in the production and marketing of casing, tubing, line pipe, and couplings for the oil and gas, industrial, automotive, and power generation industries. He was also a director of, and remained in these positions with, Lone Star Technologies, Inc., until its acquisition by United States Steel Corporation in 2007. Mr. Best has been engaged in private investments since 2007. He is also Chairman of Crosstex Energy, L.P., an energy company engaged in the gathering, transmission, treating, processing, and marketing of natural gas and natural gas liquids. Mr. Best is also a member of the board of directors of Cabot Oil & Gas Corporation, a leading North American oil and gas exploration and production company; Commercial Metals Corporation, which recycles, manufactures, and markets steel and metal products and related materials; Austin Industries, Inc., a privately-held civil, commercial, and industrial construction company; and McJunkin Red Man Corporation, a privately-held company engaged in the distribution of industrial PVF products, serving the refining, chemical, petrochemical, gas distribution and transmission, oil and gas exploration and production, pharmaceutical, and power generation industries.

Mr. Best has broad experience in managing and leading significant industrial enterprises. His service on the boards of other significant companies provides the Board with additional perspective on the Company’s operations, including its international operations and future international opportunities.

David W. Biegler, 65. Director since 1992. Mr. Biegler is a member of the Audit Committee, the Nominating Committee, and the Finance Committee. Mr. Biegler serves as the Chairman and CEO of Southcross Energy, LLC, a company engaged in natural gas transportation and processing. He retired as Vice Chairman of TXU Corp., a company engaged in the generation, transmission, and sale of electricity, at the end of 2001, having served TXU Corp. as President and Chief Operating Officer from 1997 — 2001. Mr. Biegler is also a director of Southwest Airlines, Inc., a major domestic airline; and Austin Industries, Inc., a privately-held civil, commercial, and industrial construction company. In addition, Mr. Biegler served as a director of Guaranty Financial Group Inc., a company conducting consumer and business banking activities, from 2008 — 2009; Dynegy, Inc., a company engaged in power generation, from 2003 — 2011; and Animal Health International, a company engaged in selling and distributing animal health products, from 2007 — 2011.

Mr. Biegler has broad experience in managing and leading significant industrial enterprises. His service on the boards of other significant companies provides the Board with additional perspective on the Company’s operations.

Leldon E. Echols, 56. Director since 2007. Mr. Echols is Chairman of the Audit Committee and a member of the HR Committee and the Finance Committee. He served as Executive Vice President and Chief Financial Officer of Centex Corporation (“Centex”), a residential construction company, from 2000 — 2006 when he

10

retired. Prior to joining Centex, he spent 22 years with Arthur Andersen LLP and served as Managing Partner, Audit Practice for the North Texas, Colorado, and Oklahoma Region from 1997 — 2000. Mr. Echols is a member of the American Institute of Certified Public Accountants and the Texas Society of CPAs. Mr. Echols has been engaged in private investments since 2006. He is a member of the board of directors and Chairman of the audit committee of Crosstex Energy, L.P., an energy company engaged in the gathering, transmission, treating, processing, and marketing of natural gas and natural gas liquids and Crosstex Energy, Inc., a company holding partnership interests of Crosstex Energy, L.P. He is also a member of the board of directors and Chairman of the audit committees of Holly/Frontier Corporation, an independent petroleum refiner, and Roofing Supply Group Holdings, Inc., a privately-held company engaged in the distribution of roofing and related construction materials. In addition, Mr. Echols served as a director of TXU Corp. from 2005 — 2007. The Board has determined that Mr. Echols’ service on the audit committees of these other public companies does not impair his ability to serve on the audit committee of the Company.

In addition to having gained substantial managerial experience as an executive officer of Centex, Mr. Echols possesses important skills and experience gained through his service in public accounting. His service on the boards of other significant companies provides the Board with additional perspective on the Company’s operations.

Ronald J. Gafford, 62. Director since 1999. Mr. Gafford is Chairman of the HR Committee and a member of the Nominating Committee. Mr. Gafford has been President and Chief Executive Officer of Austin Industries, Inc., a privately-held civil, commercial, and industrial construction company, since 2001 and Chairman since 2008. From 2005 — 2007, Mr. Gafford served as a member of the board of directors of Chaparral Steel Company, a leading supplier of structural steel and steel bar products.

Mr. Gafford has broad experience in managing and leading a significant industrial enterprise. His service as the Chief Executive Officer of Austin Industries, Inc. provides the Board with additional perspective on the Company’s operations.

Ronald W. Haddock, 71. Director since 2005. Mr. Haddock is a member of the Audit Committee, the Nominating Committee, and the Finance Committee. Mr. Haddock was Chief Executive Officer of FINA, Inc., an international energy company, from December 1989 until his retirement in July 2000. He was also the Executive Chairman, CEO, and director of Prisma Energy International, a power generation, power distribution, and natural gas distribution company from 2003 until its acquisition by Ashmore Energy International Limited. He currently serves as Chairman of the board and interim CEO of AEI Services, LLC, a privately-held international power generator and distributor and natural gas distribution company. He is also Chairman of the Board of Safety-Kleen Systems, Inc., an environmental services, oil recycling, and refining company; and is a director of Alon USA Energy, Inc., a petroleum refining and marketing company; and Petron, a refining and marketing company based in the Philippines. Under the Board’s retirement policy, this will be the last year that he will be nominated for election to the Board.

Mr. Haddock has broad experience in managing and leading significant enterprises. His service on the boards of other significant companies provides the Board with additional perspective on the Company’s operations, including its international opportunities.

Adrian Lajous, 68. Director since 2006. Mr. Lajous is a member of the Audit Committee and the Finance Committee. Mr. Lajous has been Senior Energy Advisor for McKinsey & Company, a management consulting firm, and President of Petrométrica, S.C., an energy consulting company, since 2001. Mr. Lajous served Pemex in several capacities between 1982 and 1999, having served as Director General and CEO from 1994 — 1999. Mr. Lajous is Chairman of the Oxford Institute for Energy Studies and is a director of Schlumberger, Ltd., an oilfield services company supplying technology, project management, and information solutions to the oil and gas industry; and Ternium, S.A., a company engaged in the production and distribution of semi-finished and finished steel products.

Mr. Lajous has broad experience in managing and leading significant industrial enterprises in Mexico, where the Company has a number of operations. His service on the boards of other significant companies provides the Board with additional perspective on the Company’s operations.

11

Melendy E. Lovett, 54. Director since March 2012. Ms. Lovett has been senior vice president, and president of the education technology business, for Texas Instruments Incorporated (“TI”), a major semiconductor manufacturer, since 2004. Since 1993, she served TI in a number of capacities, including service as Vice President and Manager, Total Compensation and HR Services from 1998 — 2004. Ms. Lovett is a certified public accountant and a member of the American Institute of Certified Public Accountants and the Texas Society of CPAs.

Ms. Lovett has substantial managerial experience as an executive officer and business group president for TI. In addition, Ms. Lovett possesses skills and experience important to the Company in the areas of human resources, information technology, and accounting. Ms. Lovett was recommended to the Nominating Committee for service as a director by Mr. Wallace.

Charles W. Matthews, 67. Director since 2010. Mr. Matthews is Chairman of the Nominating Committee and a member of the HR Committee. Mr. Matthews served Exxon Mobil Corporation, one of the leading global energy companies in the world, and its predecessor, Exxon Corporation, in several capacities in its legal department since 1971 before being appointed Vice President and General Counsel in 1995 until his retirement in 2010. He is a member of the board of directors of Cullen/Frost Bankers, Inc., a financial holding company and bank holding company.

During his long employment at Exxon Mobil Corporation, Mr. Matthews accumulated broad experience in legal, managerial, and other matters in the energy industry around the world.

Douglas L. Rock, 65.Director since 2010. Mr. Rock is a member of the Audit Committee and the HR Committee. From 1990 to August 2010, Mr. Rock served as the Chairman of the board of Smith International, Inc., an oilfield services company. Mr. Rock joined Smith International, Inc. in 1974 and served as Chief Executive Officer, President and Chief Operating Officer from 1989 — 2008. From 2004 — 2009, he served as a director of MoneyGram International, Inc., a payment service and money transfer business, and from 1999 — 2008 he served as a director of CE Franklin Ltd., a distributor of pipe, valves, flanges, fittings, production and process control equipment, tubular products and other general oilfield supplies to the oil and gas industry in Canada.

Mr. Rock has broad experience in managing and leading a significant industrial enterprise. His recent service on the boards of other significant companies provides the Board with additional perspective on the Company’s operations.

The Board of Directors recommends that you vote FOR all of the Nominees.

PROPOSAL 2 — ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

The Company seeks approval, on an advisory basis, from its stockholders of the compensation of its named executive officers as described in this proxy statement.

As discussed in the Compensation Discussion and Analysis section of this proxy statement, the Company’s long term strategic corporate vision is to be a premier multi-industry company that provides superior value to stockholders. The Board of Directors believes that realization of this vision depends in large measure on the talents of the Company’s employees. The Company’s compensation system plays a significant role in its ability to attract, motivate, and retain a high quality workforce. As described in the Compensation Discussion and Analysis, the Company’s executive compensation program (i) encourages high levels of performance and accountability, (ii) aligns the interests of executives with those of stockholders, (iii) links compensation to business objectives and strategies, and (iv) takes into account, as appropriate, the cyclical nature of the Company’s businesses.

12

At the Company’s 2011 Annual Meeting, the Company held a stockholder advisory vote on the compensation of its named executive officers as described in the 2011 proxy statement, commonly referred to as a say-on-pay vote. The stockholders overwhelmingly approved the named executive officers’ compensation, with approximately 85% of the stockholders present and entitled to vote at the meeting voting in favor of the 2011 say-on-pay resolution. The Company believes this approval affirms the stockholders’ support of the Company’s approach to executive compensation.

This proposal provides stockholders the opportunity to approve or not approve the Company’s executive compensation program through the following resolution:

“Resolved, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby approved.”

Because this is an advisory vote, it will not be binding upon the Board of Directors. However, the HR Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

The Board of Directors recommends that you vote FOR approval of this resolution.

PROPOSAL 3 — RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP

The Audit Committee has appointed Ernst & Young LLP (“Ernst & Young”) as independent registered public accounting firm of the Company for the fiscal year ending December 31, 2012, subject to ratification of stockholders.

The Company has been advised by Ernst & Young that the firm has no relationship with the Company or its subsidiaries other than that arising from the firm’s engagement as auditors, tax advisors, and consultants.

Ernst & Young, or a predecessor of that firm, has been the auditors of the accounts of the Company each year since 1958. The Company has also been advised that representatives of Ernst & Young will be present at the Annual Meeting where they will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

Fees of Independent Registered Public Accounting Firm for Fiscal Years 2011 and 2010

The following table presents fees for professional audit services rendered by Ernst & Young for the audits of the Company’s annual financial statements for the years ended December 31, 2011 and 2010, and fees for other services rendered by Ernst & Young during those periods:

| 2011 | 2010 | |||||||

Audit fees | $ | 2,857,000 | $ | 2,527,600 | ||||

Audit-related fees | 308,860 | 139,911 | ||||||

Tax fees | 224,244 | 208,248 | ||||||

All other fees | 251,740 | 193,295 | ||||||

Services rendered by Ernst & Young in connection with fees presented above were as follows:

Audit Fees

In fiscal years 2011 and 2010, audit fees include fees associated with the annual audit of the Company’s financial statements, the assessment of the Company’s internal control over financial reporting as integrated with the annual audit of the Company’s financial statements, the quarterly reviews of the financial statements included in the Company’s Form 10-Q filings, statutory audits in Mexico and Europe, and consents included in other SEC filings.

13

Audit-Related Fees

Audit-related fees include fees for employee benefit plan audits, use of online research tools, and certain compliance audits.

Tax Fees

Tax fees in fiscal years 2011 and 2010 include fees for tax advice, tax planning, and tax return review.

All Other Fees

All other fees consist of insurance claim services and government contract services. The insurance claim services related to the flooding at two of the Company’s barge facilities, one in Ashland City, Tennessee during 2010 and a second in Caruthersville, Missouri during 2011. These services include advising the Company of the appropriate methodologies for preparation of insurance claims and assisting in the assembly, analysis, and organization of accounting documentation with respect to the recovery of expenditures and business losses. The government contract services related to consultations on proper bidding procedures and documentation requirements for a government contract.

The Audit Committee pre-approves all audit and permissible non-audit services provided by Ernst & Young. These services may include audit services, audit-related services, tax services, and other services. The Audit Committee has adopted a policy for the pre-approval of services provided by Ernst & Young. In addition, the Audit Committee also may pre-approve particular services on a case-by-case basis. The Audit Committee has delegated pre-approval authority to the Chair of the Audit Committee. Pursuant to this delegation, the Chair must report any pre-approval decision by him to the Audit Committee at its first meeting after the pre-approval was obtained. Under this policy, pre-approval is generally provided for up to one year, and any pre-approval is detailed as to the particular services or category of services and includes an anticipated budget.

We are a standing committee comprised of independent directors as “independence” is currently defined by SEC regulations and the applicable listing standards of the NYSE. The Board of Directors has determined that five of the members of the Audit Committee are “audit committee financial experts” as defined by applicable SEC rules. We operate under a written charter adopted by the Board of Directors. A copy of the charter is available free of charge on the Company’s website atwww.trin.netunder the heading “Investor Relations — Governance.”

We annually select the Company’s independent auditors. That recommendation is subject to ratification by the Company’s stockholders.

Management is responsible for the Company’s internal controls and the financial reporting process. The independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and issuing a report thereon. As provided in our charter, our responsibilities include the monitoring and oversight of these processes.

Consistent with our charter responsibilities, we have met and held discussions with management and the independent auditors. In this context, management and the independent auditors represented to us that the Company’s consolidated financial statements for the fiscal year ended December 31, 2011 were prepared in accordance with U.S. generally accepted accounting principles. We reviewed and discussed the consolidated financial statements with management and the independent auditors and discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61, as amended.

14

The Company’s independent auditors have also provided to us the written disclosures and the letter required by applicable requirements of The Public Company Accounting Oversight Board regarding the independent auditor’s communications with the Audit Committee, and we discussed with the independent auditors that firm’s independence. We also considered whether the provision of non-audit services is compatible with maintaining the independent auditors’ independence and concluded that such services have not impaired the auditors’ independence.

Based upon our reviews and discussions with management and the independent auditors and our review of the representation of management and the report of the independent auditors to the Audit Committee, we recommended that the Board of Directors include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 filed with the Securities and Exchange Commission.

Audit Committee

Leldon E. Echols, Chairman

David W. Biegler

Ronald W. Haddock

Adrian Lajous

Douglas L. Rock

The Board of Directors recommends that you vote FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012.

15

Compensation Discussion and Analysis

The following Compensation Discussion and Analysis describes how the HR Committee designed the executive compensation programs and set individual pay for the executive officers named in the Summary Compensation Table.

Executive Summary

The Company is a multi-industry company that owns a variety of market-leading businesses which provide products and services to the industrial, energy, transportation, and construction sectors. Managing these diverse businesses to provide growth and long-term value to stockholders requires a team of innovative, dedicated, and experienced executives. The Company has a clear and consistent executive compensation philosophy based on pay for performance. The Company’s executive compensation programs are designed to drive executive accountability for performance of the Company as a whole. The Company’s executive compensation programs contribute to a performance-driven culture where executives are expected to deliver results that promote the Company’s position as a premier, multi-industry company.

Objectives of the Executive Compensation Programs

The primary emphasis of the Company’s executive compensation programs is to encourage and reward achievement of the Company’s annual and long-term business goals. Those goals are set by management, with oversight of the Board of Directors, and are designed to promote sustainable growth in stockholder value. As stockholders themselves, the Company’s leaders are keenly focused on achieving these goals. The executive compensation programs reflect the Company’s pay for performance philosophy.

The HR Committee’s objectives for the Company’s executive compensation programs are to:

| • | attract, motivate, and retain the key executives needed to enhance the performance and profitability of the Company; |

| • | encourage the highest level of performance and accountability for the overall success of the Company; |

| • | provide an incentive for long-term value creation for stockholders; |

| • | align compensation with short-term and long-term business objectives and strategies, financial targets, and the core values of the Company; and |

| • | take into account as appropriate the cyclical nature of the Company’s businesses. |

Role of Stockholder Say on Pay Votes

In May 2011, the Company held a stockholder advisory vote on the compensation of its named executive officers as described in the 2011 proxy statement, commonly referred to as a say-on-pay vote. The stockholders overwhelmingly approved the named executive officers’ compensation, with approximately 85% of the stockholders present and entitled to vote at the meeting voting in favor of the 2011 say-on-pay resolution. As the Company evaluated its compensation practices and talent needs throughout 2011, it was mindful of the strong support stockholders expressed for its pay for performance compensation philosophy. As a result, following its annual review of executive compensation, the HR Committee decided to maintain a consistent approach to executive compensation, with an emphasis on short- and long-term incentive compensation that rewards senior executives for delivering value for stockholders. In addition, the HR Committee considered ways to strengthen the pay for performance culture at the Company. In determining how often to hold a stockholder advisory vote on executive compensation, the Board of Directors took into account the strong preference for an annual vote

16

expressed by stockholders at the 2011 Annual Meeting. Accordingly, the Board of Directors determined that the Company will hold an annual advisory stockholder vote on executive compensation until the next say-on-pay frequency vote.

Design of the Executive Compensation Programs

The Company’s executive compensation programs reinforce the importance of performance and accountability Company-wide and at the individual level. The Company’s executive compensation programs are designed to:

| • | provide a reasonable balance between short-term and long-term compensation; |

| • | provide a reasonable mix of fixed and incentive-based compensation; |

| • | retain key executives through the cycles of the Company’s businesses; |

| • | be competitive based on market survey data and peer group proxy disclosure data; |

| • | use equity-based awards, stock ownership guidelines, and annual incentives that are linked to stockholder interests; and |

| • | be transparent and easy to understand by the programs’ participants and the Company’s stockholders. |

Components of Compensation

The executive compensation programs have four key components:

| • | a base salary; |

| • | an executive perquisite payment; |

| • | an annual incentive plan designed to focus executives on the Company’s short-term performance; and |

| • | a long-term incentive plan designed to encourage executives to promote the Company’s position as a premier, multi-industry company. |

Total Target Compensation Overview

This discussion should be read in conjunction with the Summary Compensation Table and related tables and narrative disclosures that follow the tables which set forth the compensation of the CEO and the other named executive officers.

The HR Committee considers each named executive officer’s compensation based on the overall objectives of the Company’s compensation programs and the following:

| • | past and expected future performance with respect to specific financial, strategic, and operating objectives; |

| • | the breadth, complexity, and scope of each executive’s responsibilities within the Company; |

| • | the executive’s value to the Company; |

| • | a review of peer group proxy disclosure data; and |

| • | market survey data against which compensation is benchmarked. |

The HR Committee realizes that benchmarking against market survey data and the comparison of peer group proxy disclosure data requires a degree of interpretation due to the potential differences in position scope, the complexities associated with executive compensation plans, and the evolution of public company compensation disclosures. The HR Committee uses the benchmarking information and the peer group proxy disclosures provided by the Compensation Consultant as general guidance and makes adjustments to compensation levels based on what the HR Committee believes to be consistent with the overall compensation objectives of the Company and in the best long-term interests of the Company’s stockholders.

17

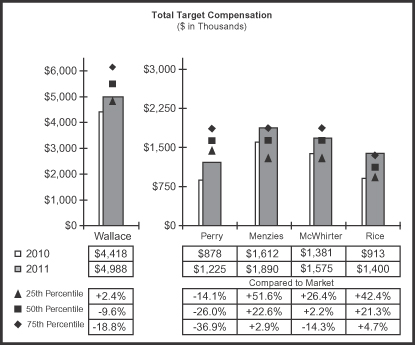

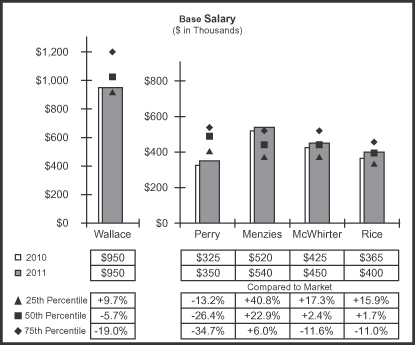

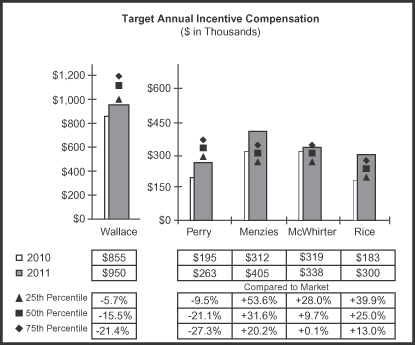

The HR Committee generally targets total compensation for the named executive officers between the 50th and 75th percentile of total target compensation for executives in similar positions as derived from market survey data. The HR Committee believes this range is appropriate and sufficient to attract, motivate, and retain the key executives needed to enhance the performance and profitability of the Company. The HR Committee develops the total target compensation amounts using the objectives noted above and the percentile range as general guidelines. Total target compensation may be set closer to the 50th percentile if named executive officers are in the early stages of their careers or relatively new to their current positions. Total target compensation may be set closer to the 75th percentile if named executive officers are seasoned executives with seniority in their roles at the Company or have extensive work experience in similar positions elsewhere that the HR Committee has determined provides additional value. The HR Committee considers this range together with an assessment of each named executive officer under the additional considerations mentioned above. The HR Committee also considers (i) the relatively high percentage of performance-based compensation, which may result in total compensation levels that vary from the target percentiles described above, (ii) the periodic and relative impact on earnings of external business conditions outside the control of the executives, and (iii) the cyclical nature of the Company’s businesses.

Allocation of Compensation

Although there is no pre-established policy or target for the allocation between short-term and long-term, or fixed and incentive-based compensation, the aggregate results of the Company’s compensation and benefits programs for named executive officers have generally reflected the following principles.

Short-term Compensation Versus Long-term Compensation

A named executive officer’s short-term compensation is normally paid in cash and consists of three primary components:

| • | a base salary; |

| • | an executive perquisite payment; and |

| • | annual incentive compensation. |

A named executive officer’s short-term compensation (the sum of the short-term components listed above) generally falls within a range of 35% to 60% of total compensation.

A named executive officer’s long-term compensation consists of four primary components:

| • | incentive compensation that typically consists of annual equity awards with long-term vesting and/or multi-year performance periods; |

| • | retirement benefits; |

| • | deferred compensation; and |

| • | pre-planned, transitional compensation. |

A named executive officer’s long-term compensation (the sum of the long-term components listed above) generally falls within a range of 40% to 65% of total compensation. The HR Committee believes that this percentage range appropriately rewards the named executive officers for meeting short-term business objectives, while also maintaining their focus on long-term Company performance.

Fixed Versus Incentive-Based Compensation

The Company combines both fixed and incentive-based compensation to attract, motivate, and retain top quality executive management, while encouraging the highest level of performance and accountability for the

18

success of the Company as a whole and to create long-term value for stockholders. A named executive officer’s fixed compensation is established to appropriately and fairly compensate the executive given the breadth, complexity, and scope of the responsibilities required by the position. The incentive-based compensation component is based on achieving measurable goals. The named executive officer’s incentive-based compensation includes the following components:

| • | annual incentives typically paid in cash; and |

| • | long-term incentives typically made through equity awards. |

Incentive-based target compensation (including both short-term and long-term compensation) is generally within a range of 60% to 80% of a named executive officer’s total target compensation. The HR Committee believes that this range is appropriate and sufficient to attract, motivate, and retain the key executives needed to enhance the profitability and performance of the Company. The percentage of compensation that is incentive-based increases as a named executive officer’s scope of responsibilities increases. As Chairman, Chief Executive Officer, and President of the Company, Mr. Wallace has a unique and broader range of responsibilities than the other named executive officers, including ultimate responsibility for the overall success of the Company. The HR Committee has therefore determined it is appropriate that he should have the highest percentage of incentive-based target compensation.

The Named Executive Officers

The Board of Directors has delegated to the HR Committee oversight of the Company’s executive compensation programs. The HR Committee reviews and recommends the compensation for the CEO to the independent directors for their approval. The HR Committee reviews and approves the compensation of the other named executive officers. The five named executive officers for 2011 were:

| • | Timothy R. Wallace, Chairman, Chief Executive Officer, and President |

| • | James E. Perry, Senior Vice President and Chief Financial Officer |

| • | D. Stephen Menzies, Senior Vice President and Group President |

| • | William A. McWhirter, Senior Vice President and Group President |

| • | S. Theis Rice, Senior Vice President, Human Resources and Chief Legal Officer |

Analysis through Benchmarking and Peer Group Proxy Disclosure Data

The HR Committee retains the Compensation Consultant to provide the HR Committee with guidance on executive compensation-related matters and to perform an annual total compensation study, including benchmarking information on each of the named executive officers. During 2010 and 2011, the Compensation Consultant provided guidance pertaining to 2011 and 2012 base salaries, annual incentive compensation, and long-term incentive compensation for executives.

The compensation study included published market surveys and peer group proxy disclosure data. The benchmarks for the 25th percentile, the 50th percentile (market median), and 75th percentile were derived from market survey data. The HR Committee selected peer companies from which to compare proxy disclosure data based on criteria that included:

| • | industry (manufacturing and industrial); |

| • | size (based on revenues, assets, market capitalization, and total number of employees); |

| • | competition (companies that potentially compete with the Company for executive talent); and |

| • | comparable executive positions (companies with executive positions with similar breadth, complexity, and scope of responsibility). |

19

A review of peer group proxy disclosure data was conducted for each of the named executive officers as shown in Table 1. This table depicts companies with revenues ranging between +50% and -50% of the Company’s average 2008 and 2009 revenue of $3.2 billion or asset values ranging between +50% and -50% of the Company’s average 2008 and 2009 asset value of $4.8 billion. An average of two years data for the Company is used to mitigate cyclicality effects on the Company’s businesses.

Table 1 — Peer Companies Used in 2011 for Proxy Statement Disclosure Data by Named Executive Officer

| Position Compared | CEO | SVP/CFO | EVP/SVP | EVP/SVP | SVP/CLO | ||||||||||||||||||||