Barnes 2021 Investor Day December 14

2Barnes 2021 Virtual Investor Day Today’s Agenda 8:30 am Welcome & Opening Remarks Bill Pitts VP, Investor Relations Company Overview, Vision & Strategy Patrick Dempsey President & CEO Differentiated Approach to Innovation Pat Hurley SVP, Chief Technology Officer M&A Strategic Framework Lukas Hovorka SVP, Corporate Development Leveraging TMS to Drive a High-Performance Organization Dawn Edwards SVP, Human Resources 9:40 am Q&A Session 10:05 am Break 10:10 am Industrial Deep Dive Steve Moule SVP & President, Industrial Aerospace Deep Dive Mike Beck SVP & President, Aerospace Financial Overview Julie Streich SVP, Finance & CFO Closing Remarks Patrick Dempsey President & CEO 11:25 am Q&A Session

3Barnes 2021 Virtual Investor Day Safe Harbor Statement This Presentation Contains Forward-looking Statements Forward-looking statements are made based upon management's good faith expectations and beliefs concerning future developments and their potential effect upon the Company. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those expressed in the forward-looking statements, including the risks and uncertainties set forth under our full disclosure located at the end of this presentation and included in our SEC filings. Any forward-looking statements speak only as of the date on which it is made, and the Company assumes no obligation to update our forward-looking statements. References to adjusted financial results are non-GAAP measures. You will find GAAP reconciliation tables at the end of this presentation. “EPS” refers to diluted earnings per share.

Company Overview, Vision & Strategy Patrick Dempsey President & CEO

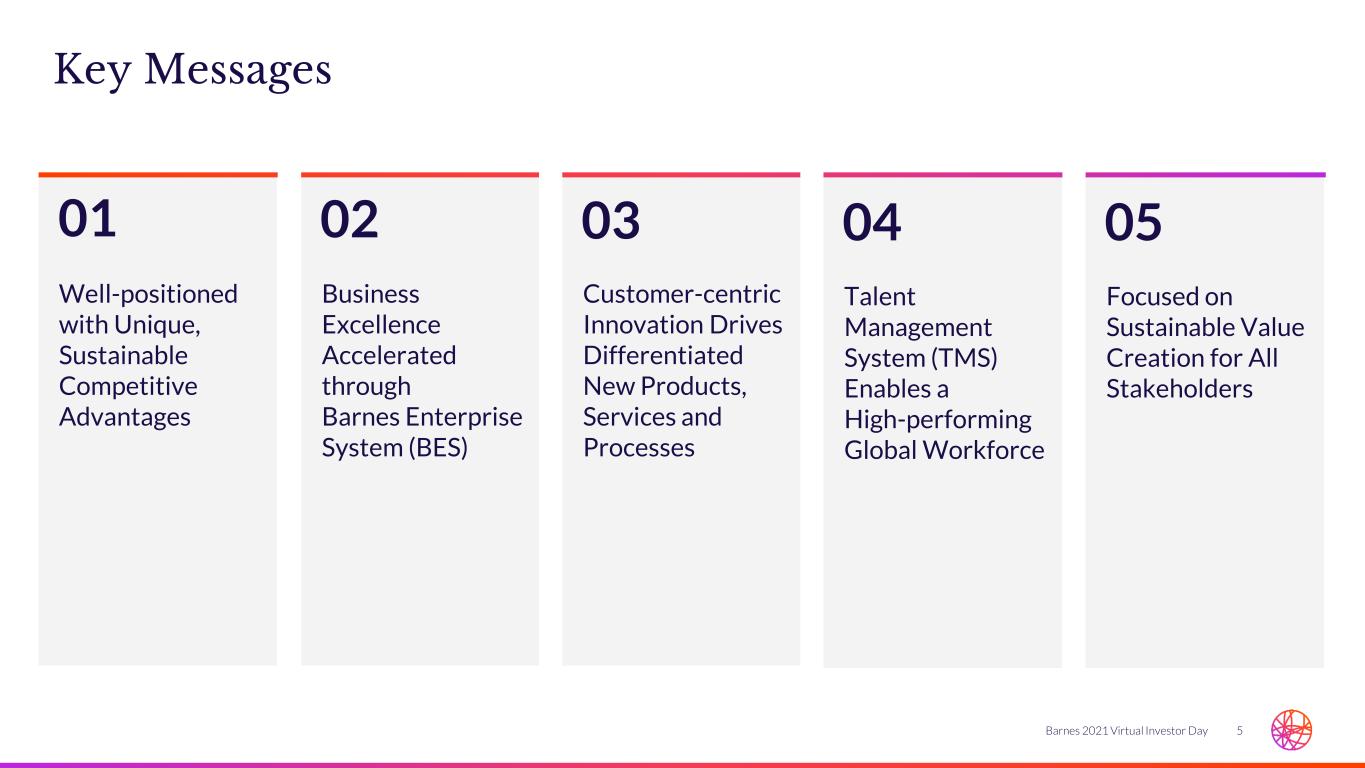

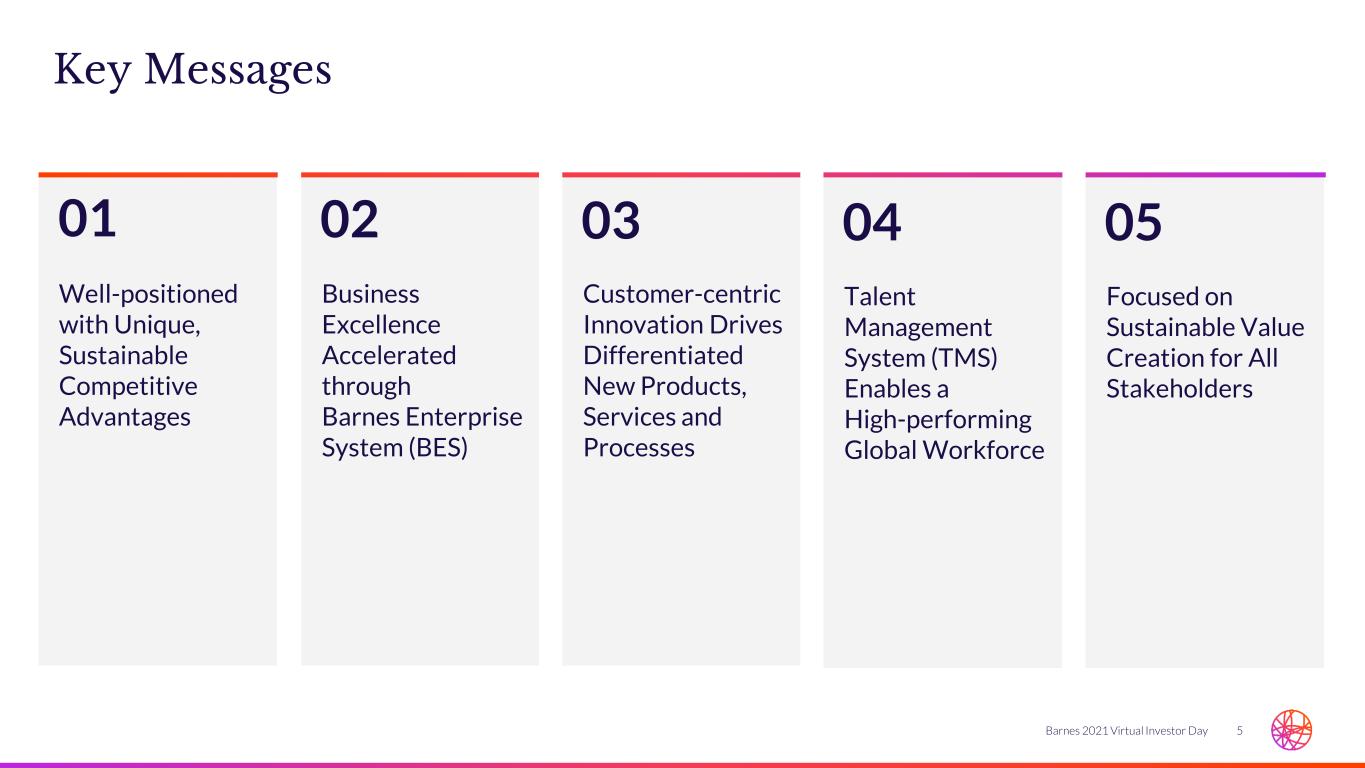

5Barnes 2021 Virtual Investor Day Key Messages Well-positioned with Unique, Sustainable Competitive Advantages Business Excellence Accelerated through Barnes Enterprise System (BES) Customer-centric Innovation Drives Differentiated New Products, Services and Processes 01 02 03 Talent Management System (TMS) Enables a High-performing Global Workforce 04 Focused on Sustainable Value Creation for All Stakeholders 05

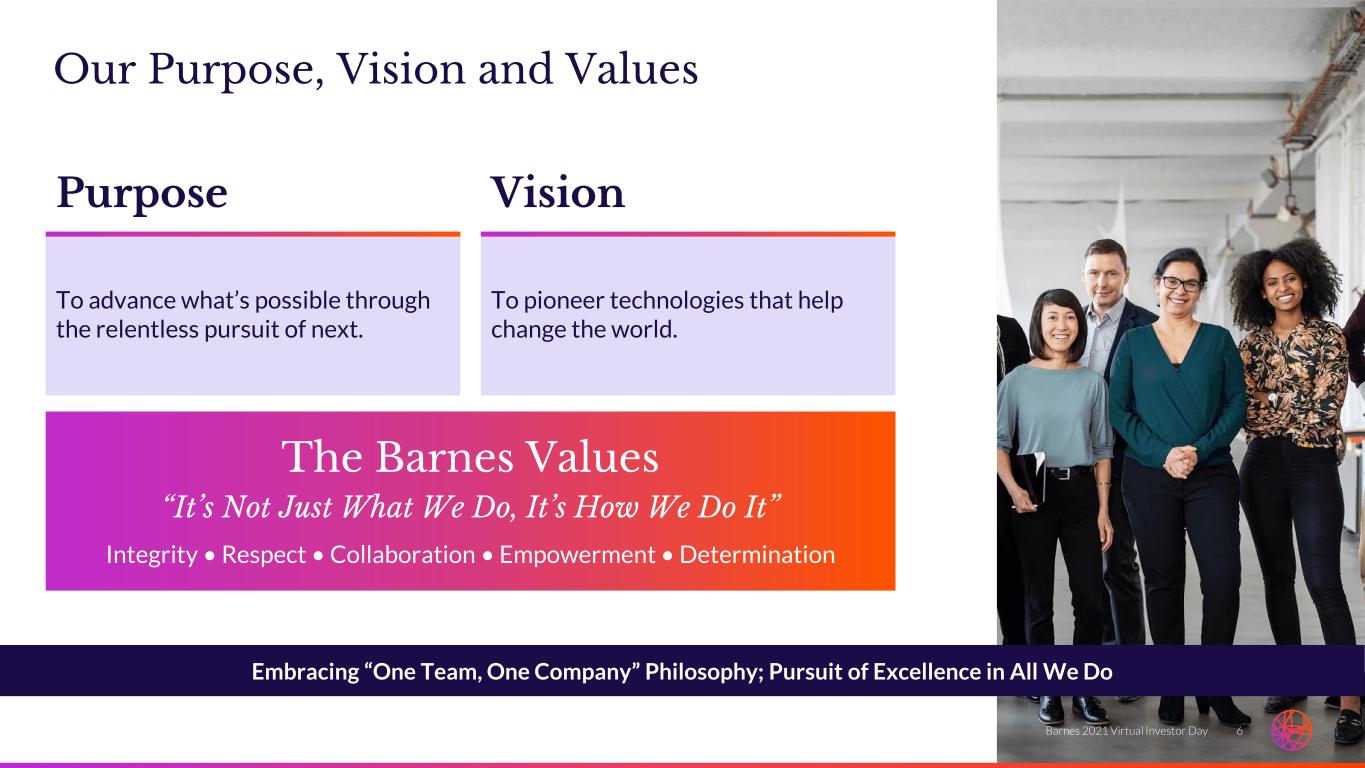

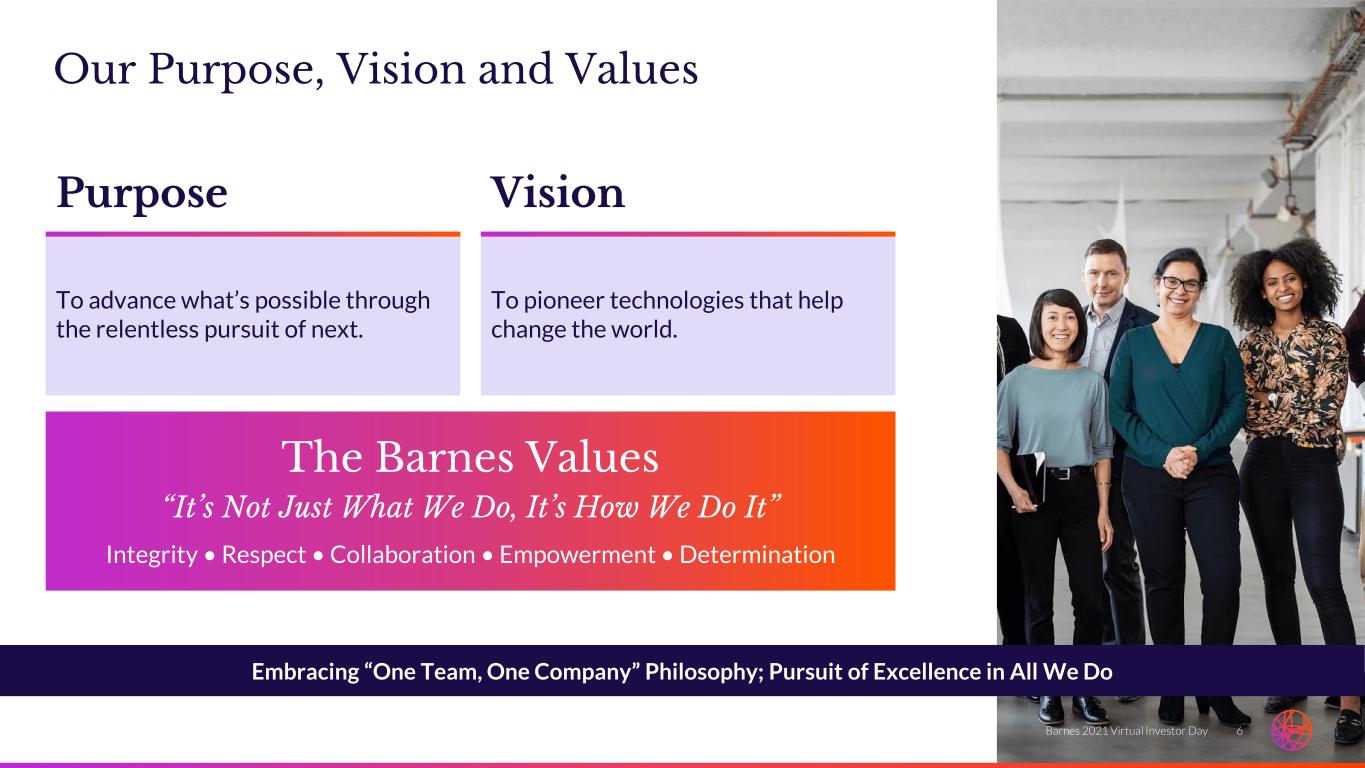

6Barnes 2021 Virtual Investor Day Embracing “One Team, One Company” Philosophy; Pursuit of Excellence in All We Do To advance what’s possible through the relentless pursuit of next. Purpose To pioneer technologies that help change the world. Vision The Barnes Values “It’s Not Just What We Do, It’s How We Do It” Integrity • Respect • Collaboration • Empowerment • Determination Our Purpose, Vision and Values

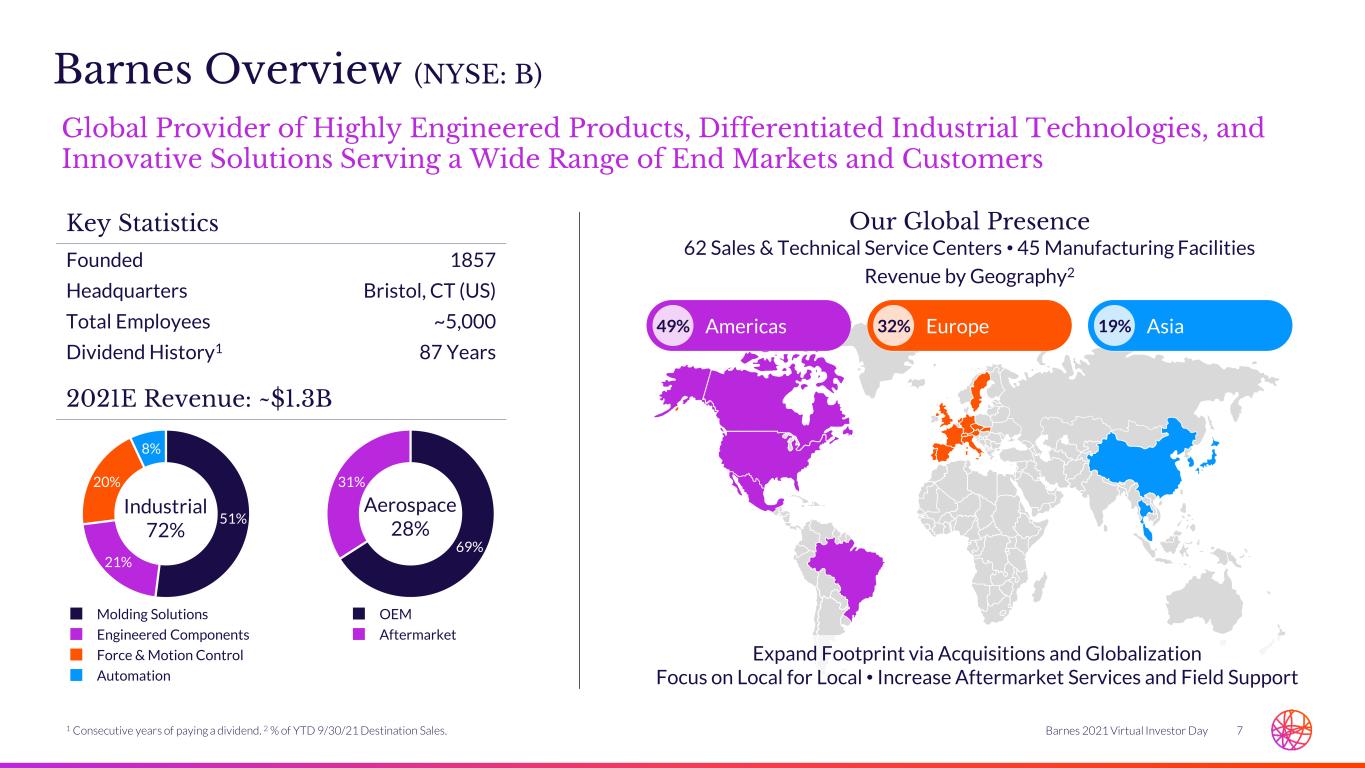

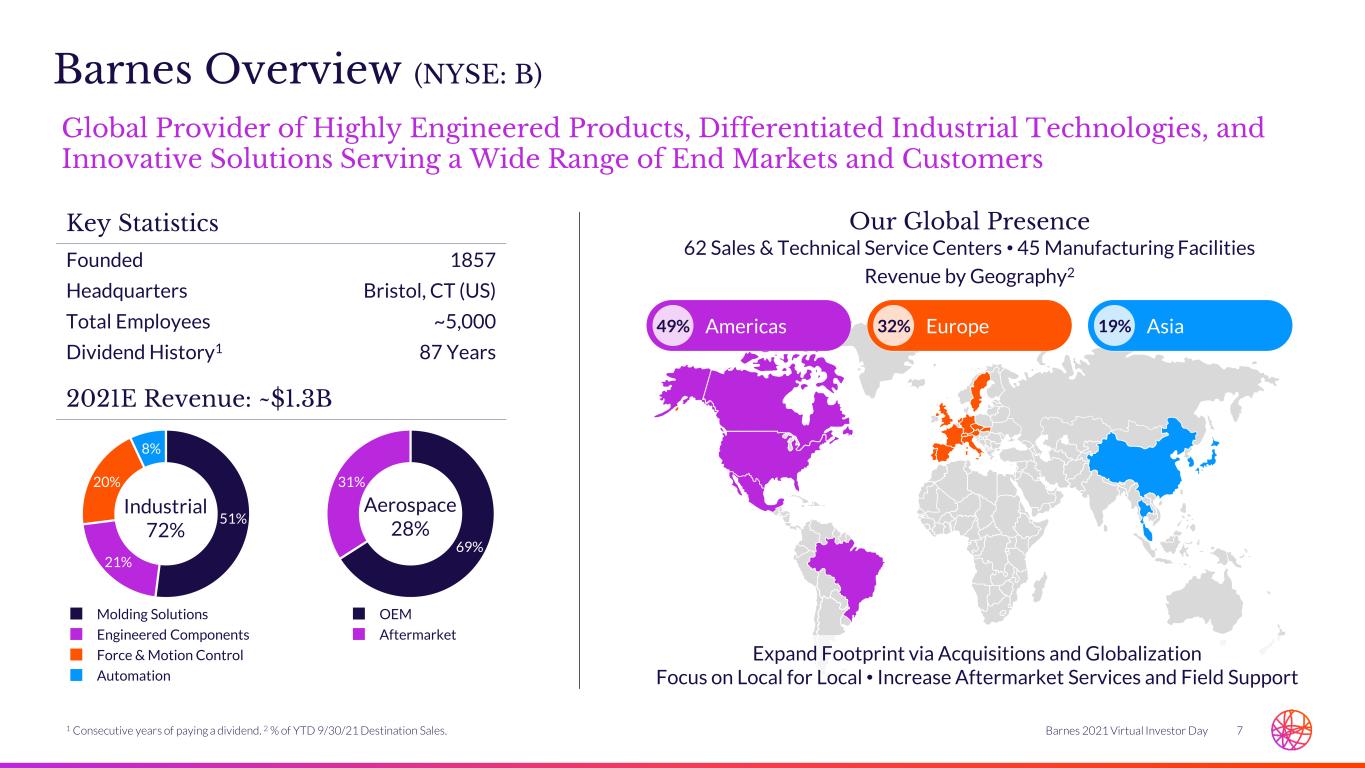

7Barnes 2021 Virtual Investor Day 69% 31% 51% 21% 20% 8% Aerospace 28% Industrial 72% Barnes Overview (NYSE: B) Global Provider of Highly Engineered Products, Differentiated Industrial Technologies, and Innovative Solutions Serving a Wide Range of End Markets and Customers Key Statistics Founded 1857 Headquarters Bristol, CT (US) Total Employees ~5,000 Dividend History1 87 Years Our Global Presence 62 Sales & Technical Service Centers • 45 Manufacturing Facilities Revenue by Geography2 Americas49% Europe32% Asia19% Expand Footprint via Acquisitions and Globalization Focus on Local for Local • Increase Aftermarket Services and Field Support Molding Solutions Engineered Components Force & Motion Control Automation OEM Aftermarket 2021E Revenue: ~$1.3B 1 Consecutive years of paying a dividend. 2 % of YTD 9/30/21 Destination Sales.

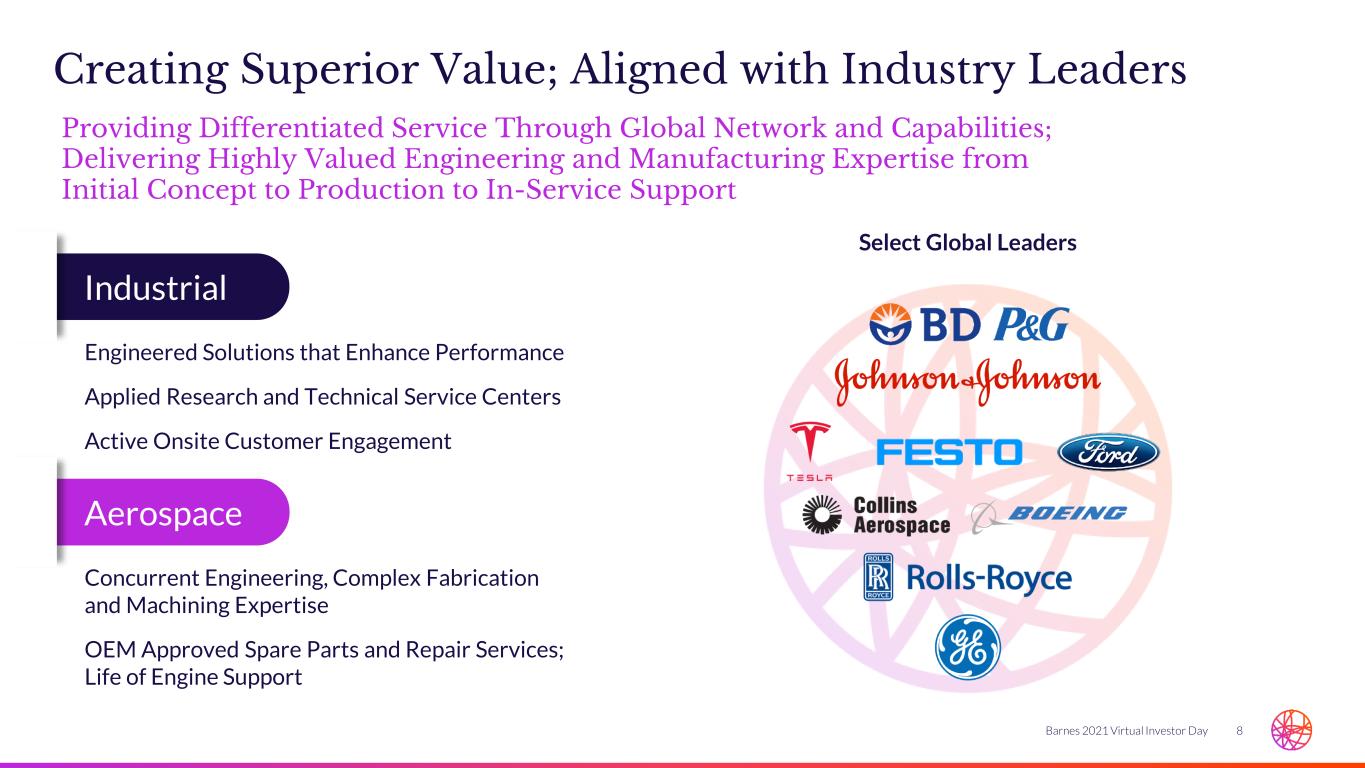

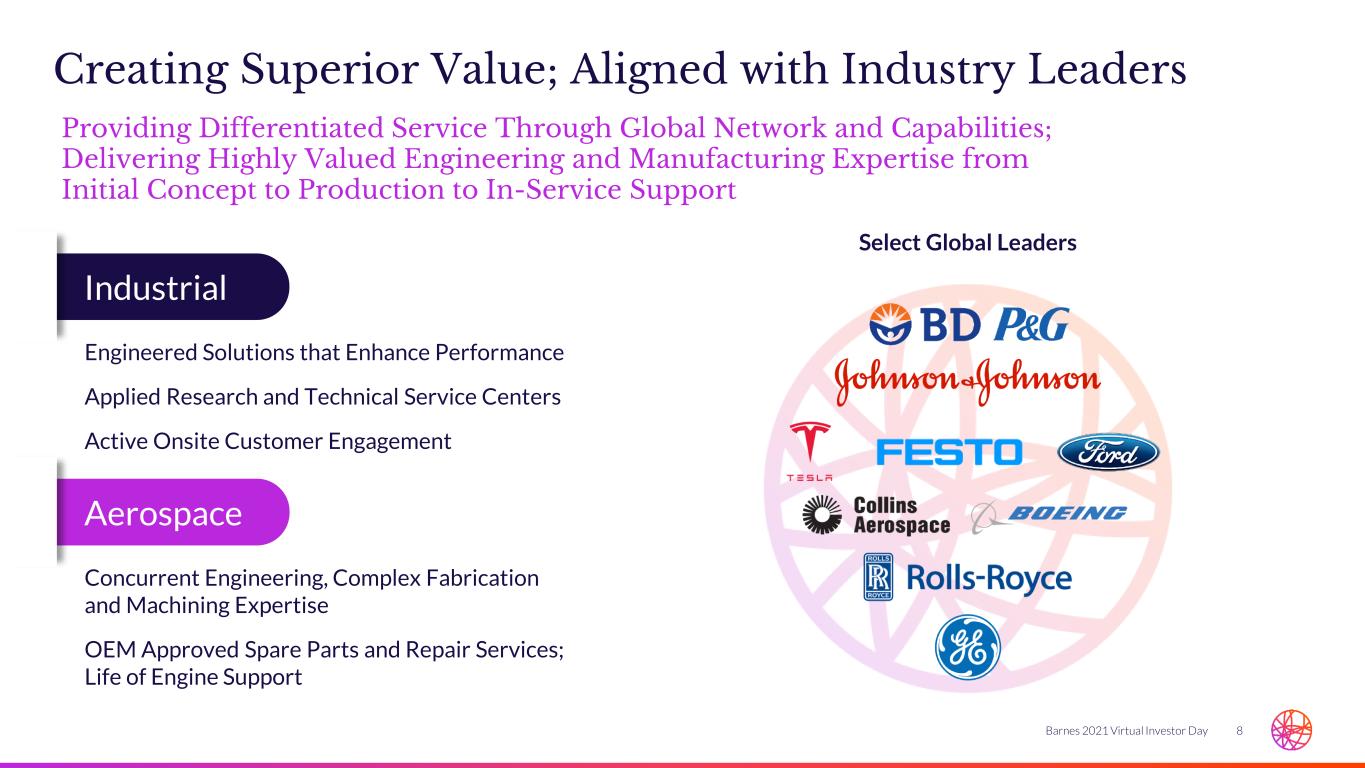

8Barnes 2021 Virtual Investor Day Industrial Creating Superior Value; Aligned with Industry Leaders Engineered Solutions that Enhance Performance Applied Research and Technical Service Centers Active Onsite Customer Engagement Concurrent Engineering, Complex Fabrication and Machining Expertise OEM Approved Spare Parts and Repair Services; Life of Engine Support Select Global Leaders Aerospace Providing Differentiated Service Through Global Network and Capabilities; Delivering Highly Valued Engineering and Manufacturing Expertise from Initial Concept to Production to In-Service Support

9Barnes 2021 Virtual Investor Day Transformation Building on Our Strong Foundation – Sustainable Competitive Advantages Core Strengths • Market leadership with high-quality brands • Culture built on strong values, teamwork, agility and community spirit • Deep, experienced management driving performance excellence • Global manufacturing, sales and service; “local for local” • Strong balance sheet with significant cash generation • Increased investment in new growth platforms — strategic marketing and digitalization • An unwavering commitment to ESG Competitive Advantages Total solutions provider of design, application and process engineering Mission-critical technologies for high-precision and high-volume applications Deep, long-standing customer partnerships with industry leaders Strategic focus on innovation, commercial excellence and digitalization Leveraging the Barnes Enterprise System (BES)

10Barnes 2021 Virtual Investor Day Patrick Dempsey President & CEO 2000 Julie Streich SVP, Finance & CFO 2021 Steve Moule SVP & President, Industrial 2019 Mike Beck SVP & President, Aerospace 2016 Lukas Hovorka SVP, Corporate Development 2008 Experienced and Energized Management Team with New Talent Driving Change Pat Hurley SVP & CTO 2019 Dawn Edwards SVP, Human Resources 1998 Jim Pelletier SVP, General Counsel 2015 Marian Acker VP, Controller 1993 Mike Kennedy VP, Tax & Treasury 2015 New to Barnes within the Last 3 Years

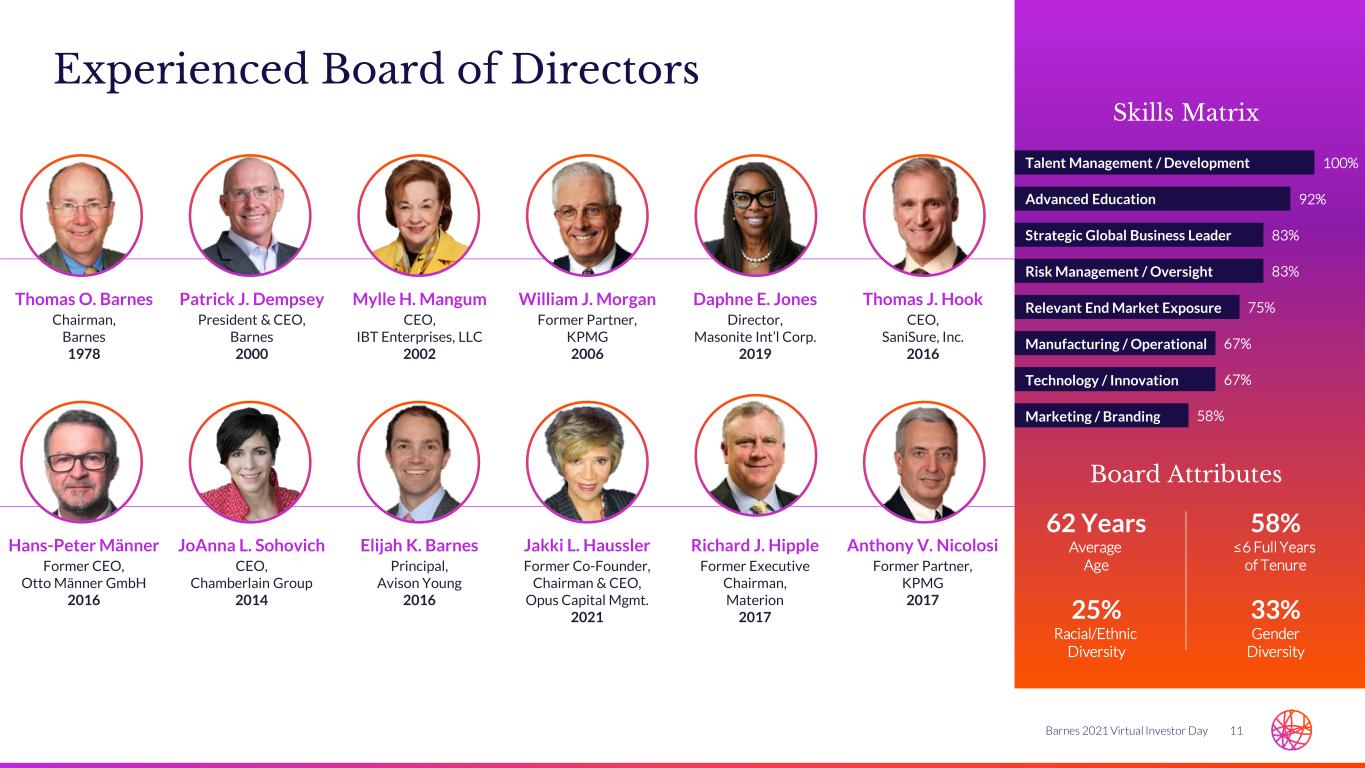

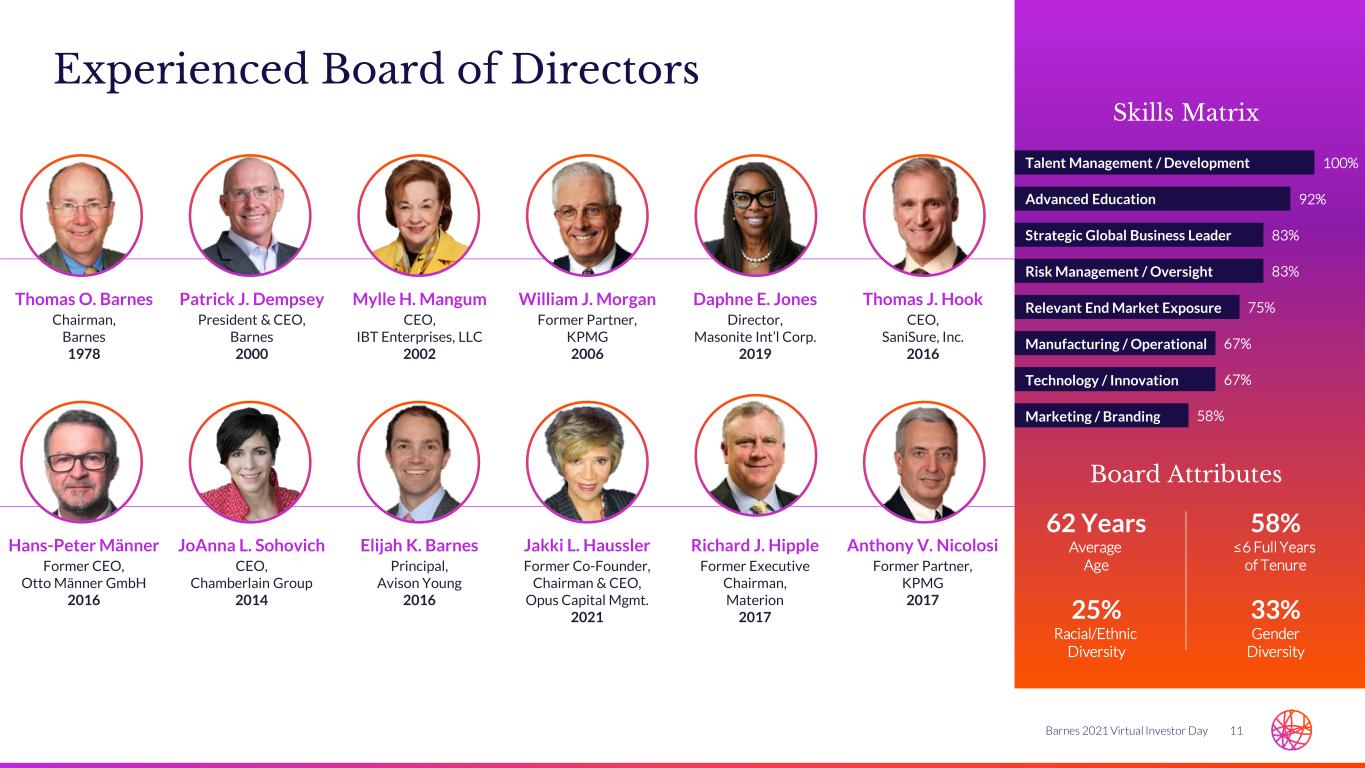

11Barnes 2021 Virtual Investor Day Experienced Board of Directors Board Attributes Skills Matrix 62 Years Average Age 58% ≤6 Full Years of Tenure 25% Racial/Ethnic Diversity 33% Gender Diversity 100% 92% 83% 83% 75% 67% 67% 58% Talent Management / Development Relevant End Market Exposure Manufacturing / Operational Technology / Innovation Marketing / Branding Advanced Education Strategic Global Business Leader Risk Management / Oversight Thomas O. Barnes Chairman, Barnes 1978 Patrick J. Dempsey President & CEO, Barnes 2000 Mylle H. Mangum CEO, IBT Enterprises, LLC 2002 William J. Morgan Former Partner, KPMG 2006 Daphne E. Jones Director, Masonite Int’l Corp. 2019 Thomas J. Hook CEO, SaniSure, Inc. 2016 Hans-Peter Männer Former CEO, Otto Männer GmbH 2016 JoAnna L. Sohovich CEO, Chamberlain Group 2014 Elijah K. Barnes Principal, Avison Young 2016 Jakki L. Haussler Former Co-Founder, Chairman & CEO, Opus Capital Mgmt. 2021 Richard J. Hipple Former Executive Chairman, Materion 2017 Anthony V. Nicolosi Former Partner, KPMG 2017

12Barnes 2021 Virtual Investor Day Where We Were Where We Are Where We Are Going Portfolio Profile Cyclical More Secular Diversified High-Performance Portfolio Geographic Exposure Overweight US Globally Balanced Globally Positioned, Local for Local Patents ~300 ~1,100 Expanding Patent Portfolio through Disciplined IP Management Core Competency Manufacturing, Distribution Design, Applications, Manufacturing & Service Digitally-Enabled Solutions, Advanced Manufacturing, Recurring Revenues and Integrated Systems IP Ownership Primarily Process Process, Products & Systems Process, Product & Systems IP as a Core Differentiator New Markets — Automation, Medical, Personal Care & Packaging, Auto Model Changes Attractive End Markets Aligned with Secular Growth Trends Strategic Evolution to Next-Gen Technology with a Growth Mindset

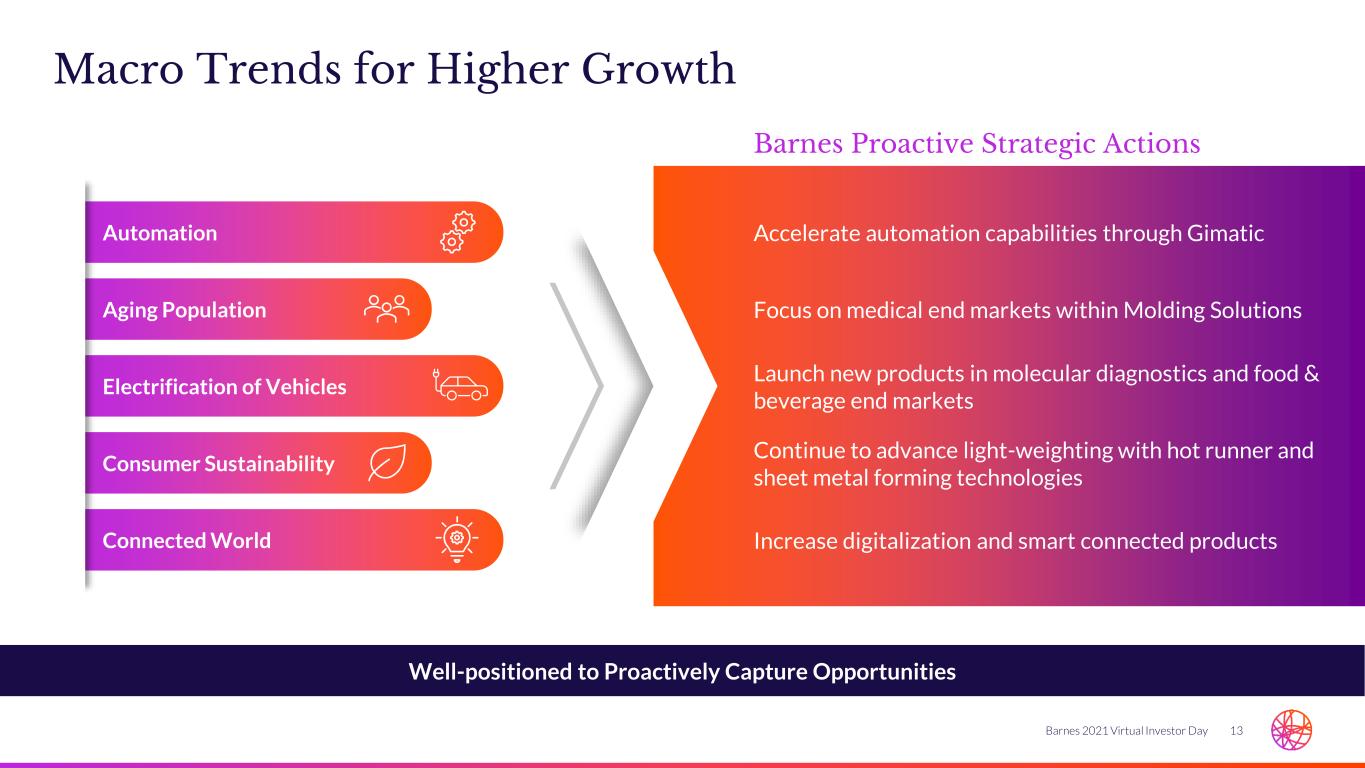

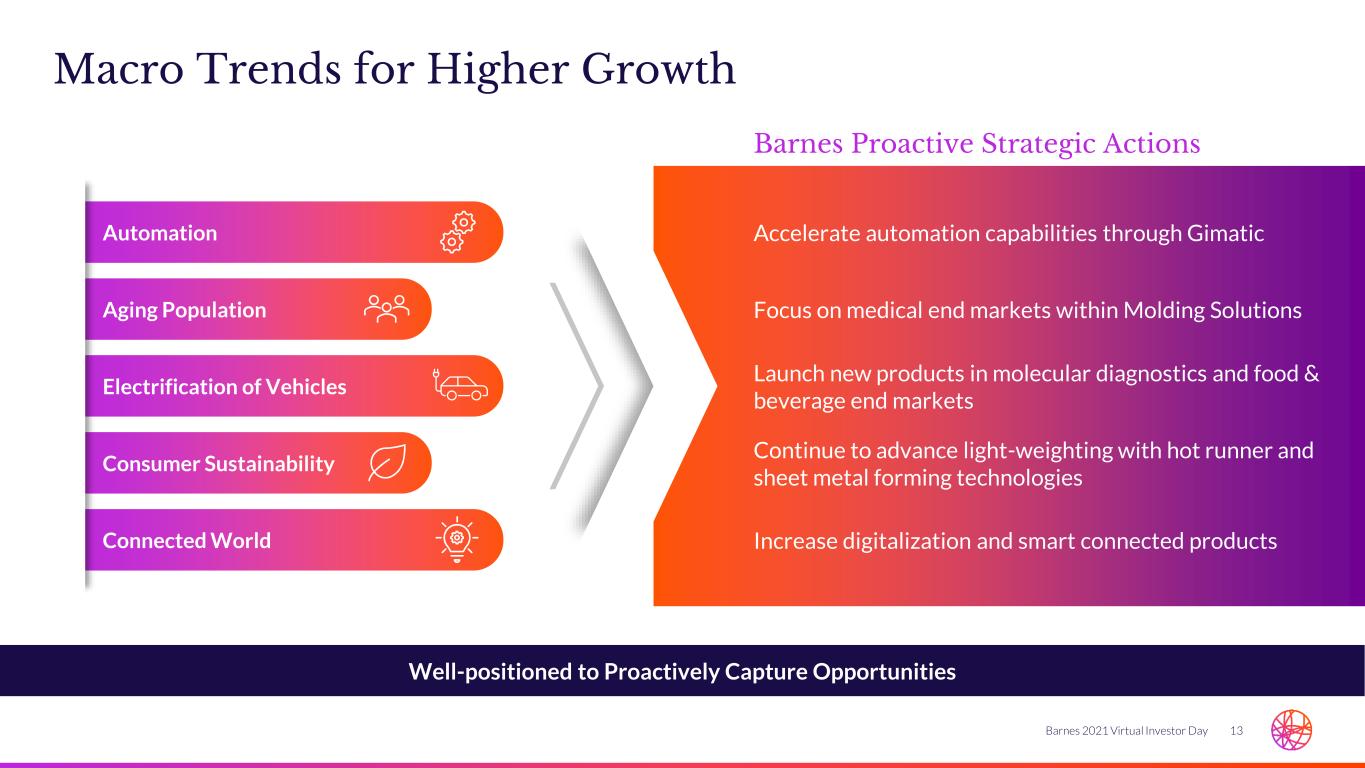

13Barnes 2021 Virtual Investor Day Automation Aging Population Electrification of Vehicles Consumer Sustainability Connected World Macro Trends for Higher Growth Well-positioned to Proactively Capture Opportunities Barnes Proactive Strategic Actions Accelerate automation capabilities through Gimatic Focus on medical end markets within Molding Solutions Launch new products in molecular diagnostics and food & beverage end markets Continue to advance light-weighting with hot runner and sheet metal forming technologies Increase digitalization and smart connected products

14Barnes 2021 Virtual Investor Day Barnes Profitable Growth Strategy 1 Total Shareholder Return, top quartile within the Russell 2000 Index. High Margin, High Growth Build a World-class Company • Actively manage portfolio with a focus on multiple platforms / market channels • Identify end markets with long- term sustainable, profitable growth • Target global expansion aligned with macro trends Leverage BES as a Significant Competitive Advantage • Achieve commercial, operational, and financial excellence • Drive margin expansion through relentless focus on productivity • Invigorate employee development, empowerment and engagement Expand and Protect Our IP to Deliver Differentiated Solutions • Build on IP as core differentiator • Drive innovation in processes, products and systems • Leverage digital technologies to create new business opportunities • Persistent IngenuityTM Create Value for All Stakeholders • Allocate capital to drive top quartile TSR1 • Create superior value for our customers • Invigorate employee development, empowerment and engagement • Respecting and giving back to our communities 3 421

15Barnes 2021 Virtual Investor Day Build a World-Class Company… … Focused on High Growth and High Margin Businesses 1 Our Operating Philosophy Closely Aligned Business Portfolio • Actively managing portfolio with a focus on multiple platforms / market channels • Creating digital infrastructure and process to accelerate growth and create new business opportunities Scalable Business Processes Global Presence and Resources Customer- Centric Culture Broad-based, Diverse Talent and Leadership Innovative Aftermarket Model

16Barnes 2021 Virtual Investor Day The Core of BES Remains Intact • Promotes a culture of employee engagement and empowerment reflecting our strong corporate values • Drives alignment across the organization around a common purpose and vision • Fosters continuous improvement and innovation in all of our business processes • Achieves results that drive sustainable profitable growth Enhanced Business Processes to Sell, Deliver and Realize Value Leveraging BES – Our Most Effective Value-Creation Lever Accelerating Performance Excellence, Empowerment and Growth Commercial Excellence Strategic Marketing Lead Generation Salesforce Coverage Contract Management Operational Excellence Product/Process Optimization Digitalization Automation Innovation R&D Global Sourcing Quality Financial Excellence Modeling Margin Expansion Supply Chain Optimization Forecasting Accuracy Working Capital Results Controls Environment 2

17Barnes 2021 Virtual Investor Day BES Strategic Enablers 2 Talent Management System01 ESG Initiatives04 Strategic Marketing Digitalization02 Innovation03 Talent Management System05

18Barnes 2021 Virtual Investor Day ESG: An Integral Part of Our Culture Unwavering Commitment to Corporate Responsibility • Launched inaugural ESG Report in 2014 — identified and implemented processes, policies, and products that benefit stakeholders, the environment, and society • Committed to corporate accountability and furthering ESG principles; for 2021, recognized as one of America’s Most Responsible Companies by Newsweek • ESG is central to our success as a responsible and eco-friendly company ENVIRONMENTAL Focused on enabling smart, sustainable product development at our Innovation Hub Driving efficiencies in our production processes 2025 Targets • 20% water usage reduction • 15% process waste reduction • 15% Scope 1 & 2 emissions reduction SOCIAL Introduced BarnesWORX™ to further accelerate R&D, process and NPD efforts Barnes Group Foundation contributes $1.1M+ annually to organizations within local communities DE&I focus — 30% of U.S. leadership are women (2020) GOVERNANCE 11 of 12 Board members are independent Ethnically and racially diverse Board Executive compensation closely aligned to stakeholder value 2

19Barnes 2021 Virtual Investor Day Barnes Intelligent Innovation Ecosystem Focus on Next-Tech Evolution 3 Note: Artificial Intelligence (AI) and Machine Learning (ML). • Elevating the future of Barnes through digital innovation o Customer value creation by leveraging client feedback loop from conception to execution o Technology so smart that we can identify the problem before it occurs (e.g., AI / ML) o New recurring revenue and business models • Connecting and deepening relationships with our entire ecosystem – leveraging outside expertise from: o Customers o Suppliers o Universities o Large materials companies o Non-profits and others • Drawing on global talent through BarnesWORXTM o No geographic boundaries o Focus on specialized in-demand skills

20Barnes 2021 Virtual Investor Day Customer Experience Essential to Enhancing the Customer Experience and Delivering Our Value Essential to the Way We Work Business Excellence Digitalization: A Growth Accelerator 3 • Seamless Digital Transactions • Ease of Doing Business • Self Service Design Configurators • Web Shop/E-Commerce • Product/System Apps • Remote Validations • Smart Products and Diagnostics • Data Analytics/Predictive Product Performance Cloud Computing Remote Monitoring and Control Automated Work Cells Process and Production Data Management Smart Connected Factory Predictive Maintenance Collaborative Robots Enterprise Data Systems

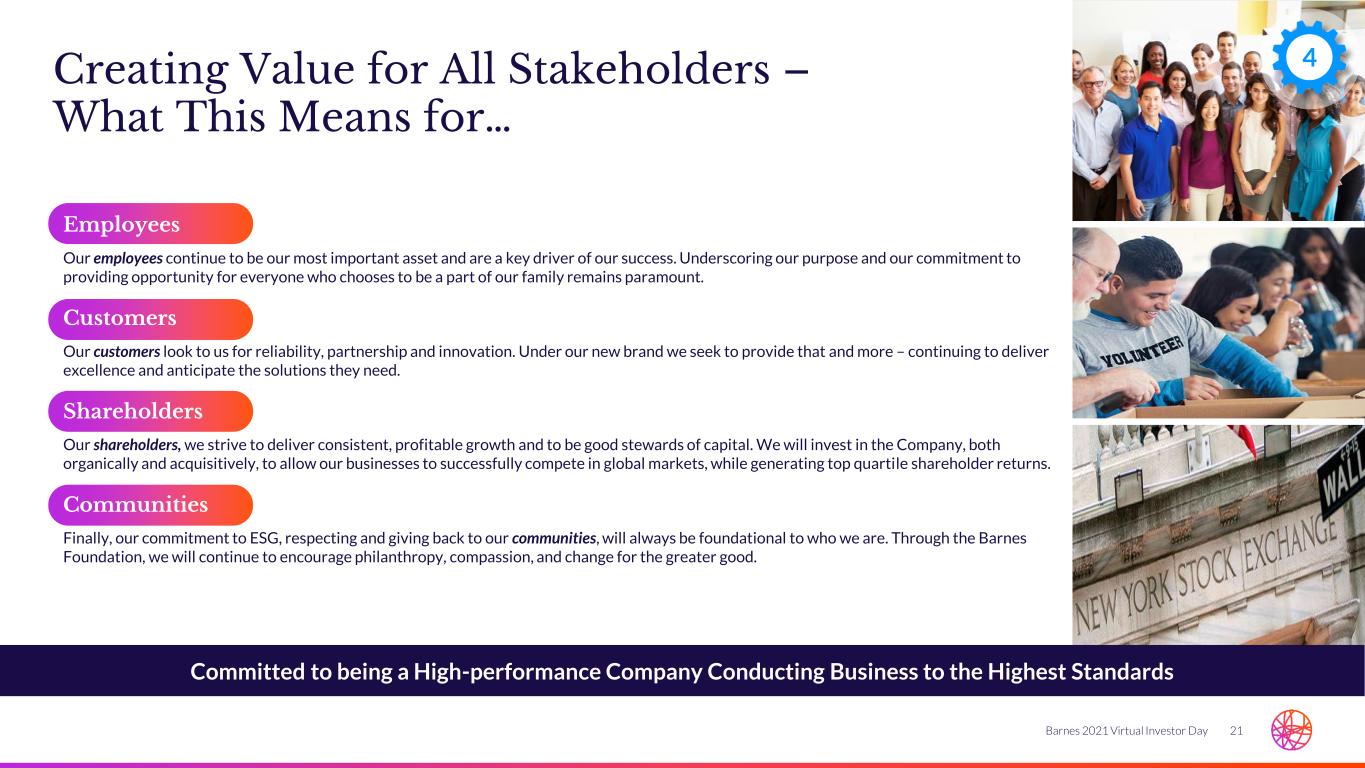

21Barnes 2021 Virtual Investor Day Creating Value for All Stakeholders – What This Means for… Committed to being a High-performance Company Conducting Business to the Highest Standards Employees Our employees continue to be our most important asset and are a key driver of our success. Underscoring our purpose and our commitment to providing opportunity for everyone who chooses to be a part of our family remains paramount. Customers Our customers look to us for reliability, partnership and innovation. Under our new brand we seek to provide that and more – continuing to deliver excellence and anticipate the solutions they need. Shareholders Our shareholders, we strive to deliver consistent, profitable growth and to be good stewards of capital. We will invest in the Company, both organically and acquisitively, to allow our businesses to successfully compete in global markets, while generating top quartile shareholder returns. Communities Finally, our commitment to ESG, respecting and giving back to our communities, will always be foundational to who we are. Through the Barnes Foundation, we will continue to encourage philanthropy, compassion, and change for the greater good. 4

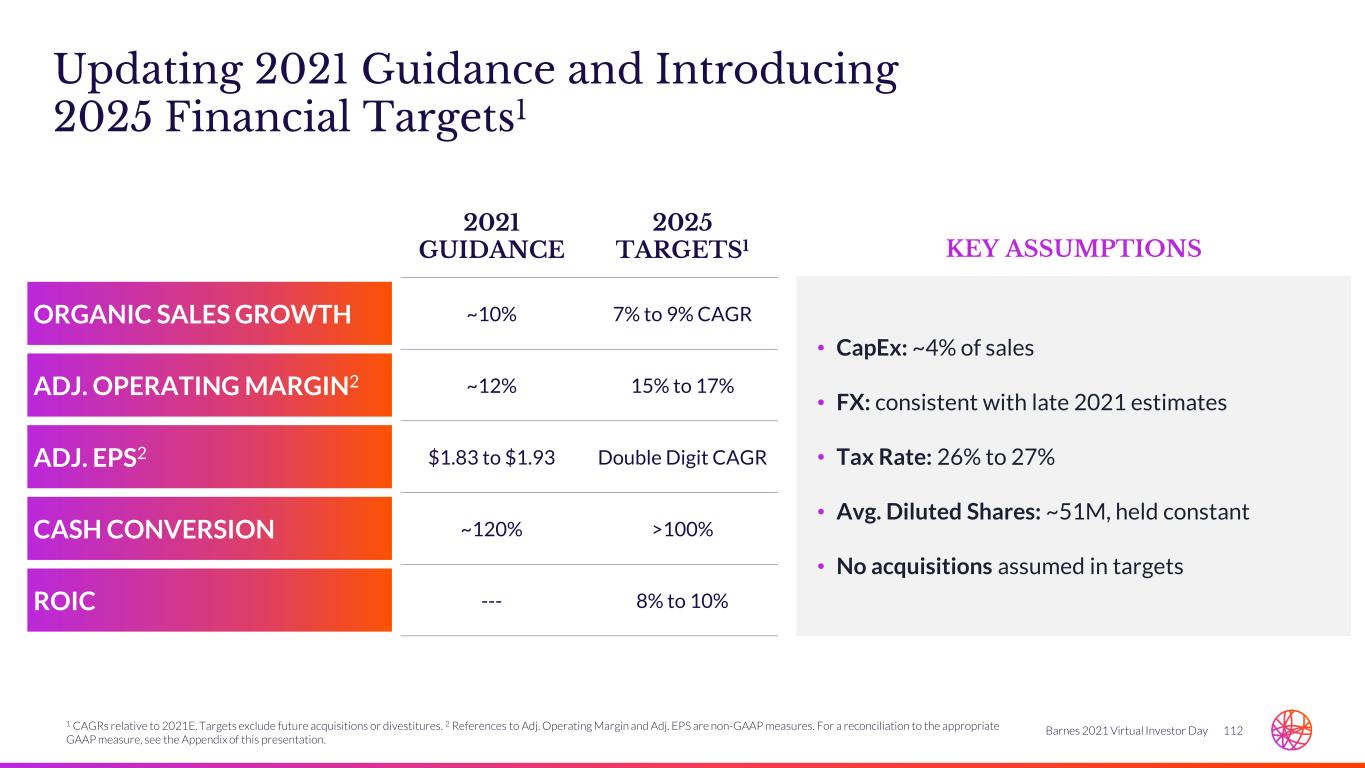

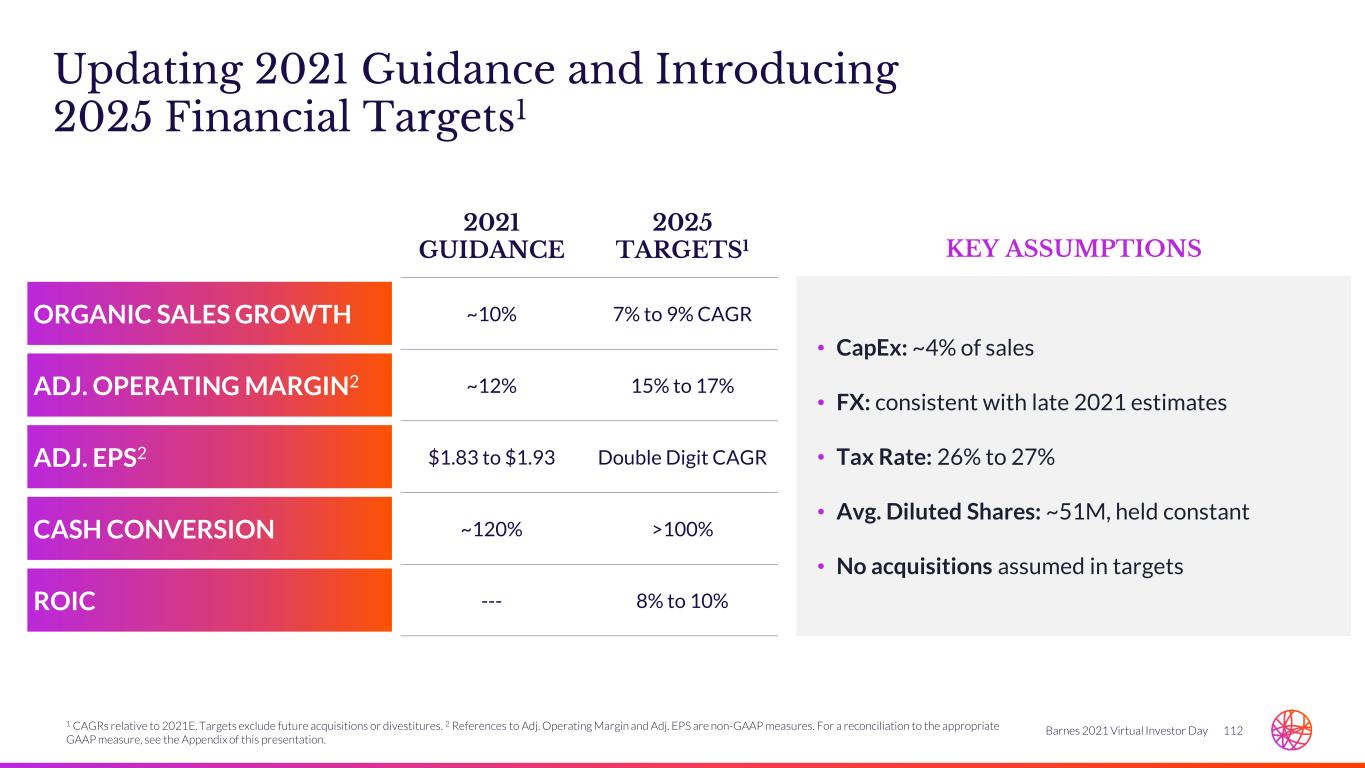

22Barnes 2021 Virtual Investor Day Introducing 2025 Financial Targets1 Today’s Investments Drive Future Growth Organic Sales CAGR 7% to 9% Adj. Operating Margin 15% to 17% EPS CAGR Double Digit ROIC 8% to 10% Cash Conversion >100% 1 CAGRs relative to 2021E. Targets exclude future acquisitions or divestitures.

23Barnes 2021 Virtual Investor Day Key Takeaways Well-positioned with Unique, Sustainable Competitive Advantages Business Excellence Accelerated through BES Customer-centric Innovation Drives Differentiated New Products, Services and Processes 01 02 03 TMS Enables a High-performing Global Workforce 04 Focused on Sustainable Value Creation for All Stakeholders 05

Differentiated Approach to Innovation Pat Hurley SVP, Chief Technology Officer

25Barnes 2021 Virtual Investor Day Key Messages Expanding Our Intelligent Innovation Ecosystem to Systematically Innovate Driving Innovation with Focused Product Areas and Modular Technology Approach Delivering Differentiated, Sustainable Solutions to Drive Long-term Organic Profitable Growth 01 02 03

26Barnes 2021 Virtual Investor Day Barnes Intelligent Innovation Ecosystem Enables Sustainable Long-term, Profitable Growth Our Goal is to be at Least 1-2 Generations Ahead of Our Competition Explore applied and fundamental opportunities Inspire a culture of innovation through sustainable, scalable and adaptable processes Bridge for knowledge, perspective and creativity that exists outside Barnes Focus on addressing global megatrends, market needs and technology transformations Partnering with the University of Massachusetts Lowell, among others, to accelerate Barnes Innovation Diverse subject matter experts in design to employ new learning, new thinking and creative methodologies to address customer needs

27Barnes 2021 Virtual Investor Day Sustaining Competitive Advantages in the Circular Economy Sustainable Innovation Approach to Fuel Top Line Growth CUSTOMERS Voice of Customers Full-Service Spectrum Product-as-a-Service PEOPLE & PROCESS Researchers & Innovators Agile Process for Product Development & Launches PRODUCTS Digital Sustainable Smart and Connected Continually Develop Solutions to Enhance Customer Experience

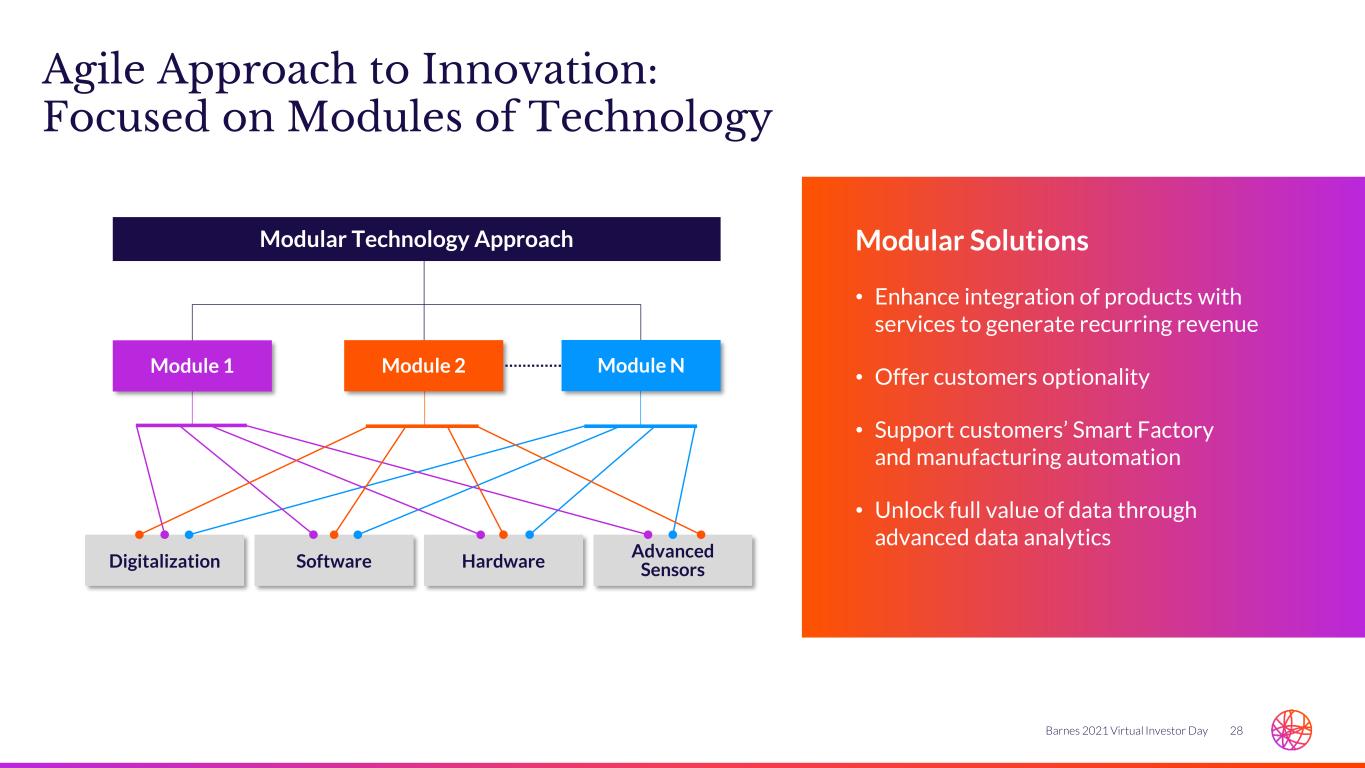

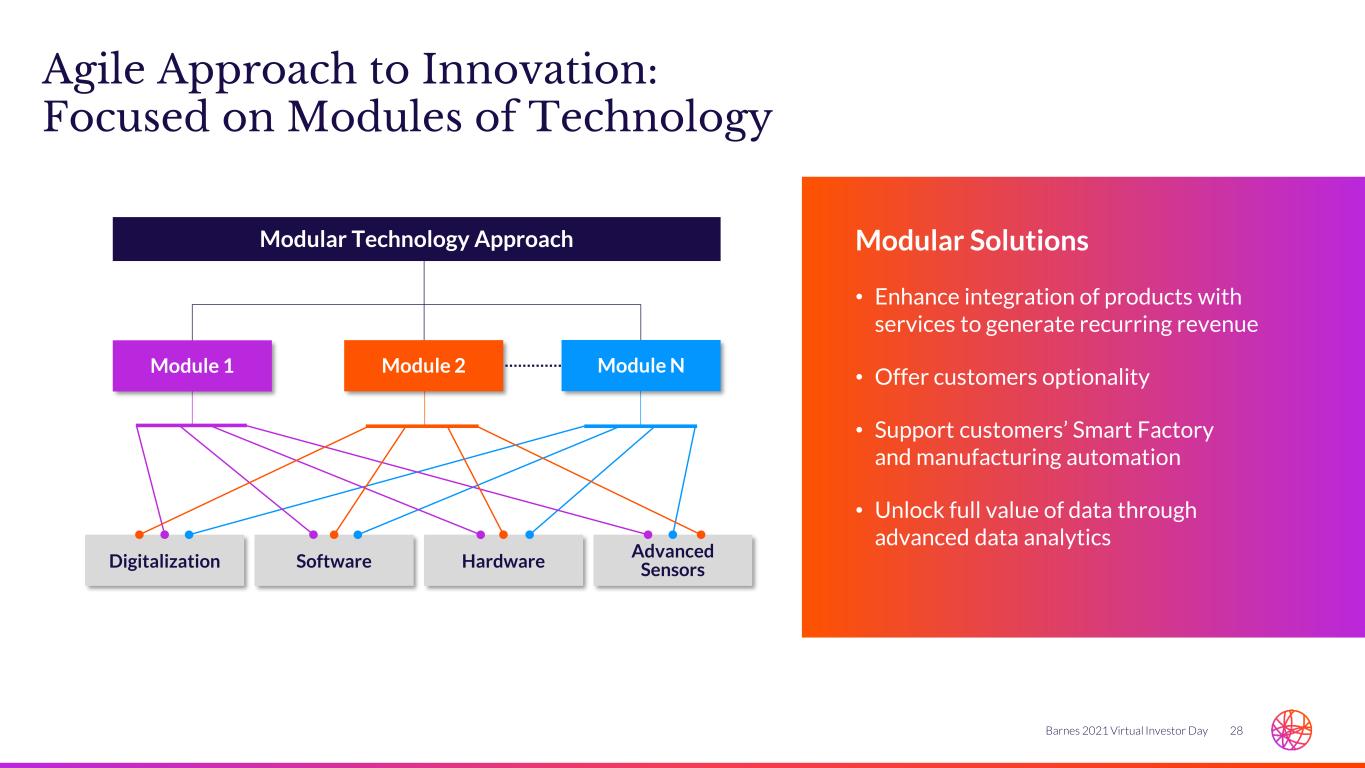

28Barnes 2021 Virtual Investor Day Agile Approach to Innovation: Focused on Modules of Technology Modular Solutions • Enhance integration of products with services to generate recurring revenue • Offer customers optionality • Support customers’ Smart Factory and manufacturing automation • Unlock full value of data through advanced data analytics Modular Technology Approach Hardware Advanced SensorsSoftwareDigitalization Module 2Module 1 Module N

29Barnes 2021 Virtual Investor Day Focus Areas to Expand Our Innovation Leadership Digital Transformation, Advanced Sensors and Controls are the Backbone for Managing Innovation 321 Integrated Smart Connected Products and Solutions Automation, Robotics, and Smart Connected Factory Sustainability and Bioplastics

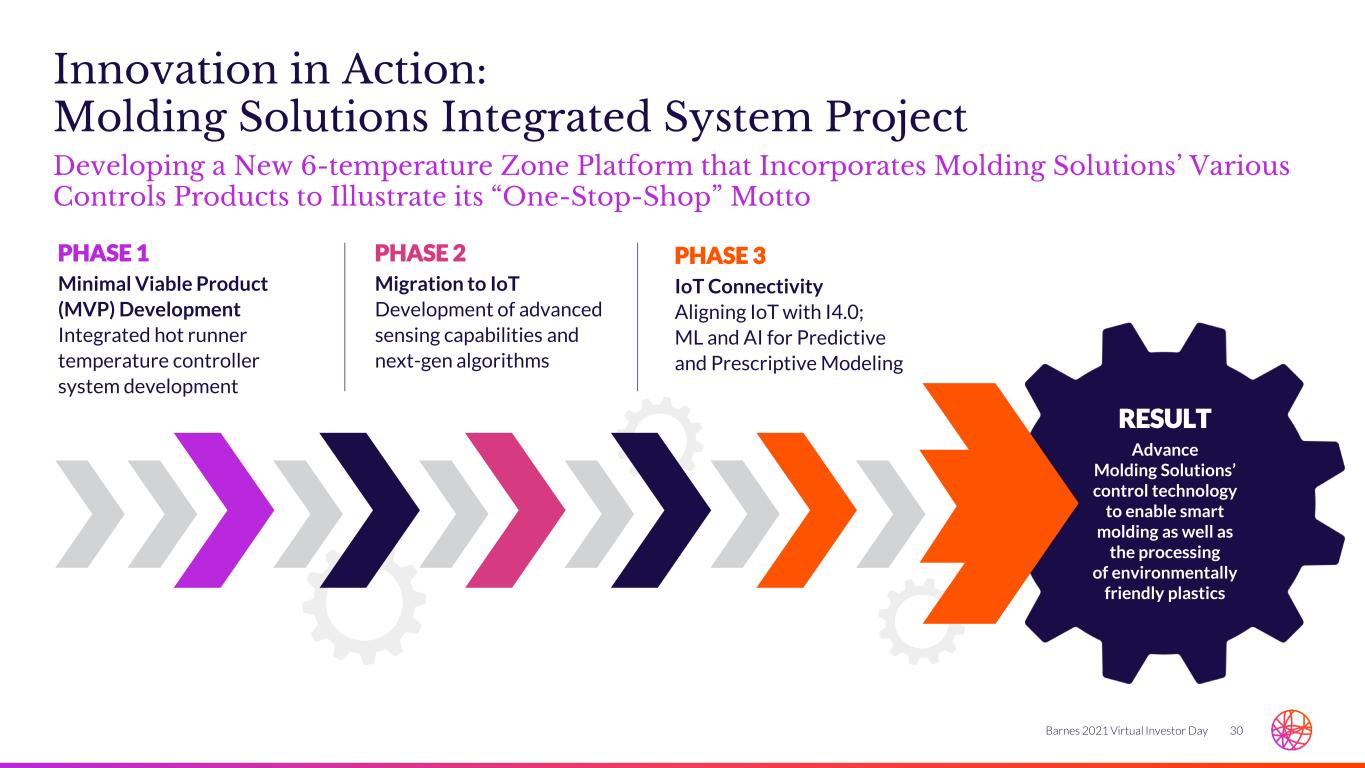

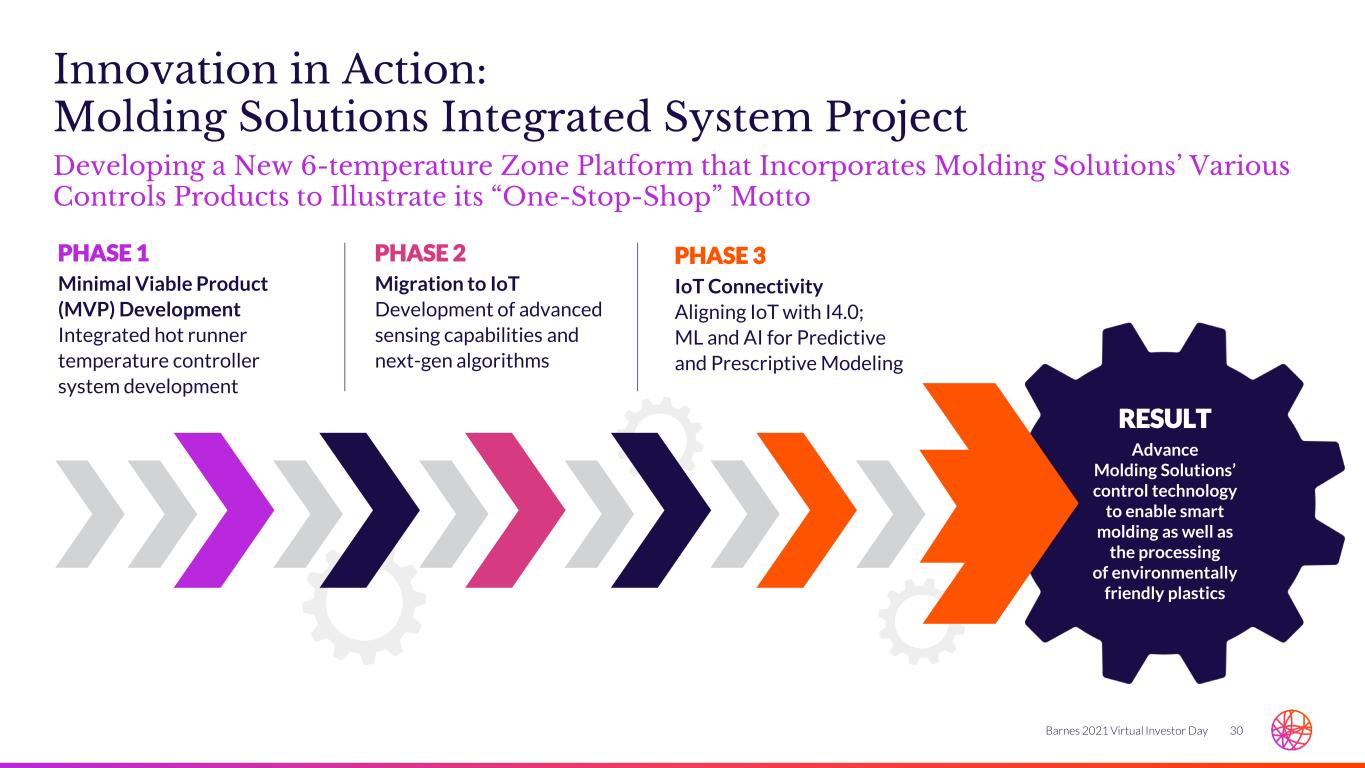

30Barnes 2021 Virtual Investor Day Innovation in Action: Molding Solutions Integrated System Project RESULT Advance Molding Solutions’ control technology to enable smart molding as well as the processing of environmentally friendly plastics PHASE 1 Minimal Viable Product (MVP) Development Integrated hot runner temperature controller system development PHASE 2 Migration to IoT Development of advanced sensing capabilities and next-gen algorithms PHASE 3 IoT Connectivity Aligning IoT with I4.0; ML and AI for Predictive and Prescriptive Modeling Developing a New 6-temperature Zone Platform that Incorporates Molding Solutions’ Various Controls Products to Illustrate its “One-Stop-Shop” Motto

31Barnes 2021 Virtual Investor Day What’s Next: Drive Sustainable, Long-term Growth in the Circular Economy Committed to Enabling the Wide Adoption of Environmentally Friendly Plastics Phases to Enable Environmentally Friendly Plastics Proprietary material processing capability (e.g., environmentally friendly plastics) Enabling a closed loop system (e.g., data analytics and smart technology) Solutions provider with integrated offerings (e.g., advanced original equipment for plastic injection molding market) 01 02 03

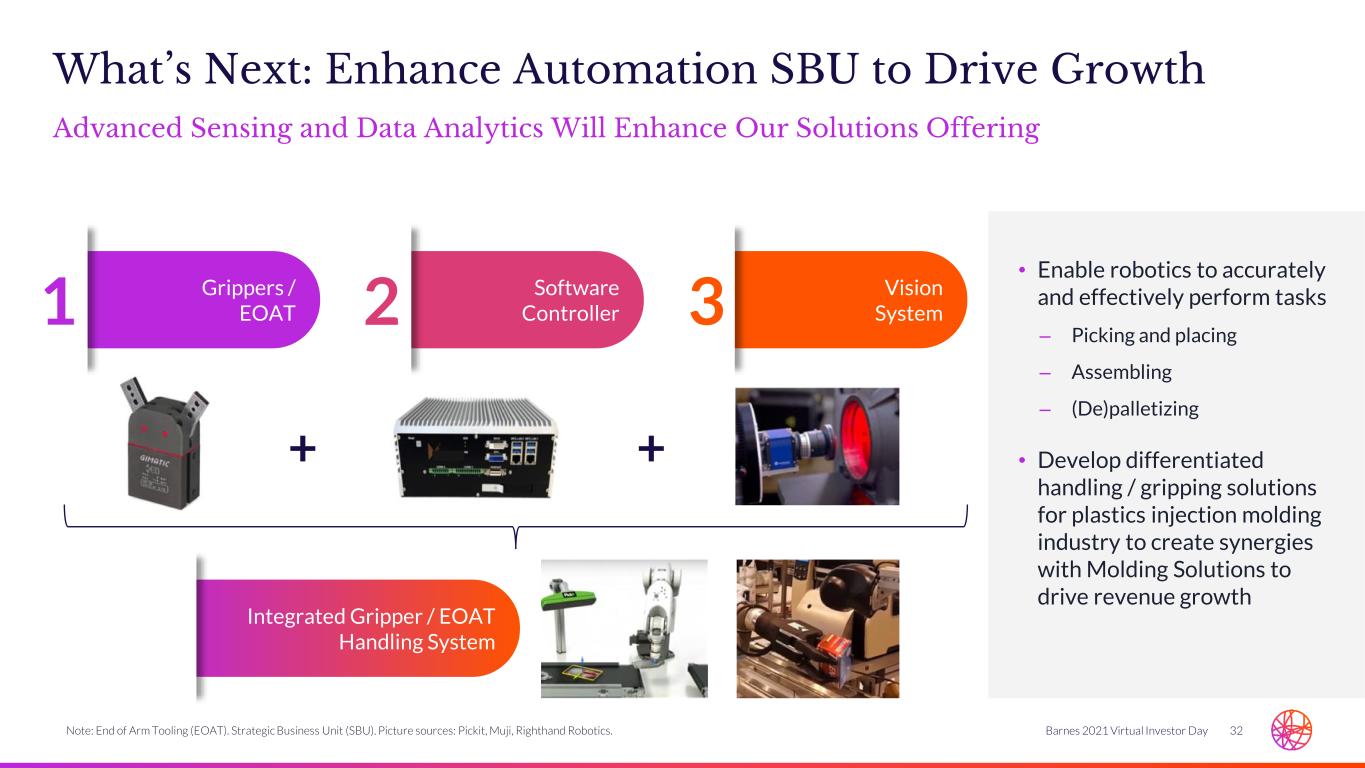

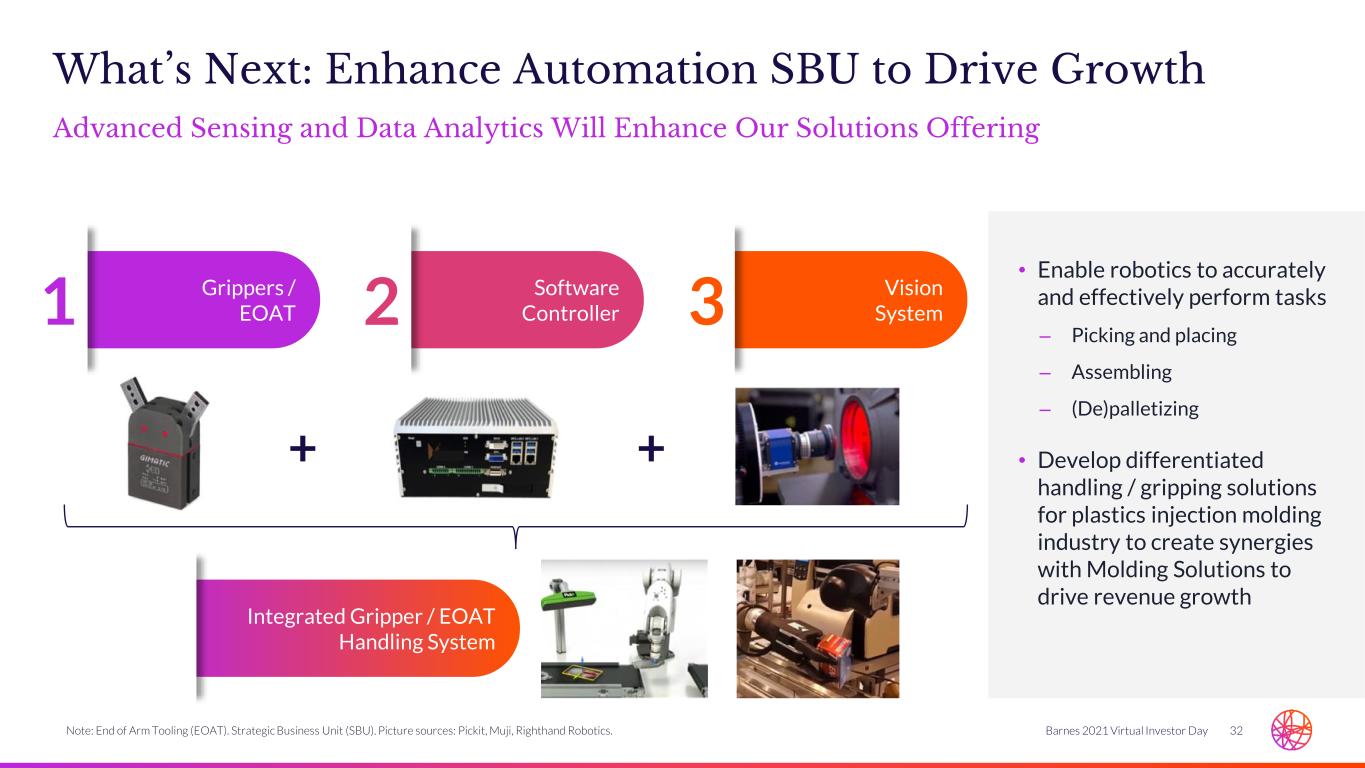

32Barnes 2021 Virtual Investor Day What’s Next: Enhance Automation SBU to Drive Growth Advanced Sensing and Data Analytics Will Enhance Our Solutions Offering • Enable robotics to accurately and effectively perform tasks ‒ Picking and placing ‒ Assembling ‒ (De)palletizing • Develop differentiated handling / gripping solutions for plastics injection molding industry to create synergies with Molding Solutions to drive revenue growth Vision System Software Controller Grippers / EOAT + + Integrated Gripper / EOAT Handling System 1 2 3 Note: End of Arm Tooling (EOAT). Strategic Business Unit (SBU). Picture sources: Pickit, Muji, Righthand Robotics.

33Barnes 2021 Virtual Investor Day Key Takeaways Expanding Our Intelligent Innovation Ecosystem to Systematically Innovate Driving Innovation with Focused Product Areas and Modular Technology Approach Delivering Differentiated, Sustainable Solutions to Drive Long-term Organic Profitable Growth 01 02 03 Persistent IngenuityTM

M&A Strategic Framework Lukas Hovorka SVP, Corporate Development

35Barnes 2021 Virtual Investor Day Key Messages Building a High-performance Business Portfolio M&A Accelerating Organic Initiatives Technology-driven Investments 01 02 03 High-growth Market Focus 04

36Barnes 2021 Virtual Investor Day Market Size Macro Trend Alignment Growth Potential Proprietary Technologies IP Type/Complexity Defensible Competitive Positions Attractive Growth Profile 35%+ GM / 20%+ EBITDA Downturn Resilience Platform Potential Market Leadership Technology Leadership Key Acquisition Criteria Investment Return Criteria | EPS ACCRETION in First Full Year • IRR = Cost of Capital + Premium • ROIC > Cost of Capital within 5 years Strategic Acquisition Filters

37Barnes 2021 Virtual Investor Day Strategic Priorities Technology • Growth Markets • Portfolio Synergies • Recurring Revenues • Sustainability Robotic Auxiliaries Vision / Sensing Motion Control Industrial System Automation Hot Runner Systems High-Cavitation Molds Process Controls Automation Solutions Automation Molding Solutions

38Barnes 2021 Virtual Investor Day Attractive Growth and Margin Profile Scalability / Platform Potential Highly Favorable Macro Trends Large Addressable Market Automation: Building a Diversified Technology Platform Strategic Rationale $12B+ TAM in Target Sectors Robotic Auxiliaries Vision / Sensing Motion Control System Automation Critical Enabling Technologies Differentiation Drivers Application Specialization Solution- Service Offering Machine Ecosystems Customer Partnerships Note: Total Addressable Market (TAM). Source: Company estimates and external market research. Complex Technologies and Systems Solutions

39Barnes 2021 Virtual Investor Day Molding Solutions: Focus on Customized Systems Solutions and Growth Markets • Integrated technology portfolio • Deep application expertise • Best-in-class systems and processes • Leadership in processing environmentally friendly materials Diabetes Care Enhance presence in North America and APAC • Global manufacturing footprint • Expand sales and service capabilities • Leverage key customer relationships Drug Delivery Infusion Therapy Diagnostics Lab Consumables Global Presence System Solutions01 • Favorable long-term growth drivers • Established blue-chip customer relationships • Utilizing existing technology and application expertise Medical & Pharma Market Expansion02 03

40Barnes 2021 Virtual Investor Day TECHNOLOGY Hot Runners Hot Runners & Molds Hot Runners Controls Molds Controls MARKET LEADERSHIP GLOBAL PRESENCE Disciplined M&A Approach Systematic Playbook Approach to Building Strong Technology Platforms, Deploying BES and Capturing Value and Synergies 2012 2015 2016 2013 2015 2017 2018 AUTOMATION Anchor Investment Targeting a Sizable Platform by Mid-decade Anchor Investment MOLDING SOLUTIONS

41Barnes 2021 Virtual Investor Day Key Takeaways Building a High-performance Business Portfolio M&A Accelerating Organic Initiatives Technology-driven Investments 01 02 03 High-growth Market Focus 04

Leveraging TMS to Drive a High-Performance Organization Dawn Edwards SVP, Human Resources

43Barnes 2021 Virtual Investor Day Key Messages Cultivating a One Team, One Company Culture Creating Value through Our Talent Management System (TMS) Digitalization of TMS: Providing the “Full Picture” of Talent Management 01 02 03 TMS Spotlight: BarnesWORXTM – a New Way to Work and Make an Impact 04

44Barnes 2021 Virtual Investor Day Our Culture We are Stronger Together, Working as One Team, One Company One Team, One Company It’s not just what we do, it’s how we do it Our values define who we are; and our culture reflects how we work together to innovate, perform and achieve results Barnes Values Integrity • Respect • Collaboration • Empowerment • Determination

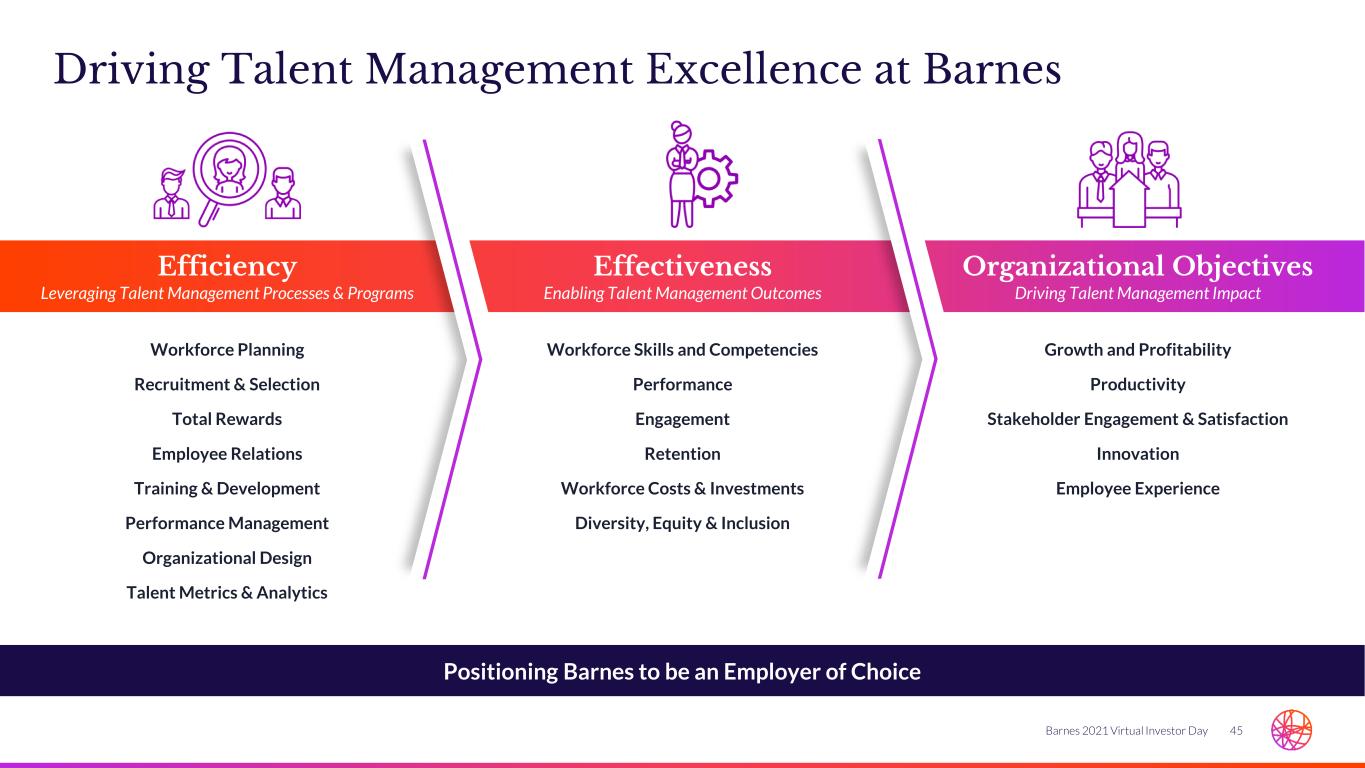

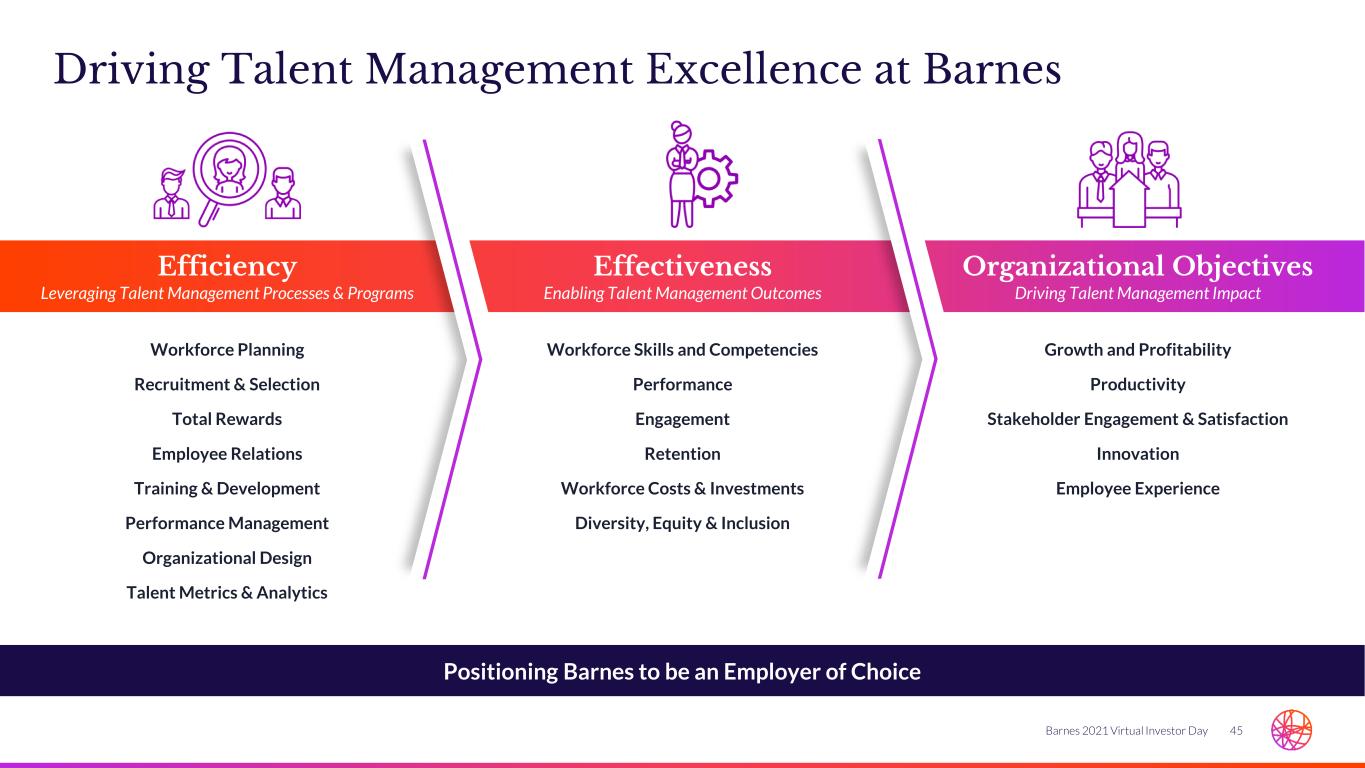

45Barnes 2021 Virtual Investor Day Driving Talent Management Excellence at Barnes Positioning Barnes to be an Employer of Choice Efficiency Leveraging Talent Management Processes & Programs Effectiveness Enabling Talent Management Outcomes Organizational Objectives Driving Talent Management Impact Workforce Planning Recruitment & Selection Total Rewards Employee Relations Training & Development Performance Management Organizational Design Talent Metrics & Analytics Workforce Skills and Competencies Performance Engagement Retention Workforce Costs & Investments Diversity, Equity & Inclusion Growth and Profitability Productivity Stakeholder Engagement & Satisfaction Innovation Employee Experience

46Barnes 2021 Virtual Investor Day Our Integrated Talent Management System (TMS) TMS: Right Talent, Right Skills, Right Positions, Right Time, Right Cost and Right Place Key Principles • Grounded in core values and BES; aligned with our purpose, vision and strategy • Facilitated by scalable, repeatable processes; measured and monitored • Promotes employee empowerment and engagement • Accelerates organizational change and effectiveness to drive business growth and performance

47Barnes 2021 Virtual Investor Day Evolving TMS: Advantages of an Integrated, Digital System Leveraging Digital to Future Proof Our TMS to Drive Organizational Performance and Agility Our New Digital Approach Designed for Digital • Cloud-based / SaaS solution • Fully integrated • Robust functionality • Augmenting with advanced technologies Focused on Continuous Improvement • Deliver global HR services easier and faster • Customize talent offerings and programs for diverse and evolving needs of our workforce • Use a flexible approach to engage individuals or groups with skills and competencies needed Leverages HR Data to Focus on What Matters • Descriptive analytics (hindsight) to explain • Predictive analytics (insight) to forecast • Prescriptive analytics (foresight) to simulate Powered by TECHNOLOGY + DATA TMS becomes a true strategic enabler of BES

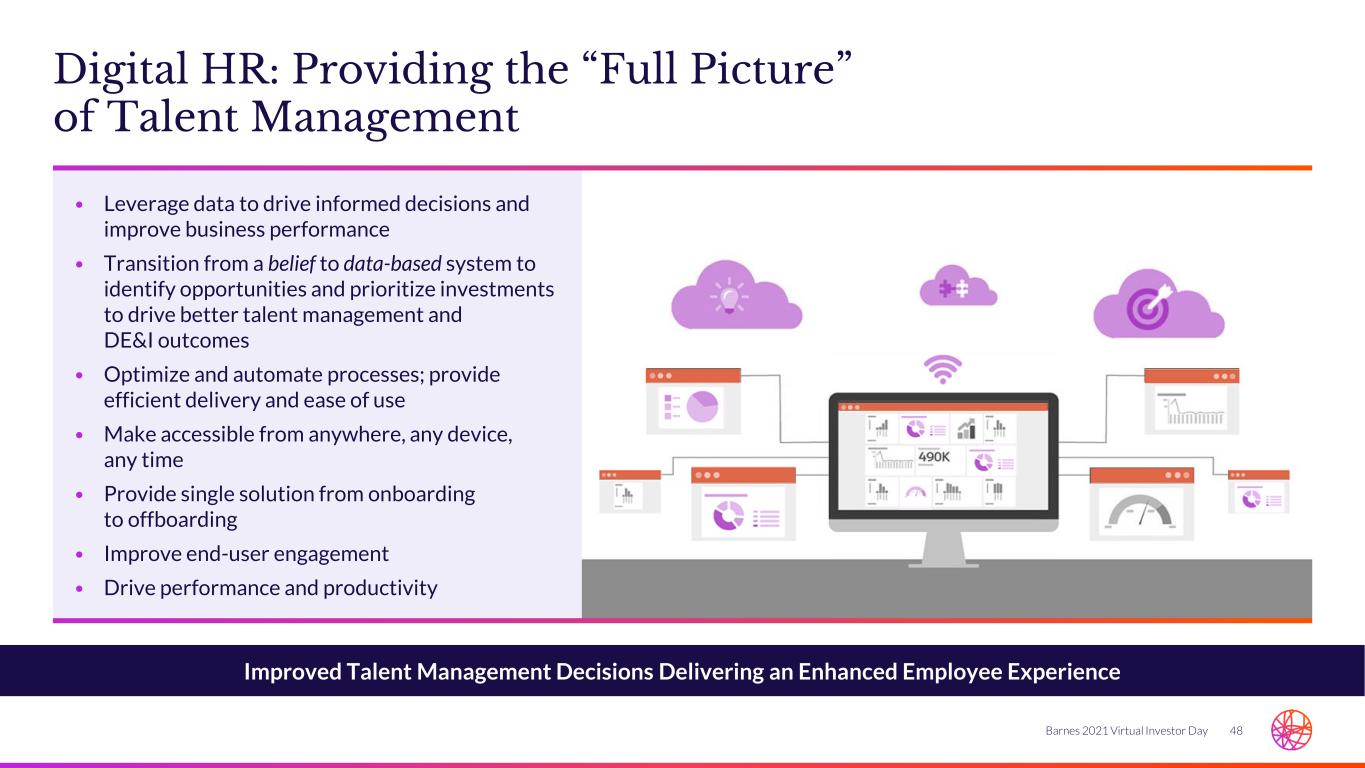

48Barnes 2021 Virtual Investor Day Digital HR: Providing the “Full Picture” of Talent Management Improved Talent Management Decisions Delivering an Enhanced Employee Experience • Leverage data to drive informed decisions and improve business performance • Transition from a belief to data-based system to identify opportunities and prioritize investments to drive better talent management and DE&I outcomes • Optimize and automate processes; provide efficient delivery and ease of use • Make accessible from anywhere, any device, any time • Provide single solution from onboarding to offboarding • Improve end-user engagement • Drive performance and productivity

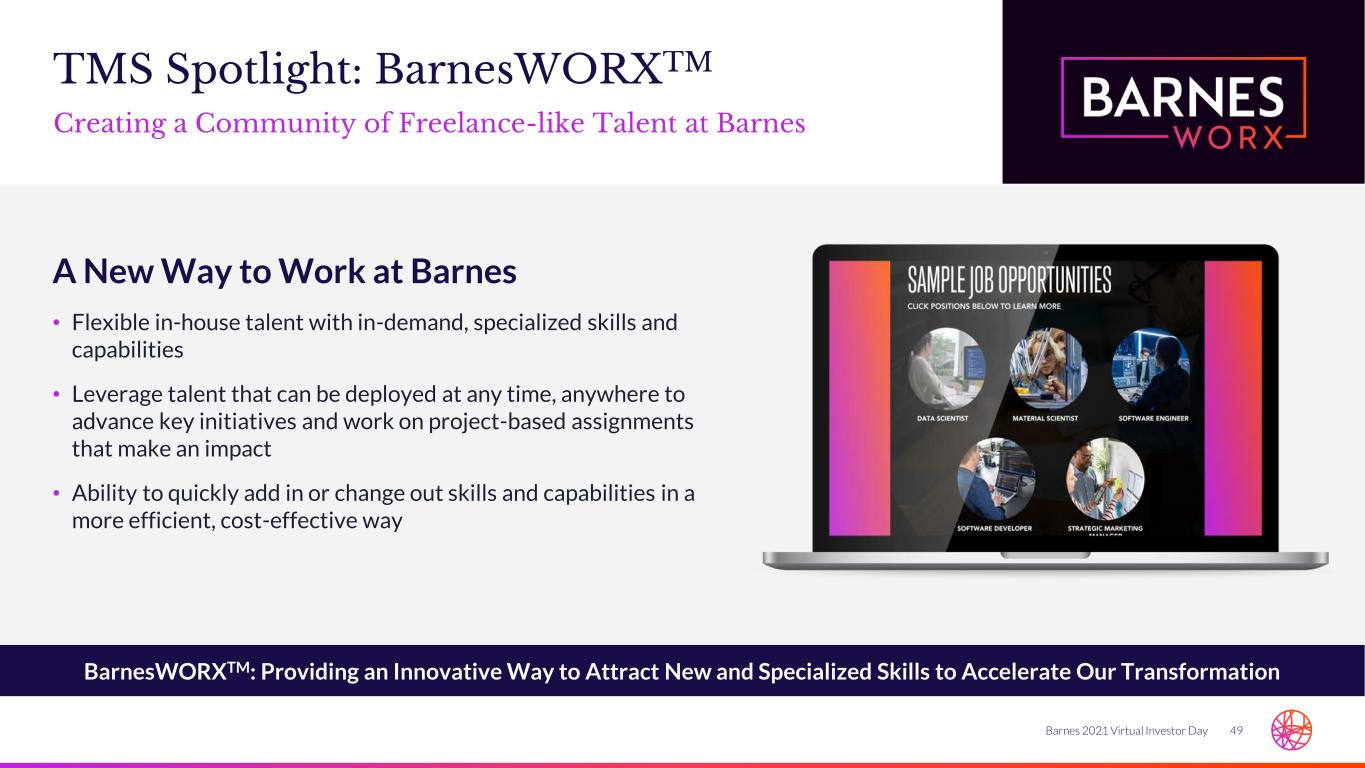

49Barnes 2021 Virtual Investor Day TMS Spotlight: BarnesWORXTM BarnesWORXTM: Providing an Innovative Way to Attract New and Specialized Skills to Accelerate Our Transformation A New Way to Work at Barnes • Flexible in-house talent with in-demand, specialized skills and capabilities • Leverage talent that can be deployed at any time, anywhere to advance key initiatives and work on project-based assignments that make an impact • Ability to quickly add in or change out skills and capabilities in a more efficient, cost-effective way Creating a Community of Freelance-like Talent at Barnes

50Barnes 2021 Virtual Investor Day Key Takeaways Cultivating a One Team, One Company Culture Creating Value through Our TMS Digitalization of TMS: Providing the “Full Picture” of Talent Management 01 02 03 BarnesWORXTM is Offering a New Way to Work and Make an Impact 04

Q&A Session Above Presenters

BREAK ~5 Minutes

Industrial Deep Dive Steve Moule SVP & President, Industrial

54Barnes 2021 Virtual Investor Day Key Messages Targeted Portfolio of Highly- engineered, Precision Products, Systems and Solutions Balanced End Market Portfolio Leveraged to Favorable Macro Trends in Medical, Automation, Sustainable Plastics and Electric Vehicles Focused and Strategically Aligned Business; Driving Growth through Deepening Customer Relationships, Digitalization and Differentiated Capabilities 01 02 03 Strong Organic and Acquisitive Growth Opportunities to Leverage Global Presence, Core Capabilities and Commercial Relationships 04 BES Anchors Profitable Growth, Innovation, Margin Expansion and Cash Generation 05

55Barnes 2021 Virtual Investor Day Key Observations ✓Outstanding portfolio of premium brands and technologies ✓ Strong operational capability and close customer partnerships ✓ Passionate and experienced leadership team ✓BES provides solid foundation for driving sustainable profitable growth Areas of Opportunity ✓Utilize BES to further build commercial capabilities and accelerate growth ✓Build high margin recurring revenue streams by connecting installed base and provide real-time information to customers ✓ Leverage strong portfolio of brands to sell greater bundles of systems ✓Accelerate growth in Asia and North America Key Observations as New Industrial Segment Leader Exceptional Portfolio of Businesses and Technologies to Drive Above Market Growth

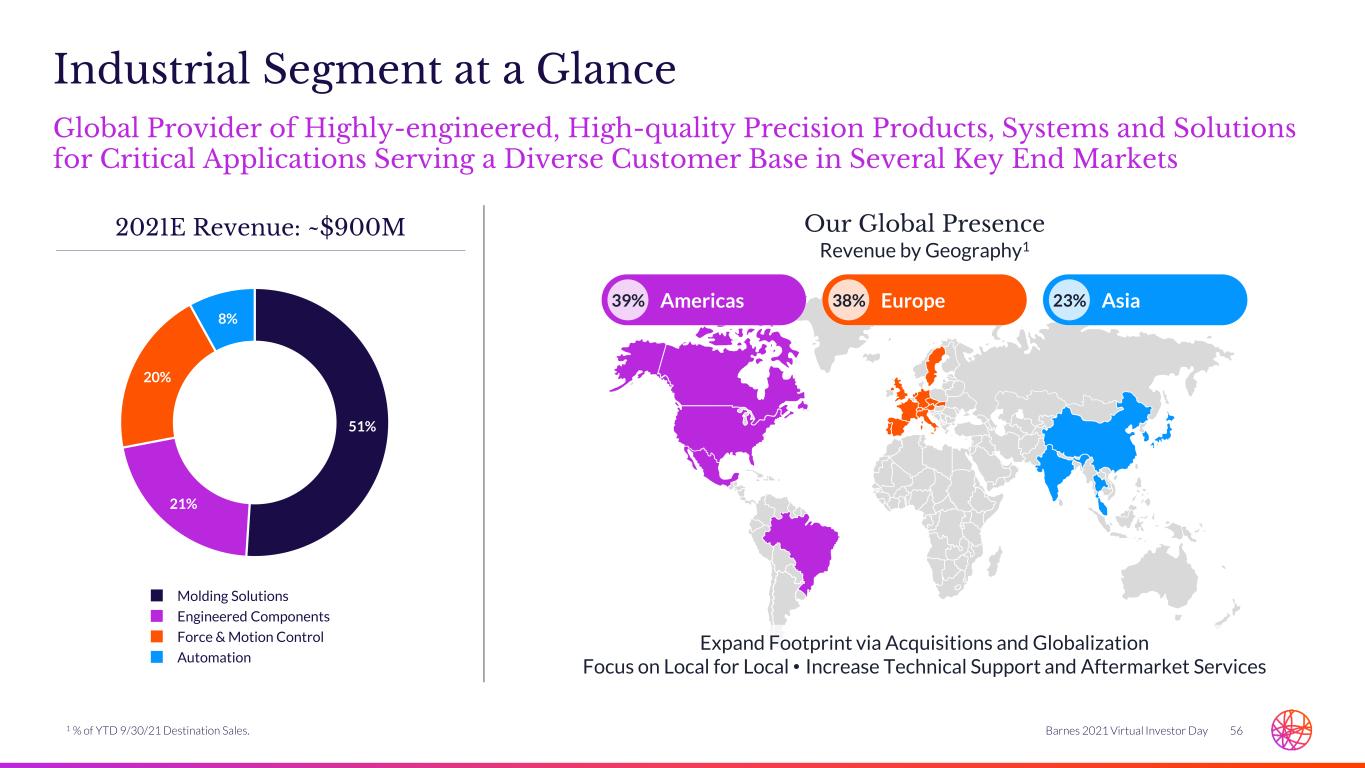

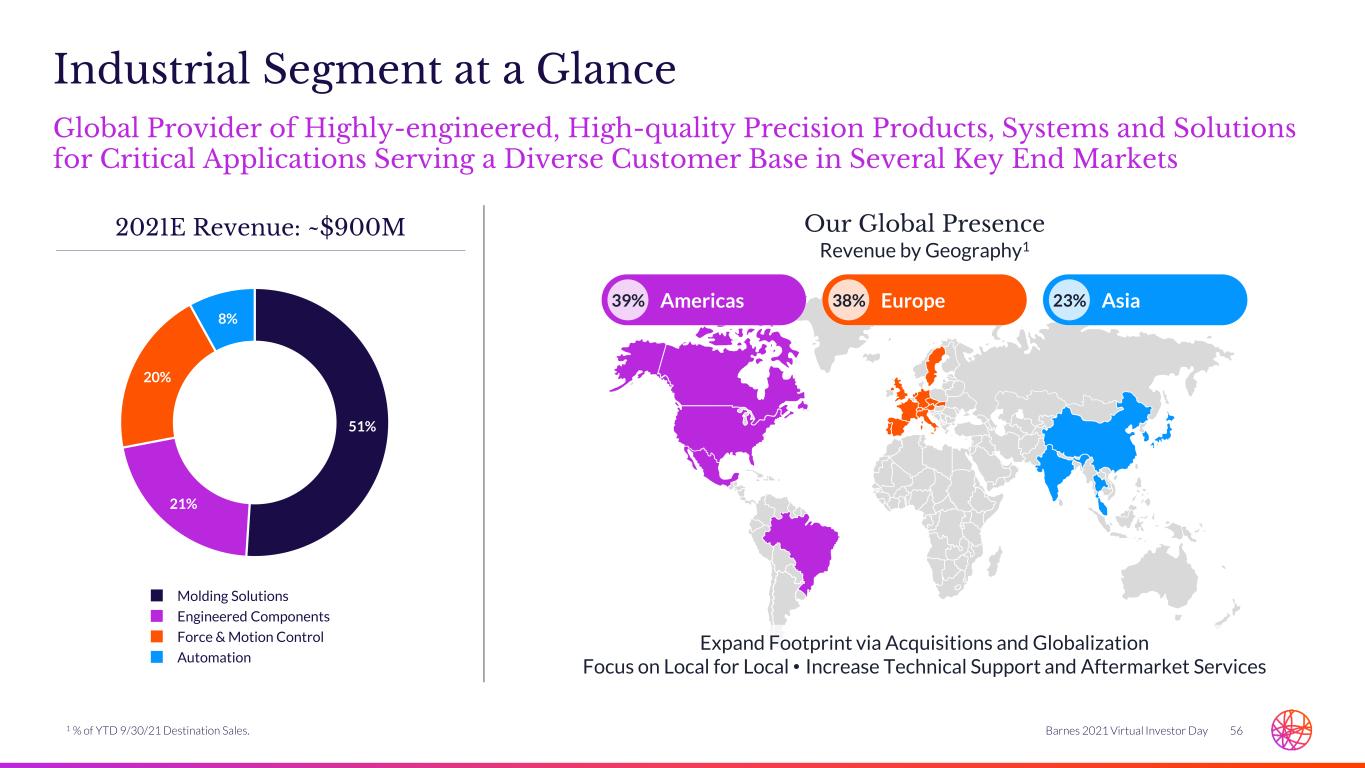

56Barnes 2021 Virtual Investor Day 51% 21% 20% 8% Industrial Segment at a Glance Global Provider of Highly-engineered, High-quality Precision Products, Systems and Solutions for Critical Applications Serving a Diverse Customer Base in Several Key End Markets Our Global Presence Revenue by Geography1 Americas39% Europe38% Asia23% Molding Solutions Engineered Components Force & Motion Control Automation 2021E Revenue: ~$900M Expand Footprint via Acquisitions and Globalization Focus on Local for Local • Increase Technical Support and Aftermarket Services 1 % of YTD 9/30/21 Destination Sales.

57Barnes 2021 Virtual Investor Day Industrial: Strategic Business Unit Overview Leading Global Provider of Highly-Engineered Precision Products, Systems and Solutions Diversified Portfolio of Market Leading Brands Serving Attractive End Markets Molding Solutions Overview Leading Customers Targeted portfolio of premium products and technologies serving high-quality segments of plastic injection molding industry Brands Force & Motion Control Innovative solutions enabling customers to overcome challenges in metal forming, heavy duty suspension, industrial and medical markets Automation Robotic grippers, vacuum cups, advanced end-of-arm tooling systems, sensors, and other components for intelligent robotic handling solutions Engineered Components Extensive range of manufacturing capabilities including fine-blanked solutions, precision components, and assemblies for industrial, medical and automotive applications

58Barnes 2021 Virtual Investor Day Portfolio Aligned with Several Long-term Macro Drivers Well-positioned to Address Key Macro Trends and Drive Higher Growth Connected World Consumer behavior and digital innovation • Connected devices improve operational performance with real time data • Digital thread and associated analytics accelerating continuous improvement in product quality and working capital management Electrification of Vehicles OEMs accelerated plans to convert new product platforms to EV by 2030 • New opportunities for high- margin specifications • Increasing number of new entrants into EV space • Opportunities to partner with OEMs on component innovation vs. build to spec Consumer Sustainability Broader preference for sustainable products and purpose-driven brands • Lightweight and environmentally friendly plastics in high demand but difficult to mold high quality parts with legacy equipment / technology • Supply chains favor earth- conscious suppliers Note: Electric Vehicle (EV). Automation Demand Increasing Demand for skilled labor exceeding capacity • Contactless manufacturing and distribution growing driven by digitalization • Continued increase in installed robotics propelled by lower equipment costs • Higher demand for system solutions based on efficiency gains through compatibility Aging Global Population Increased access to healthcare • Safety/hygiene critical consideration in packaging with higher use of disposables • Explosion of at-home testing applications due to technology and convenience

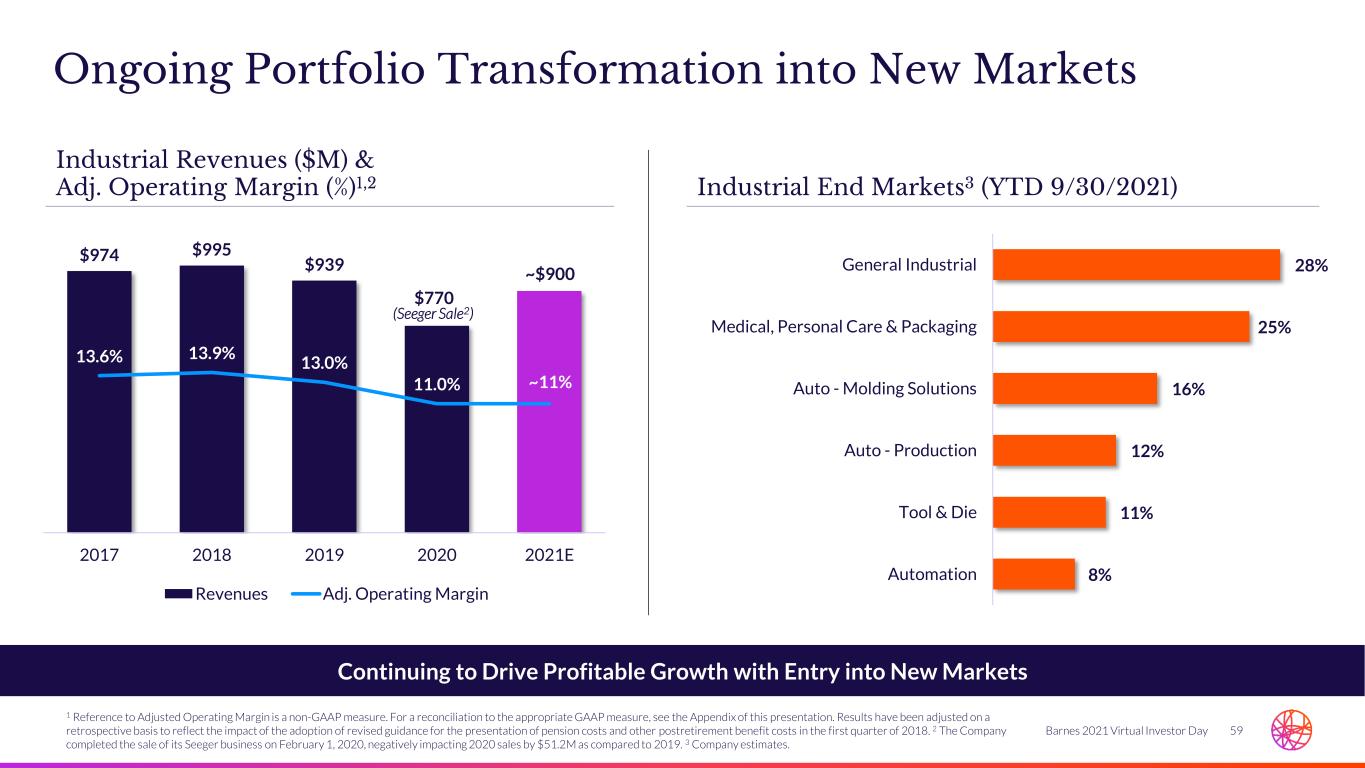

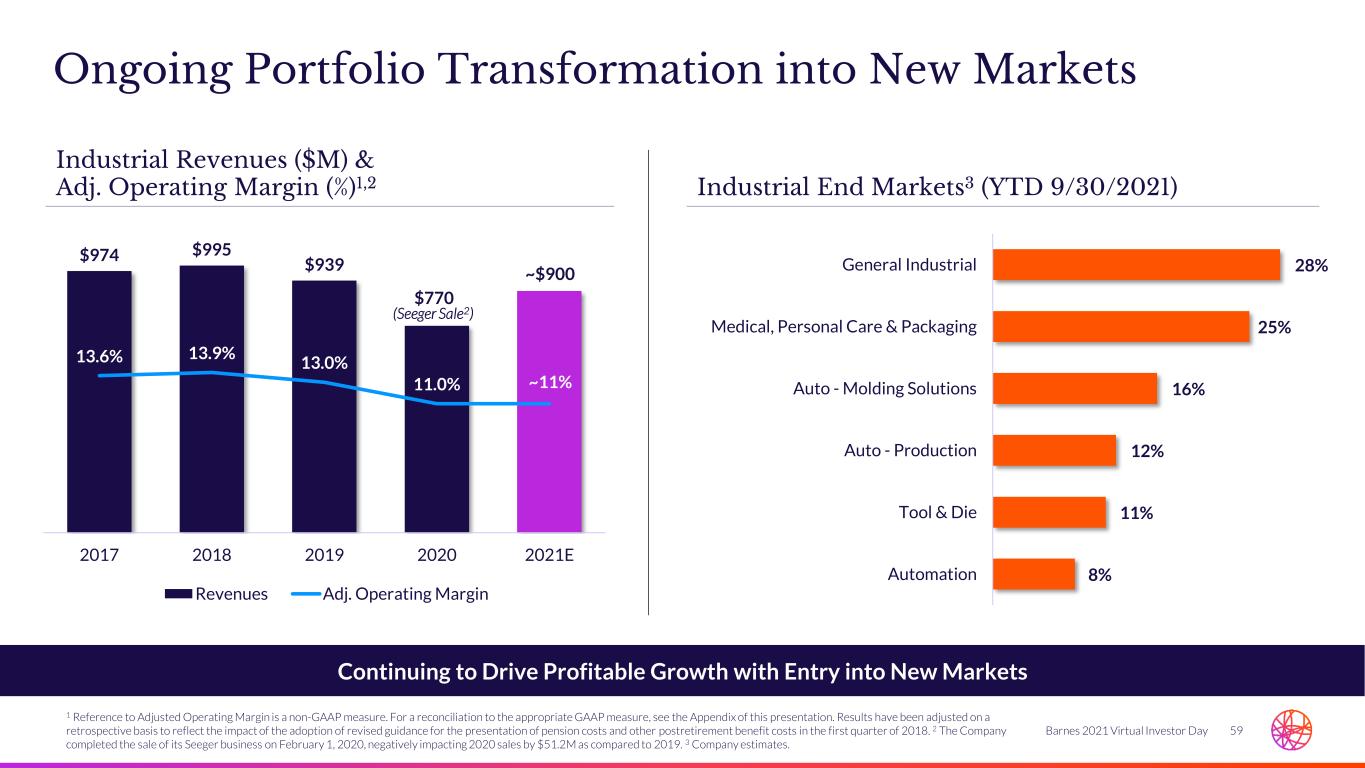

59Barnes 2021 Virtual Investor Day 8% 11% 12% 16% 25% 28% Automation Tool & Die Auto - Production Auto - Molding Solutions Medical, Personal Care & Packaging General Industrial Ongoing Portfolio Transformation into New Markets Continuing to Drive Profitable Growth with Entry into New Markets $974 $995 $939 $770 ~$900 13.6% 13.9% 13.0% 11.0% ~11% -1.0% 4.0% 9.0% 14.0% 19.0% 24.0% 0 100 200 300 400 500 600 700 800 900 1000 2017 2018 2019 2020 2021E Revenues Adj. Operating Margin (Seeger Sale2) Industrial Revenues ($M) & Adj. Operating Margin (%)1,2 Industrial End Markets3 (YTD 9/30/2021) 1 Reference to Adjusted Operating Margin is a non-GAAP measure. For a reconciliation to the appropriate GAAP measure, see the Appendix of this presentation. Results have been adjusted on a retrospective basis to reflect the impact of the adoption of revised guidance for the presentation of pension costs and other postretirement benefit costs in the first quarter of 2018. 2 The Company completed the sale of its Seeger business on February 1, 2020, negatively impacting 2020 sales by $51.2M as compared to 2019. 3 Company estimates.

60Barnes 2021 Virtual Investor Day Industrial Profitable Growth Strategy – Transforming into a Provider of Applied Technologies High Margin, High Growth Build a World-class Company Shift portfolio to high margin, recurring revenue solutions in attractive segments • Focus on attractive markets of medical, automation, mobility and packaging • Build high margin recurring revenue stream by connecting our installed base of hardware • Expand our presence and accelerate growth in attractive regions; U.S. and Asia Leverage BES as a Significant Competitive Advantage Accelerate digital transformation • Enhance customer experience and ease of doing business • Build robust digital lead generation and eCommerce capabilities to drive increased opportunity funnel and faster conversion • Drive back-office efficiencies and leverage smart factory investments Expand and Protect Our IP to Deliver Differentiated Solutions Build strategic marketing and sales force initiative tools within BES to strengthen commercial capability • Deploy operating system and goal deployment process across each SBU and cascade into each region • Leverage financial, commercial and operational excellence to drive growth, margin expansion and capital efficiency 421 Leverage BES as a Significant Competitive Advantage Attract and develop the best talent • Strengthen regional sales leadership and build a high performing sales organization focused on value-selling hardware and software solutions • Develop leaders to deploy and execute our growth strategy and operating system • Bolster strong mechanical engineering base with software developers and system architects 3

Automation Handling the Future Today

62Barnes 2021 Virtual Investor Day Automation Overview Americas 14% Europe 79% Asia 7% 100% Automation in Applications, Including Automotive, Factory Automation, Food & Beverage, Tooling, Home Appliances, Pharma & Medical, Among Others $55 $55 Up > 20% 2019 2020 2021E Revenue ($M) Geography1End Markets End of Arm Tooling Solution Vacuum Application Medical Solutions Mechanical Gripper 1 % of YTD 9/30/21 Destination Sales.

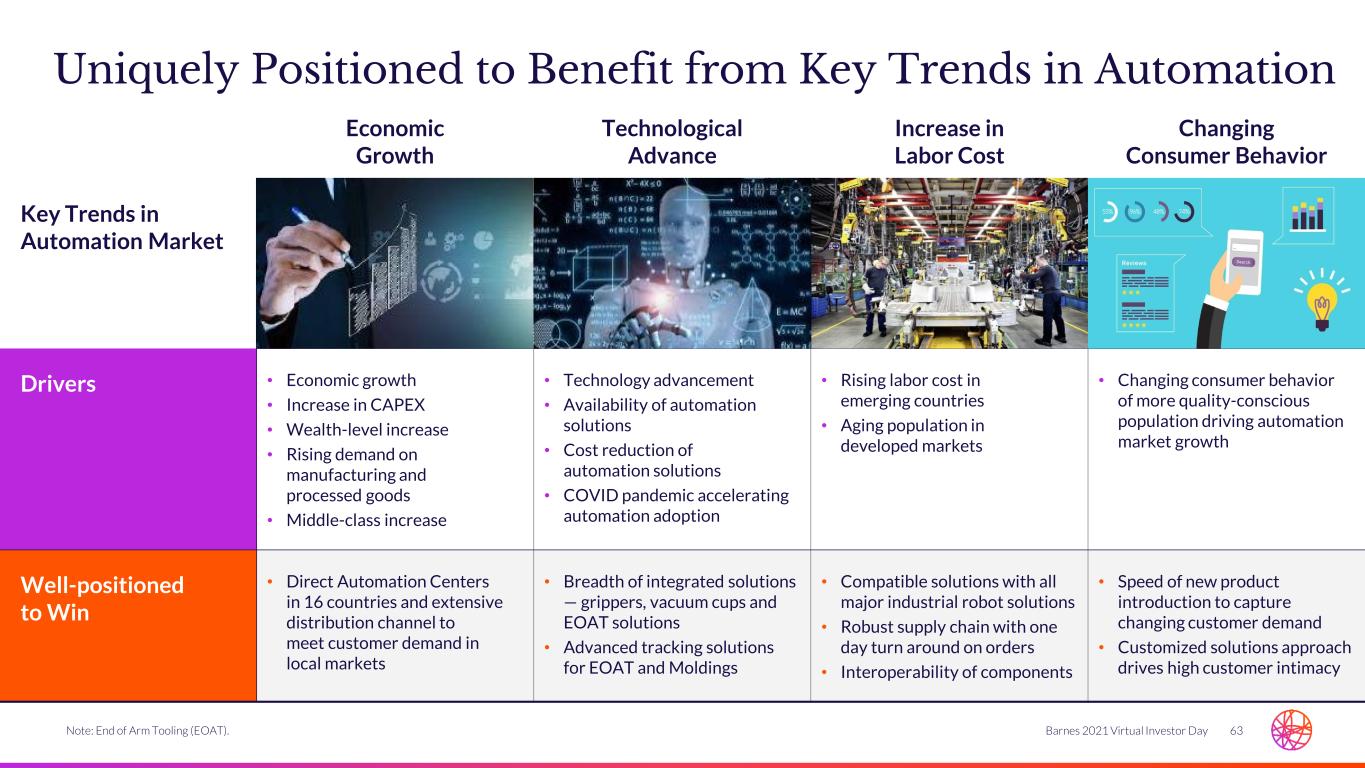

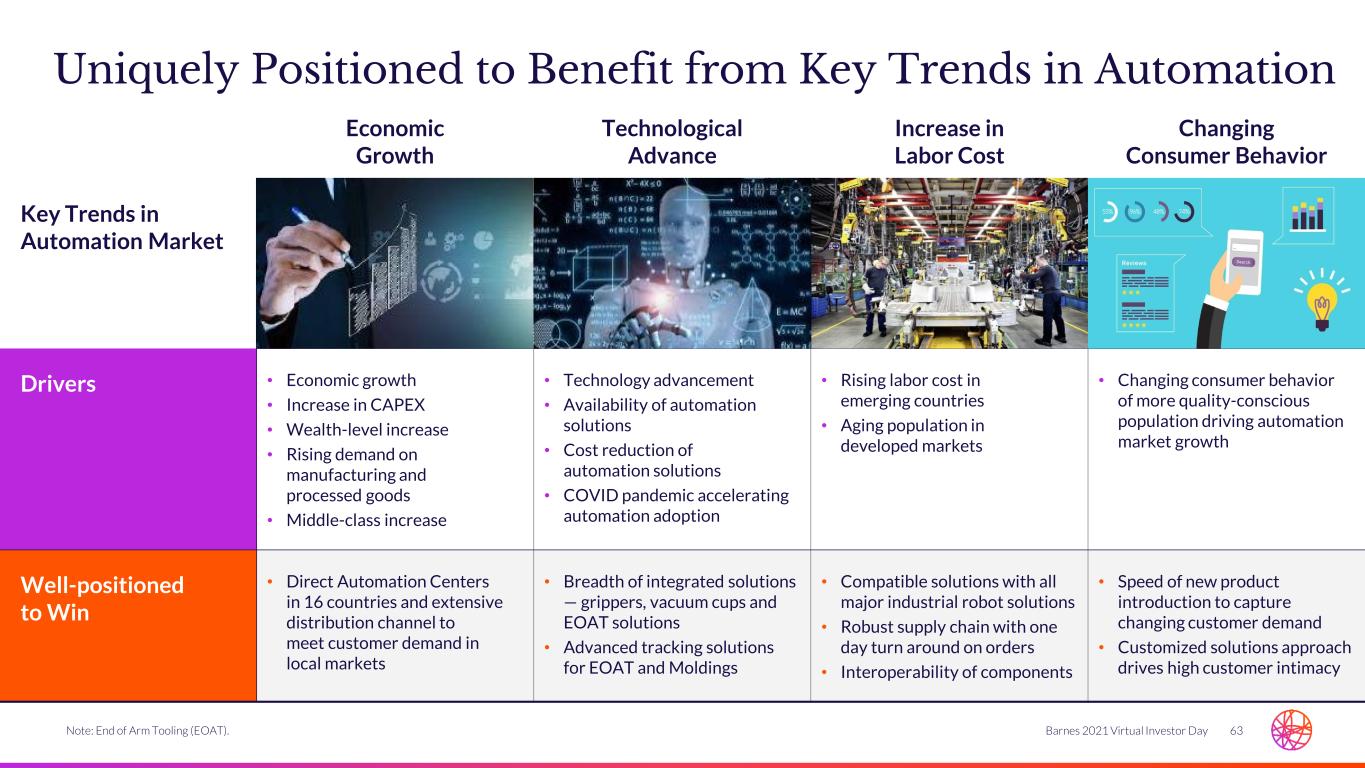

63Barnes 2021 Virtual Investor Day Economic Growth Technological Advance Increase in Labor Cost Changing Consumer Behavior Key Trends in Automation Market Drivers • Economic growth • Increase in CAPEX • Wealth-level increase • Rising demand on manufacturing and processed goods • Middle-class increase • Technology advancement • Availability of automation solutions • Cost reduction of automation solutions • COVID pandemic accelerating automation adoption • Rising labor cost in emerging countries • Aging population in developed markets • Changing consumer behavior of more quality-conscious population driving automation market growth Well-positioned to Win • Direct Automation Centers in 16 countries and extensive distribution channel to meet customer demand in local markets • Breadth of integrated solutions — grippers, vacuum cups and EOAT solutions • Advanced tracking solutions for EOAT and Moldings • Compatible solutions with all major industrial robot solutions • Robust supply chain with one day turn around on orders • Interoperability of components • Speed of new product introduction to capture changing customer demand • Customized solutions approach drives high customer intimacy Uniquely Positioned to Benefit from Key Trends in Automation Note: End of Arm Tooling (EOAT).

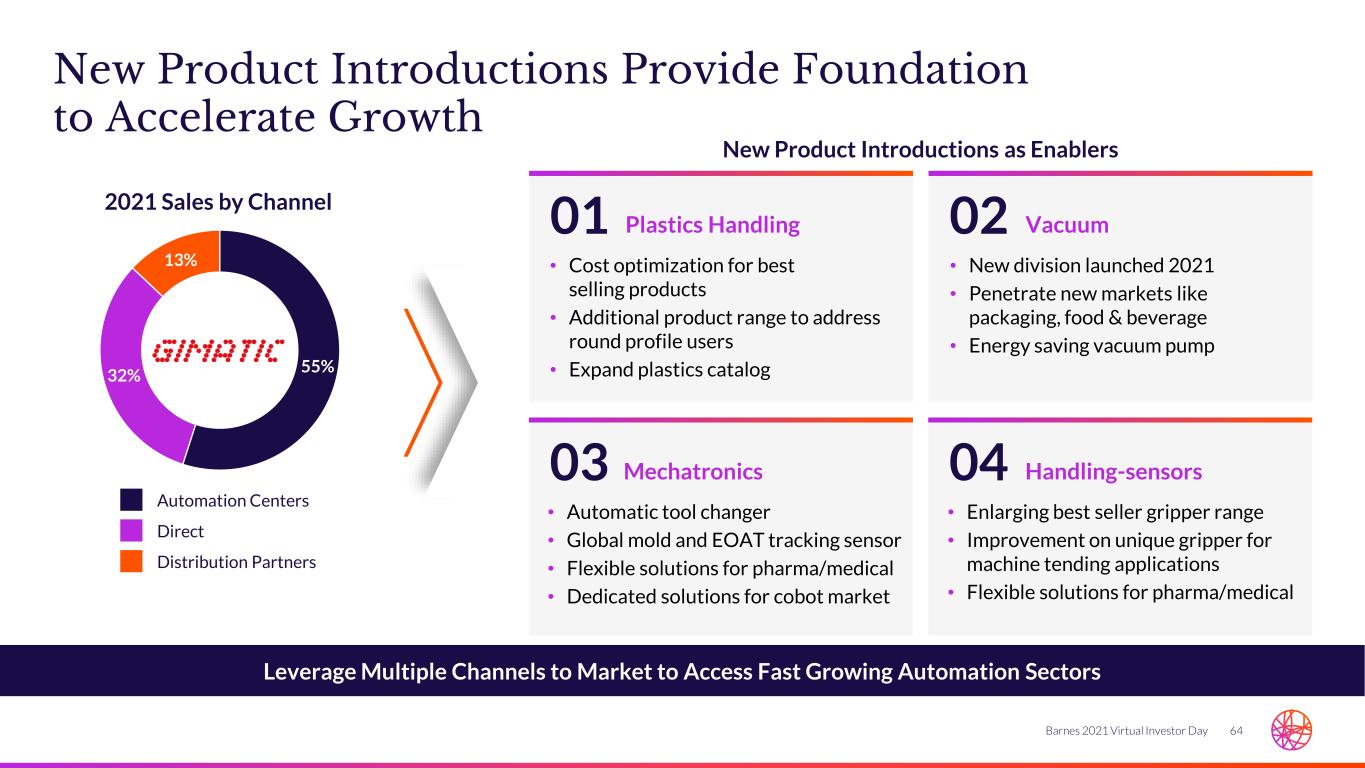

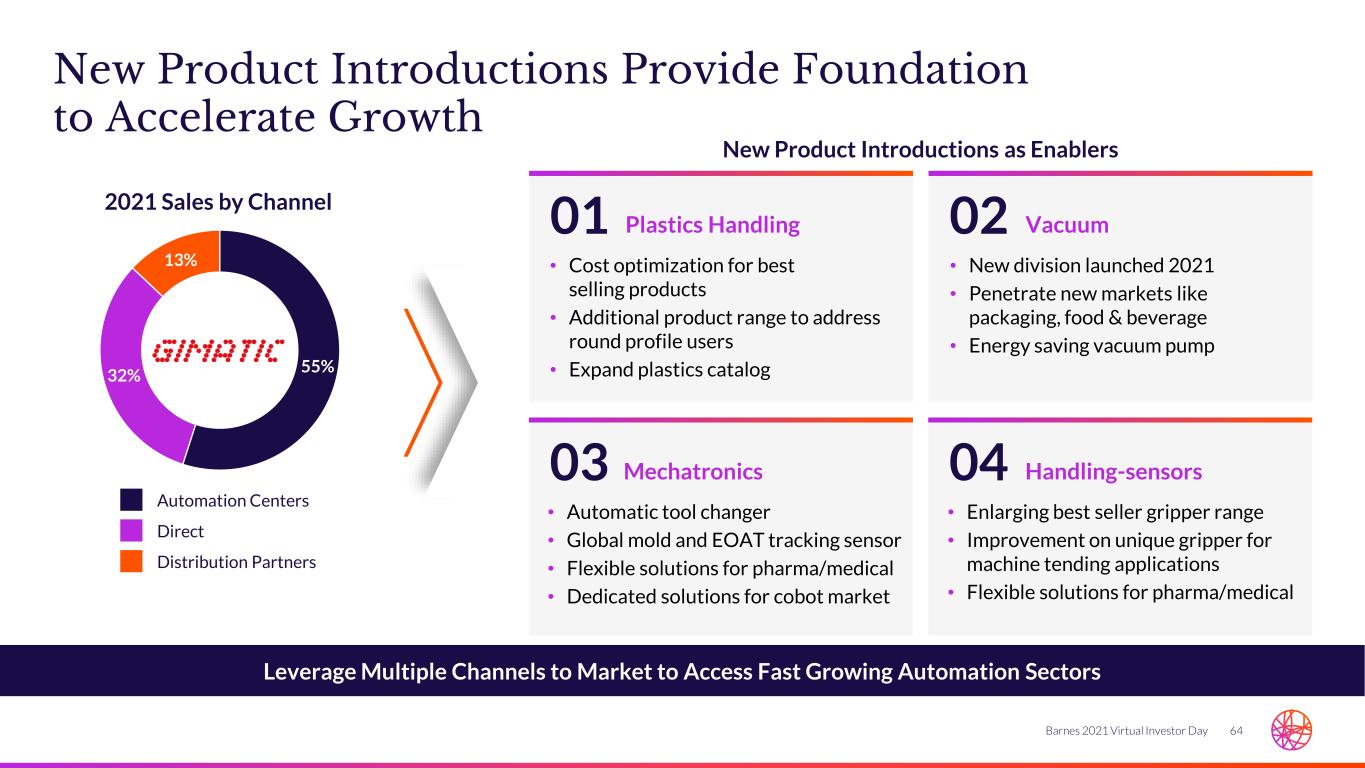

64Barnes 2021 Virtual Investor Day New Product Introductions Provide Foundation to Accelerate Growth Leverage Multiple Channels to Market to Access Fast Growing Automation Sectors New Product Introductions as Enablers • Cost optimization for best selling products • Additional product range to address round profile users • Expand plastics catalog Plastics Handling01 • Automatic tool changer • Global mold and EOAT tracking sensor • Flexible solutions for pharma/medical • Dedicated solutions for cobot market Mechatronics03 • New division launched 2021 • Penetrate new markets like packaging, food & beverage • Energy saving vacuum pump Vacuum02 • Enlarging best seller gripper range • Improvement on unique gripper for machine tending applications • Flexible solutions for pharma/medical Handling-sensors04 55% 32% 13% 2021 Sales by Channel Automation Centers Direct Distribution Partners

65Barnes 2021 Virtual Investor Day Automation: Strategy for Profitable Growth High Margin, High Growth Build a World-class Company Capitalize on leadership position in vacuum technology • Grow channel partners; expand geographic presence and penetration through comprehensive product portfolio • Leverage existing automation centers to sell direct to large key accounts • Expand presence in Europe and U.S. Leverage BES as a Significant Competitive Advantage Expand in China • Focus on product cost optimization – operations and localizations • Create high quality-innovative products – added value EOAT solutions • Capture additional sales opportunity by expanding solution offerings • Expand direct sales and technical support capability Expand and Protect Our IP to Deliver Differentiated Solutions Grow global key accounts • Expand global relations and network with key accounts; increase presence in Europe and Asia • Win global frame agreements and leverage local sales presence to maximize share of wallet • Increase brand awareness • Drive global coordination with advanced local service Create Value for All Stakeholders Drive growth in pharma and medical end markets • Leverage experience in mature markets to scale in Western Europe and U.S. • Increase segment-specific product portfolio by working in partnership with targeted customers • Speed to market with flexible and tailor- made solutions • Increase focus and marketing activities through existing channels 3 421

66Barnes 2021 Virtual Investor Day Case Study: Building Customized Grippers for Medical Applications Innovative and Unique Cleanroom Gripping Solution GIMATIC & DENSO GMP “A” CLEANROOM GRIPPING SOLUTION Denso, a leading company in 6 axis robots and SCARA deployed across a large spectrum of the manufacturing process, chose Gimatic to design and realize a mission critical solution to extend the usability of grippers and EOAT in aseptic environments such as cleanrooms Allows a manufacturing company to carry out production without running the risk of cross contamination from any type of pathogenic agents Cleanroom Gripping Solution • Compliant with GMP Grade A and B cleanliness standards • Cover made in Medical Standard approved silicon with use of special stainless-steel fingers • Complete Kit certified ISO14644-1 for ISO 2 cleanrooms • Hygienic and transparent design surfaces and materials to prevent proliferation of bacteria Results / Outcomes Cover made in medical standard approved silicon Use of special stainless-steel fingers • Demonstrate engineering expertise and flexibility • Standard product in catalog Note: Good Manufacturing Practice (GMP). Selective Compliance Assembly Robot Arm (SCARA).

67Barnes 2021 Virtual Investor Day Case Study: Vacuum Cups for Complex Food Handling Applications Well-positioned to Leverage Expanded Portfolio to Win in Attractive Vacuum Cup Market • ~30% energy savings • Improved operational efficiency and uptime • Reduced maintenance costs • Leverage complete range of gripping solutions MARKET • +$1B Vacuum Cup Market • Launched range of 1,000+ SKUs in 1Q21 CUSTOMER CHALLENGE • Major producer of potato chips in EU • Lifecycle of the suction cups • Handling different chips bags shapes with only one suction cup type • High energy consumption • Reduce the maintenance intervention and cost Our Innovative Solution • Designed a light and modular gripper structure to improve machine performance and up time • Built a 3D printed gripper with integrated vacuum pumps to improve vacuum velocity and reduce reaction time • High-performance vacuum cups that reduced energy consumption • Improved customer total cost of ownership by improving uptime and reducing maintenance intervals • Custom designed to solve specific customer challenges Results / Outcomes

Molding Solutions Thinking Bigger Together

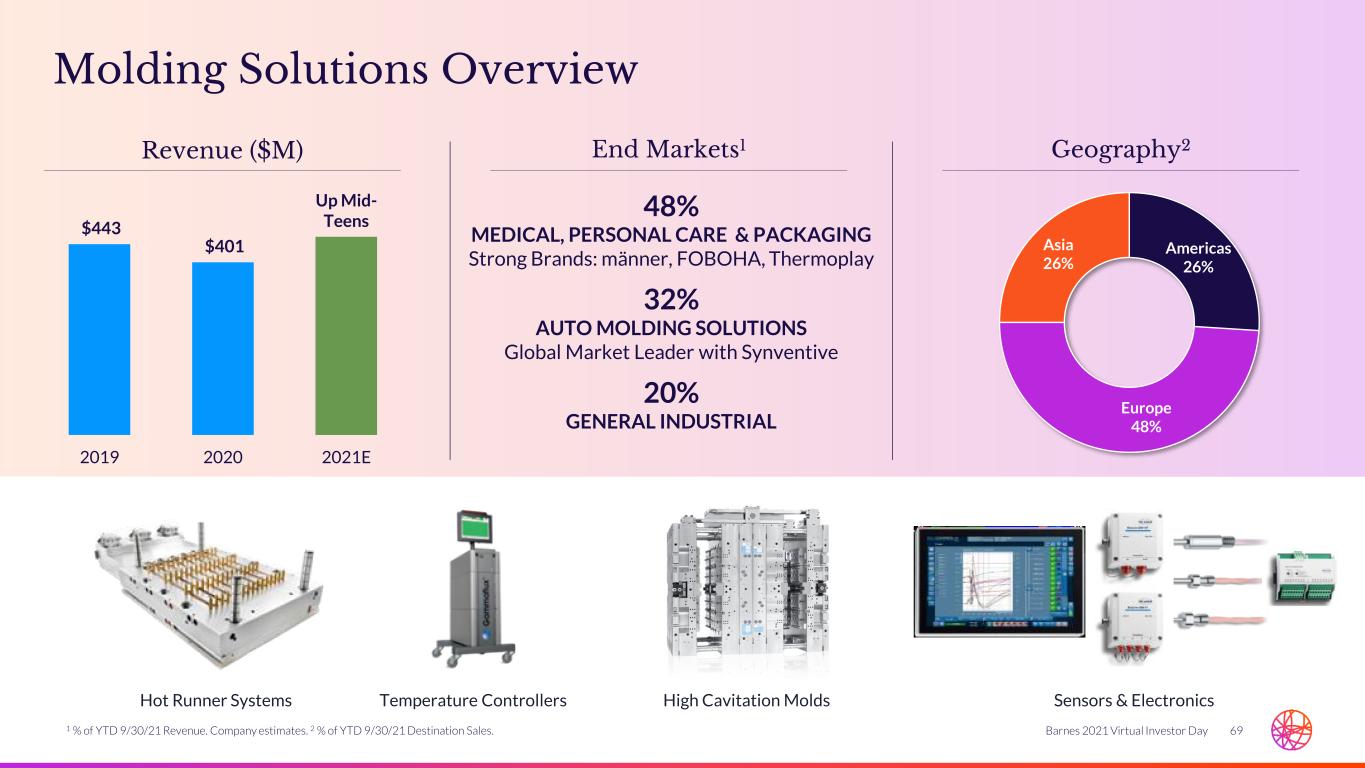

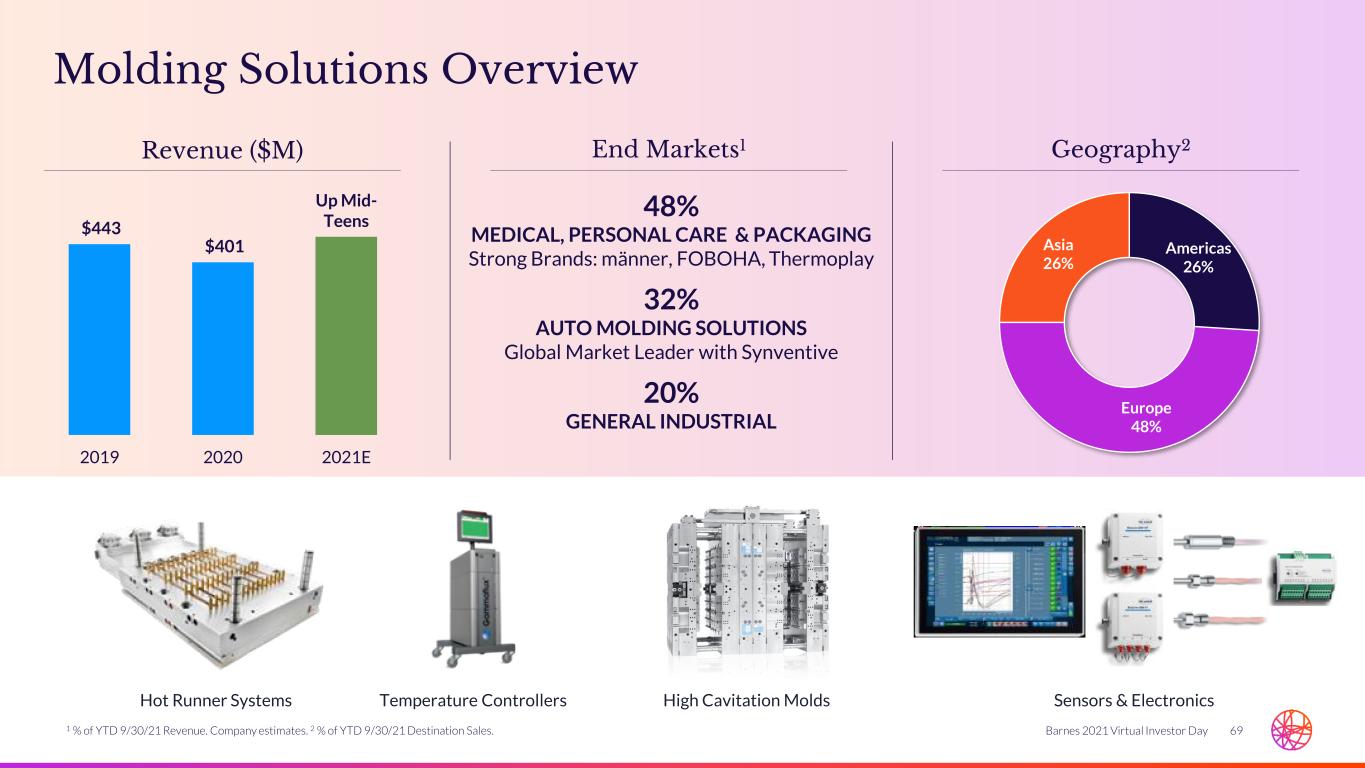

69Barnes 2021 Virtual Investor Day $443 $401 Up Mid- Teens 2019 2020 2021E 48% MEDICAL, PERSONAL CARE & PACKAGING Strong Brands: männer, FOBOHA, Thermoplay 32% AUTO MOLDING SOLUTIONS Global Market Leader with Synventive 20% GENERAL INDUSTRIAL Americas 26% Europe 48% Asia 26% Revenue ($M) Geography2End Markets1 Hot Runner Systems Temperature Controllers High Cavitation Molds Sensors & Electronics Molding Solutions Overview 1 % of YTD 9/30/21 Revenue. Company estimates. 2 % of YTD 9/30/21 Destination Sales.

70Barnes 2021 Virtual Investor Day Molding Solutions: Uniquely Positioned Portfolio Integrated Solutions to Deliver Quality Control, Molding Precision and Automated Process Adjustments Molds for High Precision and High-volume Applications Hot Runner Temperature Controllers to Optimize Conditions Control Sensors to Monitor and Diagnose Process Hot Runners to Improve Molding Efficiency $3B $3.5B $0.5B Hot RunnersMolds Controls 2021 Total Addressable Markets1 1 TAM based on company estimates and independent market data.

71Barnes 2021 Virtual Investor Day 0% 20% 40% 60% 80% 100% Leading Brands & Solutions to Win Growing Medical Market Highest Precision and Quality to Meet Demands of Medical Customers 120 100 40 300 50 75 20 50 200 Infusion System Devices1 Diabetes Care Devices Smart Syringes Autoinjectors Anesthesia Devices Infusion Pumps Drug Delivery Devices Endoscopy Devices Surgical Robotics Surgical Equipment Intraocular Lenses Ophthalmic Devices Dental Implants and Prosthetics Orthopedic Implants Medical/Diagnostic Imaging Coronary Stents Intervention Cardiology & Peripheral Vascular Laboratory Disposables • $1B+ market segment growing high single digits • Key account management capability critical as Top 5 customers represent 80% of IVD market • Europe and U.S. remain largest regions with rapid growth in Asia • Breadth of solutions capable of responding to evolving end market needs and product requirements • Lead times and global footprint important to satisfy high customer demand • High touch technical support and application expertise critical • Demand for precision and quality drives customer stickiness • Variations in product sizes require tight manufacturing tolerances Note: In Vitro Diagnostics (IVD). 1 TAM for molds and hot runners based on company estimates and independent market data.

72Barnes 2021 Virtual Investor Day Molding Solutions: Strategy for Profitable Growth Vision: One Stop Shop for Customers across Key Injection Molding Markets Globally High Margin, High Growth Build a World-class Company Leverage integrated portfolio to sell systems and get connected • Commercialize product portfolio offerings as compelling bundle to target end markets • Leverage connected devices platform and build recurring revenue streams with data driven analytics offering • Drive customer stickiness with expanded service offering Leverage BES as a Significant Competitive Advantage Focus Synventive on electrification and diversification • Drive sales initiative to gain share in core automotive • Strengthen position with new technology and application opportunities • Leverage first mover advantage in electrification • Expand into electronics and industrial segment Expand and Protect Our IP to Deliver Differentiated Solutions Accelerate growth in medical and pharma • Sell existing product portfolio offerings in IVD to grow share • Leverage existing products to grow in drug delivery • Focus on diabetes care • Build on existing hot runner share Create Value For All Stakeholders Expand and entrench in U.S. and Asia • Drive organic growth in targeted geographic regions • Develop new and bolster existing strategic partnerships • Expand key account management capability to serve large customers • Focus on inorganic growth opportunities to further expand presence 3 421

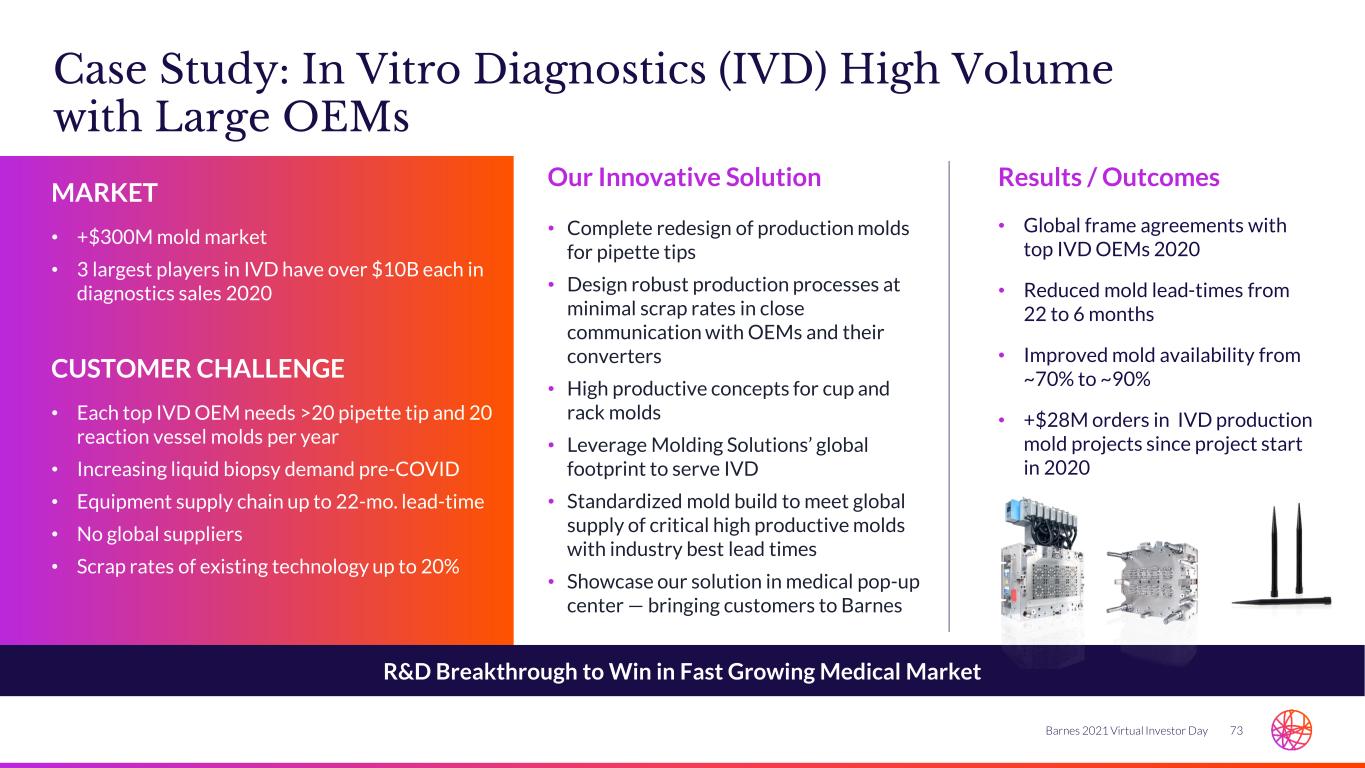

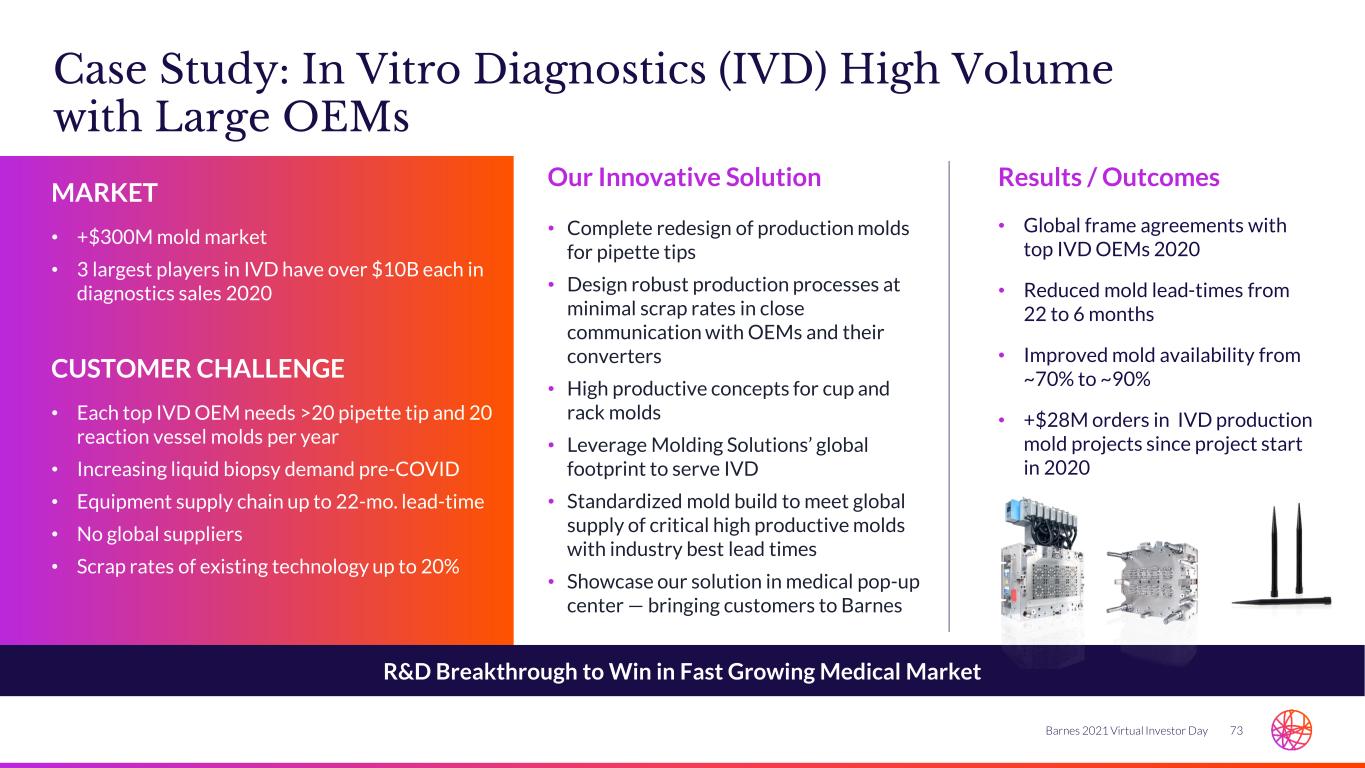

73Barnes 2021 Virtual Investor Day Case Study: In Vitro Diagnostics (IVD) High Volume with Large OEMs R&D Breakthrough to Win in Fast Growing Medical Market • Global frame agreements with top IVD OEMs 2020 • Reduced mold lead-times from 22 to 6 months • Improved mold availability from ~70% to ~90% • +$28M orders in IVD production mold projects since project start in 2020 MARKET • +$300M mold market • 3 largest players in IVD have over $10B each in diagnostics sales 2020 CUSTOMER CHALLENGE • Each top IVD OEM needs >20 pipette tip and 20 reaction vessel molds per year • Increasing liquid biopsy demand pre-COVID • Equipment supply chain up to 22-mo. lead-time • No global suppliers • Scrap rates of existing technology up to 20% Our Innovative Solution • Complete redesign of production molds for pipette tips • Design robust production processes at minimal scrap rates in close communication with OEMs and their converters • High productive concepts for cup and rack molds • Leverage Molding Solutions’ global footprint to serve IVD • Standardized mold build to meet global supply of critical high productive molds with industry best lead times • Showcase our solution in medical pop-up center — bringing customers to Barnes Results / Outcomes

74Barnes 2021 Virtual Investor Day • Building the first production mold with working digital watermark MARKET • Personal Care Packaging • P&G: leading brand with $76B revenue (2021E) P&G CHALLENGE: PACKAGING INNOVATION • Make a meaningful impact in brands key environmental impact area • 100% of packaging will be recyclable or reusable • Ensure a significant increase in responsibly sourced bio-based, recycled or more resource efficient materials Our Innovative Solution • FOBOHA partnering with P&G to pioneer production molds according to Holy Grail 2.0 consortium specifications • Traceability solutions to enable automated sorting and recycling • Realizing a digital watermark on plastic bottle caps to be detected by vision inspection in automated waste sorting lines • Hot runners and controls optimized to process recycled plastics Results / Outcomes Case Study: Post-Consumer Plastic Recycling with P&G R&D Breakthrough in Producing a Digital Watermark to Perfectly Sort Plastic Waste; Accelerate Recycling

Force & Motion Control Moving Growth Forward with Purpose

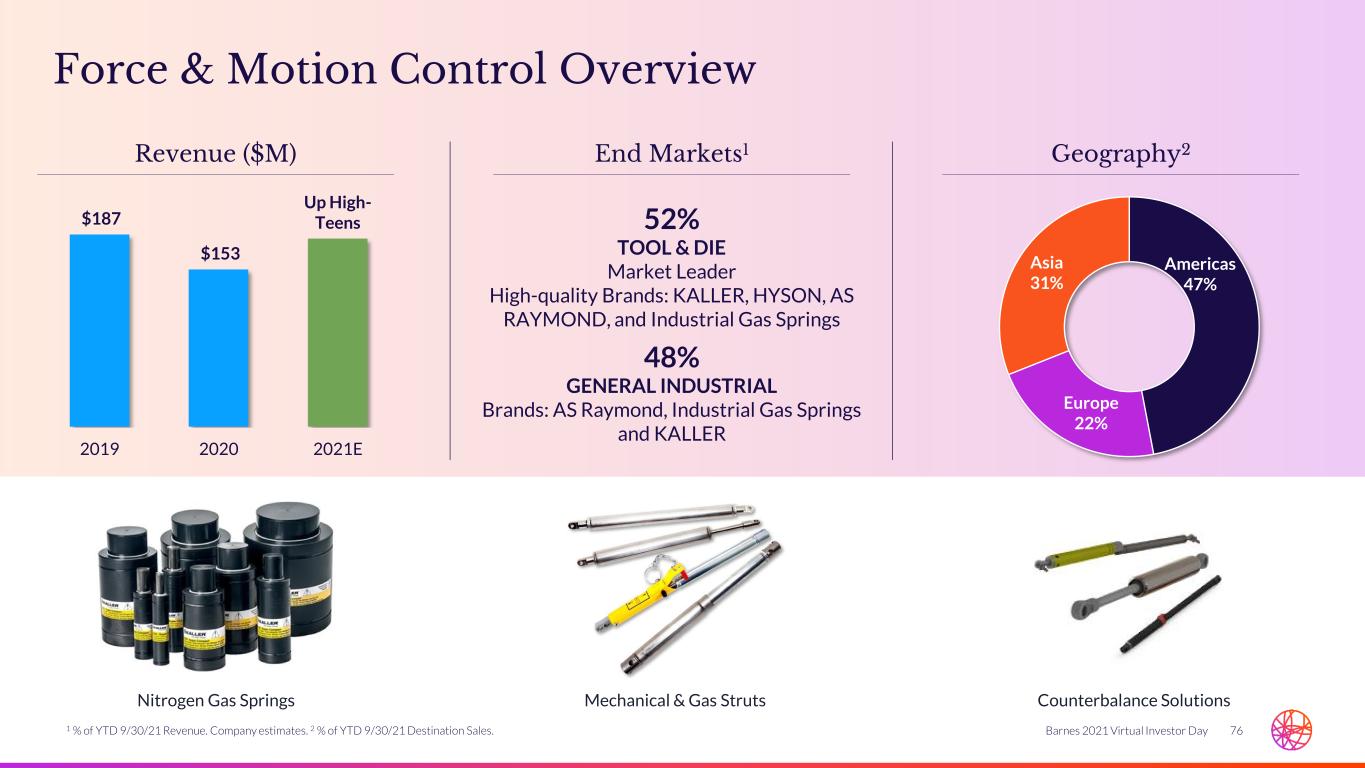

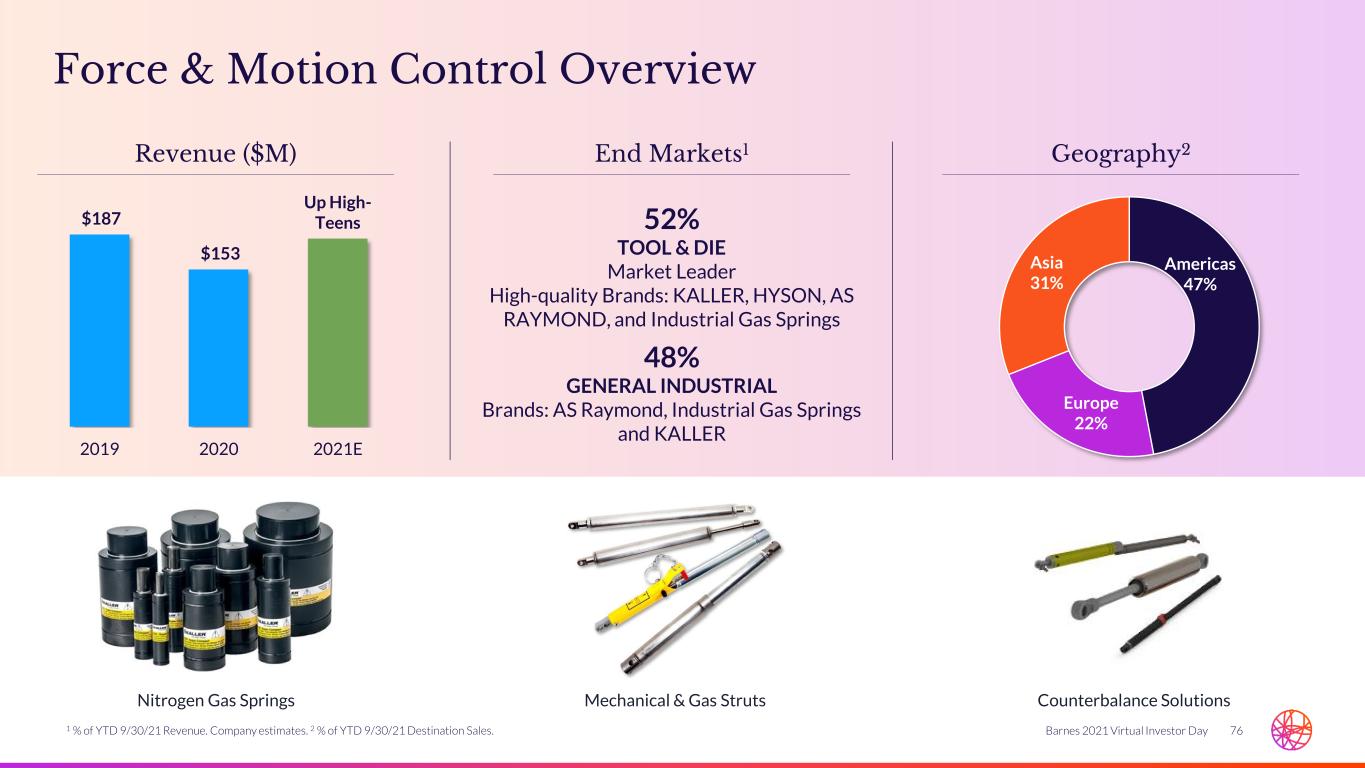

76Barnes 2021 Virtual Investor Day Force & Motion Control Overview $187 $153 Up High- Teens 2019 2020 2021E 52% TOOL & DIE Market Leader High-quality Brands: KALLER, HYSON, AS RAYMOND, and Industrial Gas Springs 48% GENERAL INDUSTRIAL Brands: AS Raymond, Industrial Gas Springs and KALLER Americas 47% Europe 22% Asia 31% Revenue ($M) Geography2End Markets1 Nitrogen Gas Springs Mechanical & Gas Struts Counterbalance Solutions 1 % of YTD 9/30/21 Revenue. Company estimates. 2 % of YTD 9/30/21 Destination Sales.

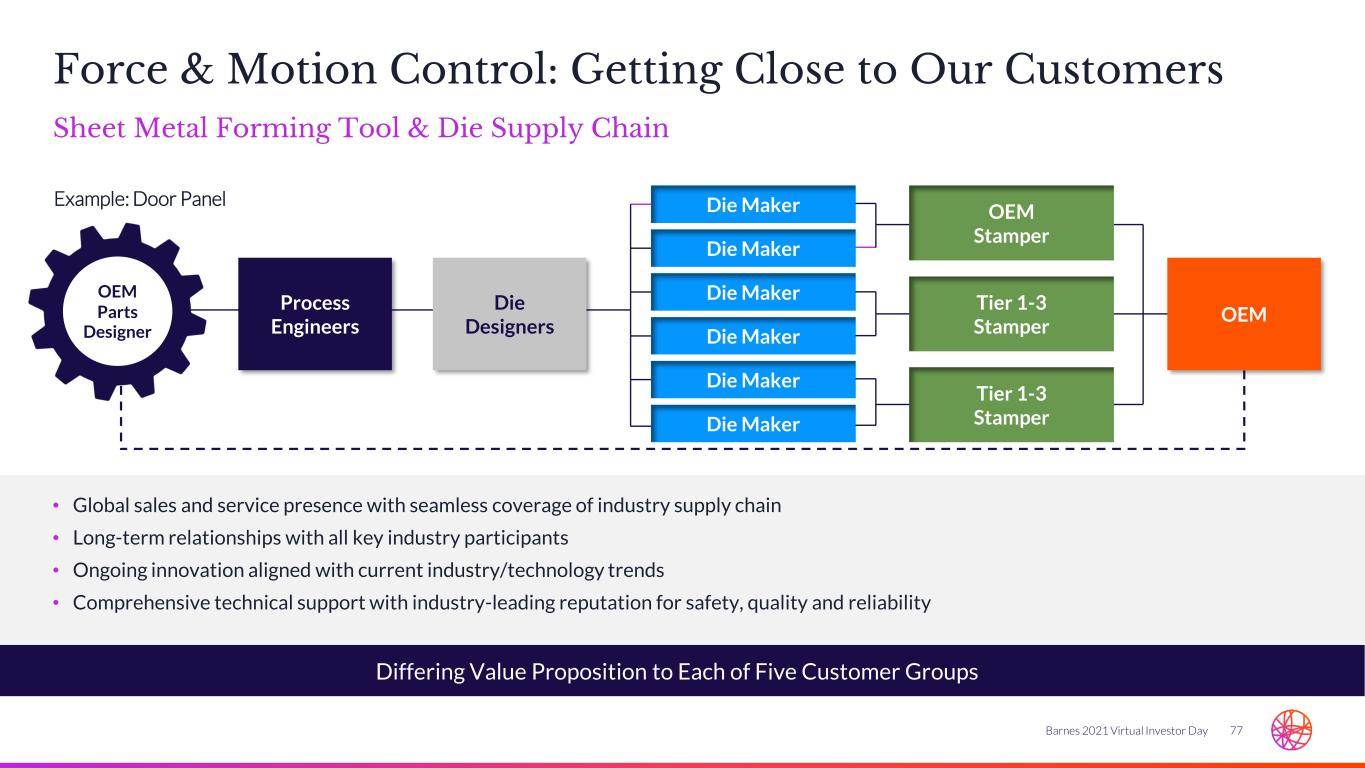

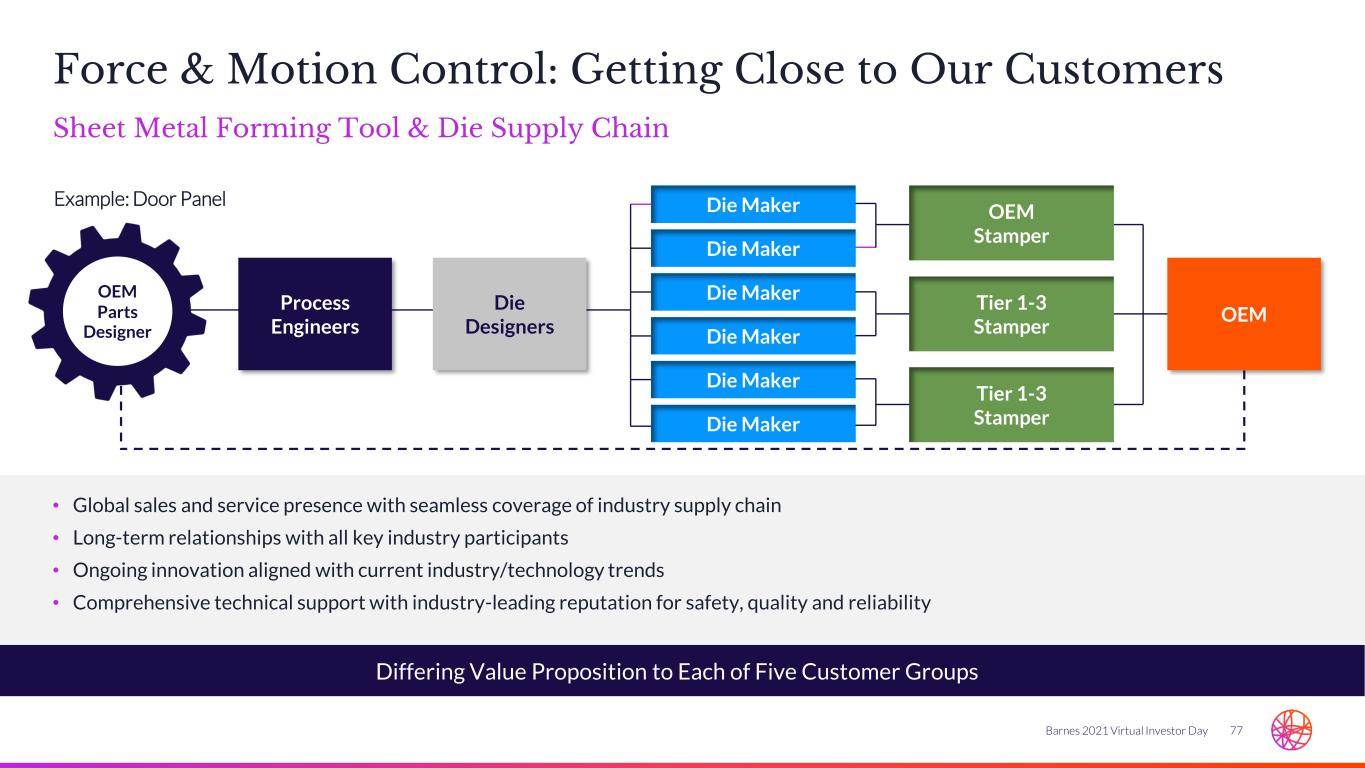

77Barnes 2021 Virtual Investor Day Force & Motion Control: Getting Close to Our Customers Sheet Metal Forming Tool & Die Supply Chain • Global sales and service presence with seamless coverage of industry supply chain • Long-term relationships with all key industry participants • Ongoing innovation aligned with current industry/technology trends • Comprehensive technical support with industry-leading reputation for safety, quality and reliability Example: Door Panel Process Engineers Die Designers Die Maker Die Maker Die Maker Die Maker Die Maker Die Maker OEM Stamper Tier 1-3 Stamper Tier 1-3 Stamper OEM OEM Parts Designer Differing Value Proposition to Each of Five Customer Groups

78Barnes 2021 Virtual Investor Day Well-positioned to Win in Higher Growth End Markets1 Leverage Product Breadth and Global Presence to Accelerate Growth Drive Share of Wallet with Large U.S. Distributors • Increase product lines carried • Provide inside sales, engineering and technical support Penetrate Attractive Industrial End Markets New EV Models Fueling Growth in Program Releases • 50% of new program releases are for hybrids or battery EV • New programs typically released 2 years prior to vehicle launch • Expected high single digit growth in demand for gas springs • Focused growth with current products into new end markets • Replace hydraulic with controllable springs and heavy-duty springs • Leverage strong brand and channel presence in Asia and North America 0% 20% 40% 60% 80% 100% White Goods Electronics Plastic Mold Japan Europe Korea China NA SA Japan Europe Korea China NA SA Japan Europe Korea China NA SA Japan Europe Korea China NA Mill 0% 20% 40% 60% 80% 100% North America Mexico Canada United States 20 15 10 5 0 A B C D E Other North America MRO by Distributor A n n u al A d d re ss ab le (U S D $ M ) US CA MX Note: Internal Combustion Engine (ICE). 1 Total Addressable Market based on Company estimates. 0% 20% 40% 60% 80% 100% 2023 2024 2025 Battery EV Battery EV Battery EV Hybrid EV Hybrid EV Hybrid EV ICE ICE ICE Other Other Other

79Barnes 2021 Virtual Investor Day Force & Motion Control: Strategy for Profitable Growth 1 High Margin, High Growth Build a World-class Company Expand industrials market share • Near-term focus on winning U.S. market expansion • Invest in key account and feet on street presence to target attractive end markets • Expand product portfolio and share of wallet with major partners • Deploy next generation eCommerce to drive recurring revenue and ease of business Leverage BES as a Significant Competitive Advantage Drive automotive growth • Position portfolio to capture opportunity from growing electrification market • Invest in innovation to develop next-generation products to provide differentiation at premium and value price points • Strengthen marketing and tech support capabilities with new entrants / Tier 1s • Focus on eCommerce as an additional channel to market Expand and Protect Our IP to Deliver Differentiated Solutions Diversify portfolio to non-automotive end markets • Focus on appliance / HVAC and plastic mold market • Expansion of heavy industrials product range globally • Connect hardware in field to provide actionable information and build recurring revenue stream 32

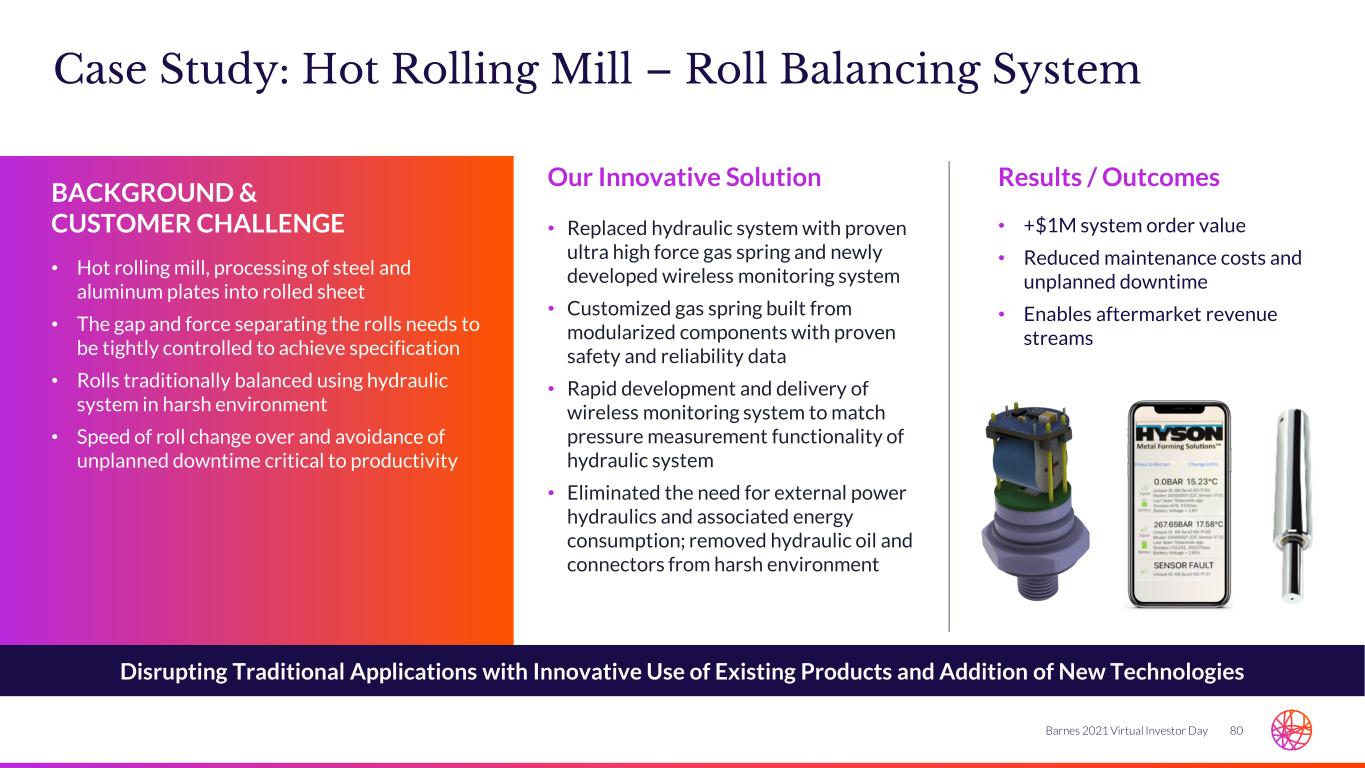

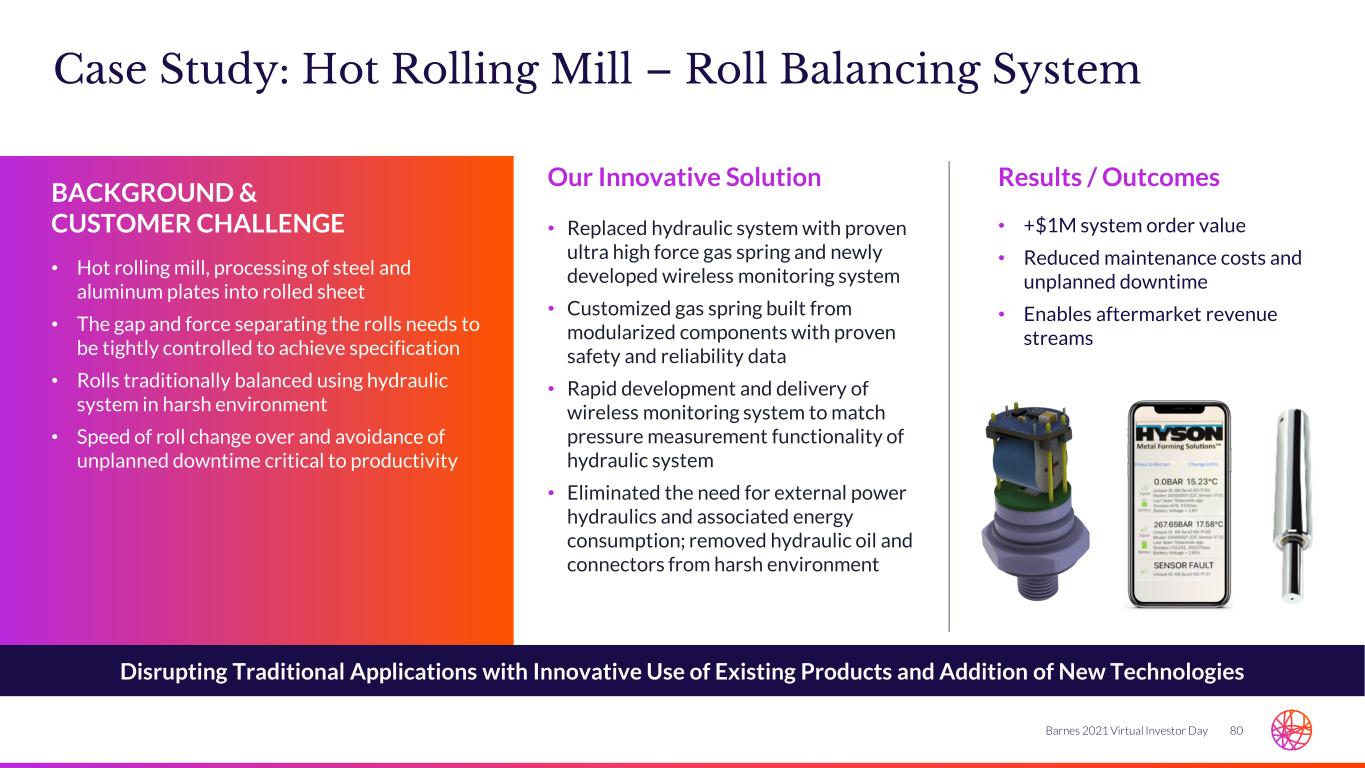

80Barnes 2021 Virtual Investor Day Case Study: Hot Rolling Mill – Roll Balancing System Disrupting Traditional Applications with Innovative Use of Existing Products and Addition of New Technologies • +$1M system order value • Reduced maintenance costs and unplanned downtime • Enables aftermarket revenue streams BACKGROUND & CUSTOMER CHALLENGE • Hot rolling mill, processing of steel and aluminum plates into rolled sheet • The gap and force separating the rolls needs to be tightly controlled to achieve specification • Rolls traditionally balanced using hydraulic system in harsh environment • Speed of roll change over and avoidance of unplanned downtime critical to productivity Our Innovative Solution • Replaced hydraulic system with proven ultra high force gas spring and newly developed wireless monitoring system • Customized gas spring built from modularized components with proven safety and reliability data • Rapid development and delivery of wireless monitoring system to match pressure measurement functionality of hydraulic system • Eliminated the need for external power hydraulics and associated energy consumption; removed hydraulic oil and connectors from harsh environment Results / Outcomes

Engineered Components Execution + Velocity = Results

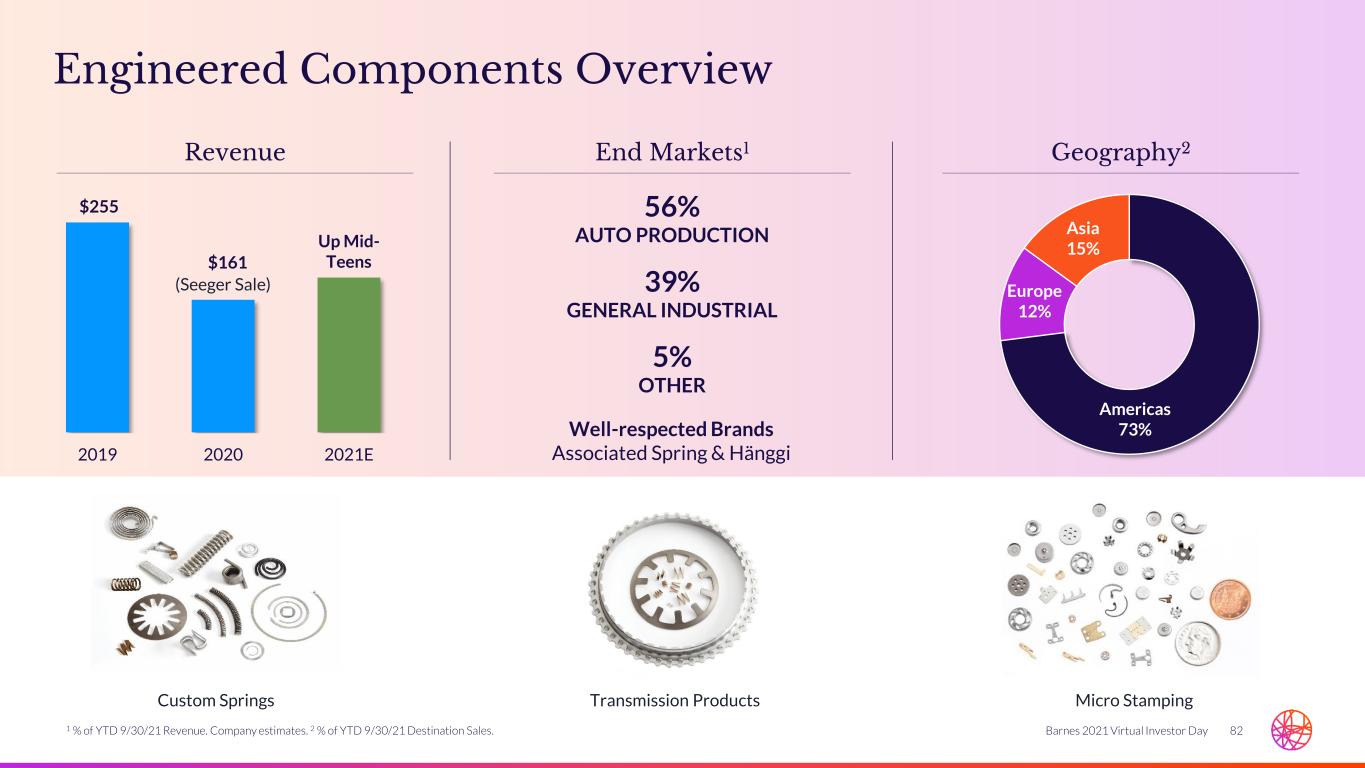

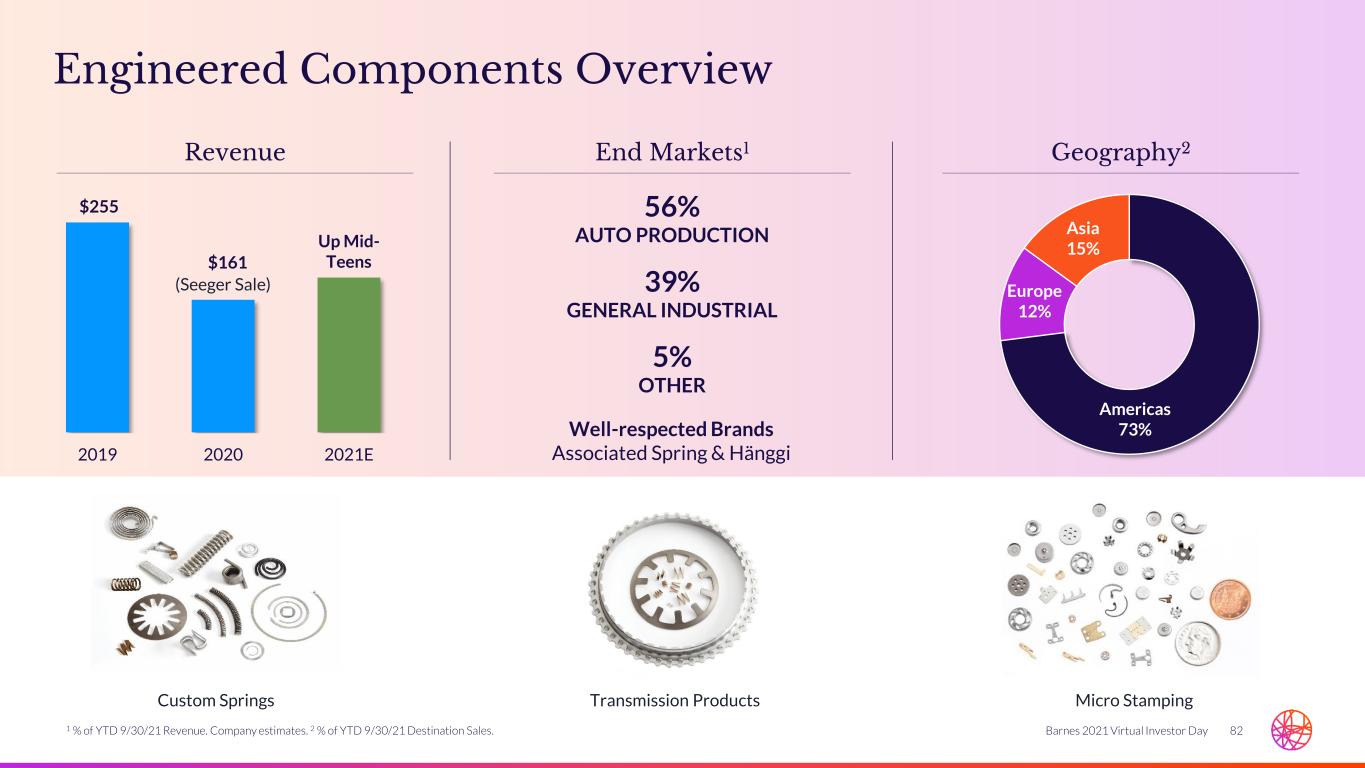

82Barnes 2021 Virtual Investor Day 56% AUTO PRODUCTION 39% GENERAL INDUSTRIAL 5% OTHER $255 $161 Up Mid- Teens 2019 2020 2021E Well-respected Brands Associated Spring & Hänggi Americas 73% Europe 12% Asia 15% (Seeger Sale) Revenue Geography2End Markets1 Custom Springs Transmission Products Micro Stamping Engineered Components Overview 1 % of YTD 9/30/21 Revenue. Company estimates. 2 % of YTD 9/30/21 Destination Sales.

83Barnes 2021 Virtual Investor Day 1 High Margin, High Growth Build a World-class Company Next Gen Automotive • Increase non-powertrain product penetration • Grow next gen powertrain in EV and Hybrid applications • Continue enhancing our value proposition to strengthen brand reputation • Experienced growth team aligned with customer expectations and global footprint High Margin, High Growth Build a World-class Company Industrial • Establish preferred, or single source, status and grow share of wallet among top customers — utilizing global reach and technical expertise • Propose and execute LTAs / frame agreements / MOUs with major customers with specific growth milestones • Dedicated commercial teams for each vertical to drive new business wins through focused service and engineering Expand and Protect Our IP to Deliver Differentiated Solutions Medical Devices • Gain share in attractive segments of glucose monitoring, endoscopy, surgical staples and contract manufacturing • Established team with 50+ years of combined medical device expertise to open doors with identified prospects, gain credibility, and build brand awareness • Identify new capabilities required to increase competitiveness and differentiation Engineered Components: Strategy for Profitable Growth 2 3 Note: Long-term Agreements (LTAs); Memorandum of Understanding (MOU).

84Barnes 2021 Virtual Investor Day Case Study: Continuous Glucose Monitoring Medical U-Cannulas Safe CGM Monitoring with Reduced Pain by Providing U-Cannulas Made by Outstanding Stamping Technology and Processes • Market leader awarded Hänggi with global CGM cannula program worth $13M over 5 yrs • Global potential for additional awards due to unique value proposition • Required process step “cannula cleaning” can be implemented in- house at Hänggi BACKGROUND & CUSTOMER CHALLENGE • Diabetes is rising worldwide — estimated increase of 50% through 20451 • Accurate continuous glucose monitoring (CGM) is essential for all affected patients • A cannula is used to insert a temporary CGM sensor under the patient’s skin • The cannula is grounded, which is expensive to manufacture but also causes a higher level of pain during insertion Our Innovative Solution • Hänggi technology provides burr-free stamped cannulas – reducing costs • Needle tip is finish stamped (no grounding) – reducing penetration force by 30%, alleviating pain during insertion • Grounding and related processes are not required – delivering a cleaner, less expensive solution • 100% in-line process monitoring ensures ISO 13485 medical requirements upheld • Hänggi developed packaging that ensures ease of handling sensitive cannulas during customer’s final assembly process Results / Outcomes 1 Source: International Diabetes Federation.

85Barnes 2021 Virtual Investor Day Key Takeaways Targeted Portfolio of Highly- engineered, Precision Products, Systems and Solutions Balanced End Market Portfolio Leveraged to Favorable Macro Trends in Medical, Automation, Sustainable Plastics and Electric Vehicles Focused and Strategically Aligned Business; Driving Growth through Deepening Customer Relationships, Digitalization and Differentiated Capabilities 01 02 03 Strong Organic and Acquisitive Growth Opportunities to Leverage Global Presence, Core Capabilities and Commercial Relationships 04 BES Anchors Profitable Growth, Innovation, Margin Expansion and Cash Generation 05

Aerospace Deep Dive Mike Beck SVP & President, Aerospace

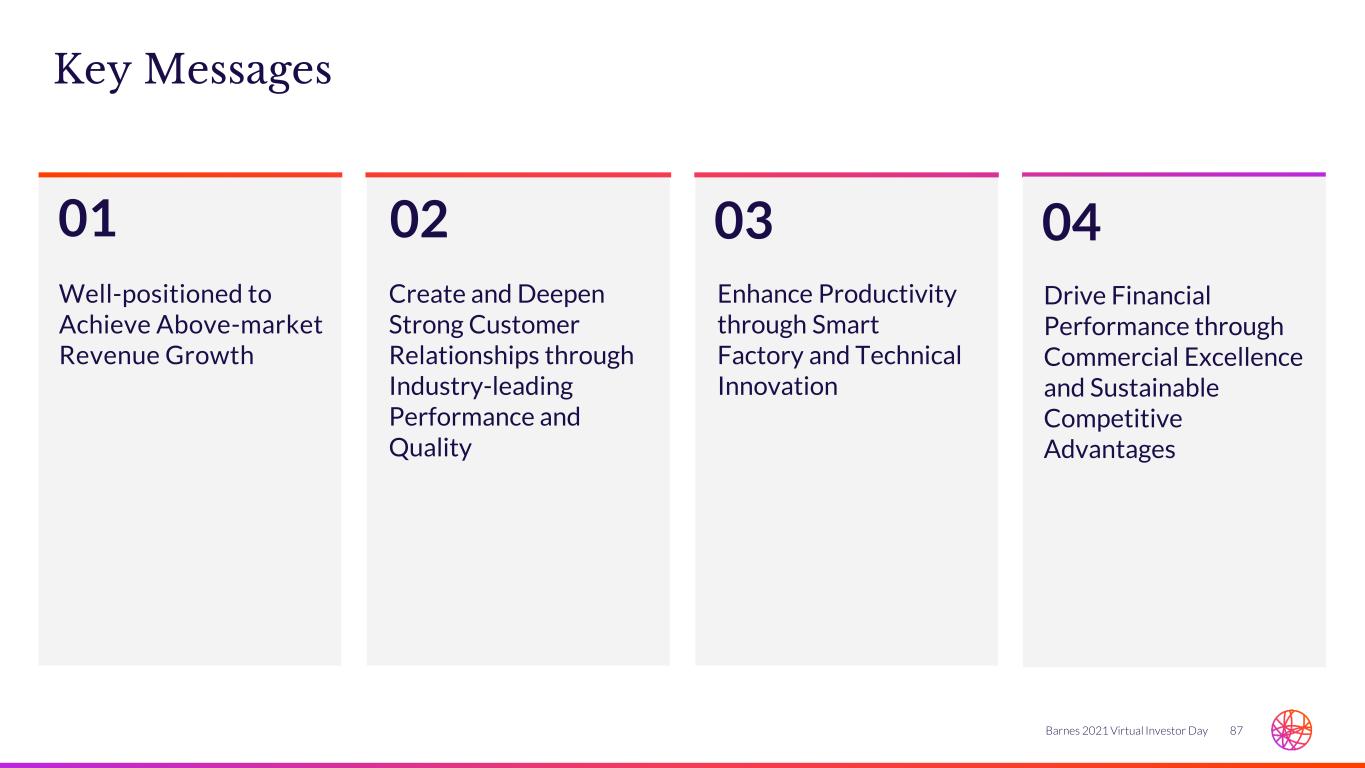

87Barnes 2021 Virtual Investor Day Key Messages Well-positioned to Achieve Above-market Revenue Growth Create and Deepen Strong Customer Relationships through Industry-leading Performance and Quality Enhance Productivity through Smart Factory and Technical Innovation 01 02 03 Drive Financial Performance through Commercial Excellence and Sustainable Competitive Advantages 04

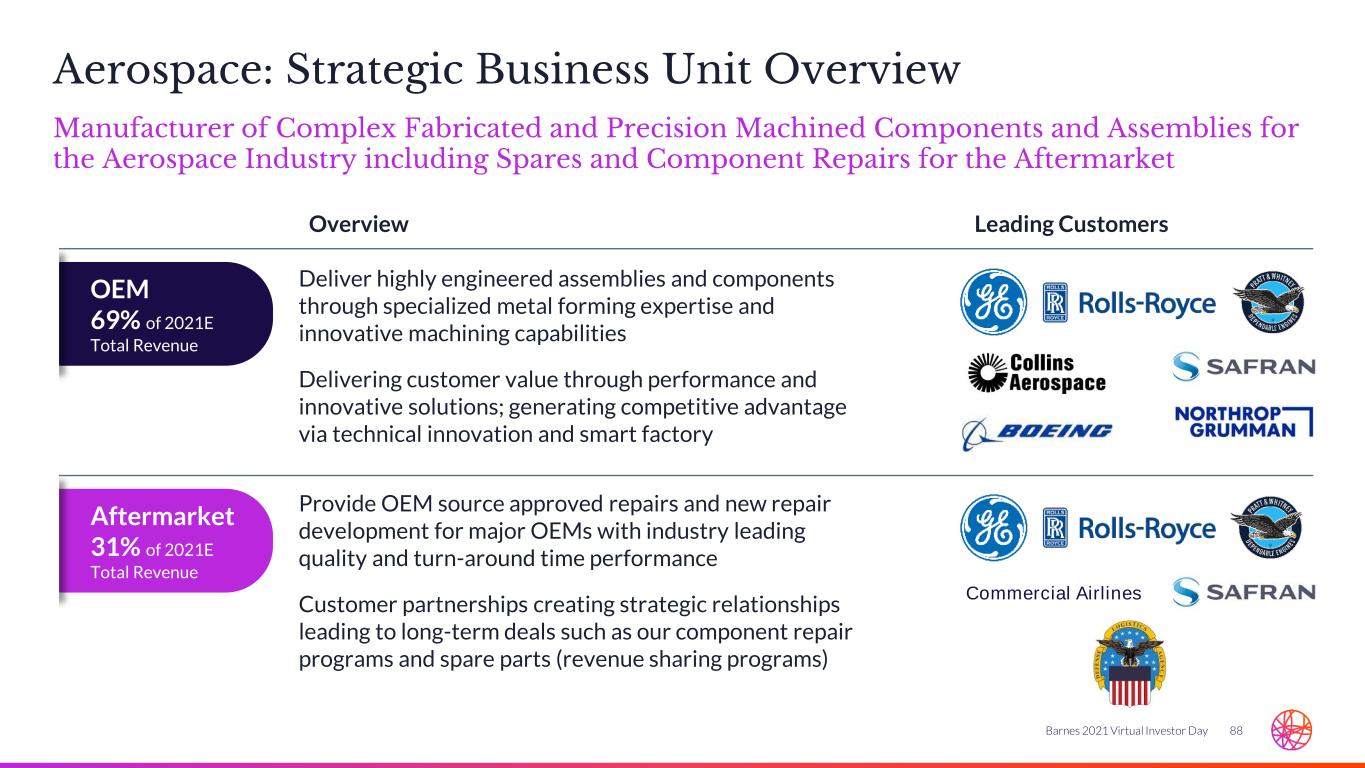

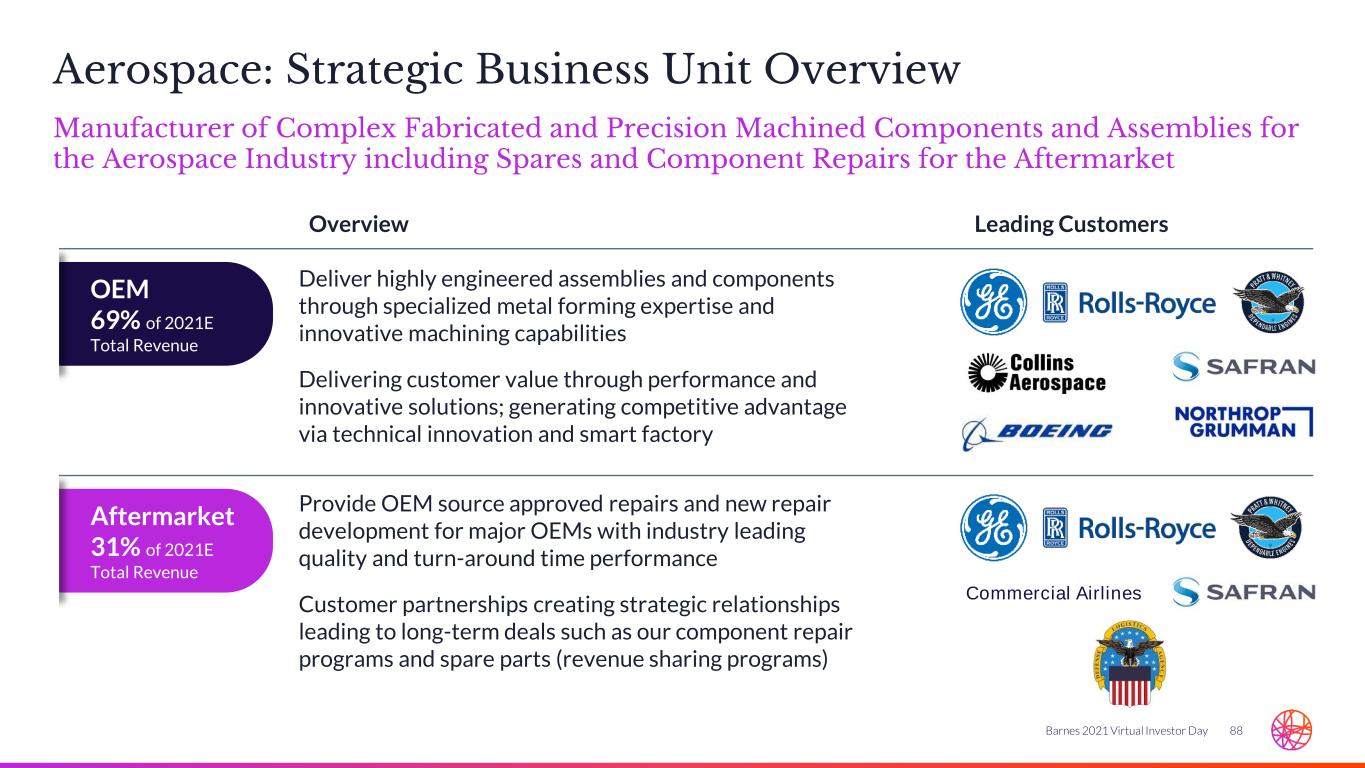

88Barnes 2021 Virtual Investor Day Aerospace: Strategic Business Unit Overview Manufacturer of Complex Fabricated and Precision Machined Components and Assemblies for the Aerospace Industry including Spares and Component Repairs for the Aftermarket OEM 69% of 2021E Total Revenue Overview Leading Customers Deliver highly engineered assemblies and components through specialized metal forming expertise and innovative machining capabilities Delivering customer value through performance and innovative solutions; generating competitive advantage via technical innovation and smart factory Provide OEM source approved repairs and new repair development for major OEMs with industry leading quality and turn-around time performance Customer partnerships creating strategic relationships leading to long-term deals such as our component repair programs and spare parts (revenue sharing programs) Aftermarket 31% of 2021E Total Revenue Commercial Airlines

89Barnes 2021 Virtual Investor Day Commercial Aftermarket Defense Diversified Portfolio Positioned to Take Advantage of Market Recovery - 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2019 2020 2021F 2022F 2023F 2024F 2025F Boeing & Airbus Commercial Deliveries1 Commercial Passenger Forecast2 % of 2019 US Defense Budget3 ($B) 0 100 200 300 400 500 600 700 800 FY2019 FY2020 FY2021 FY2022F 0% 20% 40% 60% 80% 100% 120% 140% 2019 2020 2021F 2022F 2023F 2024F 2025F 1 Source: Forecast Int’l and Teal, Forecast average. 2 Source: IATA Economics using data from Tourism / IATA Passenger Forecast, April 2021. 3 Source: US DoD.

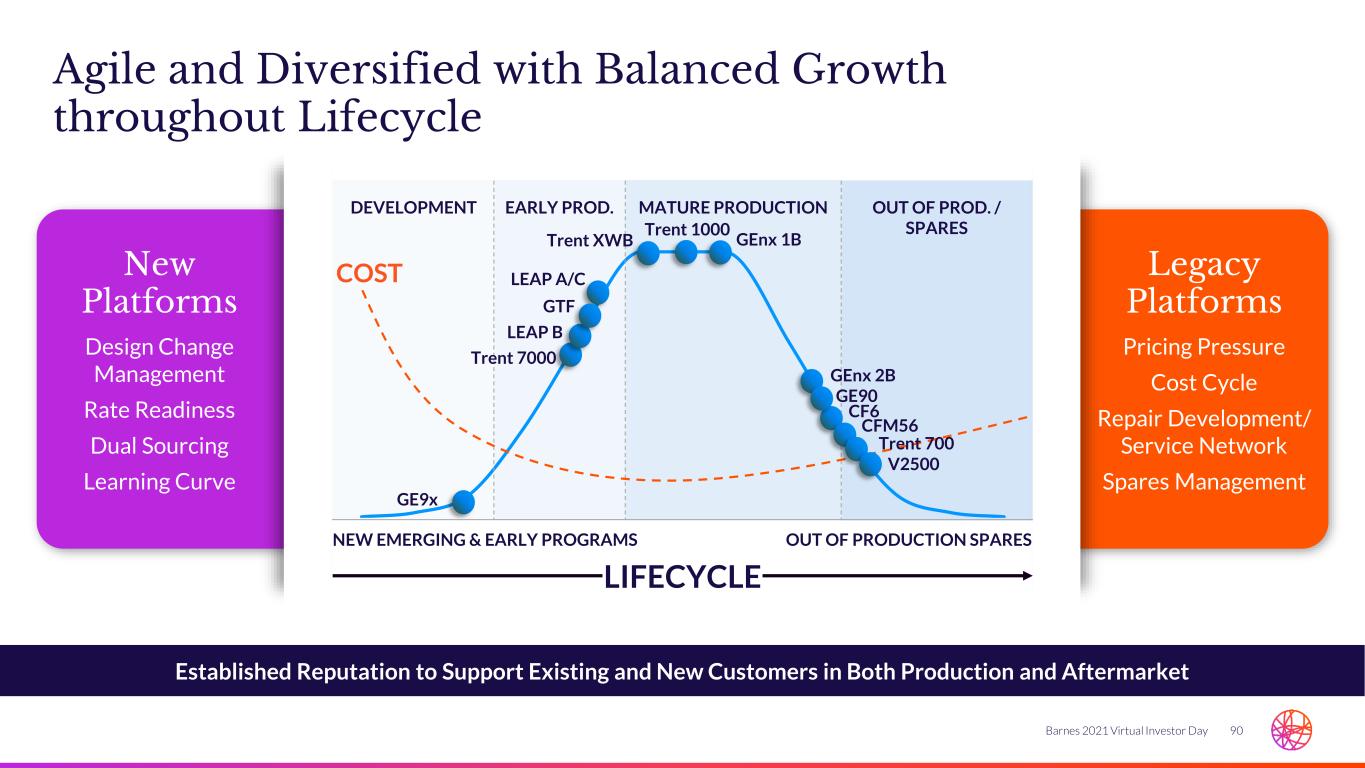

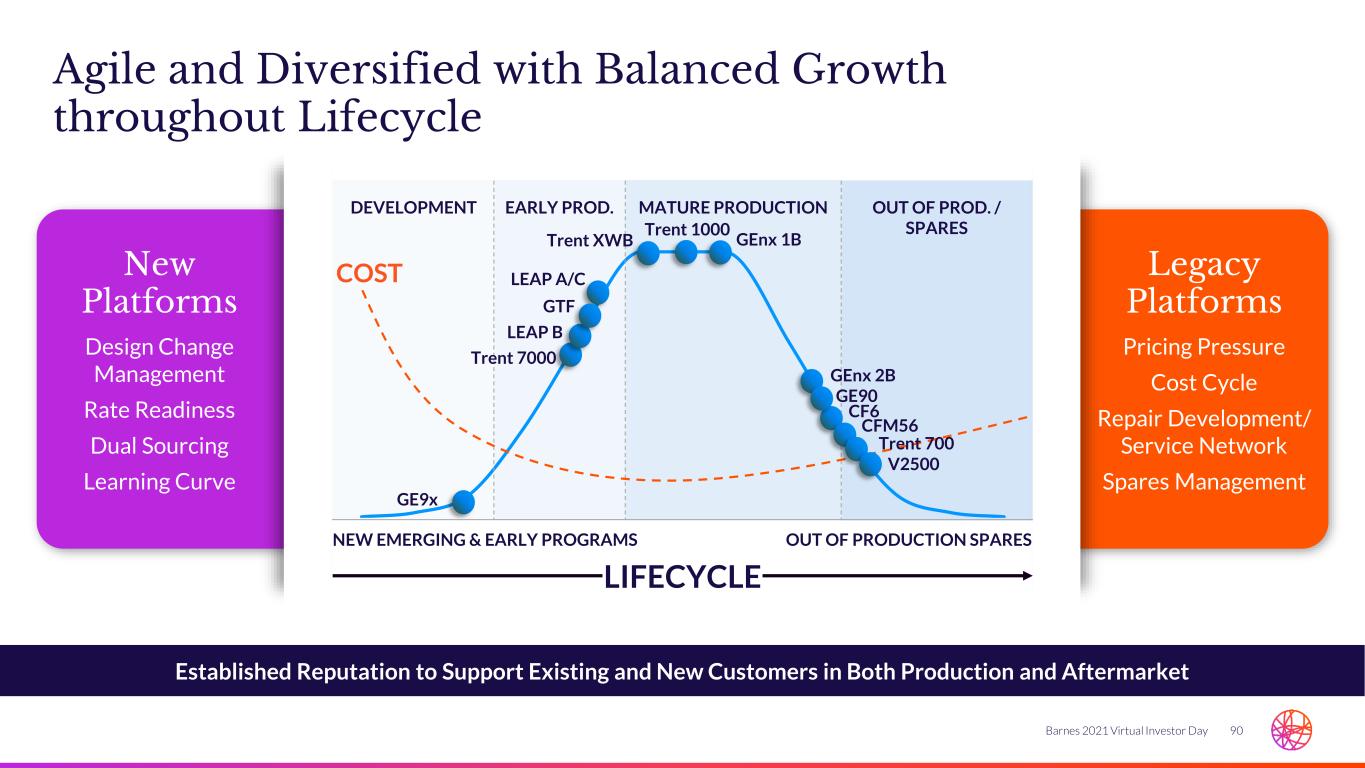

90Barnes 2021 Virtual Investor Day Agile and Diversified with Balanced Growth throughout Lifecycle Established Reputation to Support Existing and New Customers in Both Production and Aftermarket COST DEVELOPMENT EARLY PROD. MATURE PRODUCTION OUT OF PROD. / SPARES GE9x Trent 7000 LEAP A/C Trent XWB Trent 1000 GEnx 1B GEnx 2B GE90 CFM56 Trent 700 CF6 LIFECYCLE V2500 NEW EMERGING & EARLY PROGRAMS OUT OF PRODUCTION SPARES New Platforms Design Change Management Rate Readiness Dual Sourcing Learning Curve Legacy Platforms Pricing Pressure Cost Cycle Repair Development/ Service Network Spares Management GTF LEAP B

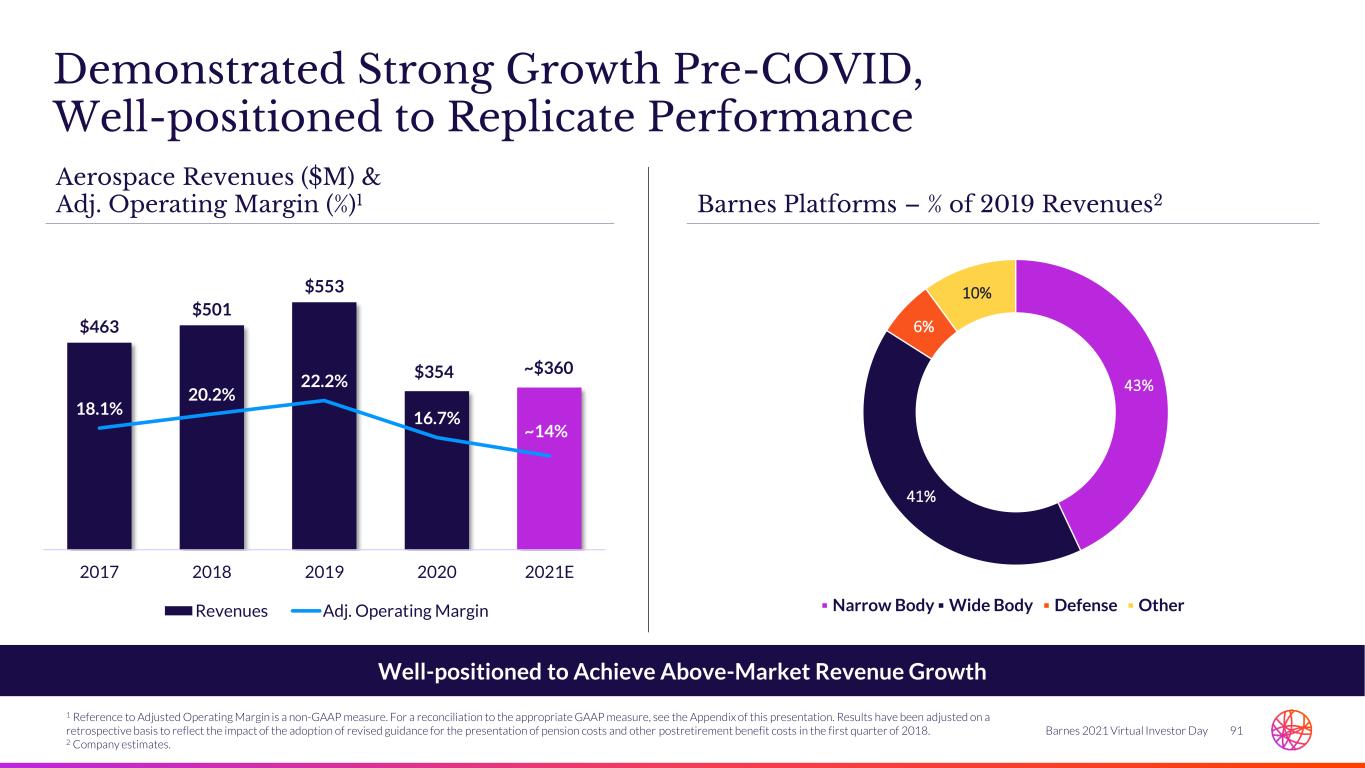

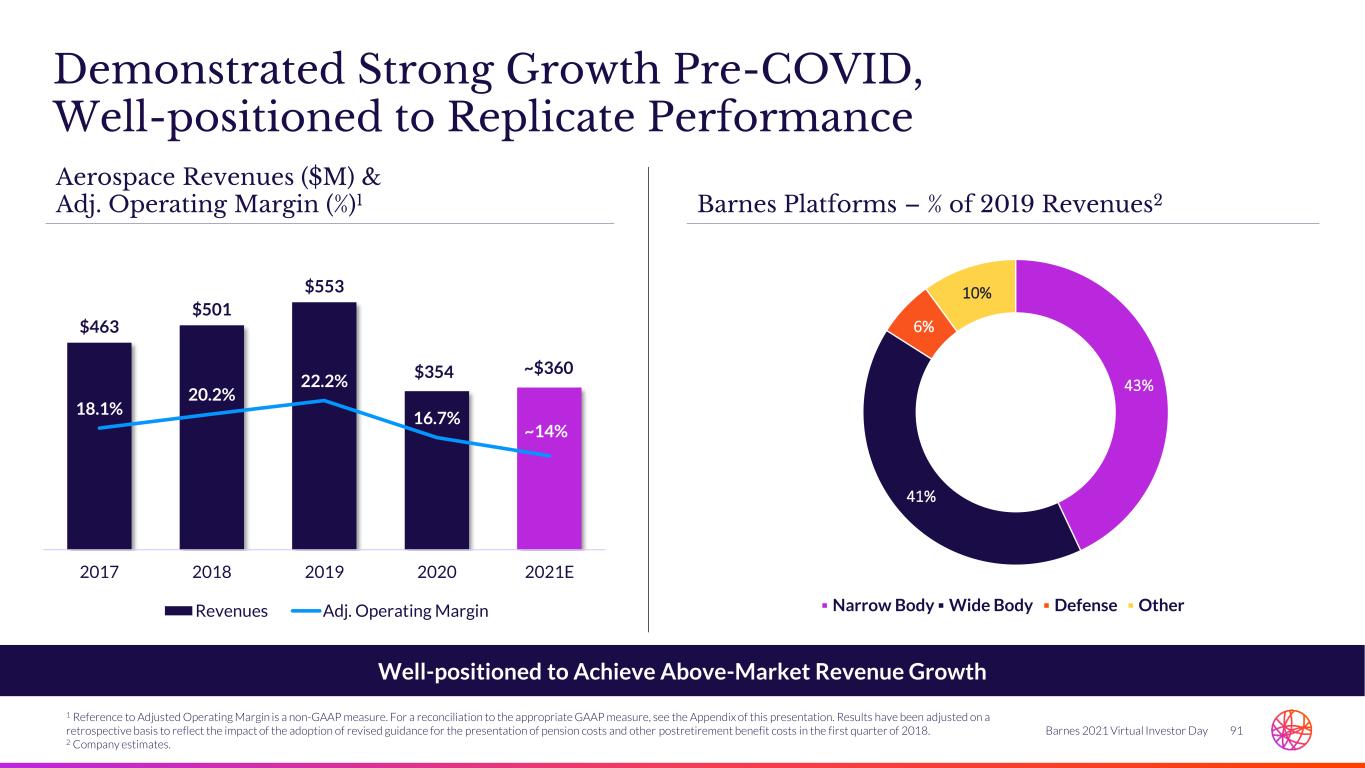

91Barnes 2021 Virtual Investor Day Demonstrated Strong Growth Pre-COVID, Well-positioned to Replicate Performance Well-positioned to Achieve Above-Market Revenue Growth $463 $501 $553 $354 ~$360 18.1% 20.2% 22.2% 16.7% ~14% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 0 100 200 300 400 500 600 2017 2018 2019 2020 2021E Revenues Adj. Operating Margin Aerospace Revenues ($M) & Adj. Operating Margin (%)1 Barnes Platforms – % of 2019 Revenues2 1 Reference to Adjusted Operating Margin is a non-GAAP measure. For a reconciliation to the appropriate GAAP measure, see the Appendix of this presentation. Results have been adjusted on a retrospective basis to reflect the impact of the adoption of revised guidance for the presentation of pension costs and other postretirement benefit costs in the first quarter of 2018. 2 Company estimates. 43% 41% 6% 10% ▪ Narrow Body ▪ Wide Body ▪ Defense ▪ Other

92Barnes 2021 Virtual Investor Day Aerospace Profitable Growth Strategy Expanding Profit through Value Creation High Margin, High Growth Build a World-class Company Deepen customer relationships • Solutions provider • Trusted • Performance mindset • Customer focused Leverage BES as a Significant Competitive Advantage Leverage BES • Competitive position • Financial excellence • Entrepreneurial mindset • Commercially astute Leverage BES as a Significant Competitive Advantage Accelerate technical and digital innovation • Concurrent engineering • Voice of customer • Smart connected factory • Business efficiency Expand and Protect Our IP to Deliver Differentiated Solutions Drive robust commercial excellence process • Operational performance • Productivity • Operating system • Value stream focus 321 4

93Barnes 2021 Virtual Investor Day Delivering Productivity and Industry-leading Performance Connecting Operations with Financial Performance Disciplined Operating System • Division monthly review • Strategic business unit review • Segment review Robust Operational Excellence Processes • Operational planning – level loading • Value stream mindset • Capacity management • Manufacturing floor execution Creating Value through Execution • Customer performance metrics (OTD and quality) • Productivity Note: On-time Delivery (OTD)

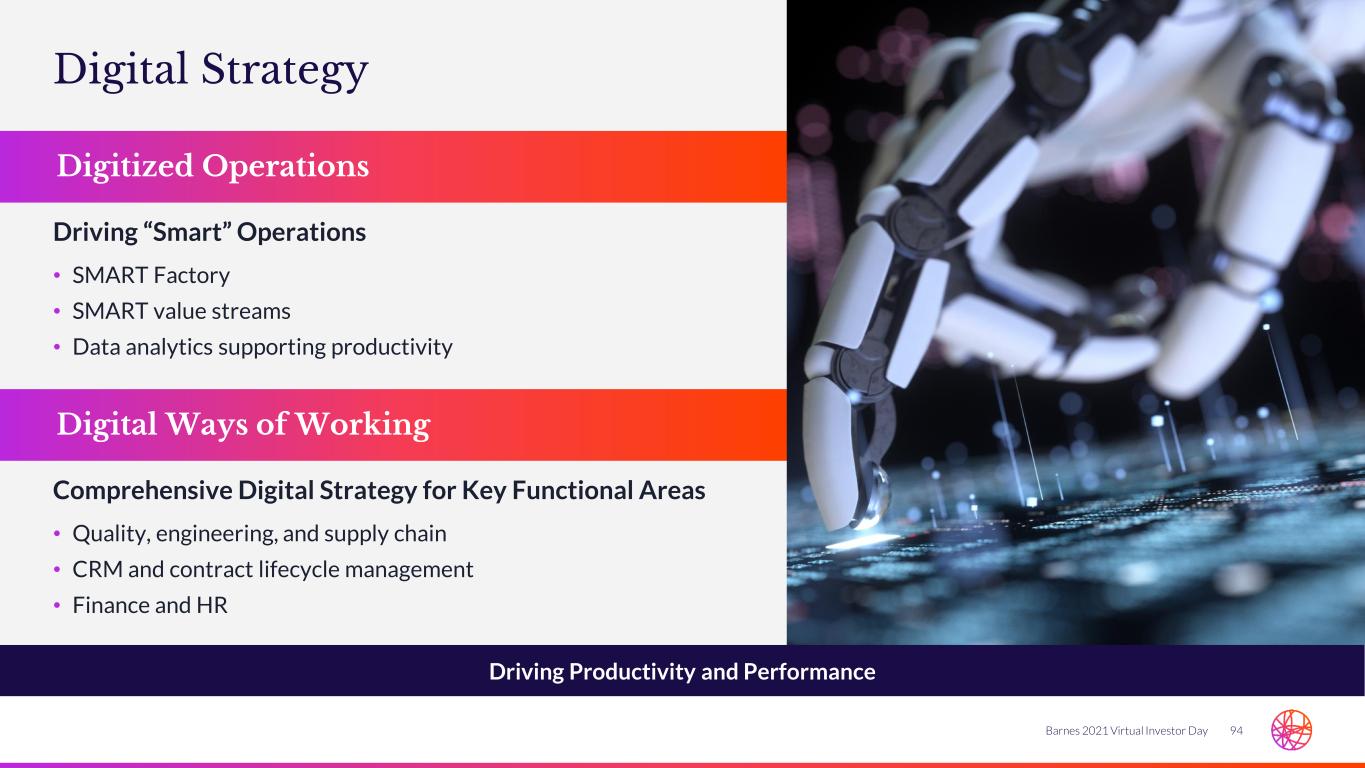

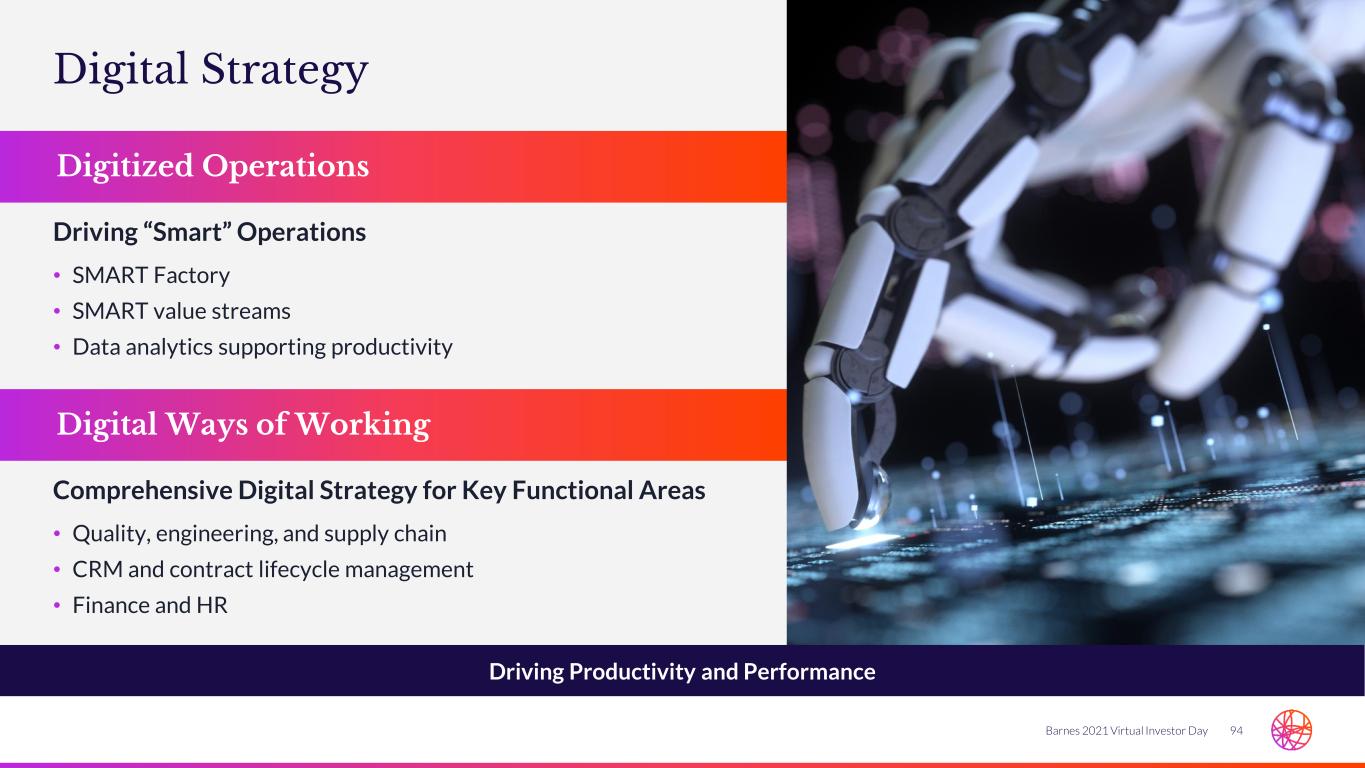

94Barnes 2021 Virtual Investor Day Digital Strategy Driving Productivity and Performance Driving “Smart” Operations • SMART Factory • SMART value streams • Data analytics supporting productivity Digitized Operations Comprehensive Digital Strategy for Key Functional Areas • Quality, engineering, and supply chain • CRM and contract lifecycle management • Finance and HR Digital Ways of Working

OEM Growth through Performance and Relationships

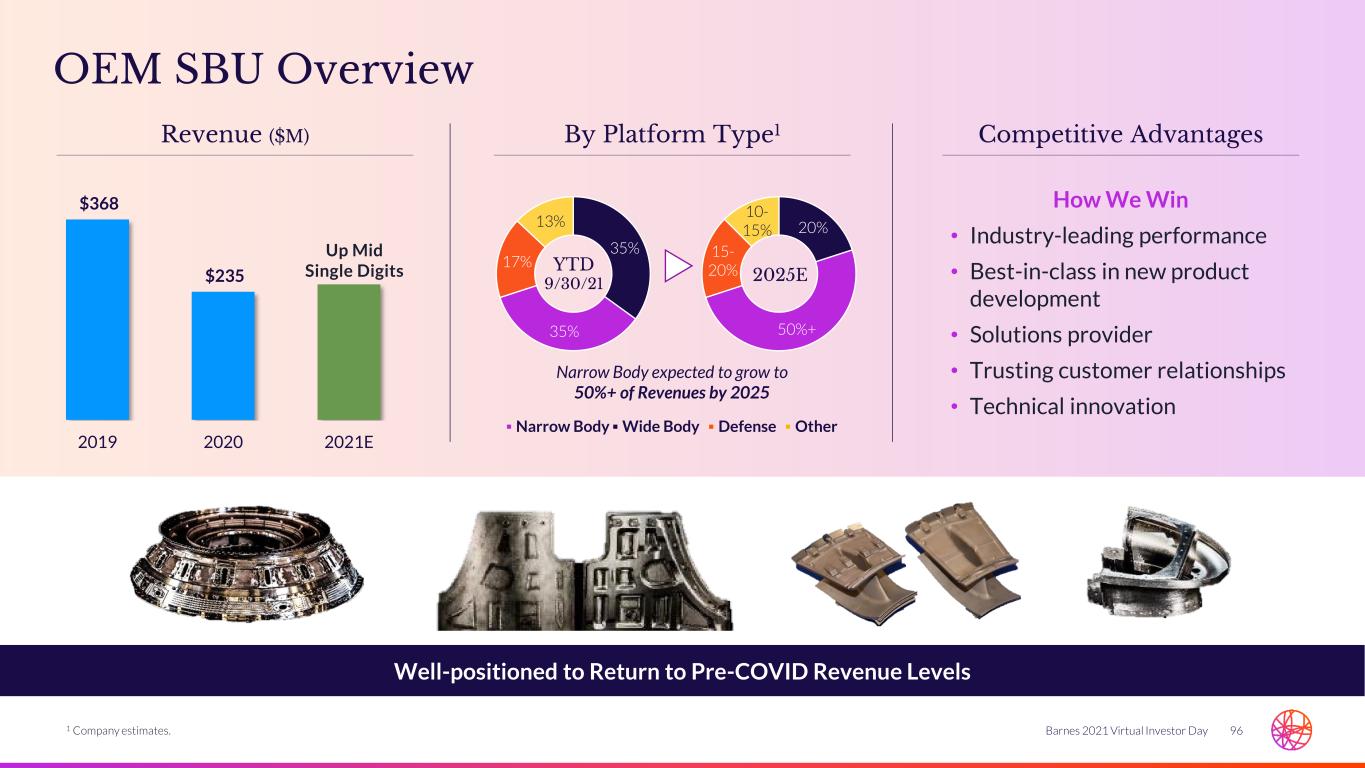

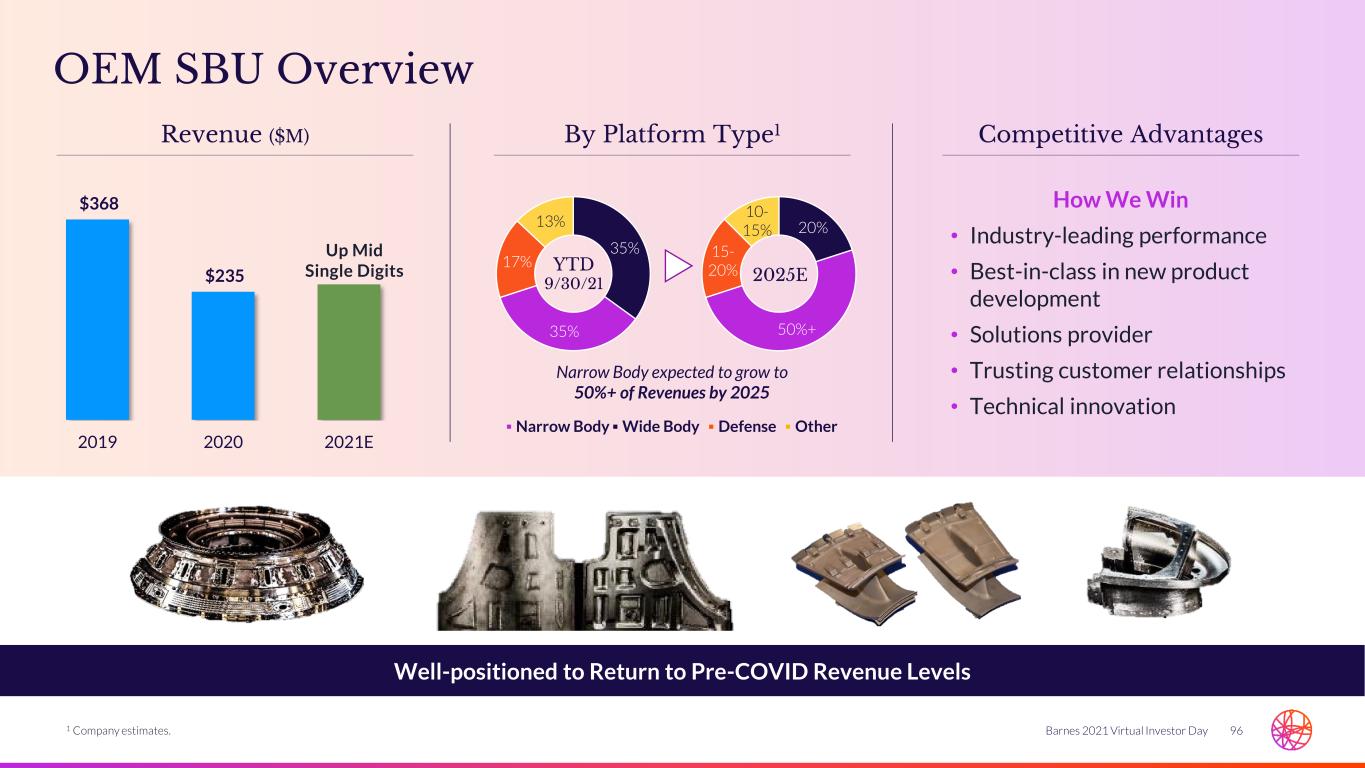

96Barnes 2021 Virtual Investor Day OEM SBU Overview Well-positioned to Return to Pre-COVID Revenue Levels How We Win • Industry-leading performance • Best-in-class in new product development • Solutions provider • Trusting customer relationships • Technical innovation Up Mid Single Digits Narrow Body expected to grow to 50%+ of Revenues by 2025 $368 $235 2019 2020 2021E Revenue ($M) Competitive AdvantagesBy Platform Type1 35% 35% 17% 13% 20% 50%+ 15- 20% 10- 15% ▪ Narrow Body ▪ Wide Body ▪ Defense ▪ Other YTD 9/30/21 2025E 1 Company estimates.

97Barnes 2021 Virtual Investor Day OEM Growth Strategy Enhancing Our Value Proposition 1 High Margin, High Growth Build a World-class Company Customer and market focus • Complex, difficult to manufacture • Commercial and military • Deep, trusted customer relationships • Proactive engagement • Program investment Leverage BES as a Significant Competitive Advantage Operational excellence • Industry-leading delivery • Robust quality through advanced product quality planning • Speed of new product introduction • Value stream mindset • Planning for success Expand and Protect Our IP to Deliver Differentiated Solutions Technical and digital innovation • Applied technology investments • Technology partnerships • Robotics/automation • Enhanced competitive position • Customer value focused 32

98Barnes 2021 Virtual Investor Day Case Study: Customer’s Preferred Partner Performance Creates Long-term Relationships Leading to Growth Background Won share of difficult to manufacture product Competitors finding the product challenging to manufacture Results Capture additional volume through performance Executed best-in-class program management productivity through smart factory Barnes’ Customized Solution • Developed a manufacturing process creating IP through technical innovation with equipment vendor that delivers robust repeatable production process • Leveraged BES program management and new product introduction process using APQP (Advanced Product Quality Planning) to industrialize the new part • Implemented Smart Factory solution and automation on the new equipment to enhance operational performance

Aftermarket Growth through Performance and Relationships

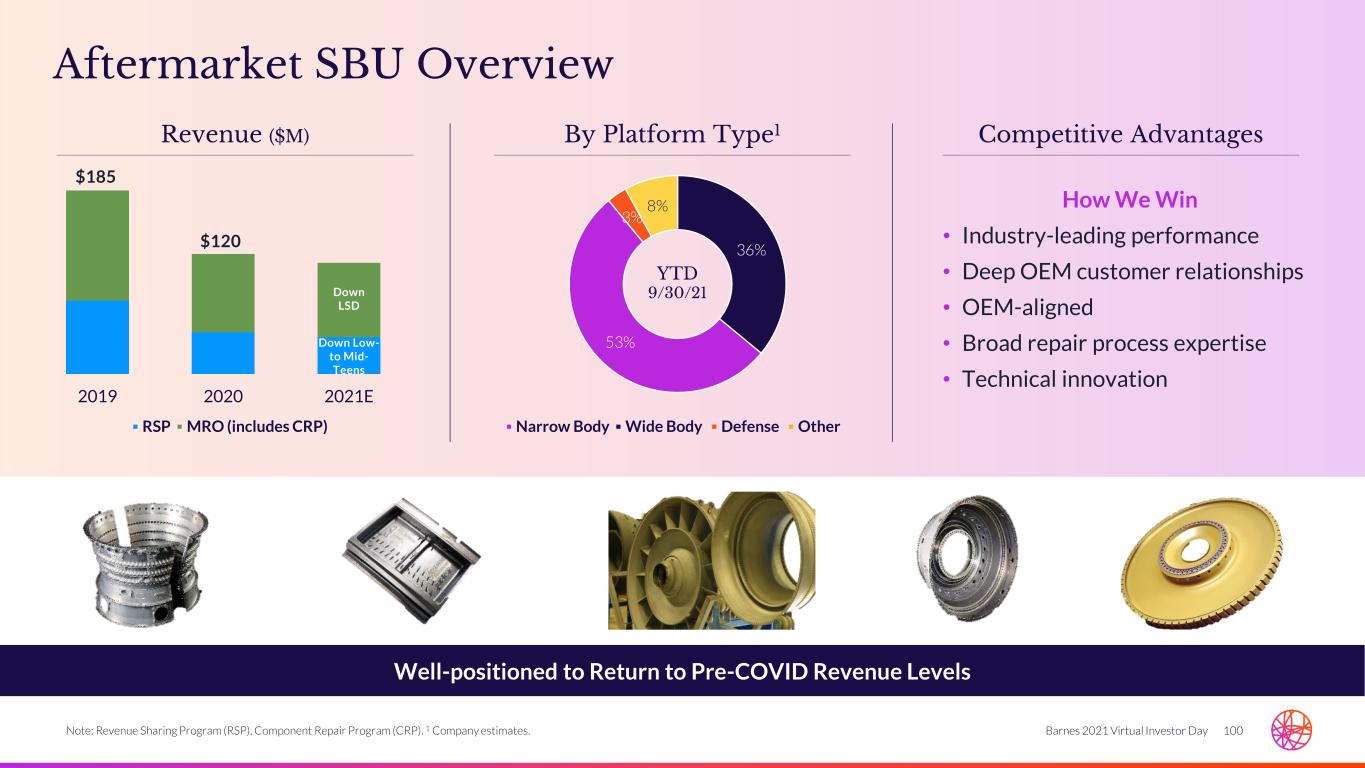

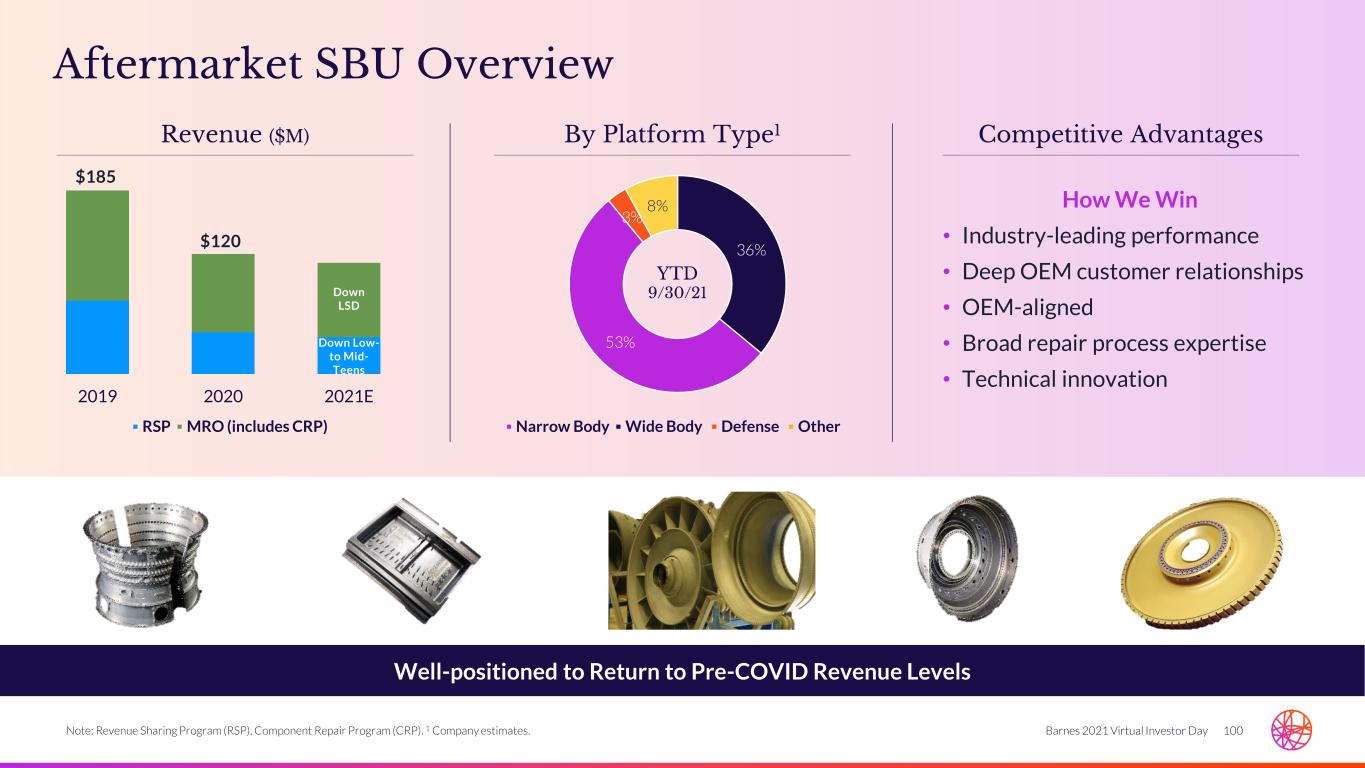

100Barnes 2021 Virtual Investor Day Aftermarket SBU Overview Well-positioned to Return to Pre-COVID Revenue Levels How We Win • Industry-leading performance • Deep OEM customer relationships • OEM-aligned • Broad repair process expertise • Technical innovation 2019 2020 2021E Revenue ($M) Competitive AdvantagesBy Platform Type1 36% 53% 3% 8% ▪ Narrow Body ▪ Wide Body ▪ Defense ▪ Other Down LSD $185 $120 ▪ RSP ▪ MRO (includes CRP) Down Low- to Mid- Teens Note: Revenue Sharing Program (RSP), Component Repair Program (CRP). 1 Company estimates. YTD 9/30/21

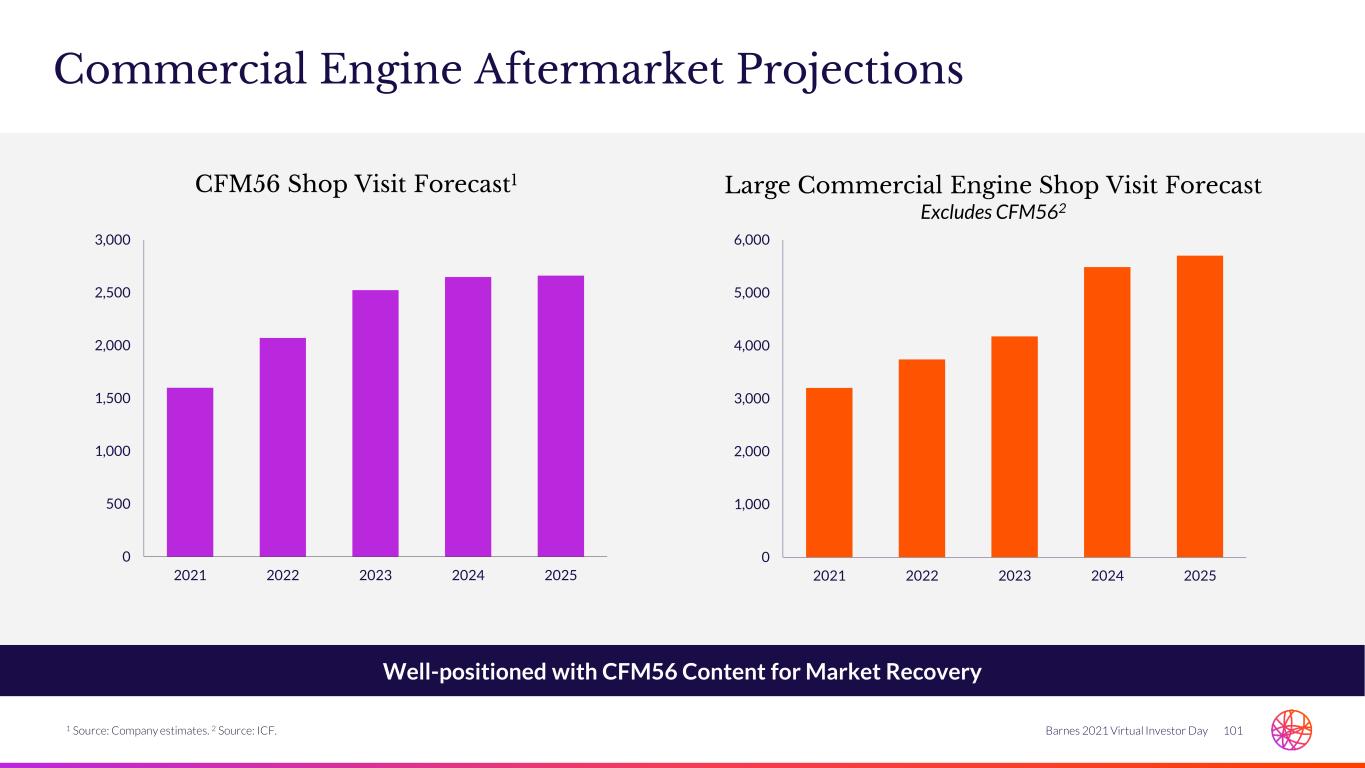

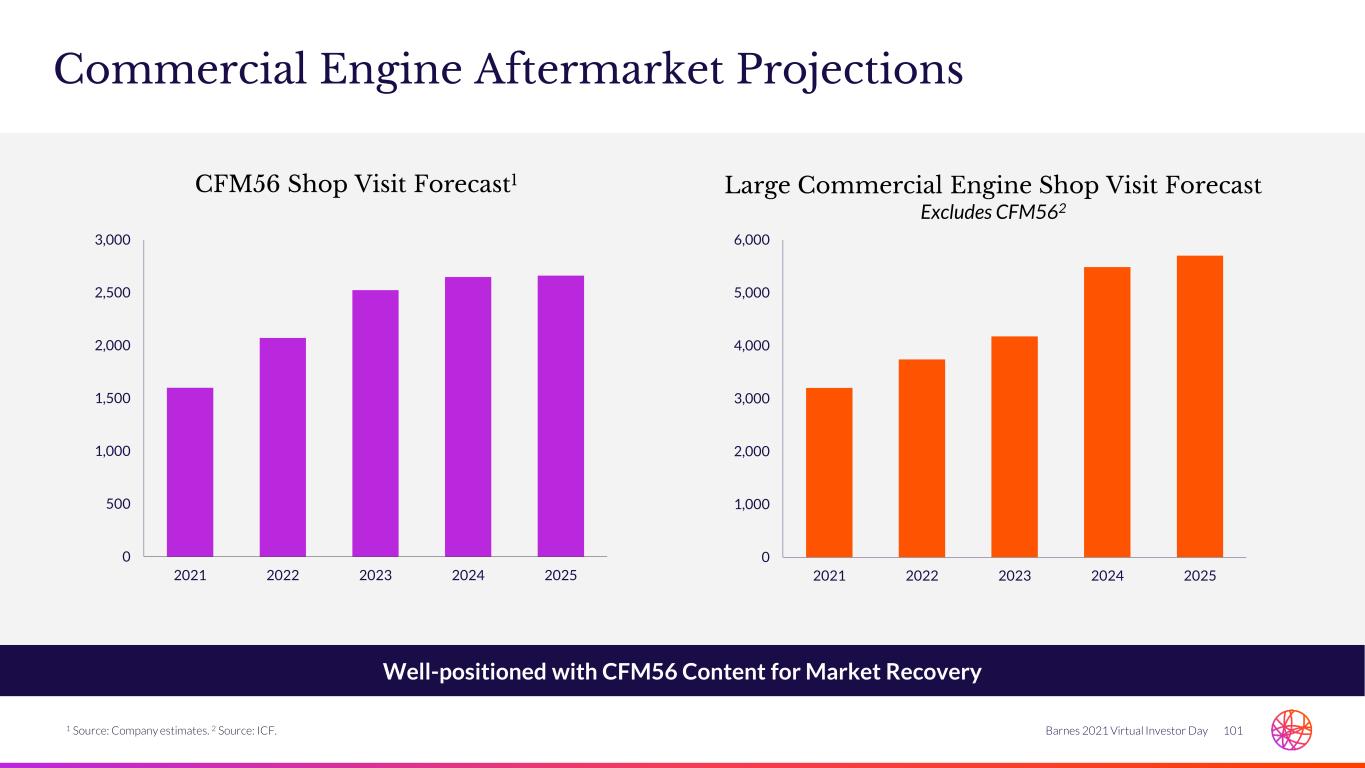

101Barnes 2021 Virtual Investor Day Commercial Engine Aftermarket Projections Well-positioned with CFM56 Content for Market Recovery 0 500 1,000 1,500 2,000 2,500 3,000 2021 2022 2023 2024 2025 0 1,000 2,000 3,000 4,000 5,000 6,000 2021 2022 2023 2024 2025 CFM56 Shop Visit Forecast1 Large Commercial Engine Shop Visit Forecast Excludes CFM562 1 Source: Company estimates. 2 Source: ICF.

102Barnes 2021 Virtual Investor Day Aftermarket Growth Strategy Industry-leading Performance and Entrepreneurial Deal Making 1 High Margin, High Growth Build a World-class Company Deep customer partnerships • Integral to OEM’s aftermarket value stream, longer term deals, new engine programs • Broad market coverage of airlines and 3rd party MRO service providers • Global customers supported through regional capabilities (N.A. and Asia) • Entrepreneurial mindset Leverage BES as a Significant Competitive Advantage Operational excellence • Industry-leading turnaround time performance • Rapid repair industrialization • Value stream mindset • Robust quality and continuous improvement Expand and Protect Our IP to Deliver Differentiated Solutions Technical and digital innovation • Innovative repair development • Repair technology investments • Enhanced competitive position • Customer value focused • Business process automation 32 Note: Maintenance, Repair and Overhaul (MRO).

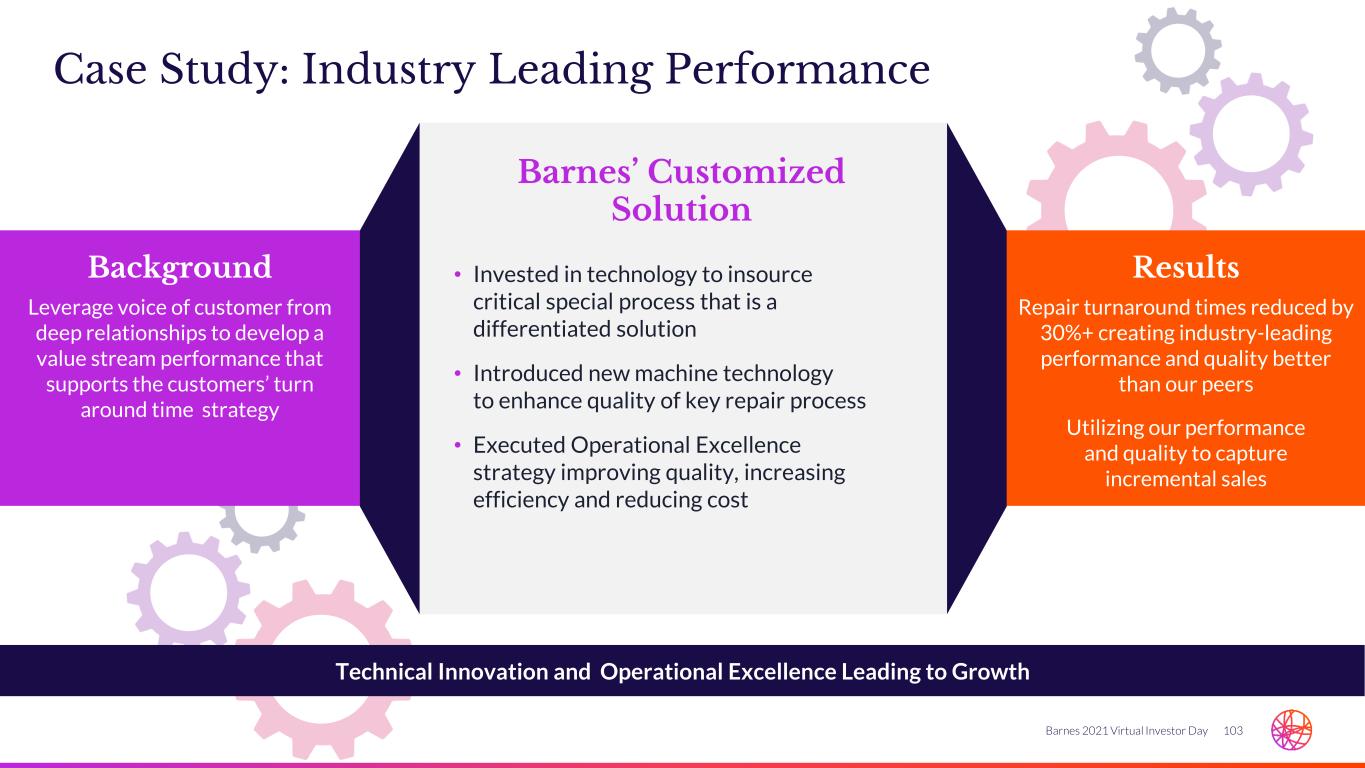

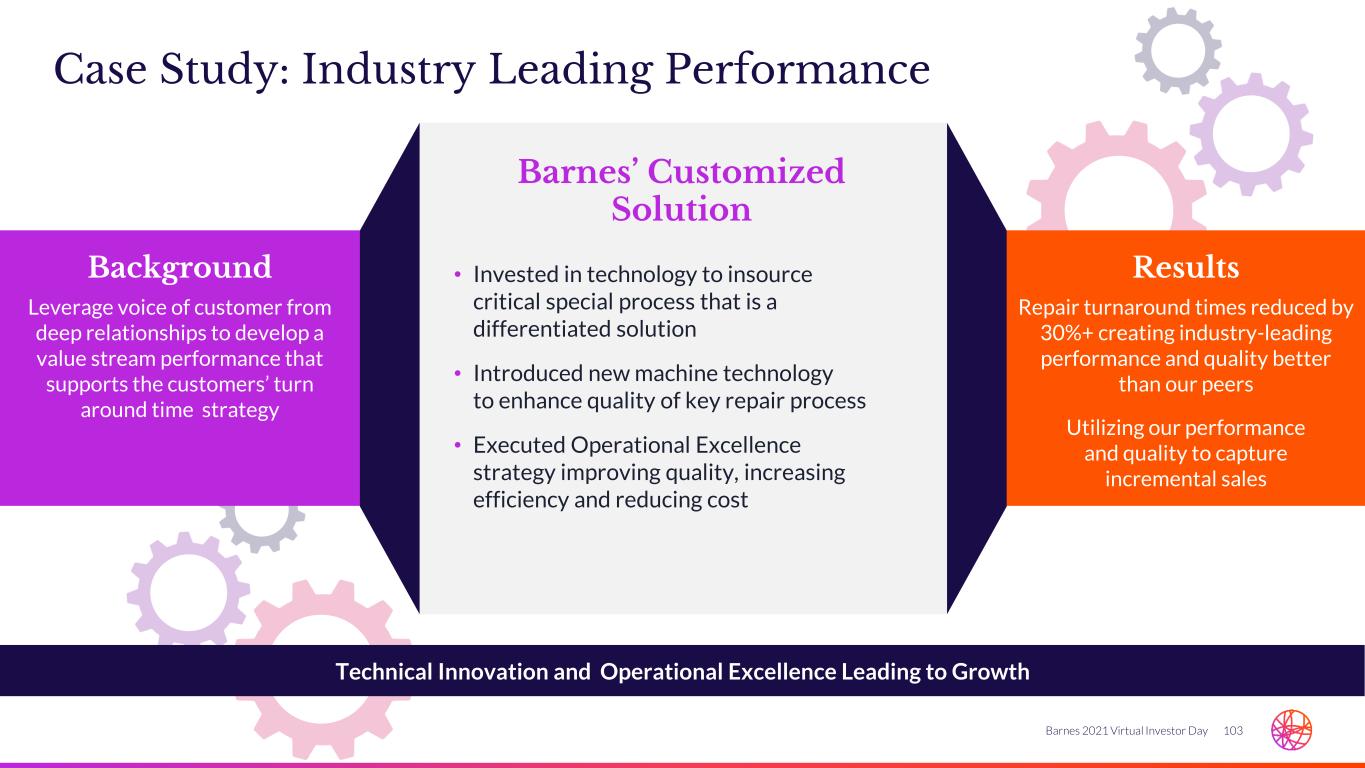

103Barnes 2021 Virtual Investor Day Case Study: Industry Leading Performance Technical Innovation and Operational Excellence Leading to Growth Background Leverage voice of customer from deep relationships to develop a value stream performance that supports the customers’ turn around time strategy Results Repair turnaround times reduced by 30%+ creating industry-leading performance and quality better than our peers Utilizing our performance and quality to capture incremental sales Barnes’ Customized Solution • Invested in technology to insource critical special process that is a differentiated solution • Introduced new machine technology to enhance quality of key repair process • Executed Operational Excellence strategy improving quality, increasing efficiency and reducing cost

104Barnes 2021 Virtual Investor Day Aerospace Key Takeaways Driving Organic and Above-market Growth in OEM and Aftermarket Engineering Expertise and Execution through BES Deepening Strong Customer Relationships Leveraging Innovative Solutions and Smart Factory to Address Customer Challenges 01 02 03 Operating System Structured to Create Profit through Productivity with Revenue Growth 04

Financial Overview Julie Streich SVP, Finance & CFO

106Barnes 2021 Virtual Investor Day Key Messages Culture of Excellence and Innovation to Create Value Strong Execution and Cash Generation Enable Agility Balance Sheet Well-positioned to Support Investments for Growth 01 02 03 Disciplined Capital Allocation 04

107Barnes 2021 Virtual Investor Day Well Controlled, Engaged Organization Committed to Driving Profitable Growth Key Observations as Newly Appointed CFO ✓Culture of integrity, transparency, and accountability ✓ Efficient balance sheet driving cash performance ✓ Strategic alignment between the management team and the board ✓Commitment to transformative growth Current Focus Areas ✓ Expanding financial and commercial excellence to execute strategy ✓Driving enhanced analytics and automation ✓Accelerating speed of execution ✓ Investing in technology and innovation

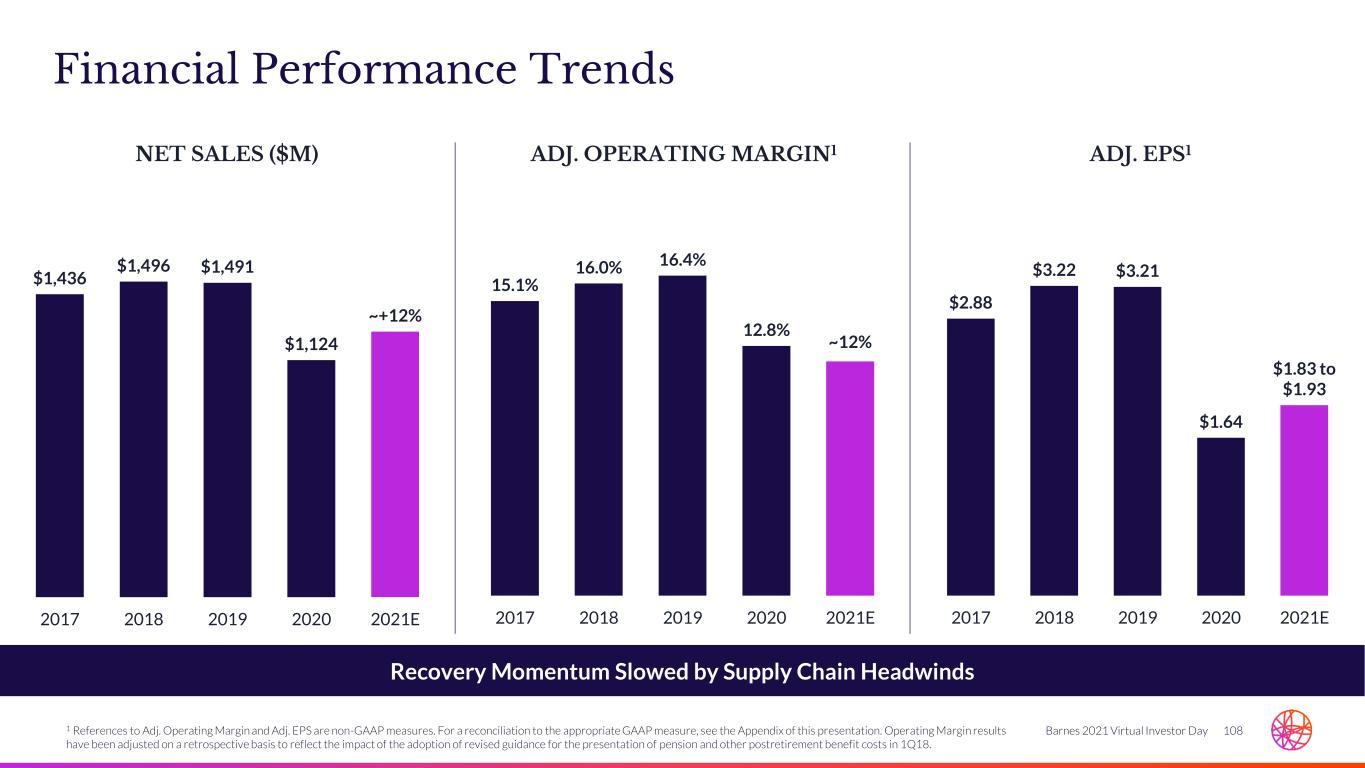

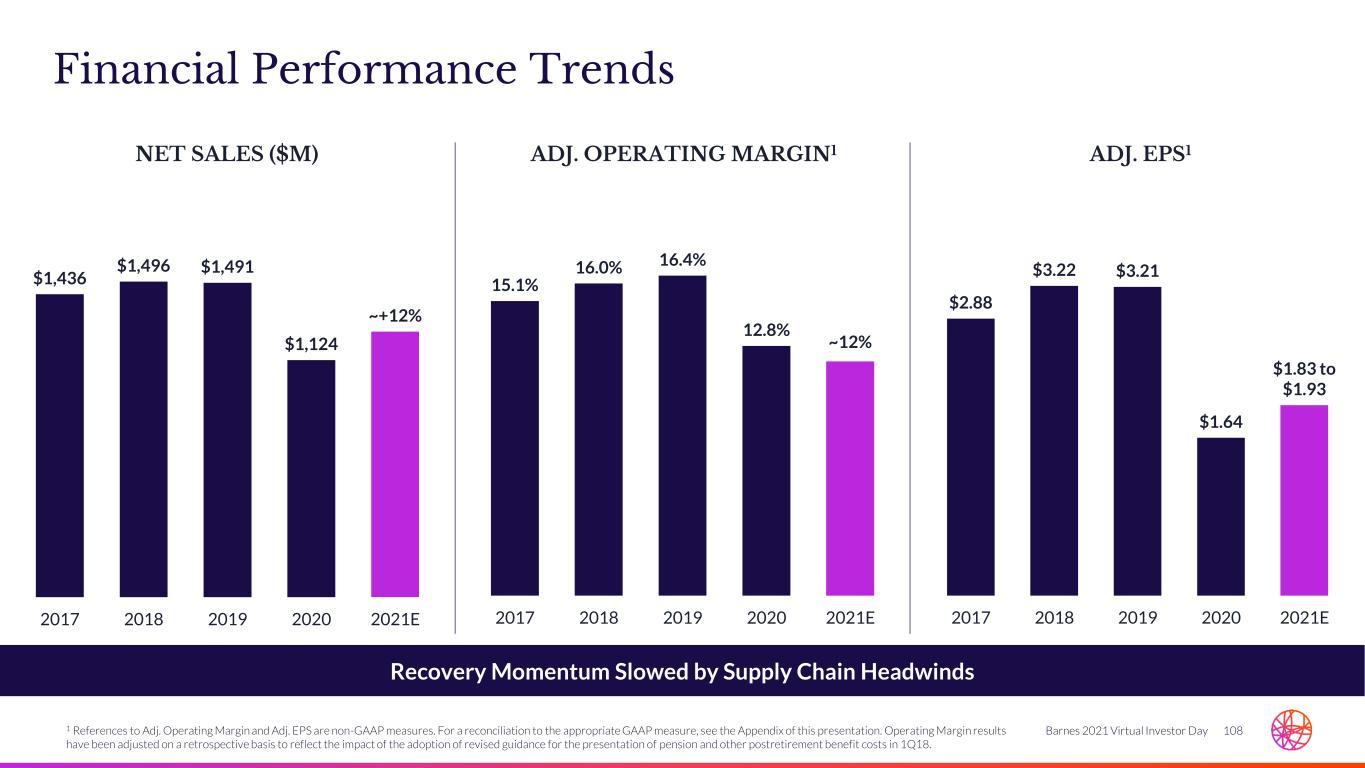

108Barnes 2021 Virtual Investor Day Financial Performance Trends Recovery Momentum Slowed by Supply Chain Headwinds NET SALES ($M) ADJ. EPS1ADJ. OPERATING MARGIN1 $1,436 $1,496 $1,491 $1,124 ~+12% 2017 2018 2019 2020 2021E 15.1% 16.0% 16.4% 12.8% ~12% 2017 2018 2019 2020 2021E $2.88 $3.22 $3.21 $1.64 $1.83 to $1.93 2017 2018 2019 2020 2021E 1 References to Adj. Operating Margin and Adj. EPS are non-GAAP measures. For a reconciliation to the appropriate GAAP measure, see the Appendix of this presentation. Operating Margin results have been adjusted on a retrospective basis to reflect the impact of the adoption of revised guidance for the presentation of pension and other postretirement benefit costs in 1Q18.

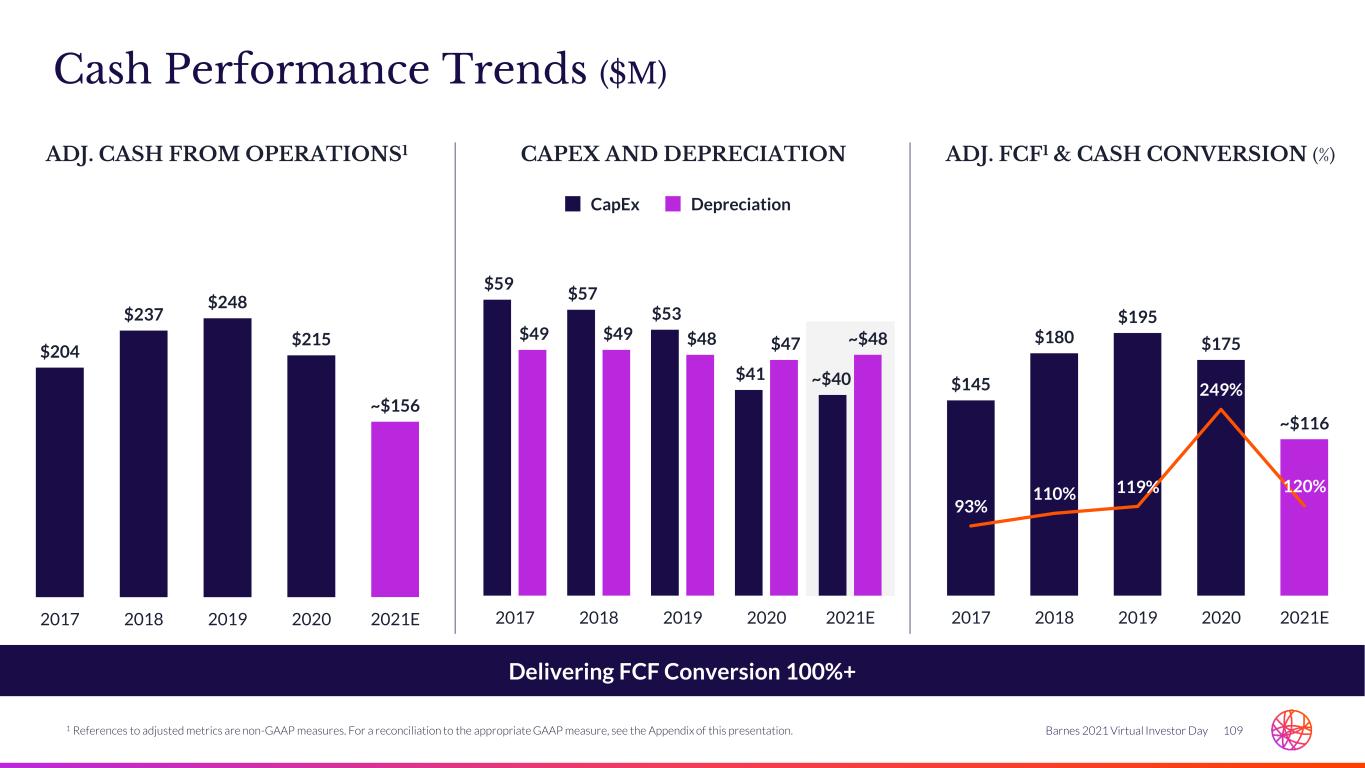

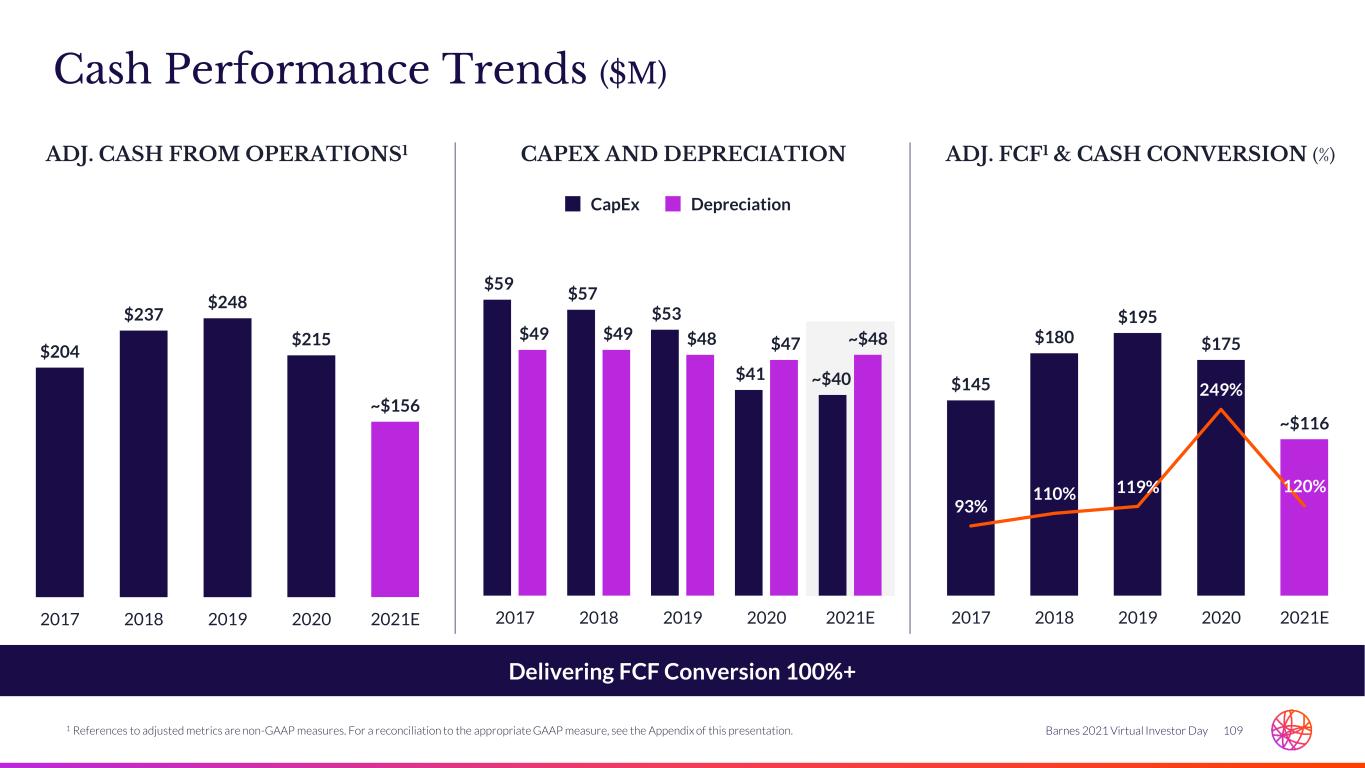

109Barnes 2021 Virtual Investor Day Cash Performance Trends ($M) Delivering FCF Conversion 100%+ ADJ. CASH FROM OPERATIONS1 ADJ. FCF1 & CASH CONVERSION (%)CAPEX AND DEPRECIATION $204 $237 $248 $215 ~$156 2017 2018 2019 2020 2021E $59 $57 $53 $41 ~$40 $49 $49 $48 $47 ~$48 2017 2018 2019 2020 2021E $145 $180 $195 $175 ~$116 93% 110% 119% 249% 120% 0% 50% 100% 150% 200% 250% 300% 350% 400% 450% $0 $50 $100 $150 $200 $250 2017 2018 2019 2020 2021E CapEx Depreciation 1 References to adjusted metrics are non-GAAP measures. For a reconciliation to the appropriate GAAP measure, see the Appendix of this presentation.

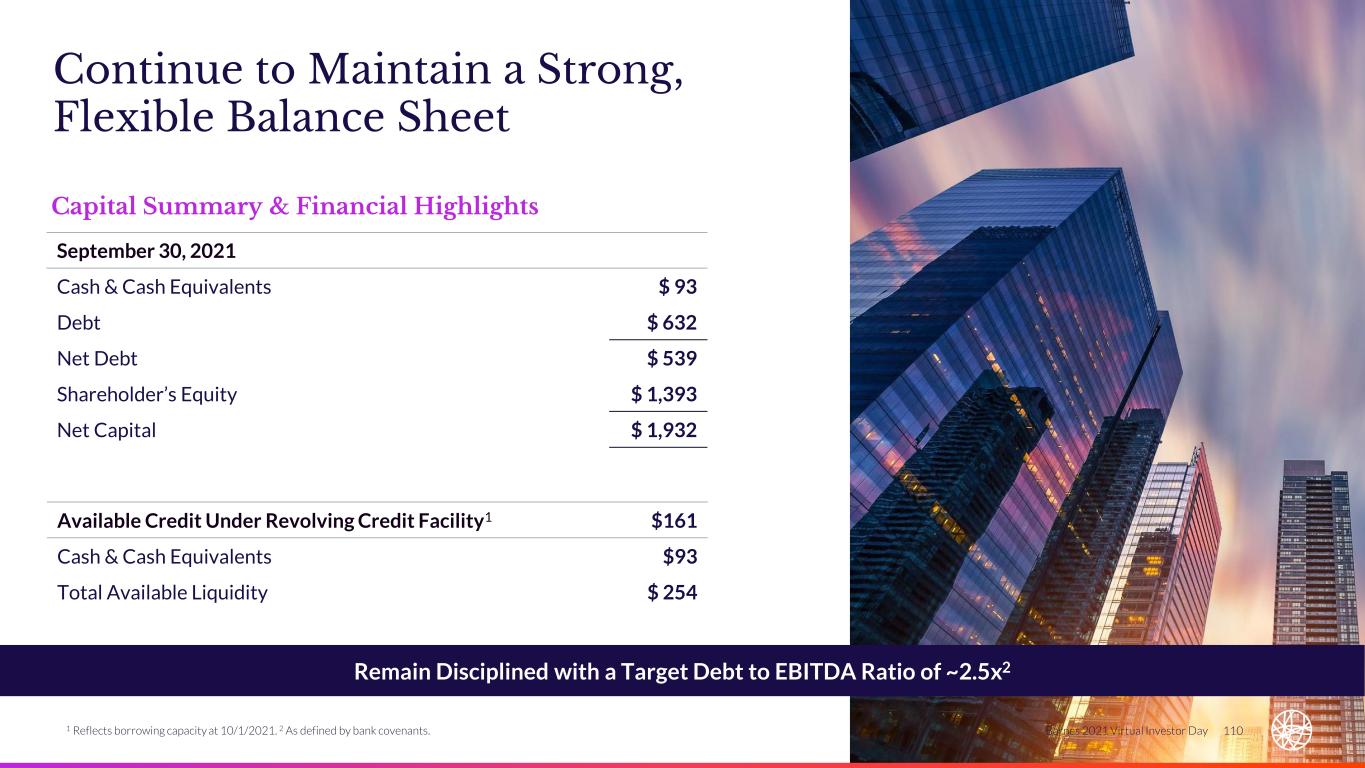

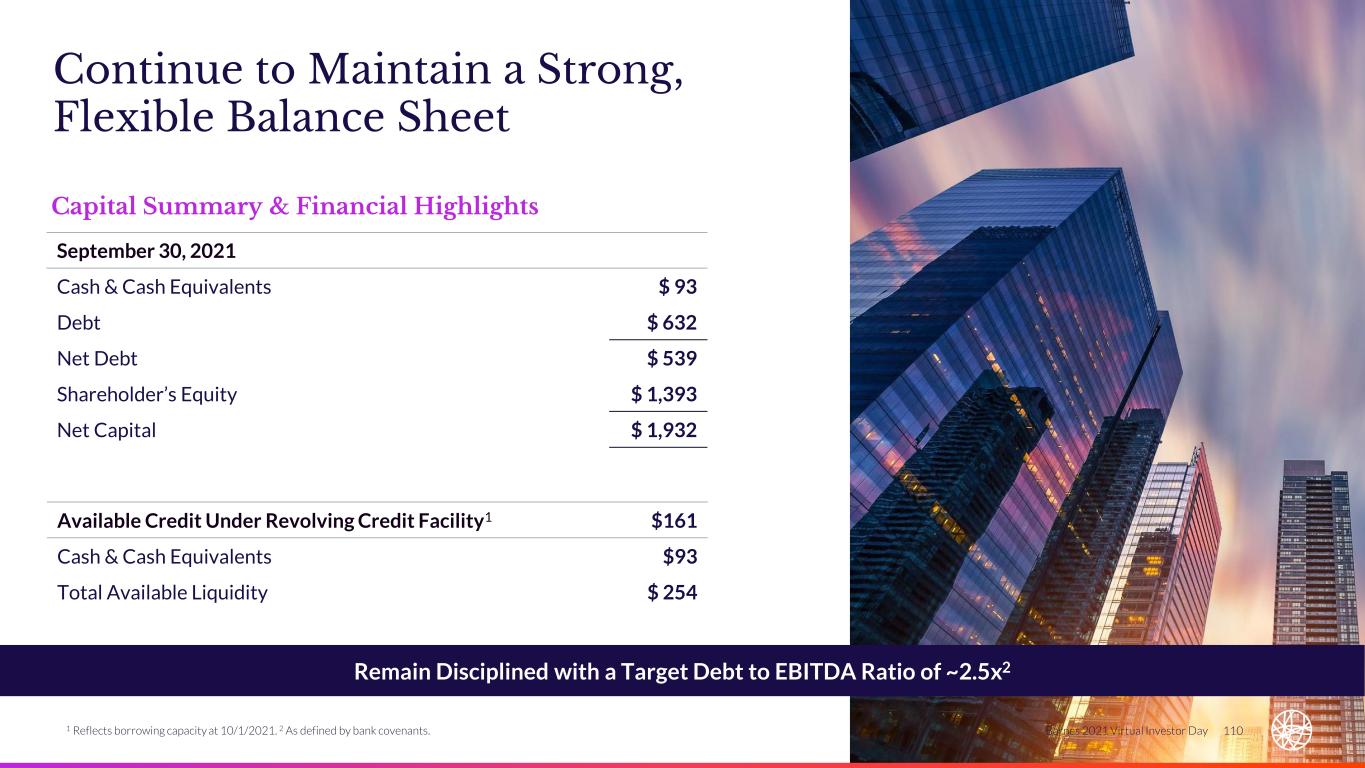

110Barnes 2021 Virtual Investor Day Continue to Maintain a Strong, Flexible Balance Sheet Remain Disciplined with a Target Debt to EBITDA Ratio of ~2.5x2 September 30, 2021 Cash & Cash Equivalents $ 93 Debt $ 632 Net Debt $ 539 Shareholder’s Equity $ 1,393 Net Capital $ 1,932 Capital Summary & Financial Highlights Available Credit Under Revolving Credit Facility1 $161 Cash & Cash Equivalents $93 Total Available Liquidity $ 254 1 Reflects borrowing capacity at 10/1/2021. 2 As defined by bank covenants.

111Barnes 2021 Virtual Investor Day Strategically Allocate Capital to Drive Top Quartile TSR DRIVE ORGANIC GROWTH • R&D, Innovation and Technology Investments • CapEx Target: 50% Growth / 50% Maintenance • New Product and Process Introductions RETURN CASH TO SHAREHOLDERS • 87 Years of Consecutive Dividend Payout • Opportunistic Share Repurchases PURSUE STRATEGIC ACQUISITIONS • Disciplined Strategic and Financial Criteria/Metrics • Target High Margin, High Growth Opportunities • Expand Global Reach and Market Penetration ~$1.5B USES OF CASH (2015 – YTD 9/30/21) Aero Aftermarket1 2% Acquisitions 41% Dividends 14% Share Buybacks 21% Capex Investments 22% 1 Aerospace Aftermarket Investments – Component Repair Programs (CRPs) and Revenue Sharing Programs (RSPs).

112Barnes 2021 Virtual Investor Day 2021 GUIDANCE 2025 TARGETS1 ORGANIC SALES GROWTH ~10% 7% to 9% CAGR ADJ. OPERATING MARGIN2 ~12% 15% to 17% ADJ. EPS2 $1.83 to $1.93 Double Digit CAGR CASH CONVERSION ~120% >100% ROIC --- 8% to 10% KEY ASSUMPTIONS • CapEx: ~4% of sales • FX: consistent with late 2021 estimates • Tax Rate: 26% to 27% • Avg. Diluted Shares: ~51M, held constant • No acquisitions assumed in targets Updating 2021 Guidance and Introducing 2025 Financial Targets1 1 CAGRs relative to 2021E. Targets exclude future acquisitions or divestitures. 2 References to Adj. Operating Margin and Adj. EPS are non-GAAP measures. For a reconciliation to the appropriate GAAP measure, see the Appendix of this presentation.

113Barnes 2021 Virtual Investor Day Revenue and Operating Margin Targets Culture of Excellence and Innovation to Create Value ~$1.3 $1.7 - $1.8 2021E 2025E Revenue ($B) ~12% 15% - 17% 2021E 2025E Adj. Operating Margin1 Market Tailwinds • Aerospace rebound • EV program launches • Legacy product mix Strategy Execution • Expansion into high growth, high margin markets • Product and process innovation • Commercial excellence • BES-driven productivity • Volume leverage 1 Reference to Adj. Operating Margin is non-GAAP measures. For a reconciliation to the appropriate GAAP measure, see the Appendix of this presentation.

114Barnes 2021 Virtual Investor Day Key Takeaways Culture of Excellence and Innovation to Create Value Strong Execution and Cash Generation Enable Agility Balance Sheet Well-positioned to Support Investments for Growth 01 02 03 Disciplined Capital Allocation 04

Closing Remarks Patrick Dempsey President & CEO

116Barnes 2021 Virtual Investor Day Well-positioned with Unique, Sustainable Competitive Advantages01 02 03 04 05 Business Excellence Accelerated through BES Customer-centric Innovation Drives Differentiated New Products, Services and Processes TMS Enables a High-performing Global Workforce Focused on Sustainable Value Creation for All Stakeholders Invest with Us

Q&A Session Patrick Dempsey & Second Session Presenters

Appendix

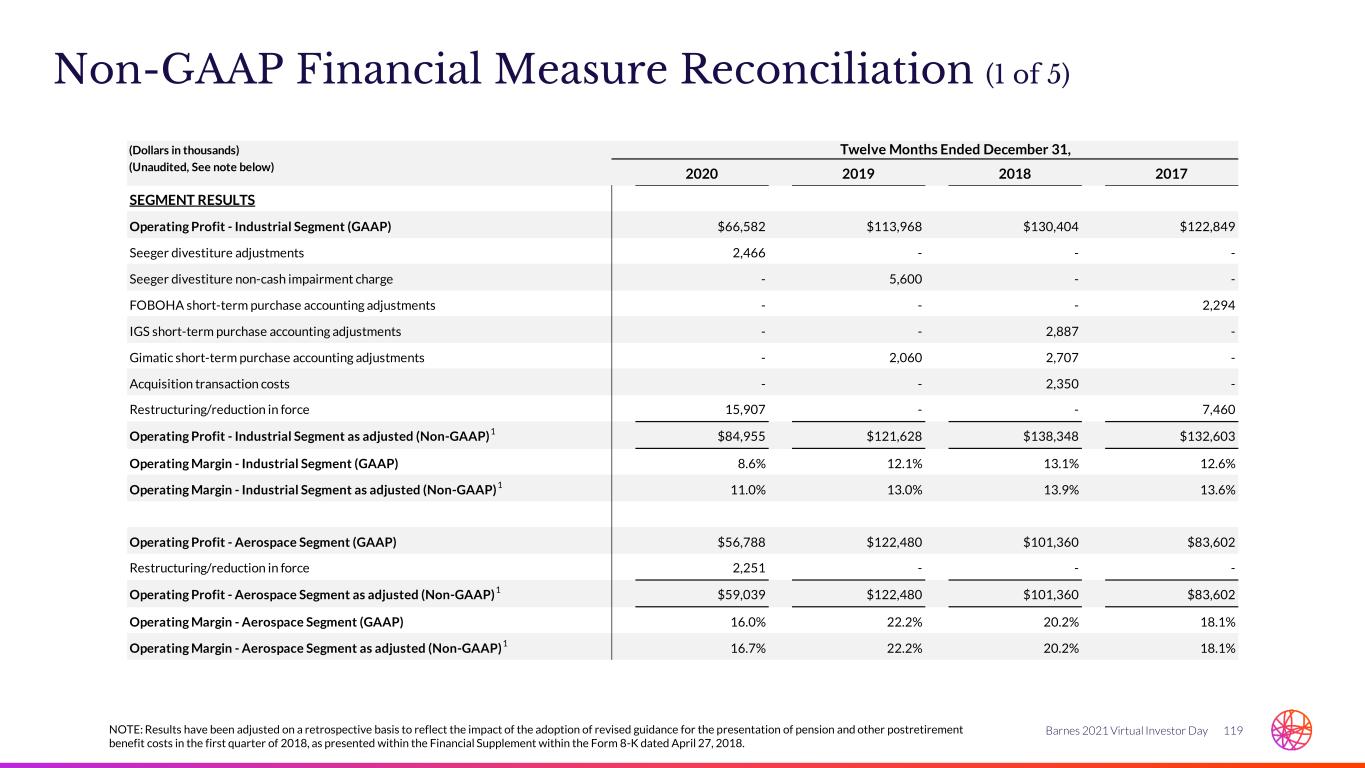

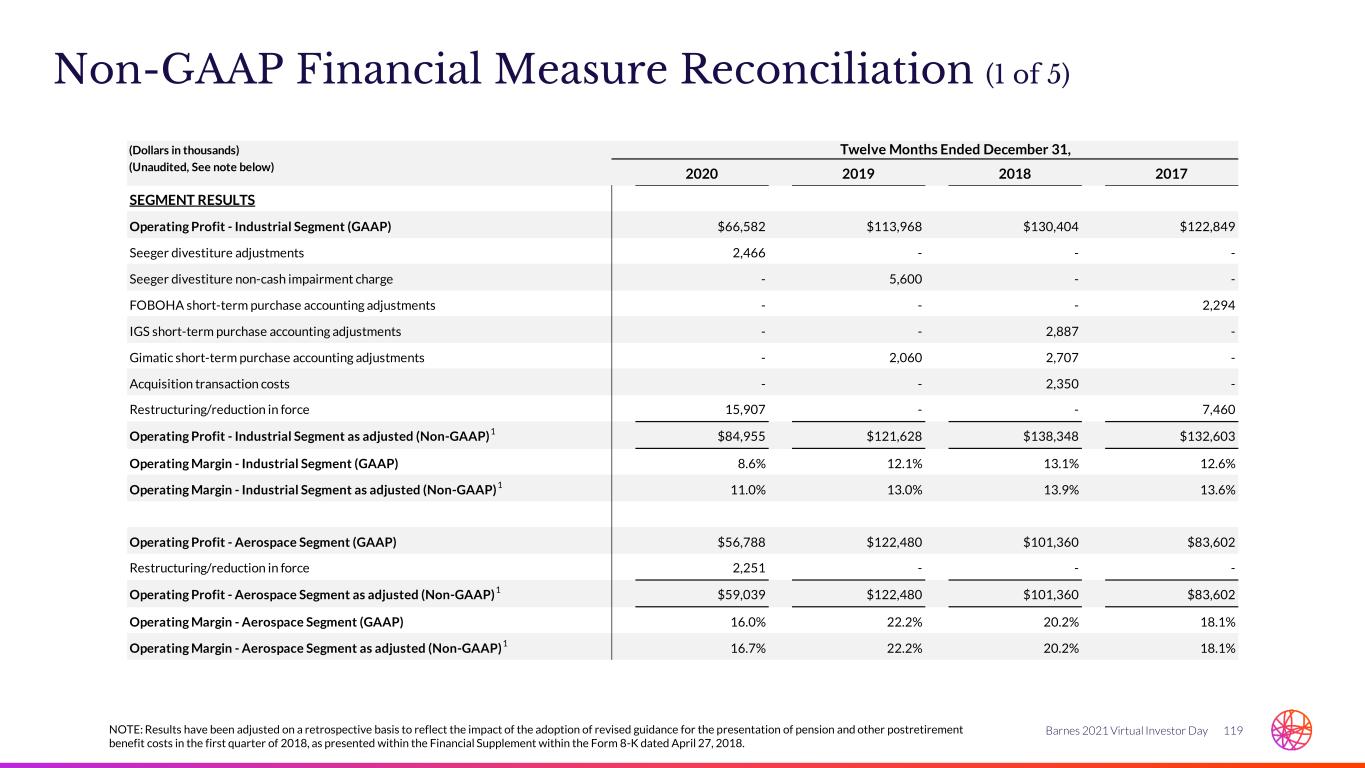

119Barnes 2021 Virtual Investor Day Non-GAAP Financial Measure Reconciliation (1 of 5) (Dollars in thousands) (Unaudited, See note below) 2020 2019 2018 2017 SEGMENT RESULTS Operating Profit - Industrial Segment (GAAP) $66,582 $113,968 $130,404 $122,849 Seeger divestiture adjustments 2,466 - - - Seeger divestiture non-cash impairment charge - 5,600 - - FOBOHA short-term purchase accounting adjustments - - - 2,294 IGS short-term purchase accounting adjustments - - 2,887 - Gimatic short-term purchase accounting adjustments - 2,060 2,707 - Acquisition transaction costs - - 2,350 - Restructuring/reduction in force 15,907 - - 7,460 Operating Profit - Industrial Segment as adjusted (Non-GAAP)1 $84,955 $121,628 $138,348 $132,603 Operating Margin - Industrial Segment (GAAP) 8.6% 12.1% 13.1% 12.6% Operating Margin - Industrial Segment as adjusted (Non-GAAP)1 11.0% 13.0% 13.9% 13.6% Operating Profit - Aerospace Segment (GAAP) $56,788 $122,480 $101,360 $83,602 Restructuring/reduction in force 2,251 - - - Operating Profit - Aerospace Segment as adjusted (Non-GAAP)1 $59,039 $122,480 $101,360 $83,602 Operating Margin - Aerospace Segment (GAAP) 16.0% 22.2% 20.2% 18.1% Operating Margin - Aerospace Segment as adjusted (Non-GAAP)1 16.7% 22.2% 20.2% 18.1% Twelve Months Ended December 31, NOTE: Results have been adjusted on a retrospective basis to reflect the impact of the adoption of revised guidance for the presentation of pension and other postretirement benefit costs in the first quarter of 2018, as presented within the Financial Supplement within the Form 8-K dated April 27, 2018.

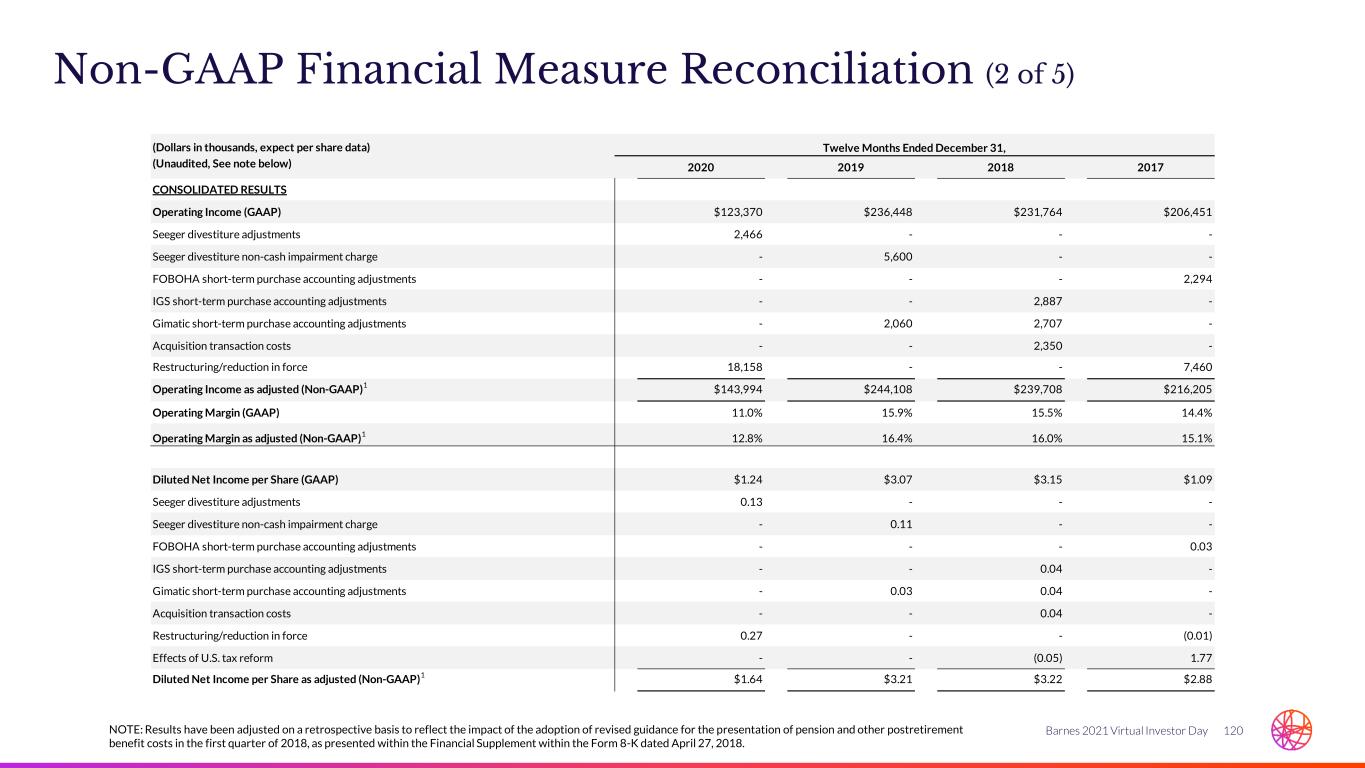

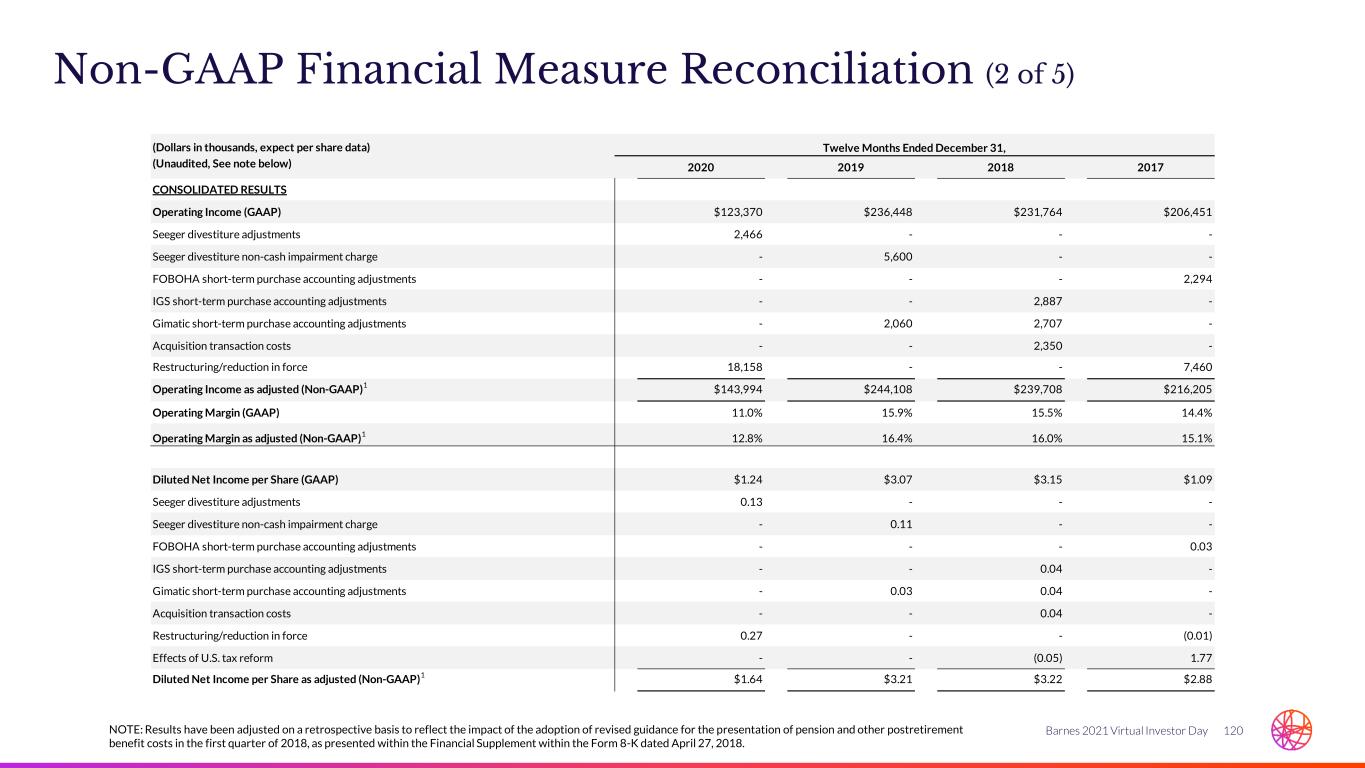

120Barnes 2021 Virtual Investor Day Non-GAAP Financial Measure Reconciliation (2 of 5) (Dollars in thousands, expect per share data) (Unaudited, See note below) 2020 2019 2018 2017 CONSOLIDATED RESULTS Operating Income (GAAP) $123,370 $236,448 $231,764 $206,451 Seeger divestiture adjustments 2,466 - - - Seeger divestiture non-cash impairment charge - 5,600 - - FOBOHA short-term purchase accounting adjustments - - - 2,294 IGS short-term purchase accounting adjustments - - 2,887 - Gimatic short-term purchase accounting adjustments - 2,060 2,707 - Acquisition transaction costs - - 2,350 - Restructuring/reduction in force 18,158 - - 7,460 Operating Income as adjusted (Non-GAAP)1 $143,994 $244,108 $239,708 $216,205 Operating Margin (GAAP) 11.0% 15.9% 15.5% 14.4% Operating Margin as adjusted (Non-GAAP)1 12.8% 16.4% 16.0% 15.1% Diluted Net Income per Share (GAAP) $1.24 $3.07 $3.15 $1.09 Seeger divestiture adjustments 0.13 - - - Seeger divestiture non-cash impairment charge - 0.11 - - FOBOHA short-term purchase accounting adjustments - - - 0.03 IGS short-term purchase accounting adjustments - - 0.04 - Gimatic short-term purchase accounting adjustments - 0.03 0.04 - Acquisition transaction costs - - 0.04 - Restructuring/reduction in force 0.27 - - (0.01) Effects of U.S. tax reform - - (0.05) 1.77 Diluted Net Income per Share as adjusted (Non-GAAP) 1 $1.64 $3.21 $3.22 $2.88 Twelve Months Ended December 31, NOTE: Results have been adjusted on a retrospective basis to reflect the impact of the adoption of revised guidance for the presentation of pension and other postretirement benefit costs in the first quarter of 2018, as presented within the Financial Supplement within the Form 8-K dated April 27, 2018.

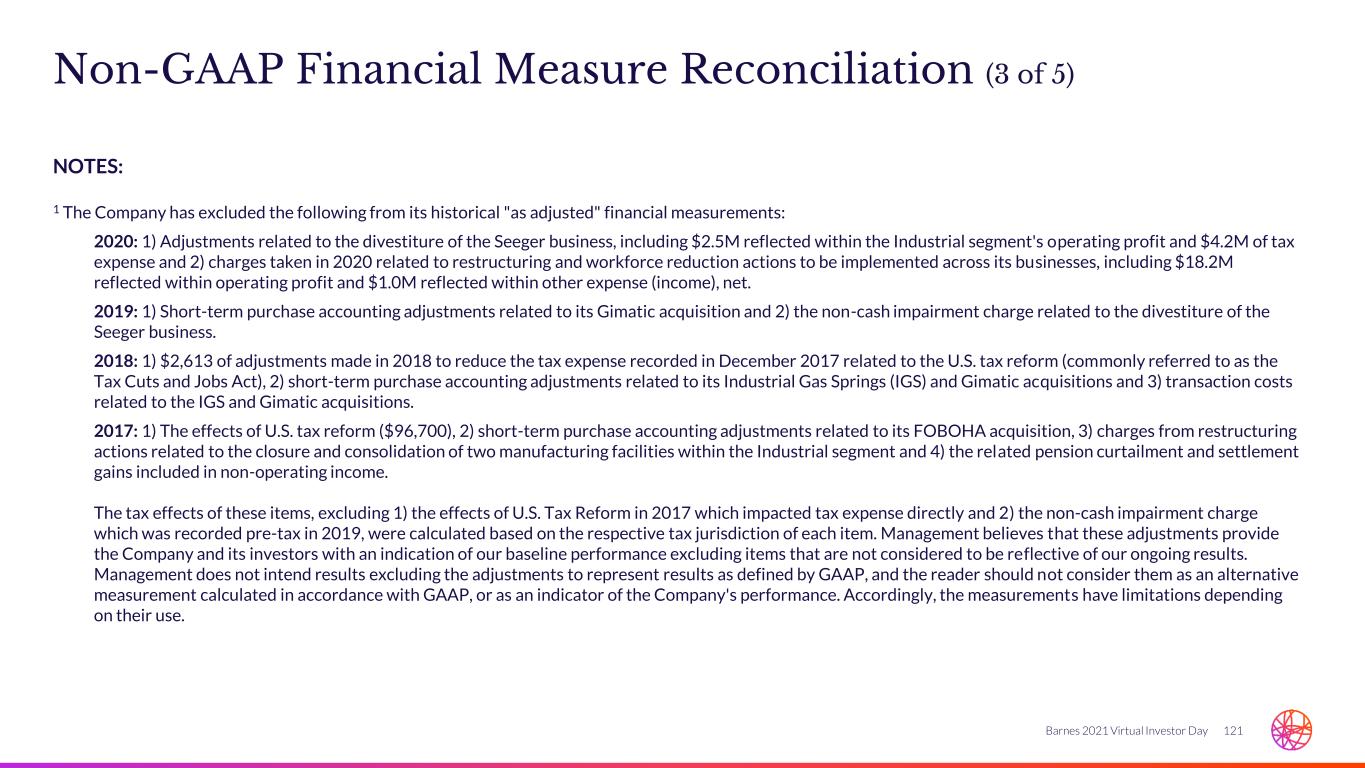

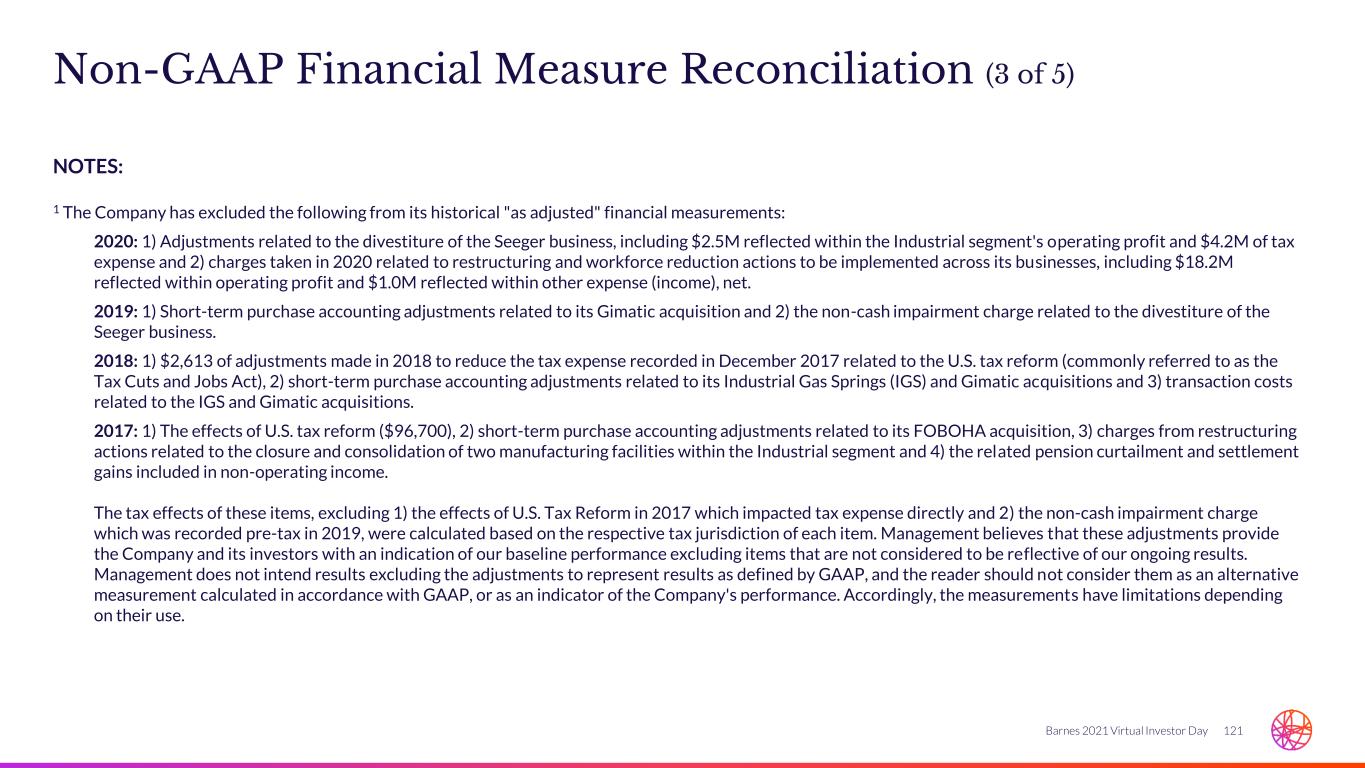

121Barnes 2021 Virtual Investor Day Non-GAAP Financial Measure Reconciliation (3 of 5) NOTES: 1 The Company has excluded the following from its historical "as adjusted" financial measurements: 2020: 1) Adjustments related to the divestiture of the Seeger business, including $2.5M reflected within the Industrial segment's operating profit and $4.2M of tax expense and 2) charges taken in 2020 related to restructuring and workforce reduction actions to be implemented across its businesses, including $18.2M reflected within operating profit and $1.0M reflected within other expense (income), net. 2019: 1) Short-term purchase accounting adjustments related to its Gimatic acquisition and 2) the non-cash impairment charge related to the divestiture of the Seeger business. 2018: 1) $2,613 of adjustments made in 2018 to reduce the tax expense recorded in December 2017 related to the U.S. tax reform (commonly referred to as the Tax Cuts and Jobs Act), 2) short-term purchase accounting adjustments related to its Industrial Gas Springs (IGS) and Gimatic acquisitions and 3) transaction costs related to the IGS and Gimatic acquisitions. 2017: 1) The effects of U.S. tax reform ($96,700), 2) short-term purchase accounting adjustments related to its FOBOHA acquisition, 3) charges from restructuring actions related to the closure and consolidation of two manufacturing facilities within the Industrial segment and 4) the related pension curtailment and settlement gains included in non-operating income. The tax effects of these items, excluding 1) the effects of U.S. Tax Reform in 2017 which impacted tax expense directly and 2) the non-cash impairment charge which was recorded pre-tax in 2019, were calculated based on the respective tax jurisdiction of each item. Management believes that these adjustments provide the Company and its investors with an indication of our baseline performance excluding items that are not considered to be reflective of our ongoing results. Management does not intend results excluding the adjustments to represent results as defined by GAAP, and the reader should not consider them as an alternative measurement calculated in accordance with GAAP, or as an indicator of the Company's performance. Accordingly, the measurements have limitations depending on their use.

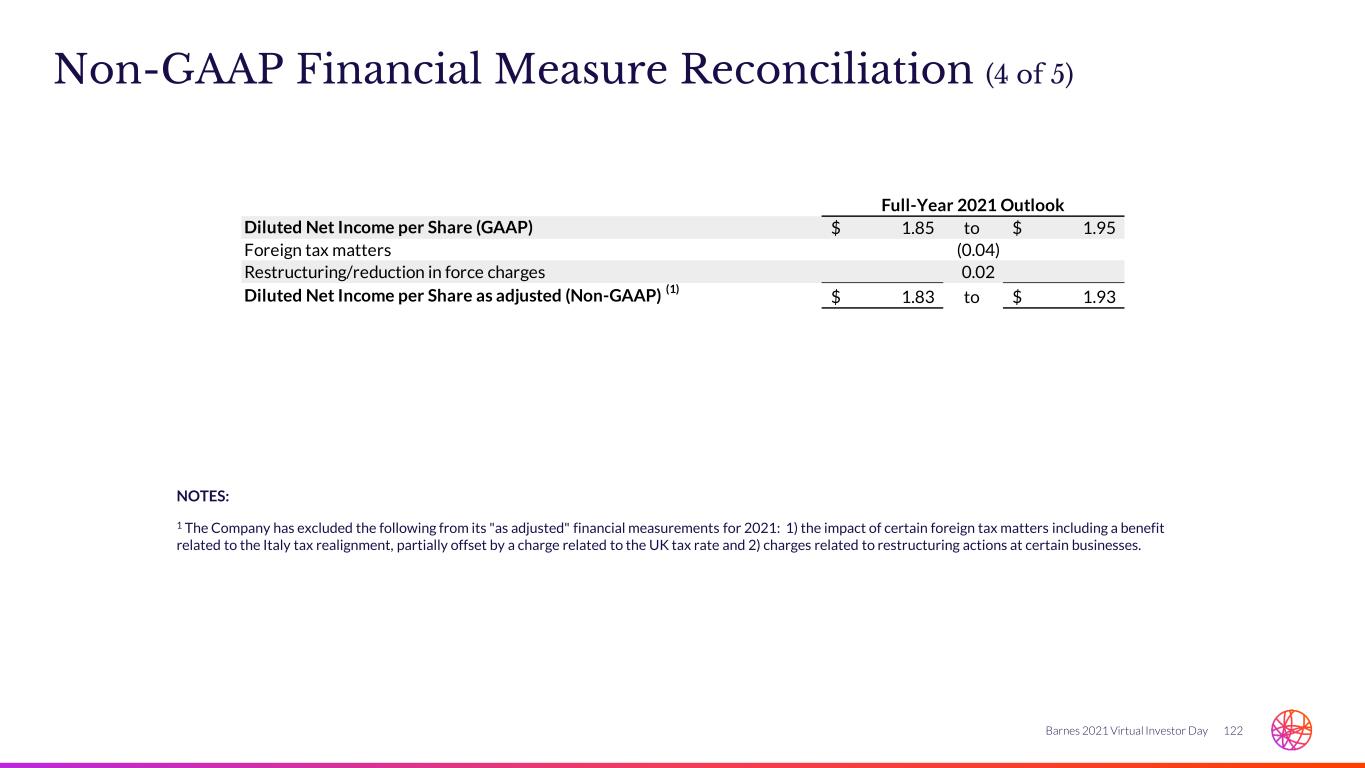

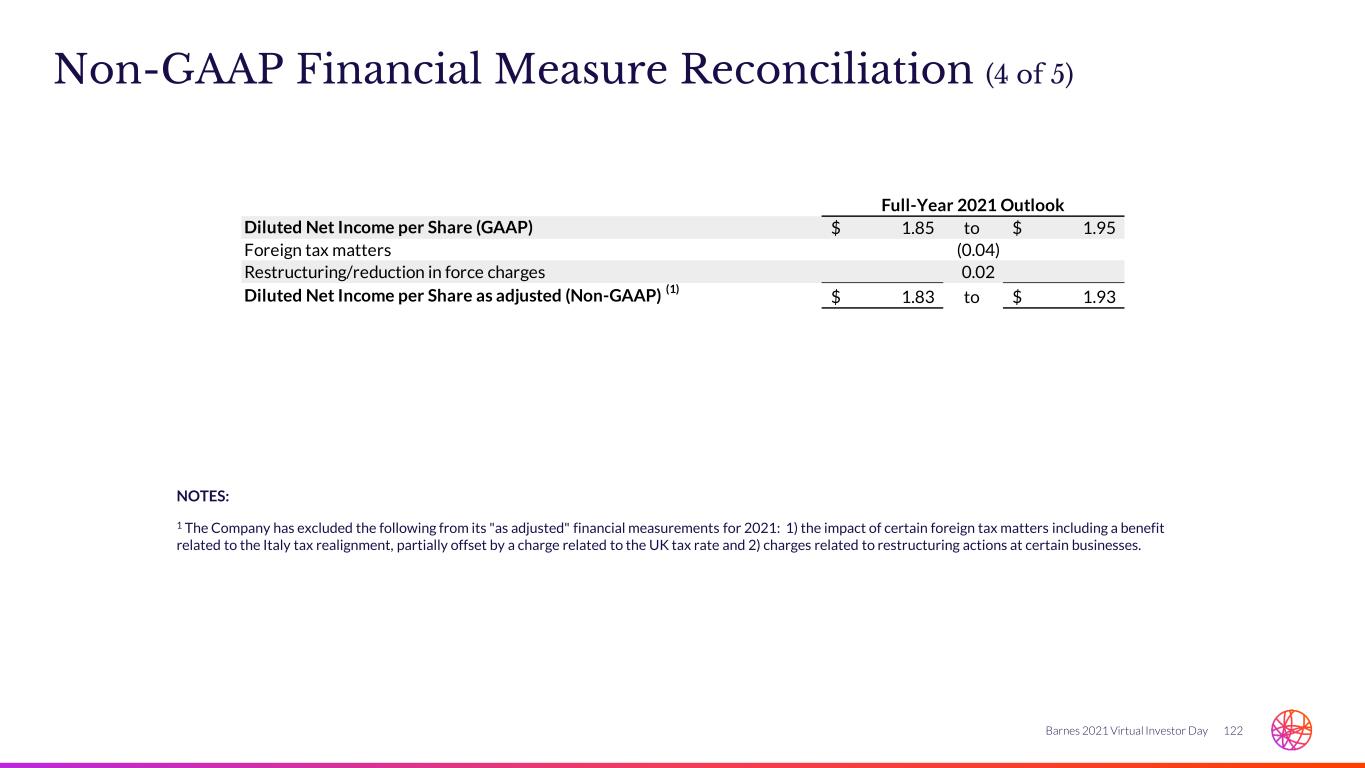

122Barnes 2021 Virtual Investor Day Non-GAAP Financial Measure Reconciliation (4 of 5) NOTES: 1 The Company has excluded the following from its "as adjusted" financial measurements for 2021: 1) the impact of certain foreign tax matters including a benefit related to the Italy tax realignment, partially offset by a charge related to the UK tax rate and 2) charges related to restructuring actions at certain businesses. Diluted Net Income per Share (GAAP) 1.85$ to 1.95$ Foreign tax matters (0.04) Restructuring/reduction in force charges 0.02 0.02 Diluted Net Income per Share as adjusted (Non-GAAP) (1) 1.83$ to 1.93$ Full-Year 2021 Outlook