UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2016 |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission filenumber: 1-14251

SAP SE

(Exact name of Registrant as specified in its charter)

SAP EUROPEAN COMPANY

(Translation of Registrant’s name into English)

Federal Republic of Germany

(Jurisdiction of incorporation or organization)

Dietmar-Hopp-Allee 16

69190 Walldorf

Federal Republic of Germany

(Address of principal executive offices)

Wendy Boufford

c/o SAP Labs

3410 Hillview Avenue, Palo Alto, CA, 94304, United States of America

650-849-4000 (Tel)

650-843-2041 (Fax)

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

American Depositary Shares, each Representing one Ordinary Share, without nominal value | | New York Stock Exchange |

Ordinary Shares, without nominal value | | New York Stock Exchange* |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary Shares, without nominal value: 1,228,504,232 (as of December 31, 2016)**

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☑ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☑

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.)

Yes ☐ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or anon-accelerated filer. See definition of “accelerated filer and large accelerated filer” inRule 12b-2 of the Exchange Act. (Check one):

| | | | |

| Large accelerated filer ☑ | | Accelerated filer ☐ | | Non-accelerated filer ☐ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ International Financial Reporting Standards as issued by the International Accounting Standards Board ☑ Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined inRule 12b-2 of the Exchange Act).

Yes ☐ No ☑

| * | Listed not for trading or quotation purposes, but only in connection with the registration of American Depositary Shares representing such ordinary shares pursuant to the requirements of the Securities and Exchange Commission. |

| ** | Including 29,880,390 treasury shares. |

[THIS PAGE INTENTIONALLY LEFT BLANK]

i

ii

INTRODUCTION

SAP SE is a European Company (Societas Europaea, or “SE”) and is referred to in this report, together with its subsidiaries, as SAP, or as “Company,” “Group,” “we,” “our,” or “us.”

In this report: (i) references to “US$,” “$,” or “dollars” are to U.S. dollars; (ii) references to ‘‘€” or “euro” are to the euro. Our financial statements are denominated in euros, which is the currency of our home country, Germany. Certain amounts that appear in this report may not add up because of differences due to rounding.

Unless otherwise specified herein, euro financial data have been converted into dollars at the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York (the “Noon Buying Rate”) on December 31, 2016, which was US$1.0552 per€1.00. No representation is made that such euro amounts actually represent such dollar amounts or that such euro amounts could have been or can be converted into dollars at that or any other exchange rate on such date or on any other date. The rate used for the convenience translations also differs from the currency exchange rates used for the preparation of the Consolidated Financial Statements. This convenience translation is not a requirement under International Financial Reporting Standards (IFRS) and, accordingly, our independent registered public accounting firm has not audited these US$ amounts. For information regarding recent rates of exchange between euro and dollars, see “Item 3. Key Information – Exchange Rates.” On February 10, 2017, the Noon Buying Rate for converting euro to dollars was US$1.0650 per€1.00.

Unless the context otherwise requires, references in this report to ordinary shares are to SAP SE’s ordinary shares, without nominal value. References in this report to “ADRs” are to SAP SE’s American Depositary Receipts, each representing one SAP ordinary share. References in this report to “ADSs” are to SAP SE’s American Depositary Shares, which are the deposited securities evidenced by the ADRs.

SAP, ABAP, Adaptive Server, Advantage Database Server, Afaria, Ariba, Business ByDesign, BusinessObjects, ByDesign, Concur, Crystal Reports, ExpenseIt, Fieldglass, hybris, PartnerEdge, PowerBuilder, PowerDesigner, Quadrem, R/3, Replication Server, SAP BusinessObjects Explorer, SAP Business Workflow, SAP EarlyWatch, SAP Fiori, SAP HANA, SAP HANA Vora, SAP Jam, SAP Lumira, SAP NetWeaver, SAP S/4HANA, SAPPHIRE, SAPPHIRE NOW, SQL Anywhere, Sybase, SuccessFactors, TheBest-Run Businesses Run SAP, TravelTrax, TripIt, TripLink, TwoGo, Web Intelligence and other SAP products and

services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP SE (or an SAP affiliate company) in Germany and other countries.

Throughout this report, whenever a reference is made to any website, such reference does not incorporate by reference into this report the information contained on such website.

We intend to make this report and other periodic reports publicly available on our web site (www.sap.com) without charge immediately following our filing with the U.S. Securities and Exchange Commission (SEC). We assume no obligation to update or revise any part of this report, whether as a result of new information, future events or otherwise, unless we are required to do so by law.

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements and information based on the beliefs of, and assumptions made by, our management using information currently available to them. Any statements contained in this report that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. We have based these forward-looking statements on our current expectations, assumptions, and projections about future conditions and events. As a result, our forward-looking statements and information are subject to uncertainties and risks. A broad range of uncertainties and risks, many of which are beyond our control, could cause our actual results and performance to differ materially from any projections expressed in or implied by our forward-looking statements. The uncertainties and risks include, but are not limited to:

| | – | | Uncertainty in the global economy, financial markets or political conditions could have a negative impact on our business, financial position, profit, and cash flows and put pressure on our operating profit. |

| | – | | Third parties have claimed, and might claim in the future, that we infringe their intellectual property rights, which could lead to damages being awarded against us and limit our ability to use certain technologies in the future. |

| | – | | Claims and lawsuits against us could have an adverse effect on our business, financial position, profit, cash flows and reputation. |

| | – | | We might not be able to obtain adequate title to, or licenses in, or to enforce intellectual property. |

We describe these and other risks and uncertainties in the Risk Factors section.

If one or more of these uncertainties or risks materializes, or if management’s underlying

1

assumptions prove incorrect, our actual results could differ materially from those described in or inferred from our forward-looking statements and information.

The words “aim,” “anticipate,” “assume,” “believe,” “continue,” “could,” “counting on,” “is confident,” “development,” “estimate,” “expect,” “forecast,” “future trends,” “guidance,” “intend,” “may,” “might,” “outlook,” “plan,” “project,” “predict,” “seek,” “should,” “strategy,” “want,” “will,” “would,” and similar expressions as they relate to us are intended to identify such forward-looking statements. Such statements include, for example, those made in theOperating Results section, our quantitative and qualitative disclosures about market risk pursuant to the International Financial Reporting Standards (IFRS), namely IFRS 7 and related statements in our Notes to the Consolidated Financial Statements; Expected Developments section; Risk Factors section; and other forward-looking information appearing in other parts of this report. To fully consider the factors that could affect our future financial results, both this report and our Integrated Report should be considered, as well as all of our other filings with the Securities and Exchange Commission (SEC). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date specified or the date of this report. We undertake no obligation to publicly update or revise any forward-looking statements as a result of new information that we receive about conditions that existed upon issuance of this report, future events, or otherwise unless we are required to do so by law.

This report includes statistical data about the IT industry and global economic trends that comes from information published by sources including Gartner, the European Central Bank (ECB); and the International Monetary Fund (IMF). This type of data represents only the estimates of Gartner, ECB, IMF, and other sources of industry data. SAP does not adopt or endorse any of the statistical information provided by sources such as Gartner, ECB, IMF, or other similar sources that is contained in this report. The data from these sources is subject to risks and uncertainties, and subject to change based on various factors, including those described above, in the Risk Factors section, and elsewhere in this report. These and other factors could cause our results to differ materially from those expressed in the estimates made by third parties and SAP. We caution readers not to place undue reliance on this data.

PERFORMANCE MANAGEMENT SYSTEM

We use various performance measures to help manage our performance with regard to our primary financial objectives, which are growth and profitability, and our primarynon-financial objectives, which are customer loyalty and employee engagement. We view growth and

profitability as indicators for our current performance, while customer loyalty and employee engagement are indicators for our future performance.

Measures We Use to Manage Our Financial Performance

Measures We Use to Manage Our Operating Financial Performance

In 2016, we used the following key measures to manage our operating financial performance:

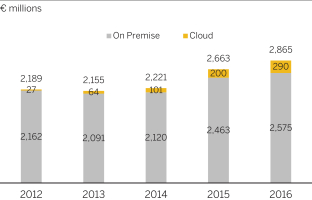

Cloud subscriptions and support revenue(non-IFRS): This revenue driver comprises the main revenues of our fast-growing cloud business. We generate cloud subscriptions and support revenue when we provide software functionality in a cloud-based infrastructure (software as a service, or SaaS) to our customers; when we provide our customers with access to a cloud-based infrastructure to develop, run, and manage applications (platform as a service, or PaaS); and also when we provide hosting services for software hosted by SAP (infrastructure as a service, or IaaS). Cloud subscriptions and support revenue are also generated when providing additional premium cloud subscription support beyond the regular support, which is embedded in the basic cloud subscription fees as well as business network services to our customers. We use the cloud subscriptions and support revenue(non-IFRS) measure both at actual currency and at constant currency.

Cloud and software revenue(non-IFRS): We use cloud and software revenue(non-IFRS) and constant currency cloud and software revenue(non-IFRS) to measure our revenue growth. Our cloud and software revenue includes cloud subscriptions and support revenue plus software licenses and support revenue. Cloud subscriptions and support revenue and software revenue are our key revenue drivers because they tend to affect our other revenue streams. Generally, customers that buy software licenses also enter into related support contracts, and these generate recurring revenue in the form of support revenue after the software sale. Support contracts cover standardized support services that comprise unspecified future software updates and enhancements. Software licenses revenue as well as cloud subscriptions and support revenue also tend to stimulate services revenue earned from providing customers with professional services, premium engagement services, training services, messaging services, and payment services.

Total revenue(non-IFRS): We use nominal total revenue(non-IFRS) and constant currency total revenue(non-IFRS) to measure our growth. The total of cloud subscriptions and support revenue and software support

2

revenue divided by total revenue is the share of more predictable revenue. This measure provides additional insight into our sustained business success.

New cloud bookings: For our cloud activities, we also look at new cloud bookings. This measure reflects the committed order entry from new customers and from incremental purchases by existing customers for offerings that generate cloud subscriptions and support revenue. In this way, it is an indicator for cloud-related sales success in a given period and for secured future cloud subscriptions and support revenue. We focus primarily on the average contract value variant of the new cloud bookings measure that takes into account annualized amounts for multiyear contracts. Additionally, we internally monitor the total contract value variant of the new cloud bookings measure that takes into account the total committed order entry amounts regardless of contract durations. There are no comparable IFRS measures for these bookings metrics. In addition to new cloud bookings, we use the measure “cloud backlog” to evaluate our sales success in the cloud business. We define cloud backlog as a measure that represents the volume of business that, as of period end, is contracted but not yet billed.

Operating profit(non-IFRS): We use operating profit(non-IFRS) and constant currency operating profit(non-IFRS) to measure our overall operational process efficiency and overall business performance. See below for more information on the IFRS andnon-IFRS measures we use.

Cloud subscriptions and support gross margin(non-IFRS): We use our cloud subscriptions and support gross margin(non-IFRS) to measure our process efficiency in our cloud business. Cloud subscriptions and support gross margin(non-IFRS) is the ratio of our cloud subscriptions and support gross profit(non-IFRS) to cloud subscriptions and support revenue(non-IFRS), expressed as a percentage.

Measures We Use to Manage OurNon-Operating Financial Performance

We use the following measures to manage ournon-operating financial performance.

Financial income, net:This measure provides insight into the return on liquid assets and capital investments and the cost of borrowed funds. To manage our financial income, net, we focus on cash flow, the composition of our liquid assets and capital investment portfolio, and the average rate of interest at which assets are invested. We also monitor average outstanding borrowings and associated finance costs.

Days Sales Outstanding (DSO): We manage working capital by controlling the days sales outstanding (DSO) for operating receivables (defined as the average number of days from the raised invoice to cash receipt from the customer).

Measures We Use to Manage Overall Financial Performance

We use the following measures to manage our overall financial performance:

Earnings per share (EPS) (IFRS andnon-IFRS): EPS measures our overall performance because it captures all operating andnon-operating elements of profit as well as income tax expense. It represents the portion of profit after tax allocable to each SAP share outstanding. EPS is influenced not only by our operating andnon-operating business as well as income taxes but also by the number of shares outstanding.

Effective tax rate (IFRS andnon-IFRS): We define our effective tax rate as the ratio of income tax expense to profit before tax, expressed as a percentage.

Operating, investing, and financing cash flows and free cash flow: Our consolidated statement of cash flows provides insight as to how we generated and used cash and cash equivalents. When applied in conjunction with the other primary financial statements, it provides information that helps us evaluate the changes of our net assets, our financial structure (including our liquidity and solvency), and our ability to affect the amounts and timing of cash flows to adapt to changing circumstances and opportunities. We use our free cash flow measure to determine the cash flow remaining after all expenditures required to maintain or expand our organic business have been paid off. This measure provides management with supplemental information to assess our liquidity needs. We calculate free cash flow as net cash from operating activities minus purchases (other than purchases made in connection with business combinations) of intangible assets and property, plant, and equipment.

Measures We Use to Manage OurNon-Financial Performance

In 2016, we used the following key measures to manage ournon-financial performance in the areas of employee engagement, customer loyalty, and leadership trust:

Employee Engagement Index: We use this index to measure the motivation and loyalty of our employees, how proud they are of our company, and how strongly they identify with SAP. The index is derived from surveys conducted among our employees. Applying this measure is recognition that our growth strategy depends on engaged employees.

3

Customer Net Promoter Score (NPS): This score measures the willingness of our customers to recommend or promote SAP to others. It is derived from our annual customer survey that identifies, on a scale of 0–10, whether a customer is loyal and likely to recommend SAP to friends or colleagues, is neutral, or is unhappy. We introduced this measure in 2012, as we are convinced that we can achieve our financial goals only when our customers are loyal to, and satisfied with, SAP and our solutions. To derive the Customer NPS, we start with the percentage of “promoters” of SAP – those who give us a score of 9 or 10 on a scale of 0–10. We then subtract the percentage of “detractors” – those who give us a score of 0 to 6. The method ignores “passives,” who give us a score of 7 or 8.

Leadership Trust Score:We use this scoreto further enhance accountability and to measure our collective effort to foster a work environment based on trust. It is derived from a question in our annual global employee survey that gauges employees’ trust in our leaders. We measure leadership trust by using the same methodology as we do determining the Net Promoter Score (NPS).

Value-Based Management

Our holistic view of the performance measures described above, together with our associated analyses, comprises the information we use for value-based management. We use planning and control processes to manage the compilation of these key measures and their availability to our decision makers across various management levels.

SAP’s long-term strategic plans, including a multiyear financial plan through 2020, are the point of reference for our short-term and midterm planning and controlling processes. We initially identify future growth and profitability drivers at a highly aggregated level. In a first step, the resulting financial plan is broken down to (i) our deployment models “On Premise,” “Software as a Service/Platform as a Service,” “Infrastructure as a Service,” and “Business Networks”, and (ii) functions such as development, sales, or administration. In a second step, the planned total revenues and total expenses are allocated to the individual board areas.

Budget administration and control, including budget adjustments applied during the year to reflect changes in priorities, to achieve efficiency targets and to reflect endogenous and exogenous factors, are handled at board area level. It is then the individual board member’s responsibility to break down, in their board area, the allocated budgets and budget adjustments. The Executive Board’s efforts to assess the performance of the company and components thereof is also done on the level of the board areas. Based on an integrated portfolio process running in parallel to the budgeting process we ensure aligned investment behavior across board areas with regards to specific solutions or solution areas. In a final step, customer-facing revenue targets and cost of sales and marketing targets are broken down into sales regions.

Based on our detailed annual plans, we determine the budget for the respective year. We also have processes in place to forecast revenue and profit on a quarterly basis, to quantify whether we expect to realize our financial goals, and to identify any deviations from plan. We continuously monitor the concerned units in the Group to analyze these developments and define any appropriate actions. Our entire network of planning, control, and reporting processes is implemented in integrated planning and information systems, based on SAP software, across all organizational units so that we can conduct the evaluations and analyses needed to make informed decisions.

Non-IFRS Financial Measures Cited in This Report

As in previous years, we provided our 2016 financial outlook on the basis of certainnon-IFRS measures. Therefore, this report contains anon-IFRS based comparison of our actual performance in 2016 against our outlook in theFinancial Performance: Review and Analysis section.

Reconciliations of IFRS toNon-IFRS Financial Measures for 2016 and 2015

Due to rounding, the sum of the numbers presented in the following table might not precisely equal the totals we provide.

4

Reconciliation of IFRS toNon-IFRS Financial Measures for the Years Ended December 31

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| € millions, unless otherwise stated | | 2016 | | | 2015 | |

| | | IFRS | | | Adj. | | | Non-IFRS | | | Currency Impact | | | Non-IFRS Constant Currency | | | IFRS | | | Adj. | | | Non-IFRS | |

Revenue measures | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

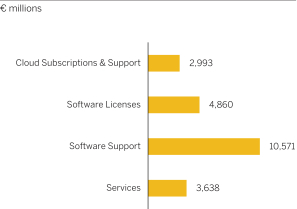

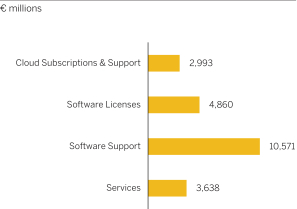

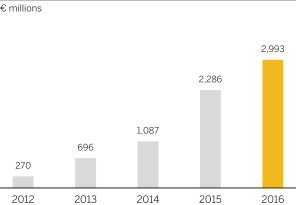

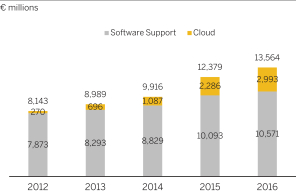

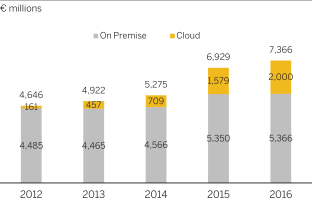

Cloud subscriptions and support | | | 2,993 | | | | 2 | | | | 2,995 | | | | 12 | | | | 3,007 | | | | 2,286 | | | | 10 | | | | 2,296 | |

Software licenses | | | 4,860 | | | | 2 | | | | 4,862 | | | | 31 | | | | 4,893 | | | | 4,835 | | | | 1 | | | | 4,836 | |

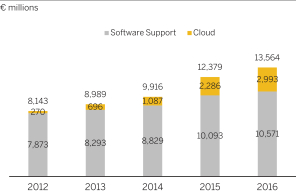

Software support | | | 10,571 | | | | 1 | | | | 10,572 | | | | 82 | | | | 10,654 | | | | 10,093 | | | | 0 | | | | 10,094 | |

Software licenses and support | | | 15,431 | | | | 3 | | | | 15,434 | | | | 113 | | | | 15,546 | | | | 14,928 | | | | 2 | | | | 14,930 | |

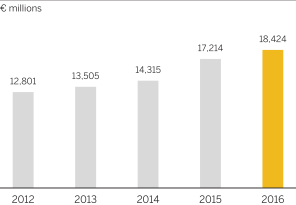

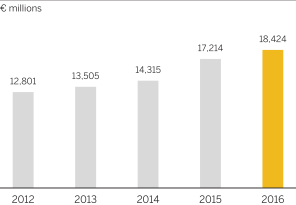

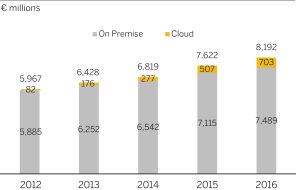

Cloud and software | | | 18,424 | | | | 5 | | | | 18,428 | | | | 125 | | | | 18,553 | | | | 17,214 | | | | 11 | | | | 17,226 | |

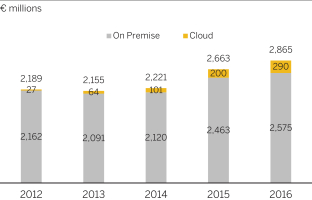

Services | | | 3,638 | | | | 0 | | | | 3,638 | | | | 39 | | | | 3,678 | | | | 3,579 | | | | 0 | | | | 3,579 | |

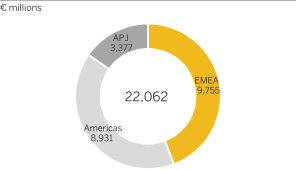

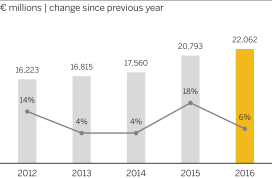

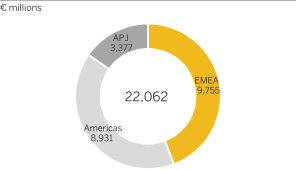

Total revenue | | | 22,062 | | | | 5 | | | | 22,067 | | | | 164 | | | | 22,231 | | | | 20,793 | | | | 11 | | | | 20,805 | |

Operating expense measures | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of cloud subscriptions and support | | | –1,313 | | | | 247 | | | | –1,066 | | | | | | | | | | | | –1,022 | | | | 232 | | | | –789 | |

Cost of software licenses and support | | | –2,182 | | | | 238 | | | | –1,944 | | | | | | | | | | | | –2,291 | | | | 283 | | | | –2,008 | |

Cost of cloud and software | | | –3,495 | | | | 485 | | | | –3,010 | | | | | | | | | | | | –3,313 | | | | 516 | | | | –2,797 | |

Cost of services | | | –3,089 | | | | 113 | | | | –2,976 | | | | | | | | | | | | –2,932 | | | | 167 | | | | –2,765 | |

Total cost of revenue | | | –6,583 | | | | 598 | | | | –5,985 | | | | | | | | | | | | –6,245 | | | | 683 | | | | –5,562 | |

Gross profit | | | 15,479 | | | | 603 | | | | 16,081 | | | | | | | | | | | | 14,548 | | | | 694 | | | | 15,242 | |

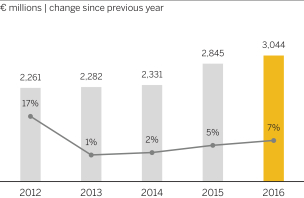

Research and development | | | –3,044 | | | | 201 | | | | –2,843 | | | | | | | | | | | | –2,845 | | | | 202 | | | | –2,643 | |

Sales and marketing | | | –6,265 | | | | 549 | | | | –5,716 | | | | | | | | | | | | –5,782 | | | | 462 | | | | –5,320 | |

General and administration | | | –1,005 | | | | 119 | | | | –886 | | | | | | | | | | | | –1,048 | | | | 116 | | | | –932 | |

Restructuring | | | –28 | | | | 28 | | | | 0 | | | | | | | | | | | | –621 | | | | 621 | | | | 0 | |

Other operating income/expense, net | | | –3 | | | | 0 | | | | –3 | | | | | | | | | | | | 1 | | | | 0 | | | | 1 | |

Total operating expenses | | | –16,928 | | | | 1,494 | | | | –15,434 | | | | –192 | | | | –15,626 | | | | –16,541 | | | | 2,084 | | | | –14,457 | |

Profit numbers | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

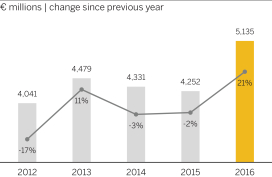

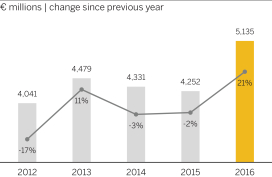

Operating profit | | | 5,135 | | | | 1,498 | | | | 6,633 | | | | –28 | | | | 6,605 | | | | 4,252 | | | | 2,095 | | | | 6,348 | |

| Othernon-operating income/expense, net | | | –234 | | | | 0 | | | | –234 | | | | | | | | | | | | –256 | | | | 0 | | | | –256 | |

Finance income | | | 230 | | | | 0 | | | | 230 | | | | | | | | | | | | 241 | | | | 0 | | | | 241 | |

Finance costs | | | –268 | | | | 0 | | | | –268 | | | | | | | | | | | | –246 | | | | 0 | | | | –246 | |

Financial income, net | | | –38 | | | | 0 | | | | –38 | | | | | | | | | | | | –5 | | | | 0 | | | | –5 | |

Profit before tax | | | 4,863 | | | | 1,498 | | | | 6,361 | | | | | | | | | | | | 3,991 | | | | 2,095 | | | | 6,087 | |

Income tax expense | | | –1,229 | | | | –474 | | | | –1,703 | | | | | | | | | | | | –935 | | | | –651 | | | | –1,586 | |

Profit after tax | | | 3,634 | | | | 1,024 | | | | 4,658 | | | | | | | | | | | | 3,056 | | | | 1,445 | | | | 4,501 | |

Attributable to owners of parent | | | 3,646 | | | | 1,024 | | | | 4,671 | | | | | | | | | | | | 3,064 | | | | 1,445 | | | | 4,509 | |

Attributable tonon-controlling interests | | | –13 | | | | 0 | | | | –13 | | | | | | | | | | | | –8 | | | | 0 | | | | –8 | |

Key ratios | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

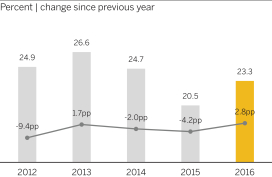

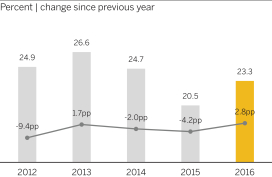

Operating margin (in %) | | | 23.3 | | | | | | | | 30.1 | | | | | | | | 29.7 | | | | 20.5 | | | | | | | | 30.5 | |

Effective tax rate (in %) | | | 25.3 | | | | | | | | 26.8 | | | | | | | | | | | | 23.4 | | | | | | | | 26.1 | |

| Earnings per share, basic (in€) | | | 3.04 | | | | | | | | 3.90 | | | | | | | | | | | | 2.56 | | | | | | | | 3.77 | |

5

Explanation ofNon-IFRS Measures

Non-IFRS Adjustments by Functional Areas

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| € millions | | 2016 | | | 2015 | |

| | | IFRS | | | Acqui-

sition-rel. | | | SBP1) | | | Restruc-

turing | | | Non-IFRS | | | IFRS | | | Acqui- sition-rel. | | | SBP1) | | | Restruc-

turing | | | Non-IFRS | |

| Cost of cloud and software | | | –3,495 | | | | 395 | | | | 89 | | | | 0 | | | | –3,010 | | | | –3,313 | | | | 441 | | | | 74 | | | | 0 | | | | –2,797 | |

| Cost of services | | | –3,089 | | | | 12 | | | | 101 | | | | 0 | | | | –2,976 | | | | –2,932 | | | | 54 | | | | 113 | | | | 0 | | | | –2,765 | |

| Research and development | | | –3,044 | | | | 10 | | | | 190 | | | | 0 | | | | –2,843 | | | | –2,845 | | | | 36 | | | | 166 | | | | 0 | | | | –2,643 | |

| Sales and marketing | | | –6,265 | | | | 257 | | | | 292 | | | | 0 | | | | –5,716 | | | | –5,782 | | | | 202 | | | | 260 | | | | 0 | | | | –5,320 | |

| General and administration | | | –1,005 | | | | 6 | | | | 113 | | | | 0 | | | | –886 | | | | –1,048 | | | | 4 | | | | 111 | | | | 0 | | | | –932 | |

| Restructuring | | | –28 | | | | 0 | | | | 0 | | | | 28 | | | | 0 | | | | –621 | | | | 0 | | | | 0 | | | | 621 | | | | 0 | |

| Other operating income/expense, net | | | –3 | | | | 0 | | | | 0 | | | | 0 | | | | –3 | | | | 1 | | | | 0 | | | | 0 | | | | 0 | | | | 1 | |

| Adjustments of total operating expenses | | | –16,928 | | | | 680 | | | | 785 | | | | 28 | | | | –15,434 | | | | –16,541 | | | | 738 | | | | 724 | | | | 621 | | | | –14,457 | |

1) Share-based payments (SBP)

We disclose certain financial measures, such as revenue(non-IFRS), operating expenses(non-IFRS), operating profit(non-IFRS), operating margin(non-IFRS), and earnings per share(non-IFRS), as well as constant currency revenue, expense, and profit that are not prepared in accordance with IFRS and are therefore considerednon-IFRS financial measures. Ournon-IFRS financial measures may not correspond tonon-IFRS financial measures that other companies report. Thenon-IFRS financial measures that we report should only be considered in addition to, and not as substitutes for, or superior to, our IFRS financial measures.

We believe that the disclosed supplemental historical and prospectivenon-IFRS financial information provides useful information to investors because management uses this information, in addition to financial data prepared in accordance with IFRS, to attain a more transparent understanding of our past performance and our anticipated future results. We use the revenue(non-IFRS) and profit(non-IFRS) measures consistently in our internal planning and forecasting, reporting, and compensation, as well as in our external communications, as follows:

| – | | Our management primarily uses thesenon-IFRS measures rather than IFRS measures as the basis for making financial, strategic, and operating decisions. |

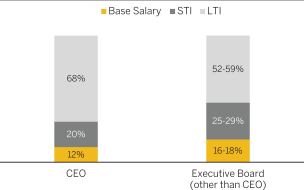

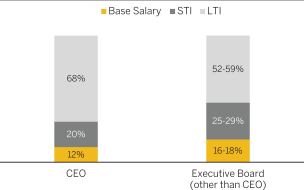

| – | | The variable components of our Executive Board members’ and employees’ remuneration are based on revenue(non-IFRS), operating profit(non-IFRS), |

| | | as well as new cloud bookings measures rather than the respective IFRS measures. |

| – | | The annual budgeting process for all management units is based on revenue(non-IFRS) and operating profit(non-IFRS) numbers rather than the respective IFRS financial measures. |

| – | | All forecast and performance reviews with all senior managers globally are based on thesenon-IFRS measures, rather than the respective IFRS financial measures. |

| – | | Both our internal performance targets and the guidance we provided to the capital markets are based on revenue(non-IFRS) and profit(non-IFRS) measures rather than the respective IFRS financial measures. |

Ournon-IFRS financial measures reflect adjustments based on the items below, as well as adjustments for the related income tax effects.

Revenue(Non-IFRS)

Revenue items identified as revenue(non-IFRS) have been adjusted from the respective IFRS financial measures by including the full amount of software support revenue, cloud subscriptions and support revenue, and other similarly recurring revenue that we are not permitted to record as revenue under IFRS due to fair value accounting for the contracts in effect at the time of the respective acquisitions.

6

Under IFRS, we record at fair value the contracts in effect at the time entities were acquired. Consequently, our IFRS software support revenue, IFRS cloud subscriptions and support revenue, IFRS cloud and software revenue, and IFRS total revenue for periods subsequent to acquisitions do not reflect the full amount of revenue that would have been recorded by entities acquired by SAP had they remained stand-alone entities. Adjusting revenue numbers for this revenue impact provides additional insight into the comparability of our ongoing performance across periods.

Operating Expense(Non-IFRS)

Operating expense numbers that are identified as operating expenses(non-IFRS) have been adjusted by excluding the following expenses:

| – | | Acquisition-related charges |

| | ◾ | | Amortization expense/impairment charges of intangibles acquired in business combinations and certain stand-alone acquisitions of intellectual property (including purchasedin-process research and development) |

| | ◾ | | Settlements of preexisting business relationships in connection with a business combination |

| | ◾ | | Acquisition-related third-party expenses |

| – | | Share-based payment expenses |

| – | | Restructuring expenses, that is, expenses resulting from measures which comply with the definition of restructuring according to IFRS |

We exclude certain acquisition-related expenses for the purpose of calculating operating profit(non-IFRS), operating margin(non-IFRS), and earnings per share(non-IFRS) when evaluating SAP’s continuing operational performance because these expenses generally cannot be changed or influenced by management after the relevant acquisition other than by disposing of the acquired assets. Since management at levels below the Executive Board does not influence these expenses, we generally do not consider these expenses for the purpose of evaluating the performance of management units. For similar reasons we eliminate share-based payment expenses as these costs are impacted by share price developments and other factors outside our control. We also eliminate restructuring expenses because they are volatile and mostly cannot be influenced by management at levels below the Executive Board.

Operating Profit(Non-IFRS), Operating Margin(Non-IFRS), Effective Tax Rate(Non-IFRS), and Earnings per Share(Non-IFRS)

Operating profit, operating margin, effective tax rate, and earnings per share identified as operating profit(non-IFRS), operating margin(non-IFRS), effective tax rate(non-IFRS), and earnings per share(non-IFRS) have been adjusted from the respective IFRS measures by

adjusting for the aforementioned revenue(non-IFRS) and operating expenses(non-IFRS) and the income tax effects thereon.

Constant Currency Information

We believe it is important for investors to have information that provides insight into our sales. Revenue measures determined under IFRS provide information that is useful in this regard. However, both sales volume and currency effects impact period-over-period changes in sales revenue. We do not sell standardized units of products and services, so we cannot provide relevant information on sales volume by providing data on the changes in product and service units sold. To provide additional information that may be useful to investors in breaking down and evaluating changes in sales volume, we present information about our revenue and various values and components relating to operating profit that are adjusted for foreign currency effects.

We calculate constant currency revenue and operating profit measures by translating foreign currencies using the average exchange rates from the comparative period instead of the current period.

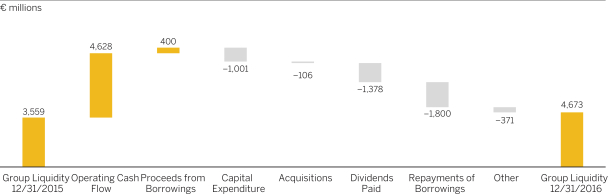

Free Cash Flow

Among others we use the measure free cash flow to manage our overall financial performance.

Free Cash Flow

| | | | | | | | | | | | |

| € millions | | 2016 | | | 2015 | | | D in % | |

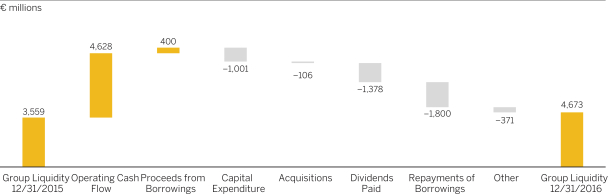

| Net cash flows from operating activities | | | 4,628 | | | | 3,638 | | | | 27 | |

| Purchase of intangible assets and property, plant, and equipment (without acquisitions) | | | –1,001 | | | | –636 | | | | 57 | |

Free cash flow | | | 3,627 | | | | 3,001 | | | | 21 | |

Usefulness ofNon-IFRS Measures

We believe that ournon-IFRS measures are useful to investors for the following reasons:

| – | | Our revenue(non-IFRS), expense(non-IFRS), and profit(non-IFRS) measures as well as the measures “new cloud bookings” and “cloud backlog” (see above) provide investors with insight into management’s decision making because management uses these measures to run our business and make financial, strategic, and operating decisions. We include the revenue adjustments outlined above and exclude the expense adjustments outlined above when making decisions to allocate resources. In addition, we use thesenon-IFRS measures to facilitate comparisons of SAP’s operating performance from period to period. |

7

| – | | Thenon-IFRS measures provide investors with additional information that enables a comparison of year-over-year operating performance by eliminating certain direct effects of acquisitions, share-based compensation plans, and restructuring plans. |

| – | | Non-IFRS andnon-GAAP measures are widely used in the software industry. In many cases, inclusion of ournon-IFRS measures may facilitate comparison with our competitors’ correspondingnon-IFRS andnon-GAAP measures. |

Limitations ofNon-IFRS Measures

We believe that ournon-IFRS financial measures described above have limitations, including but not limited to, the following:

| – | | The eliminated amounts could be material to us. |

| – | | Without being analyzed in conjunction with the corresponding IFRS measures, thenon-IFRS measures are not indicative of our present and future performance, foremost for the following reasons: |

| | ◾ | | While our profit(non-IFRS) numbers reflect the elimination of certain acquisition-related expenses, no eliminations are made for the additional revenue or other income that results from the acquisitions. |

| | ◾ | | While we adjust for the fair value accounting of the acquired entities’ recurring revenue contracts, we do not adjust for the fair value accounting of deferred compensation items that result from commissions paid to the acquired company’s sales force and third parties for closing the respective customer contracts. |

| | ◾ | | The acquisition-related amortization expense that we eliminate in deriving our profit(non-IFRS) numbers is a recurring expense that will impact our financial performance in future years. |

| | ◾ | | The remaining acquisition-related charges that we eliminate in deriving our profit(non-IFRS) numbers are likely to recur should SAP enter into material business combinations in the future. Similarly, the restructuring expenses that we eliminate in deriving our profit(non-IFRS) numbers are likely to recur should SAP perform restructurings in the future. |

| | ◾ | | The revenue adjustment for the fair value accounting of the acquired entities’ contracts and the expense adjustment for acquisition-related charges do not arise from a common conceptual basis. This is because the revenue adjustment aims to improve the comparability of the initial post-acquisition period with future post-acquisition periods, while the expense adjustment aims to improve the comparability between post-acquisition periods andpre-acquisition periods. |

| | | This should particularly be considered when evaluating our operating profit(non-IFRS) and operating margin(non-IFRS) numbers as these combine our revenue(non-IFRS) and expenses(non-IFRS) despite the absence of a common conceptual basis. |

| | ◾ | | Our restructuring charges resulted in significant cash outflows in the past and could do so in the future. The same applies to our share-based payment expense because most of our share-based payments are settled in cash rather than shares. |

| | ◾ | | The valuation of our cash-settled share-based payments could vary significantly from period to period due to the fluctuation of our share price and other parameters used in the valuation of these plans. |

| | ◾ | | In the past, we have issued share-based payment awards to our employees every year and we intend to continue doing so in the future. Thus, our share-based payment expenses are recurring although the amounts usually change from period to period. |

We believe that constant currency measures have limitations, particularly as the currency effects that are eliminated constitute a significant element of our revenue and expenses and could materially impact our performance. Therefore, we limit our use of constant currency measures to the analysis of changes in volume as one element of the full change in a financial measure. We do not evaluate our results and performance without considering both constant currency and nominal measures in revenue(non-IFRS) and operating profit(non-IFRS) measures on the one hand, and changes in revenue, operating expenses, operating profit, or other measures of financial performance prepared in accordance with IFRS on the other. We caution the readers of our financial reports to follow a similar approach by considering nominal and constant currencynon-IFRS measures only in addition to, and not as a substitute for or superior to, changes in revenue, operating expenses, operating profit, or other measures of financial performance prepared in accordance with IFRS.

Despite these limitations, we believe that the presentation of ournon-IFRS measures and the corresponding IFRS measures, together with the relevant reconciliations, provide useful information to management and investors regarding present and future business trends relating to our financial condition and results of operations.

8

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

SELECTED FINANCIAL DATA

The following table sets forth our selected consolidated financial data as of and for each of the years in the five-year period ended December 31, 2016. The consolidated financial data has been derived from, and should be read in conjunction with, our Consolidated Financial Statements prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (IFRS), presented in “Item 18. Financial Statements” of this report.

Our selected financial data and our Consolidated Financial Statements are presented in euros. Financial data as of and for the year ended December 31, 2016 has been translated into U.S. dollars for the convenience of the reader.

9

SELECTED FINANCIAL DATA: IFRS

| | | | | | | | | | | | | | | | | | | | | | | | |

| millions, unless otherwise stated | | 2016(1) US$ | | | 2016 € | | | 2015 € | | | 2014 € | | | 2013 € | | | 2012 € | |

| Income Statement Data: Years ended December 31, | | | | | | | | | | | | | | | | | | | | | | | | |

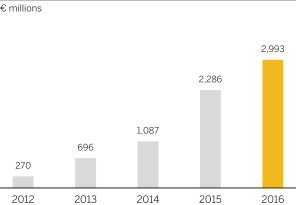

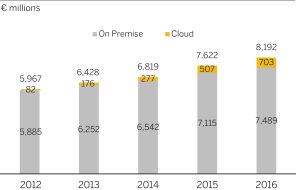

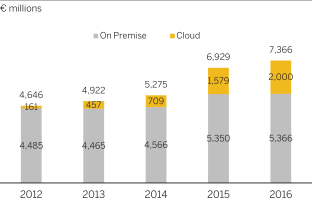

| Cloud subscriptions and support revenue | | | 3,158 | | | | 2,993 | | | | 2,286 | | | | 1,087 | | | | 696 | | | | 270 | |

| Software licenses and support revenue | | | 16,283 | | | | 15,431 | | | | 14,928 | | | | 13,228 | | | | 12,809 | | | | 12,532 | |

| Cloud and software revenue | | | 19,441 | | | | 18,424 | | | | 17,214 | | | | 14,315 | | | | 13,505 | | | | 12,801 | |

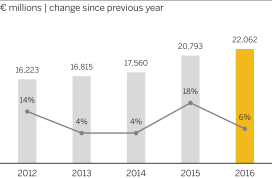

| Total revenue | | | 23,280 | | | | 22,062 | | | | 20,793 | | | | 17,560 | | | | 16,815 | | | | 16,223 | |

| Operating profit | | | 5,418 | | | | 5,135 | | | | 4,252 | | | | 4,331 | | | | 4,479 | | | | 4,041 | |

| Profit after tax | | | 3,834 | | | | 3,634 | | | | 3,056 | | | | 3,280 | | | | 3,325 | | | | 2,803 | |

| Profit attributable to owners of parent | | | 3,848 | | | | 3,646 | | | | 3,064 | | | | 3,280 | | | | 3,326 | | | | 2,803 | |

| Earnings per share(2) | | | | | | | | | | | | | | | | | | | | | | | | |

Basic in€ | | | 3.21 | | | | 3.04 | | | | 2.56 | | | | 2.75 | | | | 2.79 | | | | 2.35 | |

Diluted in€ | | | 3.21 | | | | 3.04 | | | | 2.56 | | | | 2.74 | | | | 2.78 | | | | 2.35 | |

| Other Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted-average number of shares outstanding | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 1,198 | | | | 1,198 | | | | 1,197 | | | | 1,195 | | | | 1,193 | | | | 1,192 | |

Diluted | | | 1,199 | | | | 1,199 | | | | 1,198 | | | | 1,197 | | | | 1,195 | | | | 1,193 | |

| Statement of Financial Position Data: At December 31, | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | | 3,906 | | | | 3,702 | | | | 3,411 | | | | 3,328 | | | | 2,748 | | | | 2,477 | |

| Total assets(3) | | | 46,721 | | | | 44,277 | | | | 41,390 | | | | 38,565 | | | | 27,091 | | | | 26,306 | |

| Current financial liabilities(4) | | | 1,913 | | | | 1,813 | | | | 841 | | | | 2,561 | | | | 748 | | | | 802 | |

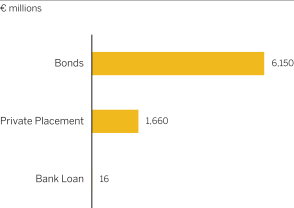

| Non-current financial liabilities(4) | | | 6,839 | | | | 6,481 | | | | 8,681 | | | | 8,980 | | | | 3,758 | | | | 4,446 | |

| Issued capital | | | 1,296 | | | | 1,229 | | | | 1,229 | | | | 1,229 | | | | 1,229 | | | | 1,229 | |

| Total equity | | | 27,854 | | | | 26,397 | | | | 23,295 | | | | 19,534 | | | | 16,048 | | | | 14,133 | |

(1) Amounts presented in US$ have been translated for the convenience of the reader at€1.00 to US$1.0552, the Noon Buying Rate for converting€1.00 into dollars on December 31, 2016. See “Item 3. Key Information — Exchange Rates” for recent exchange rates between the Euro and the dollar.

(2) Profit attributable to owners of parent is the numerator and weighted average number of shares outstanding is the denominator in the calculation of earnings per share. See Note (11) to our Consolidated Financial Statements for more information on earnings per share.

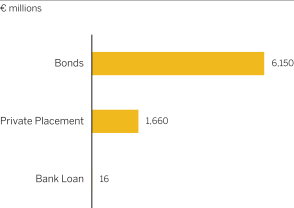

(3) The large increase in total assets from 2013 to 2014 was mainly due to the acquisition of Concur.

(4) The balances include primarily bonds, private placements and bank loans. Current is defined as having a remaining life of one year or less;non-current is defined as having a remaining term exceeding one year. The significant increase from 2013 to 2014 was due to a long-term bank loan and the issuance of a three-tranche Eurobond, both in connection with the Concur acquisition. See Note (17b) to our Consolidated Financial Statements for more information on our financial liabilities.

10

EXCHANGE RATES

The sales prices for our ordinary shares traded on German stock exchanges are denominated in euro. Fluctuations in the exchange rate between the euro and the U.S. dollar affect the dollar equivalent of the euro price of the ordinary shares traded on the German stock exchanges and, as a result, may affect the price of the ADRs traded on the NYSE in the United States. See “Item 9. The Offer and Listing” for a description of the ADRs. In addition, SAP SE pays cash dividends, if any, in euro. As a result, any exchange rate fluctuations will also affect the dollar amounts received by the holders of ADRs on the conversion into dollars of cash dividends paid in euro on the ordinary shares represented by the ADRs. Deutsche Bank Trust Company Americas is the depositary (the Depositary) for SAP SE’s ADR program. The deposit agreement with respect to the ADRs requires the Depositary to convert any dividend payments from euro into dollars as promptly as practicable upon receipt. For additional information on the Depositary and the fees associated with SAP’s ADR program see “Item 12. Description of Securities Other Than Equity Securities – American Depositary Shares.”

For details on the impact of exchange rate fluctuations see “Item 5. Operating and Financial Review and Prospects – Foreign Currency Exchange Rate Exposure”.

The following table sets forth (i) the average, high and low Noon Buying Rates for the euro expressed as U.S. dollars per€1.00 for the past five years on an annual basis and (ii) the high and low Noon Buying Rates on a monthly basis from July 2016 through and including February 10, 2017.

| | | | | | | | | | | | |

| Year | | Average(1) | | | High | | | Low | |

2012 | | | 1.2909 | | | | 1.3463 | | | | 1.2062 | |

2013 | | | 1.3303 | | | | 1.3816 | | | | 1.2774 | |

2014 | | | 1.3210 | | | | 1.3927 | | | | 1.2101 | |

2015 | | | 1.1032 | | | | 1.2015 | | | | 1.0524 | |

2016 | | | 1.1029 | | | | 1.1516 | | | | 1.0375 | |

| | | | | | | | |

| Month | | High | | | Low | |

2016 | | | | | | | | |

July | | | 1.1168 | | | | 1.0968 | |

August | | | 1.1334 | | | | 1.1078 | |

September | | | 1.1271 | | | | 1.1158 | |

October | | | 1.1212 | | | | 1.0866 | |

November | | | 1.1121 | | | | 1.0560 | |

December | | | 1.0758 | | | | 1.0375 | |

2017 | | | | | | | | |

January | | | 1.0794 | | | | 1.0416 | |

February (through February 10, 2017) | | | 1.0802 | | | | 1.0650 | |

(1) The average of the applicable Noon Buying Rates on the last day of each month during the relevant period.

The Noon Buying Rate on February 10, 2017 was US$1.0650 per€1.00.

DIVIDENDS

Dividend Distribution Policy

Dividends are jointly proposed by SAP SE’s Supervisory Board (Aufsichtsrat) and Executive Board (Vorstand) based on SAP SE’syear-end stand-alone statutory financial statements, subject to approval by the Annual General Meeting of Shareholders. Dividends are officially declared for the prior year at SAP SE’s Annual General Meeting of Shareholders. SAP SE’s Annual General Meeting of Shareholders usually convenes during the second quarter of each year. Beginning with the dividends payable for the 2016 fiscal year and in accordance with a recent change of the German Stock Corporation Act that aims to implement joint market standards in Europe for corporate actions processing, dividends will be remitted to the custodian bank on behalf of the shareholders on the third business day following the Annual General Meeting of Shareholders. Record holders of the ADRs on the dividend record date will be entitled to receive payment of the dividend declared in respect of the year for which it is declared. Cash dividends payable to such holders will be paid to the Depositary in euro and, subject to certain exceptions, will be converted by the Depositary into U.S. dollars.

Dividends paid to holders of the ADRs may be subject to German withholding tax. See “Item 8. Financial Information – Other Financial Information – Dividend Policy” and “Item 10. Additional Information – Taxation,” for further information.

11

Annual Dividends Paid and Proposed

The following table sets forth in euro the annual dividends paid or proposed to be paid per ordinary share in respect of each of the years indicated. One SAP ADR currently represents one SAP SE ordinary share. Accordingly, the final dividend per ADR is equal to the dividend for one SAP SE ordinary share and is dependent on the euro/U.S. dollar exchange rate. The table does not reflect tax credits that may be available to German taxpayers who receive dividend payments. If you own our ordinary shares or ADRs and if you are a U.S. resident, refer to “Item 10. Additional Information – Taxation,” for further information.

| | | | | | | | |

Year Ended

December 31, | | Dividend Paid per Ordinary Share | |

| | € | | | US$ | |

2012 | | | 0.85 | | | | 1.11 | (1) |

2013 | | | 1.00 | | | | 1.37 | (1) |

2014 | | | 1.10 | | | | 1.22 | (1) |

2015 | | | 1.15 | | | | 1.30 | (1) |

2016 (proposed) | | | 1.25 | (2) | | | 1.33 | (2),(3) |

(1) Translated for the convenience of the reader from euro into U.S. dollars at the Noon Buying Rate for converting euro into U.S. dollars on the dividend payment date. The Depositary is required to convert any dividend payments received from SAP as promptly as practicable upon receipt.

(2) Subject to approval at the Annual General Meeting of Shareholders of SAP SE currently scheduled to be held on May 10, 2017.

(3) Translated for the convenience of the reader from euro into U.S. dollars at the Noon Buying Rate for converting euro into U.S. dollars on February 10, 2017 of US$1.0650 per€1.00. The dividend paid may differ due to changes in the exchange rate.

The amount of dividends paid on the ordinary shares depends on the amount of profits to be distributed by SAP SE, which depends in part upon our financial performance. In addition, the amount of dividends received by holders of ADRs may be affected by fluctuations in exchange rates (see “Item 3. Key Information – Exchange Rates”). The timing, declaration, amount and payment of any future dividend will depend upon our future earnings, capital needs and other relevant factors, in each case as proposed by the Executive Board and the Supervisory Board of SAP SE and approved by the Annual General Meeting of Shareholders.

RISK FACTORS

Economic, Political, Social, and Regulatory Risk

Uncertainty in the global economy, financial markets, or political conditions could have a negative impact on our business, financial position, profit, as well as cash flows, and put pressure on our operating profit.

Our business is influenced by multiple risk factors that are both difficult to predict and beyond our influence and control. These factors include global economic and business conditions, and fluctuations in national currencies. Other examples are political developments and general regulations as well as budgetary constraints or shifts in spending priorities of national governments.

Macroeconomic developments, such as financial market volatility episodes, global economic crises, chronic fiscal imbalances, slowing economic conditions, or disruptions in emerging markets, could limit our customers’ ability and willingness to invest in our solutions or delay purchases. In addition, changes in the euro conversion rates for particular currencies might have an adverse effect on business activities with local customers and partners. Furthermore, political instability in regions such as Africa and the Middle East, political crises (including Brazil, Great Britain, Greece, Syria, Turkey, Ukraine, or Venezuela), sanctions (such as those placed on Russia), natural disasters, pandemic diseases (such as Ebola in West Africa) and terrorist attacks (including the attacks in Brussels, Belgium, in March 2016, or in Nice, France, in July 2016) could contribute to economic and political uncertainty.

These events could reduce the demand for SAP software and services, and lead to:

| – | | Delays in purchases, decreased deal size, or cancellations of proposed investments |

| – | | Potential lawsuits from customers due to denied provision of service as a result of sanctioned-party lists or export control issues |

| – | | Higher credit barriers for customers, reducing their ability to finance software purchases |

| – | | Increased number of bankruptcies among customers, business partners, and key suppliers |

| – | | Increased default risk, which might lead to significant impairment charges in the future |

| – | | Market disruption from aggressive competitive behavior, acquisitions, or business practices |

| – | | Increased price competition and demand for cheaper products and services |

Any one or more of these developments could reduce our ability to sell and deliver our software and services which could have an adverse effect on our business, financial position, profit, and cash flows.

12

Our international business activities and processes expose us to numerous and often conflicting laws and regulations, policies, standards or other requirements and sometimes even conflicting regulatory requirements, and to risks that could harm our business, financial position, profit, and cash flows.

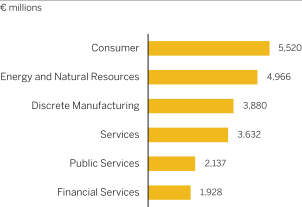

We are a global company and currently market our products and services in more than 180 countries and territories in the Americas (Latin America and North America); Asia Pacific Japan (APJ); China, Hong Kong, Macau, and Taiwan (Greater China); Europe, Middle East, and Africa (EMEA); and Middle and Eastern Europe (MEE) regions. Our business in these countries is subject to numerous risks inherent in international business operations. Among others, these risks include:

| – | | Data protection and privacy regulations regarding access by government authorities to customer, partner, or employee data |

| – | | Data residency requirements (the requirement to store certain data only in and, in some cases, also to access such data only from within a certain jurisdiction) |

| – | | Conflict and overlap among tax regimes |

| – | | Possible tax constraints impeding business operations in certain countries |

| – | | Expenses associated with the localization of our products and compliance with local regulatory requirements |

| – | | Discriminatory or conflicting fiscal policies |

| – | | Operational difficulties in countries with a high corruption perception index |

| – | | Protectionist trade policies, import and export regulations, and trade sanctions and embargoes |

| – | | Works councils, labor unions, and immigration laws in different countries |

| – | | Difficulties enforcing intellectual property and contractual rights in certain jurisdictions |

| – | | Country-specific software certification requirements |

| – | | Challenges with effectively managing a large distribution network of third-party companies |

| – | | Compliance with various industry standards (such as Payment Card Industry Data Security Standard) |

| – | | Market volatilities or workforce restrictions due to changing laws and regulations resulting from political decisions (e.g. Brexit, government elections) |

As we expand into new countries and markets, these risks could intensify. The application of the respective local laws and regulations to our business is sometimes unclear, subject to change over time, and often conflicting among jurisdictions. Additionally, these laws and government approaches to enforcement are continuing to change and evolve, just as our products and services continually evolve. Compliance with these varying laws and regulations could involve significant

costs or require changes in products or business practices.Non-compliance could result in the imposition of penalties or cessation of orders due to allegednon-compliant activity. We do not believe we have engaged in any activities sanctionable under these laws and regulations, but governmental authorities could use considerable discretion in applying these statutes and any imposition of sanctions against us could be material. One or more of these factors could have an adverse effect on our operations globally or in one or more countries or regions, which could have an adverse effect on our business, financial position, profit, and cash flows.

Social and political instability caused by state-based conflicts, terrorist attacks, civil unrest, war, or international hostilities might disrupt SAP’s business operations.

Terrorist attacks (such as in Turkey, in March, June, August, and December 2016) as well as other acts of violence or war, civil, religious, and political unrest (such as in Turkey, Ukraine, and Venezuela; Israel, Libya, Syria, and in other parts of the Middle East; and parts of Africa); natural disasters (such as hurricanes, flooding, or similar events); or pandemic diseases (such as Ebola in West Africa) could have a significant adverse effect on the local economy and beyond. Such an event could lead, for example, to the loss of a significant number of our employees, or to the disruption or disablement of operations at our locations, and could affect our ability to provide business services and maintain effective business operations. Furthermore, this could have a significant adverse effect on our partners as well as our customers and their investment decisions, which could have an adverse effect on our reputation, business, financial position, profit, and cash flows.

Market Risks

Our established customers might not buy additional software solutions, subscribe to our cloud offerings, renew maintenance agreements, purchase additional professional services, or they might switch to other products or service offerings (including competitive products).

In 2016, we continued to depend materially on the success of our support portfolio and on our ability to deliver high-quality services. Traditionally, our large installed customer base generates additional new software, maintenance, consulting, and training revenue. Despite the high quality and service level of our transformed and expanded service offering in the area of premium support services, we might be unable to meet customer expectations with regards to delivery and value proposition. This might lead to a potentially adverse impact on customer experience. Existing customers might cancel or not renew their maintenance contracts, decide not to buy additional products and services, not

13

subscribe to our cloud offerings, or accept alternative offerings from other vendors. In addition, the increasing volume in our cloud business as well as the conversion of traditionalon-premise licenses to cloud subscriptions licenses and an increased complexity in our maintenance and support cycle across our diverse solutions and offerings could have a potential negative impact on our software and maintenance revenue streams. This could have an adverse effect on our business, financial position, profit, and cash flows.

The success of our cloud computing strategy depends on positive market perception and increasing market adoption of our cloud solutions and managed cloud services. Insufficient adoption of our solutions and services could lead to a loss of SAP’s position as a leading cloud company.

The market for cloud computing is increasing and shows strong growth relative to the market for ouron-premise solutions. To offer a broad cloud service portfolio and generate the associated business value for our customers, we continue to invest in innovation and acquisitions. Due to ongoing contracts and previous substantial investments to integrate traditionalon-premise enterprise software into their businesses, as well as concerns about data protection, total cost of ownership, functional capacities, migration, security and integration capabilities, and reliability, customers and partners might be reluctant or unwilling to migrate to the cloud.

Other factors that could affect the market acceptance, adoption and extension of cloud solutions and services include:

| – | | Concerns with entrusting a third-party to store and manage critical employee or company confidential data |

| – | | Customer concerns about security capabilities and reliability |

| – | | Customer concerns about the ability to scale operations for large enterprise customers |

| – | | Inadequate level of configurability or customizability of the software |

| – | | Missing integration scenarios betweenon-premise products andcloud-to-cloud solutions |

| – | | Failure to securely and successfully deliver cloud services by any cloud service provider could have a negative impact on customer trust in cloud solutions |

| – | | Strategic alliances among our competitors and / or their growth-related efficiency gains in the cloud area could lead to significantly increased competition in the market with regards to pricing and ability to integrate solutions |

| – | | Failure to get the full commitment of our partners might reduce speed and impact in market reach |

| – | | Failure to comply with increasing governance on data privacy and data residence |

| – | | Challenge in defining adequate solution packages and scope for all customer segments |

If organizations do not perceive the benefits of cloud computing, the market for cloud business might not develop further, or it might develop more slowly than we expect, either of which could have an adverse effect on our business, competitiveness, financial position, profit, reputation and cash flows.

Our market share and profit could decline due to increased competition, market consolidation and technological innovation as well as new business models in the software industry.

The software industry continues to evolve rapidly and is currently undergoing a significant shift due to innovations in the areas of enterprise mobility, machine learning, augmented and virtual reality, cybersecurity, Big Data, hyperconnectivity, the Internet of Things, digitization, supercomputing, cloud computing, and social media. While smaller innovative companies tend to create new markets organically, large traditional IT vendors tend to enter such markets mostly through acquisitions. SAP faces increased competition in its business environment from traditional, new and in particular cooperating competitors. This competition could cause price pressure, cost increases, and loss of market share, which could have an adverse effect on our business, financial position, profit, and cash flows.

Additionally, related to our Applications, Technology & Services segment, customers could change their buying behavior by accelerating their acceptance of cloud solutions to reduce their investments, which might have a temporary adverse effect on our operating results. Furthermore, the trend in the market to invest more in cloud solutions might lead to a risk of the potential loss of existingon-premise customers. It might also have a temporary adverse effect on our revenue due to the number of conversions fromon-premise licenses to cloud subscriptions from existing SAP customers in our installed base, as we recognize cloud subscriptions revenue over the respective service provision, and that typically ranges fromone-to-three years with some up to five years.

Business Strategy Risks

Demand for our new solutions might not develop as planned and our strategy on new business models and flexible consumption models might not be successful.

Our business consists of new software licenses, software license updates, Services and maintenance fees as well as of cloud subscriptions. Our customers are expecting

14

to take advantage of technological breakthroughs from SAP without compromising their previous IT investments. However, the introduction of new SAP solutions, technologies, and business models as well as delivery and consumption models is subject to uncertainties as to whether customers will be able to perceive the additional value and realize the expected benefits we deliver along our road maps. There is a risk that such uncertainties might lead customers to wait for proof of concepts or holistic integration scenarios through reference customers or more mature versions first, which might result in a lower level of adoption of our new solutions, technologies, business models, and flexible consumption models, or no adoption at all, possibly impacting customer satisfaction and retention. This could have an adverse effect on our business, financial position, profit, and cash flows.

Though downturns or upturns in cloud sales might not be immediately reflected in our operating results, any decline in our customer renewals would harm the future operating results of our cloud business.

We recognize cloud subscriptions revenue as we provide the respective services, which typically range fromone-to-three years with some up to five years. This revenue recognition and our increasing subscription revenues could have a temporary adverse effect on our financial position, profit, and cash flows.

To maintain or improve our operating results in the cloud business, it is important that our customers renew their agreements with us when the initial contract term expires and purchase additional modules or additional capacity. Our customers have no obligation to renew their subscriptions after the initial subscription period, and we cannot assure that customers will renew subscriptions at the same or at a higher level of service, or at all. Our customers’ renewal rates might decline or fluctuate as a result of various factors, including their satisfaction or dissatisfaction with our cloud solution and services portfolio; our ability to efficiently provide cloud services according to customer expectations and meeting the service level agreements, service availability and provisioning, the integration capabilities of our cloud solutions into their existing IT environment (including hybrid solutions combining both cloud andon-premise solutions); our customer support; concerns regarding stable, efficient, and secure cloud operations and compliance with legal and regulatory requirements; our pricing; the pricing of competing products or services; mergers and acquisitions affecting our customer base; global economic conditions; and reductions in our customers’ spending levels.

If our customers do not renew their subscriptions, if they renew on terms less favorable to us, or do not purchase additional modules or users, our revenue and billings might decline, and our operating results could be negatively impacted. This could have an adverse effect on our business, financial position, profit, and cash flows.

If we are unable to scale and enhance an effective partner ecosystem, revenue might not increase as expected.

An open and vibrant partner ecosystem is a fundamental pillar of our success and growth strategy. We have entered into partnership agreements that driveco-innovation on our platforms, profitably expand all our routes to market to optimize market coverage, optimize cloud delivery, and provide high-quality services capacity in all market segments. Partners play a key role in driving market adoption of our entire solutions portfolio, byco-innovating on our platforms, embedding our technology, and reselling and/or implementing our software.

If partners consider our products or services model less strategic and/or financially less attractive compared to our competition and/or less appropriate for their respective channel and target market, if partners fear direct competition by SAP or if SAP fails to establish and enable a network of qualified partners meeting our quality requirements and the requirements of our customers, then, among other things, partners might not:

| – | | Develop a sufficient number of new solutions and content on our platforms |

| – | | Provide high-quality products and services to meet customer expectations |

| – | | Drive growth of references by creating customer use cases and demo systems |

| – | | Embed our solutions sufficiently enough to profitably drive product adoption, especially with innovations such as SAP S/4HANA and SAP Cloud Platform (formerly called SAP HANA Cloud Platform) |

| – | | Enable and train sufficient resources to promote, sell, and support to scale to targeted markets |

| – | | Comply with applicable quality requirements expected by our customers, resulting in delayed, disrupted, or terminated sales and services |

| – | | Transform their business model in accordance with the transformation of SAP’s business model in a timely manner |

| – | | Renew their existing agreements with us or enter into new agreements on terms acceptable to us or at all |

| – | | Provide ability and capacity to meet customer expectations regarding service provisioning. |

15

If one or more of these risks materialize, this might have an adverse effect on the demand for our products and services as well as the partner’s loyalty and ability to deliver. As a result, we might not be able to scale our business to compete successfully with other software vendors, which could have an adverse effect on our reputation, business, financial position, profit, and cash flows.

Human Capital Risks

If we do not effectively manage our geographically dispersed workforce, we might not be able to run our business efficiently and successfully.

Our success is dependent on appropriate alignment of our internal and external workforce planning processes, adequate resource allocation and our location strategy with our general strategy. It is critical that we manage our internationally dispersed workforce effectively, taking short- and long-term workforce and skill requirements into consideration. This applies to the management of our internal as well as our external workforce. Changes in headcount and infrastructure needs as well as local legal or tax regulations could result in a mismatch between our expenses and revenue. Failure to manage our geographically dispersed workforce effectively could hinder our ability to run our business efficiently and successfully and could have an adverse effect on our business, financial position, profit, and cash flows.

If we are unable to attract, develop, and retain leaders and employees with specialized knowledge and technology skills, or are unable to achieve internal diversity and inclusion objectives, we might not be able to manage our operations effectively and successfully, or develop successful new solutions and services.

Our highly qualified workforce is the foundation for our continued success. In certain regions and specific technology and solution areas, we continue to set very high growth targets, specifically in countries and regions such as Africa, China, Latin America, and the Middle East. In the execution of SAP’s strategic priorities, we depend on highly skilled and specialized personnel and leaders, both male and female. Successful maintenance and expansion of our highly skilled and specialized workforce in the area of cloud is a key success factor for our transition to be the leading cloud company. The availability of such personnel as well as business experts is limited and, as a result, competition in our industry is intense and could expose us to claims by other

companies seeking to prevent their employees from working for a competitor. If we are unable to identify, attract, develop, motivate, adequately compensate, and retain well-qualified and engaged personnel, or if existing highly skilled and specialized personnel leave SAP and ready successors or adequate replacements are not available or we cannot allocate our workforce as required due to local regulations and associated restrictions, we might not be able to manage our operations effectively, which could have an adverse effect on our reputation, business, financial position, profit, and cash flows. Furthermore, we might not be able to develop, sell, or implement successful new solutions and services as planned. This is particularly true as we continue to introduce new and innovative technology offerings and expand our business in emerging markets. The lack of appropriate or inadequately executed benefit and compensation programs could limit SAP’s ability to attract or retain qualified employees and lead to financial losses. In addition, we might not be able to achieve our internal gender diversity objectives to increase the number of women in management from 18% in 2010 to 25% by end of 2017.

Organizational and Governance-Related Risks

Laws and regulatory requirements in Germany, the United States, and elsewhere continue to be very stringent.

As a European company domiciled in Germany with securities listed in Germany and the United States, we are subject to European, German, U.S., and other governance-related regulatory requirements. Changes in laws and regulations and related interpretations, including changes in accounting standards and taxation requirements, and increased enforcement actions, sanctions, for example United States sanction requirements for Iran, and penalties might alter the business environment in which we operate. Regulatory requirements have become significantly more stringent in recent years, and some legislation, such as the anticorruption legislation in Germany, the U.S. Foreign Corrupt Practices Act, the UK Bribery Act, and other local laws prohibiting corrupt payments by employees, vendors, distributors, or agents, is being applied more rigorously. Emerging markets are a significant focus of our international growth strategy. The nature of these markets presents a number of inherent risks. A failure by SAP to comply with applicable laws and regulations, or any related allegations of wrongdoing against us, whether merited or not, could have an adverse effect on our business, financial position, profit, cash flows and reputation.

16

Non-compliance with applicable data protection and privacy laws or failure to adequately meet the requirements of SAP’s customers with respect to our products and services could lead to civil liabilities and fines, as well as loss of customers and damage to SAP’s reputation.