Filed by Susquehanna Bancshares, Inc.

Pursuant to Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Patriot Bank Corp.

Commission File No.: 000-26744

The following is a joint press release disseminated by Susquehanna Bancshares, Inc. and Patriot Bank Corp. on December 11, 2003

| | | |

FOR IMMEDIATE RELEASE CONTACT: Alison van Harskamp Vice President, Director of Communications 717-625-6260, communications@susqbanc.com | | [LOGO OF SUSQUEHANNA BANCSHARES, INC.] [LOGO OF PATRIOT BANK CORP.] |

Susquehanna Bancshares, Inc. and Patriot Bank Corp.

Announce Definitive Merger Agreement

LITITZ AND POTTSTOWN, PA– (December 11, 2003) Susquehanna Bancshares, Inc. (“Susquehanna”) [NASDAQ: SUSQ] and Patriot Bank Corp. (“Patriot”) [NASDAQ: PBIX] today announced the signing of a definitive merger agreement pursuant to which Susquehanna will acquire Patriot in a stock and cash transaction valued at $212 million.

Patriot Bank Corp. is a bank holding company for Patriot Bank with 20 offices in the Greater Delaware Valley region of Pennsylvania. The transaction, unanimously approved by the boards of directors of both companies, will enhance Susquehanna’s presence in Pennsylvania, particularly in the high-growth counties of Berks, Chester, Lehigh, Montgomery and Northampton. Upon completion of the transaction, Susquehanna will become the fifth largest banking company headquartered in Pennsylvania with total assets of over $7.0 billion.

“Patriot’s business lines and the excellent demographics of their market area fit perfectly with our stated acquisition strategy,” said Susquehanna’s Chairman, President and Chief Executive Officer William J. Reuter. “The projected growth rate in Patriot’s franchise area is significantly greater than that of Pennsylvania. Additionally, their focus on small- and middle-market lending and wealth management mirrors our strategy. We believe that this combination creates tremendous opportunities and value for our shareholders, customers, employees and communities.”

Under the terms of the merger agreement, shareholders of Patriot will be entitled to elect to receive per share of Patriot common stock either $30.00 in cash, 1.143 common shares of Susquehanna or a combination thereof. Patriot shareholder elections are subject to allocation procedures. The application of these procedures would result in the exchange of 20 percent of the Patriot shares and options for cash, and the remaining Patriot shares and options would be exchanged for Susquehanna common stock or converted to Susquehanna options, as appropriate. Based upon the stated value of $30.00 per share, the transaction price represents 298% of Patriot’s book value and 21.4 times Patriot’s 2004 earnings per share estimate as reported by First Call. It is anticipated that the transaction will be completed during the second quarter of 2004, pending regulatory approvals and the approval of shareholders of Patriot Bank Corp. and Susquehanna Bancshares, Inc. Two Patriot directors will be added to the Susquehanna board.

- more -

Susquehanna Bancshares, Inc. Patriot Bank Corp. Merger/Page 2 of 3

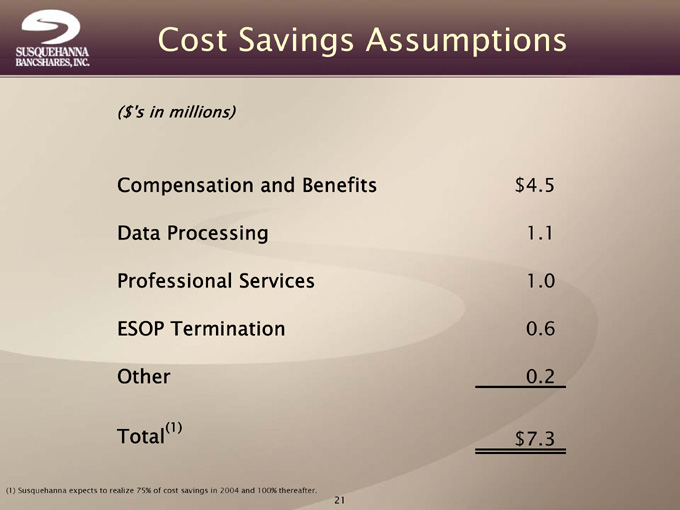

As part of the transaction, Patriot Bank will become a division of Susquehanna’s Farmers First Bank subsidiary. Patriot President and CEO Richard A. Elko will become President and CEO of the Patriot Bank division. The company expects to achieve 25 percent cost savings, or approximately $7.3 million, through the reduction of administrative and operational redundancies. The transaction is expected to be accretive to earnings per share in the first full year after closing.

Richard A. Elko, Patriot Bank Corp.’s President and Chief Executive Officer, said, “Susquehanna and Patriot share the same core values. Susquehanna’s community bank structure will enable us to make key business decisions locally, while enjoying the benefits that a large financial services organization can provide. We look forward to joining the team at Susquehanna to quickly integrate our two organizations and provide an expanded suite of products and services to our customers and communities.”

Susquehanna Bancshares, Inc. is a financial holding company with assets of $5.9 billion, operating in multiple states. It provides financial services through its subsidiaries at over 160 locations in the mid-Atlantic region. In addition to eight commercial banks, Susquehanna operates a trust and investment company, an asset management company, a property and casualty insurance brokerage company and a vehicle leasing company. Investor information may be requested on Susquehanna’s Web site atwww.susqbanc.com.

Patriot Bank Corp., parent company of Patriot Bank, is a $1 billion financial services company operating banking and lending offices in southeastern Pennsylvania. Patriot Advisors, a division of Patriot Bank Corp. with $360 million of assets under management, provides a full range of wealth and investment management services as well as certain employee benefits, brokerage and life insurance services. Investor information may be requested on Patriot’s Web site atwww.patriotbank.com.

This press release contains “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995, which are based on Susquehanna’s and Patriot’s current expectations, estimates and projections about future events. This may include statements regarding the timing of the closing of the transaction, the timing and success of integration efforts once the transaction is complete, Susquehanna’s expectations or ability to realize growth and efficiencies through the acquisition of Patriot and the impact of the transaction on Susquehanna’s business. These statements are not historical facts or guarantees of future performance, events or results. Such statements involve potential risks and uncertainties, such as whether the merger will be approved by the shareholders of Susquehanna and Patriot or by regulatory authorities, whether each of the other conditions to closing set forth in the merger agreement will be met and the general effects of financial, economic, regulatory and political conditions affecting the banking and financial services industries. Accordingly, actual results may differ materially. Susquehanna undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

# # #

Note: A conference call to discuss the transaction will be held on Thursday, December 11, 2003, at 1:00 PM EST. A live audio Web cast of the call as well as a slide presentation will be available online at Susquehanna’s Web site atwww.susqbanc.com. You may access the Web cast atwww.susqbanc.com by selecting “Investor Relations” at the top of the home page and clicking the “Live Web cast” link. To listen to the live presentation, please go to the Web site at least fifteen minutes early to download and install any necessary audio software. For those who cannot listen to the live presentation, a replay will be available from one hour after the call’s conclusion through December 25, 2003.

- more -

Susquehanna Bancshares, Inc. Patriot Bank Corp. Merger/Page 3 of 3

ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT

Patriot and Susquehanna intend to file with the SEC a proxy statement/prospectus and other relevant materials in connection with the merger. The proxy statement/prospectus will be mailed to the stockholders of Patriot and Susquehanna. Investors and security holders of Patriot and Susquehanna are urged to read the proxy statement/prospectus and the other relevant materials when they become available because they will contain important information about Patriot, Susquehanna and the merger.

The proxy statement/prospectus and other relevant materials (when they become available), and any other documents filed by Patriot or Susquehanna with the SEC, may be obtained free of charge at the SEC’s Web site at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by Patriot by contacting Richard A. Elko, Patriot Bank Corp., High and Hanover Streets, Pottstown, PA 19464, telephone (610) 323-1500 or from Patriot’s Web site at www.patriotbank.com. Investors and security holders may obtain free copies of the documents filed with the SEC by Susquehanna by contacting Drew K. Hostetter, Susquehanna Bancshares, Inc., 26 North Cedar Street, Lititz, PA 17543, telephone: (717) 625-6400.

Investors and security holders are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the merger.

The following is a slide presentation in connection with an investors and analyst teleconference call hosted by Susquehanna Bancshares, Inc. and Patriot Bank Corp. on December 11, 2003

The following is a slide presentation in connection with an investors and analyst teleconference call hosted by Susquehanna Bancshares, Inc. and Patriot Bank Corp. on December 11, 2003

Acquisition of: Strengthening our Pennsylvania Franchise December 11, 2003

We combined company after These Such statements or projected by, the forward- the acquisition of Patriot Forward-looking Statements Forward-looking statements are statements that are not historical facts.statements include, but are not limited to, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future operations and statements regarding future performance.are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the control of Susquehanna and Patriot Bank Corp., that could cause actual results to differ materially from those expressed in, or impliedThese risks and uncertainties include: whether the transaction will be approved by shareholders of Susquehanna and Patriot and regulatory authorities; the ability to consummate the transactions within the expected time-frames; the timing and success of integration efforts and cost-savings once the transaction is complete; Susquehanna’s ability to realize growth and efficiencies through carefully review and consider the various disclosures in Susquehanna’s and Patriot’s SEC filings, including, but not limited to, Annual Reports on Form 10-K for the year ended December 31, 2002 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2 During the course of this presentation, we may make certain forward-looking statements, including projections about Susquehanna Bancshares, Inc. and thethe completion of the transactions that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. looking information and statements. within the expected time-frames or at all; and the general effects of financial, economic, regulatory and political conditions affecting the banking and financial services industries.assume no obligation to update these forward-looking statements, and urge readers to 2003, June 30, 2003 and September 30, 2003.

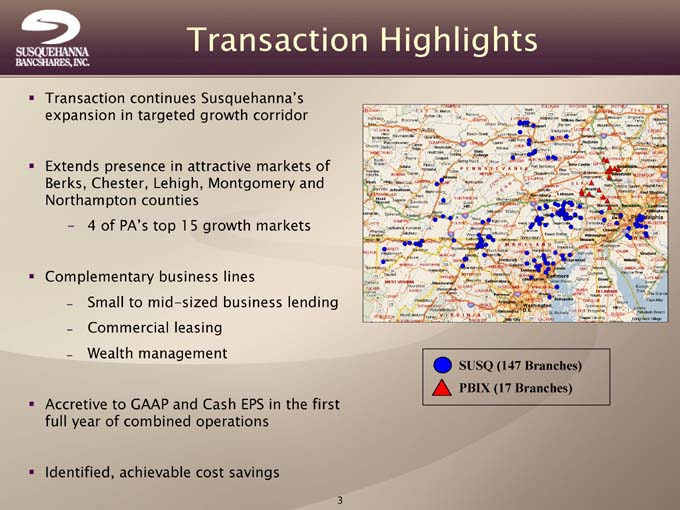

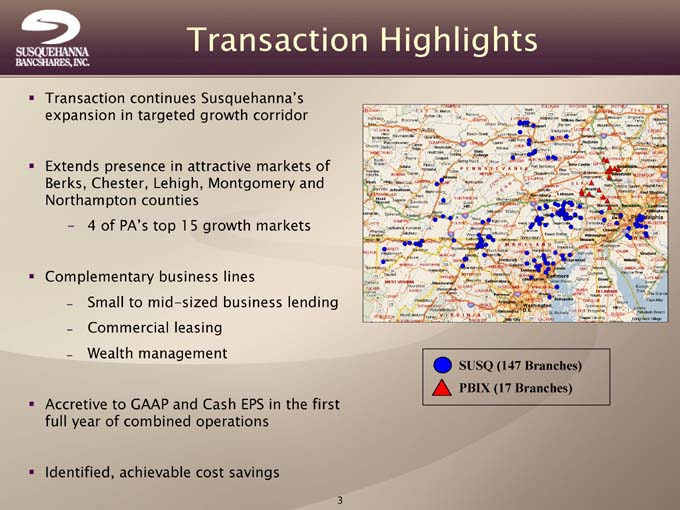

SUSQ (147 Branches) PBIX (17 Branches) Transaction Highlights 3 4 of PA’s top 15 growth markets Small to mid-sized business lending Commercial leasing Wealth management Transaction continues Susquehanna’s expansion in targeted growth corridor Extends presence in attractive markets of Berks, Chester, Lehigh, Montgomery and Northampton counties - Complementary business lines - - - Accretive to GAAP and Cash EPS in the first full year of combined operations Identified, achievable cost savings ? ? ? ? ?

o Contents Summary Corp. of Bank Impact 4 Table Transaction Patriot Financial Benefits of Proposed Strategic Overview Forma Pro o o o

PROPOSED TRANSACTION SUMMARY 5

$30.00 $212 million 80% stock / 20% cash 1.143 shares of Susquehanna common stock or $30.00 in cash or some combination thereof $7.3 million pre-tax (25% of 2004 estimated non-interest expense) $50 million in subordinated debt $15.8 million 6 (1) Summary of Significant Terms (2) Estimated Cost Savings: Value per Patriot Bank

Corp. Share: Transaction Value: Structure: Consideration: Financing: Estimated Merger Charges: (1) Based on a Susquehanna share price of $26.25. (2) Based upon 7,056,015 diluted shares.

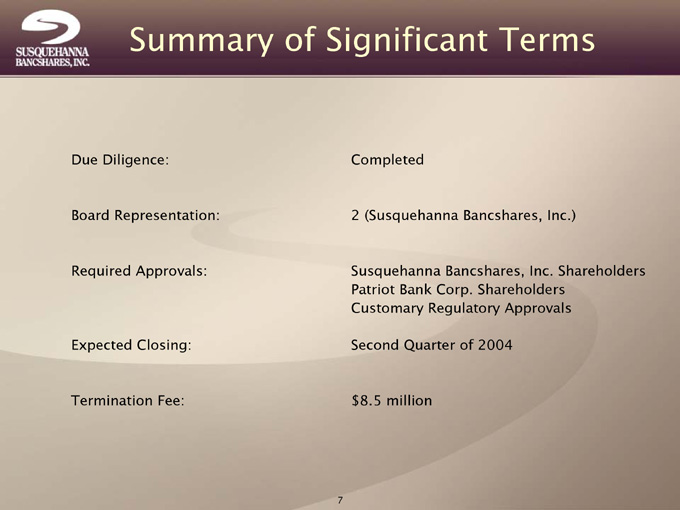

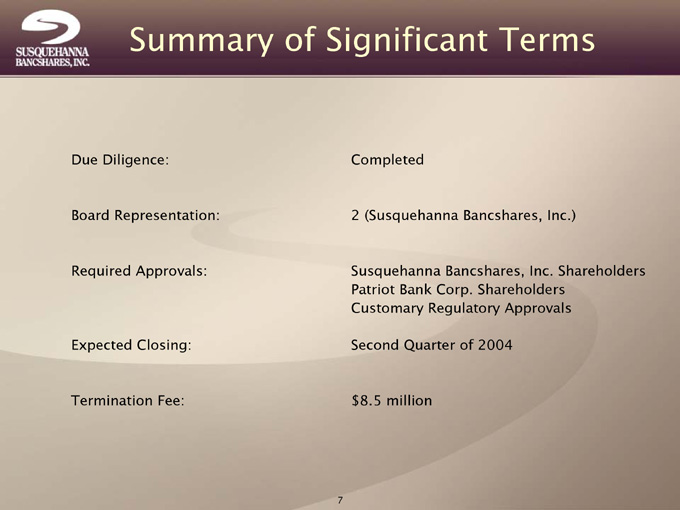

Completed 2 (Susquehanna Bancshares, Inc.) Susquehanna Bancshares, Inc. Shareholders Patriot Bank Corp. Shareholders Customary Regulatory Approvals Second Quarter of 2004 $8.5 million Summary of Significant Terms 7 Due Diligence: Board Representation: Required Approvals: Expected Closing: Termination Fee:

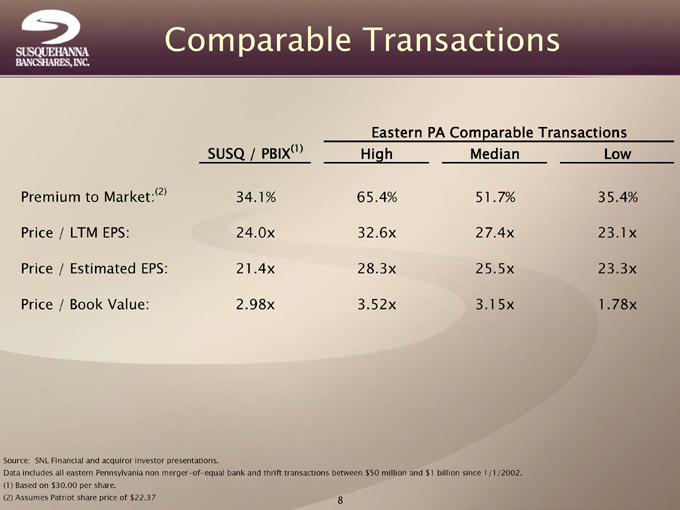

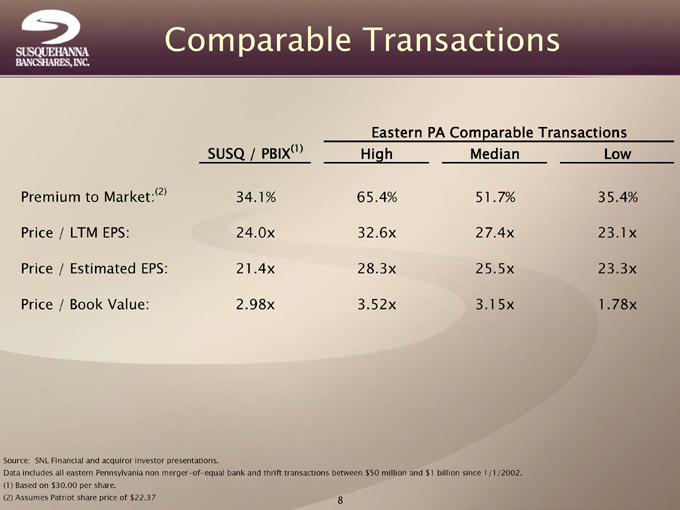

Low 35.4% 23.1x 23.3x 1.78x Eastern PA Comparable Transactions Median 51.7% 27.4x 25.5x 3.15x High 65.4% 32.6x 28.3x 3.52x 8 (1) Comparable Transactions SUSQ / PBIX 34.1% 24.0x 21.4x 2.98x (2) SNL Financial and acquiror investor presentations. Premium to Market: Price / LTM EPS: Price / Estimated EPS: Price / Book Value: Data includes all eastern Pennsylvania non merger-of-equal bank and thrift transactions between $50 million and $1 billion since 1/1/2002. (1) Based on $30.00 per share. (2) Assumes Patriot share price of $22.37 Source:

STRATEGIC BENEFITS 9

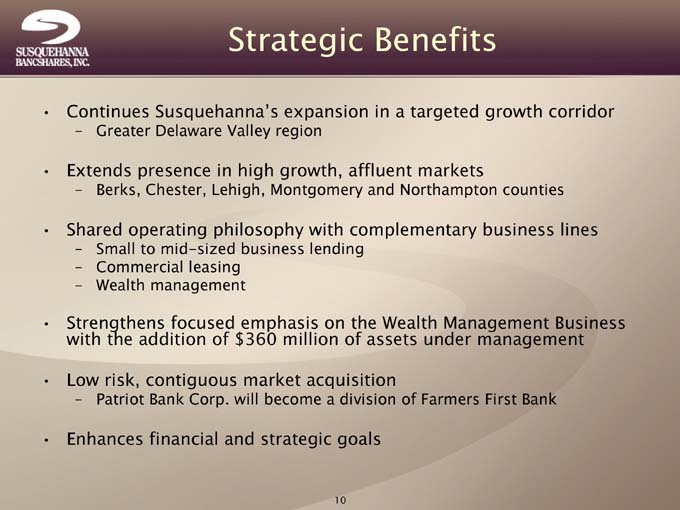

Strategic Benefits 10 Greater Delaware Valley region Berks, Chester, Lehigh, Montgomery and Northampton counties Small to mid-sized business lending Commercial leasingWealth management Patriot Bank Corp. will become a division of Farmers First Bank Continues Susquehanna’s expansion in a targeted growth corridor– Extends presence in high growth, affluent markets– Shared operating philosophy with complementary business lines––– Strengthens focused emphasis on the Wealth Management Businesswith the addition of $360 million of assets under management Low risk, contiguous market acquisition– Enhances financial and strategic goals • • • • • •

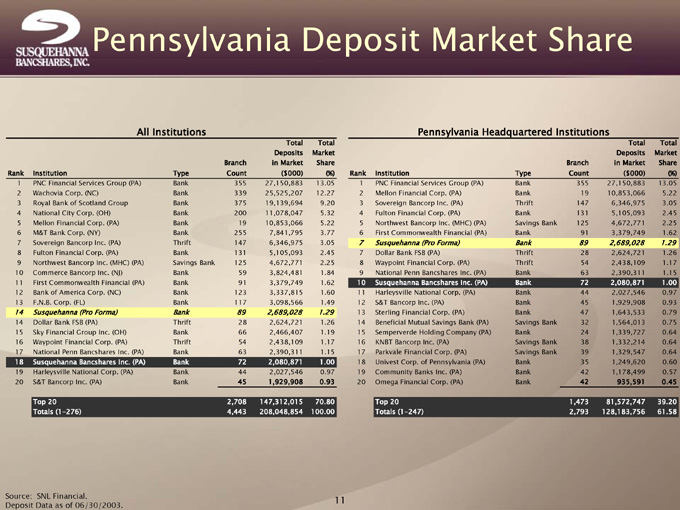

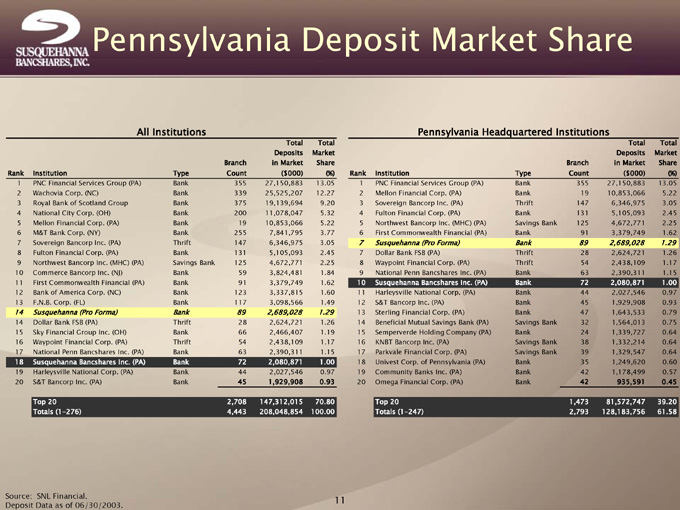

Total Market Share (%) 13.05 5.22 3.05 2.45 2.25 1.62 1.29 1.26 1.17 1.15 1.00 0.97 0.93 0.79 0.75 0.64 0.64 0.64 0.60 0.57 0.45 39.20 61.58 Total Deposits in Market ($000) 27,150,883 10,853,066 6,346,975 5,105,093 4,672,771 3,379,749 2,689,028 2,624,721 2,438,109 2,390,311 2,080,871 2,027,546 1,929,908 1,643,533 1,564,013 1,339,727 1,332,214 1,329,547 1,249,620 1,178,499 935,591 81,572,747 128,183,756 Branch Count 355 19 147 131 125 91 89 28 54 63 72 44 45 47 32 24 38 39 35 42 42 1,473 2,793 Pennsylvania Headquartered Institutions Type Bank Bank Thrift Bank Savings Bank Bank Bank Thrift Thrift Bank Bank Bank Bank Bank Savings Bank Bank Savings Bank Savings Bank Bank Bank Bank Institution PNC Financial Services Group (PA) Mellon Financial Corp. (PA) Sovereign Bancorp Inc. (PA) Fulton Financial Corp. (PA) Northwest Bancorp Inc. (MHC) (PA) First Commonwealth Financial (PA) Susquehanna (Pro Forma) Dollar Bank FSB (PA) Waypoint Financial Corp. (PA) National Penn Bancshares Inc. (PA) Susquehanna Bancshares Inc. (PA) Harleysville National Corp. (PA) S&T Bancorp Inc. (PA) Sterling Financial Corp. (PA) Beneficial Mutual Savings Bank (PA) Semperverde Holding Company (PA) KNBT Bancorp Inc. (PA) Parkvale Financial Corp. (PA) Univest Corp. of Pennsylvania (PA) Community Banks Inc. (PA) Omega Financial Corp. (PA) Top 20 Totals (1-247) Rank 1 2 3 4 5 6 7 7 8 9 10 11 12 13 14 15 16 17 18 19 20 11 Total Market Share (%) 13.05 12.27 9.20 5.32 5.22 3.77 3.05

2.45 2.25 1.84 1.62 1.60 1.49 1.29 1.26 1.19 1.17 1.15 1.00 0.97 0.93 70.80 100.00 Total Deposits in Market ($000) 27,150,883 25,525,207 19,139,694 11,078,047 10,853,066 7,841,795 6,346,975 5,105,093 4,672,771 3,824,481 3,379,749 3,337,815 3,098,566 2,689,028 2,624,721 2,466,407 2,438,109 2,390,311 2,080,871 2,027,546 1,929,908 147,312,015 208,048,854 Branch Count 355 339 375 200 19 255 147 131 125 59 91 123 117 89 28 66 54 63 72 44 45 2,708 4,443 Pennsylvania Deposit Market Share All Institutions Type Bank Bank Bank Bank Bank Bank Thrift Bank Savings Bank Bank Bank Bank Bank Bank Thrift Bank Thrift Bank Bank Bank Bank Institution PNC Financial Services Group (PA) Wachovia Corp. (NC) Royal Bank of Scotland Group National City Corp. (OH) Mellon Financial Corp. (PA) M&T Bank Corp. (NY) Sovereign Bancorp Inc. (PA) Fulton Financial Corp. (PA) Northwest Bancorp Inc. (MHC) (PA) Commerce Bancorp Inc. (NJ) First Commonwealth Financial (PA) Bank of America Corp. (NC) F.N.B. Corp. (FL) Susquehanna (Pro Forma) Dollar Bank FSB (PA) Sky Financial Group Inc. (OH) Waypoint Financial Corp. (PA) National Penn Bancshares Inc. (PA) Susquehanna Bancshares Inc. (PA) Harleysville National Corp. (PA) S&T Bancorp Inc. (PA) Top 20 Totals (1-276) SNL Financial. Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 14 15 16 17 18 19 20 Source:Deposit Data as of 06/30/2003.

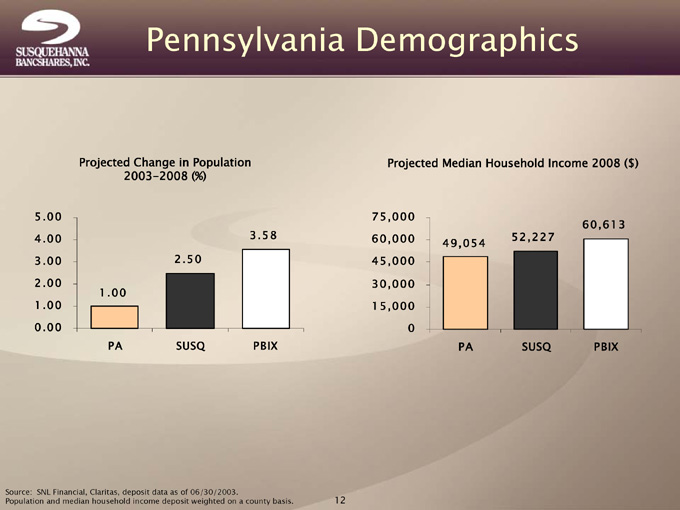

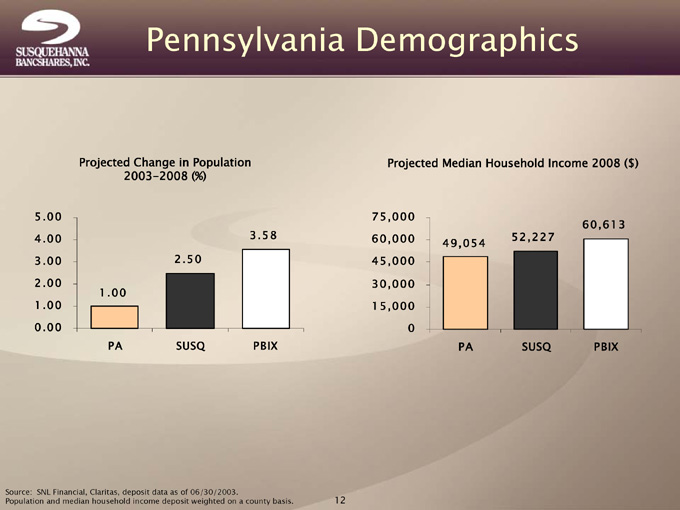

60,613 PBIX 52,227 SUSQ 49,054 PA Projected Median Household Income 2008 ($) 75,000 60,000 45,000 30,000 15,000 0 12 3.58 PBIX Pennsylvania Demographics 2003-2008 (%) 2.50 SUSQ Projected Change in Population 1.00 PA SNL Financial, Claritas, deposit data as of 06/30/2003. 5.00 4.00 3.00 2.00 1.00 0.00 Source:Population and median household income deposit weighted on a county basis.

Overview of Patriot Bank Corp. 13

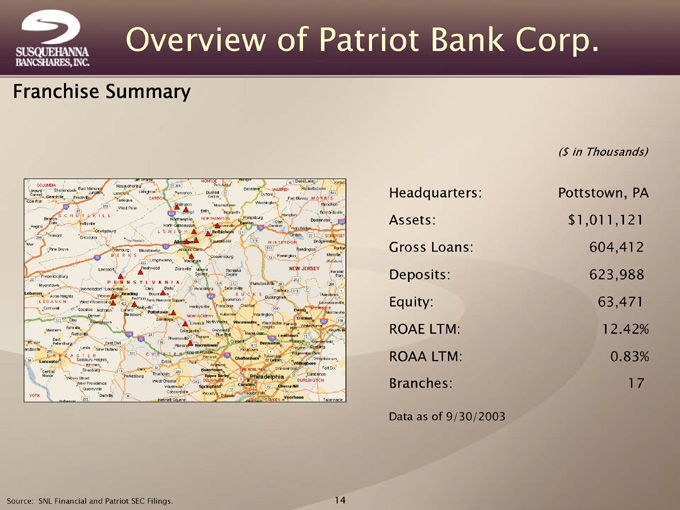

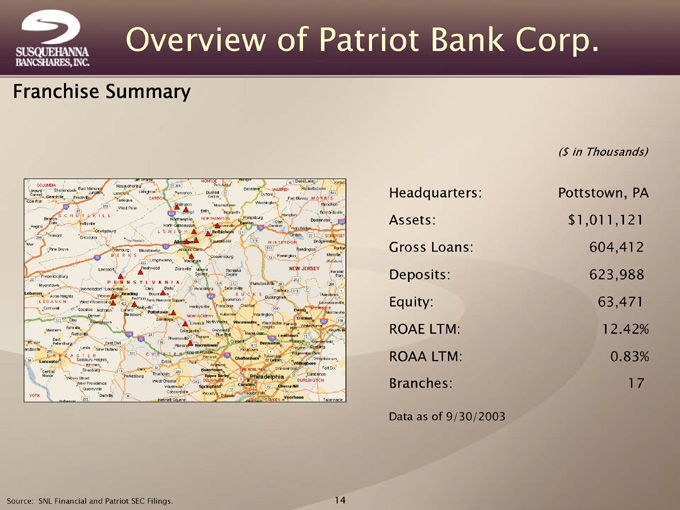

($ in Thousands) Pottstown, PA $1,011,121 604,412 623,988 63,471 12.42% 0.83% 17 Headquarters: Assets: Gross Loans: Deposits: Equity: ROAE LTM: ROAA LTM: Branches: Data as of 9/30/2003 Overview of Patriot Bank Corp. 14 Franchise Summary SNL Financial and Patriot SEC Filings. Source:

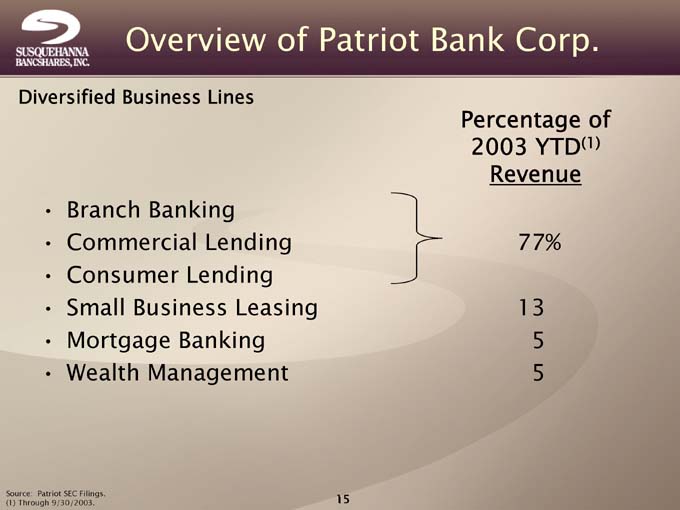

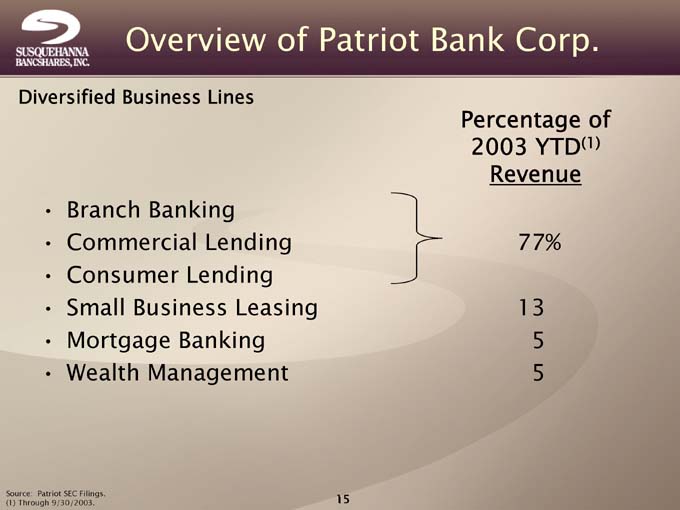

(1) Percentage of 2003 YTDRevenue 77% 13 5 5 Overview of Patriot Bank Corp. 15 Branch Banking Commercial Lending Consumer Lending Small Business Leasing Mortgage Banking Wealth Management Diversified Business Lines o o o o o o Patriot SEC Filings.(1) Through 9/30/2003. Source:

16 2 Overview of Patriot Bank Corp. Employees Second Stage Small Businesses oIn Business Three Years + oSales volume > $100,000 < $5 million o25+/- Municipalities, Institutions Relationship Consumers Target Market - - - Branch Banking o

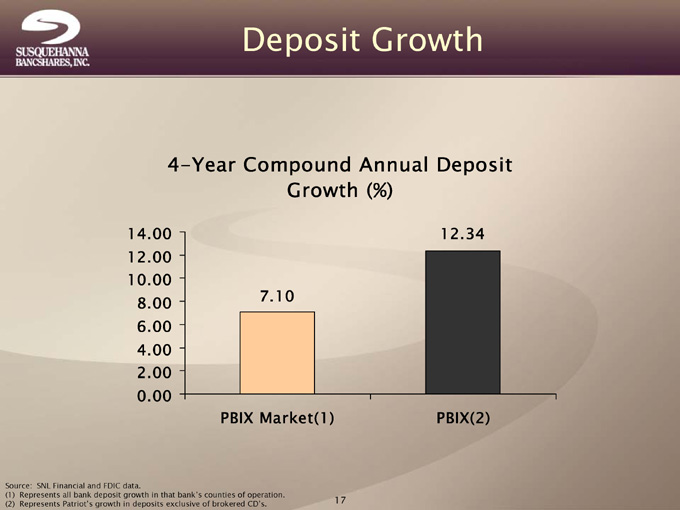

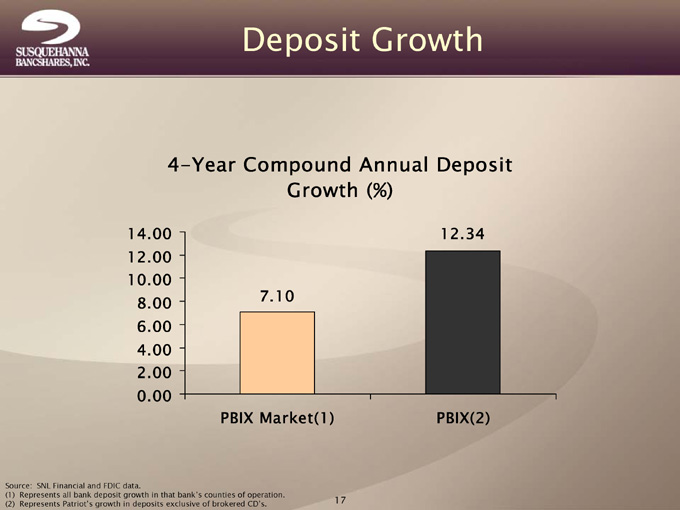

12.34 PBIX(2) Growth (%) 17 Deposit Growth 4-Year Compound Annual Deposit 7.10 PBIX Market(1) 14.00 12.00 10.00 8.00 6.00 4.00 2.00 0.00 SNL Financial and FDIC data.Represents all bank deposit growth in that bank’s counties of operation. Represents Patriot’s growth in deposits exclusive of brokered CD’s. Source:(1)(2)

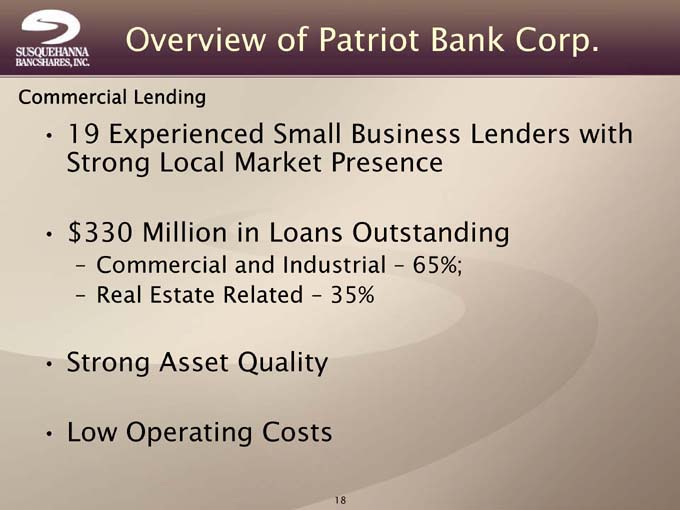

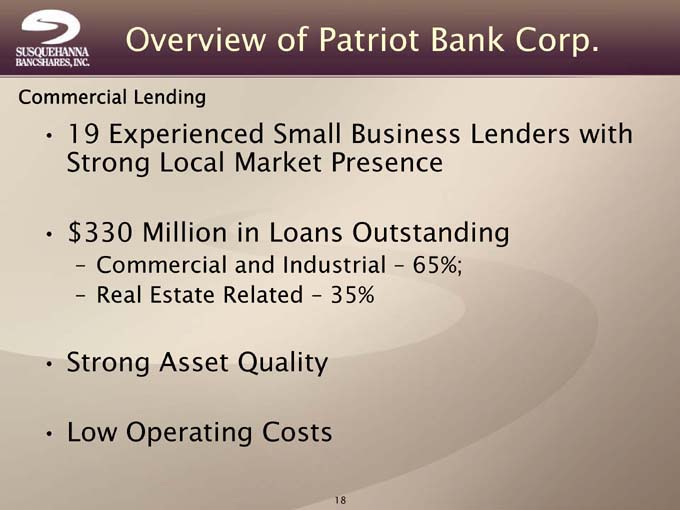

65%; Overview of Patriot Bank Corp. 35% 18 Commercial and Industrial - Real Estate Related - 19 Experienced Small Business Lenders withStrong Local Market Presence $330 Million in Loans Outstanding - - Strong Asset Quality Low Operating Costs Commercial Lending o o o o

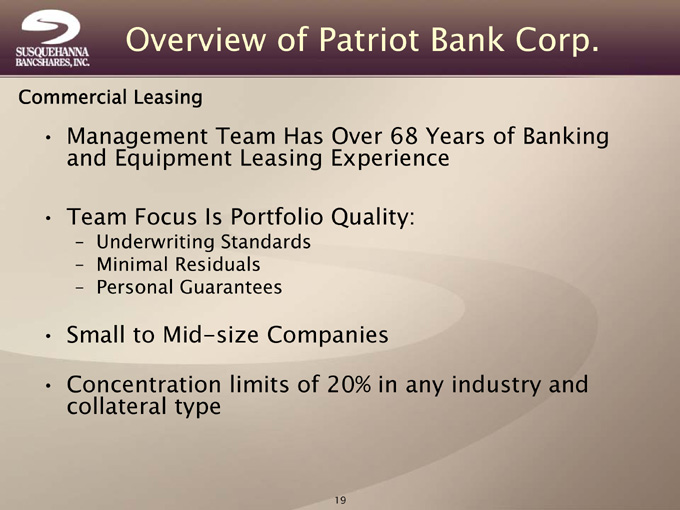

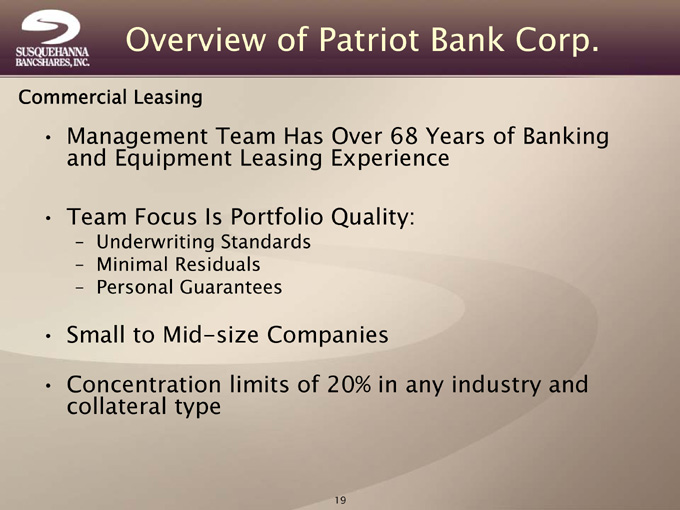

Overview of Patriot Bank Corp. 19 Underwriting StandardsMinimal ResidualsPersonal Guarantees Management Team Has Over 68 Years of Bankingand Equipment Leasing Experience Team Focus Is Portfolio Quality:––– Small to Mid-size Companies collateral type Concentration limits of 20% in any industry and Commercial Leasing • • • •

PRO FORMA FINANCIAL IMPACT 20

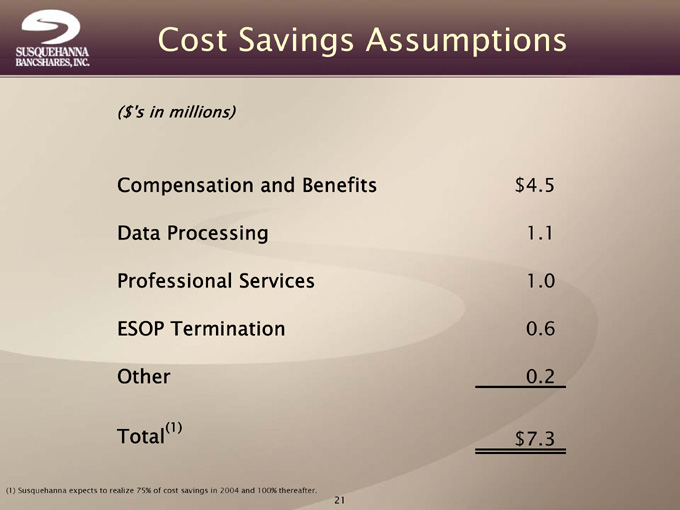

$4.5 1.1 1.0 0.6 0.2 $7.3 21 Cost Savings Assumptions Compensation and Benefits Data Processing ESOP Termination (1) ($’s in millions) Professional Services Other Total (1) Susquehanna expects to realize 75% of cost savings in 2004 and 100% thereafter.

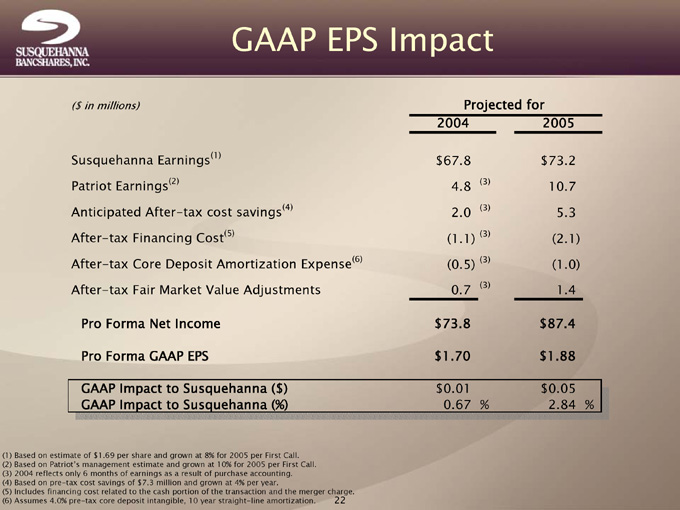

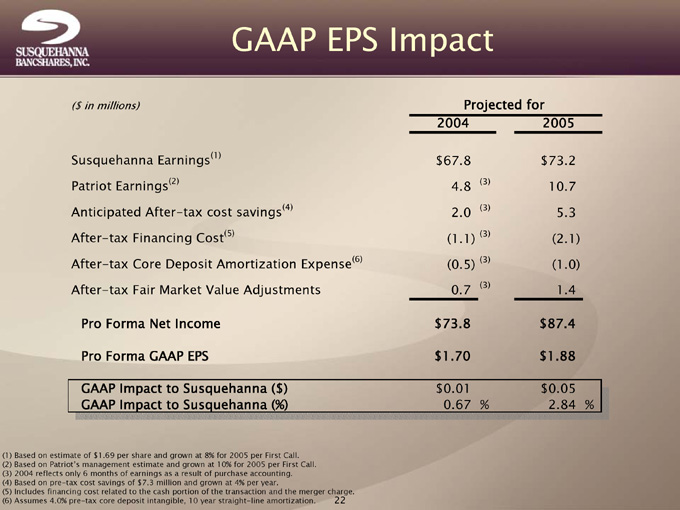

% 2005 $73.2 10.7 5.3 (2.1) (1.0) 1.4 $87.4 $1.88 $0.05 2.84 Projected for (3) (3) (3) (3) (3) % 2004 $67.8 4.8 2.0 (1.1) (0.5) 0.7 $73.8 $1.70 $0.01 0.67 (6) 22 GAAP EPS Impact (4) (5) (1) (2) Anticipated After-tax cost savings After-tax Financing Cost After-tax Core Deposit Amortization Expense After-tax Fair Market Value Adjustments Pro Forma Net Income Pro Forma GAAP EPS GAAP Impact to Susquehanna ($) GAAP Impact to Susquehanna (%) ($ in millions) Susquehanna Earnings Patriot Earnings (1) Based on estimate of $1.69 per share and grown at 8% for 2005 per First Call.(2) Based on Patriot’s management estimate and grown at 10% for 2005 per First Call.(3) 2004 reflects only 6 months of earnings as a result of purchase accounting.(4) Based on pre-tax cost savings of $7.3 million and grown at 4% per year.(5) Includes financing cost related to the cash portion of the transaction and the merger charge.(6) Assumes 4.0% pre-tax core deposit intangible, 10 year straight-line amortization.

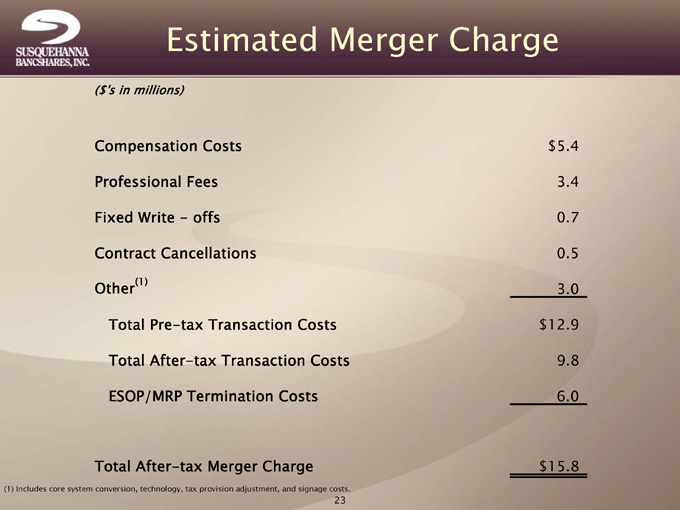

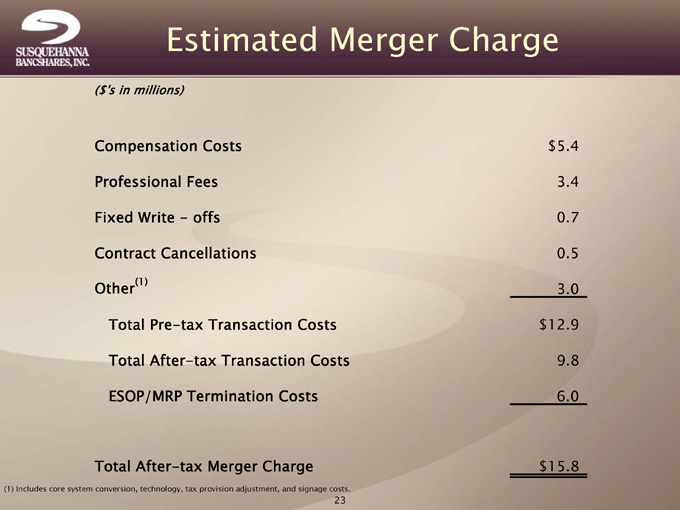

$5.4 3.4 0.7 0.5 3.0 $12.9 9.8 6.0 $15.8 Estimated Merger Charge 23 Compensation Costs Professional Fees Fixed Write—offs Contract Cancellations (1) Total Pre-tax Transaction Costs Total After-tax Transaction Costs ESOP/MRP Termination Costs ($’s in millions) Other Total After-tax Merger Charge (1) Includes core system conversion, technology, tax provision adjustment, and signage costs.

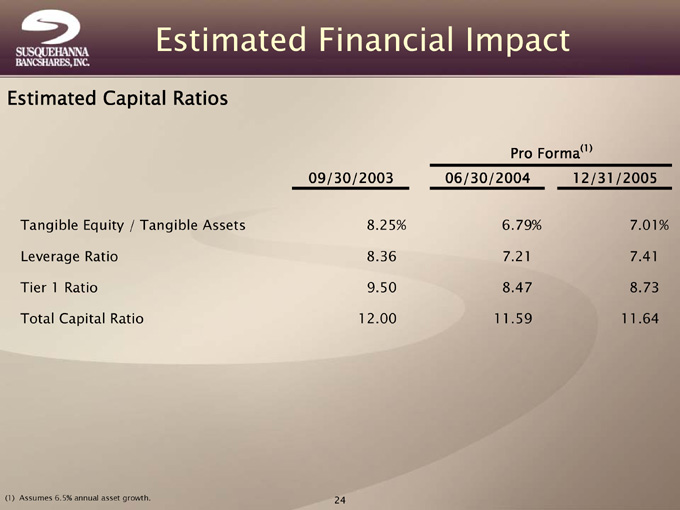

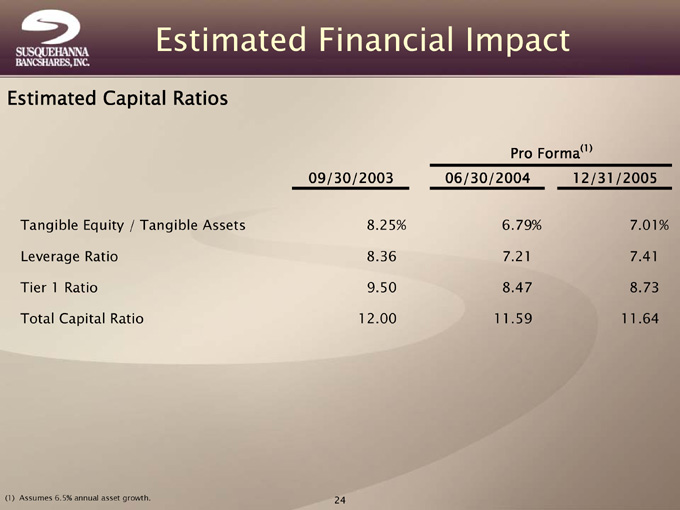

7.01% 7.41 8.73 11.64 (1) 12/31/2005 Pro Forma 6.79% 7.21 8.47 11.59 06/30/2004 8.25% 8.36 9.50 12.00 Estimated Financial Impact 09/30/2003 24 Estimated Capital Ratios Tangible Equity / Tangible Assets Leverage Ratio Tier 1 Ratio Total Capital Ratio Assumes 6.5% annual asset growth. (1)

• Strengths • Transaction Franchise Stream 25 Pennsylvania Earnings Transaction Fit Compatibility Strategic Enhances Diversifies Cultural Accretive • • • •

solicitation of proxies The final joint ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed transaction, a Susquehanna, Patriot and

their directors and officers and other members of their management and employees may be deemed to be participants in theInformation about the participants and their interests 26 This presentation may be deemed to be solicitation material in respect of the proposed merger of Susquehanna and Patriot.registration statement on Form S-4 will be filed with the SEC. SHAREHOLDERS OF SUSQUEHANNA AND PATRIOT ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE JOINT PROXY STATEMENT/PROSPECTUS THAT WILL BE A PART OF THE REGISTRATION STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. in respect of the proposed transaction.in the solicitation may be found in the joint proxy statement/prospectus.proxy statement/prospectus will be mailed to shareholders of Susquehanna and Patriot. Investors and security holders will be able to obtain the documents referred to above free of charge at the SEC’s web site, www.sec.gov, from Susquehanna Investor Relations at (717) 625-6217, or from Patriot Investors Relations at (610) 970-4623.

27

Additional Information and Where to Find It

Susquehanna Bancshares and Patriot anticipate filing a Registration Statement on Form S-4 and joint proxy statement/prospectus with the Securities and Exchange Commission (the “Commission”) shortly. THE DEFINITIVE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS SHOULD BE READ CAREFULLY BEFORE MAKING A DECISION CONCERNING THE MERGER. IN SUCH EVENT, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ SUSQUEHANNA BANCSHARES’ REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS RELATING TO THE MERGER TRANSACTION DESCRIBED ABOVE, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The final joint proxy/prospectus will be mailed to shareholders of Susquehanna Bancshares and Patriot. Investors and shareholders will be able to obtain a free copy of such documents when they become available at the Commission’s web site at www.sec.gov, from Susquehanna Bancshares by directing a request to Susquehanna Bancshares Investor Relations at (717) 625-6217, or from Patriot by directing a request to Patriot Investor Relations at (610) 970-4623. Certain of these documents may also be accessed on Susquehanna Bancshares’ website at www.susqbanc.com when they become available.

Participants in Solicitation

Susquehanna Bancshares, Patriot and their directors and executive officers and other members of their management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the participants and their interests in the solicitation may be found in the joint proxy statement/prospectus.