Filed by Susquehanna Bancshares, Inc.

Pursuant to Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Patriot Bank Corp.

Commission File No.: 000-26744

A Merger Agreement on Form 8-K on December 12, 2003 relating to Susquehanna Bancshares, Inc.’s merger with Patriot Bank Corp. was filed by Susquehanna under cover of Form 8-K today and is incorporated by reference into this filing.

The following is a memorandum distributed on December 11, 2003, by Susquehanna Bancshares, Inc. to its employees regarding questions and answers relating to the merger of Susquehanna Bancshares, Inc. and Patriot Bank Corp.

Susquehanna Bancshares, Inc./Patriot Bank Corp. Merger

Q&As

Q: What is a merger?

A: A merger is the combination of two corporations where, typically, the one firm takes on the identity of another firm. In this case, Susquehanna Bancshares, Inc. will acquire Patriot Bank Corp.

Q: Who is Patriot Bank Corp. and why are we acquiring them?

A: Patriot Bank Corp. is the holding company for Patriot Bank, a state chartered commercial bank. It serves its communities with 20 offices throughout southeastern Pennsylvania.

Patriot Bank specializes in business banking needs, providing a wide range of commercial banking products and personalized service to small- and medium-sized businesses. Patriot offers a full line of checking, savings, and loan products for both consumer and business needs, as well as commercial leasing services. Patriot also offers a full range of wealth management and investment management services. Patriot’s corporate headquarters (pictured below) is located in Pottstown, Pennsylvania.

| | Total deposits: Approximately $623 million Total net loans: Approximately $604 million Counties located: Berks, Chester, Montgomery, Northampton, and Lehigh, PA Web site: www.patriotbank.com |

Patriot Bank Corp. At A Glance (as of 9/30/03)

Number of employees: 285

Number of offices: 20

Total Assets: $1 billion

The reasons for the merger are strategically driven. By acquiring Patriot Bank Corp., Susquehanna immediately will increase its presence in the Greater Delaware Valley market. Patriot Bank has branch offices in Berks, Chester, Montgomery, Northampton and Lehigh counties. This complements the offices we already have in Chester and Montgomery counties and introduces us to Berks, Northampton and Lehigh counties.

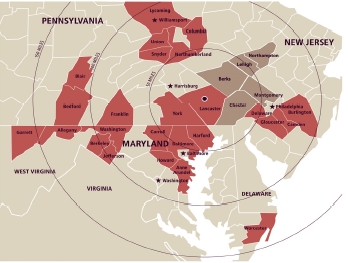

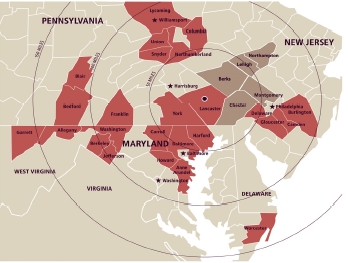

Susquehanna Bancshares/Patriot Bank Corp.’s Combined Market Map

Red = Susquehanna Bancshares, Inc.’s market area

Gray = Patriot Bank Corp.’s market area

Additionally, Susquehanna and Patriot have complementary business lines, specifically in the areas of small- to mid-sized business lending, commercial leasing, and wealth management. Finally, Susquehanna and Patriot have compatible corporate cultures – both placing a high importance on employee welfare, customer service and shareholder value.

Q: Will Patriot Bank become another bank affiliate of Susquehanna Bancshares?

A: No. Patriot Bank will be merged into Susquehanna’s subsidiary Farmers First Bank. It will be a division of Farmers First Bank, but it will not exist as a separate affiliate. Patriot Bank will retain its name, but it will be known as Patriot Bank, a division of Farmers First Bank. This is similar to when Founders’ Bank merged with Equity Bank and became known as Founders’ Bank, a division of Equity Bank.

Q: What does “a division of Farmers First Bank” mean?

A: Patriot Bank will operate under a division president and will retain its name and logo. From an operations and human resources standpoint, Patriot Bank will operate as Farmers First Bank.

Q: How will this merger benefit our customers?

A: It will provide them greater access to 17 additional Pennsylvania banking offices and 22 ATMs in Berks, Chester, Montgomery, Northampton and Lehigh counties.

Q: How should we handle customer questions about the merger?

A: At this time, please share with customers that the merger will give them expanded access to offices and ATMs detailed in the question above. At this time, we do not anticipate that the merger will have a significant impact on Farmers First Bank customers; however, a more detailed customer Q&A will be provided to you in the near future.

Q: The news release about the merger indicates that Susquehanna will realize efficiencies as a result of the merger. Does this mean that jobs will be eliminated?

A: Regrettably, as with many mergers, this merger will result in the elimination of jobs. The exact number of jobs and areas affected has not been determined at this point. As we work through the merger process, we will have a better understanding of the positions that will be affected. If an employee’s job is affected we will do everything possible to place that employee in a position within Susquehanna that matches his/her skills set; however, there will be cases where a position will not be available within the company. We hope to communicate this information to all affected employees by the end of January 2004, in order to give employees ample notice.

Q: What should I do if I get a call or question from the media regarding the merger?

A: Employees should not provide information or comments to the media. Please direct all media inquiries to Alison van Harskamp in Corporate Communications at 717-625-6260.

Q: When will the merger take place?

A: The merger, pending approvals, is scheduled to take place in the second quarter of 2004.

Q: Where can I find up-to-date information about the merger?

A: A “Susquehanna/Patriot Merger” link will be posted on Web1 in the very near future. All communication regarding the merger will be posted and archived in this area. Initial posting will appear in the News section of Web1. In addition, newsletter articles and announcements will be used to further explain the merger process.

Q: If I have a question about the merger, who can I ask?

A: By clicking on the Susquehanna/Patriot Merger link on Web1, you will have the opportunity to submit any question or comment regarding the merger.

Answers to questions will be posted regularly. The Susquehanna/Patriot Merger link will be available on Web1 in the very near future.

Additional Information and Where to Find It

Susquehanna Bancshares and Patriot anticipate filing a Registration Statement on Form S-4 and joint proxy statement/prospectus with the Securities and Exchange Commission (the “Commission”) shortly. THE DEFINITIVE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS SHOULD BE READ CAREFULLY BEFORE MAKING A DECISION CONCERNING THE MERGER. IN SUCH EVENT, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ SUSQUEHANNA BANCSHARES’ REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS RELATING TO THE MERGER TRANSACTION DESCRIBED ABOVE, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The final joint proxy/prospectus will be mailed to shareholders of Susquehanna Bancshares and Patriot. Investors and shareholders will be able to obtain a free copy of such documents when they become available at the Commission’s web site at www.sec.gov, from Susquehanna Bancshares by directing a request to Susquehanna Bancshares Investor Relations at (717) 625-6217, or from Patriot by directing a request to Patriot Investor Relations at (610) 970-4623. Certain of these documents may also be accessed on Susquehanna Bancshares’ website at www.susqbanc.com when they become available.

Participants in Solicitation

Susquehanna Bancshares, Patriot and their directors and executive officers and other members of their management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the participants and their interests in the solicitation may be found in the joint proxy statement/prospectus.