Other assets were up $8 billion or 10%, driven by higher customers’ liability under acceptances and higher commodities trading receivables, driven by client demand. Higher cash collateral also contributed to the increase.

Total liabilities increased $91 billion or 7% from last year. Foreign exchange translation increased total liabilities by $2 billion.

Deposits increased $50 billion or 6%, mainly as a result of higher business and retail deposits, driven by client activities.

Derivative liabilities were up $8 billion or 9%, mainly attributable to higher fair values on interest rate contracts, partially offset by lower fair values on foreign exchange contracts.

Other liabilities increased $32 billion or 10%, mainly attributable to higher obligations related to repurchase agreements due to increased client activity, partially offset by higher financial netting. Higher obligations related to securities sold short and higher acceptances also contributed to the increase.

Total equity increased $4 billion or 5% reflecting earnings, net of dividends and share repurchases, redemptions of preferred shares and the impact of lower discount rates on the remeasurement of our employee benefit plans, partially offset by favourable returns on plan assets.

|

Off-balance sheet arrangements |

In the normal course of business, we engage in a variety of financial transactions that, for accounting purposes, are not recorded on our Consolidated Balance Sheets.Off-balance sheet transactions are generally undertaken for risk, capital and funding management purposes which benefit us and our clients. These include transactions with structured entities and may also include the issuance of guarantees. These transactions give rise to, among other risks, varying degrees of market, credit, liquidity and funding risk, which are discussed in the Risk management section.

We use structured entities to securitize our financial assets as well as assist our clients in securitizing their financial assets. These entities are not operating entities, typically have no employees, and may or may not be recorded on our Consolidated Balance Sheets.

In the normal course of business, we engage in a variety of financial transactions that may qualify for derecognition. We apply the derecognition rules to determine whether we have transferred substantially all the risks and rewards or control associated with the financial assets to a third party. If the transaction meets specific criteria, it may qualify for full or partial derecognition from our Consolidated Balance Sheets.

Securitizations of our financial assets

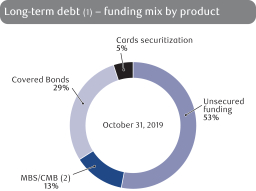

We periodically securitize our credit card receivables and residential and commercial mortgage loans primarily to diversify our funding sources, enhance our liquidity position and for capital purposes. We also securitize residential and commercial mortgage loans as part of our sales and trading activities.

We securitize our credit card receivables, on a revolving basis, through a consolidated structured entity. We securitize single and multiple-family residential mortgages through the National Housing Act Mortgage-Backed Securities (NHA MBS) program. The majority of our securitization activities are recorded on our Consolidated Balance Sheets as we do not meet the derecognition criteria. During 2019, we did not derecognize any mortgages securitized through the NHA MBS program. As at October 31, 2018, we derecognized $1.3 billion of mortgages where both the NHA MBS and the residual interests in the mortgage pools were sold to third parties resulting in the transfer of substantially all of the risks and rewards. For further details, refer to Note 6 and Note 7 of our 2019 Annual Consolidated Financial Statements.

We also periodically securitize commercial mortgage loans by selling them in collateral pools, which meet certain diversification, leverage and debt coverage criteria, to structured entities, one of which is sponsored by us. Securitized commercial mortgage loans are derecognized from our Consolidated Balance Sheets as we have transferred substantially all of the risks and rewards of ownership of the securitized assets. During the year ended October 31, 2019, we securitized $696 million of commercial mortgages (October 31, 2018 – $352 million). Our continuing involvement with the transferred assets is limited to servicing certain of the underlying commercial mortgages sold. As at October 31, 2019, there was $1.9 billion of commercial mortgages outstanding that we continue to service related to these securitization activities (October 31, 2018 – $1.5 billion).

Involvement with unconsolidated structured entities

In the normal course of business, we engage in a variety of financial transactions with structured entities to support our customers’ financing and investing needs, including securitization of our clients’ financial assets, creation of investment products, and other types of structured financing.

We have the ability to use credit mitigation tools such as third-party guarantees, credit default swaps, and collateral to mitigate risks assumed through securitization andre-securitization exposures. The process in place to monitor the credit quality of our securitization andre-securitization exposures involves, among other things, reviewing the performance data of the underlying assets. We affirm our ratings each quarter and formally confirm or assign a new rating at least annually. For further details on our activities to manage risks, refer to the Risk management section.

Below is a description of our activities with respect to certain significant unconsolidated structured entities. For a complete discussion of our interests in consolidated and unconsolidated structured entities, refer to Note 7 of our 2019 Annual Consolidated Financial Statements.

RBC-administered multi-seller conduits

We administer multi-seller conduits which are used primarily for the securitization of our clients’ financial assets. Our clients primarily use our multi-seller conduits to diversify their financing sources and to reduce funding costs by leveraging the value of high-quality collateral. The conduits offer us a favourable revenue stream and risk-adjusted return.

We provide services such as transaction structuring, administration, backstop liquidity facilities and partial credit enhancements to the multi-seller conduits. Revenue for all such services amounted to $254 million during the year (October 31, 2018 – $262 million).

Our total commitment to the conduits in the form of backstop liquidity and credit enhancement facilities is shown below. The total committed amount of these facilities exceeds the total amount of the maximum assets that may have to be purchased by the conduits under the purchase agreements. As a result, the maximum exposure to loss attributable to our backstop liquidity and credit enhancement facilities is less than the total committed amounts of these facilities.

Management’s Discussion and Analysis Royal Bank of Canada: Annual Report 2019 45