Pursuant to the Select Industries Strategy, the Adviser believes that as shifts among industry groups in the equity market have become more dramatic, group selection has become as important as individual stock selection in determining investment performance. The Adviser considers a group to be a collection of stocks whose investment performance tends to be similarly influenced by a variety of factors. The Adviser currently monitors about 150 groups. The major types of groups the Adviser monitors are:

The Adviser continuously updates its investment discipline and adjusts the Fund’s portfolio as necessary to keep the Fund invested in stocks in those groups which the Adviser believes are the most attractive.

The Adviser is the successor to Leuthold & Anderson, Inc., which commenced operations in 1987, and Leuthold, Weeden & Associates, L.P., which commenced operations in 1991, and has been each Fund’s only investment adviser. As the investment adviser to the Funds, the Adviser manages the investment portfolio for each Fund. It makes the decisions as to which securities to buy and which securities to sell.

Under the Advisory Agreements, the Adviser, at its own expense and without reimbursement from the Funds, furnishes office space and all necessary office facilities, equipment and executive personnel for managing the investments of the Funds and pays salaries and fees of all officers and directors of the Company (except the fees paid to directors who are not interested persons of the Adviser). Each Fund pays all of its expenses not assumed by the Adviser. The Adviser receives an investment advisory fee from each Fund based on such Fund’s average daily net assets at the annual rate of 1.00%.

Each Advisory Agreement continues in effect as long as its continuance is specifically approved at least annually (1) by the Directors or by the vote of a majority (as defined in the 1940 Act) of the outstanding shares of the applicable Fund, and (2) by the vote of a majority of the directors of the Company who are not parties to the Advisory Agreement or interested persons of the Adviser, cast in person at a meeting called for the purpose of voting on such approval. Each Advisory Agreement provides that it may be terminated at any time without the payment of any penalty, by the Directors or by vote of the majority of the applicable Fund’s shareholders on sixty (60) days’ written notice to the Adviser, and by the Adviser on the same notice to the Company, and that it shall be automatically terminated if it is assigned.

Each Advisory Agreement provides that the Adviser shall not be liable to the Company or its shareholders for anything other than willful misfeasance, bad faith, gross negligence or reckless disregard of its obligations or duties. Each Advisory Agreement also provides that the Adviser and its officers, directors and employees may engage in other businesses, devote time and attention to any other business whether of a similar or dissimilar nature, and render services to others.

A discussion regarding the basis for the Board of Directors approving each of the investment advisory agreements with the Adviser is available in the Funds’ latest semi-annual report to shareholders for the period ending March 31.

A description of the Funds’ policies and procedures with respect to the disclosure of each Fund’s portfolio securities is available in the Funds’ Statement of Additional Information.

For a discussion of the Select Equities Fund’s performance during the fiscal year ended September 30, 2009, see Exhibit B.

For a discussion of the Select Industries Fund’s performance during the fiscal year ended September 30, 2009, see Exhibit C.

| | |

| D. | Fund Management and Portfolio Managers |

The Directors direct the management of the business and affairs of the Funds. The Directors approve all significant agreements between the respective Fund and persons or companies furnishing services to it, including a Fund’s agreements with the Adviser and the Fund’s custodian, transfer and dividend disbursing agent. The day-to-day operations of a Fund are delegated to its officers and the Adviser, subject to the Fund’s investment objective and policies and to general supervision by the Directors.

The Adviser is the successor to Leuthold & Anderson, Inc., which commenced operations in 1987, and Leuthold, Weeden & Associates, L.P., which commenced operations in 1991, and has been each Fund’s only investment adviser. As the investment adviser to the Funds, the Adviser manages the investment portfolio for each Fund. It makes the decisions as to which securities to buy and which securities to sell.

Steven C. Leuthold and Matthew B. Paschke, CFA, are the portfolio managers of the Select Equities Fund. Mr. Leuthold is the chief investment officer and a managing member of the Adviser. Mr. Leuthold also has been Chairman and portfolio manager of Leuthold & Anderson, Inc. since its organization in August, 1987, a portfolio manager of Leuthold, Weeden & Associates, L.P. since January, 1991 and Chairman of The Leuthold Group since November, 1981. Mr. Paschke is a portfolio manager of the Adviser and has been a senior analyst of The Leuthold Group since 2000.

Steven C. Leuthold, Eric Bjorgen, CFA, and James E. Floyd, CFA, are the portfolio managers of the Select Industries Fund. Mr. Leuthold is the chief investment officer and a managing member of the Adviser. Mr. Leuthold also has been Chairman and portfolio manager of Leuthold & Anderson, Inc. since its organization in August, 1987, a portfolio manager of Leuthold, Weeden & Associates, L.P. since January, 1991 and Chairman of The Leuthold Group since November, 1981. Mr. Bjorgen is a portfolio manager of the Adviser and has been a senior analyst of The Leuthold Group since 1994. Mr. Floyd is a portfolio manager of the Adviser and has been a senior analyst of The Leuthold Group since November, 1981.

The price at which investors purchase shares of a Fund and at which shareholders redeem shares of a Fund is called its net asset value. Each Fund normally calculates its net asset value as of the close of regular trading on the New York Stock Exchange (normally 4:00 p.m. Eastern Time) on each day the New York Stock Exchange is open for trading. The New York Stock Exchange is closed on holidays and weekends. Each Fund calculates its net asset value based on the market prices of the securities (other than money market instruments) it holds. If market quotations are not available or reliable, each Fund will value securities at their fair value pursuant to procedures established by and under the supervision of the Directors.

13

The fair value of a security is the amount which the applicable Fund might reasonably expect to receive upon a current sale. The fair value of a security may differ from the last quoted price and the applicable Fund may not be able to sell a security at the fair value. Market quotations may not be available, for example, if trading in particular securities was halted during the day and not resumed prior to the close of trading on the New York Stock Exchange. Market quotations of foreign securities may not be reliable if events or circumstances that may affect the value of portfolio securities occur between the time of the market quotation and the close of trading on the New York Stock Exchange. The Funds value most money market instruments they hold at their amortized cost. Each Fund processes purchase orders that it receives and accepts and redemption orders that it receives prior to the close of regular trading on a day in which the New York Stock Exchange is open at the net asset value determined later that day. They will process purchase orders that they receive and accept and redemption orders that they receive after the close of regular trading at the net asset value determined at the close of regular trading on the next day the New York Stock Exchange is open.

For a discussion of how shares of the Funds may be purchased and redeemed, see below , provided that shares of the Select Equities Fund may no longer be purchased.

Rights of Shares

The shares of each Fund are fully paid and non-assessable; have no preference as to conversion, exchange, dividends, retirement or other features; and have no preemptive rights. Such shares have non-cumulative voting rights, meaning that the holders of more than 50% of the shares voting for the election of Directors can elect 100% of the Directors if they so choose. Generally shares are voted in the aggregate and not by each Fund, except where class voting rights by Fund is required by Maryland law or the 1940 Act.

The shares of each Fund have the same preferences, limitations and rights, except that all consideration received from the sale of shares of a Fund, together with all income, earnings, profits and proceeds thereof, belong to that Fund and are charged with the liabilities in respect of that Fund and of that Fund’s share of the general liabilities of the Company in the proportion that the total net assets of the Fund bears to the total net assets of all of the Funds. However the Directors may, in their discretion direct that any one or more general liabilities of the Company be allocated among the Funds on a different basis. The net asset value per share of each Fund is based on the assets belonging to that Fund less the liabilities charged to that Fund, and dividends are paid on shares of each Fund only out of lawfully available assets belonging to that Fund. In the event of liquidation or dissolution of the Company, the shareholders of each Fund will be entitled, out of the assets of the Company available for distribution, to the assets belonging to such Fund.

Purchasing Shares

Shares of the Select Equities Fund may no longer be purchased. Shares of the Select Industries Fund have not been registered for sale outside of the United States. The Select Industries Fund generally does not sell shares to investors residing outside the United States, even if they are United States citizens or lawful permanent residents, except to investors with United States military APO or FPO addresses.

The shares of the Select Industries Fund are open only to existing investors. If you are a participant in a retirement plan in which the shares of the Select Industries Fund have been designated as an available investment option as of the applicable close date, but not including an Individual Retirement Account (IRA), you may open a new account and add to an existing account in the shares of the Select Industries Fund.

The Select Industries Fund may also allow new investments in its sole discretion in other circumstances. The Select Industries Fund reserves the right, at any time, to re-open or modify the extent to which future sales of shares are limited.

How to Purchase Shares from the Select Industries Fund

| • | Read this Prospectus carefully. |

14

| • | Determine how much you want to invest, keeping in mind the following minimums. (The Fund reserves the right to waive or reduce the minimum initial investment amounts described below for purchases made through certain retirement, benefit , and pension plans, or for certain classes of shareholders): |

New accounts | | | |

Individual Retirement Accounts | $ | 1,000 | |

Coverdell Education Savings Account | $ | 1,000 | |

All other accounts | $ | 10,000* | |

* | The Fund may, but is not required to, accept initial investments of not less than $1,000 from investors who are related to, or affiliated with, shareholders who have invested $10,000 in the Fund. |

Existing accounts | | | |

Dividend reinvestment | No Minimum | |

Automatic Investment Plan | $ | 50 | |

All other accounts | $ | 100 | |

| • | Complete the Purchase Application accompanying the Prospectus, carefully following the instructions. For additional investments, complete the Additional Investment Form attached to the Fund’s confirmation statements. (The Fund has additional Purchase Applications and Additional Investment Forms if needed.) In compliance with the USA PATRIOT Act of 2001, please note that the transfer agent will verify certain information on your Account Application as part of the Fund’s Anti-Money Laundering Program. As requested on the Application, you should supply your full name, date of birth, social security number, and permanent street address. The Fund might request additional information about you (which may include certain documents, such as articles of incorporation for companies) to help the transfer agent verify your identity. Mailing addresses containing only a P.O. Box will not be accepted. If the transfer agent does not have a reasonable belief of the identity of a shareholder, the account will be rejected or you will not be allowed to perform a transaction on the account until such information is received. The Fund may also reserve the right to close the account within 5 business days if clarifying information/documentation is not received. If you have any questions, please call 1-800-273-6886. |

| • | Make your check payable to “Leuthold Select Industries Fund.” All checks must be in U.S. dollars drawn on U.S. banks. The Select Industries Fund will not accept payment in cash or money orders. The Select Industries Fund also does not accept cashier’s checks in amounts of less than $10,000. To prevent check fraud, the Select Industries Fund will not accept third party checks, treasury checks, credit card checks, traveler’s checks, or starter checks for the purchase of shares. The Select Industries Fund is unable to accept post dated checks, post dated online billpay checks , or any conditional order or payment. U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent, will charge a $25 fee against a shareholder’s account for any payment check returned for any reason. The shareholder will also be responsible for any losses suffered by the Fund as a result. |

15

Send the application and check to:

FOR FIRST CLASS MAIL |

Leuthold Funds, Inc.

c/o U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701 |

FOR OVERNIGHT DELIVERY SERVICE OR REGISTERED MAIL |

Leuthold Funds, Inc.

c/o U.S. Bancorp Fund Services, LLC

615 East Michigan Street, 3rd Floor

Milwaukee, WI 53202-5207 |

Please do not mail letters by overnight delivery service or registered mail to the Post Office Box address.

If you are making an initial investment in the Fund, before you wire funds, please contact the transfer agent by phone (1-800-273-6886) to make arrangements with a telephone service representative to submit your completed application via mail, overnight delivery, or facsimile. Upon receipt of your application, your account will be established and a service representative will contact you within 24 hours to provide an account number and wiring instructions. You may then contact your bank to initiate the wire using the instructions you were given. Before sending any subsequent investments by wire, please contact the transfer agent to advise them of your intent to wire funds.

Funds should be wired to:

U.S. Bank, N.A.

777 E. Wisconsin Ave.

Milwaukee, WI 53202

ABA #075000022 |

Credit: |

U.S. Bancorp Fund Services, LLC

Account #112-952-137 |

Further Credit: |

(name of Fund to be purchased)

(shareholder registration)

(shareholder account number) |

Please remember that U.S. Bank, N.A. must receive your wired funds prior to the close of regular trading on the New York Stock Exchange for you to receive same day pricing. The Fund and U.S. Bank, N.A. are not responsible for the consequences of delays resulting from the banking or Federal Reserve Wire system, or from incomplete wiring instructions.

16

Purchasing Select Industries Fund Shares from Servicing Agents

Some broker-dealers may sell shares of the Fund. These broker-dealers may charge investors a fee either at the time of purchase or redemption. The fee, if charged, is retained by the broker-dealer and not remitted to the Fund or the Adviser. Some broker-dealers may purchase and redeem shares on a three day settlement basis.

The Fund may enter into agreements with broker-dealers, financial institutions, or other service providers (“Servicing Agents”) that may include the Fund as investment alternatives in the programs they offer or administer. Servicing Agents may:

| • | Become shareholders of record of the Fund. This means all requests to purchase additional shares and all redemption requests must be sent through the Servicing Agent. This also means that purchases made through Servicing Agents may not be subject to the Fund’s minimum purchase requirement. |

| • | Use procedures and impose restrictions that may be in addition to, or different from, those applicable to investors purchasing shares directly from the Fund. Please contact your Servicing Agent for information regarding cut-off times for trading the Fund. |

| • | Charge fees to their customers for the services they provide them. Also, the Fund and/or the Adviser may pay fees to Servicing Agents to compensate them for the services they provide their customers. |

| • | Be allowed to purchase shares by telephone with payment to follow the next day. If the telephone purchase is made prior to the close of regular trading on the New York Stock Exchange, it will receive same day pricing. |

| • | Be authorized to accept purchase orders on behalf of the Fund (and designate other Servicing Agents to accept purchase orders on behalf of the Fund). This means that the Fund will process the purchase order at the net asset value which is determined following the Servicing Agent’s (or its designee’s) acceptance of the customer’s order. |

If you decide to purchase shares through Servicing Agents, please carefully review the program materials provided to you by the Servicing Agent because particular Servicing Agents may adopt policies or procedures that are separate from those of the Fund. Investors purchasing or redeeming through a Servicing Agent need to check with the Servicing Agent to determine whether the Servicing Agent has entered into an agreement with the Fund. When you purchase shares of the Fund through a Servicing Agent, it is the responsibility of the Servicing Agent to place your order with the Fund on a timely basis. If the Servicing Agent does not place the order on a timely basis, or if it does not pay the purchase price to the Fund within the period specified in its agreement with the Fund, it may be held liable for any resulting fees or losses.

If you purchase the Funds through a broker-dealer or other financial intermediary (such as a bank), the Funds and their related companies may pay the intermediary for the sale of Fund shares and related services. Specifically, the Funds and/or the Adviser may pay fees to broker-dealers and other financial intermediaries to compensate them for the services they provide their customers, to reimburse them for the marketing expenses they incur, or to pay for the opportunity to have them distribute the Funds. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s Web site for more information.

17

Other Information about Purchasing Shares of the Select Industries Fund

The Fund may reject any share purchase application for any reason. The Fund will not accept initial purchase orders made by telephone, unless they are from a Servicing Agent which has an agreement with the Fund.

The Funds will not issue certificates evidencing shares purchased. Instead, the Fund will send investors a written confirmation for all purchases of shares.

The Fund offers an automatic investment plan allowing shareholders to make purchases, in amounts of $50 or more, on a regular and convenient basis. To use this service, the shareholder must authorize the transfer of funds from their checking or savings account by completing the Automatic Investment Plan section of the Purchase Application and attaching either avoided check or pre-printed savings deposit slip. The Automatic Investment Plan must be implemented with a financial institution that is a member of the Automated Clearing House. The transfer agent is unable to debit mutual fund or pass through accounts. If your payment is rejected by your bank, the transfer agent will charge a $25 fee to your account. Any request to change or terminate an Automatic Investment Plan should be submitted to the transfer agent five days prior to effective date.

The Fund offers a telephone purchase option for subsequent purchases pursuant to which money will be moved from the shareholder’s bank account to the shareholder’s Fund account upon request. Only bank accounts held at domestic financial institutions that are Automated Clearing House (ACH) members can be used for telephone transactions. Fund shares are purchased at the net asset value determined as of the close of regular trading on the day U.S. Bancorp Fund Services, LLC receives the purchase order. If an account has more than one owner or authorized person, the Fund will accept telephone instructions from any one owner or authorized person. The minimum transaction amount for a telephone purchase is $100.

The Fund offers the following retirement plans:

Traditional IRA |

Roth IRA |

SEP IRA |

Simple IRA |

The Fund recommends that investors consult with a competent financial and tax advisor regarding the IRAs before investing through them. Investors can obtain further information about the automatic investment plan, the telephone purchase plan , and the IRAs by calling 1-800-273-6886.

Householding

To reduce expenses, the Fund generally mails only one copy of the Fund’s prospectus and each annual and semi-annual report to those addresses shared by two or more accounts and to shareholders the Fund reasonably believes are from the same family or household. This is referred to as “householding.” If you wish to discontinue householding and receive individual copies of these documents, please call us at 1-800-273-6886. Once the Fund receives notice to stop householding, they will begin sending individual copies thirty days after receiving the request. This policy does not apply to account statements.

18

Redeeming Shares

How to Redeem (Sell) Shares by Mail

Prepare a letter of instruction containing:

| • | the amount of money or number of shares being redeemed |

| • | the name(s) on the account |

| • | additional information that the Funds may require for redemptions by corporations, executors, administrators, trustees, guardians, or others who hold shares in a fiduciary or representative capacity. Please contact the Funds’ transfer agent, U.S. Bancorp Fund Services, LLC, in advance, at 1-800-273-6886 if you have any questions. |

Sign the letter of instruction exactly as the shares are registered. Joint ownership accounts must be signed by all owners.

A signature guarantee will be required for the following situations:

| • | When redemption proceeds are payable or sent to any person, address , or bank account not on record. |

| • | The redemption request is received within 30 days after an address change. |

| • | If ownership is changed on your account. |

| • | When establishing or modifying certain services on an account. |

In addition to the situations described above, the Funds and/or the Transfer Agent reserve the right to require a signature guarantee in other instances, based on the circumstances related to the particular situation. Signature guarantees will generally be accepted from domestic banks, brokers, dealers, credit unions, national securities exchanges, registered securities associations, clearing agencies and savings associations, as well as from participants in the New York Stock Exchange Medallion Signature Program and the Securities Transfer Agent Medallion Program (STAMP).

A notarized signature is not an acceptable substitute for a signature guarantee.

19

Send the letter of instruction to:

FOR FIRST CLASS MAIL |

Leuthold Funds, Inc.

c/o U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701 |

FOR OVERNIGHT DELIVERY SERVICE OR REGISTERED MAIL |

Leuthold Funds, Inc.

c/o U.S. Bancorp Fund Services, LLC

615 East Michigan Street, 3rd Floor

Milwaukee, WI 53202-5207 |

Please do not mail letters by overnight delivery service or registered mail to the Post Office Box address.

How to Redeem (Sell) Shares by Telephone

Instruct U.S. Bancorp Fund Services, LLC that you want the option of redeeming shares by telephone. This can be done by completing the appropriate section on the Purchase Application. Shares held in IRAs cannot be redeemed by telephone. In order to arrange for telephone redemptions after an account has been opened or to change the bank account or address designated to receive redemption proceeds, a written request must be sent to the transfer agent. The request must be signed by each shareholder of the account and may require a signature guarantee. Further documentation may be requested from corporations, executors, administrators, trustees, and guardians.

Assemble the same information that you would include in the letter of instruction for a written redemption request. Once a telephone transaction has been placed, it cannot be canceled or modified. If an account has more than one owner or authorized person, the Funds will accept telephone instructions from any one owner or authorized person.

Call U.S. Bancorp Fund Services, LLC at 1-800-273-6886. Please do not call the Funds or the Adviser.

How to Redeem using a Systematic Withdrawal Plan

Instruct U.S. Bancorp Fund Services, LLC that you want to set up a Systematic Withdrawal Plan. This can be done by completing the appropriate section on the Purchase Application. You may choose to receive a minimum amount of $100 on any day of the month. Payments can be made by check to your address of record, or by electronic funds transfer through the Automated Clearing House (ACH) network directly to your predetermined bank account. Your Fund account must have a minimum balance of $10,000 to participate in this Plan. This Plan may be terminated at any time by the Funds and you may terminate the Plan by contacting U.S. Bancorp Fund Services, LLC in writing. Any notification of change or termination should be provided to the transfer agent in writing at least five days prior to effective date.

20

A withdrawal under the Plan involves a redemption of shares and may result in a gain or loss for federal income tax purposes. In addition, if the amount withdrawn exceeds the dividends credited to your account, the account ultimately may be depleted.

How to Redeem (Sell) Shares through Servicing Agents

If your shares are held by a Servicing Agent, you must redeem your shares through the Servicing Agent. Contact the Servicing Agent for instructions on how to do so.

Redemption Price

The redemption price per share you receive for redemption requests is the next determined net asset value after:

| • | U.S. Bancorp Fund Services, LLC receives your written request in proper form with all required information. |

| • | U.S. Bancorp Fund Services, LLC receives your authorized telephone request with all required information. |

| • | A Servicing Agent (or its designee) that has been authorized to accept redemption requests on behalf of the Funds receives your request in accordance with its procedures. |

Payment of Redemption Proceeds

| • | For those shareholders who redeem shares by mail, U.S. Bancorp Fund Services, LLC will mail a check in the amount of the redemption proceeds typically on the business day following the redemption, but no later than the seventh day after it receives the written request in proper form with all required information. |

| • | For those shareholders who redeem by telephone, U.S. Bancorp Fund Services, LLC will either mail a check in the amount of the redemption proceeds no later than the seventh day after it receives the redemption request, or transfer the redemption proceeds to your designated bank account if you have elected to receive redemption proceeds by either Electronic Funds Transfer or wire. An Electronic Funds Transfer generally takes 2 to 3 business days to reach the shareholder’s account whereas U.S. Bancorp Fund Services, LLC generally wires redemption proceeds on the business day following the calculation of the redemption price. However, the Funds may direct U.S. Bancorp Fund Services, LLC to pay the proceeds of a telephone redemption on a date no later than the seventh day after the redemption request. |

| • | Those shareholders who redeem shares through Servicing Agents will receive their redemption proceeds in accordance with the procedures established by the Servicing Agent. |

Other Redemption Considerations

When redeeming shares of the Funds, shareholders should consider the following:

| • | The redemption may result in a taxable gain. |

21

| • | Shareholders who redeem shares held in an IRA must indicate on their redemption request whether or not to withhold federal income taxes. If not, these redemptions will be subject to federal income tax withholding. |

| • | The Funds may delay the payment of redemption proceeds for up to seven days in all cases. In addition, the Funds can suspend redemptions and/or postpone payments or redemption proceeds beyond seven days at times when the New York Stock Exchange is closed or during emergency circumstances, as determined by the Securities and Exchange Commission. |

| • | If you purchased shares by check, the Funds may delay the payment of redemption proceeds until they are reasonably satisfied the check has cleared (which may take up to 15 days from the date of purchase). |

| • | U.S. Bancorp Fund Services, LLC will send the proceeds of a redemption to an address or account other than that shown on its records only if the shareholder has sent in a written request with signatures guaranteed. |

| • | U.S. Bancorp Fund Services, LLC will not accept telephone redemption requests made within 30 days after an address change. |

| • | The Funds reserve the right to refuse a telephone redemption request if it believes it is advisable to do so. The Funds and U.S. Bancorp Fund Services, LLC may modify or terminate their procedures for telephone redemptions at any time. Neither the Funds nor U.S. Bancorp Fund Services, LLC will be liable for following instructions for telephone redemption transactions that they reasonably believe to be genuine, provided they use reasonable procedures to confirm the genuineness of the telephone instructions. They may be liable for unauthorized transactions if they fail to follow such procedures. These procedures include requiring some form of personal identification prior to acting upon the telephone instructions and recording all telephone calls. During periods of substantial economic or market change, telephone redemptions may be difficult to implement. If a shareholder cannot contact U.S. Bancorp Fund Services, LLC by telephone, he or she should make a redemption request in writing in the manner described earlier. |

| • | U.S. Bancorp Fund Services, LLC currently charges a fee of $15 when transferring redemption proceeds to your designated bank account by wire but does not charge a fee when transferring redemption proceeds by Electronic Funds Transfer. |

| • | If your account balance falls below $1,000, for any reason, you will be given 60 days to make additional investments so that your account balance is $1,000 or more. If you do not, the Fund may close your account and mail the redemption proceeds to you. |

22

Frequent Purchases and Redemptions of Shares of the Funds

The Funds generally accommodate frequent purchases and redemptions of their shares notwithstanding the potential harm to the Funds’ other shareholders. The Board of Directors believes it likely that a significant number of investors in the Funds are not long-term investors because the Funds are offered to investors who choose to do their own asset allocation rather than invest in the Leuthold Asset Allocation Fund, the Leuthold Global Fund, or the Leuthold Core Investment Fund and because of the rising stock market risk associated with short selling of the Grizzly Short Fund. Although the Funds generally accommodate frequent purchases and redemptions of their shares, they reserve the right to reject any purchase order for any reason or no reason, including purchase orders from potential investors that these Funds believe might engage in potentially disruptive purchases and redemptions of their shares.

Exchanging Shares

Eligible Funds

Shares of the Funds may be exchanged for shares of:

| • | Leuthold Asset Allocation Fund (Retail Class only) |

| • | Leuthold Undervalued & Unloved Fund |

| • | Leuthold Global Fund (Retail Class only) |

| • | Leuthold Core Investment Fund (Retail Class only, if open for investment) |

| • | Leuthold Global Clean Technology Fund (Retail Class only) |

| • | Leuthold Hedged Equity Fund (Retail Class only) |

| • | First American Prime Obligations Fund |

at their relative net asset values. An affiliate of U.S. Bancorp Fund Services, LLC, advises First American Prime Obligations Fund, a money market mutual fund. Please call 1-800-273-6886 for a prospectus describing First American Prime Obligations Fund. You may have a taxable gain or loss as a result of an exchange because the Internal Revenue Code treats an exchange as a sale of shares.

How to Exchange Shares

1. | Read this Prospectus (and, if applicable, the prospectus for First American Prime Obligations Fund) carefully. |

2. | Determine the number of shares you want to exchange keeping in mind that exchanges are subject to a $10,000 minimum. |

3. | Call U.S. Bancorp Fund Services, LLC at 1-800-273-6886. The transfer agent currently charges a fee of $5 when exchanging proceeds by telephone. You may also make an exchange by writing to Leuthold Funds, Inc., c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, Wisconsin 53201-0701. |

23

| | |

| G. | Taxes, Dividends and Distributions |

The Funds’ distributions are taxable, and are taxed as ordinary income or capital gains, unless shareholders invest through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account.

The Funds distribute substantially all of their net investment income quarterly and substantially all of their capital gains annually. Shareholders have three distribution options:

Automatic Reinvestment Option — Both dividend and capital gains distributions are reinvested in additional shares of the Funds.

Cash Dividend Option — Dividends are paid in cash and capital gains are reinvested in additional shares of the Funds.

All Cash Option — Both dividend and capital gains distributions are paid in cash.

Each Fund’s distributions, whether received in cash or additional shares, may be subject to federal and state income tax. These distributions may be taxed as ordinary income (although a portion of each Fund’s dividends may be taxable to investors at the lower rate applicable to dividend income) and capital gains (which may be taxed at different rates depending on the length of time the applicable Fund holds the assets generating the capital gains). The Funds expect that their distributions will consist primarily of long-term and short-term capital gains.

For the financial highlights of the Select Equities Fund and the Select Industries Fund , see Exhibit D .

| | |

| I. | Distribution Arrangements |

Rafferty Capital Markets, LLC serves as the distributor for the Funds.

Select Equities Fund

The Select Equities Fund has adopted a Service and Distribution Plan (the “12b-1 Plan”). The 12b-1 Plan was adopted in anticipation that the Select Equities Fund will benefit from the 12b-1 Plan through increased sales of shares, thereby reducing the Fund’s expense ratio and providing the Adviser with greater flexibility in management. The 12b-1 Plan authorizes payments by the Fund in connection with the distribution of its shares at an annual rate, as determined from time to time by the Directors, of up to 0.25% of the Fund’s average daily net assets. Amounts paid under the 12b-1 Plan by the Fund may be spent by the Fund on any activities or expenses primarily intended to result in the sale of shares of the Fund, including but not limited to, advertising, compensation for sales and marketing activities of financial institutions and others such as dealers and distributors, shareholder account servicing, the printing and mailing of prospectuses to other than current shareholders and the printing and mailing of sales literature. To the extent any activity is one which the Fund may finance without a plan pursuant to Rule 12b-1, the Fund may also make payments to finance such activity outside of the 12b-1 Plan and not subject to its limitations.

The 12b-1 Plan may be terminated by the Select Equities Fund at any time by a vote of the directors of the Company who are not interested persons of the Company and who have no direct or indirect financial interest in the 12b-1 Plan or any agreement related thereto (the “Rule 12b-1 Directors”) or by a vote of a majority of the outstanding shares of the applicable Select Equities Fund. Any change in the 12b-1 Plan that would materially increase the distribution expenses of a Select Equities Fund provided for in the 12b-1 Plan requires approval of the Directors, including the Rule 12b-1 Directors, and a majority of the Fund’s shareholders.

Select Industries Fund

The Select Industries Fund has adopted a service plan pursuant to which it may pay fees of up to 0.25% of its average daily net assets to broker-dealers, financial institutions or other service providers that provide services to investors in the Fund. Payments under these plans are authorized by the officers of the Company.

The service plan may be terminated by the Select Industries Fund at any time upon a vote of the directors of the Company who are not interested persons of the Company and who have no direct or indirect financial interest in the plans, and will be terminated if its continuance is not approved at least annually by such directors.

24

The Directors review quarterly the amount and purposes of expenditures pursuant to the service plans as reported to it by the officers of the Company.

| |

VI. | ADDITIONAL INFORMATION |

Additional information about the Funds is available in the SAI. The SAI is incorporated by reference into this Prospectus.

The SAI is available to shareholders without charge, simply by calling U.S. Bancorp Fund Services, LLC at 1-800-273-6886. This information is also available in documents filed with the SEC. You may view or obtain these documents from the SEC:

| | |

| • | In person: at the SEC’s Public Reference Room in Washington, D.C. |

| | |

| • | By phone: 1-202-551-8090 (for information on the operations of the Public Reference Room only) |

| | |

| • | By mail: Public Reference Section, Securities and Exchange Commission, Washington, D.C. 20549-0102 (duplicating fee required) |

| | |

| • | By electronic mail: publicinfo@sec.gov (duplicating fee required) |

| | |

| • | On the Internet: www.sec.gov |

| | |

VII. | MISCELLANEOUS INFORMATION |

| |

| A. | Legal Matters |

The validity of the issuance of shares of the Select Industries Fund will be passed upon by Foley & Lardner LLP, Milwaukee, Wisconsin.

The audited financial statements and financial highlights in the Prospectus and the SAI have been included in reliance on the report of Ernst & Young LLP, 220 South Sixth Street, Suite 1400, Minneapolis, Minnesota 55402, the independent registered public accounting firm for each of the Funds, given on their authority as experts in auditing and accounting.

25

Administrator

The administrator to the Company is U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202 (the “Administrator”). Pursuant to a Fund Administration Servicing Agreement entered into between the Company and the Administrator (the “Administration Agreement”), the Administrator prepares and maintains the books, accounts and other documents required by the 1940 Act, responds to shareholder inquiries, prepares each Fund’s financial statements and tax returns, prepares certain reports and filings with the SEC and with state blue sky authorities, furnishes statistical and research data, clerical, accounting and bookkeeping services and stationery and office supplies, keeps and maintains each Fund’s financial and accounting records and generally assists in all aspects of each Fund’s operations. The Administrator, at its own expense and without reimbursement from the Funds, furnishes office space and all necessary office facilities, equipment and executive personnel for performing the services required to be performed by it under the Administration Agreement. For the foregoing, the Administrator receives from the Funds a fee, paid monthly at an annual rate of 0.04% of the first $1,500,000,000 of the Funds’ average net assets, 0.03% of the next $1,500,000,000 of the Funds’ average net assets, 0.02% of the next $1,500,000,000 of the Funds’ average net assets and 0.015% of the Funds’ average net assets in excess of $4,500,000,000. Notwithstanding the foregoing, the minimum annual fee payable to the Administrator is $210,000.

The Administration Agreement will remain in effect until terminated by either party. The Administration Agreement may be terminated at any time, without the payment of any penalty, by the Directors upon the giving of ninety (90) days’ written notice to the Administrator, or by the Administrator upon the giving of ninety (90) days’ written notice to the Company.

Under the Administration Agreement, the Administrator is required to exercise reasonable care and is not liable for any error or judgment or mistake of law or for any loss suffered by the Company in connection with its performance under the Administration Agreement, except a loss resulting from willful misfeasance, bad faith or negligence on the part of the Administrator in the performance of its duties under the Administration Agreement.

Custodian

U.S. Bank, N.A., an affiliate of U.S. Bancorp Fund Services, LLC, serves as custodian of the Funds’ assets pursuant to Custody Agreement. Under the Custody Agreement, U.S. Bank, N.A. has agreed to (i) maintain a separate account in the name of each Fund, (ii) make receipts and disbursements of money on behalf of each Fund, (iii) collect and receive all income and other payments and distributions on account of each Fund’s portfolio investments, (iv) respond to correspondence from shareholders, security brokers and others relating to its duties, and (v) make periodic reports to each Fund concerning such Fund’s operations. U.S. Bank, N.A. does not exercise any supervisory function over the purchase and sale of securities. The Bank of New York Mellon, headquartered in New York, serves as a sub-custodian of the global assets of the Funds.

Transfer Agent

U.S. Bancorp Fund Services, LLC serves as transfer agent and dividend disbursing agent for the Funds under a Transfer Agent Servicing Agreement. As transfer and dividend disbursing agent, U.S. Bancorp Fund Services, LLC has agreed to (i) issue and redeem shares of each Fund, (ii) make dividend and other distributions to shareholders of each Fund, (iii) respond to correspondence by Fund shareholders and others relating to its duties, (iv) maintain shareholder accounts, and (v) make periodic reports to each Fund.

26

Fund Accounting Servicing Agent

In addition, the Company has entered into a Fund Accounting Servicing Agreement with U.S. Bancorp Fund Services, LLC pursuant to which U.S. Bancorp Fund Services, LLC has agreed to maintain the financial accounts and records of each Fund and provide other accounting services to the Funds. For its accounting services, U.S. Bancorp Fund Services, LLC is entitled to receive fees, payable monthly from the Funds at an annual rate of 0.015% for the first $1 billion of average net assets and .0005% of average net assets exceeding $1 billion. Notwithstanding the foregoing, the minimum annual fee payable for accounting services is $140,000. U.S. Bancorp Fund Services, LLC is also entitled to certain out of pocket expenses, including pricing expenses.

| |

| By Order of the Board of Directors of |

| Leuthold Funds, Inc. |

| |

| /s/ Steven C. Leuthold |

| Steven C. Leuthold

President

Leuthold Funds, Inc. |

| |

January 31, 2010 | |

27

EXHIBIT A

LEUTHOLD FUNDS, INC.

PLAN OF ACQUISITION AND LIQUIDATION

This Plan of Acquisition and Liquidation (this “Plan”) has been adopted by the Board of Directors of Leuthold Funds, Inc., a Maryland corporation (the “Corporation”), as of this 31st day of January, 2010, to provide for the reorganization of the Leuthold Select Equities Fund (the “Acquired Portfolio”) into the Leuthold Select Industries Fund (the “Acquiring Portfolio”). The Acquired Portfolio and the Acquiring Portfolio (each a “Portfolio”, and, together, the “Portfolios”) are each separate series of the Corporation, an open-end management investment company registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). The Corporation’s Board of Directors (the “Board”) has determined that it is in the best interest of the stockholders of the Acquiring Portfolio and the Acquired Portfolio (“Stockholders”) that the Acquired Portfolio transfer all of the assets attributable to the shares of common stock held by its Stockholders in exchange for shares of common stock of equal net asset value of the Acquiring Portfolio (“Acquisition Shares”), to be distributed to the Acquired Portfolio’s Stockholders, and that the Corporation redeem the outstanding shares (the “Acquired Portfolio Shares”) of the Acquired Portfolio, all as provided for below (the “Acquisition”). In this Plan, any references to a Portfolio taking action shall mean and include all necessary actions of the Corporation on behalf of a Portfolio, unless the context of this Plan or the 1940 Act requires otherwise. The Corporation intends that the Acquisition qualify as a “reorganization” within the meaning of Section 368(a) of the United States Internal Revenue Code of 1986, as amended (the “Code”), and any successor provisions, and that with respect to the Acquisition, the Acquiring Portfolio and the Acquired Portfolio will each be a “party to a reorganization” within the meaning of Section 368(b) of the Code.

1. Definitions. In addition to the terms elsewhere defined herein, each of the following terms shall have the meaning indicated for that term as follows:

“1933 Act” shall mean the Securities Act of 1933, as amended.

“Assets” shall mean all assets of any kind and all interests, rights, privileges and powers of or attributable to the Acquired Portfolio or its shares, as appropriate, whether or not determinable at the Effective Time (as defined herein) and wherever located, including, without limitation, all cash, cash equivalents, securities, claims (whether absolute or contingent, known or unknown, accrued or unaccrued or conditional or unmatured), contract rights and receivables (including dividend and interest receivables) owned by the Acquired Portfolio or attributable to its shares and any deferred or prepaid expense, other than unamortized organizational expenses, shown as an asset on the Acquired Portfolio’s books.

“Closing Date” shall mean such date as the officers of the Corporation shall designate.

“Effective Time” shall mean 5:00 p.m., Eastern Time, on the Closing Date, or such other time as the officers of the Corporation shall designate.

“Financial Statements” shall mean the audited financial statements of the relevant Portfolio for its most recently completed fiscal year and, if applicable, the unaudited financial statements of that Portfolio for its most recently completed semi-annual period.

A-1

“Liabilities” shall mean all liabilities, expenses and obligations of any kind whatsoever of the Acquired Portfolio, whether known or unknown, accrued or unaccrued, absolute or contingent or conditional or unmatured.

“N-14 Registration Statement” shall mean the Registration Statement of the Acquiring Portfolio on Form N-14 under the 1940 Act that will register the Acquisition Shares to be issued in the Acquisition.

“Valuation Time” shall mean the close of regular session trading on the New York Stock Exchange (“NYSE”) on the Closing Date, when for purposes of this Plan, the Corporation determines the net asset value per Acquisition Share of the Acquiring Portfolio and the net value of the assets of the Acquired Portfolio.

“NAV” shall mean a Portfolio’s net asset value, which is calculated by valuing and totaling assets and then subtracting liabilities and then dividing the balance by the number of shares that are outstanding.

2. Regulatory Filings. The Acquiring Portfolio shall promptly prepare and file the N-14 Registration Statement with the SEC, and the Acquiring Portfolio and the Acquired Portfolio also shall make any other required or appropriate filings with respect to the actions contemplated hereby.

3. Transfer of the Acquired Portfolio’s Assets. The Acquiring Portfolio and the Acquired Portfolio shall take the following steps with respect to the Acquisition, as applicable:

(a) On or prior to the Closing Date, the Acquired Portfolio shall pay or provide for the payment of all of the Liabilities, expenses, costs and charges of or attributable to the Acquired Portfolio that are known to the Acquired Portfolio and that are due and payable prior to or as of the Closing Date.

(b) Prior to the Effective Time, except to the extent prohibited by Rule 19b-1 under the 1940 Act, the Acquired Portfolio will declare to the Acquired Portfolio’s Stockholders of record a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing (a) all the excess of (1) the Acquired Portfolio’s investment income excludable from gross income under Section 103(a) of the Code over (2) the Acquired Portfolio’s deductions disallowed under Sections 265 and 171(a)(2) of the Code, (b) all of the Acquired Portfolio’s investment company taxable income (as defined in Code Section 852), (computed in each case without regard to any deduction for dividends paid), and (c) all of the Acquired Portfolio’s net realized capital gain (as defined in Code Section 1222), if any (after reduction for any capital loss carryover), for the taxable year ending on September 30, 2009 and for the short taxable year beginning on October 1, 2009, and ending on the Closing Date. Such dividends will be declared and paid to ensure continued qualification of the Acquired Portfolio as a “regulated investment company” for tax purposes and to eliminate fund- level tax.

(c) At the Effective Time, the Acquired Portfolio shall assign, transfer, deliver and convey the Assets to the Acquiring Portfolio, subject to the Liabilities, and the Acquiring Portfolio shall then accept the Assets and assume the Liabilities such that at and after the Effective Time (1) the Assets shall become and be assets of the Acquiring Portfolio, and (2) the Liabilities shall attach to the Acquiring Portfolio, and shall be enforceable against the Acquiring Portfolio to the same extent as if initially incurred by the Acquiring Portfolio. The Corporation shall redeem the outstanding shares of the Acquired Portfolio by issuance of shares of the Acquiring Portfolio as described more fully below.

A-2

(d) Within a reasonable time prior to the Closing Date, the Acquired Portfolio shall provide, if requested, a list of the Assets to the Acquiring Portfolio. The Acquired Portfolio may sell any asset on such list prior to the Effective Time. After the Acquired Portfolio provides such list, the Acquired Portfolio will not acquire any additional securities or permit to exist any encumbrances, rights, restrictions or claims not reflected on such list, without the approval of the Acquiring Portfolio. Within a reasonable time after receipt of the list and prior to the Closing Date, the Acquiring Portfolio will advise the Acquired Portfolio in writing of any investments shown on the list that the Acquiring Portfolio has determined to be inconsistent with its investment objective, policies and restrictions. The Acquired Portfolio will dispose of any such securities prior to the Closing Date to the extent practicable and consistent with applicable legal requirements, including the Acquired Portfolio’s investment objectives, policies and restrictions. In addition, if the Acquiring Portfolio determines that, as a result of the Acquisition, the Acquiring Portfolio would own an aggregate amount of an investment that would exceed a percentage limitation applicable to the Acquiring Portfolio, the Acquiring Portfolio will advise the Acquired Portfolio in writing of any such limitation and the Acquired Portfolio shall dispose of a sufficient amount of such investment as may be necessary to avoid the limitation as of the Effective Time, to the extent practicable and consistent with applicable legal requirements, including the Acquired Portfolio’s investment objectives, policies and restrictions.

(e) The Acquired Portfolio shall assign, transfer, deliver and convey the Assets to the Acquiring Portfolio at the Effective Time on the following basis: (1) The value of the Assets less the Liabilities of the Acquired Portfolio attributable to shares of common stock held by its Stockholders, determined as of the Valuation Time, shall be divided by the then NAV of Acquisition Shares of common stock, as applicable, and, in exchange for the transfer of the Assets, the Acquiring Portfolio shall simultaneously issue and deliver to the Acquired Portfolio the number of Acquisition Shares of common stock (including fractional shares) so determined, rounded to the second decimal place or such other decimal place as the officers of the Corporation shall designate; (2) The NAV of Acquisition Shares of common stock to be delivered to the Acquired Portfolio shall be determined as of the Valuation Time in accordance with the Acquiring Portfolio’s then applicable valuation procedures, and the net value of the Assets to be conveyed to the Acquiring Portfolio shall be determined as of the Valuation Time in accordance with the then applicable valuation procedures of the Acquired Portfolio; and (3) the portfolio securities of the Acquired Portfolio shall be made available by the Acquired Portfolio to U.S. Bank National Association, as custodian for the Acquiring Portfolio (the “Custodian”), for examination no later than five business days preceding the Valuation Time. On the Closing Date, such portfolio securities and all the Acquired Portfolio’s cash shall be delivered by the Acquired Portfolio to the Custodian for the account of the Acquiring Portfolio, such portfolio securities to be duly endorsed in proper form for transfer in such manner and condition as to constitute good delivery thereof in accordance with the custom of brokers or, in the case of portfolio securities held in the U.S. Treasury Department’s book-entry system or by The Depository Trust Company, Participants Trust Company or other third party depositories, by transfer to the account of the Custodian in accordance with Rule 17f-4, Rule 17f-5 or Rule 17f-7, as the case may be, under the 1940 Act and accompanied by all necessary federal and state stock transfer stamps or a check for the appropriate purchase price thereof. The cash delivered shall be in the form of currency or certified or official bank checks, payable to the order of the Custodian, or shall be wired to an account pursuant to instructions provided by the Acquiring Portfolio.

A-3

(f) Promptly after the Closing Date, the Acquired Portfolio will deliver to the Acquiring Portfolio a Statement of Assets and Liabilities of the Acquired Portfolio as of the Closing Date.

4. Termination of the Acquired Portfolio, Registration of Acquisition Shares and Access to Records. The Acquired Portfolio and the Acquiring Portfolio also shall take the following steps, as applicable:

(a) At or as soon as reasonably practical after the Effective Time, the Acquired Portfolio shall terminate by transferring pro rata to its Stockholders of record Acquisition Shares received by the Acquired Portfolio pursuant to Section 3(e)(1) of this Plan. The Acquiring Portfolio shall establish accounts on its share records and note on such accounts the names of the former Acquired Portfolio Stockholders and the types and amounts of the Acquisition Shares that former Acquired Portfolio Stockholders are due based on their respective holdings of the Acquired Portfolio Shares as of the close of business on the Closing Date. Fractional Acquisition Shares shall be carried to the second decimal place. The Acquiring Portfolio shall not issue certificates representing the Acquisition Shares in connection with such exchange. All issued and outstanding Acquired Portfolio Shares will be simultaneously redeemed and cancelled on the books of the Acquired Portfolio. Ownership of the Acquisition Shares will be shown on the books of the Acquiring Portfolio’s transfer agent. Following distribution by the Acquired Portfolio to its Stockholders of all Acquisition Shares delivered to the Acquired Portfolio, the Acquired Portfolio shall wind up its affairs and shall take all steps as are necessary and proper to terminate as soon as is reasonably possible after the Effective Time.

(b) At and after the Closing Date, the Acquired Portfolio shall provide the Acquiring Portfolio and its transfer agent with immediate access to: (1) all records containing the names, addresses and taxpayer identification numbers of all of the Acquired Portfolio’s Stockholders and the number and percentage ownership of the outstanding shares of the Acquired Portfolio owned by Stockholders as of the Effective Time, and (2) all original documentation (including all applicable Internal Revenue Service forms, certificates, certifications and correspondence) relating to the Acquired Portfolio Stockholders’ taxpayer identification numbers and their liability for or exemption from back-up withholding. The Acquired Portfolio shall preserve and maintain, or shall direct its service providers to preserve and maintain, records with respect to the Acquired Portfolio as required by Section 31 of, and Rules 31a-1 and 31a-2 under, the 1940 Act.

5. Conditions to Consummation of the Acquisition. The consummation of the Acquisition shall be subject to the following conditions precedent:

(a) There shall have been no material adverse change in the financial condition, results of operations, business, properties or assets of the Acquiring Portfolio or the Acquired Portfolio since the date of the most recent Financial Statements. Negative investment performance shall not be considered a material adverse change.

A-4

(b) The Corporation shall have received an opinion of Foley & Lardner LLP, substantially to the effect that for federal income tax purposes: (1) The Acquisition will constitute a “reorganization” within the meaning of Section 368(a) of the Code and that the Acquiring Portfolio and the Acquired Portfolio will each be “a party to a reorganization” within the meaning of Section 368(b) of the Code; (2) A Stockholder of the Acquired Portfolio will recognize no gain or loss on the exchange of the Stockholder’s shares of the Acquired Portfolio solely for Acquisition Shares; (3) Neither the Acquired Portfolio nor the Acquiring Portfolio will recognize any gain or loss upon the transfer of all of the Assets to the Acquiring Portfolio in exchange for Acquisition Shares and the assumption by the Acquiring Portfolio of the Liabilities pursuant to this Plan or upon the distribution of Acquisition Shares to Stockholders of the Acquired Portfolio in exchange for their respective shares of the Acquired Portfolio; (4) The holding period and tax basis of the Assets acquired by the Acquiring Portfolio will be the same as the holding period and tax basis that the Acquired Portfolio had in such Assets immediately prior to the Acquisition; (5) The aggregate tax basis of Acquisition Shares received in connection with the Acquisition by each Stockholder of the Acquired Portfolio (including any fractional share to which the Stockholder may be entitled) will be the same as the aggregate tax basis of the shares of the Acquired Portfolio surrendered in exchange therefor, and increased by any gain recognized on the exchange; (6) The holding period of Acquisition Shares received in connection with the Acquisition by each Stockholder of the Acquired Portfolio (including any fractional share to which the stockholder may be entitled) will include the holding period of the shares of the Acquired Portfolio surrendered in exchange therefor, provided that such Acquired Portfolio Shares constitute capital assets in the hands of the Stockholder as of the Closing Date; and (7) The Acquiring Portfolio will succeed to the capital loss carryovers of the Acquired Portfolio but the use of the Acquiring Portfolio’s existing capital loss carryovers (as well as the carryovers of the Acquired Portfolio) may be subject to limitation under Section 383 of the Code after the Acquisition. The opinion will be based on certain factual certifications made by officers of the Portfolios and will also be based on customary assumptions and subject to certain qualifications. The opinion is not a guarantee that the tax consequences of the Acquisition will be as described above. Notwithstanding this subparagraph (b), Foley & Lardner LLP will express no view with respect to the effect of the Acquisition on any transferred asset as to which any unrealized gain or loss is required to be recognized at the end of a taxable year (or on the termination or transfer thereof) under federal income tax principles. Each Portfolio shall provide additional factual representations to Foley & Lardner LLP with respect to the Portfolios that are reasonably necessary to enable Foley & Lardner LLP to deliver the tax opinion. Notwithstanding anything in this Plan to the contrary, neither Portfolio may waive in any material respect the conditions set forth under this subparagraph (b).

(c) The N-14 Registration Statement shall have become effective under the 1933 Act as to the Acquisition Shares, and the SEC shall not have instituted and, to the knowledge of the Acquiring Portfolio, is not contemplating instituting any stop order suspending the effectiveness of the N-14 Registration Statement.

(d) No action, suit or other proceeding shall be threatened or pending before any court or governmental agency in which it is sought to restrain or prohibit, or obtain damages or other relief in connection with the Acquisition.

(e) The SEC shall not have issued any unfavorable advisory report under Section 25(b) of the 1940 Act nor instituted any proceeding seeking to enjoin consummation of the Acquisition under Section 25(c) of the 1940 Act.

A-5

6. Closing.

(a) The Closing shall be held at the offices of the Corporation, 33 South Sixth Street, Suite 4600, Minneapolis, Minnesota 55402, or at such other place as the officers of the Corporation may designate.

(b) In the event that at the Valuation Time (i) the NYSE shall be closed to trading or trading thereon shall be restricted, or (ii) trading or the reporting of trading on said Exchange or elsewhere shall be disrupted so that accurate appraisal of the value of the net assets of the Acquired Portfolio or the Acquiring Portfolio is impracticable, the Closing Date shall be postponed until the first business day after the day when trading shall have been fully resumed and reporting shall have been restored; provided that if trading shall not be fully resumed and reporting restored within three business days of the Valuation Time, this Plan may be terminated by the Board.

(c) The Acquiring Portfolio will provide to the Acquired Portfolio evidence satisfactory to the Acquired Portfolio that Acquisition Shares issuable pursuant to the Acquisition have been credited to the Acquired Portfolio’s account on the books of the Acquiring Portfolio. After the Closing Date, the Acquiring Portfolio will provide to the Acquired Portfolio evidence satisfactory to the Acquired Portfolio that such shares have been credited pro rata to open accounts in the names of the Acquired Portfolio Stockholders.

(d) At the Closing, each party shall deliver to the other such bills of sale, instruments of assumption of liabilities, checks, assignments, stock certificates, receipts or other documents as such other party or its counsel may reasonably request in connection with the transfer of assets, assumption of liabilities and liquidation contemplated by this Plan.

7. Termination of Plan. A majority of the Board may terminate this Plan before the applicable Effective Time if: (i) any of the conditions precedent set forth herein are not satisfied; or (ii) the Board determines that the consummation of the Acquisition is not in the best interests of either Portfolio or its Stockholders.

8. Termination of the Acquired Portfolio. If the Acquisition is consummated, the Acquired Portfolio shall terminate its registration under the 1940 Act and the 1933 Act and will terminate.

9. Expenses. The Acquisition expenses shall be borne by Leuthold Weeden Capital Management.

A-6

EXHIBIT B

LEUTHOLD SELECT EQUITIES FUND PERFORMANCE

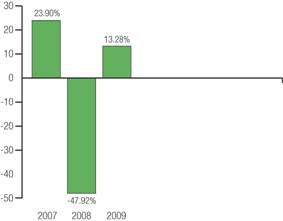

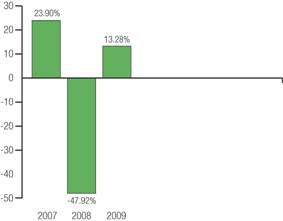

The bar charts and tables that follow provide some indication of the risks of investing in the Leuthold Select Equities Fund by showing changes in its performance from year to year and how its average annual returns over various periods compare to the performance of various indices. Please remember that the Fund’s past performance (before and after taxes) is not necessarily an indication of its future performance. It may perform better or worse in the future.

Leuthold Select Equities Fund

Total Return

(per calendar year)

Note: During the three year period shown on the bar chart, the Fund’s highest total return for a quarter was 11.57 % (quarter ended September 30, 2009 ) and the lowest return for a quarter was -27.58 % (quarter ended December 31, 2008 ).

Average Annual Total Returns

(for the periods ended December 31, 2009)

| | | | |

| | Past

Year | | Since the

inception date

of the Fund

(May 24, 2006) |

Leuthold Select Equities Fund | | | | |

Return Before Taxes | | 13.28 % | | (8.45) % |

Return After Taxes on Distribution(1) | | 13.28 % | | (8.68) % |

Return After Taxes on Distributions and Sale of Shares(1) | | 8.63 % | | (7.13) % |

S&P 500(2)(4) | | 26.46 % | | (1.17) % |

Russell 2000(3)(4) | | 27.17 % | | (2.13) % |

| |

(1) | The after-tax returns are calculated using the historical highest individual marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. The Fund’s return after taxes on distributions and sale of Fund shares may be higher than its return before taxes and after taxes on distributions because it may include a tax benefit resulting from the capital losses that would have been incurred. |

(2) | The S&P 500 (Standard & Poor’s Composite Index of 500 Stocks) is a widely recognized unmanaged capitalization-weighted index of stock prices. |

(3) | The Russell 2000 is an index comprised of 2,000 publicly traded small capitalization common stocks that are ranked in terms of capitalization below the large and mid-range capitalization sectors of the United States equity market. |

(4) | Reflects no deduction for fees, expenses or taxes. |

B-1

EXHIBIT C

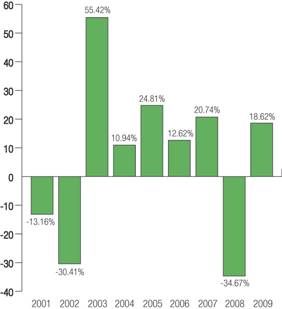

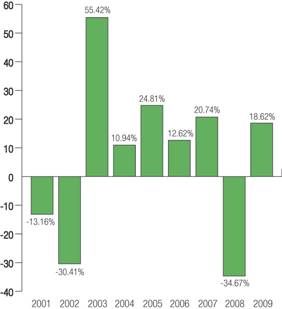

LEUTHOLD SELECT INDUSTRIES FUND PERFORMANCE

| | |

The bar charts and tables that follow provide some indication of the risks of investing in the Leuthold Select Industries Fund by showing changes in its performance from year to year and how its average annual returns over various periods compare to the performance of various indices. Please remember that the Fund’s past performance (before and after taxes) is not necessarily an indication of its future performance. It may perform better or worse in the future. |

| | |

Leuthold Select Industries Fund |

| | |

Total Return |

(per calendar year) |

| | |

|

| | |

| | |

Note: During the nine year period shown on the bar chart, the Fund’s highest total return for a quarter was 20.58 % (quarter ended June 30, 2008 ) and the lowest total return for a quarter was -22.60 % (quarter ended September 30, 2002 ). |

| | | | | | | |

Average Annual Total Returns |

(for the periods ended December 31, 2009) |

| | | | | | | |

| | Past

Year | | Past

5 Years | | Since the

inception date

of the Fund

(June 19, 2000) | |

Leuthold Select | | | | | | | |

Industries Fund | | | | | | | |

Return before | | | | | | | |

taxes | | 18.62 | % | 5.63 | % | 6.36 | % |

Return after taxes | | | | | | | |

on distributions(1) | | 18.62 | % | 4.29 | % | 5.65 | % |

Return after taxes | | | | | | | |

on distributions | | | | | | | |

and sale of Fund | | | | | | | |

shares(1) | | 12.10 | % | 4.66 | % | 5.49 | % |

S&P 500(2)(4) | | 26.46 | % | 0.42 | % | (1.17 | ) % |

Russell 2000(3)(4) | | 27.17 | % | 0.51 | % | 3.25 | % |

| | |

| |

(1) | The after-tax returns are calculated using the historical highest individual marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. The Fund’s return after taxes on distributions and sale of Fund shares may be higher than its return before taxes and after taxes on distributions because it may include a tax benefit resulting from the capital losses that would have resulted. |

(2) | The S&P 500 (Standard & Poor’s Composite Index of 500 Stocks) is a widely recognized unmanaged capitalization-weighted index of stock prices. |

(3) | The Russell 2000 is an index comprised of 2,000 publicly traded small capitalization common stocks that are ranked in terms of capitalization below the large and mid-range capitalization sectors of the United States equity market. |

(4) | Reflects no deduction for fees, expenses or taxes. |

C-1

EXHIBIT D

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand each Fund’s financial performance for the period of its operations. Certain information reflects financial results for a single Fund share outstanding throughout the period indicated. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in a Fund (assuming reinvestment of all dividends and distributions). This information has been derived from the financial statements audited by the Funds’ independent registered public accounting firm, whose report, along with the Funds’ financial statements, is included in the Annual Report which is available upon request.

Leuthold Select Equities Fund

Per Share Data:(2) | | | Year Ended

September 30,

2009 | | Year Ended

September 30,

2008 | | Year Ended

September 30,

2007 | | Period from

May 24, 2006(1)

through

September 30, 2006 | |

Net asset value, beginning of period | | $ | 8.63 | | $ | 12.31 | | $ | 9.15 | | $ | 10.00 | |

Income (loss) from investment operations: | | | | | | | | | | | | | |

Net investment loss(3) | | | (0.02 | ) | | (0.02 | ) | | (0.04 | ) | | (0.01 | ) |

Net realized and unrealized gains (losses) on investments and short positions | | | (1.86 | ) | | (3.34 | ) | | 3.20 | | | (0.84 | ) |

Total from investment operations | | | (1.88 | ) | | (3.36 | ) | | 3.16 | | | (0.85 | ) |

Less distributions: | | | | | | | | | | | | | |

From net investment income | | | — | | | (0.30 | ) | | — | | | — | |

Return of capital | | | — | | | (0.02 | ) | | — | | | — | |

Total distributions | | | — | | | (0.32 | ) | | — | | | — | |

Net asset value, end of period | | $ | 6.75 | | $ | 8.63 | | $ | 12.31 | | $ | 9.15 | |

Total return | | | (21.78 | )% | | (27.98 | )% | | 34.54 | % | | (8.50 | )% |

Supplemental data and ratios: | | | | | | | | | | | | | |

Net assets, end of period | | $ | 10,076,921 | | $ | 20,972,041 | | $ | 16,442,723 | | $ | 3,281,715 | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | |

Before expense reimbursement | | | 1.89 | % | | 1.56 | % | | 2.16 | % | | 6.20 | %(4) |

After expense reimbursement | | | 1.85 | % | | 1.80 | % | | 1.85 | % | | 1.85 | %(4) |

Ratio of net investment income to average net assets: | | | | | | | | | | | | | |

Before expense reimbursement | | | (0.32 | )% | | 0.04 | % | | (1.01 | )% | | (4.74 | )%(4) |

After expense reimbursement | | | (0.28 | )% | | (0.20 | )% | | (0.70 | )% | | (0.39 | )%(4) |

Portfolio turnover rate | | | 237.68 | % | | 198.28 | % | | 191.08 | % | | 88.00 | % |

_________________

(1) | Commencement of operations. |

(2) | For a share outstanding throughout the period. Rounded to the nearest cent. |

(3) | Net investment loss per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

D-1

Leuthold Select Industries Fund

| | Years Ended September 30, | |

Per Share Data:(1) | | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | |

Net asset value, beginning of year | | $ | 13.03 | | $ | 21.94 | | $ | 17.25 | | $ | 16.07 | | $ | 12.26 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.04 | )(2) | | (0.04 | )(3) | | 0.13 | (3) | | 0.04 | (3) | | (0.02 | )(3) |

Net realized and unrealized gains (losses) on investments and short positions | | | (0.17 | ) | | (3.15 | ) | | 4.98 | | | 1.34 | | | 3.83 | |

Total from investment operations | | | (0.21 | ) | | (3.19 | ) | | 5.11 | | | 1.38 | | | 3.81 | |

Less distributions: | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | (0.06 | ) | | (0.12 | ) | | (0.03 | ) | | — | |

From net realized gains | | | — | | | (5.63 | ) | | (0.30 | ) | | (0.17 | ) | | — | |

Return of capital | | | — | | | (0.03 | ) | | — | | | — | | | — | |

Total distributions | | | — | | | (5.72 | ) | | (0.42 | ) | | (0.20 | ) | | — | |

Net asset value, end of year | | $ | 12.82 | | $ | 13.03 | | $ | 21.94 | | $ | 17.25 | | $ | 16.07 | |

Total return | | | (1.69 | )% | | (18.90 | )% | | 30.12 | % | | 8.67 | % | | 31.08 | % |

Supplemental data and ratios: | | | | | | | | | | | | | | | | |

Net assets, end of period | | $ | 47,543,360 | | $ | 42,632,379 | | $ | 74,020,005 | | $ | 76,270,125 | | $ | 31,197,482 | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | |

Before expense reimbursement or recovery | | | 1.38 | % | | 1.30 | % | | 1.29 | % | | 1.30 | % | | 1.56 | % |

After expense reimbursement or recovery | | | 1.38 | % | | 1.30 | % | | 1.29 | % | | 1.32 | % | | 1.60 | % |

Ratio of net investment income to average net assets: | | | | | | | | | | | | | | | | |

Before expense reimbursement or recovery | | | (0.38 | )% | | (0.11 | )% | | 0.61 | % | | 0.26 | % | | (0.16 | )% |

After expense reimbursement or recovery | | | (0.38 | )% | | (0.11 | )% | | 0.61 | % | | 0.24 | % | | (0.20 | )% |

Portfolio turnover rate | | | 164.20 | % | | 139.89 | % | | 132.08 | % | | 179.88 | % | | 156.11 | % |

_________________

(1) | For a share outstanding throughout the period. Rounded to the nearest cent. |

(3) | Net investment loss per share is calculated based on average shares outstanding. |

(3) | Net investment income (loss) per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

D-2

STATEMENT OF ADDITIONAL INFORMATION

January 31, 2010

Acquisition of the Assets and Assumption of the Liabilities of

Leuthold Select Equities Fund

By, and in Exchange for Shares of,

Leuthold Select Industries Fund

This Statement of Additional Information is not a prospectus and should be read in conjunction with the Prospectus dated January 31, 2010 relating to the acquisition of the assets and liabilities of the Leuthold Select Equities Fund (the “Select Equities Fund”), a series of Leuthold Funds, Inc. (the “Company”), by the Leuthold Select Industries Fund (the “Select Industries Fund”), another series of the Company. The acquisition will be effected pursuant to that certain Plan of Acquisition and Liquidation dated as of January 31, 2010 (the “Plan”). The Plan provides for (1) the transfer of all the assets of the Select Equities Fund to the Select Industries Fund, (2) the assumption by the Select Industries Fund of all the liabilities of the Select Equities Fund, (3) the issuance to shareholders of the Select Equities Fund of shares of the Select Industries Fund, equal in aggregate net asset value (“NAV”) to the NAV of their former shares of the Select Equities Fund in redemption of their shares of the Select Equities Fund, and (4) the termination of the Select Equities Fund.