U.S. Bancorp Fund Services, LLC serves as transfer agent and dividend disbursing agent for the Funds under a Transfer Agent Servicing Agreement. As transfer and dividend disbursing agent, U.S. Bancorp Fund Services, LLC has agreed to (i) issue and redeem shares of each Fund, (ii) make dividend and other distributions to shareholders of each Fund, (iii) respond to correspondence by Fund shareholders and others relating to its duties, (iv) maintain shareholder accounts, and (v) make periodic reports to each Fund.

In addition, the Company has entered into a Fund Accounting Servicing Agreement with U.S. Bancorp Fund Services, LLC pursuant to which U.S. Bancorp Fund Services, LLC has agreed to maintain the financial accounts and records of each Fund and provide other accounting services to the Funds. For its accounting services, U.S. Bancorp Fund Services, LLC is entitled to receive fees, payable monthly from the Funds at an annual rate of 0.015% for the first $1 billion of average net assets and .0005% of average net assets exceeding $1 billion. Notwithstanding the foregoing, the minimum annual fee payable for accounting services is $160,000. U.S. Bancorp Fund Services, LLC is also entitled to certain out of pocket expenses, including pricing expenses.

EXHIBIT A

LEUTHOLD FUNDS, INC.

FORM OF PLAN OF ACQUISITION AND LIQUIDATION

This Plan of Acquisition and Liquidation (this “Plan”) has been adopted by the Board of Directors of Leuthold Funds, Inc., a Maryland corporation (the “Corporation”), as of this ____ day of ______, 2013, to provide for the reorganization of the Leuthold Asset Allocation Fund (the “Acquired Portfolio”) into the Leuthold Core Investment Fund (the “Acquiring Portfolio”). The Acquired Portfolio and the Acquiring Portfolio (each a “Portfolio”, and, together, the “Portfolios”) are each separate series of the Corporation, an open-end management investment company registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). The Corporation’s Board of Directors (the “Board”) has determined that it is in the best interest of the stockholders of the Acquiring Portfolio and the Acquired Portfolio (“Stockholders”) that the Acquired Portfolio transfer all of the assets attributable to the shares of common stock held by its Stockholders in exchange for shares of common stock of equal net asset value of the Acquiring Portfolio (“Acquisition Shares”), to be distributed to the Acquired Portfolio’s Stockholders, and that the Corporation redeem the outstanding shares (the “Acquired Portfolio Shares”) of the Acquired Portfolio, all as provided for below (the “Acquisition”). In this Plan, any references to a Portfolio taking action shall mean and include all necessary actions of the Corporation on behalf of a Portfolio, unless the context of this Plan or the 1940 Act requires otherwise. The Corporation intends that the Acquisition qualify as a “reorganization” within the meaning of Section 368(a) of the United States Internal Revenue Code of 1986, as amended (the “Code”), and any successor provisions, and that with respect to the Acquisition, the Acquiring Portfolio and the Acquired Portfolio will each be a “party to a reorganization” within the meaning of Section 368(b) of the Code.

1. Definitions. In addition to the terms elsewhere defined herein, each of the following terms shall have the meaning indicated for that term as follows:

“1933 Act” shall mean the Securities Act of 1933, as amended.

“Assets” shall mean all assets of any kind and all interests, rights, privileges and powers of or attributable to the Acquired Portfolio or its shares, as appropriate, whether or not determinable at the Effective Time (as defined herein) and wherever located, including, without limitation, all cash, cash equivalents, securities, claims (whether absolute or contingent, known or unknown, accrued or unaccrued or conditional or unmatured), contract rights and receivables (including dividend and interest receivables) owned by the Acquired Portfolio or attributable to its shares and any deferred or prepaid expense, as of the Closing Date, other than unamortized organizational expenses, shown as an asset on the Acquired Portfolio’s books.

“Closing Date” shall mean such date as the officers of the Corporation shall designate.

“Effective Time” shall mean 5:00 p.m., Eastern Time, on the Closing Date, or such other time as the officers of the Corporation shall designate.

“Financial Statements” shall mean the audited financial statements of the relevant Portfolio for its most recently completed fiscal year and, if applicable, the unaudited financial statements of that Portfolio for its most recently completed semi-annual period.

“Liabilities” shall mean all liabilities, expenses and obligations of any kind whatsoever of the Acquired Portfolio, whether known or unknown, accrued or unaccrued, absolute or contingent or conditional or unmatured, as of the Closing Date.

“N-14 Registration Statement” shall mean the Registration Statement of the Acquiring Portfolio on Form N-14 under the 1940 Act that will register the Acquisition Shares to be issued in the Acquisition.

“Valuation Time” shall mean the close of regular session trading on the New York Stock Exchange (“NYSE”) on the Closing Date, when for purposes of this Plan, the Corporation determines the net asset value per Acquisition Share of the Acquiring Portfolio and the net value of the assets of the Acquired Portfolio.

“NAV” shall mean a Portfolio’s net asset value, which is calculated by valuing and totaling assets and then subtracting liabilities and then dividing the balance by the number of shares that are outstanding.

2. Regulatory Filings. The Acquiring Portfolio shall promptly prepare and file the N-14 Registration Statement with the SEC, and the Acquiring Portfolio and the Acquired Portfolio also shall make any other required or appropriate filings with respect to the actions contemplated hereby.

3. Transfer of the Acquired Portfolio’s Assets. The Acquiring Portfolio and the Acquired Portfolio shall take the following steps with respect to the Acquisition, as applicable:

(a) On or prior to the Closing Date, the Acquired Portfolio shall pay or provide for the payment of all of the Liabilities, expenses, costs and charges of or attributable to the Acquired Portfolio that are known to the Acquired Portfolio and that are due and payable prior to or as of the Closing Date.

(b) Prior to the Effective Time, except to the extent prohibited by Rule 19b-1 under the 1940 Act, the Acquired Portfolio will declare to the Acquired Portfolio’s Stockholders of record a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing (a) all the excess of (1) the Acquired Portfolio’s investment income excludable from gross income under Section 103(a) of the Code over (2) the Acquired Portfolio’s deductions disallowed under Sections 265 and 171(a)(2) of the Code, (b) all of the Acquired Portfolio’s investment company taxable income (as defined in Code Section 852), (computed in each case without regard to any deduction for dividends paid), and (c) all of the Acquired Portfolio’s net realized capital gain (as defined in Code Section 1222), if any (after reduction for any capital loss carryover), for the taxable year ending on September 30, 2013 and for the short taxable year beginning on October 1, 2013, and ending on the Closing Date. Such dividends will be declared and paid to ensure continued qualification of the Acquired Portfolio as a “regulated investment company” for tax purposes and to eliminate fund-level tax.

(c) At the Effective Time, the Acquired Portfolio shall assign, transfer, deliver and convey the Assets to the Acquiring Portfolio, subject to the Liabilities, and the Acquiring Portfolio shall then accept the Assets and assume the Liabilities such that at and after the Effective Time (1) the Assets shall become and be assets of the Acquiring Portfolio, and (2) the Liabilities shall attach to the Acquiring Portfolio, and shall be enforceable against the Acquiring Portfolio to the same extent as if initially incurred by the Acquiring Portfolio. The Corporation shall redeem the outstanding shares of the Acquired Portfolio by issuance of shares of the Acquiring Portfolio as described more fully below.

(d) Within a reasonable time prior to the Closing Date, the Acquired Portfolio shall provide, if requested, a list of the Assets to the Acquiring Portfolio. The Acquired Portfolio may sell any asset on such list prior to the Effective Time. After the Acquired Portfolio provides such list, the Acquired Portfolio will not acquire any additional securities or permit to exist any encumbrances, rights, restrictions or claims not reflected on such list, without the approval of the Acquiring Portfolio. Within a reasonable time after receipt of the list and prior to the Closing Date, the Acquiring Portfolio will advise the Acquired Portfolio in writing of any investments shown on the list that the Acquiring Portfolio has determined to be inconsistent with its investment objective, policies and restrictions. The Acquired Portfolio will dispose of any such securities prior to the Closing Date to the extent practicable and consistent with applicable legal requirements, including the Acquired Portfolio’s investment objectives, policies and restrictions. In addition, if the Acquiring Portfolio determines that, as a result of the Acquisition, the Acquiring Portfolio would own an aggregate amount of an investment that would exceed a percentage limitation applicable to the Acquiring Portfolio, the Acquiring Portfolio will advise the Acquired Portfolio in writing of any such limitation and the Acquired Portfolio shall dispose of a sufficient amount of such investment as may be necessary to avoid the limitation as of the Effective Time, to the extent practicable and consistent with applicable legal requirements, including the Acquired Portfolio’s investment objectives, policies and restrictions.

(e) The Acquired Portfolio shall assign, transfer, deliver and convey the Assets to the Acquiring Portfolio at the Effective Time on the following basis: (1) The value of the Assets less the Liabilities of the Acquired Portfolio attributable to shares of common stock held by its Stockholders, determined as of the Valuation Time, shall be divided by the then NAV of Acquisition Shares of common stock, as applicable, and, in exchange for the transfer of the Assets, the Acquiring Portfolio shall simultaneously issue and deliver to the Acquired Portfolio the number of Acquisition Shares of common stock (including fractional shares) so determined, rounded to the second decimal place or such other decimal place as the officers of the Corporation shall designate; (2) The NAV of Acquisition Shares of common stock to be delivered to the Acquired Portfolio shall be determined as of the Valuation Time in accordance with the Acquiring Portfolio’s then applicable valuation procedures, and the net value of the Assets to be conveyed to the Acquiring Portfolio shall be determined as of the Valuation Time in accordance with the then applicable valuation procedures of the Acquired Portfolio; and (3) the portfolio securities of the Acquired Portfolio shall be made available by the Acquired Portfolio to U.S. Bank National Association, as custodian for the Acquiring Portfolio (the “Custodian”), for examination no later than five business days preceding the Valuation Time. On the Closing Date, such portfolio securities and all the Acquired Portfolio’s cash shall be delivered by the Acquired Portfolio to the Custodian for the account of the Acquiring Portfolio, such portfolio securities to be duly endorsed in proper form for transfer in such manner and condition as to constitute good delivery thereof in accordance with the custom of brokers or, in the case of portfolio securities held in the U.S. Treasury Department’s book-entry system or by The Depository Trust Company, Participants Trust Company or other third party depositories, by transfer to the account of the Custodian in accordance with Rule 17f-4, Rule 17f-5 or Rule 17f-7, as the case may be, under the 1940 Act and accompanied by all necessary federal and state stock transfer stamps or a check for the appropriate purchase price thereof. The cash delivered shall be in the form of currency or certified or official bank checks, payable to the order of the Custodian, or shall be wired to an account pursuant to instructions provided by the Acquiring Portfolio.

(f) Promptly after the Closing Date, the Acquired Portfolio will deliver to the Acquiring Portfolio a Statement of Assets and Liabilities of the Acquired Portfolio as of the Closing Date.

4. Termination of the Acquired Portfolio, Registration of Acquisition Shares and Access to Records. The Acquired Portfolio and the Acquiring Portfolio also shall take the following steps, as applicable:

(a) At or as soon as reasonably practical after the Effective Time, the Acquired Portfolio shall terminate by transferring pro rata to its Stockholders of record Acquisition Shares received by the Acquired Portfolio pursuant to Section 3(e)(1) of this Plan. The Acquiring Portfolio shall establish accounts on its share records and note on such accounts the names of the former Acquired Portfolio Stockholders and the types and amounts of the Acquisition Shares that former Acquired Portfolio Stockholders are due based on their respective holdings of the Acquired Portfolio Shares as of the close of business on the Closing Date. Fractional Acquisition Shares shall be carried to the second decimal place. The Acquiring Portfolio shall not issue certificates representing the Acquisition Shares in connection with such exchange. All issued and outstanding Acquired Portfolio Shares will be simultaneously redeemed and cancelled on the books of the Acquired Portfolio. Ownership of the Acquisition Shares will be shown on the books of the Acquiring Portfolio’s transfer agent. Following distribution by the Acquired Portfolio to its Stockholders of all Acquisition Shares delivered to the Acquired Portfolio, the Acquired Portfolio shall wind up its affairs and shall take all steps as are necessary and proper to terminate as soon as is reasonably possible after the Effective Time.

(b) At and after the Closing Date, the Acquired Portfolio shall provide the Acquiring Portfolio and its transfer agent with immediate access to: (1) all records containing the names, addresses and taxpayer identification numbers of all of the Acquired Portfolio’s Stockholders and the number and percentage ownership of the outstanding shares of the Acquired Portfolio owned by Stockholders as of the Effective Time, and (2) all original documentation (including all applicable Internal Revenue Service forms, certificates, certifications and correspondence) relating to the Acquired Portfolio Stockholders’ taxpayer identification numbers and their liability for or exemption from back-up withholding. The Acquired Portfolio shall preserve and maintain, or shall direct its service providers to preserve and maintain, records with respect to the Acquired Portfolio as required by Section 31 of, and Rules 31a-1 and 31a-2 under, the 1940 Act.

5. Conditions to Consummation of the Acquisition. The consummation of the Acquisition shall be subject to the following conditions precedent:

(a) There shall have been no material adverse change in the financial condition, results of operations, business, properties or assets of the Acquiring Portfolio or the Acquired Portfolio since the date of the most recent Financial Statements. Negative investment performance shall not be considered a material adverse change.

(b) The Corporation shall have received an opinion of Foley & Lardner LLP, substantially to the effect that for federal income tax purposes: (1) The Acquisition will constitute a “reorganization” within the meaning of Section 368(a) of the Code and that the Acquiring Portfolio and the Acquired Portfolio will each be “a party to a reorganization” within the meaning of Section 368(b) of the Code; (2) A Stockholder of the Acquired Portfolio will recognize no gain or loss on the exchange of the Stockholder’s shares of the Acquired Portfolio solely for Acquisition Shares; (3) Neither the Acquired Portfolio nor the Acquiring Portfolio will recognize any gain or loss upon the transfer of all of the Assets to the Acquiring Portfolio in exchange for Acquisition Shares and the assumption by the Acquiring Portfolio of the Liabilities pursuant to this Plan or upon the distribution of Acquisition Shares to Stockholders of the Acquired Portfolio in exchange for their respective shares of the Acquired Portfolio; (4) The holding period and tax basis of the Assets acquired by the Acquiring Portfolio will be the same as the holding period and tax basis that the Acquired Portfolio had in such Assets immediately prior to the Acquisition; (5) The aggregate tax basis of Acquisition Shares received in connection with the Acquisition by each Stockholder of the Acquired Portfolio (including any fractional share to which the Stockholder may be entitled) will be the same as the aggregate tax basis of the shares of the Acquired Portfolio surrendered in exchange therefor, and increased by any gain recognized on the exchange; (6) The holding period of Acquisition Shares received in connection with the Acquisition by each Stockholder of the Acquired Portfolio (including any fractional share to which the stockholder may be entitled) will include the holding period of the shares of the Acquired Portfolio surrendered in exchange therefor, provided that such Acquired Portfolio Shares constitute capital assets in the hands of the Stockholder as of the Closing Date; and (7) The Acquiring Portfolio will succeed to the capital loss carryovers of the Acquired Portfolio but the use of the Acquiring Portfolio’s existing capital loss carryovers (as well as the carryovers of the Acquired Portfolio) may be subject to limitation under Section 383 of the Code after the Acquisition. The opinion will be based on certain factual certifications made by officers of the Portfolios and will also be based on customary assumptions and subject to certain qualifications. The opinion is not a guarantee that the tax consequences of the Acquisition will be as described above. Notwithstanding this subparagraph (b), Foley & Lardner LLP will express no view with respect to the effect of the Acquisition on any transferred asset as to which any unrealized gain or loss is required to be recognized at the end of a taxable year (or on the termination or transfer thereof) under federal income tax principles. Each Portfolio shall provide additional factual representations to Foley & Lardner LLP with respect to the Portfolios that are reasonably necessary to enable Foley & Lardner LLP to deliver the tax opinion. Notwithstanding anything in this Plan to the contrary, neither Portfolio may waive in any material respect the conditions set forth under this subparagraph (b).

(c) The N-14 Registration Statement shall have become effective under the 1933 Act as to the Acquisition Shares, and the SEC shall not have instituted and, to the knowledge of the Acquiring Portfolio, is not contemplating instituting any stop order suspending the effectiveness of the N-14 Registration Statement.

(d) No action, suit or other proceeding shall be threatened or pending before any court or governmental agency in which it is sought to restrain or prohibit, or obtain damages or other relief in connection with the Acquisition.

(e) The SEC shall not have issued any unfavorable advisory report under Section 25(b) of the 1940 Act nor instituted any proceeding seeking to enjoin consummation of the Acquisition under Section 25(c) of the 1940 Act.

6. Closing.

(a) The Closing shall be held at the offices of the Corporation, 33 South Sixth Street, Suite 4600, Minneapolis, Minnesota 55402, or at such other place as the officers of the Corporation may designate.

(b) In the event that at the Valuation Time (i) the NYSE shall be closed to trading or trading thereon shall be restricted, or (ii) trading or the reporting of trading on said Exchange or elsewhere shall be disrupted so that accurate appraisal of the value of the net assets of the Acquired Portfolio or the Acquiring Portfolio is impracticable, the Closing Date shall be postponed until the first business day after the day when trading shall have been fully resumed and reporting shall have been restored; provided that if trading shall not be fully resumed and reporting restored within three business days of the Valuation Time, this Plan may be terminated by the Board.

(c) The Acquiring Portfolio will provide to the Acquired Portfolio evidence satisfactory to the Acquired Portfolio that Acquisition Shares issuable pursuant to the Acquisition have been credited to the Acquired Portfolio’s account on the books of the Acquiring Portfolio. After the Closing Date, the Acquiring Portfolio will provide to the Acquired Portfolio evidence satisfactory to the Acquired Portfolio that such shares have been credited pro rata to open accounts in the names of the Acquired Portfolio Stockholders.

(d) At the Closing, each party shall deliver to the other such bills of sale, instruments of assumption of liabilities, checks, assignments, stock certificates, receipts or other documents as such other party or its counsel may reasonably request in connection with the transfer of assets, assumption of liabilities and liquidation contemplated by this Plan.

7. Termination of Plan. A majority of the Board may terminate this Plan before the applicable Effective Time if: (i) any of the conditions precedent set forth herein are not satisfied; or (ii) the Board determines that the consummation of the Acquisition is not in the best interests of either Portfolio or its Stockholders.

8. Termination of the Acquired Portfolio. If the Acquisition is consummated, the Acquired Portfolio shall terminate its registration under the 1940 Act and the 1933 Act and will terminate.

9. Expenses. The Acquisition expenses shall be borne by Leuthold Weeden Capital Management.

EXHIBIT B

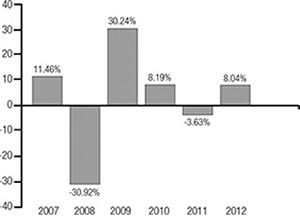

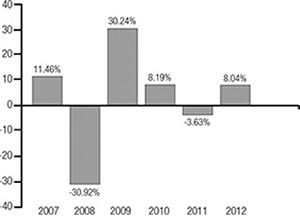

LEUTHOLD ASSET ALLOCATION FUND PERFORMACNE

The bar chart and table that follow provide some indication of the risks of investing in the Fund by showing changes in its performance from year to year and how its average annual returns over various periods compare to a broad measure of market performance. Please remember that the Fund’s past performance (before and after taxes) is not necessarily an indication of its future performance. It may perform better or worse in the future.

|

Leuthold Asset Allocation Fund |

|

Total Return of the Retail Shares |

(per calendar year) |

|

|

| |

| |

Note: During the five year period shown on the bar chart, the Fund’s highest total return for a quarter was 15.42% (quarter ended June 30, 2009) and the lowest return for a quarter was -18.72% (quarter ended December 31, 2008). |

|

The year-to-date return of the Asset Allocation Fund - Retail Class and Asset Allocation Fund - Institutional Class through August 31, 2013 is 4.80% and 4.95%, respectively. |

Average Annual Total Returns

(for the periods ended December 31, 2012 )

| | | | | | | | | |

| | Past

Year | | Past

5 Years | | Since

Retail

Inception | | Since

Institutional

Inception | |

Leuthold Asset Allocation Fund

(Retail – LAALX) | | | | | | | | | |

Return Before

Taxes | | 8.04 | % | 0.27 | % | 2.61 | % | n/a | |

Return After Taxes

on Distributions | | 7.18 | % | -0.12 | % | 2.15 | % | n/a | |

Return After Taxes

on Distributions

and Sale of

Fund Shares | | 5.67 | % | 0.11 | % | 2.06 | % | n/a | |

| | | | | | | | | |

Leuthold Asset Allocation Fund

(Institutional – LAAIX) | | | | | | | | | |

Return Before

Taxes | | 8.26 | % | 0.52 | % | n/a | | 2.17 | % |

S&P 500 Index | | 16.00 | % | 1.66 | % | 4.13 | % | 2.07 | % |

Lipper Flexible

Portfolio Fund

Index | | 13.34 | % | 2.72 | % | 5.01 | % | 3.68 | % |

Leuthold Asset

Allocation Melded

Index | | 10.83 | % | 3.31 | % | 5.20 | % | 3.85 | % |

| |

| |

The inception date for Retail Shares is May 24, 2006. The inception date for Institutional Shares is January 31, 2007. |

| |

The after-tax returns are calculated using the historical highest individual marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. The Fund’s return after taxes on distributions and sale of Fund shares may be higher than its return before taxes and after taxes on distributions because it may include a tax benefit resulting from the capital losses that would have been incurred. |

| |

The Leuthold Asset Allocation Melded Index is a custom index comprised of the returns of the S&P 500 Index (weighted 35%), the MSCIACWI Ex-US Index (weighted 15%), the Barclays Aggregate Index (weighted 40%), the MSCI REIT Index (weighted 5%) and the DJ/UBS Commodities Index (weighted 5%). |

B-1

EXHIBIT C

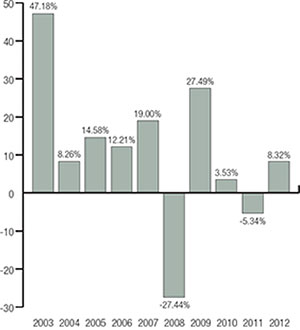

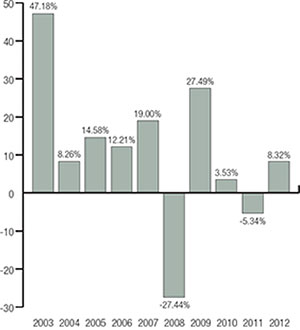

LEUTHOLD CORE INVESTMENT FUND PERFORMANCE

The bar chart and table that follow provide some indication of the risks of investing in the Fund by showing changes in its performance from year to year and how its average annual returns over various periods compare to a broad measure of market performance. Please remember that the Fund’s past performance (before and after taxes) is not necessarily an indication of its future performance. It may perform better or worse in the future.

|

Leuthold Core Investment Fund |

|

Total Return of the Retail Shares |

(per calendar year) |

|

|

| |

| |

Note: During the ten year period shown on the bar chart, the Fund’s highest total return for a quarter was 16.63% (quarter ended June 30, 2003) and the lowest total return for a quarter was -14.71% (quarter ended December 31, 2008). |

|

The year-to-date return of the Core Investment Fund - Retail Class and Core Investment Fund - Institutional Class through August 31, 2013 is 7.20% and 7.28%, respectively. |

Average Annual Total Returns

(for the periods ended December 31, 2012 )

| | | | | | | | | |

| | Past

Year | | Past

5 Years | | Past

10 Years | | Since

Institutional

Inception | |

| | | | | | | | | |

Leuthold Core Investment Fund

(Retail – LCORX) | | | | | | | | | |

Return Before Taxes | | 8.32 | % | -0.36 | % | 9.12 | % | n/a | |

Return After Taxes on Distributions | | 7.88 | % | -0.62 | % | 8.22 | % | n/a | |

Return After Taxes on Distributions and Sale of Fund Shares | | 5.68 | % | -0.40 | % | 7.78 | % | n/a | |

| | | | | | | | | |

| | | | | | | | | |

Leuthold Core Investment Fund

(Institutional – LCRIX) | | | | | | | | | |

Return Before Taxes | | 8.44 | % | -0,26 | % | n/a | | 3.65 | % |

S&P 500 Index | | 16.00 | % | 1.66 | % | 7.10 | % | 3.78 | % |

Lipper Flexible Portfolio Fund Index | | 13.34 | % | 2.72 | % | 7.31 | % | 4.64 | % |

| |

| |

The inception date for Institutional Shares is January 31, 2006. |

|

The after-tax returns are calculated using the historical highest individual marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. The Fund’s return after taxes on distributions and sale of Fund shares may be higher than its return before taxes and after taxes on distributions because it may include a tax benefit resulting from the capital losses that would have been incurred. |

C-1

EXHIBIT D

FINANCIAL HIGHLIGHTS

The following tables are intended to help you understand the financial performance of the Leuthold Asset Allocation Fund and the Leuthold Core Investment Fund for the periods presented. Certain information reflects financial results for a single Fund share. The “Total Return” figures show how much your investment would have increased or decreased during the period, assuming you had reinvested all dividends and distributions. This information (except for information for the six months ended March 31, 2013) has been derived from financial statements audited by the Funds independent registered public accounting firm. The report of independent registered public accounting firm and the Funds’ financial statements are included in the Annual Report, which is available upon request. The Funds’ unaudited financial statements for the six months ended March 31, 2013 are included in the Funds’ semi-annual report, which is available upon request. All unaudited interim financial statements reflect all adjustments which are, in the opinion of the Funds’ management, necessary to a fair statement of the results for the interim periods presented. In addition, all such adjustments are of a normal recurring nature.

D-1

|

Leuthold Core Investment Fund - Retail |

Financial Highlights |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended

March 31, 2013

(Consolidated) | | | Year Ended

September 30, 2012

(Consolidated) | | | Year Ended

September 30, 2011

(Consolidated) | | | Year Ended

September 30, 2010

(Consolidated) | | | Year Ended

September 30, 2009

(Consolidated) | | | Year Ended

September 30, 2008 | |

| | (Unaudited) | | | | | | | | | | | | | | | | | | | | | |

Per Share Data : (1) | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 16.78 | | | $ | 15.50 | | | $ | 15.99 | | | $ | 15.79 | | | $ | 15.20 | | | $ | 21.18 | |

|

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.06 | (3) | | | 0.11 | (3) | | | 0.09 | (2) | | | 0.14 | (3) | | | 0.28 | (3) | | | 0.26 | (2) |

Net realized and unrealized gains (losses) on investments and short positions | | | 1.18 | | | | 1.62 | | | | (0.51 | ) | | | 0.11 | | | | 0.45 | | | | (2.18 | ) |

Total from investment operations | | | 1.24 | | | | 1.73 | | | | (0.42 | ) | | | 0.25 | | | | 0.73 | | | | (1.92 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.26 | ) | | | (0.45 | ) | | | (0.07 | ) | | | – | | | | (0.13 | ) | | | (0.31 | ) |

From net realized gains | | | – | | | | – | | | | – | | | | – | | | | – | | | | (3.75 | ) |

From return of capital | | | – | | | | – | | | | – | | | | (0.05 | ) | | | (0.01 | ) | | | – | |

Redemption fees(4) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Total distributions | | | (0.26 | ) | | | (0.45 | ) | | | (0.07 | ) | | | (0.05 | ) | | | (0.14 | ) | | | (4.06 | ) |

Net asset value, end of period | | $ | 17.76 | | | $ | 16.78 | | | $ | 15.50 | | | $ | 15.99 | �� | | $ | 15.79 | | | $ | 15.20 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return | | | 7.48 | % | | | 11.34 | % | | | (2.61 | %) | | | 1.53 | % | | | 4.95 | % | | | (11.48 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period | | $ | 461,019,313 | | | $ | 527,760,001 | | | $ | 660,993,063 | | | $ | 858,708,522 | | | $ | 944,341,607 | | | $ | 1,103,832,039 | |

Ratio of expenses to average net assets(5) | | | 1.29 | %(6) | | | 1.22 | % | | | 1.24 | % | | | 1.37 | % | | | 1.15 | % | | | 1.28 | % |

Ratio of net investment income to average net assets(7) | | | 0.66 | %(6) | | | 0.69 | % | | | 0.54 | % | | | 0.85 | % | | | 2.14 | % | | | 1.51 | % |

Portfolio turnover rate (8) | | | 47.15 | % | | | 149.17 | % | | | 83.15 | % | | | 100.36 | % | | | 116.70 | % | | | 238.34 | % |

| |

(1) | For a share outstanding throughout the period. Rounded to the nearest cent. |

(2) | Net investment income per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

(3) | Net investment income per share is calculated based on average shares outstanding. |

(4) | Amount represents less than $0.005 per share. |

(5) | The ratio of expenses to average net assets includes dividends and interest on short positions. The expense ratios excluding dividends and interest on short positions were 1.16% for the six months ended March 31, 2013, 1.14% for the year ended September 30, 2012, 1.14% for the year ended September 30, 2011, 1.12% for the year ended September 30, 2010, 1.14% for the year ended September 30, 2009 and 1.11% for the year ended September 30, 2008 |

(6) | Annualized. |

(7) | The net investment income ratios include dividends and interest on short positions. |

(8) | The portfolio turnover rate excludes purchases and sales of short positions as the Adviser does not intend to hold the short positions for more than one year. |

D-2

|

Leuthold Core Investment Fund - Institutional |

Financial Highlights |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended

March 31, 2013

(Consolidated) | | | Year Ended

September 30, 2012

(Consolidated) | | | Year Ended

September 30, 2011

(Consolidated) | | | Year Ended

September 30, 2010

(Consolidated) | | | Year Ended

September 30, 2009

(Consolidated) | | | Year Ended

September 30, 2008 | |

| | (Unaudited) | | | | | | | | | | | | | | | | | | | | | |

Per Share Data : (1) | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 16.77 | | | $ | 15.50 | | | $ | 15.98 | | | $ | 15.78 | | | $ | 15.19 | | | $ | 21.17 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.06 | (2) | | | 0.12 | (2) | | | 0.11 | (3) | | | 0.15 | (2) | | | 0.30 | (3) | | | 0.28 | (3) |

Net realized and unrealized gains (losses) on investments and short positions | | | 1.19 | | | | 1.62 | | | | (0.50 | ) | | | 0.11 | | | | 0.45 | | | | (2.19 | ) |

Total from investment operations | | | 1.25 | | | | 1.74 | | | | (0.39 | ) | | | 0.26 | | | | 0.75 | | | | (1.91 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.27 | ) | | | (0.47 | ) | | | (0.09 | ) | | | – | | | | (0.15 | ) | | | (0.32 | ) |

From net realized gains | | | – | | | | – | | | | – | | | | – | | | | – | | | | (3.75 | ) |

From return of capital | | | – | | | | – | | | | – | | | | (0.06 | ) | | | (0.01 | ) | | | – | |

Redemption fees | | | - | | | | 0.00 | (4) | | | 0.00 | (4) | | | 0.00 | (4) | | | 0.00 | (4) | | | - | |

Total distributions | | | (0.27 | ) | | | (0.47 | ) | | | (0.09 | ) | | | (0.06 | ) | | | (0.16 | ) | | | (4.07 | ) |

Net asset value, end of period | | $ | 17.75 | | | $ | 16.77 | | | $ | 15.50 | | | $ | 15.98 | | | $ | 15.78 | | | $ | 15.19 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return | | | 7.55 | % | | | 11.40 | % | | | (2.49 | %) | | | 1.64 | % | | | 5.14 | % | | | (11.46 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period | | $ | 208,128,161 | | | $ | 263,572,111 | | | $ | 347,517,502 | | | $ | 451,654,832 | | | $ | 461,682,757 | | | $ | 317,733,525 | |

Ratio of expenses to average net assets(5) | | | 1.18 | %(6) | | | 1.11 | % | | | 1.13 | % | | | 1.27 | % | | | 1.03 | % | | | 1.18 | % |

Ratio of net investment income to average net assets(7) | | | 0.77 | %(6) | | | 0.80 | % | | | 0.66 | % | | | 0.95 | % | | | 2.25 | % | | | 1.61 | % |

Portfolio turnover rate (8) | | | 47.15 | % | | | 149.17 | % | | | 83.15 | % | | | 100.36 | % | | | 116.70 | % | | | 238.34 | % |

| |

(1) | For a share outstanding throughout the period. Rounded to the nearest cent. |

(2) | Net investment income per share is calculated based on average shares outstanding. |

(3) | Net investment income per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

(4) | Amount represents less than $0.005 per share. |

(5) | The ratio of expenses to average net assets includes dividends and interest on short positions. The expense ratios excluding dividends and interest on short positions were 1.06% for the six months ended March 31, 2013, 1.03% for the year ended September 30, 2012, 1.03% for the year ended September 30, 2011, 1.02% for the year ended September 30, 2010, 1.02% for the year ended September 30, 2009 and 1.01% for the year ended September 30, 2008. |

(6) | Annualized. |

(7) | The net investment income ratios include dividends and interest on short positions. |

(8) | The portfolio turnover rate excludes purchases and sales of short positions as the Adviser does not intend to hold the short positions for more than one year. |

D-3

|

Leuthold Asset Allocation Fund - Retail |

Financial Highlights |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended

March 31, 2013

(Consolidated) | | Year Ended

September 30, 2012

(Consolidated) | | Year Ended

September 30, 2011

(Consolidated) | | Year Ended

September 30, 2010

(Consolidated) | | Year Ended

September 30, 2009

(Consolidated) | | Year Ended

September 30, 2008 | |

| | (Unaudited) | | | | | | | | | | | |

Per Share Data : (1) | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 10.50 | | | $ | 9.72 | | | $ | 9.91 | | | $ | 9.12 | | | $ | 9.45 | | | $ | 11.43 | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.06 | (3) | | | 0.09 | (3) | | | 0.07 | (2) | | | 0.11 | (3) | | | 0.21 | (2) | | | 0.20 | (2) |

Net realized and unrealized gains (losses) on investments and short positions | | | 0.48 | | | | 1.03 | | | | (0.20 | ) | | | 0.74 | | | | (0.35 | ) | | | (1.80 | ) |

Total from investment operations | | | 0.54 | | | | 1.12 | | | | (0.13 | ) | | | 0.85 | | | | (0.14 | ) | | | (1.60 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.39 | ) | | | (0.34 | ) | | | (0.06 | ) | | | (0.02 | ) | | | (0.19 | ) | | | (0.20 | ) |

From net realized gains | | | – | | | | – | | | | – | | | | – | | | | – | | | | (0.18 | ) |

From return of capital | | | – | | | | – | | | | – | | | | (0.04 | ) | | | – | | | | – | |

Redemption fees(4) | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

Total distributions | | | (0.39 | ) | | | (0.34 | ) | | | (0.06 | ) | | | (0.06 | ) | | | (0.19 | ) | | | (0.38 | ) |

Net asset value, end of period | | $ | 10.65 | | | $ | 10.50 | | | $ | 9.72 | | | $ | 9.91 | | | $ | 9.12 | | | $ | 9.45 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return | | | 5.27 | % | | | 11.73 | % | | | (1.34 | %) | | | 9.26 | % | | | (1.20 | %) | | | (14.45 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period | | $ | 253,512,191 | | | $ | 359,697,107 | | | $ | 606,985,298 | | | $ | 843,525,684 | | | $ | 849,399,319 | | | $ | 1,205,840,473 | |

Ratio of expenses to average net assets(5) | | | 1.39 | %(6) | | | 1.42 | % | | | 1.42 | % | | | 1.57 | % | | | 1.34 | % | | | 1.34 | % |

Ratio of net investment income to average net assets(7) | | | 1.21 | %(6) | | | 0.84 | % | | | 0.72 | % | | | 1.17 | % | | | 2.60 | % | | | 1.99 | % |

Portfolio turnover rate (8) | | | 57.58 | % | | | 133.11 | % | | | 105.62 | % | | | 100.64 | % | | | 147.01 | % | | | 197.96 | % |

| |

(1) | For a share outstanding throughout the period. Rounded to the nearest cent. |

(2) | Net investment income per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

(3) | Net investment income per share is calculated based on average shares outstanding. |

(4) | Amount represents less than $0.005 per share. |

(5) | The ratio of expenses to average net assets includes dividends and interest on short positions. The expense ratios excluding dividends and interest on short positions were 1.37% for the six months ended March 31, 2013, 1.34% for the year ended September 30, 2012, 1.32% for the year ended September 30, 2011, 1.32% for the year ended September 30, 2010, 1.32% for the year ended September 30, 2009 and 1.23% for the year ended September 30, 2008. |

(6) | Annualized. |

(7) | The net investment income ratios include dividends and interest on short positions. |

(8) | The portfolio turnover rate excludes purchases and sales of short positions as the Adviser does not intend to hold the short positions for more than one year. |

D-4

|

Leuthold Asset Allocation Fund - Institutional |

Financial Highlights |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended

March 31, 2013

(Consolidated) | | | Year Ended

September 30, 2012

(Consolidated) | | | Year Ended

September 30, 2011

(Consolidated) | | | Year Ended

September 30, 2010

(Consolidated) | | | Year Ended

September 30, 2009

(Consolidated) | | | Year Ended

September 30, 2008 | | |

| | (Unaudited) | | | | | | | | | | | | | | | | | | | | | | |

Per Share Data : (1) | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 10.54 | | | $ | 9.76 | | | $ | 9.93 | | | $ | 9.13 | | | $ | 9.45 | | | $ | 11.44 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.08 | (3) | | | 0.10 | (3) | | | 0.10 | (2) | | | 0.13 | (3) | | | 0.23 | (2) | | | 0.21 | (2) | |

Net realized and unrealized gains (losses) on investments and short positions | | | 0.49 | | | | 1.05 | | | | (0.19 | ) | | | 0.73 | | | | (0.34 | ) | | | (1.81 | ) | |

Total from investment operations | | | 0.57 | | | | 1.15 | | | | (0.09 | ) | | | 0.86 | | | | (0.11 | ) | | | (1.60 | ) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.41 | ) | | | (0.37 | ) | | | (0.08 | ) | | | (0.02 | ) | | | (0.21 | ) | | | (0.21 | ) | |

From net realized gains | | | – | | | | – | | | | – | | | | – | | | | – | | | | (0.18 | ) | |

From return of capital | | | – | | | | – | | | | – | | | | (0.04 | ) | | | – | | | | – | | |

Redemption fees | | | 0.00 | (4) | | | - | | | | 0.00 | (4) | | | - | | | | 0.00 | (4) | | | 0.00 | (4) | |

Total distributions | | | (0.41 | ) | | | (0.37 | ) | | | (0.08 | ) | | | (0.06 | ) | | | (0.21 | ) | | | (0.39 | ) | |

Net asset value, end of period | | $ | 10.70 | | | $ | 10.54 | | | $ | 9.76 | | | $ | 9.93 | | | $ | 9.13 | | | $ | 9.45 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total Return | | | 5.39 | % | | | 11.96 | % | | | (0.95 | %) | | | 9.41 | % | | | (0.85 | %) | | | (14.42 | %) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period | | $ | 92,568,523 | | | $ | 267,186,481 | | | $ | 386,106,585 | | | $ | 393,296,150 | | | $ | 349,672,451 | | | $ | 683,852,979 | | |

Ratio of expenses to average net assets(5) | | | 1.15 | %(6) | | | 1.20 | % | | | 1.20 | % | | | 1.36 | % | | | 1.11 | % | | | 1.21 | % | |

Ratio of net investment income to average net assets(7) | | | 1.45 | %(6) | | | 1.06 | % | | | 0.94 | % | | | 1.38 | % | | | 2.82 | % | | | 2.12 | % | |

Portfolio turnover rate (8) | | | 57.58 | % | | | 133.11 | % | | | 105.62 | % | | | 100.64 | % | | | 147.01 | % | | | 197.96 | % | |

| |

(1) | For a share outstanding throughout the period. Rounded to the nearest cent. |

(2) | Net investment income per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

(3) | Net investment income per share is calculated based on average shares outstanding. |

(4) | Amount represents less than $0.005 per share. |

(5) | The ratio of expenses to average net assets includes dividends and interest on short positions. The expense ratios excluding dividends and interest on short positions were 1.14% for the six months ended March 31, 2013, 1.12% for the year ended September 30, 2012, 1.10% for the year ended September 30, 2011, 1.11% for the year ended September 30, 2010, 1.10% for the year ended September 30, 2009 and 1.09% for the year ended September 30, 2008. |

(6) | Annualized. |

(7) | The net investment income ratios include dividends and interest on short positions. |

(8) | The portfolio turnover rate excludes purchases and sales of short positions as the Adviser does not intend to hold the short positions for more than one year. |

D-5

PRELIMINARY AND SUBJECT TO CHANGE,

DATED SEPTEMBER 13, 2013

STATEMENT OF ADDITIONAL INFORMATION

[•] [•], 2013

Acquisition of the Assets and Assumption of the Liabilities of

Leuthold Asset Allocation Fund

By, and in Exchange for Shares of,

Leuthold Core Investment Fund

This Statement of Additional Information is not a prospectus and should be read in conjunction with the Prospectus dated [•][•], 2013 relating to the acquisition of the assets and liabilities of the Leuthold Asset Allocation Fund (the “Asset Allocation Fund”), a series of Leuthold Funds, Inc. (the “Company”), by the Leuthold Core Investment Fund (the “Core Investment Fund”), another series of the Company. The acquisition will be effected pursuant to that certain Plan of Acquisition and Liquidation dated as of [•][•], 2013 (the “Plan”). The Plan provides for (1) the transfer of all the assets of the Asset Allocation Fund to the Core Investment Fund, (2) the assumption by the Core Investment Fund of all the liabilities of the Asset Allocation Fund, (3) the issuance to shareholders of the Asset Allocation Fund of shares of the Core Investment Fund, equal in aggregate net asset value (“NAV”) to the NAV of their former shares of the Asset Allocation Fund in redemption of their shares of the Asset Allocation Fund, and (4) the termination of the Asset Allocation Fund.

Copies of the Prospectus, which has been filed with the Securities and Exchange Commission (“SEC”), may be obtained, without charge, by writing to Leuthold Funds, Inc., 33 South Sixth Street, Suite 4600, Minneapolis, Minnesota 55402, Attention: Corporate Secretary, or by calling 1-800-273-6886.

B-1

TABLE OF CONTENTS

B-2

ADDITIONAL INFORMATION ABOUT THE FUNDS

The following documents have been filed with the SEC and are incorporated by reference into this Statement of Additional Information, which means that they are legally considered to be a part of this Statement of Additional Information:

| | |

| • | The current Statement of Additional Information of the Leuthold Funds (filed January 31, 2013, Accession Number 0000897101-13-000130). |

| | |

| • | The current Annual Report of the Leuthold Funds, for the fiscal year ended September 30, 2012 (filed December 5, 2012, Accession Number 0000894189-12-006744). |

| | |

| • | The current Semi-Annual Report of the Leuthold Funds, for the fiscal period ended March 31, 2013 (filed June 7, 2013, Accession Number 0000894189-13-003351). |

B-3

PRO FORMA FINANCIAL INFORMATION

Introductory Note to Unaudited Pro Forma Financial Statements

The following unaudited pro forma information gives effect to the proposed transfer of the assets and liabilities of the Asset Allocation Fund to the Core Investment Fund, accounted for as if the acquisition had occurred as of and for the fiscal period ended March 31, 2013. Under generally accepted accounting principles, the Core Investment Fund will be the surviving entity for accounting purposes with its historical cost of investment securities and results of operations being carried forward.

The pro forma financial information should be read in conjunction with the historical financial statements and notes thereto of the Asset Allocation Fund and the Core Investment Fund incorporated by reference into this Statement of Additional Information.

The pro forma financial information has been adjusted to reflect the advisory fee arrangement for the surviving entity. Certain other operating costs have also been adjusted to reflect anticipated expenses of the combined entity. Other costs which may change as a result of the proposed acquisition are currently undeterminable.

B-4

Leuthold Core Investment Fund

Pro Forma

Consolidated Schedule of Investments

March 31, 2013

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | | Leuthold Asset

Allocation Fund | | Leuthold Core

Investment Fund | | Leuthold Core Investment Fund

Pro Forma Combined |

| | | | Shares | | Fair Value | | Shares | | Fair Value | | Shares | | Fair Value |

COMMON STOCKS | | 67.51 | % | | | | | | | | | | | | | | | | | |

Aerospace & Defense | | 0.36 | % | | | | | | | | | | | | | | | | | |

Embraer SA - ADR | | | | - | | $ | - | | | 5,225 | | $ | 186,376 | | | 5,225 | | $ | 186,376 | |

L-3 Communications Holdings, Inc. | | | | 12,899 | | | 1,043,787 | | | - | | | - | | | 12,899 | | | 1,043,787 | |

Raytheon Co. | | | | 17,201 | | | 1,011,247 | | | - | | | - | | | 17,201 | | | 1,011,247 | |

Safran SA (b) | | | | 31,143 | | | 1,389,953 | | | - | | | - | | | 31,143 | | | 1,389,953 | |

| | | | | | | 3,444,987 | | | | | | 186,376 | | | | | | 3,631,363 | |

Air Freight & Logistics | | 0.15 | % | | | | | | | | | | | | | | | | | |

FedEx Corp. | | | | 15,385 | | | 1,510,807 | | | - | | | - | | | 15,385 | | | 1,510,807 | |

Airlines | | 3.57 | % | | | | | | | | | | | | | | | | | |

AirAsia BHD (b) | | | | - | | | - | | | 356,100 | | | 329,183 | | | 356,100 | | | 329,183 | |

Alaska Air Group, Inc. (a) | | | | - | | | - | | | 93,410 | | | 5,974,503 | | | 93,410 | | | 5,974,503 | |

Copa Holdings SA - Class A (b) | | | | - | | | - | | | 35,264 | | | 4,217,927 | | | 35,264 | | | 4,217,927 | |

Delta Air Lines, Inc. (a) | | | | 126,747 | | | 2,092,593 | | | 336,762 | | | 5,559,941 | | | 463,509 | | | 7,652,534 | |

Ryanair Holdings PLC - ADR | | | | - | | | - | | | 141,865 | | | 5,927,120 | | | 141,865 | | | 5,927,120 | |

Southwest Airlines Co. | | | | 102,063 | | | 1,375,809 | | | 356,144 | | | 4,800,821 | | | 458,207 | | | 6,176,630 | |

U.S. Airways Group, Inc. (a) | | | | - | | | - | | | 354,798 | | | 6,020,922 | | | 354,798 | | | 6,020,922 | |

| | | | | | | 3,468,402 | | | | | | 32,830,417 | | | | | | 36,298,819 | |

Auto Components | | 0.21 | % | | | | | | | | | | | | | | | | | |

Halla Visteon Climate Control (b) | | | | - | | | - | | | 9,110 | | | 231,917 | | | 9,110 | | | 231,917 | |

Hyundai Mobis (b) | | | | - | | | - | | | 792 | | | 222,334 | | | 792 | | | 222,334 | |

Magna International, Inc. (b) | | | | 28,604 | | | 1,679,055 | | | - | | | - | | | 28,604 | | | 1,679,055 | |

| | | | | | | 1,679,055 | | | | | | 454,251 | | | | | | 2,133,306 | |

Automobiles | | 0.33 | % | | | | | | | | | | | | | | | | | |

Dongfeng Motor Group Co., Ltd. (b) | | | | 396,000 | | | 558,211 | | | 126,000 | | | 177,613 | | | 522,000 | | | 735,824 | |

Hyundai Motor Co. (b) | | | | 2,998 | | | 606,031 | | | 1,486 | | | 300,387 | | | 4,484 | | | 906,418 | |

Tata Motors, Ltd. - ADR | | | | - | | | - | | | 16,866 | | | 411,699 | | | 16,866 | | | 411,699 | |

Tofas Turk Otomobil Fabrikasi AS (b) | | | | - | | | - | | | 30,762 | | | 222,053 | | | 30,762 | | | 222,053 | |

Toyota Motor Corp. - ADR | | | | 10,339 | | | 1,061,195 | | | - | | | - | | | 10,339 | | | 1,061,195 | |

| | | | | | | 2,225,437 | | | | | | 1,111,752 | | | | | | 3,337,189 | |

Beverages | | 0.27 | % | | | | | | | | | | | | | | | | | |

Anheuser-Busch InBev NV - ADR | | | | 23,390 | | | 2,328,474 | | | - | | | - | | | 23,390 | | | 2,328,474 | |

Tsingtao Brewery Co., Ltd. (b) | | | | - | | | - | | | 60,000 | | | 382,842 | | | 60,000 | | | 382,842 | |

| | | | | | | 2,328,474 | | | | | | 382,842 | | | | | | 2,711,316 | |

Biotechnology | | 0.75 | % | | | | | | | | | | | | | | | | | |

Biogen Idec, Inc. (a) | | | | 11,177 | | | 2,156,155 | | | - | | | - | | | 11,177 | | | 2,156,155 | |

Celgene Corp. (a) | | | | 25,077 | | | 2,906,675 | | | - | | | - | | | 25,077 | | | 2,906,675 | |

Cubist Pharmaceuticals, Inc. (a) | | | | 14,641 | | | 685,492 | | | - | | | - | | | 14,641 | | | 685,492 | |

Gilead Sciences, Inc. (a) | | | | 25,097 | | | 1,227,996 | | | - | | | - | | | 25,097 | | | 1,227,996 | |

United Therapeutics Corp. (a) | | | | 10,280 | | | 625,744 | | | - | | | - | | | 10,280 | | | 625,744 | |

| | | | | | | 7,602,062 | | | | | | - | | | | | | 7,602,062 | |

Building Products | | 0.02 | % | | | | | | | | | | | | | | | | | |

China Liansu Group Holdings, Ltd. (b) | | | | - | | | - | | | 319,000 | | | 181,564 | | | 319,000 | | | 181,564 | |

| | | | | | | | | | | | | | | | | | | | |

Capital Markets | | 0.43 | % | | | | | | | | | | | | | | | | | |

Aberdeen Asset Management PLC (b) | | | | 158,974 | | | 1,038,902 | | | - | | | - | | | 158,974 | | | 1,038,902 | |

Ameriprise Financial, Inc. | | | | 17,790 | | | 1,310,234 | | | - | | | - | | | 17,790 | | | 1,310,234 | |

Blackrock, Inc. | | | | 4,146 | | | 1,065,024 | | | - | | | - | | | 4,146 | | | 1,065,024 | |

Goldman Sachs Group, Inc. | | | | 6,559 | | | 965,157 | | | - | | | - | | | 6,559 | | | 965,157 | |

| | | | | | | 4,379,317 | | | | | | - | | | | | | 4,379,317 | |

Chemicals | | 2.81 | % | | | | | | | | | | | | | | | | | |

Aeci, Ltd. (b) | | | | - | | | - | | | 8,038 | | | 89,197 | | | 8,038 | | | 89,197 | |

Agrium, Inc. (b) | | | | 14,435 | | | 1,407,412 | | | 41,725 | | | 4,068,188 | | | 56,160 | | | 5,475,600 | |

CF Industries Holdings, Inc. | | | | 4,817 | | | 917,012 | | | 19,651 | | | 3,740,961 | | | 24,468 | | | 4,657,973 | |

China BlueChemical, Ltd. (b) | | | | - | | | - | | | 310,000 | | | 192,754 | | | 310,000 | | | 192,754 | |

China Lumena New Materials Corp. (b) | | | | - | | | - | | | 1,224,000 | | | 264,590 | | | 1,224,000 | | | 264,590 | |

Gubre Fabrikalari TAS (a)(b) | | | | - | | | - | | | 32,216 | | | 293,898 | | | 32,216 | | | 293,898 | |

Huntsman Corp. | | | | 44,874 | | | 834,208 | | | - | | | - | | | 44,874 | | | 834,208 | |

LyondellBasell Industries NV - Class A (b) | | | | 26,621 | | | 1,684,843 | | | - | | | - | | | 26,621 | | | 1,684,843 | |

Monsanto Co. | | | | 9,871 | | | 1,042,674 | | | 83,719 | | | 8,843,238 | | | 93,590 | | | 9,885,912 | |

Mosaic Co. | | | | - | | | - | | | 69,183 | | | 4,123,999 | | | 69,183 | | | 4,123,999 | |

Valspar Corp. | | | | 16,477 | | | 1,025,693 | | | - | | | - | | | 16,477 | | | 1,025,693 | |

| | | | | | | 6,911,842 | | | | | | 21,616,825 | | | | | | 28,528,667 | |

Commercial Banks | | 3.98 | % | | | | | | | | | | | | | | | | | |

Banco Bilbao Vizcaya Argentaria SA - ADR | | | | - | | | - | | | 137,289 | | | 1,204,025 | | | 137,289 | | | 1,204,025 | |

Banco Santander SA - ADR | | | | 173,531 | | | 1,181,746 | | | 228,277 | | | 1,554,566 | | | 401,808 | | | 2,736,312 | |

Bangkok Bank PCL (b) | | | | - | | | - | | | 119,400 | | | 908,567 | | | 119,400 | | | 908,567 | |

Bank of China, Ltd. (b) | | | | 1,361,000 | | | 633,221 | | | 1,939,000 | | | 902,143 | | | 3,300,000 | | | 1,535,364 | |

Bank Pan Indonesia Tbk PT (a)(b) | | | | - | | | - | | | 3,768,000 | | | 315,279 | | | 3,768,000 | | | 315,279 | |

Credicorp, Ltd. (b) | | | | 6,808 | | | 1,130,468 | | | 27,727 | | | 4,604,068 | | | 34,535 | | | 5,734,536 | |

DBS Group Holdings, Ltd. (b) | | | | 47,000 | | | 608,313 | | | 62,000 | | | 802,455 | | | 109,000 | | | 1,410,768 | |

HSBC Holdings PLC - ADR | | | | - | | | - | | | 74,567 | | | 3,977,404 | | | 74,567 | | | 3,977,404 | |

ICICI Bank Ltd. - ADR | | | | - | | | - | | | 58,954 | | | 2,529,127 | | | 58,954 | | | 2,529,127 | |

KB Financial Group, Inc. - ADR | | | | - | | | - | | | 72,413 | | | 2,392,525 | | | 72,413 | | | 2,392,525 | |

Krung Thai Bank PCL (b) | | | | - | | | - | | | 417,700 | | | 354,987 | | | 417,700 | | | 354,987 | |

M&T Bank Corp. | | | | 14,244 | | | 1,469,411 | | | - | | | - | | | 14,244 | | | 1,469,411 | |

Nordea Bank AB (b) | | | | 157,978 | | | 1,792,215 | | | - | | | - | | | 157,978 | | | 1,792,215 | |

PacWest Bancorp | | | | - | | | - | | | 42,263 | | | 1,230,276 | | | 42,263 | | | 1,230,276 | |

PNC Financial Services Group, Inc. | | | | 14,731 | | | 979,612 | | | - | | | - | | | 14,731 | | | 979,612 | |

Sberbank of Russia - ADR (a) | | | | 45,753 | | | 588,618 | | | 42,266 | | | 543,757 | | | 88,019 | | | 1,132,375 | |

Security Bank Corp. (b) | | | | - | | | - | | | 56,400 | | | 251,640 | | | 56,400 | | | 251,640 | |

Sumitomo Mitsui Financial Group, Inc. - ADR | | | | - | | | - | | | 159,363 | | | 1,300,402 | | | 159,363 | | | 1,300,402 | |

Turkiye Vakiflar Bankasi Tao (b) | | | | 200,725 | | | 644,066 | | | - | | | - | | | 200,725 | | | 644,066 | |

Umpqua Holdings Corp. | | | | - | | | - | | | 74,298 | | | 985,191 | | | 74,298 | | | 985,191 | |

Wells Fargo & Co. | | | | - | | | - | | | 203,511 | | | 7,527,872 | | | 203,511 | | | 7,527,872 | |

| | | | | | | 9,027,670 | | | | | | 31,384,284 | | | | | | 40,411,954 | |

B-5

| | | | | | | | | | | | | | | | | | | | |

| | | | Leuthold Asset

Allocation Fund | | Leuthold Core

Investment Fund | | Leuthold Core Investment Fund

Pro Forma Combined |

| | | | Shares | | Fair Value | | Shares | | Fair Value | | Shares | | Fair Value |

Commercial Services & Supplies | | 0.02 | % | | | | | | | | | | | | | | | | | |

Valid Solucoes e Servicos de Seguranca em Meios de Pagamento e Identificacao SA (b) | | | | - | | | - | | | 10,180 | | | 195,313 | | | 10,180 | | | 195,313 | |

Communications Equipment | | 0.36 | % | | | | | | | | | | | | | | | | | |

Cisco Systems, Inc. | | | | 52,583 | | | 1,099,511 | | | - | | | - | | | 52,583 | | | 1,099,511 | |

QUALCOMM, Inc. | | | | 38,475 | | | 2,575,901 | | | - | | | - | | | 38,475 | | | 2,575,901 | |

| | | | | | | 3,675,412 | | | | | | - | | | | | | 3,675,412 | |

Computers & Peripherals | | 0.72 | % | | | | | | | | | | | | | | | | | |

Apple, Inc. | | | | 7,132 | | | 3,156,837 | | | - | | | - | | | 7,132 | | | 3,156,837 | |

EMC Corp. (a) | | | | 62,637 | | | 1,496,398 | | | - | | | - | | | 62,637 | | | 1,496,398 | |

Lenovo Group, Ltd. (b) | | | | - | | | - | | | 856,000 | | | 853,775 | | | 856,000 | | | 853,775 | |

Lite-On Technology Corp. (b) | | | | - | | | - | | | 226,000 | | | 367,622 | | | 226,000 | | | 367,622 | |

Pegatron Corp. (a)(b) | | | | - | | | - | | | 376,000 | | | 579,997 | | | 376,000 | | | 579,997 | |

SanDisk Corp. (a) | | | | 15,970 | | | 878,350 | | | - | | | - | | | 15,970 | | | 878,350 | |

| | | | | | | 5,531,585 | | | | | | 1,801,394 | | | | | | 7,332,979 | |

Construction & Engineering | | 0.01 | % | | | | | | | | | | | | | | | | | |

Tekfen Holding AS (b) | | | | - | | | - | | | 31,450 | | | 134,944 | | | 31,450 | | | 134,944 | |

| | | | | | | | | | | | | | | | | | | | |

Construction Materials | | 0.14 | % | | | | | | | | | | | | | | | | | |

China Shanshui Cement Group, Ltd. (b) | | | | - | | | - | | | 335,000 | | | 193,313 | | | 335,000 | | | 193,313 | |

Indocement Tunggal Prakarsa Tbk PT (b) | | | | - | | | - | | | 74,500 | | | 179,127 | | | 74,500 | | | 179,127 | |

Semen Indonesia Persero Tbk PT (b) | | | | 383,500 | | | 700,527 | | | 181,000 | | | 330,627 | | | 564,500 | | | 1,031,154 | |

| | | | | | | 700,527 | | | | | | 703,067 | | | | | | 1,403,594 | |

Consumer Finance | | 3.08 | % | | | | | | | | | | | | | | | | | |

American Express Co. | | | | - | | | - | | | 54,632 | | | 3,685,475 | | | 54,632 | | | 3,685,475 | |

Capital One Financial Corp. | | | | - | | | - | | | 114,826 | | | 6,309,688 | | | 114,826 | | | 6,309,688 | |

Discover Financial Services | | | | 50,482 | | | 2,263,613 | | | 194,476 | | | 8,720,304 | | | 244,958 | | | 10,983,917 | |

Ezcorp, Inc. - Class A (a) | | | | - | | | - | | | 69,990 | | | 1,490,787 | | | 69,990 | | | 1,490,787 | |

First Cash Financial Services, Inc. (a) | | | | - | | | - | | | 34,457 | | | 2,010,221 | | | 34,457 | | | 2,010,221 | |

Portfolio Recovery Associates, Inc. (a) | | | | - | | | - | | | 14,941 | | | 1,896,312 | | | 14,941 | | | 1,896,312 | |

SLM Corp. | | | | - | | | - | | | 238,365 | | | 4,881,715 | | | 238,365 | | | 4,881,715 | |

| | | | | | | 2,263,613 | | | | | | 28,994,502 | | | | | | 31,258,115 | |

Distributors | | 0.15 | % | | | | | | | | | | | | | | | | | |

Dogus Otomotiv Servis ve Ticaret AS (a)(b) | | | | - | | | - | | | 45,813 | | | 287,679 | | | 45,813 | | | 287,679 | |

Imperial Holdings, Ltd. (b) | | | | - | | | - | | | 7,793 | | | 178,319 | | | 7,793 | | | 178,319 | |

Jardine Cycle & Carriage, Ltd. (b) | | | | 16,000 | | | 661,633 | | | 9,000 | | | 372,169 | | | 25,000 | | | 1,033,802 | |

| | | | | | | 661,633 | | | | | | 838,167 | | | | | | 1,499,800 | |

Diversified Financial Services | | 2.51 | % | | | | | | | | | | | | | | | | | |

Bank of America Corp. | | | | 112,889 | | | 1,374,988 | | | - | | | - | | | 112,889 | | | 1,374,988 | |

CBOE Holdings, Inc. | | | | - | | | - | | | 101,486 | | | 3,748,893 | | | 101,486 | | | 3,748,893 | |

Citigroup, Inc. | | | | 30,186 | | | 1,335,429 | | | - | | | - | | | 30,186 | | | 1,335,429 | |

CME Group, Inc. | | | | - | | | - | | | 61,376 | | | 3,767,873 | | | 61,376 | | | 3,767,873 | |

Fubon Financial Holding Co., Ltd. (b) | | | | - | | | - | | | 221,000 | | | 317,169 | | | 221,000 | | | 317,169 | |

Interactive Brokers Group, Inc. | | | | - | | | - | | | 181,168 | | | 2,701,215 | | | 181,168 | | | 2,701,215 | |

JPMorgan Chase & Co. | | | | 65,723 | | | 3,119,213 | | | - | | | - | | | 65,723 | | | 3,119,213 | |

McGraw-Hill Cos, Inc. | | | | - | | | - | | | 37,893 | | | 1,973,467 | | | 37,893 | | | 1,973,467 | |

Moody’s Corp. | | | | 20,950 | | | 1,117,054 | | | 114,138 | | | 6,085,838 | | | 135,088 | | | 7,202,892 | |

| | | | | | | 6,946,684 | | | | | | 18,594,455 | | | | | | 25,541,139 | |

Diversified Telecommunication | | 0.38 | % | | | | | | | | | | | | | | | | | |

CenturyLink, Inc. | | | | 24,212 | | | 850,567 | | | - | | | - | | | 24,212 | | | 850,567 | |

China Communication Services Corp., Ltd. (b) | | | | - | | | - | | | 366,000 | | | 236,966 | | | 366,000 | | | 236,966 | |

China Telecom Corp., Ltd. - ADR | | | | - | | | - | | | 4,064 | | | 206,614 | | | 4,064 | | | 206,614 | |

Hutchison Telecommunications Hong Kong Holdings, Ltd. (b) | | | | - | | | - | | | 210,000 | | | 104,010 | | | 210,000 | | | 104,010 | |

Rostelecom OJSC - ADR | | | | - | | | - | | | 14,713 | | | 352,410 | | | 14,713 | | | 352,410 | |

Telekomunikasi Indonesia Persero Tbk PT - ADR | | | | - | | | - | | | 9,753 | | | 439,665 | | | 9,753 | | | 439,665 | |

Verizon Communications, Inc. | | | | 33,631 | | | 1,652,964 | | | - | | | - | | | 33,631 | | | 1,652,964 | |

| | | | | | | 2,503,531 | | | | | | 1,339,665 | | | | | | 3,843,196 | |

Electric Utilities | | 0.11 | % | | | | | | | | | | | | | | | | | |

PGE SA (b) | | | | - | | | - | | | 56,418 | | | 290,289 | | | 56,418 | | | 290,289 | |

Tauron Polska Energia SA (b) | | | | 415,602 | | | 546,794 | | | 231,852 | | | 305,040 | | | 647,454 | | | 851,834 | |

| | | | | | | 546,794 | | | | | | 595,329 | | | | | | 1,142,123 | |

Electrical Equipment | | 0.16 | % | | | | | | | | | | | | | | | | | |

Eaton Corp PLC (b) | | | | 26,815 | | | 1,642,419 | | | - | | | - | | | 26,815 | | | 1,642,419 | |

Electronic Equipment, Instruments & Components | | 0.21 | % | | | | | | | | | | | | | | | | | |

Delta Electronics Thailand PCL (b) | | | | - | | | - | | | 335,900 | | | 422,787 | | | 335,900 | | | 422,787 | |

Digital China Holdings, Ltd. (b) | | | | - | | | - | | | 328,000 | | | 444,886 | | | 328,000 | | | 444,886 | |

Hitachi (b) | | | | 174,000 | | | 1,015,815 | | | - | | | - | | | 174,000 | | | 1,015,815 | |

Hon Hai Precision Industry Co., Ltd. (b) | | | | - | | | - | | | 104,000 | | | 289,434 | | | 104,000 | | | 289,434 | |

| | | | | | | 1,015,815 | | | | | | 1,157,107 | | | | | | 2,172,922 | |

Energy Equipment & Services | | 0.25 | % | | | | | | | | | | | | | | | | | |

Ensco PLC (b) | | | | 17,046 | | | 1,022,760 | | | - | | | - | | | 17,046 | | | 1,022,760 | |

National Oilwell Varco, Inc. | | | | 21,126 | | | 1,494,665 | | | - | | | - | | | 21,126 | | | 1,494,665 | |

| | | | | | | 2,517,425 | | | | | | - | | | | | | 2,517,425 | |

Food & Staples Retailing | | 3.08 | % | | | | | | | | | | | | | | | | | |

BIM Birlesik Magazalar AS (b) | | | | 12,989 | | | 633,111 | | | 6,296 | | | 306,880 | | | 19,285 | | | 939,991 | |

Costco Wholesale Corp. | | | | 9,895 | | | 1,049,958 | | | - | | | - | | | 9,895 | | | 1,049,958 | |

CVS Caremark Corp. | | | | 40,397 | | | 2,221,431 | | | 208,270 | | | 11,452,768 | | | 248,667 | | | 13,674,199 | |

Eurocash SA (b) | | | | - | | | - | | | 22,520 | | | 367,497 | | | 22,520 | | | 367,497 | |

Grupo Comercial Chedraui SA de CV (b) | | | | - | | | - | | | 32,000 | | | 108,269 | | | 32,000 | | | 108,269 | |

Magnit OJSC (b) | | | | - | | | - | | | 8,879 | | | 402,003 | | | 8,879 | | | 402,003 | |

Walgreen Co. | | | | - | | | - | | | 262,553 | | | 12,518,527 | | | 262,553 | | | 12,518,527 | |

Wal-Mart Stores, Inc. | | | | 29,009 | | | 2,170,744 | | | - | | | - | | | 29,009 | | | 2,170,744 | |

| | | | | | | 6,075,244 | | | | | | 25,155,944 | | | | | | 31,231,188 | |

Food Products | | 0.52 | % | | | | | | | | | | | | | | | | | |

AVI, Ltd. (b) | | | | - | | | - | | | 39,887 | | | 232,924 | | | 39,887 | | | 232,924 | |

Biostime International Holdings, Ltd. (b) | | | | - | | | - | | | 47,000 | | | 245,476 | | | 47,000 | | | 245,476 | |

Bunge, Ltd. | | | | 19,583 | | | 1,445,813 | | | - | | | - | | | 19,583 | | | 1,445,813 | |

ConAgra Foods, Inc. | | | | 35,475 | | | 1,270,360 | | | - | | | - | | | 35,475 | | | 1,270,360 | |

Golden Agri-Resources, Ltd. (b) | | | | - | | | - | | | 616,000 | | | 288,263 | | | 616,000 | | | 288,263 | |

Lotte Samkang Co., Ltd. (a)(b) | | | | - | | | - | | | 580 | | | 425,621 | | | 580 | | | 425,621 | |

Thai Union Frozen Products PCL (b) | | | | - | | | - | | | 146,400 | | | 317,256 | | | 146,400 | | | 317,256 | |

Tongaat Hulett, Ltd. (b) | | | | - | | | - | | | 25,886 | | | 403,831 | | | 25,886 | | | 403,831 | |

Viscofan SA (b) | | | | 11,624 | | | 609,495 | | | - | | | - | | | 11,624 | | | 609,495 | |

| | | | | | | 3,325,668 | | | | | | 1,913,371 | | | | | | 5,239,039 | |

B-6

| | | | | | | | | | | | | | | | | | | | |

| | | | Leuthold Asset

Allocation Fund | | Leuthold Core

Investment Fund | | Leuthold Core Investment Fund

Pro Forma Combined |

| | | | Shares | | Fair Value | | Shares | | Fair Value | | Shares | | Fair Value |

Gas Utilities | | 0.03 | % | | | | | | | | | | | | | | | | | |

Perusahaan Gas Negara Persero Tbk PT (b) | | | | - | | | - | | | 460,500 | | | 282,596 | | | 460,500 | | | 282,596 | |

| | | | | | | | | | | | | | | | | | | | |

Health Care Equipment & Supplies | | 6.55 | % | | | | | | | | | | | | | | | | | |

Biosensors International Group, Ltd. (a)(b) | | | | - | | | - | | | 288,000 | | | 303,955 | | | 288,000 | | | 303,955 | |

Mindray Medical International, Ltd. - ADR | | | | - | | | - | | | 4,377 | | | 174,818 | | | 4,377 | | | 174,818 | |

Zimmer Holdings, Inc. | | | | 10,997 | | | 827,194 | | | - | | | - | | | 10,997 | | | 827,194 | |

Aetna, Inc. | | | | 21,134 | | | 1,080,370 | | | - | | | - | | | 21,134 | | | 1,080,370 | |

Bangkok Dusit Medical Services PCL (b) | | | | - | | | - | | | 45,700 | | | 255,835 | | | 45,700 | | | 255,835 | |

Community Health Systems, Inc. | | | | - | | | - | | | 109,024 | | | 5,166,647 | | | 109,024 | | | 5,166,647 | |

DaVita HealthCare Partners, Inc. (a) | | | | 9,859 | | | 1,169,179 | | | 29,881 | | | 3,543,588 | | | 39,740 | | | 4,712,767 | |

Express Scripts Holding Co. (a) | | | | - | | | - | | | 122,214 | | | 7,045,637 | | | 122,214 | | | 7,045,637 | |

HCA Holdings, Inc. | | | | - | | | - | | | 108,216 | | | 4,396,816 | | | 108,216 | | | 4,396,816 | |

Health Management Associates, Inc. - Class A (a) | | | | - | | | - | | | 400,292 | | | 5,151,758 | | | 400,292 | | | 5,151,758 | |

HealthSouth Corp. (a) | | | | 44,672 | | | 1,178,001 | | | 78,066 | | | 2,058,601 | | | 122,738 | | | 3,236,602 | |

Humana, Inc. | | | | - | | | - | | | 41,456 | | | 2,865,024 | | | 41,456 | | | 2,865,024 | |

KPJ Healthcare Bhd (b) | | | | - | | | - | | | 75,900 | | | 145,386 | | | 75,900 | | | 145,386 | |

Life Healthcare Group Holdings, Ltd. (b) | | | | - | | | - | | | 102,665 | | | 386,307 | | | 102,665 | | | 386,307 | |

Magellan Health Services, Inc. (a) | | | | - | | | - | | | 49,532 | | | 2,356,237 | | | 49,532 | | | 2,356,237 | |

Omnicare, Inc. | | | | - | | | - | | | 128,406 | | | 5,228,692 | | | 128,406 | | | 5,228,692 | |

Quest Diagnostics, Inc. | | | | - | | | - | | | 57,069 | | | 3,221,545 | | | 57,069 | | | 3,221,545 | |

Shanghai Pharmaceuticals Holding Co., Ltd. (a)(b) | | | | - | | | - | | | 173,900 | | | 382,705 | | | 173,900 | | | 382,705 | |

UnitedHealth Group, Inc. | | | | 17,377 | | | 994,138 | | | 93,141 | | | 5,328,597 | | | 110,518 | | | 6,322,735 | |

Universal Health Services, Inc. - Class B | | | | - | | | - | | | 71,336 | | | 4,556,230 | | | 71,336 | | | 4,556,230 | |

VCA Antech, Inc. (a) | | | | - | | | - | | | 81,027 | | | 1,903,324 | | | 81,027 | | | 1,903,324 | |

WellCare Health Plans, Inc. (a) | | | | - | | | - | | | 39,841 | | | 2,309,184 | | | 39,841 | | | 2,309,184 | |

WellPoint, Inc. | | | | 18,336 | | | 1,214,393 | | | 49,263 | | | 3,262,689 | | | 67,599 | | | 4,477,082 | |

| | | | | | | 6,463,275 | | | | | | 60,043,575 | | | | | | 66,506,850 | |

Hotels Restaurants & Leisure | | 0.03 | % | | | | | | | | | | | | | | | | | |

Genting Bhd (b) | | | | - | | | - | | | 87,500 | | | 284,041 | | | 87,500 | | | 284,041 | |

| | | | | | | | | | | | | | | | | | | | |

Household Durables | | 0.14 | % | | | | | | | | | | | | | | | | | |

Even Construtora e Incorporadora SA (b) | | | | - | | | - | | | 69,500 | | | 332,582 | | | 69,500 | | | 332,582 | |

Ez Tec Empreendimentos e Participacoes SA (b) | | | | - | | | - | | | 14,700 | | | 196,558 | | | 14,700 | | | 196,558 | |

Haier Electronics Group Co., Ltd. (a)(b) | | | | 399,000 | | | 636,773 | | | 163,000 | | | 260,135 | | | 562,000 | | | 896,908 | |

| | | | | | | 636,773 | | | | | | 789,275 | | | | | | 1,426,048 | |

| | | | | | | | | | | | | | | | | | | | |

Independent Power Producers & | | 0.11 | % | | | | | | | | | | | | | | | | | |

AES Corp. | | | | 83,747 | | | 1,052,700 | | | - | | | - | | | 83,747 | | | 1,052,700 | |

First Gen Corp. (a)(b) | | | | - | | | - | | | 181,000 | | | 109,602 | | | 181,000 | | | 109,602 | |

| | | | | | | 1,052,700 | | | | | | 109,602 | | | | | | 1,162,302 | |

Industrial Conglomerates | | 0.39 | % | | | | | | | | | | | | | | | | | |

Bidvest Group, Ltd. (b) | | | | 23,264 | | | 613,239 | | | 7,180 | | | 189,265 | | | 30,444 | | | 802,504 | |

General Electric Co. | | | | 46,219 | | | 1,068,583 | | | - | | | - | | | 46,219 | | | 1,068,583 | |

Siemens AG - ADR | | | | 18,032 | | | 1,943,850 | | | - | | | - | | | 18,032 | | | 1,943,850 | |

Sigdo Koppers SA (b) | | | | - | | | - | | | 49,885 | | | 137,223 | | | 49,885 | | | 137,223 | |

| | | | | | | 3,625,672 | | | | | | 326,488 | | | | | | 3,952,160 | |

Insurance | | 1.07 | % | | | | | | | | | | | | | | | | | |

Allianz SE (b) | | | | 6,538 | | | 891,278 | | | - | | | - | | | 6,538 | | | 891,278 | |

Aon PLC (b) | | | | 19,898 | | | 1,223,727 | | | - | | | - | | | 19,898 | | | 1,223,727 | |

Berkshire Hathaway, Inc. (a) | | | | 20,054 | | | 2,089,627 | | | - | | | - | | | 20,054 | | | 2,089,627 | |

Brasil Insurance Participacoes e Administracao SA (b) | | | | - | | | - | | | 8,500 | | | 94,391 | | | 8,500 | | | 94,391 | |

Everest Re Group, Ltd. (b) | | | | 9,669 | | | 1,255,616 | | | - | | | - | | | 9,669 | | | 1,255,616 | |

Hyundai Marine & Fire Insurance Co., Ltd. (b) | | | | - | | | - | | | 8,120 | | | 233,264 | | | 8,120 | | | 233,264 | |

LIG Insurance Co., Ltd. (b) | | | | - | | | - | | | 22,220 | | | 474,483 | | | 22,220 | | | 474,483 | |

PICC Property & Casualty Co., Ltd. (a)(b) | | | | 442,000 | | | 569,757 | | | 668,000 | | | 861,081 | | | 1,110,000 | | | 1,430,838 | |

Powszechny Zaklad Ubezpieczen SA (b) | | | | - | | | - | | | 2,338 | | | 290,148 | | | 2,338 | | | 290,148 | |

Prudential Financial, Inc. | | | | 13,207 | | | 779,081 | | | - | | | - | | | 13,207 | | | 779,081 | |

Sun Life Financial, Inc. (b) | | | | 78,322 | | | 2,137,407 | | | - | | | - | | | 78,322 | | | 2,137,407 | |

| | | | | | | 8,946,493 | | | | | | 1,953,367 | | | | | | 10,899,860 | |

Internet & Catalog Retail | | 0.14 | % | | | | | | | | | | | | | | | | | |

priceline.com, Inc. (a) | | | | 2,093 | | | 1,439,837 | | | - | | | - | | | 2,093 | | | 1,439,837 | |

| | | | | | | | | | | | | | | | | | | | |

Internet Software & Services | | 0.67 | % | | | | | | | | | | | | | | | | | |

Baidu, Inc. - ADR (a) | | | | - | | | - | | | 4,029 | | | 353,343 | | | 4,029 | | | 353,343 | |

eBay, Inc. (a) | | | | 18,074 | | | 979,972 | | | - | | | - | | | 18,074 | | | 979,972 | |

Google, Inc. - Class A (a) | | | | 3,624 | | | 2,877,565 | | | - | | | - | | | 3,624 | | | 2,877,565 | |

NetEase, Inc. - ADR | | | | - | | | - | | | 8,546 | | | 468,065 | | | 8,546 | | | 468,065 | |

NHN Corp. (a)(b) | | | | - | | | - | | | 1,865 | | | 450,866 | | | 1,865 | | | 450,866 | |

Sohu.com, Inc. (a)(b) | | | | 13,686 | | | 678,962 | | | - | | | - | | | 13,686 | | | 678,962 | |

Yahoo!, Inc. (a) | | | | 40,720 | | | 958,142 | | | - | | | - | | | 40,720 | | | 958,142 | |

| | | | | | | 5,494,641 | | | | | | 1,272,274 | | | | | | 6,766,915 | |

IT Services | | 4.93 | % | | | | | | | | | | | | | | | | | |

Accenture PLC - Class A (b) | | | | 11,177 | | | 849,117 | | | 26,919 | | | 2,045,036 | | | 38,096 | | | 2,894,153 | |

Alliance Data Systems Corp. | | | | - | | | - | | | 12,114 | | | 1,961,135 | | | 12,114 | | | 1,961,135 | |

Amadeus IT Holding SA (b) | | | | 23,956 | | | 649,402 | | | - | | | - | | | 23,956 | | | 649,402 | |

Amdocs, Ltd. | | | | 22,938 | | | 831,503 | | | 51,416 | | | 1,863,830 | | | 74,354 | | | 2,695,333 | |

Cielo SA (b) | | | | - | | | - | | | 18,200 | | | 535,620 | | | 18,200 | | | 535,620 | |

Cognizant Technology Solutions Corp. - Class A (a) | | | | 13,203 | | | 1,011,482 | | | 25,304 | | | 1,938,539 | | | 38,507 | | | 2,950,021 | |

Convergys Corp. | | | | - | | | - | | | 94,756 | | | 1,613,695 | | | 94,756 | | | 1,613,695 | |

DST Systems, Inc. | | | | - | | | - | | | 26,112 | | | 1,861,002 | | | 26,112 | | | 1,861,002 | |

Fiserv, Inc. (a) | | | | - | | | - | | | 31,765 | | | 2,789,920 | | | 31,765 | | | 2,789,920 | |

Gartner, Inc. (a) | | | | - | | | - | | | 33,111 | | | 1,801,570 | | | 33,111 | | | 1,801,570 | |

Global Payments, Inc. | | | | - | | | - | | | 34,995 | | | 1,737,852 | | | 34,995 | | | 1,737,852 | |

International Business Machines Corp. | | | | 9,559 | | | 2,038,935 | | | 25,035 | | | 5,339,966 | | | 34,594 | | | 7,378,901 | |

Jack Henry & Associates, Inc. | | | | - | | | - | | | 48,186 | | | 2,226,675 | | | 48,186 | | | 2,226,675 | |

Mastercard, Inc. - Class A | | | | 3,800 | | | 2,056,294 | | | 8,076 | | | 4,370,166 | | | 11,876 | | | 6,426,460 | |

Sapient Corp. (a) | | | | - | | | - | | | 166,900 | | | 2,034,511 | | | 166,900 | | | 2,034,511 | |

Total System Services, Inc. | | | | - | | | - | | | 62,722 | | | 1,554,251 | | | 62,722 | | | 1,554,251 | |

Visa, Inc. - Class A | | | | 12,022 | | | 2,041,816 | | | 30,150 | | | 5,120,676 | | | 42,172 | | | 7,162,492 | |

Western Union Co. | | | | - | | | - | | | 106,062 | | | 1,595,173 | | | 106,062 | | | 1,595,173 | |

Wipro, Ltd. - ADR | | | | - | | | - | | | 23,862 | | | 241,006 | | | 23,862 | | | 241,006 | |

| | | | | | | 9,478,549 | | | | | | 40,630,623 | | | | | | 50,109,172 | |

B-7

| | | | | | | | | | | | | | | | | | | | |

| | | | Leuthold Asset

Allocation Fund | | Leuthold Core