CONFIDENTIAL WORKING DRAFT—FOR DISCUSSION PURPOSES ONLY

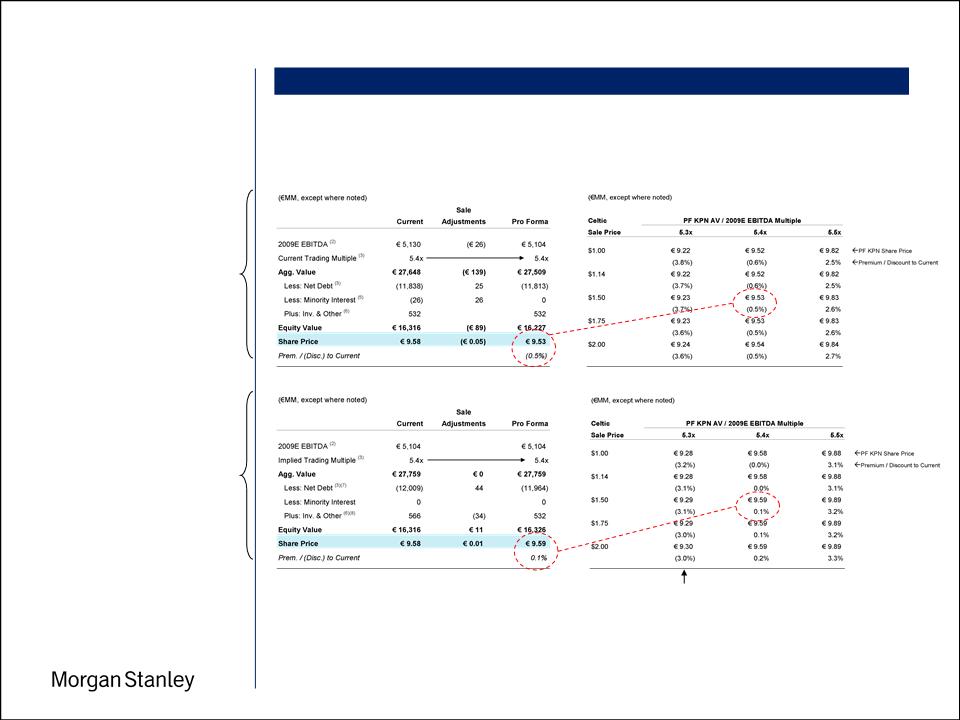

PF Share Price Sensitivity - Method B

PF Share Price Sensitivity - Method A

Pro Forma KPN Share Price - Method B

Pro Forma KPN Share Price - Method A

Source Wall Street Research, Public Filings

Hypothetical Sale of KPN’s Celtic Stake

Illustrative Pro Forma Value Impact to KPN (1)

Project Celtic

1

Notes

1. Illustrative analysis based on KPN share price of €9.58 and USD / EUR exchange rate of $1.36 as of 5/19/09

2. Current 2009E EBITDA as per Wall Street Research; Current EBITDA under Method B is reduced by Celtic’s 2009E EBITDA

3. Current AV / 2009E EBITDA multiple as of 5/19/09; balance sheet items as of 3/31/09 and also include unfunded pension liability as of 12/31/08

4. Adjustments are removal of €36MM Celtic cash and €16MM Celtic debt, with total KPN sale proceeds of €44MM assuming no tax impact

5. Represents market value of 44% minority ownership of Celtic as of 5/19/09

6. Represents KPN tax credit per Morgan Stanley Equity Research 4/20/09 and investments in associates at 3/31/09 book value (private companies)

7. Under Method B current net debt adjusted to remove €36MM of Celtic cash and €16MM of Celtic debt

8. Includes €34MM current market value of 56% KPN Celtic stake based on 5/19/09 share price of $1.14, which is removed for pro forma purposes

(4)

Current KPN Trading Multiple

Valuation Method A

• Assumes investors consolidate

Celtic and adjust for minority

interest when valuing KPN

– Sale adjustments include (a)

removing minority interest, (b)

deconsolidating Celtic’s net cash

position and EBITDA and (c)

including the proceeds from

selling Celtic

Valuation Method B

• Assumes investors treat Celtic as

an equity investment when valuing

KPN

– Sale adjustments include (a)

removing the value of the equity

investment and (b) adjusting net

debt to reflect the proceeds from

selling Celtic

Constant Multiple

Constant Multiple