CONFIDENTIAL WORKING DRAFT – FOR DISCUSSION PURPOSES ONLY

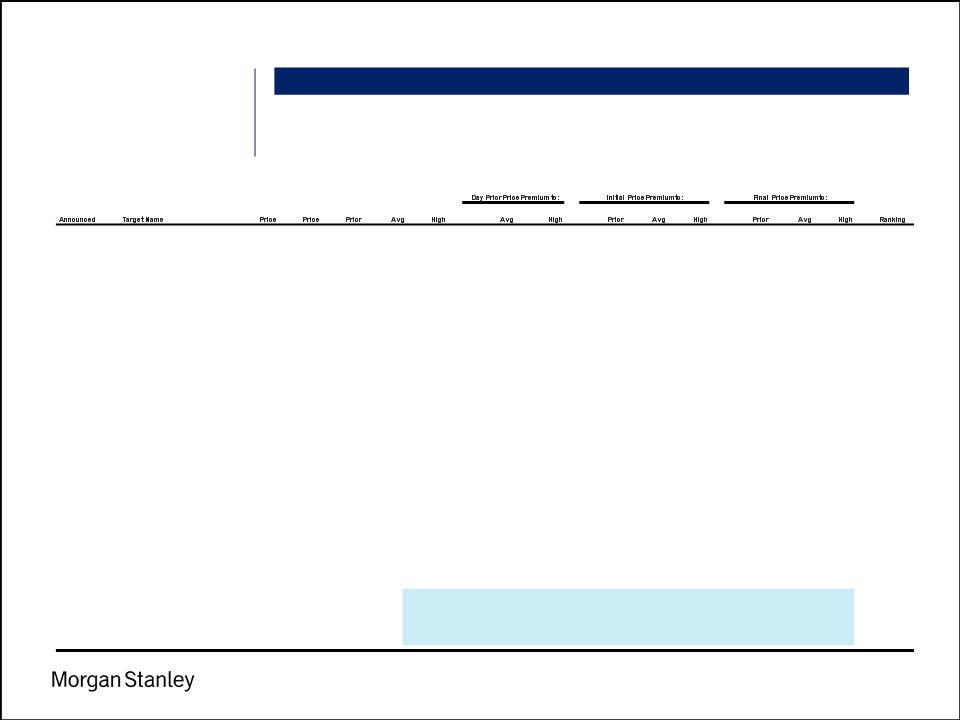

Summary of Implied Transaction Premiums

Implied Transaction Premiums vs. Stock Trading History

Project Celtic

1

• Analysis divides selected

precedents into quartiles based

on where the target’s stock was

trading relative to its trading

range during the 3 months

immediately prior to

announcement

Notes

1. Based on selected deals since 2001; all cash; US targets; minority buy-in value of $25 - $500MM; majority shareholder owned less than 90% of target

2. Final premium statistics exclude Hearst-Argyle transaction, which has not been completed

Minority Buy-in Precedents (1)

Source Public Filings, Press Releases, FactSet

Prior to announcement,

stock price was in bottom

quartile of its 3-month

trading range

Prior to announcement,

stock price was in top

quartile of its 3-month

trading range

No. of deals

11

2

4

9

Initial Premium to Prior Day Price:

Median Premium

35.6%

58.6%

28.1%

11.5%

Mean Premium

32.4%

58.6%

38.4%

14.2%

High Premium

60.0%

91.4%

97.5%

38.8%

Low Premium

8.6%

25.8%

0.0%

(7.9%)

Final Premium to Prior Day Price:

(2)

Median Premium

45.5%

29.6%

53.8%

23.9%

Mean Premium

48.3%

29.6%

56.3%

26.1%

High Premium

140.0%

29.6%

97.5%

52.9%

Low Premium

13.2%

29.6%

20.0%

6.7%