LOAN AGREEMENT

for a loan in the amount of

$8,000,000

among

ESC-ARBOR PLACE, LLC,

a Washington limited liability company

as Borrower

and

GENERAL ELECTRIC CAPITAL CORPORATION

as Agent and a Lender

and

THE OTHER FINANCIAL INSTITUTIONS WHO ARE OR HEREAFTER

BECOME PARTIES TO THIS AGREEMENT

as Lenders

Arbor Place Assisted Living

Dated as of June 30, 2006

TABLE OF CONTENTS

| | | | Page |

| ARTICLE I INCORPORATION OF RECITALS, EXHIBITS AND SCHEDULES | | | 2 |

| | Section 1.1 | Incorporation of Recitals. | 2 |

| | Section 1.2 | Incorporation of Exhibits and Schedules. | 2 |

| | Section 1.3 | Definitions. | 2 |

| ARTICLE II LOAN TERMS | | | 3 |

| | Section 2.1 | Disbursements. | 3 |

| | Section 2.2 | Interest Rate; Late Charge. | 3 |

| | Section 2.3 | Payments. | 3 |

| | Section 2.4 | Maturity. | 4 |

| | Section 2.5 | Prepayment. | 4 |

| | Section 2.6 | Application of Payments. | 4 |

| | Section 2.7 | Capital Adequacy; Increased Costs; Illegality. | 4 |

| | Section 2.8 | Sources and Uses. | 5 |

| | Section 2.9 | Defeasance. | 5 |

| | Section 2.10 | Security. | 8 |

| ARTICLE III INSURANCE, CONDEMNATION, AND IMPOUNDS | | | 8 |

| | Section 3.1 | Insurance. | 8 |

| | Section 3.2 | Use and Application of Insurance Proceeds. | 11 |

| | Section 3.3 | Condemnation Awards. | 12 |

| | Section 3.4 | Reserved. | 12 |

| | Section 3.5 | Real Estate Tax Impounds. | 12 |

| ARTICLE IV LEASING MATTERS | | | 13 |

| | Section 4.1 | Representations and Warranties on Leases. | 13 |

| | Section 4.2 | Approval Rights. | 14 |

| | Section 4.3 | Covenants. | 14 |

| | Section 4.4 | Tenant Estoppels. | 15 |

| | Section 4.5 | Security Deposits | 15 |

| ARTICLE V REPRESENTATIONS AND WARRANTIES | | | 15 |

| | Section 5.1 | Organization and Power. | 15 |

| | Section 5.2 | Guarantor/Master Tenant. | 16 |

| | Section 5.3 | Borrower's Operating Agreement. | 16 |

| | Section 5.4 | Corporate Documents. | 16 |

| | Section 5.5 | Validity of Loan Documents. | 17 |

| | Section 5.6 | Liabilities; Litigation. | 17 |

| | Section 5.7 | Taxes and Assessments. | 17 |

| | Section 5.8 | Other Agreements; Defaults. | 18 |

| | | TABLE OF CONTENTS | Page |

| | Section 5.9 | Compliance with Law. | 18 |

| | Section 5.10 | Condemnation. | 18 |

| | Section 5.11 | Access. | 18 |

| | Section 5.12 | Flood Hazard. | 18 |

| | Section 5.13 | Property. | 19 |

| | Section 5.14 | Location of Borrower. | 19 |

| | Section 5.15 | Margin Stock. | 19 |

| | Section 5.16 | Tax Filings. | 19 |

| | Section 5.17 | Solvency. | 19 |

| | Section 5.18 | Full and Accurate Disclosure. | 20 |

| | Section 5.19 | Single Purpose Entity. | 20 |

| | Section 5.20 | No Broker. | 20 |

| | Section 5.21 | Reserved. | 20 |

| | Section 5.22 | Labor Disputes. | 20 |

| | Section 5.23 | Employees. | 20 |

| | Section 5.24 | ERISA (Borrower). | 21 |

| | Section 5.25 | Intellectual Property. | 21 |

| | Section 5.26 | Anti-Terrorism and Anti-Money Laundering Compliance. | 21 |

| | Section 5.27 | Master Lease. | 23 |

| | Section 5.28 | Management Agreement. | 23 |

| | Section 5.29 | Master Tenant Purchase Contract. | 23 |

| | Section 5.30 | Approvals. | 23 |

| ARTICLE VI FINANCIAL REPORTING; NOTICES | | | 23 |

| | Section 6.1 | Financial Statements. | 23 |

| | Section 6.2 | Audits. | 25 |

| | Section 6.3 | Books and Records/Audits. | 25 |

| | Section 6.4 | Notice of Litigation or Default. | 25 |

| | Section 6.5 | Bank Accounts. | 26 |

| ARTICLE VII COVENANTS | | | 26 |

| | Section 7.1 | Inspection. | 27 |

| | Section 7.2 | Due on Sale and Encumbrance; Transfers of Interests. | 27 |

| | Section 7.3 | Taxes; Charges. | 28 |

| | Section 7.4 | Management. | 29 |

| | Section 7.5 | Operation; Maintenance; Inspection. | 29 |

| | Section 7.6 | Taxes on Security. | 29 |

| | Section 7.7 | Single Purpose Entity; Legal Existence; Name, Etc. | 29 |

| | Section 7.8 | Affiliate Transactions. | 30 |

| | Section 7.9 | Limitation on Other Debt. | 30 |

| | Section 7.10 | Further Assurances. | 30 |

| | Section 7.11 | Estoppel Certificates. | 31 |

| | Section 7.12 | Notice of Certain Events. | 31 |

| | Section 7.13 | Indemnification. | 31 |

| | Section 7.14 | Use of Proceeds, Revenues. | 31 |

| | Section 7.15 | Payments Under Master Lease. | 32 |

| | | TABLE OF CONTENTS | Page |

| | Section 7.16 | Reserved. | 32 |

| | Section 7.17 | Reserved. | 32 |

| | Section 7.18 | Reserved. | 32 |

| | Section 7.19 | Compliance with Laws and Contractual Obligations. | 32 |

| | Section 7.20 | Notice of Money Laundering. | 33 |

| | Section 7.21 | Anti-Terrorism and Anti-Money Laundering Compliance. | 33 |

| | Section 7.22 | Employees. | 35 |

| | Section 7.23 | Reserved. | 35 |

| | Section 7.24 | Representations and Warranties. | 35 |

| | Section 7.25 | Cooperation. | 35 |

| | Section 7.26 | Master Lease. | 36 |

| | Section 7.27 | Master Tenant Purchase Contracts. | 36 |

| | Section 7.28 | Financial Covenants. | 36 |

| ARTICLE VIII Health Care Matters | | | 36 |

| | Section 8.1 | Healthcare Laws. | 36 |

| | Section 8.2 | Representations, Warranties and Covenants Regarding Healthcare Matters. | 37 |

| | Section 8.3 | Cooperation. | 40 |

| ARTICLE IX EVENTS OF DEFAULT | | | 41 |

| | Section 9.1 | Payments. | 42 |

| | Section 9.2 | Certain Covenants. | 42 |

| | Section 9.3 | Covenants. | 42 |

| | Section 9.4 | Representations and Warranties. | 42 |

| | Section 9.5 | Other Encumbrances. | 42 |

| | Section 9.6 | Involuntary Bankruptcy or Other Proceeding. | 43 |

| | Section 9.7 | Voluntary Petitions, etc. | 43 |

| | Section 9.8 | Default Under Master Lease. | 43 |

| | Section 9.9 | Default Under Management Agreement. | 43 |

| | Section 9.10 | False Reports. | 43 |

| | Section 9.11 | Control. | 43 |

| | Section 9.12 | Money Laundering. | 44 |

| | Section 9.13 | Loan Documents. | 44 |

| | Section 9.14 | Arkansas Loan Documents. | 44 |

| | Section 9.15 | Other Defaults. | 44 |

| ARTICLE X REMEDIES | | | 44 |

| | Section 10.1 | Remedies - Insolvency Events. | 44 |

| | Section 10.2 | Remedies - Other Events. | 45 |

| | Section 10.3 | Agent's Right to Perform the Obligations. | 45 |

| ARTICLE XI MISCELLANEOUS | | | 46 |

| | Section 11.1 | Notices. | 46 |

| | Section 11.2 | Amendments and Waivers. | 47 |

| | Section 11.3 | Limitation on Interest. | 47 |

| | Section 11.4 | Invalid Provisions. | 48 |

| | | TABLE OF CONTENTS | Page |

| | Section 11.5 | Reimbursement of Expenses; Portfolio Administration Fee. | 48 |

| | Section 11.6 | Approvals; Third Parties; Conditions. | 49 |

| | Section 11.7 | Lender Not in Control; No Partnership. | 49 |

| | Section 11.8 | Time of the Essence. | 50 |

| | Section 11.9 | Successors and Assigns. | 50 |

| | Section 11.10 | Renewal, Extension or Rearrangement. | 50 |

| | Section 11.11 | Waivers; Forbearance. | 50 |

| | Section 11.12 | Cumulative Rights. | 51 |

| | Section 11.13 | Singular and Plural. | 51 |

| | Section 11.14 | Phrases. | 51 |

| | Section 11.15 | Exhibits and Schedules. | 51 |

| | Section 11.16 | Titles of Articles, Sections and Subsections. | 52 |

| | Section 11.17 | Promotional Material. | 52 |

| | Section 11.18 | Survival. | 52 |

| | Section 11.19 | WAIVER OF JURY TRIAL. | 52 |

| | Section 11.20 | Waiver of Punitive or Consequential Damages. | 53 |

| | Section 11.21 | Governing Law. | 53 |

| | Section 11.22 | Entire Agreement. | 53 |

| | Section 11.23 | Counterparts. | 53 |

| | Section 11.24 | Venue. | 53 |

| | Section 11.25 | Sale of Loan, Participation. | 54 |

| | Section 11.26 | Limitation on Liability of Agent's and Lender's Officers, Employees, etc. | 54 |

| | Section 11.27 | Effectiveness of Facsimile Documents and Signatures. | 54 |

| | Section 11.28 | Agency. | 54 |

LIST OF EXHIBITS AND SCHEDULES TO LOAN AGREEMENT

Exhibits:

Exhibit A Real Property

Exhibit B Form of Interest Holder Agreement

Exhibit C Intellectual Property

Exhibit D Ownership of Borrower

Exhibit E Provider Payment/Reimbursement Programs

Exhibit F Governmental Approvals

Exhibit G Master Tenant Organizational Chart

Schedules:

Schedule 2.1 Advance Conditions

Schedule 2.3 Amortization Schedule

Schedule 2.8 Sources and Uses

Schedule 3.1 Insurance Exceptions

Schedule I Certain Definitions

Schedule II Calculation of Net Operating Income

INDEX OF DEFINED TERMS

| Adjusted Actual Rent - Sch. II | 9 | | Leases - Sch. 2.1 | 3 |

| Agent | 1 | | Lender | 1 |

| Anti-Money Laundering Laws | 22 | | Licenses | 37 |

| Anti-Money Laundering Measures | 22 | | Lists | 22 |

| Anti-Terrorism Laws | 22 | | Management Agreement | 2 |

| Arkansas Amendment Documents | 1 | | Master Lease | 2 |

| Arkansas Borrower | 1 | | Master Tenant | 2 |

| Arkansas Loan | 1 | | Master Tenant Acquisition | 28 |

| Arkansas Loan Agreement | 1 | | Master Tenant LLC Agreement | 16 |

| Arkansas Loan Documents | 2 | | Master Tenant Purchase Contracts | 28 |

| Arkansas Mortgage Amendments | 1 | | Monthly Effective Rent - Sch. II | 9 |

| Arkansas Mortgages | 1 | | Monthly Reports | 24 |

| Arkansas Note | 1 | | Net Operating Income - Sch. II | 9 |

| Assignment Agreement | 7 | | Note | 1 |

| Assignment of Membership Interests - | | | Occupancy | 36 |

| Sch. 2.1 | 1 | | OFAC | 21 |

| Bankruptcy Party | 43 | | OFAC Laws and Regulations | 22 |

| Borrower | 1 | | Operating Agreement | 16 |

| Borrower Anti-Terrorism Policies | 34 | | Other Lists | 21 |

| BSA | 22 | | Permitted Debt | 30 |

| Charges | 28 | | Prepayment Premium | 4 |

| Collateral | 8 | | Project | 1 |

| CON | 37 | | Property | 1 |

| Defeasance | 5 | | Release Date | 5 |

| Defeasance Deposit | 7 | | Rent Proceeds | 32 |

| Designated Person | 22 | | Revenue - Sch. II | 9 |

| Event of Default | 44 | | Scheduled Defeasance Payments | 7 |

| Executive Orders | 22 | | SDN List | 21 |

| Expenses - Sch. II | 9 | | Secondary Market Transactions | 35 |

| FIRREA - Sch. 2.1 | 4 | | Security Agreement | 6 |

| fiscal month | 24 | | State Regulator | 33 |

| Funding Amount | 3 | | Subordination Agreement - Sch. 2.1 | 1 |

| GECC | 1 | | Subordination Amendment | 1 |

| Healthcare Laws | 36 | | Successor Borrower | 7 |

| HIPAA | 36 | | Tax Impound | 12 |

| HIPAA Compliance Date | 37 | | Taxes | 12 |

| HIPAA Compliance Plan | 37 | | Terrorism | 9 |

| HIPAA Compliant | 37 | | Third-Party Payor Programs | 39 |

| Improvements | 1 | | Title Policy - Sch. 2.1 | 2 |

| Incorporation Documents | 16 | | U.S. Obligations | 8 |

| Interest Holder Agreement | 33 | | U.S. Publicly-Traded Entity | 22 |

| Interest Rate | 3 | | Violation | 21 |

| Investor Anti-Terrorism Policies | 34 | | Yield Maintenance Amount | 8 |

LOAN AGREEMENT

This Loan Agreement is entered into as of June 30, 2006, among GENERAL ELECTRIC CAPITAL CORPORATION, a Delaware corporation (in its individual capacity, "GECC" and in its capacity as agent for the Lenders, together with its successors, "Agent"), the financial institutions other than GECC who are or hereafter become parties to this Agreement (together with GECC collectively, or individually, as the context may require, "Lender"), and ESC-ARBOR PLACE, LLC, a Washington limited liability company ("Borrower").

RECITALS

A. Lender and Agent have agreed to make the Loan to Borrower subject to the terms and conditions contained herein. The Loan is evidenced by that certain Promissory Note of even date herewith in the original principal amount of Eight Million and No/100 Dollars ($8,000,000.00) (the Promissory Note and all amendments thereto and substitutions therefor are hereinafter referred to collectively as the "Note"). The terms and provisions of the Note are hereby incorporated herein by reference in this Agreement.

B. On the Closing Date, Borrower will be the owner of the real property more particularly described on Exhibit A attached hereto (the "Property"), and the Improvements located thereon (collectively, the "Improvements"), including, without limitation, an assisted living facility. The Property, together with the Improvements, are referred to herein as the "Project."

C. On or about December 1, 2005, Lender made a loan (the "Arkansas Loan") to Emeritus Properties-Arkansas, LLC, a Delaware limited liability company ("Arkansas Borrower") in the original principal amount of Fifteen Million Nine Hundred Thirty Thousand and No/100 Dollars ($15,930,000.00). The Arkansas Loan is evidenced by, among other things (i) that certain Promissory Note dated December 1, 2005, in the original principal amount of Fifteen Million Nine Hundred Thirty Thousand and No/100 Dollars ($15,930,000.00) made by Arkansas Borrower in favor of Lender (the "Arkansas Note"), (ii) that certain Loan Agreement dated December 1, 2005, by and between Arkansas Borrower, Agent and Lender (the "Arkansas Loan Agreement"), and (iii) those three (3) Mortgages, Assignments of Rents and Security Agreements dated December 1, 2005, from Arkansas Borrower in favor of Agent (collectively, the "Arkansas Mortgages"). Concurrently herewith, Arkansas Borrower and/or Guarantor and Agent are executing (i) those certain First Amendments to Mortgage, Assignment of Rents and Security Agreement (collectively, the "Arkansas Mortgage Amendments"), (ii) that certain First Amendment to Loan Agreement, and (iii) that certain First Amendment to Subordination, Attornment and Security Agreement (the "Subordination Amendment") (the First Amendment to Loan Agreement, together with the Arkansas Mortgage Amendments, the Subordination Amendment and any other documents executed in connection therewith are collectively referred to herein as the "Arkansas Amendment Documents"). The Arkansas Note, the Arkansas Loan Agreement, the Arkansas Mortgages, the Guaranty of Payment and Performance dated December 1, 2005, from Guarantor in favor of Agent, the Subordination, Attornment and Security Agreement dated December 1, 2005, by and among Guarantor, Arkansas Borrower and Agent, and any other documents evidencing or securing the

Arkansas Loan or executed in connection therewith, as amended by the Arkansas Amendment Documents, and any further modifications, renewals and extensions thereof, are referred to herein collectively as the "Arkansas Loan Documents."

D. The Project is master leased to Silver Lake Assisted Living LLC, a Washington limited liability company ("Master Tenant") pursuant to a Lease Agreement (the "Master Lease") of even date herewith between Borrower and Master Tenant. Master Tenant and Guarantor are parties to a certain Management Agreement dated September 1, 1998 (the "Management Agreement"), pursuant to which Guarantor provides certain property management services to the Project.

E. Borrower will use the proceeds of the Loan for the purpose of acquiring the Project.

F. Borrower's obligations under the Loan will be evidenced and secured by, the Loan Documents.

NOW, THEREFORE, in consideration of the foregoing and the mutual conditions and agreements contained herein, the parties agree as follows:

ARTICLE I

INCORPORATION OF RECITALS, EXHIBITS AND SCHEDULES

Section 1.1 Incorporation of Recitals.

The foregoing preambles and all other recitals set forth herein are made a part hereof by this reference.

Section 1.2 Incorporation of Exhibits and Schedules.

The Exhibits and Schedules to this Agreement are attached hereto and are incorporated in this Agreement and expressly made a part hereof by this reference.

Section 1.3 Definitions.

All terms defined in Schedule I or otherwise in this Agreement shall, unless otherwise defined therein, have the same meanings when used in any other Loan Document, or any certificate or other document made or delivered pursuant hereto. The words "hereof", "herein", and "hereunder" and words of similar import when used in this Agreement shall refer to this Agreement as a whole.

ARTICLE II

LOAN TERMS

Section 2.1 Disbursements.

Funding. The Loan shall be funded in one advance and repaid in accordance with this Agreement and the other Loan Documents. On the Closing Date, and subject to the terms, provisions and conditions of this Agreement (including, without limitation Borrower's satisfaction of the conditions to initial advance described in Schedule 2.1 attached hereto) and the other Loan Documents, Lender shall disburse to Borrower from the proceeds of the Loan the amount of Eight Million and No/100 Dollars ($8,000,000.00) (the "Funding Amount").

Section 2.2 Interest Rate; Late Charge.

The outstanding principal balance of the Loan (including any amounts added to principal under the Loan Documents) shall bear interest at a rate of interest equal to seven and two hundred twenty-nine thousandths of one percent (7.229%) per annum (the "Interest Rate"). Interest shall be computed on the basis of a fraction, the denominator of which is three hundred sixty (360) and the numerator of which is the actual number of days elapsed from the date of the initial advance or the date on which the immediately preceding payment was due. If Borrower fails to pay any installment of interest or principal within five (5) days after the date on which the same is due, Borrower shall pay to Agent a late charge on such past-due amount, as liquidated damages and not as a penalty, equal to the greater of (a) interest at the Default Rate on such amount from the date when due until paid, and (b) five percent (5%) of such amount, but not in excess of the maximum amount of interest allowed by applicable law. While any Event of Default exists, the Loan shall bear interest at the Default Rate.

Section 2.3 Payments.

(a) Payments at Interest Rate. Commencing on August 1, 2006, Borrower shall pay interest in arrears on the first day of each month until all amounts due under the Loan Documents are paid in full. If the first day of a month is not a Business Day, then the applicable payment due hereunder shall be made on the first Business Day immediately following the first day of such month.

(b) Principal Amortization Payments. Commencing on August 1, 2006, and on the first (1st) day of each month thereafter until the Maturity Date, Borrower shall make a monthly principal amortization payment in accordance with Schedule 2.3 in addition to the interest payments required under Section 2.3(a), above. If the first day of a month is not a Business Day, then the applicable payment due hereunder shall be made on the first Business Day immediately following the first day of such month.

(c) Credit for Payments under Master Lease. Agent acknowledges and agrees that Master Tenant, in its capacity as the tenant under the Master Lease, has been

directed to make its rent payments directly to Agent to be applied against the obligations of Borrower under the Loan Agreement and the other Loan Documents and that Borrower shall be deemed to have fulfilled its obligations under this Section 2.3 as long as Agent has actually received such payments from Master Tenant, in its capacity as the tenant under the Master Lease, by the date on which any payment is due from Borrower under this Section 2.3 and such payments (after application to the Indebtedness as set forth in Section 2.6 herein) is sufficient to pay in full any amounts then due and payable under this Section 2.3.

Section 2.4 Maturity.

Maturity Date. The Loan shall mature and Borrower shall pay to Agent all outstanding principal, accrued and unpaid interest, and any other amounts due under the Loan Documents on June 30, 2013.

Section 2.5 Prepayment.

Borrower may not prepay any of the outstanding principal balance of the Loan in full or in part at any time. If the Loan is accelerated for any reason other than casualty or condemnation, Borrower shall pay, in addition to all other amounts outstanding under the Loan Documents, a prepayment premium ("Prepayment Premium") equal to one percent (1%) of the outstanding principal balance of the Loan. Defeasance pursuant to Section 2.9 below shall be available to Borrower at any time on and after July 1, 2008, as provided herein.

Section 2.6 Application of Payments.

All payments received by Agent or Lender under the Loan Documents shall be applied: first, to any fees, expenses and indemnification payments due to Agent or Lender under the Loan Documents; second, to any Default Rate interest or late charges; third, to other accrued and unpaid interest; fourth, to the principal sum and other amounts due under the Loan Documents, and fifth to the Prepayment Premium.

Section 2.7 Capital Adequacy; Increased Costs; Illegality.

(a) If Agent determines that any law, treaty, governmental (or quasi-governmental) rule, regulation, guideline or order regarding capital adequacy, reserve requirements or similar requirements or compliance by Lender with any request or directive regarding capital adequacy, reserve requirements or similar requirements (whether or not having the force of law), in each case, adopted after the Closing Date, from any central bank or other governmental authority increases or would have the effect of increasing the amount of capital, reserves or other funds required to be maintained by Lender and thereby reducing the rate of return on Lender's capital as a consequence of its obligations hereunder, then Borrower shall from time to time upon demand by Agent, pay to Lender, additional amounts sufficient to compensate Lender for such reduction. A certificate as to the amount of that reduction and showing the basis of the computation thereof submitted by Agent to Borrower shall, absent manifest error, be final, conclusive and binding for all purposes. Lender agrees

that, as promptly as practicable after it becomes aware of any circumstances referred to above which would result in any such increased cost, Lender shall, to the extent not inconsistent with such Lender's internal policies of general application, use reasonable commercial efforts to minimize costs and expenses incurred by it and payable to it by Borrower pursuant to this Section 2.7(a).

(b) If, due to either (i) the introduction of or any change in any law or regulation (or any change in the interpretation thereof) or (ii) the compliance with any guideline or request from any central bank or other governmental authority (whether or not having the force of law), in each case adopted after the Closing Date, there shall be any increase in the cost to Lender of agreeing to make or making, funding or maintaining the Loan, then Borrower shall from time to time, upon demand by Agent, pay to Lender, additional amounts sufficient to compensate Lender for such increased cost. A certificate as to the amount of such increased cost, submitted to Borrower by Agent, shall be conclusive and binding on Borrower for all purposes, absent manifest error. Lender agrees that, as promptly as practicable after it becomes aware of any circumstances referred to above which would result in any such increased cost, Lender shall, to the extent not inconsistent with such Lender's internal policies of general application, use reasonable commercial efforts to minimize costs and expenses incurred by it and payable to it by Borrower pursuant to this Section 2.7(b).

Section 2.8 Sources and Uses.

The sources and uses of funds for the contemplated transaction are as described on Schedule 2.8 attached hereto. Borrower shall deliver such information and documentation as Agent shall request to verify that the sources and uses are as indicated on Schedule 2.8. A reduction in the amounts necessary for any of the uses may, at Agent's election, result in an equal reduction in the amount of the Loan.

Section 2.9 Defeasance.

At any time from and after July 1, 2008, so long as no monetary default, material non-monetary default or Event of Default hereunder or under any of the other Loan Documents is then continuing, Borrower may obtain the release of the Project from the lien of the Security Document upon the satisfaction of the following conditions precedent ("Defeasance"):

(a) not less than thirty (30) days prior written notice to Lender specifying the first day of a calendar month (or if not a Business Day, the first Business Day of such calendar month) (the "Release Date") on which the Defeasance Deposit (hereinafter defined) is to be made;

(b) the payment to Agent on the Release Date of interest accrued and unpaid on the principal balance of the Loan to and including the Release Date;

(c) the payment to Agent on the Release Date of all other sums, not including scheduled interest or principal payments, due under the Note, the Mortgages and the other Loan Documents;

(d) the payment to Agent on the Release Date of the Defeasance Deposit and a $2,500 non-refundable processing fee;

(e) the delivery by Borrower to Agent at Borrower's sole cost and expense of:

(i) a security agreement in form and substance satisfactory to Lender, creating a first priority lien in favor of Agent on the Defeasance Deposit and the U.S. Obligations (hereinafter defined) purchased on behalf of Borrower with the Defeasance Deposit in accordance with this Section 2.9 (the "Security Agreement");

(ii) releases of the Project from the lien of the Mortgages (for execution by Lender) in a form appropriate for the jurisdiction in which the Project is located and otherwise acceptable to Agent;

(iii) an officer's certificate of Borrower certifying that the requirements set forth in this clause (e) have been satisfied;

(iv) an opinion of counsel in form and substance, and rendered by counsel, satisfactory to Agent, at Borrower's expense, stating, among other things, that Agent has a perfected first priority security interest in the Defeasance Deposit and the U.S. Obligations purchased by or on behalf of Borrower and pledged to Agent and as to enforceability of the Assignment Agreement (as hereinafter defined), the Security Agreement and other documents delivered in connection therewith, and if required by the Agent, a substantive non-consolidation opinion with respect to the Successor Borrower (as hereinafter defined); and

(v) such other certificates, documents, opinions or instruments as Agent may reasonably request; and

(f) Agent shall have received, at Borrower's expense, a certificate from a nationally or regionally recognized independent certified public accountant acceptable to Agent, in form and substance satisfactory to Lender, certifying the amount of U.S. Obligations required to be purchased with the Defeasance Deposit in order to generate sufficient sums to satisfy the obligations of Borrower under this Agreement, the Note and this Section 2.9 as and when such obligations become due.

In connection with the conditions set forth above, Borrower hereby appoints Agent as its agent and attorney-in-fact for the purpose of using the Defeasance Deposit to purchase or cause to be purchased U.S. Obligations which provide payments on or prior to, but as close as possible to, all successive scheduled Payment Dates after the Release Date

upon which interest and principal payments are required under this Agreement and the Note, including the amounts due on the Maturity Date, and in amounts equal to the scheduled payments due on such dates under this Agreement and the Note plus Agent's reasonable estimate of administrative expenses and applicable federal income taxes associated with or to be incurred by the Successor Borrower during the remaining term of, and applicable to, the Loan (the "Scheduled Defeasance Payments"). Borrower, pursuant to the Security Agreement or other appropriate document, shall authorize and direct that the payments received from the U.S. Obligations may be made directly to Agent and applied to satisfy the obligations of Borrower under this Agreement, the Note and this Section 2.9.

Upon compliance with the requirements of this Section 2.9, the Project shall be released from the lien of the Security Document and the pledged U.S. Obligations shall be the sole source of collateral securing the repayment of the Loan and the Note. Any portion of the Defeasance Deposit in excess of the amount necessary to purchase the U.S. Obligations required by the preceding paragraph and to otherwise satisfy the Borrower's obligations under this Section 2.9 shall be remitted to Borrower with the release of the Project from the lien of the Security Document. In connection with such release, a successor entity meeting Agent's then applicable single purpose entity requirements and otherwise acceptable to Agent, adjusted, as applicable, for the Defeasance contemplated by this Section 2.9 (the "Successor Borrower"), shall be established by Borrower subject to Agent's approval (or at Agent's option, by Agent) and Borrower shall transfer and assign all obligations, rights and duties under and to the Note together with the pledged U.S. Obligations to such Successor Borrower pursuant to an assignment and assumption agreement in form and substance satisfactory to Lender (the "Assignment Agreement"). Such Successor Borrower shall assume the obligations under the Note, the Security Agreement and the other Loan Documents and Borrower shall be relieved of its obligations thereunder, except (i) that Borrower shall be required to perform its obligations pursuant to this Section 2.9, including maintenance of the Successor Borrower, if applicable, and (ii) for those obligations of Borrower which expressly survive repayment of the Loan. Borrower shall pay $1,000.00 to any such Successor Borrower as consideration for assuming the obligations under the Note, the Security Agreement and the other Loan Documents pursuant to the Assignment Agreement. Borrower shall pay all reasonable costs and expenses incurred by Agent and Lender in connection with this Section 2.9, including Agent's and Lender's reasonable attorneys' fees and expenses, and any administrative and tax expenses associated with or incurred by the Successor Borrower, which amounts shall, as set forth above, be included when calculating the amount of the Defeasance Deposit.

For purposes of this Section 2.9, the following terms shall have the following meanings:

(x) The term "Defeasance Deposit" shall mean an amount equal to the Yield Maintenance Amount, any costs and expenses incurred or to be incurred in the purchase of U.S. Obligations necessary to meet the Scheduled Defeasance Payments (including Lender's reasonable estimate of administrative expenses and applicable federal, state or local income taxes associated with or to be incurred by the Successor Borrower during the remaining term of, and applicable to, the Loan) and any revenue, documentary

stamp or intangible taxes or any other tax or charge due in connection with the transfer of the Note or otherwise required to accomplish the agreements of this Section 2.9, all as estimated by Agent.

(y) The term "Yield Maintenance Amount" shall mean the amount estimated by Agent which will be sufficient to purchase U.S. Obligations providing the required Scheduled Defeasance Payments; and

(z) The term "U.S. Obligations" shall mean "Government Securities" as defined in the REMIC regulations, specifically, Treasury Regulation § 1.860G-2(a)(8)(i), as chosen by Agent.

Section 2.10 Security.

Collateral. The Loan and all other indebtedness and obligations under the Loan Documents shall be secured by the following (collectively, the "Collateral"): (a) the mortgaged property and other collateral as set forth in the Security Document, (b) a first priority security interest in all of the membership interests in Borrower pledged by all members of Borrower, (c) any other collateral or security described in this Agreement or the other Loan Documents.

ARTICLE III

INSURANCE, CONDEMNATION, AND IMPOUNDS

Section 3.1 Insurance.

Borrower shall maintain insurance as follows:

(a) Property. Borrower shall (or shall cause Master Tenant to) keep the Project insured against damage by fire and the other hazards covered by a standard extended coverage and "special perils" insurance policy (including a separate policy for broad form boiler and machinery coverage (without exclusion for explosion)) for the full insurable value thereof the term "full insurable value" to mean the actual replacement cost of the improvements and the personal property (without taking into account depreciation or co-insurance), and shall maintain such other casualty insurance as reasonably required by Agent, including, without limitation, ordinance or law coverage, in amounts and in form and with carrier(s) approved by Agent as of the Closing Date which carrier(s), amounts and form shall not be changed without the prior written consent of Agent. Borrower shall keep the Project insured against loss by flood if the Project is located in an area identified by the Federal Emergency Management Agency as an area having special flood hazards and in which flood insurance has been made available under the National Flood Insurance Act of 1968, the Flood Disaster Protection Act of 1973 and the National Flood Insurance Reform Act of 1994 (and any successor acts thereto) in an amount at least equal to the amount approved by Agent as of the Closing Date. The proceeds of insurance paid on account of any damage or destruction to the Project shall be paid to Agent to be applied as provided in Section 3.2. Notwithstanding anything contained in this Agreement to the contrary and without limitation

of any of the provisions contained in this Article III, Borrower shall at all times maintain ordinance or law coverage in amount equal to the full replacement cost of the Project and otherwise in form and substance and with carriers approved by Agent in Agent's reasonable discretion.

(b) Liability. Borrower shall maintain or shall cause Master Tenant to maintain (a) commercial general liability insurance with respect to the Project; (b) worker's compensation insurance and employer's liability insurance covering employees at the Project employed by Guarantor and/or Master Tenant (to the extent required, and in the amounts required by applicable laws); (c) business interruption insurance, including use and occupancy, rental income loss and extra expense, against all periods covered by Borrower's property insurance; (f) Umbrella liability, (g) builder's risk insurance, as applicable, (h) professional liability insurance, and (g) Terrorism insurance (subject to the requirements of this Section 3.1(a)). All of the above shall be maintained at all times during the term of the Loan with coverages, in the amounts and forms and with limits and carrier(s) approved by Agent as of the Closing Date which carrier(s), amounts, limits and form shall not be changed or reduced without the prior written consent of Agent. Without limiting the foregoing and notwithstanding anything to the contrary contained in this Agreement, if on the Closing Date, terrorism, terrorist acts or similar perils (collectively, "Terrorism") is an exclusion from coverage in any such insurance policy, or, if Terrorism is an exclusion from coverage in any such insurance policy, then Borrower shall, upon Agent's request, obtain a separate policy insuring specifically against Terrorism.

(c) Other Insurance. Borrower shall maintain or shall cause Guarantor to maintain such other insurance with respect to the Project as reasonably required by Agent.

(d) Form and Quality. All insurance policies shall be endorsed in form and substance acceptable to Agent to name Agent as an additional insured, loss payee or mortgagee thereunder, as its interest may appear, with loss payable to Agent, without contribution, under a standard New York (or local equivalent) mortgagee clause. All such insurance policies and endorsements shall be fully paid for and contain such provisions and expiration dates and be in such form and issued by such insurance companies licensed to do business in the State where the Project is located, with a rating of "A-IX" or better as established by Best's Rating Guide (or an equivalent rating approved in writing by Agent). Each policy shall provide that such policy may not be cancelled or materially changed except upon thirty (30) days' prior written notice of intention of non-renewal, cancellation or material change to Agent and that no act or thing done by Borrower shall invalidate any policy as against Agent. Borrower shall assign the policies or proofs of insurance to Agent, in such manner and form that Agent and its successors and assigns shall at all times have and hold the same as security for the payment of the Loan. Borrower shall deliver certificates of insurance to Agent evidencing the coverages required hereunder. The proceeds of insurance policies coming into the possession of Agent shall not be deemed trust funds, and Agent shall be entitled to apply such proceeds as herein provided. Borrower shall not maintain any separate or additional property insurance which is contributing in the event of loss unless it is properly endorsed and otherwise satisfactory to Agent in all respects.

(e) Adjustments. Borrower shall give immediate written notice of any loss to the insurance carrier and, if such loss is reasonably expected by Borrower to exceed the deductible or if such loss is reasonably likely to result in a material adverse change, to Agent. Borrower hereby irrevocably authorizes and empowers Agent, as attorney-in-fact for Borrower coupled with an interest, to make proof of loss, to adjust and compromise any claim under insurance policies, to appear in and prosecute any action arising from such insurance policies, to collect and receive insurance proceeds, and to deduct therefrom Agent's expenses incurred in the collection of such proceeds. Nothing contained in this Section 3.1, however, shall require Agent to incur any expense or take any action hereunder.

(f) Agent's Right to Purchase Insurance. In the event Borrower fails to provide Agent with evidence of the insurance coverage required by this Agreement, Agent may purchase insurance at Borrower's expense to protect Agent's interests in the Project. This insurance may, but need not, protect Borrower's interests. The coverage purchased by Agent may not pay any claim made by Borrower or any claim that is made against Borrower in connection with the Project. Borrower, or Agent at Borrower's request, may later cancel any insurance purchased by Agent, but only after providing Agent with evidence that Borrower has obtained insurance as required by this Agreement. If Agent purchases insurance for the Project, Borrower will be responsible for the costs of that insurance, including interest and other charges imposed by Agent in connection with the placement of the insurance, until the effective date of the cancellation or expiration of the insurance. The costs of the insurance may be added to the outstanding principal balance of the Loan if not paid by Borrower within ten (10) days after receipt of a written demand for payment from Lender accompanied by an invoice or other reasonably supporting documentation. The costs of the insurance may be more than the cost of insurance Borrower is able to obtain on its own.

(g) Borrower has advised Agent and Lender that, to the limited extent described on Schedule 3.1, it is not in compliance as of the Effective Date with certain requirements set forth in Section 3.1. Borrower nonetheless represents and warrants to Agent and Lender that the policies of insurance (including the deductible or self-insured retention provisions thereof) and risk management programs that Borrower and Guarantor have in effect as of the date hereof are, and as may be in effect at any time prior to the Maturity Date will be, consistent with custom, practice and prudent management standards in the business and industry in which Borrower and Guarantor are engaged. As and when insurance meeting the requirements set forth in Section 3.1 (to the extent Borrower is not in compliance with such requirements as provided in Schedule 3.1) becomes generally available to operators of assisted living facilities owned by institutional operators and similar to the Facility at commercially reasonable rates, as determined by Agent in its reasonable judgment, Borrower shall purchase and maintain or shall cause Master Tenant to purchase and maintain such insurance. Borrower's non-compliance with the requirements of Section 3.1, as set forth in Schedule 3.1, shall not give rise to an Event of Default so long as (i) no other Event of Default then exists, (ii) such non-compliance is limited to the matters described on Schedule 3.1, as it may be amended from time to time prior to the Maturity Date with the consent of Agent and Lender in their sole discretion, (iii) the representations

and warranties set forth in this Section 3.1(g) remain true, correct and complete in all respects, and (iv) Borrower is in compliance with the other covenants contained in this Section 3.1. Notwithstanding anything to the contrary set forth herein, if any insurance provided by Borrower or Master Tenant in accordance with Schedule 3.1 provides for coverage on a "claims-made" basis, every "claims made" renewal or replacement policy shall continue to show the first date of claims made coverage as of the date of execution of this Loan Agreement, or a date prior hereto, as its prior acts/retroactive or continuity date. Furthermore, if any "claims made" policy is cancelled or non-renewed, and not replaced by an "occurrence" policy with "full prior acts", Borrower will purchase or will cause Guarantor to purchase an "Extended Reporting Provision Option" (i.e., tail coverage), for a term equal to the then remaining term of the Loan, and if any "claims made" policy is subsequently replaced by an "occurrence" policy, Borrower agrees that said "occurrence" policy will contain a "full prior acts" provision.

Section 3.2 Use and Application of Insurance Proceeds.

Agent shall apply insurance proceeds to costs of restoring the Project or the Loan as follows:

(a) if a loss is less than or equal to twenty five percent (25%) of the original principal balance of the Loan, Agent shall apply the insurance proceeds to restoration provided that: (a) no Potential Default exists, and (b) Borrower promptly commences and diligently pursues restoration of the Project;

(b) if the loss exceeds twenty-five percent (25%) of the original principal balance of the Loan, but is not more than twenty-five percent (25%) of the replacement value of the Improvements (for projects containing multiple phases or stand alone structures, such calculation to be based on the damaged phase or structure, not the Project as a whole), Agent shall apply the insurance proceeds to restoration provided that at all times during such restoration: (a) no monetary default or non-monetary default or Event of Default exists hereunder or under any of the other Loan Documents; (b) Agent determines that there are sufficient funds available to restore and repair the Project to a condition approved by Agent; (c) Agent determines that the Net Operating Income of the Project during restoration plus the collectible proceeds of business interruption insurance plus any amounts specifically reserved by Guarantor for the sole purpose of funding the restoration will be sufficient to pay Debt Service as of the first measuring period occurring after the anticipated date of completion of restoration, (d) the Borrower will be able to satisfy the financial covenants set forth in Sections 7.26(a) and (b); (e) Agent determines that restoration and repair of the Project to a condition approved by Agent will be completed within nine (9) months after the date of loss or casualty and in any event ninety (90) days prior to the Maturity Date; and (f) Borrower promptly commences and is diligently pursuing restoration of the Project; or

(c) if the conditions set forth above are not satisfied or the loss exceeds the maximum amount specified in Subsections (b) above, in Agent's sole discretion, Agent may apply any insurance proceeds it may receive to the payment of the Loan or allow all or a portion of such proceeds to be used for the restoration of the Project.

Insurance proceeds applied to restoration will be disbursed on receipt of satisfactory plans and specifications, contracts and subcontracts, schedules, budgets, lien waivers and architects' certificates, and otherwise in accordance with prudent commercial construction lending practices for construction loan advances, including, as applicable, the advance conditions under Part C of Schedule 2.1 with respect to disbursement of insurance proceeds.

Section 3.3 Condemnation Awards.

Borrower shall immediately notify Agent of the institution of any proceeding for the condemnation or other taking of the Project or any portion thereof. Agent may participate in any such proceeding and Borrower will deliver to Agent all instruments necessary or required by Agent to permit such participation. Where the amount of the compensation or award is anticipated to be in excess of $25,000 (the "Award Threshold") Borrower shall not, without Agent's prior consent, (a) agree to any compensation or award, and (b) take any action or fail to take any action which would cause the compensation to be determined. All awards and compensation for the taking or purchase in lieu of condemnation of the Project or any part thereof are hereby assigned to Agent as security for the obligations of Borrower under this Agreement, all such awards and compensation below the Award Threshold may be paid directly to Borrower so long as no Event of Default exists and restoration or repair and the continued operation of the applicable Property is economically feasible (and the condemnation or other taking did not affect in any way the Improvements) and all such awards and compensation in excess of the Award Threshold shall be paid to Agent. Borrower authorizes Agent to collect and receive such awards and compensation in excess of the Award Threshold to give proper receipts and acquittances therefor, and in Agent's sole discretion, (a) to apply the same (after deduction of Lender's reasonable costs and expenses, if any in collecting the same) toward the payment of the Loan in such order and manner as Agent may elect, notwithstanding that the Loan may not then be due and payable, or (b) to make the same available to Borrower for the restoration or repair of the Project. If the net proceeds of the condemnation award are made available to Borrower for restoration or repair, such proceeds shall be disbursed upon satisfaction of and in accordance with the terms and conditions set forth in Section 3.2. Borrower, upon request by Agent, shall execute all instruments requested to confirm the assignment of the awards and compensation to Agent, free and clear of all liens, charges or encumbrances.

Section 3.4 Reserved.

Section 3.5 Real Estate Tax Impounds.

At the time of and in addition to the monthly installment of interest, and if applicable, principal due under the Note and this Loan Agreement, Borrower shall deposit with Agent's or Agent's designee, monthly, a sum of money (the "Tax Impound") equal to one-twelfth (1/12th) of the annual charges for real estate taxes, assessments, and impositions relating to the Project (collectively, the "Taxes"). At or before the initial advance of the Loan, Borrower shall deposit with Agent or Agent's designee a sum of money which together with the monthly installments will be sufficient to make each of such payments thirty (30) days prior to the date any delinquency or penalty becomes due with respect to such payments

and maintain a reserve equal to approximately one-sixth (1/6th) of the annual taxes, assessments and charges in Agent's sole but reasonable estimation. Deposits shall be made on the basis of Agent's estimate from time to time of the charges for the current year (after giving effect to any reassessment or, at Agent's election, on the basis of the charges for the prior year, with adjustments when the charges are fixed for the then current year). All funds so deposited shall be held by Agent or Agent's designee. These sums may be commingled with Agent or Agent's designee's general funds and shall not be deemed to be held in trust for the benefit of Borrower. So long as no Event of Default exists hereunder, Agent shall credit for Borrower's account interest on such funds held by Agent or Agent's designee from time to time at the Money Market Rate. All interest paid on such funds shall be deemed to be a part of the Tax Impound and shall be applied in accordance with this Section 3.5. Borrower hereby grants to Agent for the benefit of Lender and Agent a security interest in all funds so deposited with Agent or Agent's designee for the purpose of securing the Loan. While an Event of Default exists, the funds deposited may be applied in payment of the Taxes or to the payment of the Loan or any other charges affecting the security of Agent, as Agent may elect, but no such application shall be deemed to have been made by operation of law or otherwise until actually made by Agent. Borrower shall furnish, or cause to be furnished, to Agent bills for the Taxes at least thirty (30) days prior to the date on which the Taxes first become payable. If at any time the amount on deposit with Agent or Agent's designee, together with amounts to be deposited by Borrower before Taxes are payable, is insufficient to pay such Taxes and maintain a reserve equal to approximately one-sixth (1/6th) of the Taxes, Borrower shall deposit any deficiency with Agent or Agent's designee immediately upon demand. Agent shall pay such Taxes when the amount on deposit with Agent or Agent's designee is sufficient to pay such charges and maintain such reserve and Agent has received a bill for such charges. The obligation of Borrower to pay the Taxes, as set forth in the Security Document, is not affected or modified by the provisions of this paragraph but shall be deemed satisfied if the same are paid by Agent or Agent's designee pursuant to the provisions of this paragraph.

ARTICLE IV

LEASING MATTERS

Section 4.1 Representations and Warranties on Leases.

(a) Borrower represents and warrants to Agent with respect to Leases of the Project that, to its knowledge: (i) the occupancy certificate separately delivered to Agent at or prior to Closing, if any, is true and correct as of the date hereof, and the Leases are valid and in and full force and effect; (ii) the Leases (including amendments) are in writing, and there are no oral agreements with respect thereto; (iii) the copies of the Leases delivered to Agent are true and complete; (iv) neither the landlord nor any tenant is in default under any of the non-residential Leases; (v) Borrower has no knowledge of any notice of termination or default with respect to any non-residential Lease; (vi) Borrower has not assigned or pledged (and has not permitted Master Tenant or Guarantor to assign or pledge) any of the Leases, the rents or any interests therein, except to Agent; (vii) no non-residential tenant or other party has an option to purchase all or any portion of the Project; (viii) no tenant has the right to terminate its Lease prior to expiration of the stated term of such Lease (unless due to

casualty or condemnation of the Project); and (ix) no tenant has prepaid more than one month's rent in advance (except for bona fide security deposits not in excess of an amount equal to two month's rent).

(b) The Project shall at all times be master leased to Master Tenant pursuant to the Master Lease. The Master Lease shall, at all times during the term of the Loan, be subordinated to the lien of the Mortgage pursuant to the terms of the Subordination Agreement.

Section 4.2 Approval Rights.

(a) Borrower shall not and shall not permit Master Tenant or Guarantor to, without Agent's prior written consent, enter into or amend (in any material respect) any Lease or other rental or occupancy agreement or concession agreement with respect to the Project except as expressly permitted hereunder.

(b) Borrower shall have the right to enter into or to permit Master Tenant or Guarantor to enter into, amend and/or modify non-residential Leases without Agent's consent provided (i) the economic terms of the Lease conform to those of the market, (ii) the form of the non-residential Lease is that of the standard lease form approved by Agent, with no material modifications, (iii) the initial term is not longer than one (1) year or if longer such Lease shall be terminable by Guarantor as landlord upon not greater than 30 days prior written notice to the applicable tenant, and (iv) such Lease is not a Material Non-Residential Lease.

(c) Borrower, Guarantor and Master Tenant shall have the right to enter into or amend any residential Lease which has a term of no more than one (1) month and all such residential Leases shall be at market rates on the form previously approved by Agent without any material modifications.

(d) Except for the expiration of the Master Lease by its terms pursuant to Section 2 thereof, Borrower shall not suffer or permit an amendment or termination of the Master Lease.

Section 4.3 Covenants.

Borrower shall and shall cause Master Tenant and Guarantor to: (a) perform the obligations which Borrower and Master Tenant are required to perform under the Leases; (b) enforce the material obligations to be performed by the tenants under the Leases; (c) promptly furnish to Agent any notice of default or termination received by Borrower or Guarantor or Master Tenant from any non-residential tenant, and any notice of default or termination given by Borrower or Master Tenant or Guarantor to any non-residential tenant; (d) not collect any rents for more than one month in advance of the time when the same shall become due, except for bona fide security deposits not in excess of an amount equal to two months rent; (e) not enter into any ground lease or master lease of any part of the Project other than the Master Lease; (f) not further assign or encumber any Lease; (g) not, except

with Agent's prior written consent, cancel or accept surrender or termination of any Material Non-Residential Lease; and (h) not, except with Agent's prior written consent, modify or amend any Material Non-Residential Lease, and any action in violation of clauses (e), (f), (g), and (h) of this Section 4.3 shall be void at the election of Agent. Borrower will not suffer or permit any breach or default to occur in any of Borrower's or Guarantor's or Master Tenant's obligations under any of the Leases nor suffer or permit the same to terminate by reason of any failure of Borrower or Guarantor or Master Tenant to meet any requirement of any Lease.

Section 4.4 Tenant Estoppels.

At Agent's request, Borrower shall obtain and furnish to Agent, written estoppels in form and substance satisfactory to Agent, executed by non-residential tenants under Leases in the Project (including the Master Tenant under the Master Lease) and confirming the term, rent, and other provisions and matters relating to the non-residential Leases.

Section 4.5 Security Deposits

Neither Borrower nor Guarantor nor Master Tenant has collected or is in receipt of any security deposit from any tenant of the Project, except as described on the occupancy summary previously provided to Agent at or prior to closing. All resident trust funds shall be held in separate personal allowance funds (not commingled) for the sole use of the applicable resident, and such funds shall be recorded on the Facility's financial records as independent accounts.

ARTICLE V

REPRESENTATIONS AND WARRANTIES

Borrower represents and warrants to Agent that:

Section 5.1 Organization and Power.

Each of Borrower and Guarantor and Master Tenant is duly organized, validly existing and in good standing under the laws of the state of its formation or existence, and is in compliance with legal requirements applicable to doing business in the state of its formation. Each of Borrower and Guarantor and Master Tenant is in good standing under the laws of and is in compliance with legal requirements applicable to doing business in the state where each Project is located. Borrower is not a "foreign person" within the meaning of § 1445(f)(3) of the Internal Revenue Code.

Section 5.2 Guarantor/Master Tenant.

(a) Guarantor's principal place of business is at 3131 Elliott Avenue, Suite 500, Seattle, Washington 98121. Guarantor is the sole member of Borrower and owns one hundred percent (100%) of the membership interests in Borrower free and clear of all liens,

claims, and encumbrances. Guarantor has full right, power and authority to execute the Loan Documents on its own behalf and on behalf of Borrower.

(b) Authority/Baty. Guarantor shall have authority to make all material business decisions (including a sale or refinance) for Borrower during the term of the Loan. Daniel Baty is the chairman of the board of directors of Guarantor.

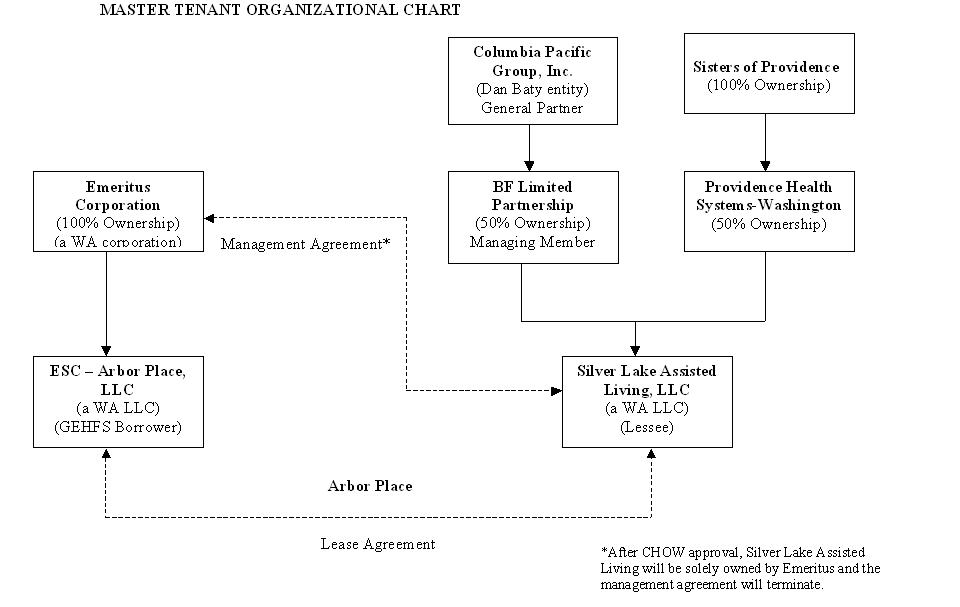

(c) Master Tenant's principal place of business is at 600 University Street, Suite 2500, Seattle, Washington 98101. BP Limited Partnership and Providence Health Systems-Washington are the sole members of Master Tenant and own one hundred percent (100%) of the membership interests in Master Tenant, free and clear of all liens, claims and encumbrances. The direct and indirect ownership interest in Master Tenant is set forth on the organization chart attached hereto as Exhibit G. All such interests are free and clear of all liens, claims, encumbrances and rights of others except as set forth on Exhibit G. Master Tenant has full right, power and authority to execute the Loan Documents on its own behalf. Guarantor shall have the authority to make all material business decisions for Master Tenant at all times following the closing of the Master Tenant Acquisition.

Section 5.3 Borrower's Operating Agreement.

A true and complete copy of the operating agreement creating Borrower and any and all amendments thereto (collectively, the "Operating Agreement") has been furnished to Agent. The Operating Agreement constitutes the entire agreement among the members of Borrower and is binding upon and enforceable against each of the members in accordance with its terms. There are no other agreements, oral or written, among any of the members relating to Borrower. No breach exists under the Operating Agreement and no condition exists which, with the giving of notice or the passage of time would constitute a breach under the Master Tenant LLC Agreement.

Section 5.4 Corporate Documents.

A true and complete copy of the articles of incorporation and by-laws of Guarantor (collectively, the "Incorporation Documents") have been furnished to Agent. The Incorporation Documents were duly executed and delivered, are in full force and effect, and binding upon and enforceable in accordance with their terms.

A true and complete copy of the operating agreement creating Master Tenant and any and all amendments thereto (the "Master Tenant LLC Agreement") has been furnished to Agent. The Master Tenant LLC Agreement constitutes the entire agreement among the members of Master Tenant and is binding upon and applicable against each of the members in accordance with its terms. There are no other agreements, oral or written, among any of the members relating to Master Tenant. No breach exists under the Master Tenant LLC Agreement and no condition exists which, with the giving of notice or the passage of time would constitute a breach under the Master Tenant LLC Agreement.

Section 5.5 Validity of Loan Documents.

The execution, delivery and performance by Borrower, Master Tenant and Guarantor of the Loan Documents to which it or they are a party: (a) are duly authorized and do not require the consent or approval of any other party or governmental authority which has not been obtained; and (b) will not violate any law or result in the imposition of any lien, charge or encumbrance upon the assets of any such party, except as contemplated by the Loan Documents. The Loan Documents constitute the legal, valid and binding obligations of Borrower and Guarantor and Master Tenant, enforceable in accordance with their respective terms, subject to applicable bankruptcy, insolvency, or similar laws generally affecting the enforcement of creditors' rights.

Section 5.6 Liabilities; Litigation.

(a) The financial statements delivered by Borrower and Guarantor and Master Tenant are true and correct with no significant change since the date of preparation. Except as disclosed in such financial statements, there are no liabilities (fixed or contingent) affecting the Project, Borrower or Master Tenant or Guarantor. Except as disclosed in such financial statements, there is no litigation, administrative proceeding, investigation or other legal action (including any proceeding under any state or federal bankruptcy or insolvency law) pending or, to the knowledge of Borrower, threatened, against the Project, Borrower, Master Tenant or Guarantor which if adversely determined would reasonably be expected to have a material adverse effect on such party, the Project or the Loan.

(b) Neither Borrower nor Guarantor nor Master Tenant is contemplating either the filing of a petition by it under state or federal bankruptcy or insolvency laws or the liquidation of all or a major portion of its assets or property, and neither Borrower nor Master Tenant nor Guarantor has knowledge of any Person contemplating the filing of any such petition against it.

Section 5.7 Taxes and Assessments.

There are no unpaid or outstanding real estate or other taxes or assessments on or against the Project or any part thereof, except general real estate taxes not due or payable. Copies of the current general real estate tax bills with respect to the Project have been delivered to Agent. The Project is comprised of one or more parcels, each of which constitutes a separate tax lot and none of which constitutes a portion of any other tax lot. Except as disclosed in the Title Policy, there are no pending or, to Borrower's best knowledge, proposed, special or other assessments for public improvements or otherwise affecting the Project, nor are there any contemplated improvements to the Project that may result in such special or other assessments.

Section 5.8 Other Agreements; Defaults.

Neither the Borrower nor Guarantor nor Master Tenant is a party to any agreement or instrument or subject to any court order, injunction, permit, or restriction which

would reasonably be expected to adversely affect the Project or the business, operations, or condition (financial or otherwise) of Borrower or Guarantor or Master Tenant. Neither Borrower nor Guarantor is in violation of any agreement which violation would reasonably be expected to have a material adverse effect on the Project, Borrower, Master Tenant, or Guarantor or Borrower's or Guarantor's or Master Tenant's business, properties, or assets, operations or condition, financial or otherwise.

Section 5.9 Compliance with Law.

Borrower, Guarantor and Master Tenant have all requisite licenses, permits, franchises, qualifications, certificates of occupancy or other governmental authorizations to own to lease and operate, the Project and carry on its business, and the Project is in compliance with all applicable legal requirements and, to the best of Borrower's knowledge, is free of structural defects, and all building systems contained therein are in good working order, subject to ordinary wear and tear. The Project does not constitute, in whole or in part, a legally non-conforming use under applicable legal requirements.

Section 5.10 Condemnation.

No condemnation has been commenced or, to Borrower's knowledge, is contemplated with respect to all or any portion of the Project or for the relocation of roadways providing access to the Project.

Section 5.11 Access.

The Project has adequate rights of access to public ways and is served by adequate water, sewer, sanitary sewer and storm drain facilities. All public utilities necessary or convenient to the full use and enjoyment of the Project is located in the public right-of-way abutting the Project, and all such utilities are connected so as to serve the Project without passing over other property, except to the extent such other property is subject to a perpetual easement for such utility benefiting the Project. All roads necessary for the full utilization of the Project for their current purpose have been completed and dedicated to public use and accepted by all governmental authorities.

Section 5.12 Flood Hazard.

The Project is not situated in an area designated as having special flood hazards as defined by the Flood Disaster Protection Act of 1973, as amended, or as a wetlands by any governmental entity having jurisdiction over the Project.

Section 5.13 Property.

A fee interest in the Project is, or contemporaneously with the initial funding of the Loan will be, owned by Borrower free and clear of all liens, claims, encumbrances, covenants, conditions and restrictions, security interests and claims of others, except only such exceptions to title as have been approved by Agent. To the best of Borrower's knowledge, the Project is in compliance with all zoning requirements, building codes,

subdivision improvement agreements, declarations, ground leases, and all covenants, conditions and restrictions of record. Except as set forth in the exceptions to title approved by Agent, the zoning and subdivision approval of the Project and the right and ability to, use or operate the Project is not in any way dependent on or related to any real estate other than the Property where the same is to be made. Except as previously disclosed to Agent in writing, to the best of Borrower's knowledge, as of the date hereof, (i) there are no, nor are there any alleged or asserted, violations of law, regulations, ordinances, codes, permits, licenses, declarations, ground leases, covenants, conditions, or restrictions of record, or other agreements relating to the Project, or any part thereof, (ii) the Project is in good condition and repair with no deferred maintenance and are free from damage caused by fire or other casualty, (iii) there is no latent or patent structural or other significant defect or deficiency in the Project, (iv) design and as-built conditions of the Project are such that no drainage or surface or other water will drain across or rest upon the Project or land of others except in areas designated for such purpose and for which a benefiting or burdening easement has been established, and (v) none of the Improvements on the Project create an encroachment over, across or upon any of the Project's boundary lines, rights of way or easements, and no buildings or other improvements on adjoining land create such an encroachment.

Section 5.14 Location of Borrower.

Borrower's principal place of business and chief executive offices are located at the address stated in Section 11.1.

Section 5.15 Margin Stock.

No part of proceeds of the Loan will be used for purchasing or acquiring any "margin stock" within the meaning of Regulations T, U or X of the Board of Governors of the Federal Reserve System.

Section 5.16 Tax Filings.

Borrower and Guarantor have filed (or have obtained effective extensions for filing) all federal, state and local tax returns required to be filed and have paid or made adequate provision for the payment of all federal, state and local taxes, charges and assessments payable by Borrower and Guarantor, respectively.

Section 5.17 Solvency.

After giving effect to the Loan, the fair saleable value of Borrower's assets exceeds and will, immediately following the making of the Loan, exceed Borrower's total liabilities, including, without limitation, subordinated, unliquidated, disputed and contingent liabilities. The fair saleable value of Borrower's assets is and will, immediately following the making of the Loan, be greater than Borrower's probable liabilities, including the maximum amount of its contingent liabilities on its Debts as such Debts become absolute and matured. Borrower's assets do not constitute and, immediately following the making of the Loan will not constitute, unreasonably small capital to carry out its business as conducted or as

proposed to be conducted. Borrower does not intend to, nor believes that it will, incur Debts and liabilities (including contingent liabilities and other commitments) beyond its ability to pay such Debts as they mature (taking into account the timing and amounts of cash to be received by Borrower and the amounts to be payable on or in respect of obligations of such Borrower).

Section 5.18 Full and Accurate Disclosure.

No statement of fact made by or on behalf of Borrower, Master Tenant or Guarantor in this Agreement or in any of the other Loan Documents contains any untrue statement of a material fact or omits to state any material fact necessary to make statements contained herein or therein not misleading. There is no fact presently known to Borrower or Guarantor or Master Tenant which has not been disclosed to Agent which adversely affects, nor as far as Borrower can reasonably foresee, would reasonably be expected to adversely affect, the Project or the business, operations or condition (financial or otherwise) of Borrower, Master Tenant or Guarantor.

Section 5.19 Single Purpose Entity.

Borrower is and has at all times since its formation been a Single Purpose Entity.

Section 5.20 No Broker.

No brokerage commission or finder's fee is owing to any broker or finder arising out of any actions or activity of Borrower in connection with the Loan.

Section 5.21 Reserved.

Section 5.22 Labor Disputes.

To the best of Borrower's knowledge, there are no strikes, boycotts, or labor disputes pending which would reasonably be expected to have a material adverse effect on the operation of the Project.

Section 5.23 Employees.

Borrower has no employees.

Section 5.24 ERISA (Borrower).

(a) Neither Borrower nor Master Tenant is an "employee benefit plan" as defined in Section 3(3) of ERISA, or a "governmental plan" within the meaning of Section 3(32) of ERISA; (b) neither Borrower nor Master Tenant is subject to state statutes regulating investments and fiduciary obligations with respect to governmental plans; (c) the assets of Borrower and Master Tenant do not constitute "plan assets" of one or more plans within the meaning of 29 C.F.R. Section 2510.3-101; and (d) one or more of the following

circumstances is true: (i) Equity interests in Borrower and Master Tenant are publicly offered securities, within the meaning of 29 C.F.R. Section 2510.3-101(b)(2) or are securities issued by an investment company registered under the Investment Company Act of 1940; (ii) Less than twenty-five percent (25%) of the value of any class of equity interests in Borrower and Master Tenant are held by "benefit plan investors" within the meaning of 29 C.F.R. Section 2510.3-101(f)(2); or (iii) Borrower and Master Tenant qualify as an "operating company", a "venture capital operating company", or a "real estate operating company" within the meaning of 29 C.F.R. Section 2510.3-101(c), (d) or (e). Borrower and Master Tenant shall deliver to Agent such certifications and/or other evidence periodically requested by Agent, in its reasonable discretion, to verify these representations and warranties. Failure to deliver these certifications or evidence, breach of these representations and warranties, or consummation of any transaction which would cause the Loan Documents or any exercise of Agent's or Lender's rights under the Loan Documents to (1) constitute a non-exempt prohibited transaction under ERISA or (2) violate ERISA or any state statute regulating governmental plans (collectively, a "Violation"), which failure continues for thirty (30) days after written notice, shall be an Event of Default. Notwithstanding anything in the Loan Documents to the contrary, no sale, assignment, or transfer of any direct or indirect right, title, or interest in Borrower or Master Tenant or the Project (including creation of a junior lien, encumbrance or leasehold interest) shall be permitted which would negate Borrower's representations in this section or cause a Violation. At least fifteen (15) days before consummation of any of the foregoing, Borrower shall obtain from the proposed transferee or lienholder (1) a certification to Agent that the representations and warranties of this subparagraph will be true after consummation and (2) an agreement to comply with this section.

Section 5.25 Intellectual Property.

Except as set forth on Exhibit C, Borrower has no interest in any trademarks, copyrights, patents or other intellectual property with respect to the Project.

Section 5.26 Anti-Terrorism and Anti-Money Laundering Compliance.

(a) Compliance with Anti-Terrorism Laws. Borrower represents and warrants to Agent that it is not, and, after making due inquiry, that no Person who owns a controlling interest in or otherwise controls Borrower or Master Tenant is, (i) listed on the Specially Designated Nationals and Blocked Persons List (the "SDN List") maintained by the Office of Foreign Assets Control ("OFAC"), Department of the Treasury, and/or on any other similar list ("Other Lists" and, collectively with the SDN List, the "Lists") maintained by the OFAC pursuant to any authorizing statute, Executive Order or regulation (collectively, "OFAC Laws and Regulations"); or (ii) a Person (a "Designated Person") either (A) included within the term "designated national" as defined in the Cuban Assets Control Regulations, 31 C.F.R. Part 515, or (B) designated under Sections 1(a), 1(b), 1(c) or 1(d) of Executive Order No. 13224, 66 Fed. Reg. 49079 (published September 25, 2001) or similarly designated under any related enabling legislation or any other similar Executive Orders (collectively, the "Executive Orders"). The OFAC Laws and Regulations and the Executive Orders are collectively referred to in this Amendment as the "Anti-Terrorism Laws".

Borrower represents and warrants that it requires, and has taken reasonable measures to ensure compliance with the requirement, that no Person who owns any other direct interest in Borrower or Master Tenant is or shall be listed on any of the Lists or is or shall be a Designated Person.

(b) Funds Invested in Borrower. Borrower represents and warrants that it has taken reasonable measures appropriate to the circumstances (and in any event as required by law), with respect to each holder of a direct or indirect interest in Borrower and Master Tenant, to assure that funds invested by such holders in Borrower and Master Tenant are derived from legal sources ("Anti-Money Laundering Measures"). The Anti-Money Laundering Measures have been undertaken in accordance with the Bank Secrecy Act, 31 U.S.C. §§ 5311 et seq. ("BSA"), and all applicable laws, regulations and government guidance on BSA compliance and on the prevention and detection of money laundering violations under 18 U.S.C. §§ 1956 and 1957 (collectively with the BSA, "Anti-Money Laundering Laws").

(c) No Violation of Anti-Money Laundering Laws. Borrower represents and warrants to Agent, to its actual knowledge after making due inquiry, that neither Borrower nor Guarantor nor Master Tenant (i) is under investigation by any governmental authority for, or has been charged with, or convicted of, money laundering under 18 U.S.C. §§ 1956 and 1957, drug trafficking, terrorist-related activities or other money laundering predicate crimes, or any violation of the BSA, (ii) has been assessed civil penalties under any Anti-Money Laundering Laws, or (iii) has had any of its funds seized or forfeited in an action under any Anti-Money Laundering Laws.

(d) Borrower Compliance with Anti-Money Laundering Laws. Borrower represents and warrants to Agent that it has taken reasonable measures appropriate to the circumstances (in any event as required by law), to ensure that Borrower and Master Tenant are in compliance with all current and future Anti-Money Laundering Laws and laws, regulations and government guidance for the prevention of terrorism, terrorist financing and drug trafficking.

(e) U.S. Publicly-Traded Entity. This Section 5.26 shall not apply to any Person to the extent that such Person's interest in the Borrower is through a U.S. Publicly-Traded Entity. As used in this Agreement, "U.S. Publicly-Traded Entity" means a Person (other than an individual) whose securities are listed on a national securities exchange, or quoted on an automated quotation system, in the United States, or a wholly-owned subsidiary of such a Person.

Section 5.27 Master Lease.

A true, correct and complete copy of the Master Lease, together with all amendments thereto, has been delivered to Agent; and the Master Lease, and all amendments thereto is in full force and effect as of the Closing Date.

Section 5.28 Management Agreement.

A true, correct and complete copy of the Management Agreement, together with all amendments thereto, has been delivered to Agent; and the Management Agreement, and all amendments thereto is in full force and effect as of the Closing Date.

Section 5.29 Master Tenant Purchase Contract.

A true, correct and complete copy of the Master Tenant Purchase Contracts, together with all amendments thereto, have been delivered to Agent; and the Master Tenant Purchase Contract, and all amendments thereto is in full force and effect as of the Closing Date.

Section 5.30 Approvals.

The form of the Master Lease has been submitted to the State of Washington, as required under applicable Law.

ARTICLE VI

FINANCIAL REPORTING; NOTICES

Section 6.1 Financial Statements.