UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ]Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[x] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

INVESTORS CAPITAL HOLDINGS, LTD.

(Name of Registrant as Specified In Its Charter) |

_____________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[x] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Notice of 2009 Annual Meeting

and

Proxy Statement |

Dear Stockholder:

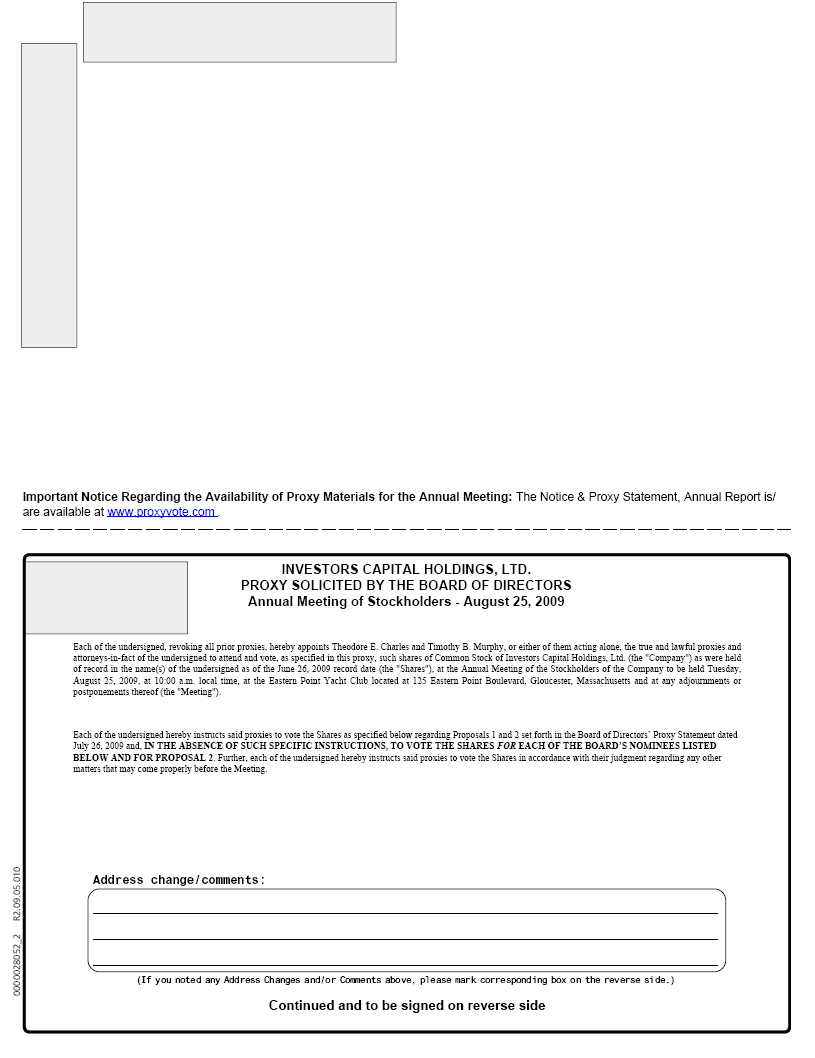

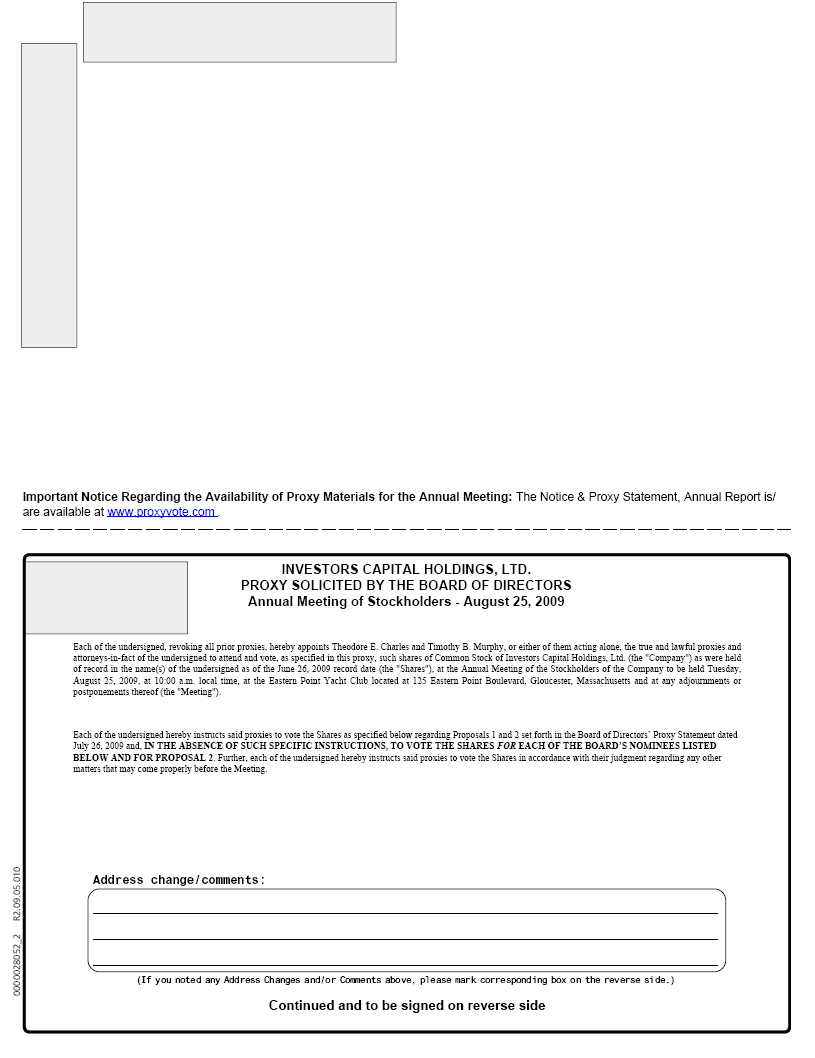

You are cordially invited to attend the Annual Meeting of Stockholders (the "Meeting") of Investors Capital Holdings, Ltd. (the "Company") to be held on Tuesday, August 25, 2009, at 10:00 a.m. local time, at the Eastern Point Yacht Club located at 125 Eastern Point Boulevard, Gloucester, Massachusetts. Your Board of Directors and management look forward to greeting those stockholders who are able to attend.

The Notice of Annual Meeting of Stockholders and Proxy Statement containing information pertaining to the business to be transacted at the Meeting appear on the following pages.

Whether or not you plan to attend, it is important that your shares be represented and voted at the Meeting. You are requested to complete, sign, date, and mail the enclosed proxy card at your earliest convenience.

On behalf of the Board of Directors and management I would like to thank you for your interest and participation in the affairs of the Company.

Timothy B. Murphy

Chief Executive Officer |

INVESTORS CAPITAL HOLDINGS, LTD.

230 Broadway East

Lynnfield, Massachusetts 01940 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, AUGUST 25, 2009

To the Stockholders:

NOTICE IS HEREBY GIVEN, that the Annual Meeting of Stockholders (the "Meeting") of Investors Capital Holdings, Ltd., a Delaware corporation (the "Company"), will be held at 10:00 a.m. local time on Tuesday, August 25, 2009 at the Eastern Point Yacht Club located at 125 Eastern Point Boulevard, Gloucester, Massachusetts for the following purposes:

| * | To elect six directors, each to serve for a term of one year or until his or her successor is elected and qualified; |

| * | To ratify the appointment by the Board of Directors of independent auditors to audit the Company's books and records for the fiscal year ending March 31, 2010; and |

| * | To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

Only holders of common stock of record as of the close of business on June 26, 2009 will be entitled to notice of, and to vote at, the Meeting, or any adjournments or postponements thereof.

Stockholders are cordially invited to attend the Meeting. Please contact the Company at 800-949-1422 to obtain directions to the meeting location.

It is important that your shares be represented and voted at the Meeting. Because many of our stockholders cannot personally attend the Meeting, it is necessary that a large number be represented by proxy in order to participate in the Meeting. Therefore, if you do not expect to attend the Meeting, but wish your stock to be voted for the business to be transacted thereat, you are requested to complete, sign and date the enclosed proxy card and return it by mailing it in the accompanying postage-paid envelope.

By Order of the Board of Directors,

Douglas C. Leonard, Esq.

Secretary |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on August 25, 2009: The Proxy Statement and the Annual Report to Stockholders are available athttps://materials.proxyvote.com/46147M.

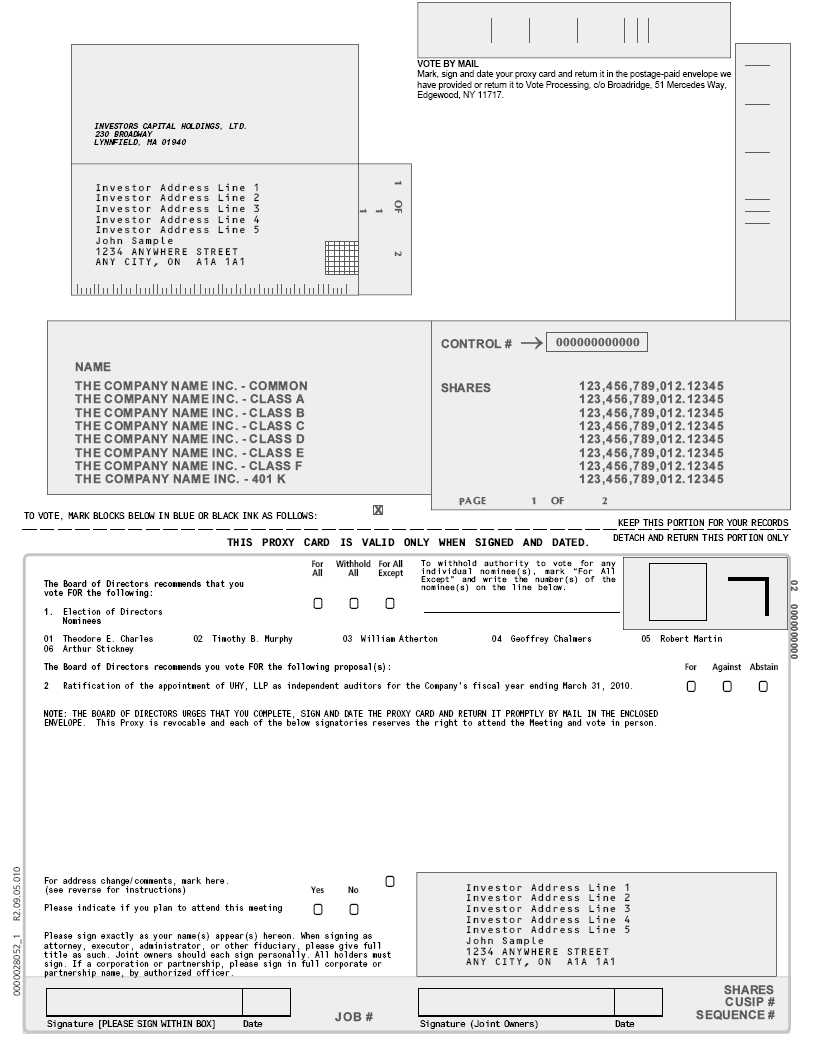

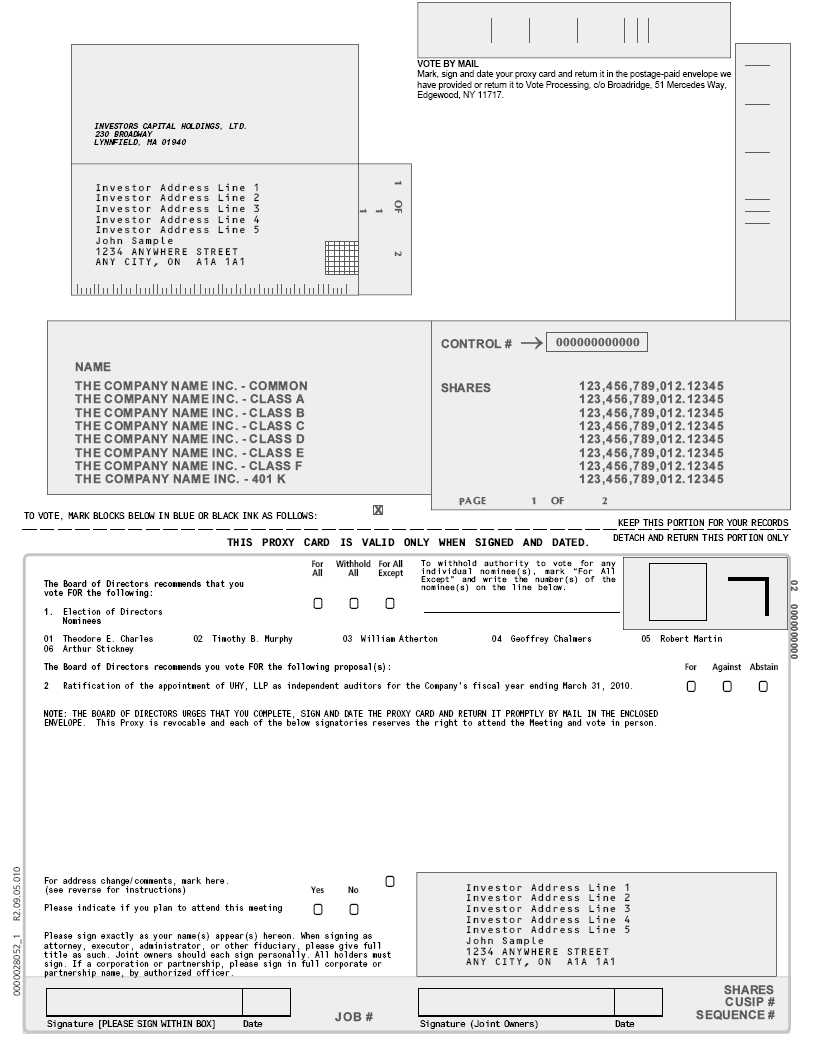

This Proxy Statement and the accompanying Proxy Card are being furnished in connection with the solicitation by the Board of Directors (the "Board") of Investors Capital Corporation, Ltd., a Delaware corporation (the "Company"), of proxies to be voted at the Annual Meeting of Stockholders of the Company (the "Meeting") to be held on Tuesday, August 25, 2009 at 10:00 a.m. local time at the Eastern Point Yacht Club located at 125 Eastern Point Boulevard, Gloucester, Massachusetts, or any adjournments or postponements thereof, for the purposes set forth in the attached Notice of Annual Meeting of Stockholders.

Only the holders of record of the Company's Common Stock, par value $.01 per share, as of the close of business on June 26, 2009 (the "Record Date"), are entitled to notice of, and to vote on, all matters properly brought before the Meeting or any adjustments or postponements thereof. As of the Record Date, there were 6,565,961 shares of common stock outstanding.

Voting and Proxy Procedures

Each stockholder is entitled to cast one vote for each share of common stock held by him or her at the close of business on the Record Date. Pursuant to the Company's Bylaws, to constitute a quorum for the transaction of business at any meeting of stockholders, there must be present, in person or by proxy, the holders of a majority of the voting power of the issued and outstanding shares of voting stock of the Company. Once a share is represented for any purpose at the meeting, it is deemed present for quorum purposes for the remainder of the meeting. A plurality of the votes cast by the shares of stock entitled to vote, in person or by proxy, at the Meeting will elect directors as long as a quorum is present. If a quorum exists, action on each other question to be voted upon will be approved if votes, in person or by proxy, cast by stockholders favoring the action exceed the vote cast by stockholder s opposing the action. When proxies in the enclosed form are returned properly executed, the shares represented thereby will be voted at the Meeting and, where instructions have been given by the stockholder, will be voted in accordance therewith. If the stockholder does not otherwise specify, the stockholder’s shares will be votedFOReach of the nominees for director, andFORthe proposal to ratify the appointment of the independent auditors, all as set forth in this Proxy Statement, and in accordance with their best judgment as to any other business which may come properly before the Meeting. Votes will be counted manually.

Abstentions and broker "non-votes" are not counted for purposes of the election of a director. On all other proposals, abstentions will be considered as a vote against the proposal, and broker non-votes will not be counted at all. A stockholder executing the accompanying proxy has the power to revoke it at any time prior to the exercise thereof by appearing at the Meeting and voting in person or by filing with the Secretary of the Company, (i) a properly executed, later-dated proxy, or (ii) a written instrument revoking the proxy.

This Proxy Statement and the accompanying Proxy Card are first being mailed to stockholders on or about July 22, 2009. A copy of the Company's Annual Report to Shareholders for the year ended March 31, 2009, is included with this Proxy Statement.

The solicitation of proxies in the accompanying form is made by, and on behalf of, the Board of Directors. We have engaged the services of Broadridge Financial Solutions, Inc. to assist us in the distribution of proxies, for which a fee will be paid. There will be no solicitation by officers and employees of the Company. The Company will make arrangements with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of proxy materials to the beneficial owners of shares held of record by such persons, and such persons will be reimbursed for reasonable expenses incurred by them in connection therewith.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents information regarding beneficial ownership of our common stock as of July 10, 2009 by: (1) each person (including any group, as defined in Section 13(d)(3) of the Exchange Act) who is known to the Company to own beneficially more than five percent (5%) of our outstanding common stock, (2) the Chairman, CEO and CFO of the Company (the “Named Executive Officers”), (3) each director and nominee, and (4) all director/nominees and Named Executive Officers as a group.

| | |

| Name of | Number of Shares | |

| Beneficial Owner | Beneficially Owned | Percent Beneficially Owned |

| |

| Theodore E. Charles | 3,225,820 | 49.13% |

| “Robino Stortini” group (1) | 782,304 | 11.91% |

| Timothy B. Murphy | 482,830 | 7.19% |

| Arthur Stickney | 5,667 | * |

| William J. Atherton | 4,000 | * |

| Robert Martin | 2,000 | * |

| Geoffrey Chalmers | - | * |

| Kathleen L. Donnelly | 100 | * |

| All directors/nominees and executive | 3,720,417 | 55.40% |

| officers as a group (7 Persons) | | |

*Less than 0.1%.

(1) From Schedule 13D filed July 9, 2008. Includes shares held, primarily on a shared voting and dispositive power basis, by a “group” reported to be comprised of: Michael Stortini (782,304 shares); RSSIAM, LLC, RSSI Investment Advisers, LLC and Charles J. Robino (761,404 shares, each); Robino Stortini Holdings II, LLC (7,913 shares); and RSH Opportunities Fund I, LLC (7,000 shares).

The persons named in the above table have sole voting and dispositive power over all shares of common stock shown as beneficially owned by them, except as otherwise indicated. 278,000 shares attributed in the above table to Mr. Charles are held by Mr. Charles as trustee of a charitable trust, and Mr. Charles denies any beneficial interest therein. The shares attributed to Mr. Charles do not include a total of 383,000 shares held by his spouse and children. Mr. Murphy holds immediately exercisable options to purchase 150,000 shares of common stock from the Company. The shares underlying these options are included in the number of shares attributed to Mr. Murphy in the above table. The shares attributed to Mr. Murphy also include 648 shares held for the benefit of 529 Plans for his children in which he denies any personal beneficial interest.

The business address of Messrs. Charles and Murphy and Ms. Donnelly is c/o Investors Capital Holdings, Ltd., 230 Broadway East, Lynnfield, Massachusetts 01940. The business address of Mr. Martin is c/o Mercury Brewing Company, 23 Hayward Street, Ipswich, Massachusetts. Correspondence to Messrs. Stickney, Atherton or Chalmers may be directed to the above address for Investors Capital Holdings, Ltd. attention of the Secretary, who will promptly forward same to the intended recipient. All of the members of the “Robino Stortini” group report an address of 102 Robino Court, Suite 101, Wilmington, DE 19804.

PROPOSAL 1.

ELECTION OF DIRECTORS |

Six directors are to be elected at the Meeting to hold office until the next annual stockholders meeting or until their successors have been duly elected and qualified. It is the intention of the proposed proxies named in the accompanying Proxy Card to voteFORthe election of the following 6 persons as directors of the Company, unless authority to do so is withheld: William J. Atherton, Geoffrey Chalmers, Theodore E. Charles, Robert Martin, Timothy B. Murphy and Arthur Stickney. The nominees, all of whom currently are directors of the Company, have consented to being nominated and named herein and to serving as directors if elected at the Meeting. In the event that any of these nominees for director should become unavailable for elect ion for any presently unforeseen reason, the proposed proxies named in the accompanying Proxy Card have the right to use their discretion to vote for a substitute.

Pursuant to the Bylaws of the Company, the number of Directors is currently set at six, and may be adjusted from time to time by vote of the Board of Directors. Each director presently is elected for a one-year term at each annual meeting of the stockholders. Officers are appointed by, and serve at the pleasure of, the Board of Directors.

The following sets forth, as of July 10, 2009, certain information with respect to each of the Board’s nominees for election as a director:

Theodore E. Charles, age 66, has served as a director and chairman of the board of the Company since its inception in July 1995. A founder of Investors Capital Holdings, Mr. Charles served as the Company’s chief executive officer and president from 1995 until August 2008. Mr. Charles also has served as the chief executive officer of our subsidiaries, Investors Capital Corporation (“ICC”) and Eastern Point Advisors, Inc (“EPA”) from their founding in 1994 and 1995, respectively, until August 2008. Mr. Charles served on the Board of Directors of Revere Savings Bank of Massachusetts from 1997 to 2001 and served on the Advisory Board of Danvers Savings Bank from 2001 to 2003. Mr. Charles currently holds various securities licenses, including series 6, 63 , 7 and 24, has been a member of the Financial Planning Association since 1985 and formerly served as Chairman of the Shareholder Advisory Board of Life USA Insurance Company.

Timothy B. Murphy, age 44, has served as a director of the Company since July 1995. A founder of the Company, Mr. Murphy has served as its president and chief executive officer since August 2008. He served as executive vice president and chief financial officer of the Company from its inception until August and December 2008, respectively, and as president of its subsidiaries, ICC and EPA, since their respective inceptions. He entered the securities industry in 1990 as an operations manager in the Boston regional office of Clayton Securities. By 1994, he was serving as compliance officer of Baybanks Brokerage and a vice president of G.R. Stuart & Company, another brokerage firm. Mr. Murphy holds various securities licenses including series 4, 7, 24, 27, 53, 63 and 65.

William J. Atherton, age 70, has served as a director of the Company since November 2004. Since 2004, Mr. Atherton has been managing director of the Atherton Group, consulting on relationships between insurers, investment and product managers, and distributors in the variable annuity industry. From 1997 until his retirement in 2004, Mr. Atherton was the first President of Ameritas Variable Life Insurance Company, a joint venture between Ameritas Life Insurance Corp. of Lincoln, Nebraska, and AmerUs Life Insurance Corp. of Des Moines, Iowa. Mr. Atherton has been a senior executive in the annuity business since 1985, when he formed North American Security Life (NASL) in Boston, a variable annuity subsidiary of North American Life Assurance of Toronto. Mr. Atherton has been the president and a director of two Variable I nsurance Trusts and recently received the John D. Marsh Memorial Award as a 2003 inductee into the NAVA Hall of Fame.

Geoffrey Chalmers, age 74, has served as a director of the Company since March 2009. Since 1996 Mr. Chalmers has been engaged in the private practice of law and legal and compliance consulting to the financial services industry. He served as Vice President and General Counsel of Commonwealth Financial Network, Inc., an independent broker-dealer, from 1992 to 1996, and of Liberty Real Estate Management, Inc., a property management firm, from 1987 to 1992. For approximately two decades prior thereto, Mr. Chalmers provided legal services, predominantly relating to the financial industry, in a number of capacities including in-house as General Counsel of Continental Investment Corporation, a financial services holding company, as Attorney-Examiner at the Securities and Exchange Commission, and as an associate of or of co unsel to several law firms. Mr. Chalmers currently serves as a director of Woodstock Financial Group, Inc., a publicly-traded broker-dealer.

Robert Martin, age 41, has served as a director of the Company since July 2005. Mr. Martin has been the owner and president of Mercury Brewing Company of Ipswich, Massachusetts since acquiring and renaming Ipswich Brewing Company in 1999. Mercury Brewing is a brewer of ales, lagers and sodas. A graduate of Rensselaer Polytechnic Institute, Mr. Martin holds a degree in Architecture and practiced in the Boston area in the 1990’s prior to his employment at the brewing company.

Arthur Stickney, age 74, has served as a director of the Company since August 2004. From 1970 through 2003, Mr. Stickney served as the head of Stickney Associates, a marketing and advertising company whose clients included such brand companies as Alex Brown, Bessemer Trust, Fidelity Investments, Fiduciary Trust, StockCross and Tucker Anthony. Mr. Stickney also served as a partner in charge of business development for Hill Holiday in the late 1960’s, as well as New England and Canadian Advertising Manager for The Wall Street Journal.

Director Meetings and Attendance

During fiscal year ended March 31, 2009 (hereinafter referred to as “fiscal 2009”), the Board held 5 meetings. During fiscal 2009, no director attended fewer than 75% of the aggregate total number of meetings of the Board and committees on which he served. The Company has no policy regarding director attendance at annual stockholder meetings; however, all directors attended the Company’s 2008 annual meeting of stockholders.

Independent Directors and their Committees

Four of the six members of the Board, Messrs. Atherton, Chalmers, Martin and Stickney, are “independent directors” as defined by the Company’s Director Independence Standards as well as applicable Securities and Exchange Commission (“SEC”) rule and NYSE American Stock Exchange (“AMEX”) listing standards. The Board maintains separately-designated standing Nominating and Governance, Audit, Human Resources and Risk Management Committees, the members of which are all independent directors (except that Mr. Charles chairs the latter committee), as described below. Messrs. Atherton and Martin also serve as the Lead Independent Director and Alternate Lead Independent Director, respectively.

The following table shows the current members of each standing committee of our Board of Directors:

| | | | |

| Director | Audit | Human Resources | Nom. & Governance | Risk Mgmt |

|

| Theodore E. Charles | | | | x |

| Timothy B. Murphy | | | | |

| William J. Atherton | x | x | x | x |

| Geoffrey Chalmers | x | x | x | |

| Rob Martin | x | x | x | x |

| Arthur Stickney | x | | x | |

| |

Audit Committee

The Audit Committee, a separately-designated standing committee established in accordance with section 3(a)(58)(A) of the Exchange Act of 1934, oversees the accounting and financial reporting processes of the Company and audits of the Company’s financial statements. The Audit Committee consults with the Company’s independent auditors and management with respect to the adequacy of internal controls as well as the Company's audited and interim financial statements before they are made public. The Committee also is responsible for retaining, determining the compensation of, overseeing, and terminating accounting firms that provide audit, review, attest and other services for the Company. The Board has determined that Mr. Chalmers is an “audit committee financial expert” as defined by applicable SEC rule. See the documentation referred to in “Director and Nominee Background s”, above, for information regarding experience of Mr. Chalmers that is relevant to serving as an audit committee financial expert. The Audit Committee met five times during fiscal 2009.

Human Resources Committee

The Human Resources Committee is responsible for determining and approving the compensation payable to the Company’s Named Executive Officers, currently, Messrs. Charles and Murphy and Ms. Donnelly, including salary and, as applicable, bonus and long-term incentive compensation. The Committee also is responsible for reviewing and approving employment agreements and severance and change of control arrangements for these officers, and administers and oversees the Company’s equity incentive plans including authorizing grants thereunder. The Committee determines such matters after carefully reviewing proposals respecting the amount and form thereof submitted by the chief executive officer, as well as information commissioned from Company staff and/or received from other sources that it deems relevant and material to the process. The Committee, in its deliberations, may consult third-party compe nsation surveys and published compensation information respecting selected peer group firms, and is empowered to engage the assistance of outside counsel and experts. The Committee met twice during fiscal 2009.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible, among other things, for identifying persons well qualified to become Board members, and recommending them to the Board as nominees for election at the next annual meeting of shareholders or to fill vacancies. The Committee also is responsible for recommending to the Board changes in the Company’s corporate governance guidelines, including policies and procedures for review, approval or ratification of transactions with related parties required to be reported under SEC rules. The Committee met four times during fiscal 2009.

Risk Management Committee

The Risk Management Committee is responsible for assessing and providing oversight to management regarding the identification, management and mitigation of strategic, operational, regulatory, informational, external and other risks relating to the Company’s business and operations. The Committee met three times during fiscal 2009.

Committee Charters

The Charters of the Audit, Human Resources, and Nominating and Governance Committees are available on our website atwww.investorscapital.com/home/investorRelations/corporateGovernance.aspx.

Director Nomination Process

In evaluating the suitability of candidates for election or re-election as directors, the Committee considers many factors, including general understanding of marketing, finance, and other disciplines relevant to the success of a publicly traded company in today’s business environment; understanding of the Company’s business and technology; educational and professional background; and personal accomplishments. The Committee also evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best ensure the success of the Company’s business and represent shareholder interests. In determining whether to recommend a director for re-election, the Committee considers the director’s past attendance at meetings and participation in and contributions to the activities of the Board and its committees.

The Nominating and Governance Committee will consider shareholder recommendations for candidates for the Board. The name of any recommended candidate for director, together with a brief biographical sketch, a document indicating the candidate’s willingness to serve, if elected, and evidence of the nominating shareholder’s ownership of Company stock should be sent to the attention of the Secretary of the Company.

Communications with the Board

Stockholder desiring to send communications, other than proposals for stockholder meetings, to the Board or individual directors should address such communications to the Company’s Secretary, who will forward such communications to the full Board, or individual directors, as deemed appropriate by senior management.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" EACH OF ITS NOMINEES FOR DIRECTOR.

PROPOSAL 2.

RATIFICATION OF APPOINTMENT OF

INDEPENDENT PUBLIC ACCOUNTANTS |

The Board of Directors, upon recommendation of its Audit Committee, has appointed the firm of UHY, LLP (“UHY”) to serve as our independent public accountants for the fiscal year ending March 31, 2010. UHY served as our independent public accountants for fiscal 2009 and is considered to be well qualified by our management. Although stockholder ratification is not required, the Board of Directors has directed that such appointment be submitted to the stockholders of the Company for ratification at the Meeting as a matter of good corporate governance. If the stockholders do not ratify the appointment of UHY, the Board of Directors may reconsider the appointment. Further, whether or not stockholder approval is given, the Audit Committee in its discretion may appoint another independent registered public accounting firm at any time during the year if the Committee believes that such a change wou ld be in the best interest of the Company and its stockholders. No representatives of UHY are expected to attend the Meeting.

Audit Fees

The aggregate fees billed for fiscal years ended March 31, 2009 and 2008 for professional services rendered by the Company's principal accountant, UHY, for the audit of the Company's annual financial statements and review of financial statements included in the Registrant’s Forms 10-Q, or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years totaled $211,429 and $234,344, respectively.

UHY leases all its personnel, who work under the control of UHY LLP Partners, from wholly-owned subsidiaries of UHY Advisors, Inc., in an alternative practice structure.

Audit-Related Fees

The aggregate fees billed for the fiscal years ended March 31, 2009 and 2008 for assurance and related services by the Company's principal accountant that are reasonably related to the performance of the audit or review of our financial statements (other than disclosed above) totaled $0 for both fiscal years.

Tax fees

The aggregate fees billed in fiscal years ended March 31, 2009 and 2008 for professional services rendered by the Company's principal accountant for tax compliance, tax advice, and tax planning (other than as disclosed above) totaled $1,500 and $0, respectively. The fees billed in the latter fiscal year were for consulting services rendered with respect to a state tax audit for a year in which UHY Advisors, Inc. prepared the Company’s tax return.

All Other Fees

In fiscal years ended March 31, 2009 and 2008 the Company was not billed by our principal accountant for services other than those disclosed above.

Engagement of Accounting Services

All audit and non-audit services provided to the Company by accountants, including its independent auditor, must be approved by the Audit Committee prior to the rendering of services unless the following conditions are met:

- The services are not recognized by the Company at the time of engagement to be non-audit services;

- The total amount of such services is less than or equal to 5% of the total amount of compensation paid bythe Company to the independent auditor during the fiscal year in which the services are provided; and

- The services are brought promptly to the attention of the Audit Committee and approved by the Committee,or by one or more members thereof who are members of the board of directors who have been delegatedapproval authority, prior to the completion of the annual audit.

All other permitted services must be pre-approved by either the Audit Committee or a delegate of the Audit Committee. If pre-approval is obtained from a delegate of the Audit Committee, the service may be performed provided that the service is presented to the Audit Committee at the next scheduled meeting.

In determining whether or not to approve non-audit accounting services from the Company’s independent auditor, the Audit Committee considers whether the provision of such services is compatible with maintaining the independence of the auditor.

100% of the costs of accountant services described in “Audit-Related Fees, Tax Fees ”and“ All Other Fees, above, were incurred in conformity with the requirements set forth above respecting circumstances where there is no Audit Committee pre-approval.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE PROPOSAL TO RATIFY THE APPOINTMENT OF UHY, LLP AS INDEPENDENT PUBLIC ACCOUNTANTS OF THE COMPANY FOR THE FISCAL YEAR ENDING MARCH 31, 2010.

As of the date of this Proxy Statement, the Board knows of no other business to be presented at the Meeting. However, if any other matters properly come before the Meeting, the persons named in the enclosed form of proxy are expected to vote the proxy in accordance with their best judgment on such matters.

* ADDITIONAL INFORMATION *

EXECUTIVE COMPENSATION |

Summary Compensation Table

The following table summarizes all plan and non-plan compensation awarded to, earned by, or paid to Messrs. Charles and Murphy and Ms. Donnelly (the “Named Executive Officers”) during the fiscal years ended March 31, 2009 and 2008 for all services rendered in all capacities to the Company and its subsidiaries. The stock awards compensation disclosed in the table is comprised of compensation recognized with respect to the granting to the Named Executive Officers and vesting of the following Company common stock:

(i) stock granted on June 12, 2006 to Messrs. Charles and Murphy under the Company’s 2005 Equity Incentive Plan (the “2005 Plan”), each in the amount of 100,000 shares. One half of the shares awarded to each of these Named Executive Officers were vested at grant, and the remainder is scheduled to vest in equal annual installments on the first five annual anniversaries of the grant date.

(ii) stock granted on February 13, 2008 to Messrs. Charles and Murphy under the Company’s 1996 Stock Incentive Plan in the amounts of 125,000 and 93,750 shares, respectively. One half of the shares awarded to each such Named Executive Officer were vested at grant, and the remainder vested in equal monthly installments on the first twelve monthly anniversaries of the grant date.

(iii) stock granted on August 23, 2007 to Ms. Donnelly under the 2005 Plan in the amount of 100 shares. One third of these shares were vested at grant, and the remainder is scheduled to vest in equal installments on the first two anniversaries of the grant date.

| | | | | | |

| | Fiscal | | | | All | |

| | Year | | | Stock | Other Compen- | |

| | Ended | Salary | Bonus | Awards | sation | Total |

| Name and Principal Position | March 31, | ($) | ($) | ($) (2) | ($) (3) | ($) |

| Theodore E. Charles | 2009 | 390,000 | - | 345,875 | 254,086 | 989,961 |

| Chairman of the Board | 2008 | 400,000 | 200,000 | 374,000 | 445,213 | 1,419,213 |

| |

| Timothy B. Murphy | 2009 | 352,500 | - | 268,531 | 170,484 | 791,515 |

| Chief Executive Officer | 2008 | 300,000 | 150,000 | 289,625 | 318,936 | 1,058,561 |

| |

| Kathleen L. Donnelly (1) | 2009 | 102,000 | - | 169 | 3,289 | 105,458 |

| Chief Fiinancial Officer | - | | | | | |

1. No compensation data for Ms. Donnelly for the fiscal year ended March 31, 2008 are given as she did not serve as CFO or other executive officer of the Company during said fiscal year.

2. The dollar amount shown for each stock award included in the above table equals the amount recognized for financial statement reporting purposes, calculated as the number of shares vested as of March 31, 2009 times the closing price of the Company’s common stock on the NYSE Amex exchange (formerly known as the American Stock Exchange) on the date of grant.

3. All Other Compensation consists of the following items:

| | | | | | | | |

| | | | Long-Term | | | | Country | |

| | Fiscal | Life | Care | 401(k) | Gross-ups | Commis- | Club | Auto |

| | Year | Insurance | Insurance | Employer | for Payment | sions | Membership | Leases and |

| | Ended | Premiums | Premiums | Match | of Taxes | Earned | Fees | Insurance |

| Name and PrincipalPosition | March 31, | ($) | ($) | ($) | ($) (1) | ($) | ($) | ($) |

| |

| Theodore E. Charles | 2009 | 53,169 | 19,511 | 11,197 | 134,838 | 3,216 | 8,964 | 23,191 |

| Chairman of the Board | 2008 | 55,193 | 19,511 | 15,563 | 308,287 | 4,693 | 11,237 | 30,729 |

| |

| Timothy B. Murphy | 2009 | 1,397 | - | 10,654 | 124,062 | 765 | 10,869 | 22,737 |

| Chief Executive Officer | 2008 | 1,697 | - | 15,500 | 251,637 | - | 14,865 | 22,737 |

| |

| Kathleen L. Donnelly (1) | 2009 | - | - | 3,289 | - | - | - | - |

| Chief Financial Officer | | | | | | | | |

1. The listed gross-up amounts were authorized to reimburse the listed Named Executive Officers for federal and state taxes payable on cash and stock bonuses awarded to them.

Executive Employment Agreements

On August 8, 2000 the Company entered into full-time employment agreements with Theodore E. Charles and Timothy B. Murphy. For each, the term of employment is three years, which, on the third anniversary of the commencement date, automatically extends for a three-year period unless earlier terminated. Under the employment agreements, which have not been terminated and the terms of which continue to be honored, Messrs. Charles and Murphy are entitled to receive an annual base salary of $400,000 and $200,000, respectively, subject to upward adjustments at the discretion of the Human Resources Committee or the Board, taking into account such factors as increases in the cost of living adjustments as well as individual and/or Company performance. Each of their current annual base salaries is $400,000 reduced by an annualized amount of $40,000 pursuant to a Company-wide 10% salary reduction instituted duri ng the fiscal year ended March 31, 2009. In addition, Messrs. Charles and Murphy may present to the Compensation Committee proposals as to an annual bonus or incentive program for them. Such proposals may or may not be accepted by the Human Resources Committee or the Board, acting with the affirmative vote of a majority of the independent members and without the participation or vote of Messrs. Charles and Murphy. The following discussion of the terms of employment for these officers refers to the terms of said agreements, as written:

If the Company fails to renew the employment term or terminates the employment of Mr. Charles, either with or without cause, or if he resigns for just cause, Mr. Charles is entitled to receive sixty (60) months' base salary at the time of termination plus, to the extent earned and not already paid, any bonus payable for the prior fiscal year plus an amount equal to any bonus payable with respect to the current fiscal year. The base salary is payable in installments on such dates on which it would be paid if Mr. Charles had not been terminated. The bonus payment is payable in a lump-sum within thirty (30) days of termination.

If the Company fails to renew the employment term or terminates the employment of Mr. Murphy, either with or without cause, or if he resigns for just cause, Mr. Murphy is entitled to receive thirty-six (36) months' base salary at the time of termination plus, to the extent earned and not already paid, any bonus payable for the prior fiscal year plus an amount equal to any bonus payable with respect to the current fiscal year. The base salary is payable in installments on such dates on which it would be paid if Mr. Murphy had not been terminated. The bonus payment is payable in a lump-sum within thirty (30) days of termination.

In the event of a “change in control” Messrs. Charles and Murphy are entitled to (i) acceleration, subject to certain conditions, of the exercisability of any stock options they may hold and to (ii) payment of any bonuses for the then current fiscal year under any bonus plans then in effect for their benefit as if fully earned. Further, the Company agreed to reimburse both of them for any excise taxes paid by them as “excess parachute payments” under Section 280G of the Internal Revenue Code (iii) on said change of control benefits and (iv) on any such reimbursement. As defined in the agreements for Messrs. Charles and Murphy, a "change in control" is deemed to have taken place if a person becomes the beneficial owner, directly or indirectly, of securities of the Company representing 75% or more of the total number of votes that may be cast for the election of the directors of the Company or as the result of, or in connection with, any tender or exchange offer, merger, consolidation or other business combination, sale of assets or one or more contested elections, or any combination of the foregoing transactions in which the persons who were directors of the Company immediately prior to the transaction shall cease to constitute a majority of the board of directors of the Company or of any successor to the Company

The employment agreements also contain a provision that neither Mr. Charles nor Mr. Murphy will compete or engage in a business competitive with our current or anticipated business during the term of the employment agreement and for a period of six months thereafter. A state court may determine not to enforce this provision or to otherwise limit its enforceability.

Ms. Donnelly, who does not have a formal written employment agreement, is paid a salary of $130,000 less a 10% reduction pursuant to the aforesaid Company-wide salary reduction program. Ms. Donnelly is employed at will and has no formal severance arrangements.

Outstanding Equity Awards At Fiscal Year-End

The following table sets forth information as of March 31, 2009 regarding unexercised stock options and non-vested stock resulting from prior awards by the Company to the Named Executive Officers. Said officers did not possess any unvested equity incentive plan awards as of said date.

| | | | | | | |

| | Option Awards | | Stock Awards |

| | Number | Number | | | | | Market |

| | of | of | | | | Number | Value of |

| | Securities | Securities | | | | of Shares | Shares |

| | Underlying | Underlying | | | | of Stock | of Stock |

| | Unexercised | Unexercised | Option | | | That Have | That Have |

| | Options | Options | Exercise | Option | | Not | Not |

| | (#) | (#) | Price | Expiration | | Vested | Vested |

| Name | Exercisable | Unexercisable | ($) | Date | | (#) (1) | ($) |

| |

| Theodore E. Charles | - | | | | | 20,000 | $27,400 |

| |

| Timothy B. Murphy | 150,000 | - | $1.00 | None | | 20,000 | $27,400 |

| |

| Kathleen L. Donnelly | - | | | | | 33 | $45 |

(1) 20,000 unvested shares listed as being held by each of Messrs. Charles and Murphy vest in equal annual installments on the 12thday of June of 2010 and 2011. The 33 unvested shares held by Ms. Donnelly vest August 23, 2009.

DIRECTOR COMPENSATION

The following table sets forth information concerning the compensation for the fiscal year ended March 31, 2009 of the Company’s directors who are not Named Executive Officers.

| | | |

| | Fee Earned or | | |

| | Paid in Cash (2) | Stock Awards (3) | Total |

| Name (1) | ($) | ($) | ($) |

| William J. Atherton | $42,250 | $0 | $42,250 |

| Robert Martin | $38,000 | $0 | $38,000 |

| Arthur Stickney | $32,000 | $0 | $32,000 |

| Geoffrey Chalmers | $8,000 | $0 | $8,000 |

| 1. | All compensation received as a director by Named Executive Officers is disclosed in the Summary Compensation Table,infra, and accordingly is not disclosed in this table. |

| 2. | Commencing the fiscal quarter ended September 30, 2008, each director who is not an employee receives the following per annum fees in quarterly installments so long as he or she serves in the following positions: (i) $20,000 as a director, (ii) $3,000, $2,000 and $2,000, respectively, as a member of the Audit, Human Resource or Nominating and Governance Committee, and (iii) an additional $5,000, $3,000 and $2,000, respectively, as Chairman of the Audit, Human Resources or Nominating and Governance Committee. During the fiscal year ended March 31, 2009, Messrs.Atherton, Martin and Stickney also served on a Special Committee with respect to potential strategic transactions for which each of them is ultimately entitled to receive $25,000 of which half was earned during the fiscal year. |

AUDIT COMMITTEE REPORT

The Board of Directors of the Company has appointed an Audit Committee composed of 4 independent directors.

The Board of Directors has adopted a written charter for the Audit Committee. The Audit Committee reviews and assesses the adequacy of its charter on an annual basis. The Audit Committee's job is one of oversight as set forth in its Charter. It is not the duty of the Audit Committee to prepare the Company's financial statements, to plan or conduct audits, or to determine that the Company's financial statements are complete and accurate and are in accordance with accounting principles generally accepted in the United States of America. The Company's management is responsible for preparing the Company's financial statements and for maintaining internal controls. The independent auditors are responsible for auditing the financial statements and for expressing an opinion as to whether those audited financial statements fairly present the financial position, results of operations, and cash flows of the Co mpany in conformity with accounting principles generally accepted in the United States of America.

The Audit Committee has reviewed and discussed the Company's audited consolidated financial statements with management and with UHY, LLP (the "Auditors"), the Company's independent auditors for fiscal 2009.

The Audit Committee has discussed with the Auditors the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards, vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board (the “PCAOB”) in Rule 3200T.

The Audit Committee has received from the Auditors the written disclosures and the letter from the Auditors required by applicable requirements of the PCAOB regarding the Auditors’ communications with the Audit Committee concerning independence, and has discussed with the Auditors the Auditors’ independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company's Annual Report on Form 10- K for the fiscal year ended March 31, 2009 for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

/s/ William J. Atherton, Geoffrey Chalmers, Robert Martin and Arthur Stickney

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Our principal executive offices, comprised of several office condominiums, are located in a 9,068 square foot facility at 230 Broadway, Lynnfield, MA. The Company also maintains an office in a 2,132 square foot facility at 218 Boston Street, Topsfield, MA. Both of these properties are leased from entities owned and controlled by the Chairman and principal shareholder of ICH for a combined annual rent of $291,200. The Company believes the annual rent amounts are consistent with current market rates for comparable space in the same geographic areas. These leases were renewed and modified on April 1, 2008 and will expire on March 31, 2012.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires directors and officers of the Company and persons, or “groups” of persons, who own more than 10% of a registered class of the Company’s equity securities (collectively, “Covered Persons”) to file with the Securities and Exchange Commission, The American Stock Exchange and the Company, within specified time periods, initial reports of beneficial ownership, and subsequent reports of changes in ownership, of certain equity securities of the Company. Based solely on its review of copies of such reports furnished to it or filed with the SEC and available on EDGAR, and upon any written representations of Covered Persons that no other reports were required, the Company believes that Covered Persons have failed to meet such filing requirements as follows: during the fiscal year ended March 31, 2009, Geoffrey Chalmers and Kathleen Donnelly ea ch failed to timely file a Form 3 initial statement of beneficial ownership of securities.

ANNUAL REPORT TO STOCKHOLDERS / FORM 10-K

The Company's Annual Report to its stockholders for the fiscal year ended March 31, 2009 (which includes a reproduction of the Form 10-K, as filed with the Securities and Exchange Commission) is being mailed to all stockholders concurrently with this Proxy Statement. Additional copies of the Company's Report on Form 10-K (excluding exhibits), as filed with the SEC, may be obtained at no cost by writing to the Corporate Secretary, Investors Capital Holdings, Ltd., 230 Broadway East, Lynnfield, Massachusetts 01940. Additional copies of exhibits listed in the Form 10-K are available upon written request to the Corporate Secretary at a nominal charge to cover printing and mailing. The Form 10-K also may be accessed on the internet athttp://www.sec.govand athttp://www.investorscapital.com/home/investorRelations/secFilingsIndex.aspx.

| PROPOSALS FOR 2010 ANNUAL MEETING |

No person who intends to present a proposal for action at the 2010 annual stockholders meeting of the Company may seek to have the proposal included in the Board of Directors’ proxy statement or form of proxy for such meeting unless that person (a) is a record or beneficial owner of at least 1% or $2,000 in market value of shares of Common Stock, (b) has held such shares for at least one year at the time the proposal is submitted, and such person shall continue to own such shares through the date and the dates upon which he acquired such shares with documentary support for a claim of beneficial ownership, (c) notifies the Company of his intention to appear personally at the meeting or by a qualified representative under applicable state law to present his proposal for action, and (d) submits his proposal timely. A proposal to be included in the Board of Directors’ proxy statement and form o f proxy for the Company's next annual meeting of stockholders will be submitted timely only if the proposal has been received at the Company's principal executive office no later than March 25, 2009. However, if the date of such meeting is changed by more than 30 calendar days from August 25, 2010, or if the proposal is to be presented at any meeting other than the next annual meeting of stockholders, the proposal must be received at the Company's principal executive office at a reasonable time before the solicitation of proxies for such meeting is made.

A person may submit only one proposal with a supporting statement of not more than 500 words, and under certain circumstances enumerated in the rules of the Securities and Exchange Commission (the “SEC”) relating to the solicitation of proxies, the Company may be entitled to omit the proposal and any statement in support thereof from its proxy statement and form of proxy.

The Company will be permitted to vote proxies in its discretion on any proposal properly coming before the Company's 2010 annual meeting of stockholders if the Company:

- does not receive notice of the proposal on or before June 7, 2010, or

- receives notice of the proposal no later than June 7, 2010andadvises stockholders in its proxystatement about the nature of the matter and how the Company intends to exercise its discretion to voteon such matter, all except as otherwise provided by applicable SEC rules.

Notices of intention to present proposals at the Company's next annual stockholders meeting should be addressed to the Company's Secretary, Douglas C. Leonard, Esq., Investors Capital Holdings, Ltd., 230 Broadway East, Lynnfield, MA 01940.

By order of the Board of Directors,

Theodore E. Charles

Chairman of the Board |