UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[x] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to § 240.14a-12

INVESTORS CAPITAL HOLDINGS, LTD.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[x] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Notice of 2012 Annual Meeting

and

Proxy Statement

July 13, 2012

Dear Stockholder:

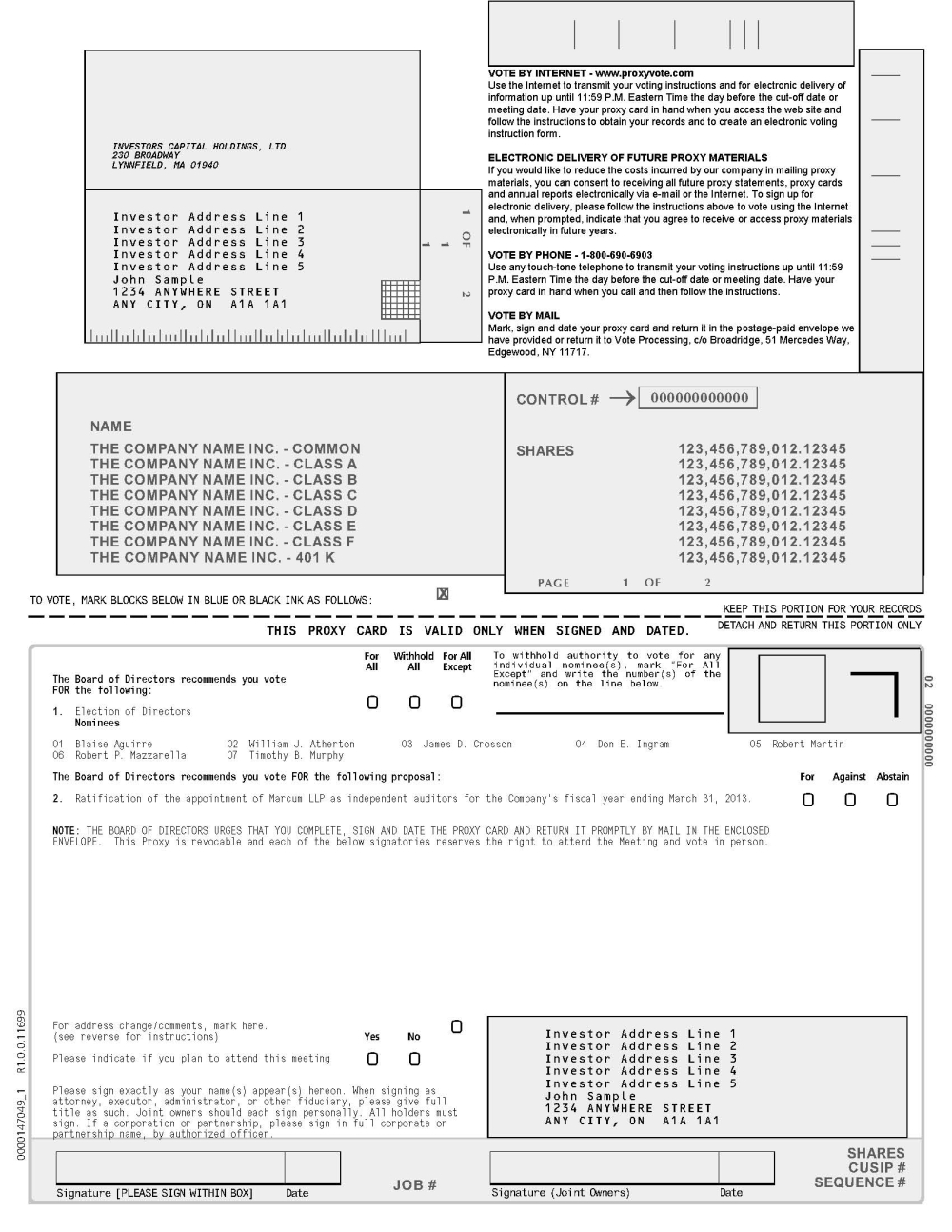

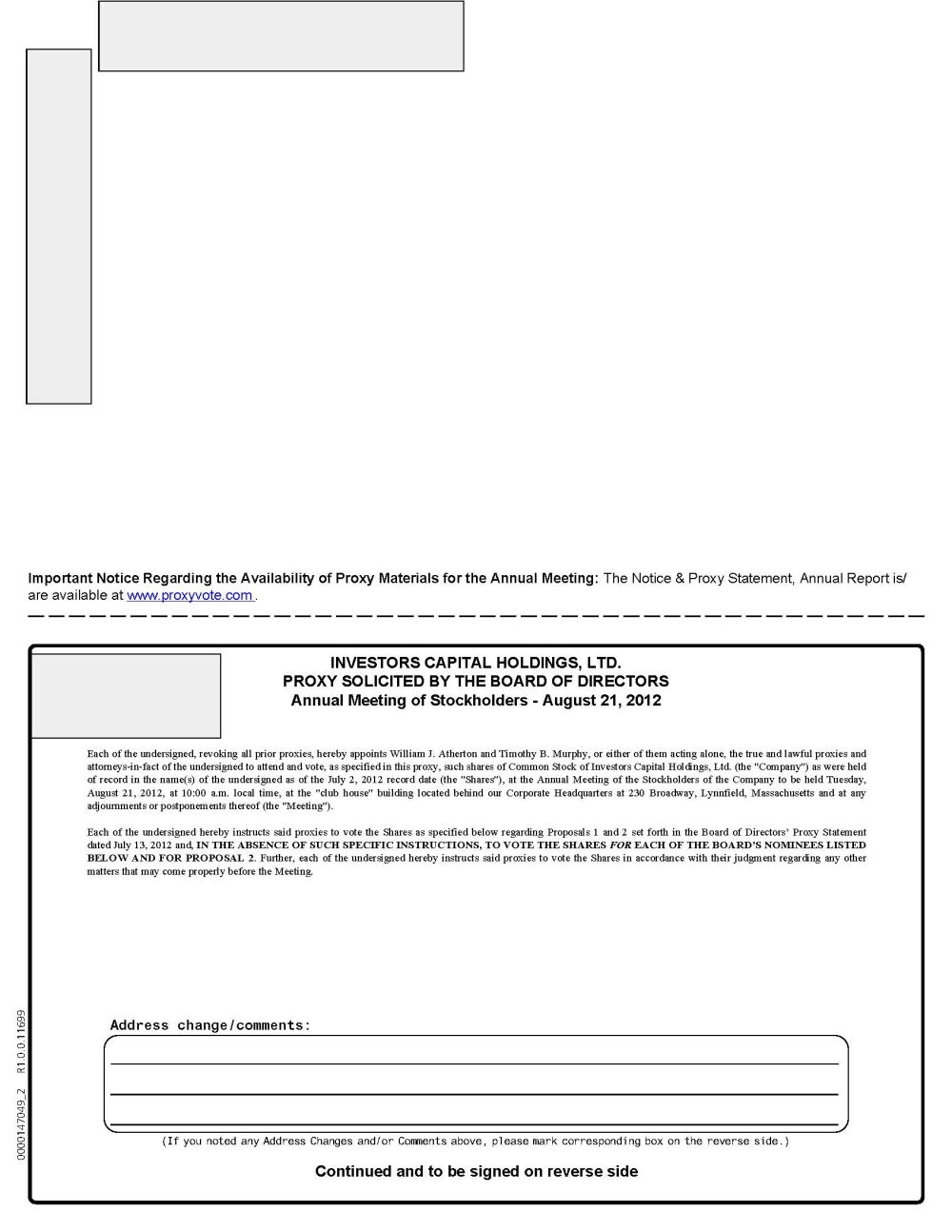

You are cordially invited to attend the Annual Meeting of Stockholders (the "Meeting") of Investors Capital Holdings, Ltd. (the "Company") to be held on Tuesday, August 21, 2012, at 10:00 a.m. local time, at the “club house” building located behind our corporate headquarters at 230 Broadway, Lynnfield, Massachusetts. Your Board of Directors and management look forward to greeting those stockholders who are able to attend.

The Notice of Annual Meeting of Stockholders and Proxy Statement containing information pertaining to the business to be transacted at the Meeting appear on the following pages.

Whether or not you plan to attend, it is important that your shares be represented and voted at the Meeting. You are requested to complete, sign, date, and mail the enclosed proxy card at your earliest convenience.

On behalf of the Board of Directors and management I would like to thank you for your interest and participation in the affairs of the Company.

Sincerely,

/s/ Timothy B. Murphy

Chief Executive Officer

INVESTORS CAPITAL HOLDINGS, LTD.

230 Broadway East

Lynnfield, Massachusetts 01940

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, AUGUST 21, 2012

July 13, 2012

To the Stockholders:

NOTICE IS HEREBY GIVEN, that the Annual Meeting of Stockholders (the "Meeting") of Investors Capital Holdings, Ltd., a Delaware corporation (the "Company"), will be held at 10:00 a.m. local time, at the “club house” building located behind our corporate headquarters at 230 Broadway, Lynnfield, Massachusetts for the following purposes:

| | * | To elect seven directors, each to serve for a term of one year or until his or her successor is elected and qualified; |

| | * | To ratify the appointment by the Board of Directors of independent auditors to audit the Company's books and records for the fiscal year ending March 31, 2013; and |

| | * | To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

Only holders of common stock of record as of the close of business on July 2, 2012 will be entitled to notice of, and to vote at, the Meeting, or any adjournments or postponements thereof.

Stockholders are cordially invited to attend the Meeting. Please contact the Company at 800-949-1422 to obtain directions to the meeting location.

It is important that your shares be represented and voted at the Meeting. Because many of our stockholders cannot personally attend the Meeting, it is necessary that a large number be represented by proxy in order to participate in the Meeting. Therefore, if you do not expect to attend the Meeting, but wish your stock to be voted for the business to be transacted thereat, you are requested to complete, sign and date the enclosed proxy card and return it by mailing it in the accompanying postage-paid envelope.

By Order of the Board of Directors,

/s/ Rebecca Hice

Assistant Secretary

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on August 21, 2012: The Proxy Statement and the Annual Report to Stockholders are available at https://materials.proxyvote.com/46147M.

PROXY STATEMENT

General

This Proxy Statement and the accompanying Proxy Card are being furnished in connection with the solicitation by the Board of Directors (the "Board") of Investors Capital Holdings, Ltd., a Delaware corporation (the "Company"), of proxies to be voted at the Annual Meeting of Stockholders of the Company (the "Meeting") to be held on Tuesday, August 21, 2012 at 10:00 a.m. local time, at the “club house” building located behind our corporate headquarters at 230 Broadway, Lynnfield, Massachusetts, or any adjournments or postponements thereof, for the purposes set forth in the attached Notice of Annual Meeting of Stockholders.

Only the holders of record of the Company's common stock, par value $.01 per share, as of the close of business on July 2, 2012 (the "Record Date") are entitled to notice of, and to vote on, all matters properly brought before the Meeting or any adjustments or postponements thereof. As of the Record Date, there were 6,683,938 shares of common stock outstanding.

Voting and Proxy Procedures

Each stockholder is entitled to cast one vote for each share of common stock held by him or her at the close of business on the Record Date. Pursuant to the Company's Bylaws, to constitute a quorum for the transaction of business at any meeting of stockholders, there must be present, in person or by proxy, the holders of a majority of the voting power of the issued and outstanding shares of voting stock of the Company. Once a share is represented for any purpose at the meeting, it is deemed present for quorum purposes for the remainder of the meeting. A plurality of the votes cast by the shares of stock entitled to vote, in person or by proxy, at the Meeting will elect directors as long as a quorum is present. If a quorum exists, action on each other question to be voted upon will be approved if votes, in person or by proxy, cast by stockholders favoring the action exceed the vote cast by stockholders opposing the action. When proxies in the enclosed form are returned properly executed, the shares represented thereby will be voted at the Meeting and, where instructions have been given by the stockholder, will be voted in accordance therewith. If the stockholder does not otherwise specify, the stockholder’s shares will be voted FOR each of the nominees for director, and FOR the proposal to ratify the appointment of the independent auditors, all as set forth in this Proxy Statement, and in accordance with their best judgment as to any other business which may come properly before the Meeting. Votes will be counted manually.

Abstentions and broker "non-votes" are not counted for purposes of the election of a director. On all other proposals, abstentions will be considered as a vote against the proposal, and broker non-votes will not be counted at all. A stockholder executing the accompanying proxy has the power to revoke it at any time prior to the exercise thereof by appearing at the Meeting and voting in person or by filing with the Secretary of the Company, (i) a properly executed, later-dated proxy, or (ii) a written instrument revoking the proxy.

This Proxy Statement and the accompanying Proxy Card are first being mailed to stockholders on or about July 17, 2012. A copy of the Company's Annual Report to Stockholders for the year ended March 31, 2012, is included with this Proxy Statement.

The solicitation of proxies in the accompanying form is made by, and on behalf of, the Board of Directors. We have engaged the services of Broadridge Financial Solutions, Inc. to assist us in the distribution of proxies, for which a fee will be paid. There will be no solicitation by officers and employees of the Company. The Company will make arrangements with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of proxy materials to the beneficial owners of shares held of record by such persons, and such persons will be reimbursed for reasonable expenses incurred by them in connection therewith.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following information is provided as of March 31, 2012 with respect to compensation plans (including individual compensation arrangements) under which equity securities of the Company are authorized for issuance.

| Equity Compensation Plan Information |

| | | | | | |

| | | | | | Number of securities |

| | Number of securities | | | | remaining available for |

| | to be issued | | Weighted-average | | future issuance under |

| | upon exercise of | | exercise price of | | equity compensation plans |

| | outstanding option, | | outstanding options, | | (excluding securities |

| Plan category | warrants and rights | | warrants and rights | | reflected in column (a)) |

| | (a) | | (b) | | (c) |

| | | | | | |

| Equity compensation | | | | | |

| plans approved by | | | | | |

| security holders | none | | - | | 461,386 |

| | | | | | |

| Equity compensation | | | | | |

| plans not approved | | | | | |

| by security holders | 150,000 | | $1.00 | | none |

| | | | | | |

| Total | 150,000 | | $1.00 | | 461,386 |

The following table presents information regarding beneficial ownership of our common stock as of July 5, 2012 by: (1) each person (including any group, as defined in Section 13(d)(3) of the Exchange Act) who is known to the Company to own beneficially more than five percent (5%) of our outstanding common stock, (2) the CEO and CFO of the Company (the “Named Executive Officers”), (3) each director and nominee, and (4) all director/nominees and Named Executive Officers as a group.

| Name of Beneficial Owner | Number of Shares Beneficially | Percent Beneficially |

| | Owned | |

| “Robino Stortini group” (1) | 782,304 | 11.70% |

| Dr. Blaise A. Aguirre | 17,468 | 0.26% |

| William J. Atherton | 7,000 | 0.10% |

| James D. Crosson | 76,344 | 1.14% |

| Kathleen L. Donnelly (2) | 14,228 | 0.21% |

| Don E. Ingram | 198,998 | 2.98% |

| Robert T. Martin | 3,000 | * |

| Robert P. Mazzarella | 3,000 | * |

| Timothy B. Murphy (3) | 626,249 | 9.16% |

| All directors/nominees and executive officers as a group (8 persons) | 946,287 | 13.85% |

| | | |

| * Less than 0.1% | | |

| (1) | Based solely on a Schedule 13D filed July 9, 2008. Includes shares therein reported to be held, primarily on a shared voting and dispositive power basis, by a “group” therein reported to be comprised of: Michael Stortini (782,304 shares); RSSIAM, LLC, RSSI Investment Advisers, LLC and Charles J. Robino (761,404 shares, each); Robino Stortini Holdings II, LLC (7,913 shares); and RSH Opportunities Fund I, LLC (7,000 shares). The Company has reason to believe that the number of shares now held by this group may be less than the number reported in the aforementioned Schedule 13D. |

| (2) | Includes 7,550 shares that are the approximate share equivalent of units in a unitized Company common stock fund held in the Company’s 401(k) plan. |

| (3) | Includes (i) 150,000 shares purchasable upon the exercise of immediately exercisable options, (ii) 78,691 shares that are the approximate share equivalent of units in a unitized Company common stock fund held in the Company’s 401(k) plan and (iii) 10,500 shares held for the benefit of 529 plans for Mr. Murphy’s children (in which such latter shares Mr. Murphy disclaims any personal beneficial interest). |

The persons named in the above table have sole voting and dispositive power over all shares of common stock shown as beneficially owned by them, except as otherwise indicated herein. Mr. Ingram shares voting and dispositive power over 3,000 of the shares beneficially owned by him.

The business address of Mr. Murphy and Ms. Donnelly is c/o Investors Capital Holdings, Ltd., 230 Broadway East, Lynnfield, Massachusetts 01940. The business address of Mr. Martin is c/o Mercury Brewing Company, 21 Hayward Street, Ipswich, Massachusetts. Correspondence to Messrs. Atherton, Mazzarella, Aguirre, Crosson or Ingram may be directed to the above address for Investors Capital Holdings, Ltd. attention of the Secretary, who will promptly forward same to the intended recipient. All of the members of the “Robino Stortini” group report an address of 102 Robino Court, Suite 101, Wilmington, DE 19804.

PROPOSAL 1.

ELECTION OF DIRECTORS

Seven directors are to be elected at the Meeting to hold office until the next annual stockholders meeting or until their successors have been duly elected and qualified. It is the intention of the proposed proxies named in the accompanying Proxy Card to vote FOR the election of the following seven persons as directors of the Company, unless authority to do so is withheld: William J. Atherton, Dr. Blaise A. Aguirre, James D. Crosson, Don E. Ingram, Robert Martin, Timothy B. Murphy and Robert P. Mazzarella. The nominees, all of whom currently are directors of the Company, have consented to being nominated and named herein and to serving as directors if elected at the Meeting. In the event that any of these nominees for director should become unavailable for election for any presently unforeseen reason, the proposed proxies named in the accompanying Proxy Card have the right to use their discretion to vote for a substitute.

Pursuant to the Bylaws of the Company, the number of Directors is currently set at seven, and may be adjusted from time to time by vote of the Board of Directors. Each director presently is elected for a one-year term at each annual meeting of the stockholders. Officers are appointed by, and serve at the pleasure of, the Board of Directors.

The following sets forth, as of July 6, 2012, certain information with respect to each of the Board’s nominees for election as a director:

Dr. Blaise A. Aguirre, MD, age 48, is a child psychiatrist who is Medical Director of 3East at Harvard-affiliated McLean Hospital and an instructor in Psychiatry at Harvard Medical School. Previously he was a broker with Investors Capital Corp., having obtained his series 7 and 63 securities licenses. Dr. Aguirre sits on the Board of Directors that oversees the annual running of the Illinois Marathon in Champaign, IL. He also was a Member of the Medical Advisory Board of IVPCARE, Inc. prior to their buy-out by Walgreens.

Dr. Aguirre has developed and maintains enduring relationships with institutional money managers, venture capitalists, and angel investors, and he has developed an expertise as a small cap stock analyst. The Company believes that the combination of these and other attributes may prove valuable to the Company in, among other things, establishing and maintaining potential sources of financing for the Company.

William J. Atherton, FLMI, CLU, age 73, has served as a director of the Company since November 2004 and currently serves as Chairman of the Board of Directors and of its Nominating and Governance Committee. Mr. Atherton is a retirement income planning consultant to insurers, money managers, distribution firms and administrative firms operating in the insurance industry. He is a former president of two life insurance companies: North American Security Life (NASL), now John Hancock Annuities, of Boston, MA from 1984 through 1996 and Ameritas Variable Life Insurance Company of Lincoln, NE., from 1997 to 2004, retiring at the mandatory age of 65. In these roles, Mr. Atherton was the President and a director of two mutual fund companies, the NASL Series Trust and the Calvert Variable Series and a member of the boards of NASL and Ameritas Holding Company. As chief executive of these companies, Mr. Atherton supervised all functions of the companies, including the actuarial, finance, sales, marketing, administration and legal departments, accountable to the boards of each firm for compliance and success in each area. The functions of chief actuary, chief financial officer, chief legal officer and chief marketing officer reported to Mr. Atherton in each company.

Prior to his election to his positions at NASL, Mr. Atherton had 25 years of administrative and marketing experience at North American Life of Toronto, and is a retiree with the surviving company, Manulife Financial. In 2003, Mr. Atherton was awarded the John D. Marsh memorial award as a sign of his induction into the Hall of Fame for the National Association for Variable Annuities (NAVA - now the Insured Retirement Institute - IRI) and is a member of the Retirement Income and the Operations and Technology committees of the IRI.

Since his retirement from corporate life, Mr. Atherton has focused on assistance to a select group of retained and project clients in the areas of business development and product design. He is a member of the boards of RAD Insurance Holdings, Inc. and The Elements Financial Group, and is often employed as an expert witness in FINRA arbitration hearings concerning variable annuity and variable life products - a product line making up close to half of Investors Capital's revenue.

Given the importance of variable annuities in the Company’s business mix, Mr. Atherton, with his lifelong CEO-level immersion in the variable insurance products industry, provides uniquely valuable insights, experience and judgment in this important area.

James D. Crosson, age 50, Mr. Crosson operates his own financial services business as a Financial Consultant. He has 28 years of industry experience with the focus of his practice being Retirement Planning. Mr. Crosson is a past board member of the Gabelli School of Business at Roger Williams University. He has instructed at UMASS Dartmouth, Bridgewater State College and Bristol Community College. He also is a past board member of The United Way. Mr. Crosson entered the securities industry in 1983 after graduating from Roger Williams University with a degree in Business Management and minors in Finance and Economics. He began as a stockbroker with First Albany Securities. In 1991 he became an independent financial consultant with LPL Financial and in 2009 he joined Investors Capital as an independent financial consultant. In the 20 years that Mr. Crosson has operated his practice, he has consistently been in the top 5% of the broker dealers he has been associated with. He has been quoted in The Wall Street Journal and various financial publications. Mr. Crosson holds his series 7, 24 and 63 securities licenses as well as his life, accident and health insurance license.

Mr. Crosson is a distinguished independent representative of ICC with decades of achievement in the industry as well as knowledge of the strengths and weaknesses of the Company. The Company believes that he will provide other Board members with valuable insights into our operations, strategic insights and suggestions for overall improvement.

Don E. Ingram, age 59, is the founder and President of Ingram Financial Group, founded in 1977, and Ingram Advisory Services located in Florida. Mr. Ingram has been affiliated with ICC as a registered representative since 1997. He is a Registered Investment Advisor with the SEC (Securities and Exchange Commission) and a Financial Advisor registered with FINRA (the Financial Regulatory Authority), and maintains Series 7, 24, 63 & 65 securities licenses as well as Life, Health and Variable Annuity Licenses. Don also holds credentials as a CFP (Certified Financial Planner), an AEP (Accredited Estate Planner), a CAP (Chartered Advisor in Philanthropy), a ChFC (Chartered Financial Consultant) and a CLU (Certified Life Underwriter). He holds an MSFS (Master of Science in Financial Services). Mr. Ingram’s extensive financial background imparts the ability to anticipate the investment, tax, and estate planning needs of the affluent investor.

Mr. Ingram currently is Vice Chairman of the Board of University of Florida Proton Therapy Institute External Advisors and serves on the Board of Trustees for Winter Haven Hospital, the Platinum Bank Board of Polk County and the Board of the University of Florida Prostate Disease Center. He is the Past Chairman of Winter Haven Hospital Foundation, has served on Boards for Florida State University, Polk State College and All Saints Academy, and was an organizing director of Commerce Bank. He is a former Commodore of the Lake Region Yacht & Country Club.

Mr. Ingram’s many years of affiliation with ICC have resulted in a deep understanding of the history, culture, policies and procedures, resources, shortcomings and potential of ICC and its independent representatives. He also has displayed impressive business acumen in the independent broker-dealer / investment advisory space by successfully managing a sophisticated financial services business for high net worth clients for decades. Recognizing the ability of Mr. Ingram and other ICC registered representatives to provide unique insights into the issues that confront ICC in today’s challenging business environment, in 2008 ICC instituted its Advisory Council, comprised of some of its most successful and senior independent representatives, and Mr. Ingram provided distinguished service as its Chairman since its inception until completion of his term in 2011.

Robert T. Martin, age 45, has served as a director of the Company since 2005 and is Chairman of the Board’s Human Resources Committee. Mr. Martin has been President, CEO and a member of the Board of Directors of Mercury Brewing Company/Ipswich Ale Brewery for the past 11 years. Prior thereto, he practiced architecture in the greater Boston area after graduating in 1990 from Rensselaer Polytechnic Institute with degrees in Science and Architecture. In 1995 Mr. Martin took a position as Director of Operations at Ipswich Brewing Company, LTD. where he oversaw all aspects of the production portion of the brewery. Mr. Martin held this position until agreeing to purchase the brewery from its original owners in 1999.

As President and CEO of Mercury Brewing Company/Ipswich Ale Brewery, Mr. Martin has overseen and participated in all aspects of the corporation including, but not limited to, accounting, legal, sales, marketing, brand acquisition, facility management, State and Federal compliance, strategic partnerships and long term forecasting. Under his leadership, revenues and production have grown approximately 1000% and 500%, respectively. By 2009, the brewery was ranked the 2nd largest micro-brewery in the United States.

Mr. Martin sits on the Board of Corporators of The Institution For Savings in Newburyport, MA, was a member of the Board of Directors of the ICC Capital Growth Fund from 2000 to 2005, and is the past President and currently a member of the Board of Directors of The Massachusetts Brewers Guild.

Among the many attributes and skills that Mr. Martin brings to the Company’s Board of Directors is his demonstrated ability to plan for, apprehend, prioritize and manage the broad range of strategic and tactical opportunities, problems and issues that inevitably confront business enterprises.

Robert P. Mazzarella, age 66, has over 40 years’ experience in the securities industry and more than 19 years at Fidelity Investments. Prior to retiring from Fidelity Investments in 2002, Mr. Mazzarella was President of Fidelity Brokerage Services LLC with supervisory oversight responsibility for all of Fidelity’s retail brokerage products and services, including 80 investor centers across the U.S. with over 1000 account executives and the rapidly growing online brokerage business. During his tenure at Fidelity, he also was President of Fidelity’s Institutional Brokerage Group, comprised of four business segments that facilitate the buying and selling of securities for customers in the institutional and retail segments of the U.S. marketplace, including Fidelity Capital Markets, correspondent clearing services, Registered Investment Advisor services, and market data distribution services.

Prior to Fidelity, Mr. Mazzarella worked at Bradford National Corporation for 10 years, where he was responsible for sales, marketing and product development groups and operations. Bradford provided a wide range of services to large and small financial institutions including clearance services. Previously, he spent two years with the National Association of Securities Dealers where he was involved in launching a new concept in clearing over-the-counter securities on a nationwide basis. He began his career at Merrill Lynch, where he was responsible for the development and operation of training programs for regional offices.

Mr. Mazzarella served on the Securities Industry Association’s Board of Directors where he chaired the SIA’s Discount Brokerage Committee and was a member of the Market Structure Committee. He also has served on the Boards of the Philadelphia Stock Clearing Corporation and Depository, The Chicago Board of Options Exchange, the Cincinnati Stock Exchange, the Boston Stock Exchange and Redibook ECN, Inc. Mr. Mazzarella was a member of The New York Stock Exchange, and served on the NYSE’s Regional Firms Committee.

Mr. Mazzarella has been serving as a director of Placemark Investments, a registered investment advisor firm, since 2002, and Siebert Financial Corp., a public brokerage firm, since 2004. He chairs the Boston Options Exchange Regulatory Board, has a member of the Board of NASDAQ OMX BS since 2007, and currently serves as Chairman of Pyxis Mobile, a technology company. He also provides consulting services to a number of major financial services firms and advises venture capital firms regarding financial services investments. He also serves as Chairman of the Board of a Boston charter school.

Timothy B. Murphy, age 47, has served as a director of the Company since July 1995. A founder of the Company, Mr. Murphy has served as its President and Chief Executive Officer since August 2008. He served as Executive Vice President and Chief Financial Officer of the Company from its inception until August and December 2008, respectively, and as President of Investors Capital Corporation (“ICC”) since 1994 and of Eastern Point Advisors, Inc. (“EPA”) from 1995 to 2008. Mr. Murphy entered the securities industry in 1990 after graduating from Babson College with degrees in Finance, Investments and Quantitative Methods and a minor in Economics. Starting as a stockbroker for Clayton securities, in 1992 Mr. Murphy accepted a trading position with G.R. Stuart & Co. where he ran trading and operations and entered into the field of compliance. In 1994 Mr. Murphy took a position with Baybanks brokerage as assistant compliance officer before joining ICC as its first president later that year. Since starting with the Company he has overseen day to day operations of all aspects of the organization. Mr. Murphy also currently serves on the board of The Financial Services Institute. Mr. Murphy holds series 4, 7, 24, 27, 53, 63 and 65 securities licenses.

His long tenure as president of ICC, his strategic position as CEO of ICH, academic background and extensive industry experience qualify Mr. Murphy to serve on the Board of Directors of the Company.

Director Meetings and Attendance

During the fiscal year ended March 31, 2012 (the fiscal years ended March 31, 2012 and 2011 are sometimes hereinafter referred to as “fiscal 2012” and “fiscal 2011”), the Board held nine meetings. The Company has no policy regarding director attendance at annual stockholder meetings; however, all directors attended the Company’s 2012 annual meeting of stockholders.

Independent Directors and their Committees

Four of the seven members of the Board, Messrs. Atherton, Aguirre, Martin and Mazzarella, are “independent directors” as defined by the Company’s Director Independence Standards as well as applicable Securities and Exchange Commission (“SEC”) rule and NYSE Amex listing standards. The Board maintains separately-designated standing Nominating and Governance, Audit, Human Resources and Risk Committees, the members of which are all independent directors, as described below. Messrs. Atherton and Martin also serve as the Lead Independent Director and Alternate Lead Independent Director, respectively.

The following table shows the current members of each standing committee of our Board of Directors:

| Director | Audit | Human Resources | Nom. & Governance | Risk |

| | | | | |

| Timothy B. Murphy | | | | x |

William J. Atherton | x | x | x | x |

| Robert Mazzarella | x | x | x | x |

Rob Martin | x | x | x | x |

| Blaise Aguirre | x | | x | |

Audit Committee

The Audit Committee, a separately-designated standing committee established in accordance with section 3(a)(58)(A) of the Exchange Act of 1934, oversees the accounting and financial reporting processes of the Company and audits of the Company’s financial statements. The Audit Committee consults with the Company’s independent auditors and management with respect to the adequacy of internal controls as well as the Company's audited and interim financial statements before they are made public. The Committee also is responsible for retaining, determining the compensation of, overseeing, and terminating accounting firms that provide audit, review, attest and other services for the Company. The Board had determined that Mr. Chalmers is an “audit committee financial expert” as defined by applicable SEC rule. Upon his resignation in May 2012, the Board determined that Mr. Mazzarella to be the “audit committee financial expert”. See the documentation referred to in “Director and Nominee Backgrounds”, above, for information regarding experience of Mr. Mazzarella that is relevant to serving as an audit committee financial expert. The Audit Committee met five times during fiscal 2012.

Human Resources Committee

The Human Resources Committee is responsible for determining and approving the compensation payable to the Company’s Named Executive Officers, currently, Mr. Murphy and Ms. Donnelly, including salary and, as applicable, bonus and long-term incentive compensation. The Committee also is responsible for reviewing and approving employment agreements and severance and change of control arrangements for these officers, and administers and oversees the Company’s equity incentive plans including authorizing grants thereunder. The Committee determines such matters after carefully reviewing proposals respecting the amount and form thereof submitted by the chief executive officer, as well as information commissioned from Company staff and/or received from other sources that it deems relevant and material to the process. The Committee, in its deliberations, may consult third-party compensation surveys and published compensation information respecting selected peer group firms, and is empowered to engage the assistance of outside counsel and experts. The Committee met two times during fiscal 2012.

Compensation Consultant

Management did not engage the services of a compensation consultant.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible, among other things, for identifying persons well qualified to become Board members, and recommending them to the Board as nominees for election at the next annual meeting of shareholders or to fill vacancies. The Committee also is responsible for recommending to the Board changes in the Company’s corporate governance guidelines, including policies and procedures for review, approval or ratification of transactions with related parties required to be reported under SEC rules. The Committee met four times during fiscal 2012.

Risk Committee

The Risk Committee is responsible for providing oversight to management and the Board regarding the identification, management and mitigation of strategic, operational, regulatory, informational, external and other risks relating to the Company’s business and operations. The Committee met two times during fiscal 2012.

Risk Oversight

As stated above, the Risk Committee of the Board is primarily responsible for oversight of risks affecting the Company and its business. To assist the Risk Committee in discharging its responsibilities, the Committee had designated a member of the Committee, Geoffrey Chalmers, as liaison with the Risk Committee of Investors Capital Corporation (“ICC”), the Company’s broker-dealer and investment advisory subsidiary (the “ICC Risk Committee”). The ICC Risk Committee, comprised of the chief executive officer, the chief financial officer, the ICC chief risk officer/general counsel, chief operating officer and various other key members of senior and middle management, meets weekly to discuss matters relating to risks associated with the business of ICC. In his role as liaison, Mr. Chalmers was and then effective May 2012 after Mr. Chalmers’ resignation, Mr. Robert Mazzarella is tasked with attending ICC Risk Committee meetings as appropriate, and reporting back to the Committee and the Board. The Audit Committee also addresses risks associated with the Company’s financial reporting, primarily by meeting with and requesting information from management and the Company’s auditors. The Board also, from time to time, addresses matters of risk, particularly when brought to their attention by the Risk Committee or Audit Committee.

Committee Charters and Code of Ethics

The Charters of the Audit Committee, Human Resources Committee, and Nominating and Governance Committee, and the Company’s Code of Ethics, are available on our website at www.investorscapital.com/home/investorRelations/corporateGovernance.aspx.

Director Nomination Process

In evaluating the suitability of candidates for election or re-election as directors, the Nominating and Governance Committee considers many factors, including general understanding of marketing, finance, and other disciplines relevant to the success of a publicly traded company in today’s business environment; understanding of the Company’s business and technology; educational and professional background; and personal accomplishments. The Committee also evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best ensure the success of the Company’s business and represent shareholder interests. In determining whether to recommend a director for re-election, the Committee considers, among other things, the director’s past attendance at meetings and participation in and contributions to the activities of the Board and its committees. Other than generally as set forth above, the Committee does not consider diversity in identifying nominees for director.

The Nominating and Governance Committee will consider shareholder recommendations for candidates for the Board. The name of any recommended candidate for director, together with a brief biographical sketch, a document indicating the candidate’s willingness to serve, if elected, and evidence of the nominating shareholder’s ownership of Company stock should be sent to the attention of the Secretary of the Company.

Communications with the Board

Stockholders desiring to send communications, other than proposals for stockholder meetings, to the Board or individual directors should address such communications to the Company’s Secretary, who will forward such communications to the full Board, or individual directors, as deemed appropriate by senior management.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" EACH OF ITS NOMINEES FOR DIRECTOR.

PROPOSAL 2.

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

On August 23, 2011, the Audit Committee appointed Marcum LLP (“Marcum”) to serve as the Company's independent registered public accountants (“the Company’s Accountants”) for the fiscal year ending March 31, 2012 (“fiscal 2012”). Although stockholder ratification is not required, the Board of Directors has directed that such appointment be submitted to the stockholders of the Company for ratification at the Meeting as a matter of good corporate governance. If the stockholders do not ratify the appointment of Marcum, the Board of Directors may reconsider the appointment. Further, whether or not stockholder approval is given, the Audit Committee in its discretion may appoint another independent registered public accounting firm at any time during the year if such committee believes that such a change would be in the best interest of the Company and its stockholders. One or more representatives of Marcum will attend the Meeting, will have an opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

During fiscal 2012 and 2011, the Company did not consult Marcum with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's consolidated financial statements, or any other matter or reportable events listed in Items 304(a)(2)(i) and (ii) of Regulation S-K.

The aggregate fees billed to the Company by the Company’s Accountants for professional services for fiscal 2012 and 2011 were as follows:

Audit Fees

The aggregate fees billed for professional services for the audit of the Company's annual financial statements and review of financial statements included in the Registrant’s Forms 10-Q, or for services that are normally provided by the Company’s Accountant in connection with statutory and regulatory filings or engagements for those fiscal years totaled $181,589 and $188,909 for services rendered by Marcum for fiscal 2012 and 2011, respectively.

Audit-Related Fees

The aggregate fees billed for fiscal 2012 and 2011 for assurance and related services by Marcum that are reasonably related to the performance of the audit or review of our financial statements (other than disclosed above) totaled $19,400 and $10,000, respectively.

Tax fees

The aggregate fees billed for fiscal 2012 for tax compliance, tax advice, and tax planning by Marcum totaled $5,000. No tax fees were billed for fiscal 2011.

All Other Fees

For fiscal 2012 and 2011 the Company was not billed by Marcum for services other than those disclosed above.

Engagement of Accounting Services

All audit and non-audit services provided to the Company by accountants, including its independent auditor, must be approved by the Audit Committee prior to the rendering of services unless the following conditions are met:

| | ● | The services are not recognized by the Company at the time of engagement to be non-audit services; |

| | ● | The total amount of such services is less than or equal to 5% of the total amount of compensation paid by the Company to the independent auditor during the fiscal year in which the services are provided; and |

| | ● | The services are brought promptly to the attention of the Audit Committee and approved by the Committee, or by one or more members thereof who are members of the board of directors who have been delegated approval authority, prior to the completion of the annual audit. |

All other permitted services must be pre-approved by either the Audit Committee or a delegate of the Audit Committee. If pre-approval is obtained from a delegate of the Audit Committee, the service may be performed provided that the service is presented to the Audit Committee at the next scheduled meeting.

In determining whether or not to approve non-audit accounting services from the Company’s independent auditor, the Audit Committee considers whether the provision of such services is compatible with maintaining the independence of the auditor.

100% of the costs of accountant services described above under the headings of Audit-Related Fees, Tax Fees, and All Other Fees, were incurred in conformity with the requirements set forth above respecting circumstances where there is no Audit Committee pre-approval.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE PROPOSAL TO RATIFY THE APPOINTMENT OF MARCUM LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS OF THE COMPANY FOR THE FISCAL YEAR ENDING MARCH 31, 2013.

OTHER MATTERS

As of the date of this Proxy Statement, the Board knows of no other business to be presented at the Meeting. However, if any other matters properly come before the Meeting, the persons named in the enclosed form of proxy are expected to vote the proxy in accordance with their best judgment on such matters.

* ADDITIONAL INFORMATION *

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table summarizes all plan and non-plan compensation awarded to, earned by, or paid to Mr. Murphy, former Chairman Mr. Charles and Ms. Donnelly (the “Named Executive Officers”) for fiscal 2012 and 2011 for all services rendered in all capacities to the Company and its subsidiaries.

| | Fiscal year | | | | | | | | | | | All other | | | | |

| Name and Principal | ended | | Salary | | | Cash Bonus | | | Stock Awards | | | Compensation | | | Total | |

| Position | March 31, | | ($) | | | ($) | | | ($) | | | ($) (1) | | | ($) | |

| | | | | | | | | | | | | | | | | |

| Timothy B. Murphy | 2012 | | | 390,000 | | | | - | | | | - | | | | 45,315 | | | | 435,315 | |

| CEO | 2011 | | | 400,000 | | | | - | | | | - | | | | 46,409 | | | | 446,409 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Kathleen L. Donnelly | 2012 | | | 148,500 | | | | - | | | | - | | | | - | | | | 148,500 | |

| CFO | 2011 | | | 160,000 | | | | - | | | | - | | | | - | | | | 160,000 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Theodore E. Charles | 2012 | | | 400,000 | | | | - | | | | - | | | | 750,638 | | | | 1,150,638 | |

| Chairman, former | 2011 | | | 400,000 | | | | - | | | | - | | | | 44,590 | | | | 444,590 | |

(1). All Other Compensation consists of the following items:

| | | | | | | | | | | | | | | | Transfer of | | | | | | | |

| | | | | | | | | | | | | | | | beneficial | | | | | | | |

| | | | | | | Long-Term | | | | | | Country | | | ownership | | | | | | | |

| | | | Life | | | Care | | | | | | Club | | | Life | | | Professional | | | Auto | |

| | Fiscal year | | Insurance | | | Insurance | | | Commissions | | | Membership | | | insurance | | | Services | | | Leases and | |

| | ended | | Premiums | | | Premiums | | | Earned | | | Fees | | | policy | | | provided | | | Insurance | |

| | March 31, | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Timothy B. Murphy | 2012 | | | 1,397 | | | | - | | | | 389 | | | | 18,234 | | | | | | | | | | 25,295 | |

| CEO | 2011 | | | 1,397 | | | | - | | | | 1,276 | | | | 18,442 | | | | | | | | | | 25,294 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Kathleen L. Donnelly | 2012 | | | - | | | | - | | | | - | | | | - | | | | | | | | | | - | |

| CFO | 2011 | | | - | | | | - | | | | - | | | | - | | | | | | | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Theodore E. Charles | 2012 | | | - | | | | - | | | | 4,479 | | | | - | | | | 568,095 | | | | 165,761 | | | | 12,303 | |

| Chairman, former | 2011 | | | - | | | | - | | | | 2,777 | | | | 10,773 | | | | | | | | | | | | 31,040 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Employment Arrangements with the Chairman and the Chief Executive Officer

Employment Agreements:

Effective April 1, 2010, the Company entered into employment agreements (each an “Employment Agreement” and collectively, the “Employment Agreements”) with Timothy B. Murphy, its Chief Executive Officer and a director of the Company, to continue serving full-time as President and Chief Executive Officer (“CEO”) of the Company, and with Theodore E. Charles, at that time the Company’s Chairman of the Board, to serve the Company full-time in the new officer position of Chairman, wherein Mr. Charles would advise the Board of Directors and the CEO on strategic planning, business development and industry and community relations. These Employments Agreements supersede in their entirety all prior employment agreements between the Company and these individuals.

As provided for in an agreement entered into between Mr. Charles and the Company on June 30, 2011 (the “Retirement Agreement”), on August 2, 2011 Mr. Charles resigned as a director and officer of the Company, including its subsidiaries, and his Employment Agreement terminated upon the close of the sale of 3,608,820 shares of Company common stock by Mr. Charles, members of his immediate family, family trusts and a controlled charitable foundation.

Under the Employment Agreements, Mr. Murphy is entitled to, and, until the termination of Mr. Charles’ Employment Agreement on August 2, 2011, Mr. Charles was entitled to (i) an annual base salary of $400,000, subject to upward adjustments at the discretion of the Board or a committee thereof, (ii) participation under annual cash bonus plans approved by the Board, (iii) participation at least annually in the Company’s equity plans, (iv) a Disability Benefit, reduced by disability payments received under any other long-term disability plan of the Company and, in the case of Mr. Charles, a more limited benefit, (v) a Life Insurance Benefit which (A) in the case of Mr. Charles consists of a life insurance policy in the face amount of $2 million (with the face amount of Mr. Charles’ policy to be reduced by $400,000 at the end of any year in which he serves as a consultant to the Company pursuant to the Consultant Agreement described below), and (B) in the case of Mr. Murphy consists of a term life insurance policy in the face amount of at least $1 million, and (vi) perquisites approved by the Board and participation in 401(k), medical and insurance plans made available to executive officers of the Company.

The term of Mr. Murphy’s Employment Agreement is indefinite and may be terminated by either party at any time for any or no reason. If Mr. Murphy’s employment is terminated:

| | (a) | by the Company without Cause, or by Mr. Murphy for Good Reason, he is entitled to (i) all earned but unpaid base salary and prior year annual bonuses, (ii) a pro rata annual bonus for the year of termination payable when normally payable but for his termination, (iii) severance totaling three times his base salary at the time of termination, payable in equal installments over the following 36 months, (iv) further severance equal to three times his prior fiscal year annual bonus, payable in a lump sum within ten days of termination, and (v) such amounts as may be vested under applicable Company retirement and equity plans under the terms thereof; |

| | (b) | by the Company with Cause, or by Mr. Murphy without Good Reason (other than retirement), he is entitled to the amounts specified in clauses (i) and (v) immediately above; |

| | (c) | upon Mr. Murphy’s Disability or death, Mr. Murphy (in the case of Disability) or his estate (in the case of death) is entitled to the amounts specified in clauses (i), (ii) and (v) of paragraph (a) above and either the Disability Benefit (in the case of Disability) or the Life Insurance Benefit (in the case of death); or |

| | (d) | upon Mr. Murphy’s retirement, he is entitled to the amounts specified in clauses (i), (ii) and (v) of paragraph (a) above. |

The foregoing notwithstanding, Mr. Murphy shall be entitled to the amounts set forth in subparagraph (a) above if, in connection with or within 24 months following a Change in Control of the Company, either (1) the Company terminates Mr. Murphy’s employment without his consent for a reason other than Limited Cause, or his disability or death, or (2) he terminates his employment on 30 days notice for any reason other than retirement.

The term of Mr. Charles’s Employment Agreement was a three year period that would automatically extend for an additional year upon each anniversary date of the Employment Agreement unless and until either party notifies the other, at least 90 days prior to any given anniversary date, that the Employment Agreement will no longer be extended. The foregoing notwithstanding, the Employment Agreement could be terminated by either party at any time for any or no reason. Prior to its termination on August 2, 2011, Mr. Charles’ Employment Agreement provided that, if Mr. Charles’ employment under the Employment Agreement were terminated:

| | (e) | by the Company without Just Cause, or by Mr. Charles for Good Reason, or upon his retirement, but not if such termination is (A) upon expiration of the term by reason of a notice not to extend (as described above) or (B) upon a voluntary termination of employment by Mr. Charles other than for Good Reason or by reason of retirement, the Employment Agreement would be superseded by the Consultant Agreement described below and, during the term of the Consultant Agreement, the Company would maintain the Disability Benefit and Life Insurance Benefit formerly provided for in his Employment Agreement; |

| | (f) | by the Company for Just Cause, Mr. Charles would not be entitled to receive any compensation or other benefits for any period after termination except unpaid bonus or as may be provided by law; |

| | (g) | by the Board due to Mr. Charles’s Disability, Mr. Charles would receive payments under a Company-provided disability policy, including the Disability Benefit; |

| | (h) | upon Mr. Charles’s death, his estate would be entitled to his base salary for the month of death, any earned but unpaid bonus, and the Life Insurance Benefit; or |

| | (i) | by Mr. Charles without Good Reason or retirement, he would be entitled to receive only his compensation, accrued and unpaid bonus, vested rights and employee benefits up to the date of termination. |

The foregoing notwithstanding, under his Employment Agreement before its termination, Mr. Charles would have the rights set forth in subparagraph (e) above if, in connection with or within 24 months following a Change in Control, either (1) the Company terminates Mr. Charles’s Employment Agreement without his consent for a reason other than Just Cause, or his Disability or death, or (2) he terminates his employment for any reason other than retirement.

In the event of a Change in Control, under Mr. Murphy’s Employment Agreement and, until its termination, under Mr. Charles’ Employment Agreement, each of Messrs. Charles and Murphy would be entitled to be reimbursed for any excise taxes paid by him as “excess parachute payments” under Section 280G of the Internal Revenue Code on said change of control benefits and on any such reimbursement, provided that any compensation otherwise payable to Mr. Murphy by reason of such Change in Control, but not more than $50,000, shall not be paid to Mr. Murphy if such forbearance would eliminate any such excess parachute payments with respect to him.

Consulting Agreement:

Also effective April 1, 2010, the Company entered into a Consulting Agreement (the “Consulting Agreement”) with Mr. Charles to be available, at reasonable times and places, to render, in an advisory or consulting capacity to senior management of the Company and the Board, up to 40 hours per month of services that are materially consistent with those he performed under and during the last twelve months of his Employment Agreement. The Consulting Agreement takes effect only upon termination of Mr. Charles’s Employment Agreement under circumstances described in paragraph (e) above or upon a Change in Control and continues for a five year term, subject to earlier termination as described below.

Effective August 2, 2011 pursuant to the Retirement Agreement, the Consultant Agreement took effect for a reduced term of one year, subject to earlier termination as described below, and also was amended in various other respects as set forth below.

Mr. Charles is entitled to be paid during the term of the Consultant Agreement a consulting fee of $400,000 per year and, until the Consultant Agreement was amended, also was entitled to participate in such cash bonus and equity based plans as the Board may determine from time to time in its sole discretion. Subject to certain terms and conditions, including compliance with the requirement of Section 409A of the Internal Revenue Code, Mr. Charles may elect to defer, up to the date of his death, any payments due him under the Consultant Agreement, and amounts so deferred may, at the determination of the Company, be credited with an interest component for the period of deferral.

Under the Consultant Agreement as originally entered into, Mr. Charles also was entitled to expense reimbursement, participation in the benefit plans maintained by the Company for its employees relating to medical insurance and/or reimbursement of uninsured medical expenses and group disability benefits, and continuation of the Disability Benefit and Life Insurance Benefit that pertained under his Employment Agreement. Upon amendment of the Consultant Agreement on August 2, 2011 pursuant to the Retirement Agreement, (i) participation in the Company’s 401(k) plan was added to the benefits provided to Mr. Charles under the Consultant Agreement, (ii) the Disability Benefit and the Life Insurance Benefit were excluded from the benefits provided under the Consultant Agreement and (iii) the Company transferred to Mr. Charles title to an existing life insurance policy with a $2 million death benefit, on the life of Mr. Charles, following repayment by the Company of all outstanding policy loans and restoration of any partial cash withdrawals thereon. This transfer was effective September 12, 2011, therefore the Company has no further obligations to pay premiums or other amounts in connection with said life insurance policy.

The Consultant Agreement may be terminated by either party at any time for any or no reason. As originally entered into, the Consultant Agreement provided that, if it were terminated:

| (u) | upon Mr. Charles’s death, his estate shall be entitled only to any portion of the consulting fee due through the month of death, and the estate or designated beneficiary shall be entitled to the Life Insurance Benefit; |

| | |

| (v) | by the Company upon the Disability of Mr. Charles, he shall be entitled only to his consulting fee through the date of termination plus the Disability Benefit; |

| (w) | by the Company with Cause, or by Mr. Charles without Good Reason, Mr. Charles shall be entitled only to his consulting fee due and owing for services previously rendered; or |

| | |

| (x) | by the Company without Cause (other than death or Disability), or by Mr. Charles with Good Reason, Mr. Charles shall be entitled to payment of his consulting fee for the remainder of the term of the Consultant Agreement in a lump sum and continuation of the Disability Benefit and Life Insurance Benefit for the remainder of the term of the Consultant Agreement or until his death. |

As amended effective August 2, 2011, the Consultant Agreement no longer provides for a Disability Benefit or Life Insurance Benefit upon any termination of the Consultant Agreement.

The Company shall not merge or consolidate into or with another entity, or reorganize or sell substantially all of its assets to another entity or person, unless said entity or person agrees to assume and discharge the obligations of the Company under the Consultant Agreement.

Restrictions on Activities:

The Consultant Agreement and the Employment Agreements provide that Messrs. Charles and Murphy shall not engage in certain competitive activity during the terms of their respective agreements. Further, they shall not engage in certain competitive or solicitation activities for an additional six months (three months, in the case of Mr. Murphy) after termination of such agreements unless such termination was by the individual for Good Reason, or by the Company for any or no reason other than Cause (Just Cause, with respect to Mr. Charles’ Employment Agreement before it was terminated) or Disability.

Employment Arrangements with Chief Financial Officer

The Company’s Chief Financial Officer, Kathleen L. Donnelly, does not have a formal written employment agreement, is employed at will and has no formal severance arrangements. Ms. Donnelly’s salary is $160,000 per year, less a 10% reduction pursuant to a Company-wide salary reduction program in place since January 2012.

Outstanding Equity Awards At Fiscal Year-End

The following table sets forth information as of March 31, 2012 regarding unexercised stock options and non-vested stock resulting from prior awards by the Company to the Named Executive Officers. Said officers did not possess any unvested equity incentive plan awards as of said date.

| | Option Awards | | Stock Awards |

| | Number | Number | | | | Number | Market |

| | of | of | | | | of Shares | Value of |

| | Securities | Securities | | | | of Stock | Shares |

| | Underlying | Underlying | | | | That Have | of Stock |

| | Unexercised | Unexercised | Option | | | Not | That Have |

| | Options | Options | Exercise | Option | | Vested | Not |

| | (#) | (#) | Price | Expiration | | (#) (1) | Vested |

| Name | Exercisable | Unexercisable | ($) | Date | | | ($) |

| | | | | | | | |

| Timothy B. Murphy | 150,000 | - | $1.00 | None | | 0 | $0 |

| | | | | | | | |

| Kathleen L. Donnelly | - | | | | | - | - |

(1) 10,000 unvested shares listed as being held by each of Messr. Murphy vested on June 12, 2011.

DIRECTOR COMPENSATION

The following table sets forth information concerning the compensation for fiscal 2012 of the Company’s directors who are not Named Executive Officers.

| | | | Fees earned or | | | | |

| | | | Paid in Cash (2) | | Stock Awards | | Total |

| | | | ($) | | ($) | | ($) |

| | | | | | | | |

| William J. Atherton | (3) | | 56,250 | | 14,700 | | 70,950 |

| | | | | | | | |

| Robert Martin | | | 31,000 | | 14,700 | | 45,700 |

| | | | | | | | |

| Robert Mazzarella | | | 17,000 | | 14,700 | | 31,700 |

| | | | | | | | |

| Blaise Aguirre | | | 14,500 | | 14,700 | | 29,200 |

| | | | | | | | |

| Geoff Chalmers | (4) | | 33,000 | | 7,350 | | 40,350 |

| 1. | Any compensation received as a director by Named Executive Officers is disclosed in the Summary Compensation Table, infra, and accordingly is not disclosed in this table. |

| 2. | Each director who is not an employee receives the following per annum fees in quarterly installments so long as he or she serves in the following positions: (i) $20,000 as a director, or $35,000 as Chairman, (ii) $3,000, $2,000 and $2,000, respectively, as a member of the Audit, Human Resource or Nominating and Governance Committee, and (iii) an additional $5,000, $3,000 and $2,000, respectively, as Chairman of the Audit, Human Resources or Nominating and Governance Committee. |

| 3. | Mr. Atherton’s compensation includes $18,250 for his role as lead financial expert for period of 2008 to 2011 which was previously omitted and paid in full November 2011. |

| 4. | Mr. Chalmers resigned from the Board on May 18, 2012. |

AUDIT COMMITTEE REPORT

The Board of Directors of the Company has appointed an Audit Committee currently composed of four independent directors.

The Board of Directors has adopted a written charter for the Audit Committee. The Audit Committee reviews and assesses the adequacy of its charter on an annual basis. The Audit Committee's job is one of oversight as set forth in its Charter. It is not the duty of the Audit Committee to prepare the Company's financial statements, to plan or conduct audits, or to determine that the Company's financial statements are complete and accurate and are in accordance with accounting principles generally accepted in the United States of America. The Company's management is responsible for preparing the Company's financial statements and for maintaining internal controls. The independent auditors are responsible for auditing the financial statements and for expressing an opinion as to whether those audited financial statements fairly present the financial position, results of operations, and cash flows of the Company in conformity with accounting principles generally accepted in the United States of America.

The Audit Committee has reviewed and discussed the Company's audited consolidated financial statements with management and with Marcum LLP ("Marcum"), the Company's independent auditors for the fiscal year ended March 31, 2012.

The Audit Committee has discussed with Marcum the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board (the “PCAOB”) in Rule 3200T.

The Audit Committee has received from Marcum the written disclosures and the letter from the Auditors required by applicable requirements of the PCAOB regarding Marcum’s communications with the Audit Committee concerning independence, and has discussed with Marcum its independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company's Annual Report on Form 10- K for the fiscal year ended March 31, 2012 for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

/s/ Robert Mazzarella, William J. Atherton, Robert Martin and Dr. Blaise A. Aguirre

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Our principal executive offices, comprised of several office condominiums, are located in an 11,737 square foot facility at 230 Broadway, Lynnfield, MA. The Company also maintained an office in a 2,132 square foot facility at 218 Boston Street, Topsfield, MA through March 31, 2012. Both of these properties are leased from entities owned and controlled by Mr. Charles, the former Chairman and former principal stockholder of ICH for a combined annual rent of $291,200 for fiscal 2012 with annual escalations thereafter for the Lynnfield office. The Topsfield and Lynnfield leases expire on March 31, 2012 and 2015, respectively. The Company is currently attempting to resolve a dispute with the lessor, specific to the tenancy at 230 Broadway Lynnfield, MA as a result of property damages that are preventing occupancy and use of all leased space.

Directors Messrs. Crosson and Ingram, have been independent registered representatives of the Company’s broker-dealer and investment advisory subsidiary, ICC, before and throughout the fiscal year ended March 31, 2012, and to the date of this Proxy Statement, and, during said time period, generated gross commission income for ICC of approximately $0.73 million and $1.45 million, respectively, for which they receive commissions payments from ICC in lesser amounts. Their continuing relationships with the Company have been carefully considered by the Company in the process of nominating them for election as directors, and measures have been taken designed to ensure that their participation on the Board of Directors will not conflict with their continuing securities practices or result in violations of applicable law or regulations.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires directors and officers of the Company and persons, or “groups” of persons, who own more than 10% of a registered class of the Company’s equity securities (collectively, “Covered Persons”) to file with the Securities and Exchange Commission, NYSE Amex and the Company, within specified time periods, initial reports of beneficial ownership, and subsequent reports of changes in ownership, of certain equity securities of the Company. Based solely on its review of copies of such reports furnished to it or filed with the SEC and available on EDGAR, and upon any written representations of Covered Persons that no other reports were required, the Company believes that no Covered Persons have failed to meet such filing requirements.

ANNUAL REPORT TO STOCKHOLDERS / FORM 10-K

The Company's Annual Report to its stockholders for fiscal 2012 is being mailed to all stockholders concurrently with this Proxy Statement. A copy of the Company's Report on Form 10-K (excluding exhibits), as filed with the SEC, may be obtained at no cost by writing to Rebecca Hice, Assistant Secretary, Investors Capital Holdings, Ltd., 230 Broadway East, Lynnfield, Massachusetts 01940. Additional copies of exhibits listed in the Form 10-K are available upon written request to the Corporate Secretary at a nominal charge to cover printing and mailing. The Form 10-K also may be accessed on the internet at http://www.investorscapital.com/home/investorRelations/secFilingsIndex.aspx and at http://www.sec.gov

PROPOSALS FOR 2012 ANNUAL MEETING

No person who intends to present a proposal for action at the 2012 annual stockholders meeting of the Company may seek to have the proposal included in the Board of Directors’ proxy statement or form of proxy for such meeting unless that person (a) is a record or beneficial owner of at least 1% or $2,000 in market value of shares of Common Stock and, if not the record holder, submits proof of beneficial ownership, (b) has held such shares continuously for at least one year at the time the proposal is submitted, and such person shall continue to own such shares through the date of the meeting and so states in writing, (c) notifies the Company of his intention to appear personally at the meeting or by a qualified representative under applicable state law to present his proposal for action, and (d) timely submits his or her proposal. A proposal to be included in the Board of Directors’ proxy statement and form of proxy for the Company's next annual meeting of stockholders will be timely submitted if the proposal has been received at the Company's principal executive office no later than March 15, 2012 (being 120 calendar days before the date of this proxy statement). However, if the date of the 2012 annual meeting is changed by more than 30 calendar days from August 21, or if the proposal is to be presented at any meeting other than the next annual meeting of stockholders, the proposal must be received at the Company's principal executive office at a reasonable time before the Company begins to print and send its proxy materials for the 2012 annual meeting.

A person may submit only one proposal with a supporting statement of not more than 500 words, and under certain circumstances enumerated in the rules of the Securities and Exchange Commission (the “SEC”) relating to the solicitation of proxies, the Company may be entitled to omit the proposal and any statement in support thereof from its proxy statement and form of proxy.

The Company will be permitted to vote proxies in its discretion on any proposal properly coming before the Company's 2012 annual meeting of stockholders if the Company:

| | ● | does not receive notice of the proposal on or before May 31, 2012 (being 45 calendar days prior to the date of this proxy statement) or if the date of the 2012 annual meeting is changed more than 30 days from August 21, the proposal must be received at the Company’s principal executive office at a reasonable time before the Company sends its proxy materials for the 2012 annual meeting, or |

| | ● | receives notice of the proposal no later than May 31, 2012 and advises stockholders in its proxy statement about the nature of the matter and how the Company intends to exercise its discretion to vote on such matter, all except as otherwise provided by applicable SEC rules. |

Notices of intention to present proposals at the Company's next annual stockholders meeting should be addressed to Rebecca Hice, Assistant Secretary, Investors Capital Holdings, Ltd., 230 Broadway East, Lynnfield, MA 01940.

By order of the Board of Directors,

/s/ William J. Atherton

Chairman of the Board