UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09114

The Needham Funds, Inc.

(Exact name of registrant as specified in charter)

250 Park Avenue, 10th Floor,

New York, NY 10177-1099

(Address of principal executive offices) (Zip code)

Mr. George A. Needham

250 Park Avenue, 10th Floor,

New York, NY 10177-1099

(Name and address of agent for service)

1-800-625-7071

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2023

Date of reporting period: January 1, 2023-June 30, 2023

Item 1. Reports to Stockholders.

SEMI-ANNUAL

REPORT

NEEDHAM FUNDS

Seeking to build wealth for long-term investors

June 30, 2023

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

www.needhamfunds.com

250 Park Avenue, 10th Floor

New York, New York 10177

1-800-625-7071

www.needhamfunds.com

Semi-Annual Report

June 30, 2023

| CONTENTS | |

| Letter from the Adviser | 1 |

| Portfolio Characteristics (Unaudited) | |

| Needham Growtˇh Fund | 5 |

| Needham Aggressive Growth Fund | 6 |

| Needham Small Cap Growth Fund | 7 |

| Disclosure of Fund Expenses | 9 |

| Schedules of Investments | |

| Needham Growth Fund | 11 |

| Needham Aggressive Growth Fund | 15 |

| Needham Small Cap Growth Fund | 19 |

| Statements of Assets and Liabilities | 22 |

| Statements of Operations | 23 |

| Statements of Changes in Net Assets | 24 |

| Financial Highlights | |

| Needham Growth Fund | 27 |

| Needham Aggressive Growth Fund | 29 |

| Needham Small Cap Growth Fund | 31 |

| Notes to Financial Statements | 33 |

| Supplementary Information | 39 |

This report is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

The prospectus contains more complete information, including investment objectives, risks, expenses and charges and should be

read carefully before investing or sending any money. To obtain a prospectus or summary prospectus, please call 1-800-625-7071.

Portfolios of The Needham Funds, Inc., like all mutual funds:

| | • | Are NOT FDIC insured |

| | • | Have no bank guarantee |

| | • | May lose value |

The Needham Funds, Inc. are distributed by Needham & Company, LLC.

Semi-Annual Report 2023

| 250 Park Avenue, 10th Floor |

| New York, New York 10177 |

| (800) 625-7071 |

| www.needhamfunds.com |

August 2023

Dear Shareholders, Friends of Needham, and Prospective Shareholders,

We are pleased to report Needham Funds’ results for the half-year ended June 30, 2023. Our mission is to create wealth for long-term investors.

IN THIS LETTER

| • | Macro Observations – John Barr, Portfolio Manager |

| • | Review of First Half Performance: |

| | O | Needham Aggressive Growth Fund – John Barr, Portfolio Manager |

| | O | Needham Small Cap Growth Fund – Chris Retzler, Portfolio Manager |

| | O | Needham Growth Fund – John Barr and Chris Retzler, Co-Portfolio Managers |

MACRO OBSERVATIONS – JOHN BARR, PORTFOLIO MANAGER

Economic growth, inflation, Federal Reserve policy, and even a bipartisan political development all pointed toward signs of stability in the first half, following the early March failures of Silicon Valley Bank (SVB) and Signature Bank.

SVB was brought down by the classic failure of mismatched assets and liabilities. SVB was invested in 10-year Treasuries but was funded with overnight, uninsured deposits. With the Fed rate hikes, the Treasuries lost value, and corporate clients with deposits over the insured limit of $250,000 rapidly withdrew funds, creating a bank run. The Federal Reserve, Treasury Department, and FDIC (Federal Deposit Insurance Corporation) issued a joint statement, insured all deposits of SVB, and SVB reopened under new management after a long weekend. Pressure on the banking system has stabilized, but deposits continue to move toward higher-yielding money market funds.

On May 3, the Federal Reserve raised interest rates by 25 bps to 5.00% - 5.25% and then paused rate hikes in June. Fed consensus calls for two more rate hikes in 2023.1 In late May, President Biden signed a bipartisan bill to extend the debt ceiling and reduce growth in Federal spending.

The economy continued to move forward with 2.0% estimated GDP growth in 2Q23, the fourth consecutive quarter of growth. 1Q23 inflation was 4.1% year-over-year, with estimates near 3.0% for 2Q23. 2Q23 will likely be the fourth quarter of 3-4% consumer price index inflation, after 5-7% in the preceding four quarters.

Important to our investing universe, NVIDIA Corporation (NVDA) reported an epic quarter and guidance based on strong demand for its AI (artificial intelligence) systems. Many of our investments benefit directly and indirectly from the adoption of AI. In March, we wrote The Growth Factor Vol. 36, “Artificial Intelligence and Needham Funds’ Investments.”2

One of the highlights of my year is my annual May trip to Omaha for the Berkshire Hathaway Annual Meeting. It reminds me of the importance of patience and long-term investing. While the purchase price of a stock may protect our downside, we earn returns by patiently holding. As Berkshire Hathaway’s Charlie Munger said, “The big money is not in the buying and the selling but in the waiting.”

NEEDHAM AGGRESSIVE GROWTH FUND FIRST HALF 2023 PERFORMANCE – JOHN BARR, PORTFOLIO MANAGER

The Needham Funds’ mission is to create wealth for long-term investors and the first half of 2023 was a positive step forward. For the half-year ended June 30, 2023, Needham Aggressive Growth Fund Institutional and Retail classes returned 27.60% and 27.31%, respectively. The Russell 2000 Growth Index returned 13.55%. The Fund’s standardized performance can be obtained at https://www.needhamfunds.com/mutual-funds/aggressive-growth-fund/.

On June 30, 2023, the Fund’s top ten positions were 43.75% of net assets. The Fund had an Active Share of 97.0% versus the Russell 2000 Growth Index, and trailing 12-month turnover was 9%. Morningstar and Lipper categorize the Fund as Small Cap Growth.

The Fund’s leading contributor in the first half was Super Micro Computer, Inc. (SMCI), which we have owned since 2009. Super Micro is seeing high growth from its Artificial Intelligence GPU (graphics processing unit) servers.

The second leading contributor was ESI Group SA (ESI-FR). The Fund first purchased ESI in 2021 as we were impressed with new CEO Cristel de Rouvray’s plans to increase margins and revenue growth. ESI supplies CAD (computer-aided design) software for the automotive, aerospace, and other heavy industries. It has particular expertise in virtual crash testing. In June, ESI announced a merger agreement with Keysight Technologies Inc. (KEYS).

1 | https://www.cnbc.com/2023/06/14/the-fed-forecasts-two-more-hikes-this-year-taking-rates-as-high-as-5point6percent.html. |

2 | https://www.needhamfunds.com/wp-content/uploads/2023/03/GF-36-Artificial-Intelligence-and-Needham-Funds-Investments.pdf. |

Needham Funds

PDF Solutions, Inc. (PDFS) was the Fund’s third leading contributor in the first half. PDF’s Exensio® data analytics platform helps customers across the electronics manufacturing industry improve manufacturing yield. In 1Q23, PDF signed a seven-figure, multi-year agreement with a customer planning to use Exensio in conjunction with SAP SE’s (SAP) enterprise resource planning (ERP) system. We believe SAP could be an important partner for PDF. PDF is already benefitting from the resurgence of activity in building semiconductor manufacturing plants in the United States.

Aspen Aerogels Inc. (ASPN) was the Fund’s only detractor of note. Aspen Aerogels makes aerogel insulation used for energy infrastructure and pipelines. The aerogel insulation is also used for thermal protection of lithium-ion batteries. Aspen won contract awards from General Motors Company (GM), Toyota Motor Corp. (TM), and other EV makers. Aspen was the Fund’s top detractor in 2022, and the downtrend continued in the first half of 2023. On its May earnings conference call, Aspen announced plans to move all manufacturing for EV customers to its Rhode Island plant, and move manufacturing for other customers to a contract manufacturer in China. Aspen guided to positive EBITDA in 4Q23, which we believe could be a turning point for the market’s view of the company.

NEEDHAM AGGRESSIVE GROWTH FUND – FIRST HALF 2023 PORTFOLIO CHANGES

The Fund’s most significant new position was Northern Technologies International Corporation (NTIC). Northern Technologies has a $100 million market cap and has two product lines. The company manufactures biodegradable plastic bags and sells resin to customers making plastic cutlery and other products. Adoption is in its early stages, and environmental awareness and regulation could drive demand. Northern Technologies’ corrosion-resistant solutions are used in the oil and gas industries.

Where did we put new capital to work? The three largest purchases were of existing holdings:

| | • | ESI Group – In May, ESI announced that it was in acquisition talks. We thought potential bidders could recognize the value that we saw. |

| | | |

| | • | Oil-Dri Corp. of America (ODC) adds value to sorbent materials like clay. It has a core lightweight cat litter business and has been investing for years in antibiotic-free animal health products. In June, Oil-Dri announced what we viewed as breakout earnings. |

| | | |

| | • | Unisys Corporation (UIS) is the renaissance of the old-line computer company, with roots back to Sperry Corporation, Burroughs Corporation, and Remington Typewriter. Unisys provides digital workplace, cloud & infrastructure, and enterprise computing solutions. In May, Unisys reported a solid quarter with revenue growth and margin expansion. |

The Fund made small reductions to a few holdings and exited several smaller positions. The Fund did more buying than selling in the first half and exited the half-year with 10.9% cash.

NEEDHAM SMALL CAP GROWTH FUND FIRST HALF 2023 PERFORMANCE – CHRIS RETZLER, PORTFOLIO MANAGER

For the half-year ended June 30, 2023, the Needham Small Cap Growth Fund Institutional and Retail classes returned 2.68% and 2.77%, respectively. The Russell 2000 Growth Index returned 13.55%. The Fund’s standardized performance can be obtained at https://www.needhamfunds.com/mutual-funds/small-cap-growth-fund/.

The Fund’s top contributors in the first half were: nLight, Inc. (LASR), Sumo Logic, Inc. (SUMO), Zuora, Inc. (ZUO), Standard BioTools, Inc. (LAB), and Vicor Corp. (VICR).

nLight, Inc. (LASR) is a fiber laser and direct energy laser manufacturer. It continues to shift sales away from China and build its market share globally. It is also developing its directed energy business that will be used for defense purposes. We expect accelerated sales from nLight over the next few years.

The Fund’s top detractors in the first half were: ViewRay, Inc. (VRAY), Adtran Holdings, Inc. (ADTN), Aspen Aerogels, Inc. (ASPN), Telos Corp. (TLS) and Cambium Networks Corp. (CMBM).

I want to address the extreme disappointment the Fund suffered from ViewRay (VRAY), a long-time holding of the Fund, and an unprecedented event in my 18 years of portfolio management. ViewRay experienced a perfect storm of liquidity pressures. We expected that the announced strategic review would lead to a sale of the company to a larger platform, however after months of efforts, that was not the final result. The rapid and shocking decline of ViewRay serves as a valuable lesson for future high-growth, small-cap companies that may encounter liquidity risks in a tightening economic environment.

In the first half, the Fund increased its investment in Aspen Aerogels, Inc. (ASPN), a long-time portfolio holding. We remain excited about Aspen Aerogels, Inc. (ASPN). Aspen manufactures aerogel-based insulation and benefits from the increased opportunity in EV battery technology and the increase in electric vehicles. The expected product ramp and penetration into the EV industry should continue to grow for many years.

Many of the Fund’s portfolio holdings are defined as technology companies, however, technology has permeated the entire global economy. We achieve diversity in the portfolio through the end markets that our portfolio companies serve. The diverse end markets of our technology holdings include advanced communications, military modernization, automotive advancement, industrial digitization, medical enhancement, 5G wireless, data center buildouts, infrastructure expansion, security improvements, and overall semiconductor processing and power management enhancements. Many of our portfolio companies sit at the crossroads of several industries and therefore in our view have multiple opportunities for success. This market positioning should give the portfolio a natural hedge and ultimately help reduce volatility and risk.

Widespread semiconductor shortages had negative implications for many end markets, including automotive, medical, industrial, and defense. However, supply chains have been recalibrated and disruptions have improved somewhat. We expect semiconductors and semiconductor capital equipment companies to continue their strong, long-term trends.

Semi-Annual Report 2023

We believe technology remains a great area for long-term investment, and there are secular trends firmly in place to support the technology sector’s continued growth. Areas of long-term investment that we like are mobile electrification, communications infrastructure, artificial intelligence, cloud computing, 5G devices and wireless connectivity, software and security, and specialty material manufacturing. We also see opportunities in military modernization.

After a challenging 2022, we were optimistic that the markets would stabilize in 2023, and they did until March when the regional bank failures caused a significant sell-off in small-cap stocks. The asset class did not recover immediately but slowly improved throughout the second quarter. Wage pressures, logistics and transportation complications, higher commodity prices, and supply chain constraints continued to hamper earnings and forward guidance for many companies. These trends hurt smaller companies that lack the buying power and operational flexibility of larger companies.

We expect the headline risk of a global economic slowdown to remain elevated as investors digest data, however, if there is ultimately a recession, it is expected to be further into the future than previously projected. We will continue our strategy of investing in small-cap growth companies that we believe have good management teams, strong balance sheets, and the ability to generate cash flow and profits.

NEEDHAM GROWTH FUND FIRST HALF 2023 PERFORMANCE – JOHN BARR AND CHRIS RETZLER, CO-PORTFOLIO MANAGERS

For the half-year ended June 30, 2023, the Needham Growth Fund Institutional and Retail classes returned 23.86% and 23.61%, respectively. The S&P 500 Index returned 16.89%, and the S&P MidCap 400 returned 8.84%. The Fund’s standardized performance can be obtained at https://www.needhamfunds.com/mutual-funds/growth-fund/.

On June 30, the Fund’s top ten positions were 52.27% of net assets. The Fund had trailing 12-month turnover of 10%. Morningstar categorizes the Fund as Mid-Cap Growth; Lipper categorizes it as Mid-Cap Core.

The Fund’s top contributor in the first half was Super Micro Computer, followed by PDF Solutions and Entegris, Inc. (ENTG). (Super Micro and PDF Solutions are discussed in the review of Needham Aggressive Growth Fund.) Entegris supplies filters, specialty materials, chemicals, and delivery systems primarily used for semiconductor manufacturing. In May, the company reported an in-line quarter and guidance. Entegris also announced an agreement to sell a division of the newly acquired CMP Materials for $700 million, and it will use the proceeds to deleverage. Revenue resilience and deleveraging progress led to Entegris’ outperformance.

The Fund’s top detractor in the first half was Aspen Aerogels (previously discussed in the reviews of Needham Aggressive Growth Fund and Needham Small Cap Growth Fund).

The Fund’s most significant new position was Unisys (previously discussed in the review of Needham Aggressive Growth Fund). The Fund’s largest additions to existing positions were to Coherent Corp. (COHR), Marvel Technology, Inc. (MRVL), Veeco Instruments, Inc. (VECO), and Vicor Corp. (VICR).

The most significant reductions were to long-time holdings PDF Solutions, Photronics Inc. (PLAB), Super Micro Computer, and Thermo Fisher Scientific, Inc. (TMO), to manage position size.

CLOSING

We believe the U.S. remains the best place in the world to invest, and we continue to see an opportunity to invest in small and mid-cap stocks. Most importantly, we see a technological revolution that has created and continues to create investment opportunities. We see opportunity in our strategy of investing in companies that we know well and believe are positioned with secular growth drivers.

We welcome our new investors and thank all of our investors for their continued support. If you have any questions, thoughts, or concerns, please contact us at (800) 625-7071 or jbarr@needhamco.com and cretzler@needhamco.com. For information about the Needham Funds, please visit our website at www.needhamfunds.com.

Sincerely,

|  |

| Chris Retzler, | John O. Barr, |

| Portfolio Manager | Portfolio Manager |

Needham Funds

The information presented in this commentary is not intended as personalized investment advice and does not constitute a recommendation to buy or sell a particular security or other investments. Past performance is no guarantee of future results. The views of Needham Investment Management L.L.C., the Funds’ investment adviser (the “Adviser”), and the securities described in this report are as of June 30, 2023; these views and portfolio holdings may have changed subsequent to this date. The specific securities discussed may, in aggregate, represent only a small percentage of a Fund’s holdings. If a specific security discussed is not found in a Fund’s Schedule of Investments, it may have been held by the Fund during the period. It should not be assumed that securities identified and discussed were, or will be, profitable, or that the investment decisions made in the future will be profitable, or equal the investment performance of the securities discussed herein. There can be no guarantee as to the accuracy of any outlooks for markets, sectors and securities as discussed herein.

This message is not an offer of the Needham Growth Fund, the Needham Aggressive Growth Fund or the Needham Small Cap Growth Fund. Shares are sold only through the currently effective prospectus. Please read the prospectus or summary prospectus carefully and consider the investment objectives, risks and charges and expenses of the Funds carefully before you invest. The prospectus and summary prospectus contain this and other information about the Funds and can be obtained on our website, www.needhamfunds.com or by contacting the Funds’ transfer agent U.S. Bancorp Fund Services LLC doing business as U.S. Bank Global Fund Services (“Fund Services”) at 1-800-625-7071.

Investment returns and principal value will fluctuate, and when redeemed, shares may be worth more or less than their original cost. Performance data quoted represents past performance, and does not guarantee future results. Current performance may be higher or lower than these results. Performance current to the most recent month-end may be obtained by calling our transfer agent at 1-800-625-7071. Total return figures include reinvestment of all dividends and capital gains.

All three of the Needham Funds have substantial exposure to small and micro capitalized companies. Funds holding smaller capitalized companies are subject to greater price fluctuation than those of larger companies. The coronavirus disease 2019 (COVID-19) global pandemic and the aggressive responses taken by many governments or voluntarily imposed by private parties, including closing borders, restricting travel and imposing prolonged quarantines or similar restrictions, as well as the closure of, or operational changes to, many retail and other businesses, have had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment. Needham & Company, LLC, member FINRA/SIPC, is the distributor of The Needham Funds, Inc.

The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. The Russell 3000 Index is a market-capitalization-weighted equity index that provides exposure to the entire U.S. stock market. The Russell 3000 Index tracks the performance of the 3,000 largest U.S.-traded stocks. The Russell 2000 Growth Index measures the performance of the small cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with relatively higher price-to-value ratios and higher forecasted growth values. Please see the disclaimer regarding these indexes under “Supplementary Information—Index Disclaimer” on page 39 of this report.

Semi-Annual Report 2023

| NEEDHAM GROWTH FUND | Retail Class |

| Portfolio Characteristics (Unaudited) | Ticker Symbol: NEEGX |

| | Institutional Class |

| | Ticker Symbol: NEEIX |

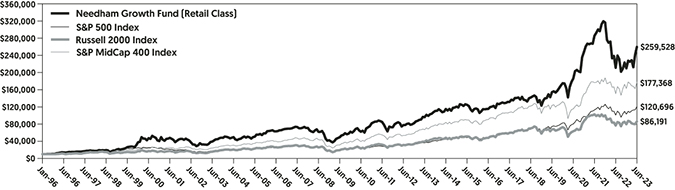

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT

The chart above assumes an initial gross investment of $10,000 made on January 1, 1996.

COMPARATIVE PERFORMANCE STATISTICS AS OF JUNE 30, 2023

| | 1 | 5 | 10 | Since |

| | Year | Years | Years | Inception |

Needham Growth Fund Retail Class(1)(2) | 22.85% | 12.84% | 10.44% | 12.57% |

Needham Growth Fund Institutional Class(1)(3) | 23.39% | 13.37% | n/a | 12.22% |

S&P 500 Index(4)(5) | 19.59% | 12.31% | 12.86% | 9.48%(9) |

S&P MidCap 400 Index(4)(6) | 17.61% | 7.79% | 10.21% | 11.02%(9) |

Russell 2000 Index(4)(7) | 12.31% | 4.21% | 8.26% | 8.15%(9) |

Top Ten Holdings*

(as a % of total investments, as of June 30, 2023)

| | | % of Total |

Security | | Investments |

| Super Micro Computer, Inc. | SMCI | 9.34% |

| PDF Solutions, Inc. | PDFS | 9.01% |

| Entegris, Inc. | ENTG | 7.45% |

| Thermo Fisher Scientific, Inc. | TMO | 6.00% |

| CarMax, Inc. | KMX | 4.06% |

| Nova, Ltd. | NVMI | 3.73% |

| Becton Dickinson & Co. | BDX | 3.41% |

| Vicor Corp. | VICR | 3.36% |

| KVH Industries, Inc. | KVHI | 3.23% |

| Photronics, Inc. | PLAB | 2.78% |

| | | |

| Top Ten Holdings = 52.37% of Total Investments | | |

Sector Weightings*

(as a % of net investments, as of June 30, 2023)

Sector(10) | Long(11) | (Short) | Total(12) |

| Cash | 1.9% | — | 1.9% |

| Communication Services | 4.9% | — | 4.9% |

| Consumer Discretionary | 4.7% | — | 4.7% |

| Energy | 0.7% | — | 0.7% |

| Health Care | 14.9% | — | 14.9% |

| Industrials | 8.0% | — | 8.0% |

| Information Technology | 63.0% | (0.6)% | 62.4% |

| Materials | 2.2% | — | 2.2% |

| Real Estate | 0.3% | — | 0.3% |

Needham Funds

| NEEDHAM AGGRESSIVE GROWTH FUND | Retail Class |

| Portfolio Characteristics (Unaudited) | Ticker Symbol: NEAGX |

| | Institutional Class |

| | Ticker Symbol: NEAIX |

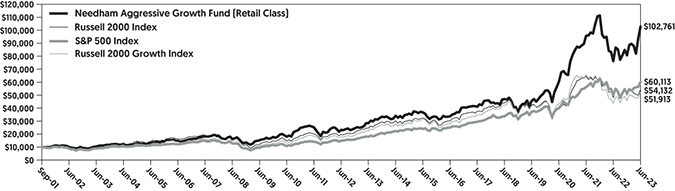

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT

The chart above assumes an initial gross investment of $10,000 made on September 4, 2001.

COMPARATIVE PERFORMANCE STATISTICS AS OF JUNE 30, 2023

| | 1 | 5 | 10 | Since |

| | Year | Years | Years | Inception |

Needham Aggressive Growth Fund Retail Class(1)(2) | 34.79% | 16.97% | 13.70% | 11.27% |

Needham Aggressive Growth Fund Institutional Class(1)(3) | 35.58% | 17.68% | n/a | 16.06% |

S&P 500 Index(4)(5) | 19.59% | 12.31% | 12.86% | 8.57%(9) |

Russell 2000 Index(4)(7) | 12.31% | 4.21% | 8.26% | 8.05%(9) |

Russell 2000 Growth Index(4)(8) | 18.53% | 4.22% | 8.83% | 7.84%(9) |

Top Ten Holdings*

(as a % of total investments, as of June 30, 2023)

| | | % of Total |

|

| Investments |

| Super Micro Computer, Inc. | SMCI | 8.54% |

| PDF Solutions, Inc. | PDFS | 7.67% |

| ESI Group | ESI FP | 6.17% |

| Vicor Corp. | VICR | 4.01% |

| Nova, Ltd. | NVMI | 3.47% |

| Entegris, Inc. | ENTG | 3.36% |

| Photronics, Inc. | PLAB | 3.01% |

| KVH Industries, Inc. | KVHI | 2.97% |

| Vertiv Holdings Co. | VRT | 2.69% |

| Unisys Corp. | UIS | 2.55% |

| | | |

| Top Ten Holdings = 44.43% of Total Investments | | |

Sector Weightings*

(as a % of net investments, as of June 30, 2023)

Sector(10) | Long(11) | (Short) | Total(12) |

| Cash | 10.9% | — | 10.9% |

| Communication Services | 0.7% | — | 0.7% |

| Consumer Discretionary | 3.8% | — | 3.8% |

| Consumer Staples | 2.1% | — | 2.1% |

| Energy | 1.8% | — | 1.8% |

| Financials | 1.1% | — | 1.1% |

| Health Care | 4.3% | — | 4.3% |

| Industrials | 16.0% | — | 16.0% |

| Information Technology | 53.2% | — | 53.2% |

| Materials | 5.1% | — | 5.1% |

| Real Estate | 1.0% | — | 1.0% |

Semi-Annual Report 2023

| NEEDHAM SMALL CAP GROWTH FUND | Retail Class |

| Portfolio Characteristics (Unaudited) | Ticker Symbol: NESGX |

| | Institutional Class |

| | Ticker Symbol: NESIX |

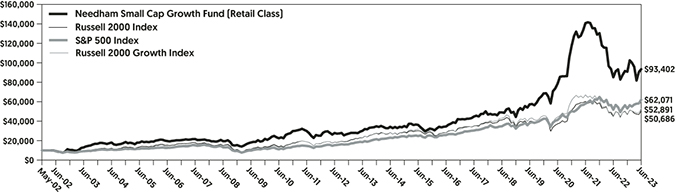

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT

The chart above assumes an initial gross investment of $10,000 made on May 22, 2002.

COMPARATIVE PERFORMANCE STATISTICS AS OF JUNE 30, 2023

| | 1 | 5 | 10 | Since |

| | Year | Years | Years | Inception |

Needham Small Cap Growth Fund Retail Class(1)(2) | 9.60% | 13.73% | 11.99% | 11.17% |

Needham Small Cap Growth Fund Institutional Class(1)(3) | 9.94% | 14.38% | n/a | 13.79% |

S&P 500 Index(4)(5) | 19.59% | 12.31% | 12.86% | 9.03%(9) |

Russell 2000 Index(4)(7) | 12.31% | 4.21% | 8.26% | 7.99%(9) |

Russell 2000 Growth Index(4)(8) | 18.53% | 4.22% | 8.83% | 8.21%(9) |

Top Ten Holdings*

(as a % of total investments, as of June 30, 2023)

| | | % of Total |

Security | | Investments |

| Aspen Aerogels, Inc. | ASPN | 6.08% |

| ADTRAN Holdings, Inc. | ADTN | 5.97% |

| nLight, Inc. | LASR | 5.52% |

| TTM Technologies, Inc. | TTMI | 4.88% |

| Vicor Corp. | VICR | 4.46% |

| Cambium Networks Corp. | CMBM | 3.99% |

| Zuora, Inc. | ZUO | 3.75% |

| AXT, Inc. | AXTI | 3.00% |

| KVH Industries, Inc. | KVHI | 2.62% |

| Akoustis Technologies, Inc. | AKTS | 2.57% |

| | | |

| Top Ten Holdings = 42.84% of Total Investments | | |

Sector Weightings*

(as a % of net investments, as of June 30, 2023)

Sector(10) | Long(11) | (Short) | Total(12) |

| Cash | 31.2% | — | 31.2% |

| Health Care | 2.7% | — | 2.7% |

| Industrials | 6.5% | — | 6.5% |

| Information Technology | 55.3% | (1.8)% | 53.5% |

| Materials | 6.1% | — | 6.1% |

Needham Funds

Each Fund’s performance figures are for the period ended June 30, 2023. The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com or call 1-800-625-7071. The returns shown above are net of expenses. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and expense reimbursements, when they are necessary to keep the Fund’s total annual operating expenses at the expense cap currently in effect, total return would be reduced. Performance figures for periods greater than one year are annualized. For information about each index shown above, please see the notes below. The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”).

| (1) | Investment results calculated after reinvestment of dividends. |

| (2) | The inception date of the Retail Class of each Fund was as follows: Needham Growth Fund – 1/1/96; Needham Aggressive Growth Fund – 9/4/01; and Needham Small Cap Growth Fund – 5/22/02. |

| (3) | The inception date of the Institutional Class of each Fund was 12/30/16. |

| (4) | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| (5) | The S&P 500 Index focuses on the large-cap sector of the market; however, since it includes a significant portion of the total value of the market, it also is considered representative of the market. Companies in the S&P 500 are considered leading companies in leading industries. |

| (6) | The S&P MidCap 400 Index provides investors with a benchmark for mid-sized companies. The index seeks to remain an accurate measure of mid-sized companies, reflecting the risk and return characteristics of the broader mid-cap universe on an on-going basis. |

| (7) | The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 8% of the total market capitalization of that index. The Russell 2000 Index includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. |

| (8) | The Russell 2000 Growth Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics. |

| (9) | The return shown for the index is from the inception date of the Retail Class. The returns for the S&P 500 Index, S&P MidCap 400 Index, Russell 2000 Growth, and the Russell 2000 Index from the inception date of the Institutional Class are 13.17%, 9.00%, 7.99% and 6.62%, respectively. |

| (10) | These categories represent broad market sectors. Refer to the Schedule of Investments for a more detailed categorization by industry. |

| (11) | Percentage of total investments includes all stocks, plus cash. |

| (12) | Net exposure represents the difference between the long exposure and the short exposure, which produces the net investment exposure. |

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

Semi-Annual Report 2023

Disclosure of Fund Expenses (Unaudited)

The following expense table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of a Portfolio, you incur transactional costs and ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. A Portfolio’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in each Portfolio and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of a six-month period and held for the entire period. The expense example table below illustrates your fund’s cost in two ways:

| • | Actual Expenses. This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the Portfolio’s actual return, and “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolio. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Portfolio under the heading entitled “Expenses Paid During Period”. |

| | |

| • | Hypothetical Expenses on a 5% Return. This section is intended to help you compare your Portfolio’s costs with those of other mutual funds. It assumes that the Portfolio had a return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Portfolio’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your Portfolio’s cost by comparing this hypothetical example with the hypothetical examples that appear in shareholders reports of other funds. |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Needham Funds

For the Period January 1, 2023 to June 30, 2023

Expense Example Table (Unaudited)

| | | Beginning | | | Ending | | | Expenses Paid | | | Expense Ratio | |

| | | Account Value | | | Account Value | | | During Period* | | | During Period* | |

| | | 1/1/23 | | | 6/30/23 | | | 1/1/23 – 6/30/23 | | | 1/1/23 – 6/30/23 | |

| Needham Growth Fund | | | | | | | | | | | | |

| Retail Class Actual Expenses | | $ | 1,000.00 | | | $ | 1,236.10 | | | $ | 9.97 | | | | 1.80 | % |

| Retail Class Hypothetical | | | | | | | | | | | | | | | | |

| Example for Comparison Purposes | | | | | | | | | | | | | | | | |

| (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.87 | | | $ | 8.99 | | | | 1.80 | % |

| Institutional Class Actual Expenses | | $ | 1,000.00 | | | $ | 1,238.60 | | | $ | 7.77 | | | | 1.40 | % |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| Example for Comparison Purposes | | | | | | | | | | | | | | | | |

| (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.85 | | | $ | 7.00 | | | | 1.40 | % |

| | | | | | | | | | | | | | | | | |

| Needham Aggressive Growth Fund | | | | | | | | | | | | | | | | |

| Retail Class Actual Expenses | | $ | 1,000.00 | | | $ | 1,273.10 | | | $ | 10.22 | | | | 1.81 | % |

| Retail Class Hypothetical | | | | | | | | | | | | | | | | |

| Example for Comparison Purposes | | | | | | | | | | | | | | | | |

| (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.88 | | | $ | 9.06 | | | | 1.81 | % |

| Institutional Class Actual Expenses | | $ | 1,000.00 | | | $ | 1,276.00 | | | $ | 6.66 | | | | 1.18 | % |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| Example for Comparison Purposes | | | | | | | | | | | | | | | | |

| (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.94 | | | $ | 5.91 | | | | 1.18 | % |

| | | | | | | | | | | | | | | | | |

| Needham Small Cap Growth Fund | | | | | | | | | | | | | | | | |

| Retail Class Actual Expenses | | $ | 1,000.00 | | | $ | 1,027.70 | | | $ | 9.19 | | | | 1.83 | % |

| Retail Class Hypothetical | | | | | | | | | | | | | | | | |

| Example for Comparison Purposes | | | | | | | | | | | | | | | | |

| (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.73 | | | $ | 9.14 | | | | 1.83 | % |

| Institutional Class Actual Expenses | | $ | 1,000.00 | | | $ | 1,026.80 | | | $ | 5.93 | | | | 1.18 | % |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| Example for Comparison Purposes | | | | | | | | | | | | | | | | |

| (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.94 | | | $ | 5.91 | | | | 1.18 | % |

| * | Expenses are equal to the average account value times the Portfolio’s annualized expense ratio multiplied 181/365 (to reflect the one-half-year period). |

Semi-Annual Report 2023

Needham Growth Fund

Schedule of Investments

June 30, 2023 (Unaudited)

| | | Shares | | | Fair Value | |

| Common Stocks (98.0%) | | | | | | |

| | | | | | | |

| Aerospace & Defense (2.6%) | | | | | | |

| Parsons Corp. (a) | | | 77,500 | | | $ | 3,730,850 | |

| | | | | | | | | |

| Biotechnology (0.9%) | | | | | | | | |

| G1 Therapeutics, Inc. (a) | | | 64,000 | | | | 159,360 | |

| Gilead Sciences, Inc. | | | 14,000 | | | | 1,078,980 | |

| | | | | | | | 1,238,340 | |

| Chemicals (2.2%) | | | | | | | | |

| Aspen Aerogels, Inc. (a) | | | 400,000 | | | | 3,156,000 | |

| | | | | | | | | |

| Commercial Services & Supplies (1.4%) | | | | | | | | |

| Clean Harbors, Inc. (a) | | | 12,000 | | | | 1,973,160 | |

| | | | | | | | | |

| Communications Equipment (5.5%) | | | | | | | | |

| ADTRAN Holdings, Inc. | | | 145,000 | | | | 1,526,850 | |

| Cambium Networks Corp. (a) | | | 90,000 | | | | 1,369,800 | |

| KVH Industries, Inc. (a)(c) | | | 500,000 | | | | 4,570,000 | |

| ViaSat, Inc. (a)(c) | | | 7,500 | | | | 309,450 | |

| | | | | | | | 7,776,100 | |

| Diversified Consumer Services (0.5%) | | | | | | | | |

| Bright Horizons Family Solutions, Inc. (a) | | | 8,000 | | | | 739,600 | |

| | | | | | | | | |

| Electrical Equipment (3.3%) | | | | | | | | |

| Vicor Corp. (a) | | | 87,850 | | | | 4,743,900 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (5.1%) | | | | | | | | |

| Coherent Corp. (a) | | | 27,500 | | | | 1,401,950 | |

| Corning, Inc. | | | 38,250 | | | | 1,340,280 | |

| nLight, Inc. (a) | | | 135,000 | | | | 2,081,700 | |

| TTM Technologies, Inc. (a) | | | 51,600 | | | | 717,240 | |

| Vishay Intertechnology, Inc. | | | 55,000 | | | | 1,617,000 | |

| | | | | | | | 7,158,170 | |

| Health Care Equipment & Supplies (4.7%) | | | | | | | | |

| Becton Dickinson & Co. | | | 18,250 | | | | 4,818,183 | |

| Medtronic PLC (Ireland) | | | 20,000 | | | | 1,762,000 | |

| ViewRay, Inc. (a) | | | 125,000 | | | | 44,025 | |

| | | | | | | | 6,624,208 | |

| Health Care Providers & Services (2.4%) | | | | | | | | |

| Laboratory Corp. of America Holdings | | | 10,700 | | | | 2,582,231 | |

| Quest Diagnostics, Inc. | | | 5,500 | | | | 773,080 | |

| | | | | | | | 3,355,311 | |

| Hotels, Restaurants & Leisure (0.1%) | | | | | | | | |

| Vacasa, Inc. – Class A (a) | | | 212,500 | | | | 144,181 | |

| | | | | | | | | |

| Industrial Conglomerates (0.4%) | | | | | | | | |

| Honeywell International, Inc. – ADR | | | 2,500 | | | | 518,750 | |

| | | | | | | | | |

| Interactive Media & Services (0.4%) | | | | | | | | |

| Alphabet, Inc. – Class A (a) | | | 5,000 | | | | 598,500 | |

See accompanying notes to financial statements.

Needham Funds

Needham Growth Fund

Schedule of Investments (Continued)

June 30, 2023 (Unaudited)

| | | Shares | | | Fair Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| IT Services (3.3%) | | | | | | |

| Akamai Technologies, Inc. (a)(c) | | | 33,000 | | | $ | 2,965,710 | |

| Unisys Corp. (a) | | | 415,000 | | | | 1,651,700 | |

| | | | | | | | 4,617,410 | |

| Life Sciences Tools & Services (6.9%) | | | | | | | | |

| Bruker Corp. | | | 7,500 | | | | 554,400 | |

| CryoPort, Inc. (a) | | | 43,500 | | | | 750,375 | |

| Thermo Fisher Scientific, Inc. | | | 16,250 | | | | 8,478,438 | |

| | | | | | | | 9,783,213 | |

| Media (4.5%) | | | | | | | | |

| The Trade Desk, Inc. – Class A (a) | | | 45,000 | | | | 3,474,900 | |

| Comcast Corp. – Class A | | | 70,000 | | | | 2,908,500 | |

| | | | | | | | 6,383,400 | |

| Oil, Gas & Consumable Fuels (0.7%) | | | | | | | | |

| Chevron Corp. | | | 5,000 | | | | 786,750 | |

| Navigator Holdings, Ltd. (a) | | | 20,000 | | | | 260,200 | |

| | | | | | | | 1,046,950 | |

| Real Estate Investment Trusts (REITs) (0.4%) | | | | | | | | |

| American Tower Corp. | | | 2,500 | | | | 484,850 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (37.1%)(d) | | | | | | | | |

| Analog Devices, Inc. | | | 10,000 | | | | 1,948,100 | |

| Applied Materials, Inc. | | | 9,000 | | | | 1,300,860 | |

| ASML Holding NV (Netherlands) | | | 2,250 | | | | 1,630,687 | |

| AXT, Inc. (a) | | | 335,450 | | | | 1,153,948 | |

| Entegris, Inc. | | | 95,000 | | | | 10,527,900 | |

| FormFactor, Inc. (a) | | | 114,900 | | | | 3,931,878 | |

| Lam Research Corp. | | | 2,500 | | | | 1,607,150 | |

| Marvell Technology, Inc. | | | 30,000 | | | | 1,793,400 | |

| MKS Instruments, Inc. | | | 22,000 | | | | 2,378,200 | |

| Nova, Ltd. (Israel) (a) | | | 45,000 | | | | 5,278,500 | |

| PDF Solutions, Inc. (a)(c) | | | 282,500 | | | | 12,740,750 | |

| Photronics, Inc. (a) | | | 152,500 | | | | 3,932,975 | |

| SiTime Corp. (a) | | | 12,000 | | | | 1,415,640 | |

| Teradyne, Inc. | | | 5,000 | | | | 556,650 | |

| Veeco Instruments, Inc. (a) | | | 90,000 | | | | 2,311,200 | |

| | | | | | | | 52,507,838 | |

| Software (0.3%) | | | | | | | | |

| Alteryx, Inc. – Class A (a) | | | 7,400 | | | | 335,960 | |

| Telos Corp. (a) | | | 50,000 | | | | 128,000 | |

| | | | | | | | 463,960 | |

| Specialty Retail (4.0%) | | | | | | | | |

| CarMax, Inc. (a) | | | 68,500 | | | | 5,733,450 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (11.1%) | | | | | | | | |

| Apple, Inc. | | | 8,000 | | | | 1,551,760 | |

| Hewlett Packard Enterprise Co. | | | 20,000 | | | | 336,000 | |

| Intevac, Inc. (a) | | | 155,000 | | | | 581,250 | |

| Super Micro Computer, Inc. (a)(c) | | | 53,000 | | | | 13,210,250 | |

| | | | | | | | 15,679,260

| |

See accompanying notes to financial statements.

Semi-Annual Report 2023

Needham Growth Fund

Schedule of Investments (Continued)

June 30, 2023 (Unaudited)

| | | Shares | | | Fair Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Trading Companies & Distributors (0.2%) | | | | | | |

| Air Lease Corp. | | | 7,500 | | | $ | 313,875 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $53,033,484) | | | | | | $ | 138,771,276 | |

| | | | | | | | | |

| Short-Term Investments (1.8%) | | | | | | | | |

| | | | | | | | | |

| Money Market Fund (1.8%) | | | | | | | | |

| Dreyfus Treasury Securities Cash Management – Institutional Class, 4.96% (b) | | | | | | | | |

| | | | | | | | | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $2,593,825) | | | 2,593,825 | | | $ | 2,593,825 | |

| | | | | | | | | |

| Total Investments (99.8%) | | | | | | | | |

| (Cost $55,627,309) | | | | | | | 141,365,101 | |

| | | | | | | | | |

| Total Securities Sold Short (-0.6%) | | | | | | | | |

| (Proceeds $776,932) | | | | | | | (845,385 | ) |

| Other Assets in Excess of Liabilities (0.8%) | | | | | | | 1,132,170 | |

| Net Assets (100.0%) | | | | | | $ | 141,651,886 | |

| | Percentages are stated as a percent of net assets. |

| | Industry classifications may be different than those used for compliance monitoring purposes. |

| (a) | Non-income producing security. |

| (b) | Rate shown is the seven day yield as of June 30, 2023. |

| (c) | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $4,537,835. |

| (d) | As of June 30, 2023, the Fund had a significant portion of its assets invested in the Semiconductors & Semiconductor Equipment industry. |

| ADR | American Depositary Receipt |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Distribution of investments by country or territory of incorporation, as a percentage of Total Investments, is as follows (Unaudited):

| Country | Long |

| United States^ | 93.9% |

| Israel | 3.7% |

| Ireland | 1.2% |

| Netherlands | 1.2% |

| Total | 100.0% |

| ^ | United States allocation includes Short-Term Investment-Money Market Fund of 1.8%. |

See accompanying notes to financial statements.

Needham Funds

Needham Growth Fund

Schedule of Securities Sold Short

June 30, 2023 (Unaudited)

| | | Shares | | | Fair Value | |

| Securities Sold Short (-0.6%) | | | | | | |

| | | | | | | |

| Semiconductors & Semiconductor Equipment (-0.5%) | | | | | | |

| Advanced Energy Industries, Inc. | | | 1,000 | | | $ | 111,450 | |

| Aehr Test Systems (a) | | | 2,500 | | | | 103,125 | |

| Cohu, Inc. (a) | | | 5,000 | | | | 207,800 | |

| Onto Innovation, Inc. (a) | | | 3,000 | | | | 349,410 | |

| | | | | | | | 771,785 | |

| Software (-0.1%) | | | | | | | | |

| Digimarc Corp. (a) | | | 2,500 | | | | 73,600 | |

| | | | | | | | | |

| Total Securities Sold Short (-0.6%) | | | | | | | | |

| (Proceeds $776,932) | | | | | | $ | 845,385 | |

| (a) | Non-income producing security. |

Distribution of securities sold short by country or territory of incorporation, as a percentage of Total Securities Sold Short, is as follows (Unaudited):

| Country | Short |

| United States | 100.0% |

| Total | 100.0% |

See accompanying notes to financial statements.

Semi-Annual Report 2023

Needham Aggressive Growth Fund

Schedule of Investments

June 30, 2023 (Unaudited)

| | | Shares | | | Fair Value | |

| Common Stocks (87.6%) | | | | | | |

| | | | | | | |

| Aerospace & Defense (1.8%) | | | | | | |

| Parsons Corp. (a) | | | 77,500 | | | $ | 3,730,850 | |

| | | | | | | | | |

| Biotechnology (0.1%) | | | | | | | | |

| G1 Therapeutics, Inc. (a) | | | 70,000 | | | | 174,300 | |

| | | | | | | | | |

| Building Products (0.4%) | | | | | | | | |

| Alpha Pro Tech, Ltd. (a) | | | 220,000 | | | | 875,600 | |

| Jewett-Cameron Trading Co., Ltd. (Canada) (a) | | | 7,500 | | | | 33,000 | |

| | | | | | | | 908,600 | |

| Chemicals (3.3%) | | | | | | | | |

| Aspen Aerogels, Inc. (a) | | | 400,000 | | | | 3,156,000 | |

| Mativ Holdings, Inc. | | | 135,000 | | | | 2,041,200 | |

| Northern Technologies International Corp. | | | 150,000 | | | | 1,606,500 | |

| | | | | | | | 6,803,700 | |

| Commercial Services & Supplies (2.7%) | | | | | | | | |

| ACV Auctions, Inc. – Class A (a) | | | 86,500 | | | | 1,493,855 | |

| Clean Harbors, Inc. (a) | | | 24,500 | | | | 4,028,535 | |

| | | | | | | | 5,522,390 | |

| Communications Equipment (4.0%) | | | | | | | | |

| ADTRAN Holdings, Inc. | | | 85,000 | | | | 895,050 | |

| Cambium Networks Corp. (a) | | | 71,400 | | | | 1,086,708 | |

| EMCORE Corp. (a) | | | 303,350 | | | | 228,301 | |

| KVH Industries, Inc. (a)(b) | | | 658,750 | | | | 6,020,975 | |

| | | | | | | | 8,231,034 | |

| Construction & Engineering (0.5%) | | | | | | | | |

| Matrix Service Co. (a) | | | 178,300 | | | | 1,050,187 | |

| | | | | | | | | |

| Construction Materials (1.7%) | | | | | | | | |

| Smith-Midland Corp. (a) | | | 146,100 | | | | 3,469,875 | |

| | | | | | | | | |

| Distributors (0.3%) | | | | | | | | |

| Educational Development Corp. (a)(d) | | | 475,000 | | | | 565,250 | |

| | | | | | | | | |

| Diversified Consumer Services (1.5%) | | | | | | | | |

| Bright Horizons Family Solutions, Inc. (a) | | | 32,500 | | | | 3,004,625 | |

| | | | | | | | | |

| Electrical Equipment (8.2%) | | | | | | | | |

| Thermon Group Holdings, Inc. (a) | | | 122,500 | | | | 3,258,500 | |

| Vertiv Holdings Co. | | | 220,000 | | | | 5,449,400 | |

| Vicor Corp. (a) | | | 150,800 | | | | 8,143,200 | |

| | | | | | | | 16,851,100 | |

| Electronic Equipment, Instruments & Components (4.1%) | | | | | | | | |

| Arlo Technologies, Inc. (a) | | | 45,000 | | | | 490,950 | |

| FARO Technologies, Inc. (a) | | | 10,300 | | | | 166,860 | |

| nLight, Inc. (a) | | | 148,800 | | | | 2,294,496 | |

| VIA Optronics AG – ADR (Germany) (a) | | | 130,000 | | | | 343,200 | |

| Vishay Precision Group, Inc. (a) | | | 137,500 | | | | 5,108,125 | |

| | | | | | | | 8,403,631 | |

See accompanying notes to financial statements.

Needham Funds

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

June 30, 2023 (Unaudited)

| | | Shares | | | Fair Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Entertainment (0.1%) | | | | | | |

| World Wrestling Entertainment, Inc. – Class A | | | 2,250 | | | $ | 244,058 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (1.4%) | | | | | | | | |

| LeMaitre Vascular, Inc. | | | 20,500 | | | | 1,379,240 | |

| Omnicell, Inc. (a) | | | 2,900 | | | | 213,643 | |

| Precision Optics Corp, Inc. (a) | | | 198,500 | | | | 1,240,625 | |

| | | | | | | | 2,833,508 | |

| Health Care Providers & Services (1.6%) | | | | | | | | |

| Laboratory Corp. of America Holdings | | | 12,300 | | | | 2,968,359 | |

| Quest Diagnostics, Inc. | | | 3,000 | | | | 421,680 | |

| | | | | | | | 3,390,039 | |

| Hotels, Restaurants & Leisure (0.3%) | | | | | | | | |

| Vacasa, Inc. – Class A (a) | | | 970,000 | | | | 658,145 | |

| | | | | | | | | |

| Household Products (2.0%) | | | | | | | | |

| Oil-Dri Corp. of America | | | 71,250 | | | | 4,203,037 | |

| | | | | | | | | |

| Insurance (1.1%) | | | | | | | | |

| Markel Group, Inc. (a) | | | 1,600 | | | | 2,213,088 | |

| | | | | | | | | |

| Interactive Media & Services (0.1%) | | | | | | | | |

| Illumin Holdings, Inc. (Canada) (a) | | | 150,000 | | | | 253,500 | |

| | | | | | | | | |

| IT Services (3.7%) | | | | | | | | |

| Akamai Technologies, Inc. (a)(b) | | | 14,500 | | | | 1,303,115 | |

| Research Solutions, Inc. (a) | | | 532,500 | | | | 1,086,300 | |

| Unisys Corp. (a) | | | 1,300,000 | | | | 5,174,000 | |

| | | | | | | | 7,563,415 | |

| Life Sciences Tools & Services (1.1%) | | | | | | | | |

| Bruker Corp. | | | 22,500 | | | | 1,663,200 | |

| CryoPort, Inc. (a) | | | 37,500 | | | | 646,875 | |

| | | | | | | | 2,310,075 | |

| Machinery (0.1%) | | | | | | | | |

| Westinghouse Air Brake Technologies Corp. | | | 3,000 | | | | 329,010 | |

| | | | | | | | | |

| Media (0.4%) | | | | | | | | |

| The Trade Desk, Inc. – Class A (a) | | | 12,000 | | | | 926,640 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels (1.8%) | | | | | | | | |

| Adams Resources & Energy, Inc. | | | 103,500 | | | | 3,638,025 | |

| | | | | | | | | |

| Professional Services (1.3%) | | | | | | | | |

| CRA International, Inc. | | | 26,000 | | | | 2,652,000 | |

| | | | | | | | | |

| Real Estate Investment Trusts (REITs) (1.0%) | | | | | | | | |

| American Tower Corp. | | | 2,250 | | | | 436,365 | |

| Equinix, Inc. | | | 2,100 | | | | 1,646,274 | |

| | | | | | | | 2,082,639 | |

See accompanying notes to financial statements.

Semi-Annual Report 2023

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

June 30, 2023 (Unaudited)

| | | Shares | | | Fair Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Semiconductors & Semiconductor Equipment (21.5%) | | | | | | |

| ASML Holding NV (Netherlands) | | | 2,500 | | | $ | 1,811,875 | |

| AXT, Inc. (a) | | | 125,000 | | | | 430,000 | |

| Entegris, Inc. | | | 61,500 | | | | 6,815,430 | |

| FormFactor, Inc. (a) | | | 31,000 | | | | 1,060,820 | |

| MKS Instruments, Inc. | | | 22,000 | | | | 2,378,200 | |

| Nova, Ltd. (Israel) (a) | | | 60,000 | | | | 7,038,000 | |

| PDF Solutions, Inc. (a)(b) | | | 345,000 | | | | 15,559,500 | |

| Photronics, Inc. (a) | | | 236,900 | | | | 6,109,651 | |

| SiTime Corp. (a) | | | 5,000 | | | | 589,850 | |

| SkyWater Technology, Inc. (a) | | | 7,500 | | | | 70,650 | |

| Teradyne, Inc. | | | 5,000 | | | | 556,650 | |

| Veeco Instruments, Inc. (a) | | | 75,000 | | | | 1,926,000 | |

| | | | | | | | 44,346,626 | |

| Software (8.2%) | | | | | | | | |

| Altair Engineering, Inc. – Class A (a) | | | 26,000 | | | | 1,971,840 | |

| American Software, Inc. – Class A | | | 50,000 | | | | 525,500 | |

| Applied Digital Corp. (a) | | | 60,000 | | | | 561,000 | |

| Arteris, Inc. (a) | | | 65,000 | | | | 443,300 | |

| Copperleaf Technologies, Inc. (Canada) (a) | | | 75,000 | | | | 322,703 | |

| ESI Group (France) (a) | | | 77,500 | | | | 12,516,095 | |

| GSE Systems, Inc. (a)(d) | | | 1,430,000 | | | | 514,800 | |

| Telos Corp. (a) | | | 32,500 | | | | 83,200 | |

| | | | | | | | 16,938,438 | |

| Specialty Retail (1.7%) | | | | | | | | |

| CarMax, Inc. (a) | | | 20,500 | | | | 1,715,850 | |

| ThredUp, Inc. – Class A (a) | | | 700,000 | | | | 1,708,000 | |

| | | | | | | | 3,423,850 | |

| Technology Hardware, Storage & Peripherals (10.9%) | | | | | | | | |

| Apple, Inc. (b) | | | 25,000 | | | | 4,849,250 | |

| Intevac, Inc. (a) | | | 75,000 | | | | 281,250 | |

| Super Micro Computer, Inc. (a)(b) | | | 69,500 | | | | 17,322,875 | |

| | | | | | | | 22,453,375 | |

| Textiles, Apparel & Luxury Goods (0.0%) | | | | | | | | |

| Allbirds, Inc. – Class A (a) | | | 50,000 | | | | 63,000 | |

| | | | | | | | | |

| Trading Companies & Distributors (0.7%) | | | | | | | | |

| Transcat, Inc. (a) | | | 17,500 | | | | 1,492,925 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $111,594,063) | | | | | | $ | 180,730,935 | |

See accompanying notes to financial statements.

Needham Funds

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

June 30, 2023 (Unaudited)

| | | Shares | | | Fair Value | |

| Short-Term Investments (10.9%) | | | | | | |

| | | | | | | |

| Money Market Fund (10.9%) | | | | | | |

| Dreyfus Treasury Securities Cash Management – Institutional Class, 4.96% (c) | | | | | | |

| | | | | | | |

| Total Short-Term Investments | | | | | | |

| (Cost $22,188,378) | | | 22,188,378 | | | $ | 22,188,378 | |

| | | | | | | | | |

| Total Investments (98.5%) | | | | | | | | |

| (Cost $133,782,441) | | | | | | | 202,919,313 | |

| Other Assets in Excess of Liabilities (1.5%) | | | | | | | 3,132,074 | |

| Net Assets (100.0%) | | | | | | $ | 206,051,387 | |

| | Percentages are stated as a percent of net assets. |

| | Industry classifications may be different than those used for compliance monitoring purposes. |

| (a) | Non-income producing security. |

| (b) | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $3,804,500. |

| (c) | Rate shown is the seven day yield as of June 30, 2023. |

| (d) | Affiliated security. Please refer to Note 11 of the Financial Statements. |

| | |

| ADR | American Depositary Receipt |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”).

Distribution of investments by country or territory of incorporation, as a percentage of Total Investments, is as follows (Unaudited):

| Country | Long |

| United States^ | 89.0% |

| France | 6.2% |

| Israel | 3.4% |

| Netherlands | 0.9% |

| Canada | 0.3% |

| Germany | 0.2% |

| Total | 100.0% |

| ^ | United States allocation includes Short-Term Investment-Money Market Fund of 10.9%. |

See accompanying notes to financial statements.

Semi-Annual Report 2023

Needham Small Cap Growth Fund

Schedule of Investments

June 30, 2023 (Unaudited)

| | | Shares | | | Fair Value | |

| Common Stocks (68.8%) | | | | | | |

| | | | | | | |

| Aerospace & Defense (0.4%) | | | | | | |

| Mercury Systems, Inc. (a) | | | 20,000 | | | $ | 691,800 | |

| | | | | | | | | |

| Chemicals (6.1%) | | | | | | | | |

| Aspen Aerogels, Inc. (a)(b) | | | 1,325,000 | | | | 10,454,250 | |

| | | | | | | | | |

| Communications Equipment (14.7%) | | | | | | | | |

| ADTRAN Holdings, Inc. (b) | | | 975,000 | | | | 10,266,750 | |

| Cambium Networks Corp. (a) | | | 450,000 | | | | 6,849,000 | |

| Ciena Corp. (a) | | | 30,000 | | | | 1,274,700 | |

| EMCORE Corp. (a) | | | 606,650 | | | | 456,565 | |

| Infinera Corp. (a) | | | 382,500 | | | | 1,847,475 | |

| KVH Industries, Inc. (a)(b) | | | 492,500 | | | | 4,501,450 | |

| | | | | | | | 25,195,940 | |

| Electrical Equipment (6.1%) | | | | | | | | |

| Generac Holdings, Inc. (a) | | | 10,000 | | | | 1,491,300 | |

| Sensata Technologies Holding PLC | | | 30,000 | | | | 1,349,700 | |

| Vicor Corp. (a) | | | 141,850 | | | | 7,659,900 | |

| | | | | | | | 10,500,900 | |

| Electronic Equipment, Instruments & Components (15.8%) | | | | | | | | |

| Akoustis Technologies, Inc. (a) | | | 1,387,500 | | | | 4,412,250 | |

| Coherent Corp. (a) | | | 20,000 | | | | 1,019,600 | |

| Frequency Electronics, Inc. (d) | | | 545,000 | | | | 3,607,900 | |

| nLight, Inc. (a)(b) | | | 615,000 | | | | 9,483,300 | |

| TTM Technologies, Inc. (a) | | | 602,900 | | | | 8,380,310 | |

| Vishay Precision Group, Inc. (a) | | | 7,500 | | | | 278,625 | |

| | | | | | | | 27,181,985 | |

| Health Care Equipment & Supplies (0.5%) | | | | | | | | |

| ViewRay, Inc. (a) | | | 2,400,000 | | | | 845,280 | |

| | | | | | | | | |

| IT Services (1.1%) | | | | | | | | |

| BigCommerce Holdings, Inc. (a) | | | 150,000 | | | | 1,492,500 | |

| Unisys Corp. (a) | | | 100,000 | | | | 398,000 | |

| | | | | | | | 1,890,500 | |

| Life Sciences Tools & Services (2.2%) | | | | | | | | |

| Standard BioTools, Inc. (a) | | | 2,000,000 | | | | 3,860,000 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (9.7%) | | | | | | | | |

| AXT, Inc. (a) | | | 1,500,000 | | | | 5,160,000 | |

| FormFactor, Inc. (a)(b) | | | 113,000 | | | | 3,866,860 | |

| MKS Instruments, Inc. | | | 27,000 | | | | 2,918,700 | |

| PDF Solutions, Inc. (a) | | | 30,000 | | | | 1,353,000 | |

| SiTime Corp. (a) | | | 17,500 | | | | 2,064,475 | |

| Veeco Instruments, Inc. (a) | | | 50,000 | | | | 1,284,000 | |

| | | | | | | | 16,647,035 | |

See accompanying notes to financial statements.

Needham Funds

Needham Small Cap Growth Fund

Schedule of Investments (Continued)

June 30, 2023 (Unaudited)

| | | Shares | | | Fair Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Software (10.5%) | | | | | | |

| 8x8, Inc. (a) | | | 1,000,000 | | | $ | 4,230,000 | |

| Alteryx, Inc. – Class A (a) | | | 53,100 | | | | 2,410,740 | |

| New Relic, Inc. (a) | | | 60,000 | | | | 3,926,400 | |

| Telos Corp. (a) | | | 275,000 | | | | 704,000 | |

| Upland Software, Inc. (a) | | | 100,000 | | | | 360,000 | |

| Zuora, Inc. – Class A (a) | | | 588,000 | | | | 6,450,360 | |

| | | | | | | | 18,081,500 | |

| Technology Hardware, Storage & Peripherals (1.7%) | | | | | | | | |

| Intevac, Inc. (a) | | | 788,100 | | | | 2,955,375 | |

| Total Common Stocks | | | | | | | | |

| (Cost $137,081,452) | | | | | | $ | 118,304,565 | |

| Warrants (0.0%) | | | | | | | | |

| Agile Therapeutics, Inc. (a) | | | 88 | | | | 46 | |

| Total Warrants | | | | | | | | |

| (Cost $1,750) | | | | | | | 46 | |

| Short-Term Investments (31.1%) | | | | | | | | |

| Money Market Fund (31.1%) | | | | | | | | |

| Dreyfus Treasury Securities Cash Management – Institutional Class, 4.96% (c) | | | | | | | | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $53,527,621) | | | 53,527,621 | | | $ | 53,527,621 | |

| Total Investments (99.9%) | | | | | | | | |

| (Cost $190,610,822) | | | | | | | 171,832,232 | |

| Total Securities Sold Short (-1.8%) | | | | | | | | |

| (Proceeds $3,001,011) | | | | | | | (3,168,800 | ) |

| Other Assets in Excess of Liabilities (1.9%) | | | | | | | 3,310,212 | |

| Net Assets (100.0%) | | | | | | $ | 171,973,644 | |

| | Percentages are stated as a percent of net assets. |

| | Industry classifications may be different than those used for compliance purposes. |

| (a) | Non-income producing security. |

| (b) | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $5,967,800. |

| (c) | Rate shown is the seven day yield as of June 30, 2023. |

| (d) | Affiliated security. Please refer to Note 11 of the Financial Statements. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”).

Distribution of investments by country or territory of incorporation, as a percentage of Total Investments, is as follows (Unaudited):

| Country | Long |

| United States^ | 100.0% |

| Total | 100.0% |

| ^ | United States allocation includes Short-Term Investment-Money Market Fund of 31.1%. |

See accompanying notes to financial statements.

Semi-Annual Report 2023

Needham Small Cap Growth Fund

Schedule of Securities Sold Short

June 30, 2023 (Unaudited)

| | | Shares | | | Fair Value | |

| Securities Sold Short (-1.8%) | | | | | | |

| | | | | | | |

| Semiconductors & Semiconductor Equipment (-1.8%) | | | | | | |

| Advanced Energy Industries, Inc. | | | 5,000 | | | $ | 557,250 | |

| Aehr Test Systems (a) | | | 25,000 | | | | 1,031,250 | |

| Cohu, Inc. (a) | | | 10,000 | | | | 415,600 | |

| Onto Innovation, Inc. (a) | | | 10,000 | | | | 1,164,700 | |

| | | | | | | | 3,168,800 | |

| Total Securities Sold Short (-1.8%) | | | | | | | | |

| (Proceeds $3,001,011) | | | | | | $ | 3,168,800 | |

| (a) | Non-income producing security. |

Distribution of securities sold short by country or territory of incorporation, as a percentage of Total Securities Sold Short, is as follows (Unaudited):

| Country | Short |

| United States | 100.0% |

| Total | 100.0% |

See accompanying notes to financial statements.

Needham Funds

Statements of Assets and Liabilities

June 30, 2023 (Unaudited)

| | | | | | Needham | | | Needham | |

| | | Needham | | | Aggressive | | | Small Cap | |

| | | Growth Fund | | | Growth Fund | | | Growth Fund | |

| Assets | | | | | | | | | |

| Investments, at Value | | | | | | | | | |

| Unaffiliated Securities (Cost $55,627,309, $128,929,200, $185,948,083) | | $ | 141,365,101 | | | $ | 201,839,263 | | | $ | 168,224,332 | |

| Affiliated Securities, (Cost $-, $4,853,241, $4,662,739) | | | — | | | | 1,080,050 | | | | 3,607,900 | |

| Foreign Currency, (Cost $-, $9, $-) | | | — | | | | 10 | | | | — | |

| Receivables: | | | | | | | | | | | | |

| Deposit with Broker for Securities Sold Short | | | 801,263 | | | | 231,702 | | | | 2,504,805 | |

| Dividends and Interest | | | 32,576 | | | | 46,688 | | | | 235,303 | |

| Fund Shares Sold | | | 402,855 | | | | 3,054,620 | | | | 811,158 | |

| Investment Securities Sold | | | 205,641 | | | | 300,392 | | | | 1,417,939 | |

| Prepaid Expenses | | | 26,184 | | | | 38,329 | | | | 52,061 | |

| Total Assets | | | 142,833,620 | | | | 206,591,054 | | | | 176,853,498 | |

| | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Securities Sold Short, at Value | | | | | | | | | | | | |

| (Proceeds $776,932, $—, $3,001,011) | | | 845,385 | | | | — | | | | 3,168,800 | |

| Payables: | | | | | | | | | | | | |

| Investment Securities Purchased | | | — | | | | 148,219 | | | | 985,271 | |

| Fund Shares Redeemed | | | 89,358 | | | | 156,868 | | | | 434,779 | |

| Due to Adviser | | | 135,912 | | | | 164,696 | | | | 137,709 | |

| Distribution Fees | | | 14,957 | | | | 16,152 | | | | 8,693 | |

| Administration and Accounting Fees | | | 25,360 | | | | 10,299 | | | | 9,672 | |

| Transfer Agent Fees | | | 7,988 | | | | 10,019 | | | | 24,583 | |

| Audit and Tax Fees | | | 24,996 | | | | 16,022 | | | | 37,984 | |

| Directors’ Fees | | | 3,376 | | | | 4,423 | | | | 5,999 | |

| Accrued Expenses and Other Liabilities | | | 34,402 | | | | 12,969 | | | | 66,364 | |

| Total Liabilities | | | 1,181,734 | | | | 539,667 | | | | 4,879,854 | |

| Net Assets | | $ | 141,651,886 | | | $ | 206,051,387 | | | $ | 171,973,644 | |

| | | | | | | | | | | | | |

| Retail Class Shares | | | | | | | | | | | | |

| Net Assets | | | 73,858,630 | | | | 85,249,856 | | | | 55,489,001 | |

| Shares Issued and Outstanding $0.001 Par Value | | | | | | | | | | | | |

| (Authorized 800,000,000, 100,000,000 and 100,000,000, respectively) | | | 1,369,542 | | | | 2,277,266 | | | | 3,482,845 | |

| Net Asset Value and Offering Price Per Share | | $ | 53.93 | | | $ | 37.44 | | | $ | 15.93 | |

| | | | | | | | | | | | | |

| Institutional Class Shares | | | | | | | | | | | | |

| Net Assets | | | 67,793,256 | | | | 120,801,531 | | | | 116,484,643 | |

| Shares Issued and Outstanding $0.001 Par Value | | | | | | | | | | | | |

| (Authorized 800,000,000,100,000,000 and 100,000,000, respectively) | | | 1,209,195 | | | | 3,080,879 | | | | 6,913,320 | |

| Net Asset Value and Offering Price Per Share | | $ | 56.06 | | | $ | 39.21 | | | $ | 16.85 | |

| | | | | | | | | | | | | |

| Components of Net Assets | | | | | | | | | | | | |

| Paid-in Capital | | | 55,487,556 | | | | 141,222,386 | | | | 250,335,761 | |

| Distributable Earnings | | | 86,164,330 | | | | 64,829,001 | | | | (78,362,117 | ) |

| Undistributed Net Investment Income | | | (596,063 | ) | | | (657,072 | ) | | | (114,877 | ) |

| Accumulated Unrealized Appreciation/(Depreciation) of Investments | | | 85,669,339 | | | | 69,136,872 | | | | (18,946,379 | ) |

| Undistributed Net Realized Gain/(Loss) | | | 1,091,054 | | | | (3,650,799 | ) | | | (59,300,861 | ) |

| Total Net Assets | | $ | 141,651,886 | | | $ | 206,051,387 | | | $ | 171,973,644 | |

See accompanying notes to financial statements.

Semi-Annual Report 2023

Statements of Operations

For the six months ended June 30, 2023 (Unaudited)

| | | | | | Needham | | | Needham | |

| | | Needham | | | Aggressive | | | Small Cap | |

| | | Growth Fund | | | Growth Fund | | | Growth Fund | |

| Investment Income | | | | | | | | | |

| Dividend Income from unaffiliated securities | | | | | | | | | |

| (net of foreign withholding tax of $1,120, $1,245, $—) | | $ | 330,320 | | | $ | 321,187 | | | $ | 140,598 | |

| Interest Income | | | 84,270 | | | | 122,316 | | | | 1,045,751 | |

| Total Investment Income | | | 414,590 | | | | 443,503 | | | | 1,186,349 | |

| | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| Investment Advisory Fees | | | 786,343 | | | | 951,658 | | | | 1,173,905 | |

| Distribution Fees | | | 81,287 | | | | 79,871 | | | | 74,293 | |

| Administration and Accounting Fees | | | 79,426 | | | | 73,513 | | | | 94,940 | |

| Audit Fees | | | 14,972 | | | | 20,557 | | | | 20,214 | |

| Chief Compliance Officer Fees | | | 5,047 | | | | 5,411 | | | | 8,088 | |

| Custodian Fees | | | 6,271 | | | | 7,108 | | | | 7,627 | |

| Directors’ Fees | | | 5,913 | | | | 6,080 | | | | 8,977 | |

Dividend Expense(1) | | | 35 | | | | — | | | | 130 | |

| Filing Fees | | | 19,354 | | | | 27,358 | | | | 33,759 | |

| Legal Fees | | | 6,660 | | | | 10,021 | | | | 36,560 | |

| Printing Fees | | | 5,122 | | | | 6,472 | | | | 12,739 | |

| Transfer Agent Fees | | | 26,253 | | | | 37,975 | | | | 79,082 | |

| Other Expenses | | | 10,167 | | | | 13,079 | | | | 18,709 | |

| Total Expenses | | | 1,046,850 | | | | 1,239,103 | | | | 1,569,023 | |

| Fees Waived by Investment Adviser | | | (36,197 | ) | | | (149,837 | ) | | | (269,756 | ) |

| Fees Recouped by Investment Adviser | | | — | | | | 11,309 | | | | 1,960 | |

| Net Expenses | | | 1,010,653 | | | | 1,100,575 | | | | 1,301,227 | |

| Net Investment Loss | | | (596,063 | ) | | | (657,072 | ) | | | (114,878 | ) |

| | | | | | | | | | | | | |

| Net Realized / Unrealized Gain (Loss) from Investments, | | | | | | | | | | | | |

| Securities Sold Short, Foreign Currency Transactions and Currency | | | | | | | | | | | | |

| Net Realized Gain (Loss) from Unaffiliated Securities | | | 1,685,740 | | | | (3,494,251 | ) | | | (29,717,933 | ) |

| Net Realized Loss from Affiliated Securities | | | — | | | | (152,612 | ) | | | (53,415 | ) |

| Net Realized Gain from Securities Sold Short | | | 35,879 | | | | — | | | | 9,209,201 | |

| Net Realized Loss from Foreign Currency Transactions and Currency | | | — | | | | (433 | ) | | | — | |

| Change in Unrealized Depreciation on Investments and Securities Sold Short | | | 26,332,336 | | | | 45,116,952 | | | | 25,867,273 | |

| Change in Unrealized Appreciation (Depreciation) on Affiliated Investments | | | — | | | | (2,242,926 | ) | | | (1,022,326 | ) |

| Change in Unrealized Appreciation on Foreign Currency Transactions and Currency | | | — | | | | (1 | ) | | | — | |

| Net Realized / Unrealized Gain from Investments, | | | | | | | | | | | | |

| Securities Sold Short, Foreign Currency Transactions and Currency | | | 28,053,955 | | | | 39,226,729 | | | | 4,282,800 | |

| Change in Net Assets Resulting from Operations | | $ | 27,457,892 | | | $ | 38,569,657 | | | $ | 4,167,922 | |

(1) | Expense related to short selling activities. |

See accompanying notes to financial statements.

Needham Funds

Needham Growth Fund

Statements of Changes in Net Assets

| | | Period Ended | | | Year Ended | |

| | | June 30, 2023 | | | December 31, 2022 | |

| Change in Net Assets | | | | | | |

| Operations: | | | | | | |

| Net Investment Loss | | $ | (596,063 | ) | | $ | (1,622,783 | ) |

| Net Realized Gain/(Loss) from Investments, Securities Sold Short, | | | | | | | | |

| Foreign Currency Transactions, and Currency | | | 1,721,619 | | | | (561,686 | ) |

| Net Change in Unrealized Appreciation/(Depreciation) on Investments, | | | | | | | | |

| Securities Sold Short, Foreign Currency Translations | | | 26,332,336 | | | | (65,440,863 | ) |

| Change in Net Assets Resulting from Operations | | | 27,457,892 | | | | (67,625,332 | ) |

| | | | | | | | | |

| Distributable Earnings: | | | | | | | | |

| Retail Class | | | — | | | | (1,112,516 | ) |

| Institutional Class | | | — | | | | (1,008,195 | ) |

| Total Distributable Earnings | | | — | | | | (2,120,711 | ) |

| | | | | | | | | |

| Capital Transactions: | | | | | | | | |

| Retail Class: | | | | | | | | |

| Shares Issued | | | 1,884,633 | | | | 3,103,586 | |

| Shares Issued in Reinvestment of Distribution | | | — | | | | 1,046,663 | |

| Shares Exchanged for Institutional Class Shares | | | (2,218 | ) | | | (329,331 | ) |

| Shares Redeemed | | | (4,305,228 | ) | | | (8,542,497 | ) |

| Institutional Class: | | | | | | | | |

| Shares Issued | | | 2,388,301 | | | | 12,533,645 | |

| Shares Issued in Reinvestment of Distribution | | | — | | | | 975,002 | |

| Shares Issued in Exchange for Retail Class Shares | | | 2,218 | | | | 329,331 | |

| Shares Redeemed | | | (6,333,317 | ) | | | (35,719,878 | ) |

| Total Change in Net Assets from Capital Transactions | | | (6,365,611 | ) | | | (26,603,479 | ) |

| | | | | | | | | |

| Change in Net Assets | | | 21,092,281 | | | | (96,349,522 | ) |

| | | | | | | | | |

| Total Net Assets | | | | | | | | |

| Beginning of Year | | | 120,559,605 | | | | 216,909,127 | |

| End of Period | | $ | 141,651,886 | | | $ | 120,559,605 | |

| | | | | | | | | |

| Share Transactions: | | | | | | | | |

| Retail Class: | | | | | | | | |

| Number of Shares Issued | | | 36,921 | | | | 57,289 | |

| Number of Shares Reinvested | | | — | | | | 23,584 | |

| Number of Shares Exchanged for Institutional Class Shares | | | (47 | ) | | | (6,573 | ) |

| Number of Shares Redeemed | | | (91,044 | ) | | | (165,817 | ) |

| Change in Retail Class Shares | | | (54,170 | ) | | | (91,517 | ) |

| Institutional Class: | | | | | | | | |

| Number of Shares Issued | | | 46,204 | | | | 228,548 | |

| Number of Shares Reinvested | | | — | | | | 21,182 | |

| Number of Shares Issued in Exchange for Retail Class Shares | | | 45 | | | | 6,351 | |

| Number of Shares Redeemed | | | (128,064 | ) | | | (638,226 | ) |

| Change in Institutional Class Shares | | | (81,815 | ) | | | (382,145 | ) |

| Total Change in Shares | | | (135,985 | ) | | | (473,662 | ) |

See accompanying notes to financial statements.

Semi-Annual Report 2023

Needham Aggressive Growth Fund

Statements of Changes in Net Assets

| | | Period Ended | | | Year Ended | |

| | | June 30, 2023 | | | December 31, 2022 | |

| Change in Net Assets | | | | | | |

| Operations: | | | | | | |

| Net Investment Loss | | $ | (657,072 | ) | | $ | (1,381,891 | ) |

| Net Realized Gain/(Loss) from Investments, Securities Sold Short, | | | | | | | | |

| Foreign Currency Transactions, and Currency | | | (3,647,296 | ) | | | 1,252,127 | |

| Net Change in Unrealized Appreciation/(Depreciation) on Investments, | | | | | | | | |

| Securities Sold Short, Foreign Currency Translations | | | 42,874,025 | | | | (47,417,967 | ) |

| Change in Net Assets Resulting from Operations | | | 38,569,657 | | | | (47,547,731 | ) |

| | | | | | | | | |

| Distributable Earnings: | | | | | | | | |

| Retail Class | | | — | | | | — | |

| Institutional Class | | | — | | | | — | |

| Total Distributable Earnings | | | — | | | | — | |

| | | | | | | | | |

| Capital Transactions: | | | | | | | | |

| Retail Class: | | | | | | | | |

| Shares Issued | | | 20,021,742 | | | | 32,589,452 | |

| Shares Issued in Reinvestment of Distribution | | | — | | | | — | |

| Shares Exchanged for Institutional Class Shares | | | (218,476 | ) | | | (738,424 | ) |

| Shares Redeemed | | | (5,983,883 | ) | | | (19,962,515 | ) |

| Capital Contribution | | | 83,012 | | | | — | |

| Institutional Class: | | | | | | | | |

| Shares Issued | | | 34,540,636 | | | | 75,218,012 | |

| Shares Issued in Reinvestment of Distribution | | | — | | | | — | |

| Shares Issued in Exchange for Retail Class Shares | | | 218,476 | | | | 738,424 | |

| Shares Redeemed | | | (16,099,081 | ) | | | (45,755,366 | ) |

| Total Change in Net Assets from Capital Transactions | | | 32,562,426 | | | | 42,089,583 | |

| | | | | | | | | |

| Change in Net Assets | | | 71,132,083 | | | | (5,458,148 | ) |

| | | | | | | | | |

| Total Net Assets | | | | | | | | |

| Beginning of Year | | | 134,919,304 | | | | 140,377,452 | |

| End of Period | | $ | 206,051,387 | | | $ | 134,919,304 | |

| | | | | | | | | |

| Share Transactions: | | | | | | | | |

| Retail Class: | | | | | | | | |

| Number of Shares Issued | | | 598,764 | | | | 962,894 | |

| Number of Shares Reinvested | | | — | | | | — | |

| Number of Shares Exchanged for Institutional Class Shares | | | (6,990 | ) | | | (23,793 | ) |

| Number of Shares Redeemed | | | (186,176 | ) | | | (635,372 | ) |

| Change in Retail Class Shares | | | 405,598 | | | | 303,729 | |