Semi-Annual

Report

Needham Funds

Seeking to build wealth for long-term investors.

June 30, 2020

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

www.needhamfunds.com

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically from the Funds by calling 1-800-625-7071 or by contacting your financial intermediary (such as a broker-dealer or bank).

You may elect to receive all future reports in paper free of charge. You can request to continue receiving paper copies of your shareholder reports by contacting your financial intermediary or, if you invest directly with a Fund, calling 1-800-625-7071 to let the Fund know of your request. Your election to receive in paper will apply to all funds held in your account.

250 Park Avenue, 10th Floor

New York, New York 10177

1-800-625-7071

www.needhamfunds.com

Semi-Annual Report

June 30, 2020

Contents

| Letter from the Adviser | 1 |

| Portfolio Characteristics | |

| Needham Growth Fund | 10 |

| Needham Aggressive Growth Fund | 14 |

| Needham Small Cap Growth Fund | 16 |

| Disclosure of Fund Expenses | 18 |

| Schedules of Investments | |

| Needham Growth Fund | 20 |

| Needham Aggressive Growth Fund | 25 |

| Needham Small Cap Growth Fund | 30 |

| Schedules of Securities Sold Short | |

| Needham Growth Fund | 24 |

| Needham Aggressive Growth Fund | 29 |

| Needham Small Cap Growth Fund | 33 |

| Statements of Assets and Liabilities | 34 |

| Statements of Operations | 36 |

| Statements of Changes in Net Assets | 37 |

| Financial Highlights | |

| Needham Growth Fund | 40 |

| Needham Aggressive Growth Fund | 42 |

| Needham Small Cap Growth Fund | 44 |

| Notes to Financial Statements | 46 |

| Supplementary Information | 56 |

This report is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus. The prospectus contains more complete information, including investment objectives, risks, expenses and charges and should be read carefully before investing or sending any money. To obtain a prospectus or summary prospectus, please call 1-800-625-7071.

Portfolios of The Needham Funds, Inc., like all mutual funds:

| | • | Are NOT FDIC insured |

| | • | Have no bank guarantee |

| | • | May lose value |

The Needham Funds, Inc. are distributed by Needham & Company, LLC.

Semi-Annual Report 2020

| 250 Park Avenue, 10th Floor |

| New York, NY 10177 |

| | (800) 625-7071 |

| | www.needhamfunds.com |

August 2020

Dear Shareholders, Friends of Needham, and Prospective Shareholders,

We are pleased to report Needham Funds’ results for the half-year ended June 30, 2020. Our mission is to create wealth for long-term investors and the first half of 2020 was another step forward despite an unprecedented economic and social background. All three Needham Funds outperformed the Russell 2000 Index and the S&P 500 Index for the half-year.

Macroeconomic and Market Commentary

Entering the year, we anticipated strategic progress and growth from our portfolio companies. That all changed with COVID-19. From late February until March 23, the S&P 500 declined 34%, its largest drop in history. It was one of the worst quarters in the recorded history of the United States’ markets, and, in April 2020, the S&P 500 posted its best month since January 1987.

Along with the stock market performance, the monetary and fiscal policy responses to COVID-19 were unprecedented. The Federal Reserve announced an unlimited bond-buying program. These bonds included high-yield ETFs, bonds rated investment grade before the crisis, small business loans, municipals, asset-backed securities, collateralized loan obligations and commercial mortgage-backed securities. The fiscal response included the CARES Act with over $2 trillion of grants and loans to all kinds of businesses, including airlines, hospitals and small businesses, payments to state and local governments, and a $1,200 direct payment to some individuals. We believe these policy responses contributed to the strong performance of equities.

Company earnings for the March quarter were as expected. Business in the U.S. was strong until shelter-in-place restrictions went into effect in mid-March. Although most companies followed the legalistic path of withdrawing guidance, their commentaries on second quarter revenue and bookings was much better than we expected.

In April, Needham Funds recovered nearly all of their entire first quarter declines. April unemployment was 14.7%, the worst since an estimated 24.9% in the Great Depression.

May was another strong month for Needham Funds and the market. We believe the monetary and fiscal stimulus was a contributor to the positive month. May unemployment improved to 13.3%. June was another positive month for Needham Funds and the markets as more states began to open their economies.

In early June, the Federal Reserve estimated second quarter GDP might drop a stunning 52.8%, following a 5.0% first quarter decline. In July, the U.S. Bureau of Economic Analysis published its first estimate of -32.8% GDP in the second quarter. Unemployment improved to 11.1% in June.

Needham Funds

Needham Funds’ Portfolio Overview & Opportunity in the Time of COVID-19

Some of the companies that have had reasonably positive outlooks and earnings so far in 2020 are involved with infrastructure build-out. This type of infrastructure is not what one typically thinks of as infrastructure. We see the beneficiaries as companies involved with the build-out of cloud data centers, communications, software-as-a service applications, technology-based manufacturing and life sciences research.

The ease with which much of the white-collar workforce has adapted to work from home is a testament to the communications infrastructure. In his book Digital Cathedrals, Mark Mills writes that the cloud is the first “foundationally new infrastructure in nearly a century.” Datacenters are the physical representations of this infrastructure. Mills states that we are still very early in the build-out of this infrastructure and even earlier in the applications and societal benefits it will bring. Many of our portfolio companies are directly involved with datacenter build-out and delivery of applications to users:

| | • | Equinix, Inc. (EQIX) is the premier data center company. Infinera Corporation (INFN), Pure Storage, Inc. (PSTG), Super Micro Computer Inc. (SMCI), Taiwan Semiconductor Manufacturing ADR (TSM) and Vicor Corporation (VICR) provide semiconductors and systems for computing and storage in data centers and communications equipment to connect data centers to the world. |

| | | |

| | • | Akamai Technologies Inc.’s (AKAM) and Limelight Networks’ (LLNW) distributed content delivery network and security services make delivery of data more efficient. |

| | | |

| | • | 8x8 Inc. (EGHT) and Vonage Holdings (VG) provide voice and data services to enterprises. |

| | | |

| | • | Appian Corporation (APPN), Everbridge, Inc. (EVBG) and Q2 Holdings, Inc. (QTWO) are SaaS providers. Pluralsight, Inc. (PS) provides a cloud-based learning platform. |

COVID-19 has also highlighted the risk of a concentrated supply chain. Manufacturing and pharmaceutical companies may look to build out capacity in the United States, Mexico and Canada to diversify supply chains and reduce transit routes. Our portfolio companies Aspen Aerogels, Inc. (ASPN), Clean Harbors, Inc. (CLH), IPG Photonics Corp. (IPGP), MKS Instruments Inc. (MKSI), National Instruments Corp. (NATI), and Vishay Precision Group, Inc. (VPG) could benefit from supply chain diversification.

We also see a build-out in scientific infrastructure used for life sciences research. Several of our portfolio companies supply equipment and consumables used for life sciences research, including Bruker Corp. (BRKR), Corning Inc. (GLW), Entegris Inc. (ENTG), MKS Instruments Inc. (MKSI), and Thermo Fisher Scientific, Inc. (TMO). CryoPort, Inc. (CYRX) supplies the cold-chain logistics to transport therapies and samples used for both research and treatment.

Readjustment to a post-COVID-19 world will be difficult. The unprecedented unemployment is the biggest issue. The economy has serious issues ahead for the travel, retail, entertainment, hospitality and other consumer-facing industries. Some of those industries may employ less people than before. Opportunities in the growing sectors require new skills for displaced workers. However, the second quarter provided a preview of elements of an optimistic future. We are hopeful.

Needham Growth Fund First Half 2020 Performance – John Barr, Chris Retzler, Co-Portfolio Managers

For the half year ended June 30, 2020, the Needham Growth Fund Institutional and Retail classes returned 6.47% and 6.19%, respectively. The Russell 2000 Index returned -12.98% and the S&P 500 Index returned -3.08%.

Vicor Corporation (VICR) was the leading contributor in the first half of 2020. Vicor makes small, modular power converters used in data centers, on servers and in cars and transportation systems. It has invested $400 million in new product development over the last decade. Vicor has worked with Alphabet’s Google (GOOGL) on its Open Compute data centers to distribute DC (direct current) power throughout the data center rather than go through the inefficient conversions to AC (alternating current) and back again to DC. Many artificial intelligence and machine learning applications require sophisticated power conversion and Vicor is uniquely positioned to meet these needs.

PDF Solutions, Inc. (PDFS) was another leading contributor in the first half. PDF’s results showed continued progress with its strategy of making Exensio, the semiconductor manufacturing industry standard big data platform. In its 1st quarter conference call, PDF discussed a multi-year, eight-figure Exensio agreement with a major semiconductor company. PDF’s stock traded down in early February when China was the center of the COVID-19 outbreak. PDF has an engineering team in Shanghai and generated 16% of revenue from China in 2019.

Gilead Sciences, Inc. (GILD), a 9-year holding of the Needham Growth Fund, was another top contributor for the half-year. In late January, Gilead’s remdesivir emerged as a leading therapeutic to treat COVID-19 patients. On May 1, the FDA issued an Emergency Use Authorization for remdesivir. On June 1, Gilead announced results from a Phase 3 study, which showed clinical improvement from a 5-day treatment regime of remdesivir.

Gilead donated its first 120,000 treatment courses of remdesivir. On June 29, the U.S. Department of Health and Human Services secured 500,000 treatment courses, nearly all of Gilead’s production through September 2020. Hospitals will pay no more than $3,200 per treatment course. Remdesivir could represent a $1-4 billion a year opportunity for Gilead. Gilead had $22 billion of revenue in 2019, so remdesivir would be a relatively small, but welcome addition.

On April 7, Gilead acquired Forty Seven, Inc. (FTSV) for $4.9 billion. Forty Seven’s lead product candidate is magrolimab, which is an anti-CD47 agent for treatment of bone marrow and blood cell cancers including MDS (myelodysplastic syndromes), AML (acute myeloid leukemia) and DLBCL (diffuse large B-cell lymphoma).

Entegris, Inc. (ENTG) was also a leading first half contributor. Entegris supplies filters and chemicals used in advanced semiconductor manufacturing processes. Over time, we believe that semiconductors will increase as a percentage of industrial output and that Entegris’ filtration and specialty materials products will grow even faster than the semiconductor industry.

KVH Industries, Inc. (KVHI) was the only significant detractor for the half-year. KVH’s first quarter results were in-line, but the company’s leisure marine business suffered due to COVID-19, growth initiatives were delayed and the stock price suffered. We remain positive about KVH’s AgilePlans, which provides connectivity-as-a-service to the maritime industry and bundles a satellite antenna, air time, and news, entertainment and training programming. KVH has continued to report positive AgilePlans subscription results.

The Fund’s largest new positions included ADTRAN, Inc. (ADTN), AXT, Inc. (AXTI), 8x8, Inc. (EGHT) and FirEeye, Inc. (FEYE). The Fund’s largest additions to existing positions were Aspen Aerogels Inc. (ASPN) and II-VI Incorporated (IIVI).

The Fund’s largest complete exits were Bill.com Holdings (BILL) over concern for its small business customer base and GenMark Diagnostics, Inc. (GNMK) on valuation after its COVID-19 testing success. Both investments were big winners. The Fund also reduced positions in some of the longer-term, larger holdings in the Fund, including Entegris, FormFactor, Inc. (FORM), PDF Solutions and Thermo Fisher Scientific, Inc. (TMO).

At June 30, 2020, the Fund’s top 10 positions were 55.63% of net assets. The Fund had 1.3% of net assets in cash and was short 0.8%. The Fund had an Active Share of 96.6% versus the Russell 2000 and trailing 12-month turnover was 18%.

Morningstar categorizes the Fund as Mid Cap Growth. Lipper categorizes it as Mid Cap Core. When you hold companies for 10-15 years, and they succeed, they grow to larger market cap categories. Our mission is to find companies that may be compounders over many years, independent of industry or market cap.

Needham Aggressive Growth Fund First Half 2020 Performance – John Barr, Portfolio Manager

For the half year ended June 30, 2020, the Needham Aggressive Growth Fund Institutional and Retail classes returned 12.96% and 12.68%, respectively. The Russell 2000 Index returned -12.98% and the S&P 500 Index returned -3.08%.

The Fund’s leading contributor in the first half was Alpha Pro Tech, Ltd. (APT), which manufactures disposable and protective apparel for health care and industrial markets, and weatherization products for the construction industry. I discovered the company on a trip to Toronto and the Fund first invested in 2018.

I was attracted by Alpha Pro Tech’s management, double-digit return on capital and robust balance sheet. Lloyd Hoffman, son of the company’s co-founder, has been at Alpha Pro Tech for 30 years and has been CEO for the last four years. The company has been profitable every year since 1997.

Alpha Pro Tech is one of only a few companies with N-95 mask manufacturing in the United States. Its N-95 masks have long been approved by the NIOSH (part of the CDC), and cleared by the FDA as a surgical mask. The company typically had $3-4 million of annual mask revenue, but we believe mask revenue will be over $50 million in 2020. While Alpha Pro Tech is a significantly smaller mask maker than Honeywell or 3M, we believe the market for domestically manufactured N-95 masks will be significantly larger in the future. The company also manufactures face shields, gowns and other PPE. We believe the company may earn $2-3 per share in 2020 and beyond.

Apple, Inc. (AAPL) was also a leading contributor in the first half. In January, Apple reported strong results and positive guidance for iPhones, Services and Wearables. However, on February 16, Apple pre-announced a negative quarter based on manufacturing, supply chain and demand issues in China. China retail stores started to open in March, and U.S. stores opened in May and June. The market looked forward to a fall launch of the 5G iPhone and demand recovery. Apple closed the second quarter near an all-time high.

Vicor Corporation (VICR), PDF Solutions, Inc. (PDFS) and Entegris, Inc. (ENTG) were also leading contributors to the Fund’s first half performance.

DIRTT Environmental Solutions Ltd. (DRTT) was the leading detractor to the Fund’s performance in the first half. DIRTT provides customized, prefabricated interior office spaces. It has an incredible virtual reality CAD system, and it manufactures walls and interior components, which are shipped and assembled on-site. As a result, there is less on-site waste and a more predictable construction schedule. DIRTT competes with dry wall construction and in the market for skilled workers. I believe DIRTT is the future of interior construction.

DIRTT’s first quarter revenue and earnings and second quarter guidance were weak. We are concerned about the impact of the weak economy, and the impact of social distancing requirements on office construction. Longer-term, we believe DIRTT could benefit from a need to modify floor plans; however, there may be a pause before companies make such changes. Consequently, the Fund sold its DIRTT position and realized a tax-loss. We will revisit this decision as we develop a view of the future of office environments. The Fund added small new positions in Clean Harbors, Inc. (CLH) and Arlo Technologies, Inc. (ARLO). We hope to build both positions over time. The largest addition to an existing holding was to Smith-Midland Corporation (SMID), a micro-cap maker of pre-cast concrete systems for road barriers and construction. We were impressed by the company’s management and believe the market misunderstands the returns from its barrier rental business.

The Fund exited Bill.com Holdings (BILL) and Coupa Software, Inc. (COUP) over concern for their small business customer bases. Both were small positions, but big winners. We hope to have a chance to repurchase shares in the future. The Fund also reduced its positions in some of the longer-term, larger holdings in the Fund, including Apple, Akamai Technologies (AKAM), Entegris and PDF Solutions.

At June 30, 2020, the Fund’s top 10 positions were 68.62% of net assets. The Fund was fully invested and was short 0.4%. The Fund had an Active Share of 99.4% versus the Russell 2000 and trailing 12-month turnover was 14%. Morningstar categorizes the Fund as Small Cap Growth, and as of April 30, 2020, Lipper also categorizes it as Small Cap Growth.

Needham Small Cap Growth Fund First Half 2020 Performance – Chris Retzler, Portfolio Manager

For the half year ended June 30, 2020, the Needham Small Cap Growth Fund Institutional and Retail classes returned 14.87% and 14.50%, respectively. The Russell 2000 Index returned -12.98% and the S&P 500 Index returned -3.08%.

After a strong finish to 2019, we were cautious entering 2020 that the momentum and strength of 2019 would continue. We remained patient with the Fund’s cash position in January and continued to exit and trim positions into February. We believed the market was due for a pullback, however, we did not expect such a violent and rapid selloff in March. This pullback offered a tremendous opportunity to invest most of our cash position at generationally low prices. We continued to deploy cash into April.

Many of the Fund’s investments are technology-defined companies, however we achieve diversity in the portfolio through the end markets that these companies serve. Technology has permeated the entire global economy. End markets with strong secular growth include advanced communications, military modernization, automotive advancement, industrial digitization, medical enhancement, 5G wireless, data center buildouts, infrastructure expansion, security improvements and overall semiconductor processing and power management enhancements. Many of our portfolio companies are at the crossroads of many industries and therefore have multiple opportunities for success. This market positioning inherently gives the portfolio a natural hedge and ultimately helps reduce volatility and risk. Using an old phrase, we like companies that “sell picks to the miners.”

The Fund benefitted in the first half from its concentrated investments in GenMark Diagnostics (GNMK), MaxLinear (MXL), Channel Advisor (ECOM), Limelight Networks, II-VI (IIVI) and Akoustis Technologies (AKTS).

GenMark received fast track approval for its COVID-19 test panel, which accelerated purchases of its primary diagnostic machines. The stock price surpassed our high-end target price, and we exited the entire position.

MaxLinear’s stock price was under pressure over the last year until April 6, when it announced the acquisition of Intel’s broadband assets at a price lower than the market’s estimate. A steady increase in share price ensued through the end of the second quarter, greatly benefiting the Fund’s position in the stock.

ChannelAdvisor benefited from increased online consumer activity driven by COVID-19 shelter-in-place restrictions. We have been patient investors in ChannelAdvisor and have been rewarded for that patience.

Limelight Networks benefitted from the need for improved infrastructure and content delivery as remote work and over-the-top media (OTT) demands surged. The stock price has nearly doubled since 2019, and we will evaluate target prices and forward growth rate opportunities.

II-IV, a materials and optoelectronics components manufacturer and long-time holding in the Fund, found its stock under pressure since its September 2019 acquisition of former rival Finisar. Investors were skeptical that II-VI could integrate and retool the Finisar assets, but the acquisition is beginning to work under the company’s dynamic leadership, and the integration is now reflected in the stock price. During the first half, II-VI achieved our price targets and we exited the position.

Finally, our investment in Akoustis Technologies also paid off, as filter technology for wireless communications continued to see customer interest and acceptance. As 5G continues to expand, we expect Akoustis to benefit and further broaden their end-market customer base.

Closing

As we enter a volatile election season filled with headline risks, we remain comfortable with our portfolio at this moment, but we will continue to evaluate our exposure and stock selection. We believe that global central banks will remain accommodative, and substantial fiscal stimulus policies will continue, with the goal of minimizing the economic impact of COVID-19 while simultaneously supporting risk assets. We expect economic activity to accelerate as we begin to recover from the dramatic stop in the first half of 2020. While we do not believe we are completely out of the woods regarding the health crisis, we believe the global economy, businesses and healthcare systems are better prepared for any deterioration resulting from any further worsening of the pandemic.

We believe the U.S. remains the best place in the world to be investing, and we continue to see an opportunity to invest in small and mid-cap stocks. Most importantly, we see a revolution happening in technology that has created and continues to create investment opportunities. We see opportunity in our strategy of investing in companies that we know well and that we believe are positioned with secular growth drivers.

We welcome our new investors and thank all of our investors for their continued support. If you have any questions, thoughts or concerns, please contact us at (800) 625-7071 or jbarr@needhamco.com and cretzler@needhamco.com. For information about the Needham Funds, please visit our website at www.needhamfunds.com.

Sincerely,

|  |

| Chris Retzler, | John O. Barr, |

| Portfolio Manager | Portfolio Manager |

Fact Sheet Links:

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

The information presented in this commentary is not intended as personalized investment advice and does not constitute a recommendation to buy or sell a particular security or other investments. Past performance is no guarantee of future results. The views of Needham Investment Management L.L.C., the Funds’ investment adviser (the “Adviser”), and the securities described in this report are as of June 30, 2020; these views and portfolio holdings may have changed subsequent to this date. The specific securities discussed may, in aggregate, represent only a small percentage of a Fund’s holdings. If a specific security discussed is not found in a Fund’s Schedule of Investments, it may have been held by the Fund during the period. It should not be assumed that securities identified and discussed were, or will be, profitable, or that the investment decisions made in the future will be profitable, or equal the investment performance of the securities discussed herein. There can be no guarantee as to the accuracy of any outlooks for markets, sectors and securities as discussed herein.

This message is not an offer of the Needham Growth Fund, the Needham Aggressive Growth Fund or the Needham Small Cap Growth Fund. Shares are sold only through the currently effective prospectus. Please read the prospectus or summary prospectus carefully and consider the investment objectives, risks and charges and expenses of the Funds carefully before you invest. The prospectus and summary prospectus contain this and other information about the Funds and can be obtained on our website, www.needhamfunds.com or by contacting the Funds’ transfer agent U.S. Bancorp Fund Services LLC doing business as U.S. Bank Global Fund Services (“Fund Services”) at 1-800-625-7071.

Investment returns and principal value will fluctuate, and when redeemed, shares may be worth more or less than their original cost. Performance data quoted represents past performance, and does not guarantee future results. Current performance may be higher or lower than these results. Performance current to the most recent month-end may be obtained by calling our transfer agent at 1-800-625-7071. Total return figures include reinvestment of all dividends and capital gains.

All three of the Needham Funds have substantial exposure to small and micro capitalized companies. Funds holding smaller capitalized companies are subject to greater price fluctuation than those of larger companies. The coronavirus disease 2019 (COVID-19) global pandemic and the aggressive responses taken by many governments or voluntarily imposed by private parties, including closing borders, restricting travel and imposing prolonged quarantines or similar restrictions, as well as the closure of, or operational changes to, many retail and other businesses, have had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment. Needham & Company, LLC, member FINRA/SIPC, is the distributor of The Needham Funds, Inc.

The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. The Russell 3000 Index is a market-capitalization-weighted equity index that provides exposure to the entire U.S. stock market. The Russell 3000 Index tracks the performance of the 3,000 largest U.S.-traded stocks. Please see the disclaimer regarding these indexes under “Supplementary Information—Index Disclaimer” on page 56 of this report.

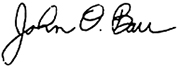

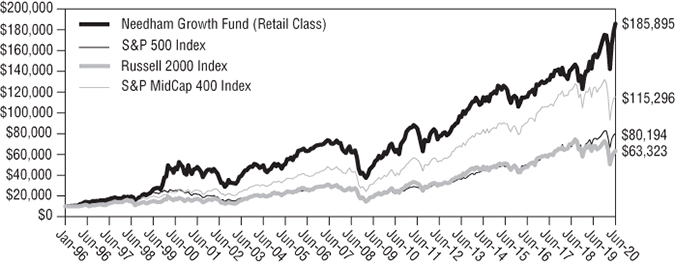

| NEEDHAM GROWTH FUND | Retail Class |

| Portfolio Characteristics (Unaudited) | Ticker Symbol: NEEGX |

| | Institutional Class |

| | Ticker Symbol: NEEIX |

Comparison of Change in Value of a $10,000 Investment

The chart above assumes an initial gross investment of $10,000 made on January 1, 1996. The Fund’s performance figures are for the period ended June 30, 2020. The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com or call 1-800-625-7071. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and expense reimbursements, when they are necessary to keep the Fund’s total annual operating expenses at the expense cap currently in effect, total return would be reduced. Performance figures for periods greater than one year are annualized. For information about each index shown in the chart above, please refer to the following page.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC., doing business as U.S. Bank Global Fund Services (“Fund Services”).

Comparative Performance Statistics as of June 30, 2020 (Unaudited)

| | 1 | 5 | 10 | Since |

| | Year | Years | Years | Inception |

Needham Growth Fund Retail Class(1)(2) | 20.47% | 8.30% | 11.55% | 12.67% |

Needham Growth Fund Institutional Class(1)(3) | 21.11% | n/a | n/a | 12.21% |

S&P 500 Index(4)(5) | 7.51% | 10.73% | 13.99% | 8.87%(8) |

S&P MidCap 400 Index(4)(6) | -6.70% | 5.22% | 11.34% | 10.50%(8) |

Russell 2000 Index(4)(7) | -6.63% | 4.29% | 10.50% | 7.83%(8) |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

| 1. | Investment results calculated after reinvestment of dividends. |

| 2. | The inception date of the Retail Class was 1/1/96. |

| 3. | The inception date of the Institutional Class was 12/30/16. |

| 4. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| 5. | The S&P 500 Index focuses on the large-cap sector of the market; however, since it includes a significant portion of the total value of the market, it also is considered representative of the market. Companies in the S&P 500 are considered leading companies in leading industries. |

| 6. | The S&P MidCap 400 Index provides investors with a benchmark for mid-sized companies. The index seeks to remain an accurate measure of mid-sized companies, reflecting the risk and return characteristics of the broader mid-cap universe on an on-going basis. |

| 7. | The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 8% of the total market capitalization of that index. The Russell 2000 Index includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. |

| 8. | The return shown for the index is from the inception date of the Retail Class. The returns for the S&P 500 Index, S&P MidCap 400 Index and Russell 2000 Index from the inception date of the Institutional Class are 11.95%, 3.76%, 3.14%, respectively. |

| Top Ten Holdings* |

| (as a % of total investments, |

| as of June 30, 2020) |

| | | % of Total |

Security |

| Investments |

| Thermo Fisher Scientific, Inc. | TMO | 8.79% |

| PDF Solutions, Inc. | PDFS | 8.13% |

| CarMax, Inc. | KMX | 6.44% |

| Entegris, Inc. | ENTG | 6.31% |

| Gilead Sciences, Inc. | GILD | 5.67% |

| Vicor Corp. | VICR | 4.69% |

| KVH Industries, Inc. | KVHI | 4.41% |

| Becton Dickinson & Co. | BDX | 4.14% |

| Comcast Corp. – Class A | CMCSA | 3.99% |

| Super Micro Computer, Inc. | SMCI | 3.51% |

Top Ten Holdings = 56.08% of Total Investments†

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

| † | Percentage of total investments less cash. |

| Sector Weightings* |

| (as a % of net investments, |

| as of June 30, 2020) |

Sector(3) | Long* | (Short)(1) | Total(1)(2) |

| Cash | 1.3% | — | 1.3% |

| Communication Services | 4.5% | — | 4.5% |

| Consumer Discretionary | 6.6% | — | 6.6% |

| Consumer Staples | 0.5% | — | 0.5% |

| Energy | 2.8% | — | 2.8% |

| Financials | 0.3% | — | 0.3% |

| Health Care | 22.4%

| — | 22.4%

|

| Industrials | 7.2% | — | 7.2% |

| Information Technology | 55.0%

| (0.8)% | 54.2%

|

| Real Estate | 0.2% | — | 0.2% |

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

(1) | Percentage of total investments includes all stocks, plus cash minus all short positions. |

(2) | Total represents the difference between the long exposure and the short exposure, which produces the net exposure. |

(3) | These categories represent broad market sectors. Refer to the Schedule of Investments for a more detailed categorization by industry. |

(This Page Intentionally Left Blank.)

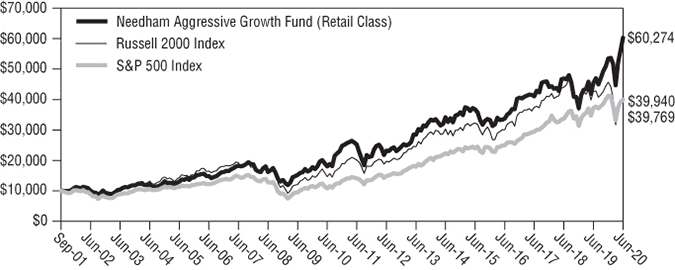

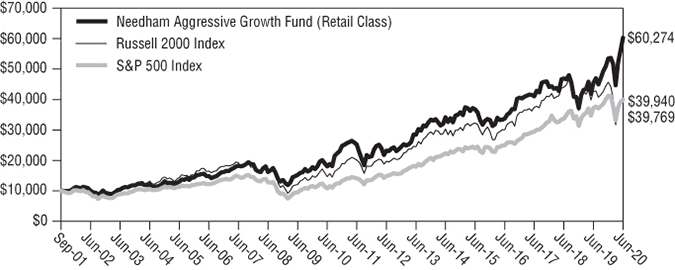

| NEEDHAM AGGRESSIVE GROWTH FUND | Retail Class |

| Portfolio Characteristics (Unaudited) | Ticker Symbol: NEAGX |

| | Institutional Class |

| | Ticker Symbol: NEAIX |

Comparison of Change in Value of a $10,000 Investment

The chart above assumes an initial gross investment of $10,000 made on September 4, 2001. The Fund’s performance figures are for the period ended June 30, 2020. The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com or call 1-800-625-7071. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and expense reimbursements, when they are necessary to keep the Fund’s total annual operating expenses at the expense cap currently in effect, total return would be reduced. Performance figures for periods greater than one year are annualized. For information about each index shown in the chart above, please refer to the following page.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC., doing business as U.S. Bank Global Fund Services (“Fund Services”).

Comparative Performance Statistics as of June 30, 2020 (Unaudited)

| | 1 | 5 | 10 | Since |

| | Year | Years | Years | Inception |

Needham Aggressive Growth Fund Retail Class(1)(2) | 32.61% | 10.40% | 12.82% | 10.02% |

Needham Aggressive Growth Fund Institutional Class(1)(3) | 33.33% | n/a | n/a | 12.58% |

S&P 500 Index(4)(5) | 7.51% | 10.73% | 13.99% | 7.64%(7) |

Russell 2000 Index(4)(6) | -6.63% | 4.29% | 10.50% | 7.61%(7) |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

| 1. | Investment results calculated after reinvestment of dividends. |

| 2. | The inception date of the Retail Class was 9/4/01. |

| 3. | The inception date of the Institutional Class was 12/30/16. |

| 4. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| 5. | The S&P 500 Index focuses on the large-cap sector of the market; however, since it includes a significant portion of the total value of the market, it also is considered representative of the market. Companies in the S&P 500 are considered leading companies in leading industries. |

| 6. | The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 8% of the total market capitalization of that index. The Russell 2000 Index includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. |

| 7. | The return shown for the index is from the inception date of the Retail Class. The returns for the S&P 500 Index and Russell 2000 Index from the inception date of the Institutional Class are 11.95% and 3.14%, respectively. |

| Top Ten Holdings* |

| (as a % of total investments, |

| as of June 30, 2020) |

| | | % of Total |

Security |

| Investments |

| PDF Solutions, Inc. | PDFS | 12.18% |

| Apple, Inc. | AAPL | 10.49% |

| Vicor Corp. | VICR | 10.34% |

| Entegris, Inc. | ENTG | 10.08% |

| KVH Industries, Inc. | KVHI | 5.93% |

| Nova Measuring | | |

| Instruments, Ltd. (Israel) | NVMI | 5.45% |

| MKS Instruments, Inc. | MKSI | 4.68% |

| Super Micro Computer, Inc. | SMCI | 3.55% |

| CarMax, Inc. | KMX | 3.30% |

| Akamai Technologies, Inc. | AKAM | 2.79% |

Top Ten Holdings = 68.79% of Total Investments†

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

| † | Percentage of total investments less cash. |

| Sector Weightings* |

| (as a % of net investments, |

| as of June 30, 2020) |

Sector(3) | Long* | (Short)(1) | Total(1)(2) |

| Cash | 0.1% | — | 0.1% |

| Communication Services | 0.2% | — | 0.2% |

| Consumer Discretionary | 3.3% | — | 3.3% |

| Consumer Staples | 2.4% | — | 2.4% |

| Energy | 1.6% | — | 1.6% |

| Health Care | 4.5% | — | 4.5% |

| Industrials | 15.7%

| — | 15.7%

|

| Information Technology | 68.5%

| (0.3)% | 68.2%

|

| Materials | 1.4% | — | 1.4% |

| Real Estate | 2.6% | — | 2.6% |

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

(1) | Percentage of total investments includes all stocks, plus cash minus all short positions. |

(2) | Total represents the difference between the long exposure and the short exposure, which produces the net exposure. |

(3) | These categories represent broad market sectors. Refer to the Schedule of Investments for a more detailed categorization by industry. |

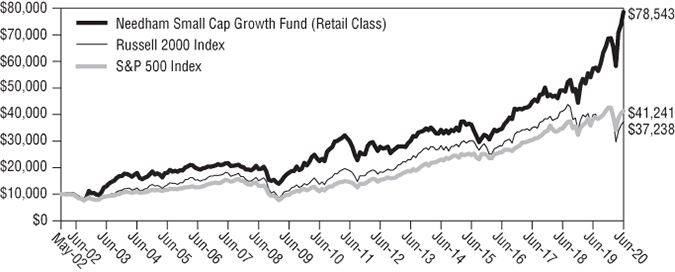

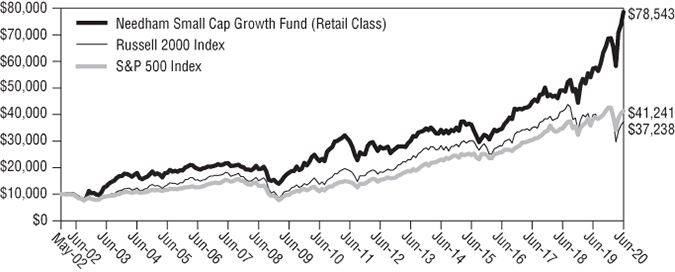

| NEEDHAM SMALL CAP GROWTH FUND | Retail Class |

| Portfolio Characteristics (Unaudited) | Ticker Symbol: NESGX |

| | Institutional Class |

| | Ticker Symbol: NESIX |

Comparison of Change in Value of a $10,000 Investment

The chart above assumes an initial gross investment of $10,000 made on May 22, 2002. The Fund’s performance figures are for the period ended June 30, 2020. The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end, please visit www.needhamfunds.com or call 1-800-625-7071. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. In the absence of fee waivers and expense reimbursements, when they are necessary to keep the Fund’s total annual operating expenses at the expense cap currently in effect, total return would be reduced. Performance figures for periods greater than one year are annualized. For information about each index shown in the chart above, please refer to the following page.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC., doing business as U.S. Bank Global Fund Services (“Fund Services”).

Comparative Performance Statistics as of June 30, 2020 (Unaudited)

| | 1 | 5 | 10 | Since |

| | Year | Years | Years | Inception |

Needham Small Cap Growth Fund Retail Class(1)(2) | 37.05% | 16.77% | 13.32% | 12.06% |

Needham Small Cap Growth Fund Institutional Class(1)(3) | 37.91% | n/a | n/a | 20.40% |

S&P 500 Index(4)(5) | 7.51% | 10.73% | 13.99% | 8.14%(7) |

Russell 2000 Index(4)(6) | -6.63% | 4.29% | 10.50% | 7.53%(7) |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

| 1. | Investment results calculated after reinvestment of dividends. |

| 2. | The inception date of the Retail Class was 5/22/02. |

| 3. | The inception date of the Institutional Class was 12/30/16. |

| 4. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| 5. | The S&P 500 Index focuses on the large-cap sector of the market; however, since it includes a significant portion of the total value of the market, it also is considered representative of the market. Companies in the S&P 500 are considered leading companies in leading industries. |

| 6. | The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 8% of the total market capitalization of that index. The Russell 2000 Index includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. |

| 7. | The return shown for the index is from the inception date of the Retail Class. The returns for the S&P 500 Index and Russell 2000 Index from the inception date of the Institutional Class are 11.95% and 3.14%, respectively. |

| Top Ten Holdings* |

| (as a % of total investments, |

| as of June 30, 2020) |

| | | % of Total |

Security |

| Investments |

| FireEye, Inc. | FEYE | 6.17% |

| MaxLinear, Inc. | MXL | 5.75% |

| Limelight Networks, Inc. | LLNW | 5.04% |

| 8x8, Inc. | EGHT | 4.29% |

| Infinera Corp. | INFN | 3.88% |

| Cambium Networks Corp. | CMBM | 3.73% |

| Mimecast Ltd. | MIME | 3.72% |

| Pluralsight, Inc. | PS | 3.49% |

| AXT, Inc. | AXTI | 3.47% |

| Super Micro Computer, Inc. | SMCI | 3.38% |

Top Ten Holdings = 42.92% of Total Investments†

* Current portfolio holdings may not be indicative of future portfolio holdings.

† Percentage of total investments less cash.

| Sector Weightings* |

| (as a % of net investments, |

| as of June 30, 2020) |

Sector(3) | Long* | (Short)(1) | Total(1)(2) |

| Cash | 6.6% | — | 6.6% |

| Communication Services | 1.8% | — | 1.8% |

| Energy | 3.0% | — | 3.0% |

| Health Care | 6.6% | — | 6.6% |

| Industrials | 2.6% | — | 2.6% |

| Information Technology | 80.8%

| (1.4)% | 79.4%

|

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

(1) | Percentage of total investments includes all stocks, plus cash minus all short positions. |

(2) | Total represents the difference between the long exposure and the short exposure, which produces the net exposure. |

(3) | These categories represent broad market sectors. Refer to the Schedule of Investments for a more detailed categorization by industry. |

Disclosure of Fund Expenses (Unaudited)

The following expense table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of a Fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. A Fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in each Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of a six-month period and held for the entire period. The expense example table below illustrates your Fund’s cost in two ways:

| • | Actual Expenses. This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading entitled “Expenses Paid During Period”. |

| | |

| • | Hypothetical Expenses on a 5% Return. This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had a return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your Fund’s cost by comparing this hypothetical example with the hypothetical examples that appear in shareholders reports of other funds. |

For the Period January 1, 2020 to June 30, 2020

Expense Example Table (Unaudited)

| | Beginning | Ending | Expenses Paid | Expense Ratio |

| | Account | Account | During Period(1) | During Period(1) |

| | Value | Value | 1/1/2020 – | 1/1/2020 – |

| | 1/1/2020 | 6/30/2020 | 6/30/2020 | 6/30/2020 |

| Needham Growth Fund | | | | |

| Retail Class Actual Expenses | $1,000.00 | $1,061.90 | $ 9.84 | 1.92% |

| Retail Class Hypothetical Example | | | | |

| for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,015.32 | $ 9.62 | 1.92% |

| Institutional Class Actual Expenses | $1,000.00 | $1,064.70 | $ 7.19 | 1.40% |

| Institutional Class Hypothetical | | | | |

| Example for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,017.90 | $ 7.02 | 1.40% |

| | | | | |

Needham Aggressive Growth Fund(2) | | | | |

| Retail Class Actual Expenses | $1,000.00 | $1,126.80 | $10.26 | 1.94% |

| Retail Class Hypothetical Example | | | | |

| for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,015.22 | $ 9.72 | 1.94% |

| Institutional Class Actual Expenses | $1,000.00 | $1,129.60 | $ 7.25 | 1.37% |

| Institutional Class Hypothetical | | | | |

| Example for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,018.05 | $ 6.87 | 1.37% |

| | | | | |

| Needham Small Cap Growth Fund | | | | |

| Retail Class Actual Expenses | $1,000.00 | $1,145.00 | $ 9.87 | 1.85% |

| Retail Class Hypothetical Example | | | | |

| for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,015.66 | $ 9.27 | 1.85% |

| Institutional Class Actual Expenses | $1,000.00 | $1,148.70 | $ 6.30 | 1.18% |

| Institutional Class Hypothetical | | | | |

| Example for Comparison Purposes | | | | |

| (5% return before expenses) | $1,000.00 | $1,019.00 | $ 5.92 | 1.18% |

(1) | Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by 182/366 (to reflect the one-half-year period). |

(2) | Effective June 1, 2020, the Adviser has contractually agreed to waive its fee and, if necessary, reimburse the Needham Aggressive Growth Fund until April 30, 2021 to the extent Total Annual Fund Operating Expenses exceed 1.85% and 1.18% of the average daily net assets of the Retail Class shares and the Institutional Class shares respectively, of the Fund. |

Needham Growth Fund

Schedule of Investments

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Common Stocks (98.7%) | | | | | | |

| | | | | | | |

| Aerospace & Defense (0.5%) | | | | | | |

| Parsons Corp. (a) | | | 14,050 | | | $ | 509,172 | |

| | | | | | | | | |

| Biotechnology (5.7%) | | | | | | | | |

| Gilead Sciences, Inc. | | | 82,000 | | | | 6,309,080 | |

| Moderna, Inc. (a) | | | 1,200 | | | | 77,052 | |

| | | | | | | | 6,386,132 | |

| Building Products (0.2%) | | | | | | | | |

| Alpha Pro Tech, Ltd. (a) | | | 7,500 | | | | 132,750 | |

| DIRTT Environmental Solutions (Canada) (a) | | | 71,500 | | | | 86,515 | |

| | | | | | | | 219,265 | |

| Capital Markets (0.3%) | | | | | | | | |

| Brookfield Asset Management, Inc. – Class A (Canada) | | | 9,259 | | | | 304,621 | |

| | | | | | | | | |

| Commercial Services & Supplies (0.2%) | | | | | | | | |

| Clean Harbors, Inc. (a) | | | 3,500 | | | | 209,930 | |

| | | | | | | | | |

| Communications Equipment (6.1%) | | | | | | | | |

| ADTRAN, Inc. | | | 22,500 | | | | 245,925 | |

| Cambium Networks Corp. (a) | | | 127,500 | | | | 938,400 | |

| KVH Industries, Inc. (a) | | | 550,000 | | | | 4,911,500 | |

| ViaSat, Inc. (a)(c) | | | 19,500 | | | | 748,215 | |

| | | | | | | | 6,844,040 | |

| Electrical Equipment (4.6%) | | | | | | | | |

| Vicor Corp. (a) | | | 72,500 | | | | 5,216,375 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (5.3%) | | | | | | | | |

| Arlo Technologies, Inc. (a) | | | 55,000 | | | | 141,900 | |

| Corning, Inc. | | | 34,500 | | | | 893,550 | |

| FARO Technologies, Inc. (a) | | | 10,000 | | | | 536,000 | |

| FLIR Systems, Inc. | | | 7,500 | | | | 304,275 | |

| Frequency Electronics, Inc. (a) | | | 30,000 | | | | 262,800 | |

| II-VI, Inc. (a) | | | 15,000 | | | | 708,300 | |

| IPG Photonics Corp. (a) | | | 6,250 | | | | 1,002,438 | |

| National Instruments Corp. | | | 19,000 | | | | 735,490 | |

| nLight, Inc. (a) | | | 2,500 | | | | 55,650 | |

| Vishay Intertechnology, Inc. | | | 60,000 | | | | 916,200 | |

| Vishay Precision Group, Inc. (a) | | | 15,000 | | | | 368,700 | |

| | | | | | | | 5,925,303 | |

See accompanying notes to financial statements.

Needham Growth Fund

Schedule of Investments (Continued)

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Energy Equipment & Services (2.6%) | | | | | | |

| Aspen Aerogels, Inc. (a) | | | 440,000 | | | $ | 2,895,200 | |

| | | | | | | | | |

| Entertainment (0.2%) | | | | | | | | |

| World Wrestling Entertainment, Inc. – Class A | | | 4,500 | | | | 195,525 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (7.1%) | | | | | | | | |

| Becton Dickinson & Co. | | | 19,250 | | | | 4,605,948 | |

| CryoPort, Inc. (a) | | | 45,000 | | | | 1,361,250 | |

| Medtronic PLC (Ireland) | | | 22,000 | | | | 2,017,400 | |

| | | | | | | | 7,984,598 | |

| Health Care Providers & Services (0.6%) | | | | | | | | |

| Laboratory Corp. of America Holdings (a) | | | 2,000 | | | | 332,220 | |

| Quest Diagnostics, Inc. | | | 3,500 | | | | 398,860 | |

| | | | | | | | 731,080 | |

| Household Products (0.4%) | | | | | | | | |

| Oil-Dri Corp. of America | | | 14,500 | | | | 503,150 | |

| | | | | | | | | |

| Industrial Conglomerates (0.3%) | | | | | | | | |

| Honeywell International, Inc. | | | 2,500 | | | | 361,475 | |

| | | | | | | | | |

| Interactive Media & Services (0.3%) | | | | | | | | |

| Alphabet, Inc. (Canada) – Class A (a) | | | 250 | | | | 354,512 | |

| | | | | | | | | |

| IT Services (3.2%) | | | | | | | | |

| Akamai Technologies, Inc. (a)(c) | | | 33,500 | | | | 3,587,515 | |

| | | | | | | | | |

| Life Sciences Tools & Services (8.8%) | | | | | | | | |

| Bruker Corp. | | | 1,000 | | | | 40,680 | |

| Thermo Fisher Scientific, Inc. (c) | | | 27,000 | | | | 9,783,180 | |

| | | | | | | | 9,823,860 | |

| Machinery (0.3%) | | | | | | | | |

| Westinghouse Air Brake Technologies Corp. | | | 5,000 | | | | 287,850 | |

| | | | | | | | | |

| Media (4.0%) | | | | | | | | |

| Comcast Corp. – Class A | | | 114,000 | | | | 4,443,720 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels (0.2%) | | | | | | | | |

| Navigator Holdings, Ltd. (a) | | | 32,000 | | | | 205,760 | |

| | | | | | | | | |

| Real Estate Investment Trusts (REITs) (0.2%) | | | | | | | | |

| American Tower Corp. | | | 1,000 | | | | 258,540 | |

See accompanying notes to financial statements.

Needham Growth Fund

Schedule of Investments (Continued)

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Semiconductors & Semiconductor Equipment (26.8%) (d) | | | | | | |

| Applied Materials, Inc. | | | 9,000 | | | $ | 544,050 | |

| AXT, Inc. (a) | | | 225,000 | | | | 1,071,000 | |

| Entegris, Inc. | | | 119,000 | | | | 7,026,950 | |

| FormFactor, Inc. (a) | | | 130,000 | | | | 3,812,900 | |

| Lam Research Corp. | | | 2,500 | | | | 808,650 | |

| MKS Instruments, Inc. | | | 22,500 | | | | 2,547,900 | |

| Nova Measuring Instruments, Ltd. (Israel) (a) | | | 50,000 | | | | 2,409,500 | |

| PDF Solutions, Inc. (a) | | | 462,500 | | | | 9,046,500 | |

| Photronics, Inc. (a) | | | 100,500 | | | | 1,118,565 | |

| SiTime Corp. (a) | | | 15,000 | | | | 711,150 | |

| Taiwan Semiconductor | | | | | | | | |

| Manufacturing Co., Ltd. – ADR (Taiwan) | | | 9,000 | | | | 510,930 | |

| Veeco Instruments, Inc. (a) | | | 34,000 | | | | 458,660 | |

| | | | | | | | 30,066,755 | |

| Software (7.5%) | | | | | | | | |

| The Trade Desk, Inc. – Class A (a) | | | 5,000 | | | | 2,032,500 | |

| 8x8, Inc. (a) | | | 35,000 | | | | 560,000 | |

| Appian Corp. (a) | | | 7,000 | | | | 358,750 | |

| ChannelAdvisor Corp. (a) | | | 52,500 | | | | 831,600 | |

| Coupa Software, Inc. (a) | | | 3,000 | | | | 831,120 | |

| Everbridge, Inc. (a) | | | 11,500 | | | | 1,591,140 | |

| FireEye, Inc. (a) | | | 27,500 | | | | 334,812 | |

| GSE Systems, Inc. (a) | | | 24,029 | | | | 24,269 | |

| Q2 Holdings, Inc. (a) | | | 17,250 | | | | 1,479,878 | |

| Zuora, Inc. – Class A (a) | | | 27,000 | | | | 344,250 | |

| | | | | | | | 8,388,319 | |

| Specialty Retail (6.5%) | | | | | | | | |

| CarMax, Inc. (a)(c) | | | 80,000 | | | | 7,164,000 | |

| Floor & Decor Holdings, Inc. – Class A (a) | | | 2,500 | | | | 144,125 | |

| | | | | | | | 7,308,125 | |

| Technology Hardware, Storage & Peripherals (5.7%) | | | | | | | | |

| Apple, Inc. | | | 2,700 | | | | 984,960 | |

| Intevac, Inc. (a) | | | 181,875 | | | | 993,038 | |

| Pure Storage, Inc. – Class A (a) | | | 30,000 | | | | 519,900 | |

| Super Micro Computer, Inc. (a) | | | 137,500 | | | | 3,903,625 | |

| | | | | | | | 6,401,523 | |

See accompanying notes to financial statements.

Needham Growth Fund

Schedule of Investments (Continued)

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Trading Companies & Distributors (1.1%) | | | | | | |

| Air Lease Corp. | | | 43,500 | | | $ | 1,274,115 | |

| Total Common Stocks | | | | | | | | |

| (Cost $43,945,460) | | | | | | $ | 110,686,460 | |

| | | | | | | | | |

| Short-Term Investments (1.3%) | | | | | | | | |

| | | | | | | | | |

| Money Market Fund (1.3%) | | | | | | | | |

| Dreyfus Treasury Securities Cash Management – | | | | | | | | |

| Institutional Class 0.08% (b) | | | | | | | | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $1,487,210) | | | 1,487,210 | | | $ | 1,487,210 | |

| | | | | | | | | |

| Total Investments (100.0%) | | | | | | | | |

| (Cost $45,432,670) | | | | | | | 112,173,670 | |

| Total Securities Sold Short (-0.8%) | | | | | | | (847,218 | ) |

| (Proceeds $721,604) | | | | | | | | |

| Other Assets in Excess of Liabilities (0.8%) | | | | | | | 870,917 | |

| Net Assets (100.0%) | | | | | | $ | 112,197,369 | |

| | Percentages are stated as a percent of net assets. |

| | Industry classifications may be different than those used for compliance monitoring purposes. |

| (a) | Non-income producing security. |

| (b) | Rate shown is the seven-day yield as of June 30, 2020. |

| (c) | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $2,263,380. |

| (d) | As of June 30, 2020, the Fund had a significant portion of its assets invested in the Semiconductors & Semiconductor Equipment industry. |

| ADR | American Depositary Receipt |

Distribution of investments by country or territory of incorporation, as a percentage of Total Investments, is as follows (Unaudited):

| Country | | Long | |

| United States^ | | | 95.1 | % | |

| Canada | | | 0.5 | % | |

| Taiwan | | | 0.5 | % | |

| Ireland | | | 1.8 | % | |

| Israel | | | 2.1 | % | |

| Total | | | 100.0 | % | |

| ^ | United States allocation includes Short-Term Investment-Money Market Fund of 1.30%. |

See accompanying notes to financial statements.

Needham Growth Fund

Schedule of Securities Sold Short

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Securities Sold Short (-0.8%) | | | | | | |

| | | | | | | |

| Communications Equipment (-0.1%) | | | | | | |

| Ubiquiti, Inc. | | | 500 | | | $ | 87,280 | |

| | | | | | | | | |

| Consumer Finance (0.0%) | | | | | | | | |

| Medallion Financial Corp. (a) | | | 2,250 | | | | 5,963 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (-0.2%) | | | | | | | | |

| Brooks Automation, Inc. | | | 5,000 | | | | 221,200 | |

| | | | | | | | | |

| Software (-0.5%) | | | | | | | | |

| Dynatrace, Inc. (a) | | | 1,750 | | | | 71,050 | |

| New Relic, Inc. (a) | | | 1,250 | | | | 86,125 | |

| SPS Commerce, Inc. (a) | | | 5,000 | | | | 375,600 | |

| | | | | | | | 532,775 | |

| Total Securities Sold Short (-0.8%) | | | | | | | | |

| (Proceeds $721,604) | | | | | | $ | 847,218 | |

| (a) | Non-income producing security. |

Distribution of investments by country or territory of incorporation, as a percentage of Total Securities Sold Short, is as follows (Unaudited):

| Country | | Short | |

| United States | | | 100.0 | % | |

| Total | | | 100.0 | % | |

See accompanying notes to financial statements.

Needham Aggressive Growth Fund

Schedule of Investments

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Common Stocks (100.1%) | | | | | | |

| | | | | | | |

| Aerospace & Defense (0.6%) | | | | | | |

| Parsons Corp. (a) | | | 9,000 | | | $ | 326,160 | |

| | | | | | | | | |

| Biotechnology (0.1%) | | | | | | | | |

| Moderna, Inc. (a) | | | 600 | | | | 38,526 | |

| | | | | | | | | |

| Building Products (2.5%) | | | | | | | | |

| Alpha Pro Tech, Ltd. (a) | | | 75,000 | | | | 1,327,500 | |

| Jewett-Cameron Trading Co., Ltd. (Canada) (a) | | | 7,500 | | | | 53,700 | |

| | | | | | | | 1,381,200 | |

| Commercial Services & Supplies (0.2%) | | | | | | | | |

| Clean Harbors, Inc. (a) | | | 2,000 | | | | 119,960 | |

| | | | | | | | | |

| Communications Equipment (6.3%) | | | | | | | | |

| ADTRAN, Inc. | | | 7,500 | | | | 81,975 | |

| Cambium Networks Corp. (a) | | | 17,500 | | | | 128,800 | |

| KVH Industries, Inc. (a) | | | 369,400 | | | | 3,298,742 | |

| | | | | | | | 3,509,517 | |

| Construction Materials (1.4%) | | | | | | | | |

| Smith-Midland Corp. (a) | | | 137,500 | | | | 779,625 | |

| | | | | | | | | |

| Electrical Equipment (10.3%) | | | | | | | | |

| Vicor Corp. (a) | | | 80,000 | | | | 5,756,000 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (3.2%) | | | | | | | | |

| Arlo Technologies, Inc. (a) | | | 55,000 | | | | 141,900 | |

| IPG Photonics Corp. (a) | | | 7,000 | | | | 1,122,730 | |

| National Instruments Corp. | | | 4,500 | | | | 174,195 | |

| Vishay Precision Group, Inc. (a) | | | 15,000 | | | | 368,700 | |

| | | | | | | | 1,807,525 | |

| Energy Equipment & Services (1.6%) | | | | | | | | |

| Aspen Aerogels, Inc. (a) | | | 138,100 | | | | 908,698 | |

| | | | | | | | | |

| Entertainment (0.2%) | | | | | | | | |

| World Wrestling Entertainment, Inc. – Class A | | | 2,250 | | | | 97,762 | |

See accompanying notes to financial statements.

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Health Care Equipment & Supplies (2.7%) | | | | | | |

| CryoPort, Inc. (a) | | | 31,000 | | | $ | 937,750 | |

| LeMaitre Vascular, Inc. | | | 22,500 | | | | 594,000 | |

| | | | | | | | 1,531,750 | |

| Health Care Providers & Services (0.5%) | | | | | | | | |

| Laboratory Corp. of America Holdings (a) | | | 500 | | | | 83,055 | |

| Quest Diagnostics, Inc. | | | 1,750 | | | | 199,430 | |

| | | | | | | | 282,485 | |

| | | | | | | | | |

| Health Care Technology (0.4%) | | | | | | | | |

| Omnicell, Inc. (a) | | | 3,000 | | | | 211,860 | |

| | | | | | | | | |

| Household Products (2.5%) | | | | | | | | |

| Oil-Dri Corp. of America | | | 39,500 | | | | 1,370,650 | |

| | | | | | | | | |

| IT Services (2.8%) | | | | | | | | |

| Akamai Technologies, Inc. (a)(c) | | | 14,500 | | | | 1,552,805 | |

| | | | | | | | | |

| Life Sciences Tools & Services (0.8%) | | | | | | | | |

| Bruker Corp. | | | 11,000 | | | | 447,480 | |

| | | | | | | | | |

| Machinery (0.7%) | | | | | | | | |

| FreightCar America, Inc. (a) | | | 65,000 | | | | 80,600 | |

| Westinghouse Air Brake Technologies Corp. | | | 5,000 | | | | 287,850 | |

| | | | | | | | 368,450 | |

| Professional Services (0.7%) | | | | | | | | |

| CRA International, Inc. | | | 10,500 | | | | 414,750 | |

| | | | | | | | | |

| Real Estate Investment Trusts (REITs) (2.7%) | | | | | | | | |

| Equinix, Inc. | | | 2,000 | | | | 1,404,600 | |

| American Tower Corp. | | | 200 | | | | 51,708 | |

| | | | | | | | 1,456,308 | |

| Semiconductors & Semiconductor Equipment (35.5%) (d) | | | | | | | | |

| AXT, Inc. (a) | | | 35,000 | | | | 166,600 | |

| Entegris, Inc. | | | 95,000 | | | | 5,609,750 | |

| FormFactor, Inc. (a) | | | 23,000 | | | | 674,590 | |

| MKS Instruments, Inc. | | | 23,000 | | | | 2,604,520 | |

| Nova Measuring Instruments, Ltd. (Israel) (a)(c) | | | 63,000 | | | | 3,035,970 | |

See accompanying notes to financial statements.

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Semiconductors & Semiconductor Equipment – Continued | | | | | | |

| PDF Solutions, Inc. (a)(c) | | | 346,500 | | | $ | 6,777,540 | |

| Photronics, Inc. (a) | | | 22,500 | | | | 250,425 | |

| SiTime Corp. (a) | | | 5,000 | | | | 237,050 | |

| Taiwan Semiconductor | | | | | | | | |

| Manufacturing Co., Ltd. (Taiwan) – ADR | | | 7,500 | | | | 425,775 | |

| Veeco Instruments, Inc. (a) | | | 6,800 | | | | 91,732 | |

| | | | | | | | 19,873,952 | |

| Software (5.5%) | | | | | | | | |

| The Trade Desk, Inc. – Class A (a) | | | 1,200 | | | | 487,800 | |

| Altair Engineering, Inc. – Class A (a) | | | 1,000 | | | | 39,750 | |

| Appian Corp. (a) | | | 1,500 | | | | 76,875 | |

| ChannelAdvisor Corp. (a) | | | 29,000 | | | | 459,360 | |

| Everbridge, Inc. (a) | | | 2,000 | | | | 276,720 | |

| GSE Systems, Inc. (a)(e) | | | 1,052,625 | | | | 1,063,151 | |

| Q2 Holdings, Inc. (a) | | | 8,000 | | | | 686,320 | |

| | | | | | | | 3,089,976 | |

| Specialty Retail (3.3%) | | | | | | | | |

| CarMax, Inc. (a)(c) | | | 20,500 | | | | 1,835,775 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (15.0%) | | | | | | | | |

| Apple, Inc. (c) | | | 16,000 | | | | 5,836,800 | |

| Intevac, Inc. (a) | | | 88,450 | | | | 482,937 | |

| Super Micro Computer, Inc. (a) | | | 69,500 | | | | 1,973,105 | |

| | | | | | | | 8,292,842 | |

| Trading Companies & Distributors (0.6%) | | | | | | | | |

| Transcat, Inc. (a) | | | 13,500 | | | | 349,110 | |

| Total Common Stocks | | | | | | | | |

| (Cost $21,517,652) | | | | | | $ | 55,803,166 | |

See accompanying notes to financial statements.

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Short-Term Investments (0.1%) | | | | | | |

| | | | | | | |

| Money Market Fund (0.1%) | | | | | | |

| Dreyfus Treasury Securities Cash Management – | | | | | | |

| Institutional Class 0.08% (b) | | | | | | |

| Total Short-Term Investment | | | | | | |

| (Cost $46,760) | | | 46,760 | | | $ | 46,760 | |

| | | | | | | | | |

| Total Investments (100.2%) | | | | | | | | |

| (Cost $21,564,412) | | | | | | | 55,849,926 | |

| Total Securities Sold Short (-0.4%) | | | | | | | (194,075 | ) |

| (Proceeds $116,901) | | | | | | | | |

| Other Assets in Excess of Liabilities (0.2%) | | | | | | | 119,968 | |

| Net Assets (100.0%) | | | | | | $ | 55,775,819 | |

| | Percentages are stated as a percent of net assets. |

| | Industry classifications may be different than those used for compliance monitoring purposes. |

| (a) | Non-income producing security. |

| (b) | Rate shown is the seven-day yield as of June 30, 2020. |

| (c) | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $4,791,920. |

| (d) | As of June 30, 2020, the Fund had a significant portion of its assets invested in the Semiconductors & Semiconductor Equipment industry. |

| (e) | Affiliated security. Please refer to Note 11 of the Financial Statements. |

ADR

| American Depositary Receipt |

Distribution of investments by country or territory of incorporation, as a percentage of Total Investments, is as follows (Unaudited):

| Country | | Long | |

| United States^ | | | 91.4 | % | |

| Canada | | | 2.4 | % | |

| Taiwan | | | 0.8 | % | |

| Israel | | | 5.4 | % | |

| Total | | | 100.0 | % | |

| ^ | United States allocation includes Short-Term Investment-Money Market Fund of 0.1%. |

See accompanying notes to financial statements.

Needham Aggressive Growth Fund

Schedule of Securities Sold Short

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Securities Sold Short (-0.4%) | | | | | | |

| | | | | | | |

| Communications Equipment (0.1%) | | | | | | |

| Ubiquiti, Inc. | | | 200 | | | $ | 34,912 | |

| | | | | | | | | |

| Consumer Finance (0.0%) | | | | | | | | |

| Medallion Financial Corp. (a) | | | 750 | | | | 1,988 | |

| | | | | | | | | |

| Software (-0.3%) | | | | | | | | |

| Dynatrace, Inc. (a) | | | 1,750 | | | | 71,050 | |

| New Relic, Inc. (a) | | | 1,250 | | | | 86,125 | |

| | | | | | | | 157,175 | |

| Total Securities Sold Short (-0.4%) | | | | | | | | |

| (Proceeds $116,901) | | | | | | $ | 194,075 | |

| (a) | Non-income producing security. |

Distribution of investments by country or territory of incorporation, as a percentage of Total Securities Sold Short, is as follows (Unaudited):

| Country | | Short | |

| United States | | | 100.0 | % | |

| Total | | | 100.0 | % | |

See accompanying notes to financial statements.

Needham Small Cap Growth Fund

Schedule of Investments

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Common Stocks (91.9%) | | | | | | |

| | | | | | | |

| Aerospace & Defense (1.9%) | | | | | | |

| Parsons Corp. (a) | | | 90,000 | | | $ | 3,261,600 | |

| | | | | | | | | |

| Biotechnology (0.6%) | | | | | | | | |

| Voyager Therapeutics, Inc. (a) | | | 90,000 | | | | 1,135,800 | |

| | | | | | | | | |

| Communications Equipment (18.1%) | | | | | | | | |

| Cambium Networks Corp. (a) | | | 850,000 | | | | 6,256,000 | |

| EMCORE Corp. (a) | | | 1,300,000 | | | | 4,134,000 | |

| Infinera Corp. (a) | | | 1,100,000 | | | | 6,512,000 | |

| Inseego Corp. (a) | | | 400,000 | | | | 4,640,000 | |

| KVH Industries, Inc. (a)(b) | | | 525,000 | | | | 4,688,250 | |

| ViaSat, Inc. (a) | | | 130,000 | | | | 4,988,100 | |

| | | | | | | | 31,218,350 | |

| Diversified Telecommunication Services (1.7%) | | | | | | | | |

| Vonage Holdings Corp. (a) | | | 300,000 | | | | 3,018,000 | |

| | | | | | | | | |

| Electrical Equipment (0.2%) | | | | | | | | |

| Vicor Corp. (a)(b) | | | 5,000 | | | | 359,750 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (7.2%) | | | | | | | | |

| Akoustis Technologies, Inc. (a) | | | 514,000 | | | | 4,261,060 | |

| Frequency Electronics, Inc. (a) | | | 156,429 | | | | 1,370,318 | |

| Vishay Intertechnology, Inc. | | | 150,000 | | | | 2,290,500 | |

| Vishay Precision Group, Inc. (a) | | | 185,000 | | | | 4,547,300 | |

| | | | | | | | 12,469,178 | |

| Energy Equipment & Services (2.3%) | | | | | | | | |

| Aspen Aerogels, Inc. (a) | | | 600,000 | | | | 3,948,000 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (4.4%) | | | | | | | | |

| Inogen, Inc. (a) | | | 140,000 | | | | 4,972,800 | |

| Sientra, Inc. (a) | | | 150,000 | | | | 580,500 | |

| ViewRay, Inc. (a) | | | 950,000 | | | | 2,128,000 | |

| | | | | | | | 7,681,300 | |

| IT Services (4.9%) | | | | | | | | |

| Limelight Networks, Inc. (a) | | | 1,150,000 | | | | 8,464,000 | |

| | | | | | | | | |

| Life Sciences Tools & Services (1.3%) | | | | | | | | |

| Fluidigm Corp. (a) | | | 562,500 | | | | 2,255,625 | |

See accompanying notes to financial statements.

Needham Small Cap Growth Fund

Schedule of Investments (Continued)

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Oil, Gas & Consumable Fuels (0.7%) | | | | | | |

| Navigator Holdings, Ltd. (a) | | | 180,000 | | | $ | 1,157,400 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (16.7%) | | | | | | | | |

| AXT, Inc. (a) | | | 1,225,000 | | | | 5,831,000 | |

| Cohu, Inc. | | | 275,000 | | | | 4,768,500 | |

| Ichor Holdings Ltd. (a) | | | 25,000 | | | | 664,500 | |

| MaxLinear, Inc. (a) | | | 450,000 | | | | 9,657,000 | |

| PDF Solutions, Inc. (a)(b) | | | 75,000 | | | | 1,467,000 | |

| Photronics, Inc. (a) | | | 425,000 | | | | 4,730,250 | |

| Veeco Instruments, Inc. (a) | | | 126,700 | | | | 1,709,183 | |

| | | | | | | | 28,827,433 | |

| Software (31.5%) (d) | | | | | | | | |

| 8x8, Inc. (a) | | | 450,000 | | | | 7,200,000 | |

| Bottomline Technologies DE, Inc. (a) | | | 30,000 | | | | 1,523,100 | |

| ChannelAdvisor Corp. (a) | | | 275,000 | | | | 4,356,000 | |

| FireEye, Inc. (a) | | | 850,000 | | | | 10,348,750 | |

| Mimecast Ltd. (a) | | | 150,000 | | | | 6,249,000 | |

| Pluralsight, Inc. – Class A (a) | | | 325,000 | | | | 5,866,250 | |

| Zuora, Inc. – Class A (a) | | | 179,500 | | | | 2,288,625 | |

| Intevac, Inc. (a) | | | 1,017,175 | | | | 5,553,775 | |

| Pure Storage, Inc., Class A (a) | | | 320,000 | | | | 5,545,600 | |

| Super Micro Computer, Inc. (a)(b) | | | 200,000 | | | | 5,678,000 | |

| | | | | | | | 54,609,100 | |

| Trading Companies & Distributors (0.4%) | | | | | | | | |

| Air Lease Corp. | | | 22,500 | | | | 659,025 | |

| Total Common Stocks | | | | | | | | |

| (Cost $145,175,870) | | | | | | $ | 159,064,561 | |

See accompanying notes to financial statements.

Needham Small Cap Growth Fund

Schedule of Investments (Continued)

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Short-Term Investments (6.5%) | | | | | | |

| | | | | | | |

| Money Market Fund (6.5%) | | | | | | |

| Dreyfus Treasury Securities Cash Management – | | | | | | |

| Institutional Class 0.08% (c) | | | | | | |

| Total Short-Term Investments | | | | | | |

| (Cost $11,172,873) | | | 11,172,873 | | | $ | 11,172,873 | |

| | | | | | | | | |

| Total Investments (98.4%) | | | | | | | | |

| (Cost $156,348,743) | | | | | | | 170,237,434 | |

| Total Securities Sold Short (-1.4%) | | | | | | | (2,387,200 | ) |

| (Proceeds $2,379,026) | | | | | | | | |

| Other Assets in Excess of Liabilities (3.0%) | | | | | | | 4,959,270 | |

| Net Assets (100.0%) | | | | | | $ | 172,809,504 | |

| | Percentages are stated as a percent of net assets. |

| | Industry classifications may be different than those used for compliance monitoring purposes. |

| (a) | Non-income producing security. |

| (b) | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $2,267,625. |

| (c) | Rate shown is the seven day yield as of June 30, 2020. |

| (d) | As of June 30, 2020, the Fund had a significant portion of its assets invested in the Software industry. |

Distribution of investments by country or territory of incorporation, as a percentage of Total Investments, is as follows (Unaudited):

| Country | | Long | |

| United States^ | | | 95.6 | % | |

| Jersey | | | 3.7 | % | |

| Marshall Islands | | | 0.7 | % | |

| Total | | | 100.0 | % | |

| ^ | United States allocation includes Short-Term Investment-Money Market Fund of 6.60%. |

See accompanying notes to financial statements.

Needham Small Cap Growth Fund

Schedule of Securities Sold Short

June 30, 2020 (Unaudited)

| | | Shares | | | Value | |

| Securities Sold Short (-1.4%) | | | | | | |

| | | | | | | |

| Semiconductors & Semiconductor Equipment (-0.5%) | | | | | | |

| Brooks Automation, Inc. | | | 20,000 | | | $ | 884,800 | |

| | | | | | | | | |

| Software (-0.9%) | | | | | | | | |

| SPS Commerce, Inc. (a) | | | 20,000 | | | | 1,502,400 | |

| Total Securities Sold Short (-1.4%) | | | | | | | | |

(Proceeds $2,379,026) | | | | | | $ | 2,387,200 | |

| (a) | Non-income producing security. |