Semi-Annual

Report

Needham Funds

Seeking to build wealth for long-term investors.

June 30, 2017

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

www.needhamfunds.com

445 Park Avenue

New York, New York 10022-2606

1-800-625-7071

www.needhamfunds.com

Semi-Annual Report

June 30, 2017

Contents

| Letter from the Adviser | | | 1 | |

| | | | | |

| Portfolio Characteristics | | | | |

| Needham Growth Fund | | | 10 | |

| Needham Aggressive Growth Fund | | | 12 | |

| Needham Small Cap Growth Fund | | | 14 | |

| Disclosure of Fund Expenses | | | 16 | |

| | | | | |

| Schedules of Investments | | | | |

| Needham Growth Fund | | | 18 | |

| Needham Aggressive Growth Fund | | | 23 | |

| Needham Small Cap Growth Fund | | | 28 | |

| | | | | |

| Schedules of Securities Sold Short | | | | |

| Needham Growth Fund | | | 22 | |

| Needham Aggressive Growth Fund | | | 27 | |

| | | | | |

| Statements of Assets and Liabilities | | | 32 | |

| | | | | |

| Statements of Operations | | | 34 | |

| | | | | |

| Statements of Changes in Net Assets | | | 35 | |

| | | | | |

| Financial Highlights | | | | |

| Needham Growth Fund | | | 38 | |

| Needham Aggressive Growth Fund | | | 40 | |

| Needham Small Cap Growth Fund | | | 42 | |

| | | | | |

| Notes to Financial Statements | | | 44 | |

| | | | | |

| Supplementary Information | | | 53 | |

This report is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus. The prospectus contains more complete information, including investment objectives, risks, expenses and charges and should be read carefully before investing or sending any money. To obtain a prospectus or summary prospectus, please call 1-800-625-7071.

Portfolios of The Needham Funds, Inc., like all mutual funds:

| | • | Are NOT FDIC insured |

| | • | Have no bank guarantee |

| | • | May lose value |

The Needham Funds, Inc. are distributed by Needham & Company, LLC.

Semi-Annual Report 2017

| 445 Park Avenue |

| New York, NY 10022 |

| (800) 625-7071 |

| www.needhamfunds.com |

August 2017

Dear Shareholders, Friends of Needham and Prospective Shareholders,

We are pleased to report results for the second quarter and first half of 2017 for the Needham Growth Fund, Needham Aggressive Growth Fund, and Needham Small Cap Growth Fund. Our mission is to create wealth for long-term investors.

Needham Funds’ Second Quarter and Semiannual Review

In the second quarter, the Needham Growth Fund Retail and Institutional classes returned 2.24% and 2.35%, respectively; the Needham Aggressive Growth Fund Retail and Institutional classes returned (0.44)% and (0.26)%, respectively; and the Needham Small Cap Growth Fund Retail and Institutional classes returned 5.43% and 5.55%, respectively. During the same period, the Russell 2000 Total Return Index returned 2.46% and the S&P 500 Total Return Index returned 3.09%.

For the half year, the Needham Growth Fund Retail and Institutional classes returned 4.03% and 4.29%, respectively; the Needham Aggressive Growth Fund Retail and Institutional classes returned 1.17% and 1.48%, respectively; and the Needham Small Cap Growth Fund Retail and Institutional classes returned 7.02 and 7.28%, respectively. For the half year, the Russell 2000 Total Return Index returned 4.99% and the S&P 500 Total Return Index returned 9.34%.

Availability of a New Institutional Share Class

The Needham Funds’ Institutional share class is available for sale. The purpose of this Institutional class is to offer a lower cost option to our investors who have a substantial amount invested in The Needham Funds. Highlights, as detailed in the prospectus1, are:

| | • | $100,000 investment minimum (aggregation permitted); |

| | | |

| | • | No 12b-1 fees; |

| | | |

| | • | An expense ratio capped at 1.40% (not including shorting and interest/dividend expenses); and |

| | | |

| | • | Tax-free conversions from the retail shares. |

Institutional shares are currently available on Fidelity, Schwab, Pershing, Raymond James, Wells Fargo, and LPL platforms, and are also available for direct shareholders of Needham Funds. We are working to broaden distribution of these lower cost shares and encourage you to contact your financial advisor or intermediary about when you might find them available.

The Institutional shares’ ticker symbols are Needham Growth Fund (NEEIX), Needham Aggressive Growth Fund (NEAIX), and Needham Small Cap Growth Fund (NESIX). The Needham Funds’ Retail shares are available as before under the ticker symbols NEEGX, NEAGX, and NESGX, respectively.

1 | Prospectus is available at http://www.needhamfunds.com/literature.html |

Needham Funds

First Half 2017

In January, the market rallied on President Trump’s inauguration and proposals of pro-growth tax reform, infrastructure spending, and a reduced regulatory burden. In February, President Trump promised a “phenomenal tax plan” and to streamline the new drug regulatory process. The markets rallied; however, failure to pass the first attempt to repeal the Affordable Care Act and introduce new healthcare legislation brought worries that tax reform would be delayed. Still, the averages rallied for each month of the quarter. For the quarter, all three Funds were positive, but trailed the averages.

In April, the market was positive and so were the Needham Funds. The preliminary GDP showed just 0.7% economic growth, although that was later revised to a still low 1.2%. The Atlanta Fed’s GDPNow shows preliminary second quarter GDP growth at a slightly higher 2.5%, making the first half of 2017 consistent with the growth of the last 8 years.

In May, the market was mixed, and the Needham Growth Fund and Needham Small Cap Growth Fund outperformed. During the month, we witnessed the firing of FBI Director James Comey and North Korea’s third missile launch.

June saw the market up and the Needham Small Cap Growth Fund outperforming the indices. There was a sell-off in the FANG stocks (Facebook, Amazon, Netflix, Google/Alphabet), which lasted about one week.

Market volatility is currently low as the VIX is close to its lowest on record. We imagine that volatility could increase from this low level.

John Barr’s Second Quarter Commentary — On the Road

“The big money is not in the buying and the selling, but in the waiting.”- Charlie Munger

As Charlie Munger, Vice Chairman of Berkshire Hathaway, said, “The big money is not in the buying and the selling, but in the waiting.” He also said, “Understanding both the power of compound interest and the difficulty of getting it is the heart and soul of understanding a lot of things.” Waiting with the right investments is the key to producing compound returns.

At the end of June, the trailing 12-month turnover for the Needham Aggressive Growth Fund was 3% and for the Needham Growth Fund was 5%. So if there’s limited trading in my Funds, what do I, the portfolio manager, do on a daily basis? From Poor Charlie’s Almanack: “The only way to win is to work, work, work, work and hope to have a few insights.” Having the patience to wait means having confidence in an investment. Each day is an opportunity to learn more about the companies in the Needham Funds and research candidates for future investment. That means reading a lot of SEC filings, earnings call transcripts, blogs and websites. It means traveling to meet with companies at their headquarters, attending industry conferences, and talking to people outside of Wall Street. It means crafting a thesis on whether or not a company has a strong strategic position and if it can earn a superior return on invested capital over the long term.

In the second quarter, I was on the road. I’d like to highlight a few of my recent trips.

Omaha

I started this section with some wisdom from Charlie Munger. In early May, I attended the Berkshire Hathaway, Inc. (BRK.A and BRK.B) annual meeting and associated dinners in Omaha. The day of the meeting, I was up at 4:30am to get in line for a seat in the CenturyLink

Semi-Annual Report 2017

Center. It was amazing to see Warren Buffett and Charlie Munger answer shareholder questions all day long. Perhaps it’s obvious, but I was struck by their steady optimism over long lifetimes of investing. They talk like businesspeople and company owners rather than stock traders.

A shareholder asked what dreams Buffett and Munger have. Ninety-three-year-old Munger answered, “Sometimes when I’m especially wistful, I think—oh to be 90 again.” While Warren Buffett’s quotes and life story are well known, Charlie Munger is just as interesting. There are two Munger biographies that I recommend, Damn Right, by Janet Lowe (Wiley, 2007), and Charlie Munger: The Complete Investor, by Tren Griffin (Columbia University Press, 2015). And the definitive work on Munger is Poor Charlie’s Almanack, compiled by Peter Kaufman and Charlie Munger (Walsworth, 2005).

I think Markel Corporation (MKL), a holding in both the Needham Growth Fund and Needham Aggressive Growth Fund, is like a mini Berkshire Hathaway, Inc.—it is a diverse financial holding company that underwrites specialty insurance products. Markel holds its one and only annual analyst and investor meeting the Sunday after the Berkshire meeting. The company started holding its meeting in Omaha in 1991—the company wanted to attract the Berkshire investors and there’s no better way than going to Omaha the first weekend of May.

Markel applies the earnings and discretionary float from the insurance to: 1) acquire complementary insurance companies; 2) buy operating companies for Markel Ventures; and 3) invest in public equities and debt. Markel has a $13 billion market cap and opportunities for growth. From its IPO in December 1986 at $8.33, Markel has compounded at 16.6% and risen to $975.86 per share as of June 30. The Markel Style defines the corporate culture which has produced these long-term results.

Chicago

In June, I attended the DIRTT Connext User Conference in Chicago. DIRTT Environmental Solutions Ltd. (TSE:DRT) is a small cap holding of the Needham Aggressive Growth Fund. The company has an incredible computer-aided design system used to design building interiors, produce a bill of materials, and then send manufacturing files to DIRTT plants, where they produce the interiors. It saves significant time and waste on a construction site. I believe DIRTT may be the future of interior construction.

I also attended a meeting with the CEO of Oil-Dri Corporation of America (ODC), Dan Jafee. Dan meets with investors twice a year. Oil-Dri had just reported earnings and has continued to make progress with its lightweight cat litter and animal health products. Should lightweight cat litter increase its market share, Oil-Dri is positioned to benefit based on its majority share of the private label market. We urge our cat owner friends and investors to try Oil-Dri’s Cat’s Pride Fresh & Light Ultimate Care cat litter!

San Francisco

In early July, I attended the annual SEMICON West manufacturing conference in San Francisco and met with many semiconductor equipment and services companies, including Needham Funds holdings: PDF Solutions, Inc. (PDFS), MKS Instruments, Inc. (MKSI), Nova Measuring Instruments, Ltd. (NVMI), Applied Materials, Inc. (AMAT), Entegris, Inc. (ENTG) and Form Factor, Inc. (FORM). I believe these companies have years of growth ahead of them.

Needham Funds

The debate in semiconductor industry circles revolves around the question of cyclical versus secular growth. It is always dangerous to say, “This time is different.” I believe consensus is that the semiconductor equipment stocks will suffer in unison, owing to an over-build in capacity. Yet, NAND memory is replacing disk drives in storage systems. Given the growth in data storage and the early stage of this replacement cycle, we believe the NAND memory and equipment makers could see growth for a number of years. Nonetheless, the stocks will have days or weeks when the “top is in” argument will rule.

It was a good quarter of working, and waiting.

Needham Growth Fund (NEEGX/NEEIX)

The Needham Growth Fund Retail class returned 2.24% and the Institutional class returned 2.35% in the second quarter. For the first six months of 2017, The Needham Growth Fund Retail class returned 4.03% and the Institutional class returned 4.29%.

For the second quarter and the half year, long-time holding and largest position Thermo Fisher Scientific Inc. (TMO) was the top contributor, returning 13.7% in the second quarter and 23.7% in the first half. Thermo Fisher develops instruments and consumables used in life science and other research-oriented industries. Thermo Fisher demonstrated solid growth and strong margins in its pharma and biotech markets.

Corium International, Inc. (CORI) was the Fund’s second leading contributor for the quarter and third leading for the half year. Corium returned 78.5% in the second quarter and 83.5% year-to-date through June 30. Corium is developing a patch-based drug-delivery system and plans to address the Alzheimer’s market with a patch-based donepezil drug.

The largest detractor in the quarter and year-to-date was PDF Solutions, Inc. (PDFS), with almost the entire 27.3% decline occurring during the second quarter. In the March quarter, PDF’s gainshare (royalty) revenue was below the estimates of the two Wall Street analysts following the company. However, we are invested in PDF for its new Design-for-Inspection service, which is sold to semiconductor design and manufacturing companies to determine whether leading-edge semiconductors can be manufactured with high yield. In 2017, PDF has made significant progress with DFI. During its July 27 conference call, PDF mentioned that John Chen of NVIDIA Corporation (NVDA) was the keynote speaker at PDF’s User Meeting. This is the first confirmation that NVIDIA, a leader in computer graphics and artificial intelligence industries with a $98 billion market cap, is a Design-for-Inspection customer. We took advantage of the weak stock price and added to our position.

In the first half, the Needham Growth Fund added new positions in Coupa Software Inc. (COUP), Clean Harbors, Inc. (CLH), comScore, Inc. (SCOR) and Markel (MKL). We also took advantage of price weaknesses and added to existing positions in KVH Industries, Inc. (KVHI), Oil-Dri Corporation of America (ODC), Pure Storage, Inc. Class A (PSTG), Amber Road, Inc. (AMBR), Photronics, Inc. (PLAB), and Agile Therapeutics, Inc. (AGRX).

The Needham Growth Fund sold its positions in Jabil Circuit, Inc. (JBL) and UltraClean Holdings, Inc. (UCTT) as both stocks hit our price targets. In the first quarter, we purchased Xactly Corp. (formerly XTLY), a sales compensation tracking and management company, and sold it in the second quarter as the company agreed to sell to Vista Equity. We are sorry to see Xactly go (as we believed it had years of growth ahead as a public company). We sold

Semi-Annual Report 2017

nearly 20% of the Fund’s position in Express Scripts Holding Company (ESRX). We also sold over 15% of the Fund’s positions in Thermo Fisher Scientific, MKS Instruments, and Nova Measuring Instruments (NVMI).

Needham Aggressive Growth Fund (NEAGX/NEAIX)

The Needham Aggressive Growth Fund Retail class lost 0.44% and the Institutional class lost 0.26% in the second quarter. For the first six months of 2017, The Needham Aggressive Growth Fund Retail class returned 1.17% and the Institutional class returned 1.48%.

Corium International was the top contributor for the second quarter and the fourth largest year-to-date as of June 30, 2017. Entegris Inc. (ENTG) was the second leading contributor for the half-year with a return of 22.6%. All of this gain came in the first quarter. Entegris supplies filters and chemicals used in advanced manufacturing processes. Semiconductor plants require the equivalent of capturing one contaminated drop of water in a day’s worth of water flowing over Niagara Falls. Advanced manufacturing is necessary to make low power semiconductors, which are necessary to extend battery life in mobile phones. After several years of investment, Entegris reported a strong 2016, including December quarter results, with margins ahead of expectations.

Four investments were both top ten contributors for the second quarter and the half year: Nova Measuring Instruments, Norsat International (NSAT), Oil-Dri, and IPG Photonics (IPGP).

Nova Measuring Instruments returned 18.8% in the second quarter and 67.9% year-to-date at June 30. Nova Measuring develops and supplies optical critical dimension (OCD) metrology equipment to the semiconductor manufacturing industry. Metrology data is now being used to control manufacturing equipment. Nova Measuring is benefiting from success with advanced logic customers, such as Taiwan Semiconductor Manufacturing Co. Ltd. (2330.TW), and memory customers. It is also benefiting from the sale of high-margin software into their installed base. Nova Measuring reported a strong first quarter.

Norsat supplies communications equipment to commercial and government customers. It returned 44.3% through June 30, as it agreed to a takeover by Hytera Communications Corporation Ltd. (002583.SHE). Norsat was a two-year holding of the Fund and was a micro-cap company. We were very impressed with the management team of CEO Dr. Aimee Chan and CFO Arthur Chin.

Oil-Dri returned 13.4% in the second quarter and 10.0% for the first half. The company continues to make progress with its private label, lightweight cat litter and animal health products.

IPG Photonics returned 20% in the second quarter and 47% for the first half. IPG Photonics is the leading fiber laser company. It is a vertically integrated maker of laser systems used in industrial cutting and welding applications. IPG is replacing the legacy carbon dioxide lasers. The automotive market is early in the adoption of fiber lasers for welding. Fiber lasers use much less power so they’re easier on the operating budgets of users. They are also easier to operate, as carbon dioxide lasers require very sophisticated set-up and support. IPG’s manufacturing scale gives a significant cost advantage. The company has a return on trailing year capital of approximately 20%, and as a supplier ranging from components to systems has good reinvestment opportunities. IPG reported a strong first quarter and the stock rallied.

Needham Funds

Cryoport, Inc. (CYRX) is a new position within the second quarter and was a top ten contributor returning 108.5%. Cyroport supplies coldchain logistics for biopharma, in vitro fertilization and animal health. It ships biological samples at temperatures down to -150C. It has been selected by most of the very high-value CAR-T (chimeric antigen receptors-T cells), which are anti-cancer drugs that the FDA is giving fast track to market. Customers include Kite Pharma, Inc. (KITE) and Novartis AG (NOVN).

The Fund’s leading detractor by far was PDF Solutions, which is also the Fund’s largest position. We took advantage of the stock price weakness to add shares.

Akamai Technologies, Inc. (AKAM) was the second largest detractor and fell 16.6% in the second quarter and 25.3% for the half year. Akamai reported disappointing guidance in its media delivery business and that it will be investing in cloud-based security and enterprise content delivery service offerings, and the market responded negatively. Longer term, the media delivery business should benefit from growth in over-the-top video.

GSE Systems, Inc. (GVP) also detracted from second quarter performance with an 8.9% decline. For the half year, GSE declined 11.4%, despite reporting very good results in the first quarter. First quarter revenue was $16.3 million—the highest total in over a decade and measured 26% growth relative to the first quarter of 2016. GSE also reported $0.8 million of adjusted EBITDA, making the seventh-consecutive quarter of positive adjusted EBITDA. New orders were near $20 million. We believe the need for training and personnel in the nuclear industry remains healthy. GSE has $1.20 per share of cash, no debt, and a $3.10 per share stock price as of June 30. Its total market cap is just $56 million. We believe the stock price decline is a reflection of the inefficiency and vagaries which may happen in microcaps, and we remain enthusiastic about GSE’s prospects.

It was a very light trading half for the Aggressive Growth Fund. In the first half, we added new positions in comScore, Markel, DIRTT Environmental (DRT), Pure Storage, Cryoport, Coupa Software, and Ecology and Environment (EEI).

We added to positions in Oil-Dri, KVH Industries, ViaSat, Inc. (VSAT), PDF Solutions, comScore, Vicor Corporation (VICR), GSE Systems, Akamai and Reis, Inc. (REIS) on their weaknesses. We exited TheStreet Inc. (TST), and also Xactly on M&A. It was an active half for M&A, as takeovers were announced of portfolio companies Xactly, Xcerra Corporation (XCRA), ARI Network Services, Inc. (ARIS) and Norsat.

Needham Small Cap Growth Fund (NESGX/NESIX)

The Needham Small Cap Growth Fund Retail class returned 5.43% and the Institutional class returned 5.55% in the 2Q17. In the first half of 2017, the Fund’s Retail class returned 7.02% and the Institutional class returned 7.28%. The Russell 2000 Total Return Index returned 2.46% in the second quarter and 4.99% in the first half. We were very pleased with the performance of the Fund in the first half of 2017 after great performance from our holdings in 2016. We were concerned regarding a greater correction in many of our stocks; however, that correction was short lived in the first quarter and recovered by the end of the first half. We used our strategic cash position to redeploy cash into both new and existing positions that we believe offer great value. Mergers and acquisitions continued in the small capitalization stocks but slowed over 2016 activity. We believe this trend is a pause until tax reforms are

Semi-Annual Report 2017

established and repatriation of cash occurs. While the first half rewarded many of our stocks, we remain vigilant to any downturn in the multi-year bull run that we have experienced.

The Fund continued to show strength into the second quarter after the short-lived market pullback in the middle of the first quarter. As fears of an economic slowdown subsided and earnings season concluded, meetings with company management teams remained upbeat and stocks recovered. We were able to significantly deploy our cash levels into new and existing positions and ended the quarter with approximately 3% cash. We also were able to return to our more normal concentration with our top ten holdings accounting for over 51% of the Fund. Top holdings at June 30 included Pure Storage (PSTG), Amber Road (AMBR), PDF Solutions (PDFS) and FireEye (FEYE). Our top quarterly contributors included Pure Storage, Corium International, FireEye, Reis, Inc. and Amber Road. Our detractors were PDF Solutions, Frequency Electronics (FEIM), Photronics (PLAB) and Navigator Holdings (NVGS). In general, our technology exposure was able to perform well even during a period of volatile political rhetoric and failure to pass any major policy changes. We continue to believe that some policy change will occur; however, as we have discussed, we believe the timing of these changes is further into the future than originally expected by the market.

We expect consolidation to continue in the enterprise hardware sector and we remain exposed to this potential trend through our investments in Pure Storage (PSTG) and Nutanix (NTNX). Both of these holdings recovered in the quarter and the correction they experienced in the early part of the year allowed us to add to these positions at more reasonable entry points. While we remain confident in their long-term business plans, we recognize that the shortage in memory components and increased pricing for these components may weigh on margins for a more extended period of time while revenue continues to expand near term.

As an update to our long-term investment in Ultra Clean Holdings, Inc. (UCTT), we exited the position as the stock price achieved and surpassed our price target. The company has been a tremendous contributor to the Fund over the past several years and we believed it was time to realize profits in the stock. While the semiconductor capital equipment cycle remains vibrant, we look for better valuation entry points to initiate or add to positions. PDF Solutions (PDFS), FormFactor (FORM) and Photronics (PLAB) are three companies that we believe offer a better risk/reward at their current valuations.

We still believe it is a good environment for investment in equities. We still expect pro-growth policies from the new administration; however, the timing of these policies is the big question mark and may take longer than initially expected. Small cap stocks in particular look more attractive now, as they significantly underperformed relative to large cap companies. The strength in the high-yield market also gives us confidence for now that small caps are in a bullish uptrend. Although a slight slowdown in activity occurred in the first half of the year, mergers and acquisitions should remain active and could accelerate if tax reform and repatriation is passed.

Closing

To reiterate our overall thesis: we believe the U.S. remains the best place in the world to be investing and working. We believe there remains an opportunity to invest in small and mid-cap stocks. Monetary policy remains accommodative. Most importantly, we see a revolution

Needham Funds

happening in technology that has created and continues to create investment opportunities. We see opportunity in our strategy of investing in companies that we know well and that we believe are positioned with secular growth drivers.

We welcome our new investors and thank all of our investors for their continued support. If you have any questions, thoughts or concerns, please contact us at (800) 625-7071 or send us an email at cretzler@needhamco.com or jbarr@needhamco.com. For information about the funds, please visit our website at www.needhamfunds.com.

Sincerely,

|  |

| | |

| Chris Retzler | John O. Barr |

| Portfolio Manager | Portfolio Manager |

Needham Funds Fact Sheet Links:

Needham Growth Fund

Needham Aggressive Growth Fund

Needham Small Cap Growth Fund

The information presented in this commentary is not intended as personalized investment advice and does not constitute a recommendation to buy or sell a particular security or other investments. Past performance is no guarantee of future results. Not all investments have been profitable.

This message is not an offer of the Needham Growth Fund, the Needham Aggressive Growth Fund or the Needham Small Cap Growth Fund. Shares are sold only through the currently effective prospectus. Please read the prospectus carefully and consider the investment objectives, risks, and charges and expenses of the Fund carefully before you invest. The prospectus contains this and other information about the Fund.

A copy of the prospectus is available at www.needhamfunds.com or by contacting the Fund’s transfer agent, U.S. Bancorp Fund Services, LLC at 1-800-625-7071.

All three of the Needham Funds have substantial exposure to small and micro capitalized companies. Funds holding smaller capitalized companies are subject to greater price fluctuation than those of larger companies.

Needham & Company, LLC, member FINRA/SIPC, is the distributor of The Needham Funds, Inc.

Semi-Annual Report 2017

Portfolio holdings are subject to change. The Needham Funds ownership as a percentage of net assets in the stated securities as of 6/30/17:

| SECURITY | NEEGX | NEAGX | NESGX | SECURITY | NEEGX | NEAGX | NESGX |

| MKL | 0.13% | 0.23% | 0.00% | ENTG | 3.07% | 6.59% | 0.00% |

| TMO | 7.84% | 0.00% | 0.00% | NSAT | 0.00% | 1.53% | 0.00% |

| CORI | 1.41% | 1.65% | 2.98% | IPGP | 0.75% | 1.72% | 0.00% |

| PDFS | 3.55% | 7.86% | 6.17% | CYRX | 0.00% | 0.58% | 0.00% |

| NVDA | 0.00% | 0.00% | 0.00% | KITE | 0.00% | 0.00% | 0.00% |

| COUP | 0.06% | 0.11% | 0.00% | NOVN | 0.00% | 0.00% | 0.00% |

| CLH | 0.14% | 0.35% | 0.00% | AKAM | 2.15% | 5.12% | 0.33% |

| SCOR | 1.59% | 2.65% | 2.65% | GVP | 0.00% | 4.99% | 0.00% |

| MKL | 0.13% | 0.23% | 0.00% | DRT.TF | 0.00% | 0.62% | 0.00% |

| KVHI | 4.42% | 5.44% | 4.32% | EEI | 0.00% | 0.56% | 0.00% |

| ODC | 0.79% | 3.28% | 0.00% | VSAT | 5.00% | 2.62% | 4.41% |

| PSTG | 0.55% | 0.30% | 8.11% | VICR | 0.31% | 2.05% | 0.00% |

| AMBR | 3.28% | 2.39% | 6.43% | REIS | 1.51% | 4.03% | 4.65% |

| PLAB | 1.27% | 1.45% | 3.80% | TST | 0.00% | 0.00% | 0.00% |

| AGRX | 0.34% | 0.50% | 3.00% | XCRA | 0.00% | 0.12% | 0.00% |

| JBL | 0.00% | 0.00% | 0.00% | ARIS | 0.00% | 0.17% | 0.00% |

| UCTT | 0.00% | 0.00% | 0.00% | FEYE | 0.00% | 0.00% | 4.82% |

| XTLY | 0.00% | 0.00% | 0.00% | FEIM | 0.41% | 0.44% | 4.11% |

| ESRX | 5.51% | 0.61% | 0.21% | NVGS | 0.04% | 0.00% | 0.55% |

| MKSI | 1.86% | 2.87% | 0.00% | NTNX | 0.21% | 0.05% | 3.53% |

| NVMI | 1.24% | 2.46% | 0.00% | FORM | 3.89% | 3.58% | 0.75% |

Needham Funds

| NEEDHAM GROWTH FUND | Retail Class |

| | Ticker Symbol: NEEGX |

| | Institutional Class |

| | Ticker Symbol: NEEIX |

Comparative Performance Statistics as of June 30, 2017 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | Gross | |

| | | | 6 | | | 1 | | | 3 | | | 5 | | | 10 | | Since | | Expense | |

| | | Months(9) | | Year | | Years(10) | | Years(10) | | Years(10) | | Inception | | Ratio(16) | |

| Needham Growth Fund |

Retail Class(1)(2) | | | 4.03 | % | | | 14.03 | % | | | 4.60 | %(11) | | | 11.14 | %(12) | | | 6.05 | %(13) | | | 12.74 | %(10)(14) | | | 2.18 | % |

| Needham Growth Fund |

Institutional Class(3) | | | 4.29 | % | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 4.29 | %(9) | | | 1.74 | % |

S&P 500 Index(4)(5) | | | 9.34 | % | | | 17.90 | % | | | 9.61 | % | | | 14.63 | % | | | 7.18 | % | | | 8.61 | %(10)(15) | | | | |

NASDAQ Composite Index(4)(6) | | | 14.76 | % | | | 28.40 | % | | | 13.13 | % | | | 17.49 | % | | | 10.25 | % | | | 9.48 | %(10)(15) | | | | |

S&P 400 MidCap Index(4)(7) | | | 5.99 | % | | | 18.57 | % | | | 8.53 | % | | | 14.92 | % | | | 8.56 | % | | | 11.68 | %(10)(15) | | | | |

Russell 2000 Index(4)(8) | | | 4.99 | % | | | 24.60 | % | | | 7.36 | % | | | 13.70 | % | | | 6.92 | % | | | 8.66 | %(10)(15) | | | | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

| 1. | Investment results calculated after reinvestment of dividends. |

| 2. | The inception date of the Retail Class was 1/1/96. |

| 3. | The inception date of the Institutional Class was 12/30/16. |

| 4. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| 5. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. |

| 6. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. |

| 7. | The S&P 400 MidCap Index is a broad unmanaged measure of the U.S. stock market. |

| 8. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. |

| 9. | Not annualized. |

| 10. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Retail Class. |

| 11. | Cumulative return for the three year period was 14.43%, assuming all dividends were reinvested in shares of the Retail Class. |

| 12. | Cumulative return for the five year period was 69.56%, assuming all dividends were reinvested in shares of the Retail Class. |

| 13. | Cumulative return for the ten year period was 79.93%, assuming all dividends were reinvested in shares of the Retail Class. |

| 14. | Cumulative return since inception was 1,216.48%, assuming all dividends were reinvested in shares of the Retail Class. |

| 15. | The return shown for the Index is from the Inception date of the Retail Class. |

| 16. | Gross expense ratio is from the Fund’s prospectus dated May 1, 2017. Additional information pertaining to the Fund’s expense ratios as of June 30, 2017 can be found in the financial highlights. Since January 1, 2009, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on April 30, 2018. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total class operating expenses would be 2.17% and 1.73% for the Retail Class and Institutional Class, respectively. |

Semi-Annual Report 2017

Top Ten Holdings*

(as a % of total investments,

as of June 30, 2017)

| | | | % of Total | |

Security | | | Investments | |

| Thermo Fisher Scientific, Inc. | TMO | | | 7.88 | % |

| Gilead Sciences, Inc. | GILD | | | 5.69 | % |

| Express Scripts Holding Co. | ESRX | | | 5.55 | % |

| CarMax, Inc. | KMX | | | 5.42 | % |

| ViaSat, Inc. | VSAT | | | 5.03 | % |

| Becton Dickinson and Co. | BDX | | | 5.00 | % |

| KVH Industries, Inc. | KVHI | | | 4.45 | % |

| Super Micro Computer, Inc. | SMCI | | | 3.98 | % |

| Comcast Corp. | CMCSA | | | 3.96 | % |

| FormFactor, Inc. | FORM | | | 3.91 | % |

Top Ten Holdings = 50.87% of Total Investments†

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

| † | Percentage of total investments less cash. |

Sector Weightings*

(as a % of net investments,

as of June 30, 2017)

Sector | | Long* | | | (Short)(1) | | | Total(1)(2) | |

| Consumer Discretionary | | | 11.1 | % | | | — | | | | 11.1 | % |

| Consumer Staples | | | 0.8 | % | | | — | | | | 0.8 | % |

| Energy | | | 1.7 | % | | | — | | | | 1.7 | % |

| Exchange Traded Funds | | | — | | | | (0.3 | )% | | | (0.3 | )% |

| Financials | | | 2.9 | % | | | (0.9 | )% | | | 2.0 | % |

| Health Care | | | 32.9 | % | | | — | | | | 32.9 | % |

| Industrials | | | 4.2 | % | | | — | | | | 4.2 | % |

| Information Technology | | | 50.4 | % | | | (3.3 | )% | | | 47.1 | % |

| Cash | | | 0.5 | % | | | — | | | | 0.5 | % |

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

(1) | Percentage of total investments includes all stocks, plus cash minus all short positions. |

(2) | Total represents the difference between the long exposure and the short exposure, which produces the net exposure. |

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Needham Funds

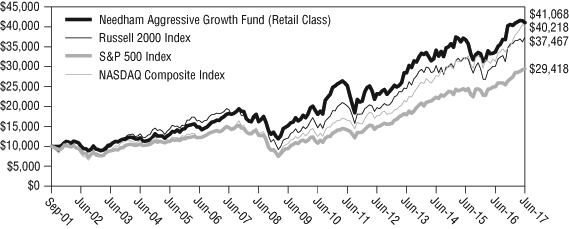

| NEEDHAM AGGRESSIVE GROWTH FUND | Retail Class |

| | Ticker Symbol: NEAGX |

| | Institutional Class |

| | Ticker Symbol: NEAIX |

Comparative Performance Statistics as of June 30, 2017 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | Gross | |

| | | | 6 | | | 1 | | | 3 | | | 5 | | | 10 | | Since | | Expense | |

| | | Months(8) | | Year | | Years(9) | | Years(9) | | Years(9) | | Inception | | Ratio(15) | |

| Needham Aggressive Growth | |

Fund Retail Class(1)(2) | | | 1.17 | % | | | 21.86 | % | | | 6.36 | %(10) | | | 12.09 | %(11) | | | 8.46 | %(12) | | | 9.34 | %(9)(13) | | | 2.71 | % |

| Needham Aggressive Growth | |

Fund Institutional Class(3) | | | 1.48 | % | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 1.48 | %(8) | | | 2.16 | % |

S&P 500 Index(4)(5) | | | 9.34 | % | | | 17.90 | % | | | 9.61 | % | | | 14.63 | % | | | 7.18 | % | | | 7.06 | %(9)(14) | | | | |

NASDAQ Composite Index(4)(6) | | | 14.76 | % | | | 28.40 | % | | | 13.13 | % | | | 17.49 | % | | | 10.25 | % | | | 9.19 | %(9)(14) | | | | |

Russell 2000 Index(4)(7) | | | 4.99 | % | | | 24.60 | % | | | 7.36 | % | | | 13.70 | % | | | 6.92 | % | | | 8.71 | %(9)(14) | | | | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

| 1. | Investment results calculated after reinvestment of dividends. |

| 2. | The inception date of the Retail Class was 9/4/01. |

| 3. | The inception date of the Institutional Class was 12/30/16. |

| 4. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| 5. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. |

| 6. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. |

| 7. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. |

| 8. | Not annualized. |

| 9. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Retail Class. |

| 10. | Cumulative return for the three year period was 20.33%, assuming all dividends were reinvested in shares of the Retail Class. |

| 11. | Cumulative return for the five year period was 76.98%, assuming all dividends were reinvested in shares of the Retail Class. |

| 12. | Cumulative return for the ten year period was 125.24%, assuming all dividends were reinvested in shares of the Retail Class. |

| 13. | Cumulative return since inception was 310.68% assuming all dividends were reinvested in shares of the Retail Class. |

| 14. | The return shown for the Index is from the Inception date of the Retail Class. |

| 15. | Gross expense ratio is from the Fund’s prospectus dated May 1, 2017. Additional information pertaining to the Fund’s expense ratios as of June 30, 2017 can be found in the financial highlights. Since January 1, 2009, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on April 30, 2018. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total class operating expenses would be 2.71% and 2.16% for the Retail Class and Institutional Class, respectively. |

Semi-Annual Report 2017

Top Ten Holdings*

(as a % of total investments,

as of June 30, 2017)

| | | | % of Total | |

Security | | | Investments | |

| PDF Solutions, Inc. | PDFS | | | 7.87 | % |

| Entegris, Inc. | ENTG | | | 6.60 | % |

| KVH Industries, Inc. | KVHI | | | 5.44 | % |

| Akamai Technologies, Inc. | AKAM | | | 5.12 | % |

| Apple, Inc. | AAPL | | | 5.01 | % |

| GSE Systems, Inc. | GVP | | | 4.99 | % |

| Reis, Inc. | REIS | | | 4.03 | % |

| FormFactor, Inc. | FORM | | | 3.58 | % |

| Super Micro Computer, Inc. | SMCI | | | 3.34 | % |

| Oil-Dri Corp. of America | ODC | | | 3.28 | % |

Top Ten Holdings = 49.26% of Total Investments†

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

| † | Percentage of total investments less cash. |

Sector Weightings*

(as a % of net investments,

as of June 30, 2017)

Sector | | Long* | | | (Short)(1) | | | Total(1)(2) | |

| Consumer Discretionary | | | 3.8 | % | | | — | | | | 3.8 | % |

| Consumer Staples | | | 3.5 | % | | | — | | | | 3.5 | % |

| Energy | | | 0.6 | % | | | — | | | | 0.6 | % |

| Financials | | | 4.3 | % | | | (1.7 | )% | | | 2.6 | % |

| Health Care | | | 11.5 | % | | | — | | | | 11.5 | % |

| Industrials | | | 7.3 | % | | | — | | | | 7.3 | % |

| Information Technology | | | 75.2 | % | | | (4.9 | )% | | | 70.3 | % |

| Cash | | | 0.4 | % | | | — | | | | 0.4 | % |

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

(1) | Percentage of total investments includes all stocks, plus cash minus all short positions. |

(2) | Total represents the difference between the long exposure and the short exposure, which produces the net exposure. |

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Needham Funds

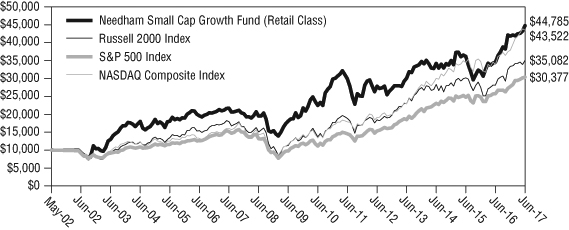

| NEEDHAM SMALL CAP GROWTH FUND | Retail Class |

| | Ticker Symbol: NESGX |

| | Institutional Class |

| | Ticker Symbol: NESIX |

Comparative Performance Statistics as of June 30, 2017 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | Gross | |

| | | | 6 | | | 1 | | | 3 | | | 5 | | | 10 | | Since | | Expense | |

| | | Months(8) | | Year | | Years(9) | | Years(9) | | Years(9) | | Inception | | Ratio(15) | |

| Needham Small Cap Growth | |

Fund Retail Class(1)(2) | | | 7.02 | % | | | 29.53 | % | | | 9.39 | %(10) | | | 9.98 | %(11) | | | 7.52 | %(12) | | | 10.43 | %(9)(13) | | | 2.15 | % |

| Needham Small Cap Growth | |

Fund Institutional Class(3) | | | 7.28 | % | | | n/a | | | | n/a | | | | n/a | | | | n/a | | | | 7.28 | %(8) | | | 1.60 | % |

S&P 500 Index(4)(5) | | | 9.34 | % | | | 17.90 | % | | | 9.61 | % | | | 14.63 | % | | | 7.18 | % | | | 7.63 | %(9)(14) | | | | |

NASDAQ Composite Index(4)(6) | | | 14.76 | % | | | 28.40 | % | | | 13.13 | % | | | 17.49 | % | | | 10.25 | % | | | 10.22 | %(9)(14) | | | | |

Russell 2000 Index(4)(7) | | | 4.99 | % | | | 24.60 | % | | | 7.36 | % | | | 13.70 | % | | | 6.92 | % | | | 8.66 | %(9)(14) | | | | |

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares.

| 1. | Investment results calculated after reinvestment of dividends. |

| 2. | The inception date of the Retail Class was 5/22/02. |

| 3. | The inception date of the Institutional Class was 12/30/16. |

| 4. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. |

| 5. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. |

| 6. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. |

| 7. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. |

| 8. | Not annualized. |

| 9. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Retail Class. |

| 10. | Cumulative return for the three year period was 30.91%, assuming all dividends were reinvested in shares of the Retail Class. |

| 11. | Cumulative return for the five year period was 60.92%, assuming all dividends were reinvested in shares of the Retail Class. |

| 12. | Cumulative return for the ten year period was 106.47%, assuming all dividends were reinvested in shares of the Retail Class. |

| 13. | Cumulative return since inception was 347.85% assuming all dividends were reinvested in shares of the Retail Class. |

| 14. | The return shown for the Index is from the Inception date of the Retail Class. |

| 15. | Gross expense ratio is from the Fund’s prospectus dated May 1, 2017. Additional information pertaining to the Fund’s expense ratios as of June 30, 2017 can be found in the financial highlights. Since January 1, 2009, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on April 30, 2018. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total class operating expenses would be 2.09% and 1.54% for the Retail Class and Institutional Class, respectively. |

Semi-Annual Report 2017

Top Ten Holdings*

(as a % of total investments,

as of June 30, 2017)

| | | | % of Total | |

Security | | | Investments | |

| Pure Storage, Inc. | PSTG | | | 8.77 | % |

| Amber Road, Inc. | AMBR | | | 6.95 | % |

| PDF Solutions, Inc. | PDFS | | | 6.67 | % |

| FireEye, Inc. | FEYE | | | 5.21 | % |

| Invuity, Inc. | IVTY | | | 5.09 | % |

| Reis, Inc. | REIS | | | 5.03 | % |

| ViaSat, Inc. | VSAT | | | 4.77 | % |

| KVH Industries, Inc. | KVHI | | | 4.67 | % |

| Frequency Electronics, Inc. | FEIM | | | 4.44 | % |

| Photronics, Inc. | PLAB | | | 4.11 | % |

Top Ten Holdings = 55.71% of Total Investments†

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

| † | Percentage of total investments less cash. |

Sector Weightings*

(as a % of net investments,

as of June 30, 2017)

Sector | | Long* | | | (Short)(1) | | | Total(1)(2) | |

| Closed-End Funds | | | 4.2 | % | | | — | | | | 4.2 | % |

| Consumer Discretionary | | | 0.2 | % | | | — | | | | 0.2 | % |

| Consumer Staples | | | 1.1 | % | | | — | | | | 1.1 | % |

| Energy | | | 7.7 | % | | | — | | | | 7.7 | % |

| Financials | | | 0.3 | % | | | — | | | | 0.3 | % |

| Health Care | | | 13.5 | % | | | — | | | | 13.5 | % |

| Industrials | | | 3.2 | % | | | — | | | | 3.2 | % |

| Information Technology | | | 66.6 | % | | | — | | | | 66.6 | % |

| Cash | | | 3.2 | % | | | — | | | | 3.2 | % |

| * | Current portfolio holdings may not be indicative of future portfolio holdings. |

(1) | Percentage of total investments includes all stocks, plus cash minus all short positions. |

(2) | Total represents the difference between the long exposure and the short exposure, which produces the net exposure. |

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Needham Funds

Disclosure of Fund Expenses (Unaudited)

The following expense table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of a Portfolio, you incur transactional costs, including redemption fees and ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. A Portfolio’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in each Portfolio and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period. The expense example table below illustrates your fund’s cost in two ways:

| • | Actual Expenses. This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the Portfolio’s actual return, and “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolio. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Portfolio under the heading entitled “Expenses Paid During Period”. |

| | |

| • | Hypothetical Expenses on a 5% Return. This section is intended to help you compare your Portfolio’s costs with those of other mutual funds. It assumes that the Portfolio had a return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Portfolio’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your Portfolio’s cost by comparing this hypothetical example with the hypothetical examples that appear in shareholders reports of other funds. |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Semi-Annual Report 2017

For the Period January 1, 2017 to June 30, 2017

Expense Example Table (Unaudited)

| | | Beginning | | | Ending | | | Expenses Paid | | | Expense Ratio | |

| | | Account | | | Account | | | During Period* | | | During Period* | |

| | | Value | | | Value | | | 1/1/17 – | | | 1/1/17 – | |

| | | 1/1/17 | | | 6/30/17 | | | 6/30/17 | | | 6/30/17 | |

| Needham Growth Fund | | | | | | | | | | | | |

| Retail Class Actual Expenses | | $ | 1,000.00 | | | $ | 1,040.30 | | | $ | 10.42 | | | | 2.06 | % |

| Retail Class Hypothetical Example | | | | | | | | | | | | | | | | |

| for Comparison Purposes | | | | | | | | | | | | | | | | |

| (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,014.58 | | | $ | 10.29 | | | | 2.06 | % |

| Institutional Class Actual Expenses | | $ | 1,000.00 | | | $ | 1,042.90 | | | $ | 8.05 | | | | 1.59 | % |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| Example for Comparison Purposes | | | | | | | | | | | | | | | | |

| (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.91 | | | $ | 7.95 | | | | 1.59 | % |

| | | | | | | | | | | | | | | | | |

| Needham Aggressive Growth Fund | | | | | | | | | | | | | | | | |

| Retail Class Actual Expenses | | $ | 1,000.00 | | | $ | 1,011.70 | | | $ | 11.42 | | | | 2.29 | % |

| Retail Class Hypothetical Example | | | | | | | | | | | | | | | | |

| for Comparison Purposes | | | | | | | | | | | | | | | | |

| (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,013.44 | | | $ | 11.43 | | | | 2.29 | % |

| Institutional Class Actual Expenses | | $ | 1,000.00 | | | $ | 1,014.80 | | | $ | 8.89 | | | | 1.78 | % |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| Example for Comparison Purposes | | | | | | | | | | | | | | | | |

| (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.97 | | | $ | 8.90 | | | | 1.78 | % |

| | | | | | | | | | | | | | | | | |

| Needham Small Cap Growth Fund | | | | | | | | | | | | | | | | |

| Retail Class Actual Expenses | | $ | 1,000.00 | | | $ | 1,070.20 | | | $ | 10.01 | | | | 1.95 | % |

| Retail Class Hypothetical Example | | | | | | | | | | | | | | | | |

| for Comparison Purposes | | | | | | | | | | | | | | | | |

| (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.12 | | | $ | 9.74 | | | | 1.95 | % |

| Institutional Class Actual Expenses | | $ | 1,000.00 | | | $ | 1,072.80 | | | $ | 7.20 | | | | 1.40 | % |

| Institutional Class Hypothetical | | | | | | | | | | | | | | | | |

| Example for Comparison Purposes | | | | | | | | | | | | | | | | |

| (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.85 | | | $ | 7.00 | | | | 1.40 | % |

| * | Expenses are equal to the average account value times the Portfolio’s annualized expense ratio multiplied 181/365 (to reflect the one-half-year period). |

Needham Funds

Needham Growth Fund

Schedule of Investments

June 30, 2017 (Unaudited)

| | | Shares | | | Market Value | |

| Common Stocks (99.4%) | | | | | | |

| | | | | | | |

| Airlines (0.3%) | | | | | | |

| United Continental Holdings, Inc.* | | | 5,000 | | | $ | 376,250 | |

| | | | | | | | | |

| Auto Components (0.1%) | | | | | | | | |

| Sypris Solutions, Inc.* | | | 95,000 | | | | 156,750 | |

| | | | | | | | | |

| Biotechnology (5.7%) | | | | | | | | |

| Gilead Sciences, Inc.† | | | 92,500 | | | | 6,547,150 | |

| | | | | | | | | |

| Capital Markets (2.6%) | | | | | | | | |

| Financial Engines, Inc.† | | | 56,000 | | | | 2,049,600 | |

| Oaktree Capital Group LLC | | | 20,000 | | | | 932,000 | |

| | | | | | | | 2,981,600 | |

| | | | | | | | | |

| Commercial Services & Supplies (0.1%) | | | | | | | | |

| Clean Harbors, Inc.* | | | 3,000 | | | | 167,490 | |

| | | | | | | | | |

| Communications Equipment (9.4%) | | | | | | | | |

| KVH Industries, Inc.* | | | 538,750 | | | | 5,118,125 | |

| ViaSat, Inc.*† | | | 87,500 | | | | 5,792,500 | |

| | | | | | | | 10,910,625 | |

| | | | | | | | | |

| Electrical Equipment (0.3%) | | | | | | | | |

| Vicor Corp.* | | | 20,000 | | | | 358,000 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (4.1%) | | | | | | | | |

| Corning, Inc. | | | 35,000 | | | | 1,051,750 | |

| FLIR Systems, Inc. | | | 15,000 | | | | 519,900 | |

| Frequency Electronics, Inc.* | | | 50,000 | | | | 477,000 | |

| IPG Photonics Corp.* | | | 6,000 | | | | 870,600 | |

| National Instruments Corp. | | | 20,800 | | | | 836,576 | |

| Vishay Intertechnology, Inc. | | | 60,000 | | | | 996,000 | |

| | | | | | | | 4,751,826 | |

| | | | | | | | | |

| Energy Equipment & Services (1.2%) | | | | | | | | |

| Aspen Aerogels, Inc.* | | | 57,500 | | | | 255,875 | |

| Core Laboratories NV | | | 3,000 | | | | 303,810 | |

| Schlumberger Ltd. | | | 12,500 | | | | 823,000 | |

| | | | | | | | 1,382,685 | |

See accompanying notes to financial statements.

Semi-Annual Report 2017

Needham Growth Fund

Schedule of Investments (Continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Market Value | |

| | | | | | | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Health Care Equipment & Supplies (10.2%) | | | | | | |

| Analogic Corp. | | | 3,100 | | | $ | 225,215 | |

| Becton Dickinson and Co. | | | 29,500 | | | | 5,755,745 | |

| CONMED Corp. | | | 30,000 | | | | 1,528,200 | |

| Invuity, Inc.* | | | 108,100 | | | | 783,725 | |

| Medtronic PLC | | | 26,290 | | | | 2,333,237 | |

| Varian Medical Systems, Inc.* | | | 11,500 | | | | 1,186,685 | |

| | | | | | | | 11,812,807 | |

| | | | | | | | | |

| Health Care Providers & Services (5.5%) | | | | | | | | |

| Express Scripts Holding Co.*† | | | 100,000 | | | | 6,384,000 | |

| | | | | | | | | |

| Health Care Technology (0.2%) | | | | | | | | |

| Castlight Health, Inc.* | | | 60,000 | | | | 249,000 | |

| | | | | | | | | |

| Household Products (0.8%) | | | | | | | | |

| Oil-Dri Corp. of America | | | 21,800 | | | | 915,818 | |

| | | | | | | | | |

| Industrial Conglomerates (0.3%) | | | | | | | | |

| Honeywell International, Inc. | | | 2,500 | | | | 333,225 | |

| | | | | | | | | |

| Insurance (0.1%) | | | | | | | | |

| Markel Corp.* | | | 150 | | | | 146,379 | |

| | | | | | | | | |

| Internet Software & Services (10.2%) | | | | | | | | |

| The Trade Desk, Inc.* | | | 11,900 | | | | 596,309 | |

| 2U, Inc.* | | | 6,000 | | | | 281,520 | |

| Akamai Technologies, Inc.*† | | | 50,000 | | | | 2,490,500 | |

| Amber Road, Inc.* | | | 443,350 | | | | 3,799,509 | |

| comScore, Inc.* | | | 70,200 | | | | 1,842,750 | |

| Coupa Software, Inc.* | | | 2,500 | | | | 72,450 | |

| Nutanix, Inc.* | | | 12,000 | | | | 241,800 | |

| Q2 Holdings, Inc.* | | | 20,000 | | | | 739,000 | |

| Reis, Inc. | | | 82,500 | | | | 1,753,125 | |

| | | | | | | | 11,816,963 | |

| | | | | | | | | |

| Life Sciences Tools & Services (8.1%) | | | | | | | | |

| Bruker Corp. | | | 10,000 | | | | 288,400 | |

| Thermo Fisher Scientific, Inc.† | | | 52,000 | | | | 9,072,440 | |

| | | | | | | | 9,360,840 | |

See accompanying notes to financial statements.

Needham Funds

Needham Growth Fund

Schedule of Investments (Continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Market Value | |

| | | | | | | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Media (4.2%) | | | | | | |

| Comcast Corp. | | | 117,000 | | | $ | 4,553,640 | |

| World Wrestling Entertainment, Inc. | | | 12,500 | | | | 254,625 | |

| | | | | | | | 4,808,265 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels (0.4%) | | | | | | | | |

| Hess Corp. | | | 10,000 | | | | 438,700 | |

| Navigator Holdings Ltd.* | | | 5,000 | | | | 41,500 | |

| | | | | | | | 480,200 | |

| | | | | | | | | |

| Pharmaceuticals (1.7%) | | | | | | | | |

| Agile Therapeutics, Inc.* | | | 105,000 | | | | 393,750 | |

| Corium International, Inc.* | | | 218,400 | | | | 1,629,264 | |

| | | | | | | | 2,023,014 | |

| | | | | | | | | |

| Professional Services (1.3%) | | | | | | | | |

| WageWorks, Inc.* | | | 22,500 | | | | 1,512,000 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (15.5%) | | | | | | | | |

| Applied Materials, Inc. | | | 7,500 | | | | 309,825 | |

| Entegris, Inc.* | | | 162,000 | | | | 3,555,900 | |

| FormFactor, Inc.* | | | 363,350 | | | | 4,505,540 | |

| Lam Research Corp. | | | 2,500 | | | | 353,575 | |

| MKS Instruments, Inc. | | | 32,000 | | | | 2,153,600 | |

| Nova Measuring Instruments Ltd.* | | | 65,000 | | | | 1,435,850 | |

| PDF Solutions, Inc.* | | | 250,000 | | | | 4,112,500 | |

| Photronics, Inc.* | | | 156,000 | | | | 1,466,400 | |

| | | | | | | | 17,893,190 | |

| | | | | | | | | |

| Software (0.9%) | | | | | | | | |

| Appian Corp.* | | | 1,346 | | | | 24,430 | |

| Red Hat, Inc.* | | | 10,000 | | | | 957,500 | |

| | | | | | | | 981,930 | |

| | | | | | | | | |

| Specialty Retail (6.2%) | | | | | | | | |

| CarMax, Inc.*† | | | 99,000 | | | | 6,242,940 | |

| Dick’s Sporting Goods, Inc. | | | 22,000 | | | | 876,260 | |

| | | | | | | | 7,119,200 | |

See accompanying notes to financial statements.

Semi-Annual Report 2017

Needham Growth Fund

Schedule of Investments (Continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Market Value | |

| | | | | | | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Technology Hardware, Storage & Peripherals (8.1%) | | | | | | |

| Apple, Inc. | | | 7,500 | | | $ | 1,080,150 | |

| Cray, Inc.* | | | 4,450 | | | | 81,880 | |

| Electronics For Imaging, Inc.* | | | 64,000 | | | | 3,032,320 | |

| Pure Storage, Inc.* | | | 50,000 | | | | 640,500 | |

| Super Micro Computer, Inc.* | | | 185,950 | | | | 4,583,668 | |

| | | | | | | | 9,418,518 | |

| | | | | | | | | |

| Textiles, Apparel & Luxury Goods (0.2%) | | | | | | | | |

| Under Armour, Inc.* | | | 12,500 | | | | 256,000 | |

| | | | | | | | | |

| Thrifts & Mortgage Finance (0.1%) | | | | | | | | |

| Ladder Capital Corp. | | | 7,673 | | | | 102,895 | |

| | | | | | | | | |

| Trading Companies & Distributors (1.6%) | | | | | | | | |

| Air Lease Corp. | | | 50,000 | | | | 1,868,000 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $52,064,518) | | | | | | $ | 115,114,620 | |

| | | | | | | | | |

| Short-Term Investments (0.4%) | | | | | | | | |

| | | | | | | | | |

| Money Market Fund (0.4%) | | | | | | | | |

| Dreyfus Treasury Securities Cash Management – | | | | | | | | |

| Institutional Class 0.75% (a) | | | | | | | | |

| (Cost $443,697) | | | 443,697 | | | $ | 443,697 | |

| | | | | | | | | |

| Total Investments (99.8%) | | | | | | | | |

| (Cost $52,508,215) | | | | | | | 115,558,317 | |

| Total Securities Sold Short (-4.2%) | | | | | | | (4,827,225 | ) |

| (Proceeds $4,060,084) | | | | | | | | |

| Other Assets in Excess of Liabilities (4.4%) | | | | | | | 5,053,728 | |

| Net Assets (100.0%) | | | | | | $ | 115,784,820 | |

| * | Non-income producing security. |

| (a) | Rate shown is the seven day yield as of June 30, 2017. |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $4,676,725. |

| | |

| | The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC. |

See accompanying notes to financial statements.

Needham Funds

Needham Growth Fund

Schedule of Securities Sold Short

June 30, 2017 (Unaudited)

| | | Shares | | | Market Value | |

| | | | | | | |

| Securities Sold Short (-3.9%) | | | | | | |

| | | | | | | |

| Capital Markets (-0.6%) | | | | | | |

| Medallion Financial Corp. | | | 310,000 | | | $ | 740,900 | |

| | | | | | | | | |

| Communications Equipment (-3.1%) | | | | | | | | |

| Applied Optoelectronics, Inc.* | | | 1,500 | | | | 92,685 | |

| Ubiquiti Networks, Inc.* | | | 67,500 | | | | 3,507,975 | |

| | | | | | | | 3,600,660 | |

| | | | | | | | | |

| Insurance (-0.2%) | | | | | | | | |

| Health Insurance Innovations, Inc.* | | | 8,750 | | | | 205,625 | |

| | | | | | | | | |

| Total Securities Sold Short (-3.9%) | | | | | | | | |

| (Proceeds $3,805,480) | | | | | | $ | 4,547,185 | |

| | | | | | | | | |

| Exchange Traded Funds Sold Short (-0.3%) | | | | | | | | |

| iShares Core S&P Small-Cap ETF | | | 2,000 | | | | 140,220 | |

| iShares S&P Small-Cap 600 Value ETF | | | 1,000 | | | | 139,820 | |

| | | | | | | | 280,040 | |

| | | | | | | | | |

| Total Exchange Traded Funds Sold Short (-0.3%) | | | | | | | | |

| (Proceeds $254,604) | | | | | | $ | 280,040 | |

| | | | | | | | | |

| Total Securities & Exchange Traded Funds Sold Short (-4.2%) | | | | | | | | |

| (Proceeds $4,060,084) | | | | | | $ | 4,827,225 | |

| * | Non-income producing security. |

See accompanying notes to financial statements.

Semi-Annual Report 2017

Needham Aggressive Growth Fund

Schedule of Investments

June 30, 2017 (Unaudited)

| | | Shares | | | Market Value | |

| | | | | | | |

| Common Stocks (99.9%) | | | | | | |

| | | | | | | |

| Biotechnology (2.6%) | | | | | | |

| Gilead Sciences, Inc.† | | | 23,000 | | | $ | 1,627,940 | |

| | | | | | | | | |

| Building Products (0.6%) | | | | | | | | |

| DIRTT Environmental Solutions* | | | 75,000 | | | | 394,012 | |

| | | | | | | | | |

| Capital Markets (1.4%) | | | | | | | | |

| Financial Engines, Inc. | | | 25,000 | | | | 915,000 | |

| | | | | | | | | |

| Commercial Services & Supplies (0.9%) | | | | | | | | |

| Clean Harbors, Inc.* | | | 4,000 | | | | 223,320 | |

| Ecology and Environment, Inc. | | | 27,869 | | | | 352,543 | |

| | | | | | | | 575,863 | |

| | | | | | | | | |

| Communications Equipment (9.6%) | | | | | | | | |

| KVH Industries, Inc.*† | | | 362,150 | | | | 3,440,425 | |

| Norsat International, Inc.* | | | 85,000 | | | | 966,875 | |

| ViaSat, Inc.*† | | | 25,000 | | | | 1,655,000 | |

| | | | | | | | 6,062,300 | |

| | | | | | | | | |

| Electrical Equipment (2.0%) | | | | | | | | |

| Vicor Corp.* | | | 72,500 | | | | 1,297,750 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (3.4%) | | | | | | | | |

| FLIR Systems, Inc. | | | 7,500 | | | | 259,950 | |

| Frequency Electronics, Inc.* | | | 28,950 | | | | 276,183 | |

| IPG Photonics Corp.* | | | 7,500 | | | | 1,088,250 | |

| National Instruments Corp. | | | 9,000 | | | | 361,980 | |

| Vishay Precision Group, Inc.* | | | 10,000 | | | | 173,000 | |

| | | | | | | | 2,159,363 | |

| | | | | | | | | |

| Energy Equipment & Services (0.6%) | | | | | | | | |

| Aspen Aerogels, Inc.* | | | 80,000 | | | | 356,000 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (4.3%) | | | | | | | | |

| Analogic Corp. | | | 3,100 | | | | 225,215 | |

| Becton Dickinson and Co. | | | 4,500 | | | | 877,995 | |

| CryoPort, Inc.* | | | 75,000 | | | | 369,000 | |

| Invuity, Inc.* | | | 53,350 | | | | 386,788 | |

| LeMaitre Vascular, Inc. | | | 28,000 | | | | 874,160 | |

| | | | | | | | 2,733,158 | |

See accompanying notes to financial statements.

Needham Funds

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Market Value | |

| | | | | | | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Health Care Providers & Services (0.9%) | | | | | | |

| Civitas Solutions, Inc.* | | | 9,000 | | | $ | 157,500 | |

| Express Scripts Holding Co.* | | | 6,000 | | | | 383,040 | |

| | | | | | | | 540,540 | |

| | | | | | | | | |

| Health Care Technology (0.9%) | | | | | | | | |

| Omnicell, Inc.* | | | 13,000 | | | | 560,300 | |

| | | | | | | | | |

| Household Durables (0.4%) | | | | | | | | |

| iRobot Corp.* | | | 3,000 | | | | 252,420 | |

| | | | | | | | | |

| Household Products (3.3%) | | | | | | | | |

| Oil-Dri Corp. of America | | | 49,442 | | | | 2,077,058 | |

| | | | | | | | | |

| Insurance (0.2%) | | | | | | | | |

| Markel Corp.* | | | 150 | | | | 146,379 | |

| | | | | | | | | |

| Internet Software & Services (16.3%) | | | | | | | | |

| The Trade Desk, Inc.* | | | 5,000 | | | | 250,550 | |

| 2U, Inc.* | | | 6,000 | | | | 281,520 | |

| Akamai Technologies, Inc.*† | | | 65,000 | | | | 3,237,650 | |

| Amber Road, Inc.*† | | | 176,650 | | | | 1,513,891 | |

| ARI Network Services, Inc.* | | | 15,000 | | | | 105,750 | |

| ChannelAdvisor Corp.* | | | 14,117 | | | | 163,051 | |

| comScore, Inc.* | | | 64,000 | | | | 1,680,000 | |

| Coupa Software, Inc.* | | | 2,500 | | | | 72,450 | |

| Nutanix, Inc.* | | | 1,500 | | | | 30,225 | |

| Q2 Holdings, Inc.* | | | 12,500 | | | | 461,875 | |

| Reis, Inc.† | | | 120,000 | | | | 2,550,000 | |

| | | | | | | | 10,346,962 | |

| | | | | | | | | |

| Media (0.2%) | | | | | | | | |

| World Wrestling Entertainment, Inc. | | | 6,000 | | | | 122,220 | |

| | | | | | | | | |

| Pharmaceuticals (2.2%) | | | | | | | | |

| Agile Therapeutics, Inc.* | | | 85,000 | | | | 318,750 | |

| Corium International, Inc.* | | | 140,000 | | | | 1,044,400 | |

| | | | | | | | 1,363,150 | |

See accompanying notes to financial statements.

Semi-Annual Report 2017

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Market Value | |

| | | | | | | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Professional Services (3.3%) | | | | | | |

| CRA International, Inc. | | | 5,000 | | | $ | 181,600 | |

| WageWorks, Inc.*† | | | 28,000 | | | | 1,881,600 | |

| | | | | | | | 2,063,200 | |

| | | | | | | | | |

| Real Estate Investment Trusts (REITs) (2.4%) | | | | | | | | |

| Equinix, Inc. | | | 3,499 | | | | 1,501,631 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (24.9%) | | | | | | | | |

| Entegris, Inc.* | | | 190,000 | | | | 4,170,500 | |

| FormFactor, Inc.* | | | 182,600 | | | | 2,264,240 | |

| MKS Instruments, Inc. | | | 27,000 | | | | 1,817,100 | |

| Nova Measuring Instruments Ltd.*† | | | 70,500 | | | | 1,557,345 | |

| PDF Solutions, Inc.*† | | | 302,500 | | | | 4,976,125 | |

| Photronics, Inc.* | | | 97,750 | | | | 918,850 | |

| Xcerra Corp.* | | | 7,500 | | | | 73,275 | |

| | | | | | | | 15,777,435 | |

| | | | | | | | | |

| Software (6.7%) | | | | | | | | |

| Appian Corp.* | | | 742 | | | | 13,467 | |

| Bottomline Technologies, Inc.* | | | 18,000 | | | | 462,420 | |

| Exa Corp.* | | | 7,500 | | | | 103,500 | |

| GSE Systems, Inc.*^ | | | 1,070,000 | | | | 3,156,500 | |

| Red Hat, Inc.* | | | 5,000 | | | | 478,750 | |

| | | | | | | | 4,214,637 | |

| | | | | | | | | |

| Specialty Retail (2.8%) | | | | | | | | |

| CarMax, Inc.*† | | | 21,500 | | | | 1,355,790 | |

| Dick’s Sporting Goods, Inc. | | | 10,000 | | | | 398,300 | |

| | | | | | | | 1,754,090 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (9.8%) | | | | | | | | |

| Apple, Inc.† | | | 22,000 | | | | 3,168,440 | |

| Electronics For Imaging, Inc.* | | | 16,000 | | | | 758,080 | |

| Pure Storage, Inc.* | | | 15,000 | | | | 192,150 | |

| Super Micro Computer, Inc.*† | | | 85,725 | | | | 2,113,121 | |

| | | | | | | | 6,231,791 | |

| | | | | | | | | |

See accompanying notes to financial statements.

Needham Funds

Needham Aggressive Growth Fund

Schedule of Investments (Continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Market Value | |

| | | | | | | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Textiles, Apparel & Luxury Goods (0.2%) | | | | | | |

| Under Armour, Inc.* | | | 7,000 | | | $ | 141,120 | |

| | | | | | | | | |

| Thrifts & Mortgage Finance (0.0%) | | | | | | | | |

| Ladder Capital Corp. | | | 1,627 | | | | 21,818 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $32,287,648) | | | | | | $ | 63,236,137 | |

| | | | | | | | | |

| Short-Term Investments (0.4%) | | | | | | | | |

| | | | | | | | | |

| Money Market Fund (0.4%) | | | | | | | | |

| Dreyfus Treasury Securities Cash Management – | | | | | | | | |

| Institutional Class 0.75% (a) | | | | | | | | |

| (Cost $245,900) | | | 245,900 | | | $ | 245,900 | |

| | | | | | | | | |

| Total Investments (100.3%) | | | | | | | | |

| (Cost $32,533,548) | | | | | | | 63,482,037 | |

| Total Securities Sold Short (-6.2%) | | | | | | | (3,909,508 | ) |

| (Proceeds $3,249,693) | | | | | | | | |

| Other Assets in Excess of Liabilities (5.9%) | | | | | | | 3,715,792 | |

| Net Assets (100.0%) | | | | | | $ | 63,288,321 | |

| * | Non-income producing security. |

| ^ | Affiliated security. Please refer to Note 11 of the Notes to Financial Statements. |

| (a) | Rate shown is the seven day yield as of June 30, 2017. |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $4,956,560. |

| | |

| | The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC. |

| | |

See accompanying notes to financial statements.

Semi-Annual Report 2017

Needham Aggressive Growth Fund

Schedule of Securities Sold Short

June 30, 2017 (Unaudited)

| | | Shares | | | Market Value | |

| | | | | | | |

| Securities Sold Short (-6.2%) | | | | | | |

| | | | | | | |

| Capital Markets (-1.3%) | | | | | | |

| Medallion Financial Corp. | | | 340,000 | | | $ | 812,600 | |

| | | | | | | | | |

| Communications Equipment (-3.9%) | | | | | | | | |

| Applied Optoelectronics, Inc.* | | | 1,000 | | | | 61,790 | |

| Ubiquiti Networks, Inc.* | | | 46,250 | | | | 2,403,613 | |

| | | | | | | | 2,465,403 | |

| | | | | | | | | |

| Insurance (-0.3%) | | | | | | | | |

| Health Insurance Innovations, Inc.* | | | 8,750 | | | | 205,625 | |

| | | | | | | | | |

| Software (-0.7%) | | | | | | | | |

| ANSYS, Inc.* | | | 3,500 | | | | 425,880 | |

| | | | | | | | | |

| Total Securities Sold Short (-6.2%) | | | | | | | | |

| (Proceeds $3,249,693) | | | | | | $ | 3,909,508 | |

| * | Non-income producing security. |

See accompanying notes to financial statements.

Needham Funds

Needham Small Cap Growth Fund

Schedule of Investments

June 30, 2017 (Unaudited)

| | | Shares | | | Market Value | |

| | | | | | | |

| Common Stocks (92.5%) | | | | | | |

| | | | | | | |

| Biotechnology (0.1%) | | | | | | |

| Exact Sciences Corp.* | | | 500 | | | $ | 17,685 | |

| | | | | | | | | |

| Commercial Services & Supplies (1.3%) | | | | | | | | |

| Mobile Mini, Inc. | | | 13,000 | | | | 388,050 | |

| | | | | | | | | |

| Communications Equipment (9.0%) | | | | | | | | |

| Infinera Corp.* | | | 7,500 | | | | 80,025 | |

| KVH Industries, Inc.* | | | 136,500 | | | | 1,296,750 | |

| ViaSat, Inc.* | | | 20,000 | | | | 1,324,000 | |

| | | | | | | | 2,700,775 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (5.3%) | | | | | | | | |