As filed with the Securities and Exchange Commission on September 8, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09114

The Needham Funds, Inc.

(Exact name of registrant as specified in charter)

445 Park Avenue, New York, NY 10022-2606

(Address of principal executive offices) (Zip code)

Mr. George A. Needham, 445 Park Avenue, New York, NY 10022-2606

(Name and address of agent for service)

1-800-625-7071

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2014

Date of reporting period: June 30, 2014

Item 1. Reports to Stockholders.

| 445 Park Avenue | |

| New York, New York 10022-2606 | |

| | |

| 1-800-625-7071 | |

www.needhamfunds.com | |

| Semi-Annual Report | |

| June 30, 2014 | |

| | |

| Contents | |

| | |

| Letter from the Adviser | 1 |

| | |

| Portfolio Characteristics | |

| Needham Growth Fund | 6 |

| Needham Aggressive Growth Fund | 7 |

| Needham Small Cap Growth Fund | 8 |

| Disclosure of Fund Expenses | 9 |

| | |

| Schedule of Investments | |

| Needham Growth Fund | 10 |

| Needham Aggressive Growth Fund | 13 |

| Needham Small Cap Growth Fund | 16 |

| | |

| Schedule of Securities Sold Short | |

| Needham Growth Fund | 12 |

| Needham Aggressive Growth Fund | 15 |

| Needham Small Cap Growth Fund | 18 |

| | |

| Statements of Assets and Liabilities | 19 |

| | |

| Statements of Operations | 20 |

| | |

| Statements of Changes in Net Assets | 21 |

| | |

| Financial Highlights | |

| Needham Growth Fund | 22 |

| Needham Aggressive Growth Fund | 23 |

| Needham Small Cap Growth Fund | 24 |

| | |

| Notes to Financial Statements | 25 |

| | |

| Supplementary Information | 30 |

This report is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus. The prospectus contains more complete information, including investment objectives, risks, expenses and charges and should be read carefully before investing or sending any money. To obtain a prospectus, please call 1-800-625-7071.

Portfolios of The Needham Funds, Inc., like all mutual funds:

| | | |

| | ● | Are NOT FDIC insured |

| | ● | Have no bank guarantee |

| | ● | May lose value |

The Needham Funds, Inc. are distributed by Needham & Company, LLC.

| | |

| Needham Funds | Semi-Annual Report 2014 |

| 445 Park Avenue |

| New York, NY 10022 |

| (800) 625-7071 |

| www.needhamfunds.com |

August 2014

Dear Shareholders, Friends of Needham and Prospective Shareholders,

We are pleased to report results for the second quarter and for the half-year ending June 30, 2014 for the Needham Growth Fund, Needham Aggressive Growth Fund and Needham Small Cap Growth Fund. Our mission is to create wealth for long-term investors.

Needham Funds’ Second Quarter and Semiannual Review

In the second quarter, the Needham Growth Fund (NEEGX) returned 3.1%, the Needham Aggressive Growth Fund (NEAGX) returned 5.1%, and the Needham Small Cap Growth Fund (NESGX) returned 0.3%. The Russell 2000 Total Return Index returned 2.1%, the S&P 500 Total Return Index returned 5.2% and the NASDAQ Composite returned 5.3%.

For the half-year, the Needham Growth Fund (NEEGX) returned 4.0%, the Needham Aggressive Growth Fund (NEAGX) returned 2.3%, and the Needham Small Cap Growth Fund (NESGX) was down 1.5%. The Russell 2000 Total Return Index returned 3.2%, the S&P 500 Total Return Index returned 7.1%, and the NASDAQ Composite returned 6.2%.

The Funds outperformed in January as our more valuation-sensitive growth holdings were not hit as hard as the broader markets. In February, the Funds had positive returns, but trailed the averages, which were led by defensive sectors, including utilities, telecommunications services, food & beverage, tobacco, real estate and energy. March and April were difficult months for the Funds and small-cap stocks as the economic weakness of the first quarter became known. May brought stabilization and June was very good for the markets with outperformance by the Needham Funds.

We Continue to See Opportunities for Growth Equities

Monetary policy remains accommodative and we continue to find opportunities. In her semiannual report, Janet Yellen wrote, “A high degree of monetary accommodation remains appropriate… Too many Americans remain unemployed… Inflation remains below our longer-run objective.” On the other hand, by October the Federal Reserve will complete its Quantitative Easing program of buying Treasuries and mortgage-backed securities. We believe they will continue to find ways to keep policy accommodative.

In September, European Central Bank President Draghi will initiate a program of negative interest rates and $1 trillion of cheap loans for European banks. Japan’s Prime Minister Abe and the Japan Central Bank President Kuroda are driven to depreciate the yen using all types of monetary tools. These central bank policies should be positive for equities.

First quarter United States GDP came in at a weather-induced -2.1%. Second quarter growth is estimated at 4.0%. This first half makes it likely the U.S. economy will grow at approximately 2% for the year; 2% growth supports the Federal Reserve’s continued accommodative monetary policies.

During the second quarter, we added new positions to the Funds, including iRobot Corporation (IRBT), Aruba Networks, Inc. (ARUN), Discovery Communications, Inc. Class A (DISCA), LifeTime Fitness, Inc. (LTM), World Wrestling Entertainment, Inc. Class A (WWE) and Bruker Corporation (BRKR).

Small caps contract in 2014. 2013 was a robust year for small-cap stocks. In the first half of 2014, small-cap stocks have retreated; we think the pullback in January was a necessary correction as the excess valuations were reduced. (See our February 2014 letter and The Growth Factor Volume 10, “Are we in a bubble? We say no, but be careful out there.”)

While international developments are unsettling and the recent loss of life in the Middle East and the Ukraine is tragic, it must be put in perspective. The 1980s and 1990s were full of war in Eastern Europe, Africa, Asia and the Middle East. These conflicts are deeply rooted in the history of Europe and the Middle East; yet, economic development moves forward. Our job is to invest in companies that we believe can grow, despite the difficult backdrop.

In The Growth Factor Volume 16 we wrote about some WOW factor people, including Dr. Joep Lange, a leading AIDs researcher and humanitarian who was killed on Malaysia Air Flight 17.

There is a technological revolution underway. Opportunities abound with the transformation of media, content, the cloud, Software-as-a-Service, low power semiconductors, the Internet of Things, mobile communications, molecular diagnostics, gene sequencing, drug discovery, and healthcare delivery. We have three portfolios full of companies capitalizing on this revolution, including our leading contributors in the second quarter.

Leading Stocks Across The Needham Funds

For the second quarter and the half-year, two stocks held by all three funds were highlights. SuperMicro Computer, Inc. (SMCI) returned 45% for the quarter and 47% for the half-year. The company makes servers and storage systems used in cloud data centers by the leading Internet companies. They’ve also benefited from expanding margins, as they’ve filled their new Taiwan manufacturing and distribution center.

Form Factor, Inc. (FORM) returned 30% in the quarter and 38% for the half-year, as it rebounded from quality and logistics issues and benefited from supplying system-on-chip wafer probe cards to companies such as Intel Corp., Broadcom Corp. and QUALCOMM Inc. These customers design leading edge, low-power semiconductors used in laptop PCs and smartphones to extend battery life. In the future, they are likely to be leaders producing semiconductors for the Internet of Things.

During the quarter, we again benefited from M&A. The acquisition of Zygo Corp. (ZIGO) by AMETEK Inc. (AME) for a 31% premium was announced in April and closed in June. Zygo was a major contributor to all three Funds.

Most acquisitions in The Needham Funds are small-cap companies acquired by larger companies. However, in June, Medtronic, Inc. (MDT) announced it was acquiring Covidien Plc. (COV), a long-term holding of the Needham Growth Fund. Domiciled in Ireland, Covidien had a $40 billion market capitalization and Medtronic a $60 billion market cap. This merger is about creating scale, increasing access to cash in the U.S. and finally the tax inversion due to Covidien’s lower tax rate.

Other acquisitions that closed in the second quarter were ATMI, Inc. (ATMI) by Entegris, Inc. (ENTG), AZ Electronic Materials (AZEM-London) by Atlas-Copco AB (ATCO.A Sweden) and Supertex, Inc. (SUPX) by Microchip Technology Inc. (MCHP.) We believe the M&A thesis will continue throughout 2014.

The leading detractors for the second quarter and the half-year were Electro Scientific Industries, Inc. (ESIO), down 30% in the quarter and 34% for the half-year, and Emulex Corporation (ELX), down 23% for the quarter and 20% for the half-year.

Electro Scientific had a disappointing 2013 and first half of 2014, as revenue from its largest customer, Apple (AAPL), declined and it has yet to develop other customers for its laser cutting and marking systems. In February, ESI unexpectedly announced the resignation of Nick Konidaris and appointed board member Ed Grady as CEO. Mr. Grady’s mandate is to find new markets and customers for ESI’s micromachining laser systems.

At Emulex, Jeff Benck was promoted from COO to CEO in July 2013, and in January 2014, Kyle Westcoat joined as new CFO. Guidance for the June quarter was well below expectations. Emulex has struggled with a product transition toward growth from its newer Ethernet access cards as its fiber channel storage connectivity business has matured.

Needham Growth Fund

The Needham Growth Fund returned 3.1% in the second quarter and 4.0% year-to-date. Major contributors were SuperMicro, FormFactor and Gilead Sciences, Inc. (GILD), which returned 17%. Gilead posted strong results from its new hepatitis C drug, Sovaldi. We note that each of these winners contributed more than any of the detractors.

The leading detractor was Financial Engines, Inc. (FNGN), down 35% in the first half. Financial Engines serves as an independent advisor that uses technology and risk management models to allocate assets in retirement plans. The company started in the defined benefit market and now addresses the 401(k) retirement market, and in the future may address the IRA and Defined Contribution markets. With success in those markets, Financial Engines could be a much larger company.

Financial Engines had been a five-bagger since its 2010 initial public offering. It closed 2013 at $69.48 per share with an enterprise value/2014 estimated revenues of 11.3x. Financial Engines closed June 30 at $45.28 per share as its multiple contracted. It now trades at an EV/2014 estimated revenue of 5.9x. We believe that Financial Engine’s recurring revenue model and new market opportunities make it a good long-term holding, despite the still-high multiple.

Electro Scientific Industries, down 30% in the quarter and 34% year-to-date, and Emulex, down 23% in the quarter and 20% year-to-date, were also leading detractors. Both companies have had disappointing earnings and now have new management teams.

There were a few changes to the portfolio. We added Air Lease Corporation Class A (AL) in the first quarter and World Wrestling Entertainment, Inc. Class A (WWE) in the second quarter on its pullback. We also added to our position in KVH Industries, Inc. (KVHI), which we believe to be the Netflix of the commercial maritime industry; in the same way Netflix offers great subscription content over the internet, KVH’s IP-Mobilecast offers news and entertainment to ships at sea over its satellite network. We trimmed our position in Thermo Fisher Scientific, Inc. (TMO) to an 8.1% position as of June 30, from a 9.5% position as of March 31, 2014, as it reached our first price target.

The Needham Growth Fund closed the half-year with holdings of 51% large cap, 14% mid cap, and 35% small and micro-cap. The Fund had a 3% short position. While Morningstar categorizes the fund as Mid-Cap Growth, we view our mandate to make money through long-term holdings with as little risk as possible.

Needham Aggressive Growth Fund

The Needham Aggressive Growth Fund returned 5.1% in the second quarter and 2.3% year-to-date. The Fund finished in the top 1% of Morningstar’s ranking of Small Cap Growth funds for the second quarter.

Akamai Technologies, Inc. (AKAM) has returned 29% year-to-date and was the top contributor in the second quarter. Akamai reported strong content delivery and security revenue in the first quarter. Other leading contributors for the second quarter and half-year were the previously mentioned Gilead, Form Factor and SuperMicro Computers.

PDF Solutions, Inc. (PDFS) was another major contributor in the second quarter with a return of 17%. PDF reported a good quarter from Samsung and Global Foundries. Most importantly, PDF signed new, multi-year contracts with a major existing customer (we think Samsung) and new customer (perhaps United Microelectronics Corp., 2303-Taiwan). Despite PDF’s strong contribution in the second quarter, it was still the Fund’s leading detractor for the first half.

The second leading detractor for the year-to-date was the short position in Federal Home Loan Mortgage Corp (FMCC), also known as Freddie Mac. We entered this position last year believing that the Senate Banking Committee, supported by the Administration and bipartisan, independent study groups, would gain momentum for a new housing finance bill, which would wind down Fannie Mae (FNMA) and Freddie Mac, leaving their common equity without value. Although the Senate Committee led by Chairman Tim Johnson (D-SD) and ranking member Mike Crapo (R-ID) got a bill out of committee on May 15, the bill lacks momentum. Speaker Reid (D-NV) has no plans to introduce the bill to the floor due to opposition from six senators who believe it does not do enough to support affordable housing.

GSEs (government-sponsored entities) benefit from an explicit guarantee of funding and liabilities from the federal government. GSEs are also not required to maintain a capital reserve or pay a commitment fee to the government. This guarantee lowers their cost to borrow, which improves the GSE’s margins and operating earnings. In exchange for these benefits, the Treasury sweeps all positive net worth above a nominal level as a dividend. A number of hedge and mutual funds have filed suit that the government’s net worth sweep is not proper and resorts to a seizure of private assets. Suits are pending.

The bill was also heavily opposed by hedge (Perry Capital, Bill Ackman of Pershing Square Capital Management) and mutual funds (Bruce Berkowitz of Fairholme Capital) seeking to secure a future for the GSEs with value retained for the equity holders. They have funded an extensive legal, lobbying and press campaign. They allied with the affordable housing advocates. The stock appreciated to $3.90 per share on June 30 from $2.86 on March 31. Mind you, FMCC traded for $0.25 for most of the last four years. The $3.90 price assumes a very optimistic set of assumptions.

Ultimately, we believe our representatives will not base the future housing finance system on two entities with government guarantees and returns to private shareholders, but there is no visibility to when such a future may happen. In the meantime, these stocks are the play toys of powerful forces. During the quarter, we reduced our short position.

By far the largest detractor for the second quarter was World Wrestling Entertainment (WWE), down 59% in the quarter. It was a top contributor and up 75% in the first quarter. When we bought WWE in 2013, it was a sleepy stock that hadn’t moved much in several years.

In the second quarter, the market was disappointed by the new WWE TV rights fees and the increase in the number of WWE Network subscribers required for breakeven. We believe WWE has extensive operating leverage, which should benefit WWE as subscriber numbers increase. We believe WWE produces great content and, over time, it will be monetized.

We sold some WWE shares in the first quarter and bought them back and more in the second quarter. WWE also paid a $0.48 per share dividend in 2013. We continued to build our positions in Crawford & Company Class A (CRD.A), KVH Industries, Inc. (KVHI) and Oil-Dri Corp. of America (ODC).

I’d like to highlight two new positions during the quarter. iRobot Corporation (IRBT) has a consumer robotic vacuum and a defense robot business. When we bought the stock, we believed the market was giving no credit for their defense business. Unfortunately, due to global instability, we think defense electronics is a good place to invest. Another new investment is Bruker Corporation (BRKR), which makes life science instruments and systems. We like their new products and reorganized business lines, which could lead to higher operating margins.

We also added starter positions in Vishay Precision Group, Inc. (VPG), Vicor Corporation (VICR) and GSE Systems, Inc. (GVP). There’s not a single analyst following any of these three companies; we love the lack of interest and competition.

The Fund exited the quarter with 32% large cap, up from 29% on December 31, 10% midcap, and 58% small and microcap, down from 64% on March 31. The Fund also ended the second quarter with a 7% short position, down from 9% at March 31.

Needham Small Cap Growth Fund

The Needham Small Cap Growth Fund returned 0.3% in the second quarter of 2014. We were relatively pleased with the performance of many of our holdings; however, that performance was overshadowed by our long-term investments in Electro Scientific Industries, down 30% in the second quarter and down 34% year-to-date, and Emulex down 23% in the second quarter and down 20% year-to-date. Both companies have had disappointing earnings and now have new management teams. We will review these positions on any recovery in the stock prices. We were pleased to see the recovery in FormFactor, which had been affected by a customer’s fire and a manufacturing mishap last year. We expect FormFactor to return to profitability after six years, and we believe the company is back on track for future growth.

We expect to see continued recovery from the first half 2014 slowdown, although we don’t expect to see robust activity. Mid-year elections will likely grab a substantial portion of news headlines this fall. We also expect to see more geopolitical events around the world that create uncertainty in the markets. We expect the release of new Apple products this fall to drive positive results for many technology companies involved in Apple’s supply chain.

We are also excited about the new Intel server platform launching this fall, which should benefit enterprise and data center sales. Our investment in SuperMicro Computer should benefit from this launch.

We spent nearly a week attending the SEMICON West Conference in San Francisco in early July and remain excited about the long-term prospects for many of the semiconductor capital equipment companies. Although the industry is in the midst of a pause that we believe may continue through the end of 2014, we believe that 2015 is setting up for year-over-year growth.

Moore’s Law, which postulates that the number of transistors in an integrated circuit doubles every two years, has slowed; however, we do not believe it is dead. The slowdown is positive for semiconductor capital equipment companies as substantially more capital expenditures are required to achieve technology transitions to smaller nodes. Simultaneously, more capacity will be required to meet the ever increasing demand for semiconductor chips with the ‘‘Internet of Everything.’’ Semiconductors are finding their way into more and more devices that previously never had them. The aerospace and automotive industries should be large consumers of semiconductor chips. We expect our investments in FormFactor, MKS Instruments (MKSI) and Rudolph Technologies (RTEC) to benefit from this trend.

Our investments in the energy industry have also performed nicely, and we believe the secular growth story remains intact as the U.S. energy renaissance continues. The non-traditional energy plays in the U.S. have required increased use of technology and services and this has driven growth for several of our investments. We remain excited about our investments in C&J Energy Services (CJES), Superior Energy Services (SPN) and WPX Energy (WPX), as we believe they are all levered to the growing energy sector.

Closing

The first half of 2014 brought a correction in January and February. High multiple, small-cap growth stocks were down. We believe the market needed time to consolidate its gains from 2012 and 2013. The second quarter of 2014 saw a return of volatility in the overall market and small-cap stocks in particular. This was exacerbated by lower than normal trading volumes that affected daily stock prices. In the end, however, the second quarter finished strongly as the concerns surrounding the effects of terrible winter weather abated and the economy began to recover. We do not find this economic growth extraordinary, but when compared to the first quarter, most economic activity is stronger.

To reiterate our overall thesis: monetary policy remains accommodative. We continue to see opportunities and have added starter positions in a few stocks. We believe that the international geopolitical situation, while disturbing, needs to be put in historical perspective. We see a revolution happening in technology that has created investment opportunities.

We see opportunity in our strategy of investing in companies that we know well and that we believe are positioned with secular growth drivers. We believe 2014 will be another good year for equities. However, we believe 2014 could bring more volatility to the markets and that our ability to short could dampen the possible volatility.

We welcome our new investors and thank all of our investors for their continued support. If you have any questions, thoughts or concerns, please contact us at (800) 625-7071 or send us an email at cretzler@needhamco.com or jbarr@needhamco.com. For information about the funds, please visit our website at www.needhamfunds.com.

Sincerely,

| | |

| |

| Chris Retzler | John O. Barr |

| Portfolio Manager | Portfolio Manager |

| Needham Funds |

| | |

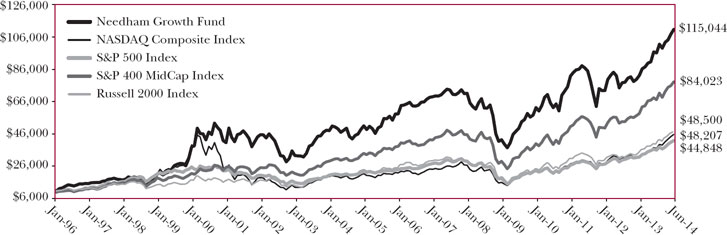

| NEEDHAM GROWTH FUND | TICKER: NEEGX |

Comparative Performance Statistics as of June 30, 2014 (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Since | | Gross Expense | |

| | | | 6 Months(7) | | 1 Year | | 3 Years(8) | | 5 Years(8) | | 10 Years(8) | | Inception(8)(12) | | Ratio(14) | |

| | Needham Growth Fund(1) | | | 3.99 | % | | | 19.69 | % | | | 10.64 | %(9) | | | 18.41 | %(10) | | | 8.79 | %(11) | | | 14.12 | %(13) | | | 1.89 | % | |

| | S&P 500 Index(2)(3) | | | 7.14 | % | | | 24.61 | % | | | 16.58 | % | | | 18.83 | % | | | 7.78 | % | | | 8.45 | % | | | | | |

| | NASDAQ Composite Index(2)(4) | | | 6.20 | % | | | 31.24 | % | | | 18.29 | % | | | 20.60 | % | | | 9.22 | % | | | 8.91 | % | | | | | |

| | S&P 400 MidCap Index(2)(5) | | | 7.50 | % | | | 25.24 | % | | | 15.26 | % | | | 21.67 | % | | | 10.50 | % | | | 12.20 | % | | | | | |

| | Russell 2000 Index(2)(6) | | | 3.19 | % | | | 23.64 | % | | | 14.57 | % | | | 20.21 | % | | | 8.70 | % | | | 8.88 | % | | | | | |

| | | |

| | Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. | |

| | 1. | Investment results calculated after reinvestment of dividends. | |

| | 2. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. | |

| | 3. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. | |

| | 4. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. | |

| | 5. | The S&P 400 MidCap Index is a broad unmanaged measure of the U.S. stock market. | |

| | 6. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. | |

| | 7. | Not annualized. | |

| | 8. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Fund. | |

| | 9. | Cumulative return for the three year period was 35.44%, assuming all dividends were reinvested in shares of the Fund. | |

| | 10. | Cumulative return for the five year period was 132.78%, assuming all dividends were reinvested in shares of the Fund. | |

| | 11. | Cumulative return for the ten year period was 132.23%, assuming all dividends were reinvested in shares of the Fund. | |

| | 12. | The inception date of the Fund was 1/1/96. | |

| | 13. | Cumulative return since inception was 1050.44%, assuming all dividends were reinvested in shares of the Fund. | |

| | 14. | Gross expense ratio is from the Fund’s prospectus dated May 1, 2014. Additional information pertaining to the Fund’s expense ratios as of June 30, 2014 can be found in the financial highlights. Since January 1, 2009, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on April 30, 2015. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 1.89%. | |

Top Ten Holdings*

(as a % of total investments, as of June 30, 2014)

| | | | | | |

| | | | | | | % of Total | |

| | | Security | | | | Investments† | |

| | 1 Express Scripts Holding Co. | ESRX | | 9.14 | % | |

| | 2 Thermo Fisher Scientific, Inc. | TMO | | 8.29 | % | |

| | 3 Gilead Sciences, Inc. | GILD | | 8.16 | % | |

| | 4 CarMax, Inc. | KMX | | 5.67 | % | |

| | 5 FormFactor, Inc. | FORM | | 4.24 | % | |

| | 6 ViaSat, Inc. | VSAT | | 4.03 | % | |

| | 7 Super Micro Computer, Inc. | SMCI | | 4.00 | % | |

| | 8 Hess Corp. | HES | | 3.82 | % | |

| | 9 Becton Dickinson and Co. | BDX | | 3.74 | % | |

| | 10 KVH Industries, Inc. | KVHI | | 2.79 | % | |

| | Top Ten Holdings = 53.88% of Total Investments† | |

| | * Current portfolio holdings may not be indicative of future portfolio holdings. | |

| | † Percentage of total investments less cash. | |

Sector Weightings*

(as a % of total investments, as of June 30, 2014)

| | | | | | | | | | | |

| | | Sector | | | Long(1) | | (Short)(1) | | Total(1)(2) | |

| | Consumer Discretionary | | 11.1 | % | | — | | | 11.1 | % | |

| | Energy | | 5.3 | % | | — | | | 5.3 | % | |

| | Exchange Traded Funds | | — | | | (0.3 | )% | | (0.3 | )% | |

| | Financials | | 3.2 | % | | — | | | 3.2 | % | |

| | Health Care | | 34.4 | % | | — | | | 34.4 | % | |

| | Industrials | | 2.9 | % | | (0.2 | )% | | 2.7 | % | |

| | Information Technology | | 43.1 | % | | (2.3 | )% | | 40.8 | % | |

| | Cash | | 2.8 | % | | — | | | 2.8 | % | |

| | * Current portfolio holdings may not be indicative of future portfolio holdings. | | |

| | (1) Percentage of total investments includes all stocks, plus cash minus all short positions. | |

| | (2) Total represents the difference between the long exposure and the short exposure, which produces the net exposure. | |

| | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Semi-Annual Report 2014 |

| | |

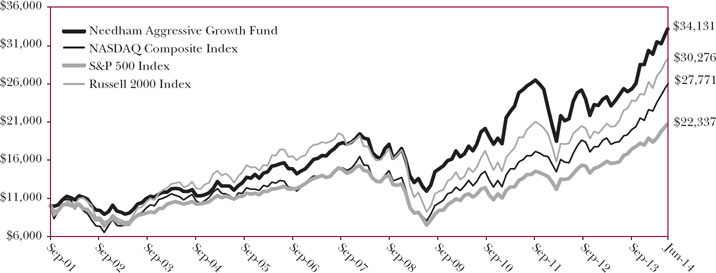

| NEEDHAM AGGRESSIVE GROWTH FUND | TICKER: NEAGX |

Comparative Performance Statistics as of June 30, 2014 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Since | | Gross Expense | |

| | | | 6 Months(6) | | 1 Year | | 3 Years(7) | | 5 Years(7) | | 10 Years(7) | | Inception(7)(11) | | Ratio(13) | |

| | Needham Aggressive Growth Fund(1) | | | 2.29 | % | | | 19.98 | % | | | 10.60 | %(8) | | | 17.54 | %(9) | | | 10.93 | %(10) | | | 10.05 | %(12) | | | 2.07 | % | |

| | | | | 7.14 | % | | | 24.61 | % | | | 16.58 | % | | | 18.83 | % | | | 7.78 | % | | | 6.47 | % | | | | | |

| | NASDAQ Composite Index(2)(4) | | | 6.20 | % | | | 31.24 | % | | | 18.29 | % | | | 20.60 | % | | | 9.22 | % | | | 8.29 | % | | | | | |

| | | | | 3.19 | % | | | 23.64 | % | | | 14.57 | % | | | 20.21 | % | | | 8.70 | % | | | 9.03 | % | | | | | |

| | | |

| | Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. | |

| | 1. | Investment results calculated after reinvestment of dividends. | |

| | 2. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. | |

| | 3. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. | |

| | 4. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. | |

| | 5. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. | |

| | 6. | | |

| | 7. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Fund. | |

| | 8. | Cumulative return for the three year period was 35.31%, assuming all dividends were reinvested in shares of the Fund. | |

| | 9. | Cumulative return for the five year period was 124.39%, assuming all dividends were reinvested in shares of the Fund. | |

| | 10. | Cumulative return for the ten year period was 182.11%, assuming all dividends were reinvested in shares of the Fund. | |

| | 11. | The inception date of the Fund was 9/4/2001. | |

| | 12. | Cumulative return since inception was 241.31% assuming all dividends were reinvested in shares of the Fund. | |

| | 13. | Gross expense ratio is from the Fund’s prospectus dated May 1, 2014. Additional information pertaining to the Fund’s expense ratios as of June 30, 2014 can be found in the financial highlights. Since inception, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on April 30, 2015. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 2.07%. | |

Top Ten Holdings*

(as a % of total investments, as of June 30, 2014)

| | | | | | | |

| | | | | % of Total | |

| | | Security | | | | Investments† | |

| | 1 Gilead Sciences, Inc. | GILD | | 9.52 | % | |

| | 2 PDF Solutions, Inc. | PDFS | | 8.80 | % | |

| | 3 Akamai Technologies, Inc. | AKAM | | 7.87 | % | |

| | 4 FormFactor, Inc. | FORM | | 5.85 | % | |

| | 5 Apple, Inc. | AAPL | | 5.44 | % | |

| | 6 Entegris, Inc. | ENTG | | 4.29 | % | |

| | 7 Super Micro Computer, Inc. | SMCI | | 4.12 | % | |

| | 8 KVH Industries, Inc. | KVHI | | 3.86 | % | |

| | 9 Electronics For Imaging, Inc. | EFII | | 3.71 | % | |

| | 10 Reis, Inc. | REIS | | 3.19 | % | |

| | Top Ten Holdings = 56.65% of Total Investments† | | |

| | * Current portfolio holdings may not be indicative of future portfolio holdings. | | |

| | † Percentage of total investments less cash. | | | | | |

Sector Weightings*

(as a % of total investments, as of June 30, 2014)

| | | | | | | | | | | | |

| | | Sector | | | Long(1) | | (Short)(1) | | Total(1)(2) | |

| | Consumer Discretionary | | 7.1 | % | | — | | | 7.1 | % | |

| | Consumer Staples | | 1.2 | % | | — | | | 1.2 | % | |

| | Energy | | 1.4 | % | | — | | | 1.4 | % | |

| | Exchange Traded Funds | | — | | | (0.1 | )% | | (0.1 | )% | |

| | Financials | | 3.3 | % | | (1.7 | )% | | 1.6 | % | |

| | Health Care | | 14.6 | % | | — | | | 14.6 | % | |

| | Industrials | | 4.9 | % | | (0.5 | )% | | 4.4 | % | |

| | Information Technology | | 73.5 | % | | (4.6 | )% | | 68.9 | % | |

| | Cash | | 0.9 | % | | — | | | 0.9 | % | |

| | * Current portfolio holdings may not be indicative of future portfolio holdings. | | |

| | (1) Percentage of total investments includes all stocks, plus cash minus all short positions. | |

| | (2) Total represents the difference between the long exposure and the short exposure, which produces the net exposure. | |

| | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

| Needham Funds |

| | |

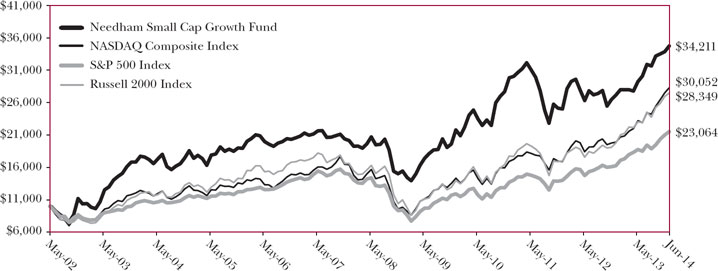

| NEEDHAM SMALL CAP GROWTH FUND | TICKER: NESGX |

Comparative Performance Statistics as of June 30, 2014 (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Since | | Gross Expense | |

| | | | 6 Months(6) | | 1 Year | | 3 Years(7) | | 5 Years(7) | | 10 Years(7) | | Inception(7)(11) | | Ratio(13) | |

| | Needham Small Cap Growth Fund(1) | | | | % | | | | % | | | | %(8) | | | | %(9) | | | | %(10) | | | | %(12) | | | 2.07 | % | |

| | | | | | % | | | | % | | | | % | | | | % | | | | % | | | | % | | | | | |

| | NASDAQ Composite Index(2)(4) | | | | % | | | | % | | | | % | | | | % | | | | % | | | | % | | | | | |

| | | | | | % | | | | % | | | | % | | | | % | | | 8.70 | % | | | | % | | | | | |

| | | |

| | Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The returns shown in the above table and accompanying footnotes are net of expenses. The table above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. | |

| | 1. | Investment results calculated after reinvestment of dividends. | |

| | 2. | It is not possible to invest directly in an index. The performance of the index does not include the deduction of expenses associated with a mutual fund, such as investment management fees. | |

| | 3. | The S&P 500 Index is a broad unmanaged measure of the U.S. stock market. | |

| | 4. | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ Global Market and Small Cap stocks. | |

| | 5. | The Russell 2000 Index is a broad unmanaged index composed of the smallest 2,000 companies in the Russell 3000 Index. | |

| | 6. | | |

| | 7. | Compound annual growth rate (annualized return). Assumes all dividends were reinvested in shares of the Fund. | |

| | 8. | Cumulative return for the three year period was 14.36%, assuming all dividends were reinvested in shares of the Fund. | |

| | 9. | Cumulative return for the five year period was 88.86%, assuming all dividends were reinvested in shares of the Fund. | |

| | 10. | Cumulative return for the ten year period was 89.85%, assuming all dividends were reinvested in shares of the Fund. | |

| | 11. | The inception date of the Fund was 5/22/02. | |

| | 12. | Cumulative return since inception was 242.11%, assuming all dividends were reinvested in shares of the Fund. | |

| | 13. | Gross expense ratio is from the Fund’s prospectus dated May 1, 2014. Additional information pertaining to the Fund’s expense ratios as of June 30, 2014 can be found in the financial highlights. Since inception, the investment performance reflects contractually agreed upon fee waivers which expire at the close of business on April 30, 2015. Without these fee waivers, the performance would have been lower. Excluding the indirect costs of investing in acquired funds, total fund operating expenses would be 2.06%. | |

| | | | |

Top Ten Holdings*

(as a % of total investments, as of June 30, 2014)

| | | | | | | |

| | | | | % of Total | |

| | | Security | | | | Investments† | |

| | 1 FormFactor, Inc. | FORM | | 13.19 | % | |

| | 2 Emulex Corp. | ELX | | 8.63 | % | |

| | 3 II-VI, Inc. | IIVI | | 6.18 | % | |

| | 4 KVH Industries, Inc. | KVHI | | 6.02 | % | |

| | 5 Electro Scientific Industries, Inc. | ESIO | | 5.32 | % | |

| | 6 Ruckus Wireless, Inc. | RKUS | | 5.30 | % | |

| | 7 Hess Corp. | HES | | 5.29 | % | |

| | 8 Super Micro Computer, Inc. | SMCI | | 5.04 | % | |

| | 9 TTM Technologies, Inc. | TTMI | | 3.80 | % | |

| | 10 Express Scripts Holding Co. | ESRX | | 3.71 | % | |

| | Top Ten Holdings = 62.48% of Total Investments† | | |

| | * Current portfolio holdings may not be indicative of future portfolio holdings. | | |

| | † Percentage of total investments less cash. | | | | | |

Sector Weightings*

(as a % of total investments, as of June 30, 2014)

| | | | | | | | | | | | |

| | | Sector | | | Long(1) | | (Short)(1) | | Total(1)(2) | |

| | Consumer Discretionary | | 3.4 | % | | — | | | 3.4 | % | |

| | Energy | | 7.1 | % | | — | | | 7.1 | % | |

| | Exchange Traded Funds | | 0 | % | | (2.9 | ) | | (2.9 | )% | |

| | Financials | | 2.8 | % | | — | | | 2.8 | % | |

| | Health Care | | 4.5 | % | | — | | | 4.5 | % | |

| | Industrials | | 1.4 | % | | — | | | 1.4 | % | |

| | Information Technology | | 56.4 | % | | (1.1 | ) | | 55.3 | % | |

| | Cash | | 28.4 | % | | — | | | 28.4 | % | |

| | * Current portfolio holdings may not be indicative of future portfolio holdings. | |

| | (1) Percentage of total investments includes all stocks, plus cash minus all short positions. | |

| | (2) Total represents the difference between the long exposure and the short exposure, which produces the net exposure. | |

| | | | | | | | | | |

Comparison of Change in Value of a $10,000 Investment

Past performance does not guarantee future results. The performance data quoted represents past performance, and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800-625-7071. The graph above does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Since inception, the Fund’s adviser has absorbed certain expenses of the Fund, without which returns would have been lower.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Disclosure of Fund Expenses (Unaudited)

The following expense table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of the fund, you incur transactional costs, including redemption fees and ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in each Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period. The expense example table below illustrates your fund’s cost in two ways:

| ● | Actual Expenses. This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading entitled “Expenses Paid During Period”. |

| ● | Hypothetical Expenses on a 5% Return. This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had a return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your Fund’s cost by comparing this hypothetical example with the hypothetical examples that appear in shareholders reports of other funds. |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

For the Period January 1, 2014 to June 30, 2014

Expense Example Table

| | | Beginning | | Ending | | Expenses | | Expense |

| | | Account | | Account | | Paid During | | Ratio During |

| | | Value | | Value | | Period* | | Period* |

| | | 1/1/14 | | 6/30/14 | | 1/1/14 – 6/30/14 | | 1/1/14 – 6/30/14 |

| Needham Growth Fund | | | | | | | | | | | | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 1,039.90 | | | $ | 9.36 | | | | 1.85 | % |

Hypothetical Example for Comparison Purposes (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.62 | | | $ | 9.25 | | | | 1.85 | % |

| | | | | | | | | | | | | | | | | |

| Needham Aggressive Growth Fund | | | | | | | | | | | | | | | | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 1,022.90 | | | $ | 10.58 | | | | 2.11 | % |

Hypothetical Example for Comparison Purposes (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,014.33 | | | $ | 10.54 | | | | 2.11 | % |

| | | | | | | | | | | | | | | | | |

| Needham Small Cap Growth Fund | | | | | | | | | | | | | | | | |

| Actual Expenses | | $ | 1,000.00 | | | $ | 984.60 | | | $ | 9.64 | | | | 1.96 | % |

Hypothetical Example for Comparison Purposes (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.08 | | | $ | 9.79 | | | | 1.96 | % |

| * | Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year. |

Needham Growth Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | Shares | | | Market Value | |

| | | | | | | |

| Common Stocks (97.3%) | | | | | | |

| | | | | | | |

| Aerospace & Defense (0.9%) | | | | | | |

| Honeywell International, Inc. | | | 15,000 | | | $ | 1,394,250 | |

| | | | | | | | | |

| Airlines (0.1%) | | | | | | | | |

| United Continental Holdings, Inc.* | | | 5,000 | | | | 205,350 | |

| | | | | | | | | |

| Auto Components (0.7%) | | | | | | | | |

| Sypris Solutions, Inc. | | | 187,500 | | | | 1,046,250 | |

| | | | | | | | | |

| Biotechnology (7.9%) | | | | | | | | |

| Exact Sciences Corp.* | | | 1,200 | | | | 20,436 | |

| Gilead Sciences, Inc.* | | | 140,000 | | | | 11,607,400 | |

| | | | | | | | 11,627,836 | |

| | | | | | | | | |

| Capital Markets (2.8%) | | | | | | | | |

| Financial Engines, Inc. | | | 67,500 | | | | 3,056,400 | |

| Oaktree Capital Group LLC | | | 20,000 | | | | 999,800 | |

| | | | | | | | 4,056,200 | |

| | | | | | | | | |

| Commercial Services & Supplies (0.6%) | | | | | | | | |

| Clean Harbors, Inc.* | | | 13,000 | | | | 835,250 | |

| | | | | | | | | |

| Communications Equipment (9.3%) | | | | | | | | |

| Emulex Corp.* | | | 610,000 | | | | 3,477,000 | |

| KVH Industries, Inc.* | | | 304,500 | | | | 3,967,635 | |

| QUALCOMM, Inc. | | | 5,000 | | | | 396,000 | |

| ViaSat, Inc.*† | | | 99,000 | | | | 5,738,040 | |

| | | | | | | | 13,578,675 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (8.4%) | |

| Corning, Inc. | | | 35,000 | | | | 768,250 | |

| Electro Scientific Industries, Inc. | | | 418,350 | | | | 2,848,964 | |

| II-VI, Inc.* | | | 145,000 | | | | 2,096,700 | |

| Jabil Circuit, Inc.† | | | 160,000 | | | | 3,344,000 | |

| Newport Corp.* | | | 100,000 | | | | 1,850,000 | |

| TCP International Holdings Ltd.* | | | 14,594 | | | | 149,734 | |

| Vishay Intertechnology, Inc. | | | 75,000 | | | | 1,161,750 | |

| | | | | | | | 12,219,398 | |

| | | | | | | | | |

| Energy Equipment & Services (1.0%) | | | | | | | | |

| Schlumberger Ltd. | | | 12,500 | | | | 1,474,375 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (8.2%) | | | | | |

| Becton Dickinson and Co. | | | 45,000 | | | | 5,323,500 | |

| CONMED Corp. | | | 48,150 | | | | 2,125,823 | |

| Covidien PLC | | | 27,500 | | | | 2,479,950 | |

| Lumenis Ltd.* | | | 8,454 | | | | 82,342 | |

| Natus Medical, Inc.* | | | 10,000 | | | | 251,400 | |

| Varian Medical Systems, Inc.* | | | 20,000 | | | | 1,662,800 | |

| | | | | | | | 11,925,815 | |

| Health Care Providers & Services (8.9%) | | | | |

| Express Scripts Holding Co.*† | | | 187,500 | | | | 12,999,375 | |

| | | | | | | | | |

| Health Care Technology (0.1%) | | | | | | | | |

| Cerner Corp.* | | | 2,500 | | | | 128,950 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure (0.2%) | | | | | | | | |

| Life Time Fitness, Inc.* | | | 5,000 | | | | 243,700 | |

| | | | | | | | | |

| Internet Software & Services (3.4%) | | | | | | | | |

| Akamai Technologies, Inc.* | | | 50,000 | | | | 3,053,000 | |

| Amber Road, Inc.* | | | 20,000 | | | | 322,600 | |

| Borderfree, Inc.* | | | 19,991 | | | | 331,251 | |

| Brightcove, Inc.* | | | 17,500 | | | | 184,450 | |

| Everyday Health, Inc.* | | | 8,100 | | | | 149,688 | |

| Q2 Holdings, Inc.* | | | 20,000 | | | | 285,200 | |

| QuinStreet, Inc.* | | | 56,558 | | | | 311,634 | |

| Xoom Corp.* | | | 10,000 | | | | 263,600 | |

| YuMe, Inc.* | | | 25,000 | | | | 147,500 | |

| | | | | | | | 5,048,923 | |

| | | | | | | | | |

| Leisure Products (0.4%) | | | | | | | | |

| Black Diamond, Inc.* | | | 50,000 | | | | 561,000 | |

| | | | | | | | | |

| Life Sciences Tools & Services (8.3%) | | | | | | | | |

| Bruker Corp.* | | | 8,500 | | | | 206,295 | |

Quintiles Transnational Holdings, Inc.* | | | 1,108 | | | | 59,045 | |

| Thermo Fisher Scientific, Inc.† | | | 100,000 | | | | 11,800,000 | |

| | | | | | | | 12,065,340 | |

| | | | | | | | | |

| Media (2.9%) | | | | | | | | |

| Comcast Corp. | | | 60,000 | | | | 3,220,800 | |

| Discovery Communications, Inc.* | | | 4,500 | | | | 334,260 | |

| Twenty-First Century Fox, Inc. | | | 10,000 | | | | 351,500 | |

World Wrestling Entertainment, Inc. | | | 25,000 | | | | 298,250 | |

| | | | | | | | 4,204,810 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels (4.1%) | | | | | | | | |

| Eclipse Resources Corp.* | | | 1,470 | | | | 36,941 | |

| Hess Corp.† | | | 55,000 | | | | 5,438,950 | |

| WPX Energy, Inc.* | | | 22,000 | | | | 526,020 | |

| | | | | | | | 6,001,911 | |

| | | | | | | | | |

| Pharmaceuticals (0.1%) | | | | | | | | |

| Corium International, Inc.* | | | 21,628 | | | | 168,050 | |

| | | | | | | | | |

| Professional Services (0.8%) | | | | | | | | |

| WageWorks, Inc.* | | | 23,500 | | | | 1,132,935 | |

See accompanying notes to financial statements.

| | Semi-Annual Report 2014 |

| | |

| Needham Growth Fund | |

| Schedule of Investments | |

| June 30, 2014 (Unaudited) | |

| | | Shares | | | Market Value | |

| | | | | | | |

| Common Stocks - Continued | | | | | | |

| | | | | | | |

| Semiconductors & Semiconductor Equipment (12.9%) | | | | |

| Broadcom Corp. | | | 5,000 | | | $ | 185,600 | |

| Brooks Automation, Inc. | | | 100,000 | | | | 1,077,000 | |

| Entegris, Inc.* | | | 210,000 | | | | 2,886,450 | |

| Entropic Communications, Inc.* | | | 389,200 | | | | 1,296,036 | |

| FormFactor, Inc.* | | | 725,000 | | | | 6,032,000 | |

| MKS Instruments, Inc. | | | 67,500 | | | | 2,108,700 | |

| Nova Measuring Instruments Ltd.* | | | 130,000 | | | | 1,561,300 | |

| PDF Solutions, Inc.* | | | 175,000 | | | | 3,713,500 | |

| | | | | | | | 18,860,586 | |

| | | | | | | | | |

| Software (1.6%) | | | | | | | | |

| A10 Networks, Inc.* | | | 1,445 | | | | 19,219 | |

| Barracuda Networks, Inc.* | | | 28,023 | | | | 869,273 | |

| King Digital Entertainment PLC* | | | 28,634 | | | | 588,429 | |

| Mavenir Systems, Inc.* | | | 60,000 | | | | 909,000 | |

| | | | | | | | 2,385,921 | |

| | | | | | | | | |

| Specialty Retail (6.6%) | | | | | | | | |

| CarMax, Inc.* | | | 155,000 | | | | 8,061,550 | |

| Dick’s Sporting Goods, Inc.† | | | 30,000 | | | | 1,396,800 | |

| Tiffany & Co. | | | 2,500 | | | | 250,625 | |

| | | | | | | | 9,708,975 | |

| Technology Hardware, Storage & Peripherals (6.4%) | | | | |

| Electronics For Imaging, Inc.* | | | 80,000 | | | | 3,616,000 | |

| Super Micro Computer, Inc.* | | | 225,000 | | | | 5,685,750 | |

| | | | | | | | 9,301,750 | |

| | | | | | | | | |

| Thrifts & Mortgage Finance (0.3%) | | | | | | | | |

| Ladder Capital Corp.* | | | 28,577 | | | | 516,386 | |

| | | | | | | | | |

| Trading Companies & Distributors (0.4%) | | | | | |

| Air Lease Corp. | | | 15,000 | | | | 578,700 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $68,419,022) | | | | | | | 142,270,711 | |

| | | | | | | | | |

| Short-Term Investment (2.7%) | | | | | | | | |

| | | | | | | | | |

| Money Market Fund (2.7%) | | | | | | | | |

Dreyfus Treasury Prime Cash Management 0.00% (a) | | | | | | | | |

| (Cost $3,941,314) | | | 3,941,314 | | | $ | 3,941,314 | |

| | | | | | | | | |

| Total Investments (100.0%) | | | | | | | | |

| (Cost $72,360,336) | | | | | | | 146,212,025 | |

| Total Securities Sold Short (-2.6%) | | | | | | | (3,860,884 | ) |

| (Proceeds $2,755,549) | | | | | | | | |

Other Assets in Excess of Liabilities (2.6%) | | | | | | | 3,784,195 | |

| Net Assets (100.0%) | | | | | | $ | 146,135,336 | |

* | Non-income producing security. |

| | |

| (a) | Rate shown is the seven day yield as of June 30, 2014. |

| | |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $5,185,200. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

Needham Growth Fund

Schedule of Securities Sold Short

June 30, 2014 (Unaudited)

| | | Shares | | Market Value | |

| Securities Sold Short (-2.4%) | | | | | | |

| | | | | | | |

| Airlines (-0.2%) | | | | | | |

| Allegiant Travel Co. | | | 2,500 | | | $ | 294,425 | |

| | | | | | | | | |

| Communications Equipment (-1.1%) | | | | | | | | |

| Ubiquiti Networks, Inc.* | | | 35,100 | | | | 1,586,169 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (-0.1%) | | | | |

| QuickLogic Corp.* | | | 20,000 | | | | 103,400 | |

| | | | | | | | | |

| Software (-1.0%) | | | | | | | | |

| ANSYS, Inc.* | | | 20,000 | | | | 1,516,400 | |

| | | | | | | | | |

| Total Securities Sold Short | | | | | | | | |

| (Proceeds $2,395,854) | | | | | | | 3,500,394 | �� |

| | | | | | | | | |

| Exchange Traded Funds Sold Short (-0.2%) | | | | | |

| iShares Russell 2000 ETF | | | 1,000 | | | | 118,810 | |

| iShares Russell 2000 Growth ETF | | | 1,000 | | | | 138,420 | |

| iShares Russell 2000 Value ETF | | | 1,000 | | | | 103,260 | |

| | | | | | | | | |

| Total Exchange Traded Funds Sold Short | | | | | | | | |

| (Proceeds $359,695) | | | | | | | 360,490 | |

| | | | | | | | | |

| Total Securities & Exchange Traded Funds Sold Short | | | | |

| (Proceeds $2,755,549) | | | | | | | 3,860,884 | |

| | | | | | | | | |

Total Securities & Exchange Traded Funds Sold Short (-2.6%) | | | | | | | (3,860,884 | ) |

| Total Investments (100.0%) | | | | | | | 146,212,025 | |

Other Assets in Excess of Liabilities (2.6%) | | | | | | | 3,784,195 | |

| Net Assets (100.0%) | | | | | | $ | 146,135,336 | |

* | Non-income producing security. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

| | Semi-Annual Report 2014 |

| | |

| Needham Aggressive Growth Fund | |

| Schedule of Investments | |

| June 30, 2014 (Unaudited) | |

| | | Shares | | | Market Value | |

| | | | | | | |

| Common Stocks (100.1%) | | | | | | |

| | | | | | | |

| Aerospace & Defense (2.0%) | | | | | | |

| Precision Castparts Corp.† | | | 5,000 | | | $ | 1,262,000 | |

| | | | | | | | | |

| Biotechnology (9.5%) | | | | | | | | |

| Gilead Sciences, Inc.*† | | | 73,500 | | | | 6,093,885 | |

| | | | | | | | | |

| Capital Markets (2.1%) | | | | | | | | |

| Financial Engines, Inc.† | | | 30,000 | | | | 1,358,400 | |

| | | | | | | | | |

| Commercial Services & Supplies (0.5%) | | | | | | | | |

| Clean Harbors, Inc.* | | | 5,000 | | | | 321,250 | |

| | | | | | | | | |

| Communications Equipment (6.0%) | | | | | | | | |

| Emulex Corp.* | | | 10,000 | | | | 57,000 | |

| KVH Industries, Inc.* | | | 189,800 | | | | 2,473,094 | |

| ViaSat, Inc.*† | | | 23,000 | | | | 1,333,080 | |

| | | | | | | | 3,863,174 | |

| | | | | | | | | |

| Electrical Equipment (0.1%) | | | | | | | | |

| Vicor Corp.* | | | 5,000 | | | | 41,900 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (4.6%) | |

| Electro Scientific Industries, Inc. | | | 77,300 | | | | 526,413 | |

| FEI Co.† | | | 14,000 | | | | 1,270,220 | |

| II-VI, Inc.* | | | 39,000 | | | | 563,940 | |

| IPG Photonics Corp.*† | | | 5,000 | | | | 344,000 | |

| TCP International Holdings Ltd.* | | | 6,392 | | | | 65,582 | |

| Vishay Precision Group, Inc.* | | | 10,000 | | | | 164,600 | |

| | | | | | | | 2,934,755 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (1.6%) | | | | | |

| Becton Dickinson and Co. | | | 5,000 | | | | 591,500 | |

| LeMaitre Vascular, Inc. | | | 55,000 | | | | 454,850 | |

| | | | | | | | 1,046,350 | |

| | | | | | | | | |

| Health Care Providers & Services (1.4%) | | | | | |

| Express Scripts Holding Co.*† | | | 13,000 | | | | 901,290 | |

| | | | | | | | | |

| Health Care Technology (0.6%) | | | | | | | | |

| Omnicell, Inc.* | | | 13,000 | | | | 373,230 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure (0.9%) | | | | | | | | |

| Life Time Fitness, Inc.* | | | 250 | | | | 12,185 | |

| Panera Bread Co.* | | | 3,700 | | | | 554,371 | |

| | | | | | | | 566,556 | |

| Household Durables (1.0%) | | | | | | |

| iRobot Corp.* | | | 15,000 | | | | 614,250 | |

| | | | | | | | | |

| Household Products (1.1%) | | | | | | | | |

| Oil-Dri Corp. of America | | | 24,000 | | | | 733,680 | |

| | | | | | | | | |

| Insurance (0.6%) | | | | | | | | |

| Crawford & Co. | | | 46,500 | | | | 376,650 | |

| | | | | | | | | |

| Internet & Catalog Retail (0.1%) | | | | | | | | |

| Coupons.com, Inc.* | | | 671 | | | | 17,654 | |

| RetailMeNot, Inc.* | | | 678 | | | | 18,042 | |

| | | | | | | | 35,696 | |

| | | | | | | | | |

| Internet Software & Services (17.6%) | | | | | | | | |

| Akamai Technologies, Inc.*† | | | 82,500 | | | | 5,037,450 | |

| Amber Road, Inc.* | | | 10,000 | | | | 161,300 | |

| ARI Network Services, Inc.* | | | 15,000 | | | | 45,450 | |

| Borderfree, Inc.* | | | 10,000 | | | | 165,700 | |

| Brightcove, Inc.* | | | 25,000 | | | | 263,500 | |

| ChannelAdvisor Corp.* | | | 3,383 | | | | 89,176 | |

| Constant Contact, Inc.*† | | | 45,000 | | | | 1,444,950 | |

| Equinix, Inc.* | | | 3,500 | | | | 735,315 | |

| Q2 Holdings, Inc.* | | | 12,500 | | | | 178,250 | |

| Reis, Inc. | | | 96,900 | | | | 2,042,652 | |

| TheStreet, Inc. | | | 255,000 | | | | 614,550 | |

| Xoom Corp.* | | | 9,000 | | | | 237,240 | |

| YuMe, Inc.* | | | 40,000 | | | | 236,000 | |

| | | | | | | | 11,251,533 | |

| | | | | | | | | |

| Life Sciences Tools & Services (0.5%) | | | | | | | | |

| Bruker Corp.* | | | 13,000 | | | | 315,510 | |

| | | | | | | | | |

| Media (1.9%) | | | | | | | | |

| Discovery Communications, Inc.* | | | 1,500 | | | | 111,420 | |

| Twenty-First Century Fox, Inc. | | | 1,000 | | | | 35,150 | |

World Wrestling Entertainment, Inc.† | | | 88,500 | | | | 1,055,805 | |

| | | | | | | | 1,202,375 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels (1.3%) | | | | | | | | |

| Eclipse Resources Corp.* | | | 645 | | | | 16,209 | |

| Hess Corp.† | | | 8,500 | | | | 840,565 | |

| | | | | | | | 856,774 | |

| | | | | | | | | |

| Pharmaceuticals (0.1%) | | | | | | | | |

| Corium International, Inc.* | | | 9,650 | | | | 74,981 | |

| | | | | | | | | |

| Professional Services (2.1%) | | | | | | | | |

| WageWorks, Inc.*† | | | 28,000 | | | | 1,349,880 | |

See accompanying notes to financial statements.

Needham Aggressive Growth Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | Shares | | | Market Value | |

| | | | | | | |

| Common Stocks – Continued | | | | | | |

| | | | | | | |

| Semiconductors & Semiconductor Equipment (24.7%) | | | |

| CEVA, Inc.* | | | 38,000 | | | $ | 561,260 | |

| Entegris, Inc.* | | | 200,000 | | | | 2,749,000 | |

| Entropic Communications, Inc.* | | | 127,150 | | | | 423,409 | |

| FormFactor, Inc.* | | | 450,000 | | | | 3,744,000 | |

| MKS Instruments, Inc.† | | | 29,100 | | | | 909,084 | |

| Nanometrics, Inc.* | | | 3,000 | | | | 54,750 | |

| Nova Measuring Instruments Ltd.* | | | 94,900 | | | | 1,139,749 | |

| PDF Solutions, Inc.*† | | | 265,500 | | | | 5,633,910 | |

| Photronics, Inc.* | | | 61,000 | | | | 524,600 | |

| Xcerra Corp.* | | | 10,000 | | | | 91,000 | |

| | | | | | | | 15,830,762 | |

| | | | | | | | | |

| Software (3.2%) | | | | | | | | |

| A10 Networks, Inc.* | | | 658 | | | | 8,751 | |

| Barracuda Networks, Inc.* | | | 13,539 | | | | 419,980 | |

| Bottomline Technologies, Inc.*† | | | 29,000 | | | | 867,680 | |

| BroadSoft, Inc.* | | | 5,000 | | | | 131,950 | |

| Exa Corp.* | | | 5,000 | | | | 56,300 | |

| GSE Systems, Inc.* | | | 25,000 | | | | 41,500 | |

| Mavenir Systems, Inc.* | | | 32,600 | | | | 493,890 | |

| | | | | | | | 2,020,051 | |

| | | | | | | | | |

| Specialty Retail (2.9%) | | | | | | | | |

| CarMax, Inc.*† | | | 22,500 | | | | 1,170,225 | |

| Dick’s Sporting Goods, Inc.† | | | 15,000 | | | | 698,400 | |

| | | | | | | | 1,868,625 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (13.3%) | | | | |

| Apple, Inc.† | | | 37,450 | | | | 3,480,228 | |

| Electronics For Imaging, Inc.*† | | | 52,500 | | | | 2,373,000 | |

| Super Micro Computer, Inc.*† | | | 104,500 | | | | 2,640,715 | |

| | | | | | | | 8,493,943 | |

| Thrifts & Mortgage Finance (0.4%) | | | | | | | | |

| Ladder Capital Corp.* | | | 13,318 | | | | 240,656 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $31,364,131) | | | | | | | 64,028,156 | |

| | | | | | | | | |

| Short-Term Investment (0.8%) | | | | | | | | |

| | | | | | | | | |

| Money Market Fund (0.8%) | | | | | | | | |

Dreyfus Treasury Prime Cash Management 0.00% (a) | | | | | | | | |

| (Cost $530,775) | | | 530,775 | | | $ | 530,775 | |

| | | | | | | | | |

| Total Investments (100.9%) | | | | | | | | |

| (Cost $31,894,906) | | | | | | | 64,558,931 | |

| Total Securities Sold Short (-6.5%) | | | | | | | (4,164,365 | ) |

| (Proceeds $2,310,393) | | | | | | | | |

Other Assets in Excess of Liabilities (5.6%) | | | | | | | 3,605,020 | |

| Net Assets (100.0%) | | | | | | $ | 63,999,586 | |

| * | Non-income producing security. |

| | |

| (a) | Rate shown is the seven day yield as of June 30, 2014. |

| | |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $9,926,820. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

| | Semi-Annual Report 2014 |

| | |

| Needham Aggressive Growth Fund | |

| Schedule of Securities Sold Short | |

| June 30, 2014 (Unaudited) | |

| | | Shares | | Market Value | |

| | | | | | | |

| Securities Sold Short (-6.4%) | | | | | | |

| | | | | | | |

| Airlines (-0.5%) | | | | | | |

| Allegiant Travel Co. | | | 2,500 | | | $ | 294,425 | |

| | | | | | | | | |

| Communications Equipment (-2.9%) | | | | | | | | |

| Ubiquiti Networks, Inc.* | | | 40,500 | | | | 1,830,195 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (-0.5%) | | | | |

| QuickLogic Corp.* | | | 65,000 | | | | 336,050 | |

| | | | | | | | | |

| Software (-0.9%) | | | | | | | | |

| ANSYS, Inc.* | | | 8,000 | | | | 606,560 | |

| | | | | | | | | |

| Thrifts & Mortgage Finance (-1.6%) | | | | | | | | |

Federal Home Loan Mortgage Corp.* | | | 265,000 | | | | 1,022,900 | |

| | | | | | | | | |

| Total Securities Sold Short | | | | | | | | |

| (Proceeds $2,250,977) | | | | | | | 4,090,130 | |

| | | | | | | | | |

| Exchange Traded Funds Sold Short (-0.1%) | | | | | |

| Market Vectors Semiconductor ETF | | | 1,500 | | | | 74,235 | |

| | | | | | | | | |

| Total Exchange Traded Funds Sold Short | | | | | |

| (Proceeds $59,416) | | | | | | | 74,235 | |

| | | | | | | | | |

| Total Securities & Exchange Traded Funds Sold Short | | | | |

| (Proceeds $2,310,393) | | | | | | | 4,164,365 | |

| | | | | | | | | |

Total Securities & Exchange Traded Funds Sold Short (-6.5%) | | | | | | | (4,164,365 | ) |

| Total Investments (100.9%) | | | | | | | 64,558,931 | |

Other Assets in Excess of Liabilities (5.6%) | | | | | | | 3,605,020 | |

| Net Assets (100.0%) | | | | | | $ | 63,999,586 | |

| * | Non-income producing security. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

Needham Small Cap Growth Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | Shares | | | Market Value |

| Common Stocks (72.2%) | | | | | | |

| | | | | | | |

| Biotechnology (0.8%) | | | | | | |

| Exact Sciences Corp.* | | | 17,300 | | | $ | 294,619 | |

| | | | | | | | | |

| Capital Markets (0.8%) | | | | | | | | |

| FXCM, Inc. | | | 20,000 | | | | 299,200 | |

| | | | | | | | | |

| Commercial Services & Supplies (0.3%) | | | | | | | | |

| Clean Harbors, Inc.* | | | 2,000 | | | | 128,500 | |

| | | | | | | | | |

| Communications Equipment (15.8%) | | | | | | | | |

| Aruba Networks, Inc.* | | | 7,500 | | | | 131,400 | |

| Emulex Corp.* | | | 425,000 | | | | 2,422,500 | |

| KVH Industries, Inc.* | | | 129,700 | | | | 1,689,991 | |

| Riverbed Technology, Inc.* | | | 20,000 | | | | 412,600 | |

| Ruckus Wireless, Inc.* | | | 125,000 | | | | 1,488,750 | |

| | | | | | | | 6,145,241 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components (11.2%) |

| Electro Scientific Industries, Inc. | | | 219,350 | | | | 1,493,774 | |

| II-VI, Inc.* † | | | 120,000 | | | | 1,735,200 | |

| TCP International Holdings Ltd.* | | | 3,862 | | | | 39,624 | |

| TTM Technologies, Inc.* † | | | 130,000 | | | | 1,066,000 | |

| | | | | | | | 4,334,598 | |

| | | | | | | | | |

| Energy Equipment & Services (0.4%) | | | | | | | | |

| C&J Energy Services, Inc.* | | | 2,000 | | | | 67,560 | |

| Superior Energy Services, Inc. | | | 2,000 | | | | 72,280 | |

| | | | | | | | 139,840 | |

| | | | | | | | | |

| Health Care Equipment & Supplies (0.6%) | | | | | |

| Cutera, Inc.* | | | 12,500 | | | | 129,875 | |

| Novadaq Technologies, Inc.* | | | 2,500 | | | | 41,200 | |

| Syneron Medical Ltd* | | | 5,000 | | | | 51,600 | |

| | | | | | | | 222,675 | |

| | | | | | | | | |

| Health Care Providers & Services (2.7%) | | | | | |

| Express Scripts Holding Co.* † | | | 15,000 | | | | 1,039,950 | |

| | | | | | | | | |

| Health Care Technology (0.3%) | | | | | | | | |

| Cerner Corp.* | | | 2,500 | | | | 128,950 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure (0.3%) | | | | | | | | |

| Life Time Fitness, Inc.* | | | 2,500 | | | | 121,850 | |

| | | | | | | | | |

| Internet Software & Services (5.3%) | | | | | | | | |

| Borderfree, Inc.* | | | 4,110 | | | | 68,103 | |

| Everyday Health, Inc.* | | | 9,200 | | | | 170,016 | |

| Reis, Inc. | | | 48,300 | | | | 1,018,164 | |

| TheStreet, Inc. | | | 330,000 | | | | 795,300 | |

| | | | | | | | 2,051,583 | |

| | | | | | | | | |

| Leisure Products (1.2%) | | | | | | | | |

| Black Diamond, Inc.* | | | 42,500 | | | | 476,850 | |

| | | | | | | | | |

| Media (1.2%) | | | | | | | | |

| World Wrestling Entertainment, Inc. | | | 40,000 | | | | 477,200 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels (6.4%) | | | | | | | | |

| Eclipse Resources Corp.* | | | 395 | | | | 9,926 | |

| Hess Corp. † | | | 15,000 | | | | 1,483,350 | |

| WPX Energy, Inc.* | | | 42,000 | | | | 1,004,220 | |

| | | | | | | | 2,497,496 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (17.6%) | |

| Entropic Communications, Inc.* | | | 220,000 | | | | 732,600 | |

| FormFactor, Inc.* | | | 445,000 | | | | 3,702,400 | |

| Mellanox Technologies Ltd* | | | 11,250 | | | | 392,175 | |

| MKS Instruments, Inc. | | | 30,000 | | | | 937,200 | |

| NeoPhotonics Corp.* | | | 96,300 | | | | 400,608 | |

| Peregrine Semiconductor Corp.* | | | 5,000 | | | | 34,300 | |

| Rudolph Technologies, Inc.* | | | 65,000 | | | | 642,200 | |

| | | | | | | | 6,841,483 | |

| | | | | | | | | |

| Software (0.3%) | | | | | | | | |

| BroadSoft, Inc.* | | | 5,000 | | | | 131,950 | |

| | | | | | | | | |

| Specialty Retail (0.5%) | | | | | | | | |

| Aeropostale, Inc.* | | | 10,000 | | | | 34,900 | |

| American Eagle Outfitters, Inc. | | | 12,500 | | | | 140,250 | |

| Francesca’s Holdings Corp.* | | | 2,000 | | | | 29,480 | |

| | | | | | | | 204,630 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (3.6%) | |

| Super Micro Computer, Inc.* | | | 56,000 | | | | 1,415,120 | |

| | | | | | | | | |

| Thrifts & Mortgage Finance (1.9%) | | | | | | | | |

| Tree.com, Inc.* | | | 25,000 | | | | 728,500 | |

| | | | | | | | | |

| Trading Companies & Distributors (1.0%) | | | | | |

| Air Lease Corp. | | | 10,000 | | | | 385,800 | |

| | | | | | | | | |

| Total Common Stocks | | | | | | | | |

| (Cost $26,965,388) | | | | | | | 28,066,035 | |

See accompanying notes to financial statements.

Needham Small Cap Growth Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | Shares | | | Market Value | |

| Common Stocks - Continued | | | | | | |

| Short-Term Investment (27.1%) | | | | | | |

| | | | | | | |

| Money Market Fund (27.1%) | | | | | | |

| Dreyfus Treasury Prime Cash Management 0.00% (a) | | | | | | |

| (Cost $10,545,496) | | | 10,545,496 | | | $ | 10,545,496 | |

| | | | | | | | | |

| Total Investments (99.3%) | | | | | | | | |

| (Cost $37,510,884) | | | | | | | 38,611,531 | |

| Total Securities Sold Short (-3.8%) (Proceeds $1,435,452) | | | | | | | (1,488,180 | ) |

| Other Assets in Excess of Liabilities (4.5%) | | | | | | | 1,742,662 | |

| Net Assets (100.0%) | | | | | | $ | 38,866,013 | |

| * | Non-income producing security. |

| (a) | Rate shown is the seven day yield as of June 30, 2014. |

| † | Security position is either entirely or partially held in a segregated account as collateral for securities sold short, aggregating a total market value of $449,740. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

Needham Small Cap Growth Fund

Schedule of Securities Sold Short

June 30, 2014 (Unaudited)

| | | Shares | | | Market Value | |

| Securities Sold Short (-1.0%) | | | | | | |

| | | | | | | |

| Communications Equipment (-1.0%) | | | | | | |

| Ubiquiti Networks, Inc.* | | | 9,000 | | | $ | 406,710 | |

| | | | | | | | | |

| Total Securities Sold Short | | | | | | | | |

| (Proceeds $356,367) | | | | | | | 406,710 | |

| | | | | | | | | |

| Exchange Traded Funds Sold Short (-2.8%) | | | | | |

| iShares Russell 2000 ETF | | | 3,000 | | | | 356,430 | |

| iShares Russell 2000 Growth ETF | | | 3,000 | | | | 415,260 | |

| iShares Russell 2000 Value ETF | | | 3,000 | | | | 309,780 | |

| | | | | | | | | |

| Total Exchange Traded Funds Sold Short | | | | | | | | |

| (Proceeds $1,079,085) | | | | | | | 1,081,470 | |

| | | | | | | | | |

| Total Securities & Exchange Traded Funds Sold Short | | | | | |

| (Proceeds $1,435,452) | | | | | | | 1,488,180 | |

| | | | | | | | | |

| Total Securities & Exchange Traded Funds Sold Short (-3.8%) | | | | | | | (1,488,180 | ) |

| Total Investments (99.3%) | | | | | | | 38,611,531 | |

| Other Assets in Excess of Liabilities (4.5%) | | | | | | | 1,742,662 | |

| Net Assets (100.0%) | | | | | | $ | 38,866,013 | |

| * | Non-income producing security. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

See accompanying notes to financial statements.

Statements of Assets and Liabilities

June 30, 2014 (Unaudited)

| | | | | | Needham | | | Needham | |

| | | Needham | | | Aggressive | | | Small Cap | |

| | | Growth Fund | | | Growth Fund | | | Growth Fund | |

| Assets | | | | | | | | | |

Investments, at Value

(Cost $72,360,336, $31,894,906, $37,510,884) | | $ | 146,212,025 | | | $ | 64,558,931 | | | $ | 38,611,531 | |

| Receivables: | | | | | | | | | | | | |

| Deposit with Broker for Securities Sold Short | | | 3,669,398 | | | | 3,768,986 | | | | 536,421 | |

| Dividends and Interest | | | 54,680 | | | | 2,300 | | | | 3,063 | |

| Fund Shares Sold | | | 7,262 | | | | 1,551 | | | | 2,947 | |

| Investment Securities Sold | | | 581,231 | | | | 138,143 | | | | 1,333,148 | |

| Prepaid Expenses | | | 25,546 | | | | 13,829 | | | | 22,197 | |

| Total Assets | | | 150,550,142 | | | | 68,483,740 | | | | 40,509,307 | |

| | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

Securities Sold Short, at Value

(Proceeds $2,755,549, $2,310,393, $1,435,452) | | | 3,860,884 | | | | 4,164,365 | | | | 1,488,180 | |

| Payables: | | | | | | | | | | | | |

| Investment Securities Purchased | | | 234,960 | | | | 142,101 | | | | 62,185 | |

| Fund Shares Redeemed | | | 58,101 | | | | 44,905 | | | | 4,561 | |

| Due to Adviser | | | 146,389 | | | | 64,257 | | | | 40,281 | |

| Distribution Fees | | | 29,560 | | | | 12,960 | | | | 7,956 | |